Attached files

| file | filename |

|---|---|

| EX-4.7 - EX-4.7 - Anacor Pharmaceuticals, Inc. | a2203077zex-4_7.htm |

| EX-4.8 - EX-4.8 - Anacor Pharmaceuticals, Inc. | a2203077zex-4_8.htm |

| EX-23.1 - EX-23.1 - Anacor Pharmaceuticals, Inc. | a2203077zex-23_1.htm |

| EX-31.1 - EX-31.1 - Anacor Pharmaceuticals, Inc. | a2203077zex-31_1.htm |

| EX-32.1 - EX-32.1 - Anacor Pharmaceuticals, Inc. | a2203077zex-32_1.htm |

| EX-31.2 - EX-31.2 - Anacor Pharmaceuticals, Inc. | a2203077zex-31_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Financial Statements

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File Number: 001-34973 |

||

ANACOR PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

25-1854385 (I.R.S. Employer Identification No.) |

||

1020 East Meadow Circle Palo Alto, CA 94303-4230 (Address of Principal Executive Offices) (Zip Code) |

||||

(650) 543-7500 (Registrant's Telephone Number, Including Area Code) |

||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on which Registered | |

|---|---|---|

| Common Stock, par value $0.001 per share | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The registrant's common stock was not publicly traded as of the last business day of the registrant's most recently completed second fiscal quarter. The number of outstanding shares of the registrant's common stock on February 28, 2011 was 27,996,928.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference to the definitive proxy statement for the Company's Annual Meeting of Stockholders to be held on or about May 26, 2011, to be filed within 120 days of the registrant's fiscal year ended December 31, 2010.

Anacor Pharmaceuticals, Inc.

Form 10-K

Index

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements, including statements regarding the progress and timing of clinical trials, the safety and efficacy of our product candidates, actions to be taken by our partner, GlaxoSmithKline LLC, or GSK, our ability to enter into and maintain additional collaborations, our ability to scale and support commercial activities, the goals of our research and development activities, estimates of the potential markets for our product candidates, availability of drug product, our expected future revenues, operations and expenditures and projected cash needs. The forward-looking statements are contained principally in the sections entitled "Business," "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements.

Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "could," "would," "expects," "plans," "anticipates," "believes," "estimates," "projects," "predicts," "potential," or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this Annual Report on Form 10-K and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this Annual Report on Form 10-K.

Overview

We are a biopharmaceutical company focused on discovering, developing and commercializing novel small-molecule therapeutics derived from our boron chemistry platform. We have demonstrated that our organization, utilizing our boron chemistry platform, is highly productive and efficient at creating novel clinical product candidates. We have discovered, synthesized and developed five molecules that are currently in clinical development, and we believe that our organization and boron chemistry platform have the potential to continue to yield clinical candidates at a similar pace and efficiency in the future. While drug development is often uncertain and occasionally uneven, our current portfolio of product candidates and our ability to efficiently fill our own pipeline provide us with a unique opportunity to create a valuable and sustainable biopharmaceutical company.

We believe that our expertise in boron chemistry enables us to identify compounds that interact with known drug targets in novel ways and also inhibit drug targets that have been historically difficult to inhibit with traditional chemistry. We have applied this expertise across a range of fungal, inflammatory, bacterial and parasitic diseases that represent significant unmet medical needs. We have discovered and advanced into clinical development multiple differentiated product candidates that we believe have significant disease-modifying potential and attractive pharmaceutical properties. We believe that our product candidates may offer significant improvements over the standard of care for diseases that represent large, well-defined commercial opportunities.

The productivity of our internal discovery capability has enabled us to generate a pipeline of both topical and systemic boron-based compounds. We currently have five product candidates in clinical development. Our three lead product candidates include two topically administered dermatologic compounds—AN2690, an antifungal for the treatment of onychomycosis, and AN2728, an anti-inflammatory for the treatment of psoriasis and atopic dermatitis, as well as a systemic antibiotic for the treatment of infections caused by Gram-negative bacteria—GSK2251052, or GSK '052 (formerly referred to as AN3365). In addition, we are developing AN2718 as a topical antifungal product candidate for the treatment of onychomycosis and skin fungal infections and AN2898 as a topical anti-inflammatory product candidate for the treatment of psoriasis and atopic dermatitis.

We have entered into and are seeking partnerships to expand the therapeutic application and commercial value of our boron chemistry platform. In October 2007, we entered into a research and development collaboration, option and license agreement with GlaxoSmithKline LLC, or GSK, for the discovery, development and worldwide commercialization of boron-based systemic anti-infectives. In July 2010, GSK exercised its option to license GSK '052, and we are actively conducting research to discover additional systemic anti-infectives with GSK. In August 2010, we entered into a collaboration with Eli Lilly and Company, or Lilly, under which we are collaborating to discover products for a variety of animal health applications. In February 2011, we entered into a research and development option and license agreement with Medicis Pharmaceutical Corporation, or Medicis, to discover and develop compounds directed against a target for the potential treatment of acne. In addition, we are applying our boron chemistry platform to the development of treatments for various neglected diseases in collaboration with leading not-for-profit organizations, including the Drugs for Neglected Diseases initiative, Medicines for Malaria Ventures, Sandler Center for Basic Research in Parasitic Diseases and the Institute for OneWorld Health.

1

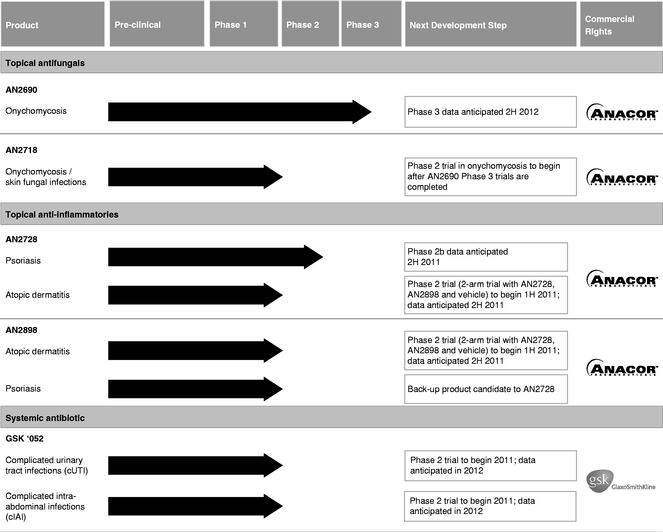

Our Clinical Pipeline

The following table summarizes the current status and the anticipated next steps in the development plans for our clinical-stage product candidates:

AN2690 is our lead topical antifungal product candidate for the treatment of onychomycosis, a fungal infection of the nail and nail bed. Onychomycosis affects approximately 35 million people in the United States, and new prescriptions to treat this disease continue to grow. Lamisil (terbinafine), a systemic drug approved for onychomycosis, had worldwide peak sales of $1.2 billion in 2004, before generic entry. According to IMS Health, for the 12-month period ending June 30, 2010, 1.4 million new prescriptions were filled in the United States for both branded and generic versions of terbinafine. Despite its high labeled efficacy (38%), we believe the usage of branded and generic terbinafine has been limited due to safety concerns related to liver toxicity. The leading topical drug for onychomycosis, Penlac Nail Lacquer (ciclopirox), had U.S. sales of $125.0 million in 2002, before generic entry. According to IMS Health, for the 12-month period ending June 30, 2010, over 350,000 new prescriptions were filled in the United States for branded or generic ciclopirox. While ciclopirox has been shown to be safe due in part to its topical administration, we believe the usage of branded and generic ciclopirox has been limited due to its low labeled efficacy (5.5%-8.5%).

