Attached files

| file | filename |

|---|---|

| 8-K - Q42010 FORM 8-K - CSX CORP | form8-k_q42010.htm |

| EX-99.1 - Q42010 PRESS RELEASE - CSX CORP | pressrelease_q42010.htm |

Exhibit 99.2

CSX Announces Record Fourth Quarter and

Full-Year 2010 Results

Fourth Quarter Highlights:

|

·

|

Operating income increases 46 percent to $846 million

|

|

·

|

Operating ratio improves 500 basis points to 70.0 percent

|

|

·

|

Earnings Per Share increases 48 percent to $1.14

|

Full Year Highlights:

|

·

|

Operating income increases 35 percent to $3.1 billion

|

|

·

|

Operating ratio improves 380 basis points to 71.1 percent

|

|

·

|

Earnings Per Share increases 40 percent to $4.06

|

Jacksonville, Fla. – January 24, 2011 – CSX Corporation (NYSE: CSX) today announced fourth quarter earnings of $430 million, or $1.14 per share, versus $303 million, or $0.77 per share, in the same period last year. This represents a 48 percent year-over-year improvement in earnings per share and a record fourth quarter for the company.

Fourth quarter revenue grew to $2.8 billion, a 21 percent increase from the prior year, on a 13 percent increase in volume. The fourth quarter of 2010 included an extra week resulting from the company’s 52/53 week fiscal reporting calendar. Excluding the extra week, revenue increased 14 percent and volume increased seven percent on a comparable basis.

Continued revenue growth, along with productivity and operating leverage, drove a 46 percent increase in operating income to $846 million, and a 500 basis point improvement in the operating ratio to 70.0 percent for the quarter.

“With growth across nearly all the markets we serve and continued strong performance in our operations, we are driving outstanding value for our customers and shareholders,” said Michael J. Ward, chairman, president and chief executive officer.

Full-year Results

CSX continued its excellent safety performance in 2010 and achieved a 17 percent reduction in its FRA personal injury rate to 1.00, an all-time record for the full year.

The company also delivered record financial results for the full year. Earnings were $1.56 billion, or $4.06 a share, versus $1.14 billion, or $2.89 a share, for 2009. These results were driven by strengthening volume, revenue, productivity and operating leverage, which also led to a record annual operating ratio of 71.1 percent.

CSX continued to apply its balanced approach to deploying capital for shareholders in 2010. The company invested $1.8 billion in its business, increased its dividend twice, repurchased $1.5 billion of its shares, and expects to repurchase approximately $300 million of its shares in the first quarter of this year, completing its current $3 billion share repurchase program.

|

Table of Contents

|

The accompanying unaudited

|

CSX CORPORATION

|

CONTACTS:

|

|

financial information should be

|

500 Water Street, C900

|

||

|

read in conjunction with the

|

Jacksonville, FL

|

INVESTOR RELATIONS

|

|

|

Company’s most recent

|

32202

|

David Baggs

|

|

|

Annual Report on Form 10-K,

|

http://www.csx.com

|

(904) 359-4812

|

|

|

Quarterly Reports on Form

|

MEDIA

|

||

|

10-Q, and any Current

|

Lauren Rueger

|

||

|

Reports on Form 8-K.

|

(877) 835-5279

|

1

2011 Expectations

CSX expects to produce record financial results, including a high-60’s operating ratio in 2011. This progress is consistent with the Company’s previously announced goal of achieving a 65 percent operating ratio no later than 2015. In addition, the company plans to invest $2 billion in its business during 2011, with approximately two-thirds of that investment in the company’s infrastructure and rolling stock, and the remaining split between strategic and regulatory investments.

“This investment will further strengthen our company’s transportation network, enhance our ability to reliably serve America’s freight transportation needs, and create shareholder value in the near- and long-term,” said Ward.

