Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAVISTAR INTERNATIONAL CORP | d8k.htm |

| EX-99.1 - PRESS RELEASE - NAVISTAR INTERNATIONAL CORP | dex991.htm |

NYSE: NAV

1

4th Quarter 2010 Earnings Presentation

December 22

nd

, 2010

Exhibit 99.2 |

NYSE: NAV

2

2

Safe Harbor

Statement

Information provided and statements contained in this presentation that are not

purely historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as

amended, Section

21E of the Securities Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements only

speak as of the date of this presentation and the Company assumes no

obligation to update the information included in this

presentation. Such forward-looking statements include information concerning

our possible or assumed future results of operations, including descriptions

of our business strategy. These statements often include words such as

“believe,” “expect,”

“anticipate,”

“intend,”

“plan,”

“estimate,”

or similar

expressions. These statements are not guarantees of performance or results and they

involve risks, uncertainties, and assumptions. For a further description of

these factors, see Item 1A, Risk Factors,

included within our Form 10-K for the year ended October

31, 2010, which was filed on

December 21, 2010. Although we believe that these forward-looking

statements are based on reasonable assumptions, there are many factors that

could affect our actual financial results or results

of operations and could cause actual results to differ materially from those in the

forward-looking statements. All future written and oral

forward-looking statements by us or persons acting on our behalf are

expressly qualified in their entirety by the cautionary statements contained or referred to above.

Except for our ongoing obligations to disclose material information as required by

the federal securities laws, we do not have any obligations or intention to

release publicly any revisions to any forward- looking statements to

reflect events or circumstances in the future or to reflect the occurrence of

unanticipated events. |

NYSE: NAV

3

3

Other Cautionary Notes

•

The financial information herein contains audited and unaudited

information and has been prepared by management in good faith

and based on data currently available to the Company.

•

Certain Non-GAAP measures are used in this presentation to assist

the reader in understanding our core manufacturing business.

We

believe this information is useful and relevant to assess and

measure the performance of our core manufacturing business as it

illustrates manufacturing performance without regard to selected

historical legacy costs (i.e. pension and other postretirement costs).

It also excludes financial services and other expenses that may not

be related to the core manufacturing business. Management often

uses this information to assess and measure the performance of our

operating segments.

A reconciliation to the most appropriate GAAP

number is included in the appendix of this presentation.

|

NYSE: NAV

4

4

Agenda

•

4Q financials

•

Full-year

•

Strategic update

•

Driving shareowner value |

NYSE: NAV

5

5

What We Said on the 3

rd

Quarter Call

for Full Year 2010

*This

slide

contains

non-GAAP

information,

please

see

the

Reg

G

in

appendix

for

detailed

reconciliation

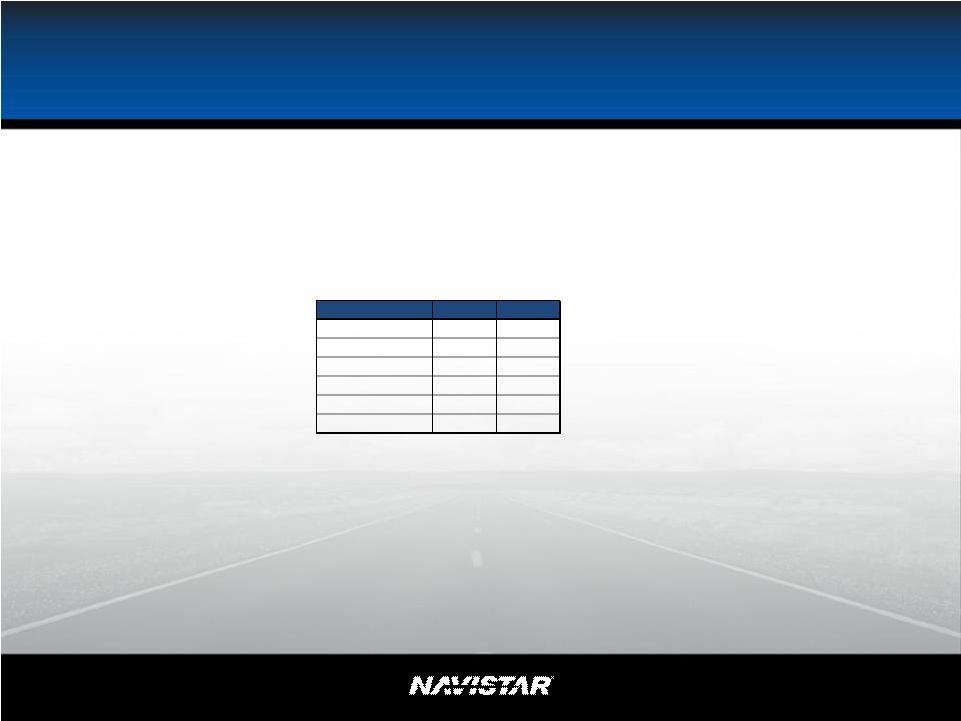

Guidance

Actual

Truck Industry Units

190,000

to

195,000

191,300

Revenue ($ Billions)

12.2

to

12.5

12.1

($ Millions (excluding EPS))

Mfg. Segment Profit*

750

to

800

741**

Below the line items*

(525)

to

(534)

(495)

Profit Excluding Tax

225

to

266

246

Net Income attributable to NIC

202

to

238

223

Tax Rate

10%

to

11%

9.4%

Diluted EPS attributable to NIC

$2.75

to

$3.25

$3.05**

# of shares

~73.3M

73.2M

**FY2010 includes $10M ($0.14) of cost for UAW agreement

$751

$3.19 |

NYSE: NAV

4Q Operations

Overall segment margins strong

•

UAW agreement expenses

-

One time items

-

Move production to Escobedo

•

Product development expense

-

4Q 2010 $126M vs. $94M in 4Q 2009

-

Launched

TerraStar™

Australia

India

•

Military Parts revenue

-

4Q 2010 $96M vs. $213M in 4Q2009

Equity in (loss) income of non-

consolidated affiliates

•

JV investment

-

4Q2010 ($18M) vs. ($10M) in 4Q2009

9800

CT630

CT610

40T/49T

31T

9

10

DT

7

11

13

Brazil

2010 emission engines

6 |

NYSE: NAV

7

75,800

86,900

22,700

24,800

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

FY 2009

FY 2010

Q409

Q410

167,800

215,500

51,300

57,600

101,500

24,900

39,600

0

50,000

100,000

150,000

200,000

250,000

300,000

FY 2009

FY 2010

4Q09

4Q10

4Q2010 and Full Year Information

Consolidated

Revenues

($

in

millions)

