Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Primerica, Inc. | d8k.htm |

Exhibit 99.1

Filed Pursuant to Rule 424(b)(3)

Registration No: 333-173271

The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 12, 2011

PROSPECTUS SUPPLEMENT

(To Prospectus Dated April 8, 2011)

12,000,000 Shares

PRIMERICA, INC.

Common Stock

Citigroup Insurance Holding Corporation, a wholly owned subsidiary of Citigroup Inc., is selling 12,000,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares of our common stock being offered hereby. The selling stockholder has granted the underwriters an option to purchase up to 1,800,000 additional shares of common stock to cover over-allotments.

Immediately following completion of this offering, Citigroup Inc. will beneficially own between approximately 20.6% and 23.1% of our outstanding common stock, depending on whether and the extent to which the underwriters exercise their over-allotment option.

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the trading symbol “PRI.” The last reported sale price of our common stock on the NYSE on April 11, 2011 was $24.03.

Investing in our common stock involves a high degree of risk. See the sections entitled “Risk Factors” beginning on page S-13 of this prospectus supplement and page 2 of the accompanying prospectus before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds to the selling stockholder |

$ | $ | ||||||

The underwriters expect to deliver the shares to purchasers on or about , 2011 through the book-entry facilities of The Depository Trust Company.

Citi

| UBS Investment Bank | ||||||||||||||

| Keefe, Bruyette & Woods | ||||||||||||||

| Macquarie Capital | ||||||||||||||

| Raymond James | ||||||||||||||

| Sandler O’Neill + Partners, L.P. | ||||||||||||||

| SunTrust Robinson Humphrey | ||||||||||||||

| CastleOak Securities, L.P. | ||||||||||||||

| Dowling & Partners Securities, LLC | ||||||||||||||

| Guggenheim Securities | ||||||||||||||

| ING | ||||||||||||||

| Willis Capital Markets & Advisory | ||||||||||||||

Prospectus Supplement dated , 2011

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the terms of the offering of the common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides more general information. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated herein and therein by reference, on the other hand, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. Neither we, nor the selling stockholder or the underwriters, have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. None of Primerica, the selling stockholder or the underwriters is making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information in this prospectus supplement, the accompanying prospectus or any other offering materials is accurate as of any date other than the date on the front of each document, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since then.

None of Warburg Pincus & Co., Warburg Pincus LLC or any of their affiliates is making this offer, and none of them is responsible for the accuracy of any information in this prospectus supplement.

As used in this prospectus supplement: (i) references to “Primerica,” “we,” “us” and “our” refer to Primerica, Inc., a Delaware corporation, and its consolidated subsidiaries; (ii) references to “Citi” refer to Citigroup Inc. and its subsidiaries; and (iii) references to “Warburg Pincus” refer collectively to Warburg Pincus Private Equity X, L.P. and Warburg Pincus X Partners, L.P.

S-1

This summary description about us and our business highlights selected information contained elsewhere in this prospectus supplement, the accompanying prospectus or incorporated by reference into this prospectus supplement and the accompany prospectus. It does not contain all the information you should consider before purchasing our securities. You should read in their entirety this prospectus supplement, the accompanying prospectus and any other offering materials, together with the additional information described under the sections entitled “Where You Can Find More Information” beginning on page S-133 of this prospectus supplement and page 23 of the accompanying prospectus.

Our Company

We are a leading distributor of financial products to middle income households in the United States and Canada with approximately 95,000 licensed sales representatives at December 31, 2010. We assist our clients in meeting their needs for term life insurance, which we underwrite, and mutual funds, annuities and other financial products, which we distribute primarily on behalf of third parties. We insured more than 4.3 million lives and more than two million clients maintained investment accounts with us at December 31, 2010. Our distribution model uniquely positions us to reach underserved middle income consumers in a cost effective manner and has proven itself in both favorable and challenging economic environments.

Our mission is to serve middle income families by helping them make informed financial decisions and providing them with a strategy and means to gain financial independence. Our distribution model is designed to:

Address our clients’ financial needs: Our sales representatives use our proprietary financial needs analysis (“FNA”) tool and an educational approach to demonstrate how our products can assist clients to provide financial protection for their families, save for their retirement and manage their debt. Typically, our clients are the friends, family members and personal acquaintances of our sales representatives. Meetings are generally held in informal, face-to-face settings, usually in the clients’ own homes.

Provide a business opportunity: We provide an entrepreneurial business opportunity for individuals to distribute our financial products. Low entry costs and the ability to begin part-time allow our recruits to supplement their income by starting their own independent businesses without incurring significant start-up costs or leaving their current jobs. Our unique compensation structure, technology, training and back-office processing are designed to enable our sales representatives to successfully grow their independent businesses.

We were the largest provider of individual term life insurance in the United States in 2009 (the latest period for which information is available) based on the amount of in-force premiums collected, according to LIMRA International, an independent market research organization. In 2010, we issued new term life insurance policies with more than $74 billion of aggregate face value and sold approximately $3.62 billion of investment and savings products.

Our History

We trace our roots to A.L. Williams & Associates, Inc. (“A.L. Williams”), an insurance agency founded in 1977 to distribute term life insurance as an alternative to cash value life insurance. A.L. Williams popularized the concept of “buy term and invest the difference,” reflecting a view that we continue to share today. A.L. Williams grew rapidly from its inception and within a few years became one of the top sellers of individual life insurance in the United States. We have since added several other product lines, including mutual funds, variable annuities, segregated funds and other financial products. Predecessors of Citi acquired our principal operating entities in the late 1980s.

S-2

In April 2010, we completed a reorganization of our business and Citi completed an initial public offering of 24,564,000 shares of our common stock and a private sale to private equity funds managed by Warburg Pincus LLC of 16,412,440 shares of our common stock and warrants to purchase from us 4,103,110 shares of our common stock at an exercise price of $18.00 per share. See the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations —The Transactions” beginning on page S-45 of this prospectus supplement.

Our Clients

Our clients are generally middle income consumers, defined by us to include households with $30,000 to $100,000 of annual income, representing approximately 50% of U.S. households. We believe that we understand the financial needs of this middle income segment well:

| • | they have inadequate or no life insurance coverage; |

| • | they need help saving for retirement and other personal goals; |

| • | they need to reduce their consumer debt; and |

| • | they prefer to meet face-to-face when considering financial products. |

We believe that our educational approach and distribution model best position us to address these needs profitably, which traditional financial services firms have found difficult to accomplish.

