Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | dex991.htm |

Q1 FY 2011 EARNINGS

February 17, 2011

Exhibit 99.2

©

2011 Brocade Communications Systems, Inc.

Page 1 of 41 |

| Prepared comments provided by Rob Eggers, Investor Relations

Thank you for your interest in Brocade’s Q1 Fiscal 2011 earnings

presentation, which includes prepared remarks, slides, and a press

release detailing fiscal first quarter 2011 financial results. The press release was issued shortly after 1:00 p.m. Pacific

time on February 17, 2011, via Marketwire. The press release, along with these

prepared comments and slides, has been made available on Brocade’s

Investor Relations website at www.brcd.com and has been furnished to the SEC on Form 8-K. |

| Cautionary Statements and Disclosures

This presentation includes forward-looking statements regarding

Brocade’s financial results, plans and business outlook as well as

worldwide SAN, Ethernet and Federal government IT spending, which are

only predictions and involve risks and uncertainties such that actual

results may vary significantly. These and other risks are set forth in

more detail in our Form 10-K for the fiscal year ended October 30,

2010. These forward-looking statements reflect beliefs, assumptions,

outlook, estimates and predictions as of today, and Brocade expressly

assumes no obligation to update any such forward-looking

statements. In addition, this presentation includes various

third-party estimates regarding the total available market and other

measures, which do not necessarily reflect the views of Brocade.

Further, Brocade does not guarantee the accuracy or reliability of any such

information or forecast.

Certain financial information is presented on a non-GAAP basis. The most

directly comparable GAAP information and a reconciliation between the

non-GAAP and GAAP figures are provided in the accompanying press

release, which has been furnished to the SEC on Form 8-K and posted

on Brocade’s website, and is included in the appendix to this

presentation. Please see risk factors on Form 10-K filed with the

SEC ©

2011 Brocade Communications Systems, Inc.

Page 2 of 41 |

Agenda

Prepared comments followed by live Q&A call

Richard Deranleau

CFO

Mike Klayko

CEO

©

2011 Brocade Communications Systems, Inc.

Page 3 of 41 |

| Today’s prepared comments include remarks by Mike Klayko, Brocade’s

CEO, regarding the company’s quarterly results, its strategy and a

review of operations, as well as industry trends and market/technology drivers related to its business; and by

Richard Deranleau, Brocade’s CFO, who will provide a financial review.

A live question-and-answer conference call will be webcast beginning at

2:30 p.m. Pacific time on February 17 at www.brcd.com

and will be archived on Brocade’s Investor Relations website for

approximately 12 months. Participants are invited to submit questions

via email at ir@brocade.com up to 60 minutes prior to the conference call and to ask live questions during the call. |

Fiscal 2011: Q1 Earnings

Mike Klayko, CEO

©

2011 Brocade Communications Systems, Inc.

Page 4 of 41 |

| Prepared comments provided by Mike Klayko, CEO

|

Q1 Executive Summary

Q1 Results

•

$546M revenues, up 1.2% Yr./Yr.

•

$0.12 non-GAAP EPS* (diluted)

Business Highlights

•

Highest end-user demand for SAN

•

SAN product revenue grew 4.9%

Qtr./Qtr. driven by Director/Server

•

Ethernet product revenue grew

32% Yr./Yr. led by EMEA and APAC

•

Operating cash flows of $118M,

up 11% Qtr./Qtr.

* Note: Non-GAAP, please see GAAP reconciliation in appendix

Quarterly Revenues

$539M

$501M

$504M

$550M

$546M

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

©

2011 Brocade Communications Systems, Inc.

Page 5 of 41 |

| Brocade reported Q1 revenues of $546M and non-GAAP diluted

earnings per share (EPS) of $0.12, which exceeded our prior guidance

range of $0.09 to $0.10 for the quarter. Our revenues in the quarter represented a 1.2% increase year-over-year

(Yr./Yr.) and a slight decrease sequentially as expected, following an

all-time record revenue quarter in Q4 FY10. A highlight in Q1

was our ability to maintain momentum in our Ethernet products revenue, which was up 32% Yr./Yr. fueled by

growth in EMEA and Asia Pacific (APAC) in terms of geographies. In addition, we

saw strong traction in the Service Provider and Enterprise businesses in

terms of customer segments. Another highlight was the performance of our

storage area networking (SAN) products revenue, which was up approximately 5%

sequentially. Specifically, we are seeing healthy end-user demand for our

SAN products as customers continue to invest in their

data center networking infrastructures to address IT imperatives

such as server virtualization sprawl and private cloud

initiatives. These dynamics are also having a positive impact in

our Director and Server products businesses. As servers run

more virtual machines, the connection rate to storage increases and the demand

for SAN switching increases. In Q1, Brocade generated its

second-highest Director product revenue, its highest Server product revenue and record sell-through or end-user

demand for its SAN business. |

Brocade FY 2011 Playbook

1.

Differentiate through Innovation

2.

Grow the Ethernet Business

3.

Maintain SAN Leadership

4.

Generate More Awareness

5.

Be an Employer of Choice

6.

Grow Top-Line Profitably

©

2011 Brocade Communications Systems, Inc.

Page 6

of 41 |

| Last quarter I discussed our FY 11 Playbook. I will now take a closer

look at our Q1 performance according to the FY 11 Playbook

fundamentals: 1.

Differentiate through Innovation

2.

Grow the Ethernet Business

3.

Maintain SAN Leadership

4.

Generate More Awareness

5.

Be an Employer of Choice

6.