Yearly and Quarterly Truck Chargeouts

Yearly and Quarterly Engine Shipments

Q/Q

Chargeouts

increased

~9%

Q/Q

Shipments

decreased

~37%

Y/Y Shipments

decreased ~11%

Y/Y Chargeouts

increased ~15%

-

Ford

269,300

240,400

90,900

$11,569

$12,145

$3,285

$3,372

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

FY 2009

FY 2010

Q409

Q410

Q/Q

Revenues

increased

~3%

Military

Revenues

($

in

millions)

$400

$495

$213

$96

$0

$100

$200

$300

$400

$500

$600

$700

4Q 2009

4Q 2010

Truck

Parts

$613

$591 |

NYSE: NAV

8

8

2007 Product Offerings

2011 Product Offerings

Well Positioned for Future

Purchased Engines

7

7

DT

DT

9

9

10

10

9900

SCHOOL BUS

9200 / 9400

Global Powertrain

7.2L

9.3L

4.8L

9

10

DT

7

11

13

JAC JV and NEOBUS JV are pending. |

NYSE: NAV

9

9

Medium

Truck

Great Products –

Market Share

Severe

Service

Truck

Heavy

Truck

FY07

60%

FY08

55%

FY09

61%

FY10

59%

FY07

36%

FY08

36%

FY09

35%

FY10

38%

FY07

25%

FY08

27%

FY09

34%

FY10

33%

FY07

15%

FY08

19%

FY09

25%

FY10

24%

Class 8

School

Bus

(U.S. & Canada)

School Bus & Combined Class 6-8 Market Share –

FY08: ;

FY09: ; FY10:

Note: Market Share based on brand and Severe Service Truck market share

excludes military FY07

18%

FY08

22%

FY09

28%

FY10

26% |

NYSE: NAV

10

10

2010 U.S. and Canada Heavy Strategy –

Maintain 25% Class 8 Share

MaxxForce

®

13L

•

Successfully transitioning customers to 13L

•

Current run rate up to 110 per day, moving to 200 per day

•

Run rate will increase throughout 2011 to coincide with

industry demand

•

Industry converting to 13L engines

MaxxForce

®

15L

•

Now accepting orders

•

EPA certification has been submitted in October

•

Customer delivery starts in January 2011

•

Additional high volume applications will be phased in

through April 2011 with marketing push at Mid-America

Truck Show

2010 Strategy

•

Convert customers to the

MaxxForce

®

13L

•

Drive customer –

pre/post buy |

NYSE: NAV

11

11

•

Moving from focused facilities to

flexible manufacturing to minimize

logistics cost

•

School bus: All assembly in Tulsa

•

Huntsville –

ability to produce

V8/I6/DT engines on same line

What’s next?

•

Engineering

Competitive Cost Structure

EAP

GAP

CAP

SAP

TBP

HEP

CBP

MPP

Product Development

FY 2009

FY 2010

$433M

$464M

$94M

Q4 2010 product development was

$126M |

NYSE: NAV

12

12

Competitive Cost Structure

New Labor Agreement/Integrated Product Development Center

Ft. Wayne

Ft. Wayne

Engineering Center

Engineering Center

Melrose Park

Melrose Park

Future

•

Capitalize on integration at lower cost

•

Increase shareowner value

Strategy

•

Labor agreement

•

Leveraging assets

•

Integrated Product Development Center

Past/Present |

NYSE: NAV

13

13

Navistar Defense

Sustainable Revenue

2008

2009

2010

2011

> $2B

> $2B

> $2B

$1.5-$2.0B

•

U.S. and FMS

$1.3B

Continue at lower rate (-)

•

Foreign Direct

$0.3B

U.K./Canada/26 countries (+/-)

•

Parts & Services

$0.5B

Continue w/more vehicles (+/-)

•

Capability Insertion

$0.1B

Increasing (+)

•

Total

$2.2B

250 MaxxPro

Recovery

Vehicles

175 MaxxPro

Dash w/ DXM

Heavy Truck Tractors New customer –

Navy Seabees

2011 Goal

~$400M in awards within last three months

Recent Wins: |

NYSE:

NAV 14

14

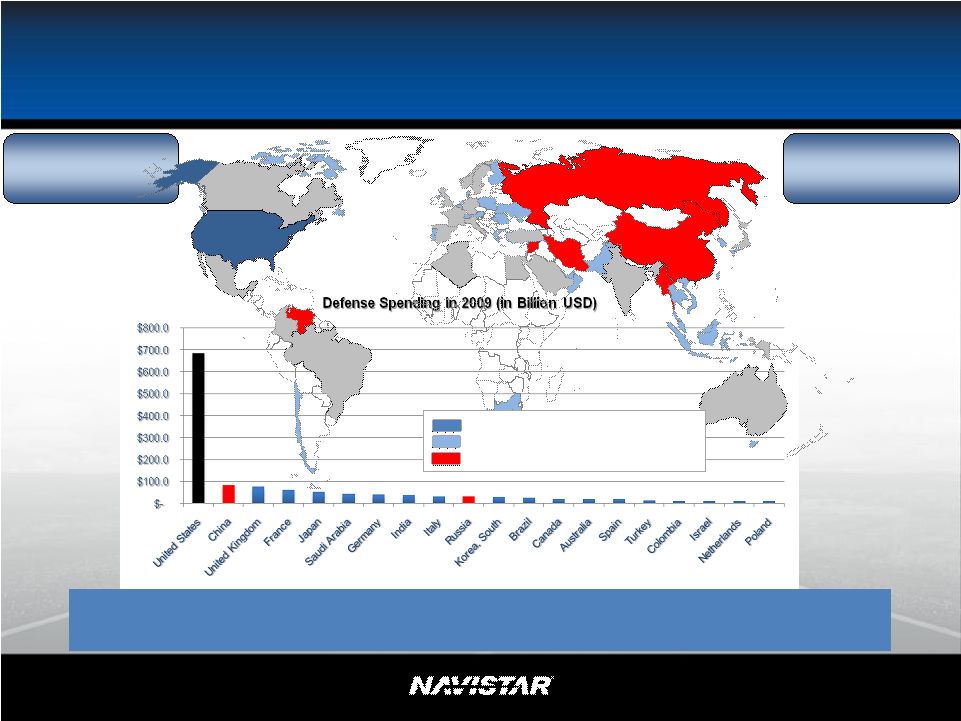

Top 15

Countries

International Market

Global Defense Budgets

1.

China

2.

United Kingdom

3.

France

4.

Japan

5.

Saudi Arabia

6.

Germany

7.

India

8.

Italy

9.

Russia

10.

S. Korea

11.

Brazil

12.

Canada

13.

Australia

14.

Spain

15.

Turkey

Iran

Colombia

Israel

Netherlands

Poland

Taiwan

Greece

Singapore

United Arab Emirates

Sweden

Norway

Pakistan

Egypt

Algeria

Belgium

Thailand

Switzerland

Oman

Chile

Denmark

50 Countries (Including US) Define 87% of the Global Defense Marketplace;

13 of top 15 Accessible to US Defense Companies

Domestic US Markets

Accessible International Markets

Excluded International Markets

Copyright ©

Jane’s

Information Group Inc., 2010.

