Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Clearwater Paper Corp | d8k.htm |

0

Clearwater Paper Corporation

Goldman Sachs 2011 Montreal Paper Conference

March 16, 2011

Exhibit 99.1 |

1

Forward-Looking Statements

This presentation contains, in addition to historical information, certain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, including

statements regarding the benefits of, and synergies from, our Cellu Tissue acquisition, internal and

external pulp purchases and sales, pulp requirements, customer purchases of private label

tissue, production capacity of operating divisions, completion of additional converting and paper making capacity, the cost and timing to complete new facilities, future

growth opportunities, sales volumes, input costs, and our financial condition and results of

operations. Words such as “anticipate,” “expect,” “intend,” “will,” “plan,” “target,” “project,”

“believe,” “schedule,” “estimate,” “may,” and similar

expressions are intended to identify such forward-looking statements. These forward-looking statements are based on

management’s current expectations, estimates, assumptions and projections that are subject to

change. Our actual results of operations may differ materially from those expressed or implied

by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risk factors described in Item

1A of Part I of our Form 10-K for the year ended December 31, 2010, as well as the following:

•

an inability to successfully implement our expansion and operating strategies;

•

difficulties with the integration process or the realization of the benefits expected from the

acquisition of Cellu Tissue; •

difficulties with the completion of our new tissue making and converting facilities;

•

the Cellu Tissue acquisition may expose our operations to unidentified liabilities;

•

changes in the cost and availability of wood fiber used in the production of our products;

•

changes in freight costs and disruptions in transportation services;

•

changes in raw material costs and energy availability and costs;

•

changes in customer product preferences and competitors’ product offerings;

•

changes in the United States and international economies and in general economic conditions in the

regions and industries in which we operate; •

cyclical industry conditions;

•

the loss of business from any of our three largest Consumer Products segment customers or a large

Pulp and Paperboard segment customer; •

competitive pricing pressures for our products;

•

reliance on a limited number of third party suppliers for raw materials;

•

our qualification to retain, or ability to utilize, tax credits associated with alternative fuels or

cellulosic biofuels; •

labor disruptions;

•

unforeseen environmental liabilities or expenditures;

•

unanticipated manufacturing or operating disruptions, including equipment malfunction and damage to

our manufacturing facilitates caused by fire or weather- related events and IT system

failures; •

changes in the relationship between supply and demand in the forest products industry, including the

amount of available manufacturing capacity and wood fiber used in manufacturing our

products; •

changes in expenses and required contributions associated with our pension plans;

•

an inability to fund our debt obligations;

•

restrictions on our business from debt covenants and terms;

•

changes in laws, regulations or industry standards affecting our business; and

•

changes in exchange rates between the U.S. dollar and other currencies.

Forward-looking statements contained in this presentation present management’s views only as

of the date of this presentation. We undertake no obligation to publicly update forward-

looking statements, whether as a result of new information, future events or otherwise.

|

2

Company Overview

Clearwater Paper is a leader in quality private label consumer

tissue

and

exceptional

bleached

paperboard

–

focused

on

helping

our customers build their brands. |

3

Clearwater Paper Overview

Leading manufacturer of private-label consumer tissue and fully-bleached SBS

paperboard, with approximately

$1.4

billion

in

net

sales

and

$166.8

million

of

Adjusted

EBITDA¹

for

the

twelve months

ended December 31, 2010

Segment

Net

Sales

2,3

Segment

Adjusted

EBITDA¹

Segment

Adjusted

EBITDA

Margin

%

1,4

% of LTM Net Sales²

($ in millions)

Pulp &

Paperboard

(PPD)

$802.9

$110.6

13.8%

$570.1

$ 87.2

15.3%

Consumer

Products

(CPD)

1 See Appendix A: “Financial Detail” for the definitions of Adjusted EBITDA and Segment

Adjusted EBITDA as well as the reconciliation to the most comparable GAAP measures. 2 Net

sales excludes intersegment net sales and transfers. 3 Amounts for Consumer Products

segment include four days of Cellu Tissue results. 4 Segment Adjusted EBITDA margin

percentage calculated by dividing Segment Adjusted EBITDA by Segment Net Sales. |

$445

$452

$504

$554

$570

$672

$731

$751

$696

$803

2006

2007

2008

2009

2010

$41

$34

$53

$138

$87

$70

$80

$35

$51

$111

9.0%

8.8%

6.0%

13.9%

12.2%

2006

2007

2008

2009

2010

4

Financial Track Record

($ in millions)

Adjusted EBITDA

2,3

Net Sales¹

$1,117

$1,183

$1,255

$1,250

$101

$104

$75

5 Yr Average: $1,236

$174

CPD

PPD

Adj. EBITDA Margin %

4

5 Yr Average: $124

$1,373

$167

1 Excludes intersegment net sales and transfers. Net sales for 2010 for CPD includes four

days of Cellu Tissue results. 2 See Appendix A: “Financial Detail” for the

definition of Adjusted EBITDA and Segment Adjusted EBITDA as well as the reconciliation to the most comparable GAAP measures.