We believe AN2690 can potentially offer significant improvements over the standards of care for onychomycosis by combining the safety of a topical drug with significant efficacy. Due to its unique boron chemistry, AN2690 has demonstrated enhanced nail penetration properties, a novel mechanism

2

of action with potent antifungal activity and, due in part to its topical administration, no observed systemic side effects in human dosing. AN2690 inhibits an essential fungal enzyme, leucyl-transfer RNA synthetase, or LeuRS, required for protein synthesis. The inhibition of protein synthesis leads to termination of cell growth and cell death, eliminating the fungal infection. We reported positive results from three Phase 2 clinical trials and held an end-of-Phase 2 meeting with the United States Food and Drug Administration, or FDA. In August 2010, we filed a Special Protocol Assessment, or SPA, request with the FDA in order to reach agreement on key endpoint measures and trial design to be used in our first of two identical planned Phase 3 clinical trials of AN2690. We have received the FDA's agreement on what we believe are the major parameters associated with the design and conduct of our first Phase 3 trial for AN2690. We initiated the Phase 3 clinical trial in onychomycosis in the fourth quarter of 2010. We are currently enrolling patients at clinical sites in the United States and also plan to enroll patients at clinical sites in Canada and Mexico in 2011.

AN2728 is our lead topical anti-inflammatory product candidate for the treatment of psoriasis, a chronic inflammatory skin disease that affects approximately 7.5 million people in the United States and over 100 million people worldwide. Approximately 80% of psoriasis patients have mild-to-moderate disease, which is mainly treated with topical corticosteroids and vitamin D analogs. However, topical corticosteroids and vitamin D analogs are limited in their use by patients due to their long-term safety and/or their tolerability profile. In spite of these limitations, according to IMS Health, approximately 3.9 million prescriptions were filled for these topical therapies to treat psoriasis in the United States in 2009.

We believe that AN2728 has the potential to be an effective psoriasis treatment with an attractive safety profile in a topical application, and thus provide an alternative to treatment with topical corticosteroids and vitamin D analogs. Due to its boron-based structure, AN2728 binds with the active site of the enzyme phosphodiesterase-4 (PDE4) in a novel manner, thus inhibiting its activity. This mechanism subsequently reduces the production of TNF-alpha, IL-12, IL-23 and other pro-inflammatory cytokines that are precursors of the inflammation associated with psoriasis. In June 2010, we successfully completed a Phase 2b dose-ranging trial to evaluate the safety and efficacy of AN2728. We have initiated a final Phase 2b trial for AN2728 in psoriasis that matches the anticipated design of our planned Phase 3 trials in which patients will be randomized to receive either AN2728 or vehicle. Following the completion of this Phase 2b trial, we plan to initiate a Phase 3 trial in the second half of 2011. We are also exploring the activity of AN2728 for the treatment of atopic dermatitis, and plan to initiate a Phase 2 trial in this indication in the first half of 2011. This Phase 2 clinical trial will be designed as a two-arm trial evaluating the efficacy and safety of AN2728 and AN2898 compared to vehicle.

GSK '052 is our lead systemic antibiotic for the treatment of infections caused by Gram-negative bacteria. Gram-negative bacterial infections are increasing in prevalence, especially in hospitals, and represent a serious public health challenge due to their growing resistance to currently available drug therapies. According to the New England Journal of Medicine, it is estimated that there were 1.7 million hospital-acquired Gram-negative and Gram-positive infections and approximately 100,000 associated deaths in the United States alone in 2002. The New England Journal of Medicine also indicates that Gram-negative bacteria are responsible for more than 30.0% of hospital-acquired infections and account for approximately 70.0% of hospital-acquired infections in the intensive care unit. IMS Health estimates there were 40 million days of Gram-negative therapy administered in the United States in 2009. Gram-negative bacterial infections are becoming a major global health issue where their growing resistance to currently available drug therapies is rapidly increasing. Furthermore, recently approved Gram-negative antibiotics have been limited to new versions of existing antibiotics, which carry the risk of rapid resistance development from pre-existing mechanisms of resistance. Preclinical studies suggest that GSK '052 could be a novel approach for the treatment of infections caused by a broad range of

3

Gram-negative bacteria, including E. coli, Klebsiella pneumoniae, Citrobacter spp., S. marcescens, P. vulgaris, Providentia spp., Pseudomonas aeruginosa and Enterobacter spp.

Due to its unique boron-based chemical structure, GSK '052 specifically targets the bacterial enzyme leucyl-transfer RNA synthetase, or LeuRS, which is required for protein synthesis. The inhibition of protein synthesis leads to termination of cell growth and cell death, eliminating the bacterial infection. Since GSK '052 is the first antibiotic to target LeuRS, bacteria have not developed resistance to it. In preclinical safety, pharmacology and toxicology studies, GSK '052 showed robust activity against multi-resistant Gram-negative bacteria with no cross resistance to existing classes of antibiotics. In a Phase 1 proof-of-concept trial, GSK '052 demonstrated a promising safety profile and linear dose-proportional pharmacokinetic properties, reaching blood levels that were many times higher than the anticipated efficacious dose. If approved, we believe GSK '052 would be the first new class of antibacterial agents to treat serious hospital-acquired Gram-negative infections in thirty years. In addition, we believe GSK '052 has the potential to be the first antibiotic specifically targeting infections caused by Gram-negative bacteria that can be administered by both IV and oral routes, which would allow patients to continue on the same antibiotic therapy they received in the hospital once they are discharged.

Following the completion of the Phase 1 trial, GSK exercised its option to obtain an exclusive license to develop and commercialize GSK '052 and has assumed responsibility for further development of the product candidate and any resulting commercialization. Following the exercise of the option in July 2010, we received a fee of $15.0 million. We are eligible to receive further development milestones up to $69.0 million, commercial milestones up to $175.0 million and double-digit tiered royalties with the potential to reach the mid-teens on annual net sales. We believe GSK currently plans to develop GSK '052 as a potential treatment for complicated urinary tract infections, or cUTI, complicated intra-abdominal infections, or cIAI, and other Gram-negative bacterial infections, such as hospital-acquired and ventilator-associated pneumonia, or HAP/VAP. We anticipate that GSK will initiate Phase 2 trials of GSK '052 in patients with cUTI and cIAI in 2011.

Our clinical pipeline also includes two additional product candidates that may extend and expand the market opportunity of our dermatology portfolio. AN2718, our second topical antifungal product candidate, has the potential to treat onychomycosis and fungal infections of the skin. We expect to initiate a Phase 2 trial of AN2718 in onychomycosis after we have completed Phase 3 trials with AN2690. AN2898, our second topical anti-inflammatory product candidate, has the potential to treat psoriasis and atopic dermatitis. We expect to initiate a two-arm Phase 2 trial with AN2898 and AN2728 compared to vehicle in atopic dermatitis in the first half of 2011.

Boron Chemistry Platform

All of our current research and development programs, including our five clinical product candidates, are based on compounds that have been internally discovered using our boron chemistry platform. Boron is a naturally occurring element that is ingested frequently through consumption of fruits, vegetables, milk and coffee. Boron has two attributes that we believe confer compounds with drug-like properties. First, boron-based compounds have a unique geometry that allows them to have two distinct shapes, giving boron-based drugs the ability to interact with biological targets in novel ways and to address targets not amenable to intervention by traditional carbon-based compounds. Second, boron's enhanced reactivity as compared to carbon allows us to design molecules that can hit targets that are difficult to inhibit with carbon chemistry.

Despite the ubiquity of boron in the environment, researchers have faced challenges in evaluating boron-based compounds as product candidates due to previously limited understanding of the physical properties necessary to provide boron-based compounds with the chemical and biological attributes required of pharmaceutical therapies as well as difficulty in chemical synthesis.

4

We have developed expertise and an understanding of the interactions of boron-based compounds with key biological targets relevant to treating disease. This know-how is primarily related to methods for modulating boron's reactivity to optimize reactions with the target and minimize unwanted chemical reactivity. Our advances have enabled the efficient optimization of disease-modifying properties for our lead compounds and their rapid progression from the research stage into clinical trials.

