Attached files

| file | filename |

|---|---|

| 8-K - Highpower International, Inc. | v213646_8-k.htm |

| EX-99.1 - Highpower International, Inc. | v213646_ex99-1.htm |

Corporate Presentation

March 2011

Providing Solutions for Clean Energy

Anytime and Everywhere

Safe Harbor

This presentation may contain "forward-looking statements" within the meaning of the “safe-harbor”

provisions of the Private Securities Litigation Reform Act of 1995 related to the

Company’s future net

income, net sales, capital expenditures, gross margin, market share and EBITDA (earnings before

income taxes, depreciation and amortization) and the global demand for Li-ion battery products. Such

statements involve known

and unknown risks, uncertainties and other factors that could cause the

actual results of Highpower International (“HPJ” or the “Company”) to differ materially from the results

expressed or implied by such statements. These risks

and uncertainties include, without limitation, the

current economic downturn adversely affecting demand for the Company’s products, fluctuations in

the cost of raw materials, the Company's dependence on, or inability to attract additional, major

customers for a significant portion of its net sales, the Company’s ability to increase manufacturing

capabilities to satisfy orders from new customers, changes in the laws of the PRC that affect the

Company's operations, the Company’s

ability to complete construction at its new manufacturing facility

on time, the Company’s ability to control operating expenses and costs related to the construction of

its new manufacturing facility, the devaluation of the U.S. Dollar relative

to the Renminbi, the

Company's dependence on the growth in demand for portable electronic devices and the success of

manufacturers of the end applications that use its battery products, responsiveness to competitive

market conditions, the Company’s

ability to successfully manufacture Li-ion batteries in the time frame

and amounts expected, the market acceptance of the Company’s Li-ion products, and changes in

foreign, political, social, business and economic conditions that affect the Company’s

production

capabilities or demand for its products. Accordingly, although the Company believes that the

expectations reflected in such forward-looking statements are reasonable, there can be no assurance

that such expectations will prove

to be correct. The Company has no obligation to update the forward-

looking information contained in this presentation.

2

3

Highpower at a Glance

Leading developer, manufacturer and marketer of Nickel-Metal

Hydride (Ni-MH) and Lithium-ion (Li-ion) rechargeable batteries and

related products

NASDAQ: HPJ - Founded in 2001 and became public in 2008

Global distribution and leading OEM customers

Estimated 2010 Revenues of $105 million

Headquartered in Shenzen, with world class manufacturing facilities

in Shenzen and Huizhou, Guangdong Province, China

Offices in New York and the San Francisco Bay Area

Over 2,600 employees

Manufacturing Facilities

Li-ion Manufacturing

Since 2008

9,000 square meters

NiMH Manufacturing

Since 2001

40,000 square meters

Huizhou Manufacturing

Q3’2011

120,000 square meters

4

5

Global Trend Toward Greener Battery Solutions

Ni-MH and Lithium rechargeable batteries are replacing the

pollutive Lead-acid and Ni-Cd batteries

Ni-MH rechargeable batteries can be recharged 500 times,

minimizing environmental pollution caused by single use

batteries.

