Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMNICARE INC | form8k-barclays.htm |

Barclays Capital

2011 Global Healthcare Conference

2011 Global Healthcare Conference

March 16, 2011

Exhibit 99.1

Forward-Looking Statements

Except for historical information discussed, the statements made today are

forward-looking statements that involve risks and uncertainties. Investors

are cautioned that such statements are only predictions and that actual

events or results may differ materially.

forward-looking statements that involve risks and uncertainties. Investors

are cautioned that such statements are only predictions and that actual

events or results may differ materially.

These forward-looking statements speak only as of this date. We undertake

no obligation to publicly release the results of any revisions to the forward-

looking statements made today, to reflect events or circumstances after

today or to reflect the occurrence of unanticipated events.

no obligation to publicly release the results of any revisions to the forward-

looking statements made today, to reflect events or circumstances after

today or to reflect the occurrence of unanticipated events.

To facilitate comparisons and enhance understanding of core operating

performance, certain financial measures have been adjusted from the

comparable amount under Generally Accepted Accounting Principles

(GAAP). A detailed reconciliation of adjusted numbers to GAAP is posted

the Investor Relations section of our Web site at http://ir.omnicare.com.

performance, certain financial measures have been adjusted from the

comparable amount under Generally Accepted Accounting Principles

(GAAP). A detailed reconciliation of adjusted numbers to GAAP is posted

the Investor Relations section of our Web site at http://ir.omnicare.com.

2

Omnicare Today

3

Omnicare Today…

A Leading Provider of Pharmacy Services

A Leading Provider of Pharmacy Services

• Long-term care pharmacy

– Pharmacy services for skilled nursing,

assisted living, chronic care and other settings

assisted living, chronic care and other settings

– 47 states, District of Columbia and Canada

– Dispenses over 110 million prescriptions/year

– Industry leader

• Specialty care

– Supports patients, providers, care-givers,

nurses, physicians and bio-pharmaceutical

companies

nurses, physicians and bio-pharmaceutical

companies

– Dispenses over 8 million prescriptions/year

– Emerging provider with growth rates

outpacing industry average

outpacing industry average

Long-term care pharmacy and specialty care provide two attractive platforms for growth

