Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | form_8k.htm |

1

November 30, 2010

FBR Capital Markets

2010 Fall Investor Conference

2

Forward-Looking Statements

This presentation contains statements that relate to the projected performance of

Zions Bancorporation and elements of or affecting such performance, including

statements with respect to the beliefs, plans, objectives, goals, guidelines,

expectations, anticipations and estimates of management. These statements

constitute forward-looking information within the meaning of the Private Securities

Litigation Reform Act. Actual facts, determinations, results or achievements may

differ materially from the statements provided in this presentation since such

statements involve significant known and unknown risks and uncertainties.

Factors that might cause such differences include, but are not limited to:

competitive pressures among financial institutions; economic, market and

business conditions, either nationally or locally in areas in which Zions

Bancorporation conducts its operations, being less favorable than expected;

changes in the interest rate environment reducing expected interest margins;

changes in debt, equity and securities markets; adverse legislation or regulatory

changes; and other factors described in Zions Bancorporation’s most recent

annual and quarterly reports. In addition, the statements contained in this

presentation are based on facts and circumstances as understood by management

of the company on the date of this presentation, which may change in the future.

Zions Bancorporation disclaims any obligation to update any statements or to

publicly announce the result of any revisions to any of the forward-looking

statements included herein to reflect future events, developments, determinations

or understandings.

Zions Bancorporation and elements of or affecting such performance, including

statements with respect to the beliefs, plans, objectives, goals, guidelines,

expectations, anticipations and estimates of management. These statements

constitute forward-looking information within the meaning of the Private Securities

Litigation Reform Act. Actual facts, determinations, results or achievements may

differ materially from the statements provided in this presentation since such

statements involve significant known and unknown risks and uncertainties.

Factors that might cause such differences include, but are not limited to:

competitive pressures among financial institutions; economic, market and

business conditions, either nationally or locally in areas in which Zions

Bancorporation conducts its operations, being less favorable than expected;

changes in the interest rate environment reducing expected interest margins;

changes in debt, equity and securities markets; adverse legislation or regulatory

changes; and other factors described in Zions Bancorporation’s most recent

annual and quarterly reports. In addition, the statements contained in this

presentation are based on facts and circumstances as understood by management

of the company on the date of this presentation, which may change in the future.

Zions Bancorporation disclaims any obligation to update any statements or to

publicly announce the result of any revisions to any of the forward-looking

statements included herein to reflect future events, developments, determinations

or understandings.

