Attached files

| file | filename |

|---|---|

| 8-K - MID AMERICA APARTMENT COMMUNITIES INC. | v210355_8-k.htm |

Capital

Markets Update February 2011

MAA’s

Strategy Full Cycle Performance Objective Superior long‐ term performance Secure

and growing dividend Lower volatility Sunbelt Region Focus Superior demand side

performance Protecting against supply side pressure Large and Secondary Market

Focus Full cycle performance profile Create value in pricing & operating

inefficiencies Outperform Local Market Norms Focus on property and asset

management Scope and sophistication of operating platform Optimize people

component Value Investor Balance Sheet execution capabilities Extensive

knowledge and market relationships Disciplined Capital Deployment Protocols

Forecasting discipline IRR driven

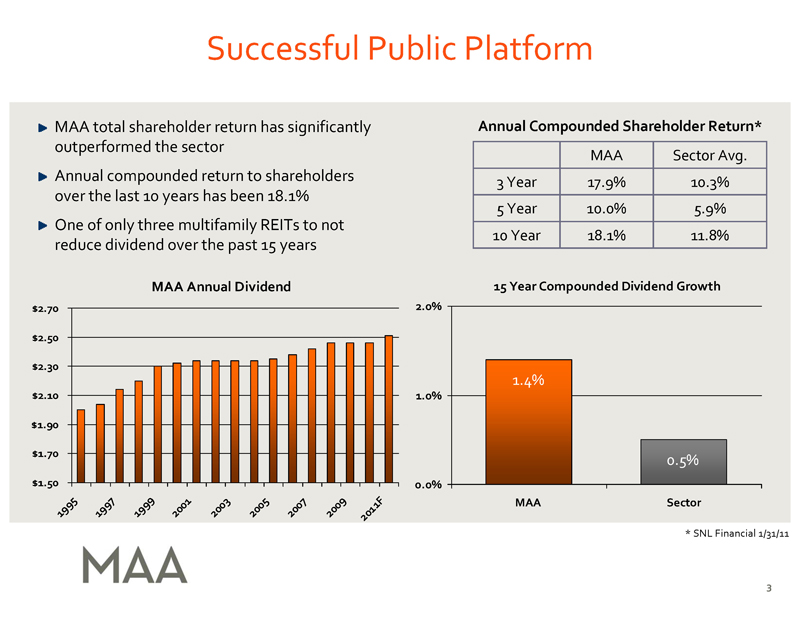

Successful

Public Platform MAA total shareholder return has significantly outperformed the

sector Annual compounded return to shareholders over the last 10 years has been

18.1% One of only three multifamily REITs to not reduce dividend over the past

15 years MAA Annual Dividend $2.70 2.0% $2.50 $2.30 $2.10 1.0% $1.90 $1.70 $1.50

0.0% 1 9 F 99 5 07 1 9 97 1 1 1999 20 0 20 0 3 2005 2 0 20 0 2 01 Annual

Compounded Shareholder Return* MAA Sector Avg. 3 Year 17.9% 10.3% 5 Year 10.0%

5.9% 10 Year 18.1% 11.8% 15 Year Compounded Dividend Growth 0.5% Sector * SNL

Financial 1/31/11

