Attached files

| file | filename |

|---|---|

| EX-32.2 - PEETS COFFEE & TEA INC | v215045_ex32-2.htm |

| EX-31.1 - PEETS COFFEE & TEA INC | v215045_ex31-1.htm |

| EX-21.1 - PEETS COFFEE & TEA INC | v215045_ex21-1.htm |

| EX-23.1 - PEETS COFFEE & TEA INC | v215045_ex23-1.htm |

| EX-31.2 - PEETS COFFEE & TEA INC | v215045_ex31-2.htm |

| EX-32.1 - PEETS COFFEE & TEA INC | v215045_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

for the fiscal year ended January 2, 2011

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 0-32233

PEET’S COFFEE & TEA, INC.

(Exact Name of Registrant as Specified in Its Charter)

______________________________

|

Washington

|

91-0863396

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification No.)

|

1400 Park Avenue

Emeryville, California 94608-3520

(Address of Principal Executive Offices)(Zip Code)

(510) 594-2100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, no par value

|

The Nasdaq National Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

________________________

Indicate by check mark whether the registrant is well-known, seasoned filer (as defined in Rule 405 under the Securities Act). Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

The approximate aggregate market value of the voting stock held by non-affiliates of the registrant based on the closing price and shares of the Common Stock outstanding on July 4, 2010 (the registrant's most recently completed second quarter), as reported by the Nasdaq National Market, was $497,235,214. Shares of Common Stock held by each officer, director and each person known to the Company to hold 5% or more of the outstanding Common Stock have been excluded as such persons may be deemed to be affiliates of the Company. Such determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 11, 2011, 13,076,221 shares of registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement related to the registrant's 2010 annual meeting of shareholders, which proxy statement will be filed under the Securities Exchange Act of 1934 within 120 days of the end of the registrant's fiscal year ended January 2, 2011, are incorporated by reference into Part III of this annual report on Form 10-K.

|

TABLE OF CONTENTS

|

||

|

Page #

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

2

|

|

Item 1A.

|

Risk Factors

|

6

|

|

Item 1B.

|

Unresolved Staff Comments

|

11

|

|

Item 2.

|

Properties

|

11

|

|

Item 3.

|

Legal Proceedings

|

11

|

|

Item 4.

|

Reserved

|

12

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

Item 6.

|

Selected Consolidated Financial Data

|

16

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

17

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

26

|

|

Item 8

|

Financial Statements and Supplementary Data

|

26

|

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

26

|

|

Item 9A.

|

Controls and Procedures

|

26

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

28

|

|

Item 11.

|

Executive Compensation

|

28

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

28

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

28

|

|

Item 14.

|

Principal Accountant Fees and Services

|

28

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

29

|

|

Signatures

|

32

|

References to “we”, “us”, “our”, “Peet’s”, and the “Company” in this annual report on Form 10-K refer to Peet’s Coffee & Tea, Inc.

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (this "report") contains forward-looking statements, including in the sections entitled "Business," "Risk Factors" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations." These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements include statements about:

|

|

·

|

our expectations regarding the cost and availability of high-quality Arabica coffee beans;

|

|

|

·

|

our expectations regarding commodity cost fluctuations other than coffee

|

|

|

·

|

our expectations regarding the uninterrupted operation of our roasting and distribution facility;

|

|

|

·

|

our ability to successfully implement our business strategy including our ability to market our products and increase our brand recognition;

|

|

|

·

|

the impact on our business of the recent recession or a worsening of the United States and global economies;

|

|

|

·

|

the impact of potential litigation or disputes on our business;

|

|

|

·

|

our ability to continue leasing our retail locations and obtain leases for new stores;

|

|

|

·

|

our ability to promote and enhance our brand;

|

|

|

·

|

our ability to hire and retain well-qualified management and other personnel;

|

|

|

·

|

our ability to attract and retain customers;

|

|

|

·

|

our expectations regarding consumers’ tastes and preferences;

|

|

|

·

|

our ability to successfully compete in our markets; and

|

|

|

·

|

our expectations regarding revenue growth, cost of sales and related occupancy and operating expenses for 2011.

|

You can identify forward-looking statements by the words "may," "should," "could," "predict," "potential," "continue," "expect," "anticipate," "future," "intend," "plan," "believe," "estimate" and similar expressions (or the negative of such expressions.) Forward-looking statements reflect our current views and expectations with respect to future events, are based on estimates and assumptions, and are subject to risks, uncertainties and other important factors. We discuss many of these risks, uncertainties and other important factors in this report in greater detail in the section entitled "Risk Factors" under Part I, Item 1A below. Given these risks, uncertainties and other important factors, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent

our views, expectations, estimates and assumptions only as of the date of this report. You should read this report and the documents that we incorporate by reference in and have filed as exhibits to this report, completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

1

PART I

Item 1. Business

Peet's Coffee & Tea is a specialty coffee roaster and marketer of fresh roasted whole bean coffee and tea. We sell our Peet’s brand coffee through multiple channels of distribution, including grocery stores, home delivery, office, restaurant and foodservice accounts and Company-owned and operated stores in six states. In addition, we sell Godiva® Chocolatier brand coffees in our grocery channel. We operate our business through two reportable segments: retail and specialty. See Note 14, “Segment Information” in the “Notes to Consolidated Financial Statements” included elsewhere in this report.

Our corporate website is located at www.peets.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments or exhibits to those reports, are available free of charge through our website at www.peets.com as soon as reasonably practicable after we file them with, or furnish them to, the Securities and Exchange Commission (“SEC”). The content on any website referred to in this report is not incorporated by reference into this report unless expressly noted. The Company was organized as a Washington corporation in 1971.

Company Retail Stores

As of January 2, 2011 we operated 192 retail stores in six states through which we sell whole bean coffee, beverages and pastries, tea, and other related items. Our stores are designed to facilitate the sale of fresh whole bean coffee and to encourage customer trial of our coffee through coffee beverages. Each store has a dedicated staff person at the bean counter to take orders and assist customers with questions on coffee origins and home brewing. Upon order, beans are scooped and ground to the customer's specific requirements. At our beverage counter, we sell freshly-brewed coffees and coffee-based beverages to promote customer familiarity, sampling, and sales of whole-bean coffees. To ensure that our freshness standards

are consistently met, it is our policy not to serve brewed coffee that is more than 30 minutes old and every espresso-based drink is made to order using freshly pulled shots of espresso and freshly steamed milk. Retail stores comprised 61.4%, 64.6% and 65.9% of net revenue for the fiscal years 2010, 2009 and 2008, respectively. See “Item 2. Properties” for further discussion about our retail stores.

Specialty

Grocery

We sell our products through a network of grocery stores, mass merchandisers and club stores, including Safeway, Stop & Shop, Ralph’s, Kroger, Publix, Whole Foods Market, Target and Walmart. To support these sales, we have developed a direct store delivery (“DSD”) selling and merchandising system. Peet's DSD route sales representatives deliver directly to their stores anywhere between one to four times per week, properly shelve the product, rotate to ensure freshness, sell and erect free-standing displays and forge store-level selling relationships. In addition, we ship directly to certain customers depending on the customer and product offering. We currently have 73 company-operated DSD route sales representatives and

approximately 219 independent distributors to support grocery accounts primarily in the western U.S., eastern seaboard and other selected markets. In addition to our Peet’s brand, in 2009, we began selling Godiva brand coffees to establish a competitive position in the flavored coffee segment in grocery stores, mass merchandisers and drug stores. Grocery comprised 22.9%, 20.1% and 18.1% of net revenue for the fiscal years 2010, 2009 and 2008, respectively.