3

Agenda

|

Overview of Zions

Key Performance Drivers

–Capital

–Credit Quality

–Revenue

Outlook Summary

|

|

|

4

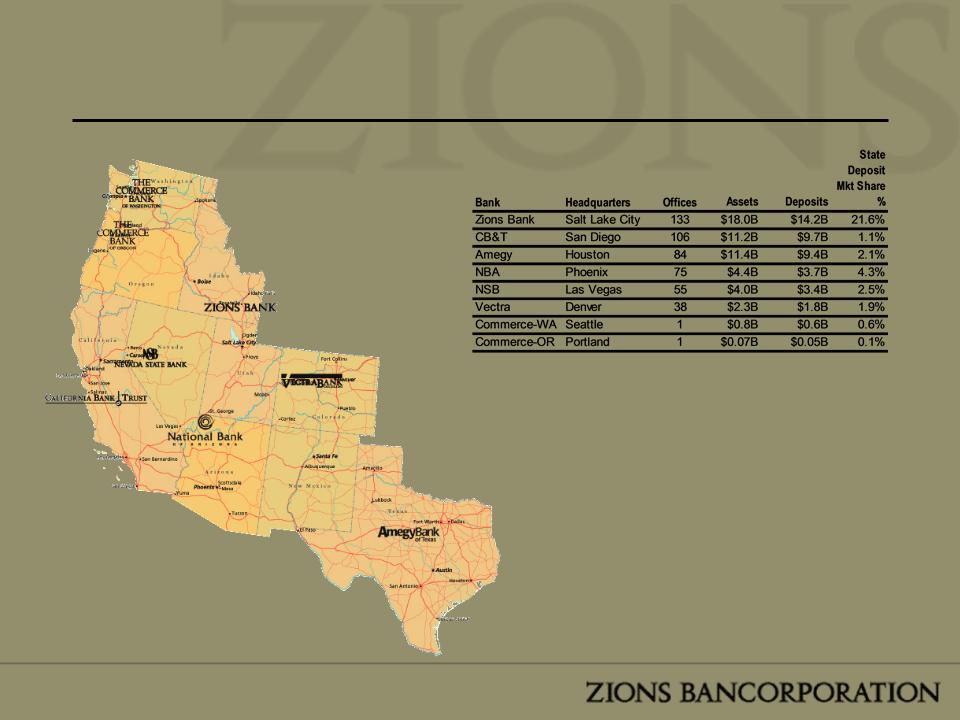

A Collection of Great Banks

Asset and deposit balances as of 3Q 2010; Deposit market share as of

2010

2010

5

Multi-Bank Business Model: Competitive

Strengths

Strengths

§ Direct customer access to local decision makers

§ Cross-pollination of ideas between banks

– CEOs & division managers meet frequently to compare best

practices, opportunities, and resolve “intramural” issues

practices, opportunities, and resolve “intramural” issues

§ Community bank feel - local marketing and branding

§ Superior lending capacity relative to community banks

§ Centralization of processing and other non-customer

facing elements of the business

facing elements of the business

§ Established market-leading small business lender

– Leading SBA Lender

• Largest SBA portfolio relative to overall size of loan book

– Superior treasury management products & services (Greenwich

survey)

survey)

§ Local “ownership” of market opportunities and

challenges

challenges

6

Small Business Banking:

National Awards:

• Overall Satisfaction

• Relationship Manager Performance

• Financial Stability

• Overall Treasury Management

Regional Awards:

• Overall Satisfaction - West

• Overall Satisfaction - Treasury

Management - West

Management - West

What Others Say About Us

2009 Greenwich Excellence Awards

in Small Business and Middle Market Banking

Middle Market Banking

National Awards:

• Overall Satisfaction

• Personal Banking

• Relationship Manager Performance

• Credit Policy

• Financial Stability

• Overall Treasury Management

• Accuracy of Operations

• Customer Service

• Treasury Product Capabilities

Regional Awards:

• Overall Satisfaction - West

• Overall Satisfaction - Treasury

Management - West

Management - West

7

*Includes FDIC supported assets

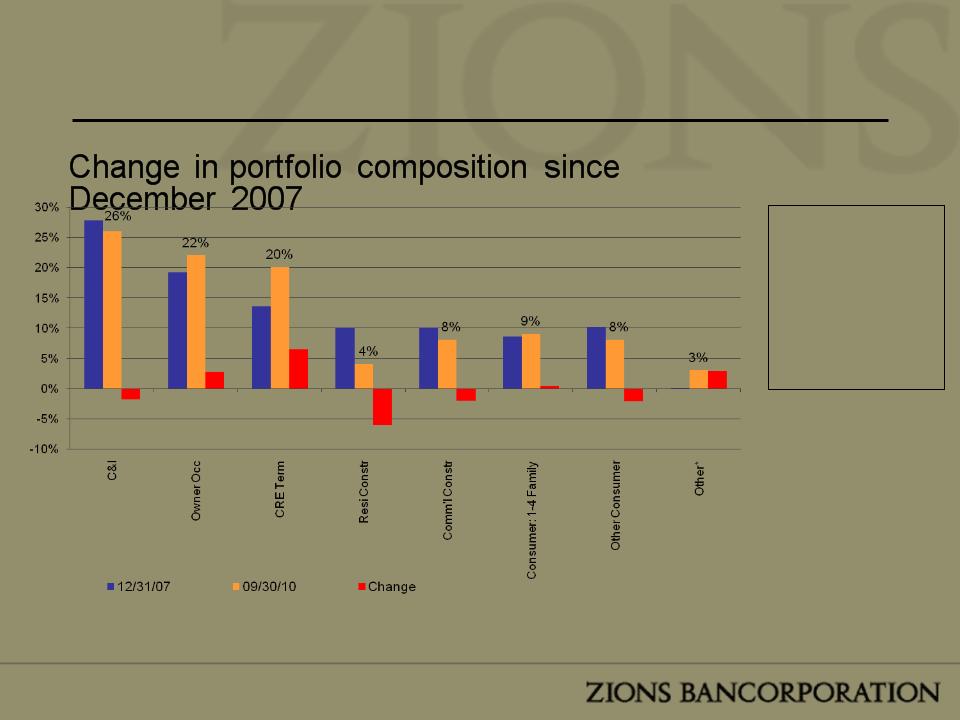

Strong Focus on Business Banking - Loan Mix

Loan Portfolio

as of 3Q10

as of 3Q10

§Commercial and

CRE Loans: 80%

CRE Loans: 80%

§Retail & Other

Loans: 20%

Loans: 20%

8

Agenda

|

Overview of Zions

Key Performance Drivers

–Capital

–Credit Quality

–Revenue

Outlook Summary

|

|

|

9

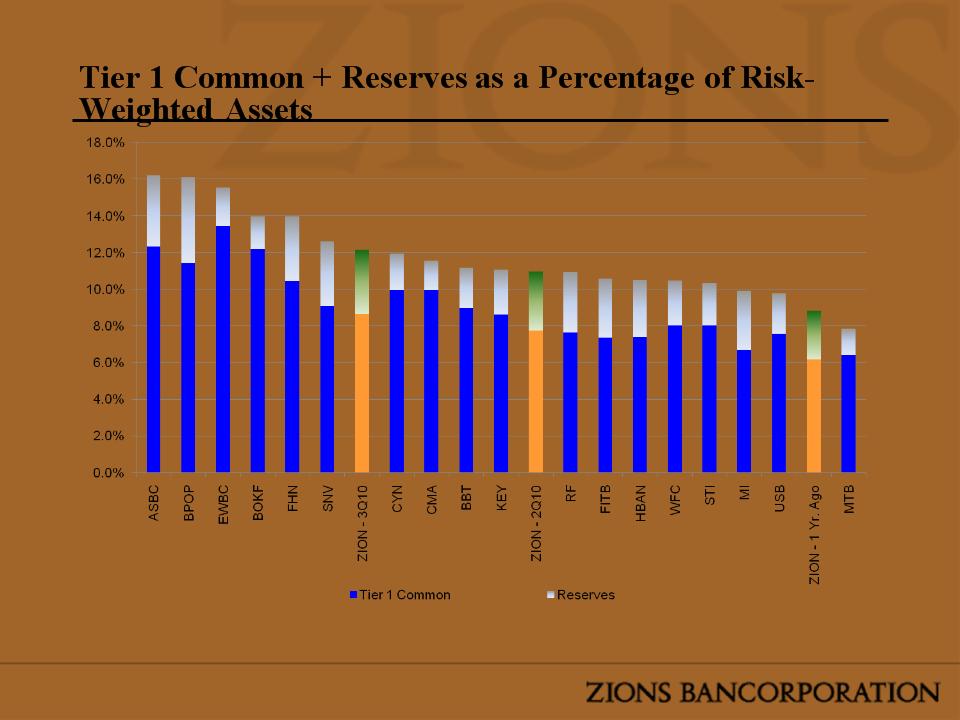

Source: SNL as of 3Q 2010

Note: Peer group includes U.S. regional banks with assets greater than $20 billion and less than $200 billion plus footprint competitors WFC and

USB

USB

10

Tier 1 + Reserves as a Percentage of Risk-Weighted

Assets

Assets

Source: SNL as of 3Q 2010

Note: Peer group includes U.S. regional banks with assets greater than $20 billion and less than $200 billion plus footprint competitors WFC and

