Attached files

| file | filename |

|---|---|

| 8-K - CHINA JO-JO DRUGSTORES, INC. 8-K - CHINA JO-JO DRUGSTORES, INC. | a6635986.htm |

| EX-99.1 - EXHIBIT 99.1 - CHINA JO-JO DRUGSTORES, INC. | a6635986ex99_1.htm |

Exhibit 99.2

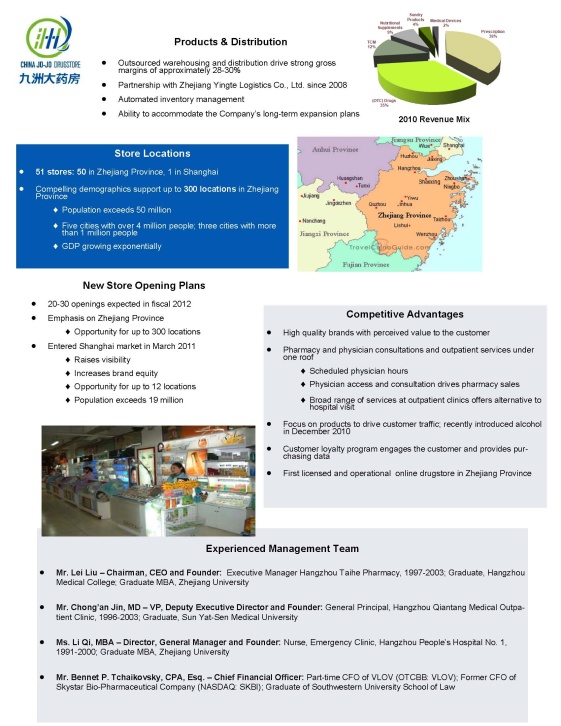

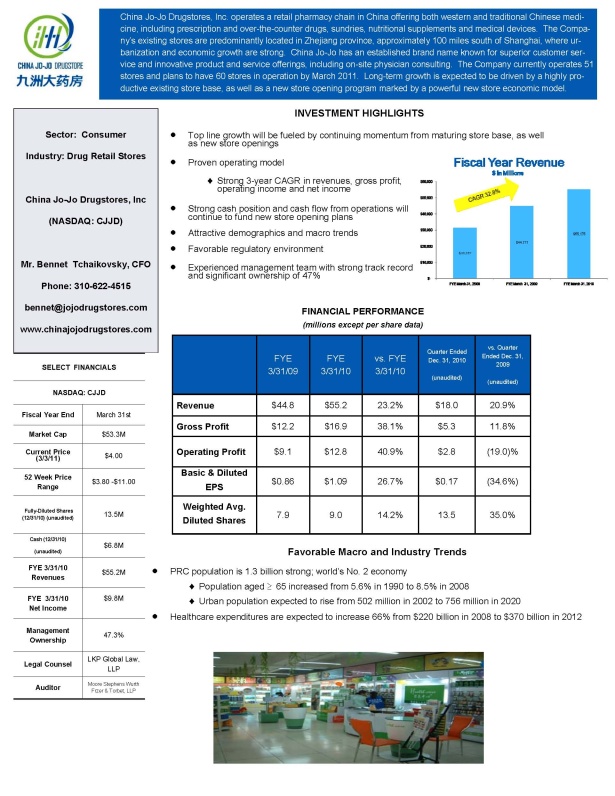

CHINA JO-JO DRUSTORE China Jo-Jo Drugstores, Inc. operates a retail pharmacy chain in China offering both western and traditional Chinese medicine, including prescription and over-the-counter drugs, sundries, nutritional supplements and medical devices. The Company’s existing stores are predominantly located in Zhejiang province, approximately 100 miles south of Shanghai, where urbanization and economic growth are strong. China Jo-Jo has an established brand name known for superior customer service and innovative product and service offerings, including on-site physician consulting. The Company currently operates 51 stores and plans to have 60 stores in operation by March 2011. Long-term growth is expected to be driven by a highly productive existing store base, as well as a new store opening program marked by a powerful new store economic model. Sector: Consumer Industry: Drug Retail Stores China Jo-Jo Drugstores, Inc (NASDAQ: CJJD) Mr. Bennet Tchaikovsky, CFO Phone: 310-622-4515 bennet@jojodrugstores.com www.chinajojodrugstores.com o Top line growth will be fueled by continuing momentum from maturing store base, as well as new store openings o Proven operating model o Strong 3-year CAGR in revenues, gross profit, operating income and net income o Strong cash position and cash flow from operations will continue to fund new store opening plans o Attractive demographics and macro trends o Favorable regulatory environment o Experienced management team with strong track record and significant ownership of 47% FINANCIAL PERFORMANCE (millions except per share data) FYE 3/31/09 FYE 3/31/10 vs. FYE 3/31/10 Quarter Ended Dec. 31, 2010 (unaudited) vs. Quarter Ended Dec. 31, 2009 (unaudited) Revenue $44.8 $55.2 23.2% $18.0 20.9% Gross Profit $12.2 $16.9 38.1% $5.3 11.8% Operating Profit $9.1 $12.8 40.9% $2.8 (19.0)% Basic & Diluted EPS $0.86 $1.09 26.7% $0.17 (34.6%) Weighted Avg. Diluted Shares 7.9 9.0 14.2% 13.5 35.0% Favorable Macro and Industry Trends PRC population is 1.3 billion strong; world’s No. 2 economy iPopulation aged ~ 65 increased from 5.6% in 1990 to 8.5% in 2008 iUrban population expected to rise from 502 million in 2002 to 756 million in 2020 Healthcare expenditures are expected to increase 66% from $220 billion in 2008 to $370 billion in 2012