Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - BE Resources Inc. | exhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - BE Resources Inc. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - BE Resources Inc. | exhibit31-1.htm |

| EX-10.23 - EXHIBIT 10.23 - BE Resources Inc. | exhibit10-23.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission file number: 000-53811

BE RESOURCES INC.

(Exact name of registrant as specified in its charter)

| Colorado | 42-1737182 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 107 Hackney Circle, Box 684, Elephant Butte, NM | 87935 |

| (Address of principal executive offices) | (Zip Code) |

(575) 744-4014

(Registrant’s telephone number,

including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Title of each class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of June 30, 2010, the last business day of the registrant’s second fiscal quarter, the aggregate market value of the registrant’s common equity held by non-affiliates was $11,150,524 based on the closing price of $0.29 per share as reported on the TSX Venture Exchange. As of March 29, 2011, there were 50,045,750 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the 2011 Annual Meeting of Shareholders are incorporated into Part III, Items 10 through 14 of this report.

TABLE OF CONTENTS

ADDITIONAL INFORMATION

Descriptions of agreements or other documents contained in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the exhibit index at the end of this report for a complete list of those exhibits.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that involve risks and uncertainties. The statements contained in this report that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and applicable Canadian securities laws. When used in this report, the words “plan,” “target,” “anticipate,” “believe,” “estimate,” “intend,” “expect” and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, without limitation, the statements regarding BE Resources Inc.’s strategy, future plans for exploration, future expenses and costs, future liquidity and capital resources, and estimates of mineralized material. All forward-looking statements in this report are based upon information available to BE Resources Inc. on the date of this report, and the company assumes no obligation to update any such forward-looking statements whether as a result of new information, future events or otherwise. Forward-looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. BE Resources Inc.’s actual results could differ materially from those discussed in this report. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the “Item 1A. Risk Factors” section of this Form 10-K.

In addition to the specific factors identified under “Item 1A. Risk Factors” in this report, other uncertainties that could affect the accuracy of forward-looking statements include:

- decisions of foreign countries and banks within those countries;

- unexpected changes in business and economic conditions;

- changes in interest and currency exchange rates;

- timing and amount of production, if any;

- technological changes in the mining industry;

- our costs;

- changes in exploration and overhead costs;

- access to and availability of materials, equipment, supplies, labor and supervision, power and water;

- results of future exploration and feasibility studies;

- the level of demand for our products;

- changes in our business strategy;

- local and community impact;

- interpretation of drill hole results and the geology, grade and continuity of mineralization;

- the uncertainty of mineralized material estimates and timing of development expenditures; and

- commodity price fluctuations.

This list, together with the factors identified under “Item 1A. Risk Factors,” is not exhaustive of the factors that may affect any of our forward-looking statements. You should read this report completely and with the understanding that our actual future results may be materially different from what we expect. These forward-looking statements represent our beliefs, expectations, opinions and what we believe to be reasonable assumptions only as of the date of this report. We do not intend to update these forward looking statements except as required by law. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

ii

CONVERSION FACTORS

The following units of measure may be used in this report:

| To Convert From | To | Multiply By |

| Feet | Metres | 0.305 |

| Metres | Feet | 3.281 |

| Miles | Kilometres | 1.609 |

| Kilometres | Miles | 0.6214 |

| Acres | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

| Grams | Ounces (Troy) | 0.03215 |

| Grams/Tonne | Ounces (Troy)/Short Ton | 0.02917 |

| Tonnes (metric) | Pounds | 2,204.62 |

| Tonnes (metric) | Short Tons | 1.1023 |

| Parts per million | Percent (%) | 0.0001 |

| Percentage | Parts per million | 10,000 |

| Grams/Tonne | Parts per billion | 1,000 |

| Parts per billion | Grams/Tonne | 0.001 |

| Parts per million | Grams/Tonne | 1.0 |

| *United States Dollar (U.S.$) (1) | Canadian Dollar (Cdn$) | 0.99 |

__________________________

(1) The applicable exchange rate

is based upon the noon buying rate of the Bank of Canada as of December 31,

2010. Note that specific calculations pertaining to the disclosure of particular

transactions or events throughout this report may utilize an exchange rate

different from that set forth above as may be appropriate under the

circumstances. In the event a different exchange rate is utilized, the

applicable exchange rate and the date will be set forth in a footnote to the

disclosure. As of March 30, 2011, the applicable exchange rate was U.S.$1 = Cdn$

0.9761.

iii

PART I

ITEM 1. BUSINESS

History and Organization

BE Resources Inc. (“we,” “us,” “BE” or the “Company”) is a mineral exploration company engaged in the exploration and evaluation of mineral properties in the State of New Mexico. We were incorporated under the laws of the State of Colorado on August 8, 2007. On October 1, 2007, we acquired a 100% interest in mineral leases and claims covering an area of approximately 20,000 acres in the State of New Mexico (the “Acquired Property”) from Great Western Exploration, LLC (“GWE”). In May 2008, we staked 690 additional lode claims overlying certain of the association placer claims previously acquired from GWE, of which 5 were subsequently dropped and in 2010, we staked an additional 207 lode claims. We refer to the mineral leases and claims acquired from GWE along with the additional claims staked by us as the “New Mexico Beryllium Project.” We were organized primarily to evaluate the grade and tonnage of beryllium in the New Mexico Beryllium Project.

We completed our initial public offering on October 26, 2009 by selling 5,750,000 shares of common stock at a price of Cdn$0.30 per share for gross proceeds of Cdn$1,725,000. Trading of our common stock commenced on the TSX -Venture Exchange on October 26, 2009 under the symbol “BER-V.”

Our principal office address is 107 Hackney Circle, Elephant Butte, New Mexico 87935. Our registered and records office address is 1700 Broadway, Suite 2100, Denver, Colorado 80290 and our telephone number is (575) 744-4014. We maintain a web site at www.beresources.com. We do not make available on our website the periodic filings we make with the Securities and Exchange Commission (“SEC”) or Canadian regulatory authorities. However, you can view the periodic filings on the SEC’s website at www.sec.gov or on the System for Electronic Document Analysis and Retrieval (“SEDAR”). We will also deliver free of charge to any interested party in either paper or electronic form our periodic reports upon written or oral request to our corporate secretary.

Recent Developments

Drilling at Warm Springs. In September 2010, pursuant to permits granted by the New Mexico Energy, Minerals and Natural Resource Department, Mining and Minerals Division (“MMD”), we commenced drilling at the Warm Springs area of our New Mexico Beryllium Project. Our initial drilling effort consisted of five core holes in an area of the property previously identified by the United States Bureau of Mines (“USBM”) as containing higher than average amounts of beryllium and identified a zone of mineralization in excess of 100 feet thick. This initial phase of the drilling program was designed to confirm the outer dimensions of the beryllium-bearing zone and to determine the extent and size of the beryllium mineralization.

