Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file Number: 001-34921

AEGERION PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 20-2960116 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

IRS Employer Identification Number) |

101 Main Street, Suite 1850, Cambridge, Massachusetts 02142

(Address of Principal Executive Offices, including Zip Code)

908-707-2100

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Common Stock, $0.001 Par Value

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Table of Contents

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant completed its initial public offering of its common stock on October 27, 2010. Accordingly, there was no public market for the registrant’s common stock before and including June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter.

As of March 15, 2011, 17,641,543 shares of the registrant’s common stock were outstanding.

Portions of the registrant’s definitive Proxy Statement for its 2011 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

TABLE OF CONTENTS

| PART I | ||||

| Item 1. | 3 | |||

| Item 1A. | 27 | |||

| Item 1B. | 52 | |||

| Item 2. | 52 | |||

| Item 3. | 52 | |||

| Item 4. | (Removed and Reserved). | 52 | ||

| PART II | ||||

| Item 5. | 52 | |||

| Item 6. | 54 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation |

56 | ||

| Item 7A. | 68 | |||

| Item 8. | 68 | |||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

91 | ||

| Item 9A. | 92 | |||

| Item 9B. | 92 | |||

| PART III | ||||

| Item 10. | 92 | |||

| Item 11. | 92 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

93 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

93 | ||

| Item 14. |

93 | |||

| PART IV | ||||

| Item 15. | 93 | |||

| SIGNATURES | 94 | |||

Table of Contents

Forward-Looking Statements

All statements included or incorporated by reference in this Annual Report on Form 10-K, or Annual Report, other than statements or characterizations of historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this Annual Report and the documents incorporated herein by reference are based on our current expectations, estimates, approximations and projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing” and similar expressions, and variations or negatives of these words. Examples of forward-looking statements include, but are not limited to: our history of operating losses; our potential need for additional capital to fund operations and develop our product candidates; uncertainties associated with the clinical development and associated regulatory filings of our product candidates, including the risk that our regulatory filings may not be accepted by the applicable regulatory authorities, the risk that our product candidates may not be approved for any indication, or if approved, the risk that the finally approved definition of the targeted patient populations for our product candidates may be narrower than we expect; risks associated with undesirable side effects experienced by some patients in clinical trials for our product candidates; risks associated with our lack of sales and marketing experience; the highly competitive industry in which we operate; risks associated with our intellectual property rights and the extent to which such intellectual property rights protect our product candidates; the risk that third parties may allege that we infringe their intellectual property rights or that we have failed to comply with the provisions of our in-license agreements; risks associated with our reliance on third parties, in particular clinical research organizations and contract manufacturers; risks associated with our ability to recruit, hire and retain qualified personnel; and risks associated with volatility in our stock price as a newly public company.

Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors, some of which are listed under Part I, Item 1A, Risk Factors of this Annual Report and in our other filings with the Securities and Exchange Commission, or SEC. These forward-looking statements reflect our management’s belief and views with respect to future events and are based on estimates and assumptions as of the date of this Annual Report and are subject to risks and uncertainties. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements in this Annual Report or in our other filings with the SEC.

In addition, past financial or operating performance is not necessarily a reliable indicator of future performance and you should not use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Except as required by law, we undertake no obligation to revise our forward-looking statements to reflect events or circumstances that arise after the date of this Annual Report or the respective dates of documents incorporated herein by reference that include forward-looking statements. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in these forward-looking statements.

In this Annual Report, “Aegerion Pharmaceuticals, Inc.,” “Aegerion,” the “Company,” “we,” “us” and “our” refer to Aegerion Pharmaceuticals, Inc. taken as a whole, unless otherwise noted.

2

Table of Contents

PART I

Overview

We are an emerging biopharmaceutical company focused on the development and commercialization of novel therapeutics to treat severe lipid disorders. Lipids are naturally occurring molecules, such as cholesterol and triglycerides, that are transported in the blood. Elevated levels of cholesterol, or hypercholesterolemia, and elevated levels of triglycerides, or hypertriglyceridemia, can dramatically increase the risk of experiencing a potentially life threatening event, such as a heart attack or stroke in the case of hypercholesterolemia or pancreatitis in the case of hypertriglyceridemia. We are initially developing our lead compound, lomitapide, as an oral, once-a-day treatment for patients with a rare inherited lipid disorder called homozygous familial hypercholesterolemia, or HoFH. These patients are at very high risk of experiencing life threatening cardiovascular events at an early age as a result of extremely elevated cholesterol levels in the blood and, as a result have a substantially reduced life span relative to unaffected individuals.

We are currently evaluating lomitapide in a pivotal Phase III clinical trial for the treatment of patients with HoFH. This is a single-arm, dose titration, open-label trial with lomitapide treatment provided for 78 weeks. We completed enrollment in March 2010 with a total of 29 patients. Of these patients, three patients withdrew their consent to participate in the trial and three patients discontinued treatment related to gastrointestinal adverse events. All of the remaining 23 patients in the trial have completed 26 weeks of therapy, which represents the time when the primary efficacy endpoint, percent change in low-density lipoprotein cholesterol, or LDL-C, is measured. Patients continue in the trial for an additional 52 week safety monitoring period. Currently 21 of the 23 patients have completed Week 56 of the trial. Currently, 16 patients have completed the full 78 weeks of the trial. We expect to complete this trial in the second half of 2011. If the results of this trial support an acceptable risk-benefit profile, we plan to submit a New Drug Application, or NDA, to the U.S. Food and Drug Administration, or FDA, and a Marketing Authorization Application, or MAA, to the European Medicines Agency, or EMA, before the end of 2011 for marketing approval of lomitapide for the treatment of HoFH. We also plan to commence a pediatric clinical trial in 2011 to evaluate lomitapide for the treatment of pediatric and adolescent patients (> 7 to < 18 years of age) with HoFH.

In October 2007, the FDA, granted lomitapide orphan drug designation for the treatment of HoFH. Untreated HoFH patients have extremely high levels of LDL-C, typically between 500 mg/dL and 1,000 mg/dL, and, as a result, are at a severely high risk of experiencing premature cardiovascular events. All of the patients enrolled in our current pivotal Phase III clinical trial are using combinations of other lipid-lowering therapies. Nonetheless, these patients have an average LDL-C level at baseline, before treatment with lomitapide, of 354 mg/dL. In the United States, the National Cholesterol Education Program, or NCEP, guidelines currently recommend that patients at high risk of experiencing a heart attack should seek to lower their LDL-C levels below 100 mg/dL with an optional therapeutic target of 70 mg/dL. Aggressive treatment, including dietary modifications plus combination therapy with currently approved lipid lowering drugs at maximum tolerated doses nearly always fails to reduce LDL-C levels to their recommended targets in these patients.

Because drug therapy and dietary modifications are insufficient to lower LDL-C to target levels, many of these patients regularly undergo an expensive, time consuming and invasive procedure called apheresis, a process similar to kidney dialysis whereby LDL-C particles are mechanically filtered from the blood. However, this provides only temporary reductions in LDL-C levels and is not readily available to all patients due to the limited number of treatment centers that perform this procedure. We believe lomitapide has the potential to provide significant reductions in LDL-C levels in this high-risk patient population, thereby reducing or potentially even eliminating the need for apheresis. In a report that we commissioned, L.E.K. Consulting LLC, or LEK, an international business consulting firm, estimates that the total number of patients with HoFH in each of the United States and, collectively,

3

Table of Contents

Germany, the United Kingdom, France, Italy and Spain, referred to herein as the European Union Five, is approximately 3,000 patients, or a combined total of approximately 6,000 patients.

