Attached files

| file | filename |

|---|---|

| 8-K - SHENANDOAH TELECOMM 8-K 3-7-2011 - SHENANDOAH TELECOMMUNICATIONS CO/VA/ | form8k.htm |

EXHIBIT 99.1

4Q 2010 Earnings Conference Call

March 7, 2011

Exhibit 99.1

2

Safe Harbor Statement

This presentation includes “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our business strategy, our prospects and our

financial position. These statements can be identified by the use of forward-looking

terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,”

“should,” “could,” or “anticipates” or the negative or other variation of these similar

words, or by discussions of strategy or risks and uncertainties. These statements are

based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary

materially from the Company’s expectations and projections. Important factors that

could cause actual results to differ materially from such forward-looking statements

include, without limitation, risks related to the following:

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our business strategy, our prospects and our

financial position. These statements can be identified by the use of forward-looking

terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,”

“should,” “could,” or “anticipates” or the negative or other variation of these similar

words, or by discussions of strategy or risks and uncertainties. These statements are

based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary

materially from the Company’s expectations and projections. Important factors that

could cause actual results to differ materially from such forward-looking statements

include, without limitation, risks related to the following:

qIncreasing competition in the communications industry; and

qA complex and uncertain regulatory environment.

A further list and description of these risks, uncertainties and other factors can be found

in the Company’s SEC filings which are available online at www.sec.gov,

www.shentel.com or on request from the Company. The Company does not undertake

to update any forward-looking statements as a result of new information or future

events or developments.

in the Company’s SEC filings which are available online at www.sec.gov,

www.shentel.com or on request from the Company. The Company does not undertake

to update any forward-looking statements as a result of new information or future

events or developments.

3

Use of Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures that are not

determined in accordance with US generally accepted accounting principles. These

financial performance measures are not indicative of cash provided or used by operating

activities and exclude the effects of certain operating, capital and financing costs and

may differ from comparable information provided by other companies, and they should

not be considered in isolation, as an alternative to, or more meaningful than measures

of financial performance determined in accordance with US generally accepted

accounting principles. These financial performance measures are commonly used in the

industry and are presented because Shentel believes they provide relevant and useful

information to investors. Shentel utilizes these financial performance measures to

assess its ability to meet future capital expenditure and working capital requirements, to

incur indebtedness if necessary, return investment to shareholders and to fund

continued growth. Shentel also uses these financial performance measures to evaluate

the performance of its businesses and for budget planning purposes.

determined in accordance with US generally accepted accounting principles. These

financial performance measures are not indicative of cash provided or used by operating

activities and exclude the effects of certain operating, capital and financing costs and

may differ from comparable information provided by other companies, and they should

not be considered in isolation, as an alternative to, or more meaningful than measures

of financial performance determined in accordance with US generally accepted

accounting principles. These financial performance measures are commonly used in the

industry and are presented because Shentel believes they provide relevant and useful

information to investors. Shentel utilizes these financial performance measures to

assess its ability to meet future capital expenditure and working capital requirements, to

incur indebtedness if necessary, return investment to shareholders and to fund

continued growth. Shentel also uses these financial performance measures to evaluate

the performance of its businesses and for budget planning purposes.