Our Distribution Model

The high fixed costs associated with in-house sales personnel and salaried career agents and the smaller-sized sales transactions typical of middle income consumers have forced many other financial services companies to focus on more affluent consumers. Product sales to affluent consumers tend to be larger, generating more sizable commissions for the selling agent, who usually works on a full-time basis. As a result, this segment has become increasingly competitive. Our distribution model — borrowing aspects from franchising, direct sales and traditional insurance agencies — is designed to reach and serve middle income consumers efficiently. Key characteristics of our unique distribution model include:

| • | Independent entrepreneurs: Our sales representatives are independent contractors, building and operating their own businesses. This “business-within-a-business” approach means that our sales representatives are entrepreneurs who take responsibility for selling products, recruiting sales representatives, setting their own schedules and managing and paying the expenses associated with their sales activities, including office rent and administrative overhead. |

| • | Part-time opportunity: Our compensation approach accommodates varying degrees of individual sales representative activity, which allows us to use part-time sales representatives and gives us a variable cost structure for product sales. By offering a flexible part-time opportunity, we are able to attract a significant number of recruits who desire to earn supplemental income and generally concentrate on smaller-sized transactions typical of middle income consumers. Virtually all of our sales representatives begin selling our products on a part-time basis, which enables them to hold jobs while exploring an opportunity with us. |

| • | Incentive to build distribution: When a sale is made, the selling representative receives a commission, as does the representative who recruited him or her, which we refer to as override compensation. Override compensation is paid through several levels of the selling representative’s recruitment and supervisory organization. This structure motivates existing sales representatives to grow our sales force by providing them with commission income from the sales completed by their recruits. |

| • | Innovative compensation system: We have developed an innovative system for compensating our independent sales force. We advance to our representatives a significant portion of their insurance |

S-3

| commissions upon their submission of an insurance application and the first month’s premium payment. In addition to being a source of motivation for our sales force, this upfront payment provides our sales force with immediate cash flow to offset costs associated with originating the business. In addition, monthly production bonuses on term life insurance sales are paid to sales representatives whose downline sales organizations meet certain sales levels. With compensation primarily tied to sales activity, our compensation approach accommodates varying degrees of individual sales representative productivity, which allows us to use a large group of part-time representatives cost effectively and gives us a variable cost structure. In addition, we incentivize our Regional Vice Presidents (“RVPs”) with equity compensation, which aligns their interests with those of our stockholders. |

| • | Large dynamic sales force: The members of our sales force primarily target and serve their friends, family members and personal acquaintances through individually driven networking activities. We believe that this warm markets approach is an effective way to distribute our products because it facilitates face-to-face interaction initiated by a trusted acquaintance of the prospective customer, which is difficult to replicate using other distribution approaches. Due to the large size of our sales force, attrition and our active recruiting of new sales representatives, our sales force is constantly renewing itself by adding new members. By relying on a large and ever-renewing sales force that has access to and a desire to help friends, family members and personal acquaintances, we are able to reach a wide market without engaging costly media channels. |

| • | Sales force leadership: A sales representative who has built a successful organization can achieve the sales designation of RVP and can earn higher commissions and bonuses. RVPs are independent contractors. They open and operate offices for their sales organizations and devote their full attention to their Primerica businesses. RVPs also support and monitor the part-time sales representatives on whose sales they earn override commissions in compliance with applicable regulatory requirements. RVPs’ efforts to expand their businesses are a primary driver of our success. |

| • | Motivational culture: Through sales force recognition events and contests, we seek to create a culture that inspires our sales representatives and rewards them for their personal success. We believe this motivational environment is a major reason that many sales representatives join and achieve success in our business. |

These attributes have enabled us to build a large sales force in North America with approximately 92,000 sales representatives licensed to sell life insurance as of April 1, 2011. Approximately 22,500 of our sales representatives were also licensed to sell mutual funds in North America as of December 31, 2010.

Our Segments

While we view the size and productivity of our sales force as the primary drivers of our product sales, the majority of our revenue is not directly correlated to our sales volume in any particular period. Rather, our revenue is principally driven by our in-force book of term life insurance policies, our sale, maintenance and administration of investment and savings products and accounts, and our investment income. The following is a summary description of our segments:

| • | Term Life Insurance: We earn premiums on our in-force book of term life insurance policies, which are underwritten by our three life insurance subsidiaries. The term in-force book is commonly used in the insurance industry to refer to the aggregate policies issued by an insurance company that have not lapsed or been settled. Revenues from the receipt of premium payments for any given in-force policy are recognized over the multi-year life of the policy. This segment also includes investment income on the portion of our invested asset portfolio used to meet our required statutory reserves and targeted capital. |

S-4

| • | Investment and Savings Products: We earn commission and fee revenues from the distribution of mutual funds in the United States and Canada, variable and fixed annuities in the United States and segregated funds in Canada and from the associated administrative services we provide. We distribute these products on behalf of third parties, although we underwrite segregated funds in Canada. In the United States, the mutual funds that we distribute are managed by third parties such as American Funds, Franklin Templeton, Invesco, Legg Mason and Pioneer. In Canada, we sell Primerica-branded Concert™ mutual funds and the funds of several other third parties. The variable and fixed annuities that we distribute are underwritten by MetLife. Revenues associated with these products are composed of commissions and fees earned at the time of sale, fees based on the asset values of client accounts and recordkeeping and custodial fees charged on a per-account basis. |

| • | Corporate and Other Distributed Products: We also earn fees and commissions from the distribution of various third-party products, including loans, long-term care insurance, auto insurance, homeowners’ insurance, prepaid legal services and a credit information product, and from our mail-order student life insurance and short-term disability benefit insurance, which we underwrite through our New York insurance subsidiary. This segment also includes corporate income, including net investment income, and expenses not allocated to other segments, interest expense on our note payable to Citi and realized gains and losses on our invested asset portfolio. |

Our Strengths

Proven excellence in building and supporting a large independent financial services sales force. We believe success in serving middle income consumers requires generating and supporting a large distribution system, which we view as one of our core competencies. We have recruited more than 200,000 new sales representatives and assisted more than 34,000 recruits in obtaining life insurance licenses in each of the last six calendar years. Approximately 3,700 RVPs registered to attend one of our 12 regional meetings in 2010, and approximately 50,000 individuals attended our most recent convention in 2007. Our next convention is scheduled to take place in June 2011 at the Georgia Dome in Atlanta, Georgia. Our RVPs conduct thousands of meetings per month to introduce our business opportunity to new recruits. More than 500 instructors conducted approximately 5,400 classes in 2010 to help our sales representatives obtain requisite life insurance licenses and fulfill state-mandated licensing requirements. We have excelled at motivating and coordinating a large and geographically diverse, mostly part-time sales force by connecting with them through multiple channels of communication and providing innovative compensation programs and home office support.

Cost-effective access to middle income consumers. We have a proven ability to reach middle income consumers in a cost-effective manner. Our back-office systems, technology and infrastructure are designed to process a high volume of transactions efficiently. Because our part-time sales representatives are supplementing their income, they are willing to pursue smaller-sized transactions typical of middle income clients. Our unique distribution model avoids the higher costs associated with advertising and media channels.

Exclusive distribution. Our sales representatives sell financial products solely for us; therefore, we do not have to compete for shelf space with independent agents for the distribution of our products. We, in turn, do not distribute our principal products through alternative channels. This approach garners loyalty from our sales representatives and eliminates competition for home office resources. Having exclusive distribution helps us to price our products appropriately for our clients’ needs, establish competitive sales force compensation and maintain our profitability.