Additionally, we have discovered new methods of synthesis of boron compounds, allowing for the creation of new compound families with broad chemical diversity and retention of drug-like properties. These new compound families expand the universe of biological targets that can be addressed by small-molecule, boron-based compounds. We have been in operation since 2002 and began generating clinical candidates in our second year. Since that time, we have discovered and synthesized thousands of boron-containing molecules, and of these, five are currently in clinical development. The rate of discovery of molecules and promotion to clinical development has occurred at a relatively constant rate.

We believe our focus on boron-based chemistry provides us with multiple advantages in the small-molecule drug discovery process. These advantages include:

- •

- Novel access to biological targets. Due to the unique

geometry and reactivity of boron-based molecules, our boron-based compounds are able to modulate existing biological targets and can address targets not amenable to intervention by traditional

carbon-based compounds. This may enable us to treat diseases that have not been effectively addressed by carbon-based compounds, for example, by developing antibiotic or antifungal therapies that kill

pathogens that have become resistant to existing drugs.

- •

- Broad utility across multiple disease areas. Our compounds

have exhibited extensive preclinical activity in multiple disease areas, including fungal, inflammatory and bacterial diseases, which are our core areas of focus, as well as in parasitic, cancer and

ophthalmic indications and for applications in animal health.

- •

- Rapid and efficient synthesis of drug-like

compounds. Our proprietary technological advances in the synthesis of boron-based compounds, coupled with our rational drug design

capabilities, have enabled us to rapidly create large families of boron-based compounds with drug-like properties. We believe that these advances have made manufacturing of boron-based

compounds economical on a commercial scale.

- •

- Unencumbered intellectual property landscape. We believe the intellectual property landscape for boron-based pharmaceutical products is relatively unencumbered compared to that of carbon-based products, providing an attractive opportunity for us to build our intellectual property portfolio.

Our Strategy

Our objective is to discover, develop and commercialize proprietary boron-based drug compounds with superior efficacy, safety and convenience for the treatment of a variety of diseases. The key elements of our strategy to achieve this objective are to:

- •

- Drive rapid, efficient discovery of novel boron-based

compounds. We believe the unique characteristics of boron and the expertise we have developed allow us to design novel product

candidates that target a broad range of diseases and drive a rapid and efficient drug development process. We have discovered and advanced five compounds that are currently in clinical development

during our first nine years of operations and, in addition, have other active research and development programs ongoing.

- •

- Focus development activities in our core therapeutic areas. We intend to focus our development activities in our core therapeutic areas of fungal, inflammatory and bacterial diseases. To fully

5

- •

- Commercialize our products ourselves in specialty markets in the United

States. We intend to build a sales force to focus on domestic specialty markets, such as dermatology. We have entered into and will continue to seek commercialization partners

for products in non-specialty and international markets.

- •

- Leverage partnerships for non-core therapeutic

areas. We believe boron chemistry has utility in a broad range of diseases outside of our core therapeutic areas. To maximize the value

of our boron chemistry platform and to provide non-dilutive capital to support development in our core therapeutic areas, we have entered into and will continue to seek partnerships early

in development for compounds in non-core areas, such as parasitic, cancer and ophthalmic indications and for applications in animal health.

- •

- Expand and protect our intellectual property. We intend to expand and aggressively prosecute our intellectual property in the area of boron chemistry and boron-based compounds. Since a relatively limited amount of research has been done in the area of boron-based drug development, we believe that we can establish a defensible and valuable intellectual property portfolio.

leverage our boron chemistry platform, we have established and will continue to pursue development partnerships in these therapeutic areas.

Our Product Candidates

Our Topical Antifungal Programs

AN2690 for Onychomycosis

Our most advanced product candidate is AN2690, a topical treatment for onychomycosis, which is a fungal infection of the nail and nail bed. We reported positive results from three Phase 2 clinical trials, have completed an end-of-Phase 2 meeting with the FDA, and filed a Special Protocol Assessment request with the FDA in order to reach agreement on key endpoint measures and trial design to be used in our planned Phase 3 clinical trials of AN2690 in onychomycosis. We initiated Phase 3 trials in the fourth quarter of 2010, at clinical sites in the United States and are enrolling at clinical sites in Canada and Mexico in 2011.

Onychomycosis Market

Onychomycosis is primarily caused by dermatophytes, which are fungi that infect the skin, hair or nails. The infection involves the nail plate, the nail bed and, in some cases, the skin surrounding the nail plate. Onychomycosis causes nails to deform, discolor, thicken, become brittle and split and separate from the nail bed. Toenails affected by onychomycosis can become so thick that routine trimming of the nails becomes difficult. The condition can also cause pain when individuals wear shoes, leading to difficulties walking. Onychomycosis can also lead to social embarrassment due to the unsightly appearance of the infected nails and because it may be perceived to be an active infection and contagious.

According to Podiatry Today, 35 to 36 million people in the United States have onychomycosis. Over 95% of onychomycosis infections are infections of the toenail, according to a report in U.S. Dermatology Review. According to the manufacturer of Lamisil, 47% of those affected by onychomycosis are not receiving treatment. For those who do seek treatment, options include debridement, oral or topical drugs or a combination of debridement and drug therapies. Debridement consists of scraping, cutting away or removal of the affected nail. Onychomycosis may persist or worsen if not treated. Onychomycosis often recurs in susceptible individuals because the fungi that cause onychomycosis are present in many common locations such as floors, the soil, socks and shoes. Consequently, the nail can

6

be reinfected, and additional courses of treatment are frequently required even after successful treatment.

Lamisil (terbinafine), a systemic drug approved for onychomycosis, had worldwide peak sales of $1.2 billion in 2004, before generic entry. According to IMS Health, for the 12-month period ending June 30, 2010, 1.4 million new prescriptions were filled in the United States for both branded and generic versions of terbinafine. Despite its high labeled efficacy (38%), we believe the usage of branded and generic terbinafine has been limited due to safety concerns related to liver toxicity. Penlac Nail Lacquer (ciclopirox), the only U.S. approved topical agent for onychomycosis, had U.S. sales of $125.0 million in 2002, before generic entry. According to IMS Health, for the 12-month period ending June 30, 2010, over 350,000 new prescriptions were filled in the United States for branded or generic ciclopirox. While ciclopirox has been shown to be safe due in part to its topical administration, we believe the usage of branded and generic ciclopirox has been limited due to its low labeled efficacy (5.5%-8.5%).

Limitations of Current Onychomycosis Therapies

Current therapies for onychomycosis include debridement and drug therapies. Debridement is time consuming and only marginally effective in eliminating the fungal infection. Drug therapies are available in two types, either oral therapies such as Lamisil, or topical therapies such as Penlac. According to the Lamisil product label, 38% of patients treated in clinical trials with a 12-week course of therapy achieved 100% clear nail and mycological cure. However, Lamisil has been associated with rare cases of liver failure, some leading to death or liver transplant. We believe this risk of liver failure limits acceptance of this therapy by both physicians and patients. Patients are recommended to undergo liver function tests prior to initiating Lamisil treatment and those patients with pre-existing liver disease cannot be treated with it.

Penlac is approved for use in onychomycosis in conjunction with frequent debridement. In the two clinical trials cited on Penlac's product label, even with frequent debridement, only 5.5% and 8.5% of patients treated with Penlac achieved 100% clear nail and mycological cure, respectively. We believe that a significant barrier to effective treatment by current topical therapies is the difficulty of formulating the drug product to penetrate through the nail plate and reach the site of infection.

Our Solution: AN2690

By addressing the limitations of current therapies, we believe AN2690 has a potential safety and efficacy profile that can make it a best-in-class therapy for the treatment of onychomycosis. We have completed three Phase 2 clinical trials in which AN2690 had no observed systemic side effects. We believe that the clinical data that we have generated to date demonstrates the potential advantages of AN2690 relative to Lamisil and Penlac.

