Attached files

| file | filename |

|---|---|

| 8-K - American Standard Energy Corp. | v213506_8k.htm |

FORWARD-LOOKING STATEMENTS

Certain statements in this overview constitute “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements that address expectations or projections about the future, including statements

about product development, market position, expected expenditures and financial results, are forward-

looking statements.

Some of the forward-looking statements may be identified by words like “expects,” “anticipates,” “plans,”

“intends,” “projects,” “indicates,” and similar expressions. Any statements contained herein that are not

statements of historical fact may be deemed to be forward-looking statements. These statements are not

guarantees of future performance and involve a number of risks, uncertainties and assumptions.

Accordingly, actual results or performance of American Standard Energy, Corp. may differ significantly,

positively or negatively, from forward-looking statements made herein. Unanticipated events and

circumstances are likely to occur. These factors include, but are not limited to, risks that our operations

may not receive the level of market acceptance anticipated; anticipated funding may prove to be

unavailable; intense competition in our market may result in lower than anticipated revenues or higher

than anticipated costs, and general economic conditions, such as the rate of employment, inflation,

interest rates, oil and natural gas prices and the condition of the capital markets may change in a way that

is not favorable to us. This list of factors is not exclusive. We undertake no obligation to update any

forward-looking statements.

Ticker: ASEN (OTC BB)

2

COMPANY OVERVIEW

American Standard Energy Corp. (“ASEN”) was formed for the purposes of owning and managing

Oil and Gas properties under a non-operator E&P model in the:

Bakken shale formation (Williston Basin) of North Dakota

Eagle Ford formations of South Texas

Niobrara shale formation of Colorado

Wolfberry (Permian Basin) of Texas

ASEN is uniquely positioned to execute rapid growth in acreage accumulation, completed wells,

petroleum production, revenues and profitability.

To date, ASEN owns more than 23,200 acres under in some of the most sought-after oil and gas

plays in the continental US.

Ticker/Listing: ASEN.OB

Stock Price as of February 24, 2011: $6.80

Common Stock outstanding: 34.5 mm

Market Capitalization as of February 21, 2011: $234.6 million

Average Daily Volume Last Three Months: 18,767

Zero debt

Ticker: ASEN (OTC BB)

3

STRATEGIC OVERVIEW

Keys to successful growth in 2011:

Accelerate Land Acquisition Plans: Continue to acquire quality acreage in the Bakken and

Permian plays for rapid development.

Precise Expansion of Acreage in Key Plays: In secondary plays, emphasize acquisition of

acreage under near-term development in the Eagle Ford,

Niobrara and other plays as they

prove up.

Expand Producing Assets: Aggressive development schedule should accelerate daily

production by 5.0x to 10.0x in 2011.

Cash Flow from Producing Wells: Acquire low-risk, proven, producing wells with high

operating margins and strong track records, reducing

equity dilution.

Leverage Large Operators: Target acreage run by best-in-class majority operators.

Remain Flexible and Opportunistic: Stay abreast of changes in market to maximize

investor momentum and support.

Ticker: ASEN (OTC BB)

4

THE ASEN NON-OP PLUS MODEL

We emphasize minority working

interests in Bakken, Eagle Ford, and

other shale plays.

Reduced competition for non-op

acreage in these plays.

Excellent value in minority working

interests in these formations.

Lean fixed cost structure through

extensive outsourcing.

We consistently partner with excellent

lead operating partners.

We push drill bit risk to best in class

operating partners.

Traditional Non Operator Attributes:

The ASEN Plus:

We have exclusive access to over 500 K

acres in the Permian and neighboring

basins.

On a highly selective basis, we have

acquired this acreage since our

formation.

Acquiring additional Permian acreage

from our affiliate for development.

Control the lead operator by lease

prior to acquisition of the assets.

Control how much is drilled in a given

location before we acquire the asset.

ASEN

ADVANTAGE

Ticker: ASEN (OTC BB)

6

THE NON-OP PLUS MODEL ACCELERATES GROWTH

ASEN employs a unique non-op plus business model to drive rapid growth.

We benefit from the high operating margins and scalability of the traditional, highly-proven non-operated

E&P model.

