Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COMERICA INC /NEW/ | d8k.htm |

| EX-99.1 - PRESS RELEASE - COMERICA INC /NEW/ | dex991.htm |

Fourth Quarter 2010 Financial Review

January 18, 2011

Comerica Incorporated

Exhibit 99.2 |

2

Safe Harbor Statement

Any statements in this presentation that are not historical facts are forward-looking statements

as defined in the Private Securities Litigation Reform Act of 1995. Words such as

"anticipates," "believes," "feels," "expects," "estimates," "seeks," "strives," "plans," "intends," "outlook," "forecast," "position,"

"target," "mission," "assume," "achievable," "potential,"

"strategy," "goal," "aspiration," "outcome," "continue," "remain," "maintain," "trend," "objective" and

variations of such words and similar expressions, or future or conditional verbs such as

"will," "would," "should," "could," "might," "can," "may" or similar

expressions, as they relate to Comerica or its management, are intended to identify

forward-looking statements. These forward-looking statements are predicated on the

beliefs and assumptions of Comerica’s management based on information known to Comerica’s management as of the date of this

news release and do not purport to speak as of any other date. Forward-looking statements may

include descriptions of plans and objectives of Comerica’s management for future or past

operations, products or services, and forecasts of Comerica’s revenue, earnings or other measures of

economic performance, including statements of profitability, business segments and subsidiaries,

estimates of credit trends and global stability. Such statements reflect the view of

Comerica’s management as of this date with respect to future events and are subject to risks and uncertainties. Should one

or more of these risks materialize or should underlying beliefs or assumptions prove incorrect,

Comerica’s actual results could differ materially from those discussed. Factors that

could cause or contribute to such differences are further economic downturns, changes in the pace of an economic recovery and

related changes in employment levels, changes in real estate values, fuel prices, energy costs or

other events that could affect customer income levels or general economic conditions, the

effects of recently enacted legislation, actions taken by or proposed by the U.S. Department of Treasury, the Board of

Governors of the Federal Reserve System, the Texas Department of Banking and the Federal Deposit

Insurance Corporation, legislation or regulations enacted in the future, and the impact and

expiration of such legislation and regulatory actions, the effects of war and other armed conflicts or acts of

terrorism, the effects of natural disasters including, but not limited to, hurricanes, tornadoes,

earthquakes, fires, droughts and floods, the disruption of private or public utilities,

the implementation of Comerica’s strategies and business models, management’s ability to maintain and expand customer

relationships, changes in customer borrowing, repayment, investment and deposit practices,

management’s ability to retain key officers and employees, changes in the accounting

treatment of any particular item, the impact of regulatory examinations, declines or other changes in the businesses or

industries in which Comerica has a concentration of loans, including, but not limited to, the

automotive production industry and the real estate business lines, the anticipated performance

of any new banking centers, the entry of new competitors in Comerica’s markets, changes in the level of fee income,

changes in applicable laws and regulations, including those concerning taxes, banking, securities and

insurance, changes in trade, monetary and fiscal policies, including the interest rate policies

of the Board of Governors of the Federal Reserve System, fluctuations in inflation or interest rates, changes in

general economic, political or industry conditions and related credit and market conditions, the

interdependence of financial service companies and adverse conditions in the stock market.

Comerica cautions that the foregoing list of factors is not exclusive. For discussion of factors that may cause

actual results to differ from expectations, please refer to our filings with the Securities and

Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning

on page 11 of Comerica’s Annual Report on Form 10-K for the year ended December 31, 2009, “Item 1A. Risk Factors”

beginning on page 67 of Comerica’s Quarterly Report on Form 10-Q for the quarter ended March

31, 2010, “Item 1A. Risk Factors” beginning on page 71 of Comerica’s Quarterly

Report on Form 10-Q for the quarter ended June 30, 2010 and “Item 1A. Risk Factors” beginning on page 72 of Comerica’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2010. Forward-looking

statements speak only as of the date they are made. Comerica does not undertake to update

forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the

forward-looking statements are made. For any forward-looking statements made in this

presentation or in any documents, Comerica claims the protection of the safe harbor for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. |

3

Financial Results

$ in millions, except per share data

1

Estimated

2

Excludes trust preferred securities, fully redeemed on 10/1/10

3

See Supplemental Financial Data slides for reconciliation of non-GAAP financial

measures 1,640

789

480

3.24%

1,646

0.88

153

123

$277

FY10

134

_

_

Preferred stock dividends to U.S. Treasury

10.54%

10.08%

1

437

215

57

3.29%

405

0.53

95

$96

4Q10

9.96%

2

Tier 1 capital ratio

(118)

59

Net income (loss) attributable to common

shares

1,650

402

Noninterest expenses

10.39%

Tangible

common

equity

ratio

3

1,050

186

Noninterest income

1,082

122

Provision for loan losses

2.72%

3.23%

Net interest margin

1,567

404

Net interest income

(0.79)

0.33

Diluted income (loss) per common share

$17

$59

Net income

FY09

3Q10 |

4

Fourth Quarter 2010 Highlights

Analysis of 4Q10 compared to 3Q10

1

Inflow to nonaccrual loans with book balances greater than $2 million

2

Watch

list:

generally

consistent

with

regulatory

defined

special

mention,

substandard

and

doubtful

loans

3

See Supplemental Financial Data slides for reconciliation of non-GAAP financial

measures Broad-based improvement in credit quality continues

•

Net credit related charge-offs declined $19 million to $113 million

•

Nonperforming assets declined $76 million

•

Inflow

to

nonaccrual

1

slowed

by

$114

million,

to

$180

million

•

Watch

list

loans

declined

$629

million,

to

$5,542

million

2

•

Provision for loan losses declined $65 million to $57 million

Period-end loan outstandings were stable with Commercial loans

increasing $713 million or 3%

•

Average loans increased $229 million, excluding $332 million decrease in

Commercial Real Estate line of business

Average core deposits increased $1.1 billion

•

Average noninterest bearing deposits increased $687 million

Revenue increased 5%

•

Strong fee income generation

Net interest margin increased 6 basis points to 3.29%

Capital ratios remain solid

•

Tangible

common

equity

ratio

3

of

10.54%

•

Fully redeemed trust preferred securities on October 1, 2010

|

5

Commercial Loan Growth

Increases in:

•

National Dealer Services $276MM

•

Mortgage Banker Finance $158MM

•

Energy $73MM

Average balances in $ millions

1

CRE: Owner-occupied and Commercial Real Estate line of business construction

and mortgage loans 2

4Q10 compared to 3Q10

Decreases in:

•

Commercial Real Estate line of

business ($332MM)

•

Middle Market ($178MM)

•

Small Business Banking ($72MM)

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Total Loans

44,782

42,753

41,313

40,672

40,102

39,999

Q-Q Change

(2,029)

(1,440)

(641)

(570)

(103)

Commerical

23,401

21,971

21,015

20,910

20,967

21,464

Q-Q Change

(1,430)

(956)

(105)

57

497

CRE

14,392

14,096

13,773

13,359

12,882

12,336

Q-Q Change

(296)

(323)

(414)

(477)

(546)

Average

loan

outstandings

included

2

:

Balance Sheet

Lines of Business

1 |

6

$0

$10

$20

$30

$40

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

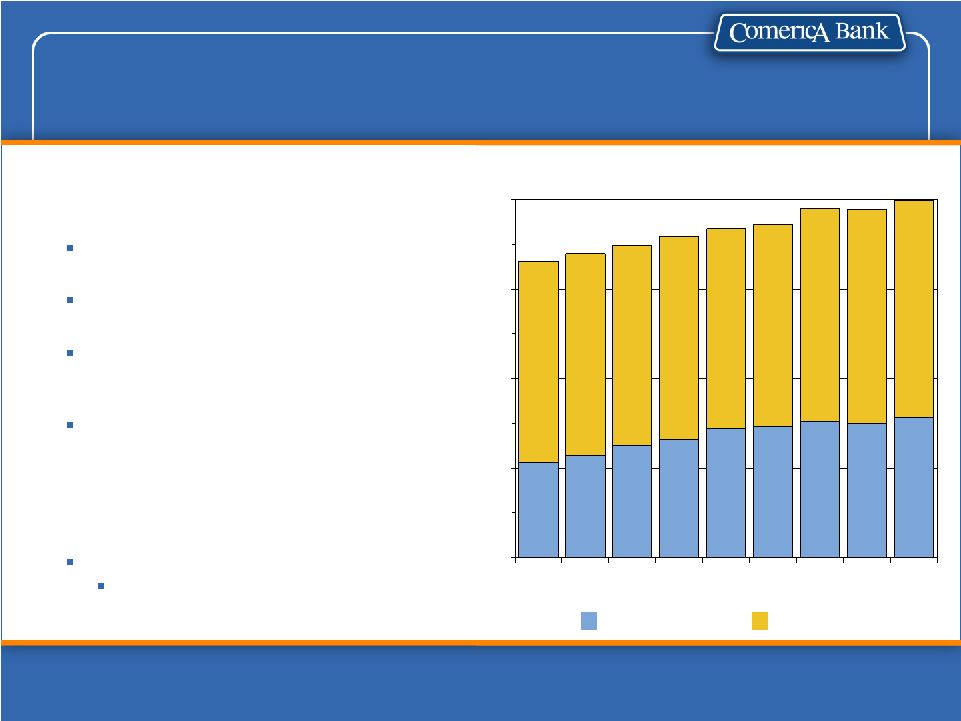

Core Deposits Increased

Average Core Deposits

$ in billions; 4Q10 vs 3Q10

1

Core

deposits

exclude

Institutional

CDs,

Retail

Brokered

CDs

and

foreign

office

time

deposits

Total

average

core

deposits

1

of

$39.9B, a $1.1B increase primarily

due to:

Noninterest-bearing deposits increased

$687MM

Money market and NOW deposits

increased $621MM

Customer CDs decreased $206MM

Total avg. core deposits:

Increased in:

•

Middle Market $442MM

•

Small Business $296MM

•

Technology & Life Sciences $152MM

•

Wealth Management $124MM

•

Financial Services Division $56MM

Decreased in:

Commercial Real Estate ($47MM)

Noninterest-bearing

Interest-bearing |

7

3.29%

3.23%

3.28%

3.18%

2.94%

2.68%

2.25%

2.50%

2.75%

3.00%

3.25%

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Net Interest Margin Improves

Excess

liquidity

position

2

:

4Q10

average $1.8B, down from

$3.0B in 3Q10

12/31/10 period end $1.3B

Negative impact on 4Q10 margin was

approximately 12 basis points

1

4Q10 vs. 3Q10

2

Excess liquidity represented by average deposits held at the Federal Reserve

Bank. See Supplemental Financial Data slide for reconciliation of

non-GAAP financial measures. Net interest margin increased six

basis

points

to

3.29%

reflecting

1

:

+

Decline

in

excess

liquidity

+

Redemption

of

higher-cost

Trust

Preferred securities (TruPS)

-

Decrease in yields on mortgage-

backed securities |

8

A Leaner, More Efficient Company

6,000

8,000

10,000

12,000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Workforce Reductions

1

4Q10 vs. 3Q10

2

Offset by increase in deferred compensation asset returns in noninterest

income Noninterest

expenses

1

:

Salaries expense increased:

•

$10MM increase in incentives

as a result of improved financial

performance and rankings

relative to peers

•

$6MM increase in Deferred

Compensation

2

•

$3MM increase in Severance

Trust preferred securities

redemption charge of $5MM |

9

$ in millions

Credit Quality Positive Trends Continued

$1,292

3.06%

$1,251

3.06%

$1,214

2.98%

$1,311

3.24%

$1,235

3.06%

Nonperforming assets

to total loans & foreclosed property

$266

$245

$199

$294

$180

Nonperforming assets inflow

$111

$89

$93

$120

$112

Foreclosed property

$101

$83

$115

$104

$62

Loans past due 90 days or more

and still accruing

$7,730

$7,502

$6,651

$6,171

$5,542

Total Watch list loans

$57

$113

1.13%

4Q10

$122

$132

1.32%

3Q10

$126

$146

1.44%

2Q10

$256

$175

Provision for Loan Losses

$173

1.68%

1Q10

$225

2.10%

4Q09

Net credit-related charge-offs

to average total loans

We believe we will continue to see improving credit quality reflecting

positive migration trends with some variability quarter to quarter

|

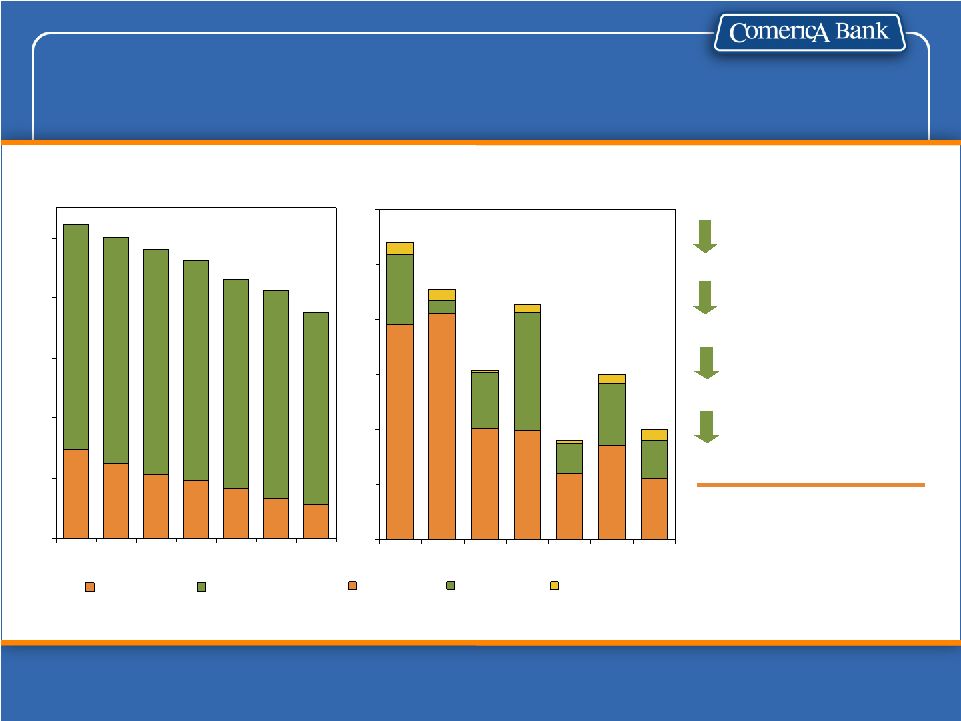

10

108

91

62

86

36

60

40

140

148

162

87

110

73

72

$0

$100

$200

$300

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Positive trends in credit quality

resulted in significant decline in

the provision for loan losses

Allowance for credit losses of

$936MM

•

Decreased $59MM, reflecting

the positive trend in all credit

metrics, particularly the watch list

•

Allowance for loan losses to total

loans 2.24%

•

Allowance for loan losses to

nonperforming loans of 80%

Recoveries of $27MM, an

increase of $14MM

Loan Sales of $70MM, an

increase of $51MM

Provision for Loan Losses

Provision and Net Charge-offs

$ in millions; 4Q10 vs 3Q10

Credit Quality Positive Trends Continued

CRE Net Charge-Offs

Non CRE Net Charge-Offs

312

311

256

175

126

122

57 |

11

Specialty

Businesses

$73MM

Small Business

$111MM

Other

$132MM

Middle

Market

$287MM

Commercial

Real Estate

$449MM

Global Corp

Banking

$28MM

$ in millions (MM); 4Q10 vs. 3Q10

Nonperforming Assets Declined

Nonperforming Assets of $1,235MM

included:

Nonaccrual loans decreased $83MM

•

Commercial Real Estate decreased

$80MM

•

Specialty Businesses decreased $14MM

$43MM Troubled Debt Restructurings

Foreclosed Property decreased $8MM

to $112MM

Average carrying value of nonaccrual

loans 54% (46% write-down)

Accruing Troubled Debt

Restructurings total $44MM

No nonaccrual loans Held-For-Sale

December 31, 2010

Nonaccrual Loans $1,080 million

By Line of Business |

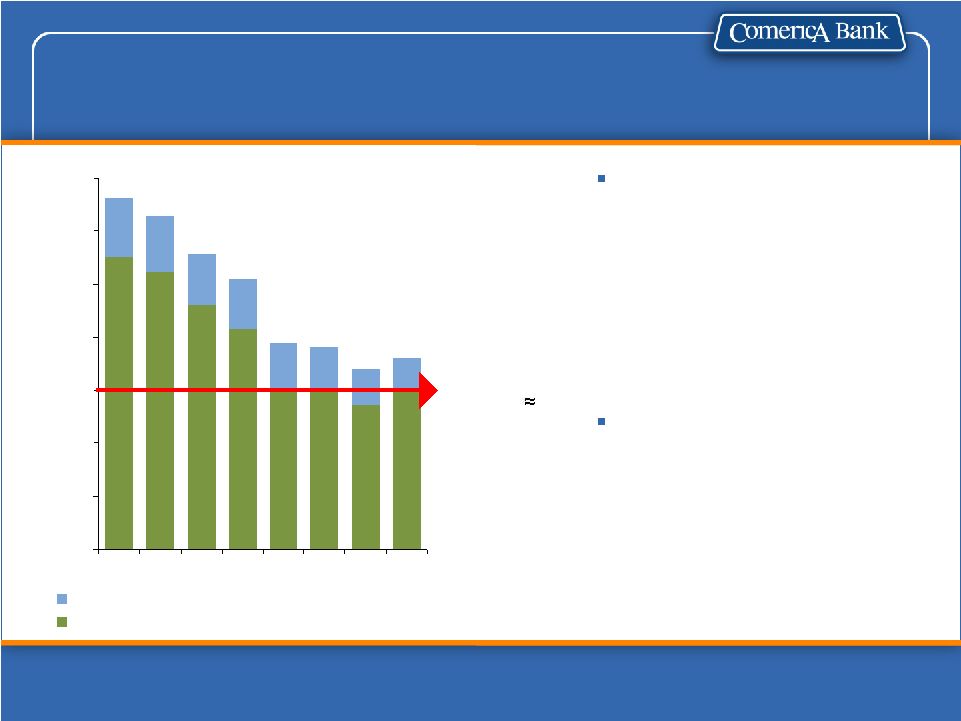

12

Expect variability

in credit metrics

with a general

improving trend

108

91

62

86

36

40

60

$0

$20

$40

$60

$80

$100

$120

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Residential

Commercial

Not Secured by RE

3,763

4,114

4,316

4,812

5,006

5,228

4,621

$0

$1,000

$2,000

$3,000

$4,000

$5,000

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Residential

Commercial

Commercial Real Estate Line of Business

Outstandings By

Property Type

Net Charge-offs By

Project Type

Period-end outstandings in $millions; excludes Commercial Real Estate line of

business loans not secured by real estate; Net Charge-offs $millions;

