Attached files

| file | filename |

|---|---|

| EX-23.1 - CHINA EDUCATION ALLIANCE INC. | v218234_ex23-1.htm |

| EX-32.2 - CHINA EDUCATION ALLIANCE INC. | v218234_ex32-2.htm |

| EX-32.1 - CHINA EDUCATION ALLIANCE INC. | v218234_ex32-1.htm |

| EX-21.1 - CHINA EDUCATION ALLIANCE INC. | v218234_ex21-1.htm |

| EX-31.2 - CHINA EDUCATION ALLIANCE INC. | v218234_ex31-2.htm |

| EX-31.1 - CHINA EDUCATION ALLIANCE INC. | v218234_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

(Mark One)

|

FORM 10-K

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________to __________

Commission file number 001-34386

CHINA EDUCATION ALLIANCE, INC.

(Exact name of registrant as specified in its charter)

|

North Carolina

|

56-2012361

|

|

|

State or other jurisdiction of

Incorporation or organization

|

(I.R.S. Employer

Identification No.)

|

|

58 Heng Shan Road, Kun Lun Shopping Mall, Harbin, People’s Republic of China

|

150090

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code 011-86-451-8233-5794

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

New York Stock Exchange, LLC

|

Securities registered pursuant to section 12(g) of the Act:

Not Applicable

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. x Yes ¨ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $78,730,670.90 (18,971,246 shares of common stock held by non-affiliates, closing price on June 30, 2010 was $4.15).

Note.—If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

The number of shares of common stock, par value $0.001 (the "Common Stock"), outstanding as of April 15, 2011 is 31,727,249.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

Table of Contents

|

|

Page

|

|

|

PART I

|

||

|

Item 1.

|

Business.

|

4 |

|

Item 1A.

|

Risk Factors.

|

15 |

|

Item 1B.

|

Unresolved Staff Comments.

|

21 |

|

Item 2.

|

Properties.

|

21 |

|

Item 3.

|

Legal Proceedings.

|

22 |

|

Item 4.

|

(Removed and Reserved).

|

22 |

|

PART II

|

||

|

Item 5.

|

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

23 |

|

Item 6.

|

Selected Financial Data.

|

24 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

25 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

38 |

|

Item 8.

|

Financial Statements and supplementary Data.

|

38 |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

43 |

|

Item 9A.

|

Controls and Procedures.

|

43 |

|

Item 9B.

|

Other Information.

|

45 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers, and Corporate Governance.

|

46 |

|

Item 11.

|

Executive Compensation.

|

53 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

57 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

59 |

|

Item 14.

|

Principal Accountant Fees and Services.

|

59 |

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

60 |

2

Cautionary Statement Regarding Forward Looking Statements

The discussion contained in this Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Form 10-K. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Form 10-K describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Form 10-K could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Form 10-K or the date of documents incorporated by reference herein that include forward-looking statements.

3

PART I

|

Item 1.

|

Business.

|

History of our Organization

We were incorporated in North Carolina on December 2, 1996 under the name of ABC Realty Co. to engage in residential real estate transactions as a broker or agent. Following the September 2004 reverse acquisition described below, our corporate name was changed to China Education Alliance, Inc. At the time of the reverse acquisition, we were not engaged in any business activity and we were considered to be a blank-check shell.

On September 15, 2004, we entered into an agreement pursuant to which:

|

|

·

|

the stockholders of Harbin Zhong He Li Da, a PRC corporation, transferred all of the stock of Harbin Zhong He Li Da to us and we issued to those stockholders a total of 18,333,333 shares of Common Stock, representing 95% of our outstanding Common Stock after giving effect to the transaction.

|

|

|

·

|

Duane Bennett, who was then our chairman of the board and controlling shareholder, caused 3,666,667 shares of Common Stock that were controlled by him to be transferred to us for cancellation, for which Harbin Zhong He Li Da or its stockholders paid $400,000, of which $300,000 was paid in cash and the balance was paid by a promissory note, which has been paid.

|

We changed our corporate name to China Education Alliance, Inc. on November 17, 2004.

General

We are an education service company that provides on-line education and on-site training in the People’s Republic of China (“PRC”). We were organized to meet what our founders believe is an unmet need for educational resources throughout the PRC. Based on the Chinese Finance Ministry’s 2010 draft budget report, the appropriation for education spending in 2010 was 215.99 billion Yuan. According to Chinese tradition, spending on education resources is one of the family’s major expenditures. However, just as economic development is not even throughout the PRC, there is an uneven allocation of educational resources in the PRC. In general, only students who pass the numerous examinations which are given at various stages of the educational process, can obtain better educational opportunities at a higher level. We believe that the examination-oriented education has created a market for products from companies that address this need.

Our principal business is the distribution of educational resources through the internet. Our website, www.edu-chn.com, is a comprehensive education network platform which is based on network video technology and large data sources of elementary education resources. We have a database comprised of such resources as test papers that were used for secondary education and university level courses as well as video on demand. Our data base includes more than 350,000 exams and test papers and courseware for college, secondary and elementary schools. While some of these exams were given in previous years, we engage instructors to develop new exams and a methodology for taking the exams. We market this data base under the name “Famous Instructor Test Paper Store.” We also offer, through our website, video on demand, which includes tutoring of exam papers and exam techniques. We compliment the past exams and test papers by providing an interactive platform for students to understand the key points from the papers and exams. Although a number of the resources are available through our website without charge, we charge our subscribers for such services as the Famous Instructor Test Paper Store and the video on demand. Subscribers can purchase debit cards which can be used to download material from our website.

We also provide on-site teaching services in Harbin, which we market under the name “Classroom of Famed Instructors.” We have a 36,600 square foot training facility in Harbin, Heilongjiang Province, PRC, which has 17 classrooms and can accommodate 1,200 students. These classes, which complement our on-line education services, provide classroom and tutoring to our students. The courses cover primarily the compulsory education curriculum of junior, middle and high school. We charge tuition for these classes.

