Attached files

| file | filename |

|---|---|

| 8-K - ROSE UPDATED PRESENTATION - NBL Texas, LLC | roseupdatedpres.htm |

1

Rosetta Resources Inc.

Credit Suisse Energy Summit

February 9, 2011

Exhibit 99.1

2

All statements, other than statements of historical fact, included in this presentation are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements

that are not historical facts, such as expectations regarding drilling plans, changes in acreage positions, and expected

capital expenditures. The assumptions of management and the future performance of the Company are subject to a

wide range of business risks and uncertainties and there is no assurance that these statements and projections will be

met. Factors that could affect the Company's business include, but are not limited to: the risks associated with drilling of

oil and natural gas wells; the Company's ability to find, acquire, market, develop, and produce new reserves; the risk of

drilling dry holes; oil and natural gas price volatility; uncertainties in the estimation of proved, probable, and possible

reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's

assumptions regarding items of income and expense and the level of capital expenditures; uncertainties in the timing of

exploitation expenditures; operating hazards attendant to the oil and natural gas business; drilling and completion

losses that are generally not recoverable from third parties or insurance; potential mechanical failure or

underperformance of significant wells; pipeline capacity availability and pipeline construction difficulties; climatic

conditions; availability and cost of material and equipment; the risks associated with operating in a limited number of

geographic areas; availability of capital; timing of planned divestitures; regulatory developments; environmental risks;

general economic and business conditions (including the effects of the worldwide economic recession); the amount and

expected benefit of hedging arrangements; industry trends; and other factors detailed in the Company's most recent

Form 10-K and other filings with the Securities and Exchange Commission. If one or more of these risks or uncertainties

materialize (or the consequences of such a development change), or should underlying assumptions prove incorrect,

actual outcomes may vary materially from those forecasted or expected. The Company undertakes no obligation to

publicly update or revise any forward-looking statements except as required by law.

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements

that are not historical facts, such as expectations regarding drilling plans, changes in acreage positions, and expected

capital expenditures. The assumptions of management and the future performance of the Company are subject to a

wide range of business risks and uncertainties and there is no assurance that these statements and projections will be

met. Factors that could affect the Company's business include, but are not limited to: the risks associated with drilling of

oil and natural gas wells; the Company's ability to find, acquire, market, develop, and produce new reserves; the risk of

drilling dry holes; oil and natural gas price volatility; uncertainties in the estimation of proved, probable, and possible

reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's

assumptions regarding items of income and expense and the level of capital expenditures; uncertainties in the timing of

exploitation expenditures; operating hazards attendant to the oil and natural gas business; drilling and completion

losses that are generally not recoverable from third parties or insurance; potential mechanical failure or

underperformance of significant wells; pipeline capacity availability and pipeline construction difficulties; climatic

conditions; availability and cost of material and equipment; the risks associated with operating in a limited number of

geographic areas; availability of capital; timing of planned divestitures; regulatory developments; environmental risks;

general economic and business conditions (including the effects of the worldwide economic recession); the amount and

expected benefit of hedging arrangements; industry trends; and other factors detailed in the Company's most recent

Form 10-K and other filings with the Securities and Exchange Commission. If one or more of these risks or uncertainties

materialize (or the consequences of such a development change), or should underlying assumptions prove incorrect,

actual outcomes may vary materially from those forecasted or expected. The Company undertakes no obligation to

publicly update or revise any forward-looking statements except as required by law.

Forward-Looking Statements

3

Cautionary Statement Concerning Resources

The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to

disclose only proved, probable and possible reserves that a company anticipates as of a given date to be economically and

legally producible by application of development projects to known accumulations. We may use certain terms in this

presentation, such as “Risked Project Inventory,” “Project Counts,” “Net Risked Resources,” “Total Resources,” “Unrisked

Potential,” “Unrisked Original Resources in Place,” and “Unrisked EUR Potential” that the SEC's guidelines strictly prohibit

us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved

reserves and accordingly are subject to substantially greater risk of actually being realized.

disclose only proved, probable and possible reserves that a company anticipates as of a given date to be economically and

legally producible by application of development projects to known accumulations. We may use certain terms in this

presentation, such as “Risked Project Inventory,” “Project Counts,” “Net Risked Resources,” “Total Resources,” “Unrisked

Potential,” “Unrisked Original Resources in Place,” and “Unrisked EUR Potential” that the SEC's guidelines strictly prohibit

us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved

reserves and accordingly are subject to substantially greater risk of actually being realized.