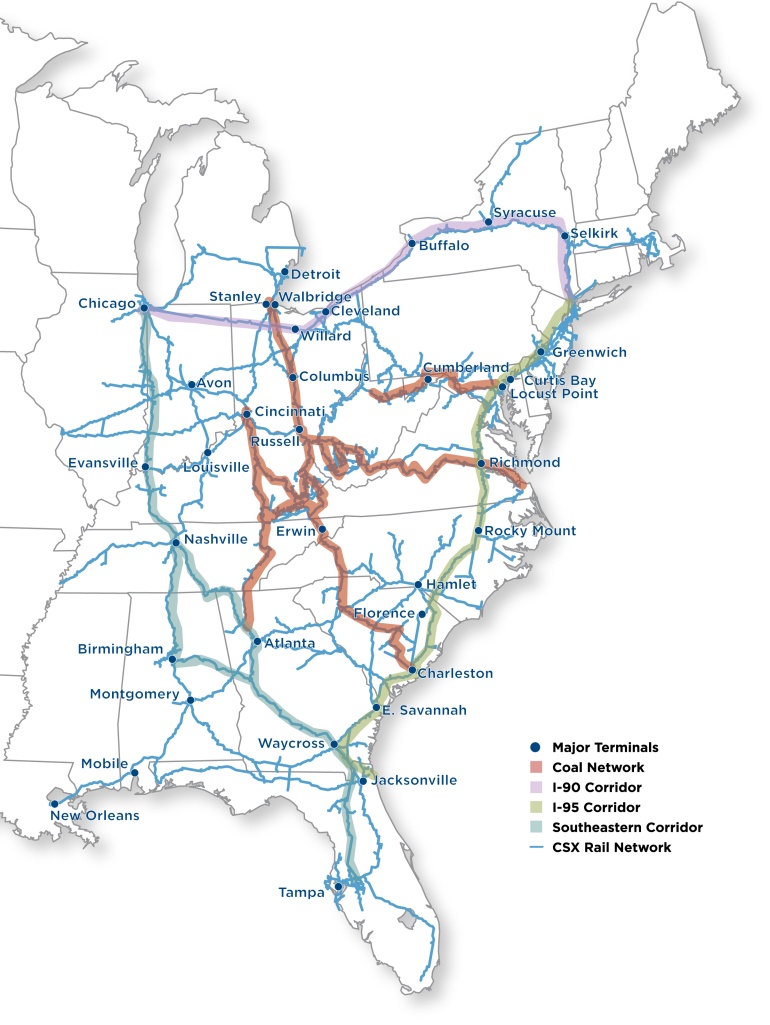

CSX Corporation, based in Jacksonville, Fla., is a leading transportation company providing rail, intermodal and rail-to-truck transload services. The company’s transportation network spans approximately 21,000 miles with service to 23 eastern states and the District of Columbia, and connects to more than 70 ocean, river and lake ports.

This earnings announcement, as well as a package of detailed financial information, is contained in the CSX Quarterly Financial Report available on the company’s website at http://investors.csx.com and on Form 8-K with the Securities and Exchange Commission (“SEC”).

CSX executives will conduct a quarterly earnings conference call with the investment community on January 25, 2010 at 8:30 a.m. Eastern Time. Investors, media and the public may listen to the conference call by dialing 1-888-327-6279 (888-EARN-CSX) and asking for the CSX earnings call. (Callers outside the U.S., dial 1-773-756-0199). Participants should dial in 10 minutes prior to the call. In conjunction with the call, a live webcast will be accessible and presentation materials will be posted on the company's website at http://investors.csx.com. Following the earnings call, an internet replay of the presentation will be archived on the company website.

Forward-looking Statements

This information and other statements by the company may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act with respect to, among other items: projections and estimates of earnings, revenues, volumes, rates, cost-savings, expenses, liquidity, capital expenditures, share repurchases or other financial items, statements of management’s plans, strategies and objectives for future operations, and management’s expectations as to future performance and operations and the time by which objectives will be achieved, statements concerning proposed new services, and statements regarding future economic, industry or market conditions or performance. Forward-looking statements are typically identified by words or phrases such as “believe,” “expect,” “anticipate,” “project,” “estimate,” “preliminary” and similar expressions. Forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or revise any forward-looking statement. If the company updates any forward-looking statement, no inference should be drawn that the company will make additional updates with respect to that statement or any other forward-looking statements.

Forward-looking statements are subject to a number of risks and uncertainties, and actual performance or results could differ materially from that anticipated by any forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by any forward-looking statements include, among others; (i) the company’s success in implementing its financial and operational initiatives; (ii) changes in domestic or international economic, political or business conditions, including those affecting the transportation industry (such as the impact of industry competition, conditions, performance and consolidation); (iii) legislative or regulatory changes; (iv) the inherent business risks associated with safety and security; (v) the outcome of claims and litigation involving or affecting the company; (vi) natural events such as severe weather conditions or pandemic health crises; and (vii) the inherent uncertainty associated with projecting economic and business conditions.

Other important assumptions and factors that could cause actual results to differ materially from those in the forward-looking statements are specified in the company’s SEC reports, accessible on the SEC’s website at www.sec.gov and the company’s website at www.csx.com.

2

|

CONSOLIDATED INCOME STATEMENTS (a)

|

|||||||||||

|

(Dollars in Millions, Except Per Share Amounts)

|

|||||||||||

|

(Unaudited)

|

(Unaudited)

|

||||||||||

|

Quarters Ended

|

Years Ended

|

||||||||||

|

Dec. 31,

|

Dec. 25,

|

Dec. 31,

|

Dec. 25,

|

||||||||

|

2010

|

2009

|

$ Change

|

% Change

|

2010

|

2009

|

$ Change

|

% Change

|

||||

|

(Adjusted)(b)

|

(Adjusted)(b)

|

||||||||||

|

Revenue

|

$2,816

|

$2,320

|

$496

|

21

|

%

|

$10,636

|

$9,041

|

$1,595

|

18

|

%

|

|

|

Expense

|

|||||||||||

|

Labor and Fringe

|

776

|

660

|

(116)

|

(18)

|

2,957

|

2,629

|

(328)

|

(12)

|

|||

|

Materials, Supplies and Other

|

496

|

517

|

21

|

4

|

2,075

|

1,999

|

(76)

|

(4)

|

|||

|

Fuel

|

346

|

250

|

(96)

|

(38)

|

1,212

|

849

|

(363)

|

(43)

|

|||

|

Depreciation

|

257

|

226

|

(31)

|

(14)

|

947

|

903

|

(44)

|

(5)

|

|||

|

Equipment and Other Rents

|

95

|

88

|

(7)

|

(8)

|

374

|

391

|

17

|

4

|

|||

|

Total Expense

|

1,970

|

1,741

|

(229)

