Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - CIMETRIX INC | cimetrixexh32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - CIMETRIX INC | cimetrixexh31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - CIMETRIX INC | cimetrixexh31-2.htm |

| EX-23.1 - EXHIBIT 23.1 - CIMETRIX INC | cimetrixexh23-1.htm |

| EX-99.1 - EXHIBIT 99.1 - CIMETRIX INC | cimetrixexh99-1.htm |

| EX-32.2 - EXHIBIT 32.2 - CIMETRIX INC | cimetrixexh32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the Fiscal Year Ended December 31, 2010 | ||

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Transition Period From _____ to _____

Commission File Number: 0-16454

CIMETRIX INCORPORATED

(Exact name of registrant as specified in its charter)

| Nevada | 87-0439107 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 6979 South High Tech Drive, Salt Lake City, UT | 84047-3757 |

| (Address of principal executive office) | (Zip Code) |

Registrant's telephone number, including area code: (801) 256-6500

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $.0001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yeso Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yeso Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 of 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx Noo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to rule 405 of Regulation S-T (§ 232.405) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yeso Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yeso Nox

As of March 15, 2011, the registrant had 44,857,767 shares of its common stock, par value $.0001, outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2010 was approximately $5,285,000. For purposes of this disclosure, shares of common stock held by persons who hold more than 5% of the outstanding shares and shares held by executive officers and directors of the registrant have been excluded because such persons may be deemed to be affiliates. This determination of executive officer or affiliate status is not intended to be determinative nor conclusive for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held May 21, 2011, are incorporated by reference into Part III hereof.

FORM 10-K

For the Year Ended December 31, 2010

TABLE OF CONTENTS

|

Signatures

|

||

FORWARD-LOOKING STATEMENTS

In addition to historical information, this Annual Report on Form 10-K contains forward-looking statements. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can generally be identified by the use of words such as “may,” “believe,” “will,” “expect,” “project,” “estimate,” “intend,” “anticipate,” “plan,” “continue,” or similar expressions. In particular, information appearing under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business” includes forward-looking statements. Forward-looking statements inherently involve many risks and uncertainties that could cause actual results to differ materially from those projected in these statements. Where we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. All forward-looking statements speak only as of the date of this Form 10-K and are expressly qualified in their entirety by the cautionary statements and risks included in this Form 10-K, including under “Risk Factors.” We undertake no obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

ITEM 1. BUSINESS

Business Overview

Cimetrix is a software engineering company that designs, develops, markets and supports factory automation and tool control products for today’s smart, connected factories. The Company’s primary customers are original equipment manufacturers (OEMs) that supply precision electronics equipment for semiconductor wafer fabrication, solar/photovoltaic (PV) and other electronics manufacturing.

Revenues are derived from the sales of software and services. Software includes the initial sale of software development kits (SDK’s), the ongoing runtime licenses for each machine shipped with Cimetrix software, and annual contracts for software license updates and product support. Services include the sale of professional services that provide customers with software solutions, typically incorporating Cimetrix software products. While Cimetrix products are installed in a wide range of industries, the Company has focused over the past several years on the global semiconductor and electronics industries, which includes the growing solar photovoltaic (PV) and LED markets.

The recent attention and investments across the globe in “green” technologies have presented opportunities for the Company. We are increasingly working with the PV industry to assist them in adopting connectivity technology similar to that used in semiconductor manufacturing and we continue to evaluate other green energy related opportunities to expand our markets. Another interesting green sector is the burgeoning light emitting diode (“LED”) lighting market, and we are investigating how that industry will be able to employ Cimetrix software products to increase yield and reliability. We are also actively engaged in a new SEMI® (Semiconductor Equipment and Materials International is a global industry association serving the electronics manufacturing community that manages the development of technical standards aimed at improving production and quality) task force investigating automation standards for LED manufacturing, and we are marketing products and services to customers in this market. Additional information about Cimetrix is available on our web site at www.cimetrix.com. Links to the Annual Report on Form 10-K and the Quarterly Reports on Form 10-Q are available free of charge on the web site. General information contained on the Company’s web site is not a part of, and is not incorporated into this Annual Report on Form 10-K or our other filings with the SEC.

Key Markets

Cimetrix has been focused for the past several years on the global semiconductor and electronics industries, both of which are a natural fit for the Company’s solutions. These industries demand data intensive manufacturing equipment that can communicate with host computers throughout the manufacturing process. These are very competitive industries that have a critical need for data to improve their productivity and manufacturing effectiveness. These two industries are discussed in more detail below.

In general, the semiconductor and electronics industries are growing, fiercely competitive, and dynamic industries. Rapid technology changes within these industries require machines that are flexible and can be quickly adapted to new requirements. The Company is uniquely positioned to meet these challenges with advanced tool control and connectivity software that is based on open standards and uses the latest in object-oriented design to provide its customers with the necessary flexibility and customization required to meet industry demands.

By focusing efforts on these two industries, the Company’s goal is to obtain a leadership position for its products in these segments. This would provide the momentum and cash flow to potentially penetrate other industries. The Company will continue to serve customers in these industries while also exploring opportunities for growth. For financial reporting, the Company considers the semiconductor, electronics, PV & LED and electronics industries as one business segment.

Semiconductor Industry

The semiconductor industry includes the manufacturing, packaging, and testing of computer chips. It is a cyclical industry that has recovered from what many regard as the most severe downturn of capital equipment investment in history, caused by the global economic downturn of 2008-2009. During that period, many of the world’s leading chip makers reported low factory utilization rates and a dramatic decline in demand for computer chips. Consequently, during that timeframe chip makers neither expanded their wafer fabrication plants nor updated them, resulting in significant declines in purchases of semiconductor capital equipment.

Based upon data from SEMI, the total worldwide revenue for the semiconductor equipment industry fell from $42.8 billion in 2007 to $16 billion in 2009, a drop of over 60%. The industry has partially recovered, with 2010 revenues ending at an estimated $37.5 billion, but still down from the 2007 level. Today, industry analysts are projecting steady, but small, growth of about 4% per year in 2011 and 2012.

In 2000, the semiconductor industry began the migration from building 8-inch (200 mm) wafers to building 12-inch (300 mm) wafers, and the majority of capital spending transitioned to 300mm equipment. The Company’s CIMConnect™, CIM300™, CIMPortal™, and CIMControlFramework™ product lines are directly applicable to makers of 300mm semiconductor tools. Cimetrix equipment supplier customers have now shipped fully automated tools to virtually all of the major 300mm manufacturing facilities throughout the world. Today we are seeing increasing adoption of the EDA/Interface A standard as semiconductor device manufacturers seek to improve and facilitate communication between their data gathering software applications and the factory equipment.

The industry is now considering moving to larger 450mm wafers, most likely in the 2012-2015 timeframe. As semiconductor companies consider this major transition, they expect to maintain the current connectivity solutions Cimetrix already offers, but the equipment manufacturers will need to re-think their tool control solutions, which could provide additional opportunities for the Company’s products.

