Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-31234

WESTWOOD HOLDINGS GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 75-2969997 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 200 Crescent Court, Suite 1200 Dallas, Texas 75201 |

75201 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (214) 756-6900

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, par value $0.01 per share |

New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value on June 30, 2010 of the voting and non-voting common equity held by non-affiliates of the registrant was $205,895,000. For purposes of this calculation, the registrant has assumed that stockholders that are not officers or directors of the registrant are not affiliates of the registrant.

The number of shares of registrant’s Common Stock, par value $0.01 per share, outstanding as of February 23, 2011: 7,786,511.

DOCUMENTS INCORPORATED BY REFERENCE

Selected portions of the registrant’s definitive Proxy Statement for the 2011 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

Table of Contents

Index

Table of Contents

PART I

| Item 1. | Business. |

Unless the context otherwise requires, the term “we,” “us,” “our,” “Westwood,” or “Westwood Holdings Group” when used in this Form 10-K (“Report”) and in the Annual Report to the Stockholders refers to Westwood Holdings Group, Inc., a Delaware corporation, and its consolidated subsidiaries and predecessors taken as a whole. This Report contains some forward-looking statements within the meaning of the federal securities laws. Actual results and the timing of some events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including without limitation those set forth under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1A. Risk Factors”.

General

We manage investment assets and provide services for our clients through our two subsidiaries, Westwood Management Corp. (“Westwood Management”) and Westwood Trust. Westwood Management provides investment advisory services to corporate retirement plans, public retirement plans, endowments and foundations, a family of mutual funds, which we call the WHG Funds, other mutual funds, individuals and clients of Westwood Trust. Westwood Trust provides trust and custodial services and participation in common trust funds that it sponsors to institutions and high net worth individuals. Our revenues are generally derived from fees based on a percentage of assets under management and at December 31, 2010, Westwood Management and Westwood Trust collectively managed assets valued at approximately $12.5 billion. We have been providing investment advisory services since 1983 and, according to recognized industry sources, including Morningstar, Inc., our principal asset classes rank at or above the median in performance within their peer groups when measured over multi-year periods of ten years and longer.

The core of our business is dependent on client relationships. We believe that, in addition to investment performance, client service is paramount in the asset management business. Accordingly, a major focus of our business strategy is to continue building strong relationships with clients to enhance our ability to anticipate their needs and satisfy their investment objectives. Our team approach is designed to result in efficient, responsive service for our clients. Our future success is dependent to a significant degree on both investment performance and our ability to provide attentive client service.

We were incorporated under the laws of the State of Delaware on December 12, 2001. We are an independent public company and our common stock is listed on the New York Stock Exchange under the ticker symbol “WHG.” We are a holding company whose principal assets consist of the capital stock of Westwood Management and Westwood Trust.

One of the priorities on which we have focused since 2002 is building a foundation in terms of personnel and infrastructure to support a potentially much larger business. We have also developed products that we believe will be desirable within our target institutional, private wealth and mutual fund markets. The costs of developing new products and building the organization can result in incurring expenses before material offsetting revenue is realized. We believe that the business foundation and appropriate products are now in place and in recent years we have been taking these products to our served markets. A high level of interest in these products has been demonstrated by investors in our target markets and we hope this increased level of interest will generate new revenue streams.

Available Information

We maintain a website at www.westwoodgroup.com. Information contained on, or connected to, our website is not incorporated by reference into this Form 10-K and should not be considered part of this report or any other filing that we make with the Securities and Exchange Commission (“SEC”). All filings made by us with the SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on our website. Additionally, our Code of Business Conduct and Ethics, our Corporate Governance Guidelines and our Audit Committee, Compensation Committee and Governance/Nominating Committee Charters are available without charge on our website. Stockholders also may obtain print copies of these documents free of charge by submitting a written request to William R. Hardcastle, Jr. at the address set forth in the front of this Report. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an internet website that contains reports, proxy and information statements, and other information regarding issuers, including Westwood Holdings Group, Inc. that file electronically with the SEC. The public can obtain any document we file with the SEC at www.sec.gov.

1

Table of Contents

Westwood Management

General

Westwood Management provides investment advisory services to large institutions, including corporate retirement plans, public retirement plans, endowments and foundations, having at least $10 – $25 million in investable assets, depending on the asset class. Westwood Management also provides advisory services to individuals and the WHG Funds and subadvisory services to other mutual funds. Our overall investment philosophy is determined by a team of professionals including our chief investment officer, Susan M. Byrne, and, with respect to the bulk of assets under management, consists of a value-oriented approach focused on achieving a superior, risk-adjusted return by investing in companies generating high levels of free cash flow with strong balance sheets and positioned for growth but not fully recognized as such in the marketplace. This investment approach is designed to preserve capital during unfavorable periods and provide superior real returns over the long term. Ms. Byrne has over 40 years of investment experience. Westwood Management’s investment advisory team consists of a number of investment management, research and trading professionals with substantial investment management experience. The continuity of the team and its years of experience are critical elements in successfully managing investments.

Managed Asset Classes

Asset Management. We offer a broad range of investment asset classes allowing us to serve various types of clients and varying investment objectives. Over 40% of our assets under management are invested in our LargeCap Value asset class. The following sets forth the principal asset classes currently managed by Westwood Management:

LargeCap Value: Investments in equity securities of approximately 45-60 well-seasoned companies with market capitalizations generally over $5 billion. This portfolio is invested in companies where we expect that future profitability, driven by operational improvements, will be higher than expectations reflected in current share prices.

Dividend Growth: Investments in equity securities of approximately 40-60 high quality companies with market capitalizations generally over $1 billion. This portfolio is invested in companies of which at least 80% pay a dividend and whose prospects for dividend growth are strong. The Dividend Growth strategy combines quantitative and fundamental research to create a diversified portfolio with companies that we believe can create value for shareholders.

MidCap Value: Investments in equity securities of approximately 50-70 companies with market capitalizations between $4 billion and $20 billion. Similar to the LargeCap Value asset class, we seek to discover operational improvements that are driving earnings growth within mid-size companies that can be purchased inexpensively.

SMidCap Plus+: Investments in equity securities of approximately 45-65 companies with market capitalizations between $2 billion and $15 billion. Similar to our other value-oriented asset classes, we seek to discover operational improvements that are driving earnings growth within small to mid-size companies that can be purchased inexpensively.

SMidCap Value: Investments in equity securities of approximately 45-65 companies with market capitalizations between $100 million and $10 billion. Similar to our other value-oriented asset classes, we seek to discover operational improvements that are driving earnings growth within small to mid-size companies that can be purchased inexpensively.

2

Table of Contents

SmallCap Value: Investments in equity securities of approximately 50-70 companies with market capitalizations between $100 million and $2.5 billion. Similar to our other value-oriented asset classes, we seek to invest in high quality companies whose earnings growth is driven by operational improvements not yet fully recognized by the market. This asset class reached its asset capacity in 2010 and is now closed to new investors.

