Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED MARCH 2, 2011 - Aegion Corp | form8k03022011.htm |

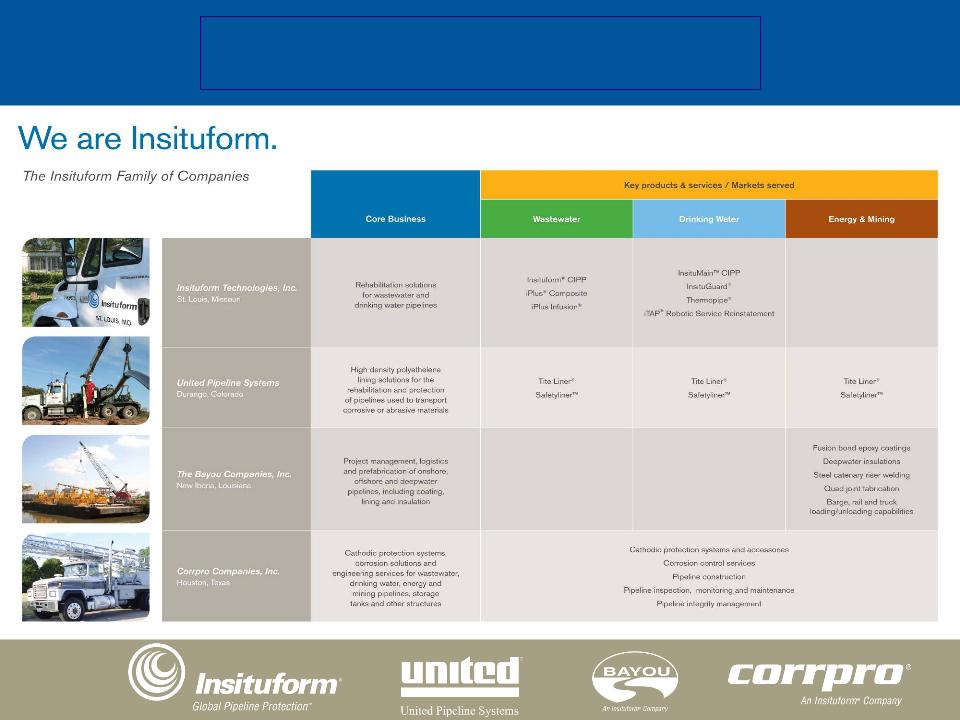

Insituform Technologies, Inc.

Investor Update

March 2011

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward looking statements. The

Company makes forward-looking statements in this Investor Presentation that represent the Company’s beliefs or

expectations about future events or financial performance. These forward-looking statements are based on

information currently available to the Company and on management’s beliefs, assumptions, estimates and

projections and are not guarantees of future events or results. When used in this presentation, the words

“anticipate,” “estimate,” “believe,” “plan,” “intend,” “may,” “will” and similar expressions are intended to identify

forward-looking statements, but are not the exclusive means of identifying such statements. Such statements are

subject to known and unknown risks, uncertainties and assumptions, including those referred to in the “Risk Factors”

section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, as filed with the

Securities and Exchange Commission on February 28, 2011. In light of these risks, uncertainties and assumptions, the

forward-looking events discussed may not occur. In addition, our actual results may vary materially from those

anticipated, estimated, suggested or projected. Except as required by law, we do not assume a duty to update

forward-looking statements, whether as a result of new information, future events or otherwise. Investors should,

however, review additional disclosures made by the Company from time to time in its periodic filings with the

Securities and Exchange Commission. Please use caution and do not place reliance on forward-looking statements.

All forward-looking statements made by the Company in this presentation are qualified by these cautionary

statements.

Company makes forward-looking statements in this Investor Presentation that represent the Company’s beliefs or

expectations about future events or financial performance. These forward-looking statements are based on

information currently available to the Company and on management’s beliefs, assumptions, estimates and

projections and are not guarantees of future events or results. When used in this presentation, the words

“anticipate,” “estimate,” “believe,” “plan,” “intend,” “may,” “will” and similar expressions are intended to identify

forward-looking statements, but are not the exclusive means of identifying such statements. Such statements are

subject to known and unknown risks, uncertainties and assumptions, including those referred to in the “Risk Factors”

section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, as filed with the

Securities and Exchange Commission on February 28, 2011. In light of these risks, uncertainties and assumptions, the

forward-looking events discussed may not occur. In addition, our actual results may vary materially from those

anticipated, estimated, suggested or projected. Except as required by law, we do not assume a duty to update

forward-looking statements, whether as a result of new information, future events or otherwise. Investors should,

however, review additional disclosures made by the Company from time to time in its periodic filings with the

Securities and Exchange Commission. Please use caution and do not place reliance on forward-looking statements.