For filings reporting year-end 2009 reserves, the SEC permits the optional disclosure of probable and possible

reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use the

term “net risked resources” to describe the Company’s internal estimates of volumes of natural gas and oil that are not

classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery

techniques. Estimates of unproved resources are by their nature more speculative than estimates of proved reserves and

accordingly are subject to substantially greater risk of actually being realized by the Company. Estimates of unproved

resources may change significantly as development provides additional data, and actual quantities that are ultimately

recovered may differ substantially from prior estimates.

reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use the

term “net risked resources” to describe the Company’s internal estimates of volumes of natural gas and oil that are not

classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery

techniques. Estimates of unproved resources are by their nature more speculative than estimates of proved reserves and

accordingly are subject to substantially greater risk of actually being realized by the Company. Estimates of unproved

resources may change significantly as development provides additional data, and actual quantities that are ultimately

recovered may differ substantially from prior estimates.

We use the term “BFIT NPV10” to describe the Company’s estimate of before income tax net present value discounted at

10 percent resulting from project economic evaluation. The net present value of a project is calculated by summing future

cash flows generated by a project, both inflows and outflows, and discounting those cash flows to arrive at a present

value. Inflows primarily include revenues generated from estimated production and commodity prices at the time of the

analysis. Outflows include drilling and completion capital and operating expenses. Net present value is used to analyze

the profitability of a project. Estimates of net present value may change significantly as additional data becomes

available, and with adjustments in prior estimates of actual quantities of production and recoverable reserves, commodity

prices, capital expenditures, and/or operating expenses.

10 percent resulting from project economic evaluation. The net present value of a project is calculated by summing future

cash flows generated by a project, both inflows and outflows, and discounting those cash flows to arrive at a present

value. Inflows primarily include revenues generated from estimated production and commodity prices at the time of the

analysis. Outflows include drilling and completion capital and operating expenses. Net present value is used to analyze

the profitability of a project. Estimates of net present value may change significantly as additional data becomes

available, and with adjustments in prior estimates of actual quantities of production and recoverable reserves, commodity

prices, capital expenditures, and/or operating expenses.

Forward-Looking Statements (Cont.)

4

Rosetta Resources - 2010 Highlights

• Capital spending focused on Eagle Ford

• High return/high value programs received vast majority of funding

• Capital exceeded internal cash flows, but balanced with asset sales

and beginning cash

and beginning cash

• 2010 asset sales are approximately $90MM

• Production growth

• Annual production rate of 135-140 MMcfe/d

• Exit rate of 159 MMcfe/d

• Eagle Ford exit rate of 86 MMcfe/d

• Reserve growth

• Double digit reserve growth rate

5

• $360 MM Capital Budget in 2011

• Focus on Eagle Ford

• 90% of 2011 capital allocated to Eagle Ford

• 40 wells planned

• Fracture stimulation services agreement in place

• Gates Ranch EUR revised upward

• Light Ranch discovery announced

• Pipeline and processing capacity expanded

• Inventory in excess of 1 TCFE

• Shift to liquids accelerates

• Southern Alberta Basin evaluation continues

• Six wells drilled

• Additional five wells to be drilled by early 2011

• Completions planned for 2011

• Additional asset sales scheduled

• DJ Basin

• Sacramento Basin

• Strong alignment with stakeholders remains fundamental driver

Taking it Up a Notch

6

Rosetta Asset Portfolio Status

7

• EOY 2007

• Rosetta has 5,000 net acres under lease with Eagle Ford potential

• EOY 2008

• Rosetta has 25,000 net acres under lease with Eagle Ford potential

• Rosetta completes vertical pilot drilling program to understand resource potential