As the results of the initial 5-hole program were inconclusive, we applied for, and were granted, a modification to our original permit to drill an additional twelve holes within the boundaries of the initial permit area. The specific target of this second phase will be the area surrounding the first hole drilled in the 5-hole program. The holes in the second phase are anticipated to range in depth from 200 to 650 feet and will be spaced on a 75-foot grid around and extending to the north of the first drill hole. As of March 30, 2011, we are also working with the MMD as they review permitting for an additional eight holes.

The Warm Springs area consists of 680 acres located in Socorro County, New Mexico. The vast majority of this area, totaling 520 acres, is privately owned by the Sullivan family and leased to us (the “Sullivan Lease”). Additionally, we are the holder of New Mexico State mining leases and various lode and association placer claims in the area which we acquired as part of the Acquired Property from GWE. In June 2009, we obtained a technical report on the Warm Springs area recognizing the presence of beryllium mineralization in amounts greater than what would be expected in average soil samples. The Technical Report is discussed in more detail in “Item 2. Properties.”

1

The remaining portions of our New Mexico Beryllium Project, which we refer to as the outlying hydrothermal areas, consist of three state mining leases and 817 unpatented mining claims located in Socorro County and Sierra County, New Mexico. The unpatented mining claims are located on land owned by the United States Department of Interior, Bureau of Land Management, which we refer to as the “BLM”. The outlying hydrothermal areas lie to the south and east of the Warm Springs area and total approximately 19,008 acres. We acquired the three state leases and 132 of the unpatented mining claims as part of our acquisition transaction with GWE. The remaining unpatented mining claims were staked by us in 2008 and in 2010.

The exploration permits allowing us to drill on the outlying hydrothermal areas were approved in 2010. However, since our current efforts are focused on the Warm Springs area, we have elected not to post the bonds required to commence drilling under those permits. We believe that we can pay those bonds and commence drilling at our discretion.

Additional Financing. In June 2010, we completed a private placement in which we sold 10 million units at a price of Cdn$0.30 per unit for gross proceeds of Cdn$3,000,000. Each unit sold in the placement consisted of one share of our common stock and one-half of one common stock purchase warrant. Each warrant entitled the holder to purchase an additional share of common stock at a price of Cdn$0.50 per share. As part consideration for services rendered in the placement, we issued compensation options to the placement agent and other members of the selling group to purchase up to 983,334 units at a price of Cdn$0.30 per unit.

In December 2010, we accelerated the expiration date of the warrants issued in connection with the placement and sold an additional 4,960,000 shares of our common stock pursuant to the exercise of those warrants. At the same time, we completed the sale of an additional 1,590,750 shares of our common stock pursuant to the exercise of compensation options issued to the placement agent and members of the selling group in connection with the placement, together with the exercise of warrants received upon exercise of the compensation options. Total proceeds from these transactions in December were Cdn$3,051,808. We have used proceeds from the original placement, and intend to use proceeds from the exercise of the compensation options and the warrants, to continue our exploration activities and for general corporate purposes.

Overview of the Beryllium Market

Beryllium is a lightweight metal possessing unique mechanical and thermal properties. According to the U.S. Department of the Interior's 2008 Minerals Yearbook (the "Yearbook"), the physical and mechanical properties of beryllium include high stiffness-to-weight and strength-to-weight ratios, stability within a broad range of temperatures, resistance to corrosion and fatigue, excellent electric conductivity and one of the highest melting points of all light metals. Beryllium products are used in a variety of high performance applications in the defense, aerospace, industrial, scientific equipment, electronics (including acoustics), medical, automotive, optical scanning and oil and gas markets. It is estimated that close to half of the beryllium sold is used in computer and telecommunications products, with the remainder used in aerospace and defense applications, automotive electronics, industrial components and other applications.

Only two beryllium minerals are commercially important: bertrandite, which contains less than 1% beryllium (and approximately 40% beryllium oxide or BeO) and is the principal beryllium mineral mined in the United States, and beryl, which contains about 4% beryllium and is the principal beryllium mineral mined outside of the United States (“U.S.”). According to the Yearbook, the U.S. is one of only three countries known to process beryllium ores and concentrates into beryllium products. A subsidiary of Materion Corporation, formerly Brush Engineered Materials Inc. produces beryllium hydroxide from bertrandite mined from open pit mines in the Spor Mountain area of Utah and from purchased beryl ore. The beryllium hydroxide is used as a raw material to make beryllium-copper master alloy, beryllium metal or beryllium oxide.

According to the Yearbook, beryl is frequently stockpiled for later processing. China is thought to be a significant producer, but does not report its beryl production. As a result, world production and the U.S. share of world production have a high degree of uncertainty. According to the Yearbook, the United States accounted for 89% of estimated world production in 2008.

2

Large quantities of beryllium are imported and exported annually on the world market. Since a very limited public market and essentially no spot or futures market exists for beryllium trading, beryllium is priced based on the negotiated price in private contracts between the mine and the producer. Thus, the price largely reflects the operating expenses, supply and demand of beryllium at the time it is being sold. The most recent report on beryllium prices by the United States Geological Survey discloses that estimates of beryllium prices rose from $154 per pound in 2009 to $230 per pound in 2010. However, the report states that these figures may not reflect true transaction prices as they represent estimates of the prices extrapolated from the price of a beryllium alloy.

Regulation of the Mining Industry in New Mexico/United States

U.S. federal laws deal with both the acquisition of mineral rights in federal lands and the development of the mineral interests secured in these lands in the U.S. The principal U.S. federal law dealing with the acquisition of mineral rights is the Mining Law of 1872. In general, it states that unless otherwise provided, all valuable mineral deposits in lands owned by the U.S. shall be free and open to mineral exploration by U.S. citizens. This law and accompanying regulations and court interpretations provide the means and methods for securing interests in these lands owned by the U.S.

On state land in New Mexico, State Trust Land Leases administered by the Commissioner of Public Land of the New Mexico State Land Office can be granted for exploration and development activities under the State Trust Land Leasing Statutes. The leases provide for the controlled development of state property and the protection of natural resources. In applying for a lease, the applicant must submit its plans for the leased land and receive the approval of the Commissioner. The leases are granted for an initial term of three years and can be renewed.

Our mineral interests are comprised of a combination of private land leases, State Trust Land Leases and federal claims.