Grow Top-Line Profitably |

1. Differentiate through Innovation

Brocade One

™

Strategy

•

Unmatched simplicity

•

Non-stop networking

•

Application optimization

•

Investment protection

Brocade MLXe

with 100 GbE

Brocade VDX

™

6720

Data Center Switches with

Brocade VCS technology

BROCADE

Brocade One in Action

Brocade One in Action

©

2011 Brocade Communications Systems, Inc.

Page 7 of 41 |

| Brocade introduced the Brocade One™

strategy to help us align our innovation priorities with four key customer

imperatives that we believe are essential for success in IT today:

Unmatched simplicity, non-stop networking, application optimization

and investment protection. Two of the best recent examples of Brocade One

“in action” are the Brocade VDX™

6720 Data

Center Switch powered by Brocade VCS™

technology and the Brocade MLXe

Core Router, which establishes industry

benchmarks for performance, scalability and investment protection for service

provider and data center networks. I will provide a brief progress

update on each platform. |

“Most Important

Enterprise IT

Product of 2010”

©

2011 Brocade Communications Systems, Inc.

Page 8 of 41 |

| (1)

http://www.cio.gov/documents/25-Point-Implementation-Plan-to-Reform-Federal%20IT.pdf

Award-Winning Brocade VDX 6720/ Brocade VCS Technology:

Brocade VCS technology to enable a new category of data center networks, or Ethernet fabrics, that are purpose-built to

help our customers simplify their network architectures and manage the rampant growth of server

virtualization inside of their data centers. This is a critical technology building block

towards highly automated, private cloud architectures that many customers are evaluating

today. The initial reception of the Brocade VDX 6720 from customers, industry pundits and

other luminaries has been very positive. Customers who are evaluating an Ethernet fabric

solution have told us, “If you are building a cloud environment, you must start with the

assumption that it will need an Ethernet fabric as its foundation”. We are also proud of the fact that CTOEdge

named the Brocade VDX 6720 the

“Most Important Enterprise Product for 2010,” pointing out that “this offering heralds a

change in the way we think about managing data centers for years to come.” We also received

favorable feedback about Ethernet fabrics from the CIO of the United States government, Vivek

Kundra, as part of a larger discussion on data center consolidation strategies and cloud

computing best practices. These two topics are top-of-mind for Mr. Kundra, as evidenced

by their prominence in his “25 Point Implementation Plan to Reform Federal Information Technology

Management”. In terms of key metrics, Q1 saw Brocade winning some

significant deals for the Brocade VDX 6720 at large enterprise customers in a number of

targeted vertical markets; energy, high-tech, media and communications. These customers have

already deployed their Brocade VDX 6720 switches into production environments in high-performance,

low-latency top-of- rack switch configurations with plans to migrate to Ethernet

fabric clusters later. These early customers helped the Brocade VDX 6720 surpass our goals for

Q1 in both unit shipments and revenue. In future quarters, we expect to leverage our time-

to-market advantage in this category.

We designed the Brocade VDX 6720 Switch and

(1) |

©

2011 Brocade Communications Systems, Inc.

Page 9 of 41 |

| The IP/Ethernet networking world is

also dealing with massive scale in terms of global digital data and

private network/Internet traffic growth. The proliferation of connected mobile devices, the

rapid adoption of public cloud computing services, the migration toward

next-generation 4G cellular as well as IPv6 technologies are some of

the factors driving customers to either upgrade or refresh their service provider and data center

networks today.

The Brocade MLXe Core Router, which was named the

“Product of the Year” by Internet Telephony magazine, is designed

to tackle these challenges, offering industry-leading 1/10/100 Gigabit

Ethernet (GbE) wire-speed density, high reliability, and

cost-saving operational efficiency for the world’s most demanding networks.

Award-Winning Brocade MLXe

Core Router: |

CERN Accelerates Scientific

Innovation with MLXe

Routers

”

“

—Jean-Michel Jouanigot, Communications

Systems Group Leader, IT Department, CERN

Excels in one of the world’s most rigorous testing environments

Brocade’s MLXe

was the only product that

met our stringent requirements (we test

prod`ucts

to destruction), and not only

delivers a solution to meet our immediate

needs but also gives us a platform to 100

GbE

when the time is right. I do not see our

appetite for data waning in the future, so

with the addition of the MLXe

in our

environment, I am confident we have a

blueprint for success.

©

2011 Brocade Communications Systems, Inc.

Page 10 of 41 |

| One such example is our Q1 win at CERN, one of the most respected

scientific research organizations in the world. CERN is using the Brocade

MLXe to manage a networking environment that generates more than 15

petabytes of data every year. Further, we are

extremely proud of this win because the Brocade MLXe

was able to out-perform all other competing solutions in a rigorous testing

process that is recognized as one of the most thorough and demanding in

the scientific community. |

IPv4 Address Exhaustion

Opportunity for IPv6-certified Brocade MLXe

core routers

Source: American Registry for Internet Numbers

2008

2009

2010

2011

688

654

654

570

537

503

436

436

369

268

235

117

0

Mar

Jun

Sep

Dec

Mar

Jun

Sep

Dec

Mar

Jun

Sep

Dec

Feb

Available Free Pool of IPv4 Addresses

from the Internet Assigned Numbers Authority

as of February 3, 2011

The last blocks of

IPv4 addresses were

distributed to each

Regional Internet

Registry on 2/3/11

©

2011 Brocade Communications Systems, Inc.

Page 11 of 41 |

| As customers and the industry make the transition to IPv6 technology,

which has garnered significant media attention recently, the

high-performance and reliability of the Brocade MLXe will be vital.

Industry experts say that IP addresses available through IPv4 are nearly

exhausted. This is hastening the migration to IPv6 among service providers and

enterprises alike. The Brocade MLXe

is one of a comprehensive set of IPv6-certified products that Brocade

offers to simplify this migration for customers, without compromising

performance levels. It is yet another example of how we’re applying

the Brocade One strategy to solve the most critical problems our customers face. |

2. Grow the Ethernet Business

•

32% Yr./Yr. growth in

Ethernet products revenue

•

Nearly 50% sequential

growth in EMEA

•

Double-digit growth in

APAC

•

315 Elite and Premier

global channel partners

Strong performance drives growth

©

2011 Brocade Communications Systems, Inc.

Page 12 of 41 |

| In Q1, our Ethernet products revenue grew more than 32% Yr./Yr. and

total Ethernet revenue (products and services) was up almost 23% Yr./Yr.

Other positive signs include Q1 being the best quarter in winning new

Ethernet customer accounts since we started to track and report on this metric. EMEA was a particular

area of strength for us with the highest growth ever in terms of

new Ethernet accounts and nearly 50%

sequential growth in terms of Ethernet products revenue. APAC had

double-digit sequential growth in Q1, and was up over 65% Yr./Yr.

