Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - United Airlines Holdings, Inc. | d8k.htm |

JP

Morgan High Yield Conference

United Continental

Holdings, Inc.

March 1, 2011

Exhibit 99.1 |

| Safe

Harbor Statement Certain

statements

included

in

this

presentation

are

forward-looking

and

thus

reflect

our

current

expectations

and

beliefs

with

respect

to

certain

current

and

future

events

and

financial

performance.

Such

forward-looking

statements

are

and

will

be

subject

to

many

risks

and

uncertainties

relating

to

our

operations

and

business

environment

that

may

cause

actual

results

to

differ

materially

from

any

future

results

expressed

or

implied

in

such

forward-looking

statements.

Words

such

as

“expects,”

“will,”

“plans,”

“anticipates,”

“indicates,”

“believes,”

“forecast,”

“guidance,”

“outlook”

and

similar

expressions

are

intended

to

identify

forward-

looking

statements.

Additionally,

forward-looking

statements

include

statements

which

do

not

relate

solely

to

historical

facts,

such

as

statements

which

identify

uncertainties

or

trends,

discuss

the

possible

future

effects

of

current

known

trends

or

uncertainties,

or

which

indicate

that

the

future

effects

of

known

trends

or

uncertainties

cannot

be

predicted,

guaranteed

or

assured.

All

forward-looking

statements

in

this

presentation

are

based

upon

information

available

to

us

on

the

date

of

this

presentation.

We

undertake

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

events,

changed

circumstances

or

otherwise,

except

as

required

by

applicable

law.

Our

actual

results

could

differ

materially

from

these

forward-looking

statements

due

to

numerous

factors

including,

without

limitation,

the

following:

our

ability

to

comply

with

the

terms

of

our

various

financing

arrangements;

the

costs

and

availability

of

financing;

our

ability

to

maintain

adequate

liquidity;

our

ability

to

execute

our

operational

plans;

our

ability

to

control

our

costs,

including

realizing

benefits

from

our

resource

optimization

efforts,

cost

reduction

initiatives

and

fleet

replacement

programs;

our

ability

to

utilize

our

net

operating

losses;

our

ability

to

attract

and

retain

customers;

demand

for

transportation

in

the

markets

in

which

we

operate;

an

outbreak

of

a

disease

that

affects

travel

demand

or

travel

behavior;

demand

for

travel

and

the

impact

that

global

economic

conditions

have

on

customer

travel

patterns;

excessive

taxation

and

the

inability

to

offset

future

taxable

income;

general

economic

conditions

(including

interest

rates,

foreign

currency

exchange

rates,

investment

or

credit

market

conditions,

crude

oil

prices,

costs

of

aviation

fuel

and

energy

refining

capacity

in

relevant

markets);

our

ability

to

cost-effectively

hedge

against

increases

in

the

price

of

aviation

fuel;

any

potential

realized

or

unrealized

gains

or

losses

related

to

fuel

or

currency

hedging

programs;

the

effects

of

any

hostilities,

act

of

war

or

terrorist

attack;

the

ability

of

other

air

carriers

with

whom

we

have

alliances

or

partnerships

to

provide

the

services

contemplated

by

the

respective

arrangements

with

such

carriers;

the

costs

and

availability

of

aviation

and

other

insurance;

the

costs

associated

with

security

measures

and

practices;

industry

consolidation

or

changes

in

airline

alliances;

competitive

pressures

on

pricing

and

on

demand;

our

capacity

decisions

and

the

capacity

decisions

of

our

competitors;

U.S.

or

foreign

governmental

legislation,

regulation

and

other

actions

(including

open

skies

agreements);

labor

costs;

our

ability

to

maintain

satisfactory

labor

relations

and

the

results

of

the

collective

bargaining

agreement

process

with

our

union

groups;

any

disruptions

to

operations

due

to

any

potential

actions

by

our

labor

groups;

weather

conditions;

the

possibility

that

expected

merger

synergies

will

not

be

realized

or

will

not

be

realized

within

the

expected

time

period;

and

other

risks

and

uncertainties

set

forth

under

Item

1A.,

Risk

Factors

of

Annual

Report

on

Form

10-K,

as

well

as

other

risks

and

uncertainties

set

forth

from

time

to

time

in

the

reports

we

file

with

the

SEC.