AllCap Value: Investments in equity securities of approximately 60-80 well-seasoned companies. The portfolio is generally comprised of the best ideas within all market capitalizations above $100 million. Similar to our other value-oriented asset classes, we seek to invest in companies across a broad range of market capitalizations where we expect that future profitability, driven by operational improvements, will be higher than expectations currently reflected in share prices.

LargeCap Enhanced: Investments in equity securities of approximately 75-100 long and 20-30 short, well-seasoned companies with market capitalizations above $3 billion. Using fundamental research with a quantitative screening overlay, this portfolio is invested in companies where we expect that future profitability, driven by operational improvements, will be higher than expectations reflected in current share prices and also shorts companies where we expect that future profitability is below what is reflected in current share prices.

Balanced: Investments in a combination of equity and fixed income securities, designed to provide both growth opportunities and income, while also emphasizing asset preservation in “down” markets. Westwood Management applies its expertise in dynamic asset allocation and security selection decisions in carrying out this balanced strategy approach.

Income Opportunity: Investments in dividend-paying common stocks, straight and convertible preferred stock, master limited partnerships, REITs and selected debt instruments. This portfolio’s strategy focuses on companies with strong and improving cash flow sufficient to support a sustainable or rising income stream for investors. This asset class is targeted towards investors seeking low volatility and high current income through dividend-paying and/or interest-bearing securities.

Master Limited Partnerships (“MLPs”): Investments include MLPs (including limited partnerships, “LPs,” and general partnerships, “GPs”), securities of tanker and other marine shipping companies and other securities. Within these types of securities, the portfolio focuses on companies that, over time, exhibit higher dividend yields, stable and predictable cash flows, low correlations to other asset classes, and growth opportunities.

Core/Intermediate Fixed Income: Investments in high-grade, intermediate term corporate and government bonds. We seek to add value to client portfolios through yield curve positioning and investing in debt instruments with improving credit quality potential.

Each asset class consists of a portfolio of equity and/or fixed income securities selected by Westwood Management’s portfolio teams and chosen to best provide the long term returns consistent with Westwood Management’s investment philosophy. Our portfolio teams make decisions for all of Westwood Management’s asset classes in accordance with the investment objectives and policies of such asset classes, including determining when and which securities to purchase and sell.

We employ a value-oriented approach in managing our equity asset classes. The common thread that permeates our investment strategies is our focus on a disciplined approach to controlling risk and, whenever possible, preserving the core value of our clients’ assets. Our value-oriented asset classes place a greater emphasis on identifying companies where earnings result from actual operational improvements rather than from improvements derived from financial statement adjustments. The overriding objective of this strategy is to prevent the loss of the core value of client assets, even at the cost of potentially higher returns. Through investments in companies that exhibit these characteristics, Westwood Management seeks to demonstrate consistently superior performance relative to our industry peers and relevant benchmark indices.

3

Table of Contents

More than half of our assets under management are invested in equity securities of companies with large market capitalizations. When measured over multi-year periods of ten years and longer, Westwood Management’s principal asset classes have consistently ranked above the median within peer group performance rankings according to recognized industry sources, including Morningstar, Inc.

Our ability to grow assets under management is primarily dependent on our competitive long-term performance record, building strong relationships with investment consulting firms as well as our ability to develop new client relationships. We continually look for opportunities to expand our assets under management by growing our existing asset classes and developing new portfolios focusing on investment areas not part of our current asset classes under management. We primarily intend to grow our asset classes internally but may consider acquiring new asset classes from third parties, as discussed under “—Growth Strategy” below. Our growth strategy provides clients with more investment opportunities and diversifies our assets under management, thereby reducing risk in any one area of investment and increasing our competitive ability to attract new clients.

Advisory and Subadvisory Service Agreements

Westwood Management manages client accounts under investment advisory and subadvisory agreements. Typical within the asset management industry, such agreements are usually terminable upon short notice and provide for compensation based on the market value of the client’s assets under management. Westwood Management’s advisory fees are paid quarterly in advance based on assets under management on the last day of the preceding quarter, quarterly in arrears based on assets under management on the last day of the previous quarter, or are based on a daily or monthly analysis of assets under management for the stated period. A limited number of our clients have a performance-based fee component in their contract, which generates additional revenues if we outperform a specified index over a specific period of time. We record revenue for performance-based fees at the end of the measurement period. Revenue from advance payments is deferred and recognized over the period that services are performed. Pursuant to these agreements, Westwood Management provides overall investment management services, including directing investments in conformity with the investment objectives and restrictions established by clients. Unless otherwise directed in writing by clients, Westwood Management has the authority to vote all proxies with respect to client assets.

Westwood Management is also a party to subadvisory agreements with other investment advisors under which it performs substantially the same services as it does under its advisory agreements. However, the investment strategy adopted for a particular client is subject to supervision and review by the client. Our subadvisory fees are computed based upon the daily net assets of the client and are payable on a monthly basis. As with our advisory agreements, these agreements are terminable upon short notice.

Under our subadvisory agreement with Teton Advisors, Inc. (formerly Gabelli Advisers, Inc.), Westwood Management provides investment advisory services to the GAMCO Westwood Funds family of mutual funds. Westwood Management owns shares of Class A Common Stock representing a 15.3% economic interest in Teton Advisors, Inc., an affiliate of GAMCO Investors, Inc. Based on SEC filings, we believe that GAMCO Investors, Inc. owned 13.2% of our common stock as of December 31, 2010. Westwood Management received subadvisory payments from Teton Advisors, Inc. of $573,000, $617,000 and $784,000 for the twelve months ended December 31, 2010, 2009 and 2008, respectively.

While Westwood Management provides subadvisory services with respect to the Westwood Funds family of funds, Westwood Management provides investment advisory services directly to the WHG Funds family of mutual funds, which includes the WHG SMidCap Fund, the WHG Income Opportunity Fund, the WHG LargeCap Value Fund, the WHG Balanced Fund and the WHG SmallCap Value Fund. As of December 31, 2010, the WHG Funds had assets under management of $902 million. Effective February 7, 2011, the McCarthy Multi-Cap Stock Fund, which had assets under management of $68 million as of December 31, 2010, was reorganized into the WHG Dividend Growth Fund. “WHG Funds” represent the family of institutional mutual funds for which Westwood Management serves as advisor. “Westwood Funds” represent the family of mutual funds for which Westwood Management serves as subadvisor.

4

Table of Contents

One of our largest clients in terms of assets paid us both asset-based and performance-based advisory fees in 2008. Due to a significant performance fee earned in 2008, this client accounted for 19.5% of our fee revenues in 2008; however, this client did not pay us a performance fee in 2010 or 2009 and accounted for less than 1% of our revenues for the years ended December 31, 2010 and 2009. Our four largest clients accounted for approximately 12.2% of our fee revenues for the year ended December 31, 2010. The loss of some or all of these large clients or failure to deliver the investment performance necessary to earn a performance fee could have a material adverse affect on our business and our results of operations.

