Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS RELEASE FOR 4Q AND YE 2010 - TEMPLE INLAND INC | tin8kex99120110208.htm |

| 8-K - 8-K FURNISHING EARNINGS RELEASE FOR 4Q AND YE 2010 - TEMPLE INLAND INC | tin8k20110208.htm |

1

Our job is to be the best

Fourth Quarter and Full

Year 2010 Earnings

Year 2010 Earnings

2

This presentation contains “forward-looking statements” within the meaning of the federal

securities laws. These statements reflect management’s current views with respect to future events

and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could

cause our actual results to differ significantly from the results discussed in the forward-looking

statements. Factors and uncertainties that might cause such differences include, but are not

limited to: general economic, market, or business conditions; the opportunities (or lack thereof)

that may be presented to us and that we may pursue; fluctuations in costs and expenses including

the costs of raw materials, purchased energy, and freight; changes in interest rates; demand for

new housing; accuracy of accounting assumptions related to impaired assets, pension and

postretirement costs, contingency reserves and income taxes; competitive actions by other

companies; changes in laws or regulations; our ability to execute certain strategic and business

improvement initiatives; the accuracy of certain judgments and estimates concerning the

integration of acquired operations and other factors, many of which are beyond our control. Except

as required by law, we expressly disclaim any obligation to publicly revise any forward-looking

statements contained in this presentation to reflect the occurrence of events after the date of this

presentation.

securities laws. These statements reflect management’s current views with respect to future events

and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could

cause our actual results to differ significantly from the results discussed in the forward-looking

statements. Factors and uncertainties that might cause such differences include, but are not

limited to: general economic, market, or business conditions; the opportunities (or lack thereof)

that may be presented to us and that we may pursue; fluctuations in costs and expenses including

the costs of raw materials, purchased energy, and freight; changes in interest rates; demand for

new housing; accuracy of accounting assumptions related to impaired assets, pension and

postretirement costs, contingency reserves and income taxes; competitive actions by other

companies; changes in laws or regulations; our ability to execute certain strategic and business

improvement initiatives; the accuracy of certain judgments and estimates concerning the

integration of acquired operations and other factors, many of which are beyond our control. Except

as required by law, we expressly disclaim any obligation to publicly revise any forward-looking

statements contained in this presentation to reflect the occurrence of events after the date of this

presentation.

This presentation includes non-GAAP financial measures. The required reconciliations to GAAP

financial measures are included on our website, www.templeinland.com.

financial measures are included on our website, www.templeinland.com.

3

2010 Consolidated Results

Net income per diluted share

Special items

Net income per diluted share excluding

special items

• 8.2% ROI in 2010 up from 7.0% in 2009

|

2010 |

2009 |

|

$ 1.52

|

$ 1.89

|

|

(0.62)

|

(1.19)

