Attached files

| file | filename |

|---|---|

| EX-2.4 - ZAPNAPS, INC. | ex2-4.htm |

| EX-32.2 - ZAPNAPS, INC. | ex32-2.htm |

| EX-32.1 - ZAPNAPS, INC. | ex32-1.htm |

| EX-31.1 - ZAPNAPS, INC. | ex31-1.htm |

| EX-31.2 - ZAPNAPS, INC. | ex31-2.htm |

| EX-10.17 - ZAPNAPS, INC. | ex10-17.htm |

| EX-10.16 - ZAPNAPS, INC. | ex10-16.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark one)

x Annual Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2010

¨ Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ______________ to _____________

Commission File Number: 000-53837

FUSIONTECH, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

261250093

|

|

|

(State of or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

No. 26 Gaoneng Street, High Tech Zone, Dalian,

Liaoning Province, China 116025

(Address of principal executive offices)

(86) 0411-84799486

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates was $0.00, based on the average bid and asked price of such common equity as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter.

At March 18, 2011 there were 29,390,000 shares of the registrant’s common stock, par value $.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

FusionTech, Inc.

Index to Contents

|

Page

Number

|

||

|

Part I

|

||

|

Item 1

|

2

|

|

|

Item 1A

|

12

|

|

|

Item 1B

|

28

|

|

|

Item 2

|

28

|

|

|

Item 3

|

28

|

|

|

Item 4

|

28

|

|

|

Part II

|

||

|

Item 5

|

29

|

|

|

Item 6

|

30

|

|

|

Item 7

|

30

|

|

|

Item 7A

|

36

|

|

|

Item 8

|

36

|

|

|

Item 9

|

36

|

|

|

Item 9A

|

37

|

|

|

Item 9B

|

37

|

|

|

Part III

|

||

|

Item 10

|

38

|

|

|

Item 11

|

41

|

|

|

Item 12

|

43

|

|

|

Item 13

|

43

|

|

|

Item 14

|

44

|

|

|

Part IV

|

||

|

Item 15

|

45

|

|

|

F-1

|

||

|

Signatures

|

46

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In this report, the terms “FusionTech,” “Company,” “we,” “us” and “our” refer to FusionTech, Inc. (“FusionTech”) and its subsidiary. This report contains forward-looking statements regarding FusionTech which include, but are not limited to, statements concerning our projected revenues, expenses, gross profit and income, mix of revenue, demand for our products, the benefits and potential applications for our products, the need for additional capital, our ability to expand our business to offer Steel Plate Fusion services, the competitive nature of our business and markets and product qualification requirements of our customers. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “hopes,” “estimates,” “should,” “may,” “will,” “with a view to” and variations of these words or similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Such factors include, but are not limited to the following:

|

·

|

our goals and strategies;

|

|

·

|

our plan to expand our business to offer Steel Plate Fusion services;

|

|

·

|

our future business development, financial conditions and results of operations;

|

|

·

|

the expected growth of the market for our products;

|

|

·

|

our expectations regarding demand for our products;

|

|

·

|

our expectations regarding keeping and strengthening our relationships with key customers;

|

|

·

|

our ability to stay abreast of market trends and technological advances;

|

|

·

|

competition in our industry in China;

|

|

·

|

general economic and business conditions in the regions in which we sell our products;

|

|

·

|

relevant government policies and regulations relating to our industry; and

|

|

·

|

market acceptance of our products.

|

Additionally, this report contains statistical data that we obtained from various publicly available government publications and industry-specific third party reports. Statistical data in these publications also include projections based on a number of assumptions. The rapidly changing nature of our customers' industries results in significant uncertainties in any projections or estimates relating to the growth prospects or future condition of our market. Furthermore, if any one or more of the assumptions underlying the market data is later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

Unless otherwise indicated, information in this report concerning economic conditions and our industry is based on information from independent industry analysts and publications, as well as our estimates. Except where otherwise noted, our estimates are derived from publicly available information released by third party sources, as well as data from our internal research, and are based on such data and our knowledge of our industry, which we believe to be reasonable. None of the independent industry publication market data cited in this report was prepared on our or our affiliates’ behalf.

We do not undertake any obligation to revise or update publicly any forward-looking statements for any reason, except as required by law. Additional information on the various risks and uncertainties potentially affecting our operating results are discussed below and are contained in our publicly filed documents available through the SEC’s website (www.sec.gov) or upon written request to our corporate secretary at: No. 26 Gaoneng Street, High Tech Zone, Dalian, Liaoning Province, China 116025.

PART I

Item 1. Business.

General

We design and manufacture clean technology industrial machinery used in the coking process, a critical but highly pollutive step in the production of crude steel. Our products are sold to large and medium size steel mills and coking plants in China who use or are planning to use the coke dry quenching (“CDQ”) method of coking, a more environmentally friendly and energy conservative method of coking as compared to the traditional coke wet quenching method.

We currently design and manufacture CDQ transport cars used in CDQ systems and clean technology coke oven products such as coke oven elevators, smoke transfer machines and coal cleaning machines. These clean technology coke oven products are used to maintain coke ovens and reduce the amount of pollution they emit. We also design and manufacture core coke oven products such as coke drums, coke drum carriers, wet quenching cars, coal freight cars, coke guide cars and coke pushers. These core coke oven products are necessary components for all coke oven systems.

In the third quarter of 2011, we plan to provide our proprietary steel plate fusion services (“Steel Plate Fusion”) to a large steel plate manufacturer in northern China, Minmetals Yingkou Medium Plate Co., Ltd. (“Minmetals Yingkou”). Minmetals Yingkou is an established steel plate manufacturer in China with over 30 years of experience in manufacturing steel plates. It is a subsidiary of the reputable China Minmetals Corporation, a Fortune Global 500 Company based in China focusing on the development and production of metals and minerals.

On June 2, 2010, we entered into a non-exclusive strategic agreement, as amended on August 9, 2010, to fuse metal slabs produced by Minmetals Yingkou using Steel Plate Fusion. Minmetals Yingkou will manufacture finished steel plates from the fused metal slabs we produce for sale to its customers and has agreed to manufacture 200,000 tonnes of steel plates per year, adjustable based on market demand to 500,000 tonnes per year. We will receive a processing fee based on the size, type and number of tonnes of fused metal slabs we produce. The processing fee is renegotiable based on the market demand for the final steel plates manufactured.