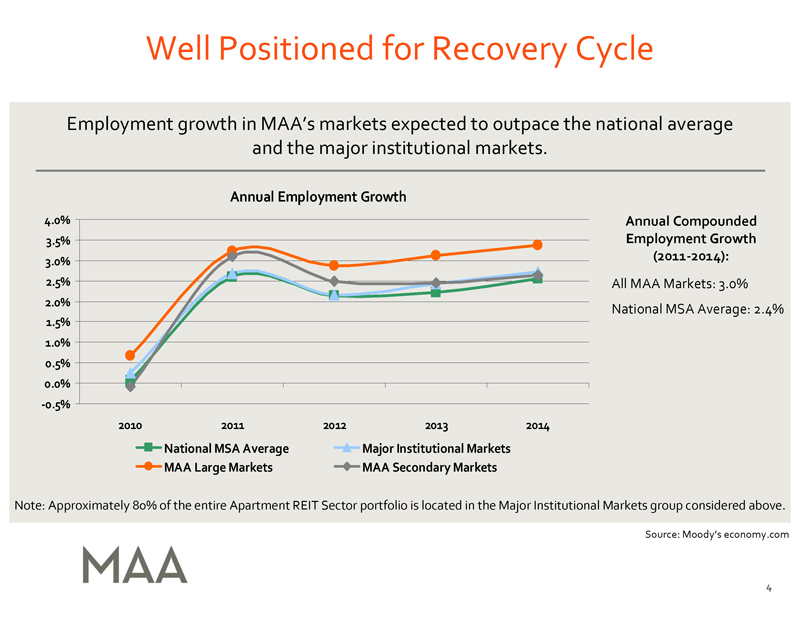

Well

Positioned for Recovery Cycle Employment growth in MAA’s markets expected to

outpace the national average and the major institutional markets . Annual

Employment Growth 4.0% Annual Compounded 3.5% Employment Growth (2011‐ 2014):

3.0% 2.5% All MAA Markets: 3.0% 2.0% National MSA Average: 2.4% 1.5% 1.0% 0.5%

0.0% ‐ 0.5% 2010 2011 2012 2013 2014 National MSA Average Major Institutional

Markets MAA Large Markets MAA Secondary Markets Note: Approximately 80% of the

entire Apartment REIT Sector portfolio is located in the Major Institutional

Markets group considered above. Source: Moody’s economy .com

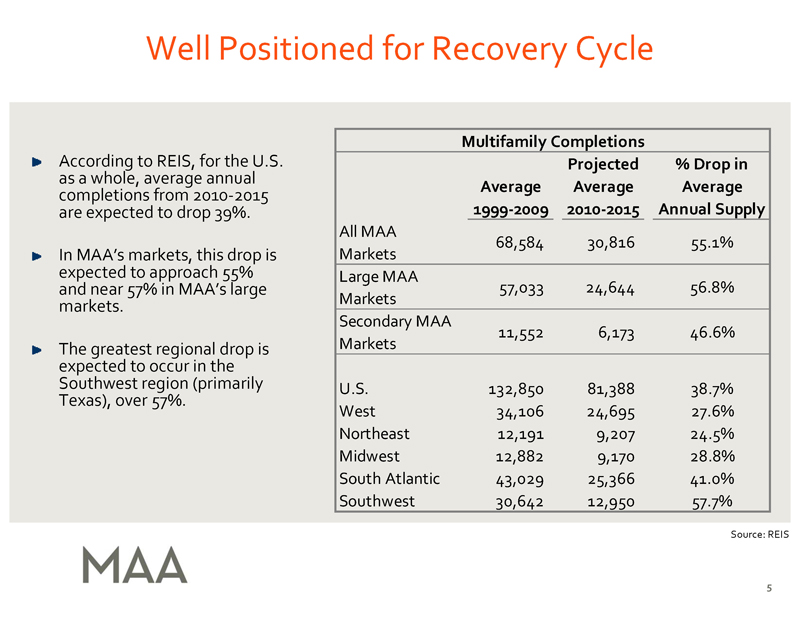

Well

Positioned for Recovery Cycle According to REIS, for the U.S. as a whole,

average annual completions from 2010‐ 2015 are expected to drop 39%. In MAA’s

markets, this drop is expected to approach 55% and near 57% in MAA’s large

markets . The greatest regional drop is expected to occur in the Southwest

region (primarily Texas), over 57%. Multifamily Completions Projected % Drop in

Average Average Average 1999‐ 2009 2010‐ 2015 Annual Supply All MAA 68,584

30,816 55.1% Markets Large MAA 57,033 24,644 56.8% Markets Secondary

MAA 11,552 6,173 46.6% Markets U.S. 132,850 81,388 38.7% West 34,106 24,695

27.6% Northeast 12,191 9,207 24.5% Midwest 12,882 9,170 28.8% South Atlantic

43,029 25,366 41.0% Southwest 30,642 12,950 57.7% Source:

