Attached files

| file | filename |

|---|---|

| EX-32.1 - STEELE OCEANIC CORP | src_ex32.htm |

| EX-21 - STEELE OCEANIC CORP | src_ex21.htm |

| EX-31.2 - STEELE OCEANIC CORP | src_ex31-2.htm |

| EX-31.1 - STEELE OCEANIC CORP | src_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended

|

Commission File Number

|

|

|

December 31, 2010

|

333-143970

|

STEELE RESOURCES CORPORATION

|

Nevada

|

75-3232682

|

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification)

|

Principal Executive Offices:

3081 Alhambra Drive, Suite 208

Cameron Park, CA 95682

(530) 672-6225

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

None

|

None

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

Title of Each Class

|

|

Common Stock $0.001 Par Value

|

Indicate by check mark if the registrant is a well-known seasoned issued, as defined in Rule 405 of the Securities Act.

|

Yes

|

No

|

X

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes

|

No

|

X

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes

|

X

|

No

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

|

No

|

X

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

[ ] Large accelerated filer

[ ] Accelerated filer

[ ] Non-accelerated filer (do not check if a smaller reporting company)

[X] Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes

|

No

|

X

|

As of June 30, 2010 the aggregate value of the voting stock held by non-affiliates of the registrant, computed by reference to the average of the bid and ask price on such date was approximately $475,000 based upon the average price of $0.25 per share.

As of March 28, 2011, the Registrant had outstanding 100,383,334 shares of common stock.

Transitional Small Business Disclosure Format: Yes [ ] No [X]

Documents Incorporated by Reference

Certain exhibits required by Item 15 have been incorporated by reference from Steele Resources’ previously filed Form 8-K’s, Form 10-Q’s and Form 10-K’s.

ii

TABLE OF CONTENTS

|

Page of

Report

|

|

iii

PART I

ITEM 1. BUSINESS

Corporate Overview

Steele Resources Corporation (formerly Steele Recording Corporation) was incorporated in the state of Nevada on February 12, 2007, at which time it was deemed a “shell company” carrying on minimal operations in the business of producing, acquiring, licensing and distribution of recorded music.

On June 17, 2010 the Company entered into and consummated a Plan and Agreement of Reorganization between the Company and Steele Resources, Inc. and certain stockholders of Steele Resources, Inc. (the “Reorganization”). Pursuant to the Reorganization, the Company acquired all of the issued and outstanding shares of Steele Resources, Inc., a Nevada Corporation (“SRI”) in exchange for 5,730,000 shares of the common stock of the Company. As a result of the Reorganization, SRI became a wholly-owned subsidiary of the Company and the four former stockholders of SRI became owners, in the aggregate, of approximately 60% of the Company’s outstanding common stock. In conjunction with this Reorganization, one previous officer and Director of the Company resigned and the Board appointed new officers and Directors. See below for further information on the new executive officers and Directors of the Company.

As a result of the Reorganization, the Company acquired the business operations of SRI which became the Company’s primary business activity consisting of mining property acquisition, mineral exploration and development and mining services with a portfolio of precious metals exploration properties located near producing regions primarily within the state of Nevada. As a result of the Reorganization SRC is no longer involved in the previous business of producing, acquiring, licensing and distribution of recorded music. The Company also changed its name from "Steele Recording Corporation" to "Steele Resources Corporation".

Business of Steele Resources Corporation

Our wholly-owned subsidiary, SRI, was incorporated in the state of Nevada on May 27, 2010 as an exploration and mining company which is focused on identifying and developing advanced stage precious metal exploration projects which show potential to achieve full production. The overall business strategy is to identify, explore and, if warranted, develop and operate mineral exploration properties and to provide mine exploration and operations services to mining properties located initially in the Western United States and Nevada in particular. The initial business strategy is to service the niche market between speculative exploration and large scale production. This niche market lies between, at one end, relatively small companies which have conducted preliminary mineral exploration on their properties and, at the other end, companies which conduct major mining operations which could generally be defined as properties having gold mineral reserves in excess of 2,000,000 ounces. Within this niche market, SRI believes there are a large number of projects in Nevada and other parts of the United States that have excellent potential but do not meet the size requirements for development by the major operators in the mining industry.

SRI’s business plan will be to evaluate properties which have considerable amounts of exploration already completed and potential resources identified yet are not of sufficient size and scope for development by the major mining companies. Based on management’s extensive experience in evaluating geological exploration data and exploration feasibility, SRI will seek to identify those exploration properties which offer the best potential for producing significant gold and silver reserves and offer favorable conditions, if warranted, for the future efficient development of the property to reach a production stage. However, the Company and SRI together represent a relatively new, exploration stage company. There is no assurance that a commercially viable mineral deposit exists on any of the properties currently leased by SRI and further exploration will be required before an evaluation of the economic and regulatory feasibility of the properties can be determined.

1

Once suitable projects are identified, SRI will utilize its contract services division in order to perform further exploration drilling, prepare feasibility studies, mine modeling, on-site construction and advance stage project engineering with the goal of establishing, if warranted, a producing mine project. Exploration services would also include securing necessary permits, environmental compliance and remediation plans.

SRI will provide its mine exploration services in one of two ways. The first approach is for SRI to acquire part or all of the mineral rights to a designated property. In this approach SRI would prepare a comprehensive mining development plan including the tasks to be accomplished, the timetable for each phase of the plan and the nature and number of service providers to perform the tasks. The exploration plan would include a detailed budget, payment schedules and a percentage royalty from any gold or silver produced, if the property is found worthy of development. SRI would then assemble the necessary service providers to carryout the exploration and, if warranted, development plan. In this approach, SRI would fund the property exploration and possible development itself in which case it would own all or a substantial portion of all the mineral production, if any, which might be realized from that particular property with a royalty typically paid to the property owner or the mineral rights assignor. This approach would also typically include certain work requirements and expenditure requirements in order to maintain the exploration/mineral rights.

The second approach will be to contract with the property owner or mineral rights holder to provide the services listed above on a contract fee basis which would include a percentage royalty on any mineral production which is actually achieved. This approach would have SRI acting in the nature of a general contractor. SRI would prepare the same type of comprehensive mining exploration plan as described above and assemble the necessary service providers to carry out the plan.

Suitable projects will typically have the following characteristics:

|

|

·

|

properties located near existing mineral zones initially focusing in the USA;

|

|

|

·

|

properties having a considerable amount of exploration completed; and

|

|

|

·

|

properties not of sufficient size for the major mining companies to advance themselves.

|

Success in gold or other mineral exploration is dependent upon a number of factors including, but not limited to, quality of management, quality and availability of geological data and the expertise to interpret it, availability of trained miners and equipment and availability of exploration capital. The exploration process can be long and costly. Due to these and other factors, the probability of our identifying individual prospects having commercially significant reserves cannot be predicted.

Properties/Interests Acquired

All of the properties currently leased by SRI have a certain amount of prior exploration data available however none of the properties currently have any probable or proven reserves. Consequently, there is no assurance that a commercially viable mineral deposit exists on any of the properties and further exploration will be required before an evaluation of the economic and regulatory feasibility of the properties can be determined.