|

|

$ 0.90

|

$ 0.70

|

4

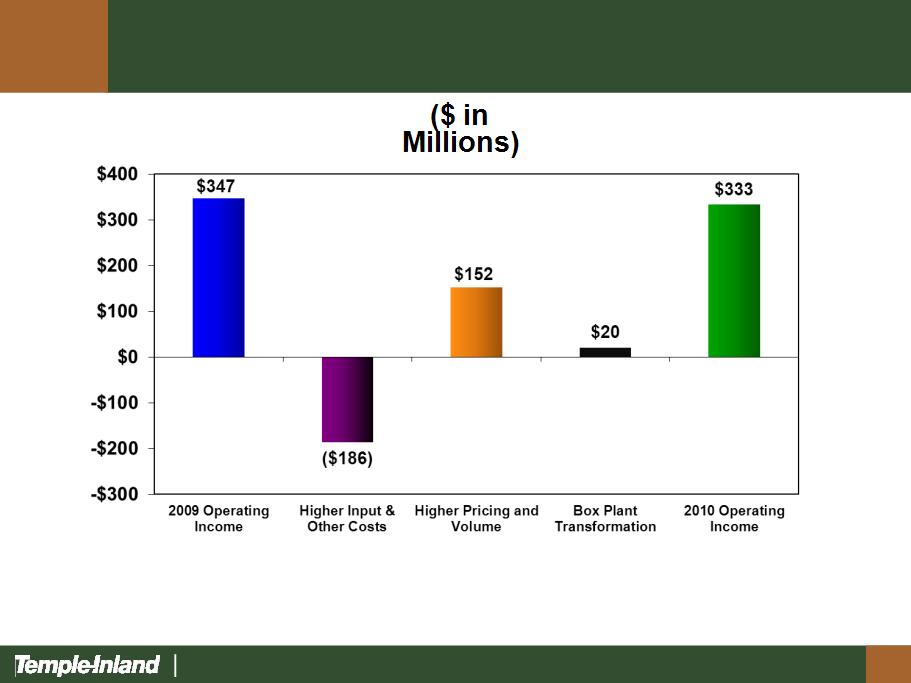

Corrugated Packaging Segment

|

|

2010

|

2009

|

2008

|

|

Revenues

|

$3,153

|

$ 3,001

|

$ 3,190

|

|

Costs and expenses

|

(2,820)

|

(2,654)

|

(2,965)

|

|

Segment operating income

|

$ 333

|

$ 347

|

$ 225

|

($ in Millions)

• Record 16.5% ROI in 2009 and 2010

• Fifth consecutive year of above cost of capital returns

5

Corrugated Packaging Segment

Earnings

Earnings

6

Box Plant Transformation

• Drive Low Cost and Increase

Asset Utilization

Asset Utilization

– Fewer Plants

– Fewer Machines

– Fewer People

• Improve Mix & Margins

C

U

L

T

U

R

E

Lower cost and higher margins

7

Box Plant Transformation I

• EBIT (Lower Costs) $80MM/Year

– Fewer Plants 4

– Fewer Machines 88

– Fewer Positions 1,157

• Investment $174MM

• ROI 46%

Complete

Box Plant Transformation I lowered costs by $10 million in 2010

8

Box Plant Transformation II

• EBIT (Lower Costs) $100MM/Year

– Fewer Plants 12

– Fewer Machines 65

– Fewer Positions 900

• Investment $250MM

• ROI 40%

Box Plant Transformation II lowered costs by $10 million in 2010

9

Box Plant Transformation

Box Plant Transformation will reduce cost by $180 million

67

51

348

194

7,911

5,837

2006 Pro-Forma Year-end 2013

(24%)

(44%)

(26%)

10

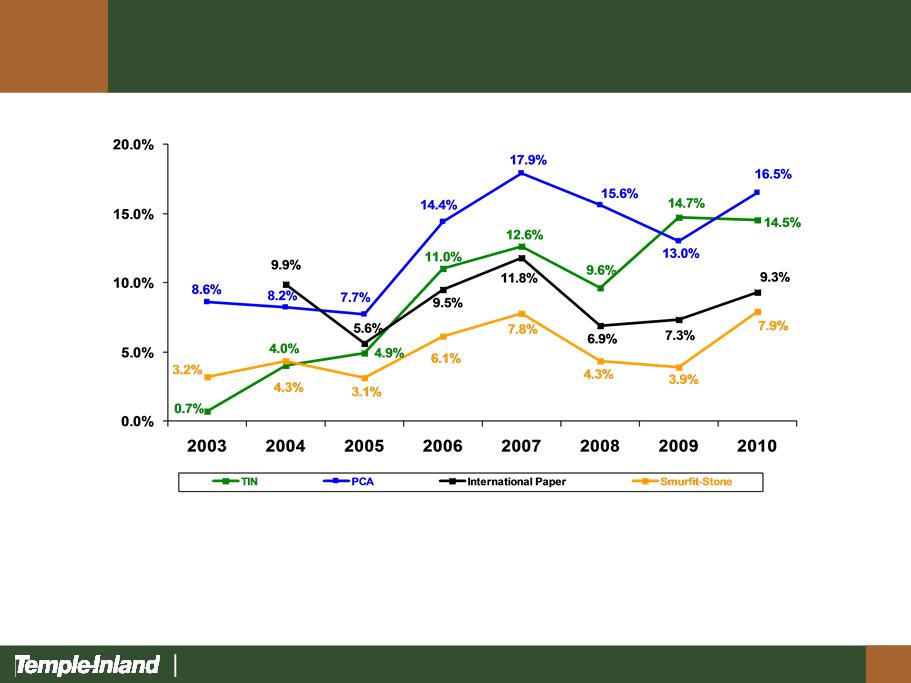

Corrugated Packaging Comparative

Peer Group Returns(ROA)

10

Notes: (1) EBIT excludes special items - For TIN and IP as reported by segment; for PCA, Gross Profit-selling and administrative

expenses; for SSCC, for containerboard, corrugated containers and reclamation operations

expenses; for SSCC, for containerboard, corrugated containers and reclamation operations

(2) Adjustments to EBIT - For SSCC, beginning in 2007, working capital interest was no longer charged to operations.

