Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

For the fiscal year ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

Commission File No. 1-11859

PEGASYSTEMS INC.

(Exact name of Registrant as specified in its charter)

Massachusetts

(State or other jurisdiction of incorporation or organization)

(IRS Employer Identification No. 04-2787865)

| 101 Main Street Cambridge, MA |

02142-1590 | |

| (Address of principal executive offices) | (zip code) |

(617) 374-9600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant based on the closing price (as reported by NASDAQ) of such common stock on the last business day of the Registrant’s most recently completed second fiscal quarter (June 30, 2010) was approximately $511 million.

There were 37,285,030 shares of the Registrant’s common stock, $0.01 par value per share, outstanding on March 3, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement related to it 2011 annual meeting of stockholders to be filed subsequently are incorporated by reference into Part III of this report.

Table of Contents

| Item |

Page | |||||

| PART I | ||||||

| 1 |

3 | |||||

| 1A |

10 | |||||

| 1B |

15 | |||||

| 2 |

15 | |||||

| 3 |

15 | |||||

| 4 |

15 | |||||

| PART II | ||||||

| 5 |

16 | |||||

| 6 |

18 | |||||

| 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||

| 7A |

39 | |||||

| 8 |

40 | |||||

| 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

73 | ||||

| 9A |

73 | |||||

| 9B |

75 | |||||

| PART III | ||||||

| 10 |

75 | |||||

| 11 |

76 | |||||

| 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

76 | ||||

| 13 |

Certain Relationships and Related Transactions, and Director Independence |

79 | ||||

| 14 |

79 | |||||

| PART IV | ||||||

| 15 |

79 | |||||

| 80 | ||||||

2

Table of Contents

PART I

Forward-looking statements

This Annual Report on Form 10-K contains or incorporates forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s beliefs and assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “estimate,” “may,” “target,” “project,” or variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. We have identified certain risk factors included in Item 1A of this Annual Report on Form 10-K that we believe could cause our actual results to differ materially from the forward-looking statements we make. We do not intend to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

| ITEM 1. | Business |

Pegasystems Inc. was incorporated in Massachusetts in 1983. Our stock is traded on the NASDAQ Global Select Market under the symbol PEGA. Our Website address is www.pega.com. We are not including the information contained on our Website as part of, or incorporating it by reference into, this Annual Report on Form 10-K. Unless the context otherwise requires, references in this Annual Report on Form 10-K to “the Company,” “we,” “us” or “our” refer to Pegasystems Inc. and its subsidiaries.

Our business

We develop, market, license, and support software to automate complex, changing business processes. Our software enables organizations to build, deploy, and change enterprise applications easily and quickly by directly capturing business objectives, automating programming, and automating work. It also allows organizations to avoid the time and expense required to create lengthy policy manuals and system specifications by unifying business rules with business processes in the software and automating the creation of system documentation. Our software is standards-based and can leverage existing technology investments to reduce implementation time. Our customers use our software and services to improve their customer service, generate new business, improve productivity, and facilitate case management.

Our PegaRULES Process Commander ® (“PRPC”) software is the primary component of our Pega BPM ® Suite, which is complemented by software solutions that we refer to as frameworks. These frameworks provide purpose or industry-specific functionality that allows our customers to quickly implement and easily customize our software to suit their unique requirement.

We provide implementation, consulting, training, and technical support services to help our customers maximize the business value they obtain from the use of our software. We maintain alliances with systems integrators and technology consulting firms that also provide consulting services to our customers.

We lead the Business Process Management (“BPM”) software market by leveraging our patented Build for Change ® technology that unifies business processes and business rules. We are also a leader in the Customer Relationship Management (“CRM”) and Dynamic Case Management software markets. We focus our sales efforts on target accounts, which are large companies or divisions within companies, and typically leaders in their industry. We frequently sell initial licenses that are focused on a specific purpose or area of operations, rather than selling large enterprise licenses. A primary objective of this strategy is to have our customers quickly realize

3

Table of Contents

business value from our software. Once a customer has realized this initial value, we work with that customer to identify opportunities for follow-on sales. The sales process for follow-on sales is often shorter as a result of our established relationship with the customer. We invest resources in professional services, customer support, and customer and partner enablement to help our customers achieve success.

Our partners

Strategic partnerships with technology consulting firms and systems integrators are important to our sales efforts because they influence buying decisions, help us to identify engagements, and complement our software with their domain expertise and services capabilities. These partners may deliver strategic business planning, consulting, project management, and implementation services to our customers. Currently, our partners include, but are not limited to, Accenture Ltd., Capgemini SA, Cognizant Technology Solutions Inc., Infosys Technologies Limited, International Business Machines Corporation (“IBM”), PricewaterhouseCoopers LLP, Tata Consultancy Services Limited, and Wipro Ltd.

Our products

Our primary software solutions are as follows:

PegaRULES Process Commander

PRPC provides capabilities designed to model, execute, monitor, and analyze results. PRPC includes an application profiler that allows a business process application to be defined based on business goals and objectives, with simplified “fill in the blank” forms. The product also simplifies process modeling, allowing business users to graphically describe and test an intended business process within the system itself. The software uses the results of the application profiler and the process modeling to create the new business solution, including the user interface and executable business models. PRPC also provides a browser-based graphical development environment, execution engine, and management dashboard for rapid business application and solution development. This product helps solve a wide range of BPM problems, including acquiring new business, providing customer service, creating a servicing backbone for enterprise-wide processing, and managing risk, fraud and compliance with regulatory requirements. PRPC also allows our customers to leverage previous technology investments by integrating software applications across a common platform.

Pega BPM Suite and Solution Frameworks

The Pega BPM Suite adds process analysis, process simulation, enterprise integration, portal integration, content management, case management and more to the PRPC capabilities.

We also offer purpose or industry-specific solution frameworks built on the capabilities of our PRPC software. These frameworks allow organizations to quickly implement new customer-facing practices and processes, bring new offerings to market, and provide customized or specialized processing to meet the needs of different customers, departments, geographies or regulatory requirements. We also offer other frameworks that address exceptions management—transactions that are not automatically processed by existing systems. By automating not only research and decision making, but also the business processes necessary to execute the decisions, our exceptions management frameworks can reduce the costs and risks associated with manual processing, while improving quality and efficiency.

Pega CRM ®

Pega CRM software offers a process-driven, customer-centric business solution in order to optimize the customer experience while reducing costs. The capabilities within Pega CRM automate customer service

4

Table of Contents

inquiries and marketing and apply analytics to predict and adapt customer service processes, which result in the delivery of a personal customer interaction. As a result of our acquisition of Chordiant Software, Inc. (“Chordiant”) in April 2010, we have increased our customer base and depth of CRM-related product capabilities.

Pega Decision Management

We offer Pega Decision Management as a result of our acquisition of Chordiant. Our decision management products and capabilities are designed to manage processes so that all actions optimize the outcome based on business objectives. Pega Decision Manager and Recommendation Advisor support cross-channel decision-making for offer management, risk, and other marketing and customer management solutions. Pega frameworks for Cross-Sell/Up-Sell, Retention, and Collections help marketing professionals build and deploy decision making solutions fast, while Predictive and Adaptive analytics support creation and improvement of decision models for outstanding operational performance.