• EOY 2009

• Rosetta has 61,000 net acres under lease with Eagle Ford potential

• Rosetta drills its successful horizontal discovery well in Springer Ranch (14,000 net acres)

• Rosetta drills its successful horizontal discovery well in Gates Ranch Area (29,500 net acres)

• EOY 2010

• Rosetta has 65,000 net acres under lease with Eagle Ford potential

• Rosetta completes full delineation of Gates Ranch

• Gates Ranch EUR revised to 7.2 Bcfe

• Rosetta has drilled its 22nd horizontal well at Gates Ranch with 100% success rate

• Dos Hermanas Pipeline in service

• 2010 exit rate of 86 MMcfe/d

Eagle Ford

8

Rosetta’s drilling focus has been primarily on the Gates Ranch Area, however, we

have embarked on the delineation of our other liquids-rich areas…

have embarked on the delineation of our other liquids-rich areas…

|

Area

|

Hydrocarbon Window

|

Net Acres

|

|

Gates Ranch Area

|

Condensate

|

29,960

|

|

Central Dimmit

|

Oil

|

7,450

|

|

Encinal Area

|

Dry Gas

|

14,500

|

|

Gonzales Area

|

Oil

|

6,500

|

|

NE LaSalle Area

|

Oil

|

3,450

|

|

Western Webb

|

Condensate

|

3,000

|

|

Total

|

77% Liquids

|

64,860

|

9

Eagle Ford - Gates Ranch

10

Gates Ranch Area

11

4-19

9-5

1-2

3-19

13-1287

B #2-24

BVP #1

BVP #2

7-15

6-12

6-6A

B #2-23

P

P

P

P

B #1-23

B #1-26

571#1

P

P

P

P

P

Gates Ranch Delineation

Initial horizontal wells were strategically located to delineate the asset

7-7A

Delineation Wells

• Gates 05D 9-5

• Gates 05D 3-19

• Gates 05D 4-19

• Gates 05D 13-1287

• Gates 05D 7-7A

• Gates 05D 6-6A

• Gates 09 Rose B 1-23

• Gates 05D 1-2

• Gates 09 Rose B 2-24

• Gates 05D 6-12

• Gates 09 Rose A BVP-2

• Gates 05D 7-15

• Gates 09 Rose A BVP-1

• Gates 09 Rose B 1-26

• Gates 10 Rose A 571-1

12

Delineation Wells

• Gates 05D 9-5

• Gates 05D 3-19

• Gates 05D 4-19

• Gates 05D 13-1287

• Gates 05D 7-7A

• Gates 05D 6-6A

• Gates 09 Rose B 1-23

• Gates 05D 1-2

• Gates 09 Rose B 2-24

• Gates 05D 6-12

• Gates 09 Rose A BVP-2

• Gates 05D 7-15

• Gates 09 Rose A BVP-1

• Gates 09 Rose B 1-26

• Gates 10 Rose A 571-1

Development Wells (Drilled by YE 2010)

• Gates 05D 6-8

• Gates 05D 2-20

• Gates 09 Rose B 1-1

• Gates 09 Rose B 2-23

• Gates 09 Rose A BVP-3

• Gates 05D 1-8A

• Gates 10 Rose A 1000-1

• Gates 05D 2-8A

• Gates 05D 8-15

• Gates 09 Rose B 2-1

• Gates 09 Rose B 2-26

Including our initial Gates Ranch discovery well, we have drilled 26 horizontal wells in the

field to date…averaging roughly 5,000 feet of horizontal length per well…

field to date…averaging roughly 5,000 feet of horizontal length per well…

4-19

9-5

1-2

3-19

13-1287

B #2-24

BVP #1

BVP #2

7-15

6-12

B #1-1

6-6A

B #2-23

2-20

B #1-23

B #1-26

571#1

7-7A

BVP #3

6-8

1000 #1

1-8A

2-8A

8-15

2-1

2-26

13

Gates Ranch New Type Curve

Based on actual well performance, the average EUR has been revised from 4.0 BCFE to 7.2 BCF