Consequently,

forward-looking

statements

should

not

be

regarded

as

representations

or

warranties

by

us

that

such

matters

will

be

realized.

2 |

Gerry

Laderman Senior Vice President Finance and Treasurer

United Continental Holdings, Inc. |

4

UAL fourth quarter 2010 results

•

Earned net income of $160M or $0.44 per

diluted share

1

•

Pre-tax earnings of $172M and pre-tax

margin of 2.0%

1

•

Passenger unit revenue increased 11.5%

year-over-year vs. pro forma 4Q 2009

•

Generated $106M of operating cash flow

•

Year end unrestricted cash balance of

$8.7B

1. Excludes specials, one-time items and non-cash MTM hedge gains/losses. See

GAAP to non-GAAP reconciliation in Appendix A Source: Earnings release Form

8-K filed on 1/26/11. |

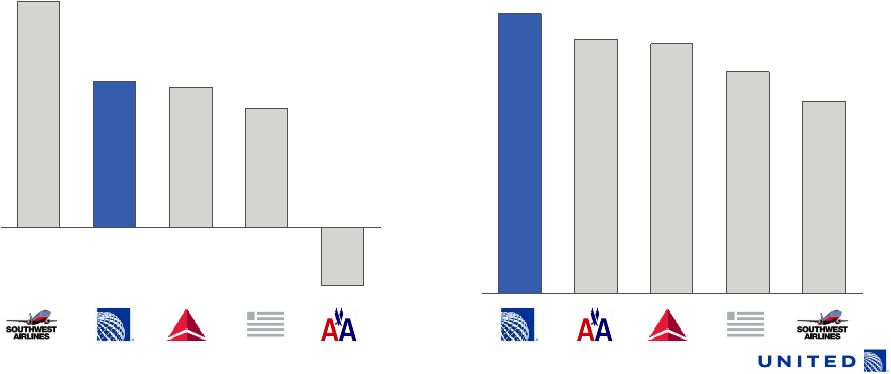

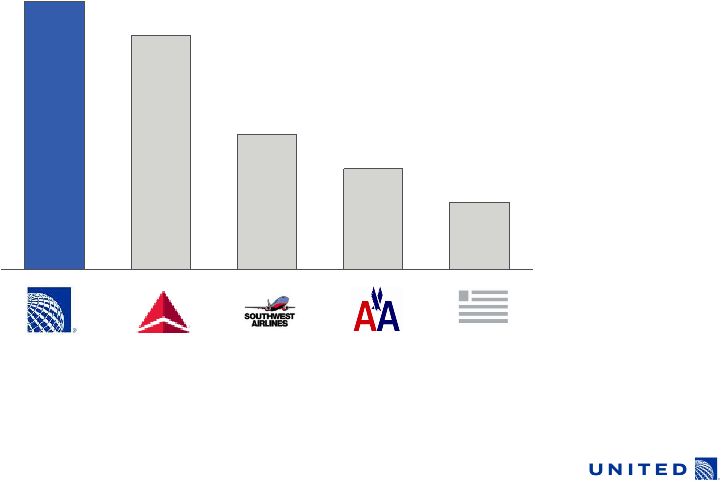

5

Top tier financial performance driven by industry leading

revenue premium

•

Well diversified global network

•

Carrier of choice for business and premium travelers

•

Award winning loyalty programs and industry leading operational performance

FY 2010 PRASM

2

FY 2010 Pre-tax Income Margin

1

-1.9%

3.9%

4.6%

4.8%

7.4%

1. Excludes specials, one-time items and non-cash MTM hedge gains/losses. See

GAAP to non-GAAP reconciliation in Appendix A 2. Consolidated PRASM numbers

for carriers other than UAL adjusted for length of haul versus UAL’s length of haul

Source: Earnings releases and SEC filings.