Pega Cloud ®

Pega Cloud is Pegasystems’ cloud computing service offering that allows customers to create and run PRPC applications using an internet-based infrastructure. This offering enables our customers to immediately build, test, and deploy their applications in a secure cloud environment while minimizing their infrastructure and hardware costs.

Our services and support

We offer services and support through our professional services group, customer support group, and our training services group. We also utilize third party contractors to assist us in providing services.

Professional services

Our professional services group helps companies and partners implement our software. This enables us to guide our customers through deployment of our software. Many of our customers choose to engage our professional services group to expand their use of our software to additional business or product lines or automate additional processes within existing solutions. In addition, systems integrators and consulting firms, with which we have alliances, help our customers deploy our products.

Customer support

Our customer support group is responsible for support of our software deployed at customer sites when customer support has been purchased. Support services include automated problem tracking, prioritization and escalation procedures, periodic preventive maintenance, documentation updates, new software releases, and regularly scheduled customer meetings with our staff.

Training services

The success of our sales strategy for multiple follow-on sales to target customers depends on our ability to train a larger number of partners and customers to implement our technology. We offer training for our staff, customers, and partners. Training is offered at our regional training facilities in Cambridge, Massachusetts, Bedford, New Hampshire, London, England, Hyderabad, India, Sydney, Australia, at third party facilities in numerous other locations, and at customer sites. Courses are designed to meet the specific requirements of process architects, system architects, and system administrators.

5

Table of Contents

Our markets and representative customers

The market for BPM and the related software markets are driven by businesses that seek to close the execution gaps that may exist between their business objectives and their existing business processes. Our target customers are large, industry-leading organizations faced with managing transaction intensive, complex and changing processes that seek the agility needed for growth, productivity, customer retention, and compliance. Our customers are typically large companies in the financial services, healthcare and insurance markets. With PRPC, we are also able to offer solutions to a broader range of companies as well as a broader range of industries, such as life sciences, communications, travel and entertainment, and government.

Financial services

Financial services organizations require software to improve the quality, accuracy, and efficiency of customer interactions and transactions processing. Pegasystems’ customer process and exceptions management products allow customers to be responsive to changing business requirements. Representative financial services customers of ours include: BBVA Bancomer S.A., BNP Paribas, Citigroup Inc., HSBC Holdings Plc, ING Bank, JP Morgan Chase, MasterCard Worldwide, National Australia Bank Limited, and RBC Financial Group.

Healthcare

Healthcare organizations seek products that integrate their front and back office initiatives and help drive customer service, efficiency, and productivity. Representative healthcare customers of ours include: Aetna Inc., Blue Cross Blue Shield of Massachusetts, Blue Cross Blue Shield of Minnesota, Blue Cross Blue Shield of Tennessee, Group Health Cooperative, HealthNow New York Inc., Medco Health Solutions, Inc., United Healthcare Services, Inc., and ViPS/WebMD.

Insurance

Insurance companies, whether competing globally or nationally for customers and channels, need software to automate the key activities of policy rating, quoting, customization, underwriting, and servicing as well as products that improve customer service and the overall customer experience. Representative insurance industry customers of ours include: American National Insurance Group, CARDIF, Chartis, Farmers Insurance Group of Companies, John Hancock Life Insurance Co., Manulife Financial Corporation, and Zurich North America.

Other industries

PRPC offers solutions to a broad range of companies and industries. We sell rules-based BPM technology to customers in telecommunications, government, life sciences, manufacturing, and travel services. Customers include: Advanced Micro Devices, Inc. (“AMD”), Deutsche Telekom, Novartis International AG, O2, Orange, The British Airport Authority, The ServiceMaster Company, UPS, and Vodafone.

Competition

We compete in the BPM, CRM, Case Management and Decision Management software markets. These markets are intensely competitive, rapidly changing, and highly fragmented, as current competitors expand their product offerings and new companies enter the market. Competitors vary in size and in the scope and breadth of the products and services offered. We encounter competition from:

| • | Service-Oriented Architecture (“SOA”) middleware vendors including IBM, Oracle Corporation, Software AG, and Tibco Software Inc.; |

6

Table of Contents

| • | BPM vendors such as Appian Corporation, Global360, Inc. the Lombardi Software division of IBM, Metastorm Inc. (pending acquisition by Open Text), and the Savvion division of Progress Software; |

| • | Business Rules Engine vendors such as Corticon Technologies Inc., Fair Isaac Corporation, and the ILOG division of IBM; |

| • | Customer Relationship Management (“CRM”) application vendors such as the Microsoft Dynamics CRM division of Microsoft, Salesforce.com, and the Siebel division of Oracle; |

| • | Enterprise Content Management-based vendors such as the Documentum division of EMC Corporation, and the FileNet division of IBM’s Information Management Group; |

| • | Companies that provide application specific software for the financial services, healthcare, insurance and other specific markets such as Guidewire Software, Inc., Norkom Group Plc, SmartStream Technologies Ltd., SunGard, and The TriZetto Group, Inc.; and |

| • | Current customers’ information technology departments, which may seek to modify existing systems or develop proprietary systems. |

We have been most successful competing for customers whose businesses are characterized by a high degree of change, complexity, and size. We believe that the principal competitive factors within our market include:

| • | Product adaptability, scalability, functionality, and performance; |

| • | Proven success in delivering cost-savings and efficiency improvements; |

| • | Ease-of-use for developers, business units, and end-users; |

| • | Timely development and introduction of new products and product enhancements; |

| • | Establishment of a significant base of reference customers; |

| • | Ability to integrate with other products and technologies; |

| • | Customer service and support; |

| • | Product price; |

| • | Vendor reputation; and |

| • | Relationships with systems integrators. |

We believe we compete favorably with our competitors on the basis of most of these competitive factors as our Build for Change technology includes a comprehensive set of business rules that are unified with business processes, can be developed quickly by both client business and IT staff, and incorporates a single, browser-based user interface. We believe we also compete favorably due to our expertise in our target industries and our long-standing customer relationships. We believe we compete less favorably on the basis of some of these factors with respect to our larger competitors, many of which have greater sales, marketing and financial resources, more extensive geographical presence and greater name recognition than we do. In addition, we may be at a disadvantage with respect to our ability to provide expertise outside our target industries.

7

Table of Contents

Sales and marketing

We market our software and services primarily through a direct sales force. Strategic partnerships with consultants and systems integrators are important to our sales efforts because they influence buying decisions, help us to identify engagements, and complement our software with their domain expertise and services capabilities.

To support our sales efforts, we conduct a broad range of marketing programs, including targeted solution campaigns, industry trade shows, including our PegaWorld user conference, solution seminars industry analysts and press relations, web marketing, community development, social media, and other direct and indirect marketing efforts. Our consulting staff, business partners, and other third parties also generate sales leads.