2

Comstock-Tyler Project

SRI’s initial exploration project consists of 30 mineral claims covering approximately 600 acres of property owned by the Bureau of Land Management (“BLM”) and referred to as the “Comstock-Tyler Project”. These claims were registered with the BLM on June 7, 2010 and allows SRI the right to conduct thorough mineral and precious metal exploration. Such exploration will be subject to typical notification to the BLM and the Nevada Department of Environmental Protection and the posting of remediation bonds as the exploration process continues. The property is located at Township 16N Range 20E Section 1 which is approximately 5 miles southwest of Virginia City, NV and lies in the historically producing Comstock Mining District. Corresponding property filings have been recorded in the Nevada Counties of Washoe and Storey reflecting SRI’s mineral rights in the Comstock-Tyler Project. The property has been physically examined in the field by the Company's senior geologist and an independent geologist with over 30 years of experience in this particular district. Pursuant to an agreement with Riggs and Allen Mineral Development LLC (“Riggs and Allen”), which performed the property staking, SRI agreed to pay a total of $60,000 in cash and stock and has granted Riggs and Allen a production royalty of 1% of the Net Smelter Returns (“NSR”) from any production realized from the property. Riggs and Allen have been issued 30,000 shares of Common Stock of SRC and cash payments of $17,580 with an additional $12,420 paid to perfect the mineral claims. SRI has the right to repurchase the 1% NSR from Riggs and Allen for $1,000,000.

The property does not have any known mineral reserves. The exploration plan is currently underway and is designed to explore the extent of gold mineralization on known fault and vein structures. After early geology and mapping by SRC staff, the company intends to have a full geophysical survey of the property completed. Based on the results of the survey, and upon receiving approved exploration permits from the appropriate government agencies, SRC will commence a multi-phase drill program consisting of 10,000 linear feet of drilling.

Fairview Hunter Mine Project

On September 24, 2010 our subsidiary SRI entered into an Asset Purchase Agreement pursuant to which SRI acquired a mineral lease agreement dated July 19, 2010 relating to property referred to as the Fairview Hunter Mine Project (the “Fairview Hunter Project”). The property is comprised of 115 mineral claims covering approximately 2,300 acres located 30 miles southeast of Fallon, Nevada. The Fairview Hunter Project lease has a term of ten years (through July 2020) and annual lease payments commencing at $25,000 and ending at $50,000 in the fifth year of the lease (2015). The Lessor also retains a production royalty of 3% of the NSR from the leased property of which SRI can buyout up to 2% of such royalty upon payment of $1,000,000 per 1% royalty amount. The lease does not specify dollar commitments for any development and allows SRI complete discretion as to conducting exploration or development activity on the property. The lease provides for SRI to pay all taxes and assessments on the property and pay all fees to the BLM or the Nevada mining agencies relating to the mining exploration or any future development of the property. The lease can be extended automatically for so long as SRI is engaged in Mining Operations on the expiration date of the lease.

The property is located approximately 30 miles southeast of Fallon, NV and occupies the northern and central portions of the historic Fairview Mining District. The topography consists of moderate to steep hilly terrain in the southern portion, becoming pediment-covered in the north with gentle slopes and numerous intermittent stream channels. Several old prospects, adits and shafts are scattered throughout the property. The project has recently had drilling conducted and two primary zones have been identified for further drilling. According to a geologic report on the property, two separate target areas were drilled at the Fairview Hunter Project. The highest Au values come from a 195’ zone (measured down hole) of anomalous geochem, with an average grade of 267 ppb (0.008 opt). This interval includes a 10’ section that averages 0.06 opt Au, contained within a large intercept (55’) that averages 0.02 opt Au. Material in the overlying rocks, which would theoretically be up dip, have a weak Au signature but are anomalous in Ag, containing a down hole intercept of 65’ averaging 7.7 ppm Ag (or 0.22 opt). Roughly 650’ along strike to the southeast, where holes FHRC –3 and 8 were drilled, and a zone within tuffs in a similar stratigraphic position were also highly anomalous in Ag but low in Au. In hole FHRC – 8 (the steeper of the two) there was a 150’ down hole interval that averaged 8.2 ppm Ag (0.24 opt). It appears that the west northwest trending structure identified on the surface could contain subsurface precious metals zones.

3

The current exploration program commenced in February, 2008 with the collection of 88 soil samples from the northern pediment-covered area, an additional 37 in-fill samples from the central portion and 36 rock chip and float samples. All the surface samples were fire assayed for gold and silver and analyzed using ICP spectrometer multi-element testing. Based on these findings, two prospective target areas were drill tested with 12 angled reverse circulation drill holes resulting in 5,360 feet of drilling and producing 1,072 samples which were submitted for both gold and silver fire assay and multi-element ICP analysis.

The property has no known mineral reserves. Our exploration plan is to perform another 12 drill holes during 2011 in targeted areas resulting in an estimated 7,200 feet of additional drilling results. The estimated 1,440 samples from this drilling program will be tested and analyzed allowing us to prepare extensive geological mapping and prepare feasibility studies for the project.

Further exploration will require the posting of a bond and filing a Notice of Intent with the BLM relating to the drilling of 12 drill holes to be performed on the property.

Pony Project

On November 3, 2010 SRI entered into a non-binding Letter Of Intent with a group of individual land owners in the state of Montana to acquire rights to 17 patented and 67 unpatented mining claims known as the Pony Exploration project (“the Pony Project”). The Project currently contains two active mines operating under a Small Miner Exclusion Statement (SMES). The Pony Project is located in the Pony Mining District near Pony, Montana. Officers of SRC have met with Montana Department of Environmental Quality officials to discuss permitting for both mining and exploration activities. The non-binding LOI provided terms for SRI to lease (with the right to acquire) the Lessors’ interests in the 84 mining claims comprising the Pony Project. The LOI included a $10,000 non-refundable deposit and allowed for a 90 day due diligence period.

Upon satisfactory completion of due diligence and securing project financing, SRI and the individual Lessors entered into a Mineral Lease Agreement With Option To Purchase (the “Pony Lease”) effective February 4, 2011. The Pony Lease provides for a six year lease period with an initial payment of $300,000 which SRI paid upon signing and an annual lease payment of $500,000 for the next five years. The initial payment of $300,000 was provided through the initial funding of the Joint Venture Agreement described below under “Project Financing”. The Leasors will also have a 2% NSR on the property. In addition the Lessors will receive a 1% NSR on any property developed by SRI located within one linear mile from any portion of the exterior boundary of the Pony Project. After the lease period expires, SRI will have the option to purchase the Pony Project for $190,000.

During its due diligence process, SRI began taking samples from the existing underground mine and surrounding claims in order to better define the extent of the potential mineralization.

The property has no known mineral reserves. The Mineral Hill Project includes both patented and unpatented claims. There are sixty-seven (67) unpatented lode claims each 20 acres for a total of 1340 acres for the purposes of exploration. There are 17 federal patented lode claims plus fractions, and total 322.05 acres. The following is a list of the names, acreages, survey numbers (Sur) and Bureau of Land Management (NMC) numbers associated with the claims:

4

|

Claim Name

|

ID Number

|

Acreage

|

Claim type:

|

|

Golden

|

NMC 215959

|

20

|

Unpatented, lode

|

|

Way

|

NMC 215964

|

20

|

Unpatented, lode

|

|

Old

|

NMC 215963

|

20

|

Unpatented, lode

|

|

Joe

|

NMC 215960

|

20

|

Unpatented, lode

|

|

Gem#2

|

NMC 215958

|

20

|

Unpatented, lode

|

|

Mexi 1

|

NMC 215961

|

20

|

Unpatented, lode

|

|

Mexi 2

|

NMC 215962

|

20

|

Unpatented, lode

|

|

MN # 1 - 60

|

NMC 221240 - 221299

|

1200

|

Unpatented, lode

|

|

North Star

|

Sur#2600; ME#2097

|

20.26

|

Federal patented lode

|

|

Pony

|

Sur#5303; ME#3805

|

15.57

|

Federal patented lode

|

|

Mountain Cliff

|

#2629; Lot 3483A

|

16.87

|

Federal patented lode

|

|

Grouse

|

Sur#5997; ME#4080

|

18.64

|

Federal patented lode

|

|

Clipper Fractured

|

Sur#6080; ME#408

|

6.6

|

Federal patented lode

|

|

Standby

|

Sur#5998; ME#4081

|

10.93

|

Federal patented lode

|

|

Bill Nye

|

Sur#59999; ME#4081

|

14.33

|

Federal patented lode

|

|

MKT

|

Sur#8730; ME#0307

|

9.59

|

Federal patented lode

|

|

Willow Creek

|

Sur#6128; ME#4358

|

2.97

|

Federal patented lode

|

|

Ned

|

Sur#504; ME 1970;Lot 38

|

11.11

|

Federal patented lode

|

|

Policy

|

ME#2865; Lot 3586

|

20.22

|

Federal patented lode

|

|

Rustler

|

Sur#2617; ME#2078;Lot 46A

|

14.68

|

Federal patented lode

|

|

Strawberry

|

#780; ME#842; Lot 41

|

10.28

|

Federal patented lode

|

|

Strawberry East

|

Sur#551; ME#1735, Lot 39

|

10.33

|

Federal patented lode

|

|

Keystone

|

Sur#728; Lot 43

|

11.41

|

Federal patented lode

|

|

Iron Mine Lode

|

Sur#2598; ME#2016, Lot 44

|

18.37

|

Federal patented lode

|

|

Owls Roost

|

Sur#5684; ME#4048

|

15.76

|

Federal patented lode

|

|

Success

|

Sur#568

|

10.22

|

Federal patented lode

|

|

N J Isdell

|

#5683; ME#4048

|

2.56

|

Federal patented lode

|

|

Dead Pine

|

Sur#6021; ME#4348

|

10.23

|

Federal patented lode

|

|

Golden Chariot

|

Sur#4673; ME#3377

|

19.03

|

Federal patented lode

|

|

Iron Chief Lode

|

Sur#5302

|

19.82

|

Federal patented lode

|

|

Dividend

|

Sur#6213; ME 4086

|

17.64

|

Federal patented lode

|

|

Clipper No. 2 Lode

|

Sur#5405; ME#3977

|

14.63

|

Federal patented lode

|

Our exploration plan is to perform another 50 drill holes during 2011 in targeted areas resulting in an estimated 25,000 feet of additional drilling results. The estimated 5,000 samples from this drilling program will be tested and analyzed allowing us to prepare extensive geological mapping and prepare feasibility studies for the project. Based on the reported historic production, the regional potential identified in historic geologic reports and SRI’s feasibility studies, SRI will prepare a Plan of Operations required by the SMES for the Pony Project.

A&P Project

On November 22, 2010 SRI entered into a non-binding Letter Of Intent with a group of individual land owners in the state of Montana to acquire two patented mining claims known as the Atlantic and Pacific Mine ("the A&P") located in the Pony Mining District in Montana. The A&P was actively mined in the early 20th Century and produced 128,600 ounces of gold from 1934 to 1941. Chicago Mining also briefly pit mined the project in 1991 but did not finish processing an estimated 12,000 ton stockpile which remains at the mine site. The A&P claim is contiguous with the larger Pony Project and is considered a key piece of the regional mineralization target. Historic reports by Chicago Mining and Newmont Mining indicated that those geologists believed the A&P to have significant gold resource potential.

The non-binding LOI provides terms for SRI to lease (with the right to acquire) two patented mining claims located in the Pony Mining District, near Pony, MT. The LOI includes a $5,000 non-refundable deposit and allows for a 90 day due diligence period. As part of its due diligence process, SRI reviewed the historical geological reports previously prepared by Chicago Mining and Newmont Mining and began taking samples from the existing underground mine and surrounding claims in order to better define the extent of the potential mineralization.

5

Upon satisfactory completion of due diligence and securing project financing, SRI and the individual lessors entered into a Mineral Lease Agreement With Option To Purchase (the “A&P Lease”) effective as of February 22, 2011. The A&P Lease provides for a five year lease period with an initial payment of $200,000 and an annual commitment of $100,000.00 for the next five years. The Lessors will also have a 2% NSR on the property during the lease term. After the lease period expires and all lease payments have been paid, full right and title of ownership of the A&P property shall be transferred to SRI. The initial payment of $200,000 was paid on March 23, 2011.

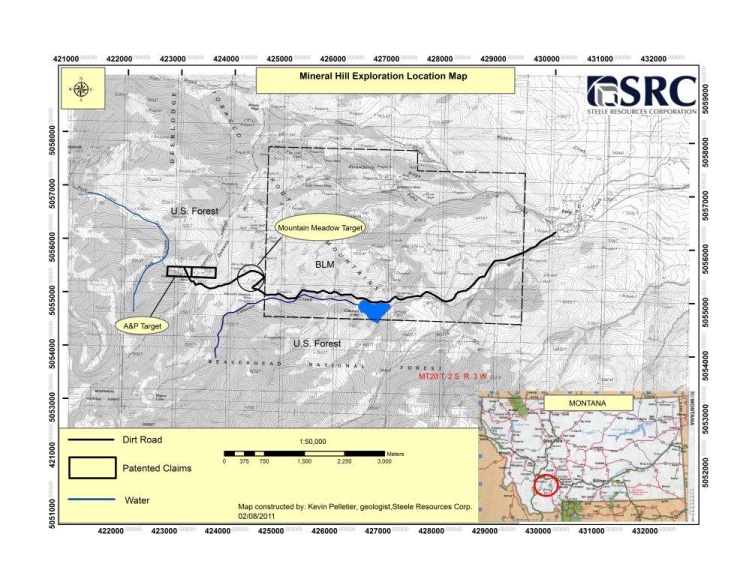

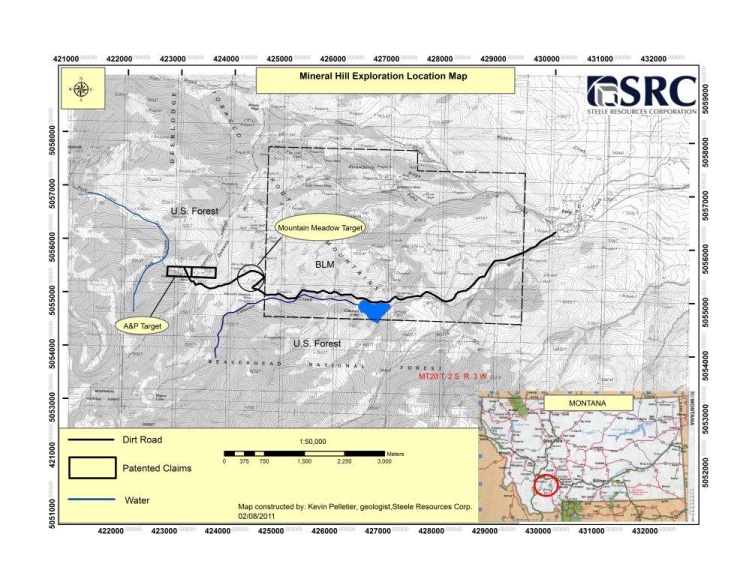

The Mineral Hill Project properties are located 3-5 miles west of Pony, Montana in the Tobacco Roots Mountain Range in Madison County. Access includes BLM and U.S. Forest service dirt roads that exist throughout the entire district and pass through most if not all of the Mineral Hill Project claims. The roads are maintained well enough to allow exploration equipment such as drill rigs and water trucks, as well as privately owned vehicles to the priority sites marked for exploration and development. Once mining activities begin the roads will likely need maintenance for haulage purposes.