Single use disposable

Rechargeable

Lithium battery powered EV & Ebike

Lead-acid battery pollution

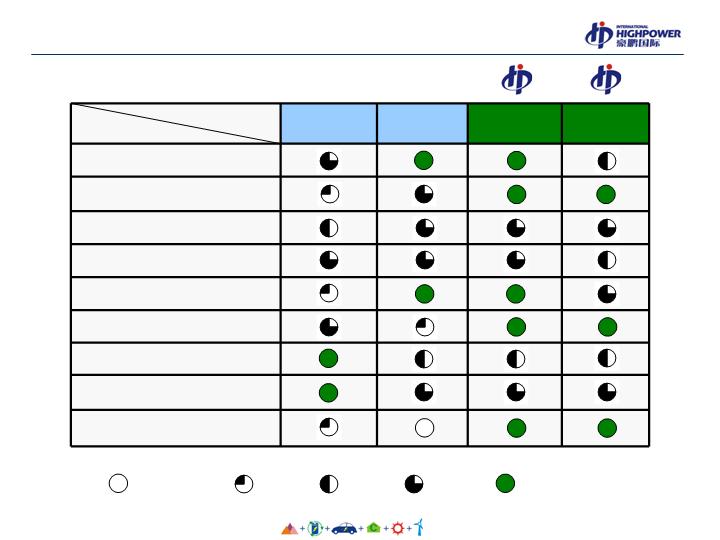

Battery Performance Comparison

Lead-acid

Ni-Cd

NiMH

Li-ion

Safety

Capacity/Density

Power Performance

Reliability

Cycle Life

Memory Effect

Raw Material Resources

Cost

Environmental Friendly

Very Good

Fair

Poor

Good

Very Poor

6

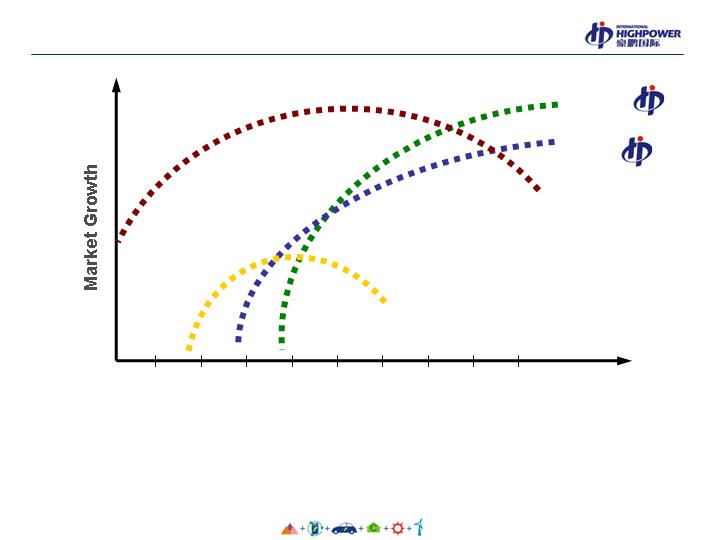

Market Potential of Ni-MH & Lithium Batteries

1990

2010

2030

2050

Lithium

Lead-acid

Ni-MH

Ni-Cd

1970

Year

Highpower’s specialization in rechargeable Ni-MH and

Lithium batteries positions the Company for future growth

Source: Company estimates and proprietary industry research

7

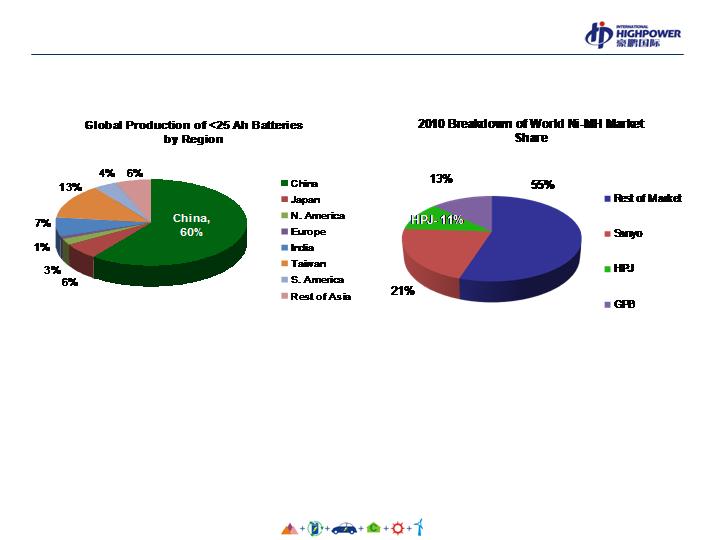

Highpower is a Market Leader

HPJ has become a worldwide leader in the Ni-MH

rechargeable battery market capturing approximately 11%

share of the 2010 global Ni-MH consumer

rechargeable

battery market, up from 10% in 2009

Source: Rodman & Renshaw estimates

Source: China Industrial Association of Power Sources

*Excluding the HEV market

8

Highpower’s Battery Applications

Lighting

Blue Tooth

Electric

Tools

eBooks

Electronic Toys

Laptops

GPS

Solar App

Wireless Phones

Medical

Devices

Tooth

Brushes

Electric

Razors

Electric

Bikes

Electric

Mowers

Backup Power

Supply

9

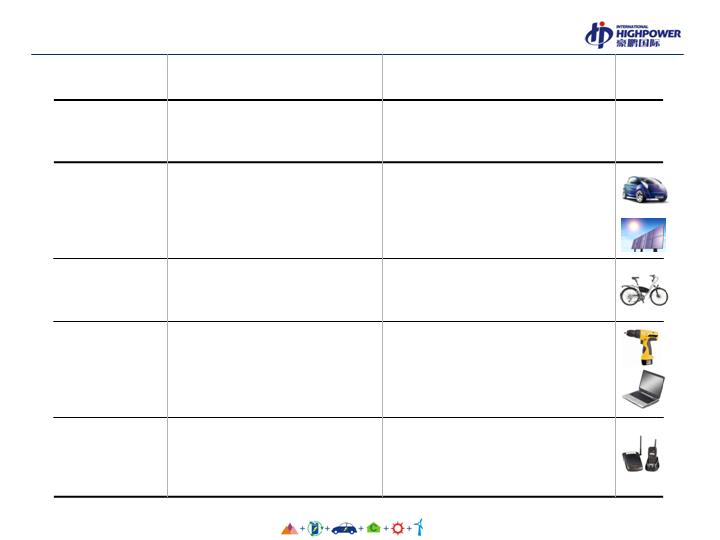

Ni-MH

Li-ion

2012-2018

Hybrid Electric Vehicles

Energy storage system

Military applications

Electric Vehicles

Power systems for solar and wind

projects

Next generation digital products

Military applications

2010-2012

Electric wheelchairs

Intelligent robots

E-bikes

High-level backup power

Power tools

2006-2009

Power tools

Electric toys

Handheld appliances

DVD players

Mobile phones

Bluetooth

MP3 players

Digital products

Before 2006

Wireless phones

Portable digital products

Consumer products

Emergency lighting

Our Product Evolution

