Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AstroNova, Inc. | form8k.htm |

(NASDAQ: ALOT)

Albert W. Ondis, Founder, Chairman & CEO

Everett V. Pizzuti, President & COO

Joseph P. O’Connell, Senior Vice President & CFO

March 31, 2011

Table of Contents

Page

Forward Looking Statements……………………..………………………………..3

Corporate Profile………..…………………………………………………………4-5

Key Investment Highlights…..…………………………………………………....6-9

Three Year Strategic Plan - Corporate Financial Objectives………………….10

Financials…...……………………………………………………………………11-19

Product Groups

QuickLabel Systems.…………………………………….……………………21-23

Ruggedized Products……………...…………………………………………..24-27

Test & Measurement….…………………………………………..…………...28-29

Grass Technologies……………………………………………………………30-33

Recent Events………………………...………………………………………… 34-36

Expectations…...…………………………………………………………………37-38

3

Certain of the statements contained in this presentation may be

considered forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Act of 1934, as amended. To the

extent that any of the statements contained herein relating to

Astro-Med, Inc. or its products or markets are forward-looking,

such statements are based on management’s assumptions

and/or current expectations that involve a number of

uncertainties and risks. Such uncertainties and risks include, but

are not limited to, those outlined in our Form 10K and other

public filings, which we make from time to time with the

Securities and Exchange Commission.

considered forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Act of 1934, as amended. To the

extent that any of the statements contained herein relating to

Astro-Med, Inc. or its products or markets are forward-looking,

such statements are based on management’s assumptions

and/or current expectations that involve a number of

uncertainties and risks. Such uncertainties and risks include, but

are not limited to, those outlined in our Form 10K and other

public filings, which we make from time to time with the

Securities and Exchange Commission.

Forward-Looking Statements

4

Corporate Profile

Astro-Med®, Inc. manufactures systems that acquire, process, analyze,

store, and present data in a variety of useable forms.

store, and present data in a variety of useable forms.

We develop and sell

hardware and software

systems for industrial

test and measurement,

ruggedized airborne printing,

neurophysiological test and

analysis, and labeling and

package identification.

All of our systems include

related consumables.

5

Corporate Profile

Astro-Med products are marketed around the world under four brand

names: Astro-Med® Ruggedized Products, Astro-Med® Test &

Measurement, Grass® Technologies, and QuickLabel® Systems.

names: Astro-Med® Ruggedized Products, Astro-Med® Test &

Measurement, Grass® Technologies, and QuickLabel® Systems.

Our product applications are diverse, and so are our customers. We

make specialty printers that produce high-end labels, and specialty

printers that produce hard copies of aircraft cockpit communications. We

make data acquisition systems that record and analyze equipment

performance, and data acquisition systems that record and analyze the

human brain.

make specialty printers that produce high-end labels, and specialty

printers that produce hard copies of aircraft cockpit communications. We

make data acquisition systems that record and analyze equipment

performance, and data acquisition systems that record and analyze the

human brain.

We focus on product innovation, and we are committed to total

quality management and customer satisfaction. We sell our products

direct in the USA, Canada, France, Germany, and in the UK, and via

channel distribution in the rest of the world. We are ISO 9001 certified

and have also achieved the rigorous AS9100 quality standard.

quality management and customer satisfaction. We sell our products

direct in the USA, Canada, France, Germany, and in the UK, and via

channel distribution in the rest of the world. We are ISO 9001 certified

and have also achieved the rigorous AS9100 quality standard.