Based on restatement of 2006 and 2005 data, EBIT is adjusted upward by $70 million for the years 2004 and 2003.

Based on restatement of 2006 and 2005 data, EBIT is adjusted upward by $70 million for the years 2004 and 2003.

(3) Assets (beginning of year) - For TIN and IP as reported by segment adjusted for acquisitions made in Q3 2008; for PCA,

consolidated Total Assets; for SSCC, consolidated Total Assets excluding Consumer Packaging prior to 2007. On January 26, 2009 SSCC

filed for Chapter 11 Bankruptcy and emerged on June 30, 2010. For 2010, the Successor Total Assets (after adjustments for the Plan of Reorganization

and Fresh Start) is used. For 2009, the Successor Total Assets, adjusted for actual cash and cash equivalents is used.

(4) Restatements - Most recent reported data used to replace prior data, as reported, when available.

11

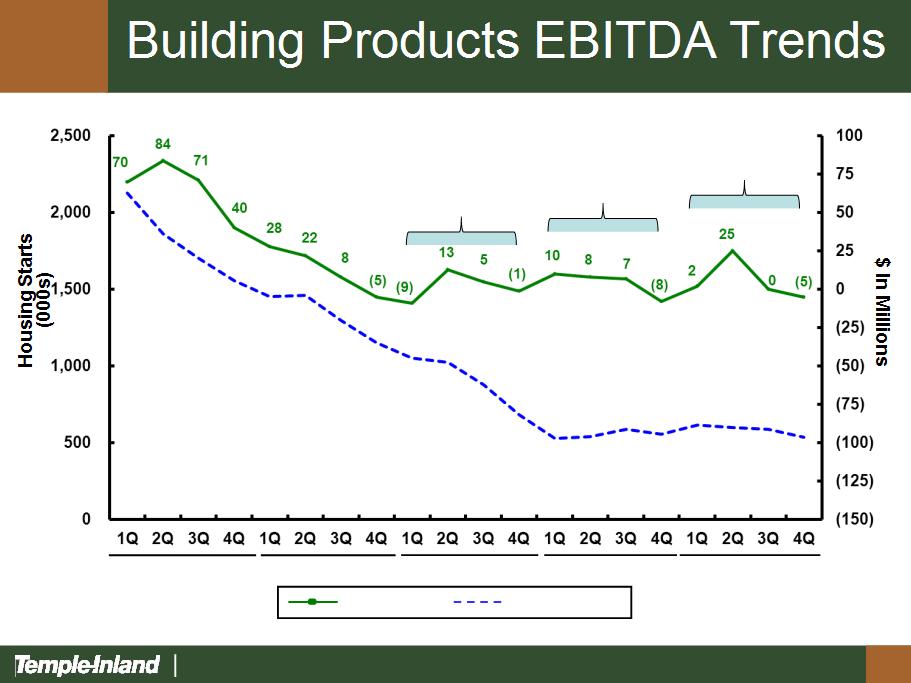

Building Products Segment

|

|

2010

|

2009

|

2008

|

|

Revenues

|

$ 646

|

$ 576

|

$ 694

|

|

Costs and expenses

|

(665)

|

(603)

|

(734)

|

|

Segment operating income (loss)

|

$ (19)

|

$(27)

|

$ (40)

|

($ in Millions)