There are presently two exploration projects within the Mineral Hill Project: the A&P target and the Mountain Meadow target.

|

|

·

|

The A&P target is a site of a small open pit and gloryhole mined in the early 20th century. The historic workings go no deeper than 180 feet beneath the surface, however, the mineralized structures likely continue downward. Mining was halted due to WWII. Current plans are to drill beneath the workings to determine if high grade mineralization continues.

|

|

|

·

|

Mountain Meadow is approximately 3000 feet east of the A&P target. Surface is covered with glacial till; therefore, the structural intersections that likely occur beneath the glacial deposit have never been visible from the surface. Since these structures are known to be mineralized to the west, north, and south, the current plan is to conduct a geophysical survey to identify the location of possible structural intersections and drill them.

|

6

To retain mineral rights to the property, the yearly maintenance fees must be paid as well as the appropriate lease payments to the owners of the claims as outlined in the definitive agreement.

The northern part of the Mineral Hill District is comprised of Archean metamorphics of the Pony Series which include gneisses and schist intruded by mafic/aplite/pegmatite dikes. The southern portion of the district is comprised of the Tobacco Root quartz-monzonite batholith which intruded into the surrounding Archean metamorphic rocks. The district contains both pre-Cambrian faults as well as region wide block faulting due to uplift of the Tobacco Root Mountains. The mineralization is always structurally controlled and occurs as quartz-sulfide vein deposits in shear zones and faults. Higher grades and tonnages usually occur at the intersections of the easterly trending structures and the subsidiary northerly trending structures. Several claims have historic workings on these structures at minimal depth, and mining activities ceased once WWII started. The mineralization likely continues at depth, a theory that will be tested during exploratory drilling. There are other potential sites covered by glacial material and never explored that are of high interest as well.

There had been work done by several companies back in the 1980’s and early 1990’s. Caara Drilling drilled 24 holes in the A&P area, and Pathfinder Gold had drilled an unknown number of holes at the Boss Tweed property. We sent our geologist to investigate the property in October and November of 2010, and conducted a limited sampling program of the Mountain Cliff mine, the A&P mine, and a district wide sampling of waste rock and dump material to assess typical grades.

There is no equipment or processing facility in place on any of the properties. There are underground workings with rail in places, but future underground work will require new drifts and shafts, as well as modern equipment. No infrastructure exists on the property.

The source of water can be a reservoir two mile east of the property, or several streams that exist throughout the district. The source of power will initially be generator based. Ultimately, power lines from Mammoth to the west or Pony to the east could be established.

The property currently has no known reserves, only in-house resource calculations established by various companies as noted in Steele Resource’s technical report on the Mineral Hill Project. Therefore, to establish any reserves, sufficient drilling will be required, and until then, this property is exploratory in nature.

The sampling program to date has been restricted to rock chip sampling and grab sampling at various locations. The following methodology was used with respect to rock/soil sampling:

|

|

·

|

Rock/Soil Sampling Methodologies: Grab samples will be taken from a location, usually less than 1 foot across and can be a single piece of rock. Composite samples are taken over a large area and represent the average composition and grade of the rock and can’t define high grade from low grade zones. Chip channel samples are continuous chip samples taken in a line across a structure or rock. This allows the geologist to determine the widths of the mineralized zones and the presence of high grade zones within low grade halos. High grade samples focus on obviously mineralized rock that is known to grade high in gold, silver, etc. Soil samples are taken from material at least 12 to 18 inches beneath the surface if possible. Soil samples can be taken in a line or grid, with the grid allowing the identification of geochemical trends. All sample sites will be tagged by a metal tag, logged in a GPS unit (if possible), and the sample will be bagged and marked.

|

|

|

·

|

Sample preparation/analysis/security: Samples have been and will always be protected from contamination or disturbance from third parties by storage away from other activity at the drill site and only geologists, drillers or lab personnel touch the lab sample bags.

|

|

|

No samples will never be collected or in any way handled by directors of the company or any associate of the issuer. The samples will be drilled, collected, transported, and processed by company employees (i.e. drillers or geologist) or independent contractors.

|

7

Most drill samples in the future will be processed by independent 43-101 compliant assay laboratories. Samples will be picked up at the storage building or drill site by the lab personnel and transported by them or by geologist directly to its sample preparation facility using chain-of-custody identification and tracking procedures. The lab will prepare the samples for assay and geochemical analysis. If the samples are wet, they will be dried in low temperature ovens. Then, depending on the type of analysis requested, the samples will be split, sieved, crushed, pulverized and analyzed at the lab. The lab will thus maintain custody of the samples the entire time. Finally, the lab will return pulps and coarse rejects back to Steele Resources on a quarterly basis, which will be transported on pallets to the appropriate storage building for long term storage. Secure steel shipping containers are being investigated as safe, secure storage options.

|

|

·

|

For future verification of assay results: 10% of all samples for soil and drill cuttings/core will be duplicates. Also, all drill samples will have standards every 100 feet and blanks every 500 feet. These “standard” samples, which have a verified known, measured content of precious metals, will be sent to lab along with regular samples in each given shipping batch. Where higher gold values are possibly encountered in the drilling or the presence of visible gold is suspected by visual geologic logging, Steele Resources will request a screen fire metallic assay. In addition, selected samples at random will have the duplicate sent to a referee lab for additional confirmation.

|

SRI's current operating plan for this project consists of completion of the geological mapping and geophysics analysis that will establish the exploration drilling phase. This initial phase will cover the first six to nine months of operations and will include performing another 42 drill holes during 2011 in targeted areas resulting in an estimated 18,000 feet of additional drilling results. The estimated 3,600 samples from this drilling program will be tested and analyzed allowing us to prepare extensive geological mapping and prepare feasibility studies for the project. Based on the reported historic production, the regional potential identified in historic geologic reports and SRI’s feasibility studies, SRI will prepare a Plan of Operations required by the SMES for the Project.

Upon satisfactory completion of this phase and with appropriate mineral deposit indications, the mining phase will commence. We do not anticipate that the Mineral Hill Project will generate revenues during the initial twelve months of operations. We do expect the mining operation to begin revenue generation during the second full year of operations. We believe that the funds provided by INCT in conjunction with the matching funds provided by us are sufficient to execute the current operating plan. SRC plans to raise the matching funds for the JV required through the private placement of our equity securities, by way of loans, utilization of the Drawdown Agreement and such other means as the Company may determine.

Proposed Property Acquisitions

Comstock-Tyler Expansion

On July 1, 2010 SRI entered into a letter of Intent with Riggs and Allen Mineral Development LLC (R&A) in which R&A agreed to stake and register 148 mineral claims totaling approximately 2,960 acres contiguous to SRI’s existing Comstock-Tyler project. On September 15, 2010 SRI terminated this LOI without further expense or obligation to SRI.

Nevada Mine Properties II, Inc.

On July 22, 2010, SRI entered into a Letter of Intent to purchase Nevada Mine Properties II, Inc, an exploration company with nine properties located in Nevada and Idaho. On August 20, 2010 SRI terminated this LOI without further expense or obligation to SRI.