We believe Steel Plate Fusion is the next generation of steel plate manufacturing technology which is superior in quality, cost and efficiency to the current methods used to manufacture clad steel plates and extra-thick carbon steel plates. Steel Plate Fusion uses an electron-beam welding machine in a vacuum chamber and a proprietary process of surface treatment and manipulation of pressure and temperature to fuse together metal slabs that are then hot rolled and compressed to produce clad steel plates and extra-thick carbon steel plates.

|

·

|

Clad steel plates are manufactured by fusing carbon steel slabs and stainless steel slabs. Clad steel plates are more economical to use than pure stainless steel plates because cheaper carbon steel is used as a base upon which a layer of stainless steel is applied. Clad steel plates provide similar functionalities as stainless steel plates and are used in similar industrial applications such as the construction of ships, piping, nuclear reactors, pressure vessels, heat exchangers, power generation equipment and coking equipment, all of which require the anti-corrosive properties of clad steel plates.

|

|

·

|

Extra-thick carbon steel plates are carbon steel plates that are more than 80 millimeters thick and are manufactured by fusing two carbon steel slabs. Extra-thick carbon steel plates are in high demand for heavy industrial applications such as the construction of large ships, bridges, buildings, metallurgical equipment, mining equipment and power generation equipment, all of which require the strength of extra-thick carbon steel plates meeting strict standards and specifications.

|

Our principal executive offices are located at No. 26, Gaoneng Street, High Tech Zone, Dalian, Liaoning Province, China 116025. Our phone number is (86) 0411-84799486 and our website address is www.cleanfusiontech.com.

Our History

We operate through our wholly owned subsidiary, Dalian Heavy Mining Equipment Manufacturing Co., Ltd. (“Dalian”), a foreign joint venture company organized under the laws of the People’s Republic of China (“PRC”). Dalian was originally organized as a limited company in the PRC on December 18, 1992. On November 17, 2010, the PRC State Administration of Industry and Commerce, or the SAIC, issued an approval notice for a Sino-foreign joint venture business license for Dalian, indicating that capital injections by Wonderful Limited and Median Asset Investments Limited, British Virgin Islands companies, was approved and registering the ownership of their respective 5% equity interests in Dalian. Dalian manufactures all of our clean coking and related products and developed our Steel Plate Fusion technology.

We were incorporated in the State of Nevada on October 10, 2007, under the name ZapNaps, Inc. as a development stage company with no revenues and no operation by Ms. Peggy Lalor, our former President and Director. On December 3, 2007, we issued 10,000,000 shares of our common stock to Ms. Lalor at $.001 per share for $10,000, representing Ms. Lalor’s initial investment in the Company.

On May 7, 2010, Ms. Lalor sold 10,000,000 shares of the Company’s common stock to Mr. David Lu for $40,000 in a private transaction exempt from registration under the Securities Act of 1933, as amended. Concurrently, Ms. Lalor resigned from her positions with the Company and Mr. Lu was appointed as President, Chief Executive Officer, Chief Financial Officer, Treasurer, Secretary and Director of the Company.

On October 28, 2010, in anticipation of the Share Exchange and related transactions described below, we changed our name from ZapNaps, Inc. to FusionTech, Inc. through a merger with our wholly owned non-operational subsidiary, FusionTech, Inc., which was established to change the Company’s name as permitted under Nevada Law. We also authorized an increase in our authorized shares of common stock from 75,000,000 to 100,000,000, effective November 1, 2010, and an 8-for-1 forward split of our common stock, effective November 12, 2010. Prior to the forward split we had 10,550,000 shares of our common stock outstanding. After giving effect to the forward split and immediately preceding the Share Exchange, we had 84,400,000 shares of our common stock outstanding. We authorized the increase in authorized shares and forward stock split to provide a sufficient number of shares to accommodate the trading of our common stock in the OTC marketplace after the acquisition of Dalian.

The acquisition of Dalian was accomplished pursuant to the terms of a Share Exchange Agreement and Plan of Reorganization, dated November 22, 2010, as amended as of March 11, 2011, or the Share Exchange Agreement. Pursuant to the Share Exchange Agreement, on November 22, 2010, we issued 24,990,000 shares of our common stock to the seven owners of Dalian in exchange for their agreement to enter into and consummate a series of transactions to transfer ownership of Dalian to the Company as a wholly foreign owned enterprise. In addition, the owners of Dalian agreed to indemnify us in the event that they failed to transfer Dalian as a wholly foreign owned enterprise of the Company under relevant PRC law. Concurrently with the Share Exchange Agreement, and as a condition thereof, we entered into an agreement with David Lu, our former Chief Executive Officer and Director, pursuant to which he returned 80,000,000 shares of our common stock to us for cancellation. Mr. Lu will receive compensation of $80,000 from us for the cancellation of his common stock. Upon completion of the foregoing transactions, we had 29,390,000 shares of our common stock issued and outstanding.

For accounting purposes, the Share Exchange transaction was treated as a reverse acquisition and recapitalization of Dalian, because prior to the transaction the Company was a non-operating public shell, and subsequent to the transaction Dalian’s owners owned a majority of the outstanding common stock of the Company and exercise significant influence over the operating and financial policies of the consolidated entity. We have no other operations or businesses other than those acquired in the Dalian acquisition.

Clean Coking and Related Products

FusionTech designs and manufactures a wide variety of clean technology coke oven products including CDQ transport cars, coke oven elevators, smoke transfer machines and coal cleaning machines. FusionTech also designs and manufactures core coke oven products including wet quenching cars, coal freight cars, coke guide cars and coke pushers. FusionTech’s products are sold to the China domestic steel and coking industries and have significant clean technology applications including use in CDQ systems.

Industry Overview

China is the world’s largest steel producer and is projected to further expand its output as domestic demand for the metal grows. According to statistics released on the World Steel Association website, www.worldsteel.org, China accounted for 47% of the world’s total crude steel output in 2009 and is estimated to have produced a record 600 million metric tons in 2010. Increased production of steel in China has also led to increased pollution. In fact, within China’s industrial sector the steel industry accounts for 15% of aggregate energy consumption, 14% of aggregate wastewater production and 17% of aggregate solid waste emission. (1) The processes of smelting, coking and steel casting, contribute in excess of 70% of the total pollution and energy consumed within the steel industry itself.(2)

(1) PRC Ministry of Industry and Information Technology “Steel and Coking Industry CDQ Technology Marketing and Implementation Plan” January 20, 2010. (“The MIIT Implementation Plan”)

(2) Ibid.

Coking is the process by which coke is produced, a basic raw material used in the production of steel. To produce coke, coal is baked in an oxygen-free coke oven at an extremely high temperate and then rapidly cooled. In the conventional cooling process, coke wet quenching, the hot coke is drenched with cold water, emitting noxious gases and wasting heat energy contained in the hot coke.

In contrast, the modern CDQ system cools coke by circulating an inert gas in an enclosed heat exchange system. A CDQ system reduces the harmful environmental effects caused by coke wet quenching because water is not contaminated with toxic pollutants and air pollutants are not released. In addition, a CDQ system can recycle the wasted heat produced during the coking process to generate electricity and/or steam. Compared to the coke wet quenching process, a steel mill using 2 CDQ systems can produce approximately 167 gigawatt hours of electricity from waste heat annually, saving approximately $9.2 million each year on electricity costs, saving approximately 3.7 million tons of water and reducing carbon dioxide emissions by approximately 130,000 metric tons.(3)

In light of the environmental benefits a CDQ system provides, China’s Ministry of Industry and Information Technology, or MIIT, mandated in July 2010 that the construction of new coke ovens or the reconstruction of old coke ovens be accompanied by the installation of a complete CDQ system. The MIIT targeted 90% of coking output by large and medium size steel mills and coking plants and 40% of coking output from the entire coking industry to be produced using the CDQ method before 2013.(4)

In addition, the PRC’s 12th Five Year Plan seeks to further curb the environmental pressures caused by the China domestic steel industry through industry consolidation. Currently, China’s steel industry consists of many small inefficient steel mills that use outdated production methods that cause environmental degradation, such as coke wet quenching. By consolidating these small steel mills into larger steel mills, the PRC hopes to increase the percentage of steel output that is produced through more environmentally friendly methods, such as coke dry quenching. (5)

Products

CDQ Transport Cars

We design and manufacture CDQ transport cars that are key components of a CDQ system.