Home Delivery

Our home delivery channel offers our customers the ability to have fresh-roasted coffee and hand-packed tea shipped directly from our roastery to their door and a wider selection of coffees and teas than available in our retail stores or at our grocery store partners. For our most loyal home delivery customers, we provide an automatic recurring delivery coffee and tea service. We offer our home delivery services on our website, peets.com, and through our team of customer service representatives who assist customers in placing orders, as well as choosing gifts. As coffee and tea experts, the customer service team also provides in-depth coffee and tea information to our customers, guiding them through their coffee and tea explorations. Home delivery comprised 5.1%, 5.5% and 6.3% of net revenue for the fiscal years

2010, 2009 and 2008, respectively.

Foodservice and Office

In the foodservice and office business, we have a staff of sales and account managers who make sales calls to potential accounts and conduct quality audits at our existing accounts. Additionally, we have established relationships with foodservice and office distributors to expand our account base in select markets and channels. These distributors have their own sales and account management resources. We have two models for servicing our foodservice accounts and distributing our products: “We Proudly Brew” (“WPB”) accounts and licensing accounts. WPB accounts are foodservice accounts where Peet’s supplies the equipment and product to brew and resell our products. Licensing accounts involve the creation of a full Peet’s beverage store

within another location such as an airport, grocery store or college campus. The license partner is responsible for the build-out and management of the unit, and we provide training and operations oversight. The office coffee channel is a distributor-based business where we sell to specialty distributors who in turn sell our products for brewing to individual offices. Foodservice and office comprised 10.6%, 9.8% and 9.7% of net revenue for the fiscal years 2010, 2009 and 2008, respectively.

2

Our Coffee

Coffee Beans

Coffee is an agricultural crop that undergoes quality changes depending on weather in coffee-producing countries. In addition, coffee is a trade commodity and, in general, its price can fluctuate depending on: weather patterns in coffee-producing countries; economic and political conditions affecting coffee-producing countries; foreign currency fluctuations; the ability of coffee-producing countries to agree to export quotas; and general economic conditions that make commodities more or less attractive investment options. We purchase only high-quality Arabica coffee beans, which are considered superior to beans traded in the commodity market. The Arabica beans purchased by us tend to trade on

a negotiated basis at a substantial premium above commodity coffee prices, depending upon the supply and demand at the time of purchase. We procure coffee from 23 countries, with a large percentage of coffee coming from Central and South America, and over 30 different exporters, brokers and growers. Our access to high-quality Arabica beans depends on our relationships with coffee brokers, exporters and growers, with whom we have built long-term relationships to ensure a steady supply of coffee beans. We believe that, as a result of our reputation that has been built over 40 years, we have access to some of the highest-quality coffee beans from the finest estates and growing regions around the world and we are occasionally presented with opportunities to purchase unique and special coffees.

Unlike roasted coffee beans, green coffee beans are not highly perishable. We generally turn our inventory of green coffee beans two to three times per year. We carry approximately $13 million to $30 million of green coffee beans in our inventory. We currently use fixed-price and not-yet-priced purchase commitments, but in the past have used and may potentially in the future use coffee futures and coffee futures options to manage coffee supply and price risk.

Our Roasting Method

Our roasting method was first developed by Alfred Peet and further honed by our talented and skilled roasting personnel. We roast by hand in small batches, and we rely on the skills and training of each roaster to maximize the flavor and potential in our beans. Our roasters undergo an extensive apprenticeship program to learn our roasting method and to gain the skills necessary to roast coffee at Peet’s and make a long-term commitment to our artisan craft.

Coffee Types and Blends

Beyond sourcing and roasting, we have developed a reputation for expert coffee blending. Our blends, such as Major Dickason’s Blend®, are well regarded by our customers for their uniqueness, consistency and special flavor characteristics. We sell approximately 28 types of coffee as regular menu items, including approximately 16 blends and 12 single origin coffees such as Colombia, Guatemala San Sebastian, Sumatra and Kenya. We also offer a line of high-end reserve coffees including JR Reserve Blend® and Kona, and we have also featured seasonal reserve coffees such as Jamaica Blue Mountain. We are active in seeking, roasting and selling unique special lot and one-time coffees. On average, we offer four to six such

coffees every year, including our Anniversary Blend and Holiday Blend.

In our grocery channel, we also offer a variety of Godiva brand coffees, including several year-round and seasonal flavored coffees, such as Chocolate Truffle and Pumpkin Spice, in addition to a Breakfast Blend.

Tea, Food and Merchandise

Peet’s offers a line of hand selected whole leaf and bagged tea. Our quality standards for tea are very high. We purchase tea directly from importers and brokers and store and pack the tea at our facility in Alameda, California. We offer a limited line of specialty food items, such as high-quality baked goods, chocolates, and other snacks. These products are carefully selected for quality and uniqueness.

Our merchandise program consists of items such as brewing equipment for coffee and tea, paper filters and brewing accessories and branded and non-branded cups, saucers, travel mugs and serveware. We do not emphasize these items, but we carry them in retail stores and offer them through home delivery as a means to reinforce our commitment to premium home-brewed coffee and tea.

3

Competitive Positioning

The specialty coffee category is highly competitive and fragmented among various distribution channels. Starbucks Corporation is the largest competitor in the category. The major distribution channels are coffeehouses (our retail segment) and grocery stores (part of our specialty segment). The specialty coffee market generates most of its sales from coffeehouses that currently number over 25,000 in the United States, according to the National Coffee Association. In addition, coffee is sold by coffee roasters like Peet’s to foodservice operators, direct to consumers through websites and mail order, offices and other places where coffee is consumed or purchased for home consumption.

In the coffeehouse business, Starbucks is our primary competition, but we also compete with small single-unit independently owned coffeehouses and regional or local chains such as Coffee Bean & Tea Leaf, Tully’s and Seattle’s Best (Starbucks). In addition, consumers may purchase prepared coffee beverages at countless locations such as convenience stores, bakeries and restaurants.

Outside of the coffeehouse business, Starbucks is also our primary competitor but we also compete with Green Mountain Coffee Roasters, Illy Caffé, Millstone (J.M. Smucker), Seattle’s Best (Starbucks), and Dunkin’ Donuts as well as numerous smaller, regional brands. In addition, we indirectly compete with more mainstream brands as Maxwell House (Kraft) and Folgers (J.M. Smucker). In the grocery channel, Kraft and J.M. Smucker are the largest players since Kraft distributes its own brands, while J.M. Smucker licenses and distributes the Dunkin’ Donuts brand in addition to its Folgers and Millstone brands.

