Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Orexigen Therapeutics, Inc. | d8k.htm |

1

Investor Presentation

Investor Presentation

December 2010

December 2010

Exhibit 99.1 |

2

Forward-Looking Statements

Forward-Looking Statements

This

presentation

contains

forward-looking

statements

about

Orexigen

Therapeutics,

Inc.

Words

such

as

“believes,”

“anticipates,”

“plans,”

“expects,”

“will,”

“intends,”

“potential,”

“assuming”

and

similar

expressions

are

intended

to

identify

forward-looking

statements.

These

statements

are

based

on

Orexigen’s

current

beliefs

and

expectations.

These

forward-looking

statements

include

statements

regarding

the

potential

for,

and

timing

of,

approval

of

the

Contrave

®

New

Drug

Application

(NDA)

and

an

NDA

submission

for

Empatic™;

the

efficacy

and

safety

of

Contrave

and

Empatic;

Orexigen's

belief

that

Contrave

and

Empatic

may

be

important

and

effective

therapeutic

options

in

the

treatment

of

obesity;

the

potential

for,

timing

of,

cost

and

design

of

a

post-

approval

study

to

evaluate

safety

risks

of

Contrave;

the

potential

milestone

and

royalty

payments

under

the

collaboration

agreement

with

Takeda

Pharmaceutical

Company

Limited;

the

potential

strength

of

Orexigen’s

market

entry

with

Contrave,

if

approved;

and

Orexigen’s

plans

to

commence

strategic

collaboration

and/or

co-promotion

discussions

with

respect

to

Empatic

and

outside

of

the

United

States,

Contrave.

The

inclusion

of

forward-looking

statements

should

not

be

regarded

as

a

representation

by

Orexigen

that

any

of

its

plans

will

be

achieved.

Actual

results

may

differ

from

those

set

forth

in

this

presentation

due

to

the

risk

and

uncertainties

inherent

in

Orexigen’s

business,

including,

without

limitation:

the

potential

for

the

U.S.

Food

and

Drug

Administration

(FDA)

to

delay

the

scheduled

Prescription

Drug

User

Fee

Act

action

date

of

January

31,

2011

due

to

the

FDA’s

internal

resource

constraints

or

other

reasons;

the

uncertainty

of

the

FDA

approval

process

and

other

regulatory

requirements;

the

uncertainty

of

the

process

with

the

FDA

to

agree

on

and

finalize

a

design

for

a

post-approval

study

to

evaluate

safety

risks

of

Contrave;

the

FDA

may

not

agree

with

Orexigen’s

interpretation

of

efficacy

and

safety

results;

the

FDA

may

require

Orexigen

to

complete

additional

clinical,

non-clinical

or

other

requirements

prior

to

the

approval

of

the

Contrave

NDA

or

the

submission

of

an

NDA

for

Empatic;

the

therapeutic

and

commercial

value

of

Contrave

and

Empatic;

reliance

on

third

parties

to

assist

with

the

development

of

Contrave

and

Empatic;

the

potential

for

adverse

safety

findings

relating

to

Contrave

or

Empatic

to

delay

or

prevent

regulatory

approval

or

commercialization;

Orexigen’s

ability

to

enter

into

additional

collaboration

or

co-promotion

arrangements;

and

other

risks

described

in

Orexigen’s

filings

with

the

Securities

and

Exchange

Commission

(SEC),

including

those

detailed

under

the

heading

“Risk

Factors”

in

Orexigen’s

periodic

filings

with

the

SEC.

You

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements,

which

speak

only

as

of

the

date

hereof,

and

Orexigen

undertakes

no

obligation

to

revise

or

update

this

presentation

to

reflect

events

or

circumstances

after

the

date

hereof.

All

forward-looking

statements

are

qualified

in

their

entirety

by

this

cautionary

statement.

This

caution

is

made

under

the

safe

harbor

provisions

of

Section

21E

of

the

Private

Securities

Litigation

Reform

Act

of

1995

and

Section

27A

of

the

Securities

Act

of

1933,

as

amended.

Information

included

herein

is

based

on

clinical

data

the

Company

has

received

to

date

and

its

evaluation

of

such

data.