We believe that lomitapide also has the potential to treat patients with other life-threatening lipid disorders who are unable to achieve recommended lipid levels on currently available therapies, particularly patients with a severe genetic form of hypertriglyceridemia called familial chylomicronemia, or FC. Untreated FC patients have extremely high levels of triglycerides, or TGs, generally greater than 2,000 mg/dL, and, as a result, experience recurrent episodes of acute pancreatitis and other serious conditions. NCEP guidelines suggest that normal TG levels in adults should be less than 150 mg/dL, as higher levels are associated with various health conditions. In particular, patients with TG levels greater than 500 mg/dL are at increased risk of acute pancreatitis, with TG levels of greater than 1,000 mg/dL representing a more definitive risk. However, even with aggressive treatment, many patients with FC are unable to achieve TG levels that meaningfully reduce their risk for acute pancreatitis. In October 2010, the EMA granted lomitapide orphan drug designation for the treatment of FC. In March 2011, the FDA also granted lomitapide orphan drug designation for this indication. We are in the process of developing a protocol for a Phase II/III clinical trial of lomitapide for the treatment of adult patients with FC. In the report that we commissioned, LEK estimates that, subject to certain factors, there are approximately 1,000 patients in the United States and the European Union Five with FC who could be eligible for treatment with lomitapide.

We believe that lomitapide also may be useful for the treatment of elevated lipids in broader patient populations, such as those suffering from heterozygous familial hypercholesterolemia, or HeFH, patients who are statin intolerant and patients with severe hypertriglyceridemia, which we define herein as patients with TG levels above 2,000 mg/dL, due to defects other than FC. If we elect to develop lomitapide for broader patient populations, we would plan to do so selectively either on our own or by establishing alliances with one or more pharmaceutical company collaborators, depending on, among other things, the applicable indications, the related development costs and our available resources.

Hyperlipidemic Disorders

Lipids are naturally occurring molecules, such as cholesterol and TGs, that are transported in the blood. The liver and the intestines are the two main sites where lipids are packaged and released within the body. The liver synthesizes cholesterol and TGs and provides the body’s intrinsic supply of lipids. The intestines are the conduit through which dietary lipids enter the body for metabolism. The delivery of cholesterol and TGs to peripheral cells in the body provides necessary sources of cellular energy and cell structure. However, excess levels of lipids in the blood can be the source of significant diseases in humans. The general term for excess lipids is hyperlipidemia. Specific elevations of cholesterol in the blood are termed hypercholesterolemia, and specific elevations of TGs in the blood are termed hypertriglyceridemia.

The direct relationship between lower LDL-C levels and reduced risk for major cardiovascular events has been consistently demonstrated for more than a decade based on over 14 trials involving more than 90,000 patients. These studies have shown about a 1% reduction in risk for every 2 mg/dL drop in LDL-C. As a result, physicians are highly focused on lowering levels of LDL-C in their patients. In the United States, for example, organizations such as the NCEP, the American Heart Association, and the American College of Cardiology have emphasized aggressive management of LDL-C. NCEP guidelines currently recommend that patients at high risk of experiencing a heart attack achieve LDL-C levels of 100 mg/dL or lower through lifestyle changes and drug therapy as appropriate based on their starting levels. Both the Canadian Cardiovascular Society and the Joint British Society have supported LDL-C treatment targets as low as 77 mg/dL for high-risk patients.

NCEP guidelines define normal TG levels in adults as less than 150 mg/dL. TG levels above 150 mg/dL are thought to be associated with obesity and insulin resistance and to confer additional risk for cardiovascular disease. Patients with TG levels greater than 500 mg/dL are at increased risk of acute pancreatitis, with TG levels of greater than 1,000 mg/dL representing a more definitive risk. Based on a 2001 article from the Online Metabolic and Molecular Bases of Inherited Disease, an online database of genetic research, we estimate that up to approximately 20,000 adults in the United States have severe hypertriglyceridemia with TG levels above 2,000 mg/dL.

4

Table of Contents

Homozygous Familial Hypercholesterolemia (HoFH)

HoFH is a rare genetic lipid disorder usually caused by defects in both copies of the low-density lipoprotein, or LDL, receptor genes, resulting in impaired or total loss of function in the LDL receptor. The LDL receptor is a protein on the surface of cells that is responsible for binding and removing LDL from the blood. A loss of LDL receptor function results in accumulation of LDL-C in the blood. Untreated HoFH patients have extremely high LDL-C levels, typically between 500 mg/dL and 1,000 mg/dL. These patients are at severely high risk of experiencing premature cardiovascular events, such as heart attack or stroke, often experiencing their first cardiovascular event in their twenties. If untreated, patients with HoFH generally die before the age of thirty. There is no patient registry or other method of establishing with precision the actual number of patients with HoFH in any geography. We recently commissioned LEK to prepare a commercial report on lomitapide for us. In this report, which is dated September 2, 2010, LEK estimates that the total number of addressable patients with symptoms consistent with HoFH in each of the United States and the European Union Five is approximately 3,000 patients, or a combined total of approximately 6,000 patients, using an approach that is consistent with the characteristics of patients that participated in our pivotal Phase III clinical trial of lomitapide. LEK derived its estimates from interviews of 51 physicians, primarily lipid disorder experts, and 23 third-party payors in the United States and the European Union Five, confirmed by its own secondary research. The total addressable market opportunity for lomitapide for the treatment of patients with HoFH will ultimately depend upon, among other things, product pricing, reimbursement, acceptance by the medical community and patient access, as well as the diagnosis criteria included in the final label for lomitapide, if approved for sale for this indication.

In our pivotal Phase III clinical trial of lomitapide for the treatment of patients with HoFH, we applied three diagnostic methods to identify patients with HoFH, any one of which would qualify a patient for admission into the trial. These methods are genotyping, fibroblast activity tests and clinical criteria. The genotyping method identifies patients on the basis of gene defects, typically mutations in each of the patient’s two LDL-receptor alleles. However, in clinical practice it is often difficult to discern which patients have HoFH based solely upon a genetic test because there are more than 900 known mutations of these genes. Additionally, rare cases of HoFH have also been attributed to defects in genes other than those of the LDL receptor. Because receptor function is diminished as a result of these mutations, clinicians also may identify patients as having HoFH by testing LDL-receptor activity in skin fibroblast cells. LDL-receptor activity of less than 20% is typically considered to be consistent with LDL-receptor defects leading to HoFH. Alternatively, physicians can utilize phenotypic criteria including a patient’s own cholesterol levels and those of both parents. We refer to patients as having HoFH if they have been diagnosed with HoFH through genotypic, functional (fibroblast activity) or phenotypic (clinical/medical) criteria.

Familial Chylomicronemia (FC)

FC is a rare genetic lipid disorder typically caused by defects in genes that reduce chylomicron clearance, including, most commonly, lipoprotein lipase, or LPL, resulting in extremely low or absent LPL activity. LPL is an enzyme that facilitates the removal of TGs from the blood. Low levels or lack of this enzyme result in the accumulation of TGs in the blood. Patients with FC have extremely high levels of TGs in the blood, generally greater than 2,000 mg/dL, that typically result in recurrent episodes of acute pancreatitis, a significant and sometimes life-threatening inflammation of the pancreas. Acute pancreatitis results in significant abdominal pain and may be associated with clinically meaningful complications, such as organ failure, respiratory complications, significant enlargement of the liver and spleen and eruptive xanthomas, or poolings of triglycerides around the tendons in the body to such a degree that the swelling is easily visible. In the report that we commissioned, LEK estimates that, subject to certain factors, there are approximately 1,000 patients in the United States and the European Union Five with FC who could be eligible for treatment with lomitapide.