Exploration and potential development of the mineral interests controlled by us are governed by both federal and New Mexico state laws. A comprehensive body of law requires the securing of various permits relating to the exploration of mineral properties and the operation of mines at both the federal and state level. In order to secure a permit involving any federal lands, the National Environmental Policy Act (federal) may require the preparation of an Environmental Assessment (“EA”) or an Environmental Impact Statement (“EIS”) for any potential development of a mining site. Generally, an EA briefly outlines the need for the proposed action, evaluates the environmental impacts of the proposed action and potential alternatives, and provides a listing of agencies and persons consulted in preparing the EA. If the EA results in a determination that the environmental consequences of the proposed exploration may be significant, an EIS is required to be prepared. An EIS analyzes the environmental impact of the proposed action in greater detail, describes any adverse environmental effects which cannot be avoided should the proposed action be implemented and provides alternatives to the proposed action. The preparation of the EIS is generally a collaborative effort between the federal and state government with a primary agency from the state or federal government taking the lead role in the development of the EIS and acting to secure input and coordinate action between the agencies.

At the state level, environmental matters fall under the Environmental Improvement Act and the New Mexico Mining Act (“Act”) which is administered by the MMD and the New Mexico Department of Energy, Minerals and Natural Resources under regulations contained in the New Mexico Administrative Code. Permits are required for mineral exploration and mining activities, and applicants for permits must demonstrate that their activities will be in compliance with all state and federal environmental laws and regulations. Applicants must provide detailed site assessments, reclamation plans and address approximately 24 additional requirements, including potential impacts on the site, surface water, groundwater, wildlife, nearby communities, traditional cultural and historic properties, and others, as set out in NMSA 1978 §§ 69-36-1, et seq. The Act also provides for significant public input and input from various state and federal agencies regarding the project.

3

Environmental and Other Matters

Like all other mining companies doing business in the U.S., we are subject to a variety of federal, state and local statutes, rules and regulations designed to protect the quality of the air and water, and threatened or endangered species, in the vicinity of our operations. These include “permitting” or pre-operating approval requirements designed to ensure the environmental integrity of a proposed mining facility, operating requirements designed to mitigate the effects of discharges into the environment during exploration and any mining operations, and reclamation or post-operation requirements designed to remediate the lands affected by a mining facility once commercial mining operations have ceased. Following completion of any exploration or development activities at the New Mexico Beryllium Project, we will also have to comply with the reclamation program under the Act to return the land to its original state.

Federal legislation in the U.S. and implementing regulations adopted and administered by the Environmental Protection Agency, the Forest Service, the BLM, the Fish and Wildlife Service, the Army Corps of Engineers and other agencies — in particular, legislation such as the federal Clean Water Act, the Clean Air Act, the National Environmental Policy Act, the Endangered Species Act, the National Forest Management Act, the Wilderness Act, the Resource Conservation and Recovery Act, the National Historic Preservation Act and the Comprehensive Environmental Response, Compensation and Liability Act—have a direct bearing on domestic mining operations. These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

State legislation in New Mexico, including the Act and the regulations contained in the New Mexico Administrative Code as they apply to the mining industry, are administered by the New Mexico Environment Department and the MMD and will also have to be complied with. As stated above, much of the state legislation compliments federal legislation and both sets of statutes and regulations are often administered at the state level.

As part of our exploration activities, we are required to monitor certain wildlife species, ground and surface water in the area surrounding our activities. Any adverse impact noted with regard to this species or the water could adversely affect our exploration and any future development efforts.

Competition

The beryllium market is currently centered in the United States. According to the Yearbook, production in the United States accounted for approximately 89% of world production in 2008. We believe that an estimated 80% of the reported world supply of beryllium is mined in Utah by Materion Brush Inc., an Ohio company wholly owned by Materion Corporation, formerly known as Brush Engineered Materials Inc., which we believe holds a monopoly on the beryllium market. In the event that we are successful in identifying and developing one or more economical deposits of beryllium on our property, we could face significant competition from Materion and other larger, more established companies.

Employees

We currently have one employee, our president and chief executive officer. We subcontract the remainder of our services to a variety of consultants, including environmental and permitting, accounting and legal firms. We believe this arrangement is suitable for the foreseeable future.

Facilities

We currently share office space at the home of our president. We currently pay him $15,000 per month for the use of this space and for all administrative services necessary to operate our executive office. We expect this arrangement to be suitable for our needs for the foreseeable future.

4

ITEM 1A. RISK FACTORS

This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operation, contain forward-looking statements and a description of our business operations which may be materially affected by several risk factors, including those summarized below.

We have no proven or probable reserves, and any funds spent by us on exploration or development could be lost. We have not established the presence of any proven or probable mineral reserves, as defined by the SEC, at any of our properties. In what is known as Industry Guide 7, the SEC has defined a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Any mineralized material discovered or produced by us should not be considered proven or probable reserves.

In order to demonstrate the existence of proven or probable reserves, it would be necessary for us to perform additional exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and then obtain a positive feasibility study. Exploration is inherently risky, with few properties ultimately proving economically successful. Establishing reserves also requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically and legally extracted and produced. We have not completed a feasibility study with regard to all or a portion of any of our properties to date. The absence of proven or probable reserves makes it more likely that our properties may never be profitable and that the money we have spent on exploration and development may never be recovered.

Our exploration activities may not be commercially successful. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labour are risks involved in the conduct of exploration programs. The success of mineral exploration and development is determined in part by the following factors:

- the identification of potential mineralization based on analysis;

- the availability of exploration permits;

- the quality of our management and our geological and technical expertise; and

- the capital available for exploration.

Substantial expenditures and time are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection.

Since we are a new business with no operating history, investors have no basis to evaluate our ability to operate profitably. We were incorporated in 2007 and have had no revenue from operations since our inception. Our activities to date have been limited to organizational efforts, acquiring our land position, raising financing, obtaining permits and commencing exploration activities. We face all of the risks commonly encountered by other new businesses, including the lack of an established operating history, need for additional capital and personnel, and intense competition.

Our operations are subject to strict permitting requirements which could require us to delay, suspend or terminate our operations on our mining properties. Our operations, including ongoing exploration drilling programs, require permits from state or federal governments, including monitoring of wildlife species and water. We have experienced significant delays in obtaining drilling permits in the past, and may experience such delays in the future. We may be unable to maintain our existing permits or obtain additional permits on reasonable terms in the future, on terms that provide us sufficient resources to develop our properties, or at all. Even if we are able to obtain such permits, the time and funding required by the permitting process is significant. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of our properties will be adversely affected, which may adversely affect our results of operations, financial condition and cash flow.

5

Our independent registered accountant has raised substantial doubt about our ability to continue as a going concern in its report on our financial statements for the year ended December 31, 2010. This doubt is based in part on the recognition that we are an exploration-stage company, have no established source of revenue, have an accumulated deficit of $12,823,328 at December 31, 2010, and are dependent on raising capital from our shareholders or other sources to continue in business. In the event that we are unable to raise additional capital, develop one or more of our properties and generate revenue, we may be forced to curtail our exploration activities, liquidate one or more of our properties or cease operations altogether. In any of those events, your investment in our company may decline.