Westwood Trust

General

Westwood Trust provides trust and custodial services and participation in common trust funds that it sponsors to institutions and high net worth individuals generally having at least $1 million in assets under management. Westwood Trust seeks to define and improve the risk/return profile of the client’s investment portfolio by complementing or enhancing existing investment strategies. Westwood Trust provides back office services to its clients, including tax reporting, distribution of income to beneficiaries, preparation of account statements and attending to the special needs of particular trusts, and also serves as trustee for tax and estate-planning purposes and for special needs trusts. Westwood Trust is chartered and regulated by the Texas Department of Banking.

Westwood Trust primarily provides services for employee benefit trusts and personal trusts. Employee benefit trusts include retirement plans of businesses to benefit their employees, such as defined contribution plans, pensions and profit sharing plans. Westwood Trust may also be appointed as a trustee and may provide administrative support for these plans, as well as investment advisory and custodial services. Personal trusts are developed to achieve a number of different objectives, and Westwood Trust acts as trustee to these trusts and assists them in developing tax-efficient trust portfolios. The fees charged by Westwood Trust are separately negotiated with each client and are based on the complexity of the operations of the trust and the amount of assets under management.

Services

Westwood Trust undertakes a fiduciary responsibility toward the management of each client’s assets and utilizes a consultative asset allocation approach. This approach involves Westwood Trust examining the client’s financial situation, including the client’s current portfolio of investments, and advising the client on ways in which it can enhance its investment returns and financial position. Westwood Trust also provides custodial services, safekeeping and accounting services.

Common Trust Funds

Westwood Trust sponsors a number of common trust funds in which client assets are commingled to achieve economies of scale. Westwood Trust’s common trust funds fall within two basic categories: personal trusts and employee benefit trusts. Westwood Trust sponsors common trust funds for most of the asset classes managed by Westwood Management. Westwood Trust also engages third party subadvisors for some common trust funds, such as our Growth Equity, International Equity and High Yield Bond common trust funds.

Enhanced Balanced Portfolios

Westwood Trust is a strong proponent of asset class diversification and offers its clients the ability to diversify among multiple different asset classes. Westwood Trust Enhanced Balanced ™ portfolios seek to combine these asset classes into a customizable portfolio for clients seeking to maximize return for a given level of risk. Periodic adjustments are made to asset class weightings in Enhanced Balanced ™ portfolios based on historical returns, risk and correlation data, as well as on an analysis of our capital markets outlook.

5

Table of Contents

Distribution Channels

We market our services through several distribution channels that allow us to expand the reach of our investment advisory services. These channels enable us to leverage existing distribution infrastructure and capabilities of other financial services firms and intermediaries while focusing on our core competency of developing and managing investment asset classes.

Institutional Investment Consultants

Investment management consulting firms serve as gatekeepers to many corporate retirement plans, public retirement plans, endowments and foundations, which represent Westwood’s primary client target markets. Consultants provide guidance to their clients in setting asset allocation strategy, as well as creating investment policies. Consultants also make recommendations for investment firms they believe can best meet their client’s investment objectives. We have established strong relationships with many national and regional investment consulting firms, which has resulted in our being considered and hired by many of their clients. Continuing to enhance our existing consulting firm relationships, as well as forging new relationships, serves to increase the awareness of our services in both the consultant community and their underlying institutional client base.

Subadvisory Relationships

Our subadvisory relationships allow us to extend the reach of our investment management services to clients of other investment companies with broad, established distribution capabilities. In subadvisory arrangements, our client is typically the investment company through which our services are offered to investors. In these subadvisory arrangements, our investment advisory services are typically made available through mutual fund offerings. The investment company that sponsors the mutual fund is responsible for marketing, distribution, operations and accounting related to these funds.

Managed Accounts

Managed accounts are similar in some respects to subadvisory relationships in that a third-party financial institution, such as a brokerage firm or turnkey asset management program provider, handles distribution to the end client. The end client in a managed account is typically a high net worth individual or small institution. In these arrangements, the third party financial institution is responsible to the end client for client service, operations and accounting.

Growth Strategy

We believe that we have established a strong platform to support future growth, deriving our strength in large part from the experience and capabilities of our management team and skilled investment professionals. We believe that this focused, stable team has contributed significantly to our solid investment performance, superior client service and a growing array of asset classes. We believe that opportunities for future growth may come from our ability to:

| • | generate growth from new and existing clients and consultant relationships |

| • | attract and retain key employees |

| • | grow assets in our additional asset classes |

| • | foster continued growth of the Westwood Trust platform |

| • | foster expanded distribution via mutual funds |

| • | pursue strategic acquisitions and alliances |

| • | continue to strengthen our brand name. |

Generate growth from new and existing clients and consultant relationships. As our primary business objective, we intend to maintain and enhance existing relationships with clients and investment consultants by continuing to provide solid investment performance and high quality customer service to existing relationships. Additionally, we intend to pursue growth through targeted sales and marketing efforts that emphasize our investment performance and superior client service. New institutional client accounts are generally derived through investment consultants and we have been successful in developing solid long-term relationships with many national and regional investment consultants. We believe that the familiarity with our firm, our people and our processes that we have built in consultant and client relationships is a key factor in being considered for new client investment mandates.

6

Table of Contents

Attract and retain key employees. In order to achieve our performance and client relationship objectives, we must be able to retain and attract talented investment professionals. We believe that we have created a workplace environment in which motivated, performance-driven, and client-oriented individuals thrive. As a public company, we are able to offer our employees a compensation program that includes strong equity incentives such that their success will be closely tied to the success of our clients and stockholders. We believe that these factors are critical ingredients in maintaining a stable, client-focused environment and accordingly we have built a firm that we believe can support significant future growth.

Grow assets in our additional asset classes. LargeCap Value is our flagship product and we believe it has significant capacity to attract additional assets; however, we continue to develop additional asset classes in response to client needs and the opportunities we identify in the marketplace. We believe these additional asset classes provide opportunities for us to grow our assets under management. For instance, we have achieved meaningful growth in assets in our SMidCap Value product since we began marketing this asset class to institutions in 2004. As a result of this growth, the SMidCap Value asset class was closed to new investors in 2010. The WHG SMidCap mutual fund remains open to existing shareholders only. In July 2010 we launched the SMidCap Plus+ product, which is managed by the same team responsible for the SMidCap product. We believe SMidCap Plus+ will be an attractive investment alternative to clients looking to invest in small to mid size companies. We are also marketing other asset classes that we have developed in recent years. We began marketing SmallCap Value to institutions in 2007 and it has completed the approval process at many investment consulting firms, winning several institutional mandates. Our AllCap product has been receiving increased interest and has been awarded several institutional mandates in the last two years. Assets in our Income Opportunity product grew substantially in 2010 with strong interest from our private wealth and mutual fund channels. In 2007, we launched an MLP portfolio in response to the needs of an existing client. We believe that we have the team in place to support these products in our target institutional, private wealth and mutual fund markets. If we continue to deliver strong performance, we believe that demand for these asset classes can provide meaningful growth in our assets under management.