5

Table of Contents

Broader Patient Populations

We believe that there is a need for additional lipid-lowering agents to address broader hyperlipidemic patient populations, where patients are unable to achieve their recommended target lipid levels on maximum tolerated doses of currently approved oral therapies. These broader patient populations include:

| • | Heterozygous Familial Hypercholesterolemia (HeFH). In the report that we commissioned, LEK estimates that approximately 600,000 patients in the United States have a single defective copy of the gene that causes familial hypercholesterolemia, and are thus deemed to have the genetic condition called heterozygous familial hypercholesterolemia, or HeFH. These patients also have very high LDL-C levels, typically between 250 mg/dL and 500 mg/dL if untreated. |

| • | Statin Intolerant. Based on a 2009 review published in the Annals of Internal Medicine, a peer-reviewed medical journal, we estimate that up to approximately 10% of hyperlipidemic patients are unable to sustain statin usage due to intolerance, resulting from unacceptable responses such as muscular aches and pains. Physicians are often wary of patients who present with muscular aches and pains, as these can be an early warning sign of a rare but serious side effect seen with statin therapy called rhabdomyolysis, a condition in which a significant amount of muscle tissue rapidly breaks down, which can cause kidney failure and potentially even death. As a result, a significant population of patients in need of LDL-C lowering may not be able to utilize statins, currently the most effective of the LDL-C-lowering therapies. |

| • | Severe hypertriglyceridemia. Based on a 2001 article from the Online Metabolic and Molecular Bases of Inherited Disease, an online database of genetic research, we estimate that up to approximately 20,000 patients in the United States suffer from severe hypertriglyceridemia, which we define herein as TG levels above 2,000 mg/dL. A number of factors can contribute to TG levels exceeding 2,000 mg/dL, including FC, diabetes and alcohol abuse. Patients with this degree of TG elevation are at an increased risk of acute pancreatitis. |

Limitations of Currently Available Treatment Options

High-Risk Hypercholesterolemia

Currently available treatment options for patients at very high risk of experiencing life threatening cardiovascular events as a result of elevated cholesterol levels are extensive but, even when combined together, are often ineffective in significantly reducing LDL-C levels. The clinical approach for these patients typically involves dietary modifications plus a combination of available lipid lowering drug therapies in order to lower their lipid levels as aggressively as possible. These drug therapies include statins, cholesterol absorption inhibitors and bile acid sequestrants. Less frequently, other drugs, such as niacin and fibrates, can be added to provide some incremental reductions in LDL-C levels, although these agents are typically used to modify other lipids. High-risk patients who are unable to reach their recommended target lipid levels on drug therapy often are supplemented with apheresis. Apheresis is expensive, costing up to approximately $150,000 per patient per year in the United States, time consuming and invasive. Because apheresis provides only temporary reductions in LDL-C levels, it must be repeated frequently, typically one or two times per month. In addition, apheresis is not readily available to all patients due to the limited number of treatment centers that perform this procedure and is associated with other complications, such as risk of infection.

High-risk hypercholesterolemia patients are particularly vulnerable for two main reasons. First, their initial LDL-C levels are so high that even with all of the available treatments they still remain very far from their recommended target LDL-C levels. Second, some treatments are not as effective at lowering LDL-C levels for these very severely affected patients due to the specific nature of their condition, which often manifests itself in the form of resistance to the existing treatments. For example, because patients with HoFH generally have mutated forms of the LDL-C receptor genes that regulate hypercholesterolemia, these patients are often resistant, or refractory, to statin therapy. High dose statin therapies that typically produce 46% to 55% reductions in LDL-C levels in the broad hypercholesterolemic patient population on average produce 18% to 24% reductions in patients with HoFH, and sometimes much less.

6

Table of Contents

Severe Hypertriglyceridemia

For patients with severe hypertriglyceridemia, the goal of treatment is to provide significant reductions in blood TG levels. Currently available treatments consist of dietary modifications to lower the intake of dietary fat and the use of omega-3 fatty acids and fibrates. However, these treatments are often inadequate to lower TG levels below 500 mg/dL, a level that predisposes patients to developing acute pancreatitis. Because of the severely elevated TG levels in this patient population, reducing TG levels below 500 mg/dL may require reductions in TG levels of 75% or more. Few individual therapies can reduce TG levels this degree. For example, Lovaza, which is comprised of omega-3 fatty acids, and marketed by GlaxosmithKline, has been shown to reduce TG levels by only approximately 45% to 52% in patients with baseline TG levels between 500 mg/dL and 2,000 mg/mL. Although fibrates have been shown to reduce TG levels by approximately 55% in patients with baseline TG levels between 500 mg/dL and 1,500 mg/dL, the effect of fibrates in patients with baseline TG levels greater than 2,000 mg/dL is not known with certainty. Moreover, patients with TG elevations of intestinal origin, such as FC patients, may be less responsive to fibrates, which act in the liver. Given the need for significant drops in TG levels in these patients, single or even combination therapies are often insufficient for many of these patients.

Our Strategy

Our objective is to develop and commercialize drugs to treat patients with rare lipid related disorders who are at very high risk of experiencing life threatening cardiovascular events at an early age. To achieve this objective, we plan to:

| • | Complete our ongoing pivotal Phase III clinical trial of lomitapide for the treatment of patients with HoFH and, based on an acceptable risk-benefit profile, file for marketing approval in the United States and the European Union. This trial includes a 78 week treatment period consisting of a 26 week efficacy phase and a 52 week safety phase. Twenty-three patients have completed the 26 week efficacy period and 21 of the 23 patients have completed Week 56 of the trial. The purpose of the 52 week safety period of the 78 week trial is to collect long-term safety data at the maximum tolerated dose. Sixteen patients have completed the full 78 weeks of the trial with seven patients remaining in the trial. Our primary business focus currently is to complete this trial in the second half of 2011 and, depending on the results, to submit an NDA to the FDA and an MAA to the EMA before the end of 2011. |

| • | Prepare to commercialize lomitapide for the treatment of patients with HoFH. Subject to obtaining marketing approval, we plan to commercialize lomitapide for HoFH in the United States and the European Union and plan to recruit a highly targeted team, comprised of sales representatives and medical education specialists who are experienced in marketing drugs for the treatment of rare, often genetic, disorders. We believe a specialized organization would be able to effectively assist physicians with patient identification, tracking and treatment while facilitating patient reimbursement of lomitapide. |

| • | Initiate a pediatric clinical trial in HoFH patients. Subject to obtaining regulatory approval for our Phase III protocol we intend to initiate a pediatric clinical trial in 2011 to evaluate lomitapide for the treatment of pediatric and adolescent patients (> 7 to < 18 years of age) with HoFH to enable label expansion. |

| • | Initiate a Phase II/III clinical trial of lomitapide for the treatment of adult patients with FC. Subject to completing and obtaining regulatory approval for a protocol for a Phase II/III clinical trial of lomitapide for the treatment of adult patients with FC, we plan to initiate such a trial in 2011. Because of the limited number of patients with FC and the fact that they typically are treated by the same specialty physicians who treat patients with HoFH, we expect to access the FC market using the same targeted team that we use to market lomitapide for HoFH. |

| • | Selectively seek to expand our distribution capabilities and potentially address broader patient populations for lomitapide. We may selectively seek to establish collaborations to reach the patients with HoFH or FC in geographies that we do not believe we can cost effectively address with our own sales and marketing capabilities. If we elect to develop lomitapide for broader patient populations, we would plan to do so selectively either on our own or by establishing alliances with one or more pharmaceutical company |

7

Table of Contents

| collaborators, depending on, among other things, the applicable indications, the related development costs and our available resources. |

Lomitapide

Overview

Our lead product compound, lomitapide, is a small molecule microsomal triglyceride transfer protein, or MTP, inhibitor, or MTP-I, that we are developing as an oral once-a-day treatment for patients with severe lipid disorders. We are conducting a single-arm, dose titration, open-label pivotal Phase III clinical trial of lomitapide for the treatment of patients with HoFH. If this single-arm, dose titration, open-label trial is successful, we plan to submit an NDA to the FDA and an MAA to the European Medicines Agency, or EMA, before the end of 2011. We also plan to commence a pediatric clinical trial in 2011 to evaluate lomitapide for the treatment of pediatric and adolescent patients (> 7 to < 18 years of age) with HoFH. In addition, we are in the process of developing a protocol for a Phase II/III clinical trial of lomitapide for the treatment of adult patients with FC.