Over the last several years, the coffee industry has seen two trends that could have a significant impact on the future of the industry and our performance. The first is the “mainstreaming” of specialty coffee as consumers have been upgrading their coffee purchases to higher quality coffee. Today, specialty coffee is growing rapidly and driving almost all of the growth in the coffee category. The second trend is the emergence of coffee makers intended to brew a single cup at a time. The single cup coffee market is still in its early stages, but is growing rapidly. The United States single cup market is currently dominated by Green Mountain Coffee Roasters (“GMCR”) with its cartridge-based Keurig® K-Cup brewing system. Starbucks and GMCR announced in March 2011 that Starbucks is “the exclusive, licensed super-premium coffee brand produced by GMCR for the Keurig Single-Cup brewing system.” There are also several other large, well funded participants with cartridge or pod-based systems competing in this market including Nestle (Nespresso® and Dolce Gusto®), Kraft (Tassimo®), Sara Lee (Senseo®

) and Mars (Flavia®). These two trends could impact our future prospects positively and negatively depending on how we are positioned to compete relative to these trends. Currently, most, but not all, single cup cartridge- or pod-based brewing systems are proprietary and could require us to come to an agreement with the owner of the brewing system to have Peet’s-branded coffee and tea available in cartridges that work in the brewers. This could positively or negatively impact us depending on whether or not we make an agreement to participate in a proprietary single cup system and, if we do, how well that single cup system performs in the marketplace.

We believe that our customers choose among specialty coffee brands based on the total value proposition that includes quality, variety, convenience, personal taste preference, and price. We believe that our market share in the specialty category in all channels is driven by the quality of our product, which is based on a differentiated position built on our bean selectivity, freshness standards and artisan-roasting style. Because of the fragmented nature of the specialty coffee market, we cannot accurately estimate our market share across the whole category.

Our roasted coffee that is sold to the end consumer is priced in tiers. Our regular menu coffees are currently priced in our retail locations within a range of $11.95 to $21.95 per pound. Our line of high-end reserve coffee is priced between $49.90 and $79.90 per pound. In the grocery channel, we sell our coffee in 12 ounce packages at prices established by the grocery store. Most grocery stores sell Peet’s at a price between $7.99 and $10.99 and Godiva between $6.99 and $9.99 for a 12 ounce bag.

Intellectual Property

We regard intellectual property and other proprietary rights as important to our success. We place high value on our Peet's trade name, and we own several trademarks and service marks that have been registered with the United States Patent and Trademark Office, including Peet’s®, Peet’s Coffee & Tea®, peets.com®, Peet’s Coffee®, Peet’s Tea®, Blend 101®, e-Cup®, Espresso Forte®, Fresh Truth®, Gaia Organic Blend®, Garuda Blend®, JR Reserve Blend®, Major Dickason's Blend®, P-Cup®, Peetniks®, Pride of the Port®, Pumphrey’s Blend®, Summer House®, Snow Leopard® and Tea Crafted From Experience®. We also have registered trademarks on our stylized logo and our P-mug design. In addition, we have applications pending with the United States Patent and Trademark Office for the mark Uzuri African Blend™. We own registered trademarks for our name and logo in Argentina, Australia, Brazil, Canada, Chile, China, Colombia, the European Union, Hong Kong, Japan, Paraguay, Philippines, Singapore, South Korea, Taiwan and Thailand. We have

filed additional applications for trademark protection in Indonesia. In addition to peets.com and coffee.com, we own several other domain names relating to coffee, Peet’s and our roasting process.

In addition to registered and pending trademarks, we consider the packaging for our coffee beans (consisting of dark brown coloring with African-style motif and lettering with a white band running around the lower quarter of the bag) and the design of the interior of our stores (consisting of dark wood fixtures, classic lighting, granite countertops and understated color) to be strong identifiers of our brand. Although we consider our packaging and store design to be essential to our brand identity, we have not applied to register these trademarks and trade dress, and thus cannot rely on the legal protections afforded by trademark registration.

4

Our ability to differentiate our brand from those of our competitors depends, in part, on the strength and enforcement of our trademarks. We must constantly protect against any infringement by competitors. If a competitor infringes on our trademark rights, we may have to litigate to protect our rights, in which case, we may incur significant expenses and divert significant attention from our business operations.

Information Systems

The information systems installed at Peet’s are used to manage our operations and increase the productivity of our workforce. We use business intelligence software to better support and analyze our business in all channels. We have a retail point-of-sale system that we believe increases store productivity, provides a higher level of service to our customers and maintains timely information for performance evaluation. We have an integrated labor and scheduling system in our retail stores that enhances productivity and customer service as well as an inventory management system. Our grocery route management system includes integration with a handheld device and software for ordering, invoicing customers and inventory management. In 2009, we completed

the development and implementation of a new $7.1 million enterprise resource planning (ERP) system.

Our website offers a variety of customer-centered features and is fully integrated with our e-commerce and internal order processing and fulfillment systems. Our multi-channel store locator assists our customers in finding our retail, licensed and grocery locations. Additionally, customers with stored value cards can check their balance as well as reload their card online. We also offer in-depth information about our history, involvement in the community and our commitment to sustainable business practices. Our information technology and marketing employees work together to optimize our e-commerce business and deliver our digital marketing programs across all of our business channels

Employees

As of March 11, 2011, we employed a workforce of 3,523 people, approximately 765 of whom work approximately 40 hours per week and are considered full-time employees. We consider our relationship with our employees to be good. Since 1979, we have offered a comprehensive benefits package to all employees who work at least 21 hours per week and have worked at least 500 total hours for the Company. We believe that our competitive benefits package is a critical element in our effort to attract and retain our employees.

Government Regulation

Our coffee roasting operations and our retail stores are subject to various governmental laws, regulations, and licenses relating to customs, health and safety, building and land use, and environmental protection. Our roasting facility is subject to state and local air-quality and emissions regulations. If we encounter difficulties in obtaining any necessary licenses or complying with these laws and regulations, then:

|

|

·

|

The opening of new retail locations could be delayed;

|

|

|

·

|

The operation of existing retail locations or our coffee roasting operations could be interrupted; or

|

|

|

·

|

Our product offerings could be limited.

|

We believe that we are in compliance in all material respects with all such laws and regulations and that we have obtained all material licenses that are required for the operation of our business. We are not aware of any environmental regulations that have or that we believe will have a material adverse effect on our operations.

Executive Officers of the Registrant

Set forth below is information with respect to the names, ages, positions and offices of our executive officers as of March 11, 2011.

|

Name

|

Age

|

Position

|

||

|

Patrick J. O'Dea

|

49

|

Chief Executive Officer, President and Director

|

||

|

Thomas P. Cawley

|

50

|

Chief Financial Officer, Vice President and Secretary

|

||

|

Kay L. Bogeajis

|

56

|

Vice President, Retail Operations

|

||

|

Shawn Conway

|

|

45

|

|

Vice President, Chief Supply Chain Officer

|

5

Patrick J. O'Dea has served as Chief Executive Officer and President and as a director since May 2002. From 1997 to 2001, he was Chief Executive Officer of Archway/Mother’s Cookies and Mother’s Cake and Cookie Company. From 1995 to 1997, Mr. O’Dea was the Vice President and General Manager of the Specialty Cheese Division of Stella Foods. From 1984 to 1995, he was with Procter & Gamble, where he marketed several of the company’s snack and beverage brands.