All

conclusions

contained

herein

are

subject

to

and

contingent

upon

additional

clinical

data

being

generated

by

the

Company

as

well

as

the

evaluation

of

such

data

by

the

FDA

and

other

regulatory

agencies. |

3

Realizing the Vision

Industry Leader in Obesity Therapeutics

PRODUCTS

Contrave

®

–

NDA under

review by FDA

Empatic™

–

Preparing

for Phase III

STRATEGY/EXECUTION

Successful Execution

on All Major Milestones

to Date

Gain High Quality

Partners for Global

Commercialization

RESOURCES

Powerful Partner for

Contrave

in

North America

Strong Balance Sheet

Experienced Team |

4

2010 –

A Year of Strong Execution

2010 –

A Year of Strong Execution

Q1

Q2

Q3

Q4

2010

Filed NDA

NDA Accepted

by FDA

Clinical Results

Published in

The Lancet

and

Obesity

Signed Takeda

Partnership

Positive Advisory

Committee

Meeting |

5

Obesity Epidemic Plus Lack of Solutions Have

Created a Perfect Storm

Obesity Epidemic Plus Lack of Solutions Have

Created a Perfect Storm

Increase in Obesity

Source: http://www.cdc.gov; http://www.fightchronicdisease.org;

Flegal KM, et al. 2010 U.S.

103M

16%

34%

43%

Serious Disease Attributable

to Obesity

Treatment Options Needed

T2DM, Driven by Obesity, Is an Epidemic

-

1 in 3 Adults in the U.S. May Have Diabetes by 2050 (CDC)

-

Associated with Premature Death & Physical/Psychosocial Consequences

Weight

Loss

of

5

10%

Confers

Significant

Benefits

Lifestyle Change is Critical, but Weight Loss Difficult to

Achieve/Maintain

Large Gaps in Current Treatment Paradigm

75M |

6

Corporate Objectives for 2011

Corporate Objectives for 2011

Pursue

Additional

Partnerships

Launch

Contrave

with Takeda

Obtain

Approval for

Contrave

Address FDA

Input |

7

Key Results from Advisory Committee

Key Results from Advisory Committee

13:7 on Approvability

11:8 –

Outcomes Trial should be Run

Post-Approval (Not Pre-approval)