Lomitapide has been evaluated in eleven Phase I, six Phase II, and one Phase III (with an extension study as a separate protocol) clinical trials. Approximately 875 patients have been treated with lomitapide as part of these clinical trials.

Microsomal triglyceride transfer protein exists in both the liver and intestines where it plays a role in the formation of lipoproteins containing cholesterol and TGs. The liver and the intestines are the two main sources of circulating lipids in the body. The liver synthesizes cholesterol and TGs and provides the body’s intrinsic supply of lipids. The intestines are the conduit through which dietary lipids enter the body for metabolism. Given the fact that MTP is involved in the formation of cholesterol-carrying lipoproteins from both liver-related, or hepatic, and intestinal sources, we believe the inhibition of MTP makes an attractive target for lipid lowering therapy. Currently, there are no MTP-Is approved by the FDA for any indication.

Although we believe lomitapide has clinical potential for treatment of broader hyperlipidemic patient populations and may seek to selectively address such broader patient populations in the future, we are currently developing lomitapide as an oral, once-a-day treatment for patients with HoFH and FC. In October 2007, the FDA granted lomitapide orphan drug designation for the treatment of HoFH. In October 2010, we withdrew our application to the EMA for orphan drug designation for lomitapide for the treatment of HoFH, based on guidance we received from the EMA that lomitapide is not eligible for orphan drug designation for this indication since lomitapide has the potential to treat hypercholesterolemia in broader patient populations. At the same time, the EMA granted lomitapide orphan drug designation for the treatment of FC. In March 2011, the FDA also granted orphan drug designation for this indication.

Ongoing Pivotal Phase III Clinical Trial (HoFH)

We are currently studying lomitapide in a pivotal Phase III clinical trial to evaluate its efficacy and long-term safety for the treatment of patients with HoFH at the maximum tolerated dose of up to 60 mg. The FDA is funding approximately $1.0 million of the cost of this trial under its orphan drug product grant program. The trial is being conducted at 11 sites in four countries. We expect to complete this trial in the second half of 2011. If this trial demonstrates an acceptable risk-benefit profile, we plan to submit an NDA to the FDA and an MAA to the EMA before the end of 2011.

This pivotal Phase III trial is a single-arm, dose titration, open-label clinical trial. We completed enrollment in March 2010 with a total of 29 patients. The patients in the trial are adult males and females with a mean age of 31. After a six week run-in period to stabilize lipid lowering therapy (including apheresis if applicable) and diet, patients are given ascending doses of lomitapide beginning at 5 mg/day and then titrated individually up to 60 mg/day over the first 26 weeks of the clinical trial. Patients are then maintained at a maximum tolerated dose for an additional 52 week safety phase. The efficacy and safety phases combined will last 78 weeks. After this time, eligible patients will be given the option to enroll in a separate protocol for a long-term, open-label extension trial to evaluate the long-

8

Table of Contents

term efficacy and safety of lomitapide at the maximum tolerated dose beyond 78 weeks. For patients who do not enter the optional open-label extension trial, there will be a six week wash-out period during which lomitapide will be discontinued and patients will remain on concomitant lipid lowering therapy.

The primary efficacy endpoint of this trial is percent change in LDL-C at the maximum tolerated dose compared to baseline after 26 weeks of treatment in combination with other lipid lowering therapies. Background therapies are maintained during the 26 week efficacy phase, but may be modified during the safety phase at the investigator’s discretion. LDL-C levels are measured at Weeks 0, 2, 6, 10, 14, 18, 22, 26, 36, 46, 56, 66 and 78. Because some patients in the trial also receive apheresis, only LDL-C levels prior to apheresis treatment are used in the trial analyses. The secondary endpoints of this trial include the evaluation of other lipid parameters, including percent change in TG levels from baseline, long-term safety, percent change in hepatic fat, as measured by magnetic resonance spectroscopy, or MRS, and pharmacokinetics in combination with other lipid lowering agents. Pharmacokinetics refers to a drug’s absorption, distribution and metabolism in, and excretion from, the body and measures, among other things, bioavailability of a drug, or concentration in the plasma.

Currently, of the 29 patients originally enrolled in the trial, three patients have withdrawn their consent to participate in the trial and three patients have discontinued treatment due to gastrointestinal adverse events. All of the remaining 23 patients have completed the 26 week efficacy phase of the trial. Currently 21 of the 23 patients have completed Week 56 of the trial and 16 patients have completed the full 78 weeks of the trial.

Under our protocol and statistical analysis plan for this clinical trial, all primary analyses will be calculated using intention-to-treat principles, which means that each patient that begins treatment is considered part of the trial, whether or not they finish the trial. For purposes of presenting our clinical trial results in this filing, we also present these results on a completer analysis basis, which means that only those results from patients who actually complete the relevant period of treatment are presented. We are also presenting the data in this manner because we believe it can be important to understand the clinical results of those patients who actually completed the full treatment period, especially for a trial with a smaller number of patients. Although we believe that both presentations are fair representations of the data we have received in this clinical trial through September 30, 2010, the intention-to-treat analysis method is generally the primary statistical method used by the FDA.

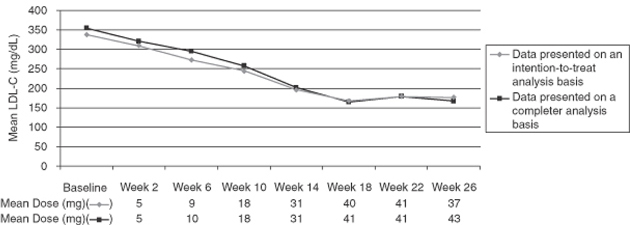

As shown in the graph below, using the intention-to-treat analysis method, at the end of the 26 week efficacy phase of the trial, the 29 patients who began treatment in the trial experienced a mean reduction in LDL-C levels of 45% in comparison with baseline, with the baseline measurements reflecting the effect of maximum tolerated background therapy. Mean baseline LDL-C levels of the 29 patients who began treatment in the trial were 337 mg/dL, and mean LDL-C levels of these patients at Week 26 were 176 mg/dL.

As shown in the graph below, the ‘completer’ analysis at the end of the 26 week efficacy phase of the trial, showed for the 23 completer patients a mean reduction in LDL-C levels of 50% in comparison with baseline, with the baseline measurements reflecting the effect of maximum tolerated background therapy. Mean baseline LDL-C levels of the 23 patients who completed the 26 week efficacy phase of the trial were 354 mg/dL, and mean LDL-C levels of these patients at Week 26 were 167 mg/dL.

Eight of the 23 patients who completed the 26 week efficacy phase of the trial achieved an LDL-C level below 100 mg/dL at week 26 and 15 of these patients achieved an LDL-C level below 175 mg/dL at week 26. The mean daily dose of lomitapide for the 23 patients who completed the 26 week efficacy phase of the trial was 44 mg at week 26 of the trial. The mean daily dose of lomitapide for the full 29 patients who began treatment in the trial was 37 mg at week 26 of the trial.