REIS

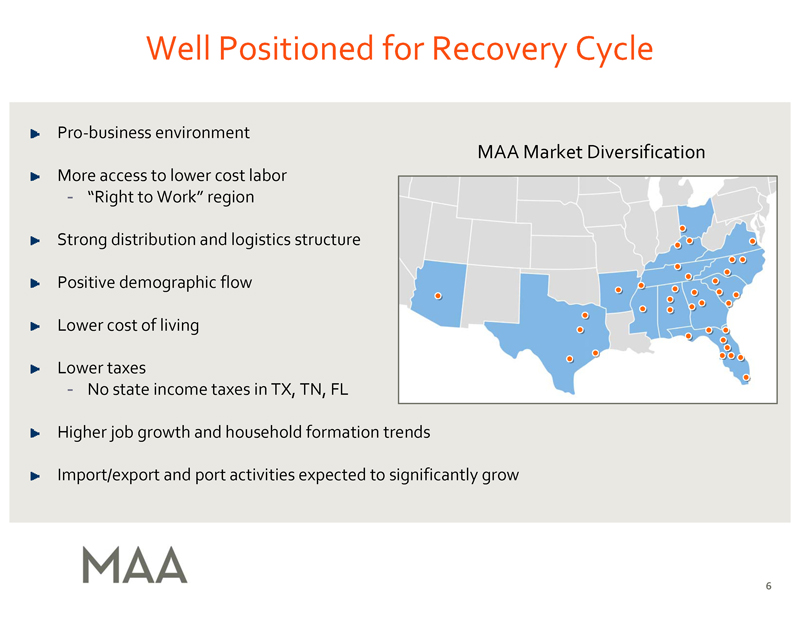

Well

Positioned for Recovery Cycle Pro‐ business environment MAA Market

Diversification More access to lower cost labor “Right to Work” region Strong

distribution and logistics structure Positive demographic flow Lower cost of

living Lower taxes No state income taxes in TX, TN, FL Higher job growth and

household formation trends Import/export and port activities expected to

significantly grow

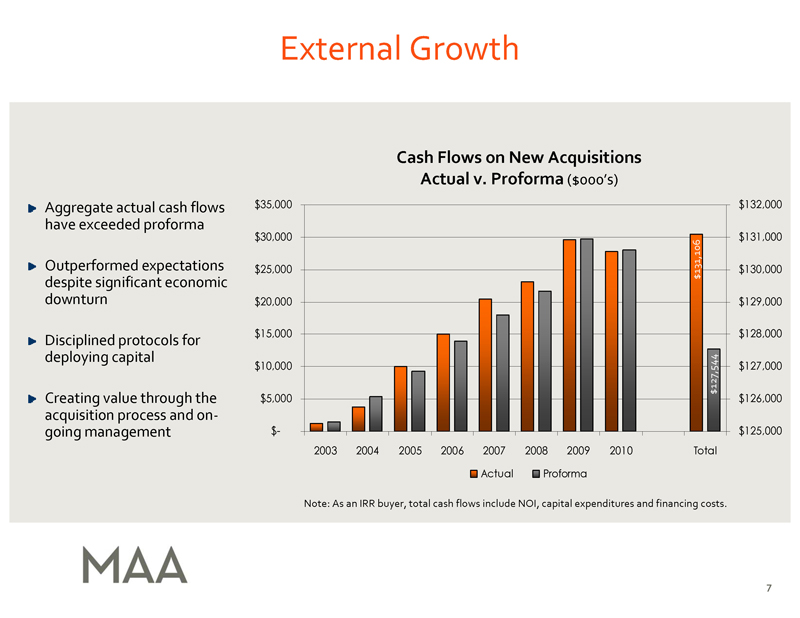

External

Growth Cash Flows on New Acquisitions Actual v. Proforma ($000’s) Aggregate

actual cash flows $35,000 $132,000

have exceeded proforma $30,000 $131,000

Outperformed expectations $25,000 131,106

$130,000

despite significant economic $ downturn $20,000 $129,000 $15,000

$128,000 Disciplined protocols for deploying capital $10,000 127,544

$127,000

Creating value through the $5,000 $ $126,000

acquisition process and ongoing management $- $125,000 2003 2004 2005

2006 2007 2008 2009 2010 Total Actual Proforma Note: As an IRR buyer,

total cash flows include NOI, capital expenditures and financing

costs.

