Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Encore Bancshares Inc | d8k.htm |

1

EBTX Investor Presentation

February 8, 2011

KBW Texas Field Trip

Exhibit 99.1 |

2

Forward-Looking Statements

This presentation may include forward-looking statements. These

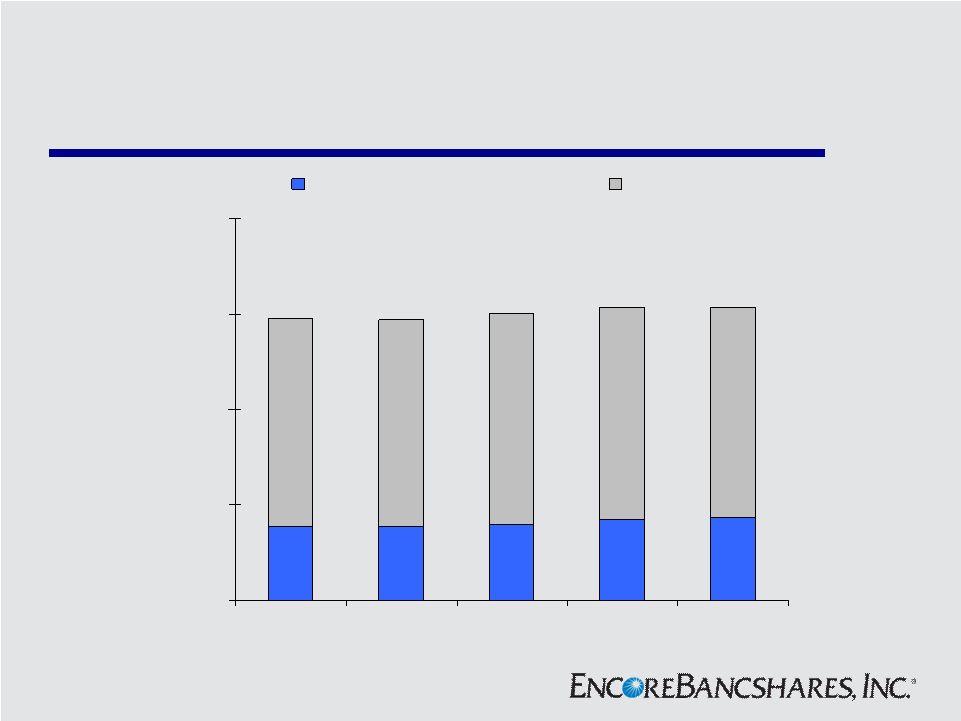

forward-looking statements

include

comments

with

respect

to

assumptions

relating

to

projected

growth,

earnings, earnings per share, capital levels and ratios and other financial

performance measures, as well as management’s short-term and

long-term performance, trends, anticipated effects on results of

operations or financial condition from recent and expected developments or

events relating to business and growth strategies and any other statements,

projections or assumptions that are not historical facts. These statements are

based upon Encore Bancshares, Inc.’s current expectations and beliefs.

However, these forward-looking statements are based on assumptions and are

subject to known and unknown risks, and uncertainties. Factors that could cause

actual results, performance or achievements, to differ materially from

anticipated or projected results, performance or achievements expressed

or implied by these forward-looking statements are described under

“Risk Factors” in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2009 and other reports and documents

filed by the Company from time to time with the SEC.

You should not place undue reliance on any forward-looking statements. These

statements speak only as of the date the statement is made. The Company

undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events, changed

circumstances or any other reason after the date the statement is made.

|

3

Encore Profile

Businesses:

Community Bank,

Wealth Management and Insurance

Headquarters:

Houston, Texas

Total Assets:

$1.5 billion

Total Loans:

$0.9 billion

Total Deposits:

$1.1 billion

Assets Under Management:

$2.9 billion

Total Equity:

$168 million

Tier 1 Risk-Based Capital:

15.06%

Private Client Offices:

11*

Current as of December 31, 2010

*Additional private client office expected to be opened Q2 2011

|

4

Current Position

•

Florida exit completed

•

Improving asset quality

•

Building Houston franchise

•

Growing fee based businesses

•

Solid capital

•

Improving net interest margin |

5

Florida Exit Completed

•

Ovation transaction -

December 31, 2010

•$180.8 million of deposits

•$61.5 million of loans

•4 branches

•

On October 29, sold $25.3 million in loans,

including $19.8 million in non-performing loans |

6

Non-performing Assets -

Florida

5.1

4.1

7.4

5.1

4.5

13.2

41.8

34.2

31.9

26.1

$0

$15

$30

$45

$60

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

FL Loans

FL REO

Total

$31.2

Total

$36.0

Total

$49.2

Total

$39.3

Total

$17.7

$ in millions |

7

Non-performing Assets -

Texas

8.9

2.4

7.9

8.5

8.7

14.5

6.4

7.2

6.5

2.7

4.8

5.8

6.2

7.0

9.5

$0

$15

$30

$45

$60

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

Commercial Nonaccruals

Consumer Nonaccruals

REO

Total

$19.4

Total

$15.8

Total

$28.6

Total

$23.2

Total

$20.0

$ in millions |

8

Building Houston Franchise

•

Take advantage of market disruptions

•

Utilize strong team of experienced commercial and

private bankers

•

Leverage local decision making and local contacts

•

Continue to grow DDA deposits and commercial loan

portfolio |

9

Houston Market

•

4

th

largest city; 6

th

largest MSA

•

Unemployment rate of 8.3% vs. 9.4% for U.S.*

•

Population growth ranked 2

nd

in the nation between

2000 and 2009

•

Second largest U.S. port based on tonnage

•

Texas entered recession a year later; exiting at the

same time

*Houston MSA rate is not seasonally adjusted

Source: Greater Houston Partnership; U.S. Dept. of Labor

|

10

Houston Deposit Market Share

# of Branches

$ in Millions

Market Share %

1

JP Morgan Chase (NY)

216

41,181

$

30.01%

2

Wells Fargo (CA)

237

14,798

10.78%

3

Bank of America (NC)

119

9,755

7.11%

4

Zions (Amegy) (UT)

83

8,577

6.25%

5

BBVA (Spain)

79

7,831

5.71%

6

Comerica *

67

4,658

3.39%

7

Prosperity

56

3,039

2.21%

8

Capital One (VA)

51

2,365

1.72%

9

Woodforest

106

2,351

1.71%

10

Frost

28

2,304

1.68%

11

Regions (AL)

27

1,519

1.11%

12

Bank of Texas (OK)

15

1,379

1.00%

13

Encore

11

1,033

0.75%

June 30, 2010

*Combined with Sterling Bank

Source: FDIC Bank Data & Statistics |

11

Houston Market

Includes additional private client office expected to be opened Q2 2011.