3 Clearwater Paper’s total Adjusted EBITDA includes corporate and eliminations.

4 Adjusted EBITDA margin percentage calculated by dividing Adjusted EBITDA by Net Sales.

|

5

Total Cost¹:

% of Total

Cost of Sales

2009

2010

Historical Cost Drivers -

Wood Fiber

2008

$325.4 M

28%

$269.7 M

26%

$314.3 M

27%

1 Excludes intersegment amounts

•

Wood fiber includes pulp, wood chips, sawdust and saw logs.

•

Historically, we have been a net buyer of approximately 85,000 tons of pulp

annually. Going forward, we expect to be a net buyer of

approximately 400,000 tons of pulp annually.

•

Historically, we produced approximately 804,000 tons of pulp representing about 92%

of our total annual pulp needs. We expect to continue to produce the

same amount of pulp going forward, which will represent about 68% of our

total annual pulp needs. •

Generally we use a mix of pulp including northern softwood, southern softwood,

northern hardwood, eucalyptus and recycled.

Wood

Fiber |

6

Total Cost:

% of Total

Cost of Sales

2009

2010

Other Key Historical Cost Drivers

Other

key

cost

drivers

are

chemicals,

energy,

transportation

and

maintenance

Energy

Transportation

2008

Total Cost:

% of Total

Cost of Sales

Total Cost¹:

% of Total

Cost of Sales

$143.0 M

12%

$114.7

10%

$97.3

9%

$92.0

8%

$123.2

10%

$100.3

9%

$117.3

10%

$ 61.9

5%

$70.0

7%

$82.4

7%

$123.2 M

12%

$132.3 M

11%

Maintenance

& Repair

Total Cost:

% of Total

Cost of Sales

Chemicals

1 Excludes related labor costs. |

7

Strong Financial Performance

($ in Millions)

Clearwater Paper

(Twelve Months Ended

December 31, 2010)

Cellu Tissue

(Period from January 1, 2010

through December 27, 2010)

Combined

Net

Sales

2

$1,373.0

$529.6

$1,902.6

Adjusted EBITDA

3

$166.8

$42.1

$208.9

Adjusted EBITDA Margin %

4

12.2%

7.9%

11.0%

Capacity ('000 TDY

)

Tissue Parent Roll

227

337

564

Tissue Converted

221

241

462

1 Cellu Tissue was acquired on December 27, 2010. Clearwater Paper’s results for 2010

include four days of Cellu Tissue results. 2 Net sales excludes intersegment net sales and

transfers. 3 See Appendix A: “Financial Detail” for the definition of Adjusted

EBITDA as well as the reconciliation to the most comparable GAAP measure. 4 Adjusted

EBITDA margin percentage calculated by dividing Adjusted EBITDA by net sales. |

8

Pro Forma Sales Mix Change

Acquisition Supports Strategy to Grow the Size and Scope of Consumer

Products Segment

Clearwater Paper

Stand Alone Sales Mix

Twelve Months Ended

December 31, 2010

Period from January 1, 2010

through December 27, 2010

Cellu Tissue

Stand

Alone

Sales

Mix¹

Pro Forma Sales Mix

$1,373 Million

$530 Million

$1,903 Million

1 Cellu Tissue was acquired on December 27, 2010. Clearwater Paper’s

results for 2010 include four days of Cellu Tissue results. Consumer

Products

58%

Pulp &

Paperboard

42%

Consumer

Products

42%

Pulp &

Paperboard

58%

Tissue

77%

Machine-

glazed

22%

Foam

1% |

9

Consumer Products Segment Overview

•

Committed to maintaining high-quality

products that match the quality of leading

national brands

•

Only U.S. consumer tissue producer that

manufactures solely private label tissue

High-Quality, Premium Products ($ in millions)

1 Cellu Tissue was acquired on December 27, 2010. Clearwater

Paper’s results for 2010 include four days of Cellu Tissue results.