Previous 4.0 BCFE EUR

Current 7.2 BCFE EUR

Actual Well Performances (13 wells)

14

|

Area

|

Initial

Gas Rate

(mmcfpd)

|

Initial

Oil Rate

(bopd)

|

EUR

(bcfe)

|

NPV Per

Well BFIT10

($MM)

|

Discounted

Payout

(years)

|

Post 2010

Inventory

(Net Wells)

|

NPV Per Area

BFIT10

($)

|

|

Gates North Type Curve

|

5.0

|

450

|

6.7

|

13.0

|

1.6

|

150

|

$1.950 billion

|

|

Gates South Type Curve

|

7.0

|

350

|

8.1

|

14.1

|

1.4

|

90

|

$1.269 billion

|

|

Gates Ranch Type Curve

|

5.7

|

412

|

7.2

|

13.4

|

1.5

|

240

|

$3.219 billion

|

Notes:

• Gates Ranch proper only (26,500 net acres)

• 100 acre well spacing

• $8.25 mm total well cost

• Strip pricing effective 10/26/2010

• “Per area” values are “per well” values multiplied by post 2010 net inventory

Gates Ranch Valuation

On average, a typical well has a 7.2 BCFE EUR and a BFIT NPV of $13.4 MM…

15

Although the Gates Ranch Area offers us more than 18 rig years...we are defining

Inventory beyond Gates Ranch Area…

Inventory beyond Gates Ranch Area…

Central Dimmit Area

16

Central Dimmit Discovery Well

Initial Test

Light Ranch #1H Discovery

Vivion

Light

Ranch

Ranch

Lasseter &

Eppright

Eppright

Central Dimmit Exploration & Development Plan

17

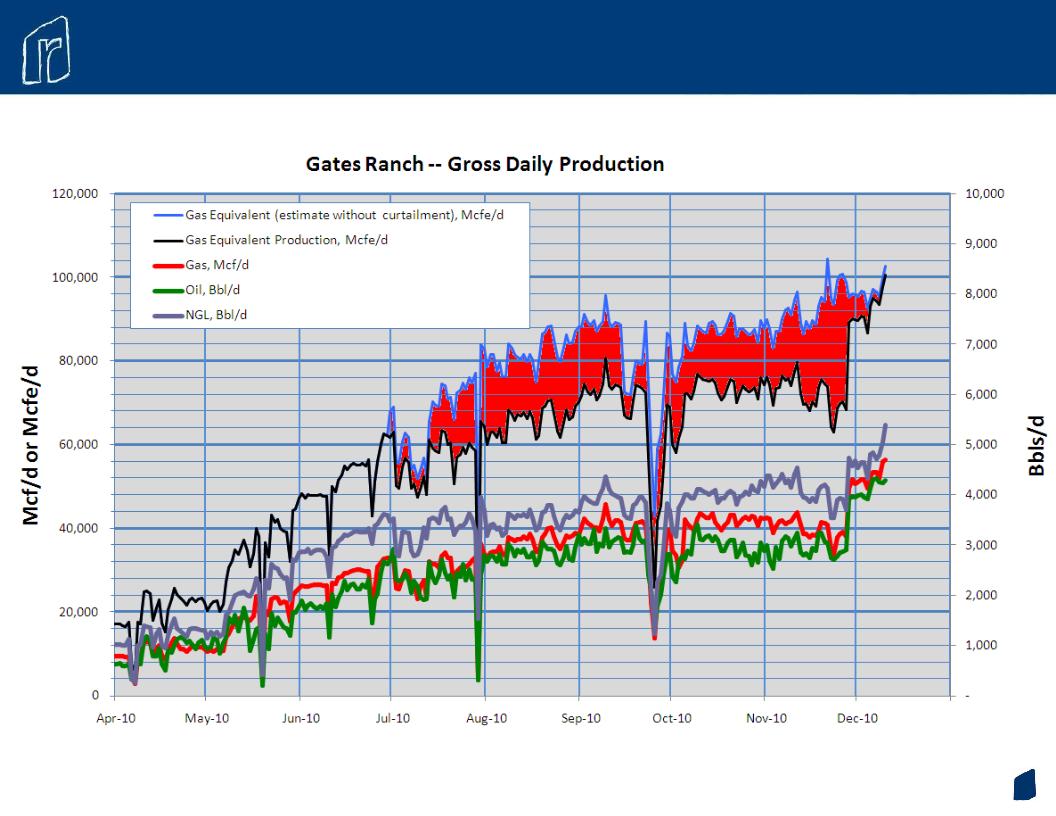

With less than 5% of our Gates Ranch Area inventory drilled and producing, we have built a

legacy asset from scratch that is currently producing more than 80 MMcfe/d…

legacy asset from scratch that is currently producing more than 80 MMcfe/d…

18

Eagle Ford Pipeline Projects

DOS HERMANAS

To HPL

Legend

Dos Hermanas

---- Dimmit Lateral

19

• Dos Hermanas in service December 2010

• Firm gathering and processing reaches 85 MMcfe/d