Highlight

Approximately 11% of the

world market share

(excluding the HEV market)

Annual segment growth rate in

excess of 60%

10

Highpower’s Ni-MH Battery Revenue By Region

N. America

23%

Europe

30%

China &

H.K.

37%

S.E. Asia

6%

S. America

1%

Other: 3%

Estimated 2010 revenue of $75 million

Highpower sold over 140 million Ni-MH batteries world-wide in 2010

Approximately 30% of batteries were sold as stand-alone consumer batteries

11

Highpower’s Lithium Battery Revenue By Region

N. America

2%

Europe

1%

China &

H.K.

94%

S.E. Asia

3%

Estimated 2010 revenue of $17 million

Highpower sold over 12.5 million Li-ion & Li-polymer batteries world-wide in 2010

The vast majority of these batteries are integrated in the end products produced

in China that are exported elsewhere throughout the world

12

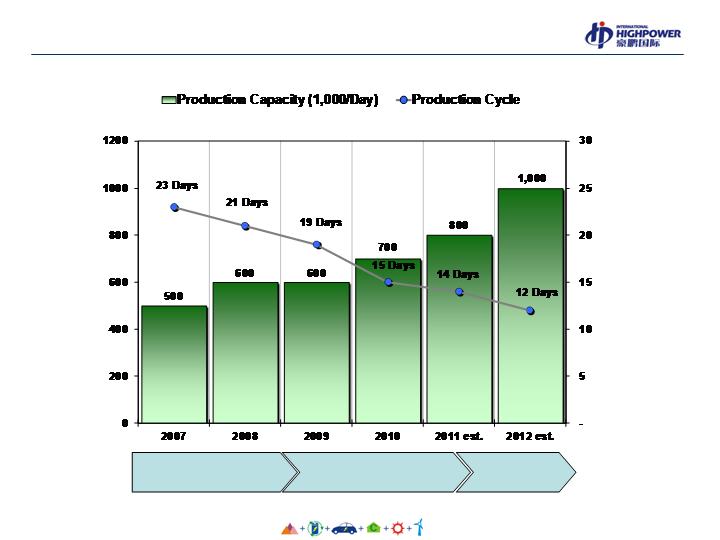

World Class Manufacturing Capabilities

23days

19days

Manual

Production

Semi-automated

Production

Automated

Production

1,000 units/Day

Days

13

Our Awards and Certifications

2010 Guangdong Province Clean

Production Award

ISO 9001 & 14001 Compliant

UL Authentication and CE

Attestation

Numerous awards received

symbolize our quality of

management and commitment to

excellence

ISO 9001

ISO 14001

UL Certification

CE Certification

14

Manufacturing Process

15

Our Commitment to R&D

20 patents received, 31 patents pending

Primary

Materials

Research

Partners:

1.

Central South University

2.

Harbin Institute of Technology

3.

ChangSha Research Institute of

Mining and Metallurgy

Battery

Materials

Research

Partners:

1.

Senior Professor of materials

science from Canada

2.

Research Center of Japanese

Santoku

3.

XiaMen Tungsten hydrogen

storage alloy Division

4.

Inner Mongolia Rare Earth;

5.

ChangSha Research Institute of

Mining and Metallurgy

6.

Freudenberg Diaphragm Division

Battery

Systems

Research

Partners:

1.

U.S. OVONIC Company

2.