Sales by geography

In 2010, 2009, and 2008, sales to customers based outside of the United States of America (“U.S.”) represented approximately 41%, 34%, and 38%, respectively, of our total revenue. We currently operate in one operating segment — Business Process Solutions. We derive substantially all of our operating revenue from the sale and support of one group of similar products and services. Substantially all of our assets are located within the U.S. See Note 16 “Geographic Information and Major Customers” included in the notes to the accompanying audited consolidated financial statements for further detail.

Research and development

Our development organization is responsible for product architecture, core technology development, product testing, and quality assurance. Our product development priority is to continue expanding the capabilities of our rules-based technology. We intend to maintain and extend the support of our existing solution frameworks, and we may choose to invest in additional frameworks which incorporate the latest business innovations. We also intend to maintain and extend the support of popular hardware platforms, operating systems, databases, and connectivity options to facilitate easy and rapid deployment in diverse information technology infrastructures. Our goal with all of our products is to enhance product capabilities, ease of implementation, long-term flexibility, and the ability to provide improved customer service.

During 2010, 2009, and 2008, research and development expenses were approximately $55.2 million, $38.9 million, and $31.5 million, respectively. We expect that we will continue to commit significant resources to our product research and development in the future to maintain our leadership position.

Employees

As of January 31, 2011, we had 1,509 employees worldwide, of which 950 were based in the U.S., 278 were based in Europe, 209 were based in India, 30 were based in Canada, 22 were based in Australia and 20 were based in Asia. Our total headcount includes 535 consulting and customer support employees, 392 sales and marketing employees, 400 research and development employees, and 182 administrative employees. In addition, we augmented our research and development and professional services employees with approximately 345 contractors.

Backlog of license, maintenance, and professional services

As of December 31, 2010, we had software license, maintenance, and professional services agreements with customers expected to result in approximately $232.1 million of future revenue, of which we expect approximately $143.9 million to be recognized in 2011. As of December 31, 2009, we had backlog of software license, maintenance, and professional services agreements with customers of approximately $192 million.

8

Table of Contents

Under some of these agreements, we must fulfill certain conditions prior to recognizing revenue, and there can be no assurance when, if ever, we will be able to satisfy all such conditions in each instance. Business conditions could change and, therefore, backlog may not be a reliable indicator of future financial performance.

Available Information

We make available free of charge through our Website www.pegasystems.com our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”). The SEC maintains a Website that contains reports, proxy, and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. We make available on our Website reports filed by our executive officers and Directors on Forms 3, 4, and 5 regarding their ownership of our securities. Our Code of Conduct, and any amendments to our Code of Conduct, is also available on our Website.

9

Table of Contents

| ITEM 1A. | RISK FACTORS |

The following important factors could cause our actual business and financial results to differ materially from those contained in forward-looking statements made in this Annual Report on Form 10-K or elsewhere by management from time to time.

Factors relating to our financial results

The number of our license arrangements has been increasing, and we may not be able to sustain this growth unless we can provide sufficient high quality professional services, training, and maintenance resources to enable our customers to realize significant business value from our software. Our customers typically request professional services and training to assist them in implementing our products. Our customers also purchase maintenance on our products in almost all cases. As a result, an increase in the number of license arrangements is likely to increase demand for professional services, training, and maintenance relating to our products. Given that the number of our license arrangements has been increasing, we will need to provide our customers with more professional services, training, and maintenance to enable our customers to realize significant business value from our software. Accordingly, we have been hiring additional personnel in these areas and improving our “on-boarding” process to ramp up new personnel in a shorter period of time. We have also been increasingly enabling our partners and customers through training to create an expanded universe of people that are skilled in the implementation of our products. However, if we are unable to provide sufficient high quality professional services, training, or maintenance resources to our customers, our customers may not realize sufficient business value from our products to justify follow-on sales, which could impact our future financial performance. In addition, the growth required to meet the increased demand for our professional services could strain our ability to deliver our services engagements at desired levels of profitability, thereby impacting our overall profitability and financial results.

We frequently enter into limited scope initial licenses with new customers, which could adversely affect our financial performance if we are not successful in obtaining follow-on business from these customers. We frequently enter into initial licenses with our new customers that are focused on a specific purpose or area of operations, rather than selling large enterprise licenses, to allow these new customers to realize business value from our software quickly and for a limited initial investment. Once a customer has realized this initial value, we work with the customer to identify opportunities for follow-on sales. However, we may not be successful in demonstrating this initial value to some customers, for reasons relating to the performance of our products, the quality of the services and support we provide for our products, or external reasons. For these customers, we may not obtain follow-on sales or the follow-on sales may be delayed, and our license revenue will be limited to the smaller initial sale. This could lower the total value of all transactions and adversely affect our financial performance.

Our professional services revenue is dependent to a significant extent on closing new license transactions with customers. We derive a substantial portion of our professional services revenue from implementation of new software licenses with our customers. Accordingly, it is imperative that we close more license transactions with our customers if we are to maintain or grow our services revenue.

If we are unable to maintain vendor specific objective evidence (“VSOE”) of fair value of our professional services arrangements, we may be required to delay a portion of our revenue to future periods. We have established VSOE of fair value of our professional services in North America and Europe, other than Spain, based on the price charged when these services are sold separately. The weakened economy and significant competition within our industry have created pricing pressure on professional services provided by technology companies. If we elect to discount our professional services pricing or otherwise introduce variability in our professional services arrangements to attract or retain customers, this could lead to an insufficient number of consistently priced professional services arrangements for us to maintain VSOE. If we do not have VSOE of fair value of our professional services, we may be required to recognize all revenue for these professional services arrangements, including any related license, maintenance, and other services revenue if the professional

10

Table of Contents

services are bundled in an arrangement, ratably over the longer of the software maintenance period or the service period.

The timing of our license revenue is difficult to predict accurately, which may cause our quarterly operating results to vary considerably. A change in the number or size of high value license arrangements, or a change in the mix between perpetual and term licenses, can cause our revenues to fluctuate materially from quarter to quarter. Our decision to enter into term licenses that require the term license revenue to be recognized over the license term as payments become due or earlier if prepaid may adversely affect our profitability in any period due to sales commissions being paid at the time of signing and the corresponding revenue being recognized over time. We plan selling and marketing expenses, product development, and other expenses based on anticipated future revenue. If the timing or amount of revenue fails to meet our expectations in any given quarter, our financial performance is likely to be adversely affected because only small portions of expenses vary with revenue. As a result, period-to-period comparisons of operating results are not necessarily meaningful and should not be relied upon to predict future performance.