9

Table of Contents

Mean LDL-C Values Across Study Visits

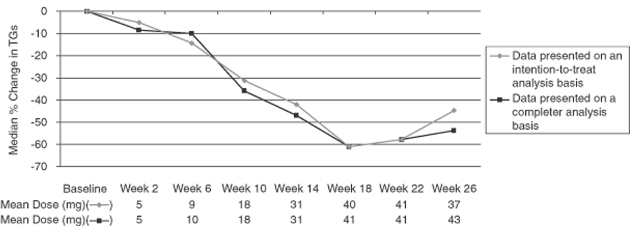

As shown in the graph below, using the intention-to-treat analysis method, at the end of the 26 week efficacy phase of the trial, the 29 patients who began treatment in the trial experienced median reduction in TG levels of 45% in comparison with baseline. Among the 29 patients who began treatment in the trial, median TG levels were 82 mg/dL at baseline, and 42 mg/dL at week 26.

As shown in the graph below, using the completer analysis method, at the end of the 26 week efficacy phase of the trial, the 23 patients who completed the 26 week efficacy phase of the trial experienced median reduction in TG levels of 54% in comparison with baseline. Among the 23 patients who completed the 26 week efficacy phase of the trial, median TG levels were 97 mg/dL at baseline, and 43 mg/dL at week 26.

Median % Change in TG Values Across Study Visits

Mild to moderate gastrointestinal adverse events have been the most commonly reported side effect in this trial. The majority of these gastrointestinal adverse events occurred during the first days following the introduction of a higher dose. In the subset of patients treated to Week 56, we have observed a reduction in gastrointestinal adverse effects after the 26 week efficacy phase in which patients are titrated to the maximum tolerated dose.

Because changes in liver function are an area of interest for this class of drugs, we are also examining the number of instances in which there are significant increases in ALT (alanine transaminase) or AST (aspartate transaminase) observed for any patient at any time during the course of this trial. ALT and AST are liver enzymes that are commonly measured clinically as a part of a diagnostic liver function test to determine liver health. Significantly elevated plasma liver enzymes are indicative of some degree of liver cell damage and in some instances can be indicative of liver toxicity. Although some drugs, such as the cholesterol-lowering class of drugs known as statins, cause an increased incidence of liver enzyme elevations, these are generally not clinically significant. Drug therapies that have high rates of clinically significant liver transaminase elevations may indicate a

10

Table of Contents

potential to cause more significant liver toxicity in some patients. The risk of liver damage is increased when clinically significant elevations in liver transaminases are seen with clinically significant elevations of bilirubin, which we have not observed in our trials. As of September 30, 2010 four patients in the trial had ALT elevations greater than five times the upper limit of normal. Of these patients, three underwent a temporary dose reduction and have been able to maintain study drug at a stable dose. One patient discontinued treatment for a period of seven weeks, after which the treatment was reinstated and the patient was able to maintain a stable dose and complete the trial per protocol. No patients have been removed from the trial due to liver function test elevations.

In accordance with the trial protocol, we are also measuring hepatic fat levels and pulmonary function at Weeks 0, 26, 56 and 78, and after the six week wash-out period for those patients who do not enter the optional open-label extension trial. As of September 30, 2010, the 22 patients who had hepatic fat measurements taken experienced an increase in hepatic fat from a mean of 1.2% to 8.7% at 26 weeks of treatment. The threshold for mild steatosis, a condition of hepatic fat accumulation, is in the range of 5 to 6% fat. Of these, 16 patients had completed 56 weeks of treatment as of September 30, 2010, and 14 of these patients had hepatic fat measurements available; these 14 patients had a mean hepatic fat level of 5.1% at this measurement time. In addition, the median change in hepatic fat from baseline in these patients was 5.48% at 26 weeks of treatment and 2.14% at 56 weeks of treatment. Some studies suggest that patients who have hepatic steatosis, which results from lifestyle factors, such as obesity and type 2 diabetes, may be at an increased risk for more severe long-term liver consequences, such as hepatic inflammation and fibrosis. However, the consequences of hepatic steatosis, which results from other factors, is unclear. For example, in an observational study published in the Journal of Lipid Research, a peer-reviewed medical journal, patients who suffer from a genetic MTP deficiency have been shown to have some degree of hepatic steatosis, with average hepatic fat levels of 14.8%, without long-term liver complications. In addition, there are FDA approved drugs for sale in the United States that are known to induce hepatic steatosis, including tamoxifen, which is used for the treatment of breast cancer, and amiodarone, which is used for the treatment of ventricular fibrillation. We expect to complete the population pharmacokinetics analysis at the end of the trial.

Additional Pre-NDA Studies

Before we submit our NDA, we must complete a thorough QT study in healthy volunteers to evaluate the effect of lomitapide on the heart’s electrical cycle, known as the QT interval, a study of lomitapide in patients who are renally impaired and a study of patients who are hepatically impaired. We will also provide to the FDA an analysis of biomarkers for hepatic inflammation and fibrosis using stored samples from a prior Phase II clinical trial as well as our ongoing Phase III trial to better determine lomitapide’s impact on these biomarkers as a proxy for more significant liver complications. We plan to complete each of these studies prior to the submission of our NDA for HoFH.

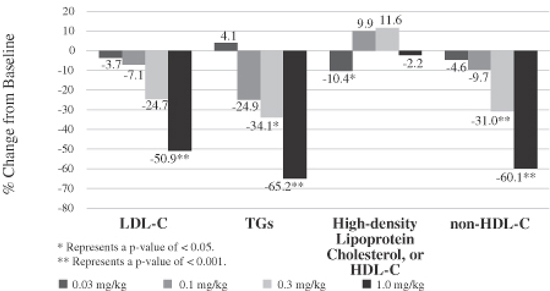

Completed Phase II Clinical Trial (HoFH)

In February 2004, UPenn completed a Phase II clinical trial of lomitapide for the treatment of patients with HoFH. In this single-arm, dose titration, open-label clinical trial, six patients were given ascending daily doses based upon body weight of 0.03 mg/kg, 0.1 mg/kg, 0.3 mg/kg and 1.0 mg/kg of lomitapide at four-week intervals for a total of 16 weeks. Given the weight-based dosing, the average dose at 1 mg/kg was 67 mg/day.

In January 2007, the results of this trial were published in The New England Journal of Medicine and are summarized below. Percentage change represents the average percentage change from baseline in the four lipid parameters for the six patient group. P-value is a measure of the likelihood that reduction in LDL-C levels versus baseline is due to random chance. A p-value of less than 0.05 means the probability that the difference is due to random chance is less than 5%, and is a commonly accepted threshold for denoting a statistically meaningful difference.

11

Table of Contents

HoFH Phase II Clinical Trial – Change in Lipids

We believe these results demonstrate a dose-dependent effect of lomitapide on lipid levels. In addition, patients treated with lomitapide experienced a mean reduction in body weight of 4.4% (2.8 kg) over the 16 weeks of therapy.

No patient withdrew from the trial and all patients were titrated to the maximum planned dose. Adverse events that were judged to be associated with drug therapy were primarily gastrointestinal, typically transient episodes of increased stool frequency of mild or moderate severity. Clinically significant elevations in the liver enzyme ALT were observed in three of the six patients. In one patient, the dose of lomitapide was temporarily reduced per protocol, after which ALT returned to lower levels. This patient subsequently was able to resume the earlier, higher dose and continue to be titrated to the maximum dose. In the other two patients, the elevations in ALT returned to lower levels with continued lomitapide treatment. Increases in hepatic fat levels were seen in four patients, whereas the other two patients had minimal changes in hepatic fat levels. With the exception of values in one patient, elevated ALT and hepatic fat levels returned to baseline levels upon cessation of therapy. The nonconforming patient, consumed large quantities of alcohol (self-reported to be 6 – 7 oz. of ethanol per day) during the trial and it is suggested that alcohol consumption may have contributed to the elevations during and after the clinical trial. Because a forced-titration scheme of treating the patients at increasing doses with four week intervals was employed, we believe it is reasonable to infer that greater increases in hepatic fat are seen with the higher doses of lomitapide.