4

We have also introduced a program of on-line vocational training services. We collaborated with the China Vocation Education Society to set up a website, www.360ve.com , which is an internet platform for training agencies and schools to offer their services. We launched www.360ve.com in September 2007. We called this program our “Millions of College Students Employment Crossroad” program. We offer job search capability and career planning courses for university students. We developed this program in response to the high jobless rate for PRC college graduates. Many college graduates pursue vocational training after their college education in order to find employment. Our program is designed to establish a long-term training program for college students to build connections with corporations and participate in educational programs prescribed by hiring corporations. We anticipate that we will constantly revise our materials to meet changes in the market as well as the demands of university students and graduates who enroll in our courses in order to meet their changing needs.

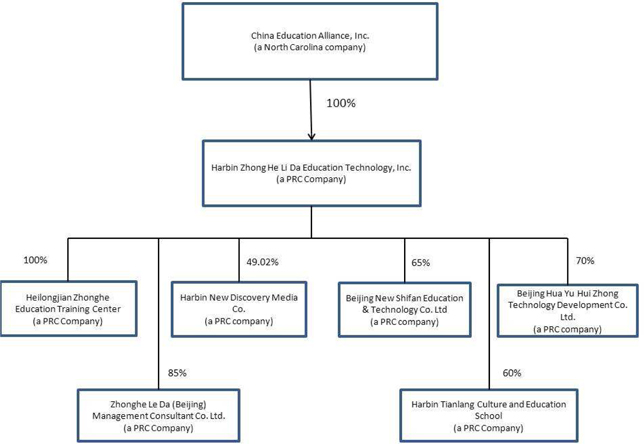

On April 18, 2008, our wholly owned subsidiary, Harbin Zhong He Li Da Education Technology, Inc. (ZHLD) entered into an agreement and supplementary agreement with Harbin Daily Newspaper Group to invest in a joint venture company, Harbin New Discovery Media Co. ZHLD contributed RMB 3,000 000 (approximately $430,000) and Harbin Daily Newspaper Group contributed RMB 3,120,000 (approximately $445,000) towards the registered capital of Harbin New Discovery Media Co. In return for their respective contributions, ZHLD will own 49.02% equity interest and Harbin Daily Newspaper Group will own 50.98% equity interest in Harbin New Discovery Media Co., Ltd. This joint venture will create new educational material distribution channels in readable newspaper format in the future. Pursuant to the terms of the supplementary agreement, Harbin Daily Newspaper Group assigned all its rights in the “Scientific Discovery” newspaper exclusively to the joint venture company. The transaction closed on July 7, 2008 and as a result, Harbin New Discovery Media Co. Ltd. is now a 49.02% owned subsidiary of ZHLD and we are now in the publication and distribution of a scientific newspaper business.

On April 27, 2008, we entered into a Share Transfer Agreement with Mr. Yuli Guo (“Guo”) and World Exchanges, Inc. (“WEI”) to purchase from Guo seventy (70) issued and outstanding common shares in WEI, representing 70% of the entire issued share capital of WEI. In consideration for the said shares, we issued to, but held in trust for Guo, 400,000 shares of our Common Stock. Guo retained the remaining 30% of the issued share capital of WEI. As a result of the transaction, WEI became a 70% owned subsidiary of China Education Alliance.

On September 20, 2010, the Company’s board of directors determined to terminate the Share Transfer Agreement with Mr. Yuli Guo and WEI. Because Mr. Guo had not completed all the transfer and legal procedures within the time period required prescribed in the agreement due to delays in transferring legal title and the non-resolution of ongoing administrative and legal matters of WEI’s five entities in the PRC. The operations and financial position of WEI were never consolidated or presented in our consolidated financial statements. The 400,000 shares of the Company’s Common Stock issued to Mr. Guo were returned to the Company for cancellation.

On January 4, 2009, our subsidiary, ZHLD entered into an agreement with Mr. Guang Li to jointly incorporate and invest in a joint venture company, Zhong He Li Da (Beijing) Management Consultant Co., Ltd. (“ZHLDBJ”). ZHLD contributed RMB 425,000 (approximately $62,107), and Mr. Guang Li contributed RMB 75,000 (approximately $10,960) towards the registered capital of ZHLDBJ, amounting to a total registered capital of RMB 500,000 (approximately $73,067). ZHLD will own a 85% equity interest in ZHLDBJ and Mr. Guang Li will own a 15% equity interest in ZHLDBJ. ZHLD has authorized Mr. Xiqun Yu to hold 20% of its equity interest of ZHLDBJ on its behalf.

ZHLDBJ was incorporated on January 4, 2009 with a business term of 20 years. The registered capital of ZHLDBJ has been paid by the parties concerned. Mr. Xiqun Yu, our CEO, is the legal representative and the managing director of ZHLDBJ. ZHLDBJ will be involved in the vocational training business, in particular, in running the “Million Managers Training Program”. The “Million Managers Training Program” is the PRC’s first management training program targeted to upgrade management skills.

5

In February 2010, the Company, through its wholly owned subsidiary, ZHLD, incorporated a new company in the PRC, Beijing New Shifan Education & Technology ("New Shifan"). Further, New Shifan has acquired all the assets and operations of Beijing Shifan Culture Communication Co., Ltd. ("Beijing Shifan") for RMB 6 million (approximately $876,808). Focused on the advancement of science and mathematics education, Beijing Shifan publishes the "Senior High School Students Mathematic, Physics, and Chemistry" magazine, which has been endorsed by the PRC Ministry of Education. The magazine was founded in 1993. Beijing Shifan is also the sponsor and organizer of a nationwide contest for middle school and high school students. This national competition tests the students' academic abilities in mathematics, physics and chemistry. There are currently 23 provinces and cities and more than 100,000 students participating in the contest, which emphasizes students' abilities, technology awareness, and innovative thinking. The winners of the contest qualify for enrollment in some of the top universities in the PRC, thus it has very significant impact on the secondary education market in China.

In October 2010, the Company founded a "Hundred Celebrity Teachers Club" in China. The goal of the club is to "assemble famous teachers, train students, and promote basic education in China". The "Hundred Celebrity Teachers Club" (the “Club”) is the first dynamic educational platform aimed at promoting math, physics, and chemistry in middle and high schools in China. So far, 80 teachers from 15 provinces of China have joined the Club, making us one of the largest bases of well-known teachers in China. As members of the Club, these famous teachers will promote high teaching standards in all three major disciplines – math, physics and chemistry – and provide consultation services to select middle and high schools in China. The Club's activities include teacher training, lectures given by celebrity teachers, education evaluation, teaching cases analysis, subjects study, and international exchanges. It provides an excellent stage for teachers to explore resources, discuss hot education topics, and promote academic growth. The “Hundred Celebrity Teachers Club" is endorsed by China's Ministry of Education.