|

12

Houston Loans

$335

$320

$308

$308

$345

$882

$892

$886

$868

$873

$0

$400

$800

$1,200

$1,600

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

Commercial Loans

Total Loans

$ in millions |

13

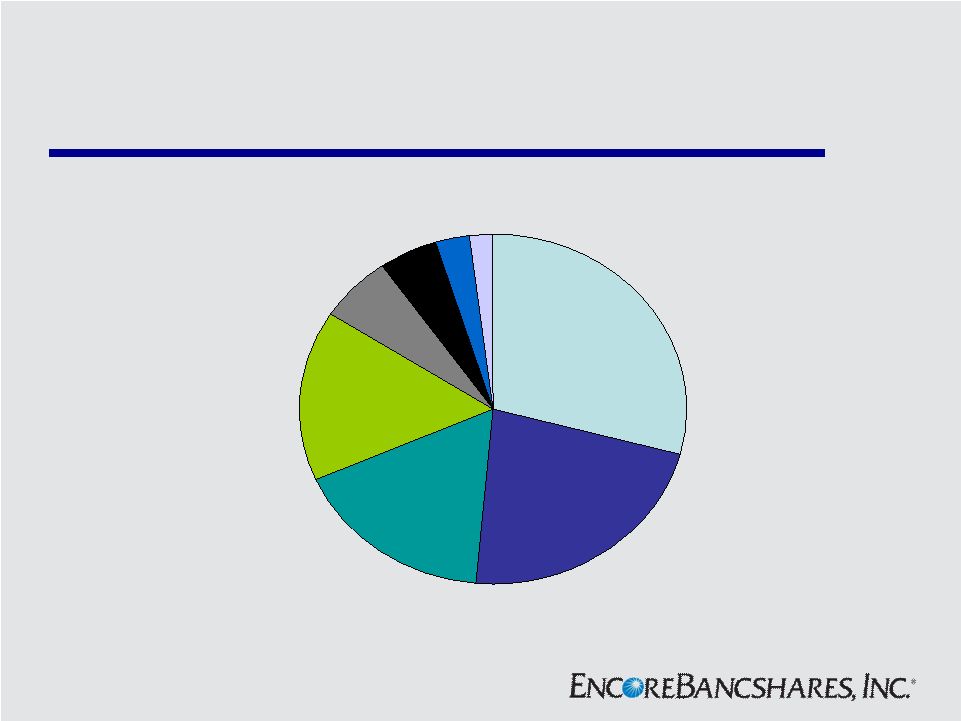

Loan Portfolio *

Residential 1st lien

22.3%

Commercial

15.7%

Residential 2nd

lien

29.2%

Commercial real

estate

16.8%

FL Retain

2.1%

Consumer

2.7%

Construction

4.9%

Home equity lines

6.3%

*As of December 31, 2010

Excludes held-for-sale of $12.8 million. |

14

Residential Loan Portfolio

$0

$100

$200

$300

$400

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

1st SBO

1st Mortgage

PMT

HELOC/Others

$222

$366

$211

$358

$216

$357

$207

$344

$206

$330

$ in millions |

15

Residential Loan Delinquency

0%

4%

8%

12%

16%

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

1st Mortgage

1st Mortgage SBO

PMT

HELOC/Others |

16

Houston Deposits

$ in millions

$183

$220

$206

$155

$156

$955

$959

$1,016

$1,044

$1,050

$0

$400

$800

$1,200

$1,600

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

Noninterest-bearing Deposits

Total Deposits |

17

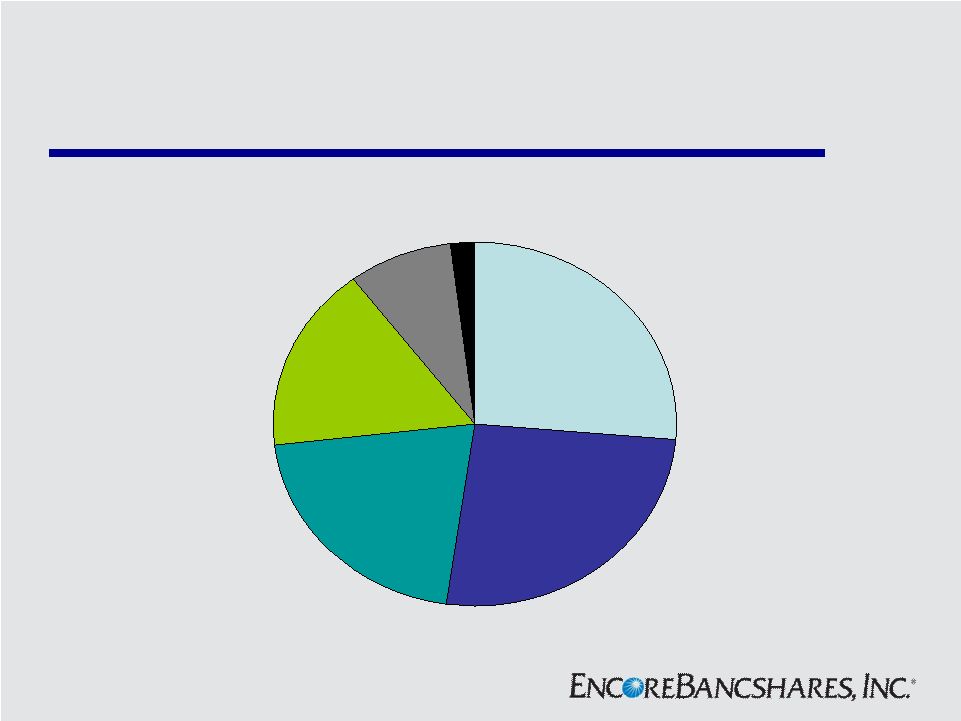

Deposit Mix

Money market

and savings

26.5%

Noninterest-

bearing deposits

20.9%

Interest checking

16.6%

CDs under

$250,000

25.7%

CDs over

$250,000

8.3%

Brokered

deposits

2.0%

As of December 31, 2010 |

18

Margin Improvement *

3.14%

2.89%

2.83%

2.92%

3.04%

3.11%

0.00%

1.00%

2.00%

3.00%

4.00%

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

4Q 10

Proforma

* Tax Equivalent |

19

Wealth Management

$2.7

$2.6

$2.7

$2.9

$2.8

$0

$1

$2

$3

$4

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

Assets Under Management

$ in Billions |

20

Wealth Management

$4.6

$4.6

$4.7

$5.2

$4.7

$0

$2

$4

$6

$8

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

Revenues

$ in Millions |

21

Insurance

•

Property and casualty insurance agency

•

Revenues of $5.9 million

•

Return on invested capital of 20%

•

Over 8,000 customers |

22

Solid Capital

12/31/2010

TCE/ Tangible Assets

6.86%

Leverage Ratio

9.06%

Tier 1 RBC

15.06%

Tier 1 Common RBC

10.28%

Allowance for Loan Losses/ Total Loans *

2.02%

* Excluding held for sale |

23

Investment Considerations

•

Solid capital position

•

Improving asset quality

•

Capacity for margin improvement

•

Attractive market valuation relative to peers

•

High margin fee-based businesses

•

Desirable Houston franchise |

24

Non-GAAP Financial Measures

(1) Tangible common equity, a non-GAAP financial measure,

includes total equity, less preferred equity, goodwill and other intangible assets. Management reviews

tangible common equity along with other measures of capital as

part of its financial analyses and has included this information because of current interest

on

the

part

of

market

participants

in

tangible

common

equity

as

a

measure

of

capital.

The

methodology

of

determining

tangible

common

equity

may

differ

among

companies.

$ in Thousands

Dec 31, 2010

Shareholders' equity (GAAP)

167,961

$

Less: Preferred stock

29,500

Goodwill and other intangible assets, net

40,515

Tangible common equity (1)

97,946

$

Total assets (GAAP)

1,467,817

$

Less: Goodwill and other intangible assets, net

40,515

Tangible assets

1,427,302

$ |