4Q10 vs. 3Q10

Commercial: Multi-Family, Retail, Office, Warehouse, Multi-use and

Commercial Charge-offs

decreased $19MM

Inflows to nonaccrual

decreased $61MM

Nonaccrual loans

decreased $80MM

Watch list loans

declined

$245MM |

13

0%

2%

4%

6%

8%

10%

12%

4Q09

1Q10

2Q10

3Q10

4Q10

Strong Capital Ratios

Tier

I

Common

Capital

Ratio

1

Peer Median

Comerica

Among the best capitalized in

peer group

Quality of capital is solid

Tier 1 made up of 100% common

equity as of 10/1/10

Fully redeemed preferred stock

issued to U.S. Treasury in 1Q10

Redeemed $500MM of 6.57%

Trust Preferreds

(TruPS) on

10/01/10

Doubled quarterly common stock

dividend to $0.10 per share

Authorized share and warrant

repurchases

Strong capital supports future

growth

Source: SNL Financial

Peer Group: BBT, FITB, HBAN, KEY, MI, MTB, PNC, RF, STI, USB, ZION

1

See Supplemental Financial Data slides for reconcilements of non-GAAP financial

measures; 4Q10 estimated |

14

2011 Full-Year Outlook

1

For the full-year 2011, management expects the following compared to

full-year 2010: Average loans: low single-digit decline

•

Excluding the Commercial Real Estate line of business, a low single-digit

increase in average loans •

Average earning assets of $48 billion

Net interest margin similar to 2010

•

Assumes no change in federal funds rate

Net credit-related charge-offs of $350 million to $400 million

•

Provision for credit losses to be $150 million to $200 million

Noninterest income: low single-digit decline

•

Fee income growth more than offset by impact of new regulations

Noninterest expenses: low single-digit increase

•

Reflects rising benefit costs

Income tax expense

•

36% of pre-tax income less $60 million in tax benefits

Cautiously manage capital

•

Commence share repurchase program that, combined with dividend payments, results

in a payout ratio less than 50% of earnings

1

This outlook is provided as of January 18, 2011 and does not include any impact

from the acquisition of Sterling Bancshares. Based on a continuation of modest

economic growth |

Appendix |

16

Basel III Implementation

New rules effective between 2013 and 2019; US adoption expected to occur over a

similar timeframe, but the final form of the US rules is uncertain

CMA is not a mandatory Basel II bank

CMA

Tier

1

Common

1

12/31/10:

10.1%

Regulatory required minimum by 2019: 7%

(4.5% minimum plus 2.5% “conservation

buffer”)

CMA has NO material impact from:

•

Mortgage servicing rights

•

Trust Preferreds

•

Deferred tax assets

•

Investments in financial institutions

Expected change in Risk Weighted Assets

not material

Higher degree of uncertainty regarding

implementation and interpretation

Will likely require more on-balance sheet

liquidity

•

Possibly increase or change the mix of

the investment securities portfolio

•

Continued focus on retail deposit

generation

Careful management of off-balance sheet

commitments; expect evolution of pricing

and terms of off-balance sheet commercial

commitments

Expected to be manageable given proven

ability to administer our balance sheet

Capital Requirement:

Liquidity Requirement:

1

See Supplemental Financial Data slides for reconciliation of non-GAAP financial

measures Impact

on

Comerica

is

estimated

and

subject

to

final

rulemaking.

Comerica

may

be

affected

by

other

changes

due

to

Basel

III. |

17

Based on the two options contemplated in the draft

Fed rules, total debit card PIN ($9 million annual

revenue

)

and

signature-based

($31

million

annual

revenue

)

interchange

fees

in

2011

would

be

reduced

by

$13MM

-

$15MM

Direct impact on client-driven energy derivatives

business

($1

million

annual

revenue

)

As currently proposed by the FDIC, CMA expects

2011 FDIC insurance expense to remain consistent

with 2010 expense ($62 million).

As currently proposed by the FDIC, there will not be

a separate assessment for unlimited deposit

insurance coverage for this period.

Could lead to increased cost of commercial demand

deposits, depending on interplay of interest, deposit

credits, and service charges

Impacts

Allows for continued growth of CMA’s core client-

driven foreign exchange ($39 million annual

revenue

)

and

interest

rate

($7

million

annual

revenue

)

derivatives

business

Derivatives –

Allows continued trading of

foreign exchange and interest rate derivatives;

energy, uncleared commodities and agriculture

derivatives will move to a separate subsidiary

New rule is consistent with CMA’s focus on core

deposit growth

Deposit Insurance

–

Changes definition of

assessment base, increases fund’s minimum

reserve ratio & permanently increases insurable

level

Could provide impetus for additional deposit

generation

TAG Extension

-

Provide unlimited deposit

insurance on noninterest-bearing accounts from

12/31/10 to 12/31/12

Government card programs, such as the

DirectExpress Social Security program, are exempt

Interchange Fees -

Limits debit card transaction

processing fees that card issuers can charge

merchants

On October 1, 2010 fully redeemed all $500

million of Trust Preferred Securities at par

Trust Preferreds

-

Prohibits certain banks from

including Trust Preferreds in Tier 1 Capital

(phase out beginning 1/1/13)

Could provide impetus for additional deposit

generation

Interest

on

Demand

Deposits

-

Allows

interest

on commercial demand deposits (one year from

enactment)

Opportunities

Key Changes

1

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act;

2

Based

on

2010

full-year

results

Impact

on

Comerica

is

estimated

and

subject

to

final

rulemaking.