12

12

Housing Starts

TIN EBITDA

2006

2007

2008

2009

2010

$8

$17

$22

13

Fourth Quarter 2010 Consolidated

Results

Results

Net income per share

Special items

Net income (loss) per share

excluding special items

|

Q4

2010

|

Q4

2009

|

Q3

2010

|

|

$ 0.24

|

$ 0.34

|

$ 1.13

|

|

0.07

|

(0.41)

|

(0.72)

|

|

$ 0.31

|

$(0.07)

|

$ 0.41

|

• Special items - $0.07 charge primarily related to Box

Plant Transformation II

Plant Transformation II

• Income tax benefit of $0.05 per share primarily related to

the expected utilization of state net operating loss carry-

forwards previously reserved

the expected utilization of state net operating loss carry-

forwards previously reserved

• Q4 2010 ROI - 9.2%

14

Corrugated Packaging Segment

($ in Millions)

|

|

Q4

2010

|

Q4

2009

|

Q3

2010

|

|

Revenues

|

$ 806

|

$ 715

|

$ 809

|

|

Costs and expenses

|

(703)

|

(658)

|

(688)

|

|

Segment operating income

|

$ 103

|

$ 57

|

$ 121

|

• Record fourth quarter and 20.4% ROI

15

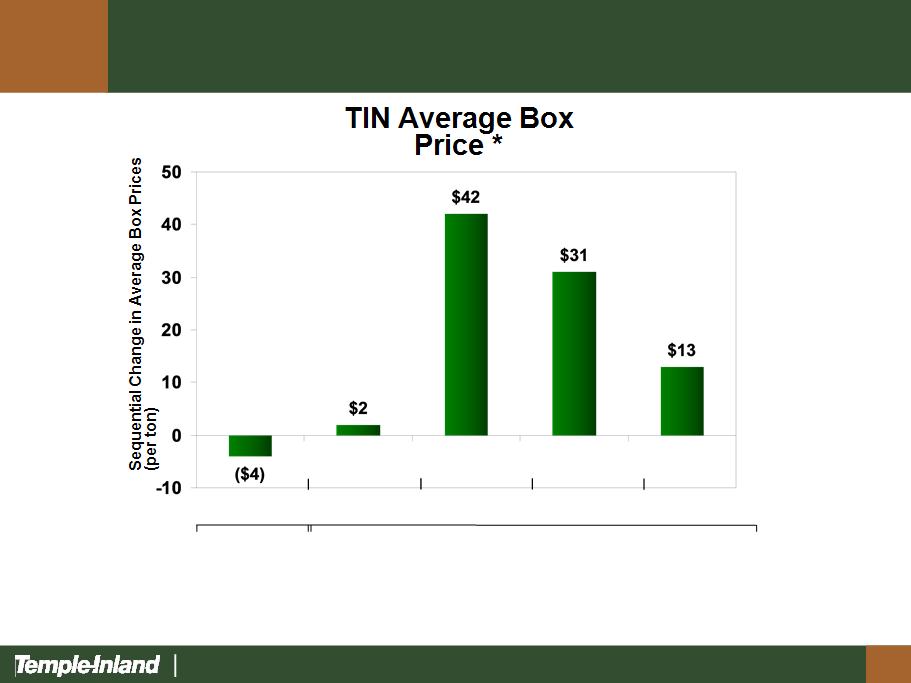

Corrugated Packaging Segment

* Average box price realization includes the impact of mix of business