PV & LED Industry

The PV market, which manufactures solar cells to produce electricity, utilizes standards and processes similar to the semiconductor industry and continues to attract substantial investment. Cimetrix achieved its first successful deployments of its products and services in the PV market during 2008 and has been steadily growing its customer base in this developing market. The PV manufacturing community is adopting industry-wide equipment communications standards in an effort to improve efficiencies. Positioned as the industry leader in SEMI standards-based software products, Cimetrix has been a part of the development of this standard. Cimetrix CIMConnect software enables customers to comply with the SEMI-sponsored PV2 (Photovoltaic Equipment Communication Interface) Specification.

The LED market is another emerging market with high correlation to semiconductor manufacturing that the Company believes may represent further growth opportunities.

Electronics Industry

In addition to the semiconductor industry, the Company serves customers in a wide variety of electronics industries, including surface mount technology, small parts assembly, disk drive, and specialized robotics. All of these industries have some usage of SEMI connectivity standards, with varying adoption levels from factory to factory. This level of adoption of SEMI standards is in contrast to semiconductor 300mm manufacturing which now requires usage of a large number of the SEMI standards. Increasing adoption rates of the SEMI standards in these electronics industries will increase the market for Cimetrix connectivity products. In addition, the electronics industries also offer growth opportunities for Cimetrix tool control products.

Notable Achievements of 2010

As we look back on 2010 with this historical perspective, we feel proud of our key accomplishments:

|

·

|

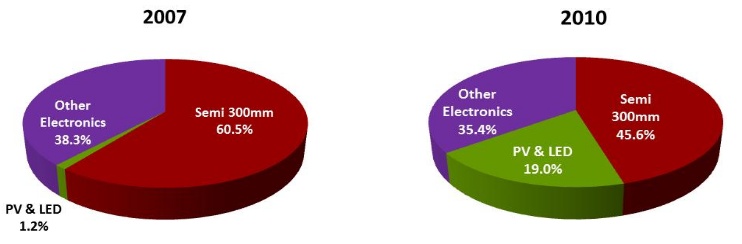

The Cimetrix strategy to diversify into new, high growth technology industries, starting in 2007 began to bear fruit in 2010 as shown below in Figure 1.

|

Figure 1

|

o

|

The Cimetrix software license revenue associated with machine shipments into 300mm semiconductor factories was still the largest market for Cimetrix products. That revenue represented approximately 45% of runtime license fees in 2010, compared to over 60% in 2007.

|

|

o

|

The Cimetrix software license revenue associated with machine shipments into the “clean tech” PV and LED factories represented approximately 19% of runtime license fees in 2010, compared to 1% in 2007.

|

|

·

|

We completed a new release of our PV2/GEM interface software product, CIMConnect, that enables customers to achieve fast compliance to the SEMI-sponsored PV2 (Photovoltaic Equipment Communication Interface) Specification.

|

|

·

|

The Company completed service releases for all of its other major Connectivity Products.

|

|

·

|

The Company completed a major new release for its CIMControlFramework tool control software product. This new release provides a number of important features for new customers, including major improvements in the operator interface, as well as greater configurability to reduce equipment installation time.

|

|

·

|

Tight cost controls implemented during the 2008/2009 recession enabled the Company to meet its goal of profitable growth with positive net income on a quarterly basis.

|

|

·

|

Cimetrix 2010 revenues increased 119% over 2009, 64% over 2008 and 6% over 2007, growing faster than the industry.

|

|

·

|

The Company ended 2010 with $1,559,000 of cash, up over $1 million compared to $339,000 on December 31, 2007.

|

|

·

|

Cimetrix established a new company in Japan to increase our business and to provide even greater customer support to our growing base of Japanese equipment suppliers.

|

Cimetrix Product Line

Tool Control

CIMControlFramework is an equipment control software framework based on the latest Microsoft .NET technology. It allows OEMs to meet the supervisory control, material handling, platform and process control, and factory automation requirements of the fabrication facilities or fabs. Developers can leverage framework components through configuration and extension, or customize when unique requirements exist. CIMControlFramework, unlike one-off solutions, is supported and maintained with upgrades, improvements, and performance enhancements. With a data-driven architecture at the core of the framework, data generated at any point on the tool can be quickly and easily accessed by any other module or external application. CIMControFramework is one of the Cimetrix flagship products, and benefited from significant investment in 2010. The new 3.0 release provides improvements to the operator interface and configurability, both of which support our customers completing their designs and accelerating installation at their customers’ sites.

The Cimetrix Open Development Environment (CODETM) is a family of open architecture machine modeling and motion control software products designed to control the most challenging multi-axis machine control applications. CODE 6 contains both a powerful off-line simulation development environment known as CIMulationTM and a robust, real-time motion and I/O control system called CIMControlTM.

Connectivity

CIMConnect is designed for general purpose equipment connectivity and enables production equipment in the semiconductor and electronics industries to communicate data to the factory’s host computer through the SEMI defined SECS (SEMI Equipment Communication Standard), GEM (Generic Equipment Model), and PV2 (new photovoltaic equipment communication standard based on SECS/GEM) standards. CIMConnect can also support other emerging communications standards for maximum flexibility. In addition, it supports multiple-host interfaces simultaneously, which allows customers to support legacy, custom, and GEM interfaces. CIMConnect is used in semiconductor wafer fabrication, semiconductor back-end (test, assembly, and packaging), flat panel display, surface mount technology, LED, PV, and disk drive industries.

TESTConnect™ is a SECS/GEM host emulator used to test equipment to ensure compliance with the SECS standards. TESTConnect simplifies the process of testing SECS implementations through the use of an intuitive, graphical user interface and menu-driven property screens that allow customers to construct message sets and test them without any programming.

SECSConnect™ is a software product for SEMI SECS standards. It can be used by equipment suppliers for sending/receiving SECS messages or by fabs for developing host-side software applications gathering data using the SECS standard.

CIM300 is a family of software tools for manufacturers of 300mm semiconductor equipment that allows for quick implementation of the required 300mm SEMI standards, including E39, E40, E87, E90, E94, and E116. These SEMI standards allow for the full automation required in manufacturing 300 mm wafers. CIM300 includes CIMFoundation™, CIM40-Process Job™, CIM87-Carrier Management™, CIM90-Substrate Tracking™, CIM94-Control Job™, and CIM116-Equipment Performance Tracking™.

CIMPortal is a family of software tools for manufacturers of semiconductor equipment that allow for quick implementation of the new Interface A SEMI standards, including E120, E125, E132, E134, E138, and E147 as well as optional features that support the emerging Enhanced Equipment Quality Assurance (EEQA) methodology. These standards are also referred to as EDA (Equipment Data Acquisition). The CIMPortal family includes products for equipment makers, fabs, and third-party application software providers. Interface A specifies a new port on each tool that provides detailed structured data that can be used for advanced process control, e-diagnostics, and other equipment engineering services applications. These software applications will become critical to the fabs as shorter ramp times are required. CIMPortal is a SEMI standards-compliant Interface A data collection and routing product with high-speed distributable data collection modules, equipment modeling tools, and a rich set of rules-based security and optimization features.