We have designed AN2690, our topical antifungal, with three distinguishing characteristics:

- •

- Enhanced nail penetration properties. We utilized our

expertise in medicinal chemistry to design AN2690 with enhanced nail penetration properties, allowing for improved delivery of the compound through the nail plate to the nail bed, the site of

onychomycosis infection. Preclinical studies utilizing human nails indicate that AN2690 is able to penetrate the nail plate 250 times more effectively than Penlac.

- •

- Novel mechanism of action with potent antifungal activity. We have utilized our expertise in boron-based chemistry to design AN2690 with potent antifungal activity. AN2690 inhibits an essential fungal enzyme, leucyl-transfer RNA synthetase, or LeuRS, required for protein synthesis. The inhibition of protein synthesis leads to termination of cell growth and cell death, eliminating the fungal infection. We have shown that this inhibitory activity requires the presence

7

- •

- No detected systemic side effects after topical dosing. We have conducted clinical trials to assess systemic absorption of AN2690. The results of these trials found that topical treatment with AN2690 resulted in low or no detectable levels of drug in the blood or urine. No treatment-related systemic side effects have been observed in any of our clinical trials, and we believe it is unlikely that treatment of onychomycosis with AN2690 will result in significant systemic side effects.

of boron within the compound, as the replacement of the boron atom with a carbon atom in AN2690 inactivated the molecule. The unique boron-based mechanism of action underlying AN2690 was detailed in the June 22, 2007 issue of the journal Science.

We have completed three Phase 2 clinical trials which demonstrated that AN2690 is efficacious as defined by the percentage of patients achieving clear nail growth and negative fungal culture. We believe that these data have demonstrated that AN2690's efficacy should be in a range that is at least twice that of Penlac and may approach that of Lamisil. In addition, in our Phase 1 and Phase 2 clinical trials, we have shown that AN2690 achieves significant nail penetration, results in little or no systemic exposure and is well-tolerated across a range of doses.

AN2690 Phase 3 Development Program

In the fourth quarter of 2010, we initiated Phase 3 clinical trials for AN2690 in onychomycosis in the United States. The AN2690 Phase 3 program consists of two double-blind, vehicle-controlled trials enrolling approximately 600 patients each. Vehicle refers to the formulation without the active ingredient. Two-thirds of the patients are randomized to receive AN2690 at the 5.0% concentration, or dose, compared to one-third who receive vehicle once daily for 48 weeks. The primary efficacy endpoint is a composite endpoint measuring complete cure of the great toenail at week 52, which is consistent with the FDA requirement for Lamisil. Complete cure requires both a mycologic cure and a completely clear nail. Mycologic cure is achieved when the fungus present in the nail plate is killed by treatment. Achieving a clear nail requires a complete elimination of the diseased portion of the nail by replacement with a new healthy growing nail and nail bed. Given the slow rate of nail growth, which is approximately one to two millimeters per month, the industry standard for conducting Phase 3 clinical trials of onychomycosis is to evaluate the nails over a 12-month period, in order to allow sufficient time for patients to grow a new nail. An end-of-Phase 2 meeting with the FDA was completed, and in August 2010 we filed an SPA request with the FDA in order to reach agreement on key endpoint measures and trial design to be used in our planned Phase 3 trials of AN2690 in onychomycosis. We have received the FDA's agreement on what we believe are the major parameters associated with the design and conduct of our Phase 3 trials for AN2690. We initiated Phase 3 trials in the fourth quarter of 2010 at clinical sites in the United States, and we also plan to enroll patients at clinical sites in Canada and Mexico in 2011. Guidance meetings have also been completed with the European Medicines Agency and regulatory authorities in Japan. Based upon these discussions, we anticipate that our Phase 3 development program will help support approval in these regions, although an additional comparator trial will likely be required in these regions.

AN2690 Phase 2 Clinical Development Program

Our Phase 2 clinical trials of AN2690 have enabled us to define multiple well-tolerated, efficacious doses and a dose-response relationship. We have also demonstrated that topical application to the toenails has led to little or no detectable systemic drug exposure in blood or urine. Results from these trials support the selection of the 5.0% dose of AN2690 for the Phase 3 clinical trials and have enabled appropriate statistical calculations for the design of those trials.

8

The following chart summarizes our Phase 2 clinical trials:

Study Number

|

Type | Dosing | Patients | Trial Objectives | Completed | |||||

|---|---|---|---|---|---|---|---|---|---|---|

200/200a |

Double-blind | Vehicle; 2.5%; 5.0%; 7.5% | 187 | Evaluate safety and efficacy compared to vehicle | August 2007 | |||||

201 |

Open-label |

5.0%; 7.5% |

60 |

Evaluate safety and efficacy |

February 2007 |

|||||

201 |

Open-label |

5.0% |

29 |

Evaluate safety and efficacy of longer treatment period |

July 2008 |

|||||

203 |

Open-label |

1.0%; 5.0% |

60 |

Evaluate efficacy of lower doses and less frequent dosing |

August 2007 |

In our Phase 2 clinical trials, we enrolled onychomycosis patients representative of a wide clinical spectrum of the disease. We believe that the results of these trials indicate that AN2690 may effectively treat patients who are representative of the population that would seek treatment for onychomycosis and collectively support Phase 3 clinical trial initiation.

Study 200/200a: Double-Blind—Safety and Efficacy Compared to Vehicle

The primary objectives of Study 200/200a were to demonstrate that the efficacy of AN2690 could be differentiated from vehicle, and to select the appropriate dose of AN2690 for Phase 3 clinical trials. A total of 187 patients were enrolled at multiple sites in Mexico and the United States. Enrolled patients were randomly assigned to be dosed with the vehicle or one of the following concentrations of AN2690 solution: 2.5%, 5.0% or 7.5%. The double-blind nature of the trial ensured that neither the patients nor the investigators were aware of which of the four treatment options was being applied. Patients dosed themselves daily for the first three months and three times per week for the remaining three months of the six-month treatment period. After an additional six months of follow-up, complete and partial responders were identified and post-treatment effects were assessed.

The study's primary endpoint was the number of patients with at least two millimeters of clear nail growth and negative fungal culture at the end of the six-month treatment period. At this time point, 27% of patients receiving the 2.5% dose, 26% of patients receiving the 5.0% dose and 32% of patients receiving the 7.5% dose were observed to achieve the trial's primary endpoint, compared to 14% of patients receiving the vehicle. Overall, significantly more patients treated with AN2690 achieved the primary endpoint, compared with the vehicle (P-value of 0.03). Of 187 enrolled patients, four subjects experienced five episodes of skin irritation, and four of these episodes were observed in patients receiving AN2690 at the highest dose level. Based upon these results, we believe the 5% dose will offer patients the best combination of efficacy and tolerability and therefore, we selected this dose for advancement into our Phase 3 clinical trials.

Study 201: Open-Label (first, second and third cohorts)—Safety and Efficacy

The objective of Study 201 was to determine the safety and efficacy of 5.0% and 7.5% topical solutions of AN2690 in treating onychomycosis. A total of 60 patients were enrolled at multiple sites in Mexico in the first two cohorts. Half received a 5.0% daily dose and the other half received a 7.5% daily dose for a period of six months, with a subset of patients receiving an additional six months of follow-up assessment. The trial was open-label, such that both investigators and the patients knew which dose was being administered. The study's primary endpoint was the number of patients with at least two millimeters of clear nail growth at six months and a negative fungal culture. At the end of the six-month treatment period, 43% of patients receiving the 5.0% dose and 53% of patients receiving the 7.5% dose were observed to have achieved the trial's primary endpoint.