Consistent with our prior guidance for the quarter, the Federal Ethernet

business in Q1 was down sequentially, but was up more than 22% on a

Yr./Yr. basis. Our non-Federal Ethernet business in the Americas was

up 37% on a Yr./Yr. basis. |

Channel Partner Momentum

John McHugh, Chief Marketing

Officer Barbara Spicek, VP of Worldwide Channels

©

2011 Brocade Communications Systems, Inc.

Page 13 of 41 |

| Overall, I am pleased with our execution in our Ethernet business,

which is a key success factor in Brocade being able to grow our

top-line profitably. We will continue to enhance existing business initiatives and introduce new ones to drive growth

in this market. Focusing on channel partner success is one example of this,

because it is a critical go-to-market route for the Ethernet

business. In Q1, Brocade successfully recruited an additional 11

Elite and Premier channel partners to our Alliance Partner Network

(APN), giving us a total of 315 such partners globally, adding to the almost

7000 Select partners in the program. We also introduced a number of new

and enhanced APN program features that are designed specifically to educate, train and certify

our partners to better address data center, virtualization and cloud computing

business opportunities. Brocade’s channel programs received

significant industry recognition in this quarter when CRN Magazine, a high-profile

publication aimed at resellers, named Vice President of Worldwide Channels

Barbara Spicek and Chief Marketing Officer John McHugh among its “Top 100 Most Influential Executives”.

|

3. Maintain SAN Leadership

•

Record SAN sell-through in Q1

•

Record quarter for Server product revenue

•

110% sequential growth for

10 GbE-based convergence

products

Driving innovation and growth in converged networking

Brocade

Brocade

MLX

MLX

FC

iSCSI

NAS

FCoE

Brocade

Brocade

DCX

DCX

SAN

©

2011 Brocade Communications Systems, Inc.

Page 14 of 41 |

| Maintaining Brocade’s leadership in the SAN market is just as important as

growing our Ethernet Business. Brocade continues to demonstrate leadership

and generate momentum in the storage networking industry in both the traditional Fibre Channel

market as well as the emerging converged networking market.

Our strength in the SAN products business is reflected in the Q1 results with

approximately 5% growth sequentially and an all- time

record in terms of sell-through following a very good Q4 FY10.

It is also reflected in the momentum of our Director and Server products

businesses, which both experienced very strong demand in Q1 including a

record quarter for the Server products. Additionally, we are

showing good progress in sales of our Ethernet fabric products supporting multiple and converged

protocols. These products include the Brocade 8000 FCoE Switch, the Brocade

1010/1020 Converged Network Adapters (CNAs), Brocade VDX 6720 and

embedded FCoE blades. The sales of these 10 GbE-based convergence products in Q1 was up

approximately 110% sequentially and more than 320% Yr./Yr., showing that

customers are turning to Brocade to connect their servers, both physical

and virtual, to shared storage, regardless of technology or protocol. We are committed to providing

leadership in this emerging category. |

Brocade Leading Fibre

Channel

Transformation

Industry’s first end-to-end 16 Gbps

product portfolio

•

Unmatched Simplicity: Integrated

compression, encryption, and routing

•

Investment Protection: Upgrade

existing SAN infrastructure

•

Non-Stop Networking:

Field-proven

“five nines”

availability

8-slot and 4-slot

Backbones

48-port 1U

16 Gbps

Fabric Switch

Mezzanine

16 Gbps

HBAs

©

2011 Brocade Communications Systems, Inc.

Page 15 of 41 |

| Getting back to Fibre

Channel, this technology continues to be, by a wide margin, the

preferred protocol to provide shared

storage for server virtualization and desktop virtualization. In

fact, the rapidly growing adoption for both server and desktop

virtualization is a driving force toward continually faster connections in

Fibre Channel technology. Brocade again expects to

lead this technology transition with our plans to introduce a full suite of next

generation 16 Gbps products and solutions from

server adapters, embedded and fabric switches to directors/backbones later this

year. Another proof point of the relative health of the Fibre

Channel business is the fact that our OEM partners are continuing to

invest in Fibre

Channel technology. In addition, most industry research firms who track the

Fibre Channel market are predicting

growth in 2011 and well beyond, which supports our belief that this market is

healthy and growing. |

4. Generate More Awareness

©

2011 Brocade Communications Systems, Inc.

Page 16 of 41 |

| One focus area in our FY 11 Playbook is our goal to generate broader global

awareness of Brocade as a complete networking solutions provider and not

just the leading “SAN company”. In fact, one of the goals of our Brocade One strategy is to

demonstrate that Brocade is leading the transformation of the network in all

areas of IT with the goal of helping our customers transition smoothly to

a world where information and applications can reside anywhere. We have

focused our global marketing and corporate communications efforts on high-impact programs to accomplish this.

Driving industry thought-leadership with contributions from across the

company is an example. In the technology arena, this is exemplified by

our recent efforts to promote Ethernet fabrics as the de

facto category name for next-generation, flat Layer

2 networks for virtualized data centers. In the non-technology realm,

Brocade being awarded the prestigious “Pinnacle Grand

Prize”

by the Association for Financial Professionals for our innovative process to

converge strategic liquidity planning with enterprise risk management is

another recent example of our thought-leadership. Finally, our

company-wide use of social media to communicate directly to all our key audiences including customers,

partners, investors and employees is an example of how Brocade is specifically

leveraging the power of networking to generate awareness. Please take a

look at our social media campaigns and assets for yourselves at

brocade.com/socialmedia. |

5. Be an Employer of Choice

5. Be an Employer of Choice

©

2011 Brocade Communications Systems, Inc.

Page 17 of 41 |

| Another important focus area in the FY 11 Playbook is our goal to be an

“employer of choice”. We received an important industry

validation when Fortune Magazine, for the second year in a row, named

Brocade as one of the “100 Best Companies to Work

For”.