EDAConnect™ is a software product that allows host side software applications such as Advanced Process Control, Fault Detection and Classification, and Prognostics and Health Management to gather data using the SEMI Interface A standards. EDAConnect is designed for fabs developing their own software applications or third-party software developers. Semiconductor manufacturers recognize the additional data delivered by Interface A allows them to increase manufacturing throughput and improve product quality, and we believe the increased adoption of the standard will lead to greater sales for Cimetrix.

Competition

The Company’s main product lines face competition from other companies, technologies, and products. These competitive threats are summarized below:

Cimetrix’s main competitor is PEER Group, Inc. a private company based in Ontario, Canada. PEER Group was primarily a systems integrator before some acquisitions in 2009. PEER Group now competes directly with Cimetrix’s tool control, connectivity products and professional services. Cimetrix competes effectively against PEER Group with superior software technology, market focus and customer support.

Large equipment suppliers that choose to create their own connectivity software solutions and do not purchase third-party products are indirect competitors. For example, Applied Materials is the largest semiconductor capital equipment manufacturer and typically develops all of its tool control and connectivity software internally. There are also a number of integration companies that offer products and/or solutions meeting the tool control and connectivity needs required by OEMs. Companies that compete with Cimetrix in certain products or markets include Rudolph Technologies, Roth & Rau, NeST, Altastream, Kornic and other smaller regional players.

Sales and Marketing

Sales and marketing operations are conducted under the direction of the Company’s Executive Vice President of Sales and Marketing, David P. Faulkner. Sales and marketing is responsible for sales, product marketing, product management and customer support. The Company's sales offices are located in Salt Lake City, Utah and Boston, Massachusetts. In addition, the Company opened Cimetrix Japan K.K. to increase sales and provide even greater customer support to our growing base of Japanese equipment suppliers. The Company also has 2 distributors in Japan and sales representation in Europe.

Software Engineering

Software engineering operations are conducted under the direction of the Company’s Vice President of Software Engineering, Paul A. Johnson. Software engineering is responsible management of all software engineering activities, including the Cimetrix software engineering process, research and development, product development, software quality assurance and professional services.

Finance, General and Administrative

Finance and general and administrative operations are conducted under the direction of the Company’s CFO, Jodi M. Juretich.

Intellectual Property Rights

The Company’s intellectual property rights are important and valuable assets that enable the Company to promote its products and services and improve its competitive position. The Company relies on copyright, trade secret, and trademark laws, confidentially and other agreements with employees and with OEMs, distributors, end users, and other customers, and various security measures, such as software encoding, to protect the proprietary nature of its products. The Company protects the source code of its software products as trade secrets and makes source code available to other parties only under limited circumstances using security measures and contractual restrictions.

The Company’s software products are generally provided to customers for use pursuant to license agreements that limit the customers’ use of those products. The Company relies in part on electronic license agreements that are not physically signed by the customers, and the enforceability of such agreements has not been conclusively determined in all jurisdictions. In addition, semiconductor-related industries have experienced a significant amount of intellectual property litigation. Litigation may be therefore become necessary to enforce the Company’s intellectual property rights, and the Company’s intellectual property rights may be challenged or invalidated, which would negatively affect the Company’s competitiveness. Litigation may also be necessary to defend the Company against claims of intellectual property infringement, and adverse results in any such litigation could limit the Company’s ability to develop and distribute its products. Moreover, intellectual property litigation can be expensive and require the time and attention of Company management and other personnel. Any of these circumstances could negatively affect the Company’s business, results, and financial condition.

Monitoring and preventing the unauthorized use of computer software and related technologies is difficult, and software piracy is a significant problem in the software industry. These challenges are particularly difficult in some international markets, where intellectual property rights are not protected as well as they are in the United States. In addition, there is no guaranty that the Company’s confidentiality agreements and other agreements will be honored by the other contracting parties, that the Company will prevail in any litigation that arises with respect to those agreements, that the Company will have adequate remedies for any breach of those agreements, or that the Company’s technology will not otherwise become known to or independently developed by others. The Company will continue to make significant efforts to protect its intellectual property rights.

Major Customers and Foreign Sales

During 2010, one customer accounted for 11% of the Company’s total revenues. During 2009, one customer accounted for approximately 12% of the Company’s total revenues. These customers were not related.

The following table summarizes domestic and export sales as a percent of total sales for the years ended December 31, 2010 and 2009:

| Years Ended December 31, | 2010 | 2009 |

|

Domestic sales

|

44%

|

49% |

|

Export Sales

|

56%

|

51% |

Through December 31, 2010, all the Company's export sales have been payable in United States dollars so that the Company is not exposed to currency fluctuations with respect to its accounts receivables.

In 2010, sales to customers in Germany and Japan accounted for 15% and 19%, respectively, of total sales. In 2009, sales to customers in Germany and Japan accounted for 14% and 12%, respectively, of total sales.

Personnel

As of December 31, 2010, the Company had 25 direct employees and 8 contractors under contract. None of the employees of the Company are represented by a union or subject to a collective bargaining agreement, and Cimetrix considers its relations with its employees to be favorable.

Statements regarding the future prospects of Cimetrix must be evaluated in the context of a number of factors that may materially affect the Company’s financial condition and results of operations. Disclosure of these factors is intended to permit the Company to take advantage of the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. In addition to the factors discussed elsewhere in this report, these are important factors that could cause actual results or events to differ materially from those contained in any forward-looking statements made by or on behalf of the Company. Although Cimetrix has attempted to list the factors that it is currently aware may have an impact on its operations, there may be other factors of which the Company is currently unaware or to which it does not assign sufficient significance, and the following list should not be considered comprehensive.

The Company has a history of operating losses and its future liquidity is largely dependent on positive cash flows from operations.

Cimetrix has an accumulated operating deficit of $32,910,000 at December 31, 2010 and total notes payable and long-term debt outstanding of $772,000. The Company’s future liquidity is dependent on sustaining positive cash flows from operations and, to the extent necessary, obtaining additional external financing through the issuance of debt or equity securities. See “Liquidity and Capital Resources.” If the Company is unable to sustain the cash flow necessary to support future operations, retire its outstanding debt, and meet its research and development needs, its future operations would be materially adversely affected.

The semiconductor capital equipment market is highly cyclical.

Cimetrix’s largest single source of revenue is the highly cyclical semiconductor capital equipment industry. The semiconductor capital equipment industry periodically has severe and prolonged downturns which could cause the Company’s operating results to fluctuate significantly. The Company is also exposed to risks associated with industry overcapacity, including reduced capital expenditures, decreased demand for the Company’s products, and potential delays by customers paying for the Company’s products. Cimetrix’s business depends in significant part upon the capital expenditure decisions of manufacturers of semiconductor devices, including manufacturers that open new, or expand existing, facilities. Periods of overcapacity and reductions in capital expenditures cause decreases in demand for the Company’s products and services.

The PV industry is highly dependent on government subsidies.

The Company has been able to successfully win new customers in the PV industry that contributed to growth in 2010. The PV market has experienced strong growth over the past several years, but the future is uncertain. Many regions of the world initiated government subsidies for solar electricity, which are at risk of being reduced or eliminated. The PV industry is still often dependent on such subsidies to remain competitive with other energy sources and would most likely be negatively impacted in the event of substantial decreases in government support.