In December 2010, the Company announced that its board of directors authorized a stock repurchase program. The program authorized a buyback of the Company's Common Stock up to a value of $10 million and was valid through December 1, 2011. The program was initialized by having the Company funds utilized to open a brokerage account in the United States.

On March 4, 2011, the Company entered into a management agreement (the “Management Agreement”) with Nanchang Institute of Technology (“NIT”), a vocational training institution based in Nanchang, People’s Republic of China. Pursuant to the Agreement, the Company will manage the daily operations of NIT for ten years for an annual management fee of RMB 10 million (approximately $1,461,347). The management fee is payable on a quarterly basis and in the event of late payment, a late fee is imposed. Additionally, a liquidated damage of RMB 50 million (approximately $7,306,736) will be paid by the party that defaults on the agreement.

In connection with the Management Agreement, the Company entered in to a loan agreement (the “Loan Agreement”), pursuant to which the Company will loan NIT RMB 50 million (approximately $7,306,736) to build training facilities and NIT will repay the RMB 50 million in ten years from the date NIT receives the principal. The loan has an annual interest rate of 20% and the interests will be waived by the Company if NIT makes all payments under the Management Agreement in a timely manner. In the event it prepays the principal and interests that are not due, NIT is subject to a prepayment penalty in the amount of 25% of the loan principal. The loan is secured by the assets of certain guarantors.

On March 14, 2011 the Company entered into a Share Transfer Agreement with the shareholder of Harbin Tianlang Culture and Education School (“Tianlang”), a tutoring school with 5,000 current students, based in Harbin, People’s Republic of China.

Pursuant to the Share Transfer Agreement, the Company agreed to purchase 60% of the equity interests of Tianlang for RMB 35 million (approximately $5.3 million). The shareholder and the Company also agreed to provide RMB 2 million (approximately $0.3 million) and RMB 3 million (approximately 0.5 million) as working capital for Tianlang, respectively. After the execution of the Share Transfer Agreement, Tianlong will establish a new board of directors with five directors, of which three directors shall be appointed by the Company and two directors shall be appointed by the shareholder.

On March 21, 2011, the Company entered into an additional agreement with NIT. Pursuant to the agreement, the Company and NIT will jointly establish Nanchang Institute of Technology College of Vocational Training and Certification (the “College”). NIT will provide facilities for free and the Company will provide teachers, curriculums and certificates of trainings and pay all the expenses incurred in the teaching process. In return, NIT and the Company will receive 20% and 80% of the total revenue of the College, respectively. The Company will be responsible for the College’s operation which will start on March 21, 2011.

6

Corporate Structure

Education Systems in the PRC

Since 1949 when the PRC was founded, the government in the PRC has considered education an important component of its economic and social development. Recently, with the emergence of its market economy, education has become a priority in the PRC.

According to the International Monetary Fund, the gross domestic product of the PRC in 2010 was calculated at $5.745 trillion, with an annual real rate of GDP growth at 10.4%. The average PRC family sets aside 10% of its savings for education according to the United Nations Educational, Scientific, and Cultural Organization. We believe that many parents are willing to invest in their children for better and higher education because it is critical for their future opportunities and advancement. The educational system in the PRC is under pressure to reform and develop. On March 14, 2004, the second session of the 10th National People’s Congress concluded that the PRC advocates “putting people first” as its development model. The PRC government sets education as a strategic priority in the China Agenda for Education.

7

The central government in the PRC, through the Ministry of Education, manages education in the PRC at a macro level, responsible for carrying out related laws, regulations, guidelines and policies of the central government; planning development of the education sector; integrating and coordinating educational initiatives and programs nationwide; maneuvering and guiding education reform countrywide. To a large degree, the provincial governments are left to implement basic education through development of teaching plans to supplement the required coursework from the central Ministry of Education and the funding of basic education in poorer areas. Provincial level governments have the main responsibilities for implementing basic education on a day to day basis.

Education is funded by a variety of sources: schools directly controlled by the central government are generally funded from the central financial pool; schools controlled by local governments are supported by local governments, the central government, and fund raising projects initiated by these schools themselves; schools sponsored by township and village governments and by public institutions are mainly financed by the sponsor institutions and subsidized by local governments; private schools are funded by sponsors (including collecting tuition from students and soliciting contributions).

In the PRC, primary and secondary education takes 12 years to complete. Primary education generally is six years, junior middle school is three years, and senior middle school is three years. Children generally begin primary school at the age of six. In 1986, the PRC passed the Compulsory Education Law, which dictates that nine years of compulsory education (grades 1 through 9) is to become mandatory and requires that provincial and local governments take the necessary steps to ensure that all students receive at least the required nine years of education. The goal of the Compulsory Education Law, as well as the subsequent guidelines, was to universalize compulsory education and to eliminate illiteracy among the PRC people. According to the Bulletin of Statistics on National Educational Development in 1999 issued by the Ministry of Education, the nine-year compulsory education has covered 80% of the PRC’s population since its inception. In 2002, the PRC began to aggressively incorporate English into its elementary school curriculum.

On March 3, 2004, the State Council approved and disseminated the 2003-2007 Action Plan for Invigorating Education in the 21st Century, which was formulated by the Ministry of Education. The plan recognizes the need to make the PRC competitive in the world economy and provides a blueprint to speed up educational reform and development in the PRC. The plan is based on two fundamental concepts to “Rejuvenating China through Science and Education” and “Reinvigorating China through Human Resource Development.” The objectives of the plan are to establish a well-to-do society and perfect the socialistic market economy in the PRC. The plan has goals to consolidate and universalize the nine-year compulsory education program and eradicate illiteracy, to continue educational reforms, to improve the quality of education and to provide a system designed to enable the public to have access to quality education. The plan emphasizes the use of information technology in education and training.

Since 2000, the PRC government has been implementing reform in educational policy to change the orientation of the education system from one based on memory learning to a more individualized creative approach.