4

Chris French

CEO and President

5

4Q’10 Highlights

q Customer Growth

u Total wireless customers 302,653 at end of year

u Total Cable RGUs 104,440 at end of year

q Cable Expansion

u November 30th closed on the purchase of Suddenlink

properties; 7,000 homes passed, 3,900 RGUs

properties; 7,000 homes passed, 3,900 RGUs

q Wireless

u Significant growth in prepaid business which began with

the purchase of approximately 50,000 current Virgin

Mobile customers in July 2010

the purchase of approximately 50,000 current Virgin

Mobile customers in July 2010

6

Cable Highlights

q Cable Upgrades

u Former Rapid Communication systems complete

u Former Jet Broadband markets work underway

q Triple Play

u High Speed data available to 89% and voice to 73%

of acquired video homes passed at 12/31/10

of acquired video homes passed at 12/31/10

q Sales Momentum

u 2010 net RGU additions of 9,972

7

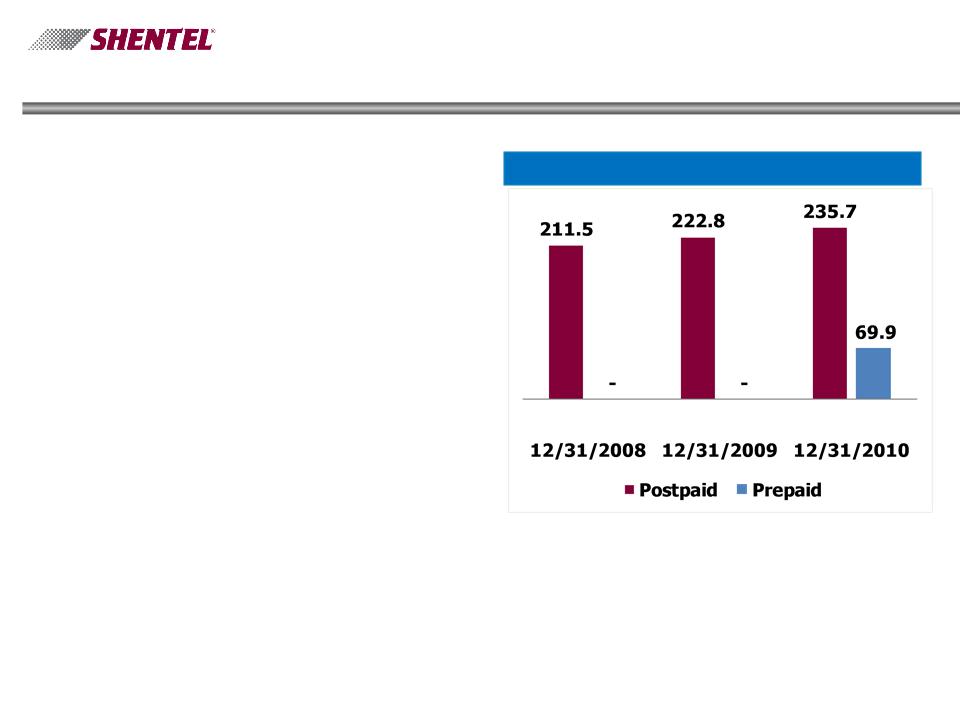

Wireless Highlights

PCS Postpaid Customers (000s)