4

Management Team Changes

New Team Focused on Execution and Growth

New Team Focused on Execution and Growth

• Appointment of John Workman to Additional Role of President

– In addition to CFO role, oversees purchasing, HR, IT and trade relations

• Additional talent added to Omnicare team

– Chief Executive Officer

– President of Specialty Care

– SVP of Finance

– SVP of Human Resources

– SVP of Trade Relations

– Promoted five operators to lead newly defined LTC divisions

5

Transitioning to an Operations-Driven Company

• Focus on corporate culture

– Management team changes

– Instill collaborative environment,

encourage employee innovation

encourage employee innovation

– Organization-wide focus on the customer

– Reinforce a commitment to compliance

• Reallocation of resources

– Align employee interests

– Reshape the organization to bring it

closer to the customer

closer to the customer

– Improve accountability with divisional

realignment

realignment

6

7

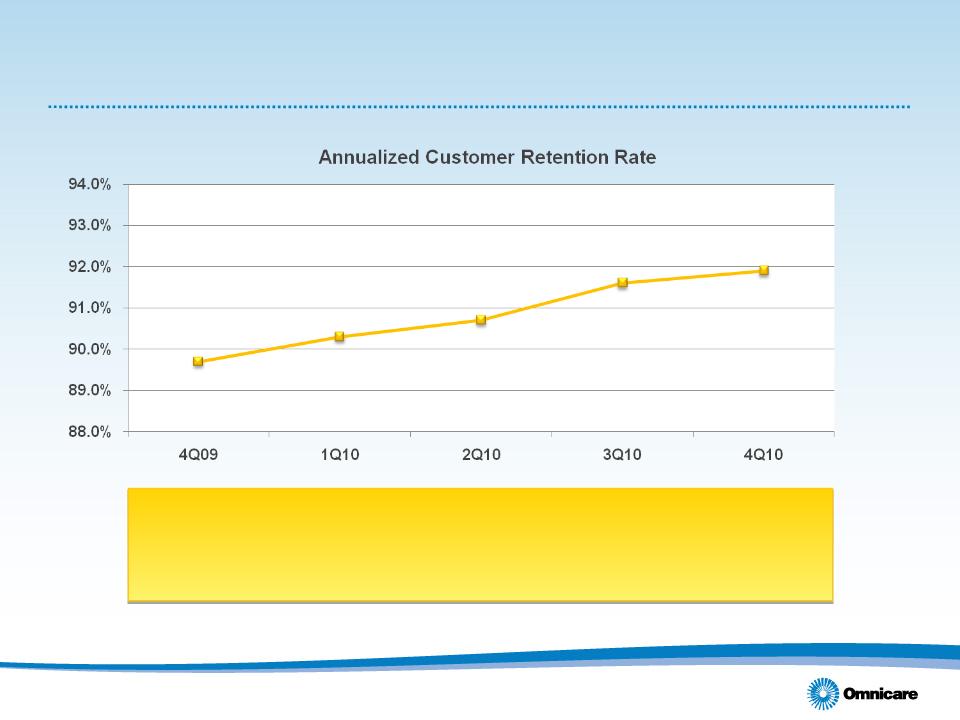

Objective is to minimize controllable losses and generate

at least 95% customer retention on a consistent basis

Focus on Customer Service

Early Response to Customer-Focused Initiatives

Early Response to Customer-Focused Initiatives

8

Transitioning to an Operations-Driven Company

Improve Sales Performance

Improve Sales Performance

• Reorganization of the sales force