The primary markets for FusionTech’s CDQ transport cars are new steel mills and coking plants in the China domestic market and existing steel mills and coking plants being modernized or seeking replacements for existing CDQ transport cars. Management estimates that CDQ transport cars have a useful life expectancy of approximately ten years.

|

A CDQ system typically requires three coke drum carriers, three coke drums and two CDQ transport cars. A coke drum carrier is a long flatcar that runs along a railway and is used to hold a coke drum, a large cylindrical container made of metal used to hold coke. The CDQ transport car is a powered locomotive engine that connects to the drum carrier and pulls it along the railway from the coke oven to the CDQ machine for processing. An operator controls the speed of the car from a control room located on top of the CDQ transport car.

FusionTech manufactures CDQ transport cars by welding together steel plates to form the car’s structure and then integrating electronic components such as engines, wheels and mechanical controls. Manufacture of CDQ transport cars requires advanced technical knowledge as CDQ transport cars must be acutely responsive to an operator’s commands to ensure the CDQ transport car stops at a precise location where dangerous hot coke can be loaded and unloaded safely. Management believes that FusionTech’s CDQ transport cars are known in the coking industry for their high quality and competitive pricing.

|

CDQ Transport Car for 6.25m Coke Oven

|

(3) United Nations Framework Convention on Climate Change: Baotou Iron & Steel CDQ and Waste Heat Utilization for Electricity Generation Project, 03/08/2007, and “CDQ-Modern coking technology,” by Anhui Vocational College of Metallurgy and Technology. Assumptions made in calculations: Steel mill using two CDQ systems, each with 125 tons/hour coal capacity and 15 megawatt electricity generating capacity, and $0.055/kilowatt hour (based on average cost per KWH paid by Huaneng in 2009).

(4) MIIT Implementation Plan.

(5) Ibid.

|

Coke Oven Elevator

We design and manufacture coke oven elevators used by workers to access the top of coke ovens where they can repair damages and prevent toxic leaks.

We sell our coke oven elevators to new steel mills and coking plants in China and to steel mills and coking plants that are replacing and/or reconstructing old coke oven elevators. Management estimates that coke oven elevators have a useful life expectancy of approximately ten years.

According to the U.S. Department of Energy, the largest environmental issue with the steelmaking process is the carburizing of coal into coke for use in the iron-making process.(6) Coke ovens, in addition to emitting dust and particulate emissions, produce noxious gases including nitrogen oxide, carbon monoxide and carbon dioxide. The PRC government has stated publicly that it plans to respond to these environmental issues by including new pollutants such as nitrogen oxide in its emission control list in China’s 12th Five Year Plan.(7)

|

Coke Oven Elevators for 7.63m Coke Oven

|

Regular coke oven maintenance through inspection and repair is one of the primary ways emissions of nitrogen oxide, carbon monoxide and carbon dioxide can be reduced during the coking process. We are one of the few manufacturers in China for coke oven elevators that attach to coke ovens that are 7 meters and 7.63 high. Demand for coke oven elevators for these specifications is increasing as smaller steel mills are consolidated into larger steel mills that typically use taller coke ovens. Management also believes that FusionTech’s coke oven elevators for these specifications are of superior quality because they are powered by an internal battery as opposed to diesel fuel.

Production

We manufacture our clean technology coke oven products and core coke oven products in our three facilities in Liaoning Province, China. Our manufacturing operations principally consist of welding together large steel plates and integrating electronic components. We base our production schedule on customer orders and schedule deliveries on a just-in-time basis. It takes us approximately six months to design and manufacture a CDQ transport car according to our customers’ specifications. Coke oven elevators can be designed and manufactured within three months. We received ISO 9001:2008 Quality Management System certification in January 2008, a certification that demonstrates our adherence to formalized business processes and our ability to consistently produce products meeting customer requirements. We have implemented comprehensive quality control procedures, including non-destructive tests for defect detection conducted by our own quality control group. As of December 31, 2010, the Company’s quality control group consisted of 10 full-time employees.

Sales and Marketing

As of December 31, 2010, we employed 10 full-time sales people to sell and market our products directly to customers. Our sales people also engage in bidding for specific projects and maintain our relationships with long-term customers. We sell our products directly to large and medium size Chinese domestic steel mills and coking plants and through four general contractors that are contracted by steel mills and coking plants to install CDQ systems. We fund our marketing costs through working capital.

Suppliers

Our principal raw material purchases are carbon steel, stainless steel and mechanical and electrical components. We have several suppliers for each of the materials we use to manufacture our products. We believe we will be able to obtain an adequate supply of steel and mechanical and electrical components to meet our manufacturing requirements. We maintain a good business relationship with all of our suppliers.

(6) United States Department of Energy. “Steel Industry Technology Roadmap.” December 2001. Available at http://www1.eere.energy.gov/industry/steel/roadmap.html.

(7) Jing, Li. “New pollution reduction targets listed.” China Daily. January 26, 2010.

Customers

Our customers are large and medium size steel mills and coking plants in China. We sell our products directly to these steel mills and coking plants or through four general contractors of CDQ systems in China who are contracted by steel mills and coking plants to install CDQ systems. We believe we have strong business relationships with these general contractors, ACRE Coking and Refractory Engineering Consulting Corporation Co., Ltd., Sinosteel Equipment and Engineering Co., Ltd., China-Japan Energy and Environment Engineering Technology Co., Ltd. and Jinan Iron and Steel Corp.

In 2010, our three largest customers, Sinosteel Equipment and Engineering Co., Ltd, ACRE Coking and Refractory Engineering Consulting Corporation, Co. Ltd., and Jinan Iron and Steel Corp., accounted for approximately 26%, 23%, and 19%, respectively, of our total revenues. In 2009 these three customers accounted for approximately 28%, 32%, and 8%, respectively, of our total revenues.

We do not have any material contracts with any of our customers with respect to our clean coking and related products business. We execute standard sales contracts and purchase orders in the ordinary course of business, forms of which are provided by our major customers, for the clean coking and related products we manufacture.

Intellectual Property

We rely on the patent laws in China, confidentiality procedures and contractual provisions to protect our intellectual property and maintain our competitive edge in the marketplace. We own seven patents, three for different models of our CDQ transport cars, one for our coke oven elevator, one for our coal cleaning machine, one for our steel belt feeding roller and one for our smoke transfer car. One of our CDQ transport car patents will expire in 2016 and two will expire in 2017. Our coke oven elevator patent will expire in 2019, our coal cleaning machine patent will expire in 2018 and our steel belt feeding roller and smoke transfer car patents will expire in 2020.