q Prepaid - 2010 net

additions of 17,071 and

66,956 prepaid subs at

12/31

additions of 17,071 and

66,956 prepaid subs at

12/31

q Steady Wireless growth

- Postpaid customers up

6% in the last year

- Postpaid customers up

6% in the last year

q Postpaid Churn

improves - Annual churn

of 1.9% compared to 2.1%

for 2009

improves - Annual churn

of 1.9% compared to 2.1%

for 2009

8

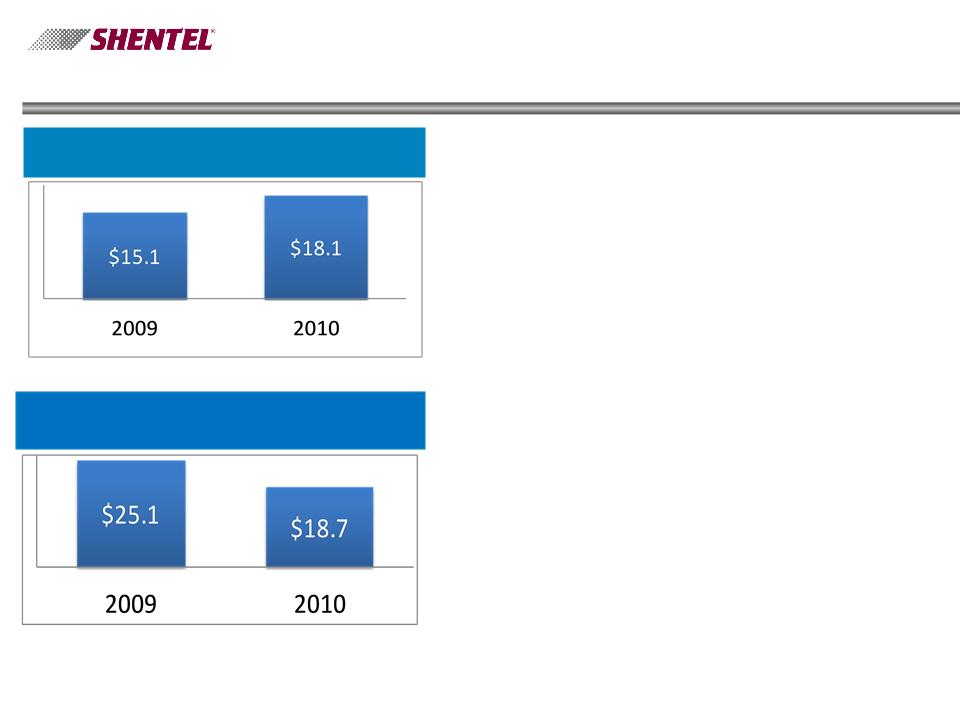

2010 Financial Highlights

q JetBroadBand acquisition-

related transaction costs -

$3.1 million before tax and $1.8

million after tax

related transaction costs -

$3.1 million before tax and $1.8

million after tax

q Prepaid - Net loss $.6 million

pre-tax, $.4 million after-tax

pre-tax, $.4 million after-tax

q Closed DB Pension Plan -

Incurred cost of $3.8 million,

pre-tax, $2.3 million after tax

Incurred cost of $3.8 million,

pre-tax, $2.3 million after tax

q Directory sale - sold

publishing rights for $4 million

gain pre-tax, $2.4 million after

tax

publishing rights for $4 million

gain pre-tax, $2.4 million after

tax

Net Income

(in millions)

Net Income from Continuing Operations

(in millions)

(in millions)