• Revised agreement in place:

• Dimmit lateral in service 2nd quarter 2011

• Dos Hermanas capacity to increase by 20 MMcfe/d in 3rd

quarter 2011

quarter 2011

• Rosetta to access new gathering and processing

capacity in 4th quarter 2011

capacity in 4th quarter 2011

Eagle Ford Gathering

20

• Southern Alberta Basin specifics

• Devonian Shale oil play in NW Montana

• Williston Basin analog

• Depths ranging from 4,500’ to 7,500’ TVD

• Over-pressured reservoirs

• Rosetta’s current Southern Alberta Basin

position

position

• 300,000 undeveloped net acres

• 13 - 15 MMBoe per square mile of resource in place

• Rosetta’s assessment to date

• Drilled 6 exploratory delineation wells

• 2 wells on strike 28 miles apart (Riverbend 12-13 and

Gunsight 31-16)

Gunsight 31-16)

• 1 well 8 miles downdip (Riverbend W 7-4)

• Drilled a north east extension and encountered thickening

Banff and Bakken intervals (Big Rock 29-13)

Banff and Bakken intervals (Big Rock 29-13)

• Drilled 2 middle of area wells which established continuity

(Little Rock Coulee 27-16 and Fee Gauge 19-1)

(Little Rock Coulee 27-16 and Fee Gauge 19-1)

• Confirmed significant oil hydrocarbons in place and

over-pressured reservoirs

over-pressured reservoirs

• Conducted vertical tests in several zones

• Multi-well vertical program underway

Southern Alberta Basin Opportunity is Unique

1st of 8 WELL

PROGRAM

PROGRAM

REMAINING ROSE

PLANNED WELLS

RB 12-13

RBW 7-4

GS 31-16

LRC 27-16

FG 19-1

BR 29-13

FB 25-5

FT 7-14

BL 5-16

GSS 12-15

GF 22-12

ROSE

ORIGINAL WELLS

21

|

Acres

|

Lessor

|

Terms

|

|

200,000

|

Blackfeet Indian Nation

|

• 5 year option with 2 well per year drilling requirement for 10 well total.