Thomas P. Cawley has served as Chief Financial Officer since July 2003. From 2000 to 2003, he was at Gap, Inc. serving as Chief Financial Officer, Gap Brand. From 1986 to 2000, Mr. Cawley was at PepsiCo/Yum Brands most recently as Chief Financial Officer of Pizza Hut. Previous to 1986, Mr. Cawley was with The Quaker Oats Company and General Foods.

Kay L. Bogeajis has served as Vice President, Retail Operations since she joined the Company in October 2007. From January 2003 to October 2007, Ms. Bogeajis served as Vice President, Western Operations for Taco Bell Corporation, a Yum! Brands, Inc. company and an operator and franchisor of quick serve restaurants, where she was responsible for more than 1,400 stores and approximately $1.4 billion in system-wide sales. From 2001 to 2003, she was Vice President Systemwide Operations for Taco Bell. Previously, she held prominent retail operations and sales positions with Taco Bell, Frito-Lay, Inc., a PepsiCo company, and Burger King Corporation.

Shawn Conway has served as Vice President, Chief Supply Chain Officer since he joined the Company in January 2010. In March 2011, he was elected as an Executive Officer of the Company. From 2002 to 2010, he was at SKYY Spirits, an alcoholic beverages producer and the North American subsidiary of Gruppo Campari, most recently as Senior Vice President of Operations. Prior to SKYY Spirits Mr. Conway served in numerous senior finance and operations roles including Chief Financial Officer of Gateway Learning Corporation, General Manager of New Ventures at Dreyer’s Grand Ice Cream, as well as various roles within the Clorox Company.

Item 1A. Risk Factors

We may not be successful in the implementation of our business strategy or our business strategy may not be successful, either of which will impede our growth and operating results.

Our business strategy emphasizes expansion through multiple channels of distribution. Our ability to implement this business strategy depends on our ability to:

|

|

·

|

market our products on a national scale and over the internet;

|

|

|

·

|

enter into distribution and other strategic arrangements with third-party retailers and other potential distributors of our coffee;

|

|

|

·

|

increase our brand recognition on a national scale;

|

|

|

·

|

effectively compete in emerging where consumers purchase their coffee such as single serve;

|

|

|

·

|

identify and lease strategic locations suitable for new stores; and

|

|

|

·

|

manage growth in administrative overhead and distribution costs likely to result from the planned expansion of our retail and non-retail distribution channels.

|

We do not know whether we will be able to successfully implement our business strategy or whether our business strategy will be successful. Our revenue and operating results will be adversely affected if we fail to implement our business strategy or if we divert resources to a business strategy that ultimately proves unsuccessful.

Because our business is highly dependent on a single product, specialty coffee, if the demand for specialty coffee decreases, our business could suffer.

Sales of specialty coffee constituted approximately 84% of our 2010 and 2009 net revenue and 83% of our 2008 net revenue. Demand for specialty coffee is affected by many factors, including:

|

|

·

|

Consumer tastes and preferences;

|

|

|

·

|

National, regional and local economic conditions;

|

|

|

·

|

Demographic trends; and

|

|

|

·

|

Perceived or actual health benefits or risks.

|

Because we are highly dependent on consumer demand for specialty coffee, a shift in consumer preferences away from specialty coffee would harm our business more than if we had more diversified product offerings. If customer demand for specialty coffee decreases, our sales would decrease accordingly.

6

If we fail to continue to develop and maintain our brand, our business could suffer.

We believe that maintaining and developing our brand is critical to our success and that the importance of brand recognition may increase as a result of competitors offering products similar to ours. Because the majority of our retail stores are located on the West Coast, primarily in California, our brand recognition remains largely regional. Our brand building initiative involves increasing the availability of our products in grocery stores, license locations and foodservice locations to increase awareness of our brand and create and maintain brand loyalty. If our brand building initiative is unsuccessful, we may never recover the expenses incurred in connection with these efforts and we may be unable to increase our future revenue or implement

our business strategy.

Our success in promoting and enhancing the Peet's brand will also depend on our ability to provide customers with high-quality products and customer service. Although we take measures to ensure that we sell only fresh roasted whole bean coffee and that our retail employees properly prepare our coffee beverages, we have no control over our whole bean coffee products once purchased by customers. Accordingly, customers may prepare coffee from our whole bean coffee inconsistent with our standards, store our whole bean coffee for long periods of time or resell our whole bean coffee without our consent, which in each case, potentially affects the quality of the coffee prepared from our products. If customers do not perceive our products and service to

be of high-quality, then the value of our brand may be diminished and, consequently, our ability to implement our business strategy may be adversely affected.

Coffee costs have increased significantly over the past year and increases in the cost of high-quality Arabica coffee beans could impact the profitability of our business.

In second half of 2010 and first quarter of 2011, we have experienced a dramatic rise in the costs of Arabica coffee traded on New York Board of Trade. In mid-March 2011, coffee commodity prices reached a 35-year high at a level approximately 50% higher than they were six months earlier and over 100% higher than they were a year earlier. While we do not purchase coffee on the commodity markets, price movements in the commodity trading of Arabic coffee beans impact the prices we pay. We expect the coffee commodity market to continue to be challenging as the market continues to be influenced by worldwide demand, the weakness of the dollar, speculative trading and weather and as Brazil – the largest coffee producing company – enters a

cyclically low production year in its biennial crop cycle.

Coffee cost is our second largest cost line item after personnel costs and in 2010 represented approximately 15% of our net revenue. In order to manage coffee costs we purchase and hold large quantities of inventory and use future fixed-price purchase commitments. As of January 2, 2011, between our ending inventory and our fixed-price commitments, we had approximately 21 million pounds of coffee at fixed prices for use in 2011 and 2012. Our requirements for green coffee for 2011 are expected to be approximately 28 to 30 million pounds. Since the coffee we purchase comes from over 20 different countries and creates 28 different types of coffee (including 12 single origin coffees), these coffees are not necessarily interchangeable or substitutable and therefore the covered needs of specific origin coffees varies due to differing growing seasons and origin specific

situations.

We have historically raised prices in each of our channels to offset the higher costs and we did increase prices in each channel in the fourth quarter of 2010 or the first quarter of 2011. Given the concentration of coffee in our cost structure, if coffee costs do not decline and we are unable to pass along increased coffee costs to our customers through further price increases, our profitability is likely to decrease. We will continue to monitor these markets and take actions we feel are appropriate to minimize the impact on us in the short and long term.

Decreases in the availability of high-quality Arabica coffee beans could impact the profitability and growth of our business.

In addition to the cost implications of the above-described factors affecting worldwide coffee production and demand, if we are not able to purchase sufficient quantities of high-quality Arabica beans due to those or other factors, we may not be able to fulfill the demand for our coffee, our revenue may decrease and our ability to expand our business may be negatively impacted.

Besides coffee, we face exposure to other commodity cost fluctuations, which could impair our profitability.