8

Filipinni and Plumas Properties

On October 1, 2010 SRI entered into a Letter of Intent to acquire certain mineral rights to the Filipinni and Plumas exploration properties located in Lander County, Nevada. On October 19, 2010, SRI terminated these LOI’s without further expense or obligation to SRI.

Project Financing

Joint Venture Agreement Governing Exploration and Development of Pony Project and A&P Project

On January 27, 2011, 2010 SRI entered into a non-binding Letter Of Intent with Innocent Inc. ("INCT"), a Nevada corporation engaged in the financing of exploration and development of mineral properties. The LOI provides for a Joint Venture Agreement ("JV") which will govern the exploration and operations of mineral rights within the Pony Project and A&P Project jointly referred to as the Mineral Hill Project (the "Mineral Hill Project").

The non-binding LOI provides terms for INCT to contribute up to $5,000,000 in operating funds over a one year period beginning with the execution of the JV agreement. The parties may jointly extend this period, by mutual agreement. In addition, upon signing of the LOI, INCT will advance $550,000 in order to allow SRI to close the Pony and A&P Project lease transactions. SRI will initially contribute its leases in the Mineral Hill Project into the JV. SRI also agrees to fund the JV with a matching $5,000,000 in operating funds no later than one year following the first $1,000,000 funded by INCT. The JV will govern the operations of the various sites within the Mineral Hill Project wherein the parties to this agreement will initially share 50%-50% joint ownership of the JV, based upon the assumption, each party fulfills its terms and responsibilities pursuant to the LOI and the final JV agreement. If either party fails to contribute the funds committed to, that party’s interest in the JV will be reduced. SRI will be responsible for operations of the JV.

On February 7, 2011, INCT completed its initial funding to the JV pursuant to the LOI in the amount of $290,000 with the proceeds being used to close the definitive lease agreement covering the Pony Project.

Pursuant to the LOI, on February 20, 2011 INCT and SRC entered into a definitive Joint Venture Agreement (the “JVAgreement”) relating to the Mineral Hill Mining Project. Pursuant to the JVAgreement INCT agreed to provide up to $5,000,000 to fund the exploration and development of the Mineral Hill Mining Project. INCT agreed to provide an initial $550,000 to close the Pony Project and the A&P Project, of which $290,000 was provided to close the Pony Project lease and an additional $250,000 was to be funded by February 25, 2011. In addition, INCT agreed to fund an additional $450,000 upon signing the JV Agreement. The JV Agreement provided that if INCT provided at least $1,000,000 within the first year, then SRC would agree to match INCT’s investment up to $5,000,000 thus providing up to an aggregate of $10,000,000 to explore and, if warranted, develop the Mineral Hill Mining Project. Under the terms of the JV Agreement INCT and SRC would each own 50% of the Joint Venture however the percentage ownership would be reduced by 10% for each $1,000,000 a party failed to contribute to the Joint Venture.

On March 23, 2011 INCT, through one of its investors, completed its second funding to the Joint Venture in the amount of $250,000 with the proceeds being used to close the A&P Lease and for working capital. This payment completed the initial capital funding required to proceed with the JV Agreement.

9

Drawdown Equity Financing Agreement

On January 14, 2011, we entered in to a drawdown equity financing agreement and registration rights agreement (collectively the “Agreements”) with Auctus Private Equity Fund, LLC (“Auctus”). In accordance with the Agreements, Auctus has committed, subject to certain conditions set forth in the Agreements, to purchase up to $10 million of the Company’s common stock over a term of up to three (3) years. Although the Company is not mandated to sell shares under the Agreement, the Agreement gives the Company the option to sell to Auctus shares of common stock at a per share purchase price equal to 95% of the average of the lowest closing bid price of the common stock of any two trading days during the five trading days following the Company’s delivery of a Drawdown Notice to Auctus (the “Notice”). At its option, the Company may set a floor price under which Auctus may not sell the shares which were the subject of the Notice. The floor price shall be a minimum price determined by the Company or 75% of the average closing price of the stock over the preceding ten (10) trading days prior to the Notice and can be waived at the discretion of the Company. The maximum amount of Common Stock that the Company can sell pursuant to any Notice is the greater of (i) an amount of the shares with an aggregate maximum purchase price of $500,000 or (ii) 200% of the average daily trading volume based on the 10 days preceding the Notice date.

Auctus is not required to purchase the shares unless: a) the shares which are subject to the Notice have been registered for resale and are freely tradable in accordance with the federal securities laws, including the Securities Act of 1933, as amended; and b) under certain conditions which are set forth in the Agreements, and which are outside of Auctus’ control. The Company is obligated to file and did file on February 10, 2011 with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-1, covering the sale of up to 20,000,000 shares of common stock to Auctus. The Company must use all commercially reasonable efforts to have such registration statement declared effective by the SEC within 120 days of filing. The Company has agreed to pay Auctus an aggregate amount of $10,000 as an origination fee with respect to the transaction.

Industry Overview

Gold Market

For centuries, gold has been desirable for its rarity, beauty and unique properties. Because gold is highly valued and in very limited supply, it has long been used as a medium of exchange or money. The CPM Group estimates in its 2009 Yearbook that about 79% of the gold consumed each year is used in the manufacture of jewelry, with approximately 13% of gold used in industrial processes. Gold is an excellent conductor of electricity, is extremely resistant to corrosion and is one of the most chemically stable of the elements, making it uniquely suited for electronic and other high-tech applications. A small amount of gold is currently used in almost every sophisticated electronic device.

Because of gold’s perceived inherent value, its demand and, hence, its price, tends to increase when there is uncertainty in the markets for other “paper currencies” such as the US dollar or Euro. Due to the current recession, threats of terrorism and the huge debt burden of many countries, the spot market price of an ounce of gold has increased to historic levels having surpassed the $1,000 per ounce mark in 2008.

The following table presents the annual high, low and average afternoon fixing prices for gold over the past ten years, expressed in US dollars per troy ounce, on the London Bullion Market.

|

Gold Price (USD) on the

London Bullion Market

|

||||||||||||

|

Year

|

High

|

Low

|

Average

|

|||||||||

|

2005

|

$ | 536 | $ | 411 | $ | 444 | ||||||

|

2006

|

$ | 725 | $ | 525 | $ | 604 | ||||||

|

2007

|

$ | 841 | $ | 608 | $ | 695 | ||||||

|

2008

|

$ | 1,011 | $ | 713 | $ | 872 | ||||||

|

2009

|

$ | 1,212 | $ | 810 | $ | 972 | ||||||

|

2010

|

$ | 1,420 | $ | 1,058 | $ | 1,224 | ||||||

Source: London Metal Exchange

10

On March 28, 2011, the afternoon fixing price for gold on the London Bullion Market was $1,421 per troy ounce.

This current price level has made it more economically feasible to produce gold as well as making gold a more attractive investment for many. Accordingly, the gross margin per ounce of gold produced per the historical spot market price range above provides significant profit potential if we are successful in identifying, exploring and, if warranted, developing suitable projects.

Gold Mining Industry Participants

By industry standards, there are generally four types of mining companies. Typically, an “exploration stage” mining company is focused on exploration to identify new, commercially viable gold deposits. “Junior mining companies” typically have proven and probable reserves of less than one million ounces of gold, generally produce less than 100,000 ounces of gold annually and / or are in the process of trying to raise enough capital to fund the remainder of the steps required to move from a staked claim to production. “Mid-tier” and large mining (“major”) companies may have several projects in production plus several million ounces of gold in proven reserves.