USB

USB

11

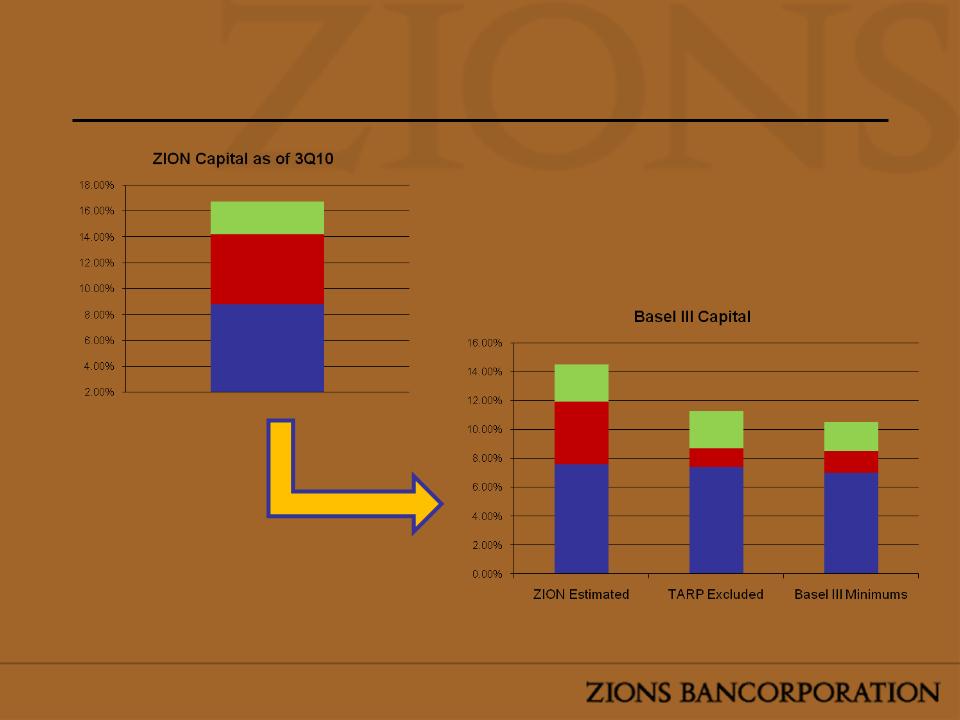

Basel III New Capital Proposal

B3 estimated capital ratios for Zions assumes elimination of trust preferred securities and other comprehensive income from Tier 1 capital, and

adjusts for deferred tax asset limits.

adjusts for deferred tax asset limits.