In addition to the increase in coffee costs discussed in the risk factor above, we are exposed to cost fluctuation in other commodities, including, in particular, milk, natural gas and gasoline. In addition, an increase in the cost of fuel could indirectly lead to higher electricity costs, transportation costs and other commodity costs. Much like coffee costs, the costs of these commodities depend on various factors beyond our control, including economic and political conditions, foreign currency fluctuations, and global weather patterns. To the extent we are unable to pass along such costs to our customers through price increases, our margins and profitability will decrease.

7

The recent recession or a worsening of the United States and global economy could materially adversely affect our business.

Our revenues and performance depend significantly on consumer confidence and spending, which have deteriorated due to the recession and may remain depressed for the foreseeable future. Some of the factors that could influence the levels of consumer confidence and spending include, without limitation, continuing conditions in the residential real estate and mortgage markets, access to credit, labor and healthcare costs, increases in fuel and other energy costs, elevated unemployment levels and other macroeconomic factors affecting consumer spending behavior. These and other economic factors could have a material adverse effect on demand for our products and on our financial condition and operating results.

Because our business is based primarily in California, a worsening of economic conditions, a decrease in consumer spending or a change in the competitive conditions in this market may substantially decrease our revenue and may adversely impact our ability to implement our business strategy.

Our California retail stores generated approximately 55% of our 2010 net revenue and approximately 60% of our 2009 and 2008 net revenue and a substantial portion of the revenue from our other distribution channels is generated in California. We expect that our California operations will continue to generate a substantial portion of our revenue. In addition, our California retail stores provide us with means for increasing brand awareness, building customer loyalty and creating a premium specialty coffee brand. As a result, if the current economic downturn and decrease in consumer spending in California continues or worsens, it may not only lead to a substantial decrease in revenue, but may also adversely impact our ability to market our brand,

build customer loyalty, or otherwise implement our business strategy.

Complaints or claims by current, former or prospective employees or governmental agencies could adversely affect us.

We are subject to a variety of laws and regulations which govern such matters as minimum wages, overtime and other working conditions, meal and rest periods, various family leave mandates and a variety of other laws enacted, or rules and regulations promulgated, by federal, state and local governmental authorities that govern these and other employment matters. We have been, and in the future may be, the subject of complaints or litigation from current, former or prospective employees or governmental agencies. In addition, successful complaints against our competitors may spur similar lawsuits against us. For instance, in 2003, two lawsuits (which have since been settled) were filed against us alleging misclassification of employment position and sought damages, restitution, reclassification and attorneys’

fees and costs. In 2008, a lawsuit (which has since been settled) was filed alleging that store managers based in California were not paid overtime wages, were not provided meal or rest periods, were not provided accurate wage statements and were not reimbursed for business expenses. In addition, on February 23, 2010, a complaint was filed by non-exempt employees on their own behalf and on behalf of employees similarly situated alleging claims for unpaid overtime, unpaid meal and rest period premiums, unpaid business expenses, unpaid minimum wages, untimely wages paid at time of termination, untimely payment of wages, failure to pay vacation wages and non-compliant wage statements. These types of claims and litigation involving current, former or prospective employees could divert our management’s time and attention from our business operations and might result in substantial costs of defense, settlement or other disposition, which could have a material adverse effect on our

results of operations in one or more fiscal periods.

Potential claims and litigation could have a material adverse effect on us.

In addition to employment-related claims, Peet’s may be subject to various other claims and litigation. For example, in August 2010, a public interest group sued a number of companies, including us, that sell “ready to drink” coffee in California for allegedly failing to issue clear and reasonable warnings with regard to potential exposures to acrylamide in accordance with California Health and Safety Code section 25249.6 (“Proposition 65”), and in 2007 Peet’s was involved as defendants in lawsuits relating to Peet’s stock option granting practices. Although option-related actions have been dismissed, Peet’s remains subject to the ongoing Proposition 65 litigation and could in the future become subject to other claims and litigation, which could involve, for

example, securities law claims, commercial disputes, public health matters and disputes relating to intellectual property. Lawsuits could divert management’s time and attention from day-to-day operations, often result in significant legal expenses, and can result in outcomes that have a material adverse effect on our business, financial condition, results of operations, cash flows and its stock price.

Labor conditions in the grocery business could negatively impact our grocery business.

There have been grocery strikes in the past that have negatively impacted our grocery business and it is possible that future grocery strikes in places where we have large distribution may adversely impact our grocery business.

8

Government mandatory healthcare requirements could adversely affect our profits.

The Company offers healthcare benefits to all employees who work at least 21 hours a week and meet service eligibility requirements. In the past, some states, including California, have proposed legislation mandating that employers pay healthcare premiums into a state run fund for all employees immediately upon hiring or pay a penalty for failing to do so. If legislation similar to this was to be enacted in California, or in the other states in which we do business, it could have an adverse affect on the Company’s results of operations. In addition, comprehensive health care legislation (the Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act of 2010) was passed and signed into law in

March, 2010. Due to the breadth and complexity of this legislation, the phased-in nature of the implementation, and the lack of implementing regulations, it is difficult to predict the financial and operational impacts this legislation will have on us. Our expenses may significantly increase over the long-term as a result of this legislation.

Because we rely heavily on common carriers to ship our coffee on a daily basis, any disruption in their services or increase in shipping costs could adversely affect our business.

We rely on a number of common carriers to deliver coffee to our customers and retail stores. We consider roasted coffee a perishable product and we rely on these common carriers to deliver fresh roasted coffee on a daily basis. We have no control over these common carriers and the services provided by them may be interrupted as a result of labor shortages, contract disputes or other factors. If we experience an interruption in these services, we may be unable to ship our coffee in a timely manner. A delay in shipping could:

|

|

·

|

have an adverse impact on the quality of the coffee shipped, and thereby adversely affect our brand and reputation;

|

|

|

·

|

result in the disposal of an amount of coffee that could not be shipped in a timely manner; and

|

|

|

·

|

require us to contract with alternative, and possibly more expensive, common carriers.

|

Any significant increase in shipping costs could lower our profit margins or force us to raise prices, which could cause our revenue and profits to suffer.

We depend on the expertise of key personnel. If these individuals leave or change their role within our Company without effective replacements, our operations may suffer.

The success of our business is dependent to a large degree on our management and our coffee roasters and purchasers. If members of our management leave without effective replacements, our ability to implement our business strategy could be impaired. If we lost the services of our coffee roasters and purchasers, our ability to source and purchase a sufficient supply of high-quality coffee beans and roast coffee beans consistent with our quality standards could suffer. In either case, our business and operations could be adversely affected.

We may not be able to hire or retain additional management and other personnel and our recruiting and training costs may increase as a result of turnover, both of which may increase our costs and reduce our profits and may adversely impact our ability to implement our business strategy.

The success of our business depends upon our ability to attract and retain highly motivated, well-qualified management and other personnel, including technical personnel and retail employees. We face significant competition in the recruitment of qualified employees. Our ability to execute our business strategy may suffer if:

|

|

·

|

we are unable to recruit or retain a sufficient number of qualified employees;

|

|

|

·

|

the costs of employee compensation or benefits increase substantially; or

|

|

|

·

|

the costs of outsourcing certain tasks to third-party providers increase substantially.

|

A significant interruption in the operation of our roasting and distribution facility could potentially disrupt our operations.