All of our patents were filed in the Company’s name and have been solely owned by the Company since the date of their initial grant. As we continue to develop our clean technology coke oven products we will apply for new patents to protect our innovations.

Competition

Our coking products compete against China domestic manufacturers and international manufacturers. The manufacturing industry for coking products in China is highly fragmented with many different manufacturers holding small shares of the total market. Our primary international competitors for CDQ transport cars are Nippon Steel Corporation and Schalke GmbH. Our deep industry expertise for the past 18 years has allowed us to successfully design and manufacture products that we believe meet the demand and satisfaction of our clients. We believe we have strong relationships with our existing customers and that our products are recognized for their high quality and innovation. Many of our competitors have manufacturing operations that span many different heavy machinery industries and may have larger operations and greater financial resources than us. We plan to remain competitive by continuing to market our 18-year operating history, our reputation for superior products, by funding research and development to improve our current line of clean technology coke oven products and by focusing on developing new innovative products that focus on environmental conservation. We believe we have the following competitive advantages:

|

·

|

Proprietary product designs - We own seven different patents including three for different models of our CDQ transport cars.

|

|

·

|

Award winning technology – We designed and manufactured a CDQ transport car that was an integral component of a major CDQ project commenced in 2004 in Maanshan, China. This CDQ project received the Metallurgical Technology First Class Award from the China Iron and Steel Association and the Chinese Society for Metals in 2005. In 2009, this CDQ project also received the National Science and Technology Second Class Award.

|

|

·

|

Strong business relationships – We have strong business relationships with four key CDQ general contractors. Management believes its relationships with these contractors will continue, providing the Company with a valuable and growing distribution channel for its clean technology coke oven products.

|

|

·

|

Industry Experience – We have been operating for 18 years and are led by our Chief Executive Officer, Lixin Wang, who has over 30 years of metallurgical, heavy machinery and coke industry experience. We have also been able to adapt our business to accommodate the changing needs of our customers. At our inception in 1992, we only manufactured traditional core coke oven products. In 2002, we were able to successfully expand our product offerings to include coke dry quenching products.

|

|

·

|

Customer Service – We work closely with our customers to design and manufacture products to their custom specifications. Our technical staff provides onsite guidance through the installation process.

|

Seasonality

We typically experience stronger sales in the third and fourth quarters of our fiscal year ending December 31st. General contractors of CDQ systems, coking plants and steel mills typically place their orders with us at the beginning of each fiscal year. We typically ship these orders and record our revenues in the second half of our fiscal year.

Employees

As of December 31, 2010, we had a total of 178 full-time employees, all of whom are in China. We plan to hire an additional 100 full-time employees by the end of 2011. We believe that relations with our employees are satisfactory and retention has been stable. We enter into standard labor contracts with our employees as required by the PRC government and adhere to state and provincial employment regulations. We provide our employees with all social insurance as required by state and provincial laws, including pension, unemployment, basic medical and workplace injury insurance. These state mandated programs are sponsored by state and provincial governments. We do not maintain any material Company-sponsored benefit programs for our executive officers or other employees. We have no collective bargaining agreements with our employees.

Planned Expansion: Steel Plate Fusion

In the third quarter of 2011, we plan to expand our existing operations to offer our proprietary Steel Plate Fusion services to China steel plate manufacturers of clad steel plates and extra-thick carbon steel plates.

A clad steel plate is a steel plate currently manufactured by welding a stainless steel plate with a carbon steel plate. Clad steel plates have the structural strength of carbon steel and the anticorrosive and heat resistant properties of stainless steel, but are less costly than pure stainless steel plates because they use a less expensive carbon steel layer. Clad steel plates can be used for industrial applications that conventionally require stainless steel plates such as the construction of ships, piping, nuclear reactors, pressure vessels, heat exchangers, power generation equipment and coking equipment, all of which require the anti-corrosive and heat resistant properties of stainless steel.

An extra-thick carbon steel plate is a carbon steel plate over 80 millimeters thick that is currently manufactured through mold casting or electroslag remelting. Extra-thick carbon steel plates are used in heavy industrial applications such as the construction of ships, bridges, buildings, metallurgical equipment, mining equipment and power generation equipment, all of which require the strength and endurance of extra-thick carbon steel plates.

Zero Power Intelligence Research expects the China domestic clad steel plate and extra-thick carbon steel plate market to experience double-digit growth over the next five years. The market demand for clad steel plates is estimated to have been 2.4 million tonnes or $6.1 billion in 2010. The demand for clad steel plates is expected to grow to 8.5 million tonnes or $22 billion by 2015. The market demand for extra-thick carbon steel plates is estimated to have been 8.2 million tonnes or $9 billion in 2010. By 2015, demand is expected to increase to 26 million tonnes or $28.7 billion.8

We believe Steel Plate Fusion will transform clad steel plate and extra-thick carbon steel plate manufacturing in China as it is a unique and innovative method of production that will offer significant cost savings and production efficiencies to China steel plate manufacturers who use existing methods.

(8) Zero Power Intelligence Research “China Thick Steel Plate Industry Research and Analysis” 2010. (the “Steel Plate Report”)

Existing Production Methods

Clad Steel Plates

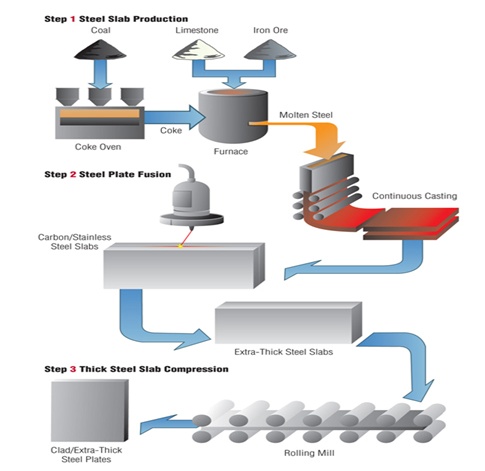

Current clad steel plate manufacturing occurs through a three-step process:

|

1.

|

Continuous casting - Molten steel is transformed into a thick rectangular slab of carbon or stainless steel through a process known as continuous casting.

|

|

2.

|

The carbon and stainless steel slabs are hot rolled through a steel rolling mill which flattens and compresses the slabs into rectangular carbon and stainless steel plates.

|

|

3.

|

The stainless steel plate is then welded to the carbon steel plate through a technique known as explosion welding. Explosion welding uses force generated from controlled explosions to weld together two dissimilar metal plates. It is the most commonly used method of welding together metal plates in China.

|

The end product is a clad steel plate which is comprised of a carbon steel plate and the anti-corrosive layer of a stainless steel plate. Explosion welding is an inherently dangerous activity and requires costly safety precautions to ensure worker safety. Additionally, the explosions used to weld the plates together can often produce unwanted bubbles on the outer surface of the plate, requiring significant time and expense on the part of the steel plate manufacturer to remove.