All rights reserved.

Next in

Rank |

NYSE: NAV

15

15

School Bus

Class 6 and 7

Combined

Class 8

Engines

Class 4 and 5

Existing Platforms + Survivability Solutions = Success

Existing Platforms + Survivability Solutions = Success

Navistar Defense

Leveraging Platforms |

NYSE: NAV

16

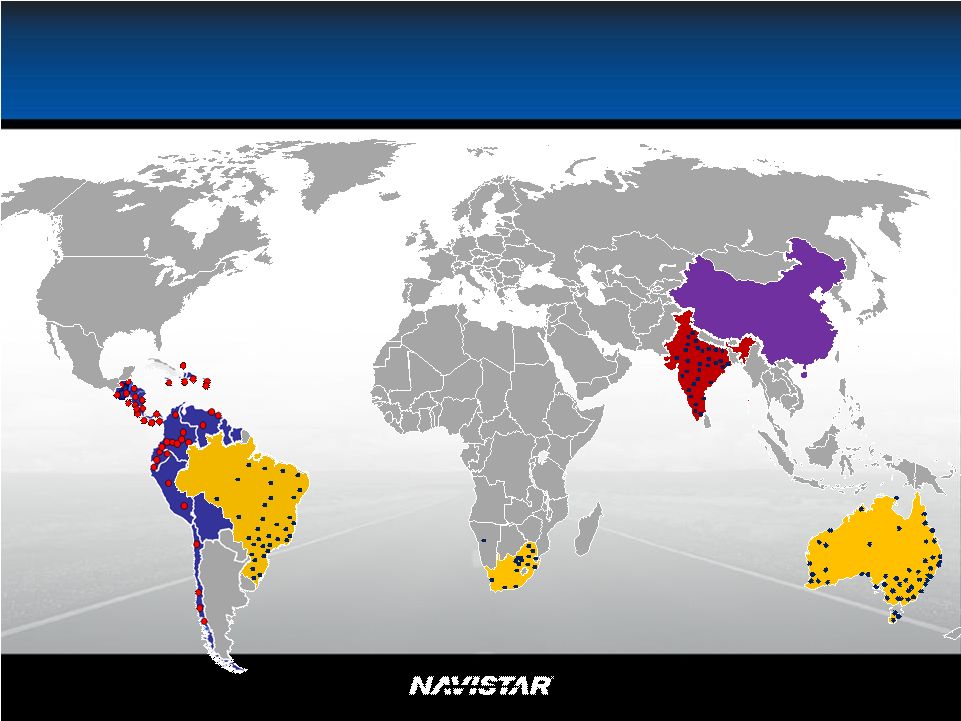

16

India

India

Latin America

Latin America

40T/49T

25T Tipper

31T

South Africa

South Africa

2011 Global Truck

Australia

Australia

CT630

CT610

Brazil

Brazil

9800 |

NYSE: NAV

17

17

2011 Global Truck |

NYSE: NAV

18

A. J. Cederoth

–

EVP & CFO

•

Strategy

•

Manufacturing cash

update

•

NFC liquidity remains

strong

•

Driving shareowner value

-

Managing legacy costs

-

Realizing tax value

•

Results will flow with

recovery

•

Thoughts for 2011 |

NYSE: NAV

19

Strategy -

Leveraging What We Have and What

Others Have Built

Note: This slide contains non-GAAP information, please see the Reg

G in appendix for detailed reconciliation. |

NYSE: NAV

4Q Manufacturing Cash Update

Note: This slide contains non-GAAP information, please see the Reg

G in appendix for detailed reconciliation.

20

($ millions)

July 31, 2010 ending manufacturing cash

1

$757

Manufacturing EBITDA

$123

Change in net working capital

2

$308

Capital expenditures

($85)

Other cash flows

($3)

October 31, 2010 ending manufacturing cash

1

$1,100

1

Includes marketable securities and cash from the consolidation of

non-controlling minority interests (includes $49 million and $16 million

of cash and cash equivalents at July 31 and October 31, 2010, respectively, from BDP and BDT)

2

NWC = A/R, Inventory, Other Current Assets, A/P & Other Current

Liabilities |

NYSE: NAV

21

21

Navistar Financial Corporation (NFC) -

Leveraging Assets & Controlling Our Destiny

•

Liquidity is strong: $719M

-

Dealer floor plan structures refinanced with > $529M of liquidity

•

Retail portfolio allied with GE Capital

-

Navistar Capital fully integrated

•

FY 2010 profitability of $95M and leverage has improved (7:1)

Retail Notes

Bank Facility

•

$815M of availability

remaining

–

Funding for retail notes,

wholesale notes, retail

accounts, and dealer open

accounts

–

Matures December 2012

On balance sheet

•

Situation as of Oct 31, 2010

–

~$1.1B funding facility

(NFSC)

–

$529M available

•

NFSC wholesale trust

–

Bank conduit portion renewed

August 2010

–

Public portions mature

January 2012 and October

2012

On balance sheet

•

Broaden product offering

•

Enhanced ability to support

large fleets

Note: $95 million of profitability is for total financial

services |

NYSE: NAV

22

22

Control Below the Line

•

FY2010 actual expense: $142M

•

FY2011 not expected to be exceed

FY2010 expense

•

Fiscal year pension returns were

17.5%

•

Pension Relief Act benefits funding

•

FY2010 actual expense: $37M

•

Continued dialogue around long term

solution

•

OPEB underfunded balance was

reduced in 2010 by $505M

•

Managed through 2010 product

transition

•

Global strategy will present new

challenges, value of partners

•

2011 opportunities

•

2011 tax rate expected to be between

13% and 18%

•

Long-term outlook -

potential to

consume NOL

•

Value of deferred tax assets will have

positive impact on balance sheet |

NYSE: NAV

23

Positioned to Take Advantage of

Industry Recovery

Note: This slide contains non-GAAP information, please see the Reg

G in appendix for detailed reconciliation.

FY2008

FY2009

FY2010

Defense Revenues

$3.9B

$2.9B

$2.2B

Engines sold to Ford

(in units)

125K

102K

25K

Post Retirement Benefit

(Costs)

$42M

($233M)

($179M)

JV Investments

(start-up costs)

NA

($20M)

($55M) |

NYSE: NAV

24

24

Thoughts for FY 2011

Full Year

Timing

North America Industry

+

Recovering Throughout the Year

Market Share

+

Building Experience in 1st Half / Gains in 2nd Half

-

Class 4/5

+

-

Class 6/7

+

-

Class 8

-

/ +

Core Business Performance

+ +

Trends with Volume

Global Growth

+

Volume Growth as Distribution Expands

Military Revenue

-

/ +

$1.5B -

$2.0B

Engine

+

OEM Volume Growth

-

South America

–

/ +

Sustain South America

Parts

+

Continued Growth

Facility Integration

Engineering Integration / Transition

–

Labor

UAW, Chatham |

NYSE: NAV

25

25

Investor

&

Analyst

Day

-

January

25,

2011

Reservation Required

Navistar’s Investor & Analyst Day

Tuesday, January 25, 2011

Melrose Park Engine Facility

Melrose Park, IL

10:30

a.m.