|

(13)

|

7,565

|

6,771

|

(794)

|

(12)

|

|||

|

Operating Income

|

846

|

579

|

267

|

46

|

3,071

|

2,270

|

801

|

35

|

|||

|

Interest Expense

|

(149)

|

(138)

|

(11)

|

(8)

|

(557)

|

(558)

|

1

|

-

|

|||

|

Other Income - Net(c)

|

4

|

15

|

(11)

|

(73)

|

32

|

34

|

(2)

|

(6)

|

|||

|

Earnings From Continuing Operations

|

|||||||||||

|

Before Income Taxes

|

701

|

456

|

245

|

54

|

2,546

|

1,746

|

800

|

46

|

|||

|

Income Tax Expense(d)

|

(271)

|

(153)

|

(118)

|

(77)

|

(983)

|

(618)

|

(365)

|

(59)

|

|||

|

Earnings from Continuing Operations

|

430

|

303

|

127

|

42

|

1,563

|

1,128

|

435

|

39

|

|||

|

Discontinued Operations(e)

|

-

|

-

|

-

|

-

|

-

|

15

|

(15)

|

100

|

|||

|

Net Earnings

|

$430

|

$303

|

$127

|

42

|

%

|

$1,563

|

$1,143

|

$420

|

37

|

%

|

|

|

Operating Ratio

|

70.0%

|

75.0%

|

71.1%

|

74.9%

|

|||||||

|

Per Common Share

|

|||||||||||

|

Net Earnings Per Share, Assuming Dilution

|

|||||||||||

|

Continuing Operations

|

$1.14

|

$0.77

|

$0.37

|

48

|

%

|

$4.06

|

$2.85

|

$1.21

|

42

|

%

|

|

|

Discontinued Operations(e)

|

-

|

-

|

-

|

-

|

-

|

0.04

|

(0.04)

|

(100)

|

|||

|

Net Earnings

|

$1.14

|

$0.77

|

$0.37

|

48

|

%

|

$4.06

|

$2.89

|

$1.17

|

40

|

%

|

|

|

Average Shares Outstanding,

|

|||||||||||

|

Assuming Dilution (Thousands)(f)

|

376,131

|

396,939

|

384,506

|

395,686

|

|||||||

|

Cash Dividends Paid Per Common Share

|

$0.26

|

$0.22

|

$0.98

|

$0.88

|

|||||||

See accompanying Notes to Consolidated Financial Statements on Page 6.

3

|

CSX Corporation

|

||

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

||

|

(Dollars in Millions)

|

||

|

(Unaudited)

|

||

|

Dec. 31,

|

Dec. 25,

|

|

|

2010

|

2009

|

|

|

(Adjusted)(b)

|

||

|

ASSETS

|

||

|

Cash, Cash Equivalents and Short-term Investments

|

$1,346

|

$1,090

|

|

Other Current Assets

|

1,509

|

1,480

|

|

Properties - Net

|

23,799

|

23,064

|

|

Investment in Affiliates and Other Companies

|

1,134

|

1,088

|

|

Other Long-term Assets

|

353

|

165

|

|

Total Assets

|

$28,141

|

$26,887

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||

|

Current Maturities of Long-term Debt

|

$613

|

$113

|

|

Other Current Liabilities

|

1,924

|

1,752

|

|

Long-term Debt

|

8,051

|

7,895

|

|

Deferred Income Taxes

|

7,053

|

6,528

|

|

Other Long-term Liabilities

|

1,800

|

1,831

|

|

Total Liabilities

|

19,441

|

18,119

|

|

Total Shareholders' Equity

|

8,700

|

8,768

|

|

Total Liabilities and Shareholders' Equity

|

$28,141

|

$26,887

|

See accompanying Notes to Consolidated Financial Statements on Page 6.

4

|

CSX Corporation

|

||

|

CONDENSED CONSOLIDATED CASH FLOW STATEMENTS

|

||

|

(Dollars in Millions)

|

||

|

(Unaudited)

|

||

|

Years Ended

|

||

|

Dec. 31,

|

Dec. 25,

|

|

|

2010

|

2009

|

|

|

OPERATING ACTIVITIES

|

(Adjusted)(b)

|

|

|

Net Earnings

|

$1,563

|

$1,143

|

|

Depreciation

|

947

|

903

|

|

Deferred Income Taxes

|

474

|

430

|

|

Contributions to Qualified Pension Plans

|

-

|

(250)

|

|

Other - Net

|

262

|

(186)

|

|

Net Cash Provided by Operating Activities

|

3,246

|

2,040

|

|

INVESTING ACTIVITIES

|

||

|

Property Additions(g)

|

(1,825)

|

(1,427)

|

|

Other Investing Activities

|

69

|

54

|

|

Net Cash Used in Investing Activities

|

(1,756)

|

(1,373)

|

|

FINANCING ACTIVITIES

|

||

|

Long-term Debt Issued

|

800

|

500

|

|

Long-term Debt Repaid

|

(113)

|

(323)

|

|

Dividends Paid

|

(372)

|

(345)

|

|

Shares Repurchased(f)

|

(1,452)

|

-

|

|

Other Financing Activities - Net(g)

|

(90)

|

(139)

|

|

Net Cash Used in Financing Activities

|

(1,227)

|

(307)

|

|

Net Increase in Cash and Cash Equivalents

|

263

|

360

|

|

CASH AND CASH EQUIVALENTS

|

||

|

Cash and Cash Equivalents at Beginning of Period

|

1,029

|

669

|

|

Cash and Cash Equivalents at End of Period

|

$1,292

|

$1,029

|

See accompanying Notes to Consolidated Financial Statements on Page 6.