9

Adele Skolits

CFO and VP of Finance

10

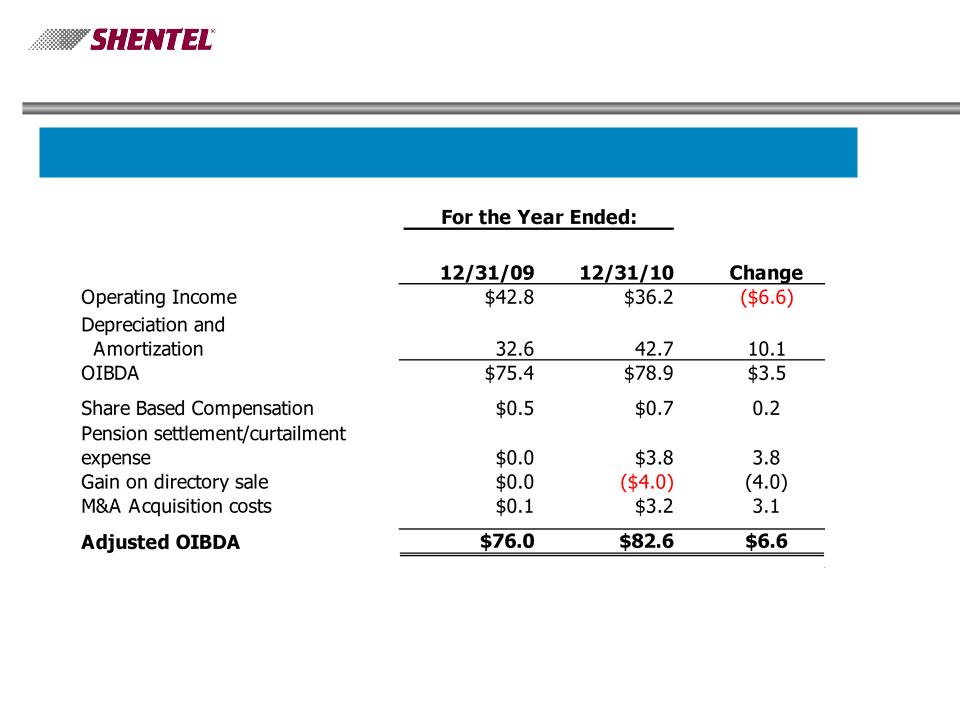

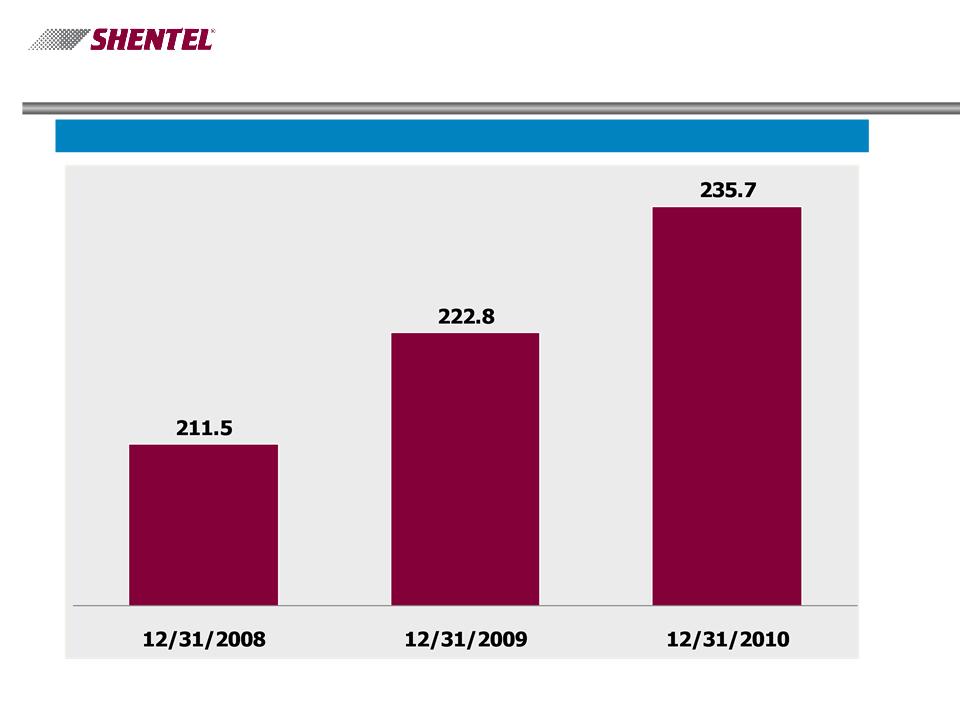

Profitability

Adjusted OIBDA ($ millions)