The Company is reliant on software license revenue associated with OEM shipments.

The Company has traditionally obtained 30% or more of its revenue from software license revenue associated with the shipment of equipment by its customers. The 2010 global economic environment increased the demand for electronic devices by consumers and businesses, resulting in dramatic increases in year-over-year spending on capital equipment. While capital equipment markets are projected to increase in 2011, our ability to accurately predict future economic conditions is particularly low.

The Company is engaged in a highly competitive industry.

Cimetrix is engaged in a highly competitive industry involving rapidly changing products. The likelihood of success of the Company must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the development of new software and other products and services as well as the competitive environments within the industry in which the Company operates. There can be no assurance that the Company will not encounter substantial delays and unexpected expenses related to research, development, production, marketing, or other unforeseen difficulties in bringing new software products and services to market.

Management believes that most, if not all, of the Company's major competitors currently have greater financial resources and market presence than Cimetrix. Accordingly, these competitors may be able to compete very effectively on pricing and develop technology to increase the effectiveness and flexibility of their products. Further, each of these competitors has already established a share of the market for their products and may find it easier to limit market penetration by Cimetrix. While management is unaware of any current initiatives, any of these competitors could be developing additional technology that will directly compete with the Company's product offerings. By focusing on the semiconductor and electronics markets for the short term, management believes the Company can earn a leadership position in the face of other competitors.

The Company may experience delays or technical difficulties in the introduction of new products.

Cimetrix may experience delays or technical difficulties in the introduction of new products, and this may be costly and adversely affect customer relationships. The Company’s success depends in part on continuing to gain “design in” wins for Cimetrix software products, which includes new product ideas. The Company’s products are complex and the Company may experience delays and technical difficulties in the introduction of new software products or product enhancements or difficulties when products are put in high volume production lines. The Company’s inability to overcome such difficulties, to meet the technical specifications of any new products or enhancements, or to ship the products or enhancements in a timely manner could materially adversely affect the Company’s business and results of operations as well as customer relationships. The Company may from time to time incur unanticipated costs to ensure the functionality and reliability of products and solutions early in their life cycles and such costs could be substantial. If the Company experiences reliability or quality problems with its new products or enhancements, it could face a number of difficulties, including reduced orders, higher customer service costs, and delays in collection of accounts receivable, all of which could materially adversely affect the Company’s business and results of operations.

The Company’s business involves a lengthy sales cycle.

Sales of Cimetrix’s software products and related services depend upon the decision of a prospective customer to change its current software applications. Therefore, the decision to purchase the Company’s products and services often requires time consuming internal procedures associated with the evaluation, testing, implementation, and introduction of new technologies into customers’ software applications. In addition, after the technical evaluation has been successfully completed, the Company may experience further delays finalizing system sales while the customer obtains internal approval for the new software application. Consequently, months or even years may elapse between the first contact with a customer regarding a potential purchase and the customer’s placing the order. The Company’s lengthy sales cycle increases sales and marketing costs and reduces the predictability of the Company’s revenues.

The Company is dependent upon OEM customers.

Cimetrix sells its products principally to equipment suppliers, or OEMs, which have relationships with the end users. The quantity of each customer’s business with the Company depends substantially on that customer’s relationships with end users, market acceptance of the customer’s products that utilize the Company's software products, and the development cycle of the customer’s products. The Company could be materially affected adversely by a downturn in either its customer’s sales or their failure to meet the expectations of their end-user customers. The Company will likely from time to time have individual customers that account for a significant portion of its business and any adverse developments in such customers’ business would adversely affect the Company. It is unclear how the recent economic downturn has affected many of the Company’s OEM customers on a long-term basis.

The Company’s markets are characterized by rapid technological changes.

The markets for Cimetrix’s products are new and emerging, and as such, these markets are characterized by rapid technological change, evolving requirements, developing industry standards, and new product introductions. The dynamic nature of these markets can render existing products obsolete and unmarketable within a short period of time. Accordingly, the life cycle of the Company's products is difficult to estimate. The Company's future success will depend in large part on its ability to enhance its products and to develop and introduce, on a timely basis, new products that keep pace with technological developments and emerging industry standards and gain a competitive advantage.

The Company is highly dependent upon key personnel.

The Company is highly dependent on the services of its key managerial and engineering personnel, including, Bob Reback, president and chief executive officer, Jodi Juretich, chief financial officer, Dave Faulkner, executive vice president of sales and marketing and Paul Johnson, vice president of software engineering. The loss of any member of the Company's senior management team could adversely affect its business prospects. The Company does not maintain key-man insurance for any of its key management personnel.

Future litigation may adversely affect the Company.

If legal proceedings are brought against Cimetrix in the future, there could be adverse consequences. If the Company were sued for a violation of the intellectual property rights of another entity, the target of a class action with respect to fluctuations in its share price, or the defendant (or even the plaintiff) in other major litigation, the business and operations of the Company could be adversely affected. Any such litigation could distract management attention and result in significant costs, without regard to the outcome of the litigation. In addition, any adverse judgment in such litigation could have a material adverse impact on the financial position of the Company and its business prospects.

Continued compliance with regulatory and accounting requirements will be challenging and costly.

As a result of compliance with the Sarbanes-Oxley Act of 2005, with the potential standards resulting from the Company’s stock being listed in the future on an exchange and with the attestation and accounting changes required by the Securities and Exchange Commission (SEC), the Company is required to implement additional internal controls, improve existing internal controls, and comprehensively document and test internal controls. As a result, the Company is required to hire additional personnel and obtain additional legal, accounting, and advisory services, all of which cause the Company’s general and administrative costs to increase, and may adversely affect its operating results.

The price of the Company’s common stock has fluctuated in the past and may continue to fluctuate significantly in the future.

The market price of the Company’s common stock has been highly volatile in the past, which may continue in the future. In addition, in recent years the stock market in general, and the market for shares of high technology stocks in particular, have experienced extreme price fluctuations. These fluctuations have often been unrelated to the operating performance of the affected companies and such fluctuations could adversely affect the market price of the Company’s common stock. In the past, securities class action litigation has often been instituted against a company following periods of volatility in its stock price. This type of litigation, if filed against the Company, could result in substantial costs and divert management’s attention and resources.

The Company is not subject to this requirement since it is not an accelerated filer.

The Company’s principal offices are located in a leased facility at 6979 South High Tech Drive, Salt Lake City Utah. The present facility consists of approximately 17,000 square feet and expires on November 30, 2011. All operations of the Company are conducted from its headquarters, with satellite offices located in Massachusetts, Texas and Yokohama-shi, Kanagawa, Japan.

ITEM 3. LEGAL PROCEEDINGS

The Company is not currently involved with any pending litigation.

