Attached files

Exhibit 99.3

CNO Financial Group

CNO is a holding company for a group of insurance companies operating throughout the United States that develop, market and administer supplemental health insurance, annuity, individual life insurance and other insurance products. We focus on serving the senior and middle-income markets, which we believe are attractive, underserved, high growth markets. We sell our products through three distribution channels: career agents, professional independent producers (some of whom sell one or more of our product lines exclusively) and direct marketing. We are a highly cash generative business and benefit from recurring revenues. As of September 30, 2010, we had 3.9 million insurance policies inforce and a $24.2 billion investment portfolio, which provide recurring premiums and investment income, respectively. CNO is a publicly listed company (NYSE: CNO) and had a market capitalization of $1.6 billion as of December 3, 2010.

For the twelve months ended September 30, 2010 (“LTM”), we had $4.1 billion of revenues, $333.7 million of earnings before net realized investment gains (losses), corporate interest expense, loss on extinguishment or modification of debt and income taxes (“EBIT”) and $134.6 million of net income. During the same period, CNO received $171.1 million of net cash distributions from its operating subsidiaries. At September 30, 2010, the Company had a debt to total capital ratio, excluding accumulated other comprehensive income and unamortized discount on the 7.0% Debentures, of 21.1%.

We manage our business through the following operating segments: Bankers Life, Washington National and Colonial Penn, which are defined on the basis of product distribution; Other CNO Business, comprised primarily of products we no longer sell actively; and corporate operations, comprised of holding company activities and certain noninsurance company businesses. Our segments are described below:

| • | Bankers Life (60% of LTM revenue), which markets and distributes Medicare supplement insurance, interest-sensitive life insurance, traditional life insurance, fixed annuities and long-term care insurance products to the middle-income senior market through a dedicated field force of career agents and sales managers supported by a network of community-based branch offices. The Bankers Life segment includes primarily the business of Bankers Life and Casualty Company (“Bankers Life”). Bankers Life also markets and distributes Medicare Advantage plans primarily through a distribution arrangement with Humana and Medicare Part D prescription drug plans through a distribution and reinsurance arrangement with Coventry. |

| • | Washington National (19% of LTM revenue), which markets and distributes supplemental health (including specified disease, accident and hospital indemnity insurance products) and traditional life insurance to middle-income consumers at home and at the worksite. These products are marketed through Performance Matters Associates, Inc. (“PMA”), a wholly owned subsidiary, and through independent marketing organizations and insurance agencies. Products being marketed by Washington National are underwritten by Washington National Insurance Company (“Washington National”). |

| • | Colonial Penn (6% of LTM revenue), which markets primarily graded benefit and simplified issue life insurance directly to customers through television advertising, direct mail, the internet and telemarketing. The Colonial Penn segment includes primarily the business of Colonial Penn Life Insurance Company (“Colonial Penn”). |

| • | Other CNO Business (15% of LTM revenue), which consists of blocks of interest-sensitive life insurance, traditional life insurance, annuities, long-term care insurance and other supplemental health products. These blocks of business are not being actively marketed and were primarily issued or acquired by Conseco Life Insurance Company (“Conseco Life”) and Washington National. |

1

The following table sets forth LTM information on our segments (dollars in millions):

| Collected Premiums | ||||||||

| $ | Percentage | |||||||

| Bankers Life |

$ | 2,622.2 | 72 | % | ||||

| Washington National |

582.3 | 16 | ||||||

| Colonial Penn |

196.3 | 5 | ||||||

| Other CNO Business |

250.3 | 7 | ||||||

| Total |

$ | 3,651.1 | 100 | % | ||||

Competitive Strengths

We believe our competitive strengths have enabled and will continue to enable us to capitalize on the opportunities in our target markets. These strengths include the following:

Leading National Provider of Life and Health Insurance Products to Growing and Underserved Market

Our Bankers Life segment is one of the leading national providers of life and health insurance products focused primarily on the senior market. We provide a number of products such as supplemental health coverage, including Medicare supplement, Medicare Advantage and Medicare Part D products and long-term care insurance, as well as selected life and annuity products, that are important to the financial well-being of seniors.

According to the most recently published report on Medicare supplement insurance by the National Association of Insurance Commissioners, we were ranked third in direct premiums earned from individual Medicare supplement insurance in 2009. Our approximately 5,400 career agents and sales managers are trained to cater to the needs of the senior market. Based on figures from the U.S. Census Bureau released in 2008, current demographic trends indicate that the senior market will continue to grow (the percentage of the U.S. population aged 65 and older is projected to increase by 50% between 2010 and 2030), and we believe our focus on seniors will provide us with a significant opportunity to increase our share of this market, as we believe we are one of only a few companies currently addressing the savings and protection needs of this demographic group.