6

Astro-Med, Inc:

Key Investment Highlights

7

Key Investment Highlights:

• Strategic Growth Plan - 3 Year

Ø Organic - R&D funding at 7% of total revenues

Ø Acquisitions - Multiple target companies identified

Ø 7% - 10% Annual revenue growth

Ø 20% - 40% Net Income growth

• Market Leader in In-House, On-Demand

Digital Color Label Printing

Ø Innovation with multiple label printing technologies

Ø Rapidly growing label consumables business

● Long-term Contracts

Ø Contracts in-hand to supply airborne printers for new Boeing

and Airbus passenger planes and also military airplanes

8

Key Investment Highlights:

· Recurring Consumables Revenues

Ø 52% of total sales revenue

● Global Distribution Network

Ø Direct sales and service - North America and Europe

Ø Dealer channel - 85 firms

· Proven, Experienced Management Team

9

Key Investment Highlights:

● Strong Capital Structure

Ø $21 million in cash and securities

Ø Current ratio 6.62 - 1

Ø No debt

Ø Strong EBITDA

Ø 10% CAGR for annual cash dividend over last 5 years

Ø Cash dividends at $0.28/share - current yield 3.7%

● Diversified Product Groups

Ø QuickLabel Systems

Ø Astro-Med Test & Measurement

Ø Astro-Med Ruggedized Products

Ø Grass Technologies

10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL REVENUE GROWTH RATE

|

7% - 15%

|

||

|

GROSS PROFIT MARGINS

|

42% - 45%

|

||

|

OPERATING PROFIT MARGINS

|

10% - 13%

|

||

|

RETURN ON SALES

|

5% - 7%

|

||

|

RETURN ON EQUITY*

|

8% - 15%

|

||

|

EBITDA TO SALES

|

8% - 14%

|

||

|

INTERNATIONAL SALES TO TOTAL SALES

|

35% - 40%

|

||

|

DIVIDEND GROWTH

|

8% - 10%

|

Three Year Strategic Plan

FY 2012-FY2014

Corporate Financial Goals

Financial

Goals

Goals

*Excludes cash and investments

11

Astro-Med, Inc:

Financials

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011(1)

|

2010(2)

|

2009

|

|

|

|

NET SALES

|

|

|

$ 71,016

|

$ 64,031

|

$71,783

|

|

|

GROSS PROFIT

|

|

|

$28,666

|

$26,628

|

$31,068

|

|

|

GROSS PROFIT%

|

|

|

40.4%

|

41.6%

|

43.3%

|

|

|

OPERATING INCOME

|

|

|

$2,656

|

$3,354

|

$4,626

|

|

|

MARGIN

|

|

|

3.7%

|

5.2%

|

6.4%

|

|

|

NET INCOME

|

|

|

$2,062

|

$2,766

|

$2,964

|

|

|

EPS - DILUTED

|

|

|

$0.28

|

$0.38

|

$0.40

|

|

|

EBITDA

|

|

|

$4,311

|

$4,922

|

$5,494

|

|

|

|

(1) Fiscal 2011 results include a tax benefit of $241,000 or $0.03 per diluted share recorded as a result of the resolution of a previously uncertain

tax position and a tax benefit of $130,000 or $0.02 per diluted share related to a favorable adjustment in the filing of the prior year’s foreign tax

returns.

tax position and a tax benefit of $130,000 or $0.02 per diluted share related to a favorable adjustment in the filing of the prior year’s foreign tax

returns.

Financial Highlights

($ in thousands except per share data)

(2) Fiscal 2010 results include a gain on legal settlement of $1,391,000 ($904,000 net of tax or $0.12 per diluted share); a gain on bargain purchase

related to the acquisition of Label Line of $112,000 or $0.02 per diluted share; and a tax benefit of $335,000 or $0.05 per diluted share recorded

as a result of the resolution of a previously uncertain tax position.

related to the acquisition of Label Line of $112,000 or $0.02 per diluted share; and a tax benefit of $335,000 or $0.05 per diluted share recorded

as a result of the resolution of a previously uncertain tax position.