The Fortune 100 list is based on direct feedback from our employees who gave us

high marks in the areas of innovation, fostering a professional

team environment, community giving, compensation, and flexible work environment. In the spirit of using

social media more, I encourage you to view my short video about the Fortune 100

award at www.youtube.com/watch?v=yZFrd7yvNCI. |

6. Grow Top-Line Profitably

•

32% growth Yr./Yr. in the Ethernet

products revenue

•

All-time record quarter of SAN

sell-through

•

320% growth Yr./Yr. in converged

networking products

•

Delivered higher EPS than outlook

Q1 2011 Summary

©

2011 Brocade Communications Systems, Inc.

Page 18 of 41 |

| Overall, I am pleased with our performance in Q1 and with our ability

to execute thus far to our FY 11 Playbook, including growing the

top-line profitably. Again, this quarter’s highlights include:

•32% growth in the Ethernet products revenue Yr./Yr. led by strength in EMEA, APAC

and our Service Provider businesses; •All-time record quarter in terms of sell-through in our SAN products business including a record in our Server products

revenue; •Good traction in sales of our converged networking products with

320% growth Yr./Yr. and 110% growth sequentially;

•Delivered non-GAAP EPS of $0.12 which topped our guidance of $0.09 to $0.10 for the

quarter. |

Q1 FY 2011 Financials

Richard Deranleau, CFO

©

2011 Brocade Communications Systems, Inc.

Page 19 of 41 |

| Prepared comments provided by Richard Deranleau, CFO

|

Financial Highlights

* Note: Non-GAAP, please see GAAP reconciliation in appendix

Growing the top-line profitably and reducing term debt

Q1 11

Revenues

Overall revenue

$546M

SAN sell-through

Record quarter

Ethernet revenue

+32% Yr./Yr.

Profitability

Non-GAAP EPS* (diluted)

$0.12

GAAP EPS (diluted)

$0.06

Generating Cash/Reducing Debt

Operating cash flow

$118M

Total debt payments

$40M

Term loan down to $311M at end of Q1 11

©

2011 Brocade Communications Systems, Inc.

Page 20 of 41 |

| Brocade executed well in Q1, achieving revenues of $546M which was up

1.2% Yr./Yr. and down slightly Qtr./Qtr., in line with the guidance we

shared with you on our last earnings call. Storage demand was very strong in Q1 with SAN sell-through

reaching an all-time high for the company. Storage product revenues were up

4.9% Qtr./Qtr., in a quarter when OEM partners

reduced their inventory positions as expected. OEM inventories are now at their

lowest since Q4 09. Ethernet product revenues were up 32.2% Yr./Yr.

driven by growth across all geographies. Ethernet product revenues were down 11.5%

Qtr./Qtr. from our all-time record revenue in Q4 driven by lower Federal

spending, consistent with our prior guidance. Non-GAAP

earnings per share on a diluted basis was $0.12 for Q1, which includes a benefit from a lower-than-expected US

Federal tax rate resulting from the passage of the R&D tax credit

bill. Excluding this benefit our non-GAAP EPS for Q1 would

have been $0.11, which is higher than the guidance we provided of $0.09 to

$0.10 for the quarter. We generated $118M in operating cash flow in Q1,

the highest cash generation since Q4 09, which we used to pay down our term loan and to build our

cash balance. |

Key Financial Metrics

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Revenue

$539M

$501M

$504M

$550M

$546M

Sequential growth

3.4%

(7.1)%

.5%

9.3%

(0.8)%

Year-over-year growth

25.0%

(1)

(1.1)%

2.1%

5.5%

1.2%

Non-GAAP gross margin*

64.9%

62.7%

60.4%

62.3%

62.0%

Non-GAAP operating margin*

26.0%

20.5%

17.3%

20.4%

17.1%

Non-GAAP EPS*—diluted

$0.19

$0.13

$0.13

$0.14

$0.12

GAAP EPS—diluted

$0.11

$0.05

$0.05

$0.05

$0.06

(1)

Acquisition of Foundry in December 2008

* Note: Non-GAAP, please see GAAP reconciliation in appendix

Managing the business to our 2-year target model

©

2011 Brocade Communications Systems, Inc.

Page 21 of 41 |

| Turning first to revenues, Q1 revenues were $546.0M in a quarter where we saw good execution

across our business segments and particularly in our EMEA and APAC geographies. Revenues came in

near the high end of the guidance range we provided in our Q4 earnings call driven by strong

storage demand and where both EMEA and APAC posted record percentage contribution of revenue for

the company in Q1. Storage product revenues were up 4.9% sequentially driven by

higher director and server sales which were up 16% and 6%, respectively, compared to Q4.

Ethernet product revenues were down 11.5% sequentially driven by lower Federal revenue as

expected, partially offset by growth in the international regions led by EMEA. We continue to see progress in

our Ethernet sales investments and are pleased with the improvements and growth in both EMEA and APAC

this quarter. Global Services revenues were down 3.6% sequentially driven by associated lower

Ethernet support revenue. OEM inventory levels exiting the quarter were down to about two weeks

of supply, as expected, as OEMs trimmed their inventory entering the seasonally slower quarters

of the year. Non-GAAP Gross Margins of 62.0% were at the high end of our guidance

range of 61.5% to 62.0% for the quarter driven by the strong storage performance. Non-GAAP

gross margins in the quarter were comfortably within our 2-year target model range of 61%

to 63%. Non-GAAP operating margins were 17.1%, above the guidance we gave of 15% to

16% for the quarter, and in our 2-year target model range of 17% to 20%. The sequential

decline in operating margins was driven by slightly lower gross margins and higher operating

expenses as a percentage of revenue driven by our sales and marketing investments over the past

two quarters. Q1 non-GAAP operating expenses were higher as a percentage of revenue at 44.9%, but lower

than the guidance of 46% to 47% for the quarter.

The Q1 11 effective non-GAAP tax rate was 15.9% and effective GAAP tax benefit was (26.6%).