9

The primary objective of the third cohort of Study 201 was to evaluate the safety of a longer treatment period of AN2690 in onychomycosis. In this open-label trial, patients received a 5.0% dose once daily for up to 360 days. A total of 29 patients were enrolled in this cohort, which indicated that 5.0% AN2690 solution applied daily for 360 days was well-tolerated by most subjects. At the end of the 12-month period, tolerability was shown to be similar to what was previously seen with 24 weeks of treatment. In addition, 14% and 24% of the patients treated in the third cohort reached the endpoint of at least two millimeters of clear nail growth and negative fungal culture at six months and twelve months, respectively. Seven percent of the third cohort patients demonstrated a completely clear nail and negative fungal culture after twelve months of dosing. The percentage of patients reaching the primary endpoint at six months in the third cohort was significantly lower than the percentage of patients reaching the primary endpoint in the first and second cohorts.

Study 203: Open-Label—Efficacy of Lower Doses and Less Frequent Dosing

The objective of Study 203 was to determine safety and efficacy of lower dosing and less frequent dosing of AN2690 in treating onychomycosis. Two groups of 30 patients were enrolled at multiple sites in the United States. Half applied a 1.0% daily dose for six months and the other half applied a 5.0% daily dose for the first month, then three times per week for the remaining five months of treatment. A subset of each treatment group was followed for an additional six months after the end of treatment. The study's primary endpoint was the number of patients with at least two millimeters of clear nail growth at six months and a negative fungal culture. At the end of the six-month treatment period, 30% of patients receiving the 1.0% dose and 50% of patients receiving the 5.0% dose achieved the primary endpoint.

AN2690 Preclinical Development Program

We believe we have completed all of the preclinical toxicology studies required for marketing approval, including a chronic (nine-month) dermal minipig study, two-year mouse and rat carcinogenicity studies and definitive characterization of ADME (absorption, distribution, metabolism, and excretion) in animals.

Former Collaboration with Schering

In February 2007, we entered into an exclusive license, development and commercialization agreement with Schering-Plough Corporation, or Schering, for the development and worldwide commercialization of AN2690. Under the agreement, Schering paid us a $40.0 million upfront fee and $9.5 million for our development-related transition activities and assumed sole responsibility for development and commercialization of AN2690. In addition, Schering invested $10.0 million in a preferred stock financing completed in December 2008. In October 2009, the end-of-Phase 2 meeting with the FDA was completed. In November 2009, Schering merged with Merck & Co., Inc., or Merck, and in May 2010, pursuant to a mutual termination and release agreement, we regained the exclusive worldwide rights to AN2690. Merck did not retain any rights to this compound. Since regaining rights to AN2690 in May 2010, Merck has transferred back to us all materials and documents relating to AN2690 and has paid us $5.8 million.

AN2718 for Topical Fungal Infections

AN2718 is our second topical antifungal in clinical development for onychomycosis and fungal infections of the skin and utilizes the same mechanism as AN2690. AN2718 appears to be well-suited to target organisms that cause common skin and topical fungal infections, including Trichophyton and Candida fungi. Based on preclinical studies and in comparison to AN2690, we believe that AN2718 has greater potency against the dermatophytes T. mentagrophytes and T. rubrum and results in similar nail

10

penetration. These studies suggest that, like AN2690, AN2718 also has significantly greater nail penetration than Penlac.

Our Phase 1 data for AN2718 has also indicated that AN2718 has a low skin irritation profile across multiple doses and that it would thus be suitable for the treatment of skin fungal infection. This Phase 1 data, which we announced in March 2009, was from a 21-day skin irritation trial. In the trial, we compared AN2718 gel at 1.5%, 2.5%, 5.0% and 7.5%, and AN2718 cream at 0.3% and 1.0% to their respective vehicles. All doses of AN2718 gel, cream and vehicle were applied to the skin of normal volunteers for 21 days using semi-occlusive, or semi-air and water-tight, adhesive patches. Application sites were then evaluated daily for signs of irritation. The irritation indices for all AN2718 doses were very low and comparable to vehicle. We currently intend to initiate a Phase 2 trial of AN2718 for onychomycosis following the completion of Phase 3 trials of AN2690.

Our Topical Anti-Inflammatory Programs

AN2728 for Psoriasis and Atopic Dermatitis

AN2728 is our lead topical anti-inflammatory product candidate for the treatment of psoriasis and atopic dermatitis, chronic inflammatory diseases that affect millions of people worldwide. We have achieved positive results from three Phase 1b, one Phase 2a, one Phase 2 and one Phase 2b clinical trials. In February 2011, we initiated a final Phase 2b trial to evaluate the safety and efficacy of AN2728 in patients with mild-to-moderate psoriasis. We anticipate that the design of this trial will be similar to that of our planned Phase 3 trials in which patients will be randomized to receive either AN2728 or vehicle. The objective of this Phase 2b trial is to demonstrate efficacy in a patient-to-patient trial design using the anticipated FDA-required endpoints and to inform the design and powering of our planned two Phase 3 trials for AN2728. Following the completion of this Phase 2b trial, we plan to have an end-of-Phase 2 meeting with the FDA and subsequently advance AN2728 into Phase 3 development in the second half of 2011.

In addition, in the first half of 2011, we expect to initiate a Phase 2 trial of AN2898 outside of the United States in patients with atopic dermatitis, which will be designed as a two-arm trial evaluating the efficacy and safety of AN2898 and AN2728 compared to vehicle. Prior to initiation of clinical trials of AN2898 in the United States, we will file an investigational new drug application, or IND, with the FDA for AN2898 for psoriasis and/or atopic dermatitis.

Psoriasis Market

Psoriasis is a chronic inflammatory skin disease that affects approximately 7.5 million people in the U.S and over 100 million people worldwide. Patients can be categorized as mild, moderate or severe, with approximately 80% of patients having mild to moderate forms of the disease. Psoriasis is characterized by thickened patches of inflamed, red skin covered with thick, silvery scales typically found at the elbows, knees, scalp and genital area. The disorder ranges from a single, small, localized lesion in some patients to a severe generalized eruption. Patients with mild-to-moderate psoriasis are typically treated with a combination of topical therapies, while patients with moderate-to-severe psoriasis are typically treated with a combination of topical and systemic therapies. The recent introductions of new systemic biologic therapies have provided new treatment options for patients with moderate to severe disease and have greatly expanded amounts spent on drugs to treat psoriasis. According to LeadDiscovery, sales of psoriasis drugs in the seven major pharmaceutical markets (United States, Japan, France, Germany, Italy, Spain and the United Kingdom) were $2.5 billion in 2008. In 2009, over 4.5 million prescriptions were written for patients with psoriasis in the United States, with approximately 3.9 million of these prescriptions written for topical therapies.

11

Limitations of Current Psoriasis Therapies

Most psoriasis patients use more than one type of treatment at any given time and may rotate treatments over time as their disease severity changes or they develop complications. Although current treatments attempt to decrease the severity of the disease, none of them cures the disease. Currently available treatments can be classified as topical, oral, injectable or phototherapy. According to IMS Health, 84% of all prescriptions for psoriasis within the United States in 2009 were for topical treatments. The most common topical treatments are corticosteroids, vitamin D derivatives, such as Dovonex (calcipotriene), topical retinoids, such as Tazorac (tazarotene), and crude coal tar preparations. Taclonex is also a treatment for psoriasis and is a combination of calcipotriene and the high potency corticosteroid betamethasone dipropionate. The most common oral treatments are the immunosuppressive drug methotrexate and the oral retinoid acetretin. A number of injectable biologic drugs in the market include Amevive, Enbrel, Humira, Remicade and Stelara. The majority of these drugs are monoclonal antibodies, complex protein molecules, some of which act by the inhibition of TNF-alpha. In addition to topicals, orals and injectables, psoriasis is also treated with ultraviolet light exposure. Typically, physicians initiate treatment by prescribing topical therapies to treat mild or moderate forms of psoriasis, followed by light therapy or oral treatments if the patient's disease does not improve. For patients who do not respond to oral treatments or light therapy, or for those who have moderate-to-severe psoriasis, physicians will prescribe injectable biologic treatments.