Tier 1 Common

8.66%

Total RBC

16.54%

Tier 1 RBC

13.97%

7.5%

14.3%

11.8%

7.4%

8.6%

7.0%

10.5%

8.5%

11.1%

12

Agenda

|

Overview of Zions

Key Performance Drivers

–Capital

–Credit Quality

–Revenue

Outlook Summary

|

|

|

13

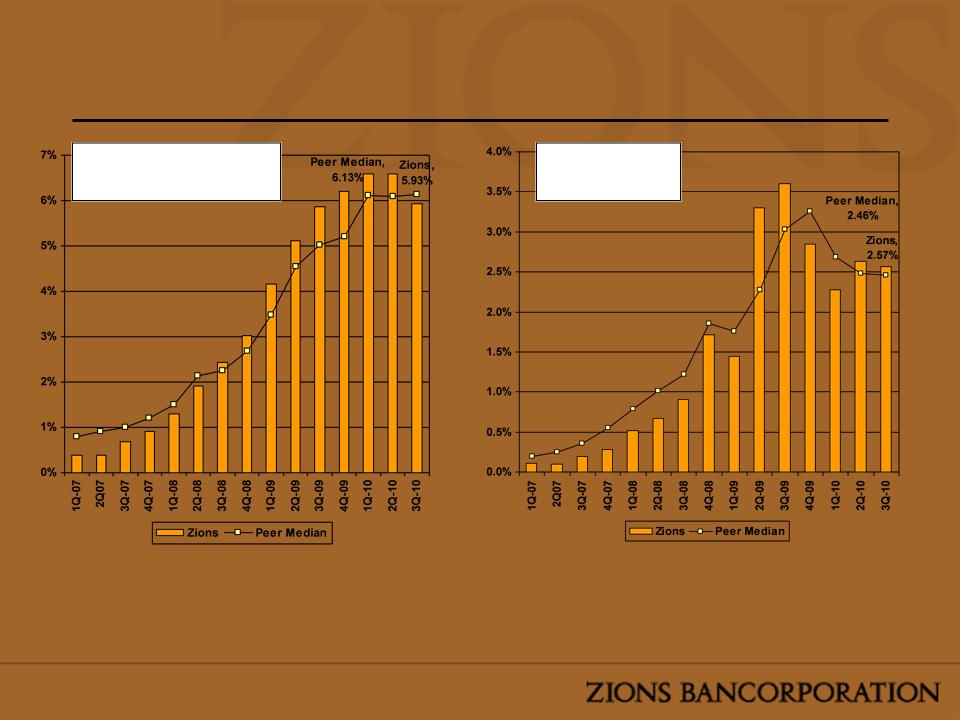

Credit Quality Trends

*Annualized

Zions excludes FDIC supported assets

Note: Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and less than $200 billion plus

footprint competitors WFC and USB

footprint competitors WFC and USB

Source: SNL

NPAs + Greater than 90

Days Delinquent /

Loans + OREO

Days Delinquent /

Loans + OREO

Net Charge-

offs as a % of

Loans*

offs as a % of

Loans*

14

Note: Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and less than $200 billion plus footprint

competitors WFC and USB

competitors WFC and USB

Source: SNL. Peer data as of 3Q10. Nonaccrual inflows from Form FR Y-9C, schedule HC-N, line M.7.

Nonaccrual Inflows - Percent of Nonaccrual

Loans

Loans

15

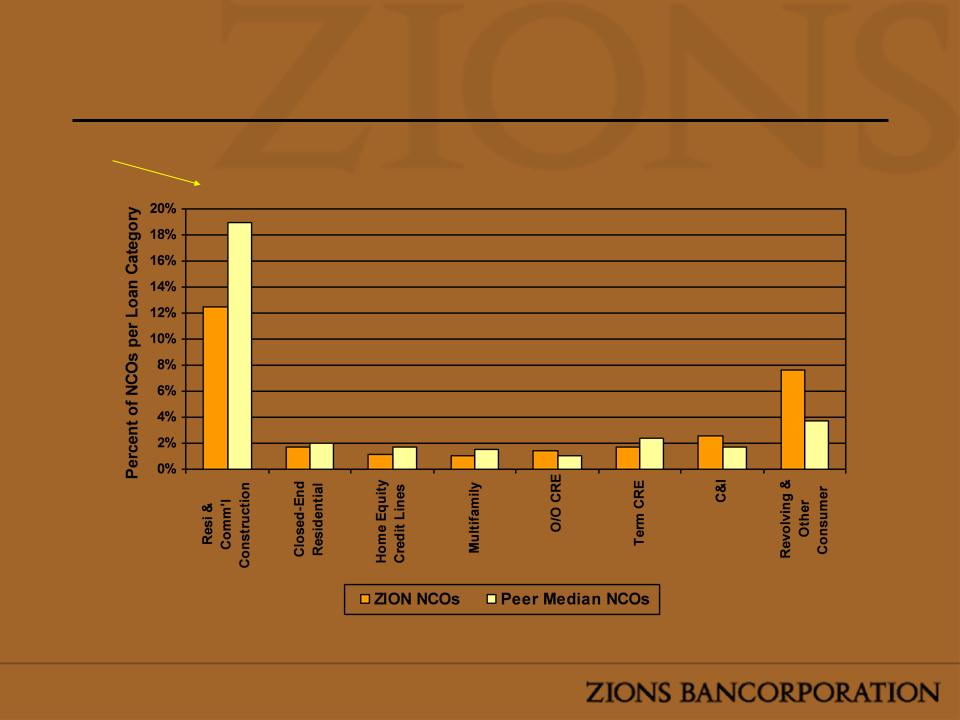

Note: Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and less than $200 billion plus footprint