Senior U.S. battery industry

consultant

3.

M&G Senior Advisor (Japan)

4.

China Industry Association

16

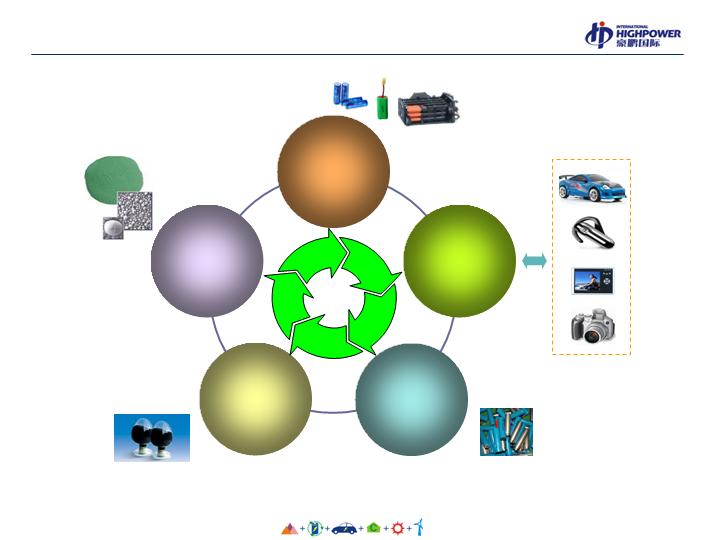

Product Strategies

Material

Processing

(Ni/Co)

End

Products

Raw

Materials

Battery

Materials

Cell,

Packs, &

Systems

Value

Chain

17

18

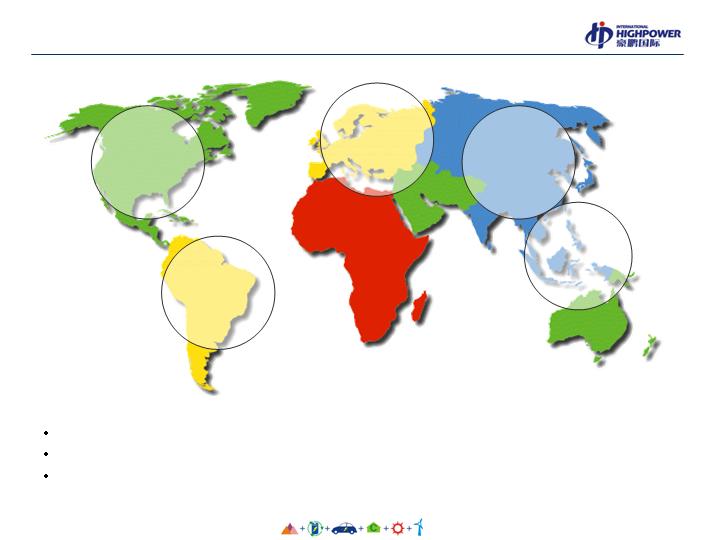

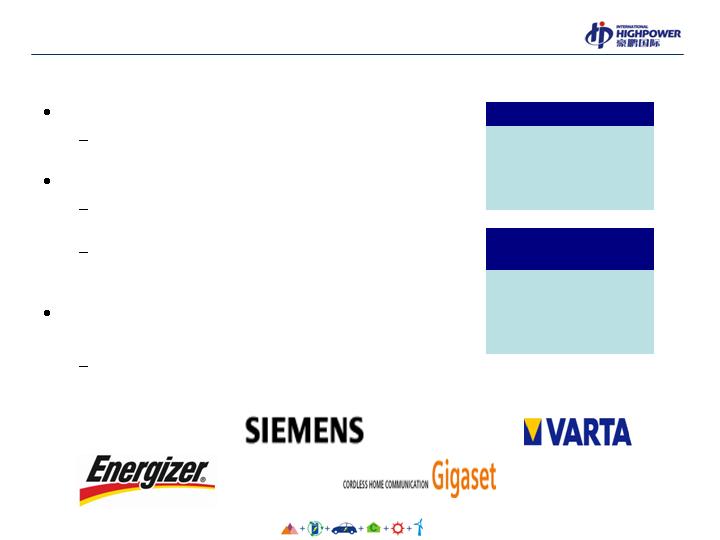

Sales Strategies

Build a Global Sales Platform

Europe, N. America, and Asia Pacific

Industry Focus

Growing industries, such as mobile

internet devices, smart phones

Emerging Industries, such as Ebikes,

energy storage systems, electric cars

Develop more Diversified World-

class Customers

Focus on major brands

Sales Staffing Levels

Sales: 65

Marketing: 8

S&M Support: 39

Planned 2011 New Int’l

Sales Offices & Staff

USA (1-2)

