Attached files

Quarterly

1

Source: SNL Financial.

Note: Quarterly PTPP ROAA ratios are annualized

PTPP is defined by SNL as: Net interest income, fees and other non-interest

income, net of non-credit-related expenses. Represents earnings

capacity that can be applied to capital or loan losses Annual

Strong Earnings Ability and Capacity

Net Income

PTPP ROAA

$10,476

$10,547

$10,708

$6,351

$581

2.28%

2.09%

1.94%

1.87%

1.99%

1.00%

1.50%

2.00%

2.50%

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

2005

2006

2007

2008

2009

$(594)

$91

$312

$772

$696

$855

$2,042

1.79%

1.89%

2.06%

2.20%

1.87%

1.76%

1.72%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

($600)

($100)

$400

$900

$1,400

$1,900

$2,400

Q1'09

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Q3'10

Performance

2005

2006

2007

2008

2009

Net Income (Loss)

$10,476

$10,547

$10,708

$6,351

$581

PTPP Earnings

$16,328

$16,644

$16,905

$16,747

$19,468

PTPP ROAA

2.28%

2.09%

1.94%

1.87%

1.99%

Q1'09

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Q3'10

($594)

$91

$312

$772

$696

$855

$2,042

$4,235

$4,581

$5,022

$5,630

$4,746

$4,428

$5,261

1.79%

1.89%

2.06%

2.20%

1.87%

1.76%

1.72%

Exhibit 99.2 |

2

Non-Covered Loan Portfolio

Construction Portfolio

Financial data as of September 30, 2010 and does not include loans covered by

the FDIC under a loss sharing agreement from the Cowlitz Bank acquisition

or the loans purchased in the Pierce Commercial Bank acquisition. Diversified

Loan Portfolio CRE Owner

Occupied

22%

Occupied

29%

Commercial and

Industrial

31%

Residential

Construction

4%

Commercial

Construction

4%

Residential Real

Estate

7%

Consumer

3%

Commercial

16%

Commercial Land

12%

Condos

25%

Residential Land

6%

Single Family

Residential

21%

A&D Residential &

Lots

20%

Total Non-Covered Loans: $759 million

Total Construction Loans: $63 million

CRE Non-Owner |

3

Commercial Loan Portfolio

Commercial Real Estate

Diversified Loan Portfolio

Financial data as of September 30, 2010 and does not include loans covered by

the FDIC under a loss sharing agreement from the Cowlitz Bank

acquisition or the loans purchased in the Pierce Commercial Bank acquisition.

CRE Owner

Occupied

26.2%

CRE Non-Owner

Occupied

35.9%

Commercial and

Industrial

37.9%

Ind./Warehouse

12.4%

Hotel/Motel

1.2%

Other

3.7%

Retail

28.1%

Office

35.3%

Multi

-

Family

9.3%

Agricultural

0.6%

Ret./Nurs./DayCare

2.0%

Church

2.0%

Recreational

1.9%

Tax-Exempt

Affordable Housing

3.5%

Total Commercial Loans: $621 million

Total Commercial Real Estate Loans: $386 million |

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2010Q3

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2010Q3

NPAs

/ Assets*

NCOs / Avg. Loans

Reserves / NPLs*

Texas Ratio

(1)

Source: SNL Financial

(1)

Texas

Ratio

=

nonperforming

assets

+

loans

90

or

more

days

past

due

/

tangible

common

equity

+

loan

loss

reserve

Please reference page 27 for a list of the companies used for the peer

group. * HFWA ratios do not include FDIC covered loans

Superior Credit Quality Relative to Peers

4

HFWA

Regional Peers

NPA level less than 1/2 of peer level

Reserve coverage over twice that of peer levels

Texas Ratio less than 1/3 of peer level

0.00%

25.00%

50.00%

75.00%

100.00%

125.00%

150.00%

175.00%

200.00%

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2010Q3

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2010Q3 |

5

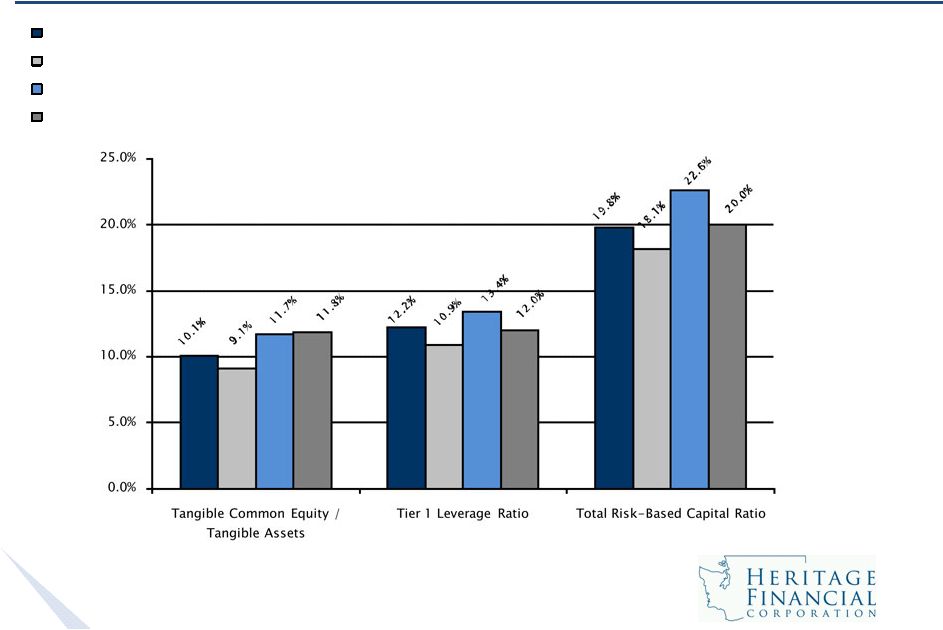

Strong Capital Ratios

Note: Ratios inclusive of a capital raise assuming gross proceeds of $45

million HFWA 9/30/10 as reported on 10-Q

Proforma HFWA 9/30/10 including Pierce Commercial Bank Acquisition

Proforma HFWA 9/30/10 including Pierce Commercial Bank Acquisition and Capital

Raise Proforma HFWA 9/30/10 including Pierce Commercial Bank Acquisition

and Capital Raise without TARP |