Extra-Thick Carbon Steel Plates

Extra-thick carbon steel plates are currently manufactured through either one of two processes: mold casting or electroslag remelting.

|

1.

|

Mold Casting - Molten steel is poured into a rectangular cast and cooled until it solidifies. The resultant thick steel slab is hot rolled through a steel rolling mill to produce a compressed extra-thick carbon steel plate. Mold casting is currently the most commonly used method to produce extra-thick carbon steel plates in China. However, mold casting is considered a timely process that produces a low quality steel plate.

|

|

2.

|

Electroslag Remelting (ESR) – Molten steel is solidified into a thick rectangular slab through continuous casting and then remelted in a metal mold. Once the remelted slab is cooled and solidified within the mold it is compressed through a steel rolling mill to produce an extra-thick carbon steel plate. ESR is used instead of mold casting for certain industry applications that require higher quality plates because it produces an extra-thick carbon steel plate with fewer flaws. However, ESR is costlier than mold casting because the steel is melted twice and the rejection rate for the final steel plate is higher.

|

Steel Plate Fusion

Steel Plate Fusion is our proprietary technology that we believe is the first and only of its kind in China. We plan to offer Steel Plate Fusion as a value added service to steel plate manufacturers in China. We believe Steel Plate Fusion will be in high demand as it will lower production costs and improve efficiencies in the manufacture of clad steel plates and extra-thick carbon steel plates.

Steel Plate Fusion uses electron-beam welding technology and a proprietary process of manipulation of pressure and temperature to fuse together large metal slabs used in the production of clad steel plates and extra-thick carbon steel plates. Electron-beam welding is a fusion welding process that was first developed in 1958 to weld together component parts used in products such as jet engines, electric motors and automobiles. Electron-beam welding employs a high-velocity electron beam in a vacuum to fuse together desired components. Through research and development, FusionTech modified traditional electron beam welding technology so that it could be used to fuse together large metal slabs to produce clad steel plates or extra-thick carbon steel plates. Management believes that Steel Plate Fusion will be a cheaper, faster and higher yielding method of clad steel plate and extra-thick carbon steel plate production in China, as compared to current methods of production.

In the first step of the Steel Plate Fusion process, the steel plate manufacturer processes coal, limestone and iron ore in a blast furnace to produce molten steel. The molten steel is then transformed into rectangular steel slabs through the continuous casting process. After the slabs have cooled and solidified, a truck transports the steel slabs to our processing facilities which are adjacent to the steel plate manufacturing plant. At our facility our staff mounts the rectangular steel slabs and fuses them together using Steel Plate Fusion. The fused slab is then transported back to the steel plate manufacturer where it is heated and compressed through a steel rolling mill to produce the final clad steel plate or extra-thick carbon steel plate.

During our testing of Steel Plate Fusion we successfully produced clad steel plates and extra-thick carbon steel plates in the facilities of a large steel plate manufacturer in China. Microscopic and x-ray testing of the steel slabs fused together through Steel Plate Fusion exceeded the stringent testing standards required by steel plate manufacturers who produce clad steel plates and extra-thick carbon steel plates. According to our tests, the final clad steel plates and extra-thick carbon steel plates produced through Steel Plate Fusion are of higher quality than those produced through explosion welding or mold casting respectively. The clad steel plates produced through Steel Plate Fusion were also free of air bubbles often present in clad steel plates manufactured through explosion welding.

Additionally, we were able to produce extra-thick carbon steel plates thicker than 100 millimeters and with an overall lower rejection rate than plates produced through mold casting or electroslag remelting. Steel Plate Fusion uses continuous casting in the production of extra-thick carbon steel plates while mold casting cannot be processed in this fashion. Continuous casting is generally accepted as the cheapest and most efficient method of producing metal slabs up to a certain thickness and also produces a higher quality end product. In addition, Steel Plate Fusion does not require the added step of remelting the solidified metal slab prior to compression in the steel rolling mill as does electroslag remelting, thereby saving time and expense in the production process.

Steel Plate Fusion Intellectual Property

We filed an application in the Company’s name for an invention patent covering Steel Plate Fusion in China on September 13, 2010. If the invention patent is granted, it will be solely owned by the Company. If granted, the invention patent will prevent competitors from utilizing our patented technology for a period of 20 years as compared to only 10 years for a utility patent. We believe our application for an invention patent will be approved as no other company in China uses technology similar to the technology utilized in our Steel Plate Fusion process.

Although the application process takes approximately 18 months to complete, the filing of an invention patent in China grants the applicant temporary protection during this time. Should any competitor in China seek to use the technology for which we have applied for patent protection in their own operations, FusionTech intends to protect its rights to the fullest extent permissible under the law.

The operation of Steel Plate Fusion requires specific skills and operational knowledge to prevent defects in production and waste of expensive raw materials. We also protect our operational knowledge of Steel Plate Fusion as a trade secret. FusionTech has implemented confidentiality procedures and contractual provisions with its employees who work with proprietary information related to Steel Plate Fusion. We will also require steel plate manufacturers who work with FusionTech to follow strict confidentiality procedures with respect to Steel Plate Fusion. We believe these steps will adequately protect our proprietary knowledge of the operational and technical aspects of Steel Plate Fusion.

Potential Customers

We believe our customer base for Steel Plate Fusion will be medium and large-scale steel plate manufacturers across China who produce clad steel plates and extra-thick carbon steel plates. We believe Steel Plate Fusion offers cost, quality and efficiency advantages over current methods of clad steel plate and extra-thick carbon steel plate production that will help drive demand for our services.

We plan to market our Steel Plate Fusion technology directly to steel plate manufacturers across China through our existing sales team for our clean technology coke oven products. We believe that our pre-existing relationships with steel manufacturers formed through the sale of our coking products will provide excellent marketing and sales channels for our Steel Plate Fusion value added service.

In the third quarter of 2011, we plan to provide Steel Plate Fusion to a large steel plate manufacturer in northern China, Minmetals Yingkou. Minmetals Yingkou is an established steel plate manufacturer in China with over 30 years of experience in producing steel plates. It is a subsidiary of the reputable China Minmetals Corporation, a Fortune Global 500 Company based in China focusing on the development and production of metals and minerals.

FusionTech is currently constructing a Steel Plate Fusion processing facility adjacent to Minmetals Yingkou’s steel plate production facilities. Minmetals Yingkou will produce carbon and stainless steel slabs using its own continuous casting machinery, and the slabs will then be sent to the adjacent FusionTech processing facility to be fused together using Steel Plate Fusion. These fused metal slabs will then be sent back to the Minmetals Yingkou facilities to be compressed by rolling machinery into finished clad steel plates and extra-thick carbon steel plates. The Company plans to hire an additional 70 employees to work in the Steel Plate Fusion processing facility in Yingkou.