–

3

p.m.

CST

Lunch, Presentation with Q&A

Plant Tour, Lab Demos & Product Displays

Reservation Required

Please contact Suzanne Sorensen at

Suzanne.Sorensen@Navistar.com to RSVP

JAC JV and NEOBUS JV are pending

7.2L

4.8L

9

10

DT

7

11

13

9.3L |

NYSE: NAV

26

Appendix |

NYSE: NAV

27

27

4Q2010 and Full Year Information:

Profitable at all points in the cycle

Quarterly Manufacturing

Segment Profit ($ in millions)

Quarterly Diluted Earnings

(loss) per share

$1.19

$0.54

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

4Q09

4Q10

$232

$146

$0.00

$50.00

$100.00

$150.00

$200.00

$250.00

4Q09

4Q10

2009

2010

Military Revenue

$613M

$591M

Truck

$400M

$495M

Parts

$213M

$96M

World Wide Chargeouts

22,800

24,800

Ford Engine Volume (US/Can)

39,600

0

Product Development Cost

$94M

$126M

UAW Agreement Costs

N/A

$10M

2009

2010

Military Revenue

$2,941M

$2,151M

Truck

$2,121M

$1,820M

Parts

$820M

$331M

World Wide Chargeouts

75,800

86,900

Ford Engine volume - full Year (US/Can)

101,500

24,900

Product Development Cost

$433M

$464M

UAW Agreement Costs

N/A

$10M

Full Year

Fourth Quarter |

NYSE: NAV

28

28

Market Share –

U.S. & Canada School Bus and Class 6-8

Navistar

1st Q

2nd Q

3rd Q

4th Q

Full Year

1st Q

2nd Q

3rd Q

4th Q

Full Year

1st Q

2nd Q

3rd Q

4th Q

Full Year

Bus (School)

57%

57%

48%

58%

55%

56%

60%

61%

66%

61%

60%

63%

52%

59%

59%

Medium (Class 6-7)

34%

35%

39%

35%

36%

30%

39%

33%

39%

35%

33%

44%

36%

37%

38%

Heavy (LH & RH)

16%

15%

19%

25%

19%

24%

23%

29%

24%

25%

23%

22%

30%

20%

24%

Severe Service

28%

26%

26%

29%

27%

32%

36%

33%

33%

34%

34%

35%

35%

29%

33%

Combined Class 8

20%

19%

21%

26%

22%

26%

27%

30%

27%

28%

26%

26%

31%

22%

26%

Combined Market Share

27%

27%

28%

32%

29%

30%

35%

36%

36%

34%

31%

35%

34%

30%

33%

2010

Market Share - U.S. & Canada School Bus and Class 6-8

2008

2009 |

NYSE: NAV

29

29

Truck Chargeouts

Note: Information shown below is based on Navistar’s fiscal year

Fiscal year 2008

1Q08

2Q08

3Q08

4Q08

Full Year 2008

BUS

3,100

3,300

2,700

4,400

13,500

MEDIUM

3,700

6,300

5,800

4,500

20,300

HEAVY

2,600

3,900

4,500

7,800

18,800

SEVERE

2,400

3,400

3,300

3,700

12,800

TOTAL

11,800

16,900

16,300

20,400

65,400

MILITARY (U.S. & Foreign)

1,600

2,200

2,300

2,600

8,700

EXPANSIONARY

5,900

8,100

8,400

5,700

28,100

WORLD WIDE TRUCK

19,300

27,200

27,000

28,700

102,200

Fiscal year 2009

1Q09

2Q09

3Q09

4Q09

Full Year 2009

BUS

2,700

3,100

3,500

4,500

13,800

MEDIUM

3,200

3,400

2,700

3,700

13,000

HEAVY

6,100

3,200

4,500

5,300

19,100

SEVERE

2,800

2,700

2,800

2,600

10,900

TOTAL

14,800

12,400

13,500

16,100

56,800

MILITARY (U.S. & Foreign)

2,500

2,100

1,200

2,000

7,800

EXPANSIONARY

2,400

1,900

2,300

4,600

11,200

WORLD WIDE TRUCK

19,700

16,400

17,000

22,700

75,800

Fiscal year 2010

1Q10

2Q10

3Q10

4Q10

Full Year 2010

BUS

3,100

3,100

2,300

3,900

12,400

MEDIUM

3,900

5,300

3,900

5,400

18,500

HEAVY

5,200

4,600

6,400

5,400

21,600

SEVERE

3,100

3,000

1,800

2,800

10,700

TOTAL

15,300

16,000

14,400

17,500

63,200

MILITARY (U.S. & Foreign)

900

900

1,600

1,200

4,600

EXPANSIONARY

3,900

4,500

4,600

6,100

19,100

WORLD WIDE TRUCK

20,100

21,400

20,600

24,800

86,900 |

NYSE: NAV

30

30

World Wide Engine Shipments

Navistar

1st Q

2nd Q

3rd Q

4th Q

Full Year

OEM sales - South America

27,600

33,800

34,500

36,700

132,600

Ford sales - U.S. and Canada

41,400

48,000

18,600

16,500

124,500

Other OEM sales

3,200

4,200

4,900

6,500

18,800

Intercompany sales

13,600

16,500

21,200

18,300

69,600

Total Shipments

85,800

102,500

79,200

78,000

345,500

Navistar

1st Q

2nd Q

3rd Q

4th Q

Full Year

OEM sales - South America

19,400

22,500

26,100

31,200

99,200

Ford sales - U.S. and Canada

12,600

26,400

22,900

39,600

101,500

Other OEM sales

4,500

2,400

1,800

2,600

11,300

Intercompany sales

14,400

12,600

12,800

17,500

57,300

Total Shipments

50,900

63,900

63,600

90,900

269,300

Navistar

1st Q

2nd Q

3rd Q

4th Q

Full Year

OEM sales - South America

30,700

34,600

33,600

33,900

132,800

Ford sales - U.S. and Canada

24,700

200

-

-

24,900

Other OEM sales

2,000

3,600

3,700

4,900

14,200

Intercompany sales

16,400

17,700

15,600

18,800

68,500

Total Shipments

73,800

56,100

52,900

57,600

240,400

2010

2008

2009 |

NYSE: NAV

31

31

Order Receipts –

U.S. & Canada

Percentage

Percentage

2010

2009

Change

Change

2010

2009

Change

Change

3,200

9,100

(5,900)

(65)

7,800

18,300

(10,500)

(57)

5,200

7,100

(1,900)

(27)

17,700

15,100

2,600

17

Class 8 heavy trucks

4,100

7,000

(2,900)

(41)

20,200

19,900

300

2

Class 8 severe service trucks

2,200

3,700

(1,500)

(41)

10,000

11,100

(1,100)

(10)

14,700

26,900

(12,200)

(45)

55,700

64,400

(8,700)

(14)

6,300

10,700

(4,400)

(41)

30,200

31,000

(800)

(3)

The

three

and

twelve

months

ended

October

31,

2009

have

been

recast

to

exclude

200

and

3,000

units,

respectively,

related

to

U.S.

military

contracts

to

reflect

our

new

methodology

for

categorization

of

“traditional”

units.