11

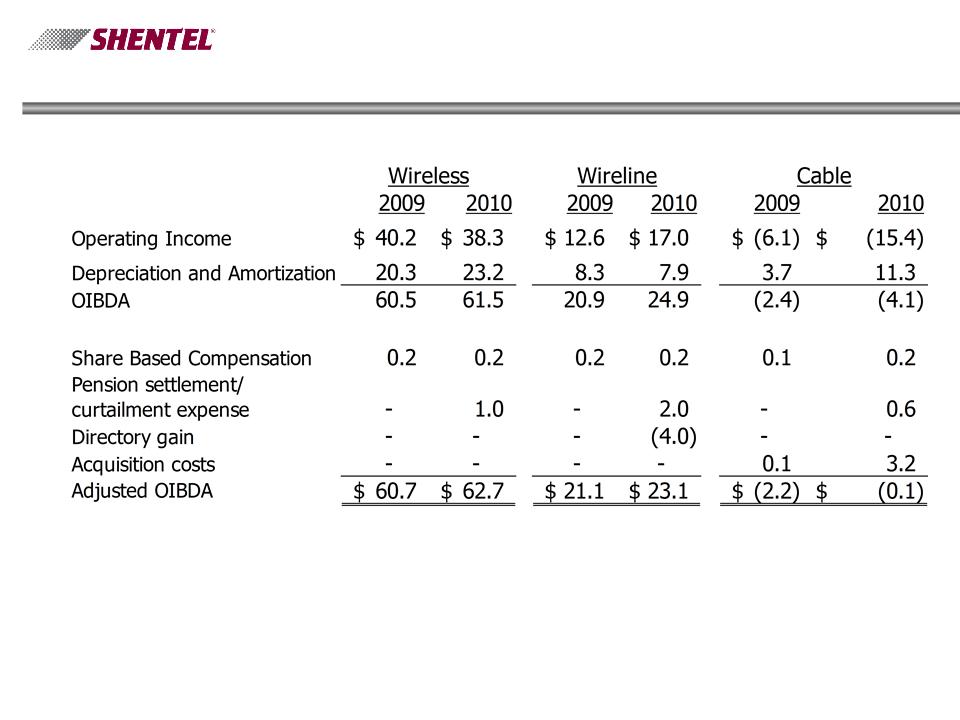

Adjusted OIBDA by Segment

12

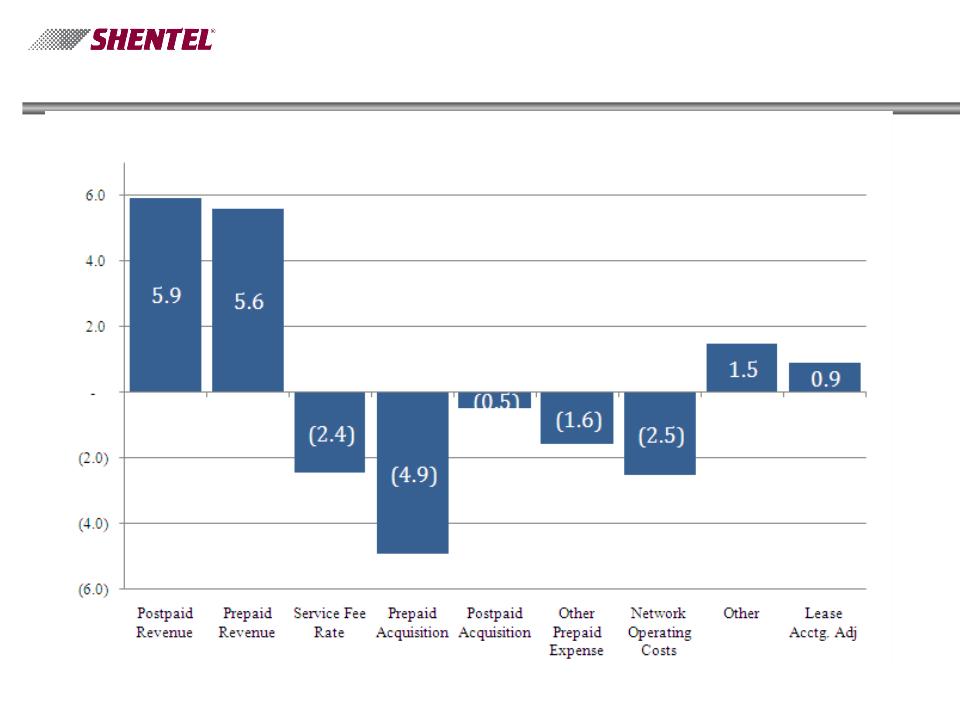

Wireless Segment - Change in Adjusted

OIBDA 2010 vs. 2009

OIBDA 2010 vs. 2009

13

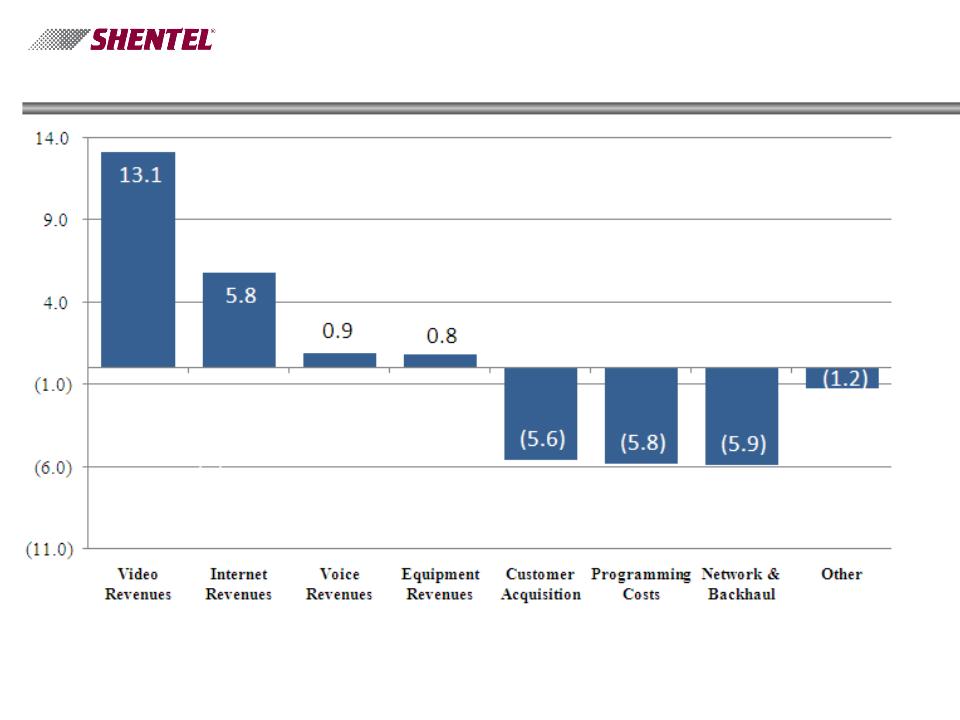

Cable Segment - Change in Adjusted

OIBDA 2010 vs. 2009

OIBDA 2010 vs. 2009

14

Earle MacKenzie

EVP and COO

15

Key Operational Results - Wireless

PCS Postpaid Customers (000s)