On-line Education

Our core business is the exam-oriented education in junior, middle, and high school. We believe that our on-line education programs are in line with the government policy of using information technology to make educational resources available throughout the country. The reforms in education policy has created a demand for new curriculum, updated educational materials and educational resources. Our portal enables our customers to access the new curriculum created by various levels of government and leading academic experts, which are endorsed by the Ministry of Education. Our courses have the necessary certification or registration with the Ministry of Education.

8

Our website makes use of its internet network resources beyond the traditional teaching methods and face-to-face constraints by providing students with access to multi-media resources such as college, middle school and elementary school test papers, courseware designed to prepare students for taking the exams, and video on demand courseware. We market our website as a platform to offer services like “Famed Instructors Test Paper Store” by offering prepaid rechargeable learning debit cards that can be used to purchase our products. The learners can have materials downloaded for off-line education or study the material on-line.

We believe that through our website, we can help to change the uneven distribution of education resources since our material is designed for nationwide exams and, though the Internet, students can have access to our material nationwide. We sell our exam papers, test papers, and video on demand through our website www.edu-chn.com. We offer both exams that were previously given as well as copyrighted exams that were developed by teachers who we hire for that purpose. These examinations cover PRC primary, middle and high school exams which are used by students who are primarily in age range of six to eighteen.

We have developed some educational software and we own a database covering all levels of basic education from primary school through high school. Our plans for expansion of our business operations include the following:

|

|

·

|

Build up the infrastructure to ensure fast access and to satisfy the volume that would develop with increasing demand;

|

|

|

·

|

Develop a nation-wide advertising campaign to increase market awareness of our products;

|

|

|

·

|

Open branch offices in key cities. Even though our website is accessible from anywhere in the PRC, course materials are not standardized throughout the PRC, and there are many differences in both the course materials and the resources among the different regions in the PRC. As a result, we believe that we can best serve the students in a region by using our branch offices to employ local teachers who understand the local educational system. In this manner, we can customize our course materials to meet the local educational requirements and develop face-to-face tutorial centers to further expand our revenue.

|

Training Center

We provide on-site teaching services under the “Big Classroom of the Famed Instructors,” our state-of-the-art training center in Harbin. At this center, we offer both classroom training and one-on-one tutoring. The training center has approximately 36,600 square feet, with 17 modern classrooms and a capacity for 1,200 students. The courses cover each phase of compulsory education, of which junior, middle and high school are the key parts. Our courses are designed to complement our students' daily school curriculum, and will vary depending on the age of the students as well as the progress of the class. Class subjects include Math, Physics, Chemistry, English, Chinese, etc. We charge students for each class taken. Thus, we determine our enrollment by the number of classes that were taken during a given period of time, and not by the number of individual students. Since the term of the classes vary, we do not schedule classes on a semester basis.

Vocational Training

We have introduced a program of on-line vocational training services. We have collaborated with the National Association of Vocation Education of China to set up a website, www.360ve.com, which is an internet platform for training agencies and schools to offer their services. We launched www.360ve.com in September 2007. We called this program our “Millions of College Students Employment Crossroad” program. We offer job search capability and career planning courses for university students. We developed this program in response to the high unemployment rate for PRC college graduates. Our program is designed to establish a long-term training program for college students to build connections with corporations and obtain educational programs prescribed by the recruiting corporations. We anticipate that we will constantly revise our materials to meet changes in the market as well as the demands of university students and graduates who enroll in our courses in order to meet their career needs.

Through our “Millions of College Students Employment Crossroad” program, we seek to address two problems - one is the need for university students to find jobs and the other is to satisfy the need of businesses to hire qualified candidates. We cooperate with businesses and other entities to enable us to communicate the requirements of potential employers, including the necessary skill sets needed, to the students who enroll in the program. In this manner, the students can learn the needs of different businesses while they are at school, and can develop educational programs in the their university to enable them to meet the educational requirements of their desired field of business. This will help students seek employment after college and improve their job seeking strategy.

9

The National Association of Vocation Education of China has a large number of institutional members, including provincial education bureaus and more than 1,000 vocational training schools across the PRC. We intend to expand our strategic cooperation with training agencies, especially in the aspects of joint enrollment, the exchange of resources and on-site training agencies facilities.

In this program we work with the National Association of Vocation Education of China, which certifies vocational certification, and coordinates our programs with the government agencies, including the education and labor ministries, to develop and evaluate programs for vocational education. We have been authorized to provide on-line vocational education and to administer the certification process for certain vocations. However, we are not yet offering theses services.

During December 2006, we acquired all of the fixed assets and franchise rights of Harbin Nangang Compass Computer Training School for approximately $1 million. The Nangang Compass Computer Training School provided classroom education resources to computer vocational school students. As a result of this acquisition, we became the exclusive partner of Beida Qingniao APTEC Software Engineering within Heilongjiang Province in the PRC for vocational training. The acquisition included materials and resources to provide on-site education classes and patented course materials. The Nangang Compass Computer Training School currently has two principal education programs focused on network engineering and ACCP software engineering with 9 on-site classrooms and 9 multimedia/computer classrooms at two centers.

Harbin New Discovery Media Co.

On April 18, 2008, ZHLD entered into an agreement and supplementary agreement with Harbin Daily Newspaper Group to invest in a joint venture company, Harbin New Discovery Media Co., ZHLD contributed RMB 3,000 000 (approximately $430,000) and Harbin Daily Newspaper Group contributed RMB 3,120,000 (approximately $445,000) towards the registered capital of Harbin New Discovery Media Co. In return for their respective contributions, ZHLD will own 49.02% equity interest and Harbin Daily Newspaper Group will own 50.98% equity interest in Harbin New Discovery Media Co., Ltd. Pursuant to the terms of the supplementary agreement, Harbin Daily Newspaper Group shall assign all its rights in the “Scientific Discovery” newspaper exclusively to the joint venture company, Harbin New Discovery Media Co. “Scientific Discovery” was established in October 2001 to popularize scientific information and knowledge with PRC citizens, and it has won strong brand recognition and a loyal readership in Heilongjiang province. In 2010, the “Scientific Discovery” circulation generated total revenues of $1.1 million during the year. Harbin New Discovery Media Co., Ltd. publishes this newspaper twice per week. The first publication targets primary and middle school students by providing pertinent and authoritative after-school tutorship materials, which are synchronized with students’ syllabi. Top-ranked educational experts and professors prepare the educational materials. The second publication targets the general population by providing scientific information and guidance in daily life.