We reduce operating and drilling risk through the experienced lead operators.

Our ability to selectively acquire proven producing acreage is a powerful catalyst to accelerate ASEN’s growth.

Immediate cash flows to fund Bakken acreage acquisitions.

Fund drilling capex in the Bakken.

Increases our engineered reserves, gaining immediate access to the debt capital markets at scale.

Our ability to acquire additional

underdeveloped acreage also provides

near-term, accelerated growth

opportunities.

ASEN can negotiate immediate joint venture partnerships with best in class drilling and operating partners.

ASEN can accelerate drilling programs in the Permian that require little to no capital outlay, driving

increased drilling, daily production, EBITDA, and engineered reserves.

All of ASEN’s Permian activity increases our immediate financial capacity to invest at scale in the Bakken now, and other shale

plays long-term.

We don’t have to wait for lead operators in the Bakken to drive ASEN’s growth in the region. We can grow very rapidly in the

Permian through relationship with our affiliate.

Ticker: ASEN (OTC BB)

5

FEBRUARY PRIVATE PLACEMENT RECAP

Ticker: ASEN (OTC BB)

7

On February 1, 2011 ASEN successfully closed a $15.4MM equity private placement led by Northland

Capital Markets.

During the capital raise, the use of proceeds were described as follows:

Permian Production: ASEN would acquire 30+ gross Permian wells with $4MM+ in EBITDA and

$20MM+ in engineered PV-10 reserves.

Bakken Acreage: ASEN would acquire 5,000+ net acres of fairway Bakken acreage.

In less than 30 days, ASEN exceeded the expectations and commitments outlined for investors:

Permian Production: ASEN expects the Permian production to produce $5MM+ in EBITDA and has

$35MM+ in engineered PV-10 reserves.

Bakken Acreage: ASEN has successfully close on 10,000 net Bakken acres.

ASEN’s stock price has reacted favorably to these events, creating a significant return on the 2/1/11 PIPE

for investors in fewer than 30 days.

American Standard Energy Corp has the ability to fully execute on capital deployment, and we have a

demonstrated track record of exceeding investors expectations.

CORPORATE TIMELINE

Ticker: ASEN (OTC BB)

8

October 2010:

ASEN publicly listed via

reverse merger.

October 2010:

ASEN closes $1.2MM

PIPE, acquires 6 gross

Bakken wells.

December 2010:

ASEN closes a

$1.5MM PIPE.

December 2010:

ASEN acquires 26

gross Bakken wells.

November 2010:

ASEN acquires 320

net Bakken acres.

February 2011:

ASEN acquires 36

gross Permian wells.

February 2011:

ASEN closes a

$15.4MM PIPE.

December 2010:

ASEN complete 2 net

new Permian wells.

March 2011:

ASEN acquires 10,000

net Bakken acres.

ASEN CLOSING PRICE

OCT 5, 2010: $1.50

ASEN CLOSING PRICE

FEB 24, 2011: $6.80

PRIOR TO PUBLIC LISTING

April 2010: Company Acquires 5,200 Bakken acres,

1,200 net Eagle Ford acres, 4,500 net Permian Acres.

August 2010: Successful close of $2.4MM private

placement.

ENHANCED PERMIAN GROWTH

Ticker: ASEN (OTC BB)

9

ASEN continues to evaluate the most efficient transition of 500,000+ Permian and neighboring basin

acreage from XOG to ASEN.

ASEN has executed on fully capitalized, acquired production to significantly increase cash flows

and engineered reserves for senior debt capacity.

ASEN has also aggressively explored JV opportunities with best in class Permian drilling and

operating partners.

ASEN has determined that partnering with excellent partners to drill more Permian wells in a

compressed timeframe will leave ASEN with strong net financial position to invest in the Bakken:

Reduced initial capital outlay to drill in the Permian.

Improved drill bit risk with best in class drilling resources.

Significantly compressed drilling timeline.

Significantly expanded Permian net wells owned by ASEN in 2011.

This strategy delivers more net cash flow and more PV-10 to lever for immediate Bakken growth,

with less upfront cash diverted to the Permian in 2011.