Both tax rates reflect the benefit from the US R&D tax credit that was approved during Q1

by the US Congress. Looking to the Balance Sheet, we repaid $39.7M of our

senior secured debt of which $30.0M was in excess of the mandatory amount due, bringing our

acquisition term debt down to approximately $311M. Total Q1 diluted shares were 491M shares and

within our expected range when we provided our outlook for the quarter. We did not repurchase any

stock during the quarter. |

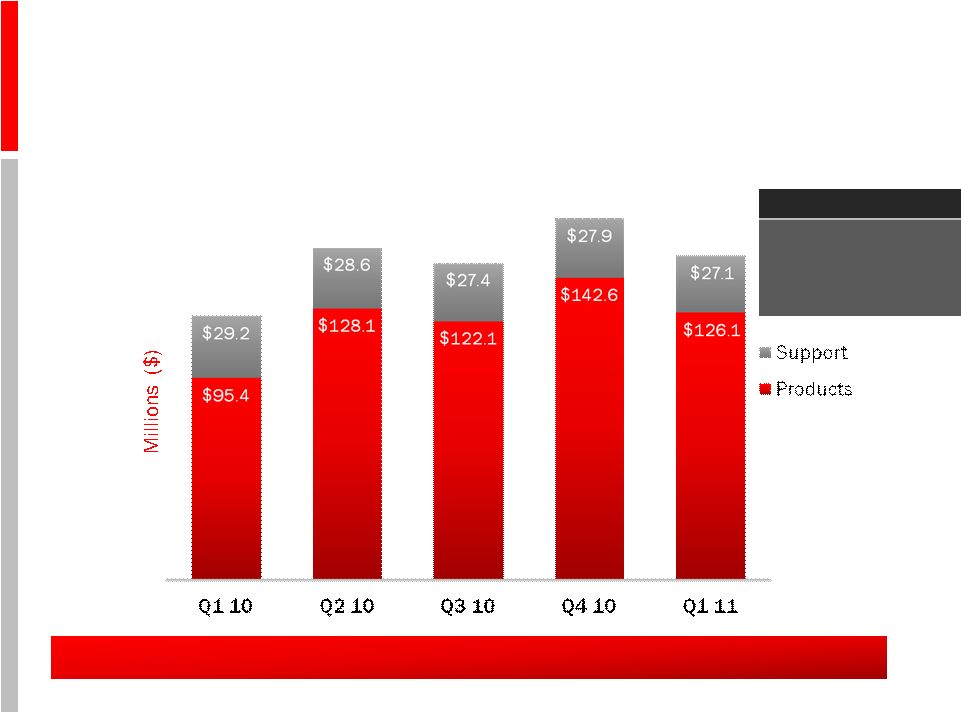

Revenue: SAN, Ethernet, and Global Services

SAN growth offset lower Federal Ethernet revenue

©

2011 Brocade Communications Systems, Inc.

Page 22 of 41 |

| Turning to revenues by business unit, our Storage product revenue was

$331.2M in the quarter, an increase of 4.9% sequentially. Storage

represented 61% of revenues in Q1 versus 57% in Q4. Our Ethernet

product revenue was $126.1M in the quarter, a decrease of 11.5% sequentially. Ethernet product revenue

represented 23% of total revenue versus 26% in Q4.

Our Global Services revenue was $88.7M in the quarter and represented 16% of

revenues, down slightly versus 17% in Q4. Global Services revenue was

down 3.6% sequentially driven primarily by lower Ethernet support revenue. |

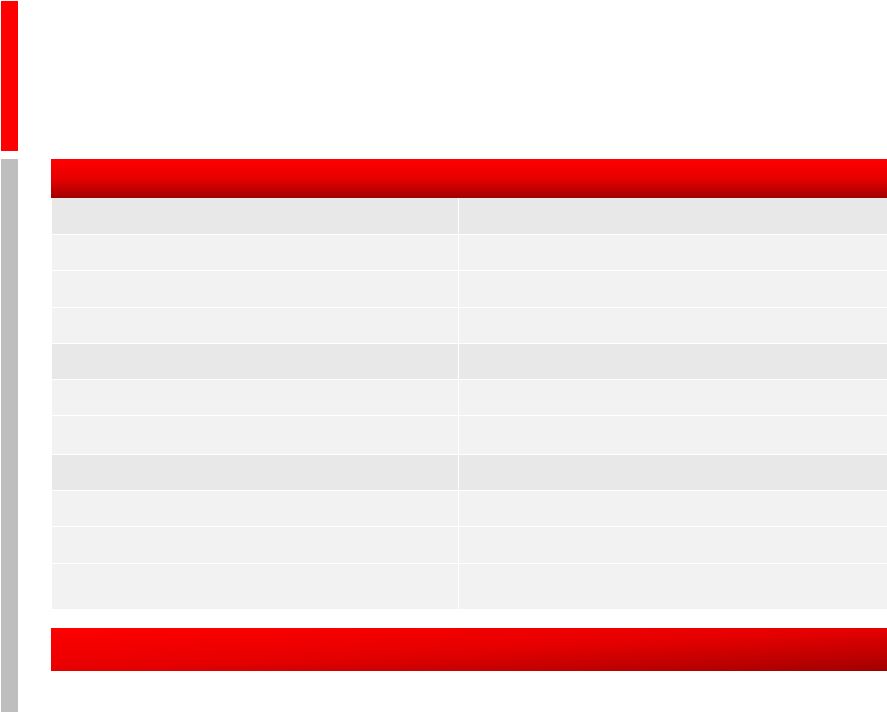

Total Ethernet Business Revenue

Strong year-over-year Ethernet revenue growth

$124.6

$156.7

$149.5

$170.5

$153.2

Total +23%

Support -7%

Products +32%

Q1 Yr./Yr. Compares

©

2011 Brocade Communications Systems, Inc.

Page 23

of 41 |

| Looking at our Ethernet business, including hardware and Ethernet based support and

services, Q1 revenues were $153.2M up 23% Yr./Yr. and down 10% from our record quarter in

Q4 10. Our Federal Ethernet business was $20.4M, up 22% Yr./Yr. which was slightly

higher than our previous guidance of $15- 20M for the quarter. Non-Federal Ethernet

revenue was also up 23% Yr./Yr. showing strength across our product portfolio and customer

base. The non-Federal Ethernet business growth was driven by strong performances in our

international geographies led by the EMEA region. We saw good growth in our new accounts with both

initial sales in the quarter as well as new customers from previous quarters returning and

buying again. We also saw strong demand for our stackables in Q1, reaching a new record for