Total "Traditional" Markets

Combined Class 8 (Heavy and Severe Service)

"Traditional" Markets

School buses

Class 6 and 7 medium trucks

Twelve Months Ended

October 31,

Order Receipts: U.S. & Canada (Units)

Three Months Ended

October 31, |

NYSE: NAV

32

32

International

Dealer

Stock

Inventory

(Units)

*

U.S. and Canada Dealer Stock Inventory

*Includes U.S. and Canada Class 4-8 and school bus inventory, but does not

include U.S. IC Bus or Workhorse Custom Chassis inventory. |

NYSE: NAV

33

33

Frequently Asked Questions

Q1:

Why did the Company disclose that it revised its previous financial

statements? A:

In Q4, the Company identified errors that originated in periods prior to 2008. The

errors included: (i) an understatement of our net obligation for pension

benefits of $25 million due to our actuarially computed projected benefit

obligations for pensions not measuring certain benefits,

(ii)

an

understatement

of

our

asbestos

claims

reserve

of

$9

million

for

a

mechanical

error in the actuarial model used to calculate our reserve, and (iii) an

understatement of our reserve for certain disability programs for our

Canadian operations of $16 million due to an error in the application of

the accounting guidance for defined benefits and a related understatement

of our deferred tax assets of $5 million. These errors resulted in the

understatement of our accumulated deficit and accumulated other

comprehensive loss of $29 million and $16 million, respectively, at October

31, 2009. The corrections are not considered material to any previously

reported consolidated financial statements. The 2009 and 2008 impact of

these errors, totaling $10 million, was recognized in our results for 2010

as they were not material to our financial results for 2009 and 2008. We

have revised our previously reported Consolidated Balance Sheet as of October 31,

2009 and Consolidated

Statements

of

Stockholders’

Deficit

for

the

years

ended

October

31,

2009

and

2008 to reflect the correction of errors identified in those statements. The

revisions did not impact the Consolidated Statements of Cash Flows for

those periods. |

NYSE: NAV

34

34

Frequently Asked Questions

Q2:

How does vertical integration of a big bore engine impact warranty?

A:

With the transition to 100% MaxxForce

engines we will assume an increased responsibility for engine

warranty,

which

was

previously

absorbed

by

our

suppliers

and

reflected

in

our

material

costs.

The

impact of this change will increase warranty expense and decrease material

costs. Q3:

What is the breakdown of your South American engine business in 2010 (broken down by

automotive, agricultural/other, and truck)? What do you expect your breakout

to be in 2012? A:

Q4:

What is in your Dealcor

debt?

A:

Dealcor

debt is comprised of wholesale (floor plan) financing and also retail financing on

lease and rental fleets for company owned dealers.

Q5:

How many Dealcor

dealers did you have as of October 31, 2010?

A:

Of our 276 primary NAFTA dealers, we have ownership interest in 11 DealCor

dealers as of

October 31, 2010.

We expect to further reduce our number of Dealcor

dealers in 2011.

Application

2010 FY

2012 FY

Pick-ups & SUVs

35%

30%

Trucks

23%

24%

Tractors

20%

9%

Buses

11%

22%

Industrial

5%

7%

GenSets

5%

6% |

NYSE: NAV

35

35

Frequently Asked Questions

Q6:

Are there any requirements for NFC leverage?

A:

NFC is compliant with our revolver leverage covenant of 6 to 1. This ratio

calculation excludes qualified retail and lease securitization debt.

Q7:

How do you fund your wholesale business?

A:

We primarily finance our wholesale portfolio in traditional private or public

securitizations, and through our bank facility.

Q8:

How are your dealers doing?

A:

We think our dealers, which have always been one of our strengths, are well

positioned. We traditionally have not had any significant dealer

losses and expect that trend to continue in the future. Q9:

What kind of rates do you charge your dealers and customers?

A:

Generally, our rates vary (those with higher credit risk have always had to pay

higher interest rates) and are usually in line with the market.

Q10:

How is your NFC portfolio performing?

A:

Repossessions, past due accounts and losses peaked in 2008 and have continued to

show improvement.

NFC portfolio performance improved considerably in 2010, which has resulted in a

lower provision for losses. |

NYSE: NAV

36

36

Frequently Asked Questions

Q11:

What is your total amount of capacity at NFC?

A:

Total availability in our funding facilities is more than $719 million as of

October 31, 2010. Q12:

What is the status of the retail financing alliance with GE Capital in the United

States? A:

Navistar

Capital

–

the

alliance

we

formed

with

GE

Capital

to

support

the

sale

of

Navistar

products

–

is

off to a great start and progressing consistent with expectations.

Q13:

Why have NFC’s wholesale receivables and debt moved onto the balance

sheet? A:

NFC

amended

its

wholesale

securitization

trust

to

allow

NFC

some

control

over

receivables

transferred

to the trust, which is a variable interest entity of which NFC is the primary

beneficiary. Under current accounting rules, the amendment requires

NFC to consolidate the assets and liabilities of the wholesale

securitization trust onto the balance sheet. Q14:

How does the latest Ground Combat Vehicle (GCV) program announcement affect

Navistar? A:

Navistar was not originally part of the GCV program. Recently, the Army

announced it would cancel the contract solicitation and issue a revised

Request for Proposal (RFP). Navistar will evaluate potential

opportunities once the RFP has been issued. Q15:

What is the current Joint Light Tactical Vehicle (JLTV) program status?

A:

As part of the Technology Development (TD) phase, Navistar and BAE delivered

right-hand drive prototypes to Australia on June 21 following delivery

of prototypes to the U.S. in May. |

NYSE: NAV

37

37

Frequently Asked Questions

Q16:

What

is

the

status

of

any

MaxxPro

®

Dash

rolling

chassis

orders?

A:

At this time, we stand ready to support any needs from the military should they

choose to retrofit the remainder

of

the

MaxxPro

fleet

with

DXM™

independent

suspension.

To

date,

Navistar

has

been

contracted

to

produce

1,305

MaxxPro

Dash

units

with

DXM

independent

suspension

and

is

currently

retrofitting

another

1,222

Dash

units

in

theater

with

the

capability.