competitors WFC and USB

competitors WFC and USB

Source: SNL YTD 3Q10

Net Charge Offs - By Loan Type

Percentage of

Zions Total Loans

Zions Total Loans

12.6% 10.7% 6.0% 2.8% 21.4% 18.3% 22.5% 5.7%

16

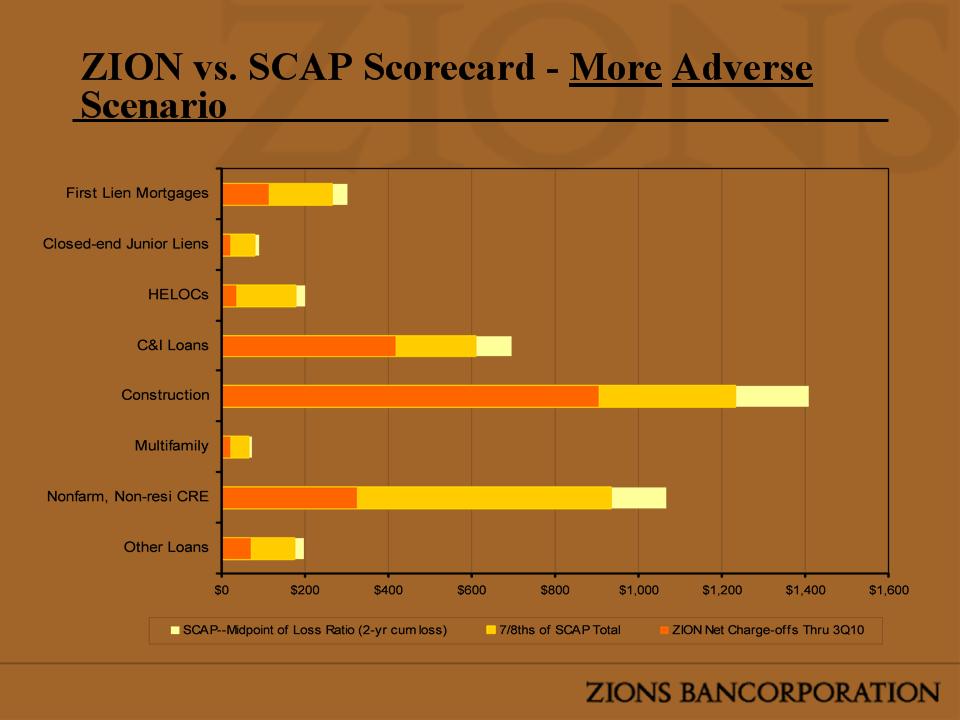

Dollars in

millions

millions

17

Change in CRE Loans Outstanding

From 4Q07 to 3Q10

Note: Approximately 2/5ths of the $2.2 billion increase in CRE Term loans are the result of reclassified Commercial

Construction loans, generally when construction has been completed and the building qualified for a term loan.

Construction loans, generally when construction has been completed and the building qualified for a term loan.