Brocade for these products. |

Total Ethernet Business Revenue

By customer segment

Strong year-over-year growth across all customer segments

$124.6

$156.7

$149.5

$170.5

$153.2

Total +23%

Federal +22%

Service Provider +58%

Enterprise +13%

Q1 Yr./Yr. Compares

©

2011 Brocade Communications Systems, Inc.

Page 24 of 41 |

| We were also very pleased with continued strength in our Service Provider and Enterprise

segments in Q1. Revenue from customers that we have identified as service providers grew to now

represent 26% of total Ethernet business and grew 5 Yr./Yr. reaching their

2nd highest revenue quarter for Brocade. Revenue from enterprise customers, excluding Federal,

were up 4.4% sequentially and grew 12.5% Yr./Yr. Federal Ethernet business was down 48% sequentially

but up 22% Yr./Yr., consistent with the expectation set out on last quarter’s earnings

call. Ethernet ASP sequential declines were in the low

single-digits, at the low end of the Q1 guidance. |

Total SAN Business Revenue

Quarter-over-quarter growth driven by Directors and Server

products $414.8

$344.3

$354.0

$379.9

$392.8

Total -5%

Support +1%

Products -6%

Q1 Yr./Yr. Compares

©

2011 Brocade Communications Systems, Inc.

Page 25 of 41 |

| Looking at our SAN business, including hardware and SAN based support and

services, Q1 revenue of $392.8M grew 3.4% from Q4.

Demand for Brocade’s leading SAN products was strong resulting in SAN product

revenue of $331.2M in the quarter, up 4.9% sequentially. Increases in revenue

across our director and server product families drove the overall SAN increase

Qtr./Qtr. We generated the 2nd

highest revenue quarter for directors and a record revenue quarter for our Server

product group in Q1.

Our Server

product group, including Embedded Switches, HBA’s, and Mezzanine Cards, posted

record revenues of $48.7M which was up 7.0% Yr./Yr. and up 6.4% from a

strong Q4. Embedded Switches were up 5.7% sequentially while our

host

products

including

HBA’s

and

Mezzanine

Cards

were

up

nearly

200%

Yr./Yr.

SAN

ASP

sequential

declines

were

in

the

low

single-digits,

consistent

with

the

prior

quarter.

-

As

we

look

at

our

multi-protocol

and

converged

networking

products

including

the

Brocade

8000,

FCoE

blades

for

our

flagship DCX storage chassis, VDX switches and CNAs, total converged product

revenue growth was more than 110% sequentially. We feel that our product

portfolio continues to demonstrate our leadership in multi-protocol and convergence

solutions in the marketplace as networks

evolve. |

Revenue: 10% Customers,

Other OEM, Channel/Direct

Higher mix of OEM revenue driven by overall mix to SAN business

©

2011 Brocade Communications Systems, Inc.

Page 26 of 41 |

| In Q1, consistent with the prior quarters, Brocade had three customers that had revenue

greater than 10%. EMC, IBM and HP all contributed more than 10% of revenues individually.

Collectively, our top three OEMs contributed 47% of revenues in Q1, up from 44% in Q4, and down

from 54% in the year ago quarter. Other OEMs represented 19% of revenues in Q1 versus 17% in Q4.

We saw very good growth from HDS and Dell in the quarter which drove this metric higher sequentiall

Channel and Direct were 34% of revenues in Q1, a decrease from 39% in Q4, reflecting the overall mix

away from Federal Ethernet business in the quarter to SAN and the OEM routes to market.

|

Segment Revenues and

Gross Margin Snapshot

Q1 11 vs. Q4 10 revenue mix and non-GAAP gross margin*

* Note: Non-GAAP, please see GAAP reconciliation in appendix

Q4 10

Q1 11

Revenues by Segment ($M)

Non-GAAP Gross Margin*

by Segment

Gross Margins: SAN strong; Ethernet down due to lower revenue

©

2011 Brocade Communications Systems, Inc.

Page 27 of 41 |

| Non-GAAP Gross Margins of 62.0% were at the high end of our guidance range of 61.5% to

62.0% for the quarter driven by the strong storage performance and down 30 basis points from

Q4. Q1 SAN gross margins, were 71.4% unchanged from Q4, reflecting a strong mix of

director products that is typical in our Q1. The higher mix of SAN products at an overall

company level increased margins by approximately 75 basis points. Q1 Ethernet

non-GAAP gross margins were 46.7%, down from 47.8% in Q4. The lower Ethernet gross margins were

primarily driven by lower volumes in the quarter. The impact of lower Ethernet gross margins on

overall company gross margins was approximately -25 basis points in Q1. We continue to be

focused on our Ethernet gross margin initiatives outlined during our Analyst Day and expect to

see improvements again in the 2nd half of 2011 to be within our Ethernet

gross margin target exiting the year.

Global Services non-GAAP gross margins were 48.7% in Q1, down versus 53.7% in Q4 due to lower

revenue and mix to lower margin support offerings. The impact of lower services gross margins

on overall company gross margins was approximately -80 basis points in Q1.

|

Operating Expenses and Margins

* Note: Non-GAAP, please see GAAP reconciliation in appendix

Non-GAAP Operating Margins*

Non-GAAP Operating Expenses*

as a Percentage of Revenues

2-year target operating

expense range: 43–44%

Operating margins within our 2-year target model

2-year target operating

margin range: 17–20%

©

2011 Brocade Communications Systems, Inc.

Page 28

of 41 |

| On a non-GAAP basis, total operating expenses were 44.9% of revenues in Q1 versus 41.9%

in Q4. Operating expenses were better than our previous guidance range of 46% to 47% of revenues

due, in part, to a slower hiring ramp than planned as well as some project spending that moved

out of the quarter. The dollar increase in operating expenses sequentially reflects the

investment in our sales organization made in Q4 as well as some additional investments in Q1.

We added 70 headcount in Q1, of which the majority was in Sales.