ITEM 4. RESERVED

EXECUTIVE OFFICERS OF THE REGISTRANT

|

Officer Name

|

Position

|

Age

|

|

Robert H. Reback

|

CEO and President

|

51

|

|

Jodi M. Juretich

|

CFO, Secretary and Treasurer

|

48

|

|

David P. Faulkner

|

Executive Vice President

|

55

|

|

Paul A. Johnson

|

Vice President of Software Engineering

|

55

|

Robert H. Reback joined Cimetrix as vice president of sales in January 1996, was promoted to executive vice president of sales in January 1997, and was promoted to president on June 25, 2001. Mr. Reback was the district manager of Fanuc Robotics' West Coast business unit from 1994 to 1995. From 1985 to 1993, he was director of sales/account executive for Thesis, Inc., a privately owned supplier of factory automation software, and was previously a senior automation engineer for Texas Instruments. Mr. Reback has a Bachelor of Science degree in Mechanical Engineering and a Master of Science degree in Industrial Engineering from Purdue University.

Jodi M. Juretich joined Cimetrix in May 2007 and was promoted to chief financial officer in November 2008. Ms. Juretich has a strong background of over 10 years in executive accounting management for private high-growth companies as well as 10 years of public accounting experience. Prior to joining Cimetrix, Ms. Juretich was vice president of finance for two venture funded private companies and general manager for a subsidiary of Monster.com. She has played key roles in raising venture capital in start-up organizations and most recently led Cimetrix in implementing and managing the new Sarbanes-Oxley compliance requirements. Ms. Juretich holds a Bachelor of Science degree in Business Management from Westminster College. She is currently a member of Institute of Management Accountants.

David P. Faulkner joined Cimetrix in August 1996. Mr. Faulkner was previously employed as the manager of PLC Marketing, manager of Automotive Operations, and district sales manager for GE Fanuc Automation, a global supplier of factory automation computer equipment specializing in programmable logic controllers, factory software, and computer numerical controls from 1986 to 1996. Mr. Faulkner has a Bachelor of Science degree in Electrical Engineering and a Master of Business Administration degree from Rensselaer Polytechnic Institute.

Paul Johnson joined Cimetrix in July 2010. Mr. Johnson has 25 years of experience in software development in a variety of industries, including finance, telecommunications, and semiconductor. Mr. Johnson has an extensive development and management background working in .NET/C#, agile development methodologies as well as object-oriented design and implementation techniques. Throughout his career, Mr. Johnson has led many software product engineering organizations, both large and small, serving in roles such as primary developer, team lead, principal architect, and executive manager. Mr. Johnson specializes in the application of mature software development technologies and processes as well as incorporating new techniques where they prove successful. Mr. Johnson has several advanced degrees in Engineering and Science.

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of the Company is quoted on the OTCQB marketplace through OTC Markets Group under the symbol "CMXX". The table below sets forth the high and low bid prices of the Company's common stock for each quarter during the past two fiscal years. The quotations presented reflect inter-dealer prices, without retail markup, markdown, or commissions, and may not necessarily represent actual transactions in the common stock.

| Period (Calendar Year) | Price Range | ||||||||

| High | Low | ||||||||

| 2009 | |||||||||

| First Quarter | $ | .04 | $ | .02 | |||||

| Second Quarter | $ | .02 | $ | .02 | |||||

| Third Quarter | $ | .04 | $ | .01 | |||||

| Fourth Quarter | $ | .10 | $ | .03 | |||||

| 2010 | |||||||||

| First Quarter | $ | .13 | $ | .06 | |||||

| Second Quarter | $ | .25 | $ | .09 | |||||

| Third Quarter | $ | .23 | $ | .13 | |||||

| Fourth Quarter | $ | .52 | $ | .16 | |||||

On March 15, 2011, the closing bid quotation for the Company’s common stock on the OTCQB market place was $0.35 per share. Potential investors should be aware that the price of the common stock in the trading market may change dramatically over short periods as a result of factors unrelated to the earnings and business activities of the Company.

On March 15, 2011, there were 44,857,767 shares of common stock outstanding held by approximately 630 shareholders of record, which does not include shareholders whose stock is held through securities position listings.

To date, the Company has not paid dividends with respect to its common stock. Management plans to retain future earnings, if any, for working capital and investment in growth and expansion of the business of the Company and does not anticipate paying any dividends on the common stock in the foreseeable future.

Equity Compensation Plan Information

In May 2006, the Company’s shareholders approved the combined amendment and restatement of the Cimetrix Incorporated 1998 Incentive Stock Option Plan and the Cimetrix Incorporated Director Stock Option Plan as the Cimetrix 2006 Long-Term Incentive Plan (the “Plan”). In addition to stock options, the Plan authorizes the grant of stock appreciation rights, restricted stock awards and other stock unit, and equity-based performance awards.

The following table summarizes the Company’s equity compensation plan as of December 31, 2010.

|

Plan Category

|

Number of Securities

to be Issued Upon

Exercise of Outstanding Options

|

Weighted Average Exercise Price of Outstanding

Options (1)

|

Number of Securities Issued as Restricted Stock Grants (2)

|

Number of

Securities Remaining Available for Future Issuance

|

|

|

Equity compensation

plans approved by

security holders (3)

|

2,817,944

|

$.21

|

2,600,236

|

598,799

|

|

(1) Excludes 391,490 shares issuable upon the exercise of warrants issued to purchasers of the Company’s Senior Notes as they were not issued as compensation to Company officers, directors or employees. See Warrants, discussed below.

|

|

(2) During the years ended December 31, 2010 and 2009, restricted stock awards for a total of 700,000 and 0 shares of the

|

|

Company’s common stock was granted, with vesting periods ranging from immediately on issuance to 21 months.

|

|

(3) A total of 6,250,000 shares of common stock have been reserved for issuance under the Plan. To date, a total of 175,521 options have been exercised under the Plan.

|

A total of 6,250,000 shares of common stock have been reserved for issuance under the Plan. Of this amount, 6,250,000 shares are registered under a Form S-8 registration statement, which became effective on August 27, 2004.

Warrants

In addition to the shares issuable under the Company’s Equity Compensation Plan, the Company has outstanding warrants held by purchasers of the Company’s Senior Notes to purchase 391,490 shares of common stock at an exercise price of $0.05 per share.

Recent Sales of Unregistered Securities

On March 23, 2010 and September 30, 2010, in connection with the exercise of previously outstanding Senior Note warrants, the Company issued 25,000 and 12,500 shares, respectively, of its restricted common stock, par value $0.0001 per share, for a price of $0.05 per share, or an aggregate of $1,875.

The sales were made in reliance on the exemptions from the registration requirements provided by Regulation D of the Securities Act of 1933, as amended. The sales were made to two accredited purchasers. The certificates representing the shares sold will bear a legend indicating that they have been issued in reliance on an exemption from the registration requirements of U.S. Securities laws and cannot be sold or transferred without compliance with such registration requirements or the availability of an exemption from such registration requirements.

The Company is not subject to this requirement since it is not an accelerated filer.

Overview

The following is a brief discussion and explanation of significant financial data, which is presented to help the reader understand the results of the Company’s financial performance for the years ended December 31, 2010 and 2009, and the Company’s financial position at December 31, 2010. The information includes discussions of sales, expenses, capital resources, and other significant financial items.