All forward-looking statements made by the Company in this presentation are qualified by these cautionary

statements.

In addition, some of the market and industry date and forecast included in this Investor Presentation are based upon

independent industry sources. Although we believe that these independent sources are reliable we have not

independently verified the accuracy and completeness of this information.

independent industry sources. Although we believe that these independent sources are reliable we have not

independently verified the accuracy and completeness of this information.

Insituform®, the Insituform® logo, InsituMain®, United Pipeline Systems®, Bayou Companies™, Corrpro®, Insituform

Blue® and our other trademarks referenced herein are the registered and unregistered trademarks of Insituform

Technologies, Inc. and its affiliates.

Blue® and our other trademarks referenced herein are the registered and unregistered trademarks of Insituform

Technologies, Inc. and its affiliates.

2

3

GLOBAL PIPELINE PROTECTION™

Ø GLOBAL

v We have operations spanning six continents

v We are the only company of our kind with the

comprehensive capabilities and experience needed to

serve the world’s pipeline infrastructure

comprehensive capabilities and experience needed to

serve the world’s pipeline infrastructure

Ø PIPELINE

v Pipelines are the core of what we do

v We tackle the myriad of challenges facing corrosion

prevention and pipeline repair for sewer, water, oil,

gas and mining pipelines

prevention and pipeline repair for sewer, water, oil,

gas and mining pipelines

Ø PROTECTION

v Internal corrosion is just one of the many threats facing

pipelines

pipelines

v We address a complete spectrum of pipeline

protection needs - our goal is to safeguard pipes -

inside and out, onshore and offshore - before, during

and after installation

protection needs - our goal is to safeguard pipes -

inside and out, onshore and offshore - before, during

and after installation

4

Strength in Numbers

§ 2010 full year income from continuing operations per diluted share at $1.54, an

improvement of over 48% from 2009, and an all-time earnings record for the

Company

improvement of over 48% from 2009, and an all-time earnings record for the

Company

§ Earnings per share have increased by 228% in the past three years

§ Operating income as a percentage of revenue increased to 9.5%, an improvement of

40% from 2009

40% from 2009

§ Return on invested capital (ROIC) increased to 9% in 2010 from 7% in 2009

§ We anticipate earnings per diluted share of $1.75-$1.90 in 2011 as each of our

business segments are poised for profitable growth and solid global market

conditions

business segments are poised for profitable growth and solid global market

conditions

§ We continue to believe we are on pace to our goal of 15% operating margin and

ROIC in 2012

ROIC in 2012

Key Business Initiatives

Our Vision

Our Vision

5

Ø SEWER REHABILITATION

§ North America - Continue profitability improvements through optimization of project management and execution

capabilities (both manufacturing and contracting businesses); building out a return driven water services platform to create

leverage from our sewer business

capabilities (both manufacturing and contracting businesses); building out a return driven water services platform to create

leverage from our sewer business

§ Europe - Focus on improving profitability through optimizing and right-sizing installation businesses, expanding third party

tube sales throughout Europe and selectively targeting new lining products and services

tube sales throughout Europe and selectively targeting new lining products and services

§ Asia-Pacific - Growth in India, Hong Kong, Singapore and Australia and expansion of third party tube sales through

development of certified installer program throughout Asia

development of certified installer program throughout Asia

Ø ENERGY AND MINING

§ Expand service offering selectively through joint ventures and partnerships - specialty linings, insulation coatings, double

joint welding, etc.

joint welding, etc.