Recently,

the

company

also

received

an

order

for

250

of

the

new

MaxxPro

Recovery

MRAP

variant.

Q17:

What are your margins for military vehicles?

A:

We do not break margins out specific to our military vehicles. These numbers are

reported as part of our Truck Group financials.

Q18:

What are the 2010 emissions requirements?

A:

The

rules

allow

manufacturers

to

go

to

a

maximum

of

0.50

NOx

if

they

reduced

earlier

with

advanced

technology;

manufacturers

need

to

be

at

0.20

NOx

if

they

chose

not

to

introduce

advanced

technologies

to

reduce

their

emissions

earlier.

Q19:

What

will

Navistar

do

to

meet

the

0.20

NOx

emissions

when

its

credits

are

depleted?

A:

Navistar remains committed to its strategy of providing solutions that let

customers focus on their business, not emissions regulations.

Solutions under development are multi-pronged and include our

prime

path

of

in-cylinder

solutions

along

with

application-specific

solutions

such

as

the

Amminex

metal

ammine-based

NOx

reductant

delivery

system

which

Navistar

announced

in

December

2009. |

NYSE: NAV

38

38

Frequently Asked Questions

Q20:

How much net operating losses remain, and why is there still a valuation allowance

against deferred tax assets?

A:

The Company has U.S. federal net operating losses available as of October 31, 2010

with an undiscounted cash value of $161 million.

In addition, we have state NOLs

valued at $85 million and

foreign

NOLs

valued

at

$85,

for

a

total

undiscounted

cash

value

of

$331

million.

(The

$25

million

reduction in our financial statement NOL deferred tax component relates to stock

option accounting.) A

substantial

portion

of

these

NOL

assets

are

subject

to

a

valuation

allowance.

In

addition

to

the

deferred

tax assets attributable to the NOLs, we have other deferred tax assets arising from

temporary book- tax differences subject to a valuation allowance, for a

total balance of deferred tax assets subject to a valuation allowance of

$1.8 billion. Under U.S. GAAP rules, when the Company is able to

demonstrate sufficient earnings (both historically and in the future) to absorb

these future deductions, the Company will release its valuation

allowances. If U.S. operations continue to improve, we believe it is

reasonably possible that the Company may release all or a portion of its

U.S. valuation allowance in the next twelve months. When we release the valuation

allowance, $49 million would favorably impact paid in capital and the balance would

favorably impact net income. |

NYSE: NAV

39

39

Frequently Asked Questions

Q21:

How has recent tax legislation affected Navistar?

A:

The Worker, Homeownership, and Business Assistance Act of 2009 provided an

opportunity to carry back alternative minimum tax net operating losses from

the Company’s 2010 fiscal year and to receive a

refund

of

alternative

minimum

tax

(AMT)

payments

made

in

the

prior

five

fiscal

years.

The

Company

expects

to

receive

a

refund

of

$29

million

of

AMT

credits

as

a

result

of

this

legislation.

The

Tax

Relief,

Unemployment

Insurance

Reauthorization,

and

Job

Creation

Act

of

2010

(the

Tax

Relief

Act)

extends

current

tax

rules

in

several

areas,

which

if

not

extended,

could

have

adversely

impacted

the

Company’s

tax

results.

In

addition,

the

Act

provides

the

opportunity

for

businesses

to

fully

depreciate

qualifying

property

purchased

through

the

end

of

2011

(50%

first

year

depreciation

for

purchases

in

2012), which could benefit both Navistar and its customers.

Q22:

What makes up our consolidated tax expense?

A:

Our pre-tax operating profits reflect our worldwide operations; similarly our

consolidated tax expense reflects the impact of differing tax positions

throughout the world. In general, we currently have full valuation

allowances

against

the

deferred

tax

assets

of

our

U.S.

and

Canadian

operations.

Consequently, our tax expense in those jurisdictions is generally limited to

current state or local taxes and the impact of alternative minimum

taxes. In 2010 we reported a refund of $29 million in AMT

credits which we expect to receive in 2011. Our Brazilian and Mexican

operations are profitable and as a result we accrue taxes in those

jurisdictions. This combination of factors contributes to our low

overall consolidated effective tax rate.

Q23:

What contributed to the $14 million decrease in income tax expense as compared to

2009? A:

The decrease in tax expense was primarily driven by the $29 million refund of U.S.

alternative minimum tax, offset by increases in our foreign taxes as a

result of higher foreign income. |

NYSE: NAV

40

40

Frequently Asked Questions

Q24:

Your

tax

footnote

in

the

10K

discloses

gross

deferred

tax

assets

of

$1.9

billion.

How

will

those

assets

be

used

to

offset

future

taxable

income?

A:

Simply put, deferred tax assets represent the value of future tax deductions

attributable to items that have already been expensed or deducted for book

purposes. The most commonly understood

component of deferred tax assets is the value of our net operating losses, which

will serve to reduce taxable

income

in

the

future.

In

addition,

we

have

several

other

major

components

of

deferred

taxes

which will reduce taxable income in the future.

For example, the Company has accrued significant

OPEB, pension and other employee benefit expenses during prior years based on

expected payments to be made in the future.

As these payments are made, the Company will realize tax deductions to the

extent of its future taxable income.

Q25:

What is your expected 2010 pension and OPEB GAAP expense?

A:

Assuming no further containment actions and no curtailment events, we anticipate

2011 pension and OPEB GAAP expense will not exceed 2010 levels.

Q26:

What are your expected 2011 and beyond pension funding requirements?

A:

Current forecasts indicate that we may need to contribute approximately $180

million in 2011. We believe the recently enacted pension funding relief

legislation Preservation of Access to Care for Medicare Beneficiaries and

Pension Relief Act of 2010 will materially reduce the amount of required

cash

contributions

into

our

major

US

defined

benefit

plans

over

the

next

five

years.

Although

certain

specific

regulations

related

to

funding

relief

have

not

yet

been

defined,

we

anticipate

that

minimum

required cash contributions will be reduced between $300 and $400 million for the

year 2012 through 2014 compared with our estimate of minimum required cash

contributions before funding relief. |

NYSE: NAV

41

41

Frequently Asked Questions

Q27:

What causes the variance between manufacturing cash interest payments and GAAP

interest expense?

A:

The

main

variance

between

cash

and

GAAP

interest

results

from

the

recent

issuance

of

new

manufacturing

debt.

In

October

2009,

our

manufacturing

company

issued

$1

billion

of

senior

unsecured

high

yield

notes

and

$570

million

of

senior

subordinated

convertible

notes.

As

a

result

of

this

issuance,

future

manufacturing

interest

expense

will

be

higher

than

cash

interest

payments

due

to

the

amortization

of

debt

issuance

costs

which

are

amortized

over

the

life

of

each

note

($36

million),

amortization

of

the

original

issue

discount

of

the

high

yield

notes

($37

million)

and

amortization

of

the

embedded

call

option

in

the

convertible

notes

($114

million).