Minmetals Yingkou is responsible for selling the steel plates to their customers. Minmetals Yingkou plans to use its existing distribution network and customer relationships to sell and market the clad steel plates and extra-thick carbon steel plates manufactured using Steel Plate Fusion. The agreement provides for the production of 200,000 tonnes of steel plates per year, adjustable based on market demand to 500,000 tonnes per year. We will receive a processing fee based on the size, type and number of tonnes of fused metal slabs produced. The processing fee is renegotiable based on the market demand for the final steel plates produced.

FusionTech plans to use a similar business model with other medium and large-scale steel plate manufacturers across China. We believe this model of expansion, where we build processing factories adjacent to major China steel plate manufacturers and charge a value added fee, will provide us with a first mover advantage and discourage potential competitors from entering our newly created market.

Steel Plate Fusion Business Strategy

We believe that we are the only company in China to offer Steel Plate Fusion as a method of producing clad steel plates and extra-thick carbon steel plates. We believe that the production efficiencies, quality improvement and cost savings offered by Steel Plate Fusion will enable us to successfully compete in a market dominated by less efficient and more costly production methods. We plan to remain competitive by vigorously protecting our intellectual property and heavily marketing our Steel Plate Fusion technology as the low-cost, higher efficiency alternative to current production methods for clad steel plates and extra-thick carbon steel plates. Our business strategy contains four key elements:

|

·

|

First mover advantage –We believe our Steel Plate Fusion services will be successful because FusionTech is the only company to offer this low cost and high efficiency method of producing clad steel plates and extra-thick carbon steel plates in China, the market demand for which are expected to grow in the next five years by 262% and 217% respectively, according to the Steel Plate Report.

|

|

·

|

Established barriers to entry –FusionTech has applied for an invention patent for Steel Plate Fusion which, if granted, will provide legal protection for our proprietary technology for twenty years. We believe that the invention patent will be approved. Additionally, we believe our expansion model, where we build processing facilities next to steel plate manufacturers we have contracted with, will strengthen our presence throughout different areas of China and discourage potential competitors.

|

|

·

|

Significant costs savings and higher efficiencies over existing technologies – Based on our testing of Steel Plate Fusion, management estimates that Steel Plate Fusion technology will save steel plate manufacturers considerable costs, time, resources and help to expand production output of both clad steel plates and extra-thick carbon steel plates.

|

|

·

|

Asset-light, value added service business model - Management plans to offer Steel Plate Fusion as a value added service to large steel manufacturers rather than becoming a horizontally integrated manufacturer of clad steel plates and extra-thick carbon steel plates, which would require extensive capital investment to produce a final product. As a result, FusionTech will not invest in expensive continuous casting and steel rolling equipment. Our business strategy allows us to leverage the existing distribution network and customer base of Minmetals Yingkou as opposed to taking the risk of developing our own market for clad steel plates and extra-thick carbon steel plates.

|

Research and Development

We spent $262,675 and $140,700 on research and development in 2010 and 2009, respectively. We continue to evaluate opportunities to develop new products and will increase or decrease expenditures for research and development accordingly.

Governmental and Environmental Regulation

Environmental Matters

We are subject to the National Environmental Protection Law of the PRC as well as local laws regarding pollutant discharge, air, water and noise pollution, with which we comply. Neither the manufacturing of our coke oven products nor the fusion of steel plates using our Steel Plate Fusion technology generates any material air emission, waste water discharge, solid waste or noise pollution. As such, we do not currently incur any material costs in order to comply with applicable environmental laws.

We are not subject to any other government regulations that would require us to obtain a special license or approval from the PRC government to operate our coke oven products business or Steel Plate Fusion services.

M&A Rules

On August 8, 2006, six PRC regulatory agencies, namely, the PRC Ministry of Commerce, or MOFCOM, the State Assets Supervision and Administration Commission, or SASAC, the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission, or CSRC, and SAFE jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which became effective on September 8, 2006, and was amended by MOFCOM on June 22, 2009 (the “M&A Rules”). According to Rule 52 of the M&A Rules and Guidance Manual on Administration of Entry of Foreign Investment, as amended, issued by the Department of Foreign Investment Administration of the Ministry of Commerce in December 2008, conversion from a joint venture enterprise to a wholly owned foreign entity by way of equity transfer from a Chinese party to a foreign shareholder or investor, shall not be subject to the M&A Rules.

The M&A Rules also require offshore companies formed for overseas listing purposes through acquisitions of PRC domestic companies and controlled by PRC operating companies or individuals to obtain the approval of the CSRC prior to the public listing of their securities on an overseas stock exchange. On September 21, 2006, pursuant to the M&A Rules and other PRC Laws, the CSRC published on its official website relevant guidance with respect to the listing and trading of PRC domestic enterprises’ securities on overseas stock exchanges (“Related Clarifications”), including a list of application materials regarding the listing on overseas stock exchanges by special purpose vehicles. However, the CSRC currently has not issued any definitive rule concerning whether the transactions effected by the overseas listing would be subject to the M&A Rules and Related Clarifications. Article 238 of the PRC Securities Law also provides that any domestic enterprise that directly or indirectly issues any securities abroad or lists its securities abroad for trading shall be subject to the approval of the securities regulatory authority under the State Council according to the relevant provisions of the State Council.

The M&A Rules do not have express provisions in terms of penalties for failure to obtain CSRC approval prior to the public listing of our securities. However, there are substantial uncertainties regarding the interpretation, application and enforcement of the above rules, and CSRC has yet to promulgate any written provisions or formally to declare or state whether the overseas listing of a PRC-related company similar to ours is subject to the approval of CSRC. Any violation of these rules could result in fines and other penalties on our operations in China, restrictions or limitations on remitting dividends outside of China, and other forms of sanctions that may cause a material and adverse effect to our business, operations and financial conditions.

Notwithstanding the foregoing, we have been advised by our PRC counsel that the M&A Rules did not apply to our share exchange transaction. The share exchange did not require CSRC approval because we were not a special purpose vehicle formed or controlled by PRC operating companies or PRC individuals and because our foreign ownership of Dalian is qualified as a foreign joint venture, it is not subject to the M&A Rules.

Foreign Investment in PRC Operating Companies

The Foreign Investment Industrial Catalogue jointly issued by MOFCOM and the National Development and Reform Commission (“NDRC”) in 2007 classified various industries/business into three different categories: (i) encouraged for foreign investment; (ii) restricted to foreign investment; and (iii) prohibited from foreign investment. For any industry or business not covered by any of these three categories, they will be deemed an industry or business permitted to have foreign investment. Except for those expressly provided restrictions, encouraged and permitted industries and businesses are usually 100% open to foreign investment and ownership. With regard to those industries or businesses restricted to or prohibited from foreign investment, there is always a limitation on foreign investment and ownership. The reason that our business is not subject to limitation on foreign investment and ownership is as follows:

(i) our business, including the proposed steel plate fusion services, falls under the class that is encouraged for foreign investment and open to 100% foreign investment and ownership; and

(ii) our business does not fall under the industry categories that are restricted to or prohibited from foreign investment.

Item 1A. Risk Factors.