– Reassess alignment of sales force

– Deploy resources in attractive markets

– Improve coordination of selling process

• Investments to enhance selling effectiveness

– Develop industry-leading training program

– Reposition leading technology offering

– Create consistent market message

– Investments in sales tools

– Revamped compensation structure

9

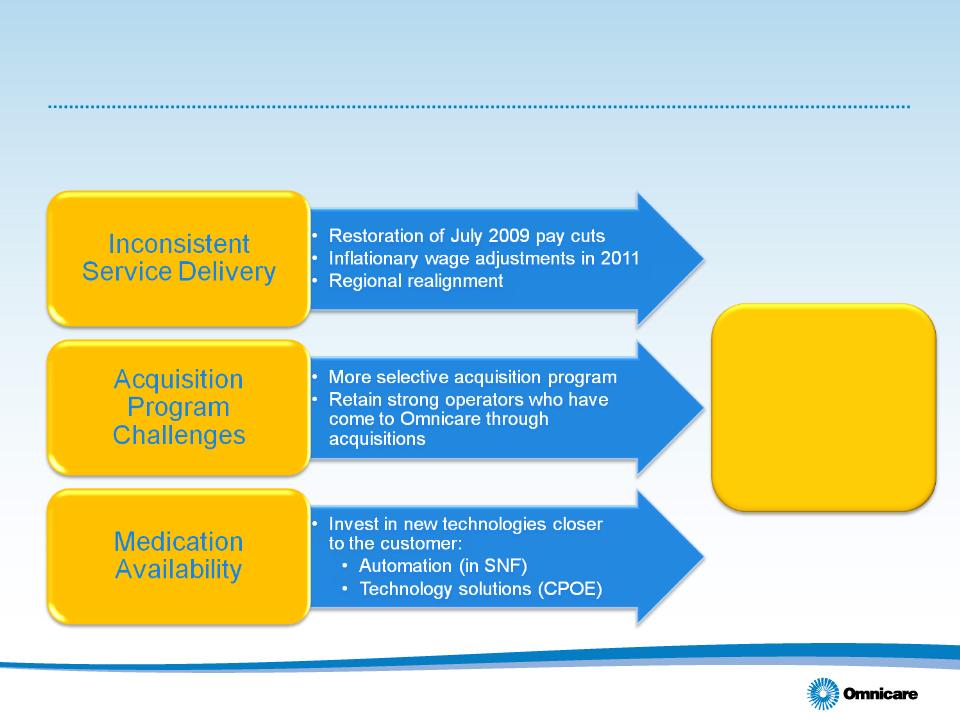

Transitioning to an Operations-Driven Company

Focus on Customer Service

Focus on Customer Service

Net Bed

Growth

Growth

Problem

Solution

Result

10

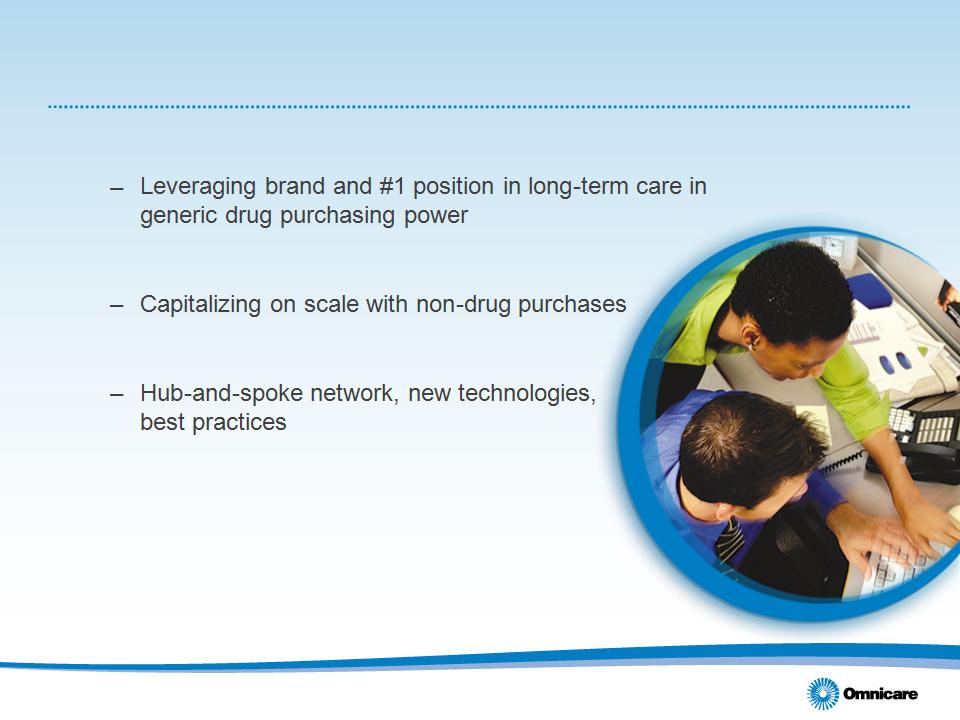

Transitioning to an Operations-Driven Company

Initiatives Focused on Productivity Improvements

Initiatives Focused on Productivity Improvements

• Drug purchasing

• Strategic sourcing

• Operating initiatives

11

Industry Outlook

12

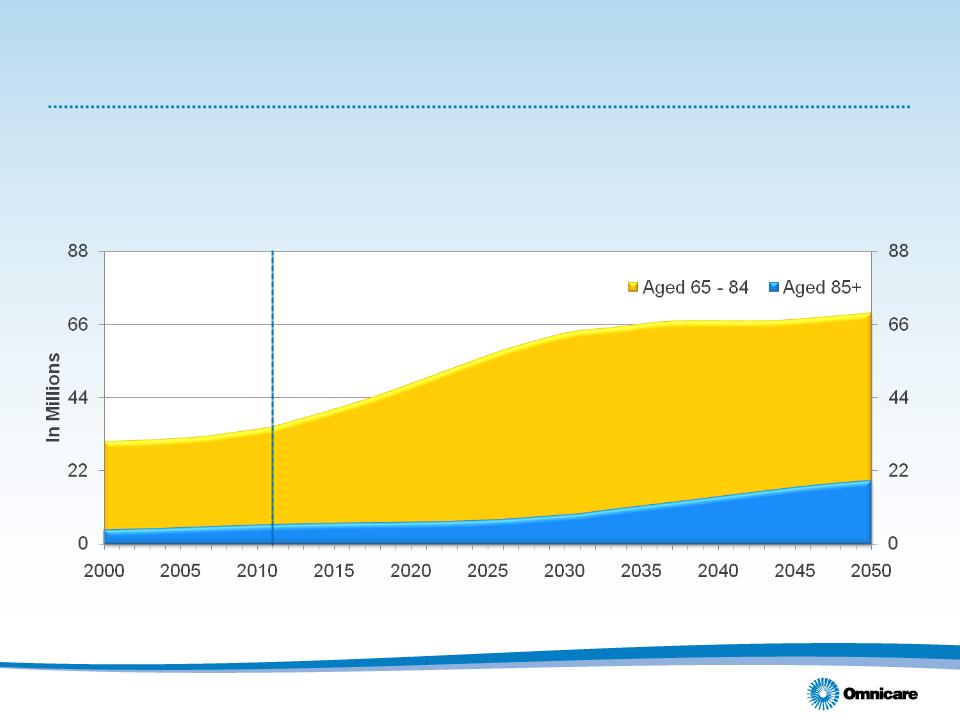

Demographic Trends

Aging Population Shaping Healthcare

Aging Population Shaping Healthcare

• Life expectancy continues to lengthen

• Significant population mix shift towards seniors

Source: U.S. Census Bureau

13

Pharmaceutical Market

Trends

Trends

• Branded drugs

• Major market shift to generic drugs

• Development and utilization of

specialty drugs increasing

specialty drugs increasing

14

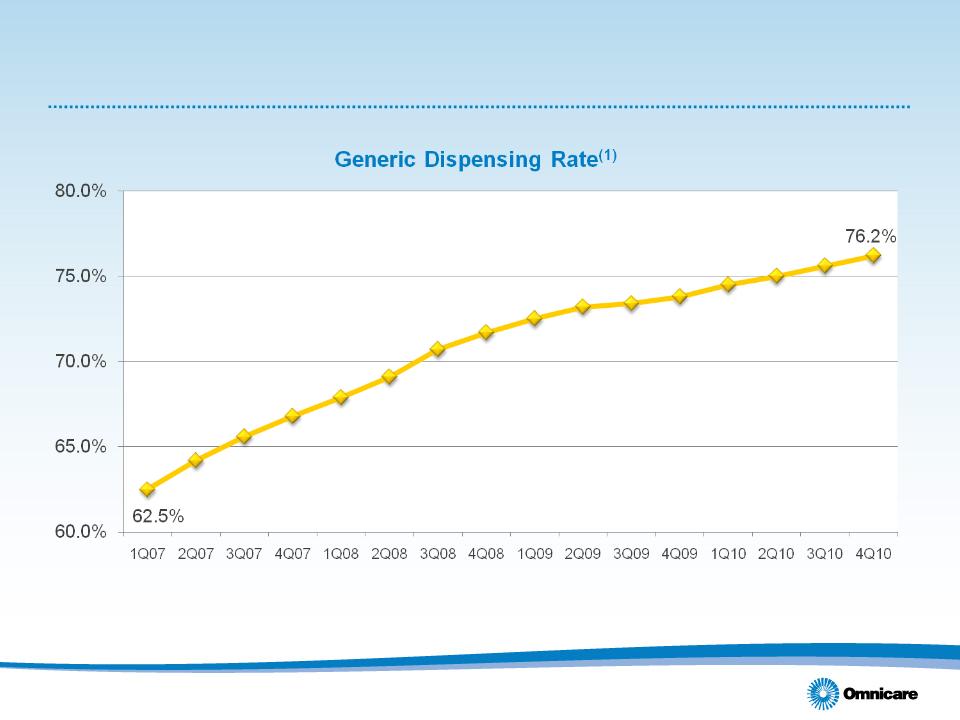

Brand to Generic Drugs

Increasing Utilization of Generics