In

FY

2010,

this

variance

is

much

larger

due

to

the

timing

of

interest

payments

on

the

high

yield

notes.

Interest

payment

dates

are

in

May

and

November

starting

in

May

2010.

Therefore,

we

had

only

one

cash

payment

this

fiscal

year

even

though

expense

will

show

the

full

year

amount.

As

a

result

of

this

and

other

non-cash

interest

expense,

FY

2010

shows

a

variance

of

approximately

$79

million

between

cash

and

GAAP

interest.

Q28:

What are the $225 million of Recovery Zone Facility Revenue Bonds (RZFB) Series 2010

due October 15, 2040 being used for?

A:

We

are

using

the

proceeds

to

invest

in

our

product

development

strategy

and

our

HQ

consolidation.

Great

products

are

a

key

pillar

of

our

three

pronged

strategy.

Streamlining

and

improving

our

product

development

processes

will

continue

to

provide

competitive

advantages

for

us

in

the

marketplace.

The

funding

from

RZFB

will

allow

us

to

consolidate

many

facilities

into

a

new

facility

and

make

necessary

renovations

to

that

facility.

Additionally

we

will

invest

in

an

existing

facility,

which

includes

investments

in

equipment

and

technology

that

will

help

us

create

and

improve

our

product

development

process

and

thus

shareholder

value. |

NYSE: NAV

Frequently Asked Questions

Q29:

Why did you use RZFB financing?

A:

The recovery zone facility bonds are a cost effective, long-term form of

capital that is complementary to our capital structure.

The bonds have a 30 year maturity and a fixed rate coupon of 6.50% per

annum.

They are callable at par any time after 10 years (October 15, 2020).

Issuing

bonds

in

the

tax-exempt

market

gave

us

exposure

to

a

new

source

of

investors

that

we

wouldn’t

otherwise

have

access

to

if

not

for

the

Recovery

Zone

Facility

Bond

program.

Q30:

What should we assume for capital expenditures in fiscal 2011?

A:

We

plan

to

continue

capital

spending

within

the

traditionally

guided

range

of

$250

-

$350

million

for

products and development.

There is capital spending related to Product Development Consolidation

not included in the range that is fully funded through Recovery Zone Bonds.

Q31:

How do you think about accounting vs. economic dilution on your convertible

debt? A:

Please

see

the

presentation

on

the

IR

website

(http://ir.navistar.com/dilution.cfm

) entitled

Dilution

overview

resulting

from

the

Convertible

Notes

issued

on

October

2009.

Q32:

How does your Class 8 industry compare to A:

ACT Research?

Reconciliation to ACT

ACT*

199,737

199,737

CY to FY adjustment

(20,000)

(16,000)

Other misc. specialty vehicles Included in ACT

(8,500)

(5,000)

Total (ACT comparable Class 8 to Navistar)

171,237

178,737

Navistar Industry Retail Deliveries Combined Class 8 Trucks

160,000

172,000

Navistar difference from ACT:

11,237

6,737

*Source: ACT N.A. Commercial Vehicle Outlook - December 10th, 2010

* * Navistar will update this number at the January 25th Analyst Day

U.S. and Canadian Class 8 Truck Sales

2011

42 |

NYSE: NAV

($ in millions)

Note: This slide contains non-GAAP information, please see the Reg G in

appendix for detailed reconciliation FYTD Manufacturing Cash Flow

Beginning Mfg. Cash¹ Balance

Fiscal 2007

Fiscal 2008

Fiscal 2009

YTD - FY 2010

October 31, 2006

$1,214

October 31, 2007

$722

October 31, 2008

$777

October 31, 2009

$1,152

Approximate Cash Flows:

From Operations

($231)

$414

$514

$409

Dividends from NFC

$400

$15

$0

$0

From Investing / (Cap Ex)

($200)

($220)

($284)

($350)

From Financing / (Debt Pay Down)

($480)

($133)

$56

($110)

Exchange Rate Effect

$19

($21)

$9

($1)

Net Cash Flow

($492)

$55

$295

($52)

Blue Diamond Consolidation

$0

$0

$80

$0

Ending Mfg. Cash¹ Balance:

October 31, 2007

$722

October 31, 2008

$777

October 31, 2009²

$1,152

April 30, 2010²

$1,100

1

Cash = Cash, Cash Equivalents & Marketable Securities

2

Includes cash from the consolidation of non-contolling minority interests

43 |

NYSE: NAV

44

44

SEC Regulation G

This

presentation

is

not

in

accordance

with,

or

an

alternative

for,

U.S.

generally

accepted

accounting

principles

(GAAP).

The

non-GAAP

financial

information

presented

herein

should

be

considered

supplemental

to,

and

not

as

a

substitute

for,

or

superior

to,

financial

measures

calculated

in

accordance

with

GAAP.

However,

we

believe

that

non-GAAP

reporting,

giving

effect

to

the

adjustments

shown

in

the

reconciliation

above,

provides

meaningful

information

and

therefore

we

use

it

to

supplement

our

GAAP

reporting

by

identifying

items

that

may

not

be

related

to

the

core

manufacturing

business.

Management

often

uses

this

information

to

assess

and

measure

the

performance

of

our

operating

segments.

We

have

chosen

to

provide

this

supplemental

information

to

investors,

analysts

and

other

interested

parties

to

enable

them

to

perform

additional

analyses

of

operating

results,

to

illustrate

the

results

of

operations

giving

effect

to

the

non-GAAP

adjustments

shown

in

the

above

reconciliations

and

to

provide

an

additional

measure

of

performance.

DEBT

October 31,

2010

October 31,

2009

(in millions)

Manufacturing operations

8.25% Senior Notes, due 2021, net of unamortized discount of $35 and $37 million at the

respective dates

965

$

963

$

3.0% Senior Subordinated Convertible Notes, due 2014, net of unamortized discount of $99

and $114 at the respective dates

476

456

Debt of majority owned dealership

66

148

Financing arrangements and capital lease obligations

221

271

Loan Agreement related to 6.5% Tax Exempt Bonds, due 2040

225

Other

33

23

Total manufacturing operations debt

1,986

$

1,861

$

Less: Current portion

(145)

(191)

Net long-term manufacturing operations debt

1,841

$

1,670

$

Financial services operations

Asset-backed debt issued by consolidated SPEs, at variable rates, due serially through 2018

1,731

$

1,227

$

Bank revolvers, at fixed and variable rates, due dates from 2010 through 2016

974

1,518

Revolving retail warehouse facility, at variable rates, due 2010

-

500

Commercial Paper, at variable rates, due serially through 2011

67

52

Borrowing secured by operating and finance leases, at various rate, due serially through

2017 112

134

Total financial services operations debt

2,884

$

3,431

$

Less: Current portion

(487)

(945)

