Attached files

Exhibit 10.48

AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

TRIGON ENERGY PARTNERS LLC

A DELAWARE LIMITED LIABILITY COMPANY

This AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT (this “Agreement”) of TRIGON ENERGY PARTNERS LLC (the “Company”) is made and entered into as of October 31, 2010 (the “Effective Date”), by and among Trigon Energy Management LLC (“Management LLC”) and GeoResources, Inc., or its designated wholly-owned subsidiary (“GeoResources”), and such other holders of membership interests in the Company who become parties hereto from time to time.

NOW THEREFORE, in consideration of the mutual covenants and agreements contained herein, and in consideration of the respective capital contributions made and to be made by the Members, the undersigned Members hereby agree to the following, and upon the Effective Date set forth above, this Amended and Restated Limited Liability Company Agreement shall replace and supersede any and all prior agreements of the Company in their entirety:

ARTICLE 1

DEFINITIONS

The following definitions shall be applicable to the terms set forth below as used in this Agreement:

“Act” shall mean the Delaware Limited Liability Company Act as it may be amended from time to time, and any corresponding provisions of succeeding law.

“Affiliate” shall mean, with respect to any Person or entity, any other Person or entity that directly or indirectly controls, or is controlled by, or is under common control with, such first party. For the purposes of this definition, “control” when used with respect to any Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Agreement” shall mean this Amended and Restated Limited Liability Company Agreement of Trigon Energy Partners LLC, as the same may be amended, supplemented or restated from time to time in accordance with the terms hereof.

“Articles of Organization” shall mean the articles of organization for the Company as filed in the Office of the Secretary of State of Delaware, as such articles may be amended from time to time.

“Capital Account” shall mean the capital account maintained by the Company with respect to each Member in accordance with the capital accounting rules described in Article 3.

“Capital Account Gross Income” and “Capital Account Deduction” shall mean, respectively, items of gross income and deduction of the Company determined in accordance with Section 703(a) of the Code (including all items of income, gain, loss or deduction required to be stated separately pursuant to Section 703(a)(1) of the Code), with the following adjustments:

(a) Any income of the Company that is exempt from Federal income tax shall be taken into account as Capital Account Gross Income;

(b) Any expenditures of the Company described in Section 705(a)(2)(B) of the Code shall be taken into account as Capital Account Deductions;

(c) In the event the book value of any Company asset as determined for Capital Account purposes is adjusted pursuant to Section 3.6(b) or Section 3.6(c), the amount of such adjustment shall be taken into account as an item of Capital Account Gross Income or Capital Account Deduction; and

(d) With respect to property reflected in the Capital Accounts at a book value different from its adjusted basis, items of depreciation, amortization and gain or loss shall be computed in the same manner as such items are computed for federal income tax purposes, except that the computation shall be made with reference to such property’s book value as determined for purposes of maintaining the Capital Accounts instead of its adjusted tax basis, in accordance with Treasury Regulations Section 1.704-1(b)(2)(iv)(g).

“Capital Contribution” shall mean the amount of money and/or the fair market value of any property (net of any liabilities encumbering such property that the Company is considered to assume or take subject to under Code Section 752) contributed to the capital of the Company by any Member.

“Code” shall mean the Internal Revenue Code of 1986, as amended. All references in this Agreement to provisions of the Code shall be deemed to refer, if applicable, to their successor statutory provisions to the extent appropriate in light of the context herein in which such references are used.

“Company” shall mean the limited liability company organized and continuing under this Agreement, notwithstanding changes in its membership.

“Covered Person” shall mean any Director, any Member, any Manager, any Affiliate of any Director, Member or Manager, any employee, officer, shareholder, partner or member of any Director, Member or Manager, or their respective Affiliates, or any of the Company’s officers, employees, representatives or agents or their respective Affiliates.

“Default Interest Rate” shall mean the lesser of (a) the Prime Rate, plus 8 percent, and (b) the maximum non-usurious rate of interest under applicable law.

2

“Discretion” when used with respect to any Person, means its sole and absolute discretion.

“Dissolution Event” shall have the meaning set forth in Section 14.2 hereof.

“Effective Date” shall have the meaning set forth in the preamble to this Agreement.

“Excess Nonrecourse Liabilities” shall have the meaning set forth in Section 5.6 hereof.

“LADA” means the Lease Acquisition and Development Agreement between the Company and CEU Eagle Ford, LLC, dated May 4, 2010, as amended.

“Liquidating Gains” and “Liquidating Losses” shall mean taxable income or loss of the Company as determined by taking into account only items of Capital Account Gross Income and Capital Account Deduction that arise from the sale or deemed sale of all or substantially all of the assets of the Company, and by excluding items that are specifically allocated pursuant to Exhibit B hereto.

“Managers” shall have the meaning set forth in Section 7.1 hereof.

“Member Nonrecourse Debt Minimum Gain” shall have the meaning set forth in Item 1 on Exhibit B hereto.

“Members” shall mean collectively, and as of any date of reference, all Persons who as of such date are admitted as a Member of the Company in accordance with the provisions of this Agreement, in each case in such Person’s capacity as a Member of the Company. The term “Member” may be used herein to refer individually to any of such Members.

“Membership Interests” shall mean a percentage of the ownership interests in the Company, including but not limited to, a percentage ownership interest in Profits, Losses, and any other distributions, allocations, or rights set forth herein.

“Minimum Gain” shall have the meaning set forth in Item 1 on Exhibit B hereto.

“Other Similar Activities” shall mean the acquisition of mineral leases, exploration, development, mining or production, processing, refining, transportation (including pipelines transporting gas, oil or products thereof), or the marketing of any mineral or natural resource and all activities directly or indirectly related thereto.

“Partner Nonrecourse Deductions” shall have the meaning set forth in Item 4 on Exhibit B hereto.

“Person” shall mean any individual, corporation, association, partnership (general or limited), joint venture, limited liability company, limited liability partnership, joint stock company, unincorporated organization, government entity (or any agency or political subdivision thereof), trust (including any beneficiary thereof), estate or other legal entity or organization.

3

“Prime Rate” means a rate per annum equal to the lesser of (a) an annual rate of interest which equals the floating commercial loan rate of Wells Fargo Bank N.A., or its successors and assigns, announced from time to time as its “base rate,” adjusted in each case as of the banking day in which a change in the base rate occurs; and (b) the maximum rate permitted by applicable law.

“Profits” and “Losses” shall mean, for each fiscal year or other period, an amount equal to the Company’s net income or loss for such year or period, determined by taking into account only items of Capital Account Gross Income and Capital Account Deduction, and excluding Liquidating Gain and Liquidating Loss, and excluding items that are specifically allocated pursuant to Exhibit B hereto.

“Regulations” shall mean the federal income tax regulations as promulgated by the U.S. Treasury Department, as such regulations may be in effect from time to time. All references in this Agreement to provisions of the Regulations shall be deemed to refer, if applicable, to their successor regulatory provisions to the extent appropriate in light of the context herein in which such references are used.

“Regulatory Allocations” shall have the meaning set forth in Item 7 on Exhibit B hereto.

“Subsequent Capital Contribution” shall mean any Capital Contribution subsequent to a Member’s initial Capital Contribution described in Section 3.4.

“Substitute Member” shall mean a Transferee who is admitted as a Member of the Company pursuant to Section 12.2.

“Tax Matters Member” shall have the meaning set forth in Section 11.3(a).

“Transfer” (and related words) shall mean any sale, assignment, gift (outright or in trust), hypothecation, pledge, encumbrance, mortgage, exchange or other disposition, whether voluntary or involuntary, by operation of law or otherwise, of all or any portion of a Member’s Membership Interests.

“Transferee” shall mean a person who receives a Membership Interest or Membership Interests by means of a Transfer.

“Transferor” shall mean a Member whose Membership Interests are subject to a Transfer in whole or in part.

ARTICLE 2

ORGANIZATION

2.1 FORMATION OF COMPANY. Pursuant to and under the Act, the Company was formed as a Delaware limited liability company under the laws of the State of Delaware by the filing of the Articles of Organization with the Office of the Secretary of State of Delaware on April 22, 2010. The rights and liabilities of the Members shall be determined pursuant to the Act and this Agreement. To the extent that the rights or obligations of any Member are different

4

by reason of any provision of this Agreement than they would be in the absence of such provision, this Agreement shall, to the extent permitted by the Act, control.