Our business and an investment in our securities are subject to a variety of risks. The following risk factors describe the most significant events, facts or circumstances that could have a material adverse effect upon our business, financial condition, results of operations, ability to implement our business plan and the market price for our securities. Many of these events are outside of our control. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks Related to Our Business

Our plans for growth rely on a new business that we have not yet commenced. This line of business will be critical to our success in the future, and if it is unsuccessful our potential for growth may be adversely affected.

Steel Plate Fusion is a new service offered by the Company that will commence operations in the third quarter of 2011. While we have already signed an agreement with a large steel plate manufacturer in China to provide these services, we have not yet commenced mass production at any facility. We cannot assure you that large scale production will be profitable or that the production techniques we use will be suitable for mass production. Moreover, while during the testing of Steel Plate Fusion we successfully produced clad and extra-thick carbon steel plates and the final produced steel plates met or exceeded the quality standards required by our customer, we cannot assure you that we will be able to maintain such standards when we commence mass production. Therefore we cannot assure you that Steel Plate Fusion will be a profitable line of business and will ultimately succeed as currently planned. Any significant setback in our plans for Steel Plate Fusion may adversely affect our future profitability and potential for growth.

We may need additional capital to execute our business plan and fund operations and may not be able to obtain such capital on acceptable terms or at all.

In connection with the planned expansion of our business to offer Steel Plate Fusion services we will likely require additional capital to fund our operations of approximately $9 million in 2011. Management anticipates that our existing capital resources and cash flows from operations and current short-term bank loans will be adequate to satisfy our liquidity requirements for our current business for the next 12 months. However, if available liquidity is not sufficient to meet our plans for expansion, current operating expenses and loan obligations as they come due, our plans include pursuing alternative financing arrangements. Our ability to obtain additional capital on acceptable terms or at all is subject to a variety of uncertainties, including:

|

§

|

investors’ perceptions of, and demand for, companies in our industry;

|

|

§

|

investors’ perceptions of, and demand for, companies operating in China;

|

|

§

|

conditions of the United States and other capital markets in which we may seek to raise funds;

|

|

§

|

our future results of operations, financial condition and cash flows;

|

|

§

|

governmental regulation of foreign investment in companies in particular countries;

|

|

§

|

economic, political and other conditions in the United States, China, and other countries; and

|

|

§

|

governmental policies relating to foreign currency borrowings.

|

We may be required to pursue sources of additional capital through various means, including joint venture projects and debt or equity financings. There is no assurance we will be successful in locating a suitable financing transaction in a timely fashion or at all. In addition, there is no assurance we will obtain the capital we require by any other means. Future financings through equity investments are likely to be dilutive to our existing shareholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences or superior voting rights, be combined with the issuance of warrants or other derivative securities, or be the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Furthermore, we may incur substantial costs in pursuing future capital and financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition.

If we cannot raise additional funds on favorable terms or at all, we may not be able to carry out all or parts of our strategy to maintain our growth and competitiveness or to fund our operations. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

We are a major purchaser of certain raw materials that we use in the manufacturing process of our clean coking and related products, and price changes for the commodities we depend on may adversely affect our profitability.

The Company’s largest raw materials purchases consist of stainless steel and carbon steel. As such, fluctuations in the price of steel in the China domestic market will have an impact on the Company’s operating costs and related profits. International steel prices were lower in 2009 than in 2008, but prices have increased in 2010 along with the general economic recovery. The iron ore import price in China has also increased since 2009, which will impact the price and volume of steel produced by the China domestic steel industry.

Our profitability depends in part upon the margin between the cost to us of certain raw materials, such as stainless steel and carbon steel, used in the manufacturing process, as well as our fabrication costs associated with converting such raw materials into assembled products, compared to the selling price of our products, and the overall supply of raw materials. It is our intention to base the selling prices of our products in part upon the associated raw materials costs to us. However, we may not be able to pass all increases in raw material costs and ancillary acquisition costs associated with taking possession of the raw materials through to our customers. Although we are currently able to obtain adequate supplies of raw materials, it is impossible to predict future availability or pricing. The inability to offset price increases of raw materials by sufficient product price increases, and our inability to obtain raw materials, would have a material adverse effect on our consolidated financial condition, results of operations and cash flows.

The Company does not engage in hedging transactions to protect against raw material fluctuations, but attempts to mitigate the short-term risks of price swings by purchasing raw materials in advance.

We derive a substantial part of our revenues from a few major customers. If we lose any of these customers or they reduce the amount of business they do with us, our revenues may be seriously affected.

Our three largest customers accounted for approximately 68% of total sales for the fiscal year ended December 31, 2010, and our largest customer accounted for approximately 26% of total sales in the fiscal year ended December 31, 2010. These customers may not maintain the same volume of business with us in the future. If we lose any of these customers or they reduce the amount of business they do with us our revenues and profitability may be seriously affected. We do not foresee our relying on these same customers for revenue generation as we introduce new product lines, new generations of existing product lines and expand our business to include Steel Plate Fusion services. We cannot be assured, however, that we will be able to successfully introduce new products or services.

In addition, we currently only have one prospective customer, Minmetals Yingkou, for our Steel Plate Fusion services. Our success in developing the Steel Plate Fusion business depends, in part, upon our delivery of products to our customer that meets their specifications in a timely, cost-effective manner. If we are unable to deliver products in this manner this customer could terminate our relationship, which would adversely affect our plans for growth. We cannot assure you that we will be able to diversify our services by entering into relationships with steel plate manufacturers in the future.

We may lose customers for our traditional coke oven products due to consolidation of the steel industry in China.

We currently sell our traditional coke oven products to a number of medium size steel mills and coking plants in China. If these medium size steel mills and coking plants are forced to close or consolidate with larger operations, we may lose them as our customers. While we believe that consolidation of the steel industry in China will increase the demand for our clean coking products as larger steel mills and coking plants with greater capital resources are formed, there are no guarantees that we will be able to successfully retain these larger steel mills and coking plants as our customers.

The steel industry is cyclical in nature and is subject to the fluctuations of the global economy, a downturn in which could adversely affect our revenues and the profitability of our planned expansion into Steel Plate Fusion.

Our clean coking and related products are used by large and medium size steel mills and coking plants in China whose businesses are dependent on the strength of the global steel industry. Any drop in the demand for steel due to global economic factors may cause these steel mills and coking plants to reduce their level of capital expenditures which in turn could adversely affect our revenues from our coke oven products. Such an occurrence may also negatively affect the profitability of our planned expansion into Steel Plate Fusion.

If we are not able to manage our growth, we may not be profitable.

Our continued success will depend on our ability to expand and manage our operations and facilities. There can be no assurance we will be able to manage our growth, meet the staffing requirements for our current or planned business or successfully assimilate and train new employees. In addition, to manage our growth effectively, we may be required to expand our management base and enhance our operating and financial systems. If we continue to grow, there can be no assurance the management skills and systems currently in place will be adequate. Moreover, there can be no assurance we will be able to manage any additional growth effectively. Failure to achieve any of these goals could have a material adverse effect on our business, financial condition or results of operations.

