Attached files

First

Midwest Bancorp Fourth Quarter 2010 Supplemental Schedules

January 26, 2011

Exhibit 99.3 |

1

1

Forward Looking Statement

Forward Looking Statement

This presentation may contain, and during this presentation our management may

make statements

that

may

constitute

“forward-looking

statements”

within

the

meaning

of

the

safe

harbor provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements

are

not

historical

facts

but

instead

represent

only

our

beliefs

regarding

future

events,

many of which, by their nature, are inherently uncertain and outside our

control. Forward- looking statements include, among other things,

statements regarding our financial performance, business prospects, future

growth and operating strategies, objectives and results. Actual

results, performance or developments could differ materially from those

expressed or implied by these forward-looking statements. Important factors

that could cause actual results to differ from those in the

forward-looking statements include, among others, those discussed in

our Annual Report on Form 10-K and other reports filed with the Securities

and Exchange Commission, copies of which will be made available upon

request. The information contained herein is unaudited. Except

as required by law, we undertake no duty to update the contents of this

presentation after the date of this presentation. |

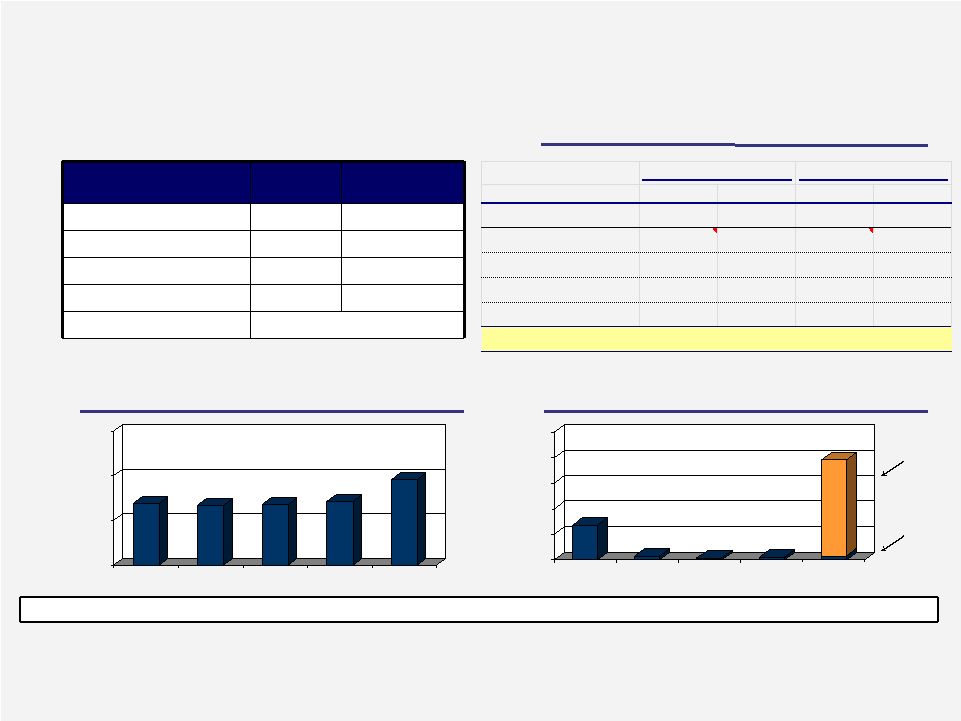

NPA

Resolution Strategy Shift ($ in millions)

2

2

Strategy Objective:

More Aggressively Pursue NPA Resolution

Focus:

Selected Construction and Land Related Assets

Fourth Quarter 2010 Net Charge-Offs

Selected Assets

and OREO Write-Downs

Charge-Offs

Charge-Offs as

Beginning

Related to

Balance at

a % of

Related to

Balance

Strategy Shift

Dec. 31, 2010

Beginning Balance

Ordinary

Strategy Shift

Total

Asset Class

Residential Construction & Land Loans

$ 55

$ 26

$ 29

47%

$ 10

$ 26

$ 36

Commercial Construction & Land Loans

15

8

7

53%

0

8

8

Other Loans

21

3

14

14%

27

3

30

Subtotal

$ 91

$ 37

$ 54

41%

$ 37

$ 37

$ 74

OREO (Primarily Construction & Land)

24

11

13

46%

4

11

15

Total

$ 115

$ 48

$ 67

42%

$ 41

$ 48

$ 89

Reported Fourth Quarter 2010 Net Income to Common

($30)