2009

Q4 Q1 Q2 Q3 Q4

2010

16

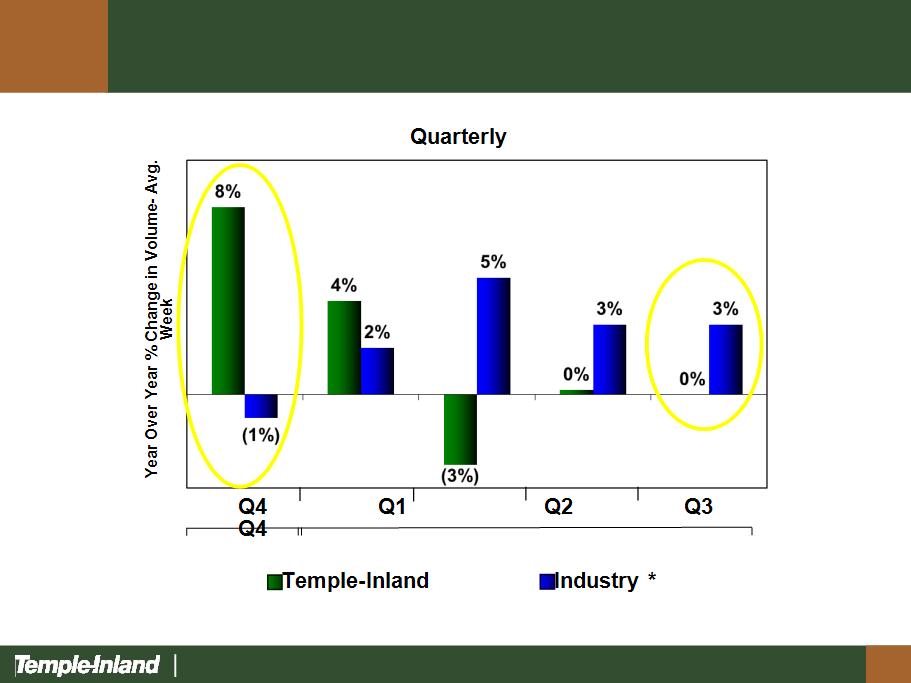

Corrugated Packaging Segment

Box Shipments

* Source: Fibre Box Association

2009

2010

17

Corrugated Packaging Segment

Fourth Quarter

• 24,000 tons of maintenance related downtime

• 32,000 tons lower outside sales compared

with third quarter

with third quarter

• Inventories increased by 40,000 tons from

third quarter’s unsustainably low levels

third quarter’s unsustainably low levels

• Inventories consistent with year-end 2009 levels

18

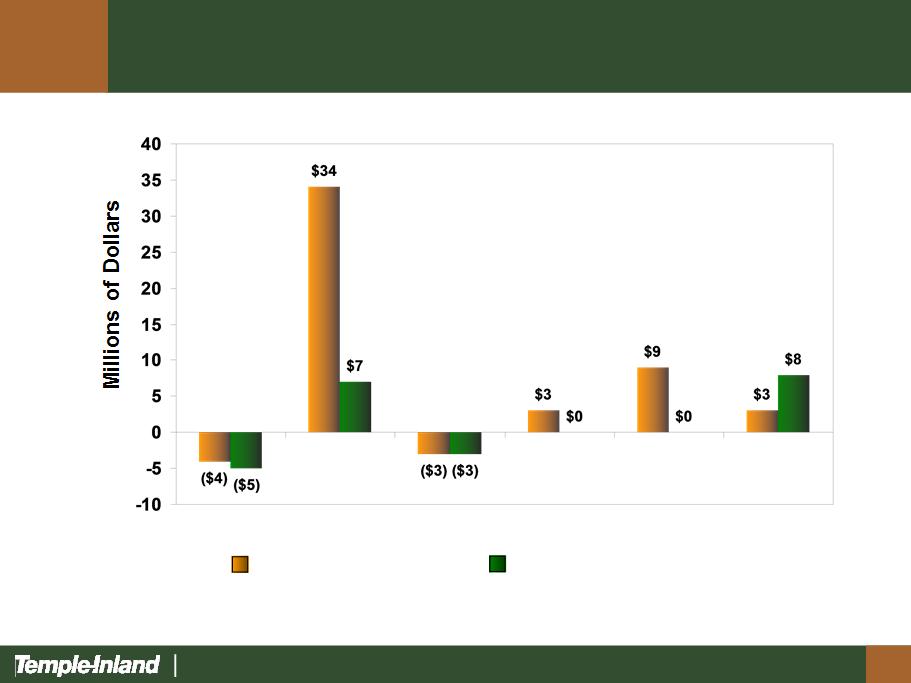

Corrugated Packaging Segment

Q4 2010 vs. Q4 2009 Q4 2010 vs. Q3 2010

Virgin Fiber OCC Energy Chemicals Freight Wax

*Key input cost include the impact of inventory changes

Key Input Cost Changes*

19

Looking Forward

First Quarter

• Higher input costs

• Seasonally lower box prices

• Weather

• 24,000 tons maintenance downtime

20

Building Products Segment

($ in Millions)

|

|

Q4

2010

|

Q4

2009

|

Q3

2010

|

|

Revenues

|

$ 146

|

$ 130

|

$ 157

|

|

Costs and expenses

|

(161)

|

(148)

|

(167)

|

|

Segment operating income

(loss) |

$ ( 15)

|

$ ( 18)

|

$ (10)