Our financial results may be adversely affected if we are required to change certain estimates, judgments, and positions relative to our income taxes. In the ordinary course of conducting a global business enterprise, there are many transactions and calculations undertaken whose ultimate tax outcome cannot be certain. Some of these uncertainties arise as a consequence of positions we have taken regarding valuation of deferred tax assets, transfer pricing for transactions with our subsidiaries, and potential challenges to nexus and tax credit estimates. We estimate our exposure to unfavorable outcomes related to these uncertainties and estimate the probability for such outcomes. Future realization of our deferred tax assets ultimately depends on the existence of sufficient taxable income within the available carryback or carryforward periods. We record a valuation allowance to reduce our deferred tax assets to an amount we believe is more likely than not to be realized. If our taxable income is not consistent with our expectations or the timing of income is not within the applicable carryforward period, we may be required to establish a valuation allowance on all or a portion of these deferred tax assets. Changes in our valuation allowance impact income tax expense in the period of adjustment. Although we believe our estimates are reasonable, no assurance can be given that the final tax outcome of these matters or our current estimates regarding these matters will not be different from what is reflected in our historical income tax provisions, returns, and accruals. Such differences, or changes in estimates relating to potential differences, could have a material impact, unfavorable or favorable, on our income tax provisions, require us to change the recorded value of deferred tax assets, and adversely affect our financial results.

We are investing heavily in sales and marketing and professional services in anticipation of a continued increase in license arrangements, and we may experience decreased profitability or losses if we are unsuccessful in increasing the value of our license arrangements in the future. We have been increasing our investment in sales and marketing to meet increasing demand by hiring additional sales and marketing personnel. We anticipate that we will need to provide our customers with more professional services, training, and maintenance as a result of this increase in demand, and have been hiring additional personnel in these areas. These investments have resulted in increased fixed costs that do not vary with the level of revenue. If the increased demand for our products does not continue, we could experience decreased profitability or losses as a result of these increased fixed costs.

Factors relating to our products and markets

The continued weakness in the U.S and international economies may negatively impact our sales to, and the collection of receivables from, our financial services and insurance customers and possibly our customers in other industries. Our sales to, and our collection of receivables from, our customers may be impacted by adverse changes in global economic conditions, especially in the U.S., Europe and Asia Pacific. In the past few years, these regions have experienced instability in financial markets, tightening credit, and weak overall economic conditions, which has impacted the financial services and insurance industries in particular. These trends could impact the ability and willingness of our financial services and insurance

11

Table of Contents

customers, and possibly our customers in other industries, to make investments in technology, which may delay or reduce the amount of purchases of our software and professional services. These factors could also impact the ability and willingness of these customers to pay their trade obligations and honor their contractual commitments under their non-cancellable term licenses. These customers may also become subject to increasingly restrictive regulatory requirements, which could limit or delay their ability to proceed with new technology purchases. Our financial services and insurance customers as a group represent a significant amount of our revenues and receivables. Accordingly, their potential financial instability could negatively impact our business, operating results, and financial condition.

We will need to acquire or develop new products, evolve existing ones, and adapt to technology change. Technical developments, customer requirements, programming languages, and industry standards change frequently in our markets. As a result, success in current markets and new markets will depend upon our ability to enhance current products, to acquire or develop and introduce new products that meet customer needs, keep pace with technology changes, respond to competitive products, and achieve market acceptance. Product development requires substantial investments for research, refinement, and testing. There can be no assurance that we will have sufficient resources to make necessary product development investments. We may experience difficulties that will delay or prevent the successful development, introduction, or implementation of new or enhanced products. Inability to introduce or implement new or enhanced products in a timely manner would adversely affect future financial performance.

The market for our offerings is increasingly and intensely competitive, rapidly changing, and highly fragmented. The market for BPM software and related implementation, consulting, and training services is intensely competitive, rapidly changing and highly fragmented. We currently encounter significant competition from internal information systems departments of potential or existing customers that develop custom software. We also compete with large technology companies such as IBM, Oracle and SAP, companies that target the customer interaction and workflow markets, companies focused on business rules engines or enterprise application integration, “pure play” BPM companies, and professional service organizations that develop custom software in conjunction with rendering consulting services. Competition for market share and pressure to reduce prices and make sales concessions are likely to increase. Many competitors have far greater resources and may be able to respond more quickly and efficiently to new or emerging technologies, programming languages or standards or to changes in customer requirements or preferences. Competitors may also be able to devote greater managerial and financial resources to develop, promote, and distribute products and provide related consulting and training services. There has been recent consolidation in the BPM market whereby larger companies such as IBM, Oracle, SAP and Progress Software have acquired companies that provide BPM software, which we expect will further increase competition. There can be no assurance that we will be able to compete successfully against current or future competitors or that the competitive pressures faced by us will not materially adversely affect our business, operating results, and financial condition.

We have historically sold to the financial services, insurance and healthcare markets, and rapid changes or consolidation in these markets could affect the level of demand for our products. We have historically derived a significant portion of our revenue from customers in the financial services, insurance, and healthcare markets, and sales to these markets are important for our future growth. Competitive pressures, industry consolidation, decreasing operating margins, regulatory changes, and privacy concerns affect the financial condition of our customers and their willingness to buy. In addition, customers’ purchasing patterns in these industries for large technology projects are somewhat discretionary. The financial services and insurance markets are undergoing intense domestic and international consolidation and financial turmoil, and consolidation has been occurring in the healthcare market. Consolidation may interrupt normal buying behaviors and increase the volatility of our operating results. In recent years, several of our customers have been merged or consolidated, and we expect this to continue in the near future. Future mergers or consolidations may cause a decline in revenues and adversely affect our future financial performance. All of these factors affect the level of demand for our products from customers in these industries, and could adversely affect our business, operating results and financial condition.

12

Table of Contents

We rely on certain third-party relationships. We have a number of relationships with third parties that are significant to sales, marketing and support activities, and product development efforts. We rely on software and hardware vendors, large system integrators, and technology consulting firms to provide marketing and sales opportunities for the direct sales force and to strengthen our products through the use of industry-standard tools and utilities. We also have relationships with third parties that distribute our products. There can be no assurance that these companies, most of which have significantly greater financial and marketing resources, will not develop or market products that compete with ours in the future or will not otherwise end or limit their relationships with us.

We face risks from operations and customers based outside of the U.S. Sales to customers located outside of the U.S. represented approximately 41% of our total revenue in 2010, 34% of our total revenue in 2009, and 38% of our total revenue in 2008. We, in part through our wholly owned subsidiaries, market products and render consulting and training services to customers based outside of the U.S. including, for example, customers based in Canada, the United Kingdom, France, Germany, Spain, Italy, the Netherlands, Belgium, Switzerland, Austria, Ireland, Finland, Hungry, Poland, Sweden, Turkey, Russia, Mexico, Australia, China, Hong Kong, and Singapore. We have established offices in Canada, Europe, Asia and Australia. We believe that growth will necessitate expanded international operations, requiring a diversion of managerial attention and increased costs. We anticipate hiring additional personnel to accommodate international growth, and we may also enter into agreements with local distributors, representatives, or resellers. If we are unable to do one or more of these things in a timely manner, our growth, if any, in our foreign operations may be restricted, and our business, operating results, and financial condition could be materially and adversely affected.