Growing Distribution Force Enables Us to Access Our Middle-Income Market Customers

We are able to reach our customers through a growing distribution force consisting of:

| • | over 5,400 Bankers Life career agents and sales managers who are trained to cater to the needs of the senior market. These agents sell a number of products such as supplemental health coverage, including Medicare supplement, Medicare Advantage and Medicare Part D products and long-term care insurance, as well as selected life and annuity products, that are important to the financial well-being of seniors. This agency force typically visits the home of a policyholder or potential policyholder, which helps develop strong personal relationships; |

| • | over 1,000 independent agents of our captive Performance Matters Associates, Inc. subsidiary, who distribute Washington National’s supplemental health products which customers can purchase at home or through their worksite. These agents sell specified disease insurance, such as cancer and heart/stroke products, as well as accident, disability and life insurance to middle-income customers; and |

| • | Colonial Penn’s direct contacts with customers through direct mail, television advertising and the Internet for the sale of simple, low-cost life insurance products. |

2

Strong, Nationally Recognized Brand Names

We believe our brands are widely recognized by our customers and distributors. We believe we have successfully developed product-focused consumer recognition in our chosen markets through three distinct brands—Bankers Life & Casualty, Colonial Penn and Washington National. We believe our multiple-brand strategy has insulated our business from some of the recent challenges in the economy. We continue to raise the profile of our Bankers Life brand through informal relationships with the Alzheimer’s Association, the International Longevity Center and Meals on Wheels. We believe that our brands give us a key competitive advantage, allowing us to continue to build and maintain strong relationships with our customers and distributors.

Experienced Management with a Proven Track Record

We have a strong, experienced senior management team. The ten members of our senior management team have, on average, more than 20 years of industry experience. We have made significant changes to our management team in recent years and it has been strengthened by the addition of many experienced industry executives, led by C. James Prieur, who has served as Chief Executive Officer since September 2006. Before joining us, Mr. Prieur previously worked at Sun Life Financial, Inc. since 1979, where he served in a variety of investment management positions before being promoted to President and Chief Operating Officer for all U.S. operations of Sun Life Financial in 1999.

The current management team has taken a number of measures to strengthen the Company’s operations and financial profile, including:

| • | in the fourth quarter of 2008, transferred the stock of Senior Health Insurance Company of Pennsylvania—an insurance subsidiary housing a substantial block of run-off long-term care business, which produced volatile earnings in the past and drained substantial capital from the core operations—to an independent trust; and |

| • | in the fourth quarter of 2009 and the first six months of 2010, raised $296 million from the sale of equity and $283 million from the sale of convertible debt to refinance existing indebtedness, reduce outstanding debt and bolster holding company liquidity. |

Credit Strengths

Strong Cash Generation of Operating Subsidiaries

Our subsidiaries generate substantial free cash flow (available to the holding company as dividends subject to approval from state insurance regulators) for the following reasons:

| • | focus on insurance products with relatively moderate protection benefits and capital needs means that new business generation does not impose an unmanageable surplus strain; |

| • | moderate first year commissions to our sales force similarly means that the origination of new policies does not create a strain on capital as some high commission products do; |

| • | our cash tax payments are limited to minimal amounts of alternative minimum income taxes due to our $4.5 billion net operating loss carryforward position. |

The cash generation capacity of our insurance subsidiaries may be approximated by their statutory operating earnings before fees and interest paid to the holding company. For the twelve months ended September 30, 2010, the insurance subsidiaries generated $335 million of statutory operating earnings before fees and interest paid to the holding company, which compares to $52 million of holding company operating expenses and $82 million of interest expense on corporate debt.

3

Insurance Operations Resilient to Adverse Economic Environments

The sales and profitability of our products are not strongly correlated with equity or credit market performance. We primarily sell products with capped payouts that provide protection in case of death or illness. We do not sell complex variable annuity or life products with guaranteed benefits. Furthermore, over 80% of our premiums during 2009 were generated by proprietary and exclusive distribution channels, which made our sales and business retention less sensitive to changes in our credit ratings than that of many of our competitors. During the financial crisis in 2008 and 2009 our operating subsidiaries continued to deliver strong operating results as measured by collected premiums of $4.5 billion and $4.1 billion, respectively. We were also able to maintain and grow the size of our career agency sales force in 2009.