To the extent that SRI is hired by a property owner to carry out advanced stage exploration and development of a mining project, SRI would not be deemed a “mining company” but rather a mining service provider. To the extent SRI actually acquires the mining rights to a mining property, which will be its primary focus, it could be characterized as an exploration company falling somewhere between an “exploration stage” and a “junior” mining company depending on the stage of development activity at each project.

Gold Reserves

Generally worldwide gold reserves have been declining for a number of years for the following reasons:

|

|

·

|

The extended period of low gold prices from 1996 to 2001 made it economically unfeasible to explore for new deposits for most mining companies.

|

|

|

·

|

The demand for and production of gold products have exceeded the amount of new reserves added over the last several consecutive years.

|

Reversing the decline in lower gold reserves is a long term process. Due to the extended time frame it takes to explore, develop and bring new production on line, the large mining companies are facing an extended period of lower gold reserves. Accordingly, junior companies that are able to increase their gold reserves and/or development projects more quickly should directly benefit with an increased valuation.

Additional factors causing higher gold prices over the past two years have come from a weakened United States dollar. Reasons for the lower dollar compared to other currencies include the historically low US interest rates, the increasing US budget deficit and trade deficits, the current economic recession and the general worldwide political instability caused by the war on terrorism.

Competition

Of the four types of mining companies, we believe junior companies represent the largest group of gold mining companies. All four types of mining companies may have projects located in any of the gold producing continents of the world and many have projects located in Nevada and other Western states. As an exploration stage company, we will compete with other mineral resource exploration and development companies for financing and for acquisition of new mineral properties.

11

Many of our competitors have greater exploration, production, and capital resources than we do, and may be able to compete more effectively in any of these areas. For example, these competitors may be able to spend greater amounts on acquisition of desirable mineral properties, on exploration of their mineral properties and on development of their mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance the exploration and development of their mineral properties. Our inability to secure capital to fund exploration and, if warranted, development costs for our mineral properties would create a competitive cost disadvantage in the marketplace which would have a material adverse effect on our operations and potential profitability.

We also compete in the hiring and retention of key executives, skilled laborers, experienced subcontractors and other employees and contract personnel. Consequently, though unlikely, it is possible that we may not be able to hire or retain qualified geologists, miners or operators in the numbers or at the times desired.

Employees

As of December 31, 2010, we had four full-time employees and one part-time employee. Employees include a CEO, a Mine Manager and a CFO. We anticipate hiring additional employees during the current year to work on the mining sites in Nevada as our exploration development programs commence. While skilled equipment and operations personnel are in demand, we believe we will be able to hire the necessary workers to sustain our current exploration and any future development programs. Our employees are not expected to be subject to a labor contract or collective bargaining agreement. We consider our employee relations to be good.

Consulting services, relating primarily to geologic and geophysical interpretations, and relating to such metallurgical, engineering, and other technical matters as may be deemed useful in the evaluation and exploration activities, will be provided by independent contractors.

Government Controls and Regulations

Gold exploration, mining and processing operations are subject to various federal, state and local laws and regulations governing prospecting, exploration, development, production, labor standards, occupational health, mine safety, control of toxic substances, and other matters involving environmental protection and employment. United States environmental protection laws address the maintenance of air and water quality standards, the preservation of threatened and endangered species of wildlife and vegetation, the preservation of certain archaeological sites, reclamation, and limitations on the generation, transportation, storage and disposal of solid and hazardous wastes, among other things. There can be no assurance that all the required permits and governmental approvals necessary for any mining project with which we may be associated can be obtained on a timely basis, or maintained. Delays in obtaining or failure to obtain government permits and approvals may adversely impact our operations. The regulatory environment in which we operate could change in ways that would substantially increase costs to achieve compliance. In addition, significant changes in regulation could have a material adverse effect on our operations and ability to timely and effectively explore and, if warranted, develop mining properties.

Outlined below are some of the more significant aspects of governmental controls and regulations which materially affect the mining properties we will seek to explore.

12

Regulation of Mining Activity

Federal

Mining activities, including exploration, and possible future development and production activities are subject to environmental laws, policies and regulations. These laws, policies and regulations affect, among other matters, emissions to the air, discharges to water, management of waste, management of hazardous substances, protection of natural resources, protection of endangered species, protection of antiquities and reclamation of land. Mining properties are also subject to numerous other federal, state and local laws and regulations. At the federal level, the mines are subject to inspection and regulation by the Division of Mine Safety and Health Administration of the Department of Labor (“MSHA”) under provisions of the Federal Mine Safety and Health Act of 1977. The Occupation and Safety Health Administration (“OSHA”) also has jurisdiction over certain safety and health standards not covered by MSHA. Mining operations and all proposed exploration and development will require a variety of permits. In addition, any mining operations occurring on federal property are subject to regulation and inspection by the Bureau of Land Management (“BLM”). While we have considerable experience in the mine permitting process, permitting procedures are complex, costly, time consuming and subject to potential regulatory delay. We will seek to identify projects where existing permitting requirements and other applicable environmental protection laws and regulations would not pose a material hindrance to our ability to explore and possibly develop such mine properties. As part of our initial evaluation of suitable projects, we will ascertain a property’s regulatory compliance status and any issues affecting current or future permitting requirements. However, we cannot be certain that future changes in laws and regulations would not result in significant additional expenses, capital expenditures, restrictions or delays associated with the exploration and possible future development of our selected projects. We cannot predict whether we will be able to obtain new permits or whether material changes in permit conditions will be imposed. Granting new permits or the imposition of additional conditions could have a material adverse effect on our ability to explore and develop the mining properties which we are providing services for or in which we have an interest.

Legislation has been introduced in prior sessions of the U.S. Congress to make significant revisions to the U.S. General Mining Law of 1872 that would affect our exploration and potential development of unpatented mining claims on federal lands, including any royalty on gold production. It cannot be predicted whether any of these proposals will become law. Any levy of the type proposed would only apply to unpatented federal lands and accordingly could adversely affect the profitability of any future gold production from projects being explored by SRI on federal property.

Nevada

The State of Nevada, where we expect our initial mine properties to be located, adopted the Mined Land Reclamation Act (the “Nevada Act”) in 1989 which established design, operation, monitoring and closure requirements for all mining facilities located in Nevada. The Nevada Act has increased the cost of designing, operating, monitoring and closing mining facilities and could affect the cost of operating, monitoring and closing existing or future mine facilities. The State of Nevada also has adopted reclamation regulations pursuant to which reclamation plans must be prepared and financial assurances established for existing facilities. The financial assurances can be in the form of cash placed on deposit with the State or reclamation bonds underwritten by insurance companies. Nevada mining and environmental regulations are enforced by the Nevada Department of Environmental Protection (“NDEP”). Compliance with all required environmental regulations required by BLM and NDEP is a prerequisite to the issuance of mining permits. Our ability to develop mining properties in the future is subject to obtaining all necessary mining permits. We have not yet submitted applications for the requisite permits in the State of Nevada.

13

Montana

In the State of Montana our exploration and mining operations will be under supervision of the Montana Department of Environmental Quality (“MDEQ”) which enforces Montana’s Environmental Policy Act and mining regulations. Exploration and mining activity at the Mineral Hills Project, which SRI intends to acquire, is currently conducted under a Small Miner Exclusion Statement (SMES). An SMES allows for expedited treatment for exploration/mining operations which affect no more than 25 square miles of property. While such a limitation makes mining under an SMES infeasible for large gold mining companies, SRC, by contrast, can operate efficiently in this smaller space as a small exploration company. In order to carry on our planned exploration program we will need to secure necessary permits by filing a Plan of Operation with the MDEQ which was submitted in March, 2011.