In addition, there can be no assurance that we will be able to maintain or increase international market demand for our products. Several of our international sales are denominated in U.S. dollars. Accordingly, any appreciation of the value of the U.S. dollar relative to the currencies of those countries in which we sell our products may place us at a competitive disadvantage by effectively making our products more expensive as compared to those of our competitors. Additional risks inherent in our international business activities generally include unexpected changes in regulatory requirements, increased tariffs and other trade barriers, the costs of localizing products for local markets and complying with local business customs, longer accounts receivable patterns and difficulties in collecting foreign accounts receivable, difficulties in enforcing contractual and intellectual property rights, heightened risks of political and economic instability, the possibility of nationalization or expropriation of industries or properties, difficulties in managing international operations, potentially adverse tax consequences (including restrictions on repatriating earnings and the threat of “double taxation”), increased accounting and internal control expenses, and the burden of complying with a wide variety of foreign laws. There can be no assurance that one or more of these factors will not have a material adverse effect on our foreign operations, and, consequentially, our business, operating results, and financial condition.

We are exposed to fluctuations in currency exchange rates that could negatively impact our financial results and cash flows. Because a significant portion of our business is conducted outside the U.S., we face exposure to adverse movements in foreign currency exchange rates. These exposures may change over time as business practices evolve, and they could have a material adverse impact on our financial results and cash flows. Our international sales have increasingly become denominated in foreign currencies. The operating expenses of our foreign operations are primarily denominated in foreign currencies, which partially offset our foreign currency exposure. Our U.S. operating company invoices most of our foreign customers in foreign currencies, so it holds cash and receivables valued in these foreign currencies, which are subject to foreign currency transaction gains or losses. A decrease in the value of foreign currencies, particularly the British pound and the Euro relative to the U.S. dollar, could adversely impact our financial results and cash flows.

13

Table of Contents

Factors relating to our internal operations and potential liabilities

We depend on certain key personnel, and must be able to attract and retain qualified personnel in the future. The business is dependent on a number of key, highly skilled technical, managerial, consulting, sales, and marketing personnel, including our Chief Executive Officer. The loss of key personnel could adversely affect financial performance. We do not have any significant key-man life insurance on any officers or employees and do not plan to obtain any. Our success will depend in large part on the ability to hire and retain qualified personnel. The number of potential employees who have the extensive knowledge of computer hardware and operating systems needed to develop, sell, and maintain our products is limited, and competition for their services is intense, and there can be no assurance that we will be able to attract and retain such personnel. If we are unable to do so, our business, operating results, and financial condition could be materially adversely affected.

We may experience significant errors or security flaws in our product and services, and could face privacy, product liability and warranty claims as a result. Despite testing prior to their release, software products frequently contain errors or security flaws, especially when first introduced or when new versions are released. Errors in our software products could affect the ability of our products to work with other hardware or software products, or could delay the development or release of new products or new versions of products. The detection and correction of any security flaws can be time consuming and costly. Errors or security flaws in our software could result in the inadvertent disclosure of confidential information or personal data relating to our customers, employees, or third parties. Software product errors and security flaws in our products or services could expose us to privacy, product liability and warranty claims as well as harm our reputation, which could impact our future sales of products and services. Our license agreements typically contain provisions intended to limit the nature and extent of our risk of product liability and warranty claims. There is a risk that a court might interpret these terms in a limited way or could hold part or all of these terms to be unenforceable. Also, there is a risk that these contract terms might not bind a party other than the direct customer. Furthermore, some of our licenses with our customers are governed by non-U.S. law, and there is a risk that foreign law might give us less or different protection. Although we have not experienced any material product liability claims to date, a product liability suit or action claiming a breach of warranty, whether or not meritorious, could result in substantial costs and a diversion of management’s attention and our resources.

We face risks related to intellectual property claims or appropriation of our intellectual property rights. We rely primarily on a combination of copyright, trademark and trade secrets laws, as well as confidentiality agreements to protect our proprietary rights. We have obtained patents from the U.S. Patent and Trademark Office relating to the architecture of our systems. We cannot assure that such patents will not be invalidated or circumvented or that rights granted thereunder or the claims contained therein will provide us with competitive advantages. Moreover, despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or to obtain the use of information that we regard as proprietary. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the U.S. There can be no assurance that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar technology.

There can be no assurance that third parties will not claim infringement by us with respect to current or future products. Although we attempt to limit the amount and type of our contractual liability for infringement of the proprietary rights of third parties, these limitations often contain certain exclusions, and we cannot be assured that these limitations will be applicable and enforceable in all cases. Even if these limitations are found to be applicable and enforceable, our liability to our customers for these types of claims could be material in amount given the size of certain of our transactions. We expect that software product developers will increasingly be subject to infringement claims as the number of products and competitors in our industry segment grows and the functionality of products in different industry segments overlaps. Any such claims, with or without merit, could be time-consuming, result in costly litigation, cause product shipment delays, or require us to enter into royalty or licensing agreements. Such royalty or licensing agreements, if required, may not be available on terms acceptable to us or at all, which could have a material adverse effect upon our business, operating results, and financial condition.

14

Table of Contents

If our security measures are breached and unauthorized access is obtained to a customer’s confidential information from our cloud computing service offering, we may be exposed to significant legal and financial liabilities. Our cloud computing service offering allows customers to create and run PRPC-based applications using an internet-based infrastructure. This offering involves the hosting of customers’ confidential information, including personal and financial data regarding their end customers. Security breaches could expose us to a risk of loss or misuse of this information. Our security measures may be breached as a result of third-party action, including intentional misconduct by computer hackers, system error, human error or otherwise. Because the techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. Any security breach could result in a loss of confidence in the security of our service, damage our reputation, disrupt our business, lead to legal liability and negatively impact our future sales.

The acquisition of other businesses and technologies may present new risks. We have undertaken an acquisition during the past two years and may continue to evaluate and consider other potential strategic transactions, including acquisitions of businesses, technologies, services, products and other assets in the future. These acquisitions, if undertaken, may involve significant new risks and uncertainties, including distraction of management attention away from our current business operations, insufficient new revenue to offset expenses, inadequate return on capital, integration challenges, new regulatory requirements, and issues not discovered in our due diligence process. No assurance can be given that such acquisitions will be successful and will not adversely affect our profitability or operations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | Properties |

Our principal administrative, sales, marketing, support, and research and development operations are located at 101 Main Street, Cambridge, Massachusetts in an approximately 105,000 square foot leased facility. The lease for this facility expires in 2013, subject to our option to extend for two additional five-year periods. We also lease space for our other offices in the U.S., Australia, Canada, India, the United Kingdom and in other European countries. These leases expire at various dates through 2020. We believe that additional or alternative space will be available as needed in the future on commercially reasonable terms.

| ITEM 3. | Legal Proceedings |

None.

| ITEM 4. | [Removed and Reserved] |

15

Table of Contents

PART II

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

Our common stock is quoted on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “PEGA.” The following table sets forth the range of high and low sales prices of our common stock on NASDAQ for each quarter in the years ended December 31:

| Common Stock Price | ||||||||||||||||

| 2010 | 2009 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 39.65 | $ | 32.25 | $ | 19.20 | $ | 11.74 | ||||||||

| Second Quarter |

$ | 39.66 | $ | 26.33 | $ | 27.98 | $ | 16.21 | ||||||||

| Third Quarter |

$ | 33.94 | $ | 20.36 | $ | 35.29 | $ | 22.23 | ||||||||

| Fourth Quarter |

$ | 37.81 | $ | 23.92 | $ | 36.09 | $ | 25.75 | ||||||||

Holders

As of February 11, 2011, we had approximately 39 stockholders of record and approximately 26,300 beneficial owners of our common stock.