|

• Q4 2010 actual housing starts fell 2% vs. Q4 2009

• Q4 2010 actual housing starts fell 25% vs. Q3 2010

21

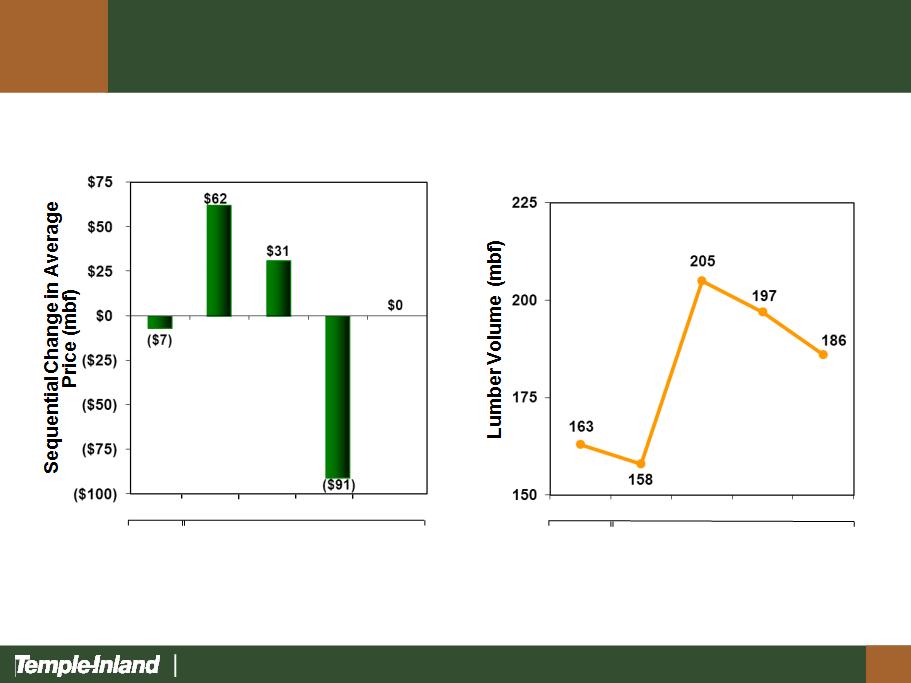

Building Products Segment

Lumber

Price

2009

2010

Q4 Q1 Q2 Q3 Q4

Volume

2009

2010

Q4 Q1 Q2 Q3 Q4

22

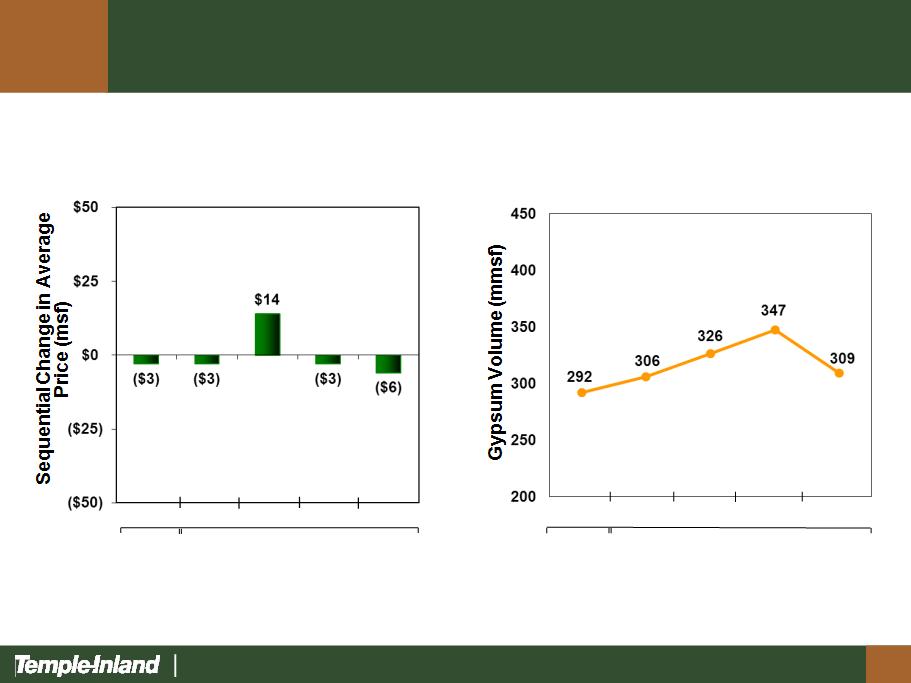

Building Products Segment

Gypsum

Volume

2009

2010

Q4 Q1 Q2 Q3 Q4

Price

Q4 Q1 Q2 Q3 Q4

2009

2010

23

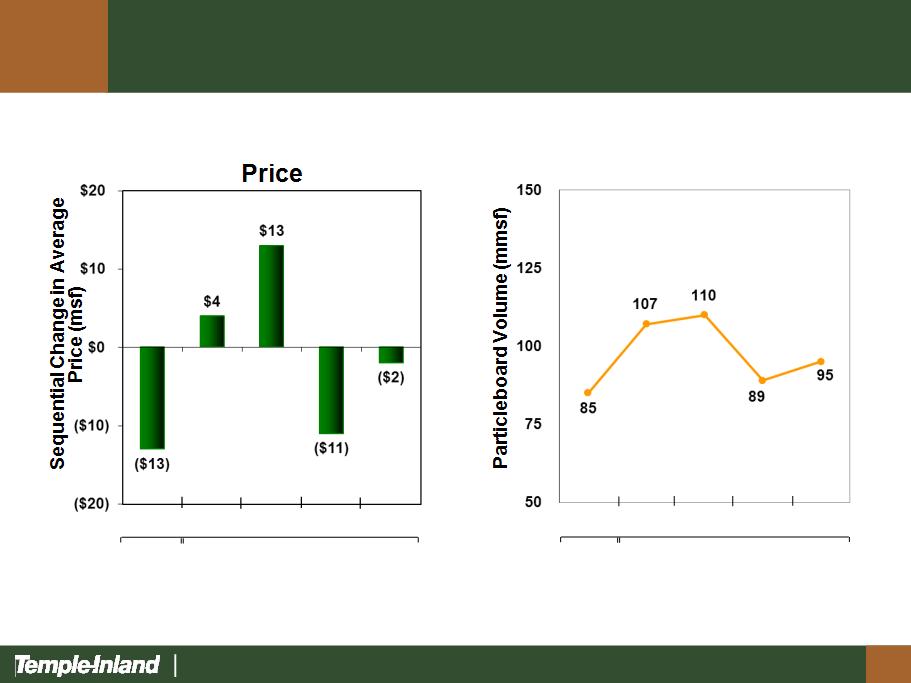

Particleboard

Volume

Building Products Segment

2009

2010

Q4 Q1 Q2 Q3 Q4

Q4 Q1 Q2 Q3 Q4

2009

2010

24

2010 Fourth Quarter and Full Year

Financial Highlights

Financial Highlights

• Cash provided by operations $260 million for the year

– Operations provided $334 million

– Working capital was a use of $74 million

• Balance Sheet

– Long-term debt $718 million at year-end vs.

$710 million a year ago

$710 million a year ago

– Debt/total capital 44% at year-end vs. 47% a year ago

• Liquidity

– Committed credit of $960 million at year-end 2010

– Unused borrowing capacity of $766 million at year-end

2010

25

2011

• Capital Expenditures

– 2010 : $233MM

– 2011 : $225 - 235MM

• Depreciation

– 2010 : $193MM

– 2011 : $200MM

• Pension

– Net periodic pension expense in 2011

essentially flat: $60MM

essentially flat: $60MM

– No anticipated required cash contribution in

2011

2011

– Voluntary, discretionary contribution in 2011:

$30MM

$30MM

26

2011

• General and administrative expenses

– 2010 : $70MM

– 2011 : $70 - $72MM

• Share-based and long-term incentive

compensation

compensation

– 2010 : $33MM

– 2011 : $36MM, $1 change in share price = $2.5

million

million

• Interest expense

– 2010 : $51MM

– 2011 : $50 - $52 MM

• Income tax

– 2011 effective tax rate = 40%

– 2011 cash tax rate = 10%

27

2011 Financial Priorities

• Return cash to shareholders

– Raised annual dividend by 18% to

$0.52 per share

$0.52 per share

• Reduce debt

• Invest in our business

• Profitably grow

28

Our job is to be the best