We will require significant additional capital to fund our business plan. At December 31, 2010, we had limited working capital, no producing properties and no cash flow from operations. We will be required to expend significant amounts for drilling, geological and geochemical analysis, assaying, additional permitting and bonding and, if warranted, feasibility studies. We may not benefit from such investments if we are unable to identify commercially exploitable mineralized material. If we are successful in identifying reserves, we will require significant additional capital to extract the reserves. That funding, in turn, depends upon a number of factors, including the state of the national and worldwide economy, capital markets, and the price of beryllium. We may not be successful in obtaining the required financing for these and other purposes, in which case our ability to continue operating would be adversely affected. Failure to obtain such additional financing would result in delay or indefinite postponement of further exploration or if applicable, development and the possible, partial or total loss of our interest in the New Mexico Beryllium Project. The possible development or a possible joint venture of our property will require additional financing and we may not be able to obtain such financing on terms favorable to us or at all. We are unable at this time to estimate with any reasonable degree of certainty the amount of capital required in the future. However, we believe that the amount will be significant. Also, any adverse developments in our exploration efforts may force us to sell our stock at a discount to raise additional funds.

We have a history of losses and may incur losses in the future. We have incurred losses since inception and may incur net losses in the future. We incurred the following losses from operations during each of the following periods:

- approximately $6.7 million for the year ended December 31, 2010;

- approximately $1.5 million for the year ended December 31, 2009; and

- approximately $2.2 million for the year ended December 31, 2008.

We had an accumulated deficit of approximately $12.8 million as of December 31, 2010.

We expect to continue to incur losses unless and until such time, if ever, as one of our properties enters into commercial production and generates sufficient revenues to fund continuing operations. The amount and timing of future expenditures will depend on a number of factors, including the progress of permitting and exploration activities, the timing of any future development, if economical, the commercial viability of production and other factors. We may never achieve profitability.

At the present time, we are totally dependent upon the discovery of beryllium or other metals in commercially viable quantities from a single project, raising the risk if the area proves unproductive. Since we have never produced beryllium or other metals from the New Mexico Beryllium Project or any other property, and since we have no proven or probable reserves, we may not be able to economically produce beryllium or other metals under existing and future costs and expenses. If we are unable to economically produce beryllium from the New Mexico Beryllium Project, we would be forced to identify and invest substantial sums in one or more additional properties, and we may be unable to obtain such properties on terms favorable to us.

6

The volatility of the price of beryllium could adversely affect our future operations and our ability to explore and develop the New Mexico Beryllium Project. The commercial feasibility of the New Mexico Beryllium Project and our ability to raise funding to conduct exploration and development is dependent on the price of beryllium and other metals. The price of beryllium may also have a significant influence on the market price of our common stock and the value of our assets. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of beryllium may prevent the New Mexico Beryllium Project from being explored, economically mined or result in the write-off of assets whose value is impaired as a result of lower beryllium prices. We believe that an estimated 80% of the reported world supply of beryllium is mined in Utah by Materion Brush Inc., which we believe presently dominates the world beryllium market. The current market price of beryllium is affected by this monopoly and could significantly decrease upon the discovery of other large proven commercially viable reserves and the entry of new participants into the market. The exact world supply of beryllium is unknown. The majority of beryllium mining outside of the United States is not publicly reported. There is speculation that stockpiles of beryllium still exist in Russia and Kazakhstan. There is also speculation that China may currently be mining beryllium. If proven reserves or stockpiles of beryllium are discovered outside of the U.S., such a discovery could impact the market price of beryllium. The price of beryllium may also be affected by factors such as inflation, fluctuation in value of the U.S. Dollar and foreign currencies, global and regional demand, and the political and economic conditions of beryllium producing countries throughout the world. The volatility of mineral prices represents a substantial risk, which no amount of planning or technical expertise can completely eliminate.

The existing monopoly for mining of beryllium may create barriers to entry which are difficult to overcome. If we are successful in identifying one or more economical deposits of beryllium, and decide to market this beryllium ourselves, it will be necessary for us to overcome barriers created by the existing monopoly for this product. Since it is likely that our initial production will be limited, the holder of the monopoly could reduce its price, making it more difficult for us to operate at a profit. It will also be necessary for us to identify purchasers willing to purchase our product when little public information exists about the market for this product. The existence of limited market may also make it more difficult for us to identify individuals with the technical expertise and experience necessary to mine and market the product. For all of these reasons, the discovery of an economical deposit does not ensure that we can operate at a profit.

Legislation has been proposed that would significantly affect the mining industry. Periodically, members of the U.S. Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872, which governs unpatented mining claims. One such amendment has become law and has imposed a moratorium on the patenting of mining claims, which reduced the security of title provided by unpatented claims. Another proposed amendment has sought to impose a federal 4% to 8% gross royalty on production of minerals from public lands, impose additional claim maintenance fees on unpatented mining claims, and declare certain lands as unsuitable for mining. If such proposed legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties, and could significantly impair our ability to develop mineral resources on unpatented mining claims. The enactment of any legislation imposing such royalties or fees could adversely affect the potential development of mining claims and could adversely affect our business.

We are subject to extensive governmental regulations in addition to permitting requirements which could require us to delay, suspend or terminate our operations. The exploration, and possible future development and production of the New Mexico Beryllium Project, are subject to various federal and state laws governing prospecting, development, production, labor standards and occupational health, mine safety, toxic substances, land use, water use, taxes and others. For example, applicable federal legislation in the United States would require us to immediately suspend operations, including exploration activities, upon discovery of any remains, funerary objects, or objects of ceremonial, historic or cultural importance to Native Americans. The application of these laws may require us to delay, suspend or terminate our operations. The enactment of additional laws and regulations, amendments to current laws and regulations, and/or more stringent application of existing laws or regulation could adversely impact our exploration timetable and business plan.

The mining and production of beryllium are subject to occupational health and safety legislation due to the hazardous nature of air-borne beryllium and the health risks associated with exposure. The U.S. Department of Health and Human Services and the International Agency for Research on Cancer have reported that beryllium is a human carcinogen. Beryllium exposure increases the risk of developing chronic beryllium disease and significantly elevated risks of lung cancer. Exposure to beryllium dust through skin contact increases the risk of skin disease. As a result of the health risks, the U.S. Environmental Protection Agency and U.S. Occupational Safety and Health Administration issue health and safety standards for exposure to beryllium. Complying with these standards will require additional expenditure on testing and the installation of safety equipment. Failure to comply with health and safety standards could result in statutory penalties and civil liability.