Current topical therapies have demonstrated varying levels of efficacy. However, their use has been limited due to issues of safety and tolerability. Long-term use of topical corticosteroids is associated with atrophy, or thinning, of the skin and has the potential to suppress the body's ability to make normal amounts of endogenous corticosteroids, which limit the duration of safe treatment with these therapies. Vitamin D derivatives can cause skin irritation, and some patients report burning sensations associated with their use. Topical retinoids can also cause skin irritation and have been shown to cause birth defects. Thus, their use must be avoided during pregnancy. Oral and injectable drugs have greater activity than topical therapies, but also have well-documented and significant systemic side effects, such as liver toxicity, increase in blood fats and suppression of the immune system. In addition, injectable biologic drugs are very expensive, costing tens of thousands of dollars annually. Ultraviolet light treatments can be effective, but require multiple visits to the doctor's office each week and may increase patients' risk of developing skin cancer.

Atopic Dermatitis Market

Atopic dermatitis is a chronic rash characterized by inflammation and itchiness. In 2007, Datamonitor reported that atopic dermatitis affected approximately 40 million people across the seven major pharmaceutical markets. The condition most commonly appears in childhood, with 20% of children in the United States affected, and it can persist into adulthood. Skin that is broken and chafed from itching allows bacterial or viral access, which leads to secondary infections.

Limitations of Current Atopic Dermatitis Therapies

Current atopic dermatitis treatments attempt to reduce inflammation and itchiness to maintain the protective integrity of the skin. Combinations of antibiotics, antihistamines, topical corticosteroids and topical immunomodulators, such as Elidel and Protopic, are the current standard of care. However, these have limited utility because of lack of efficacy and side effects. While not approved by the FDA for treatment of atopic dermatitis, ultraviolet light has been used to treat this disease.

Our Solution: AN2728

We believe that AN2728 will have comparable efficacy to that of topical corticosteroids and vitamin D analogs in treating psoriasis, but with a better safety and tolerability profile thus allowing for

12

longer duration of treatment. AN2728 is a novel boron-containing small molecule that inhibits PDE4 and reduces the production of TNF-alpha, a precursor of the inflammation associated with psoriasis, as well as other cytokines, including IL-12 and IL-23, which are proteins believed to be involved in the inflammation process and immune responses. If approved, AN2728 would be the first topical non-steroidal treatment that inhibits TNF-alpha release. Because AN2728 has a novel mechanism of action, it can potentially be combined with topical corticosteroids and vitamin D analogs for patients with mild-to-moderate psoriasis. In addition, patients with severe psoriasis who combine topical and systemic therapies may use AN2728. We believe the anti-inflammatory characteristics of AN2728 may also prove effective for the treatment of patients with atopic dermatitis.

AN2728 Phase 2b and Phase 3 Development Programs

In February 2011, we initiated a final Phase 2b trial to evaluate the safety and efficacy of AN2728 in patients with mild-to-moderate psoriasis. We anticipate that the design of this trial will be similar to that of our planned Phase 3 trials in which patients will be randomized to receive either AN2728 or vehicle. The objective of this Phase 2b trial is to demonstrate efficacy in a patient-to-patient trial design using the anticipated FDA-required endpoints and to inform the design and powering of our planned two Phase 3 trials for AN2728. Following the completion of this Phase 2b trial, we plan to have an end-of-Phase 2 meeting with the FDA and subsequently advance AN2728 into Phase 3 development with the first of two planned Phase 3 trials anticipated to commence in the second half of 2011. We anticipate that we will have data from at least one of our two Phase 3 trials for AN2728 by the second half of 2012.

AN2728 Phase 1 and Phase 2 Development Program

AN2728 has demonstrated initial tolerability and activity against psoriatic lesions in three Phase 1b, one Phase 2a, one Phase 2 and one Phase 2b clinical trials. For AN2728, all three of our completed Phase 1b microplaque trials showed significant activity over vehicle. Subsequently, our three completed Phase 2 trials confirmed the results of the microplaque studies when applied by the patient.

The following chart summarizes our AN2728 clinical trials to date which compared AN2728 to existing topical treatments for psoriasis or vehicle:

Study Number

|

Type | Dosing | Patients | Trial Duration |

Trial Objectives |

Completed | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Microplaque Phase 1b |

Open-label | 5.0% Betnesol-V, Protopic, Vehicles | 12 | 12 days | Evaluate safety and efficacy compared to Betnesol-V, Protopic and vehicles | March 2007 | ||||||

Microplaque Phase 1b |

Open-label |

0.5%, 2.0%, 5.0%, Betnesol-V, Protopic, Vehicle |

12 |

12 days |

Evaluate safety and efficacy of multiple doses compared to Betnesol-V, Protopic and vehicle |

December 2007 |

||||||

Microplaque Phase 1b |

Open-label |

0.3%, 1.0%, 2.0%, Betnesol-V, Vehicle |

12 |

12 days |

Evaluate safety and efficacy of multiple doses compared to Betnesol-V and vehicle |

March 2008 |

||||||

Phase 2a |

Double-blind |

Vehicle; 5.0% |

35 |

4 weeks |

Evaluate safety and efficacy compared to vehicle |

March 2008 |

||||||

Phase 2 |

Double-blind |

Vehicle; 5.0% |

30 |

12 weeks |

Evaluate optimal duration of therapy |

December 2008 |

||||||

Phase 2b dose-ranging |

Double-blind |

Vehicle; 0.5%, 2.0% once and twice daily |

145 |

12 weeks |

Evaluate optimal dose and duration of therapy |

June 2010 |

13

Phase 1b Clinical Trials

We have completed three Phase 1b clinical trials of AN2728. These trials utilized a microplaque design in which each patient had small areas of a large psoriatic lesion treated with various medications for 12 days. Each of the treatment areas was evaluated at days one, eight and twelve. The primary endpoint for each of these trials was the change in thickness of the psoriatic lesion as measured by sonography, and the secondary endpoint was improvement based on clinical score as evaluated by a physician. No treatment-related adverse events were observed in these trials.

In March 2007, we completed our first Phase 1b microplaque clinical trial of AN2728 in patients with psoriasis. The study enrolled 12 patients for a 12-day treatment and compared AN2728 5.0% ointment, AN2728 5.0% cream, Betnesol-V cream (betamethasone vallerate, a mid potency corticosteroid) and Protopic ointment (tacrolimus, an immunomodulator), vehicle cream and vehicle ointment. This study demonstrated that AN2728 caused a significant reduction in the thickness of psoriatic lesions compared to both vehicles, at a P-value of 0.025. The mean percent reduction in infiltrate thickness for AN2728 was 54%, as compared to 48% for Protopic and 72% for Betnesol-V. The results of the secondary endpoint paralleled the results of the primary endpoint.

In December 2007, we completed our second Phase 1b microplaque clinical trial of AN2728 in patients with psoriasis. This study was a dose-ranging study designed to compare 0.5%, 2.0% and 5.0% AN2728 ointment, Betnesol-V cream, Protopic, and the ointment vehicle. Based on the primary endpoint, which was the change in the thickness of the inflammatory infiltrate, all three concentrations were significantly better than the ointment vehicle (P-values less than 0.003). The mean percent reductions for 5.0%, 2.0% and 0.5% AN2728 ointment were 36%, 35%, and 26%, respectively. The percent reductions for Betnesol-V and Protopic were 59% and 34%, respectively.

In March 2008, we completed our third Phase 1b microplaque trial in patients with psoriasis. This was a study designed to compare 0.3%, 1% and 2% AN2728, Betnesol-V and vehicle. The study enrolled 12 patients for a 12-day treatment. In the study, 1% and 2% AN2728 demonstrated significant improvement over vehicle and 0.3% AN2728 demonstrated a strong trend in superiority over vehicle.

Phase 2 Clinical Trials

Psoriasis is often bilateral and symmetrical, meaning that patients with psoriasis commonly have similar areas of psoriasis on opposing sides of their body. Each of our Phase 2 studies of AN2728 for the treatment of psoriasis were designed as a bilateral study in which patients treat one of their plaques with one treatment and a similar plaque or the other side of the body with a comparison treatment. This allowed patients to serve as their own control.

