Attached files

| file | filename |

|---|---|

| 8-K - MAGNUM HUNTER RESOURCES CORP FORM 8-K - MAGNUM HUNTER RESOURCES CORP | mhr_8k-011911.htm |

| EX-99.1 - PRESS RELEASE - MAGNUM HUNTER RESOURCES CORP | mhr_8k-ex9901.htm |

Exhibit 99.2

NuLoch Resources, Inc. Acquisition

Public Company (TSX-V: NLR) (OTCQX: NULCF)

Public Company (TSX-V: NLR) (OTCQX: NULCF)

1

|

Reserves(i)

|

Ø Estimated proved reserves of 5.9 MMBoe as of December 31, 2010

(85% crude oil and 35% PDP) Ø Estimated probable reserves of 3.3 MMBoe as of December 31, 2010

Ø Long-lived reserves with an R/P ratio of 10.4 years

|

|

Production

|

Ø Current corporate productive capacity of approximately 1,550 Boe/d

Ø 85% crude oil; 69% from the Williston Basin

Ø 13.6 net Bakken/Three Forks Sanish producing wells

|

|

Acreage

|

Ø 71,600 net acres in the Williston Basin (32,900 in Divide and Burke

Counties) Ø 50,680 net acres located in Alberta

|

|

Drilling

Opportunities |

Ø Multi-year inventory of approximately 267 net identified Williston Basin

drilling locations Ø Drilling locations targeting the Bakken/Three Forks Sanish

|

Ø On January 19, 2011, Magnum Hunter announced that it entered into a definitive

agreement to acquire Williston Basin focused NuLoch Resources, Inc. in an all

common stock transaction valued at approximately $327 million (USD).

agreement to acquire Williston Basin focused NuLoch Resources, Inc. in an all

common stock transaction valued at approximately $327 million (USD).

(i) NuLoch Resources, Inc. internal estimates as of 12/31/2010

NuLoch - Areas of Operation

2

Williston Basin Properties:

Ø 267 net unrisked drilling locations

Ø Net productive capacity of 1,070

Boe/d

Boe/d

Ø Divide & Burke County:

• 32,900 net acres

• Bakken/Three Forks Sanish

Potential

Potential

Ø Saskatchewan:

• 38,700 net acres

• Three Forks Sanish Potential

Alberta Properties:

Ø 50,680 net acres

Ø Net daily production of 480 Boe/d

(53% light crude oil)

(53% light crude oil)

Central Alberta

(Non-Core)

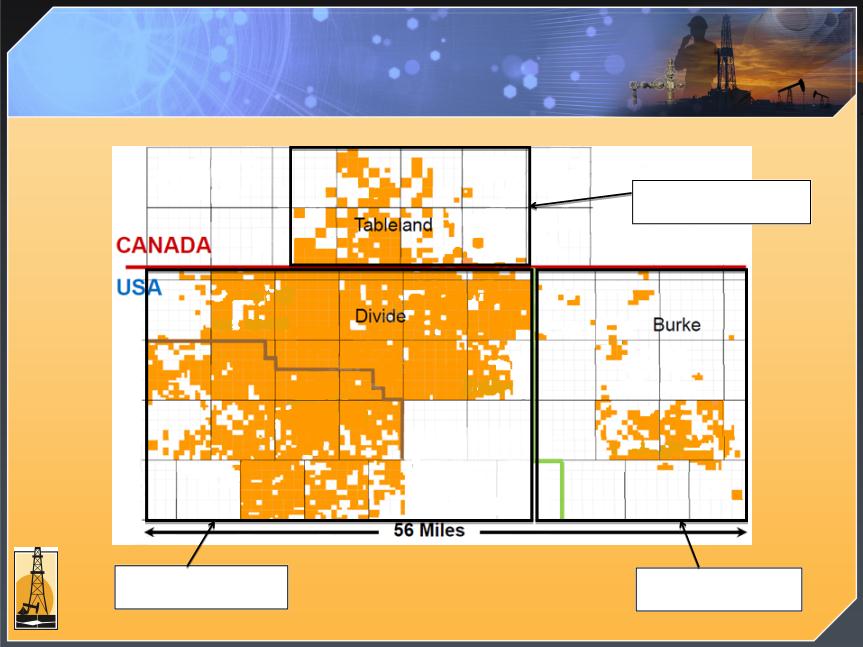

NuLoch - Williston Basin Acreage Map

3

72% Avg. NRI

38,700 net acres

23% Avg. NRI

6,700 net acres

9.5% Avg. NRI

24,500 net acres

Summary Terms of NuLoch Acquisition

4

Total transaction value of approximately $327 million

Ø Magnum Hunter has agreed to acquire NuLoch for $2.50 (Canadian) per share with a fixed