“Million Managers Training Program”

We, along with The National Association of Vocational Education of China and Beijing Huayu Education Foundation are dedicated to building the PRC’s first management training program, Million Managers Training Program, with the goal of improving management skills and designing a complete solution for management, clients and suppliers. The topics are aimed at improving management skills, increasing corporate profitability and sustaining development. The program comprises 9 education modules:

|

|

·

|

Ongoing enterprise and operation strategies;

|

|

|

·

|

Marketing;

|

|

|

·

|

General management;

|

10

|

|

·

|

Enterprise management tactics;

|

|

|

·

|

Enterprise culture;

|

|

|

·

|

Financial management and capital management;

|

|

|

·

|

Purchasing and production management; and

|

|

|

·

|

Enterprise self-management and improvement.

|

The program takes 60 days with tuition of RMB 10,000 (approximately $1,437) to RMB 80,000 (approximately $11,491) based on different learning components. Some top experts from several industries are instructors in the program in Beijing.

Marketing

We employ sales persons who market our products to the Ministry of Education and the provincial education commissions. Although the government agencies do not purchase our products, we need to obtain their approval for the use of our programs in connection with the curriculums in schools under their jurisdiction. We also use these marketing calls to generate information to assist us in developing new educational products and opportunities. Our sales force is also actively involved with educators in developing curriculums based on our products.

We intend to use our web-based educational portal to assist us in marketing our educational products. This portal provides data and other materials free but charges users for downloads of our products.

We also market our Training Center and Vocational products by way of the following methods: (A) directly at conferences and events where we invite teachers, students and their families to learn about our education materials; (B) through various internet links and search engines; (C) by traditional media advertising, such as TV and newspaper advertisements; and (D) through fliers or coupons handed out to students in front of high schools and other major education institutions. We are also able to attract users by reputation and referrals from current students or users.

“Scientific Discovery,” a scientific information newspaper focusing on introducing scientific knowledge to elementary and secondary school students exclusively, is marketed by the joint venture company, New Discovery. This joint venture creates new educational material distribution channels in readable newspaper format and promotes our core businesses. Harbin New Discovery Media Co., Ltd. publishes this newspaper twice per week,. The first publication targets primary and middle school students by providing pertinent and authoritative after-school tutorship materials, which are synchronized with students’ syllabi. The educational materials are prepared by top-ranked educational experts and professors. The second publication targets the general population by providing scientific information and guidance in daily life.

Our Million Managers Training Program is supported by the China Industry-University-Research Institute Collaboration Association and the Asian Brand China Committee, which both benefit economic development and employment. China Education Alliance, along with The National Association of Vocational Education of China and Beijing Huayu Education Foundation is dedicated to building the first management training program in the PRC with the goal of improving management skills and designing a total solution for management, clients and suppliers. The topics are aimed at improving management skills, increasing corporate profitability and sustaining development. The program is advertised through newspapers, web portals, radio, and national TV programs in the PRC. Through the program, we aim to increase its revenue and gain recognition in the PRC.

11

We expense advertising costs for outdoor spots at the time they are aired and for all other advertising the first time the respective advertising takes place. These costs are included in selling, general and administrative expenses. The total advertising expenses incurred for the years ended December 31, 2010 and 2009 were $1,308,290 and $1,093,535, respectively.

Major Customers

For the years ended December 31, 2010 and 2009, three customers each accounted for greater than 10% of sales during each year. A certain distribution agent in each of Heilongjing, Jinlin and LiaoNing Provinces accounted for 15.3%, 13.5%, and 14.2%, respectively of the total revenue for the year 2010, and 14.8%, 11.3% and 14.0%, respectively of total revenue for the year 2009. The loss of these customers would have a material adverse effect on the Company and its subsidiaries taken as a whole.

Competition

We compete with a number of PRC and international companies that sell educational materials in the PRC market. Many of our competitors are larger, more established companies, many of which have diverse businesses and are better capitalized. In some cases, these are new companies that are entering the educational market in the PRC and may offer products and services at lower costs to build up market share.

Government Regulations

The education industry in the PRC is heavily regulated at all levels - national, provincial and local. PRC practices and policies have limited contact with non-PRC entities in the education industry. In addition, our business is subject to numerous PRC rules and regulations, including restrictions on foreign ownership of Internet and education companies and regulation of Internet content. Many of the rules and regulations that we face are not explicitly communicated, but arise from the fact that education and the Internet are politically sensitive areas of the economy. We believe that the Ministry of Education and the provincial education commissions prefer to contract with PRC companies in the industry of education. As a result, all of our PRC subsidiaries are staffed with PRC nationals. All of our revenue is derived from our PRC subsidiaries, and our success is dependent on the skill and experience of the employees of our subsidiaries.

Ownership Restrictions on Foreign Internet Service Providers

The State Council promulgated the Administrative Rules on Foreign-Invested Telecommunications Enterprises in December 2001, as amended on September 10, 2008, or the FITE Rules. The FITE Rules set forth detailed requirements with respect to capitalization, investor qualifications and application procedures in connection with the establishment of a foreign-invested telecommunications enterprise. Pursuant to the FITE Rules, the ultimate capital contribution ratio of the foreign investor or investors in a foreign-funded telecommunications enterprise that provides value-added telecommunications services shall not exceed 50%. In addition, pursuant to the FITE Rules, permitted foreign investment ratio of value-added telecommunications services is no more than 50%.

In addition, for a foreign investor to acquire any equity interest in a value-added telecommunications business in China, it must satisfy a number of stringent performance and operational experience requirements, including demonstrating a track record and experience in operating a value-added telecommunications business overseas. Moreover, foreign investors that meet these requirements must obtain approvals from China’s Ministry of Industry and Information (“MII”) and the Ministry of Commerce or their authorized local counterparts, which retain considerable discretion in granting approvals.