Scalable operating platform. We have a compensation and administration system designed to encourage our sales representatives to build their sales organizations, which gives us the capacity to expand our sales force and increase the volume of transactions we process and administer with minimal additional investment.

S-5

Conservative financial profile and risk management. We manage our risk profile through conservative product design and selection and other risk-mitigating initiatives. Our life insurance products are generally limited to term life and do not include the guaranteed minimum benefits tied to asset values that have recently caused industry disruption. We further reduce and manage our life insurance risk profile by reinsuring a significant majority of the mortality risk in our newly issued life insurance products. Furthermore, our invested asset portfolio is composed primarily of highly liquid, investment-grade securities and cash equivalents.

Experienced management team and sales force. We are led by a management team that has extensive experience in our business and a thorough understanding of our unique culture and business model. Our senior executives largely have grown up in the business. Our Co-Chief Executive Officers, John Addison and Rick Williams, both joined our company more than 20 years ago and were appointed Co-Chief Executive Officers in 1999. The 14 members of our senior management team have an average of 24 years of experience at Primerica. Equally important, our more successful sales representatives, who have become influential within our sales organization, also have significant longevity with us. Of our sales representatives, approximately 20,000 have been with us for at least ten years, and approximately 7,000 have been with us for at least 20 years.

Our Strategy

Our strategies are designed to leverage our core strengths to serve the vast and underserved middle income segment. These strategies include:

Grow our sales force. Our strategy to grow our sales force includes:

| • | Increasing the number of recruits. Our existing sales representatives replenish and grow our sales force through recruiting activities that generate a high volume of new recruits. Moreover, the introduction of new recruits to our business provides us with an opportunity for product sales, both to the recruits themselves and to their friends, family members and personal acquaintances. When our Co-Chief Executive Officers were appointed in 1999, they prioritized recruiting growth. The number of recruits more than doubled to over 202,000 in 2002, the highest annual number since the company’s inception up to that time. We have continued to increase the level of recruiting, with 221,920 recruits in 2009 and 231,390 recruits in 2010. We intend to continue to focus on recruiting through a number of initiatives launched in recent years, including a reduction in the upfront entry fee charged to new recruits to join our sales force, increased use of our electronic application technology and an expansion of early-stage compensation opportunities for new recruits. |

| • | Increasing the number of licensed sales representatives. We have launched a series of initiatives designed to increase the number of recruits who obtain life insurance licenses. Working with industry groups and trade associations, we seek to address unnecessary regulatory barriers to licensing qualified recruits. In addition, we continue to design and improve educational courses, training tools and incentives that are made available to help recruits prepare for state and provincial licensing examinations. |

| • | Growing the number of RVPs. We had approximately 4,000 RVPs as of December 31, 2010. The number of RVPs is an important factor in our sales force growth; as RVPs build their individual sales organizations, they become the primary driver of our sales force recruiting and licensing success. We continue to provide new technology to our sales representatives to enable RVPs to reduce the time spent on administrative responsibilities associated with their sales organizations so they can devote more time to sales and recruiting activities. The new technology, coupled with our equity award program, is designed to encourage more of our sales representatives to make the commitment to become RVPs. |

S-6

Increase our use of innovative technology. We expect to continue to invest in technology to make it easier for individuals to join our sales force, complete licensing requirements and build their own businesses. We provide our sales representatives, who are generally most active during nights and weekends and outside their own homes and offices, with access to innovative technology, including wireless communication devices and Internet record access, to facilitate straight-through-processing of the client information that they collect. In October 2010, in cooperation with Morningstar, Inc., a leading provider of independent investment research, we deployed Client Account Manager, a client portfolio management tool, to assist our sales representatives with monitoring individual client investment accounts. We expect this tool to create additional sales opportunities for our investment and savings products. We intend to continue to develop new analytical tools to help our sales representatives manage their businesses better and increase efficiency.

Enhance our product offerings. We will continue to enhance and refine the basic financial products we offer with features, riders and terms that are most appropriate for the market we serve and our distribution system. We typically select products that we believe are highly valued by middle income families, making it easy for sales representatives to feel confident selling them to individuals with whom they have a personal relationship. Prior product developments have included a 35-year term life insurance policy, new mutual fund families, other protection products and our Primerica DebtWatchers™ product. The enhancement of our product offerings increases our sources of revenue.

Risk Factors

There are a number of risks that you should understand before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk Factors” beginning on page S-13 of this prospectus supplement. These risks include, but are not limited to:

| • | Risks related to our distribution structure, such as: |

| • | our failure to continue to attract new recruits, retain sales representatives or maintain their licenses; |

| • | determinations that laws relating to business opportunities, franchising or pyramid schemes are applicable to our distribution model; |

| • | challenges to the independent contractor status of our sales representatives; and |

| • | violation of, or non-compliance with, applicable laws and regulations by us or our sales representatives, including misconduct or failure to protect the confidentiality of our clients’ information. |

| • | Risks related to our insurance business, such as: |

| • | our estimates regarding mortality and persistency may prove to be materially inaccurate; |

| • | the occurrence of a catastrophic event; |

| • | our methodologies and estimates regarding the valuation of our investments and the determination of whether a decline in the fair value of our invested assets is other-than-temporary may prove to be incorrect; |

| • | ratings downgrades in the financial strength ratings of our insurance subsidiaries; and |

| • | the failure of our reinsurers to perform their obligations. |

S-7

| • | Risks related to our investments and savings products business, such as: |

| • | a deterioration of the overall economic environment and savings and investment levels in the United States and Canada; |

| • | the failure of our investment and savings products to remain competitive with other investment options or the loss of our relationship with companies that offer mutual fund and variable annuity products; and |

| • | changes in laws and regulations, including heightened standards of conduct or more stringent licensing requirements, that could require us to alter our business practices. |

| • | Other risks, such as: |

| • | the loss of key personnel; and |

| • | conflicts of interest resulting from our relationships with Citi and Warburg Pincus. |

The Transactions

In this prospectus supplement, we refer to the series of transactions that occurred in connection with our initial public offering, including a corporate reorganization, certain reinsurance transactions, certain concurrent transactions, and a private sale by Citi to Warburg Pincus of our common stock and warrants, as the “Transactions.” We believe the Transactions gave us the opportunity to fold our years of experience, expertise and innovation into an organization with a more streamlined balance sheet. See the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations —The Transactions” beginning on page S-45 of this prospectus supplement.