Net long-term financial services operations debt

2,397

$

2,486

$

Cash & Cash Equivalents

October 31,

2010

October 31,

2009

Manufacturing non-GAAP (Unaudited)

534

$

1,152

$

*

Financial Services non-GAAP (Unaudited)

51

60

Consolidated US GAAP (Audited)

585

$

1,212

$

Manufacturing Cash & Cash Equivalents non-GAAP (Unaudited)

534

$

1,152

$

*

Manufacturing Marketable Securities non-GAAP (Unaudited)

566

-

Manufacturing Cash, Cash Equivalents & Marketable Securities non-GAAP

(Unaudited) 1,100

$

1,152

$

*Includes cash and cash equivalents from consolidating Blue Diamond Truck and Blue

Diamond Parts |

NYSE: NAV

45

45

SEC Regulation G

Three Months Ended October 31, 2010

($ millions)

Net income (loss) attributable to NIC

39

$

Add back income taxes

6

Income before income taxes

45

$

Less equity income from financial service operations

(33)

Income before income taxes and equity income from financial service operations

12

$

Add back manufacturing interest expense

38

Manufacturing EBIT

50

$

Add back manufacturing depreciation and amortization

1

73

Adjusted manufacturing EBITDA

123

$

1

Includes

depreciation

of

equipment

leased

to

others

and

excludes

debt

issuance

cost/discount

amortization |

NYSE: NAV

46

46

SEC Regulation G –

Fiscal Year Comparison

Manufacturing

Segment

Profit

is

not

in

accordance

with,

or

an

alternative

for,

U.S.

generally

accepted

accounting

principles

(GAAP).

The

non-GAAP

financial

information

presented

herein

should

be

considered

supplemental

to,

and

not

as

a

substitute

for,

or

superior

to,

financial

measures

calculated

in

accordance

with

GAAP.

However,we

believe

that

non-GAAP

reporting,

giving

effect

to

the

adjustments

shown

in

the

reconciliation

above,

provides

meaningful

information

and

therefore

we

use

it

to

supplement

our

GAAP

reporting

by

identifying

items

that

may

not

be

related

to

the

core

manufacturing

business.

Management

often

uses

this

information

to

assess

and

measure

the

performance

of

our

operating

segments.

We

have

chosen

to

provide

this

supplemental

information

to

investors,

analysts

and

other

interested

parties

to

enable

them

to

perform

additional

analyses

of

operating

results,

to

illustrate

the

results

of

operations

giving

effect

to

the

non-GAAP

adjustments

shown

in

the

above

reconciliations

and

to

provide

an

additional

measure

of

performance.

Future

2009

U.S. and Canada Industry

414,500

350,000

($billions)

Sales and revenues, net

$ 15 +

$ 20 +

($millions)

Manufacturing segment profit*

$ 1,600

Below the line items

Income excluding income tax

Income tax expense

(298)

Net Income attributable to Navistar International Corporation (NIC)

Diluted earnings per share ($'s) attributable to NIC

$12.31

Weighted average shares outstanding: diluted (millions)

Original Target

@ 414.5k Industry

Revised Target

@ 350k Industry

$ 1,780

(590)

~ 72.5

$892

~ 72.5

(500)

1,100

(275)

$825

$11.46

1,190 |

NYSE: NAV

SEC Regulation G –

Fiscal Year Comparison

This

presentation

is

not

in

accordance

with,

or

an

alternative

for,

U.S.

generally

accepted

accounting

principles

(GAAP).

The

non-GAAP

financial

information

presented

herein

should

be

considered

supplemental

to,

and

not

as

a

substitute

for,

or

superior

to,

financial

measures

calculated

in

accordance

with

GAAP.

However,

we

believe

that

non-GAAP

reporting,

giving

effect

to

the

adjustments

shown

in

the

reconciliation

above,

provides

meaningful

information

and

therefore

we

use

it

to

supplement

our

GAAP

reporting

by

identifying

items

that

may

not

be

related

to

the

core

manufacturing

business.

Management

often

uses

this

information

to

assess

and

measure

the

performance

of

our

operating

segments.

We

have

chosen

to

provide

this

supplemental

information

to

investors,

analysts

and

other

interested

parties

to

enable

them

to

perform

additional

analyses

of

operating

results,

to

illustrate

the

results

of

operations

giving

effect

to

the

non-GAAP

adjustments

shown

in

the

above

reconciliations

and

to

provide

an

additional

measure

of

performance.

2009

2008

Non GAAP

Non GAAP

Non GAAP

Non GAAP

As Reported

Non GAAP

Non GAAP

As Reported

Non GAAP

Non GAAP

As Reported

Without All

Impacts

Other

Impacts

Without UAW

Impacts

UAW

Impacts

With Impacts

Without

Impacts

Impacts

With Impacts

Without

Impacts

Impacts

With Impacts

U.S. and Canada Industry

191,300

181,800

244,100

($billions)

Sales and revenues, net

12.1

$

11.6

$

14.7

$

($millions)

Manufacturing segment profit *

(excluding items listed below)

725

$

-

$

725

$

-

$

725

$

707

$

-

$

707

$

1,088

$

-

$

1,088

$

Ford settlement net of related charges

-

27

27

-

27

-

160

160

-

(37)

(37)

UAW Expenses

-

-

-

(11)

(11)

-

-

-

-

-

-

Impairment of property, plant and equipment

-

-

-

-

-

-

(31)

(31)

-

(358)

(358)

Manufacturing segment profit

725

27

752

(11)

741

707

129

836

1,088

(395)

693

Below the line items

(excluding items listed below)

(496)

$

-

$

(496)

$

-

$

(496)

$

(468)

-

(468)

(502)

-

(502)

UAW Expenses

-

-

-

1

1

-

-

-

-

-

-

Write-off of debt issuance cost

-

-

-

-

-

-

(11)

(11)

-

-

-

Below the line items

(496)

-

(496)

1

(495)

(468)

(11)

(479)

(502)

-

(502)

Income (loss) excluding income tax

229

27

256

(10)

246

239

118

357

586

(395)

191

Income tax benefit (expense)

(23)

-

(23)

-

(23)

(34)

(3)

(37)

(58)

1

(57)

Net Income (loss) attributable to Navistar International Corporation

206

$

27

$

233

$

(10)

$

223

$

205

$

115

$

320

$

528

$

(394)

$

134

$

Diluted earnings (loss) per share ($'s) attributable to Navistar International Corporation

2.82

$

0.37

$

3.19

$

(0.14)

$

3.05

$

2.86

$

1.60

$

4.46

$

7.21

$

(5.39)

$

1.82

$

Weighted average shares outstanding: diluted (millions)

73.2

73.2

73.2

73.2

73.2

71.8

71.8

73.2

73.2

* Includes: non-controlling minority interest in net income of subsidiaries net of tax;

extraordinary gain net of tax 2010

47 |