On July 26, 2006, MII publicly released the Notice on Strengthening the Administration of Foreign Investment in Operating Value-added Telecommunications Business, dated July 13, 2006, or the MII Notice, which reiterates certain provisions under the FITE Rules. According to the MII Notice, if any foreign investor intends to invest in a Chinese telecommunications business, a foreign-invested telecommunications enterprise shall be established and such enterprise shall apply for the relevant telecommunications business licenses. The MII Notice prohibits domestic telecommunication services providers from leasing, transferring or selling telecommunications business operating licenses to any foreign investor in any form, or providing any resources, sites or facilities to any foreign investor for their illegal operation of a telecommunications business in China. According to the MII Notice, either the holder of a value-added telecommunication service license or its shareholders must directly own the domain names and trademarks used by such license holders in their provision of value-added telecommunication services. The MII Notice also requires each license holder to have the necessary facilities, including servers, for its approved business operations and to maintain such facilities in the regions covered its license.

We completed our reverse merger and our corporate structure was established in September 2004, before the implementation of the FITE Rules and the MII Notice. Accordingly, we do not believe that the FITE Rules and the MII Notice apply to us. Further, even if they did, we do not believe that we are in the telecommunications business. We do not provide connectivity and internet services. We are primarily in the education business and only a portion of our education resources is disseminated to our paying customers as opposed to the general public via internet download. Finally, our vocational training services are provided in collaboration with and through a PRC company, China Vocation Education Society. We do not own or have any equity stake in China Vocation Education Society.

12

However, there are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including the laws and regulations governing the enforcement and performance of our contractual arrangements in the event of imposition of statutory liens, bankruptcy and criminal proceedings. Accordingly, we cannot assure you that the PRC regulatory authorities will not ultimately take a contrary view.

If the PRC government finds that the agreements that establish the structure of our operations in China do not comply with PRC government restrictions on foreign investment in our industry, we could be subject to severe penalties.

Under our current corporate structure, ZHLD is our sole Wholly Foreign Owned Entity (WFOE).

Regulation of Online and Distance Education

Pursuant to the Administrative Regulations on Educational Websites and Online and Distance Education Schools issued by the Ministry of Education (MOE) in 2000, or the Online Education Regulation, educational websites and online education schools may provide education services in relation to higher education, elementary education, pre-school education, teacher education, occupational education, adult education and other educational services. Under the Online Education Regulations, “Educational websites” refers to education websites providing education or education-related information services to website visitors by means of a database or an online education platform connected via the Internet or an educational television station through an Internet service provider, or ISP. Under the Online Education Regulations, “Online education schools” refer to organizations providing academic education services or training services with the issuance of various certificates.

Under the Online Education Regulations, setting up educational websites and online education schools is subject to approval from relevant education authorities, depending on the specific types of education provided. Under the Online Education Regulations, any educational website and online education school shall, upon receipt of approval, indicate on its website such approval information as well as the approval date and file number.

According to the Administrative License Law promulgated by the National People’s Congress on August 27, 2003 and effective as of July 1, 2004, only laws promulgated by the National People’s Congress and regulations and decisions promulgated by the State Council may establish administrative license requirements. On June 29, 2004, the State Council promulgated the Decision on Cutting Down Administrative Licenses for the Administrative Examination and Approval Items Really Necessary to be Retained, in which the administrative license for “online education schools” was retained, while the administrative license for “educational websites” was not retained.

We believe we are not required to obtain a license to operate “education websites” or “online education schools” from the MOE under the current PRC laws and regulation because we do not offer through our website education services or training programs that directly offer government accredited academic degrees or other government accreditation certifications. For the same reason, we do not believe that we need to obtain a license to operate our onsite tutoring services. Finally, there appears to be no restriction against foreign ownership and it is unclear whether foreign ownership is restricted for businesses providing such “education websites” or “online education schools”.

13

Business Scope of our PRC Operating Entities

All our PRC operating subsidiaries, including ZHLD are in the business of providing education services. Particularly, ZHLD is a holding company of all other subsidiaries and also provides online exam preparation services, Heilongjiang Zhonghe Education Training Center provides onsite vocational training and after school tutoring services, Beijing Hua Yu Hui Zhong Technology Development Co., Ltd provides onsite vocational training and online college graduate electronic database and pre-employment training , Zhonghelida (Beijing) Management Consultant Co. Ltd. provides onsite vocational training services, Harbin New Discovery Media Co. is in the educational newspaper publishing business and Beijing New Shifan Education & Technology Co., Ltd publishes a high school education magazine and organizes high school students contests.

Intellectual Property

The exams and other materials on our websites include material that is generally available, such as exams that were previously given, and exams and other material that were developed for us. We engage authors, who are teachers, university professors or experts in their fields, to develop materials for our websites. Under the terms of our contracts, we own the copyright on all materials produced for us by these authors. We pay each author a fixed fee and certain percentage of sales as royalty. We also enter into agreements to use and publish educational materials developed by others, for which we pay for the use right.

Employees

As of April 15, 2011, we have approximately 409 employees, consisting of 36 executives, 38 administrative and finance employees, 212 marketing and sales personnel, 40 research and development staff, 19 information technicians, 12 designers, 34 teaching and education administrative staff, and 18 other employees engaged in security, planning, human resources and other activities. We have no collective bargaining agreements, and we believe that we have good relations with our employees.

Education and Business Licenses

Below is a list of the education and business licenses and permits of the Company and our operating subsidiaries:

Harbin Zhong He Li Da Education Technology, Inc.

1. Certificate of Approval

2. Business License

3. Tax Registration Certificate

4. Organization Code Certificate

5. State Administration of Foreign Exchange Registration Card

Heilongjiang Zhonghe Education Training Center

1. Certificate of Approval

Beijing Hua Yu HuiZhong Technology Development Co., Ltd

1. Business License

2. Tax Registration Certificate

3. Organization Code Certificate

Harbin New Discovery Media Co.

1. Business License

2. Tax Registration Certificate

3. Organization Code Certificate

Zhong He Li Da (Beijing) Management Consultant Co. Ltd

1. Business License

2. Tax Registration Certificate

3. Organization Code Certificate

14

2. Tax Registration Certificate

3. Organization Code Certificate

Beijing Wei Shi Yi Tong Education Technology Co., Inc.