16

Key Operational Results - Wireless

Gross Additions - Postpaid

Net Additions - Postpaid

n Continued postpaid net

growth

growth

n Q4 2010 net adds of

5,112, a 68% increase

over Q4 2009

5,112, a 68% increase

over Q4 2009

n Q4 2010 churn of 1.8%

down from 2.0% in Q4

2010

down from 2.0% in Q4

2010

n Decrease in churn from

2.1% for 2009 to 1.9% for

2010

2.1% for 2009 to 1.9% for

2010

17

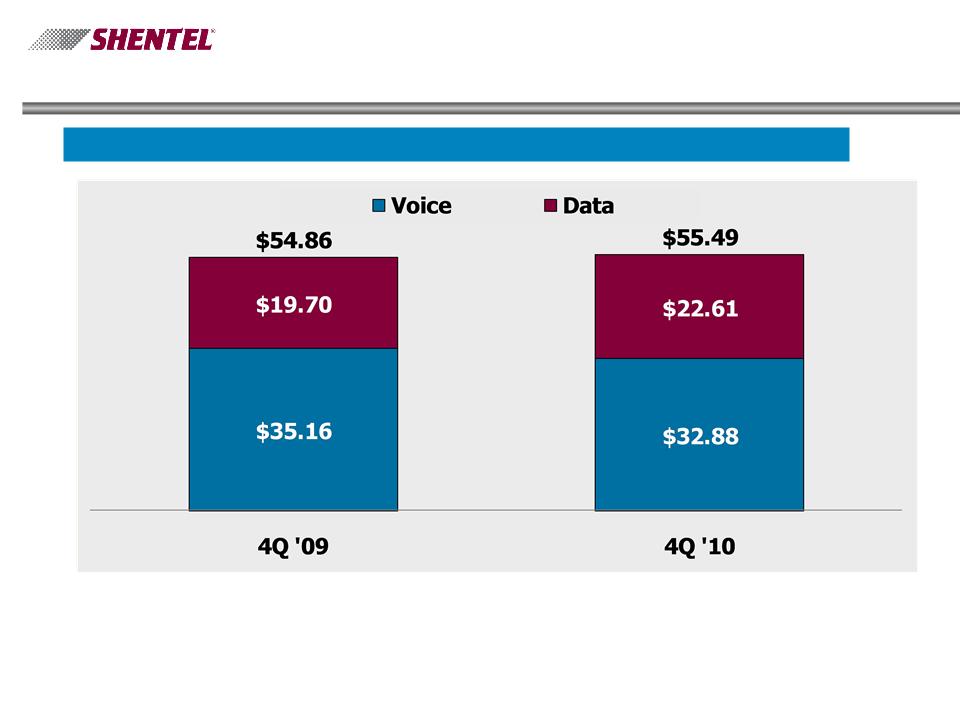

Key Operational Results - PCS

Gross Billed Revenue per Postpaid User - Data & Voice 1

1 - Before Service credits, bad debt, Sprint Nextel fees.

18

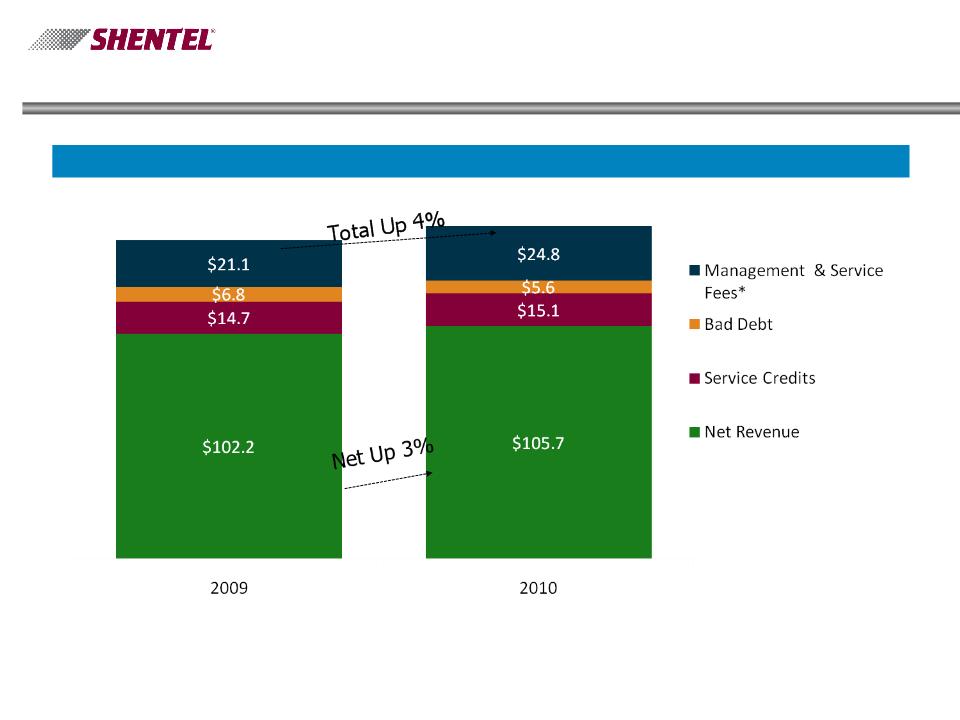

PCS Revenues

Gross Billed Revenues - Postpaid ($ millions)