Comerica

may

be

impacted

by

other

changes

due

to

the

financial reform legislation.

Timing of prescribed changes varies by rule.

Overall, relative impact from Financial Reform will likely be less than other major

banks Financial Reform

1

2

2

2

2

2 |

18

Business and Market Segment

Contributions to Net Income

$17

(15)

(110)

43

(48)

$147

FY 09

$277

TOTAL

16

Other

1

(234)

Finance

(3)

Wealth &

Institutional

Management

(31)

Retail Bank

$529

Business Bank

FY 10

$ in millions

1

Includes discontinued operations and items not directly associated with the three

major business segments or the Finance Division 2

Includes discontinued operations and items not directly associated with the

geographic markets $17

(125)

24

77

(23)

40

(16)

$40

FY09

100

Other Markets

(13)

Florida

114

Western

$277

TOTAL

(218)

Finance and

Other

2

53

International

70

Texas

$171

Midwest

FY 10 |

19

Investment Securities Portfolio

Consists primarily of AAA

mortgage-backed Freddie

Mac and Fannie Mae

government agency

securities

•

Net unrealized pre-tax gain

$55MM as of 12/31/10

•

Average life of 3.4 years as

of 12/31/10

Repurchased customers’

Auction-Rate Securities in

4Q08

•

Cumulative redemptions and

sales of $668MM

(4Q10 $12MM)

•

Cumulative gains on

redemptions and sales of

$27MM (4Q10 $1MM)

$ in millions (MM)

$3,500

$4,500

$5,500

$6,500

$7,500

$8,500

$9,500

$10,500

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Average Auction-Rate Securities

Average Investment Securities Available-for-Sale

Target:

Mortgage-backed

Securities $6.5B |

20

Other

Markets

$3.7B 9%

Int'l

$1.5B 4%

Florida

$1.6B 4%

Midwest

$14.3B 36%

Western

$12.5B 31%

Texas

$6.4B 16%

Diverse Loan Portfolio

1

Specialty Businesses includes: Financial Services Division, Entertainment,

Energy, Leasing, Mortgage Banker Finance and Technology and Life Sciences

(TLS ) Geography based on office of origination; Midwest: MI, OH, IL;

Western: CA, AZ, NV, CO, WA; Other

Markets

include

markets

not

separately

identified

above

in

addition

to

businesses

with

a

national

perspective

Average 4Q10: $40.0 billion

By Geographic Market

By Line of Business

Global Corp

Banking

$4.3B 11%

Commercial

Real Estate

$4.7B 12%

Middle

Market

$11.9B 30%

Nat'l Dealer

Services

$3.8B 9%

Specialty

Businesses

1

$5.3B 13%

Personal

Banking

$1.8B 4%

Small

Business

Banking

$3.4B 9%

Private

Banking

$4.8B 12% |

21

Loans By Geographic Market

Average loans in $billions; Geography based on office of origination; Midwest: MI,

OH, IL; Western: CA, AZ, NV, CO, WA; Other

Markets

include

markets

not

separately

identified

above

in

addition

to

businesses

with

a

national

perspective

4Q10

3Q10

FY10

FY09

Midwest

$14.3

$14.3

$14.5

$17.0

Western

12.5

12.6

12.7

14.3

Texas

6.4

6.3

6.5

7.4

Florida

1.6

1.6

1.6

1.7

Other Markets

3.7

3.8

3.7

3.9

International

1.5

1.5

1.5

1.9

TOTAL

$40.0

$40.1

$40.5

$46.2 |

22

Loans by Line of Business

Average loans in $billions;

1

Specialty Businesses includes: Financial Services Division, Entertainment, Energy,

Leasing, Mortgage Banker Finance, and TLS 4Q10

3Q10

FY10

FY09

Middle Market

$11.9

$12.0

$12.1

$14.3

Commercial Real Estate

4.7

5.1

5.2

6.1

Global Corporate Banking

4.3

4.4

4.6

6.0

National Dealer Services

3.8

3.5

3.4

3.5

Specialty Businesses

1

5.3

5.0

5.0

5.5

SUBTOTAL –

BUSINESS BANK

$30.0

$30.0

$30.3

$35.4

Small Business Banking

3.4

3.5

3.5

3.9

Personal Banking

1.8

1.8

1.9

2.1

SUBTOTAL –

RETAIL BANK

$5.2

$5.3

$5.4

$6.0

Private Banking

4.8

4.8

4.8

4.8

SUBTOTAL –

WEALTH &

INSTITUTIONAL MANAGEMENT

$4.8

$4.8

$4.8

$4.8

TOTAL

$40.0

$40.1

$40.5

$46.2 |

23

Fourth Quarter 2010 Average Loans Detail

$ in billions; geography based on office of origination.

1

Specialty Businesses includes: Financial Services Division, Entertainment, Energy,

Leasing, Mortgage Banker Finance and TLS Midwest

Western

Texas

Florida

Other

Markets

Int’l

TOTAL

Middle Market

$5.3

$3.8

$1.7

$0.2

$0.9

$0.0

$11.9

Commercial Real Estate

0.9

1.4

1.2

0.4

0.8

-

4.7

Global Corporate Banking

1.3

0.8

0.2

0.1

0.4

1.5

4.3

National Dealer Services

0.7

2.4

0.2

0.3

0.2

-

3.8

Specialty Businesses

1

1.0

1.5

1.5

0.0

1.3

-

5.3

SUBTOTAL –

BUSINESS BANK

$9.2

$9.9

$4.8

$1.0

$3.6

$1.5

$30.0

Small Business Banking

1.7

0.8

0.9

-

-

-

3.4

Personal Banking

1.4

0.1

0.2

-

0.1

-

1.8

SUBTOTAL –

RETAIL BANK

$3.1

$0.9

$1.1

$-

$0.1

$-

$5.2

Private Banking

2.0

1.7

0.5

0.6

-

-

4.8

SUBTOTAL –

WEALTH &

INSTITUTIONAL MANAGEMENT

$2.0

$1.7

$0.5

$0.6

$0.0

$-

$4.8

TOTAL

$14.3

$12.5

$6.4

$1.6

$3.7

$1.5

$40.0 |

24

Shared National Credit Relationships

Approx. 940

borrowers

Majority of relationships

include ancillary business

Comerica is agent for

approximately 17.5%

Adhere to same credit

underwriting standards as

rest of loan book

Credit quality mirrors total

portfolio

December 31, 2010: $7.3 billion

Shared National Credit (SNC): Facilities greater than $20 million shared by three