1. Certificate of Approval

2. Business License

3. Tax Registration Certificate

4. Organization Code Certificate

|

Item 1A.

|

Risk Factors.

|

The reader should carefully consider each of the risks described below. If any of the following risks described below should occur, our business, financial condition or results of operations could be materially adversely affected and the trading price of our Common Stock could decline significantly.

Risks Associated with our Business

Our business is dependent upon the PRC government’s educational policies and programs .

As a provider of educational services, we are dependent upon governmental educational policies. Almost all of our revenue to date has been generated from the sale of test papers and materials relating to courses at different educational levels. To the extent that the government adopts policies or curriculum changes that significantly alter the testing and course materials used in the PRC educational system, our products could become obsolete, which would affect our ability to generate revenue and operate profitably. We cannot assure you that the PRC government agencies would not adopt such changes.

We are subject to numerous PRC rules and regulations that restrict the scope of our business and could have a material adverse impact on us.

We may be subjected to numerous rules and regulations in the PRC, including, without limitation, restrictions on foreign ownership of Internet and education companies and regulation of Internet content. Many of the rules and regulations that we face are not explicitly communicated, but arise from the fact that education and the Internet are politically sensitive areas of the economy. We are not aware that any of our agreements or our current organizational structure is in violation of any governmental requirements or restrictions, explicit or implicit.

In particular, we do not believe that Administrative Rules on Foreign-Invested Telecommunications Enterprises and the Notice on Strengthening the Administration of Foreign Investment in Operating Value-added Telecommunications Business apply to us because our corporate structure was established before these rules came into effect. Further, we do not provide connectivity and internet services. We are primarily in the education business and only a portion of our education resources is disseminated to our paying customers as opposed to the general public via internet download. Finally, our vocational training services are provided in collaboration with and through a PRC company, China Vocation Education Society. We do not own or have any equity stake in China Vocation Education Society. With regard to our education services, we do not believe that the Administrative Regulations on Educational Websites and Online and Distance Education Schools and the Decision on Cutting Down Administrative Licenses for the Administrative Examination and Approval Items Really Necessary to be Retained apply to us, because we do not offer through our website education services or training programs that directly offer government accredited academic degrees or other government accreditation certifications. Even if these rules applied to us, there appears to be no restriction against foreign ownership and it is unclear whether foreign ownership is restricted for businesses providing such “education websites” or “online education schools”. For more discussion on these issues, please refer to “Foreign Ownership Restrictions on Internet Content Provision Businesses” and “Regulation of Online and Distance Education”.

15

However, there can be no assurance that we are in compliance now, or will be in the future. Moreover, operating in the PRC involves a high risk that restrictive rules and regulations could change. Indeed, even changes of personnel at certain ministries of the government could have a negative impact on us. With any change in administration, more scrutiny, emphasis or regulation may be levied on our type of business or organizational structure. The determination that our structure or agreements are in violation of governmental rules or regulations in the PRC would have a material adverse impact on us, our business and on our financial results.

Our business may be subject to seasonal and cyclical fluctuations in sales .

We may experience seasonal fluctuations in our revenue in some regions in the PRC, based on the academic year and the tendency of parents and students to make purchases relating to their education just prior to or at the beginning of the school year in the autumn. Any seasonality may cause significant pressure on us to monitor the development of materials accurately and to anticipate and satisfy these requirements.

Our business is subject to the health of the PRC economy .

The purchase of educational materials not provided by the state educational system is discretionary and dependent upon the ability and willingness of families or students to spend available funds on extra educational products to prepare for national examinations. A general economic downturn either in our market or a general economic downturn in the PRC could have a material adverse effect on our revenue, earnings, cash flow and working capital.

We depend on our senior officers to manage and develop our business .

Our success depends on the management skills of Mr. Xiqun Yu, our chief executive officer and president and his relationships with educators, administrators and other business contacts. We also depend on successfully recruiting and retaining highly skilled and experienced authors, teachers, managers, sales persons and other personnel who can function effectively in the PRC. In some cases, the market for these skilled employees is highly competitive. We may not be able to retain or recruit such personnel, which could materially and adversely affect our business, prospects and financial condition. Except for Ms. Alice Lee Rogers, our Chief Financial Officer, we do not have employment contracts with any other officers or employees. The loss of Mr. Yu would delay our ability to implement our business plan and would adversely affect our business.

We may not be successful in protecting our intellectual property and proprietary rights.

Our intellectual property consists of old test papers, which are contained in our library, and courseware which we developed by engaging authors and educators to develop these materials. Our proprietary software products are primarily protected by trade secret laws. Although we require our authors and software development employees to sign confidentiality and non-disclosure agreements, we cannot assure you that we will be able to enforce those agreements or that our authors and software development employees will not be able to develop competitive products that do not infringe upon our proprietary rights. We do not know the extent that PRC courts will enforce our proprietary rights.

Others may bring defamation and infringement actions against us, which could be time-consuming, difficult and expensive to defend.

As a distributor of educational materials, we face potential liability for negligence, copyright, patent or trademark infringement and other claims based on the nature and content of the materials that we publish or distribute. Any claims could result in us incurring significant costs to investigate and defend regardless of the final outcome. We do not carry general liability insurance that would cover any potential or actual claims. The commencement of any legal action against us or any of our affiliates, whether or not we are successful in defending the action, could both require us to suspend or discontinue the distribution of some or a significant portion of our educational materials and require us to allocate resources to investigating or defending claims.

16

We depend upon the acquisition and maintenance of licenses to conduct our business in the PRC.

In order to conduct business in the PRC, we need licenses from the appropriate government authorities, including general business licenses and an education service provider license. The loss or failure to obtain or maintain these licenses in full force and effect will have a material adverse impact on our ability to conduct our business and on our financial condition.

Our growth may be inhibited by the inability of potential customers to fund purchases of our products and services.

Many schools in the PRC, especially those in rural areas, do not have sufficient funds to purchase textbooks, educational materials or computers to use our web-based educational portal. In addition, provincial and local governments may not have the funds to support the implementation of a curriculum using our educational products or may allocate funds to programs which are different from our products. Our failure to be able to sell our products and services to students in certain areas of the PRC may inhibit our growth and our ability to operate profitably.

Changes in the policies of the government in the PRC could significantly impact our ability to operate profitably.