2 See Appendix A: “Financial Detail”

for the definition of Segment Adjusted EBITDA as well as the reconciliation to the

most comparable GAAP measure. $41

$34

$53

$138

$87

$129

$0

$20

$40

$60

$80

$100

$120

$140

$160

2006

2007

2008

2009

2010

PF 2010 |

10

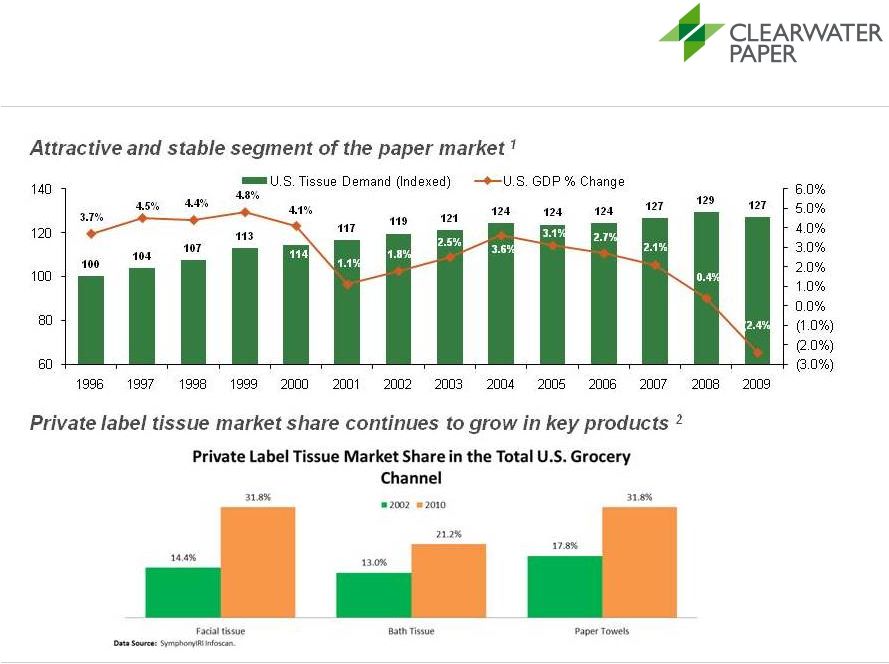

Attractive Industry Characteristics -Tissue

Source: RISI and IRI.

1 Based on converted short tons.

2 Represents market share as a % of sales in U.S. grocery channel.

|

30%

17%

16%

7%

6%

5%

4%

2%

2%

2%

1%

1%

1%

1%

1%

1%

0%

0%

0%

4%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

11

2010 North American Tissue Market by Producer

Remaining Manufacturing Base Highly Fragmented

Large Brand Manufacturers

Source: Equity research.

1 Represents pro forma Clearwater Paper tissue parent roll capacity combined

with Cellu Tissue tissue parent roll production. 1

The Combined Company Was the Sixth-Largest Manufacturer in

the

North American Tissue Market in 2010 |

Consumer Products Strategy

Cellu Tissue Acquisition

•

National

manufacturing

footprint

to

complement

existing

national

customer

footprint

•

Ability to service all tissue quality segments (ultra, premium, value and economy)

as well as away-from-home tissue market

•

Strengthen position as one of the leading private label tissue manufacturers

•

Papermaker and converter of tissue products with 14 combined sites throughout North

America

Shelby, NC Expansion

•

Building a 70,000 ton TAD paper machine facility and 7 tissue converting lines

capable of producing ultra grades of private label tissue products

•

Initial 2 converting lines expected to come on-line in second quarter of 2011,

adding 27,000 tons of annual converting capability; paper machine expected

to begin production in the second half of 2012

12 |

Cellu Tissue Synergies

•

Reduction in Freight Cost

•

Pulp Integration

•

Pulp Purchasing

•

SG&A

•

Parent Roll Integration

•

Efficiency Improvements

•

Scale Benefits

13

$15-$20 Million of Annual Net Cost Savings Expected to Be

Realized by End of 2012 |

Synergy Opportunity Example

Underutilized

large converting winder in Neenah, WI (formerly Cellu Tissue) can more

efficiently produce Away-from-Home products and 1000 count bathroom

tissue •Actions:

1.

Relocate a wrapper machine from Elwood, IL (formerly CLW) to Neenah, WI

2.

Reposition an underutilized case packer in Neenah, WI

3.