Regulatory Capital Adequacy of Bankers Life, Colonial Penn and Washington National

A significant constraint on the ability of our regulated insurance company subsidiaries to make dividend payments to our holding company is their regulatory capital adequacy.

The regulatory capital adequacy of an insurance company is measured by its Risk-Based Capital (“RBC”) ratio, which is calculated by dividing the insurer’s Total Adjusted Capital (“TAC”) by its “Company Action Level RBC”, a minimum, formula-based capital requirement set by The National Association of Insurance Commissioners (“NAIC”). The RBC formulas take into account the insurer’s asset, market and credit risks, underwriting and pricing risks, the risk that the return from assets are not aligned with the requirements of the Company’s liabilities and general business risk. See “Governmental Regulation”.

As of September 30, 2010, the individual TAC of our subsidiaries, Bankers Life, Colonial Penn and Washington National, which are actively writing new business, were significantly in excess of the levels that would prompt regulatory action under the insurance laws of their respective jurisdictions. TAC and RBC are calculated annually by insurers as of December 31 of each year. However, for the purpose of a covenant in the existing Senior Secured Credit Agreement and a covenant to be included in the New Senior Secured Credit Agreement, we calculate RBC, TAC and our consolidated RBC ratio on a quarterly basis. The consolidated RBC ratio of our insurance company subsidiaries was 320% at September 30, 2010. See “Risk Factors—The New Senior Secured Credit Agreement will contain various restrictive covenants and required financial ratios that will limit our operating flexibility. The violation of one or more loan covenant requirements will entitle our lenders to declare all outstanding amounts under the New Senior Secured Credit Agreement to be due and payable”.

Consistent Ability of Insurance Subsidiaries to Distribute Cash to the Holding Company

Our holding company has three sources of cash from its operating subsidiaries: dividends, management fees under authorized affiliate services agreements and interest on internal surplus debentures. The payment of these management fees and interest on surplus debentures (with respect to interest payments on surplus debentures, provided the RBC ratio of Conseco Life of Texas exceeds 100%) by our insurance subsidiaries does not require further regulatory approval (other than interest payments on surplus debentures, which can not be made unless the RBC ratio of Conseco Life Insurance Company of Texas (“Conseco Life of Texas”) exceeds 100%). For the twelve months ended September 30, 2010, the holding company received dividends, management fees and interest on surplus debentures from our insurance subsidiaries of $271 million. During the same period, we contributed $99 million to the capital of our insurance subsidiaries.

Conservative Investment Portfolio

Our investment portfolio is primarily comprised of high quality fixed maturity securities. At September 30, 2010, the investment portfolio was in a $1.3 billion net unrealized gain position and 92% of the fixed maturity securities were investment grade. Investment grade and below investment grade corporate debt securities in the

4

portfolio constituted 60% and 5% of our portfolio, respectively, while structured securities accounted for 16%. The structured securities in our portfolio were highly rated with 86% of the portfolio rated investment grade. Commercial mortgage loans constituted 8% of the total investment portfolio. We believe our commercial mortgage loan portfolio is well diversified geographically and by property type. The balance of the portfolio was comprised of trading securities, investments held by variable interest entities, equity securities, policyholder loans and other invested assets.

Conservative Holding Company Capital Structure

With the December 2009 recapitalization and positive momentum in our earnings, we reduced our debt to total capital ratio, excluding accumulated other comprehensive income and unamortized discount on the 7.0% Debentures, to 21.1% at September 30, 2010 and achieved 4.0x LTM EBIT coverage of our interest expense on corporate debt. Our leverage ratio at September 30, 2010 was below, and our LTM EBIT interest coverage ratio was above, the level rating agencies typically require of insurers in our ratings category.