Cimetrix is a software company that designs, develops, markets and supports factory automation and tool control solutions worldwide. The Company offers software products and professional services tailored to meet the needs of equipment suppliers in the areas of advanced tool control, general purpose equipment connectivity, and specialized connectivity for 300mm semiconductor wafer fabrication facilities. Revenues are derived from the sales of software and services. Software includes the initial sale of software development kits, the ongoing runtime licenses that equipment suppliers purchase for each machine shipped with Cimetrix software and annual contracts for software license updates and product support. Services include the sale of professional services that provide customers with software solutions typically incorporating Cimetrix software products. While Cimetrix products are installed in a wide range of industries, the Company has focused over the past several years on the global semiconductor and electronics industries. For a detailed discussion of the Company’s products, markets, and other Company information, refer to Item 1, “Business.”

Critical Accounting Policies

The preparation of financial statements in conformity with generally accepted accounting principles of the United States (“GAAP”) requires estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses, and related disclosures of contingent assets and liabilities in the consolidated financial statements and accompanying notes. The SEC has defined a company’s critical accounting policies as the ones that are most important to the portrayal of the company’s financial condition and results of operations, and which require the company to make its most difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. Based on this definition, we have identified the critical accounting policies and judgments addressed below. We also have other key accounting policies, which involve the use of estimates, judgments, and assumptions that are significant to understanding our results. For additional information, see Note 1 of our notes to consolidated financial statements. Although we believe that our estimates, assumptions, and judgments are reasonable, they are based upon information presently available. Actual results may differ significantly from these estimates under different assumptions, judgments, or conditions. Our critical accounting policies are described below.

Revenue Recognition

The Company derives revenues from two primary sources, software and professional services. Software revenues are reported in two categories, the sale of new software licenses and software license updates and product support. The Company has “off-the-shelf” software packages in the tool control and connectivity product lines. Tool control products include items such as CIMControlFramework, CIMControl, and CIMulation. Connectivity products include items such as CIM300, CIMConnect, and CIMPortal. New software licenses include the sale of software development kits as well as the runtime license fees associated with deployment of the Company’s software products. Software license updates and product support are typically annual contracts with customers that are paid in advance, which provides the customer access to new software releases, maintenance releases, patches, and technical support personnel. Professional service sales are derived from the sale of services to design, develop, and implement custom software applications typically using Cimetrix software products.

Before the Company recognizes revenue, the following criteria must be met:

|

1)

|

Evidence of a financial arrangement or agreement must exist between the Company and its customer. Purchase orders and signed OEM contracts are two examples of items accepted by the Company to meet this criterion.

|

|

2)

|

Delivery of the products or services must have occurred. The Company treats either physical or electronic delivery as having met this requirement. It is the policy of the Company to provide its customers a 30-day right to return. However, because the amount of returns has been insignificant, the Company recognizes revenue immediately upon transfer of both title and risk of loss to the customer upon shipment of the product. If the number of returns were to increase, the Company would establish a reserve based on a percentage of sales to account for any such returns.

|

|

3)

|

The price of the products or services is fixed and measurable.

|

|

4)

|

Collectability of the sale is reasonably assured and receipt is probable. Collectability of a sale is determined on a customer-by-customer basis. Typically, Cimetrix sells to large corporations which have demonstrated an ability to pay. If it is determined that a customer may not have the ability to pay, revenue is deferred until the payment is collected.

|

The software component of the Company’s products is an integral part of its functionality. As such, the Company applies the provisions of the Accounting Standards Codification (“ASC”) Topic 985-605 Software - Revenue Recognition.

The Company’s products are fully functional at the time of shipment. The software components of the Company’s products do not require significant production, modification, or customization. As such, revenue from product sales is recognized upon shipment provided that the criteria outlined above are met.

Revenue related to services is recognized as services are performed if there is not an extended contract related to such services. If the services are provided pursuant to a contract that extends over a period of time, the revenue from services is recorded ratably over the contract period, generally using the percentage of completion method. When the current estimates of total contract revenue and contract cost indicate a loss, a provision for the entire loss on the contract is made in the period in which the loss becomes evident.

If a sale involves a bundled package of new software licenses, software license updates and product support, and professional services, and the Company has vendor specific objective evidence of fair value among arrangement elements in accordance with ASC Topic 985-605, then revenue is first allocated to software license updates and product support and professional service obligations at fair market value. The remaining amount is applied to new software license revenue. Assuming all of the above criteria have been met, revenue from the new software license portion of the package is recognized upon shipment. Revenue from material software license updates and product support contracts is recognized ratably over the term of the contract, which is generally 12 months. Revenue from professional services is recognized as services are performed. Standard payment terms for sales are net 30 days for sales in the United States and net 45 to 60 days for foreign customers. On occasion, extended payment terms will be offered. If the Company provides payment terms greater than 90 days and collection is not reasonably assured, then revenues are generally recognized as payments are received.

In the event that the Company does not have vendor-specific objective evidence of fair value among arrangement elements in a bundled package of products and services, the Company reports the revenue in a single revenue line presentation in the consolidated statements of operations in accordance with ASC Topic 985–605.

Stock-Based Compensation

We account for stock-based compensation in accordance with ASC Topic 718-10, Compensation - Stock Compensation. ASC Topic 718-10 requires measurement of compensation cost for equity-based awards (i.e., stock options, warrants and restricted stock) at fair value on date of grant and recognition of the fair value of compensation for awards expected to vest over the requisite service period.

We currently use the Black-Scholes option pricing model to determine the fair value of stock options and warrants. The determination of the fair value of stock-based awards on the date of grant using an option pricing model is affected by our stock price as well as assumptions regarding a number of complex and subjective variables. These variables include our expected stock price volatility over the expected term of the awards, actual and projected employee stock option exercise behaviors, the risk-free interest rate, estimated forfeitures, and expected dividends.

We estimate the expected term of options granted by calculating the average term from our historical stock option exercise experience. We estimate the volatility of our common stock by using historical volatility. We base the risk-free interest rate on zero-coupon yields implied from U.S. Treasury issues with remaining terms similar to the expected term on the options. We do not anticipate paying any cash dividends in the foreseeable future and therefore use an expected dividend yield of zero in the option pricing model.

We are required to estimate forfeitures at the time of grant and revise those estimates in subsequent periods if actual forfeitures differ from those estimates. We use historical data to estimate pre-vesting option forfeitures and record stock-based compensation expense only for those awards that are expected to vest. If we use different assumptions for estimating stock-based compensation expense in future periods or if actual forfeitures differ materially from our estimated forfeitures, the change in our stock-based compensation expense could materially affect our operating income, net income and net income per share.

Accounts Receivable

Trade accounts receivable are carried at original invoice amount less an estimate made for doubtful accounts. The Company offers credit terms on the sale of its products to a majority of its customers and requires no collateral from these customers. The Company performs ongoing credit evaluations of its customers’ financial condition and maintains an allowance for doubtful accounts based upon historical collection experience and expected collectability of all accounts receivable. The Company’s allowance for doubtful accounts, which is determined based on historical experience and a specific review of customer balances, was $20,000 as of December 31, 2010 and 2009. Trade receivables are written off when deemed uncollectible. Recoveries of trade receivables previously written off are recorded as income when received.