Foster continued growth of the Westwood Trust platform. Westwood Trust has experienced solid growth in serving small-to medium-sized institutions and high net worth individuals. We see continued interest from clients and prospects in our diversified, highly attentive service model. A significant percentage of new asset growth at Westwood Trust stems from referrals and additional assets from existing clients. We believe the continued acceptance of our Enhanced Balanced ™ product, which offers diversified exposure to multiple asset classes in a tax efficient, comprehensive solution for clients, provides opportunities for future growth. Our recent acquisition of McCarthy Group Advisors in Omaha, Nebraska enables us to introduce Westwood Trust products and services to a new market, which we believe offers attractive growth opportunities.

Foster expanded distribution via mutual funds. The WHG Funds consist of WHG SMidCap (WHGMX), WHG Income Opportunity (WHGIX), WHG LargeCap Value (WHGLX), WHG Balanced (WHGBX) and WHG SmallCap Value (WHGSX), which were launched from 2005 through 2007. In addition, the WHG Dividend Growth Fund (WHGDX) was launched in February 2011 subsequent to the reorganization of the McCarthy Multi-Cap Stock Fund. The WHG SMidCap Fund was closed to new investors in January 2011. Also in January 2011, we filed a registration statement for the WHG SMidCap Plus+ Fund, which we expect to be available later in 2011. The WHG Funds, which mirror our institutional strategies, offer capped expense ratios and are available in an institutional share class for all funds. In December 2007 we launched an A share for WHG LargeCap Value and WHG Income Opportunity in order to target No Transaction Fee (“NTF”) mutual fund supermarket platforms and the broker/dealer marketplace. In 2009 we reduced the expense cap for WHG Income Opportunity and WHG Balanced in order to increase their appeal to investors. We believe that access to our asset classes via an institutional mutual fund vehicle will present an attractive offering for certain segments of institutional investors, including 401(k) plans.

Pursue strategic acquisitions and alliances. We will carefully evaluate strategic acquisition, joint venture and alliance opportunities. We may express an interest in pursuing acquisitions of asset management firms, mutual funds, or trust companies having assets where we have expertise or that appear appropriate as a means of expanding our range of asset classes or services or expanding our distribution capabilities. By acquiring investment firms that successfully manage asset classes beyond our current expertise we can increase opportunities to attract new clients and provide existing clients with an even more diversified range of asset classes. We may also consider entering into alliances with other financial services firms to allow us to leverage our core competency of developing superior investment products in combination with alliance partners that could provide us with enhanced distribution capabilities or provide our clients with access to additional service offerings.

7

Table of Contents

Continue strengthening our brand name. We believe that the strength of our brand name has been a key component to our successful long-term participation in the investment industry and will be instrumental to our future success. We have developed our strong brand name largely through high profile coverage in investment publications and electronic media. A number of our investment professionals, including Susan Byrne, David Spika, Mark Freeman and Ragen Stienke, are visible in print and electronic media, which we believe enhances our brand name. We will continue to look for creative ways to strengthen our brand name and reputation in our target client markets.

Competition

We are subject to substantial and growing competition in all aspects of our business. Barriers to entry to the asset management business are relatively low, and we believe that we will face a growing number of competitors. Although no one company dominates the asset management industry, many companies are larger, better known and have greater resources than our company.

Further, we compete with other asset management firms on the basis of asset classes offered, the investment performance of those asset classes in absolute terms and relative to peer group performance, quality of service, fees charged, the level and type of compensation offered to key employees, and the manner in which asset classes are marketed. Many of our competitors offer more asset classes and services and have substantially greater assets under management.

We compete against numerous investment dealers, banks, insurance companies and others that sell equity funds, taxable income funds, tax-free investments and other investment products. In addition, the allocation of assets by many investors from active equity investment to index funds, fixed income or similar asset classes has enhanced the ability of firms offering non-equity asset classes and passive equity management to compete with us effectively. In short, our competitive landscape is intense and dynamic and there can be no assurance that we will be able to compete effectively in the future as an independent company.

Additionally, most prospective clients perform a thorough review of an investment manager’s background, investment policies and performance before committing assets to that manager. In many cases, prospective clients invite a number of competing firms to make presentations. The process of obtaining a new client typically takes twelve to eighteen months from the time of the initial contact. While we have achieved a high degree of success in competing successfully for new clients, it is a process to which we must continue to dedicate significant resources over an extended period, with no certainty of success.

Regulation

Westwood Management

Virtually all aspects of our business are subject to federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and stockholders of registered investment advisers. Under such laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit advisers from carrying on their business in the event that they fail to comply with such laws and regulations. In such event, possible sanctions that may be imposed include suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines. We believe that we are in substantial compliance with all material laws and regulations.

8

Table of Contents

Our business is subject to regulation at both federal and state levels by the SEC and other regulatory bodies. Westwood Management is registered with the SEC under the Investment Advisers Act of 1940 and under the laws of various states. As a registered investment adviser, Westwood Management is regulated and subject to examination by the SEC. The Investment Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary duties, record keeping requirements, operational requirements, marketing requirements and disclosure obligations. Westwood Management also acts as adviser to a family of mutual funds, the WHG Funds, which are registered with the SEC under the Investment Company Act of 1940. As adviser to a registered investment company, Westwood Management must comply with the requirements of the Investment Company Act and related regulations. The Investment Company Act imposes numerous obligations on registered investment companies, including requirements relating to operations, fees charged, sales, accounting, record-keeping, disclosure, governance and restrictions on transactions with affiliates. Under the rules and regulations of the SEC promulgated pursuant to the federal securities laws, we are subject to periodic examination by the SEC. The SEC is authorized to institute proceedings and impose sanctions for violations of the Investment Advisers Act and the Investment Company Act, ranging from censure to termination of an investment adviser’s registration. The failure of Westwood Management to comply with the requirements of the SEC could have a material adverse effect on Westwood. We must also comply with anti-money laundering laws and regulations, including the USA PATRIOT Act of 2001, as subsequently amended and reauthorized. We believe that we are in substantial compliance with the requirements of the regulations under the Investment Advisers Act, the Investment Company Act and the USA PATRIOT Act.