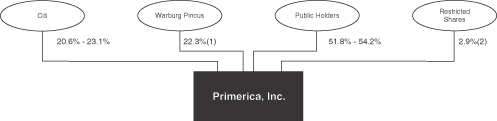

Our Ownership Structure

The following diagram depicts the ownership structure of our business immediately following the completion of this offering. Approximate percentage ownership is shown based on 73,759,838 shares of common stock outstanding as of April 1, 2011. The ownership percentages below vary depending on whether and the extent to which the underwriters exercise their over-allotment option.

| (1) | Does not include 4,103,110 shares of our common stock issuable upon exercise of warrants held by Warburg Pincus. These warrants have an exercise price of $18.00 per share. |

| (2) | Held primarily by U.S. employees and directors. Does not include 2,345,882 outstanding restricted stock units held by Canadian employees and sales force leaders. |

S-8

Conflicts of Interest

Immediately following completion of this offering, Citi will own between approximately 20.6% and 23.1% of our outstanding common stock, depending on whether and the extent to which the underwriters exercise their over-allotment option. Prior to this offering we have had, and after this offering we will continue to have, numerous commercial and contractual arrangements with affiliates of Citi, the selling stockholder. In addition, Citigroup Global Markets Inc., the sole book-running manager of this offering, is a wholly owned subsidiary of Citigroup Inc. The selling stockholder will receive all of the net proceeds of this offering. Because an affiliate of Citigroup Global Markets Inc. will receive more than 5% of the net proceeds of this offering, not including underwriting compensation, and it beneficially owns more than 10% of the shares prior to the closing of this offering, this offering is being conducted in compliance with Financial Industry Regulatory Authority (“FINRA”) Rule 5121 or any successor rule (“Rule 5121”). See the sections entitled “Risk Factors — Risks Related to Our Relationships with Citi and Warburg Pincus,” “Use of Proceeds” and “Underwriting” beginning on pages S-32, S-41 and S-127, respectively, of this prospectus supplement.

Recent Developments

We are currently in the process of finalizing our consolidated financial results for the three months ended March 31, 2011, and therefore our actual results for such period are not yet available. Based on our preliminary unaudited financial results for the three months ended March 31, 2011, we expect our total revenues for the first quarter of 2011 to be in the range of $266.0 million to $286.0 million, and expect our net income for such quarter to be in the range of $50.0 million to $55.0 million, or $0.65 to $0.72 per diluted share. The diluted earnings per share range reflects non-recurring income of (i) $0.07 for ceded premium recoveries as discussed in Note 6 to our consolidated and combined financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2010 (the “2010 Annual Report”), which is incorporated by reference into the accompanying prospectus; (ii) $0.02 for deferred policy acquisition cost (“DAC”)-related items; and (iii) $0.01 for income received from called fixed-income investments.

We added approximately 53,000 recruits during the first quarter of 2011, compared to approximately 58,000 recruits added during the first quarter of 2010. As of March 31, 2011, we had approximately 92,000 licensed sales representatives, compared to approximately 95,000 licensed sales representatives as of December 31, 2010. During the first quarter of 2011, we issued more than 51,000 term life insurance policies and had investment and savings product sales of approximately $1.1 billion, compared to approximately 52,000 and $970.0 million, respectively, in the prior year period.

The foregoing information constitutes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Please refer to the section entitled “Cautionary Statement Concerning Forward-Looking Statements” beginning on page S-39 of this prospectus supplement.

The preliminary financial data included above have been prepared by us, and our independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to such information. Our independent registered public accounting firm is in the process of conducting its review of our financial statements for the three months ended March 31, 2011. Such review could result in changes to the preliminary estimates indicated above. No assurance is made that our actual results of operations for the three months ended March 31, 2011 will be consistent with the foregoing estimates.

Our principal executive offices are located at 3120 Breckinridge Blvd., Duluth, Georgia 30099, and our telephone number is (770) 381-1000. Our website address is www.primerica.com. This reference to our website is an inactive textual reference only and is not a hyperlink. The contents of our website are not part of this prospectus supplement, and you should not consider the contents of our website in making an investment decision with respect to our securities.

S-9

The Offering

| Common stock to be sold by Citi in this offering |

• 12,000,000 shares (16.3% of our outstanding common stock) |

• 13,800,000 shares (18.7% of our outstanding common stock) if the underwriters exercise their over-allotment option in full

| Common stock to be held by Citi after this offering |

• 17,002,148 shares (23.1% of our outstanding common stock) |

| • 15,202,148 shares (20.6% of our outstanding common stock) if the underwriters exercise their over-allotment option in full |

| Common stock outstanding |

73,759,838 shares |

| Use of proceeds |

We will not receive any proceeds from the sale of shares of our common stock being offered hereby. |

| Stock exchange symbol |

Our common stock is listed on the NYSE under the trading symbol “PRI.” |

Throughout this prospectus supplement, unless otherwise indicated, all references to the number and percentage of shares of common stock outstanding, and percentage ownership information, assume the following:

| • | no exercise by Warburg Pincus of warrants to purchase 4,103,110 shares of our common stock at an exercise price of $18.00 per share; and |

| • | the number of shares of common stock excludes 2,345,882 shares issuable upon the lapse of outstanding restricted stock units. |

S-10

SUMMARY FINANCIAL AND OPERATING DATA

The summary statements of income data for the years ended December 31, 2010, 2009 and 2008 and the summary balance sheet data as of December 31, 2010 presented below have been derived from our consolidated and combined financial statements included in the 2010 Annual Report, which is incorporated by reference into the accompanying prospectus.

All financial data presented in this prospectus supplement have been prepared using U.S. generally accepted accounting principles (“GAAP”). The summary statements of income data may not be indicative of the revenues and expenses that would have existed or resulted if we had operated independently of Citi. The summary financial data are not necessarily indicative of the financial position or results of operations as of any future date or for any future period.

The unaudited summary pro forma statement of income data for the year ended December 31, 2010 have been derived from our consolidated and combined financial statements included in the 2010 Annual Report, which is incorporated by reference into the accompanying prospectus, and give effect to the Transactions as if they had occurred on January 1, 2010. The unaudited summary pro forma statement of income data are based on available information and assumptions that we believe are reasonable. The unaudited summary pro forma statement of income data are not necessarily indicative of the results of future operations or actual results that would have been achieved had the Transactions occurred on January 1, 2010.

The Transactions have and will continue to result in financial performance that is materially different from that reflected in the financial data that appear elsewhere in this prospectus supplement and are incorporated by reference into this prospectus supplement and the accompanying prospectus. Due to the timing of the Transactions and their impact on our financial position and results of operations, year-over-year comparisons of our financial position and results of operations will reflect significant non-comparable accounting transactions and account balances.