Impairment of Long-Lived Assets

The Company periodically reviews its long-lived assets, including definite-lived intangible assets, for impairment when events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. The Company evaluates, at each balance sheet date, whether events and circumstances have occurred which indicate possible impairment. The carrying value of a long-lived asset is considered impaired when the anticipated cumulative undiscounted cash flows of the related asset or group of assets is less than the carrying value. In that event, a loss is recognized based on the amount by which the carrying value exceeds the estimated fair market value of the long-lived asset.

In 2010, the Company did not have any impairment of its long-lived assets.

Income Taxes

As part of the process of preparing consolidated financial statements, the Company is required to estimate income taxes in each of the jurisdictions in which it operates. This process involves estimating the Company’s actual current income tax exposure together with assessing temporary differences resulting from differing treatment of items for income tax and financial accounting purposes. These temporary differences result in deferred tax assets and liabilities. When appropriate, the Company records a valuation allowance to reduce its deferred tax assets to the amount that the Company believes is more likely than not to be realized. Key assumptions used in estimating a valuation allowance include potential future taxable income, projected income tax rates, expiration dates of net operating loss and tax credit carry forwards, and ongoing prudent and feasible tax planning strategies. Income tax expense did not increase significantly as a result of the Company’s net income for the year ended December 31, 2010 because of the net operating loss carry-forwards. At December 31, 2010, the Company had fully reduced its net deferred tax assets by recording a valuation allowance of $9,962,000. If the Company were to determine that it would be able to realize its deferred tax assets in the future in excess of the net recorded amount, an adjustment to reduce the valuation allowance would increase income in the period such determination was made.

Operations Review

The following table sets forth the percentage of costs and expenses to net revenues derived from the Company's Consolidated Statements of Operations for each of the two preceding fiscal years.

| December 31, | ||||||

| 2010 | 2009 | |||||

|

Total Revenues

|

100

|

%

|

100

|

%

|

||

|

Operating costs and expense:

|

||||||

|

Cost of revenues

|

22

|

31

|

||||

|

Sales and marketing

|

16

|

25

|

||||

|

Research and development

|

12

|

17

|

||||

|

General and administrative

|

20

|

35

|

||||

|

Depreciation and amortization

|

0

|

3

|

||||

|

Total operating costs and expenses

|

70

|

111

|

||||

|

Income (loss) from operations

|

30

|

(11)

|

||||

|

Other expense, net

|

(1)

|

(4)

|

||||

|

Net income (loss)

|

29

|

%

|

(15)

|

%

|

||

Cimetrix reported net income of $1,904,000 for the year ended December 31, 2010, compared to a net loss of $476,000 for the year ended December 31, 2009. The net income for 2010 and loss for 2009 includes non-cash expenses of $68,000 and $52,000, respectively, related to stock-based compensation. The net income for 2010 and the loss for 2009 also include non-cash expense of $29,000 and $85,000, respectively, for depreciation and amortization. The decrease from prior years was from certain intangible assets becoming fully amortized in 2010 and aging equipment becoming fully depreciated in 2010.

Net cash provided by operating activities was $1,802,000 for the year ended December 31, 2010. Net cash used in operating activities was $525,000 for the year ended December 31, 2009.

Results of Operations

Revenues

The following table summarizes revenues by category and as a percent of total revenues:

| Year Ended December 31, | |||||

| 2010 | 2009 | ||||

|

New software licenses

|

$ 5,108,000

|

75%

|

$ 1,333,000

|

43%

|

|

|

Software license updates and product support

|

855,000

|

13%

|

852,000

|

27%

|

|

|

Total software revenues

|

5,963,000

|

88%

|

2,185,000

|

70%

|

|

|

Professional services

|

844,000

|

12%

|

926,000

|

30%

|

|

|

Total revenues

|

$ 6,807,000

|

100%

|

$ 3,111,000

|

100%

|

|

Total revenues for 2010 increased $3,696,000, or 119%, to $6,807,000, from $3,111,000 in 2009. As the table above indicates, the increase in net sales in 2010 as compared to 2009 was attributed primarily to increased revenues for new software licenses as our customers increased their shipments of equipment as the global capital equipment markets recovered. The mix of revenue categories is subject to change on a year-to-year basis. The decrease in professional services revenue in the current year compared to last year can be attributed to smaller staff levels entering the year and a change in focus to selling software products. The market for semiconductor 300mm capital equipment, our largest single source of revenue for the past several years, experienced a nice year-over-year recovery, but was still below peak 2007 levels. Cimetrix revenues associated with software license updates and product support was essentially flat year-over-year as some customers went out of business or could no longer afford to purchase annual support, which were replaced by new customers.

Cost of Revenues

The Company's cost of revenues as a percentage of total revenues for the years ended December 31, 2010 and 2009 was 22% and 31%, respectively. Cost of revenues increased $549,000, or 57%, to $1,516,000 for 2010, from $967,000 for 2009. These increases were a combination of higher revenues, as discussed above, investment in our current products, profit sharing, and elimination of pay cuts and furloughs that were in place in 2008 and 2009. Cost of revenues as a percentage of total revenues will vary from period to period depending on the mix of software and professional service revenues, the type of service projects completed, the pricing strategy for the projects, the extent of utilization of outside resources, and other factors.

Sales and Marketing

Sales and marketing expenses increased $289,000 or 37%, to $1,077,000 in 2010, from $788,000 in 2009. These increases were a combination of increased commissions on higher revenues, as discussed above, profit sharing implemented in 2010 and elimination of pay cuts and furloughs that were in place in 2008 and 2009. Sales and marketing expenses reflect the direct payroll and related travel expenses of the Company’s sales and marketing staff, the development of product brochures and marketing materials, costs associated with press releases, branding, search engine optimization, website design improvements, and the costs related to the Company’s representation at industry trade shows.

Research and Development

Research and development expenses increased $327,000 or 63%, to $846,000 in 2010, from $519,000 in 2009. The increase is primarily due to a resurgence of investment in our current products as well as our new CIMControlFramework software product in 2010, profit sharing implemented in 2010 and elimination of pay cuts and furloughs that were in place in 2008 and 2009. Research and development expenses include only direct costs for wages, benefits, materials, and education of technical personnel involved in product development. All indirect costs such as rents, utilities, depreciation, and amortization are included in general and administrative expenses, as discussed below.

General and Administrative

General and administrative expenses increased $232,000, or 21%, to $1,337,000 in 2010, from $1,105,000 in 2009. General and administrative expenses include all direct costs for administrative and accounting personnel and all rents and utilities for maintaining Company offices. The majority of these increases were a combination of the elimination of pay cuts and furloughs that were in place in 2008 and 2009 and profit sharing implemented in 2010. The Company continues to incur general and administrative expenses related to its public company status and Sarbanes-Oxley internal controls compliance activities.