$144.8

$151.2

*-The Net Service Fee percentage increased from 8.8% to 12% effective 6/1/10

19

Postpaid PCS Customers Top Picks Q4 2010

n Top Service Plans - 63% of

Gross Adds

Gross Adds

u Everything Data Family

1500 - 47%

1500 - 47%

u Everything Messaging

Family 1500 - 8%

Family 1500 - 8%

u Everything 450 - 8%

n Top Devices - New Activations

- All Channels

- All Channels

u LG Rumor Touch 17%

u HTC EVO 4G 14%

u Samsung Seek 7%

u LG Optimus S 6%

u Samsung Epic 4G 5%

u Mobile Data Cards 6%

u Mobile Computing 1%

20

PCS Prepaid Statistics

ØAcquired 49,885 prepaid subscribers effective 7/1/10

§Paid $138 per sub

ØGross adds of 19,199 in Q4 2010 and 33,488 since

7/1/10

7/1/10

ØNet adds of 10,775 in Q4 2010 and 17,071 since 7/1/10

ØEnding subscribers of 66,956

ØChurn rate of 4.6% for Q4 2010 and 4.9% since 7/1/10

ØAverage Billed Revenue of $18.42 in Q4 2010 and $17.61

since 7/1/10

since 7/1/10

21

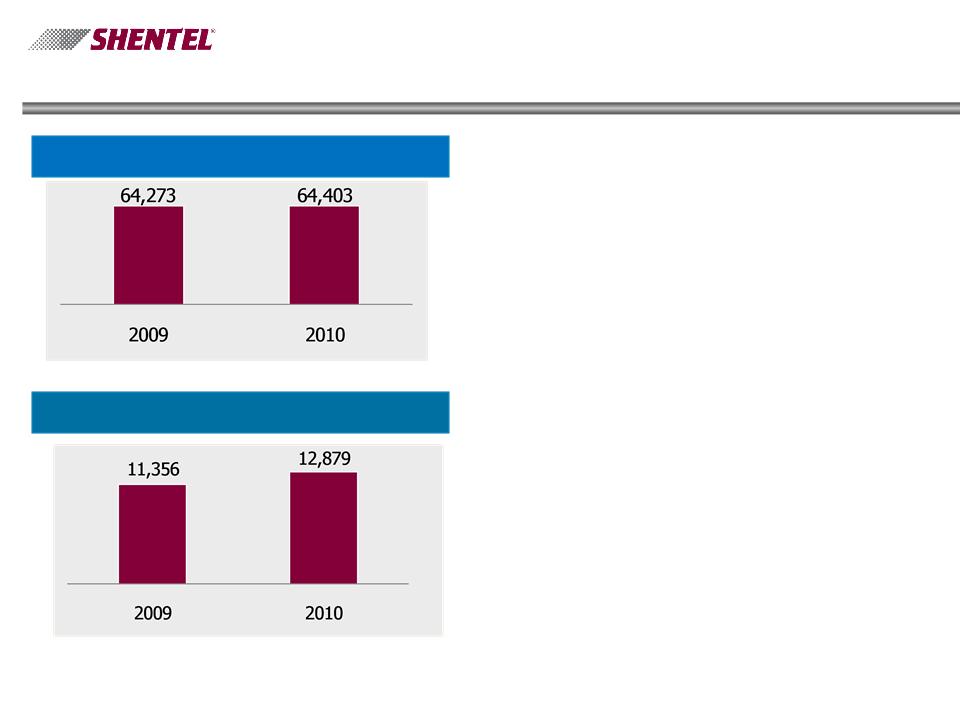

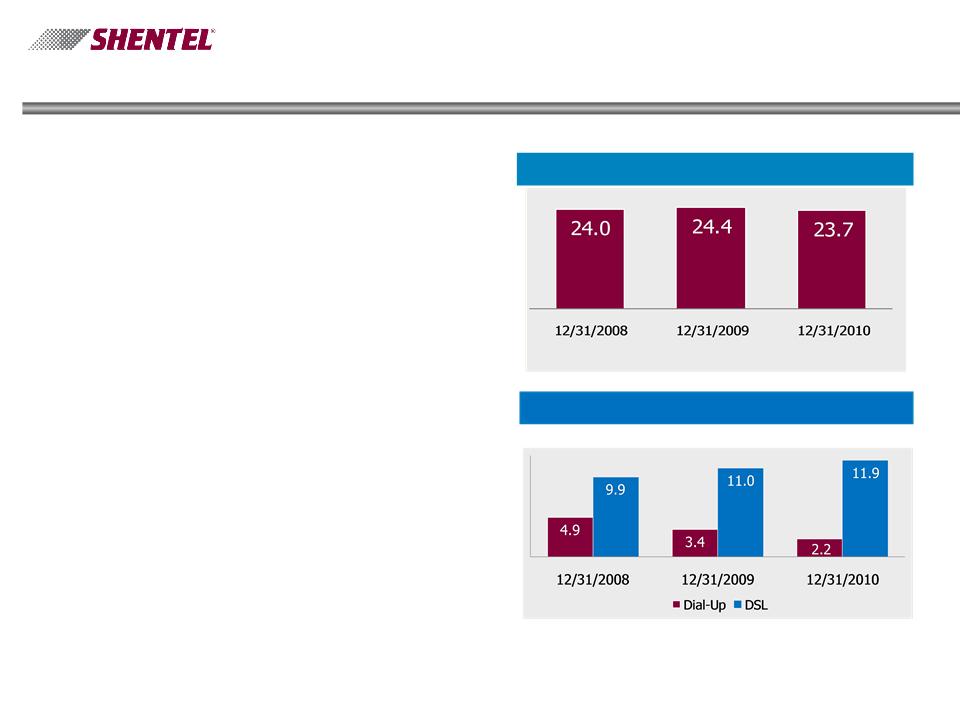

Key Operational Results - Wireline

n Modest access line loss

n Improved broadband

penetration to over 50%

penetration to over 50%