2.2 COMPANY NAME. The name of the Company is “Trigon Energy Partners LLC”. The business of the Company shall be conducted under such name or under such other name or names as the Company may from time to time determine.

2.3 TERM. The term of the Company commenced on April 22, 2010 and shall continue indefinitely, unless dissolved earlier pursuant to this Agreement.

2.4 BUSINESS PURPOSES. The Company shall acquire, own, operate, develop, deal with and sell oil and gas leases and related rights pursuant to the LADA, and may carry on any lawful businesses and activities as from time to time are permitted under the Act and that the Managers deem appropriate.

2.5 POWERS. In furtherance of its business purposes, the Company shall have and may exercise all the powers conferred by the laws of Delaware upon limited liability companies formed under the Act, as now in effect or at any time hereafter amended, which are necessary or convenient to the conduct, promotion or attainment of the business purposes set forth in Section 2.4.

2.6 PLACE OF BUSINESS, AGENT AND OFFICE OF THE COMPANY. The principal business office of the Company shall be 110 Cypress Station Dr., Suite 220, Houston Texas, 77090 or at such other locations as determined by GeoResources. The Company shall establish a registered office in the State of Delaware, and shall register as a foreign limited liability company and take such other actions as the Company deems necessary or appropriate to allow the Company to conduct business in such jurisdictions as the Company deems appropriate.

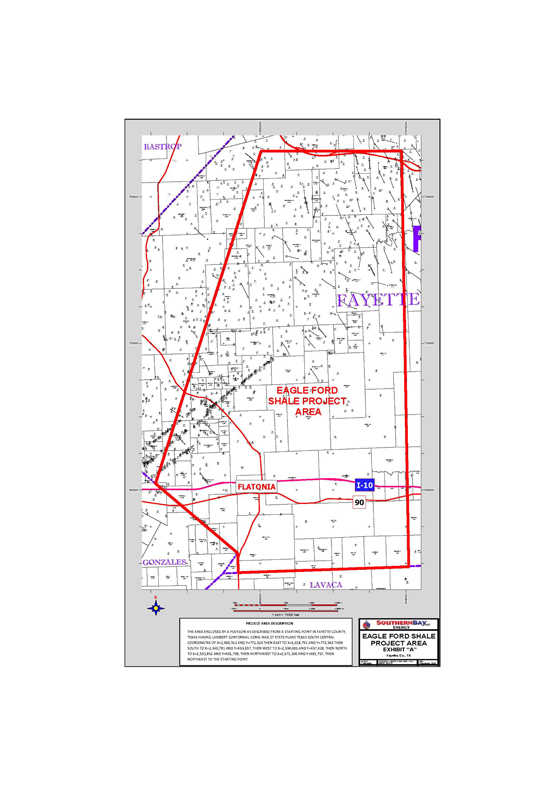

2.7 CERTAIN REPRESENTATIONS BY MANAGEMENT LLC. Trigon and CEU Eagle Ford LLC (“CEU”) have been acquiring leases in Atascosa, McMullen, Gonzales and Fayette counties in Texas in accordance with the terms and provisions of the LADA. Management LLC represents that as of October 21, 2010 Trigon owns an undivided 10% working interest in approximately 9,761 net mineral acres (8/8ths) shown as “Closed” on the acreage summary attached hereto as Exhibit A (“Exhibit A”) and in accordance with the LADA has a right to acquire a 10% undivided interest in those leases show as “Pending” and “Possible” on Exhibit A if, as and when such leases are acquired by CEU and Trigon. All such leases are referred to collectively as “Leases”. Management LLC further represents that CEU owns an undivided 90% interest in approximately 9,761 net mineral acres (8/8ths) and in accordance with the LADA has a right to acquire a 90% undivided interest in those leases shown as “Pending” and “Possible” on Exhibit A if, as and when such leases are acquired by CEU and Trigon. Further Management LLC represents that Trigon has a right to acquire no less than a 65% (of 8/8’s) interest in all such Leases acquired by Trigon and CEU on or before the Relevant Interest Notice Date (as defined in Section 3.4(c) below) provided it pays that amount to CEU (if that is the interest acquired) in accordance with the terms of the LADA. Thereafter, subject to an election made by CEU under the LADA, Leases will be acquired by CEU in an amount equal to CEU’s AMI Interest, if at all, and the remainder by Trigon. Management LLC represents that

5

CEU is contractually required to assign the acquired interest in the Leases owned as of the Relevant Interest Notice Date to Trigon promptly after receipt of payment.

ARTICLE 3

CAPITAL AND CAPITAL ACCOUNTS

3.1 CAPITAL STRUCTURE. The ownership interests in the Company shall be evidenced by Membership Interests, with each Membership Interest evidencing a specific percentage interest in the Company during its existence and in its assets upon its dissolution.

3.2 CAPITAL CONTRIBUTIONS. As of the next business day following the Relevant Interest Notice Date, Management LLC (or its predecessors) shall have made cumulative Capital Contributions to the Company equal to 10% of the Funded Capital (as defined in the LADA). Subsequent Capital Contributions shall be made as set forth below. If Management LLC has funded more than 10% of the Funded Capital as of such date, Management LLC shall be entitled to a return of such excess.

3.3 MEMBERS. Subject to Section 15.16, the Members of the Company are GeoResources and Management LLC. Each Member’s Membership Interest in the Company will be determined as follows:

(a) Management LLC’s Membership Interest shall be a percentage interest determined by dividing (i) ten percent (10%) by (ii) the difference between one hundred percent (100%) and CEU’s AMI Interest; and

(b) GeoResources’ Membership Interest shall be a percentage interest determined by dividing (i) the difference between ninety percent (90%) and CEU’s AMI Interest, by (ii) the difference between one hundred percent (100%) and CEU’s AMI Interest.

Subject to Section 6.8(b), Persons may be admitted to the Company as Members as determined by the Managers. The terms of admission or issuance may provide for the creation of different classes or groups of Members having different rights, powers and duties. The Managers may reflect the creation of any new class or group in an amendment to this Agreement indicating the different rights, powers and duties, and subject to such amendment being approved by the unanimous consent of the Members. Any such admission is effective only after such new Member has executed and delivered to the Members and the Company an instrument containing the notice address of the new Member, the Member’s ratification of this Agreement and agreement to be bound by it.

3.4 SUBSEQUENT CAPITAL CONTRIBUTIONS. No Member shall be required to make any Subsequent Capital Contribution to the Company, except as may be required under the provisions of this Section 3.4, or as required by applicable law. With respect to Subsequent Capital Contributions, the following provisions shall apply:

(a) LADA. The Members acknowledge that the Company is subject to the terms of the LADA. Terms used in this Section 3.4 that are defined in the LADA shall have the meanings given in the LADA.

6

(b) Further Subsequent Capital Contributions. GeoResources agrees to make Subsequent Capital Contributions to the Company in an amount sufficient to fund the reacquisition of CEU interests, the acquisition of additional leases, and fund certain drilling obligations either through Subsequent Capital Contributions or directly, both as specified below, equal to the “Required Funder Commitment” under the LADA, but not to exceed $60,000,000, without the express approval of Geo Resources, for the purposes set forth in this Section 3.4.

(c) Reacquisition of CEU Interests. Upon the execution of this Agreement, CEU will have the right to specify CEU’s AMI Interest under the LADA, and upon receipt of the Relevant Interest Notice from CEU by the Company (the date of such receipt being referred to herein as the “Relevant Interest Notice Date”) will be required to pay CEU the CEU Returned Capital. GeoResources shall contribute to the Company the funds necessary for the Company to pay the CEU Returned Capital to CEU within the time periods set forth in the LADA. The funding of these Subsequent Capital Contributions for lease acquisitions will occur in stages with the initial funding sufficient to make the acquisition from CEU for leases shown as “Closed” on Exhibit A and for leases that are shown as “Pending” or “Possible” and that are funded by CEU and Trigon on or before the Relevant Interest Notice Date.