Depreciation and Amortization

Depreciation and amortization expense decreased $56,000, or 66%, to $29,000 in 2010 from $85,000 in 2009. The decrease over prior years was a result of certain intangible assets associated with the EFS Solutions acquisition in October 2005 becoming fully amortized in 2010 and from aging equipment becoming fully depreciated in early 2010. In 2010, the Company began investing in software and equipment upgrades, and the cost associated with those upgrades is reflected in the cash flows used in investing activities.

Other Income (Expense)

Cimetrix did not earn any interest income in 2010 and 2009. The absence of interest income in 2010 was a result of lower cash reserves in the first half of the year combined with near zero interest rates in 2010. The absence of interest income in 2009 was a result of lower levels of cash reserves as the Company responded to the cash shortages caused by the global economic crisis.

Interest expense decreased $29,000, or 23%, to $98,000 in 2010, compared to $127,000 in 2009. The decrease in 2010 is attributable to the termination of the credit facility in 2010 as well as an associated interest decrease related to the repayment of Senior Notes in July, 2010.

Gain on Sale of Property and Equipment decreased $4,000 or 100% to $0 in 2010, from $4,000 in 2009. The 2009 Gain on Sale of Property and Equipment resulted from the sale of warehouse equipment located in the Company’s headquarters’ facility in Salt Lake City, UT and the sale of a Company automobile associated with our France operations.

Liquidity and Capital Resources

At December 31, 2010, the Company had current assets of $2,265,000, including cash and cash equivalents of $1,559,000, and current liabilities of $1,144,000, resulting in a working capital of $1,121,000. Current liabilities include deferred revenue of $237,000 at December 31, 2010, which requires the Company to provide services and support but does not represent a scheduled obligation requiring the outlay of Company funds other than the payment of employee expenses and other costs necessary to provide the support.

As of December 31, 2010, the Company had notes payable and long-term debt totaling $777,000 comprised of the following:

|

10% Senior Notes due September 30, 2012

|

$ | 772,000 | ||

|

Bank loan

|

- | |||

|

Other

|

5,000 | |||

|

Total

|

777,000 | |||

|

Less current portion

|

5,000 | |||

|

Long-term portion

|

$ | 772,000 |

Included in the 10% Senior Notes is $396,000 held by officers, directors, employees, or their affiliates.

Senior Notes - As of December 31, 2010, the Company had Senior Notes Payable totaling $772,000 and warrants, issued with the Senior Notes, to purchase 391,490 shares of common shares of the Company at $0.05 per share.

Bank Loan - The Company and Silicon Valley Bank entered into a Loan and Security Agreement, effective as of December 26, 2007, that was previously amended by agreements dated April 9, 2008 and January 20, 2009. On January 12, 2010, the Company and the Bank entered into a Third Amendment to the Facility Agreement (the “Third Amendment”), effective December 24, 2009. The Third Amendment extended the maturity date of the Facility Agreement to December 23, 2010. As of July 31, 2010, the Facility was fully paid off and the Company and Silicon Valley Bank terminated the Loan and Security Agreement.

Historically, the Company has incurred net losses and negative cash flows from operations. As of December 31, 2010, the Company had an accumulated deficit of $32,910,000 and total stockholders’ equity of $533,000. During the year ended December 31, 2010, the Company reported net income of $1,904,000 and generated net cash from operating activities of $1,802,000. Management believes the existing cash and anticipated cash flows from operations will be sufficient to fund planned operations for the next twelve months. However, there can be no assurance that operations and operating cash flows will continue at the current levels or improve in the near future. If the Company is unable to maintain profitable operations and positive operating cash flows sufficient to meet scheduled debt obligations, it may need to seek additional funding or be forced to scale back its development plans or to significantly reduce or terminate operations.

Net cash generated by operating activities for the year ended December 31, 2010 was $1,802,000, compared to net cash used in operating activities of $525,000 for the year ended December 31, 2009. The increase in net cash generated by operating activities in 2010 over 2009 was primarily due to the increased revenues and changes in the Company’s business model.

Net cash used in investing activities for the year ended December 31, 2010 was $76,000. Net cash provided by investing activities for the year ended December 31, 2009 was $6,000. The increase in cash used in investing activities in 2010 consisted of the acquisition of new property and equipment.

Net cash used in financing activities was $306,000 for the year ended December 31, 2010, composed of $15,000 in proceeds from the sale of common stock related to Senior Note warrants and employee stock options exercised, Senior Note repayments of $50,000, bank loan repayments of $393,000, partially offset by borrowings from the bank loan of $147,000 and payments of other debt of $25,000. Net cash provided by financing activities was $643,000 for the year ended December 31, 2009, composed of $650,000 in proceeds from the sale of common stock, $1,876,000 in borrowings from the bank loan, $75,000 in proceeds from the sale of Senior Notes, $175,000 in proceeds from the sale of Senior Notes to related parties, and short-term related party advances of $125,000. These were partially offset by Bank loan repayments of $2,113,000, payments of other debt of $20,000, and repayment of short-term related party advances of $125,000.

The Company has not been adversely affected by inflation. Revenues from foreign customers were $3,808,000 during the year ended December 31, 2010, representing 56% of the Company’s total revenues, compared to $1,578,000, or 51%, of total revenues during the year ended December 31, 2009. There are potential economic risks inherent in foreign trade. To minimize the risk from changes in foreign currency exchange rates, the Company’s export sales are transacted in United States Dollars (USD).

The Company considers its cash resources and projected cash from operations to be sufficient to meet the operating needs of the business for the next twelve months.

Contractual Obligations and Commitments

The future contractual obligations of the Company at December 31, 2010 are as follows:

|

Payments Due by Period

|

||||||||||||

|

2011

|

2012

|

Total

|

||||||||||

|

Sr. Notes Payable

|

$ | - | $ | 722,000 | $ | 722,000 | ||||||

|

Interest on Sr. Notes Payable

|

72,000 | 54,000 | 126,000 | |||||||||

|

Other Notes Payable

|

4,000 | - | 4,000 | |||||||||

|

Capital lease obligations

|

1,000 | - | 1,000 | |||||||||

|

Operating lease obligations

|

93,000 | 1,000 | 94,000 | |||||||||

|

Total contractual cash obligations

|

$ | 170,000 | $ | 777,000 | $ | 947,000 | ||||||

Recently Issued Accounting Standards

See Note 1 of our notes to consolidated financial statements for information regarding the effect of new accounting pronouncements on our financial statements.

Factors Affecting Future Results

Total revenues for 2010 increased 119% compared to 2009, reflecting increased purchases of Cimetrix new software licenses as our customers shipped more capital equipment revenues from new software licenses include sales of software development kits and runtime revenue associated with OEM customer machine shipments. Runtime revenue increased year-over-year as new customer shipments were increased due to the overall growth in capital equipment shipments by the Company’s customers. Sales of software development kits are difficult for the Company to forecast, as the Company is highly dependent on the timing of the equipment suppliers’ decision to initiate a new machine development program and utilize the Company’s products. During 2010 the Company was able to secure a one-time SDK order from an existing customer for $1 million that contributed to new software license revenue.