Plus: NCOs / Losses Related to Shift in Strategy

48

Less: Tax Benefit

(19)

Adjusted Fourth Quarter 2010 Net Income to Common

($1)

Adjusted Fourth Quarter 2010 Earnings per Share

($0.02) |

3

3

Residential Construction & Land Loans

Residential Construction & Land Loans

(Represent 3% of Total Loans; $ in Millions)

(Represent 3% of Total Loans; $ in Millions)

$113

$93

$71

$61

$52

$0

$60

$120

$180

4Q09

1Q10

2Q10

3Q10

4Q10

Non-Performing Loans

Net Charge-Offs

$38

$4

$10

$4

$10

$26

$0

$10

$20

$30

$40

$50

4Q09

1Q10

2Q10

3Q10

4Q10

Loan Summary

Performing

Non-

Performing

Size of Portfolio

$123

$52¹

Avg. Loan Size ($000s)

$542

$747

Supported by Interest Reserve

2%

0%

30-89 Days Past Due

$0

$0

Allocated Loss Reserve

$27

NPLs / Loans

35.9%

33.8%

29.5%

27.0%

30.0%

NCOs / Avg. Loans²

42.90%

6.03%

15.45%

7.64%

71.72%

Note: Portfolio data as of December 31, 2010, excludes covered loans.

¹

Includes $29 million of selected loans impacted by shift in strategy.

²

Annualized.

$36

Charge-

Offs

Related to

Shift in

Strategy

Ordinary

Charge-

Offs

Performing Loans

Non-Performing Loans

$

%

$

%

Raw Land

$

16

13

%

$

19

37

%

Developed Land

70

57

13

25

Under Construction

13

10

2

4

Substantially Completed

22

18

11

21

Mixed & Other

2

2

7

13

Total Loans

$

123

100

%

$

52

100

% |

4

4

Commercial Construction & Land Loans

Commercial Construction & Land Loans

(Represent 3% of Total Loans; $ in Millions)

(Represent 3% of Total Loans; $ in Millions)

$21

$20

$20

$21

$29

$0

$15

$30

$45

4Q09

1Q10

2Q10

3Q10

4Q10

Non-Performing Loans

Net Charge-Offs

$3

<$1

<$1

<$1

<$1

$8

$0

$2

$4

$6

$8

$10

4Q09

1Q10

2Q10

3Q10

4Q10

NPLs

/ Loans

9.0%

8.6%

10.1%

11.1%

17.4%

NCOs / Avg. Loans²

4.07%

0.46%

0.21%

0.46%

17.33%

Performing

Non-Performing

Size of Portfolio

$135

$29¹

Avg. Loan Size ($000s)

$993

$3,490

Supported by Interest Reserve

11%

$0

30-89 Days Past Due

$0

$0

Allocated Loss Reserve

$8

Note: Portfolio data as of December 31, 2010, excludes covered loans.

¹

Includes $7 million of selected loans impacted by shift in strategy.

²

Annualized.

$8

Charge-

Offs

Related to

Shift in

Strategy

Ordinary

Charge-

Offs

Loan Summary

Performing Loans

Non-Performing Loans

$

%

$

%

Raw Land

$

28

21

%

$

19

66

%

Developed Land

62

46

10

34

Under Construction

23

17

–

–

Substantially Completed

22

16

–

–

Mixed & Other

0

0

–

–

Total Loans

$

135

100

%

$

29

100

% |

5

5

Overview of Other Real Estate Owned (OREO)

Overview of Other Real Estate Owned (OREO)

($ in millions)

($ in millions)

Write-Downs As

Beginning

Write-Downs Related to

Balance at

a % Of Beginning

Property Type

Balance

Strategy Shift

December 31, 2010

Balance

Residential Lots

$ 13.6

$ 6.0

$ 7.6

44.2 %

Raw Land

11.0

3.5

7.5

31.9 %

Farm

5.6

1.0

4.7

17.2 %

Office, Retail, Industrial

4.3

0.0

4.3

0.0 %

Commercial Lots

4.1

0.0

4.1

0.0 %

Other Commercial

1.3

0.2

1.1

14.9 %

Single Family

1.1

0.0

1.1

0.0 %

Condo

0.8

0.0

0.8

0.0 %

Total

$ 41.8

$ 10.7

$ 31.1

25.5 %

Note: Portfolio data as of December 31, 2010, excludes covered OREO

|

6

6 |