Increasing Utilization of Generics

(1) Omnicare’s generic prescriptions dispensed as a percent of total scripts

15

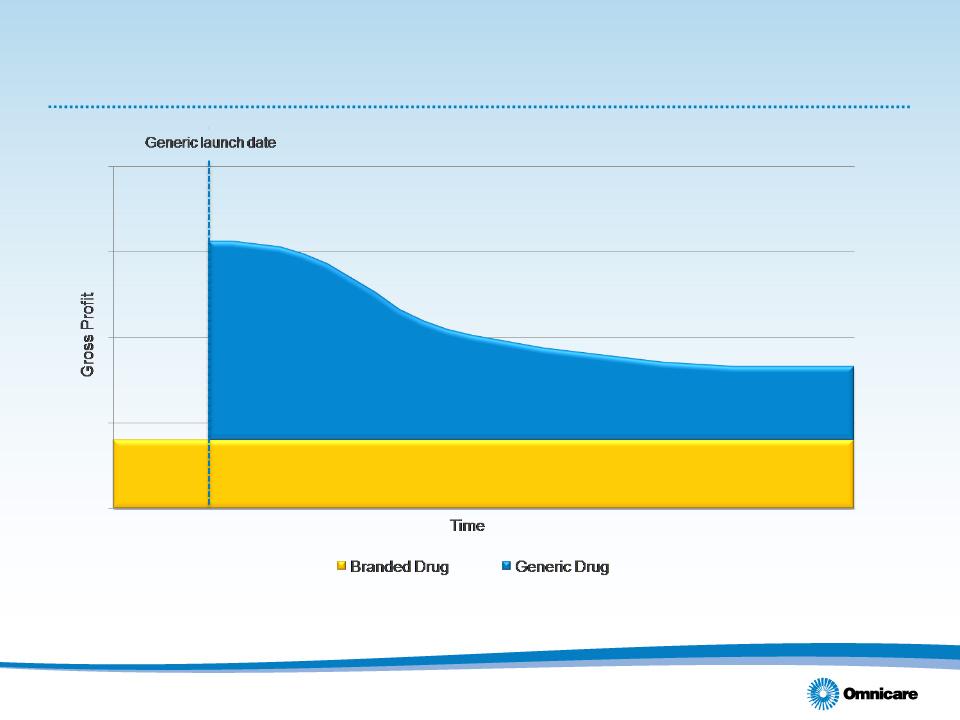

Major Shift to Generic Drugs

Benefits

Benefits

• Omnicare’s sourcing abilities create unique

opportunity within industry

opportunity within industry

– #1 buyer of generics in long-term care

channel

channel

• Reduces sales, but increases gross profit -

both dollars and margins

both dollars and margins

• Favorable impact on working capital

16

Major Shift to Generic Drugs

Typical Life Cycle of Nonexclusive Generic Drug

Typical Life Cycle of Nonexclusive Generic Drug

NOTE: Graph is for illustrative purposes only. Not representative of every generic drug, as each generic drug has unique

characteristics.

characteristics.

17

(1) All generic launches are subject to change due to litigation or pediatric exclusivity.

|

2011

|

2012

|

2013

|

|

Fazaclo

|

Actos

|

Aciphex

|

|

Femara

|

Diovan

|

Asacol

|

|

Gabitril

|

Geodon

|

Avodart

|

|

Levaquin

|

Invega

|

Cymbalta

|

|

Lipitor

|

Lexapro

|

Humalog

|

|

Primaxin Inj

|

Lidoderm

|

Lupron Depot

|

|

Uroxatrol

|

Plavix

|

Niaspan SR

|

|

Vancocin Caps

|

Seroquel

|

Oxycontin

|

|

Xalatan

|

Singulair

|

Renagel

|

|

Zyprexa

|

Xopenex

|

Travatan

|

2011-2013 Potential Patent Expirations(1),(2)