7

Our exploration and development activities are subject to environmental risks, which could expose us to significant liability and delay, suspension or termination of our operations. The exploration, possible future development and production phases of our business will be subject to federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set out limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulations, if any, may adversely affect our operations. If we fail to comply with any of the applicable environmental laws, regulations or permit requirements, we could face regulatory or judicial sanctions. Penalties imposed by either the courts or administrative bodies could delay or stop our operations or require a considerable capital expenditure. There is a possibility that those opposed to exploration and mining will attempt to interfere with our operations, whether by legal process, regulatory process or otherwise.

We could be subject to environmental lawsuits. Neighboring landowners and other third parties could file claims based on environmental statutes and common law for personal injury and property damage allegedly caused by the release of hazardous substances or other waste material into the environment on or around our properties. We may not be successful in defending any claims that are brought against us. A successful claim against us could have an adverse effect on our business prospects, financial condition and results of operation.

We are subject to risks related to community action. All industries, including the mining industry, are subject to community actions. In recent years, communities and non-governmental organizations have become more vocal and active with respect to mining activities at or near their communities. These parties may take actions such as road blockades, applications for injunctions seeking work stoppage and lawsuits for damages. These actions can relate not only to current activities but also in respect of decades old mining activities by prior owners of subject mining properties.

If we lose our key executive, we may not be able to find a suitable replacement on acceptable terms. Our success is dependent to a large degree on the efforts and abilities of David Q. Tognoni, our president and chief executive officer. If Mr. Tognoni were to die, become disabled or leave the Company, we would be forced to identify and retain an individual to replace him. We may not find a suitable individual to replace Mr. Tognoni or to add to our employee base if that becomes necessary. We have no insurance on Mr. Tognoni at this time. Therefore, if the services of Mr. Tognoni were to be lost, our plans and operations could be adversely affected.

A portion of the New Mexico Beryllium Project is comprised of a lease on privately owned lands. The Sullivan Lease continues until January 2, 2024 and continues thereafter unless terminated by either party based on a default by the other of any of the obligations of the other under the lease. Upon the expiration of the lease, in the event that for any reason we are unable to extend the lease or purchase the land from the owner, we would be forced to forfeit the underlying minerals and our ability to explore and develop the property would be adversely affected.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of our property. Our ability to explore and potentially develop beryllium and other valuable minerals depends on the validity of title to the New Mexico Beryllium Project. In addition to the Sullivan Lease, the New Mexico Beryllium Project includes state leases and unpatented mining claims. Unpatented mining claims are unique property interests and are generally considered to be subject to greater risk than other real property interests because the validity of unpatented mining claims is often uncertain. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from descriptions of record. There may be challenges to the title to our property which could prove both time-consuming and costly to defend. Additionally, if valuable mineral deposits are discovered on our property, a successful challenge to our title could adversely impact exploration, extraction, development, operations and the value of our assets and future earnings and revenue potential. Our investigation of the status of title to the New Mexico Beryllium Project should not be construed as a guarantee of title. Title to the New Mexico Beryllium Project may be challenged by a third party. Our interests may be subject to unregistered agreements or transfers or may be affected by undetected defects.

8

Any mineral production from the New Mexico Beryllium Project is subject to royalty payments in favor of third parties in addition to the lessor of the property, which may reduce the revenue, if any, that we receive from the Project or reduce the value of the Project if we attempt to sell it to a third party. In addition to royalties payable to landowners or lessors, David Tognoni, our president and chief executive officer, is the owner of a 1% gross royalty on the New Mexico Beryllium Project which he acquired as part consideration for his service as an officer and employee of our company. Further, GWE and certain others hold a 10% net profits royalty in the New Mexico Beryllium Project which they received as part consideration for the transfer of the Acquired Property. These royalties are payable indefinitely based on adjusted revenue generated from the New Mexico Beryllium Project and any additional claims that may be staked in an area of interest surrounding the New Mexico Beryllium Project, as defined in the respective agreements. In addition, under the Sullivan Lease, we are obligated to pay a 4% gross production royalty, with a $12,000 annual minimum, from the sale or disposition of minerals taken from the Warm Springs area. Finally, the leases with the State of New Mexico which cover a portion of the Project require payment of a 2% royalty on production, subject to certain offsets. If we are successful in identifying sufficient mineralization to warrant placing the property into production, the obligation to pay royalties to the holders of the royalties would reduce the revenue we receive and may reduce the value of the New Mexico Beryllium Project if we endeavor to sell it to a third party.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses. The business of exploring for minerals, including beryllium, involves a high degree of risk. Few properties are ultimately developed into producing mines. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit, including size, grade and proximity to infrastructure, metal prices, which can be highly variable, and government regulation, including environmental and reclamation obligations. Uncertainties as to the metallurgical amenability of any minerals discovered may not warrant the mining of these minerals on the basis of available technology. Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

- encountering unusual or unexpected formations;

- environmental pollution;

- personal injury, flooding and landslides;

- variations in grades of minerals;

- labor disputes; and

- a decline in the price of beryllium.

We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down on our investment in such property interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

We do not insure against all risks to which we may be subject in our planned operations. The exploration phase of our business will involve a significant amount of risk. We currently maintain no insurance on any of our current or proposed operations. Even if we acquire insurance in the future, such insurance may not cover all potential risks associated with exploration activities. We may also not be able to maintain insurance to cover risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, the insurance against risks such as environmental pollution or other hazards as a result of exploration is generally not available on acceptable terms to companies in the mining industry. We might also become subject to liability for environmental pollution or other hazards associated with mineral exploration and production which may not be insured against, which may exceed the limits of our insurance coverage, or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could materially adversely affect our financial condition and our ability to fund exploration and any development and production activities. A significant loss could force us to reduce or terminate our operations.

9

Our directors and officers face potential conflicts of interest in their capacities as such. David Tognoni, Edward Godin and Carmelo Marrelli serve as officers and/or directors for us as well as other mineral exploration and development companies. Conflicts of interests could arise between these persons’ duties as officers and directors of our company and their respective positions as officers and directors of such other entities. These conflicts may arise from corporate opportunities that may be presented to such individuals or because of the time they must devote to their position with each company. In addition to these potential conflicts, these individuals have in the past, and may in the future, enter into agreements with our company, either as individuals or as officers or directors of other companies. For example, David Tognoni was a manager of GWE, from which we purchased the Acquired Property. We also entered into an employment agreement with Mr. Tognoni and granted stock options to each of our officers and directors. None of these agreements were negotiated at arms’ length.