You should read the following summary financial and operating data in conjunction with the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Selected Financial Data” beginning on pages S-45 and S-43, respectively, of this prospectus supplement and with our consolidated and combined financial statements included in the 2010 Annual Report, which is incorporated by reference into the accompanying prospectus.

| Pro Forma(1) |

Actual |

|||||||||||||||

| Year ended December 31, |

Year ended December 31, |

|||||||||||||||

| 2010 |

2010 |

2009 |

2008(1) |

|||||||||||||

| (In thousands) | ||||||||||||||||

| Statements of income data |

||||||||||||||||

| Revenues: |

||||||||||||||||

| Direct premiums |

$2,181,074 | $ | 2,181,074 | $ | 2,112,781 | $ | 2,092,792 | |||||||||

| Ceded premiums |

(1,746,695 | ) | (1,450,367 | ) | (610,754 | ) | (629,074 | ) | ||||||||

| Net premiums |

434,379 | 730,707 | 1,502,027 | 1,463,718 | ||||||||||||

| Net investment income |

110,376 | 165,111 | 351,326 | 314,035 | ||||||||||||

| Commissions and fees |

382,940 | 382,940 | 335,986 | 466,484 | ||||||||||||

| Realized investment gains (losses), including other-than-temporary impairments |

34,145 | 34,145 | (21,970 | ) | (103,480 | ) | ||||||||||

| Other, net |

48,960 | 48,960 | 53,032 | 56,187 | ||||||||||||

| Total revenues |

1,010,800 | 1,361,863 | 2,220,401 | 2,196,944 | ||||||||||||

S-11

| Pro Forma(1) |

Actual |

|||||||||||||||

| Year ended December 31, |

Year ended December 31, |

|||||||||||||||

| 2010 |

2010 |

2009 |

2008(2) |

|||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Benefits and expenses: |

||||||||||||||||

| Benefits and claims |

189,499 | 317,703 | 600,273 | 938,370 | ||||||||||||

| Amortization of deferred policy acquisition costs |

|

96,646 |

|

168,035 | 381,291 | 144,490 | ||||||||||

| Insurance commissions |

18,235 | 19,904 | 34,388 | 23,932 | ||||||||||||

| Insurance expenses |

49,420 | 75,503 | 148,760 | 141,331 | ||||||||||||

| Sales commissions |

179,924 | 179,924 | 162,756 | 248,020 | ||||||||||||

| Interest expense |

27,809 | 20,872 | — | — | ||||||||||||

| Goodwill impairment |

— | — | — | 194,992 | ||||||||||||

| Other operating expenses |

183,855 | 180,779 | 132,978 | 152,773 | ||||||||||||

| Total benefits and expenses |

745,388 | 962,720 | 1,460,446 | 1,843,908 | ||||||||||||

| Income before income taxes |

265,412 | 399,143 | 759,955 | 353,036 | ||||||||||||

| Income taxes |

94,002 | 141,365 | 265,366 | 185,354 | ||||||||||||

| Net income |

$ | 171,410 | $ | 257,778 | $ | 494,589 | $ | 167,682 | ||||||||

| Segment data |

||||||||||||||||

| Revenues: |

||||||||||||||||

| Term Life Insurance |

$ | 463,901 | $ | 808,568 | $ | 1,742,065 | $ | 1,673,022 | ||||||||

| Investment and Savings Products |

361,807 | 361,807 | 300,140 | 386,508 | ||||||||||||

| Corporate and Other Distributed Products |

185,092 | 191,488 | 178,196 | 137,414 | ||||||||||||

| Segment income (loss) before income taxes: |

||||||||||||||||

| Term Life Insurance |

$ | 178,910 | $ | 299,044 | $ | 659,012 | $ | 511,819 | ||||||||

| Investment and Savings Products |

113,530 | 113,530 | 93,404 | 125,164 | ||||||||||||

| Corporate and Other Distributed Products |

27,028 | (13,431 | ) | 7,539 | (283,947 | ) | ||||||||||

| Operating data |

||||||||||||||||

| Number of new recruits |

|

231,390 | 221,920 | 235,125 | ||||||||||||

| Number of newly insurance-licensed sales representatives |

|

34,488 | 37,629 | 39,383 | ||||||||||||

| Average number of life-insurance licensed sales representatives during period |

|

96,840 | 100,569 | 99,361 | ||||||||||||

| Number of life-insurance licensed sales representatives (end of period) |

|

94,850 | 99,785 | 100,651 | ||||||||||||

| Number of term life insurance policies issued |

|

223,514 | 233,837 | 241,173 | ||||||||||||

| Client asset values (end of period) |

|

$ | 34,869 | $ | 31,303 | $ | 24,677 | |||||||||

| As of December 31, 2010 |

||||

| (In thousands) | ||||

| Balance sheet data |

||||

| Investments |

$ | 2,153,584 | ||

| Cash and cash equivalents |

126,038 | |||

| Due from reinsurers |

|

3,731,634 |

| |

| Deferred policy acquisition costs |

853,211 | |||

| Total assets |

9,884,306 | |||

| Future policy benefits |

4,409,183 | |||

| Note payable |

300,000 | |||

| Total liabilities |

8,452,814 | |||

| Stockholders’ equity |

1,431,492 | |||

| (1) | Unaudited |

| (2) | Includes a $191.7 million pre-tax charge due to a change in our deferred policy acquisition costs and reserve estimation approach implemented as of December 31, 2008. |

S-12

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the specific risks set forth below and the other information in this prospectus supplement, as well as the risks described in the 2010 Annual Report, which is incorporated by reference into the accompanying prospectus, and any risk factors set forth in our other filings with the Securities and Exchange Commission (the “SEC”) pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. If any of these risks actually materializes, our business, financial condition and results of operations could be materially adversely affected. As a result, the trading price of our common stock could decline and you could lose part or all of your investment. These risks are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also materially affect our business, financial condition and results of operations. See the sections entitled “Where You Can Find More Information” beginning on page S-133 of this prospectus supplement and page 23 of the accompanying prospectus.

Risks Related to Our Distribution Structure

Our failure to continue to attract new recruits, retain sales representatives or maintain the licensing of our sales representatives would materially adversely affect our business.

New sales representatives provide us with access to new referrals, enable us to increase sales, expand our client base and provide the next generation of successful sales representatives. As is typical with insurance and distribution businesses, we experience a high rate of turnover among our part-time sales representatives, which requires us to attract, retain and motivate a large number of sales representatives. Recruiting is performed by our current sales representatives, and the effectiveness of our recruiting is generally dependent upon our reputation as a provider of a rewarding and potentially lucrative income opportunity, as well as the general competitive and economic environment. The motivation of recruits to complete their training and licensing requirements and to commit to selling our products is largely dependent upon the effectiveness of our compensation and promotional programs and the competitiveness of such programs compared with other companies, including other part-time business opportunities.

If our new business opportunities and products do not generate sufficient interest to attract new recruits, motivate them to become licensed sales representatives and incentivize them to sell our products and recruit other new sales representatives, our business would be materially adversely affected.

Furthermore, if we or any other direct sales businesses with a similar distribution structure engage in practices resulting in increased negative public attention for our business, the resulting reputational challenges could adversely affect our ability to attract new recruits. Direct sales companies such as ours can be the subject of negative commentary on website postings and other non-traditional media. This negative commentary can spread inaccurate or incomplete information about the direct sales industry in general or our company in particular, which can make our recruiting more difficult.

Certain of our key RVPs have large sales organizations that include thousands of downline sales representatives. These key RVPs are responsible for attracting, motivating, supporting and assisting the sales representatives in their sales organizations. The loss of one or more key RVPs, together with a substantial number of their sales representatives, for any reason, including movement to a competitor, or any other event that causes the departure of a large number of sales representatives, could materially adversely affect our financial results and could impair our ability to attract new sales representatives.

S-13

There are a number of laws and regulations that could apply to our distribution model, which subject us to the risk that we may have to modify our distribution structure.

In the past, certain direct sales distribution models have been subject to challenge under various laws, including laws relating to business opportunities, franchising, pyramid schemes and unfair or deceptive trade practices.