Major Takeaways

Efficacy Met FDA Guidance

Strong Support for Comprehensive Risk Mitigation Strategy

Desire for a Post-Approval Outcomes Study

Risk/Benefit Deemed Acceptable for Approval |

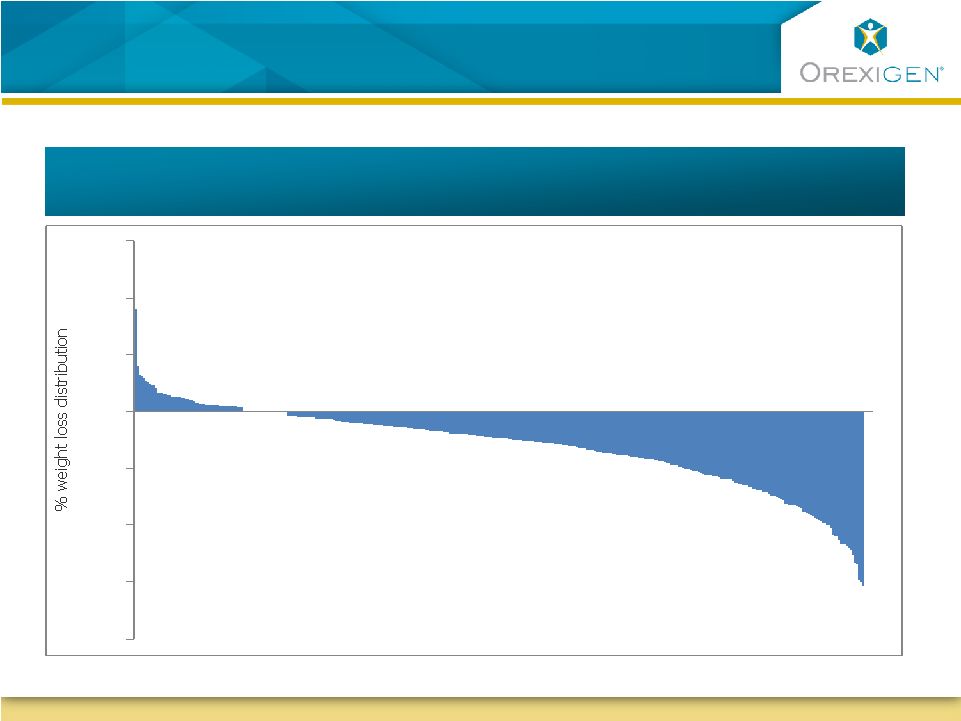

8

-40

-30

-20

-10

0

10

20

30

Typical Response to Weight Loss Therapy

is not Uniform

Typical Response to Weight Loss Therapy

is not Uniform

COR-I Weight Loss Distribution (Contrave32) |

9

-40

-30

-20

-10

0

10

20

30

Our Recommended Treatment Algorithm Focuses on

Patients who Achieve a Meaningful Response

Our Recommended Treatment Algorithm Focuses on

Patients who Achieve a Meaningful Response

Our Focus: Patients

Who Lose

5%

<5% weight loss

COR-I Weight Loss Distribution (Contrave32) |

10

Treatment Algorithm: Identify Early Responders

for Continued Long-term Therapy

Treatment Algorithm: Identify Early Responders

for Continued Long-term Therapy

Appropriate BMI

Motivated to Adhere

to Lifestyle Change

Inadequate

Response to Diet &

Exercise

Select Responders

for Continued

Treatment

Reinforce Adherence

to Appropriate Use

Evaluate Adherence

to Appropriate Use

Guidance

Assess Response

to Therapy (>5%)

Screening

16-Week

Therapeutic Trial

Long-Term

Therapy |

11

Contrave

Early Responders Go on to Achieve

Substantial Long Term Weight Loss

Contrave

Early Responders Go on to Achieve

Substantial Long Term Weight Loss

Represents

one

year

data

for

responders

(patients

with

5%

weight

loss

at

week

16

per

recommended

treatment

protocol)

Weight Loss Distribution

0% -

5%

Weight loss

10% -

15%

Weight Loss

Avg

Wt Loss =

26.7 lbs

>15% Wt Loss

Avg

Wt Loss =

43.9 lbs

Weight Gain

5% -

10%

Weight Loss

Avg

Wt Loss =

17.0 lbs |

12

Contrave

Responders Achieve Improvement across

Multiple Cardiometabolic

Parameters

Contrave

Responders Achieve Improvement across

Multiple Cardiometabolic

Parameters

Improvement

(Standardized Mean Change from Baseline)

Contrave32

Contrave32

N=1038

N=1038

Placebo

N=254

-11.3%

-8.6%

-9.5 cm

-7.2 cm

5.2 mg/dL

2.9 mg/dL

-2.5 mg/dL

1.7 mg/dL

-16.0%

-9.2%

-38.9%

-36.2%

14.7

12.3

-1.0%

-0.6%

-0.9 mm Hg

-2.8 mm Hg

-1.6 mm Hg

-2.6 mm Hg

0.2 bpm

-2.3 bpm

Proportion w/

5% Wt Loss Wk 16

51%

19%

Contrave32 Standardized Mean

Change from Baseline at 1 Year

Change from Baseline at 1 Year

Body Weight

Waist Circ.