In March 2008, we completed a Phase 2a bilateral trial of AN2728 to characterize the safety profile and to assess efficacy. In this trial, patients, in a double-blinded fashion, treated one of their areas of psoriasis with AN2728 5.0% ointment and a matching area on the opposite side of the body with the vehicle alone. The trial treated 35 patients with mild-to-moderate psoriasis. The primary endpoint was the proportion of patients in whom the AN2728-treated area improved more than the vehicle-treated area based on the overall target plaque severity score, or OTPSS. The OTPSS is a scoring system used by investigators that characterizes severity of disease, which ranges from zero (no evidence of disease) to eight (very severe). Based on the OTPSS after four weeks, the trial achieved its primary endpoint, with 69% of the AN2728 treated plaques demonstrating a lower score than the vehicle treated plaques as compared to 6% of the vehicle treated plaques (P-value less than 0.001). Significant differences were also noted after two weeks and three weeks and in all secondary endpoints, including scaling, erythema and plaque elevation. In addition to no serious adverse events, there were no treatment-related adverse reactions or application site reactions.

14

In December 2008, we completed a Phase 2 double-blind bilateral trial comparing 5.0% AN2728 ointment and vehicle using a design similar to our Phase 2a study but using a longer treatment duration. In this Phase 2 study, patients with mild-to-moderate psoriasis applied AN2728 and vehicle twice daily for 12 weeks in order to define the optimal duration of therapy. Results showed statistically significant reductions in the OTPSS, as well as in the individual signs of psoriasis, such as erythema, scale and plaque thickness at several time points. Compared to those treated with vehicle, psoriasis plaques treated with AN2728 achieved a lower OTPSS in a significantly greater proportion of patients after as few as two weeks of treatment, with optimal responses seen at six and eight weeks (P-value less than 0.001 and 0.01, respectively). Thirteen percent of the treated plaques cleared completely and 43% of the plaques achieved clear or almost clear with a two-grade improvement from baseline. Treatments were generally well-tolerated with the most common side effect being irritation at the application site. During the course of the trial, one serious adverse event was reported in a patient who developed a rash after receiving an injection of penicillin outside of the trial for a sore throat and needed to be hospitalized for this non-life threatening reaction.

In June 2010, we completed a 145-patient randomized, double-blind, vehicle-controlled, multicenter, Phase 2b bilateral dose-ranging trial to evaluate the safety and efficacy of 0.5% and 2.0% AN2728 ointment, applied either once or twice daily for 12 weeks for the treatment of mild-to-moderate psoriasis. Compared to those treated with vehicle, psoriasis plaques treated with AN2728 achieved greater improvement in the OTPSS in a significantly higher proportion of patients after six weeks in the 2.0% AN2728 twice daily dosing group (P-value less than 0.001), which was the primary endpoint of the trial. A dose response was also observed across the four dosing groups for this outcome. Additionally, of those plaques treated for 12 weeks with 2.0% AN2728 twice daily, 54% achieved complete or near complete clearance with at least a two-grade improvement from their baseline severity score.

Based on these results, we initiated and have completed enrollment in a double-blind, Phase 2b trial for AN2728 in February 2011. The Phase 2b trial is designed to evaluate the safety and efficacy of AN2728 in patients with mild to moderate plaque-type psoriasis and is being conducted under anticipated Phase 3 conditions. This double-blind, randomized, vehicle-controlled trial has enrolled 68 patients with mild to moderate plaque-type psoriasis at ten centers in the United States. Patients have been randomized to 2% AN2728 topical ointment or vehicle in a 2:1 ratio and will apply the ointment twice daily for 12 weeks. Given its size, the trial is not designed to demonstrate statistical differentiation of AN2728 from vehicle, but to inform the size and design of the two planned pivotal Phase 3 trials for AN2728. Following the completion of this Phase 2b trial, we plan to have an end-of-Phase 2 meeting with the FDA and subsequently advance AN2728 into Phase 3 development with the first of two planned Phase 3 trials anticipated to commence in the second half of 2011. We anticipate that we will have data from at least one of our two Phase 3 trials for AN2728 by the second half of 2012.

AN2898 for Psoriasis and Atopic Dermatitis

AN2898 is our second anti-inflammatory product candidate for psoriasis and atopic dermatitis. Like AN2728, AN2898 is a novel boron-containing small molecule that inhibits PDE4 and reduces the production of both TNF-alpha, a precursor of the inflammation associated with psoriasis, and other cytokines, including IL-12 and IL-23. AN2898 has a similar mechanism of action to that of AN2728 and appears to have activity in a larger set of animal models, which may predict greater clinical efficacy than AN2728 in atopic dermatitis.

In February 2009, we initiated a Phase 1b study evaluating AN2898 in 12 patients with plaque-type psoriasis for 12 days. This was a microplaque study conducted in a similar fashion as the AN2728 microplaque trials. Achieving its primary endpoint, this study demonstrated that AN2898 caused a significant reduction in the thickness of psoriatic lesions compared to vehicle, at a P-value less than

15

0.0001. The mean percent reduction in infiltrate thickness on day 12 for AN2898 was 39%, as compared to 60% for Betnesol-V, the positive control. The results relative to the secondary endpoint (clinical response) paralleled those of the primary endpoint.

In a cumulative irritation trial completed in the first quarter of 2009, AN2898 ointment at 5.0% and its vehicle were applied daily to the skin of normal volunteers under occlusive, adhesive patches for four consecutive days. Application sites were evaluated daily for signs of irritation. No irritation potential was seen for 5.0% AN2898 ointment or the vehicle.

In the first half of 2011, we expect to initiate a Phase 2 trial of AN2898 outside of the United States in patients with atopic dermatitis, which will be designed as a two-arm trial evaluating AN2898 and AN2728 compared to vehicle. Prior to initiation of clinical trials of AN2898 in the United States, we will file an IND with the FDA for AN2898 for psoriasis and/or atopic dermatitis. We are also evaluating AN2898 for the treatment of psoriasis. However, we expect AN2728 to remain our lead product candidate in psoriasis since it has reached a more advanced stage of clinical development.

Our Systemic Antibiotic Program

GSK '052 for Gram-Negative Infections

GSK '052 (formerly AN3365) is our lead systemic antibiotic product candidate for the treatment of infections caused by Gram-negative bacteria. In July 2010, GSK exercised its option to obtain an exclusive license to develop and commercialize GSK '052. GSK has assumed responsibility for further development of the product candidate and any resulting commercialization. We anticipate that GSK will initiate Phase 2 trials of GSK '052 in patients with cUTI and cIAI in 2011.

Gram-Negative Infection Market

Gram-negative infections are a type of bacterial infection caused by a broad class of bacteria called Gram-negative bacteria and are most commonly acquired and treated in the hospital setting. Many commonly used antibiotics do not work against Gram-negative bacteria and resistance to existing therapies continues to be a growing problem. According to the New England Journal of Medicine, it is estimated that there were 1.7 million hospital-acquired Gram-negative and Gram-positive infections and approximately 100,000 associated deaths in the United States alone in 2002. The New England Journal of Medicine also indicates that Gram-negative bacteria are responsible for more than 30.0% of hospital-acquired infections and account for approximately 70.0% of hospital-acquired infections in the intensive care unit. IMS Health estimates that there were 40 million days of Gram-negative therapy administered in the United States in 2009. According to the Archives of Internal Medicine, hospital-acquired infections related to sepsis and pneumonia alone caused $8.1 billion in additional hospital costs in 2006.