§ Focus on selective geographic expansion (Asia, Middle East) coordinated with current Insituform theatre management

§ Continue investment in building business development opportunities for comprehensive service platform

§ Well-positioned in key spend areas - Gulf of Mexico, Canadian Oil Sands

Ø WATER REHABILITATION

§ Focus on successful implementation of InsituMain®

§ Development of broader water platform to capitalize on growing water infrastructure needs globally with particular

emphasis on leveraging our North American platform

emphasis on leveraging our North American platform

6

Financial Performance

2010 Income

from

Continuing

Operations up

56% from 2009

from

Continuing

Operations up

56% from 2009

While Contracting

remains largest line of

business, strategy and

focus has been to

increase emphasis on

higher margin products

and services

remains largest line of

business, strategy and

focus has been to

increase emphasis on

higher margin products

and services

7

Financial Condition

Company has a strong history of solid cash flow

Total cash (unrestricted) at December 31, 2010

was $114.8 million

was $114.8 million

Conservative capital structure,

coupled with strong cash flow will

enable Company to pursue strategic

opportunities for profitable growth

coupled with strong cash flow will

enable Company to pursue strategic

opportunities for profitable growth

North American Sewer Rehabilitation (NAR)

8

PERFORMANCE

§ Operating income in 2010 was a record and in 2011 expect to further improvement

§ 13.0% growth in revenue from 2009 resulting from stronger market conditions

§ Growth in operating income over last three years has been primarily attributable to the following factors - increasing manufacturing

profitability through optimized internal transfer pricing arrangements and increased third party tube sales, improving project

management capability and lower operating costs

profitability through optimized internal transfer pricing arrangements and increased third party tube sales, improving project

management capability and lower operating costs

§ Win rate by dollar has remained steady

OUTLOOK

§ Market conditions continue to be solid as municipal budgets stablize

§ Continue to optimize market share and win rate - focus on large projects and improving bidding discipline

§ Continuous improvement in project management capability

§ Continue to grow third party tube sales business through increased market penetration

§ Increase operating expense efficiency - LEVERAGE GROWTH

(1) See financial reconciliation on page A-3

Energy and Mining

9

PERFORMANCE

§ Strong rebound of oil, gas and mining commodity markets in 2010 have bolstered business across all business lines - linings, coatings and

cathodic protection

cathodic protection

§ United Pipeline Systems (“UPS”) experienced record revenue and operating income in 2010 of $70.5 million and $11.9 million, respectively

§ Bayou performance significantly increased in 2010 resulting from large coating projects driven primarily from US shale plays (natural gas)

and Canadian Oil Sands pipeline development

and Canadian Oil Sands pipeline development

§ Corrpro achieved a record year in operating income on improved market penetration and controlled operating expenses

OUTLOOK

§ Bayou’s Canadian pipe coating and insulation operation (51% owned joint venture) exceeded 2010 expectations and we expect solid

growth in 2011

growth in 2011

§ UPS should continue momentum of 2010 with another record year in 2011, maintaining strong backlog and gaining momentum in new

international markets (e.g. Asia and Middle East)

international markets (e.g. Asia and Middle East)

§ Corrpro backlog remains strong; re-entered Middle East market in 2010 and are exploring Asian platform opportunities; expect Corrpro to

have another record year in 2011

have another record year in 2011

(1) See financial reconciliation on page A-3

European Sewer Rehabilitation

10

PERFORMANCE

§ Gross margin trends very positive - 27.7% in 2010, versus 26.5% for 2009 and 22.3% for 2008, despite weak market conditions prevailing in

many parts of market (UK, France, Eastern Europe)

many parts of market (UK, France, Eastern Europe)

§ Quality improvements - large improvement on project execution

§ In December 2009, reorganized the European business, exiting certain unprofitable contracting markets, along with realignment of various

functions and responsibilities throughout Europe, thereby reducing administrative overhead costs -annualized cost savings of approximately

$3.2 million realized in 2010

functions and responsibilities throughout Europe, thereby reducing administrative overhead costs -annualized cost savings of approximately

$3.2 million realized in 2010

§ Continuing to pursue opportunities for growing third-party tube sales throughout Europe - expanding product capabilities to include structural

glass liners

glass liners

§ German JV - continuing to improve revenue and profitability from stronger market conditions and new products to the market