(d) Acquisition of Additional Leases under the LADA. Each Member of the Company will make Subsequent Capital Contributions in proportion to their respective Membership Interests as from time to time required for the Company to fund its requisite portion of the costs for the acquisition of all subsequent leases under the LADA.

(e) Drilling Obligations. In addition to the foregoing capital contributions, GeoResources will drill or cause the drilling of (i) at least 10 gross wells (the “Carry Wells”) on the acreage held by Company (such that Management LLC is carried on 1 net well (subject to reduction as set forth below) to the tanks, with Management LLC being deemed to own for these purposes an interest in each Carry Well equal to Trigon’s working interest in each such well multiplied by Management LLC’s ownership interest in the Company), with one hundred percent (100%) of the drilling and completion costs (related to the Company’s interest in the Carry Wells) to be funded by GeoResources, and (ii) after the Carry Wells, 10 additional gross wells (“Subsequent Wells”). For all Subsequent Wells, the Company’s share of drilling and completion costs shall be funded by Subsequent Capital Contributions made by the Members in proportion to their Membership Interests, or at the direction of GeoResources may be funded directly to the operator of the drilling unit, if such operator is GeoResources or an affiliate of Management LLC. Further, to the extent that a third party is the operator and the Company is a non-operating participant, GeoResources will request the operator to recognize the interests of GeoResources and Management LLC directly for purpose of joint interest billings under the relevant joint operating account; provided, that in the event such non-operated well is a Carry Well, GeoResources will be responsible for all of the drilling and completion costs associated with such well. The Carry Wells may be reduced by a percentage equal to one minus the Acreage Shortfall Percentage, as defined below, if the Acreage Shortfall Percentage is less than 100%. All wells drilled by the Company, whether in operated or non-operated drilling units, will be subject to the GeoResources’ approval (based on anticipated economic results satisfactory to GeoResources) and a failure to drill or participate shall not subject GeoResources to any penalties or damages under this Agreement or otherwise.

7

(f) As used herein, “Acreage Shortfall Percentage” shall mean that percentage determined by dividing the net mineral acres (on 8/8ths basis) for the Leases that are acquired by the Company by 14,000. The Members acknowledge that the leases shown as “Possible” on Exhibit A are not subject to an existing agreement between the landowner and the Company and in the event that the Company is not able to acquire any of the leases shown as “Possible” on Exhibit A, the Members will use their reasonable best efforts to agree on replacement acreage that is acceptable from a land (based on the bonus payment, landowner royalty, term and lease provision) and geologic perspective to be acquired in lieu of such “Possible” leases.

(g) To the extent that the Company has insufficient cash to fund its ongoing administrative expenses, including, without limitation, accounting expenses under Article 13 and tax report preparation under Article 11, each Member shall make a capital contribution in proportion to its Membership Interest in such amounts as from time to time requested by the Managers for such expenses.

(h) All Subsequent Capital Contributions required hereunder shall be paid to the Company within ten business days or, in the case of payments made pursuant to the LADA, within the time specified in the LADA, following written notice from the Managers specifying in reasonable detail the expenditures to which such capital contribution relates.

(i) In addition to the foregoing obligations of GeoResources, GeoResources shall pay to Management LLC a fee of $1,000,000 in consideration of general and administrative expenses incurred by Management LLC prior to the date hereof; provided, however, that such fee shall be reduced in the event the Acreage Shortfall Percentage is less than 100%, in which case the total fee due to Management LLC shall not exceed $1,000,000 times the Acreage Shortfall Percentage. The fee due to Management LLC shall be paid in increments proportional to the incremental payments by GeoResources for the leases as set forth on Exhibit A.

(j) Under no circumstances shall Management LLC be required to make any Subsequent Capital Contribution hereunder if GeoResources is not also making its prorata share of such Subsequent Capital Contribution due to the limitations set forth in Section 3.4(b).

3.5 FAILURE TO CONTRIBUTE.

(a) If a Member (the “Delinquent Member”) does not contribute by the time required all or any portion of an additional Capital Contribution that such Member is required to make under Sections 3.4 (the “Default Amount”), then the Company, at the direction of the other members (the “Non-Defaulting Members”) holding a majority of the Membership Interests of the Non-Defaulting Members, may take any or all of the following actions:

(i) pursue any remedies at law to collect the Default Amount and any interest accrued thereon, and recover the costs of collection; or

(ii) require the Non-Defaulting Members to make a Capital Contribution to the Company in an amount equal to the Default Amount, in the proportion that their Membership Interests bear to each other, which shall be treated as a recourse loan from the Non-Defaulting Members to the Delinquent Member, secured by the Delinquent Member’s Membership Interest (the “Default

8

Loan”), and as a Capital Contribution of that same amount to the Company by the Delinquent Member. The principal balance of the Default Loan shall be equal to the aggregate amount of the Capital Contribution made by the Non-Defaulting Members pursuant to this Section 3.5(a), and shall bear interest at a rate equal to the Default Interest Rate. The Non-Defaulting Members are hereby authorized to take all actions and sign all documents they deem required or necessary to perfect their security interest in the Delinquent Member’s Membership Interest. While any Default Loan is outstanding and unrepaid, the Company shall pay directly to the Non-Defaulting Members (in the same proportions that the Non-Defaulting Members made the Capital Contribution to the Company) any distributions to which the Delinquent Member is entitled pursuant to Article 4 until such Default Loan with interest has been repaid in full. The principal and accrued but unpaid interest under the Default Loan shall be due and payable in full on the third anniversary of the date on which the Default Loan was made. If any Default Loan and accrued but unpaid interest thereon is not paid when due, the Non-Defaulting Members shall, without forfeiting other remedies, be entitled to continue to receive all amounts that would otherwise be distributed by the Company to the Delinquent Member until such Default Loan with all accrued but unpaid interest (plus any costs of collection) is paid in full.

(b) THE MEMBERS AGREE THAT THE LIQUIDATED DAMAGES DESCRIBED IN THIS SECTION 3.5 ARE A FAIR AND ADEQUATE MEASURE OF THE DAMAGES THAT WILL BE SUFFERED BY THE NON-DEFAULTING MEMBERS AS A RESULT OF A BREACH BY A MEMBER OF ITS OBLIGATION TO MAKE CAPITAL CONTRIBUTIONS UNDER SECTIONS 3.4 AND NOT A PENALTY.

3.6 NO THIRD PARTY RIGHT TO ENFORCE. No Person other than a Member shall have the right to enforce any obligation of a Member to contribute capital hereunder and specifically no lender or other third party shall have any such rights.

3.7 LOANS TO THE COMPANY. Any Member, directly or through an Affiliate, may at any time or from time to time lend funds to the Company with the consent of the Managers. Any such loan shall be repayable by the Company to the Member (or its Affiliate, if applicable) at such date or dates as they may agree, and shall bear interest and carry such other terms as they may agree at a fair market interest rate and terms for similar loans between unaffiliated parties. The Members expressly agree and acknowledge that nothing in this Section 3.8 shall be deemed to require or otherwise obligate any Member to make any such loan to the Company. A loan by a Member to the Company shall not increase the interest of the lending Member in the capital of the Company and shall not entitle such Member to any increased share in the Company’s capital, Profits or Losses.

3.8 CAPITAL ACCOUNTS.

(a) A Capital Account shall be established for each Member and shall be determined and maintained in accordance with the provisions of Code Section 704 and the Regulations thereunder. A Member that has more than one class or series of Membership Interests shall have a single Capital Account that reflects all such class, classes or series of

9

Membership Interests and regardless of time or manner in which such Membership Interests were acquired. In addition to such other adjustments as may be required under this Agreement or pursuant to such Regulations, each Member’s Capital Account shall be (a) increased by (i) such Member’s Capital Contribution to the Company, plus (ii) the amount of any Profits and Liquidating Gains allocated to such Member and items of Capital Account Gross Income specially allocated to such Member pursuant to Article 5, and (b) decreased by (i) the amount of any Losses and Liquidating Losses allocated to such Member and items of Capital Account Deduction specially allocated to such Member pursuant to Article 5, (ii) the amount of any cash or other assets distributed to such Member by the Company, and (iii) the fair market value, as determined by the Managers, of any property distributed, or deemed hereunder to be distributed, to such Member by the Company (net of any liabilities that such Member is considered to assume or take subject to under Code Section 752 upon any such distribution of property).