Westwood Trust

Westwood Trust operates in a highly regulated environment and is subject to extensive supervision and examination. As a Texas chartered trust company, Westwood Trust is subject to the Texas Finance Code (the “Finance Code”), the rules and regulations promulgated under the Finance Code and supervision by the Texas Department of Banking. These laws are intended primarily for the protection of Westwood Trust’s clients and creditors, rather than for the benefit of investors. The Finance Code provides for and regulates a variety of matters, such as:

| • | minimum capital maintenance requirements |

| • | restrictions on dividends |

| • | restrictions on investments of restricted capital |

| • | lending and borrowing limitations |

| • | prohibitions against engaging in certain activities |

| • | periodic examinations by the office of the Texas Department of Banking Commissioner |

| • | furnishing periodic financial statements to the Texas Department of Banking Commissioner |

| • | fiduciary record-keeping requirements |

| • | prior regulatory approval for certain corporate events (such as mergers, sale/purchase of all or substantially all of the assets and transactions transferring control of a trust company). |

The Finance Code also gives the Banking Commissioner broad regulatory powers (including penalties and civil and administrative actions) if the trust company violates certain provisions of the Finance Code or conservatorship or closure if Westwood Trust is determined to be in a “hazardous condition” (as defined by law). Westwood Trust’s failure to comply with the Finance Code could have a material adverse effect on Westwood.

Westwood Trust is limited by the Finance Code in the payment of dividends to undivided profits which is described as that part of equity capital equal to the balance of net profits, income, gains, and losses since its formation date minus subsequent distributions to stockholders and transfers to surplus or capital under share dividends or appropriate board resolutions. At the discretion of its board of directors, Westwood Trust has made quarterly and special dividend payments to Westwood Holdings Group out of undivided profits.

Employee Retirement Income Security Act of 1974

We are subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and to the related regulations, insofar as we are a “fiduciary” under ERISA with respect to some clients. ERISA and applicable provisions of the Internal Revenue Code impose certain duties on persons who are fiduciaries under ERISA or who provide services to ERISA plan clients and prohibit certain transactions involving ERISA plan clients. Our failure to comply with these requirements could have a material adverse effect.

9

Table of Contents

Employees

At December 31, 2010, we had 77 full-time employees, including 29 investment management, research and trading professionals, 26 marketing and client service professionals, and 22 operations and business management professionals. No employees are represented by a labor union and we believe our employee relations to be good.

Segment information

For information about our operating segments, Westwood Management and Westwood Trust, please see footnote 13 “Segment Reporting” in the financial statements accompanying this Report.

10

Table of Contents

| Item 1A. | Risk Factors |

We believe these represent the material risks currently facing our business. Our business, financial condition or results of operations could be materially adversely affected by these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. You should carefully consider the risks described below before making an investment decision. You should also refer to the other information included or incorporated by reference in this Report, including our financial statements and related notes.

Poor investment performance of assets managed by us could adversely affect our results of operations.

Because we compete with many asset management firms on the basis of asset classes offered and the investment performance of those asset classes, our success is dependent to a significant extent on the investment performance of the assets that we manage. Because our revenue is primarily generated from fees derived as a percentage of assets under management, poor performance tends to result in the loss or reduction of client accounts, which correspondingly decreases revenues. Underperformance relative to peer groups for our various asset classes could adversely affect our results of operations, especially if such underperformance continues for a lengthy period of time.

Some management employees are considered critical to our success, and our inability to attract and retain key employees could compromise our future success.

We believe that our future success will depend to a significant extent upon the services of our executive officers, particularly Susan M. Byrne, our Chairman of the Board and Chief Investment Officer, and Brian O. Casey, our President and Chief Executive Officer. As with other asset management businesses, our future performance depends to a significant degree upon the continued contributions of these and other key officers, investment professionals, marketing, client service and management personnel. There is substantial competition for skilled personnel and the loss of key employees or our failure to attract, retain and motivate qualified personnel, could negatively impact our business, financial condition, results of operations and future prospects.

Our revenues are dependent upon the performance of the securities markets and negative performance of the securities markets could reduce our revenues.

Our results of operations are affected by many economic factors, including the performance of the securities markets. Negative performance within the securities markets or short-term volatility within the securities markets could result in investors withdrawing assets, decreasing their rates of investment or shifting assets to cash or other asset classes that we do not manage, all of which could reduce our revenues. Because most of our revenues are based on the value of assets under management, a decline in the value of those assets would also adversely affect our revenues. In addition, in periods of slowing growth or declining revenues, profits and profit margins are adversely affected because certain expenses remain relatively fixed.

In particular, a significant amount of our assets under management is invested in equity securities of companies with large market capitalizations. As a consequence, we are particularly susceptible to the volatility associated with changes in the market for large capitalization stocks. Due to this concentration, any change or reduction in such markets, including a shift of our clients’ and potential clients’ preference from investments in equity securities of large capitalization stocks to other equity or fixed income securities could have a significant negative impact on our revenues and results of operations. This negative impact could occur due to the depreciation in value of our assets under management, the election by clients to select other firms to manage their assets or the election by clients to allocate assets away from asset classes that we manage. Any of these events would result in decreased assets under management and therefore reduced revenues and a decline in results of operations.

If we are unable to realize benefits from the costs we have incurred and are continuing to incur to develop new asset classes and otherwise broaden our capabilities, our growth opportunities may be adversely affected.

We have incurred significant costs during the last several years to develop new asset classes, including SmallCap Value, AllCap Value, Income Opportunity, MidCap, LargeCap Enhanced (130/30), Global Strategic Diversification, an MLP portfolio and SMidCap Plus+, to launch new mutual funds under the WHG Funds name, and to upgrade our business infrastructure. Some costs associated with these improvements will continue to be incurred in future periods and are relatively fixed. We may not realize the benefits of these investments and in the event we are unable to do so our results of operations and growth opportunities may be adversely affected.

11

Table of Contents

Due to the substantial cost and time required to introduce new asset classes in our industry, we may not be able to successfully introduce new asset classes in a timely manner, or at all.

The development and marketing of new asset classes in our industry requires a substantial amount of time and financial resources. Our ability to market and sell a new asset class successfully depends on our financial resources, the performance results of the specific asset class, the timing of the offering and our marketing strategies. Once an asset class is developed, whether through acquisition or internal development, we must effectively market the asset class to our existing and prospective clients. This entails incurring substantial financial costs related to research on the target assets and the demand for such asset class in the market, as well as sales and marketing costs associated with attracting assets to the new asset class. In addition, our ability to sell new asset classes to our existing and prospective clients depends on our ability to meet or exceed the performance of our competitors who offer the same or similar asset classes. We may not be able to manage the assets within a given asset class profitably. Moreover, it may take years before we are able to produce the level of results that will enable us to attract clients. If we are unable to realize the benefits of the costs and expenses incurred in developing new asset classes, we may experience losses as a result of our management of these asset classes, and our ability to introduce further new asset classes and compete in our industry may be hampered.