An increase in the international normalized ratio, which measures the blood’s ability to form clots, was observed in the two patients receiving warfarin, an anti-coagulation therapy, which may be due to a drug-drug interaction. It is possible that patients who use lomitapide with warfarin may require monitoring of the international normalized ratio, as is commonly experienced by patients taking warfarin with other drugs and adjust dosages as necessary. In addition, pulmonary function tests were conducted at baseline, at the end of each dose and four weeks after study treatment. Pulmonary function tests remained unchanged for the duration of treatment compared to baseline in all patients.

Historical Development of Lomitapide

Although we are currently focused on the development of lomitapide for the treatment of severe forms of elevated cholesterol and TGs, we, BMS and UPenn previously pursued extensive development of lomitapide for potentially broader use or the treatment of high cholesterol for patients at moderately high risk of a cardiovascular event or for patients who were unable to tolerate a statin and therefore required additional LDL-C lowering in pursuit of their recommended target LDL-C levels.

In the mid-to-late 1990s, BMS developed lomitapide as a monotherapy treatment aimed at producing LDL-C lowering efficacy equal to or greater than that seen at maximum dosing with statins. Early clinical trials produced meaningful percent reductions in LDL-C levels, but participants discontinued at a high rate due to gastrointestinal adverse effects. We believe this resulted in large part from the failure to employ dose titration, which is the gradual

12

Table of Contents

increase in dosing over time to allow the body to adapt to the impact of a higher dose coupled with a low fat diet. In 2003, BMS donated certain patent rights and other rights related to this product candidate to The Trustees of the University of Pennsylvania, or The Trustees of UPenn. In May 2006, we entered into an exclusive, worldwide patent license with The Trustees of UPenn for the right to develop and commercialize lomitapide to treat specified patient populations.

The historical clinical program for lomitapide consisted of:

| • | eleven Phase I clinical trials involving 251 patients who received single or multiple doses of lomitapide of between 1 mg/day and 200 mg/day; and |

| • | six Phase II clinical trials, including the Phase II clinical trial in patients with HoFH sponsored by UPenn and a Phase II clinical trial in patients with hypercholesterolemia sponsored by BMS, involving 452 patients who received lomitapide. Patients in five of these Phase II trials lomitapide at daily doses between 2.5 mg/day and 67 mg/day over four and 12 weeks, while the patients in the HoFH Phase II trial sponsored by UPenn received weight-based dosing with mean doses of 2 mg/day to 67 mg/day during the 16 week trial. |

The following table summarizes the four Phase II trials of lomitapide that we completed for indications other than HoFH.

| Trial Description |

Dose Range and Concomitant Drugs |

Duration of Trial | Number of Patients Dosed with Lomitapide | |||

| Combination use of lomitapide with ezetimibe |

Lomitapide, 5 mg to 10 mg with or without ezetimibe, 10 mg |

12 weeks | 56 | |||

| Combination use of lomitapide with atorvastatin |

Lomitapide, 5 mg to 10 mg with or without atorvastatin, 20 mg |

8 weeks | 104 | |||

| Combination use of lomitapide and other lipid lowering therapies |

Lomitapide, 2.5 to 10 mg; Lomitapide, 5 mg with atorvastatin, 20 mg, fenofibrate, 145 mg, or ezetimibe, 10 mg |

12 weeks | 227 | |||

| Impact of titration on efficacy, safety and tolerability of lomitapide in combination with atorvastatin |

Lomitapide, 2.5 mg and 5 mg, with or without atorvastatin, 20 mg |

8 weeks | 21 | |||

In the Phase II clinical trials summarized in the table above, lomitapide at doses ranging from 2.5 mg/day to 10 mg/day reduced LDL-C levels in a dose dependent manner by 9% to 37% from baseline, respectively, when given as a monotherapy, by 35% to 46% from baseline, respectively, when used with ezetimibe, a drug that inhibits intestinal absorption of cholesterol, and by 47% to 51% from baseline, respectively, when used with atorvastatin. In comparison, ezetimibe monotherapy at a dose of 10 mg/day reduced LDL-C levels by 22% from baseline, and atorvastatin monotherapy at a dose of 20 mg/day reduced LDL-C levels by 42% from baseline after 12 weeks of treatment. Modest reductions in TG levels and body weight were also observed in patients treated with lomitapide in these trials. Most of the reductions in LDL-C levels from baseline were statistically significant. However, many of the changes in TG levels were not statistically significant due to the naturally high degree of variability in TG levels in the blood, the small sample size and the fact that the trials were designed to evaluate effect on LDL-C levels and not TG levels.

13

Table of Contents

In all six Phase II clinical trials and the eleven Phase I clinical trials, the most common adverse events reported were gastrointestinal, including diarrhea, nausea and vomiting. These adverse events were generally mild to moderate in nature. In addition, liver enzyme elevations occurred in a small proportion of patients and led to discontinuations from study drug. In these Phase I clinical trials and the earlier Phase II clinical trials, persistent elevation in liver transaminase levels at three times the upper limit of normal was used as a cutoff for discontinuation of lomitapide treatment. In these trials, out of a total of 351 patients treated with lomitapide at doses of 5 mg/day to 200 mg/day, 14 patients, or 4%, discontinued treatment. In later Phase II clinical trials, based on discussions with the FDA, persistent elevations in liver transaminase levels at five times the upper limit of normal was used as a cutoff for discontinuation of lomitapide treatment. In these trials, out of a total of 352 patients treated with lomitapide at doses of 2.5 mg/day to 10 mg/day alone or in combination with other lipid lowering agents, five patients, or 1.4%, discontinued treatment. In the majority of patients who experienced liver enzyme elevations and remained on study drug, the levels returned to baseline while continuing dosing.

In the six Phase II and eleven Phase I clinical trials, patients with baseline hepatic fat concentrations of less than 6.2% experienced increased mean hepatic fat four weeks after initiation of dosing, which then plateaued at eight weeks and at 12 weeks of dosing to levels of 6.2% to 9.7% for study doses of 2.5 mg/day to 10 mg/day. Higher levels of hepatic fat increases were occasionally observed at higher dose levels.

Familial Chylomicronemia (FC)

We also plan to develop lomitapide for use as an oral, once-a-day treatment for adult patients with FC. In October 2010, the EMA granted lomitapide orphan drug designation for the treatment of FC. In March 2011 the FDA also granted orphan drug designation for this indication. We are currently treating two patients with lomitapide for severe hypertriglyceridemia under the FDA’s compassionate use program, through which a licensed physician may request from a manufacturer an investigational drug for the diagnosis, monitoring or treatment of a serious disease or condition in an individual patient. The FDA will authorize the use if it determines that (1) the patient has no comparable or satisfactory alternative therapy; (2) the potential benefit justifies the potential risks of the treatment; (3) the probable risk to the patient from the investigational drug is not greater than the probable risk from the disease or condition; (4) the patient cannot obtain the drug under another investigational new drug application, or IND, or protocol; and (5) providing the investigational drug will not interfere with the initiation, conduct or completion of clinical investigations to support marketing approval. The physician must obtain written informed consent from the patient and institutional review board, or IRB, approval prior to administering the investigational drug, and a summary of the results of such use, including adverse events, must be provided to the FDA.