Geriatric Market

Geriatric Market

18

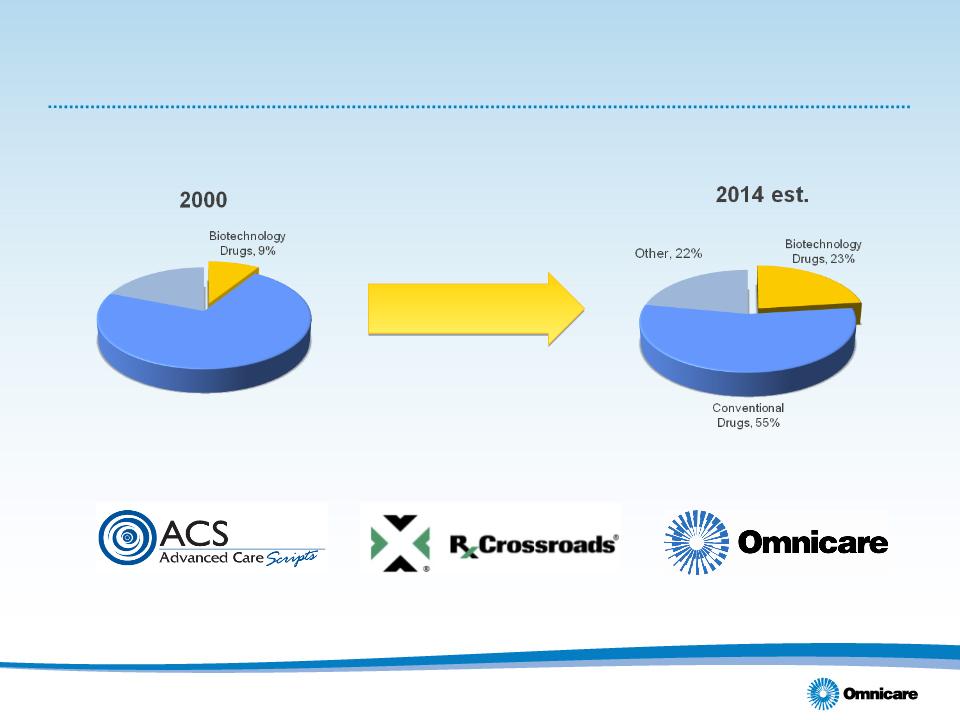

Specialty Pharmaceuticals

A Growth Industry

A Growth Industry

Pharmaceutical Market Share(1) by Drug Type

Mail order specialty pharmacy

Outsourced services for

biotechnology firms

biotechnology firms

Omnicare’s institutional

pharmacies

pharmacies

Conventional

Drugs, 72%

Drugs, 72%

Other, 19%

Omnicare’s Positioning Within Specialty Pharmaceuticals…

(1) Source: EvaluatePharma

19

Growth

20

Specialty Care

Growth Outside Institutional Setting

Growth Outside Institutional Setting

Omnicare specialty care growth has been robust…and opportunities

exist to further accelerate growth through:

exist to further accelerate growth through:

• Addition of new leadership

• Coordination of efforts

• Leveraging long-term care business and relationships to create new

opportunities

opportunities

• Penetrate additional disease states

– Primary disease states currently multiple sclerosis and oncology

• Potential additional acquisitions to fill-out portfolio in the future

Two-year CAGR(1) for Omnicare’s specialty care businesses > 20%

(1) Quarterly revenues based on fourth quarter 2010 results for Advanced Care Scripts, RxCrossroads and excelleRx

(as compared with fourth quarter 2008 results)

(as compared with fourth quarter 2008 results)