8.11

9.36

10.55

10.71

11.81 |

World’s leading network with unsurpassed presence

6

#1 across the

Pacific

#2 across the

Atlantic

#2 to Latin

America

#1 in US /

Canada

Rankings by ASMs as of TME 4Q10

Source: Earnings releases and SEC filings. |

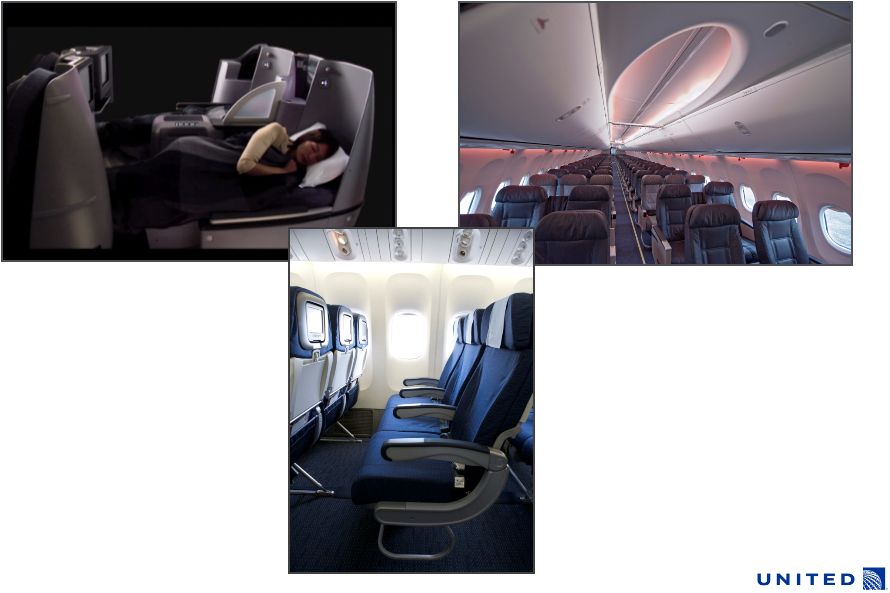

Best-in-class products, including Economy Plus seating

7

Lie-flat seats in premium cabins

Boeing Sky Interior on new B-737

Economy Plus®

seating with up to

5 inches of more legroom |

Continue

to grow ancillary revenue streams and expect them to exceed $2B in 2011

8

Creating industry leading products

to let customers tailor their experience

Improving how and when we offer

these products to our customers

Economy Plus®

Upsell

Premium Cabin Upsell

Seating & Space

Onboard

Buy-on-Board Meals

Premium Wines

Baggage Services

1

st

& 2

nd

Checked Bags

Premium Experience

United Club Lounge Pass

Premier®

Travel

Premier Line

Award Accelerator

Flexibility

FareLock® |

Expect to

generate net synergies of $1.0 to $1.2B 9

•

Airport efficiencies

•

Improved website content,

accessibility and penetration

•

Streamline corporate overhead

•

Co-locate airport facilities

•

Reduce IT overlap

Examples:

Expected by summer 2011:

•

Harmonized boarding and departure

management processes

•

Websites will offer and sell flights

across the new United Airlines as

one network

•

All management employees selected

•

Co-located at more than 35 stations

•

Transition to selected major IT

systems underway |

10

We remain focused on achieving our Go Forward Plan goals

Fly to Win

•Be profitable every year, across the business cycle

Fund the future

•Maintain appropriate liquidity and use our assets to

build our future

Make reliability a reality

•Deliver clean, safe and reliable air transportation and a

competitive product

Working together

•Make the new United a great place to work

|

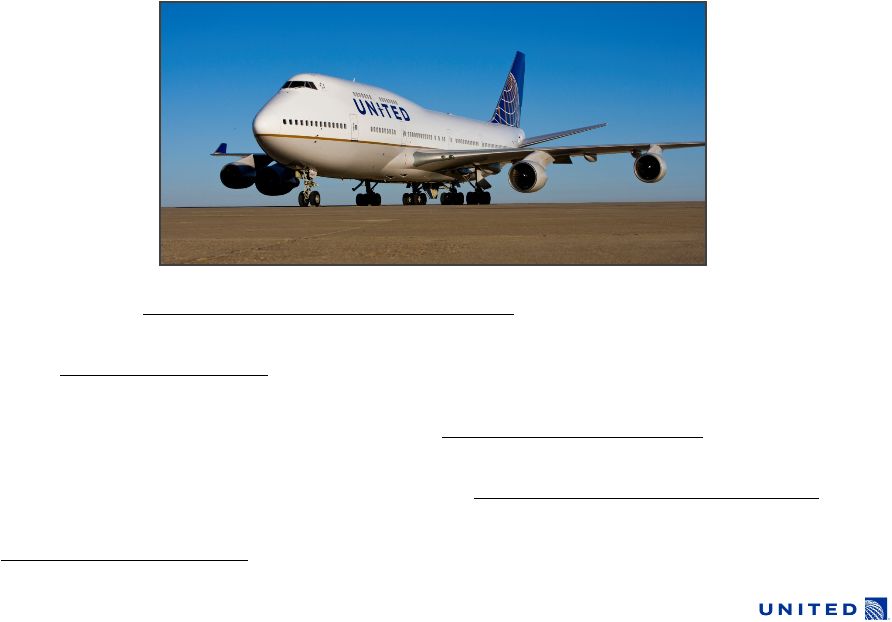

United

continues to manage fleet for profitability, fuel efficiency and

flexibility 11

•

Expected 2011 deliveries: 4 Boeing 737

•

1Q: 2 Boeing 737-800

•

2Q: 1 Boeing 737-900

•

3Q: 1 Boeing 737-800

•

New 737 equipped with winglets; will

replace older less fuel efficient aircraft

•

Firm orders for 50 Boeing 787 and 25

Airbus A350 aircraft

Industry leading order book will

continue to improve fuel efficiency

Over 325 aircraft have leases expiring or

will become unencumbered by 2015 |

12

Capacity and hedge strategies help to mitigate

risk due to rising fuel

FY 2011 capacity guidance

remains disciplined

Approximately 40% of expected

2011 fuel needs hedged

2Q11

1Q11

17%

4Q11

3Q11

34%

50%

63%

Consolidated

1.0% -

2.0%

International

4.5% -

5.5%

Domestic

(0.5)% -

(1.5%)