exchange ratio of 0.3304, which was based on the seven-day volume weighted average price of

Magnum Hunter’s common stock as of January 18, 2011, of $7.63 per share

exchange ratio of 0.3304, which was based on the seven-day volume weighted average price of

Magnum Hunter’s common stock as of January 18, 2011, of $7.63 per share

Ø Magnum Hunter will issue approximately 42.8 million new common shares to NuLoch common

shareholders, representing approximately 32% of Magnum Hunter’s current fully diluted

common shares outstanding, assuming final close of the NGAS Resources (“NGAS”) acquisition

announced by the Company on December 27, 2010

shareholders, representing approximately 32% of Magnum Hunter’s current fully diluted

common shares outstanding, assuming final close of the NGAS Resources (“NGAS”) acquisition

announced by the Company on December 27, 2010

Ø As of December 31, 2010, NuLoch had no outstanding long term debt

Ø Magnum Hunter has received a commitment for a new $250 million senior credit facility with an

initial borrowing base of $145 million secured by the Company’s existing asset base, including the

assets being acquired from NGAS and NuLoch; BMO Capital Markets will syndicate the new bank

facility

initial borrowing base of $145 million secured by the Company’s existing asset base, including the

assets being acquired from NGAS and NuLoch; BMO Capital Markets will syndicate the new bank

facility

Ø The transaction is expected to close on or before April 30, 2011

Transaction Highlights

5

Ø Seasoned professional management team with long histories in creating substantial shareholder

value

value

Ø Strategically focused on developing large in-place light oil resource plays in the Williston Basin

Ø Multi-year inventory of approximately 267 net identified Williston Basin drilling locations

targeting the Bakken and Three Forks Sanish formations

targeting the Bakken and Three Forks Sanish formations

Ø Adds significant scale to Magnum Hunter’s existing Bakken/Three Forks Sanish position

Ø Joint Venture arrangements with leading operators in North Dakota include:

§ Samson

§ Baytex Energy

Ø Transitioning from acreage accumulation to exploitation and development

Ø Estimated risked reserve potential of 31.4 MMBoe

Ø Initial 30-day production rates (“IP rate”) in the 180 to 450 Boe per day range with estimated

ultimate recoveries (“EUR’s”) in the 185 to 475 MBoe range per well

ultimate recoveries (“EUR’s”) in the 185 to 475 MBoe range per well

NuLoch - Capital Expenditure Schedule

6

2010 CAPEX

$63.1 MM

2011E CAPEX

$80.3 MM

Saskatchewan

$32.0

Saskatchewan

$43.3

North Dakota

$35.5

North Dakota

$29.6

Other $1.5

Other $1.5

($ in millions)

Note: The Saskatchewan CAPEX is discretionary due to being 100% operated

MHR Pro Forma

7

Ø $1 Billion Market Capitalization

Ø Debt-to-Total Capitalization less than 20%

Ø Current daily production in excess of 6,000 boe/d (approximately 55% oil / liquids)

Ø Total Proved Reserves of approximately 32 MMBoe

Ø Significant land positions in three of the top five unconventional resource plays

§ Bakken, Marcellus, and Eagle Ford

Ø Over 547,000 net acres

§ Eagle Ford: 23,704 net acres

§ Appalachia: 394,795 net acres (includes 50,652 net Marcellus acres)

§ Williston Basin/Bakken: 78,050 net acres

§ Other: 51,423 net acres (includes 50,680 net Alberta acres)

Ø Identified inventory of over 500 drilling locations

Upon completion of the NGAS and NuLoch acquisitions, Magnum Hunter

will have the following:

will have the following:

9

Forward Looking Statements - NuLoch

12/22/10

Except for historical information contained herein, the statements in this presentation are forward looking and made pursuant to

the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and may involve a number of risks and

uncertainties. Forward-looking statements are based on information available to management at the time, and such forward-

looking statements involve judgments. Such forward-looking statements include, but are not limited to, statements regarding the

expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction considering the

various closing conditions; the benefits of such transaction and its impact on the Company’s business; and any statements of

assumptions underlying any of the foregoing. In addition, if and when the proposed transaction is consummated, there will be

risks and uncertainties related to the Company’s ability to successfully integrate the operations and employees of the Company

and NuLoch. Forward-looking statements include expressions such as “believe,” “anticipate,” “expect,” “estimate,” “intend,”

“may,” “plan,” “predict,” “will,” and similar terms and expressions. These forward-looking statements are made based on

expectations and beliefs concerning future events affecting the Company and are subject to various risks, uncertainties and

other factors relating to its operations and business environment, all of which are difficult to predict and many of which are

beyond management’s control, that could cause actual results to differ materially from estimated results expressed in or implied

by these forward-looking statements. Such risks and uncertainties include, but are not limited to, the risk to both companies that

the proposed transaction will not be consummated; failure to satisfy any of the conditions to the proposed transaction, such as

the inability to obtain the requisite approvals of NuLoch’s shareholders, the Company’s shareholders and the Court of Queen’s

Bench of Alberta with respect to the proposed transaction; adverse effects on the market prices of the companies’ common stock

and on operating results because of a failure to complete the proposed transaction; failure to realize the expected benefits of the

proposed transaction; negative effects of announcement or consummation of the proposed transaction on the market price of the

companies’ common stock; significant transaction costs and/or unknown liabilities; general economic and business conditions

that affect the companies following the proposed transaction; and other factors, all of which are described more fully in the

Company’s filings with the Securities and Exchange Commission (the “SEC”). Forward-looking statements made in this

presentation, or elsewhere, speak only as of the date on which the statements were made. New risks and uncertainties arise

from time to time, and it is impossible for management to predict these events or how they may affect the Company or

anticipated results. All forward-looking statements are qualified in their entirety by this cautionary statement. In light of these

risks and uncertainties, readers should keep in mind that any forward-looking statement made in this presentation may not occur.

The Company has no duty or obligation to, and does not intend to, update or otherwise revise any forward-looking statements,

whether as a result of new information, future events or other factors, except as may be required by law. Readers are cautioned

not to place undue reliance on forward-looking statements.

the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and may involve a number of risks and

uncertainties. Forward-looking statements are based on information available to management at the time, and such forward-

looking statements involve judgments. Such forward-looking statements include, but are not limited to, statements regarding the

expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction considering the

various closing conditions; the benefits of such transaction and its impact on the Company’s business; and any statements of

assumptions underlying any of the foregoing. In addition, if and when the proposed transaction is consummated, there will be

risks and uncertainties related to the Company’s ability to successfully integrate the operations and employees of the Company

and NuLoch. Forward-looking statements include expressions such as “believe,” “anticipate,” “expect,” “estimate,” “intend,”

“may,” “plan,” “predict,” “will,” and similar terms and expressions. These forward-looking statements are made based on

expectations and beliefs concerning future events affecting the Company and are subject to various risks, uncertainties and

other factors relating to its operations and business environment, all of which are difficult to predict and many of which are

beyond management’s control, that could cause actual results to differ materially from estimated results expressed in or implied

by these forward-looking statements. Such risks and uncertainties include, but are not limited to, the risk to both companies that

the proposed transaction will not be consummated; failure to satisfy any of the conditions to the proposed transaction, such as

the inability to obtain the requisite approvals of NuLoch’s shareholders, the Company’s shareholders and the Court of Queen’s

Bench of Alberta with respect to the proposed transaction; adverse effects on the market prices of the companies’ common stock

and on operating results because of a failure to complete the proposed transaction; failure to realize the expected benefits of the

proposed transaction; negative effects of announcement or consummation of the proposed transaction on the market price of the

companies’ common stock; significant transaction costs and/or unknown liabilities; general economic and business conditions

that affect the companies following the proposed transaction; and other factors, all of which are described more fully in the

Company’s filings with the Securities and Exchange Commission (the “SEC”). Forward-looking statements made in this

presentation, or elsewhere, speak only as of the date on which the statements were made. New risks and uncertainties arise

from time to time, and it is impossible for management to predict these events or how they may affect the Company or

anticipated results. All forward-looking statements are qualified in their entirety by this cautionary statement. In light of these

risks and uncertainties, readers should keep in mind that any forward-looking statement made in this presentation may not occur.