Our Strategic Direction

Our mission is to be a premier provider of life insurance, supplemental health products and annuities to America’s middle-income consumers with a focus on seniors and to provide value to our shareholders. We believe we can accomplish this mission through the effective execution of the following strategies:

| • | Remain focused on the Needs of Our Senior and Middle Income Market Customers. We define our business by our target markets and not by our products. We continue to adapt our distribution, product offerings and product features to the evolving needs of our middle income and senior customers. We provide a broad range of middle market products to meet the protection needs of our customers and to provide them with longevity solutions. We are able to reach our customers through our career agents and independent agent relationships, directly, through our Colonial Penn direct distribution platform, and at work, through our worksite marketing channel. |

| • | Expand and Improve the Efficiency of our Distribution Channels. The continued development and maintenance of our distribution channels is critical to our continued sales growth. We dedicate substantial resources to the recruitment, development and retention of our Bankers Life career agents and seek to maximize their productivity by providing them with high quality leads for new business opportunities. In addition, investments in both our direct distribution platform, Colonial Penn, and in PMA, have enabled us to achieve significant sales growth since 2004. |

| • | Seek Profitable Growth. We continue to pursue profitable growth opportunities in the middle income market. We focus on marketing and selling products that meet the needs of our customers and we believe it will enable us to provide long-term value for our shareholders. As part of this strategy, we have de-emphasized products with return characteristics that we consider to be inadequate. |

| • | Pursue Operational Efficiencies and Cost Reduction Opportunities. We seek to strengthen our competitive position with a focus on cost control and enhanced operational efficiency. Our efforts include: |

| • | improvements to our policy administration processes and procedures to reduce costs and improve customer service; |

| • | continued consolidation of policy processing systems, including conversions and elimination of systems; |

5

| • | streamlining administrative procedures and consolidating processes across the enterprise to reduce personnel costs; and |

| • | eliminating expenses associated with the marketing of those products that do not meet our return objectives. |

| • | Continue to manage and reduce the risk profile of our business where possible. We actively manage the risks associated with our business and have taken several steps to reduce the risk profile of our business. In the fourth quarter of 2007, we completed a transaction to coinsure 100% of a block of inforce fixed index annuity and fixed annuity business sold through our independent distribution channel. Such business was largely out of the surrender charge periods and had policyholder and other reserves of $2.8 billion. This transaction significantly reduced the asset and liability risks associated with this business. In the fourth quarter of 2008, we transferred the stock of Senior Health Insurance Company of Pennsylvania (“Senior Health”) to an independent trust, eliminating our exposure to a substantial block of long-term care business previously included in our run-off segment. In 2009, we began coinsuring a significant portion of the new long-term care business written through our Bankers Life segment. These transactions have reduced our exposure to long-term care business that has led to volatile earnings in the past. |

We have purposefully avoided products like variable life, variable annuity and guaranteed investment contracts that we believe would expose us to risks that are not commensurate with potential profits. We plan to continue to emphasize products that are straight forward and have a lower risk profile. We believe such products meet various needs of the middle income markets we serve. We will continue to manage the investment risks associated with our insurance business by:

| • | maintaining a largely investment-grade, diversified fixed-income portfolio; |

| • | maximizing the spread between the investment income we earn and the yields we pay on investment products within acceptable levels of risk; and |

| • | continually tailoring our investment portfolio to consider expected liability durations, cash flows and other requirements. |

We believe that our focus on middle-income families and seniors will position us favorably to capitalize on the future growth in these markets.

Concurrently with the closing of this offering of the Notes, we expect to enter into a new $325 million senior secured credit agreement (the “New Senior Secured Credit Agreement”) maturing on September 30, 2016. The New Senior Secured Credit Agreement will be guaranteed by substantially all of our current and future domestic subsidiaries that are not regulated insurance companies and secured by substantially all of our and the Subsidiary Guarantors’ assets (collectively, the “Collateral”). The New Senior Secured Credit Agreement and the Notes offered hereby will share a first priority lien on the Collateral, and the relative rights between the lenders under the New Senior Secured Credit Agreement and holders of the notes will be governed by an intercreditor agreement (the “Intercreditor Agreement”). See “Description of Certain Indebtedness” for a more detailed description of the terms of the New Senior Secured Credit Agreement and “Description of the Notes—Intercreditor Agreement” for a description of the Intercreditor Agreement. The consummation of this offering will occur concurrently with, and is conditioned upon, the funding of the New Senior Secured Credit Agreement.