Based on the TG reductions seen in these patients and the TG reductions seen in other clinical trials of lomitapide, we believe lomitapide has potential for treating patients suffering from extremely high levels of TGs leading to life threatening pancreatitis.

We are in the process of developing a protocol for a Phase II/III clinical trial for the treatment of adult patients with FC. Based on our current plans, the protocol would provide for adult patients with FC to enter the trial on their existing treatment regimen and then be randomized to a lomitapide or a placebo treatment arm for 12 weeks. Patients receiving lomitapide would start at 5 mg and be titrated to 10 mg and 20 mg at four week intervals. The primary efficacy endpoint would be the percent reduction in TG levels at week 12. After week 12, patients would remain on lomitapide as part of a long-term safety phase of the trial. The FDA or the EMA may not accept our protocol and could instead require separate Phase II and Phase III clinical trials.

Potential Future Product Candidate

Implitapide

We believe that we have the opportunity to develop implitapide, our second MTP-I, for the treatment of the same indications as lomitapide. To date, we have focused our efforts with implitapide on optimizing its manufacturing process. Based on clinical data developed by Bayer Healthcare AG, or Bayer, we believe this compound may have a role in addressing LDL-C and TG lowering needs of severe and high-risk patients. Because a lower concentration of implitapide was needed to inhibit the activity of MTP to 50% of its baseline activity in the intestines than in the liver, we believe implitapide may be slightly more active in the intestines than the liver, perhaps positioning it as a preferable treatment of hypertriglyceridemia of intestinal origin.

14

Table of Contents

In June 2007, we received notice from the FDA of a partial clinical hold with respect to clinical trials of longer than six months duration for both our product candidates, lomitapide and implitapide. At that time, the FDA did not apply this partial clinical hold to our pivotal Phase III clinical trial of lomitapide for the treatment of patients with HoFH. The FDA removed the partial clinical hold with respect to lomitapide in February 2010, but this partial clinical hold remains in effect with respect to implitapide.

Sales and Marketing

Given our stage of development, we have not yet established a commercial organization or distribution capabilities. In the United States and the European Union, due to the rare nature of the diseases we are seeking to address and the limited options for treatment, patients suffering from these diseases, such as HoFH and FC, together with their physicians, often have a high degree of organization and are well informed, which may make it easier to identify target populations after a drug is approved.

Most patients with HoFH or FC are treated at a limited number of academic and apheresis centers or otherwise by physicians who specialize in the treatment of highly elevated lipid levels. If approved for the treatment of patients with HoFH or FC, we believe that it will be possible to commercialize lomitapide for these indications with a relatively small specialty sales force that calls on a limited and focused group of physicians. Our current plan is to commercialize lomitapide ourselves for these indications in the United States and the European Union. We plan to recruit a sales force and medical education specialists and take other steps to establish the necessary commercial infrastructure at such time as we believe that lomitapide is approaching marketing approval.

Outside of the United States and the European Union, subject to obtaining necessary marketing approvals, we likely will seek to commercialize lomitapide through distribution or other collaboration arrangements for HoFH and FC. If we elect to develop lomitapide for broader patient populations, we would plan to do so selectively either on our own or by establishing alliances with one or more pharmaceutical company collaborators, depending on, among other things, the applicable indications, the related development costs and our available resources.

As a result of the ongoing release of our Phase III clinical data, we have been engaged in dialogue with many of these specialists who serve patients with HoFH and FC. We believe that these activities have provided us with a growing knowledge of the physicians we plan to target for commercial launch of lomitapide for these conditions, subject to marketing approval in the United States and the European Union.

Manufacturing and Supply

Both lomitapide and implitapide are small molecule drugs that are synthesized with readily available raw materials using conventional chemical processes. Hard gelatin capsules are prepared at 2.5 mg, 5 mg and 20 mg strength by filling the capsule shell with formulated drug product.

We currently have no manufacturing facilities and limited personnel with manufacturing experience. We rely on contract manufacturers to produce both drug substances and drug products required for our clinical trials. All lots of drug substance and drug products used in clinical trials are manufactured under current good manufacturing practices, with oversight by our internal managers. We plan to continue to rely upon contract manufacturers and, potentially, collaboration partners to manufacture commercial quantities of our drug substances and drug product candidates if and when approved for marketing by the applicable regulatory authorities.

We currently rely on a single manufacturer for the preclinical and clinical supplies of each of our product candidates. We purchase these supplies from this manufacturer on a purchase order basis and do not have a long-term supply arrangement in place. We also do not have agreements in place for redundant supply or a second source for any of our product candidates although we have identified a possible secondary supplier of drug substance. We believe that there are alternate sources of supply that can satisfy our clinical trial requirements without significant delay or material additional costs.

Competition

Our industry is highly competitive and subject to rapid and significant technological change. Our potential competitors include large pharmaceutical and biotechnology companies, specialty pharmaceutical and generic drug

15

Table of Contents

companies, academic institutions, government agencies and research institutions. Key competitive factors affecting the commercial success of our product candidates are likely to be efficacy, safety and tolerability profile, reliability and durability of response, convenience of dosing and price and reimbursement.

The market for lipid lowering therapeutics is large and competitive with many applicable drug classes. However, our products, if approved, will be unique in their mechanisms of action, providing efficacy not possible with other approved drug products in this space, and will be focused, at least initially, on niche markets where they will be used in combination with existing approved therapies, such as statins, to provide incremental efficacy in currently underserved patient populations. We believe that lomitapide will face distinct competition for the treatment of both HoFH and FC. Although there are no MTP-I compounds currently approved by the FDA for the treatment of hyperlipidemia, we are aware of other MTP-I compounds in early stage clinical trials and other pharmaceutical companies that are developing the following potentially competitive product candidates:

| • | HoFH — Isis Pharmaceuticals, Inc. or Isis is developing an antisense apoB-100 inhibitor, mipomersen, as a weekly subcutaneous injection for lowering high cholesterol, LDL-C and apolipoprotein B and has completed four Phase III clinical trials for this product candidate. The FDA has granted mipomersen orphan drug designation for the treatment of patients with HoFH. Therefore, if mipomersen is approved by the FDA, Isis will be entitled to seven years of marketing exclusivity for such indication as to competitive products that are the same drug as mipomersen. |

| • | FC — In December 2009, Amsterdam Molecular Therapeutics Holding N.V., or AMT, filed an application for marketing approval for Glybera, an injectable gene therapy, with the EMA for the treatment of patients with FC. AMT has stated that it is expecting approval of this MAA in 2011. This product candidate has been tested in a total of 27 patients in three different clinical trials. It would represent the first gene therapy approved in the European Union. |

If we obtain marketing approval of lomitapide for the treatment of patients with HoFH in the United States and Isis obtains marketing approval of mipomersen for the treatment of patients with HoFH in the United States, lomitapide would compete in the same market with mipomersen. If Isis obtains marketing approval of mipomersen for the treatment of patients with HoFH in the United States prior to us, Isis could obtain a significant competitive advantage associated with being the first to market. In connection with obtaining marketing approval for mipomersen, Isis will also obtain orphan drug exclusivity for mipomersen, but we do not believe that Isis’ obtaining orphan drug exclusivity for mipomersen prior to our receiving orphan drug exclusivity for lomitapide would have an adverse effect on our business as mipomersen and lomitapide are different drugs under FDA rules and any exclusivity applicable to either drug will not apply to the other drug. Thus, because mipomersen is a different drug than lomitapide, we could obtain both approval and orphan drug exclusivity for lomitapide even if Isis has already obtained orphan drug exclusivity for mipomersen and Isis could obtain both approval and orphan drug exclusivity for mipomersen even if we have already obtained orphan drug exclusivity for lomitapide.