5

CSX Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

|

a)

|

Fiscal year: CSX follows a 52/53 week fiscal reporting calendar. The fourth quarter of 2010 includes an extra week, making the fourth quarter 14 weeks and the year 53 weeks.

|

|

b)

|

Rail grinding: As previously disclosed, certain prior year amounts have been adjusted for the retrospective change in accounting policy for rail grinding. See page 12 for effects of the adjustments.

|

|

c)

|

Other Income – Net: Miscellaneous expense for the fourth quarter of 2010 included higher than normal equity losses related to non-operating subsidiaries. Other income – net consisted of the following:

|

|

Quarters Ended

|

Years Ended

|

||||||

|

Dec. 31,

|

Dec. 25,

|

Dec. 31,

|

Dec. 25,

|

||||

|

(Dollars in Millions)

|

2010

|

2009

|

$ Change

|

2010

|

2009

|

$ Change

|

|

|

Interest Income

|

$2

|

$2

|

$-

|

$6

|

$11

|

$(5)

|

|

|

Income from Real Estate Operations

|

10

|

13

|

(3)

|

30

|

31

|

(1)

|

|

|

Miscellaneous Income (Expense)

|

(8)

|

-

|

(8)

|

(4)

|

(8)

|

4

|

|

|

Total Other Income - Net

|

$4

|

$15

|

$(11)

|

$32

|

$34

|

$(2)

|

|

|

d)

|

Income Tax Expense: In the fourth quarter of 2010, CSX recognized net tax expense of $5 million primarily related to state tax expense that was partially offset by a tax benefit from newly enacted federal income tax legislation. In the fourth quarter of 2009, CSX recognized a tax benefit of $15 million, primarily related to a change in the apportionment of state taxes and this benefit was not repeated in 2010.

|

|

e)

|

Discontinued Operations: In 2009, CSX sold the stock of a subsidiary that indirectly owned Greenbrier Hotel Corporation, owner of The Greenbrier resort. A gain on this transaction, as well as losses from operations, is shown in this net earnings amount. Because of the sale, these amounts are reported as discontinued operations in the Company’s consolidated income statements.

|

|

f)

|

Shares Repurchased: During the fourth quarter of 2010, CSX repurchased approximately 5.6 million shares for $347 million under the Company’s previously announced share repurchase program. During fiscal year 2010, CSX repurchased 26.7 million shares for $1.45 billion.

|

|

g)

|

Property Additions and Other Financing Activities: In addition to 2009 property additions of $1,427 million shown in investing activities, capital expenditures for 2009 included purchases of new assets using seller financing of approximately $160 million, for which payments are included in other financing activities on the consolidated cash flow statements. There were none in 2010.

|

6

|

VOLUME AND REVENUE (Unaudited)

|

||||||||||||||

|

Volume (Thousands of Units); Revenue (Dollars in Millions); Revenue Per Unit (Dollars)

|

||||||||||||||

|

REPORTED GAAP(a) (includes extra week in 2010)

|

||||||||||||||

|

Quarters Ended December 31, 2010 (14 weeks) and December 25, 2009 (13 weeks)

|

||||||||||||||

|

Volume

|

Revenue

|

Revenue Per Unit

|

||||||||||||

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

||||||

|

Agricultural

|

||||||||||||||

|

Agricultural Products

|

121

|

112

|

8

|

%

|

$288

|

$255

|

13

|

%

|

$2,380

|

$2,277

|

5

|

%

|

||

|

Phosphates and Fertilizers

|

76

|

78

|

(3)

|

126

|

98

|

29

|

1,658

|

1,256

|

32

|

|||||

|

Food and Consumer

|

26

|

24

|

8

|

65

|

57

|

14

|

2,500

|

2,375

|

5

|

|||||

|

Industrial

|

||||||||||||||

|

Chemicals

|

117

|

104

|

13

|

383

|

319

|

20

|

3,274

|

3,067

|

7

|

|||||

|

Automotive

|

96

|

78

|

23

|

230

|

176

|

31

|

2,396

|

2,256

|

6

|

|||||

|

Metals

|

60

|

52

|

15

|

127

|

104

|

22

|

2,117

|

2,000

|

6

|

|||||

|

Housing and Construction

|

||||||||||||||

|

Emerging Markets

|

107

|

99

|

8

|

155

|

145

|

7

|

1,449

|

1,465

|

(1)

|

|||||

|

Forest Products

|

70

|

62

|

13

|

160

|

134

|

19

|

2,286

|

2,161

|

6

|

|||||

|

Total Merchandise

|

673

|

609

|

11

|

1,534

|

1,288

|

19

|

2,279

|

2,115

|

8

|

|||||

|

Coal

|

407

|

365

|

12

|

861

|

641

|

34

|

2,115

|

1,756

|

20

|

|||||

|

Intermodal(b)

|

611

|

524

|

17

|

350

|

333

|

5

|

573

|

635

|

(10)