21

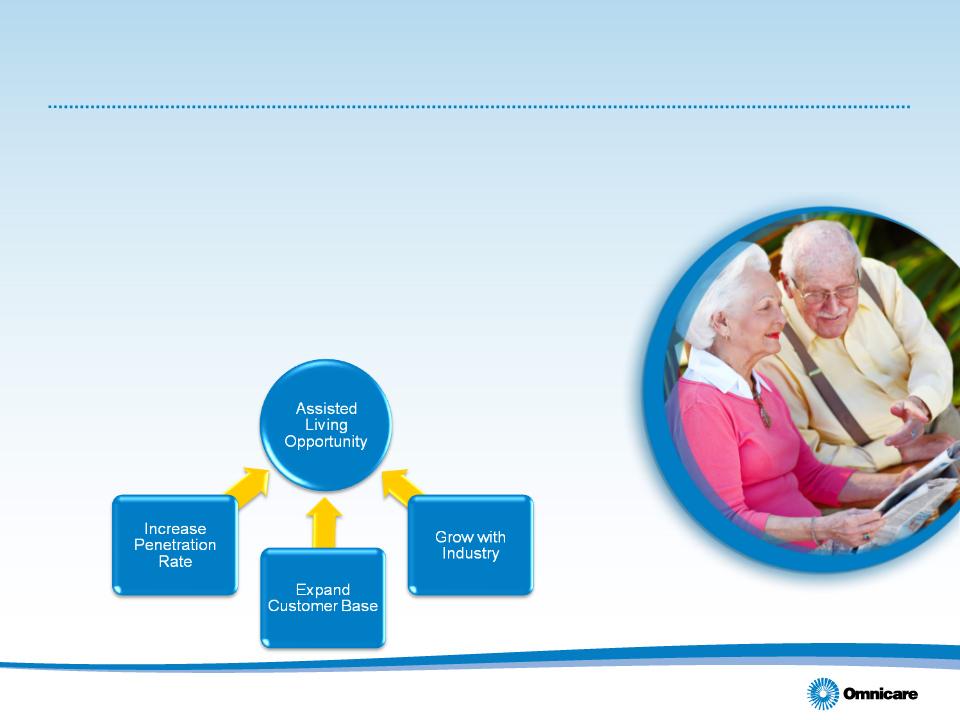

Long-Term Care

• Skilled Nursing Facilities

– Organic growth through improved customer

service, technology

service, technology

– Selected acquisitions

• Assisted Living Facilities

– Three-pronged growth opportunity

22

Financial Elements

23

Fourth Quarter 2010 Highlights

• Scripts dispensed increased 2.1% sequentially

– Scripts benefitted from a full quarter’s impact of the CCRx acquisition

– Utilization relatively even sequentially

– Census was lower, although rate of decline improved again sequentially

• Qtr. ending number of beds served(1) even sequentially

– Patient assistance programs up 5,000; LTC beds 5,000 lower

– Losses 3.7% lower sequentially, 25.7% lower compared to 4Q09

• Net sales, gross profit higher sequentially; gross margin even at 22.0%(2),(3)

• Adjusted EBITDA(2),(3) up 4.4% sequentially to $146.9 million; margin

expansion of 30 basis points to 9.4%

expansion of 30 basis points to 9.4%

• Adjusted EPS(2),(3) of $0.51; 1.9% lower sequentially from $0.52 due to

higher effective tax rate in 4Q10

higher effective tax rate in 4Q10

• $21.9 million returned to shareholders through dividends and share

repurchases

repurchases

24

(1) Includes patients served under patient assistance programs.

(2) Excludes discontinued operations.

(3) Excludes special items. A reconciliation of certain non-GAAP information has been attached to our press release and is also available on our Web

site under ‘Supplemental Financial Information’ from the ‘Investors’ page..

site under ‘Supplemental Financial Information’ from the ‘Investors’ page..

(1) Excludes discontinued operations.

(2) Excludes special items. A reconciliation of certain non-GAAP information is available on Omnicare’s Web site under ‘Supplemental

Financial Information’ from the ‘Investors’ page.

Financial Information’ from the ‘Investors’ page.

Financial Performance

2010 Progression (In $ millions, except per share data)

2010 Progression (In $ millions, except per share data)

25

Focus on Cash Flows

(1) Excludes discontinued operations.

(2) Cash flows from continuing operations includes approximately $38 million of settlement payments and approximately $8 million in

tender premium payments in 2Q10, $21 million of settlement payments in 3Q10 and $7 million of separation-related payments

related to three former Omnicare executives in 3Q10.

tender premium payments in 2Q10, $21 million of settlement payments in 3Q10 and $7 million of separation-related payments

related to three former Omnicare executives in 3Q10.

(3) Excludes special items. A reconciliation of certain non-GAAP information is available on Omnicare’s Web site under

‘Supplemental Financial Information’ from the ‘Investors’ page.

‘Supplemental Financial Information’ from the ‘Investors’ page.

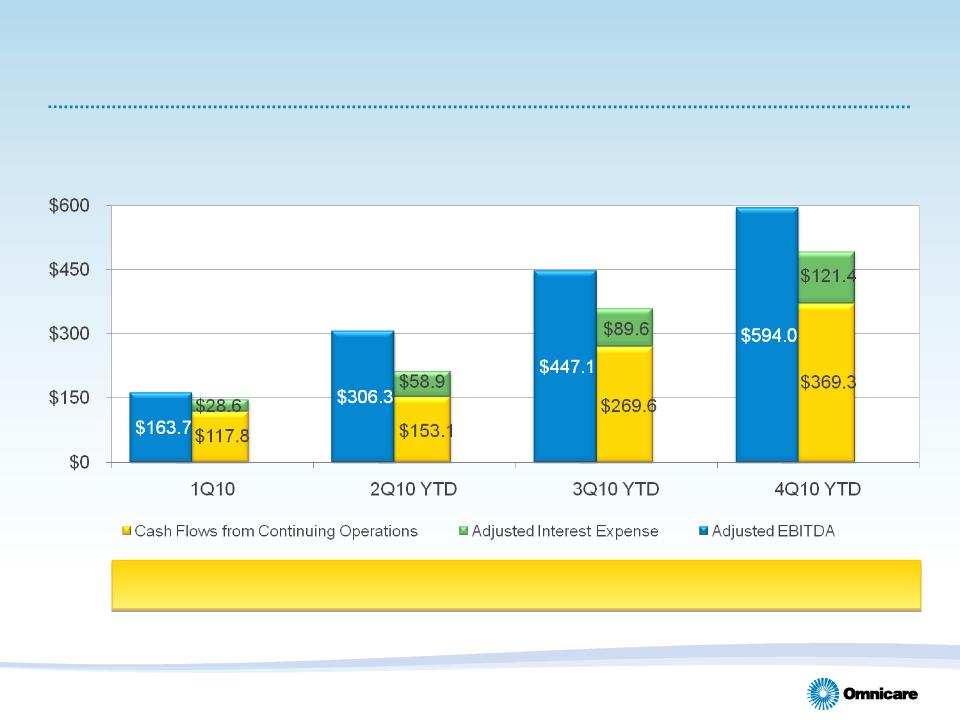

2010 YTD Cash Flows from Continuing Operations(1),(2) and Interest Expense vs.

YTD Adjusted EBITDA(1),(3) (in $ millions)

Significant amount of EBITDA translates into cash flow from operations.