External

Growth Significant deal flow and opportunities as a result of long

established regional focus and in‐ place networks . Extensive market and sub‐

market knowledge supports accurate and timely analysis . Strong property

management and asset management capabilities support accurate underwriting

and ability to identify opportunities . Strong balance sheet enables quick

and assured execution for sellers. Strong execution capabilities enables

ability to handle more complex transactions/more

attractive opportunities . Competitive advantage within region and

markets drives ability to outperform market norms and create value;

versus hyper competitive environment in heavy institutional markets where

value creation is more challenged .

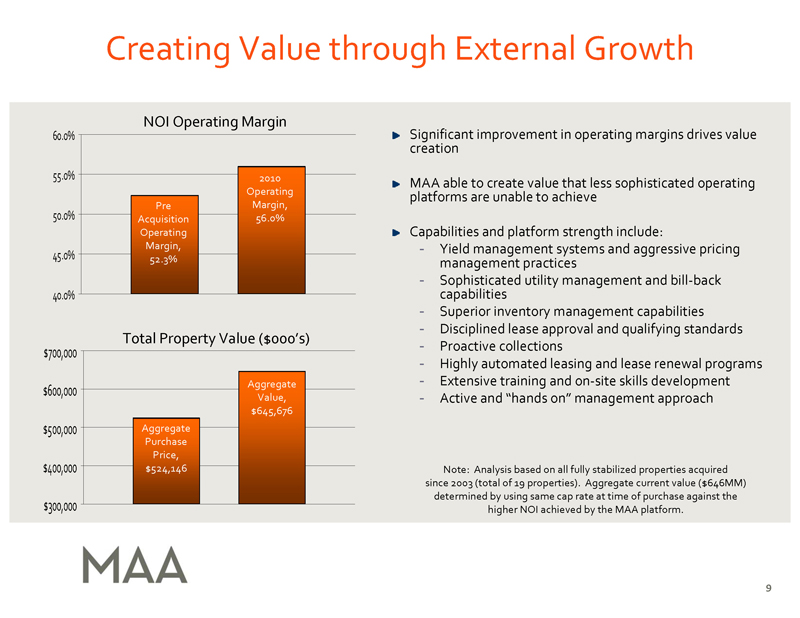

Creating

Value through External Growth NOI Operating Margin 60.0% Significant improvement

in operating margins drives value creation 55.0% 2010 MAA able to create value

that less sophisticated operating Operating platforms are unable to achieve Pre

Margin, 50.0% Acquisition 56.0% Operating Capabilities and platform strength

include: Margin, -

Yield management systems and aggressive pricing 45.0% 52.3%

management practices Sophisticated utility management and bill‐ back 40.0%

capabilities Superior inventory management capabilities Disciplined lease

approval and qualifying standards Total Property Value ($000’s) $700,000 - Proactive

collections Highly automated leasing and lease renewal programs Aggregate - Extensive

training and on‐ site skills development $600,000 Value, - Active and “hands

on” management approach $645,676 $500,000 Aggregate Purchase Price,

$400,000 $524,146 Note: Analysis based on all fully stabilized properties

acquired since 2003 (total of 19 properties) . Aggregate current value ($646MM)

determined by using same cap rate at time of purchase against the $300,000

higher NOI achieved by the MAA platform.

