Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGIONS FINANCIAL CORP | d8k.htm |

| EX-99.2 - SUPPLEMENTAL FINANCIAL INFORMATION - REGIONS FINANCIAL CORP | dex992.htm |

| EX-99.1 - PRESS RELEASE - REGIONS FINANCIAL CORP | dex991.htm |

Regions Financial

4

th

Quarter Earnings Conference Call

January 25, 2011

Exhibit 99.3 |

›Forward-Looking Statements

2 |

Summary of Fourth Quarter

2010 Results Earnings Highlights

›

Credit trends are improving

›

Non-performing loans, excluding loans HFS,

declined $212 million to $3.2 billion

›

Loan loss provision of $682 million; provision

essentially equaled net charge-offs

Credit Update

($ in millions)

4Q09

3Q10

4Q10

Non-performing loans *

$ 3,488

$ 3,372

$ 3,160

Net Charge Offs

$ 692

$ 759

$ 682

Provision Build

$ 487

$ 1

$ -

Loan Loss Provision

$ 1,179

$ 760

$ 682

Note: Amounts exclude non-core items impacting the current and prior quarters

* Non –

GAAP; Refer to Financial Supplement for adjustments to PPNR

($ in millions)

4Q09

3Q10

4Q10

Net Interest Income

$ 850

$ 868

$ 877

Adjusted Non-Interest Revenue*

$ 743

$ 748

$ 795

Adjusted Non-Interest Expense*

$ 1,207

$ 1,162

$ 1,211

Adjusted PPNR*

$ 386

$ 454

$ 461

EPS

($0.51)

($0.17)

$0.03

›

Earnings per diluted share of $0.03

›

Adjusted Pre-tax Pre-provision Net Revenue

(“PPNR”) of $461 million; compared to 3Q10:

›

Net interest income increased $9 million and

net interest margin expanded 4 bps to 3.00%

›

Adjusted

non-interest

revenues

increased $47

million or 6% reflecting strong revenue at

Morgan Keegan

›

Adjusted non-interest expenses increased

$49 million or 4% primarily due to higher

professional and legal fees and Morgan

Keegan incentive-based compensation

1

*Excluding loans held for sale |

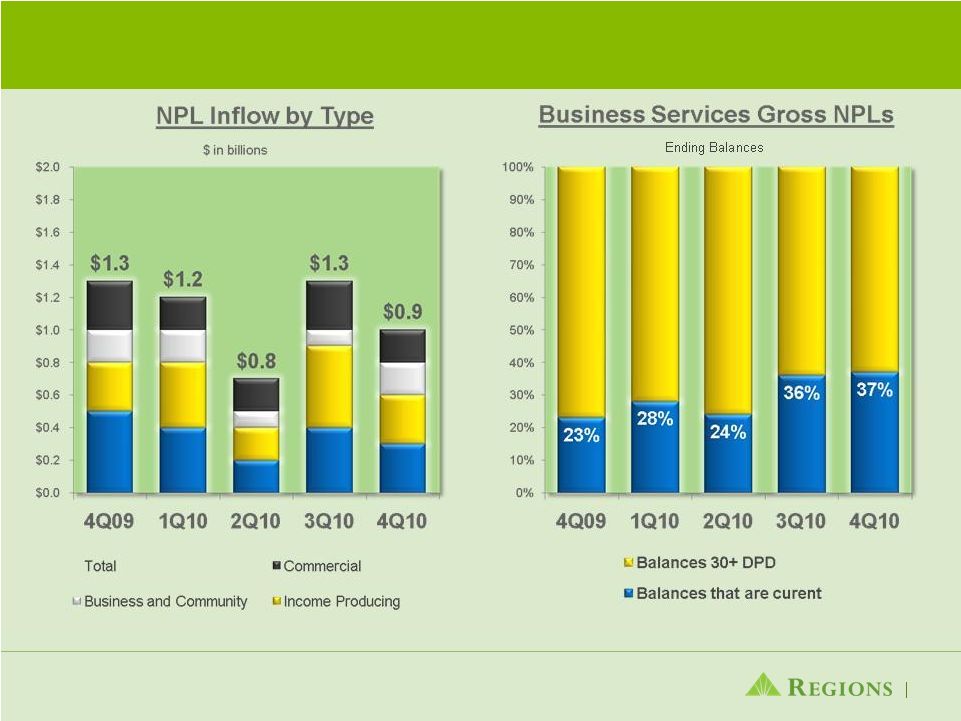

Non-Performing Loan

Inflows Decline 2 |

Non-performing Asset

Levels Decline ›

Non-performing loans declined $212 million

›

Non-performing assets declined $308 million from third quarter

›

For the full year non-performing assets declined $494 million

3 |

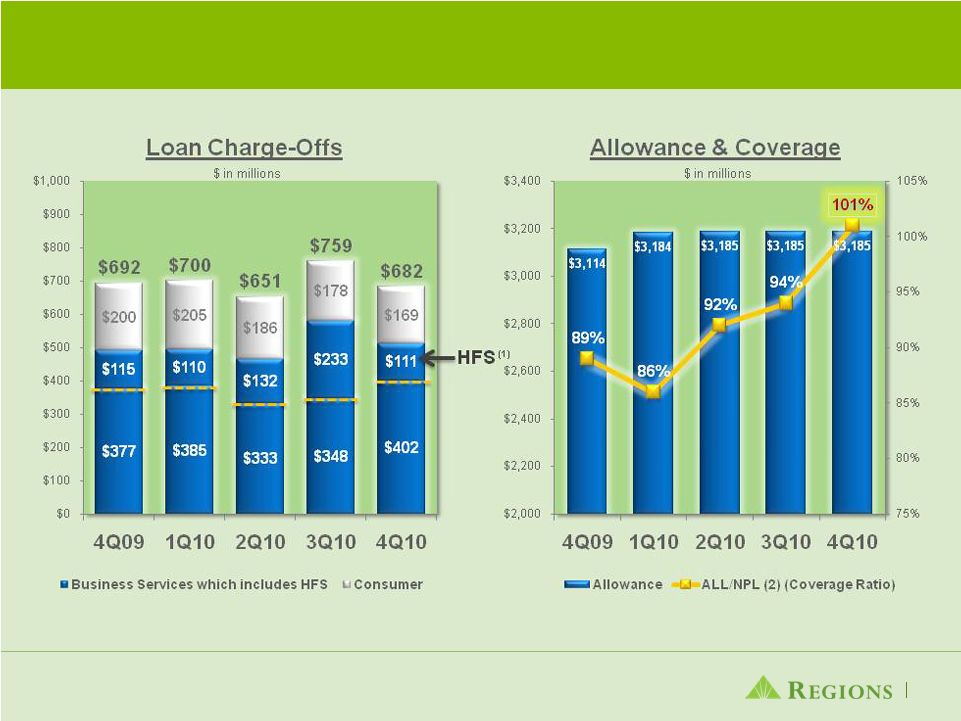

Loan Charge-Offs and

Allowance (1) Loan charge-offs related Sales / Transfer to Held for Sale

(2) Excludes loans held for sale

4 |

Commercial and Industrial

Growing; Investor Real Estate Reflects De-risking Efforts

›

Specialty Lending Groups

›

Small Business Focus

›

Growth in C&I more broadly distributed across market and in more industries than the

3

rd

quarter

›

Investor Real Estate declined $1.6 billion; down close to $6 billion year-over-year

›

Targeting Specific Areas for Growth:

›

Direct Consumer

›

Underserved Banking Segment

($ in millions)

9/30/2010

12/31/2010

$ Change

% Change

Commercial & Industrial

21,501

$

22,540

$

1,039

$

5%

Commercial Real Estate - Owner-Occupied

12,372

12,516

144

1%

Investor Real Estate

17,464

15,908

(1,556)

-9%

Residential First Mortgage

15,723

14,898

(825)

-5%

Home Equity

14,534

14,226

(308)

-2%

Other consumer

2,826

2,776

(50)

-2%

Total Loans

84,420

$

82,864

$

(1,556)

$

-2%

Ending Balances

5 |

Decline in Deposit Costs

Driven by Changing Deposit Mix

›

As anticipated, our improving cost structure impacted overall deposit balances

›

Deposit costs declined 6 bps linked quarter; down 51 bps year-over-year

›

Total funding costs declined 11 bps linked quarter to 0.91%

($ in millions)

3Q10

Avg Rate

4Q10

Avg Rate

$ Change

% Change

Low Cost Deposits

69,917

$

0.17%

71,273

$

0.17%

1,356

$

2%

Time Deposits

25,100

2.16%

23,347

2.07%

(1,753)

-7%

Customer Deposits

95,017

0.70%

94,620

0.64%

(397)

0%

Corporate Treasury Deposits

61

1.30%

22

3.61%

(39)

-64%

Total Deposits

95,078

$

0.70%

94,642

$

0.64%

(436)

$

0%

($ in millions)

9/30/2010

Deposit Mix %

12/31/2010

Deposit Mix %

$ Change

% Change

Low Cost Deposits

70,745

$

74%

71,813

$

76%

1,068

$

2%

Time Deposits

24,177

26%

22,784

24%

(1,393)

-6%

Customer Deposits

94,922

100%

94,597

100%

(325)

0%

Corporate Treasury Deposits

56

0%

17

0%

(39)

-70%

Total Deposits

94,978

$

100%

94,614

$

100%

(364)

$

0%

Ending Balances and Deposit Mix

Average Balances and Average Rates

6 |

Decline in Deposit Costs

and Improvement in Loan Yields Drive Net Interest Income Higher

›

Net interest margin climbed

4bps linked quarter; up 28 bps

year-to-date

›

Repricing

opportunities remain

with over $13.5 billion of CD’s

maturing in the next 12

months at an average of

2.05%

›

Loan yields increased 5 bps

linked quarter; improvement

going forward will be driven by

widening loan spreads

›

Excess liquidity impacted

margin 11 bps compared to 8

bps in Q3

7 |

Solid non-interest

revenue; focused expense management

›

Adjusted non-interest revenue* 6% higher versus prior quarter

›

Increase in interchange income reflects increased debit card volume and fee-

based account growth

›

Morgan Keegan’s revenues were solid reflecting strength in private client and

investment banking revenue

›

Mortgage revenue down due to MSR valuations

›

Adjusted non-interest expenses* 4% higher versus prior quarter

›

Increase in professional and legal fees

›

Increase in Morgan Keegan incentive-based compensation

›

Credit-related costs continue to result in higher non-interest expenses

8

* Non –

GAAP; Refer to page 26 of the Financial Supplement |

Capital Ratios Remain

Strong; Liquidity Profile Solid

(1)

Current Quarter ratios are estimated

(2)

Subject to change as interpretation of Basel III rules is ongoing and dependent on guidance from Basel

and regulators.

›

Solid liquidity at both the bank and holding company

›

Loan-to-deposit ratio of 88 percent

›

Well-positioned with respect to the Liquidity Coverage Ratio

prescribed under Basel III

3Q10

4Q10

(1)

Pro forma for Basel III

4Q10

(2)

Tier 1 Common

7.6%

7.9%

7.6%

Tier 1 Capital

12.1%

12.4%

11.4%

Total Risk-Based Capital

16.0%

16.4%

14.9%

9 |

|