GAAP BASIS

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011

|

2010

|

2009

|

|

|||

|

NET SALES

|

|

|

$ 71,016

|

$ 64,031

|

$71,783

|

|

|

GROSS PROFIT

|

|

|

$28,666

|

$26,628

|

$31,068

|

|

|

GROSS PROFIT%

|

|

|

40.4%

|

41.6%

|

43.3%

|

|

|

OPERATING INCOME

|

|

|

$2,656

|

$1,963

|

$4,626

|

|

|

MARGIN

|

|

|

3.7%

|

3.1%

|

6.4%

|

|

|

NET INCOME

|

|

|

$1,691

|

$1,415

|

$2,964

|

|

|

EPS - DILUTED

|

|

|

$0.23

|

$0.19

|

$0.40

|

|

|

EBITDA

|

|

|

$4,311

|

$4,922

|

$5,494

|

|

|

|

Fiscal Year Ended

January 31,

Financial Highlights

($ in thousands except per share data)

NON GAAP BASIS

14

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

|

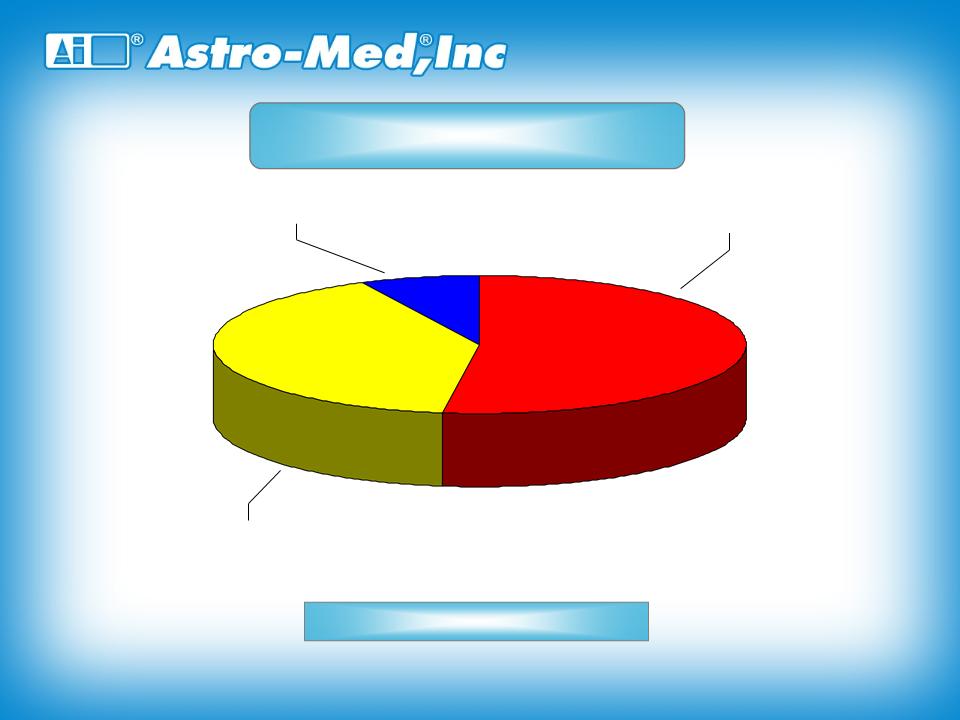

Consumables $37,113 [ 52%]

Hardware $28,686 [ 41%]

Service and Other $5,217 [ 7%]

Product Mix

FY2011 Net Sales: $71,016

($ in thousands)