Our business is dependent on investment advisory, subadvisory and trust agreements that are subject to termination or non-renewal. As a result, we could lose any of our clients on very short notice.

Substantially all of our revenues are derived pursuant to investment advisory, subadvisory and trust agreements with our clients. In general, either party may terminate these agreements upon 30 days’ notice. Any termination of, or failure to renew, a material number of these agreements could have a material adverse impact on us, particularly because many of our costs are relatively fixed.

A small number of clients account for a substantial portion of our business. As such, the reduction or loss of business with any of these clients could have an adverse impact on our business, financial condition and results of operations.

One of our largest clients in terms of assets paid us both asset-based and performance-based advisory fees in 2008. Due to a significant performance fee earned in 2008, this client accounted for 19.5% of our fee revenues for the year ended December 31, 2008; this client did not pay a performance fee in 2009 or 2010 and accounted for less than 1% of our revenues for the years ended December 31, 2009 and 2010. Our four largest clients accounted for approximately 12.2% of fee revenues for the year ended December 31, 2010. We are dependent to a significant degree on our ability to maintain existing relationships with these clients. There can be no assurance that we will be successful in maintaining these existing client relationships, securing additional clients or achieving the superior investment performance necessary to earn performance-based advisory fees. Any failure by us to retain one or more of these large clients or establish profitable relationships with additional clients could have a material adverse effect on our business, financial condition and results of operations.

Competitive fee pressures could reduce revenues and profit margins.

The investment management business is highly competitive and has relatively low barriers to entry. To the extent we have to compete on the basis of price, we may not be able to maintain our current fee structure. Although our investment management fees vary from product to product, we have competed primarily on the performance of our products and client service rather than on the level of our investment management fees relative to our competitors. In recent years there has been a trend toward lower fees in the investment management industry. In order to maintain our fee structure in a competitive environment, we must be able to continue to provide clients with investment returns and service that make investors willing to pay our fees. We cannot be assured that we will succeed in providing investment returns and service that will allow us to maintain our current fee structure. Fee reductions on existing or future new business could have an adverse effect on our profit margins and results of operations.

12

Table of Contents

Performance fees could have a significant effect on our revenues and results of operations.

We have performance fee agreements with a small number of our clients, which would pay us a fee if we outperform a specified index over predetermined periods of time. There can be no assurance that we will outperform relative to such indexes and the failure to do so would cause us to earn none or only part of those potential revenues, which would have a material adverse effect on our revenues and results of operations. Our revenues from performance-based fees could fluctuate significantly from one measurement period to the next, depending on how we perform relative to the indexes specified in these agreements. For example, we earned a significant performance fee in 2008, but did not earn performance fees in 2009 or 2010.

Any event that negatively affects the asset management industry in general could have a material adverse effect on us.

Any event affecting the asset management industry that results in a general decrease in assets under management or a significant general decline in the number of advisory clients or accounts could negatively impact our revenues. Our future growth and success depends in part upon the growth of the asset management industry.

Our business is subject to extensive regulation with attendant costs of compliance and serious consequences for violations.

Virtually all aspects of our business are subject to various laws and regulations including the Investment Advisers Act, the Investment Company Act, and anti-money laundering laws. These laws and regulations generally grant regulatory agencies broad administrative powers, including the power to limit or restrict us from operating our business as well as the powers to place us under conservatorship or closure in the event we fail to comply with such laws and regulations. Violations of such laws or regulations could subject us and/or our employees to disciplinary proceedings and civil or criminal liability, including revocation of licenses, censures, fines or temporary suspension, permanent barring from the conduct of business, conservatorship, or closure. Any such proceeding or liability could have a material adverse effect upon our business, financial condition, results of operations and business prospects. Due to the extensive regulations and laws to which we are subject, our management is required to devote substantial time and effort to legal and regulatory compliance issues.

In addition, the regulatory environment in which we operate is subject to change. We may be adversely affected as a result of new or revised legislation or regulations or by changes in the interpretation or enforcement of existing laws and regulations. See “ — Regulation.”

Misuse of assets and information in the possession of our investment professionals and employees could result in costly litigation and liability for us and our clients.

Our investment professionals handle a significant amount of assets along with financial and personal information for our clients. Although we have implemented a system of controls to minimize the risk of a fraudulent taking or misuse of assets and information, there can be no assurance that our controls will be adequate to prevent such fraudulent actions by our portfolio managers or employees. If our controls are ineffective in preventing the fraudulent taking or misuse of assets and information, we could be subject to costly litigation, which could consume a substantial amount of our resources, distract management from our operations, and could also result in regulatory sanctions. Additionally, any such fraudulent actions could adversely affect some clients in other ways, and these clients could seek redress against us.

Acquisitions involve inherent risks that could compromise the success of the combined business and dilute the holdings of current stockholders.

As part of our long-term business strategy, we may consider acquisitions of similar or complementary businesses. See “ — Growth Strategy.” If we are not correct when we assess the value, strengths, weaknesses, liabilities and potential profitability of acquisition candidates or if we are unsuccessful in integrating the operations of the acquired businesses, the success of the combined business could be compromised. Any future acquisitions will be accompanied by the risks commonly associated with acquisitions. These risks include, among others, potential exposure to unknown liabilities of acquired companies and to acquisition costs and expenses, the difficulty and expense of integrating the operations and personnel of the acquired companies, the potential disruption to the business of the combined company and potential diversion of management’s time and attention, the impairment of relationships with and the possible loss of key employees and clients as a result of the changes in management, potential future write-downs related to goodwill impairment in connection with acquisitions, and dilution to the stockholders of the combined company if the acquisition is made for stock of the combined company. In addition, asset classes, technologies or businesses of acquired companies may not be effectively assimilated into our business or have a positive effect on the combined company’s revenues or earnings. The combined company may also incur significant expense to complete acquisitions and to support acquired asset classes and businesses. Further, any such acquisitions may be funded with cash, debt or equity, which could have the effect of diluting the holdings or limiting the rights of stockholders. Finally, we may not be successful in identifying attractive acquisition candidates or completing acquisitions on favorable terms.

13

Table of Contents

Acquisitions executed by us were forecasted to add revenues, expenses and earnings to our business. The failure to realize these revenues and earnings could adversely impact our results of operations.

We have made two business acquisitions in the last two years. There is no guarantee that these acquisitions will yield the benefits that we forecasted due to a variety of factors, including retention of acquired clients. If these acquisitions do not yield expected benefits, our revenues and results of operations could be negatively impacted and we could be required to record an impairment against earnings for the intangible assets and goodwill acquired in these transactions.

Various factors may hinder the declaration and payment of dividends.