6

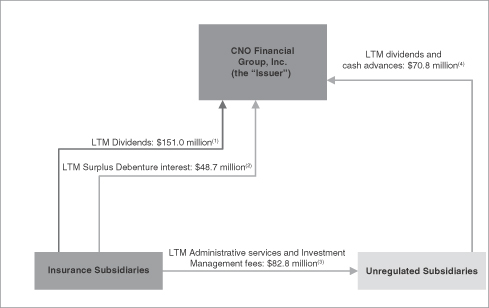

Holding Company Cash Sources and Uses

We are organized in a holding company structure as is typical for insurance companies. Business activities are conducted by our operating subsidiaries while corporate debt is serviced at the holding company level. The holding company, CNO, has three sources of cash: intercompany dividends, interest on internal debt and management fees from subsidiaries. CNO also generates some investment income. Dividends from unregulated subsidiaries are unrestricted, while those from the regulated insurance company subsidiaries require approval from state insurance regulators. CNO holds four internal surplus debentures issued to Conseco Life of Texas. The surplus debentures have a combined face value of $750 million, mature on December 31, 2030 and pay interest at a rate which is the greater of Libor + 400 basis points and 6.5%. These interest payments do not require additional approval, but they do require prior written notice to the applicable regulator prior to each payment. CNO and its unregulated subsidiaries also receive regular, contractually set management fees for services rendered from the operating subsidiaries. The terms of these management contracts were approved by regulators and the payment of fees pursuant to the contracts does not require further regulatory approval. The primary expenses of CNO are interest on indebtedness and corporate overhead. The operating subsidiaries have no outstanding third party indebtedness, except for borrowings related to investment transactions.

|

|

| (1) | During the 12-month period ended September 30, 2010, CNO contributed $99.4 million of capital back to its subsidiaries. |

| (2) | Internal surplus debentures of $750 million (variable rate-6.5% at September 30, 2010; 2030 maturity). |

| (3) | Reflects (i) gross amount of investment management fees plus (ii) the amount, net of costs, that have been incurred by the insurance subsidiaries for administrative services provided during the 12-month period ended September 30, 2010. |

| (4) | Represents the administrative services and investment management fees received by unregulated subsidiaries from insurance subsidiaries less operating expenses at unregulated subsidiaries paid over the 12-month period ended September 30, 2010. |

7

The table below shows the sources of cash held by the holding company, CNO, and the uses for such cash:

| Twelve

months ended September 30, 2010 |

Year ended December 31, | |||||||||||

| 2009 | 2008 | |||||||||||

| Sources of holding company cash: |

||||||||||||

| Dividends from our insurance subsidiaries |

$ | 151.0 | $ | 35.0 | $ | 20.0 | ||||||

| Surplus debenture interest |

48.7 | 59.3 | 56.4 | |||||||||

| Administrative services and investment management fees (net of costs to provide such services) |

70.8 | 80.5 | 71.5 | |||||||||

| Amount received in conjunction with the termination of commission financing agreement with Conseco Insurance Company |

— | 16.2 | — | |||||||||

| Intercompany loan from a non-life subsidiary |

— | 17.5 | — | |||||||||

| Revolving credit agreement |

— | — | 75.0 | |||||||||

| Proceeds from issuance of 7.0% Debentures |

282.8 | 172.0 | — | |||||||||

| Equity proceeds, net of expenses |

297.7 | 296.3 | — | |||||||||

| Tax sharing payments |

0.9 | 3.4 | 1.1 | |||||||||

| Total sources of cash available to service our debt and other obligations |

851.9 | 680.2 | 224.0 | |||||||||

| Uses of holding company cash: |

||||||||||||

| Debt service commitments of CNO: |

||||||||||||

| Interest payments |

77.2 | 76.0 | 53.3 | |||||||||

| Principal payments under the: |

||||||||||||

| Senior Health Note |

25.0 | 25.0 | — | |||||||||

| Senior Secured Credit Agreement |

198.2 | 204.7 | 24.0 | |||||||||

| Revolving credit agreement |

— | 55.0 | 20.0 | |||||||||

| Capital contributions to our insurance subsidiaries |

99.4 | — | 79.4 | |||||||||

| Repurchase of 3.5% Debentures |

293.0 | 176.5 | — | |||||||||

| Corporate expense and other |

54.6 | 55.9 | 80.3 | |||||||||

| Total uses of cash |

747.4 | 593.1 | 257.0 | |||||||||

| Net increase (decrease) in cash |

104.5 | 87.1 | (33.0 | ) | ||||||||

| Cash balance, beginning of period |

85.6 | 59.0 | 92.0 | |||||||||

| Cash balance, end of period |

$ | 190.1 | $ | 146.1 | $ | 59.0 | ||||||

Our principal executive offices are located at 11825 N. Pennsylvania Street, Carmel, Indiana 46032, and our telephone number at this location is (317) 817-6100. Our website is www.cnoinc.com. Information on our website should not be construed to be part of this Offering Memorandum. Our common stock is listed on the NYSE under the symbol “CNO”.

8