ASEN 2011 GROWTH OBJECTIVES

ASEN has a business model that leverages diversity by play and takes advantage of all available market

information. Our balanced investment model is focused on a mixture of low-risk, highly proven

investments

in the Williston and Permian basins, complemented by high-appreciation investments in emerging shale

formations. Below is a summary of ASEN’s growth objectives by geographic play in 2011:

Core Holdings

Bakken (Williston)

84,000 incremental net acres. 100,000 net acres in total

150+ incremental AFE’s.

8.6 incremental net wells. 9.6 net wells in total.

Permian Basin

10,000+ net incremental acres. 16,000+ net acres in total.

5-10+ incremental net wells planned for Wolfberry through JV Partners

30+ net wells in the Permian by year-end 2011

Areas for Potential Expansion

Eagle Ford

12 gross wells to be completed by Cheyenne, majority partner

ASEN expects to have 1.2 net wells in Eagle Ford with 3 active rigs.

Niobrara:

ASEN recognizes the rapidly emerging value of the Niobrara play

Executed option to acquire 27,500 net acres at a discount to FMV

Identify JV partners for joint development of Niobrara acreage.

Ticker: ASEN (OTC BB)

10

RECENT PERMIAN ACQUISITION

On February 15, 2011, ASEN announced the acquisition of Permian acreage and proven producing wells from

Geronimo Holdings Corporation, our private affiliate.

ASEN acquired 36 gross wells, 13.1 net wells based on the following criteria:

We acquired these wells based on consistent daily production averaging more than 350 BOE

per day in 2010.

Consistent lease operating margins.

Very strong PV-10 engineered reserves, particularly PDP and PDNP that should convert to

additional PDP with limited capex.

22 highly desirable PUD sites for development.

The immediate financial impact of this Permian acquisition to ASEN:

Monthly cash flows increase more than $400,000.

Engineered PV-10 increases our senior borrowing capacity by $25 million.

ASEN paid $7,000,000 for these assets to accelerate our Bakken growth.

With this transaction, ASEN can afford to acquire an additional 30,000 Bakken acres in 2011 and more predictably fund Bakken AFEs.

Ticker: ASEN (OTC BB)

11

INDICATIVE PERMIAN JOINT VENTURE

ASEN actively negotiating multiple joint venture relationships expected to close in Q1 2011. The purpose

of this joint venture was to immediately develop key Permian acreage held by ASEN. Below

is an

indicative structure for ASEC’s Permian JV activity:

ASEN contributes acreage in Upton or Andrews Counties, the two most active counties in the

Permian Basin in 2010 to the JV.

The lead operating partner commits to drill and operate a minimum of 10 wells, and up to 20 wells

on this acreage within 12 months.

ASEN would retain a 25% minority working interest in all wells drilled.

ASEN would contribute no capital to the joint venture for the first well on each lease.

ASEN would participate in 25% of all subsequent capex for drilling on these leases, using cash flow

from Well #1 to reduce total capital outlays.

Impact to ASEN’s Growth in the Bakken:

ASEN could see daily production increase by 200-400 BOE per day over the next year (assuming a 100 BOE daily production rate per well, with

80% NRI prior to the JV).

Incremental operating income to ASEN could be $3.5-7.0MM annually.

Incremental senior debt capacity could be $15MM or more.

ASEN could leverage this cash flow to add 22,000 additional Bakken acres in 2012 with a significantly reduced Permian capital outlay.

Ticker: ASEN (OTC BB)

12

FORECASTED GROWTH OF NET WELLS BY REGION

Note: This forecast excludes any additional Permian or Eagle Ford joint

venture or majority interest drilling activities.

Ticker: ASEN (OTC BB)

13

2011 Impact:

1.28 additional net

Bakken wells vs.

prior forecast

2012 Impact:

24.7 additional net

Bakken wells vs.

prior forecast

FORECASTED GROWTH OF BAKKEN NET WELLS

AND WORKING INTEREST

Note: This forecast emphasizes the impact of acquiring 50,000 acres in the Bakken in 2011. Limited benefit is

projected from continued acreage acquisition in 2012 solely due to variability

in development timeline.