Dividends

In July 2006, we began paying a quarterly cash dividend of $0.03 per share of common stock. Quarterly cash dividends are expected to continue at $0.03 per share to stockholders of record as of the first trading day of each quarter, subject to change or elimination at any time by our Board of Directors.

Issuer Purchases of Equity Securities

The following table sets forth information regarding our repurchases of our common stock during the fourth quarter of 2010.

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Share Repurchase Program (1) |

Approximate Dollar Value of Shares That May Yet Be Purchased Under Publicly Announced Share Repurchased Programs (1) (in thousands) |

||||||||||||

| 10/1/10 – 10/31/10 |

20,137 | $ | 26.96 | 20,137 | $ | 9,250 | ||||||||||

| 11/1/10 – 11/30/10 |

56,000 | 29.36 | 56,000 | 13,356 | ||||||||||||

| 12/1/10 – 12/31/10 |

3,247 | 36.52 | 3,247 | 13,237 | ||||||||||||

| Total |

79,384 | $ | 29.05 | |||||||||||||

| (1) | Since 2004, our Board of Directors has approved stock repurchase programs that have authorized the repurchase, in the aggregate, up to $80.8 million of our common stock. On November 8, 2010, we announced that our Board of Directors approved an increase in the remaining funds available under the program expiring on December 31, 2010, from $9.2 million to $15 million, and an extension of the |

16

Table of Contents

| expiration date to December 31, 2011. Under this program, purchases may be made from time to time on the open market or in privately negotiated transactions. Shares may be repurchased in such amounts as market conditions warrant, subject to regulatory and other considerations. We have established a pre-arranged stock repurchase plan, intended to comply with the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, and of Rule 10b-18 of the Exchange Act (the “10b5-1 Plan”). All share repurchases under the Current Program during closed trading window periods will be made pursuant to the 10b5-1 Plan. |

Stock Performance Graph and Cumulative Total Stockholder Return

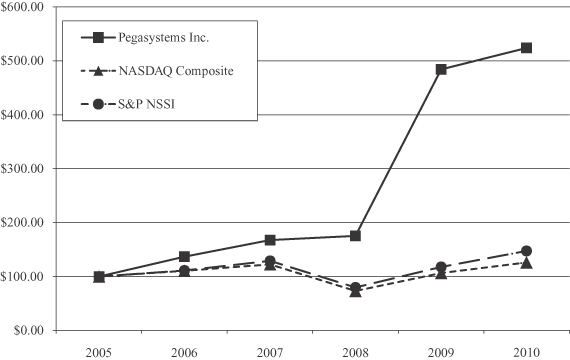

The following performance graph represents a comparison of the cumulative total stockholder return (assuming the reinvestment of dividends) for a $100 investment on December 31, 2005 in our common stock, the Total Return Index for the NASDAQ Composite (“NASDAQ Composite”), a broad market index, and the Standard & Poors (“S&P”) North Software-Software Index™ (“S&P NSSI”), a published industry index that was formerly the S&P Goldman Sachs Technology Software Index. We paid dividends of $0.12 per share during 2010, 2009, 2008, and 2007 and $0.06 per share during 2006. The graph lines merely connect measurement dates and do not reflect fluctuations between those dates.

| 12/31/2005 | 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | |||||||||||||||||||

|

Pegasystems Inc. |

$ | 100.00 | $ | 136.53 | $ | 167.39 | $ | 175.22 | $ | 484.20 | $ | 523.60 | ||||||||||||

| NASDAQ Composite |

$ | 100.00 | $ | 110.39 | $ | 122.15 | $73.32 | $ | 106.58 | $ | 125.93 | |||||||||||||

| S&P NSSI |

$ | 100.00 | $ | 111.03 | $ | 129.06 | $79.75 | $ | 117.95 | $ | 147.62 | |||||||||||||

17

Table of Contents

| ITEM 6. | Selected Financial Data |

The selected financial data presented below has been derived from our audited consolidated financial statements. This data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, the consolidated financial statements and accompanying notes.

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Total revenue |

$ | 336,599 | $ | 264,013 | $ | 211,647 | $ | 161,949 | $ | 126,023 | ||||||||||

| (Loss) income from operations |

(2,580 | ) | 41,819 | 14,479 | 1,951 | (7,114 | ) | |||||||||||||

| (Loss) income before (benefit) provision for income taxes |

(6,197 | ) | 47,415 | 15,672 | 9,942 | 1,187 | ||||||||||||||

| Net (loss) income |

(5,891 | ) | 32,212 | 10,977 | 6,595 | 1,842 | ||||||||||||||

| Net (loss) earnings per share: |

||||||||||||||||||||

| Basic |

$ | (0.16 | ) | $ | 0.89 | $ | 0.30 | $ | 0.18 | $ | 0.05 | |||||||||

| Diluted |

$ | (0.16 | ) | $ | 0.85 | $ | 0.29 | $ | 0.18 | $ | 0.05 | |||||||||

| Cash dividends declared per common share |

$ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.09 | ||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||

| Total cash, cash equivalents, and marketable securities |

$ | 87,251 | $ | 202,653 | $ | 167,229 | $ | 149,981 | $ | 127,758 | ||||||||||

| Working capital |

71,944 | 188,552 | 159,080 | 159,547 | 147,229 | |||||||||||||||

| Long-term license installments, net of unearned interest income |

1,223 | 2,976 | 5,413 | 8,267 | 17,458 | |||||||||||||||

| Intangible assets, net of accumulated amortization |

80,684 | 336 | 479 | - | - | |||||||||||||||

| Goodwill |

22,618 | 2,391 | 2,141 | 1,933 | 2,346 | |||||||||||||||

| Total assets |

337,481 | 279,585 | 245,850 | 243,307 | 214,008 | |||||||||||||||

| Stockholders’ equity |

195,670 | 205,219 | 173,114 | 172,944 | 166,158 | |||||||||||||||

The following items impact the comparability of our consolidated financial data:

| — | Our acquisition of Chordiant in April 2010. See Note 7 “Acquisition, Goodwill, and Other Intangibles Assets” in the notes to the accompanying audited consolidated financial statements for further discussion. |

| — | Foreign currency transaction (losses) gains of $(5.6) million, $2.1 million, $(4.5) million, $0.3 million, and $1.2 million during the years ended December 31, 2010, 2009, 2008, 2007, and 2006, respectively. See Item 7A. “Quantitative and Qualitative Disclosure about Market Risk” for further discussion of our foreign currency exchange risk. |

18

Table of Contents

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Business overview

We develop, market, license, and support software to automate complex, changing business processes. Our software enables organizations to build, deploy, and change enterprise applications easily and quickly by directly capturing business objectives, automating programming, and automating work. Our software is used to build a wide range of business process solutions including customer on-boarding and account opening, CRM, exception and case management, and risk/fraud and compliance management. We also provide professional services, maintenance, and training related to our software.