Competition in the mining industry is intense, and we have limited financial and personnel resources with which to compete. Competition in the mining industry for desirable properties, investment capital, equipment and personnel is intense. Numerous companies headquartered in the United States, Canada and elsewhere throughout the world compete for properties on a global basis. We are currently an insignificant participant in the beryllium mining industry due to our limited financial and personnel resources. We may be unable to attract the necessary investment capital to fully develop the New Mexico Beryllium Project, be unable to acquire other desirable properties, be unable to attract and hire necessary personnel, or be unable to purchase necessary equipment.

Colorado law and our Articles of Incorporation may protect our directors from certain types of lawsuits at the expense of the shareholders. The laws of the State of Colorado provide that directors of a company shall not be liable to the company or shareholders of the company for monetary damages for all but limited types of conduct. Our Articles of Incorporation permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing shareholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use limited assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment or other circumstances.

We are required to evaluate our internal controls under Section 404 of the Sarbanes-Oxley Act of 2002, and any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the price of our shares of common stock. Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we are and will be required to furnish a report by management on our internal controls over financial reporting. Such report contains, among other matters, an assessment of the effectiveness of our internal control over financial reporting, including a statement as to whether or not our internal control over financial reporting is effective. This assessment must include disclosure of any material weaknesses in our internal control over financial reporting identified by our management.

We will be required to evaluate and test our internal controls on an ongoing basis. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that such internal control is effective and we could lose investor confidence in the accuracy and completeness of our financial reports, which would have a material adverse effect on our stock price.

Gain recognized by non-U.S. shareholders on the sale or other disposition of shares of our common stock may be subject to U.S. federal income tax. We believe that we are currently a “U.S. real property holding corporation” under section 897(c) of the Internal Revenue Code (“USRPHC”) and there is a substantial likelihood that we will continue to be a USRPHC. Generally, gain recognized by a non-U.S. holder on the sale or other disposition of our common stock will be subject to U.S. federal income tax on a net income basis at normal graduated U.S. federal income tax rates if we are a USRPHC at any time during the 5-year period ending on the date of the sale or disposition of the common stock (or the non-U.S. holder’s holding period for the common stock if shorter). Under an exception to these USRPHC rules, if the common stock is “regularly traded” on an “established securities market,” the common stock will not be treated as a USRPHC. This exception is not available, however, to a non-U.S. holder that held or was deemed to hold, directly or under certain constructive ownership rules, more than 5% of the common stock at any time during the 5-year period ending on the date of the sale or other disposition (or the non-U.S. holder’s holding period of the common stock if shorter). Our common stock may never be “regularly traded” on an “established securities market” as recognized by the Internal Revenue Code.

10

Our stock price has been and may continue to be volatile and as a result you could lose all or part of your investment. The market prices for the securities of companies engaged in mineral exploration and development can be volatile. The value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

- changes in the worldwide price for beryllium;

- disappointing results from our exploration or development efforts;

- failure to meet our operating budget or achieve profitability;

- decline in demand for our common stock;

- the issuance of additional securities;

- downward revisions in securities analysts’ estimates or changes in general market conditions;

- technological innovations by competitors or in competing technologies;

- investor perception of our industry or our prospects; and

- general economic trends.

In addition, stock markets have experienced extreme price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock. As a result, investors may be unable to resell their shares at a fair price.

We have never paid dividends on our common stock and we may never pay them in the future. We have never declared or paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. Our ability to pay dividends is dependent on our ability to successfully develop one or more properties and generate revenue from operations. Further, our initial earnings, if any, may be retained to finance our growth. Any future dividends will be directly dependent upon any future earnings, our then-existing financial requirements and other factors and are solely within the discretion of our board of directors.

A large number of our shares will be eligible for future sale and may depress the price of our common stock. In addition to the shares issued in our initial public offering, a large amount of our common stock is currently eligible for sale under Rule 144 of the United States Securities Act of 1933 (the “Securities Act”). Under Rule 144, a shareholder owning restricted stock who is not an affiliate of our Company is permitted to sell all of the common stock owned by him or her following expiration of the shorter of: (i) one year from the date of acquisition; or (ii) six months from the date of acquisition, assuming we have been required to file reports with the SEC for at least 90 days and have filed all reports required to be filed with the SEC up to the time of the proposed sale. Affiliates of our Company are permitted to sell securities owned by them in limited quantities at a similar time under Rule 144. As of March 29, 2011, we also have outstanding options to purchase an aggregate of 5,950,000 shares of common stock, a significant portion of which are exercisable at a price below the public offering price of our common stock and have issued compensation warrants for 440,499 additional shares of our common stock. The sale of common stock in the future may depress the price of our common stock, may result in a loss in your investment and may make it difficult for us to sell common stock in the future.

Since no broker or dealer has committed to create or maintain a market in our stock, our stock may never be quoted in the OTC Bulletin Board, and purchasers of our common stock may have difficulty selling their shares, should they desire to do so. It is our intention to seek one or more broker-dealers to apply for quotation of our common stock in the OTC Bulletin Board. However, we have no agreement with any broker-dealer at this time, and we may not find one in the future. In addition, we believe that our stock will be characterized as a “micro-cap” security and therefore subject to increased scrutiny by the Financial Industry Regulatory Authority (“FINRA”). A micro-cap security is generally a low priced security issued by a small company, or the stock of companies with low capitalization. If we are unable to obtain quotation of our common stock on the OTC Bulletin Board, trading in our stock may be limited, and purchasers of our common stock may have difficulty selling their shares, should they desire to do so.

11

Since our stock will not be listed on a stock exchange in the United States, trading in our shares may be subject to rules governing “penny stocks,” which will impair trading activity in our shares. It is likely that our common stock will not initially be listed on a national stock exchange registered with the Securities and Exchange Commission, or SEC, and may therefore be subject to rules regulating broker dealer practices in connection with transactions in penny stocks. Those disclosure rules applicable to penny stocks require a broker dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized disclosure document required by the SEC. These rules also require a cooling off period before the transaction can be finalized. These requirements may have the effect of reducing the level of trading activity in any secondary market for our common stock. Many brokers may be unwilling to engage in transactions in our common stock because of the added disclosure requirements, thereby making it more difficult for stockholders to dispose of their shares.

Issuances of our common stock in the future could dilute existing shareholders and adversely affect the market price of our common stock. We have the authority to issue up to 250,000,000 shares of common stock, 10,000,000 shares of preferred stock and to issue options and warrants to purchase shares of our common stock without stockholder approval. These future issuances could be at values substantially below the price at which our common stock was sold in our initial public offering. In addition, we could issue large blocks of our common stock to fend off unwanted tender offers or hostile takeovers without further stockholder approval. Because trading in our common stock is limited, the issuance of our stock may have a disproportionately large impact on its price compared to larger companies.