Non-GAAP operating margins were 17.1% in Q1, lower than our strong Q4 operating margins of 20.4%

due to higher operating expenses and slightly lower gross margins in the quarter. Our

2-year target range of operating margins is 17% to 20% and we plan to be at the low end of

that range for the full year. |

Balance Sheet and Cash Flow Highlights

as of January 29, 2011

Cash flows enable de-leveraging and reinvestment

* Note: Adjusted EBITDA is as defined in the term debt credit agreement

** Note: Giving effect to the McDATA

convertible debt of $173M repaid on February 16, 2010

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Cash from operations

$69.1M

$67.7M

$55.3M

$106.4M

$118.2M

Capital expenditures

$47M

$62M

$47M

$46M

$23M

Free cash flow

$22M

$6M

$9M

$61M

$95M

Debt payments

$506.5M

$202.2M

$30.6M

$30.2M

$39.7M

Cash, equivalents, and

short term investments

$328M**

$290M

$296M

$336M

$416M

Senior secured debt

$1.04B

$1.01B

$0.99B

$0.96B

$0.92B

Adjusted EBITDA*

$154.7M

$116.4M

$101.5M

$127.7M

$114.5M

Stock repurchase

$0

$20M

$5M

$0

$0

Senior secured leverage ratio

1.99x

1.95x

1.97x

1.92x

2.0x

Covenant

2.5x

2.5x

2.5x

2.5x

2.5x

Fixed charge coverage ratio

2.0x

1.8x

1.7x

1.7x

1.8x

Covenant

1.25x

1.25x

1.25x

1.25x

1.5x

©

2011 Brocade Communications Systems, Inc.

Page 29 of 41 |

| Cash from operations was over $118M in Q1, our highest level since Q4 09 and better than our

previous guidance. Total capital expenditures in the quarter were $23M. Free cash flow was

nearly $95M in the quarter, again the highest since Q4 09. Capital spending on the Company campus

fell to approximately $2M in the quarter, reflecting the completion of the project with only

minor final payments remaining through Q3 11. Cash and equivalents grew to $416M, up $80M from $336M in Q4. In Q1, we reduced our debt principal by

$39.7M including $30.0M in excess of the mandatory payment.

As we stated during our Analyst Day, we continue to focus on increasing operating cash flow and our

priorities for cash will be focused on paying down our term debt first, continuing to build our

cash reserves, and repurchasing stock on an opportunistic basis and subject to debt

covenants. |

Net Debt:

Defined as Total Debt Less Total Cash

Net-debt decreased by $570M from Q1 09 to Q1 11

More than

50% reduction

in 2 years

©

2011 Brocade Communications Systems, Inc.

Page 30 of 41 |

| Net Debt has declined from $1,073M at the end of Q1 09 to $503M at the end of Q1 11. This

represents a $570M or 53% reduction over the last two years, demonstrating Brocade’s

ability to generate cash and reduce our long-term debt. Our term debt loan balance is now

down to $311M. Adjusted EBITDA in the quarter was $114.5M, which was down from the Q4 level of

$127.7M. The Senior Secured Leverage Ratio of 2.00x and the Fixed Charge Coverage Ratio of

1.80x are both within the covenant requirements of our term credit agreement.

|

| Q2 2011 Planning Assumptions

IT market conditions

•

Macro economic conditions improving

•

Strength building in international IT spending

•

Federal spending improving

•

SAN revenue slightly better than typical seasonality

•

Expect to grow at least with market in Ethernet

ASP trends

•

Low single-digit declines in SAN pricing

•

Low to mid single-digit declines in Ethernet pricing

Taxes

•

Outlook tax rate does not include discrete items

•

Outlook tax rate includes R&D tax credit

OEM inventories

•

Expect to come down slightly exiting Q2

©

2011 Brocade Communications Systems, Inc.

Page 31

of 41 |

| Now, as we look forward to Q2 11, here are some things to consider in

developing your financial models: •

We continue to look at GDP and IT spending forecasts for next quarter and this

year. Our current GDP growth assumptions have not changed since Analyst

Day 2010 but we are seeing more positive signs as we enter our Q2.

•

We continue to monitor the strength of international markets, specifically

Europe and Japan, and expect to see continued growth as these economies

strengthen. •

We are mindful of the

ongoing

Federal budget discussions but believe that we will see an improvement in the

Federal spending in Q2.

•

Q2 SAN demand is historically down 6% to 8% and we expect Q2 11 revenue to be

slightly better than historical performance.

•

We continue to expect improvements

and growth in our Ethernet business as our new sales headcount becomes more

productive.

•

We anticipate that our new VDX and VCS products will continue to

ramp but will have minimal impact to revenue/gross

margin in Q2.

•

We expect quarterly ASP declines in our SAN business to remain in the

low-single digits. ASP declines in our Ethernet business are

expected to be in the low to mid-single digits. •

From a tax rate perspective, we do not forecast discrete events due to the

inherent uncertainty of their timing, but have reflected the benefit of

the passage of the R&D tax credit in our full year tax rate.

•

Regarding OEM inventory, we would expect OEM inventory levels to

be flat to a slight decline in absolute dollar terms

exiting Q2, given that we are in our seasonally

softer quarters. |

Q2 2011 Financial Outlook

As of February 17, 2011

* Note: Non-GAAP estimates assume exclusion of the same category of items

excluded from Q4 10 non-GAAP results Q2 11

Revenue range (up 9–11% Yr./Yr.)

$545M–555M

Non-GAAP gross margin*

61.5%–62.0%

Non-GAAP operating expenses*

45.5%–46.0%

Non-GAAP operating margin*

15.5%–16.0%

Other income/other expense

($21M)

Non-GAAP tax rate*

24%–25%

Fully diluted shares outstanding

497M–502M

Non-GAAP EPS*

$0.10

Operating cash flow

$90M–$100M

Capital expenditures

$30M–$33M

Free cash flow

$60M–$67M

©

2011 Brocade Communications Systems, Inc.

Page 32 of 41 |

| Given these planning assumptions, in Q2 11 we expect:

•Overall

revenue to be $545M to $555M, flat to up 2% Qtr./Qtr. and up 9% to 11% Yr./Yr.