Ticker: ASEN (OTC BB)

14

Independent oil and natural gas company engaged in the development and operation of oil and

gas properties.

XOG operates more than 4,000 wells and owns and additional 1,000 wells. XOG acts as the key

operating partner for Geronimo throughout the Permian.

ASEN intends to selectively use XOG as its operator for Permian and Arkoma wells. On a

contracted basis, XOG is also a strategic partner for ASEN, acting as a technical advisor on

sourcing,

evaluating and acquiring opportunistic investments unrelated to Geronimo’s existing

holdings.

STRATEGIC RELATIONSHIPS

XOG Operating, LLC

Geronimo owns extensive oil and gas producing properties in in the Permian Basin, the Gulf

Coast Basin, the Arkoma Basin, the Niobrara, the Bakken & Three Forks, and the Eagle Ford.

Geronimo has grown its reserves and production through development, drilling, and exploration

activities over the past 30 years.

Geronimo should continue to be a ready source of attractive producing assets and properties for

future production at a deeply discounted purchase price relative to FMV for the foreseeable

future.

GERONIMO HOLDINGS CORPORATION

Ticker: ASEN (OTC BB)

15

XOG-GERONIMO AS A SOURCE FOR

FUTURE ACQUISITIONS

Bakken: XOG holds a 40,000 net acre position in the Bakken today. With 26 landmen

working on XOG’s behalf, XOG can readily

source 100,000 additional for sale to ASEN.

Niobrara: XOG holds more than 55,000 net acres in this shale play.

Eagle Ford: XOG holds 10,000-12,000 net acres held by production with a 100% working

interest in this region for future development.

Permian: XOG owns more than 1,000 net wells in the Permian and neighboring

geographies. These assets generate $30MM+ in annual

EBITDA.

Arkoma: XOG owns more than 700 natural gas PUD sites under 16 sections, including

more than 100 producing wells today.

Marcellus: XOG owns more than 1MM net acres of natural gas assets.

Royalties: XOG owns a diverse portfolio of royalties that generate more than $1MM in

monthly EBITDA from the Permian, Arkoma, Bakken,

and other regions.

XOG-Geronimo currently owns more than 1,000 wells and 2.5 MM acres in 17 states.

ASEN’s competitive advantage comes from its ability to acquire, at will, both production and

property to be developed at a deep discount to FMV.

The list below summaries some of the assets and production readily available for acquisition by

ASEN today:

Ticker: ASEN (OTC BB)

16

LONG-TERM GROWTH SUMMARY

ASEN should also have the opportunity to acquire additional assets from XOG. Our growth

strategy is threefold:

Acquire Additional High Value Assets for Expanded Development:

ASEN plans to acquire 50,000+ net Bakken acres from XOG in 2012.

Identified up to 100,000 net acres of held by production, underdeveloped acreage

in the Eagle Ford, Cana, Permian and Niobrara for acquisition, from XOG, in 2012

and beyond.

Most of these assets would only be acquired by ASEN with a defined JV plan to

partner with a proven drilling and operating partner, with ASEN retaining a strong

minority WI in the JV.

Acquire Additional Proven Producing Assets:

Focused acquisitions of up to 250 total producing wells and royalty interest in 400

additional wells from XOG in 2011 and beyond.

Could add $15-20MM in EBITDA to ASEN post-acquisition.

Would add more than 1,000 PUD sites for future drilling and production.

Ticker: ASEN (OTC BB)