We have historically paid a quarterly dividend. However, payment of future dividends is subject to the discretion of our Board of Directors and various factors may prevent us from paying dividends. Such factors include our financial position, capital requirements and liquidity, the existence of a stock repurchase program, state corporate and banking law restrictions, results of operations and such other factors as our Board of Directors may consider relevant. In addition, as a holding company, our ability to pay dividends is dependent on the dividends and income we receive from our subsidiaries. Currently, our primary source of cash consists of dividends that may be received from Westwood Management or Westwood Trust. The payment of dividends by Westwood Management or Westwood Trust is subject to the discretion of their Boards of Directors and compliance with applicable laws, including, in particular, the provisions of the Texas Finance Code applicable to Westwood Trust. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our business is vulnerable to systems failures that could have a material adverse effect on our business, financial condition and results of operations.

Any delays or inaccuracies in securities pricing information or information processing could give rise to claims against us, which could have a material adverse effect on our business, financial condition and results of operations. We are highly dependent on communications and information systems and on third party vendors for securities pricing information and updates from certain software. We may suffer a systems failure or interruption, whether caused by an earthquake, fire, other natural disaster, power or telecommunications failure, unauthorized access, act of God, act of war or otherwise, and our back-up procedures and capabilities may be inadequate to eliminate the risk of extended interruptions in operations.

We may not be able to fund future capital requirements on favorable terms, if at all.

We cannot be certain that financing to fund our working capital or other cash requirements, if needed, will be available on favorable terms, if at all. Our capital requirements will vary greatly from quarter to quarter depending on, among other things, capital expenditures, fluctuations in our operating results and financing activities. If future financing is necessary, we may or may not be able to obtain financing on favorable terms, if at all. Further, any future equity financings could dilute the relative percentage ownership of then existing holders of our common stock and any future debt financings could involve restrictive covenants that limit our ability to take certain actions.

14

Table of Contents

Failure to maintain effective internal controls could have a material adverse effect on our business and stock price.

Effective internal controls are necessary to provide reliable financial reports. If we cannot provide reliable financial reports, our brand and operating results could be harmed. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

We cannot be certain that the measures we take to evaluate and improve our internal controls will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. If we fail to maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. In addition, failure to achieve and maintain an effective internal control environment could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

Our organizational documents contain provisions that may prevent or deter another group from paying a premium over the market price to our stockholders to acquire our stock.

Our organizational documents contain provisions that require a vote of two-thirds of the shares of stock entitled to vote to remove directors for cause, establish that stockholders cannot act by written consent, and that authorize our Board of Directors to issue, without shareholder approval, blank check preferred stock. In addition, as a Delaware corporation, we are subject to Section 203 of the Delaware General Corporation Law relating to business combinations. These provisions could delay, deter or prevent a merger, consolidation, tender offer or other business combination or change of control involving us that could include a premium over the market price of our common stock that some or a majority of our stockholders might consider to be in their best interests.

We are a holding company and are dependent on the operations and funds of our subsidiaries.

We are a holding company, with no revenue generating operations and no assets other than our ownership interests in Westwood Management and Westwood Trust. Accordingly, we are dependent on the cash flow generated by these operating subsidiaries and must rely on dividends or other intercompany transfers from these operating subsidiaries to generate the funds necessary to meet our obligations.

| Item 2. | Properties. |

Westwood, Westwood Management and Westwood Trust conduct their principal operations through leased office space with approximately 21,600 square feet, expanding to 25,555 square feet in the third quarter of 2011, located in Dallas, Texas. The initial term of the lease agreement expires in November 2021. In addition, we lease office space with approximately 5,045 square feet located in Omaha, Nebraska pursuant to a lease with an initial term that expires in July 2014. We believe these facilities will be adequate to serve our currently anticipated business needs.

| Item 3. | Legal Proceedings. |

We are subject from time to time to certain claims and legal proceedings arising in the ordinary course of our business. We do not believe the outcome of these proceedings will have a material impact on our financial position, operations or cash flow.

15

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

Our common stock has traded on the New York Stock Exchange (the “NYSE”) under the symbol “WHG” since July 1, 2002. At December 31, 2010, there were approximately 177 record holders of our common stock, although we believe that the number of beneficial owners of our common stock is substantially greater. The table below sets forth the high and low sale prices for the common stock, as reported by the NYSE for the periods indicated.

| High | Low | |||||||

| 2010 |

||||||||

| Fourth Quarter |

$ | 40.65 | $ | 33.19 | ||||

| Third Quarter |

39.00 | 28.49 | ||||||

| Second Quarter |

40.56 | 33.84 | ||||||

| First Quarter |

40.48 | 34.10 | ||||||

| 2009 |

||||||||

| Fourth Quarter |

$ | 40.60 | $ | 33.35 | ||||

| Third Quarter |

42.28 | 33.50 | ||||||

| Second Quarter |

44.44 | 37.28 | ||||||

| First Quarter |

42.92 | 24.12 | ||||||

Dividends

We have declared a cash dividend on our common stock for each quarter since the date that our common stock was first publicly traded. The table below sets forth the dividends declared for the periods indicated.

| Dividend per share of common stock |

||||||||

| Regular | Special | |||||||

| 2010 |

||||||||

| Fourth Quarter |

$ | 0.33 | $ | 0.33 | ||||

| Third Quarter |

0.33 | |||||||

| Second Quarter |

0.33 | |||||||

| First Quarter |

0.33 | |||||||

| 2009 |

||||||||

| Fourth Quarter |

$ | 0.33 | ||||||

| Third Quarter |

0.30 | |||||||

| Second Quarter |

0.30 | |||||||

| First Quarter |

0.30 | |||||||

In addition, on February 3, 2011 we declared a quarterly cash dividend of $0.35 per share on our common stock payable on April 1, 2011 to stockholders of record on March 15, 2011. We currently intend to continue paying cash dividends in such amounts as our Board of Directors determines are appropriate. Any future payment of cash dividends will be at the discretion of the Board of Directors and subject to limitations under the Delaware General Corporation Law.

Westwood Holdings Group, Inc. is the sole stockholder of both Westwood Management and Westwood Trust. Westwood Trust is limited under applicable Texas law in the payment of dividends to undivided profits which is defined as that part of equity capital equal to the balance of net profits, income, gains, and losses since its formation date minus subsequent distributions to stockholders and transfers to surplus or capital under share dividends or appropriate Board of Directors’ resolutions.