Our accounts receivables remain outstanding for a significant period of time, which has a negative impact on our cash flow and liquidity.

Our agreements with our customers related to our clean coking and related products generally provide that approximately 30% of the purchase price is due upon the placement of an order, 30% when the manufacturing process is substantially complete and 30% upon customer acceptance of the product. As a common practice in the manufacturing business in China, payment of the final 10% of the purchase price is due no later than the termination date of our warranty period, which is typically a negotiated term of up to 12 to 18 months from the acceptance date. Sales revenue, including the final 10% of the purchase price, is recognized after delivery is complete, customer acceptance of the product occurs and collectability is reasonably assured. Payments received before satisfaction of all relevant criteria for revenue recognition are recorded as unearned revenue.

We do not accrue any warranty reserve on our products. Moreover, we have no historical basis on which to establish a reserve because of our limited operating history and lack of warranty expense since we began production.

We offer a warranty on our products to each of our customers to repair or replace any defective product during the warranty term, which is a negotiated term of up to 18 months from the customer acceptance date, but currently we record no reserve for warranty claims. Warranty expense accrual is a company estimate of future warranty claims based primarily on testing and quality control procedures with consideration also given to the history of prior warranty claims and our abbreviated operating history. Although we have not and do not currently intend to accrue warranty expense, if we incur warranty claims in the future, we would be required to make a reserve for warranty expense.

We may experience material disruptions to our operations.

We depend upon three facilities to operate our business. While we seek to operate our facilities in compliance with applicable rules and regulations and take measures to minimize the risks of disruption at our facilities, a material disruption at one of our facilities could prevent us from meeting customer demand, reduce our sales and/or negatively impact our financial results. Any of our facilities, or any of our machines within an otherwise operational facility, could cease operations unexpectedly due to a number of events, including: prolonged power failures; equipment failures; disruptions in the transportation infrastructure including roads, bridges, railroad tracks; and fires, floods, earthquakes, acts of war, or other catastrophes.

We cannot be certain our innovations and marketing successes will continue.

We believe our past performance has been based on, and our future success will depend, in part, upon our ability to continue to improve our existing products through product innovation and to develop, market and produce new products and services. We cannot assure you that we will be successful in introducing, marketing and producing any new products or services, or that we will develop and introduce in a timely manner innovations to our existing products which satisfy customer needs or achieve market acceptance. Our failure to develop new products or services and introduce them successfully and in a timely manner could harm our ability to grow our business and could have a material adverse effect on our business, results of operations and financial condition.

The technology used in our products and services may not satisfy the changing needs of our customers.

While we believe we have hired or engaged personnel who have the experience and ability necessary to keep pace with advances in technology, and while we continue to seek out and develop “next generation” technology through our research and development efforts, there is no guarantee we will be able to keep pace with technological developments and market demands in our target industries and markets. Although certain technologies in the industries we occupy are well established, we believe our future success depends in part on our ability to enhance our existing products and develop new products and services in order to continue to meet customer demands. With any technology, including the technology of our current and proposed products and services, there are risks that the technology may not address successfully all of our customers’ needs. Moreover, our customers’ needs may change or vary. This may affect the ability of our present or proposed products and services to address all of our customers’ ultimate technology needs in an economically feasible manner, which could have a material adverse affect on our business.

We may not be able to keep pace with competition in our industry.

Our clean coking and related products business is subject to risks associated with competition from new or existing industry participants who may have more resources and better access to capital. The manufacturing industry for coking products in China is highly fragmented with many different manufacturers holding small shares of the total market. Our primary international competitors for our CDQ transport cars are Nippon Steel Corporation and Schalke GmbH. Many of our competitors and potential competitors may have substantially greater financial and government support, technical and marketing resources, larger customer bases, longer operating histories, greater name recognition and more established relationships in the industry than we do. Among other things, these industry participants compete with us based upon price, quality, location and available capacity. We cannot be sure we will have the resources or expertise to compete successfully in the future. Some of our competitors may also be able to provide customers with additional benefits at lower overall costs to increase market share. We cannot be sure we will be able to match cost reductions by our competitors or that we will be able to succeed in the face of current or future competition.

We will face different market dynamics and competition as we develop new products and services to expand our target markets. In some markets, our future competitors would have greater brand recognition and broader distribution than we currently enjoy. We may not be as successful as our competitors in generating revenues in those markets due to lower recognition of our brand, lower customer acceptance, lower product quality history and other factors. As a result, any new expansion efforts could be more costly and less profitable than our efforts in our existing markets.

If we are not as successful as our competitors in our target markets, our sales could decline, our margins could be impacted negatively and we could lose market share, any of which could materially harm our business.

Our coking products may contain defects, which could adversely affect our reputation and cause us to incur significant costs.

Despite testing by us, defects may be found in existing or new products. Any such defects could cause us to incur significant return and exchange costs, re-engineering costs, divert the attention of our engineering personnel from product development efforts, and cause significant customer relations and business reputation problems. Any such defects could force us to undertake a product recall program, which could cause us to incur significant expenses and could harm our reputation and that of our products. If we deliver defective products, our credibility and the market acceptance and sales of our products could be harmed.

The nature of our products creates the possibility of significant product liability and warranty claims, which could harm our business.

Material failure of any of our clean coking or related products would have a material adverse affect on our business. Customers use some of our products in potentially hazardous applications that can cause injury or loss of life and damage to property, equipment or the environment. In addition, some of our products are integral to the production process for some end-users and any failure of our products could result in a suspension of their operations. Although we have a quality control group consisting of 10 employees specifically charged with inspecting our products prior to delivery, we cannot be certain our products will be completely free from defects. Moreover, we do not have any product liability insurance and may not have adequate resources to satisfy a judgment in the event of a successful claim against us. While we have not yet experienced any product liability claims against us, we cannot predict whether product liability claims will be brought against us in the future or the impact of any resulting negative publicity on our business. The successful assertion of product liability claims against us could result in potentially significant monetary damages and require us to make significant payments.

Our Steel Plate Fusion technology and the steel plates it is used to produce may contain defects, which could adversely affect our planned business expansion.

While the tests we have conducted on our Steel Plate Fusion technology have revealed no defects in the technology or in the steel plates produced, we have not used Steel Plate Fusion to produce a large quantity of steel plates, and will not do so until the third quarter of 2011. We cannot be certain that when the technology is used to produce a large quantity of steel plates that the final produced steel plates will be free of defects. Any such defects could adversely affect our planned business expansion.

We may not be able to protect our technology and other proprietary rights adequately.

Our success will depend in part on our ability to obtain and protect our products, methods, processes and other technologies, to preserve our trade secrets, and to operate without infringing on the proprietary rights of third parties, both domestically and abroad. Despite our efforts, any of the following may reduce the value of our owned and used intellectual property:

|

§

|

issued patents and trademarks that we own or have the right to use may not provide us with any competitive advantages;

|

|

§

|

our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology or that of those from whom we license our rights to use;

|

|

§

|

our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we use or develop; or

|

|

|

§

|