We have only one roasting and distribution facility that roasts Peet’s coffee. A significant interruption in the operation of our roasting and distribution facility, whether as a result of a natural disaster, pandemic or other causes, could significantly impair our ability to operate our business. Since we only roast our coffee to order, we do not carry inventory of roasted coffee in our roasting plant. Therefore, a disruption in service in our roasting facility would impact our sales in our retail and specialty channels almost immediately. Moreover, our roasting and distribution facility and most of our stores are located near several major earthquake faults and our roastery is located directly on the bay in Alameda. The impact of a major earthquake or

tsunami on our facilities, infrastructure and overall operations is difficult to predict and an earthquake or tsunami could seriously disrupt our entire business.

A major earthquake or tsunami could seriously disrupt our entire business.

Our roasting and distribution facility and several dozens of our stores are located near several major earthquake faults and near the water in the San Francisco Bay area. The impact of a major earthquake and/or tsunami in the San Francisco Bay area on our facilities, infrastructure and overall operations is difficult to predict, and an earthquake or tsunami could seriously disrupt our entire business. Our insurance may not adequately cover our losses and expenses in the event of an earthquake. As a result, a major earthquake or tsunami in the San Francisco Bay area could not only seriously disrupt our business, but may also lead to substantial losses.

9

Our costs could be negatively affected by an unpredictable workers' compensation environment.

The majority of our employees are located in California, which has experienced higher workers compensation costs and rates than other states. For the policy years beginning March 2002 through February 2008 our workers' compensation insurance program was a modified self-insured program with a high deductible and an overall program ceiling to limit exposure. For those years, we have established a reserve of $0.5 million. However, the settlement costs for the remaining claims for those years could exceed our reserves. For the policy years beginning March 1, 2008, we have purchased a guaranteed cost policy. As a result, for 2008 and subsequent policy years, we remain exposed to premium fluctuations due to California’s unpredictable workers compensation environment and rising costs and our

historical worker compensation experience. Settlement costs in excess of our reserves (for claims before March 2008) or an increase in insurance premiums could impair our profitability.

Our roasting methods are not proprietary, so competitors may be able to duplicate them, which could harm our competitive position.

We consider our roasting methods essential to the flavor and richness of our roasted whole bean coffee and, therefore, essential to our brand. Because we do not hold any patents for our roasting methods, it may be difficult for us to prevent competitors from copying our roasting methods. If our competitors copy our roasting methods, the value of our brand may be diminished, and we may lose customers to our competitors. In addition, competitors may be able to develop roasting methods that are more advanced than our roasting methods, which may also harm our competitive position.

Competition in the specialty coffee market is intense and could affect our profits and outlook.

The specialty coffee category is highly competitive and fragmented among various distribution channels. Our major distribution channels remain coffeehouses (our retail segment) and grocery stores (part of our specialty segment), but coffee is sold by coffee roasters like Peet’s to foodservice operators, direct to consumers through websites and mail order, offices and other places where coffee is consumed or purchased for home consumption.

In addition, the single cup coffee market, though still in the early stages, is growing rapidly. The United States single cup market is currently dominated by Green Mountain Coffee Roasters (“GMCR”) with its cartridge-based Keurig® K-Cup brewing system. Starbucks and GMCR announced in March 2011 that Starbucks is “the exclusive, licensed super-premium coffee brand produced by GMCR for the Keurig Single-Cup brewing system.” There are also several other large, well funded participants with cartridge- or pod-based systems competing in this market including Nestle (Nespresso and Dolce Gusto), Kraft (Tassimo), Sara Lee (Senseo) and Mars (Flavia). Currently, most, but not all, single cup cartridge- or

pod-based brewing systems are proprietary and could require us to come to an agreement with the owner of the brewing system to have Peet’s-branded coffee and tea available in cartridges that work in the brewers. If the single cup cartridge or pod-based market of proprietary brewing systems continues to grow rapidly at the expense of the non-proprietary single cup brewing methods or existing drip brewing methods and we do not participate in that market segment, our revenue and profit margins could be negatively impacted in the future.

Many of Peet’s competitors, including Starbucks, GMCR, Millstone (J.M. Smucker) Nestle and Kraft, are much larger and have greater financial resources than we do. As a result, these competitors may greater flexibility and resources to react to changes in the market. For instance, we were unable to purchase Diedrich Coffee in 2009, because GMCR, the eventual purchaser of Diedrich Coffee, had substantially greater financial resources than us and was able to pay a substantially higher purchase price for Diedrich Coffee. Our competitors may continue to use their size and financial resources to impair our ability to execute our business strategy and reduce our profit margins in the future.

Adverse public or medical opinion about caffeine may harm our business.

Our specialty coffee contains significant amounts of caffeine and other active compounds, the health effects of some of which are not fully understood. A number of research studies conclude or suggest that excessive consumption of caffeine may lead to increased heart rate, nausea and vomiting, restlessness and anxiety, depression, headaches, tremors, sleeplessness and other adverse health effects. An unfavorable report on the health effects of caffeine or other compounds present in coffee could significantly reduce the demand for coffee, which could harm our business and reduce our sales and profits. In addition, we could become subject to litigation relating to the existence of such compounds in our coffee; litigation that could be costly and

could divert management attention.

10

Adverse publicity regarding product quality or food and beverage safety, whether or not accurate, may harm our business.

We may be the subject of complaints or litigation from customers alleging beverage and food-related illnesses, injuries suffered on the premises or other quality, health or operational concerns. Adverse publicity resulting from such allegations may materially adversely affect us, regardless of whether such allegations are true or whether we are ultimately held liable. In addition, any litigation relating to such allegations could be costly and could divert management attention.

Item 1B. Unresolved Staff Comments

Not Applicable.

Item 2. Properties

Peet’s headquarters are located in Emeryville, California. The lease for our main office space devoted to general corporate and business channel overhead and a call center for the home delivery business is approximately 60,000 square feet and extends to October 2015 with two five-year extension options. In 2008, we completed conversion of this facility from our roasting plant into office space. In addition, we have a lease for a second office and warehouse space totaling approximately 8,000 square feet through April 30, 2013.

In December 2006, we purchased approximately 460,000 square feet of land and a 138,000 square foot building with related site improvements in Alameda, California, for the purpose of operating a new roasting and distribution facility. The final purchase price of the facility and the land was $18.6 million. We transitioned our operations to this facility and were effectively at full production capability by May 2007.

In 2010, we opened 2 new stores and we closed 2 stores upon the expiration of their leases. Our retail locations are all company-owned and operated in leased facilities. Our stores are typically located in urban neighborhoods, suburban shopping centers (usually consisting of grocery, specialty and service stores) and on high-traffic streets.