16

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION

The following table gives information as of December 31, 2010 about shares of our common stock that may be issued upon the exercise of options, warrants and rights under the Third Amended and Restated Westwood Holdings Group, Inc. Stock Incentive Plan, our only equity compensation plan in effect at that time. The material terms of this plan were approved by our stockholders at our 2009 Annual Meeting and are discussed in note 9 of the financial statements included in this Form 10-K.

| Plan Category |

Number of securities to be issued upon exercise of outstanding options (a) |

Weighted- average exercise price of outstanding options (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|||||||||

| Equity compensation plans approved by security holders |

38,400 | $ | 12.90 | 331,000 | ||||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

| Total |

38,400 | $ | 12.90 | 331,000 | ||||||||

17

Table of Contents

PERFORMANCE GRAPH

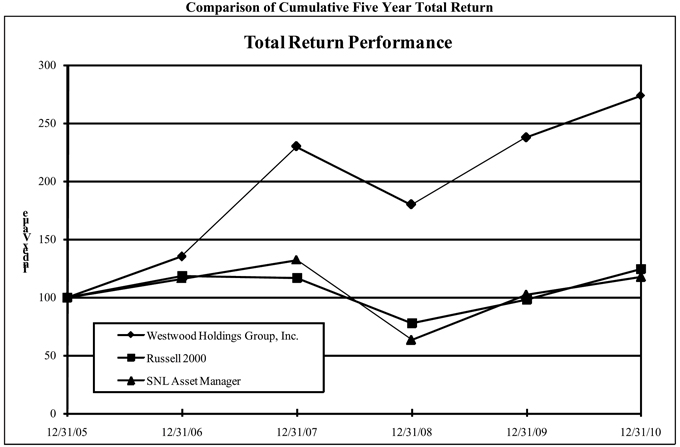

The following graph compares total stockholder returns of Westwood since December 31, 2005 with the total return of the Russell 2000 Index and the SNL Asset Manager Index. The SNL Asset Manager Index is a composite of 31 publicly-traded asset management companies.

| Index |

Period ended | Cumulative Five-Year Total Return |

||||||||||||||||||||||||||

| 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | |||||||||||||||||||||||

| Westwood Holdings Group, Inc. |

$ | 100.00 | $ | 135.10 | $ | 229.47 | $ | 179.52 | $ | 237.33 | $ | 272.99 | 172.99 | % | ||||||||||||||

| Russell 2000 Index |

100.00 | 118.37 | 116.51 | 77.15 | 98.11 | 124.46 | 24.46 | |||||||||||||||||||||

| SNL Asset Manager Index |

100.00 | 115.97 | 132.01 | 62.74 | 101.78 | 117.15 | 17.15 | |||||||||||||||||||||

The total return for our stock and for each index assumes $100 invested on December 31, 2005 in our common stock, the Russell 2000 Index, and the SNL Asset Manager Index, including reinvestment of dividends. Our common stock is traded on the NYSE under the ticker symbol “WHG.”

The closing price of our common stock on the last trading day of the year ended December 31, 2010 was $39.96 per share. Historical stock price performance is not necessarily indicative of future price performance.

18

Table of Contents

| Item 6. | Selected Consolidated Financial Data. |

SELECTED CONSOLIDATED FINANCIAL DATA

The selected consolidated financial data presented below for the five years ended December 31, 2010, except Assets Under Management, is derived from our consolidated financial statements as audited by Grant Thornton LLP, independent registered public accounting firm as of and for the years ended December 31, 2010, 2009, 2008, 2007 and 2006, and should be read in conjunction with those statements. The earnings per share amounts set forth below for the years ended December 31, 2009, 2008, 2007 and 2006 were retrospectively adjusted in order to conform to the current year presentation, which uses the two-class method. For a further discussion of the two-class method please see “Note 10. EARNINGS PER SHARE” in the financial statements included in this Report. The information set forth below should be read in conjunction with “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Report.

| Year ended December 31, (in thousands, except per share amounts) |

||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Consolidated Statements of Income Data: |

||||||||||||||||||||

| Total revenues |

$ | 55,313 | $ | 42,553 | $ | 46,456 | $ | 36,292 | $ | 27,364 | ||||||||||

| Total expenses |

37,592 | 30,235 | 29,921 | 24,085 | 20,110 | |||||||||||||||

| Income before income taxes |

17,721 | 12,318 | 16,535 | 12,207 | 7,254 | |||||||||||||||

| Provision for income taxes |

6,441 | 4,423 | 5,992 | 4,263 | 2,785 | |||||||||||||||

| Income before cumulative effect of accounting change |

11,280 | 7,895 | 10,543 | 7,944 | 4,469 | |||||||||||||||

| Net income |

11,280 | 7,895 | 10,543 | 7,944 | 4,508 | |||||||||||||||

| Earnings per share before cumulative effect of change in accounting principle – basic |

$ | 1.62 | $ | 1.10 | $ | 1.53 | $ | 1.19 | $ | 0.58 | ||||||||||

| Earnings per share before cumulative effect of change in accounting principle – diluted |

$ | 1.58 | $ | 1.09 | $ | 1.52 | $ | 1.18 | $ | 0.58 | ||||||||||

| Earnings per share – basic |

$ | 1.62 | $ | 1.10 | $ | 1.53 | $ | 1.19 | $ | 0.59 | ||||||||||

| Earnings per share – diluted |

$ | 1.58 | $ | 1.09 | $ | 1.52 | $ | 1.18 | $ | 0.59 | ||||||||||

| Cash dividends declared per common share |

$ | 1.65 | $ | 1.23 | $ | 1.20 | $ | 1.15 | $ | 1.33 | ||||||||||

| As of December 31, (in thousands) |

||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||

| Cash and investments |

$ | 45,044 | $ | 45,125 | $ | 31,650 | $ | 26,704 | $ | 20,110 | ||||||||||

| Total assets |

72,628 | 59,886 | 50,847 | 39,024 | 28,722 | |||||||||||||||

| Stockholders’ equity |

60,677 | 47,218 | 38,794 | 29,346 | 22,735 | |||||||||||||||

| Assets Under Management (in millions) |

$ | 12,477 | $ | 10,174 | $ | 7,185 | $ | 7,853 | $ | 5,927 | ||||||||||

19

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

You should read the following discussion and analysis in conjunction with “Selected Consolidated Financial Data” included in this Report, as well as our consolidated financial statements and related notes thereto appearing elsewhere in this Report.

Forward-Looking Statements

Statements in this Report and the Annual Report to Stockholders that are not purely historical facts, including statements about our expected future financial position, results of operations or cash flows, as well as other statements including words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “should,” “could,” “goal,” “target,” “designed,” “on track,” “comfortable with,” “optimistic” and other similar expressions, constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results and the timing of some events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including, without limitation, those set forth below:

| • | our ability to identify and market services that appeal to our customers; |

| • | the significant concentration of our revenues in four of our customers; |

| • | our relationships with investment consulting firms; |

| • | our relationships with current and potential customers; |

| • | our ability to retain qualified personnel; |

| • | our ability to develop and market new asset classes successfully; |

| • | our ability to maintain our fee structure in light of competitive fee pressures; |

| • | competition in the marketplace; |

| • | downturns in financial markets; |

| • | new legislation adversely affecting the financial services industries; |

| • | interest rates; |

| • | changes in our effective tax rate; |

| • | our ability to maintain an effective system of internal controls; and |

| • | other risks as detailed from time to time in our SEC reports. |