• With each commercial well, Rosetta earns the right to lease 20,000 acres

surrounding that well for a 10 year term. • Continuous drilling obligation of 1 well per 9 months beginning on the 4th

year. |

|

30,000

|

WAVE Energy

|

• Terms similar to option acreage.

|

|

52,000

|

Allottee (Blackfeet Families)

|

• Typically 5 year lease terms, with option to extend term at the end of the

primary period. |

|

18,000

|

Fee Acreage

|

|

Southern Alberta Basin

Acreage Recap

Acreage Recap

22

Financial Strategy

• Bias for conservative and disciplined approach to financial

management

management

• Actively manage and monitor use of debt

• Debt to book cap < 40%

• Debt to EBITDAX < 1.75x

• Attempt to maintain high level of liquidity throughout cycles

• Asset sales to “balance” 2011 capital program

1 Adjusted for the high yield offering

23

Risk Management

• Selective hedging program:

• Gas hedges of 50,000 MMBtu/d in 2011 and 20,000 MMBtu/d in 2012

• Oil hedges of 2,700 Bbl/d in 2011 and 3,100 Bbl/d in 2012

• NGL Hedges of 1,300 Bbl/d in 2011/1,450 Bbl/d in 2012

• Fracture stimulation services/agreement in place

• 2 year term

• 3 weeks per month

• Favorable pricing

• Transportation and processing

• 35 MMcfe/d base agreement

• 50 MMcfe/d on Dos Hermanas

• Dimmit County lateral in place 2nd quarter 2011

• 20 MMcfe/d added in 3rd quarter of 2011

• Additional capacity available in 4th quarter of 2011

24

• Focus on high return Eagle Ford inventory

• Production guidance dependent on divestiture timing

• 160-170 MMcfe/d including divestment properties

• DJ Basin/California expected to produce approximately 35 MMcfe/d for full year

• 2011 exit rate, excluding divestment properties, to range from 155-165 MMcfe/d

• Divest additional legacy assets to fund development

• Simplify and reduce unit cost structure

• Focus on returns

• Test Southern Alberta Basin position

2011 Program

25

26

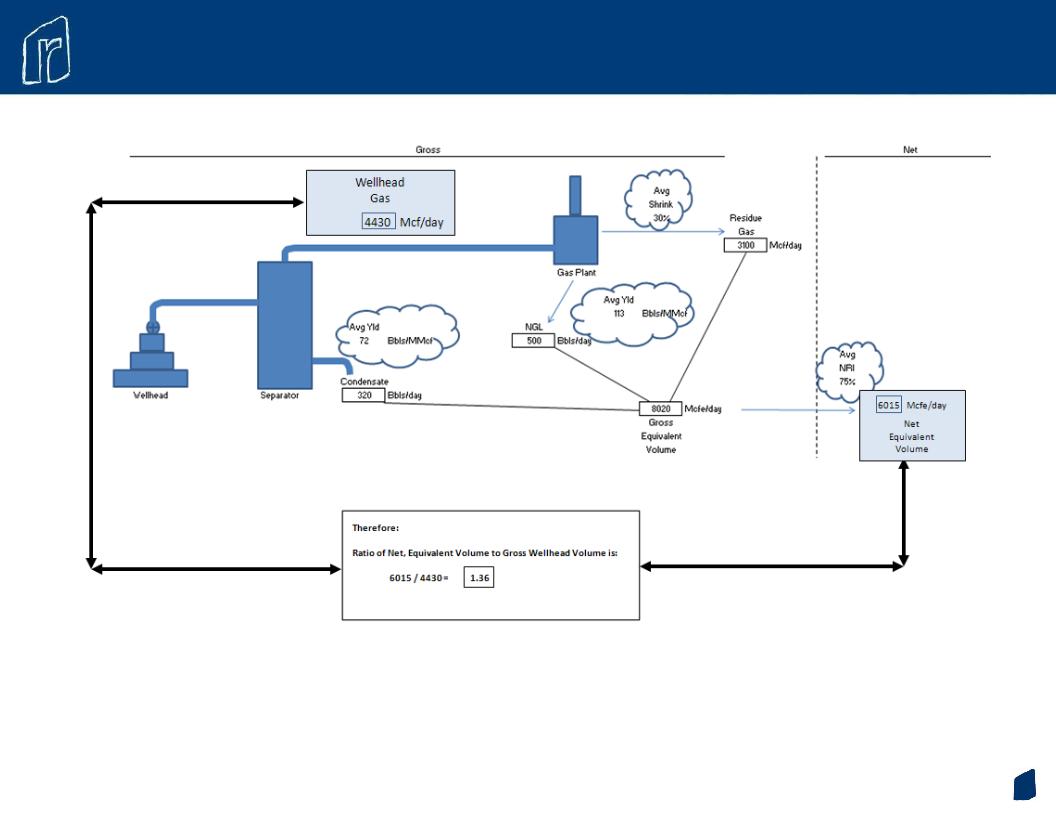

Appendix 1 of 5: 3-Stream Process Flow - Gates Ranch

Note: This example describes the 3-streams of production from the average 2010 Gates Ranch horizontal