n 8% growth in DSL

customers since

12/31/09

customers since

12/31/09

Access lines (000s)

Internet Customers (000s)

22

RGU Growth by Quarter - Cable

Net RGU growth excludes 1,754 RGU’s sold Q4’09 and 65,338 acquired Q3’10 and 4,245

acquired in Q4’10

acquired in Q4’10

23

Key Operational Results - Cable

Note: Video homes passed includes 16K homes located in Shenandoah County, VA, where internet and

voice services are not available from the cable company.

voice services are not available from the cable company.

24

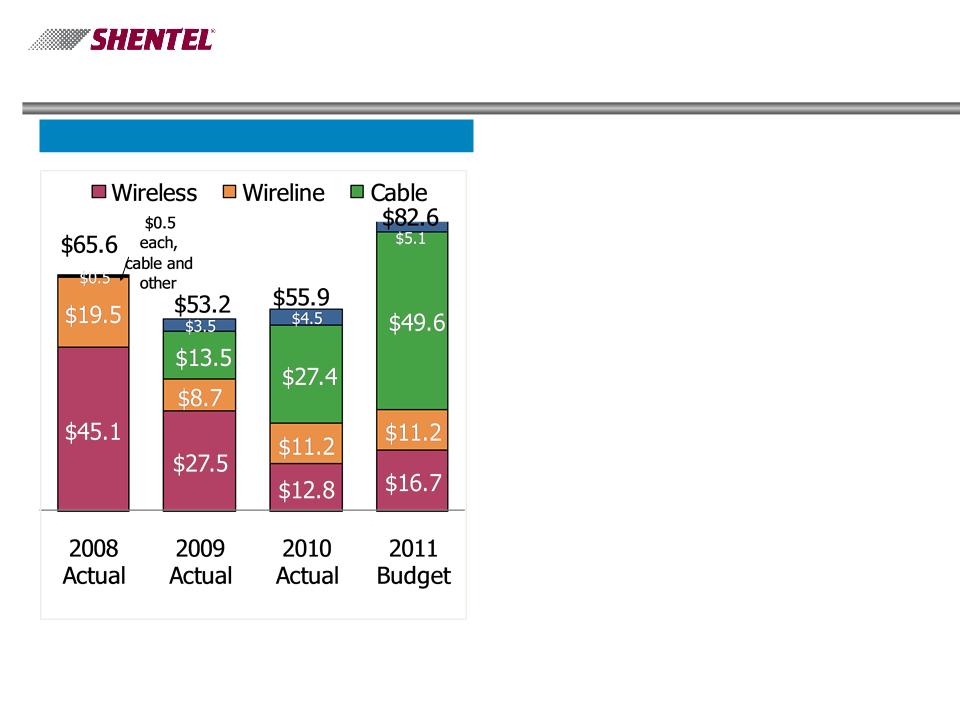

Investing in the Future

n Completed upgrade of 2008

Rapid acquisition in Q4 2010

Rapid acquisition in Q4 2010

n Completed hardening of Jet

Network in Q4 2010

Network in Q4 2010

n Began upgrade of Farmville

system to be completed in Q2

2011

system to be completed in Q2

2011

n All Virginia systems upgrades

projected to be completed in

2011

projected to be completed in

2011

n West Virginia systems

upgrades to be completed in

2012

upgrades to be completed in

2012

Capex Spending

25

Q&A

26

Appendix

27

Non-GAAP Financial Measure - Billed Revenue per Postpaid Subscriber