(b) In accordance with Regulations Section 1.704-1(b)(2)(iv)(e), immediately prior to the actual or deemed distribution of any Company asset in kind, the Capital Accounts of all Members and the Company’s book carrying value of such Company asset shall be adjusted upward or downward to reflect any unrealized gain or unrealized loss attributable to such Company asset as if such unrealized gain or unrealized loss had been recognized upon an actual sale of such Company asset immediately prior to such distribution and had been allocated to the Members at such time pursuant to Article 5. For purposes of determining such unrealized gain or unrealized loss, the fair market value, as determined by the Managers, of Company assets shall be used.

(c) Upon any event described in Regulation Section 1.704-1(b)(2)(iv)(f)(5), the Capital Accounts may, at the Discretion of the Managers, be restated to reflect a revaluation of the assets of the Company in order to reflect the manner in which the unrealized income, gain, loss, or deduction inherent in such property (that has not been reflected in the Capital Accounts previously) would be allocated among the Members if there were a taxable sale of such assets for their fair market value as determined by the Managers.

(d) Upon any Transfer of Membership Interests, the Transferee shall be credited on the Company’s books with the portion of the Transferor’s Capital Account that corresponds to the Transferred Membership Interests.

3.9 GENERAL PROVISIONS REGARDING CAPITAL CONTRIBUTIONS. Except as otherwise expressly provided in this Agreement (a) no Member shall have the right to demand or receive a return of its Capital Contribution, (b) under circumstances requiring hereunder a return of any Capital Contribution, no Member shall have the right to demand or receive property other than cash, and (c) no Member shall receive any interest, salary or draw with respect to its Capital Contribution or its Capital Account. An unrepaid Capital Contribution is not a liability of the Company or of any Member. A Member shall not be required to contribute or to lend any cash or property to the Company to enable the Company to return any Member’s Capital Contribution.

3.10 LIMITATION ON LIABILITY. Except as otherwise required under the Act, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and no Member

10

shall be personally liable for or otherwise obligated with respect to any such debt, obligation or liability of the Company by reason of being a Member of the Company. The Members agree that the rights, duties and obligations of the Members in their capacities as members of the Company are only as set forth in this Agreement and as otherwise arise under the Act. Furthermore, the Members agree that the existence of any rights of a Member, or the exercise or forbearance from exercise of any such rights shall not create any duties or obligations of the Member in their capacities as members of the Company, nor shall such rights be construed to enlarge or otherwise alter in any manner the duties and obligations of the Members.

ARTICLE 4

DISTRIBUTION OF COMPANY FUNDS

4.1 DISTRIBUTIONS GENERALLY. Except as provided in Section 3.5, above, and Section 4.4, below, distributions to the Members shall be made only to all Members simultaneously on a pro rata basis in accordance with the percentage of Membership Interests held by each Member; provided, however, that any loans from Members pursuant to Section 3.7 hereof that are then due and payable shall be repaid prior to any distributions to Members. Any distributions by the Company will be made only to Persons who, according to the books and records of the Company, were the Members who were holders of record of Membership Interests in the Company on the date determined by the Managers as of which the Members are entitled to the distribution or distributions in question.

4.2 OPERATING DISTRIBUTIONS. Distributions, other than distributions payable in accordance with Sections 4.3 hereof, shall be made at such times and in such amounts equal to all distributions of any nature received by the Company from the Partnership, except for such amounts determined by the Managers to be retained for the necessary expenses of the Company and for the reasonable and necessary reserves as determined from time to time by the Managers in its sole Discretion.

4.3 TAX DISTRIBUTIONS. In any event, within seventy-five (75) days following the end of each taxable year, the Company shall make a distribution to each Member, subject to available funds, equal to the difference between (x) a Member’s individual federal and state income tax liability in respect of such Member’s ownership of Membership Interests in the Company at a combined tax rate equal to the sum of the highest marginal federal and Colorado income tax rates applicable to an individual, and (y) the amount of distributions to such Member previously made for such tax year. Distributions under this Section 4.3 shall be made equally to the Members in proportion to their Membership Interests.

4.4 DISTRIBUTIONS ON DISSOLUTION AND WINDING UP. Upon the dissolution and winding up of the Company, the proceeds of liquidation after the payment of creditors as specified in Section 14.2 hereof shall be distributed to all of the Members in accordance with their positive Capital Account balances as properly adjusted through the time of distribution.

4.5 DISTRIBUTIONS OF CEU SPUD FEES. Under the Joint Operating Agreement made a part of the LADA, the Company, as operator, is to receive from CEU a fee of $150,000 (proportionately reduced to CEU’s AMI Interest) for each horizontal well spudded

11

under the LADA (the “CEU Spud Fee”). The Members agree that the CEU Spud Fee shall be distributed (and allocated among the parties for tax purposes) as follows:

(a) For the first ten wells on which the CEU Spud Fee is paid:

| (i) | 40% to GeoResources; and |

| (ii) | 60% to Management LLC. |

(b) For all wells thereafter, the CEU Spud Fee shall be distributed to the Members in proportion to their respective Membership Interests in the Company; or if the Company has been dissolved in accordance with Article 14, the in proportion to their respective interests in the leases attributable to the well for which such spud fee was received.

(c) The Members agree to use reasonable good faith efforts to negotiate compensation for the Operator of the wells drilled under the LADA, in accordance with industry practices, in the event that an affiliate of Management LLC acts as Operator, or in the event that GeoResources or an affiliate of Management LLC is operating multiple drilling rigs on the lands covered by the LADA. In no case, shall an affiliate of Management LLC be required to serve as operator without being reasonably compensated for out-of-pocket expenses incurred in connection with operations and for other expenses mutually determined by the parties.

(d) If GeoResources or an affiliate of Management LLC serves as Operator and therefore bills and collects the CEU Spud Fee, it shall promptly upon receipt distribute such CEU Spud Fee, as specified above.

4.6 LIMITATION ON DISTRIBUTIONS. Notwithstanding any other provision to the contrary in this Agreement, the Company shall not make a distribution to any Member if such distribution would violate the Act or other applicable law.

4.7 WITHHOLDING OF TAXES. The Company will withhold taxes from distributions to the extent required to do so by applicable law. Any amounts so withheld and paid or required to be paid to a taxing authority will be treated as if they had been distributed to the Member from whose distribution the amount was withheld.

ARTICLE 5

ALLOCATIONS

5.1 ALLOCATIONS OF PROFIT AND LOSS. Profits and Losses for a taxable year of the Company, and each item thereof, shall be allocated among the Members on a pro rata basis on account of the percentage of Membership Interests held by each Member, except as otherwise provided in Section 3.4 above and Exhibit B hereto.

5.2 ALLOCATIONS OF LIQUIDATING GAIN AND LOSS. Liquidating Gains and Liquidating Losses shall be allocated among the Members so that, to the maximum extent possible, the Members’ resulting Capital Account balances are in proportion to the percentage of Membership Interests held by each Member, except as otherwise provided in Exhibit B hereto.

12

5.3 TRANSFERS. In the event of a transfer of Membership Interests during a taxable year, the Company shall make an interim closing of its books (or, at the election of the applicable transferor and transferee and with the consent of the Managers, utilize any other method permitted under Section 706 of the Code) for purposes of determining the allocations and distributions required under this Agreement.

5.4 ADDITIONAL ALLOCATIONS. Additional allocations shall be made in accordance with the allocation rules set forth in Exhibit B hereto.

5.5 AGREEMENT TO ALLOCATIONS. The Members understand and approve the allocations of tax items set forth in Items 8, 9 and 10 of Exhibit B hereto, and agree to report for federal income tax purposes consistently therewith.