HDL

LDL

Triglycerides

hsCRP

IWQOL

HbA1c

SBP

DBP

Heart Rate |

13

Contrave: Well Characterized Safety Profile

Contrave: Well Characterized Safety Profile

Delivers Safety Experience Consistent with

20+ Year History of Underlying Agents

Known Areas of Focus –

CV Effects, Seizure, Psychiatric Effects, Creatinine

Meets FDA Guidance for Patient Exposure for Evaluation

of Safety and Tolerability with >4,500 Patients

Long Term Evaluation of Benefits and Outcomes

Proposed for Post-approval |

14

Label

Appropriate Selection

and Management of

Patients

REMS

Medication Guide,

Communication Plan

and Assessment

Post-Marketing

Data Capture

Prospective

Cohort Study

Outcomes Trial

Comprehensive Risk Mitigation Plan Designed

to Drive Appropriate Use

Comprehensive Risk Mitigation Plan Designed

to Drive Appropriate Use

Appropriate Use Program: Delivers Tools for Screening,

Evaluation and Comprehensive

Weight Management |

15

Post-approval Outcomes Trial Represents Significant

Opportunity for Orexigen

Post-approval Outcomes Trial Represents Significant

Opportunity for Orexigen

Beneficial

outcomes

predicted

based

on

cardiometabolic

improvements

--

Demonstrating

outcomes

benefit

could

be

transformational

for

Contrave

and

the obesity field

Proposing

large

simple

trial

(LST)

--

Streamlined,

practical,

affordable

trial

design targeting per-patient cost at a fraction of typical outcomes trials

Aligned with principles of FDA-Duke Clinical Trial Transformation Initiative

(CTTI) |

16

SCALE

Top 15 Pharma

Significant U.S. Presence

Primary Care Focus

COMMITMENT

TO OBESITY

Partnership

with Amylin

Stated

Strategy

DOMAIN

EXPERTISE

Leader in

Cardiometabolic

Care

Excellence in

Life Cycle

Management

POWERFUL

BRAND BUILDER

Actos ~$3B in U.S.

Sales in 2009

Prevacid ~$3B in U.S.

Sales in 2009

Takeda Is the Ideal Partner for Contrave

Takeda Is the Ideal Partner for Contrave |

17

Competitive Product Profile Attractive to Patients

Competitive Product Profile Attractive to Patients

% of

Patients Losing

10% of Body

Weight after

Completing 1 year

of Treatment

Women Dominate the Market

1/3 to 1/2 Experienced Market-Meaningful Weight Loss

No Addictive Concerns

Avg

Loss

34 lbs

Avg

Loss

35 lbs

Avg

Loss

39 lbs

No Abuse Liability

No DEA Limitations on

Distribution Expected

73%

73%

Sources:

Orexigen

Quantitative

Market

Research

2009;

IMS

NDTI

Audit

Data,

6

Months Ending 3/09

Female, Often

Childbearing Age |

18

Contrave: Keys to Commercial Success

Contrave: Keys to Commercial Success

Source: CDC (2009)

103M

US Obesity Rate Growth

Obesity

Rate

Blockbuster Market Size

Market Growth

Significant Unmet Need –

Limited Competition

Diet & Lifestyle Modifications

Contrave: Differentiated Profile

Takeda: Heavily Resourced

BMI

Distribution

of US Pop:

Morbidly Obese

Obese

Overweight

~ 113K People

Treated w/ Surgery

~ 2 Million People

Treated w/ Rxs

Majority of Obese are Untreated in an Environment of Limited Treatment Options

US Population

~ 1 in 3 People

in the US

Are Obese |

19

We Partnered Early for the Significant Activities

Required for a Quality Launch

We Partnered Early for the Significant Activities

Required for a Quality Launch

Sales Force

Sales Aids

Direct Mail

Physician Ed Brochure

Sales Training

Professional

Advisory Boards

KOL Identification

Peer-to-Peer Programs

HCP Website

Patient

Patient Ed Brochure

Patient Support Program

Websites/Digital Ads

Pharmacy Programs

Brand

Development

Market Research

Positioning / Targeting

Customer Segmentation

Sample Strategy

Market

Development

KOL Mapping

Medical Education

Publications

Health Outcomes

Managed Markets;