•Non

-GAAP Gross Margins to be 61.5% to 62.0% •Non-GAAP Operating Expenses to be 45.5% to 46.0%

•Non

-GAAP Operating Margins to be 15.5% to 16.0%

•Other

Income/Expense net to be approximately ($21M)

•Non

-GAAP tax rate to be approximately 24% to 25% •Diluted shares outstanding to be in a range of 497M to 502M shares

•Non

-GAAP EPS to be 10 cents •Operating Cash Flow of $90M to $100M •Capital Expenditures of $30M to $33M •Free Cash Flow of $60M to $67M |

Financial Summary

Richard Deranleau, CFO

©

2011 Brocade Communications Systems, Inc.

Page 33 of 41 |

| To summarize from a financial perspective, we are pleased with a very

good start to our FY 11. We continue to be focused on delivering

shareholder value by focusing on our FY11 Playbook for this year. We are

looking forward to answering your questions in the Q&A session of our conference call.

|

Jason Nolet

VP Data Center

and Enterprise

Networking

Live Q&A Call

February 17, 2011, 2:30PM Pacific Time

Richard

Deranleau

CFO

John McHugh

CMO

Ian Whiting

SVP WW Sales

Mike Klayko

CEO

Dave Stevens

CTO

©

2011 Brocade Communications Systems, Inc.

Page 34

of

41 |

| Prepared comments provided by Rob Eggers, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on

February 17 Brocade will host a webcast conference call at www.brcd.com primarily devoted to answering questions submitted via email to ir@brocade.com and taken

live from participants via telephone.

Thank you for your interest in Brocade. |

Appendix and Reconciliations

©

2011 Brocade Communications Systems, Inc.

Page 35 of 41 |

Quarterly Net Income

GAAP/Non-GAAP Reconciliation

(In Thousands)

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Net income on a GAAP basis

51,095

22,380

21,961

23,416

27,179

Adjustments:

Legal fees associated with indemnification obligations

and other related expenses, net

301

277

(74)

(666)

124

Stock-based compensation expense

21,523

30,146

24,682

25,275

19,906

Amortization of intangible assets

34,902

30,657

30,657

30,657

30,656

Acquisition and integration costs

204

–

–

–

–

Loss on sale of property

8,783

(47)

–

–

–

Restructuring costs and facilities lease loss

–

–

–

1,059

–

Legal fees associated with certain pre-acquisition litigation

299

17

13

243

77

Provision for certain pre-acquisition litigation

–

–

1,604

–

–

Interest due to adoption of new standard

2,142

348

–

–

–

Income tax effect of adjustments

(25,239)

(21,044)

(15,217)

(13,975)

(17,208)

Non-GAAP net income

94,010

62,734

63,626

66,009

60,734

©

2011 Brocade Communications Systems, Inc.

Page 36

of

41 |

Adjusted EBITDA and Sr. Secured Leverage Ratio

As defined in the term credit agreement

Consolidated Senior Secured Leverage Ratio

Q1 FY 10

Q2 FY 10

Q3 FY 10

Q4 FY 10

Q1 FY 11

$ Thousand

Actual

Actual

Actual

Actual

Actual

Consolidated Net Income

$51,095

$22,380

$21,961

$23,416

$27,179

plus

(i) Consolidated Interest Charges

$22,073

$19,522

$22,061

$22,202

$21,546

(ii) Provision for Federal, state, local and foreign income taxes payable

$1,277

$0

$0

$5,988

$0

(iii) Depreciation and amortization expense

$51,012

$46,600

$50,493

$51,532

$52,522

(iv) Fees, costs and expenses incurred on or prior to the Acquisition Closing

Date in connection with the Acquisition and the financing thereof

$0

$0

$0

$0

$0

(v) Any cash restructuring charges and integration costs in connection with the

Acquisition, in an aggregate amount not to exceed $75,000,000

$204

$0

$0

$0

$0

(vi) Non-cash restructuring charges incurred in connection with the

Transaction, all as approved by Arrangers

$1,502

$1,084

$1,006

$930

$848

(vii) Other non-recurring expenses reducing such Consolidated Net Income

which do not represent a cash item in such period or any future period

(in each case of or by the Borrower and its Subsidiaries for such

Measurement Period) $8,783

($47)

$0

$574

$175

(viii) Any non-cash charges for stock compensation expense in compliance

with FAS 123R and amortization of the fair value of unvested options

under the Acquired Business’

employee stock option plan assumed by the Borrower

$21,523

$30,146

$24,682

$25,275

$19,906

(ix)

Legal fees and expenses relating to the Borrower’s indemnification

obligations for the benefit of its former officers and directors in

connection with its historical stock option litigation

$250

724

376

$22

$15

minus

(i)

Federal, state, local and foreign income tax credits

$0

($840)

($15,096)

$0

$5,717

(ii)

All non-cash items increasing Consolidated Net Income (in each case of or

by the Borrower and its Subsidiaries for such Measurement Period)

($3,036)

($3,127)

($4,026)

($2,212)

$1,995

Consolidated EBITDA

$154,683

$116,442

$101,457

$127,727

$114,479

4 Quarter Trailing Consolidated EBITDA

$523,861

$520,429

$502,567

$500,309

$460,105

Consolidated Senior Secured Debt

$1,041,483

$1,015,957

$989,803

$959,491

$919,312

Consolidated Senior Secured Leverage Ratio (x)

1.99

1.95

1.97

1.92

2.00

©

2011 Brocade Communications Systems, Inc.

Page 37 of 41 |

Q1 2011 Cash and Debt Covenant

Adjusted EBITDA* Performance

(In Millions)

Strong Capital Structure

(In Millions)

Within Debt Covenant

Cash Balance**

(In Millions)

* Note: Adjusted EBITDA is as defined in the term debt credit

agreement ** Cash, equivalents and short term investments

©

2011 Brocade Communications Systems, Inc.

Page 38

of 41 |

Domestic and International

Reported Revenue

Reported revenue on a ship-to basis

©

2011 Brocade Communications Systems, Inc.

Page 39 of 41 |

Segment Revenue Detail

Product segment as a percent of revenue

* Reallocation of SAN common hardware altered historic SAN percentages

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

SAN Business

*

Directors

47%

40%

37%

39%

44%

Switches

41%

46%

49%

46%

41%

Server

12%

14%

14%

15%

15%

Ethernet Business

Chassis

61%

64%

65%

63%

58%

Stackables

39%

36%

35%

37%

42%

©

2011 Brocade Communications Systems, Inc.

Page 40

of 41 |

Thank You

www.brcd.com

©

2011 Brocade Communications Systems, Inc.

Page 41 of 41 |