17

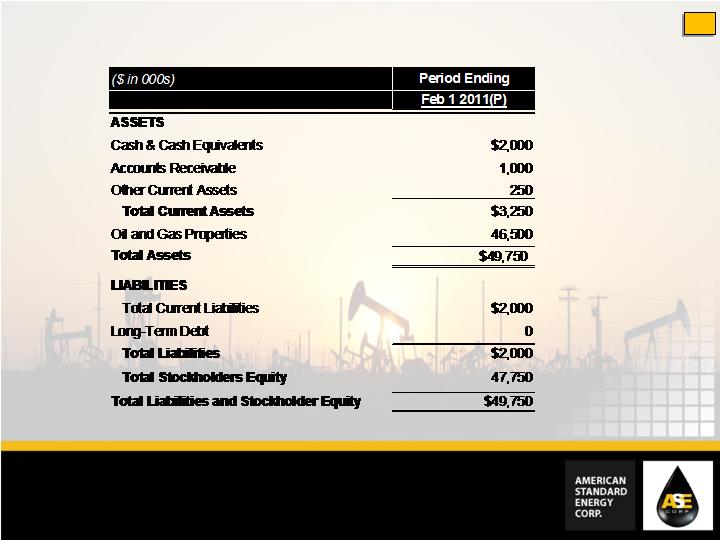

PRO FORMA BALANCE SHEET

Ticker: ASEN (OTC BB)

18

MANAGEMENT BIOS

Scott Feldhacker: Chief Executive Officer

Mr. Feldhacker has been actively involved in his family-run oil & gas business for more than 10 years. He has also acted

as an executive consultant within the industry for more than a decade.

Mr. Feldhacker began as a Wealth Manager for

Allmerica Financial then Mass Mutual Oppenheimer prior to venturing into entrepreneurship. Over the next 20 years he

gained entrepreneurial success over diverse industries as an owner and officer. He has

consulted for both private and

public companies in various industries including several oil and gas E & P companies. In 2005 Mr. Feldhacker co-founded

a successful firm which placed its focus on emerging markets, consulting with companies entering

the U.S. Capital

Markets via the RTO process , providing public-side guidance, market awareness support and navigating each to senior

listings. Mr. Feldhacker has acquired, merged, raised capital, funded and sold businesses including creating patented

technologies.

Richard MacQueen: President

Prior to co founding American Standard Energy Corp (ASEN) Mr. MacQueen has been a successful entrepreneur for

twenty plus years. Mr. MacQueen has owned, operated and developed a number of successful businesses

including: A

successful U.S. Capital Markets Consulting Firm with an emphasis on emerging markets and navigation to the NASDAQ

(the company co-founded with Scott Feldhacker in 2005) with clients in Alternative Fuel, Automotive and Oil &

Gas in

particular. Mr. MacQueen also ran a successful technical sales firm that concentrated on Fortune 100 companies in Aero

Space, Medical, High Speed Low Skew and Automotive. Prior to that, Mr. MacQueen owned successful restaurant

chain

with distribution into four states in the Southwest which Mr. MacQueen developed, owned, operated and franchised

prior to selling the business.

Ticker: ASEN (OTC BB)

19

MANAGEMENT BIOS

Andrew Wall: General Counsel

Andrew Wall is the founder of The Wall Law Firm, PLC, a corporate/business and real estate law firm located in the Phoenix,

Arizona metropolitan area. Mr. Wall’s practice focused on all levels of corporate

transactions for both public and private

entities, start-ups, public and private funding, mergers and acquisitions as well as corporate governance and compliance. Mr.

Wall’s corporate clients included technology firms, energy and natural resource

firms and consultants, and financial entities.

In addition to 19 corporate transactions Mr. Wall has advised and consulted on various business interests and decisions and

has conducted informational seminars on legal and ethical issues in business.

Mr. Wall also spent nine years in the real estate

industry as a property manager, real estate appraiser and investor. Mr. Wall holds a Bachelor’s of Science degree.

Scott Mahoney: Chief Financial Officer

Scott Mahoney has more than 15 years experience in the finance industry, primarily in commercial and investment banking.

Scott has successfully transitioned into an operational role as an interim Chief Financial

Officer for two companies based in

Phoenix, AZ. In this capacity, Scott was responsible for all operational finance matters, strategic capital raises, and the

structuring of four mergers and acquisitions opportunities. Prior to assuming these management

roles Scott was with

JPMorgan Chase in Phoenix, where he was responsible for originating senior and mezzanine debt, identification of equity

placements, treasury management supervision, and strategic planning for large middle market private

companies. Scott is a

graduate of Thunderbird International School of Business and the University of New Hampshire. Scott is also a Chartered

Financial Analyst and has been nationally recognized by the Risk Management Association

of America for white papers on

equity research applied to non-public companies and specialty small cap investing.

Ticker: ASEN (OTC BB)

20