26

Cash Deployment

27

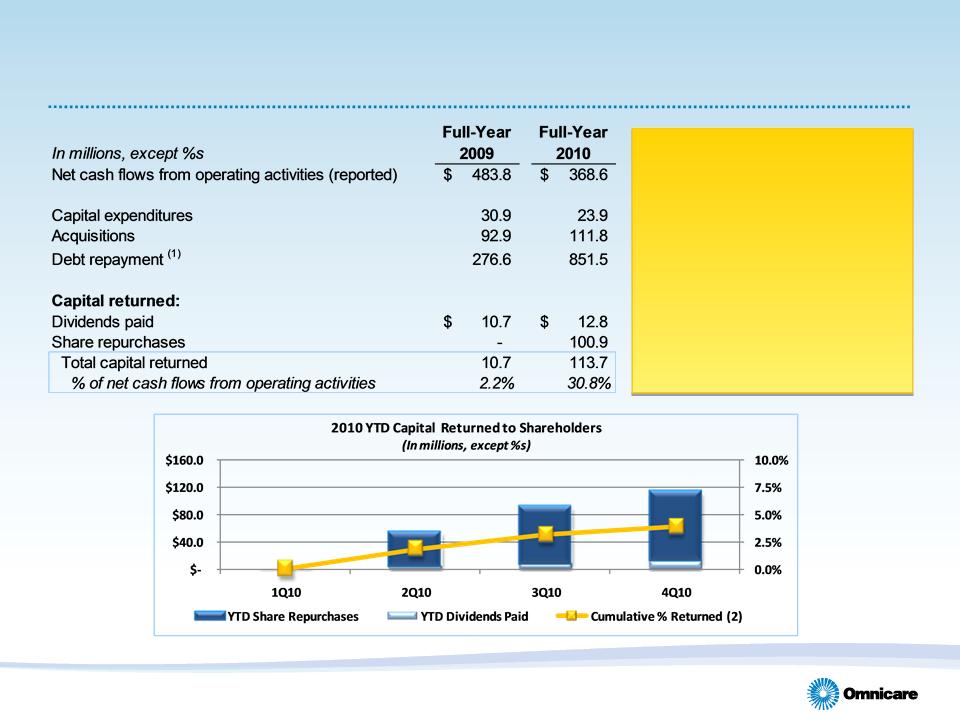

(1) During the second quarter of 2010, Omnicare issued $400 million of 7.75% Senior Subordinated Notes due 2020 and tendered $217 million of 6.75% Senior

Subordinated Notes due 2013. During the fourth quarter of 2010, Omnicare issued $575 million convertible debentures due 2025 and repurchased $525

million of 3.25% convertible debentures due 2035 with a put option in 2015.

Subordinated Notes due 2013. During the fourth quarter of 2010, Omnicare issued $575 million convertible debentures due 2025 and repurchased $525

million of 3.25% convertible debentures due 2035 with a put option in 2015.

(2) Cumulative % Returned = (Dividends Paid + Share Repurchases) / 12/31/09 Market Capitalization of $2,908.4 million.

• Full-year 2010 acquisition spend

largely driven by CCRX acquisition

largely driven by CCRX acquisition

• 4Q10 dividend of $0.0325 per share

• Repurchased an additional 0.8

million shares ($18.2 million) during

4Q10 (4.4 million shares

repurchased in 2010)

million shares ($18.2 million) during

4Q10 (4.4 million shares

repurchased in 2010)

• $99.1 million of authorization

remaining under current share

repurchase program as of Dec. 31,

2010.

remaining under current share

repurchase program as of Dec. 31,

2010.