15

|

|

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

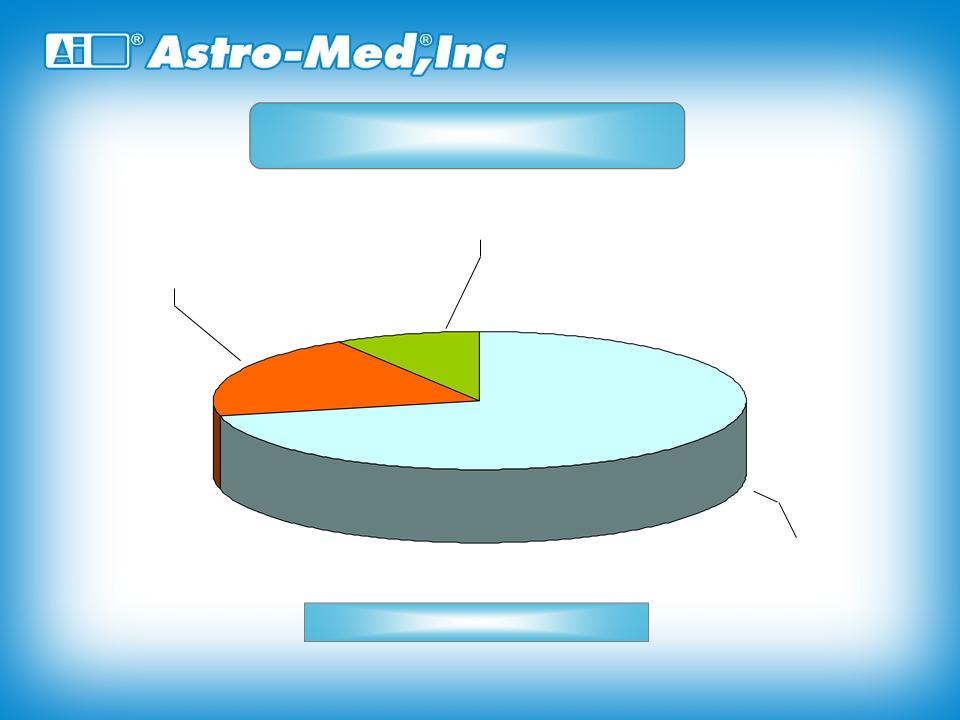

Domestic $50,614 [ 71%]

International Branches $14,027 [ 20%]

International Dealers $6,375 [ 9%]

FY2011 Net Sales: $71,016

($ in thousands)

Channel Distribution

16

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

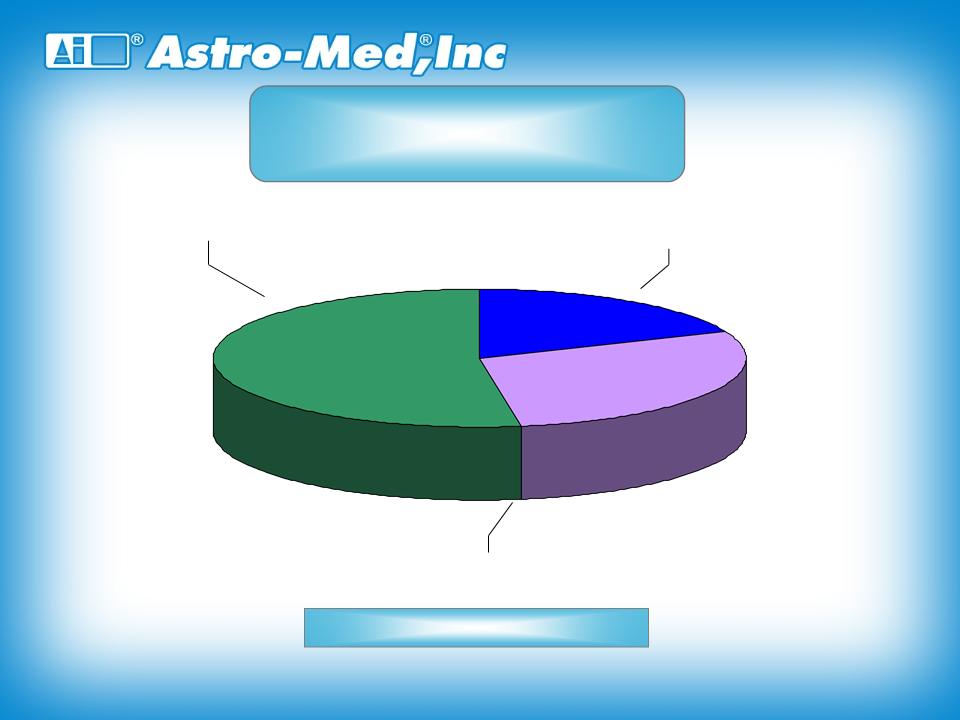

QuickLabel $39,500 [ 56%]