In general, state business opportunity and franchise laws in the United States prohibit sales of business opportunities or franchises unless the seller provides potential purchasers with a pre-sale disclosure document that has first been filed with a designated state agency and grants purchasers certain legal recourse against sellers of business opportunities and franchises. In Canada, the provinces of Alberta, Ontario, New Brunswick and Prince Edward Island have enacted legislation dealing with franchising, which typically requires mandatory disclosure to prospective franchisees.

We have not been, and are not currently, subject to business opportunity laws because the amounts paid by our new representatives to us (i) are less than the minimum thresholds set by many state statutes and (ii) are not fees paid for the right to participate in a business, but rather are for bona fide expenses such as state-required insurance examinations and pre-licensing training. We have not been, and are not currently, subject to franchise laws for similar reasons. However, there is a risk that a governmental agency or court could disagree with our assessment or that these laws and regulations could change. In addition, the Federal Trade Commission (the “FTC”) is in the process of promulgating a revised Business Opportunity Rule. If enacted in the form of the current proposal as recommended by the FTC staff, we do not believe the revised rule would apply to our company. However, it could be broadened prior to enactment or interpreted after enactment in a manner inconsistent with our interpretation. Becoming subject to business opportunity or franchise laws or regulations could require us to provide certain disclosures and regulate the manner in which we recruit our sales representatives that may increase the expense of, or adversely impact our success in, recruiting new sales representatives and make it more difficult for us to successfully attract and recruit new sales representatives.

There are various laws and regulations that prohibit fraudulent or deceptive schemes known as pyramid schemes. In general, a pyramid scheme is defined as an arrangement in which new participants are required to pay a fee to participate in the organization and then receive compensation primarily for recruiting other persons to participate, either directly or through sales of goods or services that are merely disguised payments for recruiting others. The application of these laws and regulations to a given set of business practices is inherently fact-based and, therefore, is subject to interpretation by applicable enforcement authorities. Our representatives are paid by commissions based on sales of our products and services to bona fide purchasers, and for this and other reasons we do not believe that we are subject to laws regulating pyramid schemes. Moreover, our representatives are not required to purchase any of the products marketed by us. However, even though we believe that our distribution practices are currently in compliance with, or exempt from, these laws and regulations, there is a risk that a governmental agency or court could disagree with our assessment or that these laws and regulations could change, which may require us to cease our operations in certain jurisdictions or result in other costs or fines.

There are also federal, state and provincial laws of general application, such as the Federal Trade Commission Act (the “FTC Act”), and state or provincial unfair and deceptive trade practices laws that could potentially be invoked to challenge aspects of our recruiting of sales representatives and compensation practices. In particular, our recruiting efforts include promotional materials for recruits that describe the potential opportunity available to them if they join our sales force. These materials, as well as our other recruiting efforts and those of our sales representatives, are subject to scrutiny by the FTC and state and provincial enforcement authorities with respect to misleading statements, including misleading earnings claims made to convince potential new recruits to join our sales force. If claims made by us or by our sales representatives are deemed to be misleading, it could result in violations of the FTC Act or comparable state and provincial statutes prohibiting unfair or deceptive trade practices or result in reputational harm.

S-14

Being subject to, or out of compliance with, the aforementioned laws and regulations could require us to change our distribution structure, which could materially adversely affect our business, financial condition and results of operations.

There may be adverse tax and employment law consequences if the independent contractor status of our sales representatives is successfully challenged.

Our sales representatives are independent contractors who operate their own businesses. In the past, we have been successful in defending our company in various contexts before courts and administrative agencies against claims that our sales representatives should be treated like employees. Although we believe that we have properly classified our representatives as independent contractors, there is nevertheless a risk that the Internal Revenue Service (“IRS”) or another authority will take a different view. Furthermore, the tests governing the determination of whether an individual is considered to be an independent contractor or an employee are typically fact sensitive and vary from jurisdiction to jurisdiction. Laws and regulations that govern the status and misclassification of independent sales representatives are subject to change or interpretation by various authorities.

In September 2010, legislation was introduced in Congress known as the Fair Playing Field Act of 2010 (the “Fair Playing Field Act”), which, if enacted, would require the Department of the Treasury to prospectively eliminate Section 530 of the Revenue Act of 1978 (“Section 530”). Section 530 currently prevents the IRS from reclassifying independent contractors as employees if the company has consistently treated the workers as independent contractors and has a reasonable basis (such as an IRS ruling or judicial precedent) for its independent contractor classification. The proposed legislation would also require businesses that use independent contractors on a regular and ongoing basis to provide workers with a written notice informing them of their federal tax obligations, of the employment laws that do not apply to them, and of their right to seek a determination of their employment status from the IRS. The White House budget proposal includes provisions similar to those in the Fair Playing Field Act and allocates $25 million to the Department of Labor (“DOL”) for additional enforcement relating to the misclassification of workers as independent contractors. Neither the White House Budget proposal nor the proposed Fair Playing Field Act expressly changes the standard for distinguishing between employees and independent contractors.

If a federal, state or provincial authority or court enacts legislation or adopts regulations that change the manner in which employees and independent contractors are classified or makes any adverse determination with respect to some or all of our independent contractors, we could incur significant costs in complying with such laws and regulations, including, in respect of tax withholding, social security payments and recordkeeping, or we may be required to modify our business model, any of which could have a material adverse effect on our business, financial condition and results of operations. In addition, there is the risk that we may be subject to significant monetary liabilities arising from fines or judgments as a result of any such actual or alleged non-compliance with federal, state, or provincial tax or employment laws or with respect to any applicable employee benefit plan.

Our or our sales representatives’ violation of or non-compliance with laws and regulations and the related claims and proceedings could expose us to material liabilities.

Extensive federal, state, provincial and local laws regulate our products and our relationships with our clients, imposing certain requirements that our sales representatives must follow. The laws and regulations applicable to our business include those promulgated by FINRA; the SEC; the Municipal Securities Rulemaking Board (the “MSRB”); the FTC; and state insurance, lending and securities regulatory agencies in the United States. In Canada, the following Canadian regulatory authorities have responsibility for us: the Office of the Superintendent of Financial Institutions Canada (“OSFI”); the Financial Transactions and Reports Analysis Centre of Canada (“FINTRAC”); the Financial Consumer Agency of Canada (“FCAC”); the Mutual Fund

S-15

Dealers Association of Canada (the “MFDA”); and provincial and territorial insurance regulators and provincial and territorial securities regulators. At any given time, we may have pending state, federal or provincial examinations or inquiries of our investment and savings products, insurance or loan businesses. In addition to imposing requirements that representatives must follow in their dealings with clients, these laws and rules generally require us to maintain a system of supervision to attempt to ensure that our sales representatives comply with these requirements. We have developed policies and procedures to comply with these laws. However, despite these compliance and supervisory efforts, the breadth of our operations and the broad regulatory requirements could result in oversight failures and instances of non-compliance or misconduct on the part of our sales representatives.