or more federally supervised financial institutions which are reviewed by

regulatory authorities at the agent bank level. Period-end outstandings

as of December 31, 2010 Global Corp

Banking

$2.3B 32%

Nat'l Dealer

Services $0.3B

4%

Energy

$1.3B 18%

Other

$0.5B 7%

Middle Market

$1.7B 23%

Commercial

Real Estate

$1.2B 16% |

25

5,542

8,250

6,651

7,502

7,730

6,171

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Total

Watch

List

Loans

1

Watch List Improvement Continued

Watch list loans

1

decreased

$629MM, fifth

consecutive quarter

of decline

Watch list loans

1

decreased $2.7B

over past five

quarters

Loans past due 90 days or more

and still accruing declined

Foreclosed property decreased

and remains relatively small

$ in millions; Analysis of 4Q10 compared to 3Q10

1

Watch

list:

generally

consistent

with

regulatory

defined

special

mention,

substandard

and

doubtful

(nonaccrual)

loans |

26

By Geographic Market

Texas

$9MM 8%

Western

$42MM 37%

Midwest

$52MM 46%

Florida

$8MM 7%

Other Markets

$2MM 2%

Specialty

Businesses

$4MM 4%

Middle Market

$23MM 20%

Private Banking

$18MM 16%

Small Business

Banking $17MM

14%

Personal

Banking $5MM

5%

Global

Corporate

Banking $6MM

5%

Commercial

Real Estate

$40MM 36%

4Q10: $113 Million

Net Loan Charge-offs

By Line of Business

$ in millions; Geography based on office of origination; Midwest: MI, OH,

IL; Western: CA, AZ, NV, CO, WA Other

Markets

include

markets

not

separately

identified

above

in

addition

to

businesses

with

a

national

perspective

Specialty Businesses includes: Financial Services Division, Entertainment, Energy,

Leasing, Mortgage Banker Finance, TLS and National Dealer Services

|

27

Net Loan Charge-offs by Line of Business

$ in millions;

1

Includes $26MM related to a Middle Market/National group that focused on higher

levered relationships 2

Specialty Businesses includes: Financial Services Division, Entertainment, Energy,

Leasing, Mortgage Banker Finance, TLS and National Dealer Services

4Q10

3Q10

2Q10

1Q10

4Q09

Commercial Real Estate

$40

$60

$36

$86

$62

Middle Market

23

32

71

1

39

76

Small Business Banking

17

14

16

20

22

Wealth & Institutional

Management

18

14

11

10

12

Specialty Businesses

4

8

4

10

18

Personal Banking

5

4

6

6

8

Global Corporate Banking

6

0

2

2

26

TOTAL

$113

$132

$146

$173

$224

Provision for loan losses

$57

$122

$126

$175

$256

2 |

28

Net Loan Charge-offs by Market

$ in millions

Geography based on office of origination; Midwest: MI, OH, IL; Western: CA,

AZ, NV, CO, WA; 1

Other

Markets

include

markets

not

separately

identified

above

in

addition

to

businesses

with

a

national

perspective

2

Includes $26MM related to a Middle Market/National group that focused on higher

levered relationships 4Q10

3Q10

2Q10

1Q10

4Q09

Midwest

$52

$61

$44

$55

$97

Western

42

58

47

65

85

Texas

9

5

8

25

13

Florida

8

6

7

10

4

Other Markets /

International

2

2

40

2

18

25

TOTAL

$113

$132

$146

$173

$224

Provision for loan losses

$57

$122

$126

$175

$256

1 |

29

Nonaccrual Loans

36

248

$5–$10

3

84

Over $25

1,066

$1,080

Total

23

342

$10–$25

58

179

$2–$5

946

$227

Under $2

# of Relationships

Outstanding

Period-end balances in $ millions (MM) as of December 31, 2010

Sold $41MM in nonperforming loans

at prices approximating carrying

value plus reserves in 4Q10

Proactively review nonaccrual loans

every quarter

Charge-offs and reserves taken to

reflect current market conditions

Granularity of nonaccrual loans:

72%

68%

66%

64%

61%

59%

56%

56%

55%

55%

54%

25%

40%

55%

70%

2Q08

4Q08

2Q09

4Q09

2Q10

4Q10

Carrying Value of Nonaccrual Loans

as % of Contractual Value |

30

Commercial Real Estate Loan Portfolio

4Q10: $12.3 billion

4Q10 averages in $billions

1

Included in Commercial Real Estate line of business

Commercial Real Estate

Line of Business:

Nonaccrual loans of $449MM, down

$80MM from 3Q10

Loans over $2MM transferred to

nonaccrual totaled $71MM

($132MM in 3Q10 and $32MM in

2Q10)

Net loan charge-offs of

$40MM ($60MM in 3Q10

and $36MM in 2Q10)

Primarily

Owner-

Occupied

Commercial

Mortgages

$8.4B 68%

Real Estate

Construction

$1.9B 16%

Commercial

Mortgages

$2.0B 16%

1

1 |

31

Commercial Real Estate Line of Business

December

31,

2010

Loan

Outstandings:

$3.8

billion

1

By Project Type

By Location of Property

Period-end balances in $billions;