Environmental Regulations

Legislation and implementation of regulations adopted or proposed by the United States Environmental Protection Agency (“EPA”), the BLM and by comparable agencies in various states directly and indirectly affect the mining industry in the United States. These laws and regulations address the environmental impact of mining and mineral processing, including potential contamination of soil and water from tailings, discharges and other wastes generated by mining process. In particular, legislation such as the Clean Water Act, the Clean Air Act, the Federal Resource Conservation and Recovery Act (“RCRA”), and the National Environmental Policy Act require analysis and/or impose effluent standards, new source performance standards, air quality standards and other design or operational requirements for various components of mining and mineral processing, including gold-ore mining and processing. Such statutes also may impose liability on mine developers for remediation of waste they have created.

Gold mining and processing operations by an entity would generate large quantities of solid waste which is subject to regulation under the RCRA and similar state laws. The majority of the waste which is produced by such operations is “extraction” waste that EPA has determined not to regulate under RCRA's "hazardous waste" program. Instead, the EPA is developing a solid waste regulatory program specific to mining operations under the RCRA. Of particular concern to the mining industry is a proposal by the EPA entitled “Recommendation for a Regulatory Program for Mining Waste and Materials under Subtitle D of the Resource Conservation and Recovery Act” (“Strawman II”) which, if implemented, would create a system of comprehensive Federal regulation of the entire mine site. Many of these requirements would be duplicates of existing state regulations. Strawman II as currently proposed would regulate not only mine and mill wastes but also numerous production facilities and processes which could limit internal flexibility in operating a mine. To implement Strawman II the EPA must seek additional statutory authority, which is expected to be requested in connection with Congress' reauthorization of RCRA.

Mining projects also are subject to regulations under (i) the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA" or “Superfund”) which regulates and establishes liability for the release of hazardous substances and (ii) the Endangered Species Act (“ESA”) which identifies endangered species of plants and animals and regulates activities to protect these species and their habitats. Revisions to “CERCLA” and “ESA” are being considered by Congress; however, the impact of these potential revisions on our business is not clear at this time

The Clean Air Act, as amended, mandates the establishment of a Federal air permitting program, identifies a list of hazardous air pollutants, including various metals and cyanide, and establishes new enforcement authority. The EPA has published final regulations establishing the minimum elements of state operating permit programs. We will be required to comply with these EPA standards to the extent adopted by the State in which development projects are located.

14

In addition, developing mine sites requires mitigation of long-term environmental impacts by stabilizing, contouring, resloping, and revegetating various portions of a site. While a portion of the required work can be performed concurrently with developing the property, completion of the environmental mitigation occurs once removal of all facilities has been completed. These reclamation efforts are conducted in accordance with detailed plans which have been reviewed and approved by the appropriate regulatory agencies. The mine developer must insure that all necessary cash deposits and provision to cover the estimated costs of such reclamation as required by permit are made.

Any exploration and development of mining projects by SRI will be conducted in substantial compliance with federal and state regulations and be consistent with the need to remediate any environmental impact.

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors in evaluating our business before purchasing any of our common stock. We have described the risks we consider to be material. However, there may be additional risks that we view as not material or of which we are not presently aware. If any of the events described below were to occur, our business, prospects, financial condition, results of operations or cash flow could be materially adversely affected.

BUSINESS RISKS

SRC is a new company with no operating history which makes the evaluation of its future business prospects difficult.

Prior to June 17, 2011 SRC was a shell company with no designated business or operations. As a result of the Reorganization SRC has only recently changed its business to focus on the natural resource sector which new business will be carried out primarily by its wholly-owned subsidiary, SRI. SRI is an exploration stage company which only recently was formed and commenced its business. Consequently, it has limited operating history and an unproven business strategy. SRI’s primary activities to date have been the design of its business plan and identifying potential advanced stage gold exploration projects which fit SRI’s project profile. As such we may not be able to achieve positive cash flows and our lack of operating history makes evaluation of our future business and prospects difficult. The Company has not generated any revenues to date. The Company’s success is dependent upon the successful identification and future development of suitable mineral exploration projects. Any future success that we might achieve will depend upon many factors, including factors beyond our control which cannot be predicted at this time. These factors may include but are not limited to: changes in or increased levels of competition; the availability and cost of bringing exploration stage projects into production; the amount of gold reserves identified and the market price of gold and other metals. These conditions may have a material adverse effect upon SRI’s and the Company’s business operating results and financial condition.

As a new company, SRC and its subsidiary SRI are unable to predict future revenues which makes an evaluation of its business speculative.

Because of the Company’s recent change of business and SRI’s lack of operating history and the introduction of its property exploration strategy, SRI’s ability to accurately forecast its revenues is very difficult. Future variables include the market for precious metals and the availability of suitable advanced stage exploration projects. To the extent we are unsuccessful in establishing our business strategy and increasing our revenues through our subsidiary, SRI, we may be unable to appropriately adjust spending in a timely manner to compensate for any unexpected revenue shortfall or will have to reduce our operating expenses, causing us to forego potential revenue generating activities, either of which could have a material adverse effect in our business, results of operations and financial condition.

15

SRC expects its operating expenses to increase in the future with no assurance that revenues will be sufficient to cover those expenses which could delay or prevent SRC from achieving profitability.

As SRC’s business grows and expands, it will spend substantial capital and other resources on exploring and potentially developing its exploration projects, establishing strategic relationships and operating infrastructure. SRC expects its cost of revenues, property exploration, general and administrative expenses, to continue to increase. However, revenues are not expected in the near future to offset these expenses. Consequently if outside capital is not secured, there may be a material adverse effect on our business, cash flow and financial condition.

SRC will need to raise funds through debt or equity financings in the future, which would dilute the ownership of our existing stockholders and possibly subordinate certain of their rights to the rights of new investors or creditors.

We expect to raise additional funds in debt or equity financings if they are available to us on terms we believe reasonable to provide for working capital, carry out exploration programs or to make acquisitions. Any sales of additional equity or convertible debt securities would result in dilution of the equity interests of our existing stockholders, which could be substantial. Additionally, if we issue shares of preferred stock or convertible debt to raise funds, the holders of those securities might be entitled to various preferential rights over the holders of our common stock, including repayment of their investment, and possibly additional amounts, before any payments could be made to holders of our common stock in connection with an acquisition of the Company. Such additional debt, if authorized, would create rights and preferences that would be senior to, or otherwise adversely affect, the rights and the value of our common stock and would have to be repaid from future cash flow.

If SRC fails to raise additional capital to fund its business growth and project exploration, it’s new business could fail.

The Company anticipates having to raise significant amounts of capital to meet its anticipated needs for working capital and other cash requirements for the near term to explore our mining properties. The Company will attempt to raise such capital through the Drawdown Agreement or the Joint Venture Agreement (discussed below) in addition to the sale of common stock or debt instruments or securing commercial lines of credit. However, there is no assurance that the Company will be successful in raising or borrowing sufficient additional capital and we have no arrangements for future financing and there can be no assurance that additional financing will be available to us. If adequate funds are not available or are not available on acceptable terms, our ability to fund SRI’s exploration projects, take advantage of potential acquisition opportunities, possibly develop or enhance its properties in the future or respond to competitive pressures would be significantly limited. Such limitation could have a material adverse effect on the Company’s business and financial condition.