From time to time, we are subject to private litigation as a result of alleged misconduct by our sales representatives. Examples include claims that a sales representative’s failure to disclose underwriting-related information regarding the insured on an insurance application resulted in the denial of a life insurance policy claim, and with respect to investment and savings products sales, errors or omissions that a representative made in connection with an account. Non-compliance or misconduct by our sales representatives could result in adverse findings in either examinations or litigation and could subject us to sanctions, significant monetary liabilities, restrictions on or the loss of the operation of our business, claims against us or reputational harm, any of which could have a material adverse effect on our business, financial condition and results of operations.

Any failure to protect the confidentiality of client information could adversely affect our reputation and have a material adverse effect on our business, financial condition and results of operations.

Pursuant to federal laws, various federal regulatory and law enforcement agencies have established rules protecting the privacy and security of personal information. In addition, most states and some provinces have enacted laws, which vary significantly from jurisdiction to jurisdiction, to safeguard the privacy and security of personal information. Many of our sales representatives and employees have access to and routinely process personal information of clients through a variety of media, including the Internet and software applications. We rely on various internal processes and controls to protect the confidentiality of client information that is accessible to, or in the possession of, our company, our employees and our sales representatives. We have a significant number of sales representatives and employees, and it is possible that a sales representative or employee could, intentionally or unintentionally, disclose or misappropriate confidential client information. If we fail to maintain adequate internal controls, including any failure to implement newly required additional controls, or if our sales representatives or employees fail to comply with our policies and procedures, misappropriation or intentional or unintentional inappropriate disclosure or misuse of client information could occur. Such internal control inadequacies or non-compliance could materially damage our reputation or lead to civil or criminal penalties, which, in turn, could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Insurance Business and Reinsurance

We may face significant losses if our actual experience differs from our expectations regarding mortality or persistency.

We set prices for life insurance policies based upon expected claim payment patterns derived from assumptions we make about the mortality rates, or likelihood of death, of our policyholders in any given year. The long-term profitability of these products depends upon how our actual mortality rates compare to our pricing assumptions. For example, if mortality rates are higher than those assumed in our pricing assumptions, we could be required to make more death benefit payments under our life insurance policies or to make such payments sooner than we had projected, which may decrease the profitability of our term life insurance products and result in an increase in the cost of our subsequent reinsurance transactions.

The prices and expected future profitability of our life insurance products are also based, in part, upon assumptions related to persistency, which is the probability that a policy will remain in force from one period to

S-16

the next. Actual persistency that is lower than our persistency assumptions could have an adverse effect on profitability, especially in the early years of a policy, primarily because we would be required to accelerate the amortization of expenses we deferred in connection with the acquisition of the policy. Actual persistency that is higher than our persistency assumptions could have an adverse effect on profitability in the later years of a block of policies because the anticipated claims experience is higher in these later years. If actual persistency is significantly different from that assumed in our pricing assumptions, our reserves for future policy benefits may prove to be inadequate. We are precluded from adjusting premiums on our in-force business during the initial term of the policies, and our ability to adjust premiums on in-force business after the initial policy term is limited by our insurance policy forms to the maximum premium rates in the policy.

Our assumptions and estimates regarding persistency and mortality require us to make numerous judgments and, therefore, are inherently uncertain. We cannot determine with precision the actual persistency or ultimate amounts that we will pay for actual claim payments on a block of policies, the timing of those payments, or whether the assets supporting these contingent future payment obligations will increase to the levels we estimate before payment of claims. If we conclude that our reserves, together with future premiums, are insufficient to cover actual or expected claims payments and the scheduled amortization of our DAC assets, we would be required to first accelerate our amortization of the DAC assets and then increase our reserves and incur income statement charges for the period in which we make the determination, which could materially adversely affect our business, financial condition and results of operations.

The occurrence of a catastrophic event could materially adversely affect our business, financial condition and results of operations.

Our insurance operations are exposed to the risk of catastrophic events, which could cause a large number of premature deaths of our insureds. Catastrophic events include wars and other military actions, terrorist attacks, natural or man-made disasters and pandemics or other widespread health crises. Catastrophic events are not contemplated in our actuarial mortality models. A catastrophic event could also cause significant volatility in global financial markets and disrupt the economy. Although we have ceded a significant majority of our mortality risk to reinsurers since the mid-1990s, a catastrophic event could cause a material adverse effect on our business, financial condition and results of operations. Claims resulting from a catastrophic event could cause substantial volatility in our financial results for any quarter or year and could also materially harm the financial condition of our reinsurers, which would increase the probability of default on reinsurance recoveries. Our ability to write new business could also be adversely affected.

In addition, most of the jurisdictions in which our insurance subsidiaries are admitted to transact business require life insurers doing business within the jurisdiction to participate in guaranty associations, which raise funds to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or failed issuers. It is possible that a catastrophic event could require extraordinary assessments on our insurance companies, which may have a material adverse effect on our business, financial condition and results of operations.

Our insurance business is highly regulated, and statutory and regulatory changes may materially adversely affect our business, financial condition and results of operations.

Life insurance statutes and regulations are generally designed to protect the interests of the public and policyholders. Those interests may conflict with your interests as a stockholder. Currently, in the United States, the power to regulate insurance resides almost exclusively with the states. Much of this state regulation follows model statutes or regulations developed or amended by the National Association of Insurance Commissioners (the “NAIC”), which is composed of the insurance commissioners of each U.S. jurisdiction. The NAIC re-examines and amends existing model laws and regulations (including holding company regulations) in addition to determining whether new ones are needed.

S-17

The laws of the various U.S. jurisdictions grant insurance departments broad powers to regulate almost all aspects of our insurance business. The U.S. Congress continues to examine the current condition of U.S. state-based insurance regulation to determine whether to impose federal regulation and to allow optional federal insurance company incorporation. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) created an Office of Federal Insurance Reform that will, among other things, study methods to modernize and improve insurance regulation, including uniformity and the feasibility of federal regulation. We cannot predict with certainty whether, or in what form, reforms will be enacted and, if so, whether the enacted reforms will materially affect our business. Changes in federal statutes, including the Gramm-Leach-Bliley Act and the McCarran-Ferguson Act, financial services regulation and federal taxation, in addition to changes to state statutes and regulations, may be more restrictive than current requirements or may result in higher costs, and could materially adversely affect the insurance industry and our business, financial condition and results of operations.

Provincial and federal insurance laws regulate many aspects of our Canadian insurance business. Changes to provincial or federal statutes and regulations may be more restrictive than current requirements or may result in higher costs, which could materially adversely affect the insurance industry and our business, financial condition and results of operations. We have also entered into an undertaking agreement with OSFI in connection with our initial public offering and the Transactions pursuant to which we have agreed to provide OSFI certain information, including advance notice, where practicable, of certain corporate actions. If we fail to comply with our undertaking to OSFI or if OSFI determines that our corporate actions do not comply with applicable Canadian law, Primerica Life Insurance Company of Canada (“Primerica Life Canada”), our Canadian life insurance company, could face sanctions or fines, and Primerica Life Canada could be subject to increased capital requirements or other requirements deemed appropriate by OSFI.