Redirect the existing 1000 count product from Lewiston, ID (formerly CLW) and

Thomaston, GA (formerly CLU) to Neenah, WI

4.

Increase the production schedule of the existing underutilized large

converting winder in Neenah, WI from 5 to 7 days

•Expected Results:

1.

Creates

new

case

capacity

in

the

systems

at

Neenah,

Lewiston

and

Thomaston

2.

Reduces freight

3.

Improves paper machine trim

14 |

15

Pulp and Paperboard Segment Overview

•

Focus on high-end paperboard products,

such as pharmaceuticals and cosmetics

packaging

–

Superior print surfaces and cleanliness for

discriminating domestic and international

markets

–

Valued industry consulting

–

Effective logistics to meet just-in-time

customer needs

High-Quality, Premium Products ($ in millions)

Segment Adjusted EBITDA

1,2

Net Sales¹

1 Includes Wood Products segment.

2 See Appendix A: “Financial Detail”

for the definition of Segment Adjusted EBITDA as well as the reconciliation to the

most comparable GAAP measure. |

16

Attractive Industry Characteristics –

Paperboard

Source: RISI.

1 Top 5 manufacturers in 1998 were International Paper, Westvaco,

Temple-Inland, Georgia-Pacific and Potlatch. Top 5 manufacturers in 2010 were International Paper, MeadWestvaco,

Georgia-Pacific, Evergreen Packaging and Clearwater Paper.

2 Based on tons produced.

3 Average price per short ton of 16 pt. SBS folding carton C1S.

|

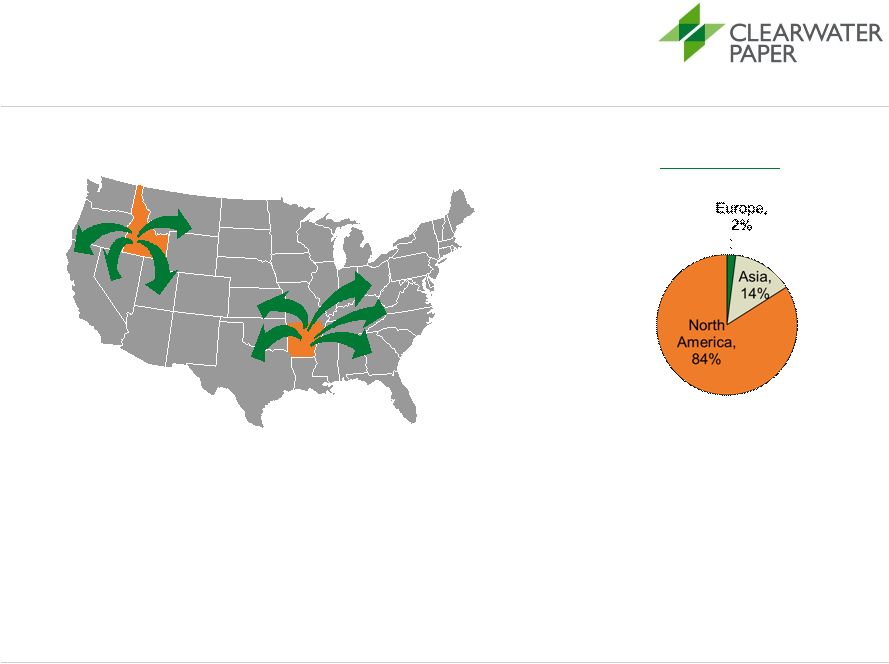

17

Strategically Positioned Pulp & Paperboard Facilities

Facilities positioned to provide broad geographic

reach and cost-efficient transportation points

•

Idaho Mill

–

Reduced transportation

costs to Asia versus East

Coast competitors

–

One of two bleached

paperboard mills in

Western U.S.

–

423,000 tons of bleached

paperboard produced

in 2010

•

Arkansas Mill

–

Central location reduces freight

costs to Midwest and East Coast

–

Most recently built bleached

paperboard mill in North

America

–

317,000 tons of bleached

paperboard produced in 2010

2010 PPD Sales |

18

Appendix A: Financial Detail |

19

External Pulp Purchases –

CLW

External Pulp Purchases –

CLU²

External Pulp Sales

Net Pulp Purchased

Projected¹

Approximate Pulp Flows

2010

134,000

0

(60,000)

74,000

134,000

240,000

0

374,000

1

We expect to eliminate external pulp sales over time and instead utilize that pulp

in our Consumer Products segment. 2

Excludes recycled fiber used at Ladysmith, WI

Pulp Production

External Pulp Purchases

External Pulp Sales

Internal Pulp Requirements

804,000

134,000

(60,000)