1

Excludes Commercial Real Estate line of business loans not secured by real

estate Land Carry

$0.4B 10%

Land

Development

$0.2B 5%

Single Family

$0.3B 7%

Retail

$0.9B 23%

Multi-family

$0.9B 26%

Comml/Other

$0.3B 8%

Multi-use

$0.5B 12%

Other

Markets

$0.6B 15%

Florida

$0.5B 12%

Western

$1.2B 35%

Michigan

$0.5B 12%

Texas

$1.0B 26%

Office

$0.3B 9% |

32

Real Estate Construction Loans

December 31, 2010 period-end $ in millions; Western: CA, AZ, NV

Commercial Real Estate Line of Business by Location of Property

47

-

-

33

14

-

Commercial

119

-

14

42

6

57

Office

201

27

-

52

5

117

Multi-use

579

92

131

227

-

129

Multi-family

Other CRE:

157

27

9

52

9

60

Land Development

353

45

48

74

27

159

Total Residential

485

29

27

262

48

119

Retail

18

-

2

6

-

10

Other

$1,826

$193

$222

$707

$109

$595

TOTAL

Residential:

-

$18

Other

Markets

24

-

11

9

4

Land Development

$196

$39

$22

$18

$99

Single Family

TOTAL

Florida

Texas

Michigan

Western |

33

Commercial Mortgage Loans

Commercial Real Estate Line of Business by Location of Property

December 31, 2010 period-end $ in millions; Western: CA, AZ, NV

239

16

18

20

45

140

Land Carry

386

80

64

16

98

128

Retail

249

87

-

31

16

115

Multi-use

Other CRE:

202

41

37

35

31

58

Total

Residential

$69

$30

$6

$17

$3

$13

Single Family

Residential:

121

22

-

17

33

49

Commercial

221

17

11

12

34

147

Office

404

45

115

138

55

51

Multi-family

115

61

-

-

47

7

Other

$369

11

Other

Markets

$1,937

$245

$269

$359

$695

TOTAL

133

31

18

28

45

Land Carry

TOTAL

Florida

Texas

Michigan

Western |

34

Residential Real Estate Development

$0

$500

$1,000

$1,500

$2,000

$2,500

2Q09

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Single Family

Residential - Land Carry/Development

Period-end balances in $millions

Western: CA, AZ, NV

Reduced Residential Real

Estate Development

exposure by $1.7B since

6/30/08 to $555MM at

12/31/10

Geographic breakdown:

•

Western

39%

•

Texas

20%

•

Florida

15%

•

Michigan

11%

•

Other

15%

Reduced Western Market

Local Residential Real

Estate Developer Portfolio to

$105MM at 12/31/10 from

$932MM at 12/31/07 |

35

Consumer Loan Portfolio

9.9% of total outstandings

No sub-prime mortgage programs

Self-originated & relationship

oriented

Net loan charge-offs of $17MM

4Q10: $4.0 billion

4Q10 averages in $billions; Geography based on office of origination

1

Residential mortgages on the balance sheet are primarily associated with Private

Banking customers. Residential mortgages originated through the

banking centers are typically sold to a third party. 2

The “other”

category includes automobile, personal watercraft, student and recreational

vehicle loans. 3

Data on loans booked through the Consumer Loan Center which encompasses about 86%

of the Home Equity Lines and Loans Consumer Loan Portfolio

Midwest

62%

Florida

3%

Texas

9%

Western

26%

About 85% home equity lines and 15%

home equity loans

Avg. FICO score of 753 at origination

86%

have

CLTV

80%

at

origination

Average loan vintage is 5.3 years

4Q10: $1.7 billion

Home Equity Portfolio

3

Consumer loans-

Other

2

$0.7B

17%

Consumer

Loans-Home

Equity $1.7B

43%

Residential

Mortgages

1

$1.6B

40% |

36

Core Deposits By Geographic Market

Average

deposits

in

$

billions;

Geography

based

on

office

of

origination;

Midwest:

MI,

OH,

IL;

Western:

CA,

AZ,

NV,

CO,

WA;

Other

Markets

include

markets

not

separately

identified

above

in

addition

to

businesses

with

a

national

perspective

Excludes

Foreign

Office

Time

Deposits

(4Q10

$0.5B,

3Q10

$0.4B,

FY10

$0.5B,

FY09

$0.7B)

and

Inst.

&

Retail

Brokered

CDs

of

$0.1B

in

3Q10;

$0.3B

in

FY10;

and

$4.1B

in

FY09

4Q10

3Q10

FY10

FY09

Midwest

$17.9

$17.8

$17.7

$17.0

Western

12.5

11.8

12.0

11.1

Texas

5.6

5.4

5.3

4.5

Florida

0.4

0.4

0.4

0.3

Other Markets

2.2

2.2

2.2

1.6

International

1.1

1.1

1.0

0.8

Finance/Other

0.2

0.1

0.1

0.0

TOTAL

$39.9

$38.8

$38.7

$35.3 |

37

Line of Business Deposits

4Q10

3Q10

FY10

FY09

Middle Market

$5.3

$4.8

$4.9

$4.3

Commercial Real Estate

0.9

0.9

1.0

0.7

Global Corporate Banking

6.6

6.6

6.6

5.1

National Dealer Services

0.2

0.2

0.2

0.1

Specialty Businesses

1

7.0

6.7

6.4

5.1

SUBTOTAL –

BUSINESS BANK

$20.0

$19.2

$19.1

$15.3

Small Business Banking

4.5

4.2

4.1

3.9

Personal Banking

12.7

12.8

12.8

13.5

SUBTOTAL –

RETAIL BANK

$17.2

$17.0

$16.9

$17.4

Private Banking

2.7

2.6

2.8

2.7

SUBTOTAL –

WEALTH &

INSTITUTIONAL MANAGEMENT

$2.7

$2.6

$2.8

$2.7

Finance/Other

2

0.5

0.5

0.7

4.6

TOTAL

$40.4

$39.3

$39.5

$40.0

Average deposits in $billions

1

Specialty Businesses includes: Entertainment, Energy, Financial Services Division, Leasing, Mortgage

Banker Finance and TLS 2

Finance/Other includes Inst. and Retail Brokered CD’s: 4Q10 - none; 3Q10 - $0.1B; FY10

- $0.3B; FY09 - $4.1B |

38

Fourth Quarter 2010 Average Deposits Detail

$ in billions

1

Specialty

Businesses

includes:

Entertainment,

Energy,

Financial

Services

Division,

Leasing,

Mortgage

Banker

Finance

and

TLS

2

Finance/Other includes $0.1B in Inst. and Retail Brokered CD’s; included in

Finance Division segment Midwest

Western

Texas

Florida

Other

Markets

Int’l

TOTAL

Middle Market

$1.2

$3.4

$0.6

$0.0

$0.1

-

$5.3

Commercial Real Estate

0.2

0.5

0.1

0.0

0.1

-

0.9

Global Corporate Banking

3.0

0.5

0.9

0.1

0.8

1.3

6.6

National Dealer Services

0.1

0.1

0.0

0.0

0.0

-

0.2

Specialty Businesses

0.7

4.3

0.9

0.1

1.0

-

7.0

SUBTOTAL

–

BUSINESS

BANK

$5.2

$8.8

$2.5

$0.2

$2.0

$1.3

$20.0

Small Business Banking

2.2

1.1

1.2

-

-

-

4.5

Personal Banking

9.8

1.1

1.7

-

0.1

-

12.7

SUBTOTAL

–

RETAIL

BANK

$12.0

$2.2

$2.9

$--

$0.1

$--

$17.2

Private Banking

0.8

1.4

0.2

0.2

0.1

-

2.7

SUBTOTAL

–

WEALTH

&

INSTITUTIONAL MANAGEMENT

$0.8

$1.4

$0.2

$0.2

$0.1

$--

$2.7

Finance/Other

0.5

-

-

-

-

-

0.5

TOTAL

$18.5

$12.4

$5.6

$0.4

$2.2

$1.3

$40.4

1

2 |

39

A

A

A-

A2

Comerica

BBB-

BBB-

BBB+

A-

BBB+

A-

BBB+

A-

A+

A+

AA-

Fitch

BBB

BB+

Ba3

Regions Financial

BBB

BBB

Baa2

Huntington

BBB (low)

BBB-

B2

Zions Bancorporation

BBB (high)

BB+

Baa1

Marshall & Ilsley

Baa1

Baa1

Baa1

A3

A3

A2

Aa3

Moody’s

A (high)

A

PNC

A (low)

A-

M&T Bank

A (high)

A

BB&T

A (low)

BBB

Fifth Third

A (low)

BBB

SunTrust

BBB (high)

BBB+

KeyCorp

AA

DBRS

S&P

Senior Unsecured/Long-Term Issuer Rating

A+

US Bancorp

Holding Company Debt Ratings

As of 01/11/2011

Source: SNL Financial

Debt Ratings are not a recommendation to buy, sell, or hold securities.

|

40

Supplemental Financial Data

The

Tier

1

common

capital

ratio

removes

preferred

stock

and

qualifying

trust

preferred

securities

from

Tier

1

capital

as

defined

by

and calculated

in

conformity

with

bank

regulations.

The

tangible

common

equity

ratio

removes

preferred

stock

and

the

effect of

intangible assets from capital and the effect of intangible assets from total

assets. The Corporation believes these measurements are meaningful measures

of capital adequacy used by investors, regulators, management and others to

evaluate the adequacy of common equity and to compare against other companies in the industry.

1

Regulatory Capital, Tier 1 Capital and risk-weighted assets as defined and

calculated in accordance with regulation. 2

December 31, 2010 Regulatory Capital, Tier 1 Capital, and Risk-Weighted assets

are estimated. 10.39%

$54,848

$55,004

150

6

$5,701

$5,857

--

150

6

5,940

59,608

9.96%

$5,940

--

--

$8,566

9/30/10

10.54%

$53,511

$53,667

150

6

$5,637

$5,793

--

150

6

6,027

59,806

10.08%

$6,027

--

--

$8,654

12/31/10

10.11%

$55,729

$55,885

150

6

$5,636

$5,792

--

150

6

5,876

59,877

9.81%

$6,371

--

495

$9,001

6/30/10

9.68%

$56,949

$57,106

150

7

$5,511

$5,668

--

150

7

5,816

60,792

9.57%

$6,311

--

495

$9,062

3/31/10

$10,468

Total

Regulatory

Capital

2

7.99%

$59,091

$59,249

150

8

$4,720

$7,029

2,151

150

8

5,058

61,815

8.18%

$7,704

2,151

495

12/31/09

Total shareholders’

equity

Less:

Less: Goodwill

Less: Other intangible assets

Tangible common equity ratio

Total assets

Less: Goodwill

Less: Other intangible assets

Tangible common equity

Tier 1 capital

1,2

Less:

Less: Trust preferred securities

Tangible assets

Tier

1

common

capital

2

Risk-weighted

assets

1,2

Tier

1

common

capital

ratio

2

Fixed rate cumulative perpetual preferred stock

Fixed rate cumulative perpetual preferred stock

Reconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in

millions) |

41

The Corporation believes this measurement provides meaningful information to investors, regulators,

management and others of the impact on net interest income and net interest margin resulting

from the Corporation’s short-term investment in low yielding instruments.

1

Excess liquidity represented by interest earned on and average balances deposited with the Federal

Reserve Bank. (0.19)%

3.23%

3.42%

$47,026

$50,009

2,983

$50,189

180

$403

$405

2

3Q10

$53,953

107

$52,941

62

$51,835

80

$49,102

139

Average earnings assets

Less: Average net unrealized gains on

investment securities available-for-sale

(0.12)%

3.29%

3.41%

$47,170

$48,963

1,793

$405

$406

1

4Q10

(0.23)%

3.28%

3.51%

$48,036

$51,755

3,719

$422

$424

2

2Q10

(0.24)%

3.18%

3.42%

$48,787

$52,879

4,092

$ 413

$ 416

3

1Q10

(0.13)%

2.94%

3.07%

$51,393

$53,846

2,453

$ 397

$ 398

1

4Q09

Average earnings assets for net interest

margin (FTE)

Less: Excess liquidity

1

Net interest margin (FTE)

Net interest margin (FTE), excluding

excess liquidity

Average earnings assets for net interest

margin (FTE), excluding excess liquidity

Net interest income (FTE)

Less: Interest earned on excess liquidity

Impact of excess liquidity on net interest

margin (FTE)

Net interest income (FTE), excluding

excess liquidity

Supplemental Financial Data

Reconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in

millions)

1 |

|