5.6 NONRECOURSE LIABILITIES. For purposes of Regulations Section 1.752-3(a)(3), the Members agree that “Excess Nonrecourse Liabilities” of the Company, as defined in Regulations Section 1.752-3(a)(3), shall be allocated to the Members in proportion to their percentage Membership Interests.

5.7 NEGATIVE CAPITAL ACCOUNTS. In no event shall any Member be obligated to pay to the Company, any Member or any creditor of the Company any deficit balance in its Capital Account.

ARTICLE 6

MEETINGS OF MEMBERS

6.1 TIME AND PLACE. Any meeting of the Members may be held at such time and place, within or outside the State of Texas, as may be fixed by the Managers or as shall be specified in the notice or waiver of notice of the meeting. If the place for a meeting is not fixed by the Managers, such meeting shall be held at the Company’s principal office.

6.2 ANNUAL MEETING. The annual meeting shall be held on the date and at the time and place fixed from time to time by the Managers. The annual meeting shall be for the purpose of transacting such business as may properly be brought before the meeting.

6.3 SPECIAL MEETING. A special meeting for any purpose or purposes may be called by the Managers.

6.4 RECORD DATE FOR DETERMINATION OF MEMBERSHIP. In order that the Company may determine the Members entitled to notice of or to vote at any meeting, or at any adjournment of a meeting, of Members, or entitled to express consent to action in writing without a meeting, or entitled to exercise any rights in respect of any change, conversion, or exchange of stock, or for the purpose of any other lawful action, the Managers may fix, in advance, a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Managers. The record date for determining the Members entitled to notice of or to vote at any meeting of the Members or any adjournment thereof shall not be more than sixty nor less than ten days before the date of such meeting.

13

6.5 NOTICE TO MEMBERS. Written notice stating the place, date, and hour of the meeting and, in case of a special meeting, the purpose or purposes for which the meeting is called, shall be given not less than ten nor more than 60 days before the date of the meeting, except as otherwise required by the Act, either by depositing the notice in the United States mail, addressed to each Member of record entitled to vote at such meeting, postage paid, and registered or certified with return receipt requested, or by delivering the notice to each Member of record entitled to vote at such meeting in person, by courier, or by facsimile transmission. If mailed or delivered by courier, such notice shall be deemed to be given when deposited in the United States mail, postage prepaid, or when deposited with a reputable overnight courier, addressed to the Member at its address as it appears in the records of the Company. If given by facsimile transmission, such notice shall be deemed to be given when upon receipt of confirmation of a successful facsimile transmission to the facsimile number of the Member as it appears in the records of the Company. If given personally or otherwise than by mail, courier or facsimile transmission, such notice shall be deemed to be given when either handed to the Member or delivered to the Member’s address as it appears in the records of the Company. If an annual or special meeting of Members is adjourned to a different date, time, or place, notice need not be given of the new date, time, or place if the new date, time, or place is announced at the meeting before adjournment; provided, however, that, if a new record date for the adjourned meeting is fixed pursuant to Section 6.4 hereof, notice of the adjourned meeting shall be given to persons who are Members as of the new record date.

6.6 WAIVER. Attendance of a Member, either in person or by proxy, at any meeting, whether annual or special, shall constitute a waiver of notice of such meeting, except where a Member attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. A written waiver of notice of any such meeting signed by a Member or Members entitled to such notice, whether before, at, or after the time for notice or the time of the meeting, shall be equivalent to notice. Neither the business to be transacted at, nor the purpose of, any meeting need be specified in any written waiver of notice.

6.7 QUORUM. The holders of a majority of the percentage of Membership Interests entitled to vote at the meeting, present in person or represented by proxy, shall constitute a quorum at all meetings of the Members for the transaction of business, except as otherwise provided by the Act. If, however, such a quorum shall not be present at any meeting of Members, the Members entitled to vote, present in person or represented by proxy, shall have the power to adjourn the meeting from time to time, without notice if the time and place are announced at the meeting, until a quorum shall be present. At such adjourned meeting at which a quorum shall be present, any business may be transacted which might have been transacted at the original meeting. If the adjournment is for more than thirty days or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each Member of record entitled to vote at the meeting.

6.8 VOTING RIGHTS.

(a) The holders of Membership Interests shall each have the right and power to vote on any and all matters on which the holders of any Membership Interest are entitled to

14

vote. Each Member shall be entitled to that number of votes equal to the percentage of Membership Interests held by such Member.

(b) The unanimous approval of the Members shall be necessary for effecting or validating the following actions:

(i) Any amendment, alteration, or repeal of any provision of this Agreement or the Company’s Articles of Organization; or

(ii) Any authorization, designation or issuance, whether by reclassification or otherwise, of any new Membership Interests.

6.9 VOTING AND PROXIES. At every meeting of the Members, each Member shall be entitled to vote in person or by proxy, but no proxy shall be voted on or after three years from its date unless the proxy provides for a longer period. When a quorum is present at any meeting, the vote of the holders of a majority of the percentage Membership Interests present in person or represented by proxy shall decide any question brought before such meeting, unless the question is one upon which, by express provision of the Act or this Agreement, a different vote is required, in which case such express provision shall govern.

6.10 ACTION BY CONSENT OF THE MEMBERS. Any action required or permitted to be taken at a meeting of the Members, including at the annual meeting, may be taken without a meeting if a written consent setting forth the action so taken is signed by Members holding the percentage of Membership Interests as is required by the Act or this Agreement for approval of the action in question; provided, that all Members shall receive written notice of any action so taken not later than ten days after the date of such action. Such consent may be in one instrument or in several instruments, and shall have the same force and effect as a vote of the Members at a meeting duly called and held.

6.11 TELEPHONIC MEETINGS. Members may participate in any meeting of the Members through the use of any means of conference telephones or similar communications equipment as long as all persons participating can hear one another. A Member so participating shall be deemed to be present in person at the meeting.

6.12 COMPENSATION OF MEMBERS. Except as expressly provided in any written agreement between the Company and a Member, no Member shall receive any compensation from the Company for services provided to the Company in its capacity as a Member.

ARTICLE 7

MANAGEMENT

7.1 BOARD OF DIRECTORS.

(a) The conduct and operation of the Company’s business and affairs shall be fully vested in, and managed, subject to the provisions of Section 6.8 above, a Board of Directors, which shall have the right to delegate management to the Manager of the Company. The Board of Directors shall consist of not less than 3 and not more than 5 members.

15

Management LLC shall have the right to designate one member of the Board of Directors and GeoResources shall have the right to designate all other members of the Board of Directors.

(b) Management LLC may appoint (and remove and approve replacements for) two Board observers (the “Board Observers”) reasonably acceptable to the GeoResources. The Board Observers shall receive notice of and be permitted to attend all Board meetings and shall receive all materials delivered to the Board, subject to the confidentiality restrictions as shall reasonably be determined by GeoResources.

7.2 TIME AND PLACE. Any meeting of the Board may be held at such time and place, within or outside the State of Texas, as may be fixed by the Chairman of the Board or as shall be specified in the notice or waiver of notice of the meeting. If the place for a meeting is not fixed by the Chairman, such meeting shall be held at the Company’s principal office.

7.3 NOTICE TO DIRECTORS. Written notice stating the place, date, and hour of the meeting and the purpose or purposes for which the meeting is called, shall be given to all Directors not less than two days before the date of the meeting, except as otherwise required by the Act.

7.4 WAIVER. Attendance of a Director, either in person or by proxy, at any meeting, whether annual or special, shall constitute a waiver of notice of such meeting, except where a Director attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. A written waiver of notice of any such meeting signed by a Director entitled to such notice, whether before, at, or after the time for notice or the time of the meeting, shall be equivalent to notice. Neither the business to be transacted at, nor the purpose of, any meeting need be specified in any written waiver of notice.

7.5 QUORUM. A majority of the Directors, present in person or represented by proxy, shall constitute a quorum at all meetings of the Board of Directors for the transaction of business, except as otherwise provided by the Act.

7.6 VOTING RIGHTS.

(a) Each Director shall have one vote at all meetings of the Board of Directors.

(b) A simple majority vote of the Directors present at a meeting shall be necessary for effecting or validating any actions by the Board of Directors.

(c) The Board Observers shall have no voting rights.