Limitations of Current Gram-Negative Antibiotics

Traditionally, Gram-negative infections have been treated with antibiotics, particularly beta-lactams, including penicillins, cephalosporins and carbapenems, and quinolones, including flouroquinolones. However, the effectiveness of existing antibiotics has been declining due to increasingly prevalent drug resistance. Bacteria develop resistance to drugs through genetic mutations or by acquiring genes from other bacteria that have become resistant. For example, in a recent survey of resistance rates of Gram-negative bacteria to current therapies in the United States, the resistance of E. coli to fluoroquinolones has been dramatically increasing. For example, resistance of E. coli to ciprofloxacin increased from 4% in 1999 to 30% in 2008 and resistance of E. coli to levofloxacin increased from 10% in 2003 to 30% in 2008. Over the same period, resistance of another Gram-negative bacteria, Klebsiella pneumoniae, to third generation cephalosporins, such as ceftriaxone and ceftazidime, increased from virtually no resistance to 15%. The same survey also showed that by 2008, 17%-19% of Pseudomonas aeruginosa were resistant to fluoroquinolones, 10%-70% were resistant to third generation

16

cephalosporins and 7%-15% were resistant to carbapenems, such as meropenem and imipenem. Therefore, there is an ongoing need for novel antibiotics to combat the widespread proliferation of antibiotic resistance, particularly for Gram-negative bacteria. Additionally, currently marketed products have side effect profiles that can include nausea, diarrhea, vomiting, rash, insomnia, and potential liver toxicity. Also, currently approved antibiotics specifically targeting infections caused by Gram-negative bacteria are only available in either IV or oral formulations, but not both, so patients cannot continue on the same antibiotic therapy they received in the hospital once they are discharged.

Our Solution: GSK '052

GSK '052 is a novel boron-based, small molecule product candidate that targets the bacterial enzyme leucyl tRNA synthetase. The inhibition of protein synthesis leads to termination of cell growth and cell death, eliminating the bacterial infection. Since GSK '052 is the first antibiotic to target LeuRS, bacteria have not developed resistance to it. Preclinical studies suggest that GSK '052 could be a novel approach for the treatment of infections caused by Gram-negative bacteria, including E. coli, Klebsiella pneumoniae, Citrobacter spp., S. marcescens, P. vulgaris, Providentia spp., Pseudomonas aeruginosa and Enterobacter spp. GSK '052 has demonstrated a favorable profile in preclinical safety and toxicology studies. Results from a Phase 1 proof-of-concept trial showed that GSK '052 demonstrated a promising safety profile and linear dose-proportional pharmacokinetic properties, reaching blood levels that were multiple times higher than the anticipated efficacious dose. We believe, if approved, GSK '052 would be the first new class antibacterial to treat serious hospital-acquired Gram-negative infections in thirty years. In addition, we believe GSK '052 has the potential to be the first antibiotic specifically targeting infections caused by Gram-negative bacteria that can be administered by both IV and oral routes, which, for the first time, would allow patients to continue on the same antibiotic therapy they received in the hospital once they are discharged.

GSK '052 Development Program

In November 2009, we initiated a Phase 1 dose-escalating clinical study for GSK '052, to evaluate the safety, tolerability and pharmacokinetics of GSK '052 in healthy volunteers. The randomized, double-blind, placebo-controlled, dose-escalation study enrolled 72 subjects. Participants in this study received GSK '052 in single or multiple doses for treatment durations of up to 14 days and included doses that achieve blood levels that are approximately four times the expected efficacious blood levels based on our preclinical studies. In June 2010, we reported Phase 1 results showing that GSK '052 appeared to be safe and well-tolerated. In July 2010, GSK exercised its option to obtain an exclusive license to develop and commercialize GSK '052. Upon exercise of the option, we received a fee of $15.0 million. We are eligible to receive further development milestones up to $69.0 million, commercial milestones up to $175.0 million and double-digit tiered royalties with the potential to reach the mid-teens on annual net sales. GSK has assumed responsibility for further development of the product candidate and any resulting commercialization. We believe GSK currently plans to develop GSK '052 as a potential treatment for cUTI, cIAI, and other Gram-negative bacterial infections, such as HAP/VAP. We anticipate that GSK will initiate Phase 2 trials of GSK '052 in patients with cUTI and cIAI in 2011.

Research Activities

Other Systemic Anti-Infective Programs in Collaboration with GSK

Under our collaboration with GSK, we are conducting research on additional systemic anti-infectives in three target-based project areas in addition to GSK '052. The collaborative research term of the agreement is six years, subject to a two-year extension if agreed to by both parties.

17

Internal Research Activities

Our internal research activities include follow-on research to our existing compounds as well as investigation of novel activity of our boron chemistry platform in multiple therapeutic applications. Key efforts currently include the further development of topical and systemic PDE4 inhibitors for the treatment of inflammatory diseases, the development of novel anti-infectives against targets not covered in our existing GSK collaboration, and work on novel kinase inhibitors.

Neglected Diseases Initiative

Neglected diseases are defined as diseases that disproportionately affect the world's poorest people, including tuberculosis, or TB, malaria, visceral leishmaniasis, Chagas disease, human African trypanosomiasis, or African sleeping sickness, and filarial worms. Despite the fact that these diseases cause significant morbidity and mortality worldwide, and that the current standards of care are difficult to administer, have significant toxicities and are increasingly becoming less effective due to resistance, there has been little investment in developing new therapies for these diseases due to the absence of a reasonable expectation of a financial return.

Our boron chemistry platform appears to be particularly well suited for the treatment of these types of infectious diseases, and we feel a responsibility to apply our technology to the development of new treatments. Until such time as we are profitable, however, we are committed to doing that research only when we can use grants and other non-dilutive sources of funding in a cash-neutral manner.

In recent years, a number of foundations and governments have created public-private partnerships to address this gap by funding promising technologies that may result in new drugs. In December 2007, we established a partnership with the Drugs for Neglected Diseases initiative, or DNDi, to develop new therapeutics for African sleeping sickness, visceral leishmaniasis and Chagas disease. In May 2009, we established a collaboration with the Global Alliance for TB Drug Development. In April 2010, we entered into a research collaboration with the Medicines for Malaria Venture, or MMV, to identify lead compounds for the treatment of prophylaxis of malaria and in March 2011 we also entered into a development agreement with MMV to develop our compound AN3661 for the treatment of malaria. In December 2010, we entered into a collaboration with the Sandler Center for Drug Discovery at the University of California at San Francisco to discover new drug therapies for the treatment of river blindness, a parasitic disease that is the second leading cause of infectious blindness worldwide. In March 2011, we announced the establishment of our joint research agreement with the Institute for OneWorld Health to discover antibacterial compounds for treating diarrheal diseases.

Our work in this area also allows us the potential benefits of expanding the chemical diversity of our boron compounds, understanding new properties of our boron compounds, receiving future incentives, such as the potential grant of a priority review voucher by the FDA, and, ultimately if a drug is approved, potential revenue in some regions.

Collaboration with GSK

In October 2007, we entered into a research and development collaboration, option and license agreement with GSK for the discovery, development and worldwide commercialization of boron-based systemic anti-infectives. Under the agreement, we are currently working to identify and develop multiple product candidates in three target-based project areas. The collaborative research term of the agreement is six years, subject to an extension of up to two years if agreed to by both parties.

In each project, GSK has the option to obtain an exclusive license to develop, commercialize and market worldwide certain product candidates once they have achieved certain proof-of-concept criteria. We will be primarily responsible for the discovery and development of each product candidate from the

18

research stage until GSK exercises an option for such product candidate, at which point GSK will assume sole responsibility for the further development and commercialization of such product candidate on a worldwide basis, including the responsibility to obtain regulatory approvals on a country-by-country basis. During the research term, we are committed to use diligent efforts to discover and optimize compounds pursuant to agreed research plans and to provide specified resources, including certain numbers of full-time equivalent scientists, on a project-by-project basis. Each party is responsible for its own research and development costs.

Pursuant to the agreement, GSK paid us a $12.0 million non-refundable, non-creditable upfront fee in October 2007. In addition, GSK invested $30.0 million in a preferred stock financing completed in December 2008.