We focus our sales efforts on target accounts, which are large companies or divisions within companies, and typically leaders in their industry. Our strategy is to sell initial licenses that are focused on a specific purpose or area of operations, rather than selling large enterprise licenses. This strategy allows our customers to quickly realize business value from our software and limits their initial investment. Once a customer has realized this initial value, we work with the customer to identify opportunities for follow-on sales.

Our license revenue is primarily derived from sales of our PRPC software and related solution frameworks. PRPC is a comprehensive platform for building and managing BPM applications that unifies business rules and business processes. Our solution frameworks are built on the capabilities of PRPC and are purpose or industry-specific collections of best practice functionality to allow organizations to quickly implement new customer-facing practices and processes, bring new offerings to market, and provide customized or specialized processing. These products often result in shorter implementation periods than competitive enterprise software products. PRPC and related solution frameworks can be used by a broad range of customers within financial services, insurance and healthcare markets, as well as other markets, such as life sciences and government.

As a result of our acquisition of Chordiant in April 2010, we expanded our ability to develop and license CRM software. We acquired additional products (Chordiant Decision Management, Chordiant Foundation Server, and Chordiant Marketing Director solutions) that enable customers to maximize customer lifetime value through a suite of industry-leading technologies. We intend to remain a leader in the use of decision management to improve customer experiences, provide better cross-sell/up-sell abilities, and aid customer retention by leveraging our flexible, Build for Change configuration capabilities.

We also offer Pega Cloud, which is our cloud computing service offering that allows customers to create and run PRPC applications using an internet-based infrastructure. This offering enables our customers to immediately build, test, and deploy their applications in a secure cloud environment while minimizing their infrastructure and hardware costs.

Our total revenue increased 27% in 2010 compared to 2009 and reflects revenue growth in each of software license, maintenance, and professional services revenue. Maintenance revenue increased 67% primarily due to the recognition of the fair value of deferred maintenance revenue acquired from Chordiant and the continued increase in the aggregate value of the installed base of our software. Due to the rapid integration of the products, sales force, and operations of Chordiant, it is no longer feasible to separately identify revenue from new arrangements as being attributable to either Chordiant or Pegasystems. However, our total revenue in 2010 includes approximately $12.1 million of maintenance revenue related to the recognition of the fair value of deferred maintenance revenue acquired from Chordiant and approximately $3.6 million of professional services revenue related to Chordiant professional services arrangements existing at the acquisition date. We incurred $5.9 million of acquisition-related expenses and $8.1 million in restructuring costs associated with our acquisition of Chordiant. In 2010, we generated approximately $18.4 million in cash from operations, which was primarily driven by our net loss as adjusted for noncash items and changes in working capital, and ended the year with $87.3 million in cash, cash equivalents, and marketable securities.

19

Table of Contents

We believe our growth and success in 2010 were due to:

| — | Increased market acceptance of our industry leading technology; |

| — | Expansion of our solutions frameworks offerings; |

| — | Disciplined and focused strategy of selling to targeted customers; |

| — | Expansion of our targeted customer list; |

| — | Development and growth of our proficiency across new industries; and |

| — | Our acquisition of Chordiant. |

We believe that the ongoing challenges for our business include our ability to drive revenue growth, expand our expertise in new and existing industries, remain a leader in the decision management market, and maintain our leadership position in the BPM market.

To support our growth and successfully address these challenges through 2011 we plan to:

| — | Invest in our research and development by significantly increasing headcount; |

| — | Hire significantly more sales and marketing professionals; |

| — | Expand our partner alliances; and |

| — | Develop and increase our solutions frameworks offerings and expertise across targeted industries. |

RESULTS OF OPERATIONS

2010 Compared to 2009

| (Dollars in thousands) | Year Ended December 31, | Increase (Decrease) | ||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Total revenue |

$ | 336,599 | $ | 264,013 | $ | 72,586 | 27 | % | ||||||||

| Gross profit |

207,865 | 173,076 | 34,789 | 20 | % | |||||||||||

| Acquisition-related costs |

5,924 | - | 5,924 | n/m | ||||||||||||

| Restructuring costs |

8,064 | - | 8,064 | n/m | ||||||||||||

| Other operating expenses |

196,457 | 131,257 | 65,200 | 50 | % | |||||||||||

| Total operating expenses |

210,445 | 131,257 | 79,188 | 60 | % | |||||||||||

| (Loss) income before (benefit) provision for income taxes |

(6,197) | 47,415 | (53,612) | (113) | % | |||||||||||

n/m – not meaningful

We continue to experience demand for our software solutions and related services, which we believe is due to the strong value proposition, short implementation period, and variety of licensing models we offer our customers.

The increase in gross profit was primarily due to the increase in maintenance and license revenue.

The increase in operating expenses during 2010 was primarily due to the continued expansion of our sales force and our research and development operations. It was also due to the acquisition-related expenses and restructuring costs associated with our acquisition of Chordiant.

20

Table of Contents

The decrease in (loss) income before (benefit) provision for income taxes during 2010 compared to 2009 was primarily due to the higher growth rate in operating expenses and lower total gross profit percent in 2010. The lower total gross profit percent was due to lower software license gross profit percent in 2010 as a result of the amortization of acquired Chordiant technology intangible assets. The decrease in (loss) income before (benefit) provision for income taxes was also due to the $5.6 million foreign currency transaction loss in 2010 compared to a gain of $2.1 million in 2009.

Revenue

| (Dollars in thousands) | Year Ended December 31, |

Increase (Decrease) |

||||||||||||||||||||||

| 2010 | 2009 | |||||||||||||||||||||||

| License revenue |

||||||||||||||||||||||||

| Perpetual licenses |

$ | 79,041 | 66 | % | $ | 71,678 | 62 | % | $ | 7,363 | 10 | % | ||||||||||||

| Term licenses |

31,940 | 27 | % | 36,638 | 32 | % | (4,698 | ) | (13) | % | ||||||||||||||

| Subscription |

8,858 | 7 | % | 7,618 | 6 | % | 1,240 | 16 | % | |||||||||||||||

| Total license revenue |

$ | 119,839 | 100 | % | $ | 115,934 | 100 | % | $ | 3,905 | 3 | % | ||||||||||||

License revenue is primarily due to new license arrangements executed in the period. Through the first three quarters of 2010, the aggregate value of new license arrangements executed was lower compared to the same periods in 2009. However, we executed a record aggregate value of new license arrangements during the fourth quarter of 2010, and as a result, the aggregate value of new license arrangements executed for the year exceeded that of 2009. Consistent with our strategy to focus on follow-on sales to our targeted customers, approximately 75% of the aggregate value of new license arrangements executed during 2010 were from existing customers.