The following table lists the number of retail locations as of January 2, 2011:

|

Location

|

Number

|

|||

|

Northern California

|

126 | |||

|

Southern California

|

41 | |||

|

Illinois

|

2 | |||

|

Oregon

|

8 | |||

|

Massachusetts

|

5 | |||

|

Washington

|

7 | |||

|

Colorado

|

3 | |||

|

Total

|

192 | |||

Item 3. Legal Proceedings

In 2008, we were sued in California Superior Court, Alameda County by three former employees on behalf of themselves and all other California store managers. The plaintiffs alleged that store managers based in California were not paid overtime wages, were not provided meal or rest periods, were not provided accurate wage statements and were not reimbursed for business expenses. On December 16, 2009, we reached a tentative settlement pursuant to which we would deny any liability but agree to maximum payment of $2.6 million, including plaintiff’s attorney’s fees. The California Superior Court approved the final settlement on September 1, 2010. Based on the final settlement amount, we recorded into income a credit of $93,000 during the thirteen weeks ended October 3, 2010 based

on the difference between the original $2.6 million recorded liability and the anticipated settlement payment. These costs are shown separately as litigation-related expenses in the consolidated statements of income.

On February 23, 2010, we were sued in Orange County Superior Court by two former employees, on behalf of themselves and all other non-exempt employees similarly situated in the state of California naming us as a defendant. One of the plaintiffs was removed by an amended complaint and the remaining plaintiff alleges claims for unpaid overtime, unpaid meal and rest period premiums, unpaid business expenses, unpaid minimum wages, untimely wages paid at time of termination, untimely payment of wages, failure to pay vacation wages, violation of California Business & Professions Code section 17200 and non-compliant wage statements, and seeks injunctive relief, restitution, monetary damages, penalties under the California Labor Code Private Attorneys General Act, costs and attorneys’ fees, penalties,

and prejudgment interest. At this time, it is not feasible to predict the outcome of or a range of loss, should a loss occur, from this proceeding. We have previously settled two employment-related lawsuits certified as a class: In addition to the $2.5 million settlement in 2010 discussed above, we made a final settlement payment for $2.1 million in 2004 of another class action lawsuit.

11

On February 2, 2010, the Council for Education and Research on Toxics (“CERT”), a public interest group, issued a series of pre-litigation notices of intent to sue a number of companies, including us, which sell “ready to drink” coffee in California for allegedly failing to issue clear and reasonable warnings with regard to potential exposures to acrylamide in accordance with Proposition 65. We were among a number of companies named in an action filed in California Superior Court, Los Angeles County, on August 7, 2010. On December 14, 2010, CERT served a new 60-day notice letter to us and other companies alleging additional violations of Proposition 65 arising from potential acrylamide exposures from coffee sold at retail and brewed and consumed elsewhere. We intend to

vigorously defend against these claims. As this matter is at a very early stage, at this time, we are not able to predict the probability of the outcome or estimate of loss, if any, related to this matter.

We may from time to time become involved in certain legal proceedings in the ordinary course of business. We are not a party to any other legal proceedings that management believes would have a material adverse effect on the financial position or results of operations of the Company.

Item 4. Reserved

12

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for the Registrant’s Stock

The Company’s common stock is traded on the Nasdaq National Market under the symbol ‘‘PEET’’. The following table sets forth, for the periods indicated, the high and low closing prices for our common stock as reported on the Nasdaq National Market for each quarter during the last two fiscal years.

|

High

|

Low

|

|||||||

|

Fiscal Year Ended January 2, 2011

|

||||||||

|

Fourth Quarter

|

$ | 42.73 | $ | 33.20 | ||||

|

Third Quarter

|

41.93 | 33.34 | ||||||

|

Second Quarter

|

41.63 | 35.69 | ||||||

|

First Quarter

|

41.66 | 31.82 | ||||||

|

Fiscal Year Ended January 3, 2010

|

||||||||

|

Fourth Quarter

|

$ | 41.58 | $ | 27.51 | ||||

|

Third Quarter

|

28.54 | 25.20 | ||||||

|

Second Quarter

|

29.00 | 21.33 | ||||||

|

First Quarter

|

23.54 | 19.41 | ||||||

As of March 11, 2011, there were approximately 361 registered holders of record of the Company’s common stock. On March 11, 2011, the last sale price reported on the Nasdaq National Market for the common stock was $42.80 per share.

Dividend Policy

We have not declared or paid any dividends on our capital stock since becoming a public company. We expect to retain any future earnings to fund the development and expansion of our business. Therefore, we do not anticipate paying cash dividends on our common stock in the foreseeable future.

Issuer Purchases of Equity Securities

In October 2008, our Board of Directors authorized the repurchase up to one million shares of common stock, with no deadline or target date for completion. During the year ended January 2, 2011, we repurchased and retired 735,888 shares of common stock at an average price of $38.64 per share in accordance with this program. No shares remain available for purchase under this program.

In September 2010, our Board of Directors authorized the repurchase up to one million additional shares of common stock, with no deadline or target date for completion. During the year ended January 2, 2011, we repurchased and retired 194,549 shares of common stock at an average price of $40.57 per share in accordance with this program. From January 3, 2011 through March 11, 2011, we repurchased and retired 390,795 shares of common stock at an average price of $40.99 per share in accordance with this program. As of March 11, 2011, 414,656 shares remain available for purchase under this program. Repurchases under this program may be made from time to time on the open market at prevailing market prices or in negotiated transactions off

the market.

13

The following table sets forth all purchases made by us or any “affiliated purchaser” as defined in Rule 10b-18(a)(3) of the Exchange Act of the Company’s common stock during the fourth fiscal quarter of 2010.

|

Period

|

Total Number of

Shares

Purchased

|

Average Price

Paid per Share

|

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

|

Maximum Number of Shares that

May Yet Be Purchased Under the

Plans or Programs

|

||||||||||||

|

October 4, 2010 -

November 7, 2010

|

- | $ | - | 994,781 | 1,005,219 | |||||||||||

|

November 8, 2010 -

December 5, 2010

|

67,000 | $ | 38.64 | 1,061,781 | 938,219 | |||||||||||

|

December 6, 2010 -

January 2, 2011

|

132,768 | $ | 41.48 | 1,194,549 | 805,451 | |||||||||||

14

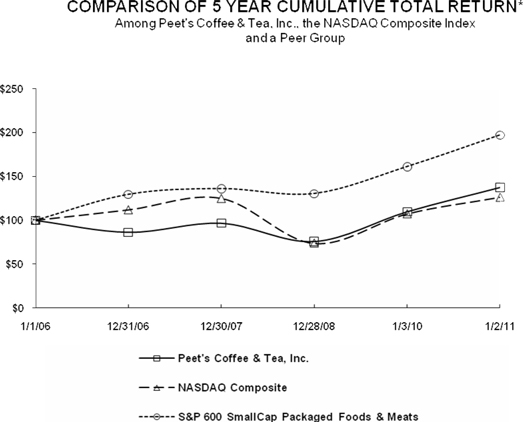

Performance Graph*

The following graph depicts the Company’s total return to shareholders from January 1, 2006 through January 2, 2011, relative to the performance of the NASDAQ Composite Index, and the Standard & Poor’s Smallcap 600 Consumer Goods Sector, Packaged Foods & Meats Industry. All indices shown in the graph have been reset to a base of 100 as of January 1, 2006, assume an investment of $100 on that date and the reinvestment of dividends paid since that date, calculated on a monthly basis. Since becoming a public company, the Company has not paid cash dividends on its common stock. The points represent index levels based on the last trading day of the Company’s fiscal year. The chart set forth below was prepared by Research Data Group, Inc., which holds a license to provide the

indices used herein. The stock price performance shown in the graph is not necessarily indicative of future price performance.