The Company has no duty or obligation to, and does not intend to, update or otherwise revise any forward-looking statements,

whether as a result of new information, future events or other factors, except as may be required by law. Readers are cautioned

not to place undue reliance on forward-looking statements.

Additional Information - NuLoch

10

In connection with the proposed transaction, the Company will file a preliminary proxy statement and definitive proxy statement

with the SEC. The information contained in the preliminary filing will not be complete and may be changed.

STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT WHEN IT BECOMES AVAILABLE AND

ANY OTHER RELEVANT MATERIALS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO.

with the SEC. The information contained in the preliminary filing will not be complete and may be changed.

STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT WHEN IT BECOMES AVAILABLE AND

ANY OTHER RELEVANT MATERIALS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO.

The definitive proxy statement will be mailed to the Company’s stockholders seeking their approval of the issuance of the MHR

Shares (including the MHR Shares issuable upon exchange of the Exchangeable Shares) as consideration for the proposed

transaction. The Company’s stockholders may also obtain a copy of the definitive proxy statement free of charge once it is

available by directing a request to: Magnum Hunter Resources Corporation at 832-369-6986 or 777 Post Oak Boulevard, Suite

650, Houston, Texas 77056 Attention: Investor Relations. In addition, the preliminary proxy statement, definitive proxy

statement and other relevant materials filed with the SEC will be available free of charge at the SEC’s website at www.sec.gov

or stockholders may access copies of such documentation filed with the SEC by the Company by visiting the Investors section

of the Company’s website at www.magnumhunterresources.com.

Shares (including the MHR Shares issuable upon exchange of the Exchangeable Shares) as consideration for the proposed

transaction. The Company’s stockholders may also obtain a copy of the definitive proxy statement free of charge once it is

available by directing a request to: Magnum Hunter Resources Corporation at 832-369-6986 or 777 Post Oak Boulevard, Suite

650, Houston, Texas 77056 Attention: Investor Relations. In addition, the preliminary proxy statement, definitive proxy

statement and other relevant materials filed with the SEC will be available free of charge at the SEC’s website at www.sec.gov

or stockholders may access copies of such documentation filed with the SEC by the Company by visiting the Investors section

of the Company’s website at www.magnumhunterresources.com.

Participants in the Solicitation

The Company and its respective directors, executive officers and other members of management and employees, under SEC

rules, may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information

regarding the names, affiliations and interests of certain of the Company’s executive officers and directors in the solicitation is

available in the proxy statement for the Company’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on

September 3, 2010.

rules, may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information

regarding the names, affiliations and interests of certain of the Company’s executive officers and directors in the solicitation is

available in the proxy statement for the Company’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on

September 3, 2010.

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there by any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. The MHR Shares and Exchangeable Shares to be issued in the proposed

transaction in exchange for NuLoch Shares have not been and will not be registered under the Securities Act of 1933, as

amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable

exemption from registration requirements. The Company intends to issue such shares pursuant to the exemption from

registration set forth in Section 3(a)(10) of the Securities Act. The Arrangement Agreement contemplates that the issuance of

the MHR Shares upon exchange of the Exchangeable Shares will be registered under the Securities Act.

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. The MHR Shares and Exchangeable Shares to be issued in the proposed

transaction in exchange for NuLoch Shares have not been and will not be registered under the Securities Act of 1933, as

amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable

exemption from registration requirements. The Company intends to issue such shares pursuant to the exemption from

registration set forth in Section 3(a)(10) of the Securities Act. The Arrangement Agreement contemplates that the issuance of

the MHR Shares upon exchange of the Exchangeable Shares will be registered under the Securities Act.