Gold exploration is highly speculative in nature, involves substantial expenditures and is frequently non-productive.

Success in gold or other mineral exploration is dependent upon a number of factors including, but not limited to, quality of management, quality and availability of geological data and the expertise to interpret it, availability of trained miners and equipment and availability of exploration capital. The exploration process can be long and costly. Due to these and other factors, the probability of our identifying individual prospects having commercially significant reserves cannot be predicted. It is likely that many of the projects considered will not contain any commercially viable reserves. Consequently, substantial funds may be spent on project evaluation which may identify only a few, if any, projects having commercial development potential. In addition, if commercially viable reserves are identified, significant amounts of capital will be required to mine and process such reserves.

16

We have not yet identified all properties that we intend to explore.

SRI has currently identified and acquired an interest in or signed a Letter-of-Intent relating to four groups of exploration projects, two located in Nevada and two located in Montana. However, SRI has not yet commenced exploration or development of these projects. Therefore we are unable to determine the quantity of gold, if any we may be able to recover. We, through our wholly-owned subsidiary, SRI, will continue to seek and identify additional suitable potential mineral resources, which is a subjective process depending in part on the quality of available data and the assumptions used and judgments made in interpreting such data. There is significant uncertainty in any resource estimate such that the actual deposits encountered or reserves validated and the economic viability of mining the deposits may differ materially from our expectations.

We may lose the mineral rights to properties if we fail to meet payment requirements or development or production schedules.

We expect to acquire rights to some of our mineral properties from leaseholds or purchase option agreements that may require the payment of option payments, rent, minimum exploration expenditures or other installment fees or specified expenditures. Both the Pony Project and the A&P Project Mineral Leases require annual rent to be paid by SRI to the lessors. If we fail to make these payments when they are due, our leased mineral rights to the property may be terminated. This would be true for any other mineral rights which require payments to be made in order to maintain such rights.

Some contracts with respect to mineral rights we may acquire may require development or production schedules. If we are unable to meet any or all of the development or production schedules, we could lose all or a portion of our interests in such properties. Moreover, we may be required in certain instances to pay for government permitting or posting reclamation bonds in order to maintain or utilize our mineral rights in such properties. Because our ability to make some of these payments is likely to depend on our ability to generate internal cash flow or obtain external financing, we may not have the funds necessary to meet these development/production schedules by the required dates.

We may have to compete with other companies for favorable projects to explore.

Due to the current high market value for gold and silver many companies are attempting to explore properties which show potential for significant gold and silver reserves. Consequently, we will face competition from other companies for those projects showing the most favorable exploration results. While we intend to focus on smaller projects which do not meet the size/volume requirements of the established, large mining companies, we nonetheless expect competition from other companies, many of which are larger and better funded than SRC.

Consequently, if we are unable to secure projects meeting our desired project profile, we are more likely to end up with projects having a lower success potential and ultimately having a lower return on the project’s investment.

Mineral exploration and mining are highly regulated industries.

Mining is subject to extensive regulation by state and federal regulatory authorities. State and federal statutes regulate environmental quality, safety, exploration procedures, reclamation, employees’ health and safety, use of explosives, air quality standards, pollution of stream and fresh water sources, noxious odors, noise, dust, and other environmental protection controls as well as the rights of adjoining property owners. We will strive to verify that projects being considered are currently operating in substantial compliance with all known safety and environmental standards and regulations applicable to each State in which properties are located. However, there can be no assurance that our compliance review could be challenged or that future changes in federal or state laws, regulations or interpretations thereof will not have a material adverse effect on our ability to establish and sustain mining operations.

17

Gold mining has a number of risks.

The business of gold and silver mining is subject to certain types of risks, including environmental hazards, industrial accidents, and theft. While we will attempt to secure insurance consistent with industry practice, it is not possible to insure against all risks associated with the mining business, or prudent to assume that insurance will continue to be available at a reasonable cost. We may not obtain certain types of liability insurance on our projects because such coverage is not considered by management to be cost effective. If any project lacks insurance coverage, any losses would have to be absorbed by the Company or other participants which could have a significant adverse impact on the Company’s operations and revenues.

Our business will depend on certain key Company personnel, the loss of whom would adversely affect our chances of success.

The Company’s success depends to a significant extent upon the continued service of its senior management and key executives. We do not have “key person” life insurance policies on or employment agreements with any of our officers or other employees. The loss of the services of any of the key members of senior management, other key personnel or consultants, or our inability to retain high quality subcontractor and mining personnel may have a material adverse effect on our business and operating results.

We will incur increased costs and may have difficulty attracting and retaining qualified directors and executive officers as a result of being a public company.

SRC is a public “reporting company” with the SEC. As a public reporting company, we will incur significant legal, accounting, reporting and other expenses not generally applicable to a private company. We also will incur costs associated with corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 as well as other rules implemented by the SEC. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect these rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage. As a result, we may experience difficulty attracting and retaining qualified individuals to serve on our board of directors or as executive officers. We cannot predict or estimate the amount of these continuing costs we will incur as a result of being a public company.

Our officers and directors have the ability to exercise significant influence over matters submitted for stockholder approval and their interests may differ from other stockholders.

As a result of the Reorganization, the initial stockholders of SRI were issued common stock of the Company representing 60% of the Company’s outstanding common stock and three of the initial stockholders of SRI are now officers and/or directors of the Company. Accordingly, our directors and officers, whether acting alone or together, will have significant influence in determining the outcome of any corporate transaction or other matter submitted to our Board for approval, including issuing additional common or preferred stock and appointing officers, which could have a material effect on the approval or disapproval of mergers, acquisitions, consolidations or the sale of all or substantially all of our assets. As significant stockholders of the Company, these individuals will have significant influence in the election of directors as well as the power to prevent a change of control. The interests of these officers and directors may differ from the interests of the other stockholders.

18

A decline in the price of gold and other resources will adversely affect our chances of success.

The price of gold has experienced an increase in value over the past several years, generally reflecting among other things relatively low interest rates in the United States; worldwide instability due to terrorism; and a continuing global economic slump. Gold prices at historic highs closing at $1342 per ounce on January 24, 2011 as reported on the Chicago Mercantile Exchange. We believe that the economic conditions causing these high market valuations will continue for the foreseeable future. However the price of gold and silver can be very volatile and is subject to numerous factors beyond our control including industrial and jewelry demand, inflation, the strength of the US dollar, interest rates and the amount of global economic instability. Any significant drop in the price of gold or other natural resources could make some exploration projects no longer viable and will have a materially adverse effect on the results of our operations unless we are able to offset such a price drop by substantially increased production.

The Auditor’s Report for fiscal year 2010 states there is substantial uncertainty about the ability of SRC or SRI to continue its operations as a going concern.

In their audit report dated March 31, 2011 included in this annual report, the auditors have expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business.

Management may be unable to implement the business strategy.

The Company’s and SRI’s business strategy is to service the niche market between speculative exploration and large scale production, the latter of which is dominated by industry majors. SRI plans to identify and explore smaller exploration projects that have already been established as project worthy. There is no assurance that we will be able to identify and provide our services to such “project worthy” properties. In addition, even if we find and ultimately develop such project worthy properties, the time and cost of development may exceed our expectations or, when developed, the amount of gold or other precious metals recovered may fall significantly short of our expectations thus providing a lower return on investment or a loss to the Company.

SECURITIES RISKS

There is a limited active trading market for our common stock making our stock vulnerable to significant price and volume fluctuations.