|

|||||

|

Other

|

-

|

-

|

-

|

71

|

58

|

22

|

-

|

-

|

-

|

|||||

|

Total

|

1,691

|

1,498

|

13

|

%

|

$2,816

|

$2,320

|

21

|

%

|

$1,665

|

$1,549

|

7

|

%

|

||

|

Years Ended December 31, 2010 (53 weeks) and December 25, 2009 (52 weeks)

|

||||||||||||||

|

Volume

|

Revenue

|

Revenue Per Unit

|

||||||||||||

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

||||||

|

Agricultural

|

||||||||||||||

|

Agricultural Products

|

446

|

428

|

4

|

%

|

$1,056

|

$960

|

10

|

%

|

$2,368

|

$2,243

|

6

|

%

|

||

|

Phosphates and Fertilizers

|

313

|

289

|

8

|

465

|

373

|

25

|

1,486

|

1,291

|

15

|

|||||

|

Food and Consumer

|

102

|

100

|

2

|

245

|

233

|

5

|

2,402

|

2,330

|

3

|

|||||

|

Industrial

|

||||||||||||||

|

Chemicals

|

461

|

424

|

9

|

1,485

|

1,267

|

17

|

3,221

|

2,988

|

8

|

|||||

|

Automotive

|

340

|

234

|

45

|

800

|

511

|

57

|

2,353

|

2,184

|

8

|

|||||

|

Metals

|

243

|

200

|

22

|

520

|

399

|

30

|

2,140

|

1,995

|

7

|

|||||

|

Housing and Construction

|

||||||||||||||

|

Emerging Markets

|

418

|

405

|

3

|

615

|

585

|

5

|

1,471

|

1,444

|

2

|

|||||

|

Forest Products

|

265

|

258

|

3

|

600

|

547

|

10

|

2,264

|

2,120

|

7

|

|||||

|

Total Merchandise

|

2,588

|

2,338

|

11

|

5,786

|

4,875

|

19

|

2,236

|

2,085

|

7

|

|||||

|

Coal

|

1,573

|

1,553

|

1

|

3,267

|

2,727

|

20

|

2,077

|

1,756

|

18

|

|||||

|

Intermodal(b)

|

2,223

|

1,902

|

17

|

1,291

|

1,184

|

9

|

581

|

623

|

(7)

|

|||||

|

Other

|

-

|

-

|

-

|

292

|

255

|

15

|

-

|

-

|

-

|

|||||

|

Total

|

6,384

|

5,793

|

10

|

%

|

$10,636

|

$9,041

|

18

|

%

|

$1,666

|

$1,561

|

7

|

%

|

||

(a) GAAP represents generally accepted accounting principles.

(b) The revenue-per-unit decline was primarily driven by the continued impact of terminating the prior interline agreement. See the explanation for intermodal variances for further information.

7

|

CSX Corporation

|

||||||||||||||

|

VOLUME AND REVENUE (Unaudited)

|

||||||||||||||

|

Volume (Thousands of Units); Revenue (Dollars in Millions); Revenue Per Unit (Dollars)

|

||||||||||||||

|

COMPARABLE NON-GAAP (excludes extra week in 2010)(a)

|

||||||||||||||

|

Quarters Ended December 24, 2010 (13 weeks) and December 25, 2009 (13 weeks)

|

||||||||||||||

|

Volume

|

Revenue

|

Revenue Per Unit

|

||||||||||||

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

||||||

|

Agricultural

|

||||||||||||||

|

Agricultural Products

|

113

|

112

|

1

|

%

|

$269

|

$255

|

5

|

%

|

$2,381

|

$2,277

|

5

|

%

|

||

|

Phosphates and Fertilizers

|

71

|

78

|

(9)

|

116

|

98

|

18

|

1,634

|

1,256

|

30

|

|||||

|

Food and Consumer

|

24

|

24

|

-

|

62

|

57

|

9

|

2,583

|

2,375

|

9

|

|||||

|

Industrial

|

||||||||||||||

|

Chemicals

|

109

|

104

|

5

|

357

|

319

|

12

|

3,275

|

3,067

|

7

|

|||||

|

Automotive

|

92

|

78

|

18

|

220

|

176

|

25

|

2,391

|

2,256

|

6

|

|||||

|

Metals

|

56

|

52

|

8

|

118

|

104

|

13

|

2,107

|

2,000

|

5

|

|||||

|

Housing and Construction

|

||||||||||||||

|

Emerging Markets

|

103

|

99

|

4

|

149

|

145

|

3

|

1,447

|

1,465

|

(1)

|

|||||

|

Forest Products

|

65

|

62

|

5

|

148

|

134

|

10

|

2,277

|

2,161

|

5

|

|||||

|

Total Merchandise

|

633

|

609

|

4

|

1,439

|

1,288

|

12

|

2,273

|

2,115

|

7

|

|||||

|

Coal

|

384

|

365

|

5

|

807

|

641

|

26

|

2,102

|

1,756

|

20

|

|||||

|

Intermodal(b)

|

581

|

524

|

11

|

331

|

333

|

(1)

|

570

|

635

|

(10)