Pursuant to pending Canadian tax proposals, Canadian holders of our stock may be subject to rules for investments in offshore investment funds. In the Canadian federal budget released on March 4, 2010, the Minister of Finance announced that certain prior tax proposals relating to the taxation of Canadian residents investing in certain non-resident entities (the "FIE Proposals") will not be implemented. The Minister of Finance proposed to replace the FIE Proposals with a slightly revised version of the current offshore fund property rules. These revisions were released as draft legislation on August 27, 2010. The offshore investment fund property rules may, in certain circumstances, require a Canadian holder of shares of common stock to include an amount in income in a taxation year in respect of the shares of common stock, if the value of such shares may reasonably be considered to be derived, directly or indirectly, primarily from portfolio investments in certain assets and one of the main reasons for the Canadian holder acquiring or holding the shares is to derive a benefit from the income, profits and gains on those portfolio investments in such a manner that Canadian taxes payable by the Canadian holder are less than would have been the case if the Canadian holder had earned that income, profits or gains directly. The determination of whether or not our common stock may constitute an offshore investment fund property of a Canadian holder at any time depends upon our property and our activities at that time.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

New Mexico Beryllium Project — Overview

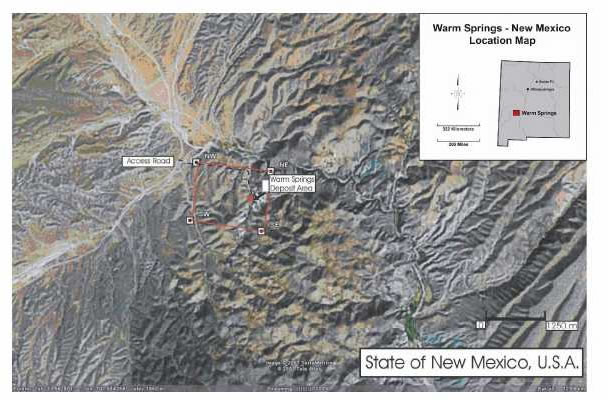

The New Mexico Beryllium Project consists of the Company’s interest in Socorro County and Sierra County, New Mexico described in this report as the Warm Springs area and the outlying hydrothermal areas. The New Mexico Beryllium Project covers an area of approximately 20,000 acres and is comprised of a private lease, state leases and unpatented mining claims. The map below shows the general location of the Warm Springs area in New Mexico.

12

Unpatented mining claims comprise the vast majority of the project, covering 18,240 acres or roughly 96% of the total acreage of the New Mexico Beryllium Project. Unpatented mining claims are governed by the General Mining Law of 1872 (“General Mining Law”) as amended, 30 U.S.C. §§ 21-161 (various sections), which allows the location of mining claims on public domain lands of the United States upon the discovery of a valuable mineral deposit and proper compliance with claim location requirements. A valid mining claim provides the holder with the right to conduct mining operations for the removal of locatable minerals, subject to compliance with the General Mining Law and New Mexico state law governing the staking and registration of mining claims, as well as compliance with various federal, state, and local exploration, operating, and environmental laws, regulations, and ordinances.

As the owner of the unpatented mining claims, we have the right to conduct mining operations on the lands, subject to the prior procurement of required exploration and operating permits and approvals, compliance with the terms and conditions of the claims, and compliance with applicable federal, state, and local laws, regulation and ordinances. Historically, the owner of an unpatented mining claim could, upon strict compliance with legal requirements, file a patent application to obtain full fee title to the surface and mineral rights with the claim; however, continuing Congressional moratoriums have precluded new mining claim patent applications since 1993.

As discussed below, our unpatented mining claims consist of lode claims and association placer claims. Lode claims are mining claims located on a classic vein, ledge, or other rock in place between definite walls. A lode claim is located by metes and bounds. The maximum length of a lode claim is 1,500 feet by 600 feet. Association placer claims are mining claims located upon sand or gravel. Association placer claims are located by legal subdivision and can be located up to a maximum 160 contiguous acres.

The following disclosure more fully discusses our specific mineral property interests comprising the New Mexico Beryllium Project and has been derived from various agreements to which the Company is a party, together with the Technical Report dated June 5, 2009 prepared by Fred Brown, CPG, Pr. Sci. Nat., and Tracy Armstrong, P. Geo., of P&E Mining Consultants Inc., each an independent qualified person within the meaning of National Instrument 43-101—Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). NI 43-101 is designed to implement standards of disclosure for mineral properties of companies subject to the jurisdiction of the Canadian Securities Administrators. The Technical Report is available for inspection and review during normal business hours at our registered and records office and has been filed on SEDAR at www.sedar.com.

13

Cautionary Note to U.S. Investors: National Instrument 43-101 is promulgated under Canadian laws and regulations and uses definitions and standards that differ from those in the SEC’s Industry Guide 7 regarding disclosure on mineral properties. Accordingly, information contained in reports prepared pursuant to NI 43-101 containing descriptions of the Company’s mineralization may not be comparable to similar information that the Company can disclose in the reports it files with the SEC pursuant to the requirements of United States federal securities laws and the rules and regulations thereunder.

Warm Springs Area

Property Description and Tenure. The Warm Springs area consists of 680 acres located in Socorro County, New Mexico. The vast majority of this area, 520 acres, is privately owned by the Sullivan family and leased to us under the Sullivan Lease dated January 2, 2004. We became the lease holder under the Sullivan Lease and certain New Mexico State mining leases and the owner of various lode and association placer claims on October 1, 2007. On April 9, 2008, we executed an amendment to the Sullivan Lease in order to clarify certain provisions of the lease relating to the property description, term, and conduct of operations.

The Sullivan Lease is described as: All of Special Section 2, and access through the East ½ of Special Section 4, Township 8 South, Range 7 West, save and except that portion of the Real Estate conveyed previously to Commissioners of the Acequia de Canada Alamosa of Sierra County, New Mexico.

The Sullivan Lease provides us with the ability to conduct mining exploration and operations with respect to all minerals, including beryllium, in the Warm Springs area of the New Mexico Beryllium Project. The surface and water rights on the Warm Springs area are also owned by the Sullivan family and the Sullivan Lease allows us water rights and surface access to the leased property as necessary for mining and milling operations. In exchange, we are required to pay a gross production royalty to the Sullivans equal to 4% of the annual proceeds from the sale or disposition of minerals, metals and materials obtained from the leased property, and from any claims or leases we acquire within a one mile area of interest from the perimeter of the leased property, in the minimum amount of $12,000 per year. The $12,000 minimum annual gross production royalty payment is due on January 1st of each year for the balance of the lease.