878,000

804,000

374,000

0

1,178,000

(92% of requirements)

(68% of requirements)

Projected¹

2010

Net Pulp Purchased

Pulp Integration

(in tons) |

20

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper EBITDA and Adjusted EBITDA

1 See last page of Appendix A for definitions of EBITDA and Adjusted

EBITDA. ($ in millions)

2006

2007

2008

2009

2010

Net Earnings

$20.9

$25.3

$9.7

$182.5

$73.8

Income Tax Provision

12.4

14.1

5.6

93.2

2.4

Interest Expense

13.0

13.0

13.1

15.5

22.6

Earnings Before Interest and

Income Taxes

46.3

52.4

28.5

291.2

98.8

Depreciation & Amortization

54.3

51.3

47.0

47.4

47.7

EBITDA¹

$100.6

$103.7

$75.4

$338.7

$146.5

Alternative Fuel Mixture Tax

Credit

(170.6)

Debt Retirement Costs

-

-

-

$6.2

-

Cellu Tissue Acquisition

Related Expenses

20.3

Adjusted EBITDA¹

$100.6

$103.7

$75.4

$174.3

$166.8 |

21

Reconciliation of GAAP to Non-GAAP:

Cellu Tissue EBITDA and Adjusted EBITDA

1 See last page of Appendix A for definitions of EBITDA and Adjusted

EBITDA. ($ in millions)

Cellu Tissue

(Period from January 1, 2010

through December 27, 2010)

Net Loss

$(56.2)

Income Tax Provision

(34.6)

Interest Expense

86.4

Earnings Before Interest and

Income Taxes

(4.4)

Depreciation & Amortization

33.3

EBITDA

1

$28.9

Acquisition Related Expenses

13.2

Adjusted EBITDA¹

$42.1 |

22

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper Segment EBITDA and Segment Adjusted EBITDA

($ in millions)

1 See last page of Appendix A for definitions of Segment EBITDA and

Segment Adjusted EBITDA. 2006

2007

2008

2009

2010

Consumer Products

Operating Income

$25.7

$17.6

$37.3

$122.1

$63.7

Depreciation

15.8

16.3

15.7

16.0

17.0

Segment EBITDA¹

$41.5

$33.9

$53.0

$138.1

$80.7

Cellu Tissue Acquisition

Related Expenses

-

-

-

-

6.5

Segment Adjusted EBITDA¹

$41.5

$33.9

$53.0

$138.1

$87.2

Pulp & Paperboard

Operating Income¹

$32.2

$45.0

$4.4

$191.9

$81.9

Depreciation

38.1

34.6

30.9

29.9

28.7

Segment EBITDA¹

$70.2

$79.6

$35.3

$221.8

$110.6

Alternative Fuel Mixture Tax

Credits

-

-

-

(170.6)

-

Segment Adjusted EBITDA¹

$70.2

$79.6

$35.3

$51.1

$110.6 |

23

Definitions of Non-GAAP Measures

Clearwater Paper Definitions of Non-GAAP Measures

EBITDA is a non-GAAP measure that Clearwater Paper management uses to evaluate the cash generating

capacity of Clearwater Paper. The most directly comparable GAAP measure is net earnings.

EBITDA, as defined by Clearwater Paper management, is net earnings adjusted for net interest

expense, income taxes, and depreciation and amortization. It should not be considered as an alternative to net earnings computed under

GAAP.

Adjusted EBITDA is a non-GAAP measure that Clearwater Paper management defines as EBITDA adjusted

for items that we do not believe are indicative of our core operating performance, including

acquisition related expenses and alternative fuel mixture tax credits. The most directly

comparable GAAP measure is net earnings. It should not be considered as an alternative to net

earnings computed under GAAP. Segment EBITDA is a non-GAAP measure used by Clearwater Paper management. The most directly

comparable GAAP measure is segment operating income. Segment EBITDA, as defined by Clearwater

Paper management, is segment operating income adjusted for segment depreciation and

amortization. It should not be considered as an alternative to segment operating income computed under GAAP.

Segment Adjusted EBITDA is a non-GAAP measure that Clearwater Paper management defines as Segment

EBITDA adjusted for nonrecurring expenses or income, including alternative fuel tax

credits. The most directly comparable GAAP measure is segment operating income. It should

not be considered as an alternative to segment operating income computed under GAAP.

|