|

|||||

|

Other

|

-

|

-

|

-

|

68

|

58

|

17

|

-

|

-

|

-

|

|||||

|

Total

|

1,598

|

1,498

|

7

|

%

|

$2,645

|

$2,320

|

14

|

%

|

$1,655

|

$1,549

|

7

|

%

|

||

|

Years Ended December 24, 2010 (52 weeks) and December 25, 2009 (52 weeks)

|

||||||||||||||

|

Volume

|

Revenue

|

Revenue Per Unit

|

||||||||||||

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

||||||

|

Agricultural

|

||||||||||||||

|

Agricultural Products

|

438

|

428

|

2

|

%

|

$1,037

|

$960

|

8

|

%

|

$2,368

|

$2,243

|

6

|

%

|

||

|

Phosphates and Fertilizers

|

308

|

289

|

7

|

455

|

373

|

22

|

1,477

|

1,291

|

14

|

|||||

|

Food and Consumer

|

100

|

100

|

-

|

242

|

233

|

4

|

2,420

|

2,330

|

4

|

|||||

|

Industrial

|

||||||||||||||

|

Chemicals

|

453

|

424

|

7

|

1,459

|

1,267

|

15

|

3,221

|

2,988

|

8

|

|||||

|

Automotive

|

336

|

234

|

44

|

790

|

511

|

55

|

2,351

|

2,184

|

8

|

|||||

|

Metals

|

239

|

200

|

20

|

511

|

399

|

28

|

2,138

|

1,995

|

7

|

|||||

|

Housing and Construction

|

||||||||||||||

|

Emerging Markets

|

414

|

405

|

2

|

609

|

585

|

4

|

1,471

|

1,444

|

2

|

|||||

|

Forest Products

|

260

|

258

|

1

|

588

|

547

|

7

|

2,262

|

2,120

|

7

|

|||||

|

Total Merchandise

|

2,548

|

2,338

|

9

|

5,691

|

4,875

|

17

|

2,234

|

2,085

|

7

|

|||||

|

Coal

|

1,550

|

1,553

|

-

|

3,213

|

2,727

|

18

|

2,073

|

1,756

|

18

|

|||||

|

Intermodal(b)

|

2,193

|

1,902

|

15

|

1,272

|

1,184

|

7

|

580

|

623

|

(7)

|

|||||

|

Other

|

-

|

-

|

-

|

289

|

255

|

13

|

-

|

-

|

-

|

|||||

|

Total

|

6,291

|

5,793

|

9

|

%

|

$10,465

|

$9,041

|

16

|

%

|

$1,663

|

$1,561

|

7

|

%

|

||

(a) CSX reports its financial results in accordance with generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP financial measures used to manage the company’s business that fall within the meaning of Regulation G (Disclosure of Non-GAAP Financial Measures) by the SEC may provide users of the financial information with additional meaningful comparisons to prior reported results. In an effort to provide financial statement users with comparable information and because revenue can be systematically calculated on a weekly basis, CSX has provided financial information adjusted for the extra week, which are non-GAAP financial measures. Likewise, this information facilitates comparisons to financial results that are directly associated with ongoing business operations as well as provides comparable historical information. These non-GAAP measures should not be considered a substitute for GAAP measures.

(b) The revenue-per-unit decline was primarily driven by the continued impact of terminating the prior interline agreement. See the explanation for intermodal variances for further information.

8

CSX Corporation

VOLUME AND REVENUE

(Comparable Non-GAAP)

CSX follows a 52/53 week fiscal reporting calendar. The fourth quarter of 2010 includes an extra week, making the fourth quarter 14 weeks and the year 53 weeks. In the following discussion of quarterly comparisons, the comparable 13 week periods outlined in the table on previous page are compared.

CSX fourth quarter results reflect continued strong year-over-year volume and revenue growth as a result of the improving economy. The greatest volume increases occurred in the automotive, metals and intermodal markets. Ongoing emphasis on pricing above rail inflation, along with higher fuel recovery associated with the increase in fuel prices drove revenue-per-unit increases in most markets.

Merchandise

Agricultural

Agricultural Products – Volume was relatively flat with increased shipments of feed grains and ethanol offset by weakness in export feed ingredients.

Phosphates and Fertilizers – While demand was strong for domestic fertilizers resulting in significant revenue growth, volumes declined from the temporary loss of short haul phosphate moves within Florida.

Food and Consumer – Volume was flat as strength in refrigerated products and alcoholic beverages was offset by weakness in canned goods and appliances.

|

|

Industrial

|

Chemicals – Growth occurred across most markets reflecting improvement in demand for intermediate products used in manufacturing automobiles and consumer goods.

Automotive – Strong growth was due to an increase in North American light-vehicle production driven by higher sales.

Metals – Volume growth was driven by increased shipments of sheet steel for auto production and increases in scrap steel resulting from higher steel production.

|

|

Housing and Construction

|

Emerging Markets – Volume and revenue gains were driven by increased shipments of minerals and waste as a result of overall market growth due to the improving economy.

Forest Products – Volume increased despite the weakness in construction related markets with strength in shipments of pulp board and paper used in packaging for consumer products.

Coal

Growth was driven by higher export shipments due to greater demand for U.S. metallurgical coal, and by higher shipments to utility customers as stockpiles approach more normal levels. The increase in revenue per unit was driven by improved yield, higher fuel recovery and positive mix. Additionally, the fourth quarter of 2010 was negatively impacted by weather during the last month. In 2011, CSX expects to ship approximately 35 to 40 million tons of export coal.