The increase in perpetual license revenue during 2010 compared to 2009 was driven by an increase in the number and value of new perpetual license arrangements. Many of our perpetual license arrangements include extended payment terms and/or additional rights of use that delay the recognition of revenue to future periods. The aggregate value of payments due under these perpetual and certain subscription licenses was $32.8 million as of December 31, 2010 compared to $57.1 million as of December 31, 2009. See the table of future cash receipts by year from perpetual and subscription licenses on page 31.

We recognize revenue for our term license arrangements over the term of the agreement as payments become due or earlier if prepaid. Our term license revenue decreased in 2010 compared to 2009 primarily due to more prepayments of term licenses by a few customers in 2009 and the expiration of one term license in 2009. While term license revenue decreased in 2010, the aggregate value of new term license arrangements executed in 2010 was significantly higher than in 2009. As a result, the aggregate value of future payments due under term licenses increased to $90.9 million as of December 31, 2010 compared to $76.3 million as of December 31, 2009 and includes approximately $30.9 million of term license payments that we expect to recognize as revenue in 2011. Our term license revenue in 2011 could be higher than $30.9 million as we complete new term license agreements in 2011 or if we receive prepayments from existing term license agreements. See the table of future cash receipts by year from these term licenses on page 31.

A change in the mix between perpetual and term license arrangements executed, which varies based on customer needs, can cause our revenues to vary materially quarter to quarter.

21

Table of Contents

Subscription revenue primarily relates to our arrangements that include a right to unspecified future products and is recognized ratably over the term of the arrangement. The increase in subscription revenue during 2010 compared to 2009 was due to a new customer arrangement that began in the third quarter of 2009 and continued through all of 2010. The timing of scheduled payments under customer arrangements and a change in a customer’s selection of a renewal option can cause our subscription revenue to vary quarter to quarter.

| (Dollars in thousands) | Year Ended December 31, | Increase | ||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Maintenance revenue |

||||||||||||||||

| Maintenance |

$ | 83,878 | $ | 50,099 | $ | 33,779 | 67 | % | ||||||||

The increase in maintenance revenue during 2010 compared to 2009 was primarily due to the $12.1 million in maintenance revenue attributable to the recognition of the fair value of deferred maintenance revenue acquired from Chordiant and the continued increase in the aggregate value of the installed base of our software.

| (Dollars in thousands) | Year Ended December 31, | Increase | ||||||||||||||||||||||

| 2010 | 2009 | |||||||||||||||||||||||

| Professional services revenue |

||||||||||||||||||||||||

| Consulting services |

$ | 126,283 | 95 | % | $ | 93,910 | 96 | % | $ | 32,373 | 34 | % | ||||||||||||

| Training |

6,599 | 5 | % | 4,070 | 4 | % | 2,529 | 62 | % | |||||||||||||||

| Total Professional services |

$ | 132,882 | 100 | % | $ | 97,980 | 100 | % | $ | 34,902 | 36 | % | ||||||||||||

Professional services are primarily consulting services related to new license implementations. The increase in consulting services and training revenue during 2010 compared to 2009 was primarily due to a higher demand for these services in North America associated with new license arrangements executed in the later part of 2009 and includes approximately $3.6 million of revenue associated with professional services arrangements existing at the acquisition date of Chordiant.

| (Dollars in thousands) | Year Ended December 31, | Increase | ||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Gross Profit |

||||||||||||||||

| Software license |

$ | 115,536 | $ | 115,813 | $ | (277 | ) | n/m | ||||||||

| Maintenance |

72,837 | 43,896 | 28,941 | 66 | % | |||||||||||

| Professional services |

19,492 | 13,367 | 6,125 | 46 | % | |||||||||||

| Total gross profit |

$ | 207,865 | $ | 173,076 | $ | 34,789 | 20 | % | ||||||||

| Total gross profit percent |

62 | % | 66 | % | ||||||||||||

| Software license gross profit percent |

96 | % | 100 | % | ||||||||||||

| Maintenance gross profit percent |

87 | % | 88 | % | ||||||||||||

| Professional services gross profit percent |

15 | % | 14 | % | ||||||||||||

n/m – not meaningful

The decrease in software license gross profit percent during 2010 compared to 2009 was due to the amortization of acquired technology intangibles related to Chordiant.

22

Table of Contents

Gross profit percent for maintenance and professional services during 2010 were relatively unchanged compared to 2009.

| (Dollars in thousands) |

Year Ended December 31, |

Increase | ||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Amortization of intangibles: |

||||||||||||||||

| Cost of software license |

$ | 4,231 | $ | 121 | $ | 4,110 | n/m | |||||||||

| Selling and marketing |

3,285 | - | 3,285 | n/m | ||||||||||||

| General and administrative |

185 | 20 | 165 | n/m | ||||||||||||

| $ | 7,701 | $ | 141 | $ | 7,560 | n/m | ||||||||||

n/m – not meaningful

The increase in amortization expense during 2010 compared to 2009 was due to the amortization associated with $88 million of acquired intangible assets recognized as a result of the purchase price allocation of Chordiant. The identifiable intangible assets are expected to be amortized over a weighted-average period of 8.4 years on a straight-line basis.

Operating expenses

| (Dollars in thousands) |

Year Ended December 31, |

Increase | ||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Selling and marketing |

||||||||||||||||

| Selling and marketing |

$ | 116,230 | $ | 74,378 | $ | 41,852 | 56 | % | ||||||||

| As a percent of total revenue |

35 | % | 28 | % | ||||||||||||

| Selling and marketing headcount |

377 | 253 | 124 | 49 | % | |||||||||||

Selling and marketing expenses include compensation, benefits, and other headcount-related expenses associated with our selling and marketing personnel as well as expenses for advertising, promotions, trade shows, seminars, and other programs. Selling and marketing expenses also include the amortization of customer related intangibles.

We significantly increased sales hiring in the first half of 2010 in order to target new accounts across expanded geographies and to create additional sales capacity for future periods. The increase in selling and marketing expenses was primarily due to a $23.3 million increase in compensation and benefit expenses associated with higher headcount, a $3.3 million increase in amortization expense related to the acquired Chordiant customer related intangibles, a $3.9 million increase in travel expenses, a $3.2 million increase in expenses related to marketing programs, including our 2010 PegaWorld user conference. We did not host a PegaWorld conference in 2009. The increase was also due to a $1.0 million increase in contractor services, a $1.0 million increase in telecom expenses, a $0.5 million increase in training expenses and a $0.3 million increase in agency and recruiting expenses.

| (Dollars in thousands) |

Year Ended December 31, |

Increase | ||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Research and development |

||||||||||||||||

| Research and development |

$ | 55,193 | $ | 38,862 | $ | 16,331 | 42 | % | ||||||||

| As a percent of total revenue |

16 | % | 15 | % | ||||||||||||

| Research and development headcount |

397 | 222 | 175 | 79 | % | |||||||||||