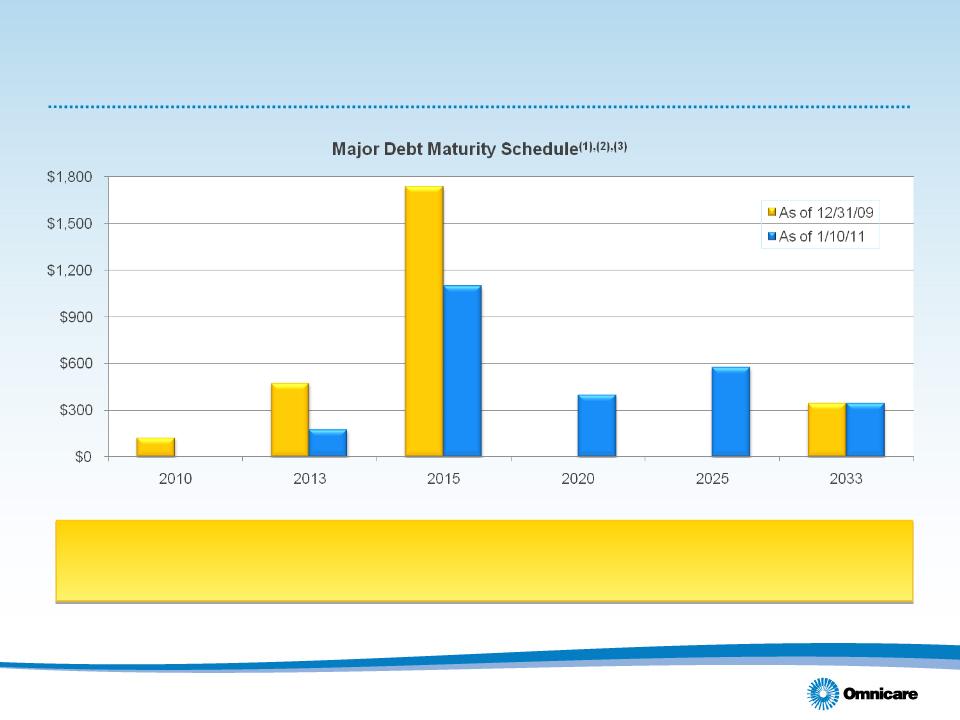

(1) Assumes convertible debentures due 2035 are put to the company in 2015 with related tax capture included.

(2) Debt amounts shown exclusive of unamortized debt discount.

(3) In $ millions

Capital Structure

Recent capital restructuring initiatives have extended maturities,

providing more flexibility for capital allocation strategies

28

29

(1) Excludes special items and discontinued operations

(2) Effective January 1, 2009 the Company adopted the provisions of the authoritative guidance regarding Accounting for Convertible Debt

Instruments That May be Settled in Cash upon Conversion (Including Partial Cash Settlement). 2008 is restated for this change in accounting.

Instruments That May be Settled in Cash upon Conversion (Including Partial Cash Settlement). 2008 is restated for this change in accounting.

(3) Results have been revised to reflect results of certain home healthcare and related ancillary businesses as discontinued operations.

Credit Profile (1)

Three-Year Trend

|

|

2008 (2),(3)

|

2009

|

2010

|

|

• Debt/Total Capital

|

39.2%

|

35.2%

|

35.6%

|

|

• Net Debt/Total Capital

|

36.9%

|

31.9%

|

29.7%

|

|

• Cash Position (millions)

|

$215

|

$275

|

$495

|

29

Outlook

30

Regulatory Environment

Current Issues

Current Issues

• RUG-IV

– Medicare reimbursement changes impacting SNFs

– Effective 10/1/10

– Intent is to drive up acuity levels in nursing homes

(through a greater mix of clinically complex residents)

(through a greater mix of clinically complex residents)

• Federal Upper Limit (“FUL”) definitions

– No less than 175% of the weighted average manufacturer’s price (“AMP”)

– Effective 10/1/10 (the first FUL list has not yet been published)

– Some Medicaid, facility contracts impacted (Part D contracts restructured to

another reimbursement benchmark)

another reimbursement benchmark)

– In most cases, new FULs would have to be lower than MACs to impact

reimbursement for relevant payers

reimbursement for relevant payers

Anticipate small positive to Omnicare

Anticipate small negative to Omnicare

31

Regulatory Environment

Current Issues

Current Issues

• Short-cycle dispensing

– Weekly dispensing for branded drugs dispensed under Part D

– Effective 1/1/12 (although currently in 60-day

comment period)

comment period)

– Expected to impact approximately

6 million scripts, or 5% of prescriptions

dispensed

6 million scripts, or 5% of prescriptions

dispensed

– We believe the automation within

our pharmacies creates an advantage

over competitors not using automation

over competitors not using automation

Anticipate small negative to Omnicare in 2012;

we believe we are best positioned among peers

32

2011 Drivers (1)

|

Major 2011 Drivers

|

1st Half 2011

|

2nd Half 2011

|

|

• Brand-to-generic and drug price inflation

|

Positive

|

Positive

|

|

• Annualized pricing adjustments

|

Negative

|

Neutral

|

|

• Annualized impact of bed losses

|

Negative

|

Neutral

|

|

• Impact of payroll costs

|

Negative

|

Negative

|

|

• Productivity improvements

|

Positive

|

Positive

|

2011 drivers point to a stronger 2nd half than 1st half

33

(1) Information on this slide is not intended to represent the company’s guidance for 2011.

Forward-Looking Major Drivers (1)

|

Major Drivers

|

2011

|

2012

|

2013

|

|

• Brand-to-generic

|

Positive

|

Positive

|

Neutral

|

|

• Organic growth - Long-term care

|

Neutral

|

Positive

|

Positive

|

|

• Specialty care (2)

|

Neutral

|

Positive

|

Positive

|

|

• Omnicare-at-home

|

Neutral

|

Neutral

|

Positive

|

Omnicare expects a double digit CAGR in adjusted EPS

for the three-year period ending 2013.

for the three-year period ending 2013.

34

(1) Information on this slide is not intended to represent the company’s financial guidance for 2011, 2012 or 2013

(2) Includes an assumption for acquisitions

Disciplined use of cash flow

Omnicare’s Fundamental Value Drivers

35

Barclays Capital

2011 Global Healthcare Conference

2011 Global Healthcare Conference

March 16, 2011