T&M and Ruggedized Products

$14,837 [ 21%]

$14,837 [ 21%]

Grass $16,679 [ 23%]

By Segment

FY2011 Net Sales: $71,016

($ in thousands)

17

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

QuickLabel $1,847 [ 29%]

T&M and Ruggedized Products

$1,200 [ 19%]

$1,200 [ 19%]

Grass $3,358 [ 52%]

By Segment

FY2011 Segment Operating

Profit: $6,405

($ in thousands)

18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011

|

2010

|

2009

|

|

|

CASH & MARKETABLE SECURITIES

|

|

|

$20,630

|

$23,670

|

$22,104*

|

|

|

CURRENT ASSETS

|

|

|

$49,700

|

$49,868

|

$48,023

|

|

|

TOTAL ASSETS

|

|

|

$64,999

|

$64,676

|

$62,155

|

|

|

CURRENT LIABILITIES

|

|

|

$ 7,503

|

$ 7,552

|

$ 7,904

|

|

|

DEBT

|

|

|

0

|

0

|

0

|

|

|

SHAREHOLDERS’ EQUITY

|

|

|

$54,289

|

$54,233

|

$51,471

|

|

Fiscal Year Ended January 31,

______________________

*Includes investments classified as non-current.

Selected Balance Sheet Data

($ in thousands)

19

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011

|

2010

|

2009

|

|

|

CASH PER SHARE(1)

|

|

|

$2.85

|

$3.32

|

$ 3.15

|

|

|

CURRENT RATIO

|

|

|

6.62:1

|

6.12:1

|

6.08:1

|

|

|

BOOK VALUE PER SHARE

|

|

|

$7.50

|

$7.58

|

$7.33

|

|

|

RETURN ON EQUITY(2)

|

|

|

6.3%

|

8.8%

|

8.0%

|

|

|

CASH DIVIDEND PER SHARE

|

|

|

$0.28

|

$0.24

|

$0.24

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended January 31,

__________________

(1) Includes investments.

(2) Excludes cash and investments.

Selected Financial Metrics

($ in thousands)

20

Astro-Med, Inc:

Product Groups

21

QuickLabel Systems Brand

22

• Market Size: $4 Billion

• Revenue FY2011: $40 million

• Market Growth: 8% to 15%

• Growth Driver: The growing demand for fast turn-around digitally

printed color labels

printed color labels

• Technologies: Electrophotographic (EP - toner-based)

Thermal Transfer; Ink Jet

• Products: ● Digital Label Printers

● Consumables: Labels and Inks

● Custom Label Printing Services

● Labeling Software & Accessory Devices

● Service & Support

23

• Industry Markets:

Ø Food & Beverage

Ø Industrial Chemicals & Chemical Cleansers

Ø Dietary Supplements & Pharmaceuticals

Ø Personal Care Products

Ø Medical Device Products

Ø Hardware

Ø Electronics

Ø Household Goods

Ø Tires

Ø Promotional Products & Advertising Specialties

Ruggedized Product Group

25

• Estimated Annual Market Size: $50 Million

• Market Growth: 15% to 25%

• Growth Driver: Improved passenger safety in the

skies through accurate communications

skies through accurate communications

• Contracts on Hand: - Airbus A380

- Airbus A400M

- Boeing 787

- Boeing C-17

- Airbus A400M

- Boeing 787

- Boeing C-17

- Lockheed C-130 (via Boeing)

- Panasonic In-flight Entertainment Systems on:

- Boeing 747,767,777

- Airbus A330, A340

- Bombardier Global Vision Flight Deck

- Air Cargo Carrier

26

Boeing C-17

TW4, TS

Airbus A400M

TW4

Boeing C-130 AMP

TW4, TS2

Boeing B787

TW4

Lockheed Martin C-130J

TS2

Airbus A380

flight deck, cabin

TW4

Bombardier Global Express

TW4

Panasonic IFE

TW4

Thales IFE

TW4

Bombardier Global 5000

TW4

Contracts On Hand

27

28

Test & Measurement Product Group

29

• Market Size: $100 Million

• Revenue FY2011: $9 Million

• Market Growth: 5% to 8%

• Growth Driver: The increased need to troubleshoot the complex

electrical and electronic systems in industrial

systems and grids

electrical and electronic systems in industrial

systems and grids

• Technologies: Data Acquisition

• Products: Portable Data Recorders, Telemetry Recorder

Workstations

Workstations

• Industry Markets: Aerospace, Power, Heavy Industry, Military,

Transportation, Manufacturing

Transportation, Manufacturing

30

Grass Technologies Corporation

31

• Revenue FY2011: $17 million

• Market Growth: 4% to 6%

• Growth Driver: Continued growth in Sleep health and

expansion of Neurodiagnostic monitoring

in ICU.

expansion of Neurodiagnostic monitoring

in ICU.

• Industry Markets: Neurodiagnostic Devices and Supplies

for Clinical and Research Applications

for Clinical and Research Applications

32

• Sleep Diagnostic/PSG Instruments:

Ø Comet XL Lab-based PSG, Comet Portable PSG, AURA

PSG Wireless/Ambulatory Systems, AURA PSG LITE

Ambulatory Sleep Screener, SleepTrek3 Home Sleep

Screener

PSG Wireless/Ambulatory Systems, AURA PSG LITE

Ambulatory Sleep Screener, SleepTrek3 Home Sleep

Screener

• Research Instruments:

Ø Amplifiers, Amplifier Systems, Stimulators, Transducers

and Tissue-Organ Baths

and Tissue-Organ Baths

Product Lines:

33

• EEG/Long-Term Monitoring:

Ø Comet XL Lab-based EEG, Comet Portable EEG, TREA

Ambulatory EEG System, Beehive Horizon Long-term

Monitoring, S12x cortical stimulator

Ambulatory EEG System, Beehive Horizon Long-term

Monitoring, S12x cortical stimulator

• Electrodes:

Ø Genuine Grass® Precious Metal Recording Electrodes,

Grass Disc, Ear Clip, Needles & Nasopharyngeal

Electrodes, Grass Silver-Silver Chloride Electrodes,

Grass Cortical Electrode Accessories

Grass Disc, Ear Clip, Needles & Nasopharyngeal

Electrodes, Grass Silver-Silver Chloride Electrodes,

Grass Cortical Electrode Accessories

Product Lines:

34

Astro-Med, Inc:

Recent Events

35

Recent Events

♦ Recently introduced the VIVO! Touch intelligent color label printer at

several important trade shows including the Pack Expo in Chicago,

Illinois

several important trade shows including the Pack Expo in Chicago,

Illinois

♦ Established Three Year Strategic Business Plan for

FY 2012 - FY 2014

♦ Introduced the ToughWriter® 5, the smallest and lightest

fully-featured cockpit printer in the world

♦ Achieved AS9100 Quality Management System Certification,

meeting rigorous Aerospace Industry standard for Ruggedized

products

♦ Launched Test & Measurement’s TMXTM, a multi-channel

high speed data acquisition system

high speed data acquisition system

36

Recent Events (continued)

♦ Received FDA Clearance to Market its S12X Cortical Brain Stimulator

♦ Completed expansion of consumable manufacturing facility in

Rhode Island

♦ Expanded QuickLabel media manufacturing in Frankfurt, Germany and

Montreal, Canada

Montreal, Canada

♦ Continued expansion of Astro-Med’s Export business

37

Astro-Med, Inc:

Expectations

38

Expectations

♦ Sales Revenue in FY 2012 expected to grow 10%

♦ Operating Income in FY 2012 expected to grow > 25%

♦ EPS expected to be $0.33 - $0.35 in FY 2012

♦ Internally developed new products will promote revenue

and profit growth in FY 2012

♦ Strategic Acquisitions, as appropriate, to be made in FY

2012

2012

39

Thank You

“ALOT”!