Intermodal

Volume strength was primarily driven by the stronger U.S. economy and new international gains as a result of the intermodal portfolio of service and network offerings. The revenue and revenue-per-unit decline was driven by the continued impact of terminating the prior interline agreement and was partially offset by increased fuel recovery and an improved pricing environment.

Other

|

|

Revenue gains were primarily driven by benefits for contract volume commitments not met.

|

9

CSX Corporation

EXPENSE

Expenses increased $229 million from last year’s fourth quarter, including increases related to the extra week in fourth quarter 2010. Significant variances are described below.

Labor and Fringe expense increased $116 million. This increase was primarily driven by incremental volume, inflation, and higher incentive compensation.

Materials, Supplies and Other expense decreased $21 million due to several items:

|

·

|

Inland transportation expense reductions of $45 million were related to continued impact of terminating the prior intermodal interline agreement.

|

|

·

|

Inflation and other volume-related expenses were higher during the quarter.

|

|

·

|

As safety and occupational claim trends have continued to improve, benefits were taken in both years’ fourth quarters - $40 million in 2010 and $20 million in 2009. This resulted in a year-over-year decrease in expense of $20 million.

|

Fuel expense increased $96 million primarily due to higher prices and higher volume.

Depreciation expense increased $31 million due to a larger asset base related to higher capital spending and an additional week of expense due to the extra week.

Equipment and Other Rents expense increased $7 million primarily due to higher volume.

|

FUEL STATISTICS

|

|||||||

|

Quarters Ended

|

Years Ended

|

||||||

|

Dec. 31,

|

Dec. 25,

|

Dec. 31,

|

Dec. 25,

|

||||

|

2010

|

2009

|

Change

|

2010

|

2009

|

Change

|

||

|

Estimated Locomotive Fuel Consumption (Millions of gallons)

|

131.7

|

112.2

|

(19.5)

|

489.6

|

445.7

|

(43.9)

|

|

|

Price Per Gallon (Dollars)

|

$2.42

|

$2.03

|

$(0.39)

|

$2.26

|

$1.71

|

$(0.55)

|

|

|

Total Locomotive Fuel Expense (Dollars in millions)

|

$319

|

$228

|

$(91)

|

$1,106

|

$762

|

$(344)

|

|

|

Total Non-Locomotive Fuel Expense (Dollars in millions)

|

27

|

22

|

(5)

|

106

|

87

|

(19)

|

|

|

Total Fuel Expense (Dollars in millions)

|

$346

|

$250

|

$(96)

|

$1,212

|

$849

|

$(363)

|

|

|

EMPLOYEE COUNTS (Estimated)

|

|||||

|

2010

|

2009

|

Change

|

|||

|

October

|

30,131

|

29,567

|

564

|

||

|

November

|

30,134

|

29,375

|

759

|

||

|

December

|

29,985

|

29,308

|

677

|

||

|

Average

|

30,083

|

29,417

|

667

|

||

10

|

OPERATING STATISTICS (Estimated)(a)

|

|||||||||

|

Quarters Ended

|

Years Ended

|

||||||||

|

Dec. 31,

|

Dec. 25,

|

Improvement

|

Dec. 31,

|

Dec. 25,

|

Improvement

|

||||

|

Coal (Millions of Tons)

|

2010

|

2009

|

(Decline) %

|

2010

|

2009

|

(Decline) %

|

|||

|

Domestic

|

|||||||||

|

Utility

|

31.1

|

28.8

|

8

|

%

|

121.6

|

129.8

|

(6)

|

%

|

|

|

Other

|

4.0

|

3.9

|

3

|

14.7

|

13.5

|

9

|

|||

|

Total Domestic

|

35.1

|

32.7

|

7

|

136.3

|

143.3

|

(5)

|

|||

|

Export

|

8.2

|

6.1

|

34

|

30.1

|

22.5

|

34

|

|||

|

Coke and Iron Ore

|

2.0

|

1.7

|

18

|

8.0

|

5.8

|

38

|

|||

|

Total Coal

|

45.3

|

40.5

|

12

|

%

|

174.4

|

171.6

|

2

|

%

|

|

|

Revenue Ton-Miles (Billions)(b)

|

|||||||||

|

Merchandise

|

34.0

|

29.5

|

15

|

%

|

129.2

|

116.9

|

11

|

%

|

|

|

Coal

|

20.1

|

17.1

|

18

|

79.4

|

75.2

|

6

|

|||

|

Intermodal

|

5.6

|

4.7

|

19

|

20.4

|

17.3

|

18

|

|||

|

Total

|

59.7

|

51.3

|

16

|

%

|

229.0

|

209.4

|

9

|

%

|

|

|

Gross Ton-Miles (Billions)

|

|||||||||

|

Total Gross Ton-Miles

|

110.0

|

95.4

|

15

|

%

|

419.8

|

381.5

|

10

|

%

|

|

|

(Excludes locomotive gross ton-miles)

|

|||||||||

|

Safety and Service Measurements

|

|||||||||

|

FRA Personal Injury Frequency Index

|

0.99

|

0.99

|

-

|

%

|

1.00

|

1.20

|

17

|

%

|

|

|

Number of FRA-reportable injuries per 200,000 man-hours

|

|||||||||

|

FRA Train Accident Rate

|

2.23

|

2.84

|

21

|

%

|

2.68

|

2.94

|

9

|

%

|

|

|

Number of FRA-reportable train accidents per million train miles

|

|||||||||

|

On-Time Train Originations

|

75%

|

79%

|

(5)