7.7 ACTION BY CONSENT OF THE MEMBERS. Any action required or permitted to be taken at a meeting of the Board of Directors may be taken without a meeting if a written consent setting forth the action so taken is signed by Directors holding the percentage required by this Agreement for approval of the action in question.

16

7.8 TELEPHONIC MEETINGS. Directors may participate in any meeting of the Board of Directors through the use of any means of conference telephones or similar communications equipment as long as all persons participating can hear one another. A Director so participating shall be deemed to be present in person at the meeting.

7.9 DELEGATION TO MANAGERS. The Board of Directors shall have the right to delegate such portions of conduct and operation of the Company’s business and affairs as determined by the Board of Directors to one or more Managers. Among the duties delegated to the Manager is the control of operations in which the Company is engaged.

7.10 NUMBER; QUALIFICATION; TENURE. The number of Managers shall be not less than one and not more than 3, unless otherwise fixed from time to time pursuant to a resolution adopted by a majority of the Directors. A Manager need not be a Member. Upon the Effective Date of this Agreement, the Manager of the Company shall be Frank A. Lodzinski; provided, however, that prior to the Relevant Interest Notice Date, L.M. Cannon shall continue to serve as the Manager. The Manager of the Company shall not be entitled to any compensation for acting as Manager unless otherwise fixed by the Board of Directors.

ARTICLE 8

OFFICERS

8.1 OFFICERS. The Company may, but is not obligated to appoint executive officers. All executive officers of the Company, if any, shall be selected by, and serve at the pleasure of, the Manager. Such officers shall have the authority and duties delegated to each of them, respectively, by the Manager from time to time.

ARTICLE 9

INDEMNIFICATION

9.1 LIABILITY, EXCULPATION AND INDEMNIFICATION.

(a) To the fullest extent permitted by law but subject to the limitations expressly provided in this Agreement, all Covered Persons shall be indemnified and held harmless by the Company from and against any and all losses, claims, damages, liabilities, joint or several, expenses (including legal fees and expenses), judgments, fines, penalties, interest, settlements or other amounts arising from any and all claims, demands, actions, suits or proceedings, whether civil, criminal, administrative or investigative, in which any Covered Person may be involved, or is threatened to be involved, as a party or otherwise, by reason of its status as a Covered Person; provided, that in each case the Covered Person acted in good faith and in a manner that such Covered Person reasonably believed to be in, or (in the case of a Person other than the Managers) not opposed to, the best interests of the Company and, with respect to any criminal proceeding, had no reasonable cause to believe its conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere, or its equivalent, shall not create a presumption that the Covered Person acted in a manner contrary to that specified above. Any indemnification pursuant to this Section shall be made only out of the assets of the Company, it being agreed that the Members, Managers and officers shall not be personally liable for such indemnification and shall have no

17

obligation to contribute or loan any monies or property to the Company to enable it to effectuate such indemnification.

(b) To the fullest extent permitted by law, expenses (including legal fees and expenses) incurred by a Covered Person who is indemnified pursuant to Section 9.1(a) in defending any claim, demand, action, suit or proceeding shall, from time to time, be advanced by the Company prior to the final disposition of such claim, demand, action, suit or proceeding upon receipt by the Company of any undertaking by or on behalf of the Covered Person to repay such amount if it shall be determined that the Covered Person is not entitled to be indemnified as authorized in this Section 9.1.

(c) The indemnification provided by this Section 9.1 shall be in addition to any other rights to which a Covered Person may be entitled under any agreement, pursuant to any vote of the Members, as a matter of law or otherwise, both as to actions in the Covered Person’s capacity as a Covered Person and as to actions in any other capacity, and shall continue as to a Covered Person who has ceased to serve in such capacity and shall inure to the benefit of the heirs, successors, assigns and administrators of the Covered Person.

(d) The Company may purchase and maintain insurance, on behalf of the Managers, officers and Members and such other Persons as the Managers shall determine, against any liability that may be asserted against or expense that may be incurred by such Person in connection with the Company’s activities or such Person’s activities on behalf of the Company, regardless of whether the Company would have the power to indemnify such Person against such liability under the provisions of this Agreement.

(e) For purposes of this Section 9.1, the Company shall be deemed to have requested a Covered Person to serve as fiduciary of an employee benefit plan whenever the performance by it of its duties to the Company also imposes duties on, or otherwise involves services by, it to the plan or participants or beneficiaries of the plan; excise taxes assessed on a Covered Person with respect to an employee benefit plan pursuant to applicable law shall constitute “fines” within the meaning of Section 9.1(a); and action taken or omitted by it with respect to any employee benefit plan in the performance of its duties for a purpose reasonably believed by it to be in the interest of the participants and beneficiaries of the plan shall be deemed to be for a purpose which is in, or not opposed to, the best interests of the Company.

(f) In no event may a Covered Person subject the Members to personal liability by reason of the indemnification provisions set forth in this Agreement.

(g) A Covered Person shall not be denied indemnification in whole or in part under this Section 9.1 because the Covered Person had an interest in the transaction with respect to which the indemnification applies if the transaction was otherwise permitted by the terms of this Agreement.

(h) The provisions of this Section 9.1 are for the benefit of the Covered Persons, their heirs, successors, assigns and administrators and shall not be deemed to create any rights for the benefit of any other Persons.

18

(i) No amendment, modification or repeal of this Section 9.1 or any provision hereof shall in any manner terminate, reduce or impair the right of any past, present or future Covered Person to be indemnified by the Company, nor the obligations of the Company to indemnify any such Covered Person under and in accordance with the provisions of this Section 9.1 as in effect immediately prior to such amendment, modification or repeal with respect to claims arising from or relating to matters occurring, in whole or in part, prior to such amendment, modification or repeal, regardless of when such claims may arise or be asserted.

ARTICLE 10

OTHER

10.1 OTHER SIMILAR ACTIVITIES OF THE MEMBERS. Each Member acknowledges, agrees and understands that, from and after the date of this Agreement (or, in the case of any new Member or Substitute Member, from and after the date such Person becomes a Member), a Member may conduct Other Similar Activities whether within or outside the AMI under the LADA, independent of this Agreement and the Company; provided, however, that if one Member acquires any leases within a one mile radius of any of the Leases acquired by the Company, such Member shall offer the other party and CEU its proportionate share of such lease (based upon the 8/8ths ownership of the Leases) on terms and time frames similar to those contemplated by Section 3.1 of the LADA; provided, further that GeoResources shall have no obligation to offer any leases to Management LLC or to CEU to the extent such leases fall within the area in Fayette County outlined on Exhibit C attached hereto (the “Ramshorn AMI”) and Management LLC shall not compete for or acquire leases within the Ramshorn AMI (other than leases within the Ramshorn AMI that are shown as “Pending” or “Possible “ leases on Exhibit A).

10.2 RELATED PARTY TRANSACTIONS. All transactions between the Company and any Member or the Affiliate of any Member shall be on arms-length terms and conditions.

10.3 SALE OF PROPERTIES. If the Managers or GeoResources desires for the Company to sell any of its properties to any Person, the Managers shall provide Management LLC with written notice of such proposed sale and the relevant terms and conditions of such sale. If Management LLC does not want to participate in such sale, Management LLC shall have the right to cause the Company to distribute its interest in such properties (based upon its Membership Interest) to Management LLC in which case Management LLC shall not share in any of the proceeds of, or be allocated any of the Profits and Losses related to, such sale.

ARTICLE 11

TAXES

11.1 TAX RETURNS. The Tax Matters Member shall prepare and timely file (on behalf of the Company) all federal, state and local tax returns required to be filed by the Company. Each Member shall furnish to the Company all pertinent information in its possession relating to the Company’s operations that is necessary to enable the Company’s tax returns to be timely prepared and filed. The Company shall bear the costs of the preparation and filing of its returns.