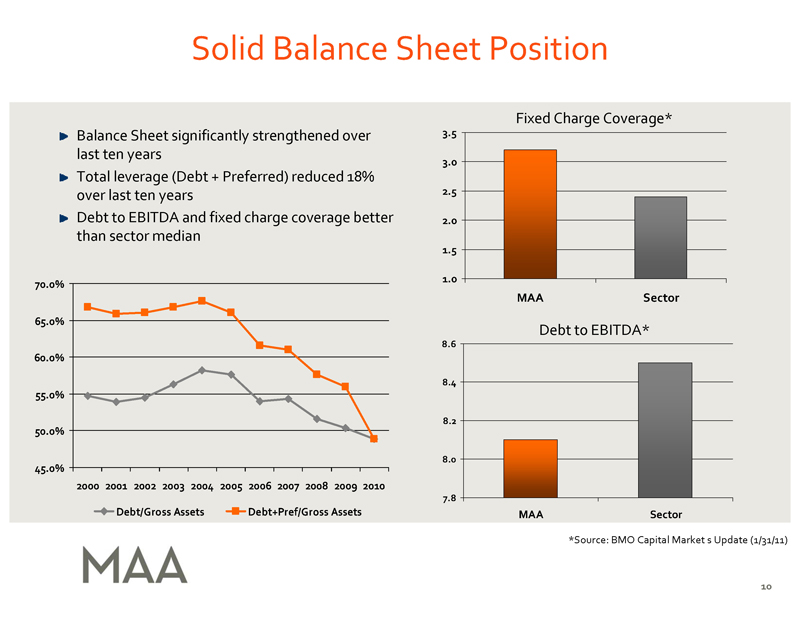

Solid

Balance Sheet Position Balance Sheet significantly strengthened over last ten

years Total leverage (Debt + Preferred) reduced 18% over last ten years Debt to

EBITDA and fixed charge coverage better than sector median Sector *Source: BMO

Capital Market s Update (1/31/11) Debt to EBITDA* 70.0% 65.0% 60.0% 55.0% 50.0%

45.0% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Debt/Gross Assets

Debt+Pref/Gross Assets 8.6 8.4 8.2 8.0 7.8 Fixed Charge

Coverage*

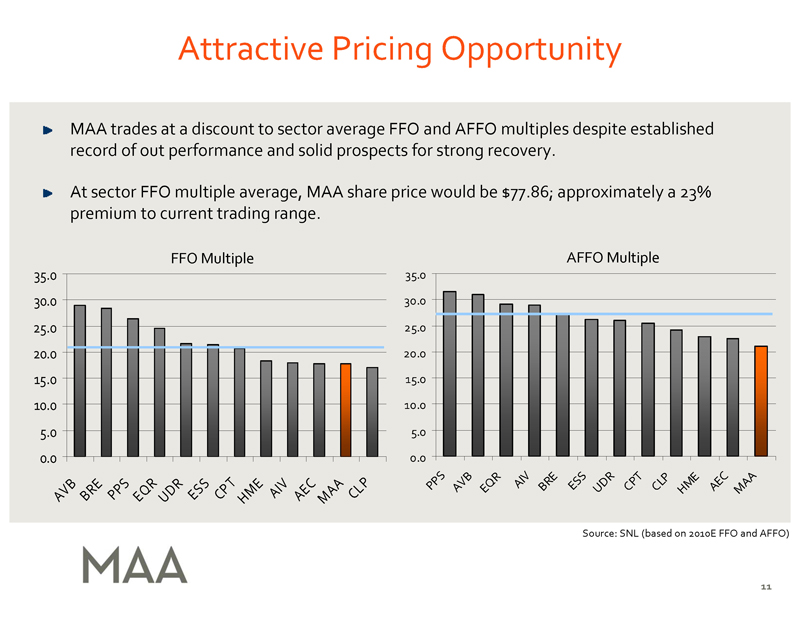

Attractive

Pricing Opportunity MAA trades at a discount to sector average FFO and AFFO

multiples despite established record of out performance and solid prospects for

strong recovery . At sector FFO multiple average, MAA share price would be

$77.86; approximately a 23% premium to current trading range. FFO Multiple AFFO

Multiple 35.0 35.0 30.0 30.0 25.0 25.0 20.0 20.0 15.0 15.0 10.0 10.0 5.0 5.0 0.0

0.0 R P S Q AI V SS PPS ESSCP T ACLP P AVB E BRE E U D R CPT C LP HM E AEC MA A

A VBBRE EQRUDR HME AIVA ECMA Source: SNL (based on 2010E FFO and

AFFO)