|

%

|

75%

|

81%

|

(7)

|

%

|

|

|

On-Time Destination Arrivals

|

70%

|

79%

|

(11)

|

%

|

69%

|

80%

|

(14)

|

%

|

|

|

Dwell (Hours)

|

25.5

|

24.3

|

(5)

|

%

|

25.0

|

24.1

|

(4)

|

%

|

|

|

Cars-On-Line

|

208,944

|

211,975

|

1

|

%

|

210,984

|

216,013

|

2

|

%

|

|

|

Train Velocity (Miles per hour)

|

21.3

|

22.0

|

(3)

|

%

|

21.0

|

21.8

|

(4)

|

%

|

|

|

Resources

|

Decrease %

|

||||||||

|

Route Miles

|

21,084

|

21,190

|

(1)

|

%

|

|||||

|

Locomotives (Owned and long-term leased)

|

4,072

|

4,071

|

-

|

%

|

|||||

|

Freight Cars (Owned and long-term leased)

|

80,302

|

84,282

|

(5)

|

%

|

|||||

|

(a)

|

CSX follows a 52/53 week fiscal reporting calendar. The fourth quarter of 2010 includes an extra week, making the fourth quarter 14 weeks and the year 53 weeks.

|

|

(b)

|

Prior periods have been reclassified to conform to current presentation.

|

11

CSX Corporation

RAIL GRINDING PRIOR PERIOD INFORMATION

Effective in the second quarter of 2010, CSX changed the accounting policy for rail grinding costs from a capitalization method, under which the cost of rail grinding was capitalized and then depreciated, to a direct expense method, under which rail grinding costs are expensed as incurred. This represents a change from an acceptable method under generally accepted accounting principles to a preferable method, and is consistent with recent changes in industry practice. The effects of this change are not material to the financial condition, results of operations, or liquidity for any of the periods presented. All previous periods have been adjusted to reflect this change. For further details, see CSX’s 2010 Annual Report on Form 10-K, which is required to be filed by March 1, 2011.

|

2009 Impact of Retrospective Change in Accounting Policy for Rail Grinding (unaudited)

|

|||||||

|

Quarter Ended December 25, 2009

|

Year Ended December 25, 2009

|

||||||

|

Consolidated Income Statement

|

As Previously Reported

|

Impact of Adjustment

|

As Adjusted

|

As Previously Reported

|

Impact of Adjustment

|

As Adjusted

|

|

|

(Dollars in Millions, Except Per Share Amounts)

|

|||||||

|

Materials, Supplies and Other

|

$512

|

$5

|

$517

|

$1,979

|

$20

|

$1,999

|

|

|

Depreciation

|

227

|

(1)

|

226

|

908

|

(5)

|

903

|

|

|

Total Expense

|

1,737

|

4

|

1,741

|

6,756

|

15

|

6,771

|

|

|

Operating Income

|

583

|

(4)

|

579

|

2,285

|

(15)

|

2,270

|

|

|

Earnings from Continuing Operations Before Taxes

|

460

|

(4)

|

456

|

1,761

|

(15)

|

1,746

|

|

|

Income Tax Expense

|

(155)

|

2

|

(153)

|

(624)

|

6

|

(618)

|

|

|

Earnings from Continuing Operations

|

305

|

(2)

|

303

|

1,137

|

(9)

|

1,128

|

|

|

Net Earnings

|

305

|

(2)

|

303

|

1,152

|

(9)

|

1,143

|

|

|

Net Earnings per Share, Assuming Dilution

|

|||||||

|

Continuing Operations

|

$0.77

|

$-

|

$0.77

|

$2.87

|

$(0.02)

|

$2.85

|

|

|

Net Earnings

|

$0.77

|

$-

|

$0.77

|

$2.91

|

$(0.02)

|

$2.89

|

|

|

December 25, 2009

|

|||||||

|

Consolidated Balance Sheet

|

As Previously Reported

|

Impact of Adjustment

|

As Adjusted

|

||||

|

(Dollars in Millions)

|

|||||||

|

Properties - Net

|

23,213

|

(149)

|

23,064

|

||||

|

Deferred Income Taxes

|

6,585

|

(57)

|

6,528

|

||||

|

Retained Earnings

|

9,182

|

(92)

|

9,090

|

||||

|

Year Ended December 25, 2009

|

|||||||

|

Consolidated Cash Flow Statement

|

As Previously Reported

|

Impact of Adjustment

|

As Adjusted

|

||||

|

(Dollars in Millions)

|

|||||||

|

Net Earnings

|

$1,152

|

$(9)

|

$1,143

|

||||

|

Depreciation

|

908

|

(5)

|

903

|

||||

|

Deferred Income Taxes

|

436

|

(6)

|

430

|

||||

|

Net Cash Provided by Operating Activities

|

2,060

|

(20)

|

2,040

|

||||

|

Property Additions

|

(1,447)

|

20

|

(1,427)

|

||||

|

Net Cash Used in Investing Activities

|

(1,393)

|

20

|

(1,373)

|

||||

12

13