wells (based on completions as of July, 2010) and also provides a “rule of thumb” factor to convert “net

Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d.) This is important

for understanding Rosetta’s takeway capacity situation. As described, gross wellhead gas, and therefore

takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

wells (based on completions as of July, 2010) and also provides a “rule of thumb” factor to convert “net

Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d.) This is important

for understanding Rosetta’s takeway capacity situation. As described, gross wellhead gas, and therefore

takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

27

Appendix 2 of 5: Converting Wellhead to Sales

|

|

Well Head

Production |

Effect of

Processing

|

Mcfe

Equivalent

|

|

Gas

|

4,430 Wet Mcf/d

|

3,100 Lean Mcf/d

|

3,100 Mcfe/d

|

|

NGL

|

--

|

500 Bbl/d

|

3,000 Mcfe/d

|

|

Condensate

|

320 Bbl/d

|

320 Bbl/d

|

1,920 Mcfe/d

|

|

Gross Production

|

8,020 Mcfe/d

|

||

|

Net Production

|

6,015 Mcfe/d

|

|

|

6,015 Net

|

|

|

|

Uplift

|

|

=

|

1.36

|

|

|

4,430 Gross

|

|

|

Note: This example describes the 3-streams of production from the average 2010 Gates Ranch horizontal

wells (based on completions as of July 2010) and also provides a “rule of thumb” factor to convert “net

Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d). This is

important for understanding Rosetta’s takeaway capacity situation. As described, gross wellhead gas,

and therefore takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

wells (based on completions as of July 2010) and also provides a “rule of thumb” factor to convert “net

Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d). This is

important for understanding Rosetta’s takeaway capacity situation. As described, gross wellhead gas,

and therefore takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

28

Appendix 3 of 5: Converting to Net 3-Stream Volumes

|

|

Well Head

Production |

Effect of

Processing

|

Mcfe

Equivalent

|

|

Gas

|

85,000 Wet Mcf/d

|

59,481 Lean

|

59,481 Mcfe/d

|

|

NGL

|

--

|

9,594 Bbl/d

|

57,564 Mcfe/d

|

|

Condensate

|

2,889 Bbl/d

|

6,139 Bbl/d

|

36,834 Mcfe/d

|

|

Gross Production

|

153,879 Mcfe/d

|

||

|

Net Production

|

115,409 Mcfe/d

|

|

|

115,409 Net

|

|

|

|

Uplift

|

|

=

|

1.36

|

|

|

85,000 Gross

|

|

|

Note: This example describes the 3-streams of production from the average 2010 Gates Ranch horizontal

wells (based on completions as of July 2010) and also provides a “rule of thumb” factor to convert “net

Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d). This is

important for understanding Rosetta’s takeaway capacity situation. As described, gross wellhead gas,

and therefore takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

wells (based on completions as of July 2010) and also provides a “rule of thumb” factor to convert “net

Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d). This is

important for understanding Rosetta’s takeaway capacity situation. As described, gross wellhead gas,

and therefore takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

29

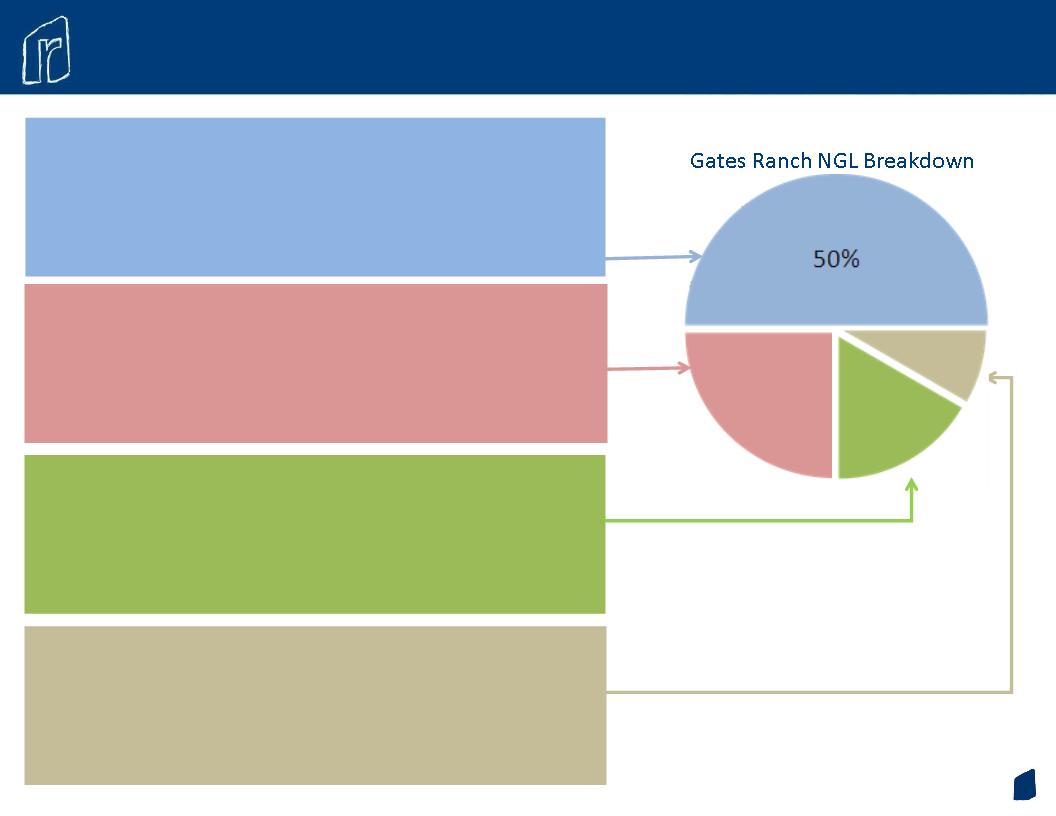

Natural Gasoline Use: Petrochemical and Refining

Price: 92% WTI

Note: Comprised of all remaining

components

components

Price Risk: Low

Butane Use: Primarily heating and industrial

Price: 86% of WTI Crude

Note: Butane market more robust

Price Risk: Low

Propane Use: 50% Residential and Commercial

Heating, 50% Petrochemical

Heating, 50% Petrochemical

Price: 50% of WTI Crude

Note: Propane demand is seasonal and is

subject to weather

subject to weather

Price Risk: Medium

Appendix 4 of 5: Gates Ranch NGL Breakdown

Ethane Use: Petrochemical feedstock (plastics)

Price: 25% WTI Crude

Note: May be rejected and combined with

gas sale when priced below residual

gas price

gas sale when priced below residual

gas price

Price Risk: High

C2

C5+

C4

C3

17%

25%

8%

30

Appendix 5 of 5: NGL Hedge Detail

|

Barrel Component

|

% of Bbl

|

% WTI

|

Hedged

Volume |

$/GAL

|

$/Bbl

|

|

Ethane

|

50%

|

25%

|

-

|

-

|

-

|

|

Propane

|

25%

|

50%

|

350

|

1.00

|

41.92

|

|

Butane (I&N)

|

17%

|

86%

|

210

|

1.33

|

55.50

|

|

Natural Gasoline

|

8%

|

92%

|

140

|

1.68

|

70.61

|

|

Avg. Price per Bbl

|

|

47%

|

700

|

1.23

|

51.74

|