The economy of the PRC is a planned economy subject to five-year and annual plans adopted by the government that set down national economic development goals. Government policies can have significant effect on the economic conditions of the PRC generally and the educational system in particular. Although the government in the PRC has confirmed that economic development will follow a model of market economy under socialism, a change in the direction of government planning may materially affect our business, prospects and financial condition.

Inflation in the PRC could negatively affect our profitability and growth.

While the economy in the PRC has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in our costs, it may have an adverse effect on profitability. In order to control inflation in the past, the government has imposed controls in bank credits, limits on loans for fixed assets purchase, and restrictions on state bank lending. Such an austerity policy can lead to a slowing economic growth which could impair our ability to operate profitably.

If we make any acquisitions, they may disrupt or have a negative impact on our business.

If we make acquisitions, we could have difficulty integrating personnel and operations of the acquired companies with our own. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot predict the affect expansion would have on our core business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business, distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions are accompanied by a number of inherent risks, including, without limitation, the following:

|

|

·

|

the difficulty of integrating acquired products, services or operations;

|

|

|

·

|

the potential disruption of the ongoing businesses and distraction of our management and the management of acquired companies;

|

|

|

·

|

the difficulty of incorporating acquired rights or products into our existing business;

|

|

|

·

|

difficulties in disposing of the excess or idle facilities of an acquired company or business and expenses in maintaining such facilities;

|

|

|

·

|

difficulties in maintaining uniform standards, controls, procedures and policies;

|

|

|

·

|

the potential impairment of relationships with employees and customers as a result of any integration of new management personnel;

|

17

|

|

the potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products to new and existing customers;

|

|

|

·

|

the effect of any government regulations which relate to the business acquired;

|

|

|

·

|

potential unknown liabilities associated with acquired businesses or product lines, or the need to spend significant amounts to retool, reposition or modify the marketing and sales of acquired products or the defense of any litigation, whether or not successful, resulting from actions of the acquired company prior to our acquisition.

|

Our business could be severely impaired to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with these acquisitions, many of which cannot be presently identified, these risks and problems could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations.

Our operations and assets in the PRC are subject to significant political and economic uncertainties.

Government policies are subject to rapid change, and the government of the PRC may adopt policies which have the effect of hindering private economic activity and greater economic decentralization. There is no assurance that the government of the PRC will not significantly alter its policies from time to time without notice in a manner which reduces or eliminates any benefits from its present policies of economic reform. In addition, a substantial portion of productive assets in the PRC remains government-owned. For instance, all lands are state owned and leased to business entities or individuals through governmental granting of state-owned land use rights. The granting process is typically based on government policies at the time of granting, which could be lengthy and complex. The government of the PRC also exercises significant control over its economic growth through the allocation of resources, controlling payment of foreign currency and providing preferential treatment to particular industries or companies. Uncertainties may arise with changing of governmental policies and measures. In addition, changes in laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency, the nationalization or other expropriation of private enterprises, as well as adverse changes in the political, economic or social conditions in the PRC, could have a material adverse effect on our business, results of operations and financial condition.

Price controls may affect both our revenues and net income.

The laws of the PRC provide the government broad power to fix and adjust prices. We need to obtain government approval in setting our prices for classroom coursework and tutorials. Although the sale of educational materials over the Internet is not presently subject to price controls, we cannot give you any assurance that they will not be subject to controls in the future. To the extent that we are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our services will be limited and we may face no limitation on our costs. As a result, we may not be able to pass on to our students any increases in costs we incur, or any increases in the costs of our faculty. Further, if price controls affect both our revenue and our costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable PRC regulatory authorities.

Our operations may not develop in the same way or at the same rate as might be expected if the PRC economy were similar to the market-oriented economies of most developed countries.

The economy of the PRC has historically been a nationalistic, “planned economy,” meaning it functions and produces according to governmental plans and pre-set targets or quotas. In certain aspects, the PRC’s economy has been making a transition to a more market-oriented economy, although the government imposes price controls on certain products and in certain industries. However, we cannot predict the future direction of these economic reforms or the effects these measures may have. The economy of the PRC also differs from the economies of most developed countries including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. As a result of these differences, our business may not develop in the same way or at the same rate as might be expected if the economy of the PRC were similar to those of other developed countries.

18

Because most of our officers and directors reside outside of the United States, it may be difficult for you to enforce your rights against them or enforce United States court judgments against them in the PRC .

Most of our directors and our executive officers reside in the PRC and all of our assets are located in the PRC. It may therefore be difficult for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under federal securities laws. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement of criminal penalties of the federal securities laws.

We may have limited legal recourse under PRC law if disputes arise under contracts with third parties.

All of our agreements, which are made by our PRC subsidiaries, are governed by the laws of the PRC. The PRC legal system is a civil law system based on written statutes. Accordingly decided legal cases have little precedential value. The government of the PRC has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, these laws are relatively new and their experience in implementing, interpreting and enforcing these laws and regulations is limited. Therefore, our ability to enforce commercial claims or to resolve commercial disputes may be uncertain. The resolution of these matters may be subject to the exercise of considerable discretion by the parties charged with enforcement of the applicable laws. Any rights we may have to specific performance or to seek an injunction under PRC law may be limited, and without a means of recourse, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Because we may not be able to obtain business insurance in the PRC, we may not be protected from risks that are customarily covered by insurance in the United States.

Business insurance is not readily available in the PRC. To the extent that we suffer a loss of a type which would normally be covered by insurance in the United States, such as product liability and general liability insurance, we would incur significant expenses in both defending any action and in paying any claims that result from a settlement or judgment.

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

19

Fluctuations in the exchange rate could have a material adverse effect upon our business .

We conduct our business in the Renminbi. The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. On July 21, 2005, the PRC government changed its decade old policy of pegging its currency to the U.S. currency. Under the current policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximately 26% appreciation of the Renminbi against the U.S. dollar between July 21, 2005 and April 15, 2011. However, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. dollar. To the extent our future revenues are denominated in currencies other the United States dollars, we would be subject to increased risks relating to foreign currency exchange rate fluctuations which could have a material adverse affect on our financial condition and operating results since our operating results are reported in United States dollars and significant changes in the exchange rate could materially impact our reported earnings.