Similarly, in the European Union, notwithstanding the fact that the EMA has granted lomitapide orphan drug designation for the treatment of FC, if a competitor subsequently obtains approval and market exclusivity for its orphan designated drug for the treatment of FC, our marketing application for FC would not be accepted and we would be excluded from the market only if lomitapide was a “similar medicinal product” to our competitor’s product. In the European Union, a drug is a “similar medicinal product” if it contains a “similar active substance” or substances and is intended for the same therapeutic indication. A “similar active substance” is an identical active substance, or an active substance with the same principal molecular structural features and which acts via the same mechanism. We do not believe orphan drug exclusivity for mipomersen in the European Union would have an adverse effect on our business because we do not believe that lomitapide would be considered a “similar medicinal product” to mipomersen.

If lomitapide receives marketing approval for the treatment of patients with HoFH or FC, we believe that the reductions in LDL-C levels and TG levels that have been observed in clinical trials of this product candidate, its oral form of administration and mechanism of action as a small molecule will be important features that physicians and patients will consider in comparing lomitapide with an injectable and drugs employing complex mechanisms of action, such as antisense compounds and gene therapy.

16

Table of Contents

If we decide to develop and commercialize our product candidates for broader patient populations, we likely will compete more directly with other lipid lowering drugs in these indications. There are a range of drugs in this category, some of which, such as statins, are inexpensive, safe and effective and widely accepted by patients and physicians.

Many of our potential competitors have substantially greater financial, technical and human resources than we do and significantly greater experience in the discovery and development of product candidates, obtaining FDA and other marketing approvals of products and the commercialization of those products. Accordingly, our competitors may be more successful than we may be in obtaining FDA and other marketing approvals for drugs and achieving widespread market acceptance. Our competitors’ drugs may be more effectively marketed and sold than any drug we may commercialize and may render our product candidates obsolete or non-competitive before we can recover the expenses of developing and commercializing any of our product candidates. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available. Finally, the development of new treatment methods for the diseases we are targeting could render our drugs non-competitive or obsolete.

Intellectual Property

Our policy is to pursue patents, developed internally and licensed from third parties, and other means to protect our technology, inventions and improvements that are commercially important to our business. We also rely on trade secrets that may be important to our business.

Our success will depend significantly on our ability to:

| • | obtain and maintain patent and other proprietary protection for the technology, inventions and improvements we consider important to our business; |

| • | defend our patents; |

| • | preserve the confidentiality of our trade secrets; and |

| • | operate without infringing the patents and proprietary rights of third parties. |

As of March 15, 2011, our lomitapide patent portfolio consists of five issued U.S. patents and related issued patents in Europe, Canada, Israel and Japan, one pending U.S. non-provisional patent application and related pending applications in Europe, Australia, Japan, Canada, Israel, South Korea and New Zealand. We hold an exclusive worldwide license from The Trustees of UPenn to these patents and patent applications. This license is described below. The issued U.S. patents described above contain claims directed to the compound, lomitapide, and various methods of use, including methods of treating atherosclerosis, hyperlipidemia or hypercholesterolemia, and methods of reducing serum lipid levels, cholesterol or TGs, and are scheduled to expire between 2013 and 2019. The U.S. patent covering the composition of matter of lomitapide is scheduled to expire in 2015. The non-U.S. patents directed to lomitapide are scheduled to expire in 2016.

As of March 15, 2011, our implitapide patent portfolio consists of four issued U.S. patents, two pending U.S. non-provisional applications, and related patents and pending applications in Europe, Australia, Asia, Africa, and South America. We hold an exclusive worldwide license from Bayer to these patents and patent applications. This license is described below. The issued U.S. patents described above contain claims directed to the compound, implitapide, methods for treating obesity and atherosclerosis, and processes for making implitapide, and are scheduled to expire between 2015 and 2017. The U.S. patent and non-U.S. patents covering the composition of matter of implitapide are scheduled to expire in 2015.

In addition to the patents and patent applications described above, we have filed four non-provisional U.S. patent applications and related foreign applications in Australia, Canada, Europe and Japan and two international applications directed to pharmaceutical combinations of a MTP-I, such as lomitapide or implitapide, and other cholesterol lowering drugs, and to methods of using such combinations in certain dosing regimens to reduce serum cholesterol or TG concentrations.

17

Table of Contents

Depending upon the timing, duration and specifics of FDA approval of the use of lomitapide or implitapide, some of our U.S. patents may be eligible for limited patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, referred to as the Hatch-Waxman Act. See “— Regulatory Matters — Patent Term Restoration and Marketing Exclusivity.”

Licenses

University of Pennsylvania

In May 2006, we entered into a license agreement with The Trustees of UPenn, pursuant to which we obtained an exclusive, worldwide license from The Trustees of UPenn to certain know-how and a range of patent rights applicable to lomitapide. In particular, we obtained a license to certain patents and patent applications owned by The Trustees of UPenn relating to the dosing of MTP-Is, including lomitapide, and certain patents and patent applications and know-how covering the composition of matter of lomitapide that were assigned to The Trustees of UPenn by BMS for use in the field of monotherapy or in combination with other dyslipidemic therapies for treatment of patients with severe hypercholesterolemia unable to come within 15% of NCEP LDL-C goal on maximal tolerated oral therapy, as determined by the patient’s prescribing physician, or with severe combined hyperlipidemia unable to come within 15% of NCEP non-HDL-C goal on maximal tolerated oral therapy, as determined by the patient’s prescribing physician, or with severe hypertriglyceridemia unable to reduce TG <1,000 on maximal tolerated therapy. We also have the right to use lomitapide either as a monotherapy or with other dyslipidemic therapies to treat patients with HoFH. We refer to the patents and patent applications assigned by BMS to The Trustees of UPenn and licensed to us by The Trustees of UPenn as the BMS-UPenn assigned patents.

To the extent that rights under the BMS-UPenn assigned patents were not licensed to us under our license agreement with The Trustees of UPenn or were retained by The Trustees of UPenn for non-commercial education and research purposes, those rights, other than with respect to lomitapide, were licensed by The Trustees of UPenn back to BMS on an exclusive basis pursuant to a technology donation agreement between The Trustees of UPenn and BMS. In the technology donation agreement, BMS agreed not to develop or commercialize any compound, including lomitapide, covered by the composition of matter patents included in the BMS-UPenn assigned patents in the field licensed to us exclusively by The Trustees of UPenn. Through our license with The Trustees of UPenn, as provided in the technology donation agreement, we have the exclusive right with respect to the BMS-UPenn assigned patents regarding their enforcement and prosecution in the field licensed exclusively to us by The Trustees of UPenn.

The license from The Trustees of UPenn covers, among other things, the development and commercialization of lomitapide alone or in combination with other active ingredients in the licensed field. The license is subject to customary non-commercial rights retained by The Trustees of UPenn for non-commercial educational and research purposes. We may grant sublicenses under the license, subject to certain limitations.

We are obligated under this license agreement to use commercially reasonable efforts to develop, commercialize, market and sell at least one product covered by the licensed patent rights, such as lomitapide. Pursuant to this license agreement, we paid The Trustees of UPenn a one-time license initiation fee of $56,250. We will be required to make development milestone payments to The Trustees of UPenn of up to an aggregate of $150,000 when a licensed product’s indication is limited to HoFH or severe refractory hypercholesterolemia, and an aggregate of $2.6 million for all other indications within the licensed field. All such development milestone payments for these other indications are payable only once, no matter how many licensed products for these other indications are developed. In addition, we will be required to make royalty payments in a range of levels not greater than 10% on net sales of products covered by the license (subject to a variety of customary reductions), and share with The Trustees of UPenn specified percentages of sublicensing royalties and other consideration that we receive under any sublicenses that we may grant.