In addition to the royalty, we are also obligated to pay all real property taxes assessed on the leased property, provide accountings to the Sullivan family with respect to monies received from the sale or disposition of ore from the leased property, purchase and maintain commercial general liability insurance and state industrial insurance, conduct our operations in a workmanlike manner, and protect the leased property from liens which result from our activities on the leased property. If we fail to satisfy any of these obligations under the Sullivan Lease, then we would be in breach of the lease, and the Sullivan family could, after providing notice to us and an opportunity to cure the defect, elect to terminate the Sullivan Lease. The Sullivan Lease provides for a term of 20 years and continues thereafter unless terminated by either party based on a default by the other of any of the obligations of the other under the lease.

We hold our interest in the remaining 160 acres of the Warm Springs area under an unpatented mining claim known as Bertrandite claim #45 which we acquired from GWE as part of the 133 unpatented mining claims included in the Acquired Property. This is an association placer claim situated to the south of the area covered by the Sullivan Lease. We acquired this claim in October 2007 as part of our acquisition from GWE.

Accessibility. The Warm Springs property is located approximately 50 miles northwest of the community of Elephant Butte, New Mexico. From Elephant Butte, travel is along the paved portion of state highway NM52 for 41 miles. The remaining nine miles are along the well-maintained unpaved portion of state highway NM52 to the Warm Springs property entrance. Property access is along seasonal four-wheel drive tracks.

14

Climate. The Warm Springs property is located in a semi-arid, high-desert climate approximately twenty miles north of Chloride/Winston, New Mexico. Chloride/Winston has an average annual temperature range between 18° F in January and 55° F in July. Average annual precipitation is 13 inches, and average annual snowfall is 11 inches.

Local Resources and Infrastructure. The Warm Springs property is currently undeveloped except for seasonal dirt access roads. However, the property is well situated with regard to surrounding infrastructure, with a power line crossing highway NM52 within seven miles of the property. Water in the area is typically sourced from local wells. New Mexico is home to a developed mineral industry, producing coal, uranium, silver, manganese, potash, salt, perlite, copper ore and tin concentrates. The nearby town of Elephant Butte is a small residential community with a population of approximately 1,300 serviced by a modern municipal airport. Albuquerque, a major urban center, lies approximately 170 miles to the north-northeast of the Warm Springs property, and the New Mexico Institute of Mining and Technology is located in nearby Socorro, New Mexico.

Physiography. The Warm Springs property lies in the foothills of the northern Sierra Cuchillo Mountains, just south of Monticello Canyon and north of Iron Mountain. Maximum local elevation is approximately 6,600 feet, with a vertical relief of 400 feet. Intermittent seasonal stream channels drain the property. Local vegetation is typical of semi-arid regions and includes juniper, cedar and pinion.

History. The Warm Springs property lies on the northern-most limit of the Church Rock mining district, which also encompasses numerous beryllium and tungsten deposits at Iron Mountain. Beryllium mineralization at Warm Springs was first reported by M. Howard Milligan in November 1961.

Eighteen exploration drill holes were completed in the 1960’s as part of a USBM project investigating mineralization in the northern Cuchillo Mountains. Drilling was centered on a bertrandite mineralized outcrop. Samples from seven trenches were also taken. The overall drilling depth was limited by the water table. Six drill holes penetrated the surface mineralization and intersected additional mineralization at depth. The deposit was also examined by the USBM with a portable beryllium detector, and additional samples were taken from shallow trenches in the bertrandite mineralized outcrop.

Subsequent to the USBM project, a reexamination of the property was completed by Hillard in 1969, who mapped a thick sequence of andesitic and latitic flows. Later sampling of non-magnetic concentrates in stream sediments yielded anomalous values of lead, molybdenum, zinc and copper.

No original source records of the sampling program or the USBM investigation were available for the Technical Report, except for information contained in Hillard (1969) and Meeves (1966). The location of the USBM drill holes and trenches were not able to be verified in the field by the authors of the Technical Report. The accuracy and validity of the historical results were therefore not established by the authors of the Technical Report.

A total of fourteen exploratory RC drill holes for a total of 7,576 feet were completed in 2001 and 2002 in the general vicinity of the bertrandite mineralized outcrop located by the USBM program. The Beryllium Group, LLC was in control of the project from 2001 to 2002. GWE was in control of the project from February 2004 to October 1, 2007. BE has been in control of the property since October 1, 2007.

The initial six drill holes were completed and the remaining eight drill holes were sealed with a concrete plug with the exception of BE20 and BE25, which were left as water wells for the property owner. All drilling was done with a reverse circulation air-rig with six-inch down-the-hole hammer and tri-cone bit as required. Drill hole collar locations were determined by Mr. David Tognoni using a Magellan SporTrak Pro handheld GPS unit. No drill-hole surveys were undertaken.

Regional Geology. The Warm Springs property lies within the eastern edge of the Datil-Mogollon volcanic field of southern New Mexico. The volcanic field consists of mafic to silicic extrusive units of Tertiary age and Quaternary basalts. The volcanic field is cut along its eastern margin by multiple north-striking normal faults which formed a series of eastward-tilted fault blocks in the Sierra Cuchillo. The Datil-Mogollon volcanic field is bordered on the east by the Rio Grande rift, where a series of rhyolitic ash-flow tuffs have been exposed. Beneath the ash-flow tuffs are latite conglomerates, mud-flow deposits and sandstones representing the alluvial apron which surrounded the Datil-Mogollon field prior to its ignimbrite climax. The base of the volcanic pile rests unconformably upon rocks ranging from late Eocene to Precambrian in age. Much of the area lies on the northeast flank of a major Laramide uplift from which the Mesozoic rocks were stripped by early Tertiary erosion. Basal volcanic rocks resting upon late Paleozoic limestones, quartzites, or shales on the uplift lap off the structure onto Eocene arkosic sediments which overlie Cretaceous sandstones and shales. Locally, Precambrian rocks generally consist of low-grade metasedimentary rocks, metavolcanic rocks, and intrusive rocks ranging from large granitic plutons to gabbroic stocks and diabase dikes.

15

Property Geology. Hillard (1969) identified several lithologies in the Warm Springs property area. Arranged in approximate stratigraphic order these are: gravel, dikes, flow-banded rhyolite, rhyolite, massive rhyolite, rhyolite tuff, sedimentary rocks, andesitic and latite flows, and latitic tuffs and coarse pyroclastics, as well as a quartz monzonite intrusive plug. Andesitic and latite flows are the most widespread volcanic unit in the area. The surficial geology is dominated by colluvium and Tertiary volcanics. James (1978) further suggests that the local high hills are underlain by a hypabyssal stock complex cut by a swarm of radial dykes. The area is highly faulted, situated on the eastern edge of the graben between the Sierra Cuchillo and the Black Range.