Germany (1-2)

Hong Kong (3-4)

Strategic Relationships

Key Strategic Suppliers

Key Financial Partners

19

Our Competitive Advantages

Excellent customer relationships

Lower cost and better quality

High quality product performance

Continual investment in R&D

Strong relationship with the Chinese government

Vast experience with international business partners

20

Our Management Team

Name & Title

Years of

Experiences

Past Experiences

George Pan

Chairman and CEO

>20

Shenzhen Highpower

HuangPu Aluminum Co.

Guangzhou Aluminum Products Co.

Wen Liang Li

VP, CTO and Director

>21

Zhuhai Taiyi Battery Co., Ltd.

Council of China Industrial Association of Power

Source

Henry Sun

CFO

>15

Finance, accounting, and IR management positions

at Zoomlion Machinery Company, Yasheng Group,

Sohu.com, Merrill Lynch, Cepheid

Michael Wang

VP of Sales & Marketing

>17

Sales & marketing management positions at Vale

Inco, Beijing Zhongke Sanhuan Hi-Tech Co., Ltd.

Bin Ran

VP of Strategy & Human

Resource

>18

Senior management positions with CBHansun,

Flink Group, GP Battery

Wen Wei Ma

VP of Manufacturing

>17

Shenzhen Highpower

Wen Jia Xiao

VP of Quality Control

>8

Shenzhen Highpower

21

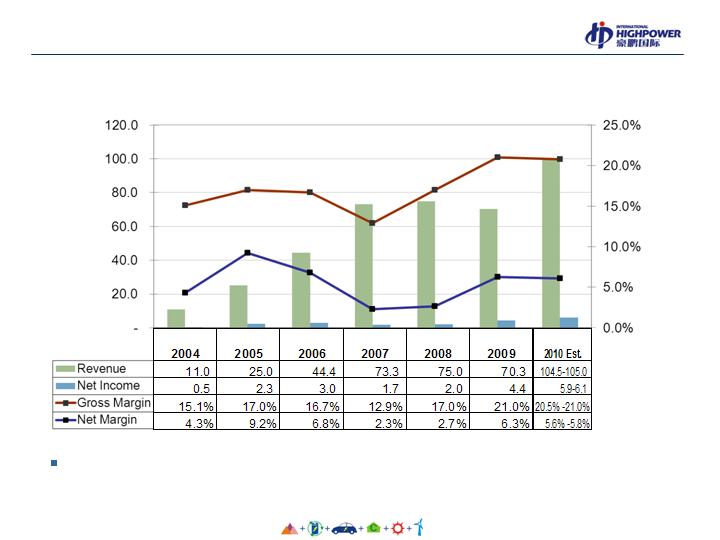

Revenue Growth and Margins

USD Millions

Our gross margins can be impacted by rapid changes in commodity prices

22

Note: 2010 estimates based on Company guidance announced on March 4, 2011

Strong Balance Sheet

23

($ in millions)

9/30/2010

Cash and Cash Equivalents and Restricted Cash

$13.0

Total Current Assets

$54.1

Total Assets

$71.4

Total Debt*

$21.7

Total Current Liabilities

$45.4

Stockholders’ Equity

$25.9

*Available unused bank credit facilities = $13.3 million

Drivers for Growth

Near Term

Continue to build our global sales platform

Increase our portfolio of products that sell into high

growth and emerging industries

Improved operating efficiencies

Long Term

Capitalize on the increasing global demand for clean

energy products and solutions

Continued R&D investments

Integrate our upstream and downstream businesses

24

HPJ Stock Snapshot

Nasdaq: HPJ

Recent Stock Price: $3.40

52-week Range: $2.99 - $6.70

Market Cap: $46.6 million

3-month Daily Average Trading Volume: 68,000

Fully Diluted Shares Outstanding: 13.7 million

Insider Ownership: 54%

Estimated FY 2010 Revenue: $104.5 - $105.0 million

Estimated FY 2010 Net Income: $5.9 - $6.1 million

P/E Ratio: 7.8x

25

Our Investment Thesis

Seasoned industry leadership

Large and growing market for rechargeable batteries

Competitive advantages in battery production quality,

consistency and reliability

Strong market share of Ni-MH global rechargeable

battery market

Complementary entry into attractive Li-ion battery market

Leading OEM customers

Green enterprise enabler of new technologies in

renewable energy

26