*This section is not “soliciting material”, is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act or the Securities Exchange Act made before or after the date hereof and irrespective of any general incorporation language in any such filing.

15

Item 6. Selected Consolidated Financial Data

The table below shows selected consolidated financial data for our last five fiscal years. Our fiscal year is based on a 52 or 53-week year and ends on the Sunday closest to the last day in December.

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this report.

Selected Consolidated Financial Data

(in thousands, except per share data)

| Year | ||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

(52 weeks)

|

(53 weeks)

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

||||||||||||||||

|

Statement of Income Data:

|

||||||||||||||||||||

|

Net revenue

|

$ | 333,808 | $ | 311,270 | $ | 284,822 | $ | 249,389 | $ | 210,493 | ||||||||||

|

Cost of sales and related occupancy expenses

|

154,892 | 142,776 | 133,537 | 118,389 | 98,928 | |||||||||||||||

|

Operating expenses

|

109,646 | 106,652 | 98,844 | 85,800 | 72,272 | |||||||||||||||

|

Transaction related expenses/(income)

|

970 | (4,183 | ) | - | - | - | ||||||||||||||

|

Litigation related expenses

|

(93 | ) | 2,957 | - | - | - | ||||||||||||||

|

General and administrative expenses

|

25,088 | 24,508 | 22,519 | 22,682 | 20,634 | |||||||||||||||

|

Depreciation and amortization expenses

|

15,767 | 15,167 | 12,921 | 10,912 | 8,609 | |||||||||||||||

|

Income from operations

|

27,538 | 23,393 | 17,001 | 11,606 | 10,050 | |||||||||||||||

|

Gain on sale of marketable securities

|

- | 7,305 | - | - | - | |||||||||||||||

|

Interest income, net

|

8 | 112 | 726 | 1,446 | 2,456 | |||||||||||||||

|

Income before income taxes

|

27,546 | 30,810 | 17,727 | 13,052 | 12,506 | |||||||||||||||

|

Income tax provision

|

10,045 | 11,558 | 6,562 | 4,675 | 4,690 | |||||||||||||||

|

Net income

|

$ | 17,501 | $ | 19,252 | $ | 11,165 | $ | 8,377 | $ | 7,816 | ||||||||||

|

Net income per share:

|

||||||||||||||||||||

|

Basic

|

$ | 1.34 | $ | 1.48 | $ | 0.81 | $ | 0.61 | $ | 0.57 | ||||||||||

|

Diluted

|

$ | 1.28 | $ | 1.44 | $ | 0.80 | $ | 0.59 | $ | 0.55 | ||||||||||

|

Shares used in calculation of net income per share:

|

||||||||||||||||||||

|

Basic

|

13,038 | 12,997 | 13,723 | 13,724 | 13,733 | |||||||||||||||

|

Diluted

|

13,643 | 13,349 | 13,997 | 14,120 | 14,202 | |||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 44,629 | $ | 47,934 | $ | 4,719 | $ | 15,312 | $ | 7,692 | ||||||||||

|

Working capital

|

81,621 | 67,188 | 36,422 | 38,380 | 37,254 | |||||||||||||||

|

Total assets

|

208,832 | 204,803 | 176,352 | 177,547 | 153,005 | |||||||||||||||

|

Total shareholders' equity

|

172,500 | 165,056 | 143,907 | 147,253 | 127,439 | |||||||||||||||

See discussion of Transaction related expenses/(income), litigation related expenses, and gain on sale of marketable securities in 2010 and 2009 in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis in conjunction with our consolidated financial statements and related notes included elsewhere in this report. Except for historical information, the discussion below contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. The fiscal year ended January 2, 2011 (fiscal 2010) included 52 weeks, the fiscal year ended January 3, 2010 (fiscal 2009) included 53 weeks, and the fiscal year ended December 28, 2008 (fiscal 2008) included 52 weeks.

Company Overview and Industry Outlook

Peet’s is a specialty coffee roaster and marketer of fresh, deep-roasted whole bean coffee and tea sold through multiple channels of distribution for home and away-from-home enjoyment. Founded in Berkeley, California in 1966, Peet's has established a loyal customer base with strong brand awareness in California. Our growth strategy is based on the sale of whole bean coffee, tea and high-quality beverages in multiple channels of distribution including our own retail stores, grocery, home delivery, and foodservice and office accounts throughout the United States.

We expect the specialty coffee industry, fueled by continued consumer interest in high-quality coffee and related products, to continue to grow. We believe that growth opportunities exist in all of our distribution channels and that our specialty segment can expand to geographies where we do not have a retail presence. Our first priority has been to develop primarily in the western U.S. markets where we already have a presence and higher customer awareness. In the long-term, we expect to continue to open new retail stores in strategic west coast locations that meet our demographic profile. In grocery, we expect to continue to expand into new markets in addition to the western U.S., eastern seaboard and other selected markets, although the full extent of our penetration will depend upon the growth

of the specialty coffee category in those markets. We will continue to partner with distributors and companies to expand our presence in the foodservice and office environment.

Our goals for 2011 are a continuation of the strategy that the Company has undertaken for the past 3 years which focuses on: growing the Company’s specialty business by increasing market share in existing geographies and expanding to new markets and channels, improving operating margins in our retail business, and delivering sustainable cost improvements across the Company. Results in 2010 reflect the success of achieving these objectives. In 2010, we grew our grocery business 24% on a comparable 52-week basis, with growth in both existing markets and new distribution. We significantly improved operating margins in our retail business by continuing to focus on labor and other operational improvements. In addition, while growing the

business, we have leveraged the Company’s infrastructure, gaining efficiencies in the roasting plant and reducing operating expenses.

In second half of 2010 and first quarter of 2011, we have experienced a dramatic rise in the costs of Arabica coffee traded on New York Board of Trade. In mid-March 2011, coffee commodity prices reached a 35-year high at a level approximately 50% higher than they were six months earlier and over 100% higher than they were a year earlier. While we do not purchase coffee on the commodity markets, price movements in the commodity trading of Arabica coffee beans impact the prices we pay. We expect the coffee commodity market to continue to be challenging as the market continues to be influenced by worldwide demand, the weakness of the dollar, speculative trading and weather and as producers in Brazil—the world’s largest coffee producing country—enter a cyclically low

production year in its biennial crop cycle.

Coffee cost is our second largest cost line item after personnel costs and in 2010 represented approximately 15% of our net revenue. In order to manage coffee costs we purchase and hold large quantities of inventory and use future fixed-price purchase commitments. As of January 2, 2011, between our ending inventory and our fixed-price commitments, we had approximately 21 million pounds of coffee at fixed prices for use in 2011 and 2012. We estimate approximately 2 million pounds will be available for 2012. Our requirements for green coffee for 2011 are expected to be approximately 28 to 30 million pounds. Since the coffee we purchase comes from over 20 different countries and creates 28 different types of coffee (including 12 single origin coffees), these coffees are not necessarily interchangeable or substitutable and therefore the covered needs of specific origin coffees

varies due to differing growing seasons and origin specific situations.