OUTLOOK

§ Improved profitability in 2011 from a variety of factors - return of UK market, improved manufacturing profitability resulting from growth in third

party tube sales and more optimized transfer pricing, and lower operating costs

party tube sales and more optimized transfer pricing, and lower operating costs

§ Expansion of higher margin profile product and service capabilities through selective partnering and distribution arrangements

§ Introduction of InsituMain® into select European markets

(1) See financial reconciliation on page A-3

Asia-Pacific Sewer Rehabilitation

11

PERFORMANCE

§ Grew revenues from $1.0 million in 2007 to $43.5 million in 2010

§ Creating a capable execution organization on a market-specific basis - contracting focused on large-diameter pipes and product sale

focused on small-diameter pipes

focused on small-diameter pipes

§ Australia performed above our expectations in 2010 as a result of solid performance on large Sydney Water projects; also expanded

presence in other large Australian cities

presence in other large Australian cities

§ Singapore - acquired licensee in January 2010, approximately $22 million in backlog at 12/31/10

§ Certified installer program to promote tube sales in small-diameter markets (Singapore, Malaysia, China)

§ Early 2010 Indian results impacted by one-time project write-down in India of approximately $3 million

§ Year-end backlog of $79.8 million versus $57.4 million at December 31, 2009, an increase of 39%, due to strength of Australia, Hong-Kong

and Singapore markets

and Singapore markets

OUTLOOK

§ Growth from strong backlog positions in Australia, Hong Kong and Singapore

§ Expect substantial improvement in profitability in 2011 from growth in all markets and the elimination of losses in India from 2010

§ Indian market should return to normal market conditions, with large tenders coming in early 2011 and more stabilized contractual

specifications on new projects

specifications on new projects

(1) See financial reconciliation on page A-3

Water Rehabilitation

12

PERFORMANCE

§ Introduced InsituMain® in March 2009 -

- Fully structural CIPP water product

- Current capability - diameters from 6” to 36”, operating pressures up to 150 psi and any type of host pipe material - very important as it

should allow us to address 70% of market issues

should allow us to address 70% of market issues

§ Pilot testing throughout 2009 and 2010 has been successful

§ Key to success and growth - getting cost profile below dig and replace methods.

OUTLOOK

§ 2010 was a pivotal year for the business segment as it transitions from pilot phase into fully commercial contracting business

§ Expect to continue expanding product and service capabilities in 2011

§ Strategically pursuing broader product/service opportunities to complement execution capabilities and geographic footprint / customer

relationships

relationships

Focus on Water and Energy for Future Growth

13

Ø We are continuing to review opportunities to expand

capability:

capability:

v Broader linings capabilities and insulation products in high spend

geographies - Gulf of Mexico, Canadian Oil Sands

geographies - Gulf of Mexico, Canadian Oil Sands

v Expand Water platform focused on inspection / leak detection and

broader product capability

broader product capability

v Break-through in India to create a growing bid table reflective of need

v Continue to broaden our Asia-Pacific platform positioning our

product/services to take advantage of theatre growth

product/services to take advantage of theatre growth

Strength in Numbers

14

Ø We have expanded our vision and

opened up much larger addressable

markets to sustain higher growth rates

in the future

opened up much larger addressable

markets to sustain higher growth rates

in the future

Ø We have momentum in each of our

business segments for growth in

revenue and profitability

business segments for growth in

revenue and profitability

Ø Annual earnings per share guidance for

2011 of $1.75 - $1.90 (growth from

2010 of 14% - 23% )

2011 of $1.75 - $1.90 (growth from

2010 of 14% - 23% )

Appendix

Insituform is a leading global provider of proprietary technologies and

services for rehabilitating and maintaining sewer, water and energy and

mining piping systems and the corrosion protection of industrial pipelines

services for rehabilitating and maintaining sewer, water and energy and

mining piping systems and the corrosion protection of industrial pipelines

A-1

Financial Reconciliation

(GAAP to Non-GAAP Information)

(GAAP to Non-GAAP Information)

The following is a reconciliation of Insituform's financial information as shown in presentation (GAAP to Non-GAAP) on

page 5:

page 5:

A-2

Financial Reconciliation

(GAAP to Non-GAAP Information)

(GAAP to Non-GAAP Information)

The following is a reconciliation of Insituform's financial information as shown in presentation (GAAP to Non-GAAP)

A-3