We received approval from the Minister of Finance (Canada) under the Insurance Companies Act (Canada) in connection with our indirect acquisition of Primerica Life Canada. The Minister expects that a person controlling a federal insurance company will provide ongoing financial, managerial or operational support to its subsidiary should such support prove necessary, and has required us to sign a support principle letter to that effect. This ongoing support may take the form of additional capital, the provision of managerial expertise or the provision of support in such areas as risk management, internal control systems and training. However, the letter does not create a legal obligation on the part of the person to provide the support. In the event that OSFI determines Primerica Life Canada is not receiving adequate support from us under applicable Canadian law, Primerica Life Canada may be subject to increased capital requirements or other requirements deemed appropriate by OSFI.

If there were to be extraordinary changes to statutory or regulatory requirements, we may be unable to fully comply with or maintain all required insurance licenses and approvals. Regulatory authorities have relatively broad discretion to grant, renew and revoke licenses and approvals. If we do not have all requisite licenses and approvals, or do not comply with applicable statutory and regulatory requirements, the regulatory authorities could preclude or temporarily suspend us from carrying on some or all of our insurance activities or monetarily penalize us, which could materially adversely affect our business, financial condition and results of operations. We cannot predict with certainty the effect any proposed or future legislation or regulatory initiatives may have on the conduct of our business. See the section entitled “Business — Regulation — Regulation of Insurance Products” beginning on page S-106 of this prospectus supplement.

A decline in risk-based capital of our insurance subsidiaries could result in increased scrutiny by insurance regulators and ratings agencies and have a material adverse effect on our business, financial condition and results of operations.

Each of our insurance subsidiaries is subject to risk-based capital (“RBC”) standards and other minimum statutory capital and surplus requirements (in Canada, minimum continuing capital and surplus requirements (“MCCSR”), and Tier 1 capital ratio requirements) imposed under the laws of its respective jurisdiction of

S-18

domicile. The RBC formula for U.S. life insurance companies generally establishes capital requirements relating to insurance, business, asset and interest rate risks. Our U.S. insurance subsidiaries are required to report their results of RBC calculations annually to the applicable state department of insurance and the NAIC. Our Canadian insurance subsidiary is required to provide its MCCSR and Tier 1 capital ratio calculations to the Canadian regulators. The capitalization of our life insurance subsidiaries is maintained at levels in excess of the effective minimum requirements of the NAIC in the United States and OSFI in Canada. These minimum standards are 100% of the Company Action Level of RBC for our U.S. insurance subsidiaries and, for our Canadian insurance subsidiary, MCCSR of 150% and a Tier 1 capital ratio of 105%. The capital required is the same for both the MCCSR and Tier 1 ratios, however the capital available for the Tier 1 ratio excludes certain assets as prescribed by OSFI. To comply with RBC levels prescribed by the regulators of our insurance subsidiaries, our initial capitalization levels were based on our estimates and assumptions regarding our business. In any particular year, statutory capital and surplus amounts and RBC and MCCSR ratios may increase or decrease depending on a variety of factors, including the amount of statutory income or losses generated by our insurance subsidiaries (which is sensitive to equity and credit market conditions), the amount of additional capital our insurance subsidiaries must hold to support business growth, changes in their reserve requirements, the value of certain fixed-income and equity securities in their investment portfolios, the credit ratings of investments held in their portfolios, the value of certain derivative instruments, changes in interest rates, credit market volatility, changes in consumer behavior, as well as changes to the NAIC’s RBC formula or the MCCSR calculation of OSFI. Many of these factors are outside of our control.

Our financial strength and credit ratings are significantly influenced by the statutory surplus amounts and RBC and MCCSR ratios of our insurance company subsidiaries. Ratings agencies may change their internal models, effectively increasing or decreasing the amount of statutory capital we must hold to maintain our current ratings. In addition, ratings agencies may downgrade the invested assets held in our portfolio, which could result in a reduction of our capital and surplus by means of other-than-temporary impairments. Changes in statutory accounting principles could also adversely impact our ability to meet minimum RBC, MCCSR and statutory capital and surplus requirements. Furthermore, during the initial years of operation after the reinsurance transactions, which we entered into in March 2010 in connection with our initial public offering (the “Citi reinsurance transactions”), our statutory capital and surplus may prove to be insufficient and we may incur ongoing statutory losses as a result of the high amounts of upfront commissions that are paid to our sales force in connection with the issuance of term life insurance policies. The statutory capital and surplus strain associated with payment of these commissions will be of greater impact during the initial years of our operations as a public company, as the in-force book of business, net of the Citi reinsurance transactions, grows. There is no assurance that our insurance subsidiaries will not need additional capital or that we will be able to provide it to maintain the targeted RBC and MCCSR levels to support their business operations. For a description of the Citi reinsurance transactions, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations — The Transactions” beginning on page S-45 of this prospectus supplement.

The failure of any of our insurance subsidiaries to meet its applicable RBC and MCCSR requirements or minimum capital and surplus requirements could subject it to further examination or corrective action imposed by insurance regulators, including limitations on its ability to write additional business, supervision by regulators or seizure or liquidation. Any corrective action imposed could have a material adverse effect on our business, financial condition and results of operations. A decline in RBC or MCCSR also limits our ability to take dividends or distributions out of the insurance subsidiary and could be a factor in causing ratings agencies to downgrade the financial strength ratings of all our insurance subsidiaries. Such downgrades would have an adverse effect on our ability to write new insurance business and, therefore, could have a material adverse effect on our business, financial condition and results of operations.

A ratings downgrade by a ratings organization could materially adversely affect our business, financial condition and results of operations.

We have three insurance subsidiaries. Primerica Life Insurance Company (“Primerica Life”), our Massachusetts domiciled life insurance company; National Benefit Life Insurance Company (“NBLIC”), our

S-19

New York life insurance company; and Primerica Life Canada, our Canadian life insurance company, have each been assigned a financial strength rating of A+ (superior; second highest of 16 ratings) by A.M. Best Co. (“A.M. Best”) with a negative outlook. Primerica Life currently also has an insurer financial strength rating of AA- (very strong; fourth highest of 22 ratings) from Standard & Poor’s with a stable outlook. NBLIC and Primerica Life Canada are not rated by Standard & Poor’s.

Financial strength ratings are an important factor in establishing the competitive position of insurance companies. Such ratings are important to maintaining public confidence in us and our ability to market our insurance products. Ratings organizations review the financial performance and financial conditions of insurance companies, including our three insurance subsidiaries, and provide opinions regarding financial strength, operating performance and ability to meet obligations to policyholders. A downgrade in the financial strength ratings of our insurance subsidiaries, or the announced potential for a downgrade, could have a material adverse effect on our business, financial condition and results of operations, including by:

| • | reducing sales of insurance products; |

| • | adversely affecting our relationships with our sales representatives; |

| • | materially increasing the amount of policy cancellations by our policyholders; |

| • | requiring us to reduce prices to remain competitive; and |

| • | adversely affecting our ability to obtain reinsurance at reasonable prices or at all. |