19

11.2 TAX ELECTIONS.

(a) The Company shall make the following elections on the appropriate tax returns:

(i) to adopt as the Company’s fiscal year the calendar year;

(ii) to adopt the method of accounting permitted under the Code;

(iii) to make the election under Section 754 of the Code in accordance with applicable regulations thereunder, subject to the reservation of the right to seek to revoke any such election upon the Tax Matters Member’s determination that such revocation is in the best interests of the Members;

(iv) to elect to amortize the organizational expenses of the Company ratably over a period of 60 months as permitted by Section 709(b) of the Code; and

(v) any other election the Managers may deem appropriate.

(b) Neither the Company nor any Member shall make an election for the Company to be excluded from the application of the provisions of subchapter K of chapter 1 of subtitle A of the Code or any similar provisions of applicable state law and no provision of this Agreement shall be construed to sanction or approve such an election.

11.3 TAX MATTERS MEMBER.

(a) GeoResources, or such other Member selected by the Board of Directors, shall act as the “tax matters partner” of the Company pursuant to Section 6231(a)(7) of the Code (the “Tax Matters Member”). The Tax Matters Member shall take such action as may be necessary to cause to the extent possible each Member to become a “notice partner” within the meaning of Section 6223 of the Code. The Tax Matters Member shall inform each Member of all significant matters that may come to its attention in its capacity as Tax Matters Member by giving notice thereof on or before the fifth business day after becoming aware thereof and, within that time, shall forward to each Member copies of all significant written communications it may receive in that capacity.

(b) The Tax Matters Member shall take no action without the authorization of the Managers, other than such action as may be required by applicable law. Any cost or expense incurred by the Tax Matters Member in connection with its duties, including the preparation for or pursuance of administrative or judicial proceedings, shall be paid by the Company.

(c) The Tax Matters Member shall not enter into any extension of the period of limitations for making assessments on behalf of the Members without first obtaining the consent of the Managers. The Tax Matters Member shall not bind any Member to a settlement agreement without obtaining the consent of such Member. Any Member that enters into a settlement agreement with respect to any Company item (as described in Section 6231(a)(3) of

20

the Code) shall notify the other Members of such settlement agreement and its terms within 90 days from the date of the settlement.

(d) No Member shall file a request pursuant to Section 6227 of the Code for an administrative adjustment of Company items for any taxable year without first notifying the other Members. If the Managers consent to the requested adjustment, the Tax Matters Member shall file the request for the administrative adjustment on behalf of the Members. If such consent is not obtained within 30 days from such notice, or within the period required to timely file the request for administrative adjustment, if shorter, any Member may, subject to Section 5.5 hereof, file a request for administrative adjustment on its own behalf. Any Member intending to file a petition under Sections 6226, 6228 or other Section of the Code with respect to any item involving the Company shall notify the other Members of such intention and the nature of the contemplated proceeding. In the case where the Tax Matters Member is intending to file such petition on behalf of the Company, such notice shall be given within a reasonable period of time to allow the Members to participate in the choosing of the forum in which such petition will be filed.

(e) If any Member intends to file a notice of inconsistent treatment under Section 6222(b) of the Code, such Member shall give reasonable notice under the circumstances to the other Members of such intent and the manner in which the Member’s intended treatment of an item is (or may be) inconsistent with the treatment of that item by the other Members.

(f) The Members acknowledge that the tax provisions set forth in this Agreement may, from time to time, not result in the economic consequences anticipated by the Members. Accordingly, from time to time, the Members agree that they shall approve amendments to this Agreement as are reasonably requested by a Member to reflect tax considerations consistent with the economic provisions of this Agreement.

ARTICLE 12

TRANSFER OF MEMBERS’ INTERESTS;

ADMISSION OF ADDITIONAL MEMBERS

12.1 RESTRICTIONS ON TRANSFERS OF MEMBERSHIP INTERESTS.

(a) No Member may Transfer all or any portion of its Membership Interests, to any Person other than to a Person who at the time is already a Member of the Company without obtaining the approval of a majority of the Board of Directors.

(b) The approval by the Board of Directors of a Transfer shall also act as an approval to admit the Transferee as a Substitute Member.

(c) It is understood that GeoResources shall have the right, without any required approval from the Board of Directors or otherwise, to Transfer up to 50% of its Membership Interests in the Company to a third party and will promptly notify Management LLC in writing of such transaction, and the relevant terms and provisions thereof, after the completion thereof. It is provided however, that no such Transfer may dilute the economic benefits hereunder of Management LLC. Further, to the extent that GeoResources (directly or indirectly) realizes incremental economic benefits from the Transfer in excess of the total

21

contributions and costs of GeoResources attributable to the Transferred Membership Interests, GeoResources shall promptly pay or assign to Management LLC one-third of such incremental economic benefits.

12.2 FURTHER ADMISSIONS OF ADDITIONAL MEMBERS. The Company may authorize the issuance of additional Membership Interests to any Person at any time for such consideration as the Company deems appropriate even if such admission causes a dilution of the amount of Membership Interests then owned by Members of the Company. The issuance of additional Membership Interests to any Person who is not then a Member shall be subject to the approval provisions of Section 6.8.

12.3 TAG ALONG. If GeoResources, proposes to Transfer, directly or indirectly, other than a Transfer to a Person who is then a Member of the Company, or as otherwise permitted under Section 12.1(c), its Membership Interests, or if the leases held by the Company have been distributed to the Members as provided in Article 14, such that after such Transfer GeoResources will have transferred in the aggregate more than 50% of its Membership Interests or leasehold interests, then GeoResources shall give written notice (the “Sale Notice”) to Management LLC at least 30 calendar days prior to the closing of such Transfer. The Sale Notice shall describe in reasonable detail the proposed Transfer including, without limitation, the amount of interests to be transferred, the nature of such Transfer, the consideration to be paid, whether such consideration is to be paid in one lump sum or installments, the name and address of each prospective transferee, and the other material terms of the Transfer (the “Sale Terms”). Upon such Sale Notice:

(a) The consummation of such Transfer shall be subject to the right (the “Co-Sale Right”) of Management LLC to, upon written notice to GeoResources within 10 calendar days after receipt of the Sale Notice, participate in such Transfer by transferring a percentage of its Membership Interests or leasehold interests, as applicable, equal to the percentage being Transferred by GeoResources on the same terms and conditions specified in the Sale Notice.

12.4 GEORESOURCES RIGHT OF FIRST OFFER.

(a) If at any time or times Management LLC proposes to Transfer, directly or indirectly, other than a Transfer to a Person who is then a Member of the Company, its Membership Interests, or if the leases held by the Company have been distributed to the Members as provided in Article 14, then Management LLC shall deliver written notice (the “ROFO Notice”) to GeoResources of such intent to sell specifically identifying the Membership Interest or leases to be sold (the “Subject Properties”).

(b) For thirty (30) days following the receipt of the ROFO Offer by GeoResources, GeoResources shall have the right, at its option, to negotiate with Management LLC regarding the purchase of the Subject Properties and to submit an offer to purchase all (but not less than all) of the Subject Properties, which option may be exercised by delivering a written binding purchase offer (the “Purchase Offer”) to Management LLC within such 30-day period.

(c) To the extent that Management LLC does not elect to sell to GeoResources pursuant to the Purchase Offer, Management LLC shall be free to pursue a transaction and to

22

enter into a purchase and sale agreement (“PSA”) with a third party during the one hundred fifty (150) days after receipt of the Offer Period. Any sale by Management LLC to a third party in accordance with the terms hereof shall be at a price and on terms no more favorable to the purchaser than those specified in the Purchase Offer (if GeoResources submitted a Purchase Offer for the Subject Properties), or Management LLC shall be required to again offer the Subject Properties to GeoResources on the terms specified in the PSA and GeoResources shall have fifteen days in which to elect to purchase on such terms by executing an agreement substantially similar to the PSA within such 15-day period.

(d) The rights of GeoResources under this Section 12.4 shall terminate on the earlier of (i) a change in control of GeoResources, (ii) December 31, 2013, or (iii) the failure of GeoResources to complete any purchase pursuant to a Purchase Offer.

ARTICLE 13

BOOKS OF ACCOUNT, RECORDS AND REPORTS

13.1 PREPARATION AND MAINTENANCE OF BOOKS AND RECORDS. The Company shall prepare and maintain records and books of account covering such matters relative to the Company’s business as are usually entered into records and books of account maintained by limited liability companies engaged in businesses of like character. The Company’s books and records shall be maintained in accordance with partnership accounting practices and procedures and shall incorporate such method of tax accounting as the Company determines is permissible and would be in the best interests of the Company.