Government Affairs

Employer Segmentation

Health Outcomes Research

Pricing/Contracting

Advocacy/Policy |

20

Seeking High Quality Partner for Contrave

Commercialization in ROW

Seeking High Quality Partner for

Contrave Commercialization in ROW 8 to 10

Attractive

Potential

Partners

Commitment to Cardiometabolic

Disease in Target Markets

Strong Regulatory Track Record

Powerful Commercialization Capacities

Motivated to Build Late Stage Pipeline |

21

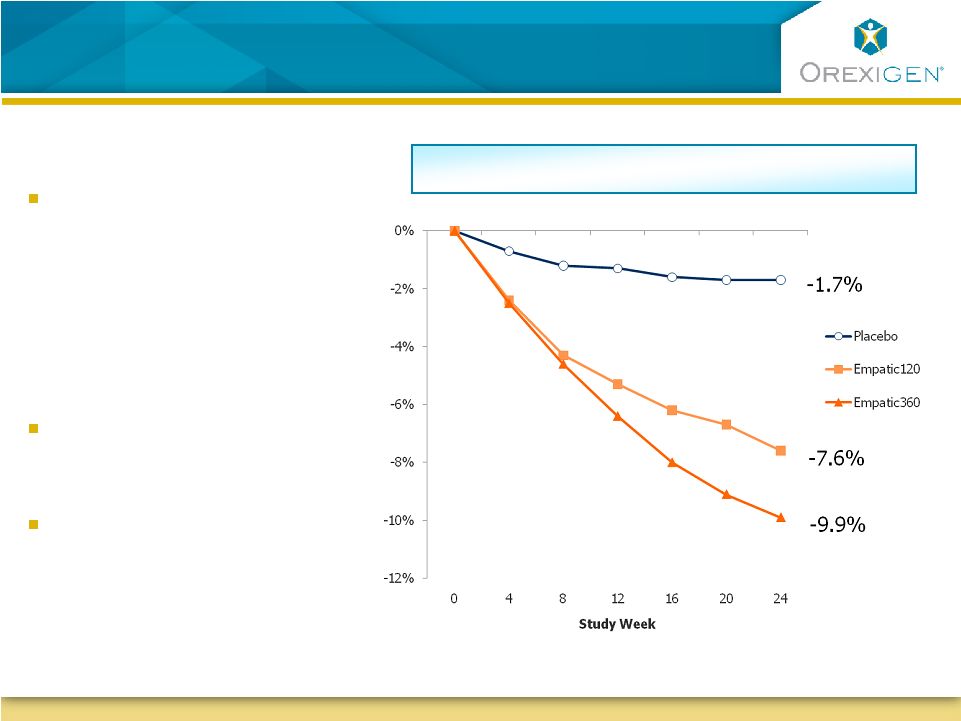

Empatic: Second Late Stage Obesity Program with

Complementary Profile

Empatic: Second Late Stage Obesity Program with

Complementary Profile

Observed Case Analysis

Key to Multi-Solution

Approach

-

High Efficacy

-

Different MOA than

Contrave

-

Helps Orexigen

Meet

Differing Patients Needs

Safety Profile Appears

Consistent with Underlying

Constituents

Phase II Completed;

Exploring Partnership

Options for Phase III

Note

:

All

differences

between

Empatic

and

placebo

statistically

significant

at

all

time

points.

Data

are

LS

mean. |

22

2011

2012

Contrave

PDUFA

Potential Launch

with Takeda in

United States

Partnership

for Ex-NA

Multiple Near-Term High-Value Catalysts

Multiple Near-Term High-Value Catalysts

Empatic

Phase III Planning

End of Phase II Meeting

Partnership

Phase III Initiation

Lifecycle

Management

Opportunities |

23

No Foreseeable Need to Finance

No Foreseeable Need to Finance

$50M Payment from Takeda in Q3

$100M of Cash and Investments as of 9/30/10

Strong Balance Sheet

$100M in Milestones Achievable Between Now and

Product Launch

Additional Milestones for New Potential Collaborations

Near-Term Milestones

Takeda Responsible for All Commercialization Expenses in NA

Post-Approval Development Costs Shared

Ex-NA and Empatic

Activities Focused on Selecting Partner

Run-rate Opex

under $60M

Low Burn Rate |

24

Realizing the Vision

Industry Leader in Obesity Therapeutics

PRODUCTS

Contrave

®

-

NDA under

review by FDA

Empatic™

–

Preparing

for Phase III

STRATEGY/EXECUTION

Successful Execution

on All Major Milestones

to Date

Gain High Quality

Partners for Global

Commercialization

RESOURCES

Powerful Partner for

Contrave

in

North America

Strong Balance Sheet

Experienced Team |

25 |