Guidance Range

Source: 1/26/11 UAL Form 8-K Investor Update. |

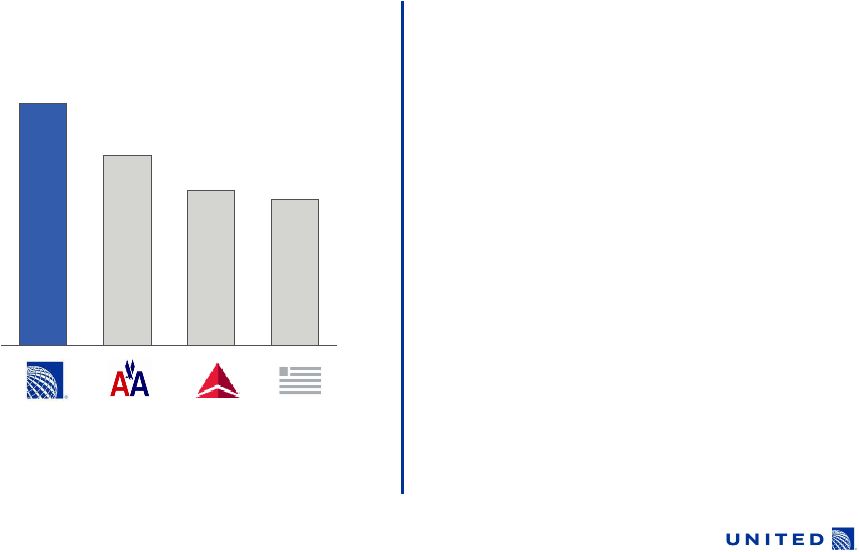

13

United generated more than $3.2B of operating

cash flow during 2010

FY 2010 Operating Cash Flow ($B)

1.

Revenue defined as 2010 FY consolidated revenue.

Source: Carrier Form 10-Ks.

OCF % of Revenue

1

9.4%

8.7% 12.9% 5.6%

6.8%

0.8

1.2

1.6

2.8

3.2 |

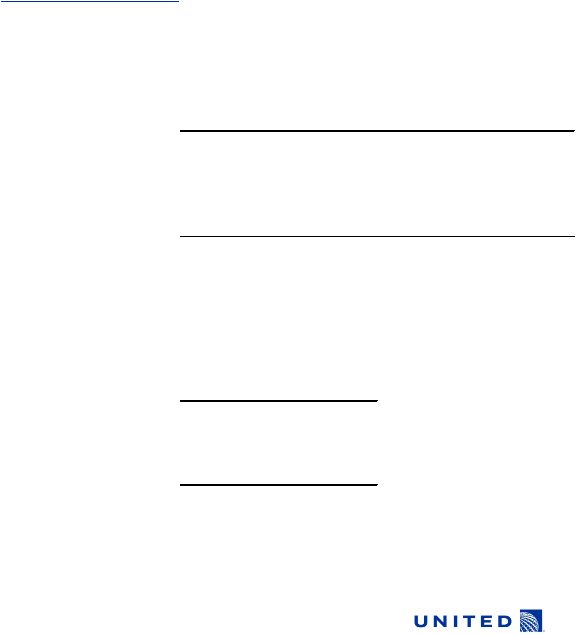

14

United has strong liquidity position and announced

plans to prepay debt

2010 Year End Liquidity

1

(Percent of 2010 Revenue)

1.

Liquidity is calculated based on 4Q10 ending unrestricted cash balance and 2010 FY

consolidated revenue. 2.

Source: Carrier Earnings Release 8Ks

•

Prepaid $150M of debt in January 2011

•

Has $2.5B of scheduled debt payments

in 2011

•

Even at current elevated fuel price,

United has sufficient liquidity for

integration

16.1%

16.4%

20.3%

25.5%

Year End

Liquidity

Balance

$8.7B

$4.5B $5.2B $1.9B |

15

In 2011 United will work to:

Achieve sustained, sufficient profitability

through the business cycle

Capture synergies

through network optimization and cost savings

Maintain focus on operating a clean, reliable and safe

airline

Continue to systematically hedge to reduce fuel volatility exposure

Manage cash balance

to mitigate economic environment and integration risk |

16

Appendix A

GAAP to non-GAAP reconciliation

Three Months Ended

Twelve Months Ended

12/31/2010

12/31/2010

PRE-TAX MARGIN ($M)

Earnings/(Loss) before income taxes and after equity in earnings of affiliates

($324)

$854

Add: impairments, special items and other charges and non-cash, net mark-

to-market gains/losses

$496

$777

Adjusted Pre-Tax Income/(Loss)

$172

$1,631

Revenue

$8,433

$34,013

Adjusted Pre-Tax Margin

2.0%

4.8%

Three Months Ended

12/31/2010

NET INCOME/(LOSS) - GAAP ($M)

Earnings/(Loss) after income taxes and equity in earnings of affiliates

($325)

Add: impairments, special items and other charges and non-cash, net mark-

to-market gains/losses

$485

Adjusted Net Income/(Loss)

$160 |