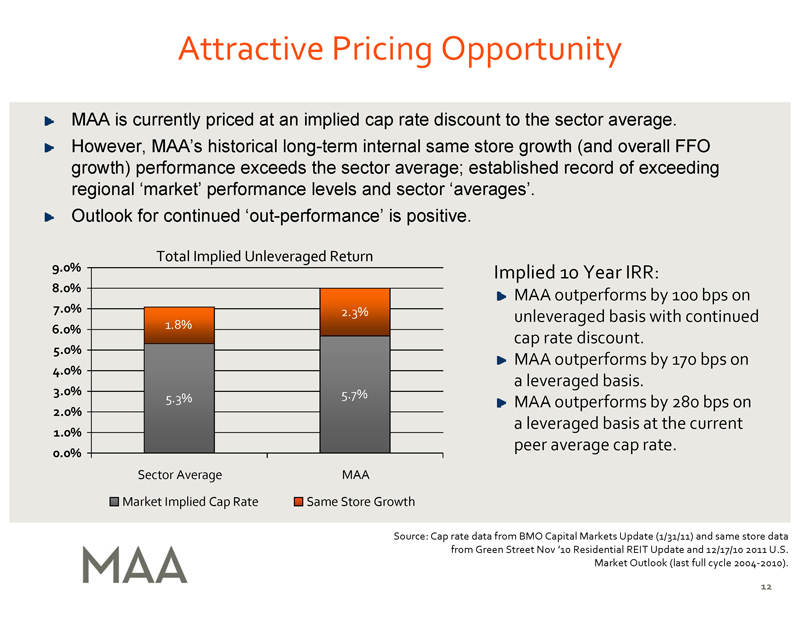

Attractive

Pricing Opportunity MAA is currently priced at

an implied cap rate discount to the sector average . However, MAA’s historical

long-term internal same store growth (and overall FFO growth) performance

exceeds the sector average; established record of exceeding regional ‘market’

performance levels and sector ‘averages’ . Outlook for continued

‘out-performance’ is positive . Total Implied Unleveraged Return Implied

10 Year IRR: MAA outperforms by 100 bps on unleveraged basis with

continued cap rate discount . MAA outperforms by 170 bps on a

leveraged basis. MAA outperforms by 280 bps on a leveraged basis at the

current peer average cap rate. Source: Cap rate data from BMO Capital

Markets Update (1/31/11) and same store data from Green Street Nov ’10

Residential REIT Update and 12/17/10 2011 U.S. Market Outlook (last full

cycle 2004‐ 2010). 9.0% 8.0% 7.0% 2.3% 6.0% 1.8% 5.0% 4.0% 3.0% 5.7% 5.3% 2.0%

1.0% 0.0% Sector Average MAA Market Implied Cap Rate Same Store

Growth

Summary

Unique strategy with proven long‐ term performance Established and proven

public platform Solid internal growth prospects Competitive strengths enables

regional outperformance Disciplined approach to capital deployment Solid

balance sheet position Well positioned to perform as compared to the sector

Value opportunity as compared to the sector at current

pricing

End of

Presentation Certain matters in this presentation may constitute forward ‐

looking statements within the meaning of Section 27‐ A of the Securities Act of

1933 and Section 21E of the Securities and Exchange Act of 1934. Such statements

include, but are not limited to, statements made about anticipated economic and

market conditions, expectations for future demographics, the impact of

competition, general changes in the apartment industry, expectations for

acquisition and joint venture performance, ability to pay dividends and the

ability to obtain financing at reasonable rates. Actual results and the timing

of certain events could differ materially from those projected in or

contemplated by the forward ‐ looking statements due to a number of factors,

including a downturn in general economic conditions or the capital markets,

competitive factors including overbuilding or other supply/demand imbalances in

some or all of our markets, changes in interest rates and other items that are

difficult to control such as the impact of legislation, as well as the other

general risks inherent in the apartment and real estate businesses . Reference

is hereby made to the filings of Mid‐ America Apartment Communities, Inc., with

the Securities and Exchange Commission, including quarterly reports on Form 10‐

Q, reports on Form 8‐ K, and its annual report on Form 10‐ K, particularly

including the risk factors contained in the latter filing. Eric Bolton Al

Campbell Leslie Wolfgang Jennifer Patrick CEO CFO External Reporting Investor

Relations 901‐ 248‐ 4127 901‐ 248‐ 4169 901‐ 248‐ 4126 901‐ 435‐ 5371

eric.bolton@maac .net al.campbell@maac .net leslie.wolfgang@maac .net jennifer

.patrick@maac .net http://ir .maac.net