13.2 COMPANY DOCUMENTATION REQUIREMENTS. The Company shall keep at its principal office the following:

(a) A current list of the full name and last known business or residence address of each Member and Assignee (if any) set forth in alphabetical order together with the contribution of each Member and Assignee;

(b) Copies of the Company’s federal, state and local income tax or information returns and reports, if any, for the six most recent taxable years;

(c) A copy of the Articles of Organization and all amendments thereto;

(d) Copies of this Agreement and all amendments thereto;

(e) The books and records of the Company as they relate to the business affairs and operations of the Company for the current and the four most recent fiscal years; and

(f) Any other books and records that the Company is required to maintain under the Act or other applicable law.

13.3 FISCAL YEAR. The Fiscal Year of the Company shall be the calendar year.

23

13.4 COMPANY FUNDS. The funds of the Company shall be deposited in such bank account or accounts, or invested in such interest-bearing or non-interest-bearing investments, as shall be designated by the Managers. All withdrawals from any such bank accounts shall be made by the duly authorized agent or agents of the Company, including the Managers.

13.5 STATEMENTS.

(a) The Company shall cause to be prepared at least annually, at Company expense, the information related to the Company’s business activities necessary for the preparation of each Members’ federal and state income tax returns, and upon the written request of a Member, the Company shall send or cause to be sent such information relevant for such Member to each requesting Member within 90 days after the end of each taxable year, unless the Company reasonably determines there is good reason to defer the sending of such information, but in no event shall such information be sent to such Member later than 180 days after the end of the taxable year. If the Company deems it required or desirable, a copy of the Company’s federal, state and/or local income tax or information returns for that year shall also be sent to such Member along with such information.

(b) The Company shall provide to the Members such annual or other periodic reports on its business and financial affairs as may be required under the Act, other applicable law, or as otherwise deemed appropriate by the Managers.

(c) In addition to the information, reports and statements furnished to the Members pursuant to subsections 13.5(a) and (b) hereof, the Company shall furnish each Member, within 120 days after the end of each fiscal year:

(i) a balance sheet of the Company as of the beginning and close of such fiscal year;

(ii) a statement of Company Profits and Losses for such fiscal year; and

(iii) a statement of such Member’s Capital Account as of the close of such fiscal year, and changes therein during such fiscal year.

ARTICLE 14

DISTRIBUTIONS IN KIND; MANAGEMENT FEE; DISSOLUTION AND

TERMINATION OF THE COMPANY

14.1 CERTAIN DISTRIBUTIONS IN KIND.

(a) Upon the completion of each well in which the Company (directly or indirectly) participated in the drilling and completion, the Manager shall cause the Company to distribute and assign the leasehold interests attributable to that well, and the wellbore, to the Members in proportion to their Membership Interests; provided that the Member to whom a distribution is to be made is not then in default under the provisions of this Agreement.

24

(b) At any time, on or before June 30, 2011, Management LLC will have the right to purchase up to an undivided 10% interest (on an 8/8ths basis) of all, but not less than all, of the leaseholds then owned by the Company; excluding however, any leasehold interests attributable to wells in which the Company participated in the drilling and in the drilling units for such wells (not to exceed 640 acres per well, plus regulatory allowed incremental increases). The purchase price for such leasehold interests shall be equal to 10% (or such lesser elected amount) of the Company’s total costs incurred in acquiring those leasehold interests.

(c) Except as otherwise provided herein, no Member may compel a distribution in kind by the Company or may be compelled to accept a distribution of any asset in kind from the Company unless such Member is receiving an undivided interest in such asset equal to its Membership Interest. Subject to the foregoing, the Board of Directors may cause the Company to distribute assets in kind to the Members from time to time.

14.2 DISSOLUTION. The death, dissolution, bankruptcy, expulsion or removal of a Member shall not cause the dissolution of the Company, and upon any such event the business of the Company shall continue to be conducted pursuant to the terms of this Agreement. The Company shall be dissolved and its affairs wound up on the happening of any of the following events (herein each a “Dissolution Event”):

(a) At such time as the assets of the Company have been sold or distributed and the Company has no ongoing activities or operations;

(b) By the unanimous approval of the Members to dissolve the Company;

(c) The entry of a decree of judicial dissolution of the Company; or

(d) The occurrence of any event that makes it unlawful for the business of the Company to be carried on or for the Members to carry it on in a limited liability company form.

14.3 WINDING UP AND LIQUIDATION. Upon the occurrence of a Dissolution Event, the Managers shall cause a full accounting of the assets and liabilities of the Company to be taken and shall cause the business of the Company to be wound up as promptly as possible. To the extent of the assets of the Company, the Company shall satisfy liabilities to creditors of the Company (whether by payment or by making of reasonable provision for payment), including any loans to the Company by Members. Any remaining assets of the Company shall be distributed to the Members in-kind in proportion to their Membership Interests, in accordance with Section 4.3 hereof, which assets shall remain subject to the terms of the LADA. The holders of Membership Interests shall continue to share distributions, profits, losses and allocations during the period of liquidation in accordance with Articles 3, 4 and 5.

14.4 NO RECOURSE. A Member shall look solely to the assets of the Company for the return of its Capital Contributions, and if the assets remaining after the payment and discharge of Company debts and liabilities are insufficient to provide for the return of its Capital Contributions, a Member shall have no recourse against any other Member. No holder of an interest in the Company shall have any right to demand or receive property other than cash upon dissolution, winding up and termination of the Company.

25

14.5 NO DEFICIT CONTRIBUTION OBLIGATION. No Member shall have any obligation, upon a liquidation, to make any Capital Contribution for purposes of eliminating or diminishing any negative balance in such Member’s Capital Account.

ARTICLE 15

MISCELLANEOUS

15.1 NO REGISTRATION OF MEMBERSHIP INTERESTS. Each Member agrees that the Membership Interests being issued hereunder to the Members may be securities and that such Membership Interests have been issued without registration under the Securities Act of 1933, as amended (the “Securities Act”), or registration or qualification under any state securities or “Blue Sky” laws, in reliance on exemptions from those registration and qualification provisions. Each Member represents and warrants to the Company that he, she or it has acquired or is acquiring his, her or its Membership Interests for investment purposes and without any view toward or intent to dispose of or distribute such Membership Interests or any interest therein. Each Member also agrees that, in the absence of an applicable exemption from registration and qualification, neither the Membership Interests, nor any interest therein may be transferred without registration under the Securities Act and registration or qualification under applicable state securities or “Blue Sky” laws.

15.2 SECTION HEADINGS AND REFERENCES. The Article and Section headings used in this Agreement are for reference purposes only and should not be used in construing this Agreement. Unless specified otherwise, references herein to a “Section” or an “Article” shall mean the specified Section or Article of this Agreement. In any Section of this Agreement, reference to a “subsection” shall mean the specified subsection within such Section.

15.3 GENDER AND NUMBER. Wherever from the context it appears appropriate, each term in this Agreement stated in either the singular or the plural shall include the singular and the plural, and pronouns stated in either the masculine, feminine or the neuter gender shall include the masculine, the feminine and the neuter.

15.4 EXHIBITS. Each of the Exhibits attached to this Agreement are incorporated herein by reference and expressly made a part of this Agreement for all purposes. References to any Exhibit in this Agreement shall be deemed to include this reference and incorporation.

15.5 SEVERABILITY. If any provision of this Agreement or portion thereof, or the application of such provision or portion thereof to any person or circumstance, shall be held invalid, the remainder of this Agreement, or the application of such provision or portion thereof to persons or circumstances other than those to which it is held invalid, shall not be affected thereby.

15.6 SUCCESSORS AND ASSIGNS. Except as otherwise herein provided, this Agreement shall be binding upon and inure to the benefit of the parties hereto, their respective heirs executors, administrators and successors, and all other persons hereafter having or holding an interest in this Company, whether as Assignees, Transferees, Substitute Members or otherwise.

26