$’s in billions

18

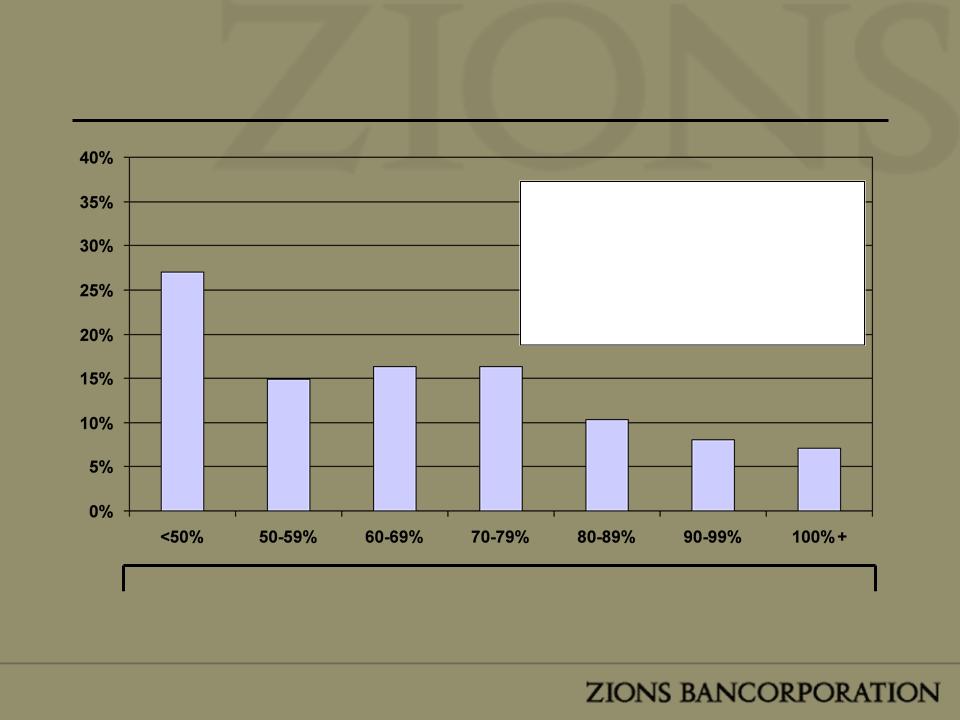

Term CRE

Updated LTV Stratification

Updated LTV Stratification

The MIT Transaction Based Index is a national index that has been applied to Zions’ mostly regional CRE Portfolio

Zions loan data and TBI data as of 3Q10

|

Percentage of Loans within each bucket that are Non-Accrual

|

||||||

|

2.2%

|

1.8%

|

3.5%

|

3.0%

|

8.3%

|

5.3%

|

5.3%

|

• By attaching each loan to

the TBI index as of the

date of the loans last

appraisal we can see an

estimate of the updated

LTV ratios of the portfolio

the TBI index as of the

date of the loans last

appraisal we can see an

estimate of the updated

LTV ratios of the portfolio

19

Agenda

|

Overview of Zions

Key Performance Drivers

–Capital

–Credit Quality

–Revenue

Outlook Summary

|

|

|

20

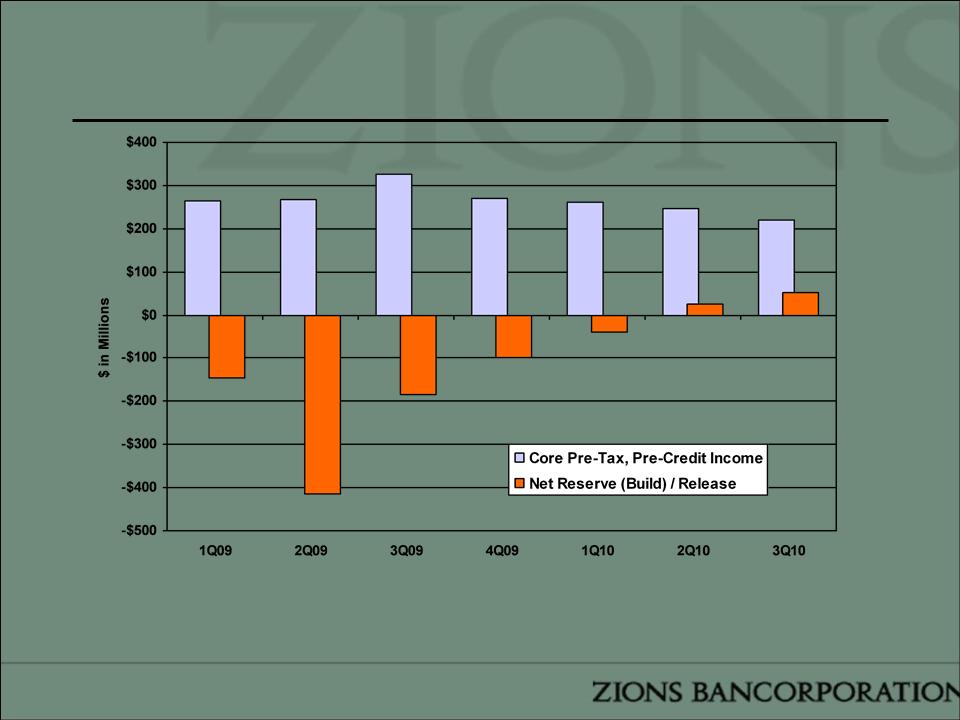

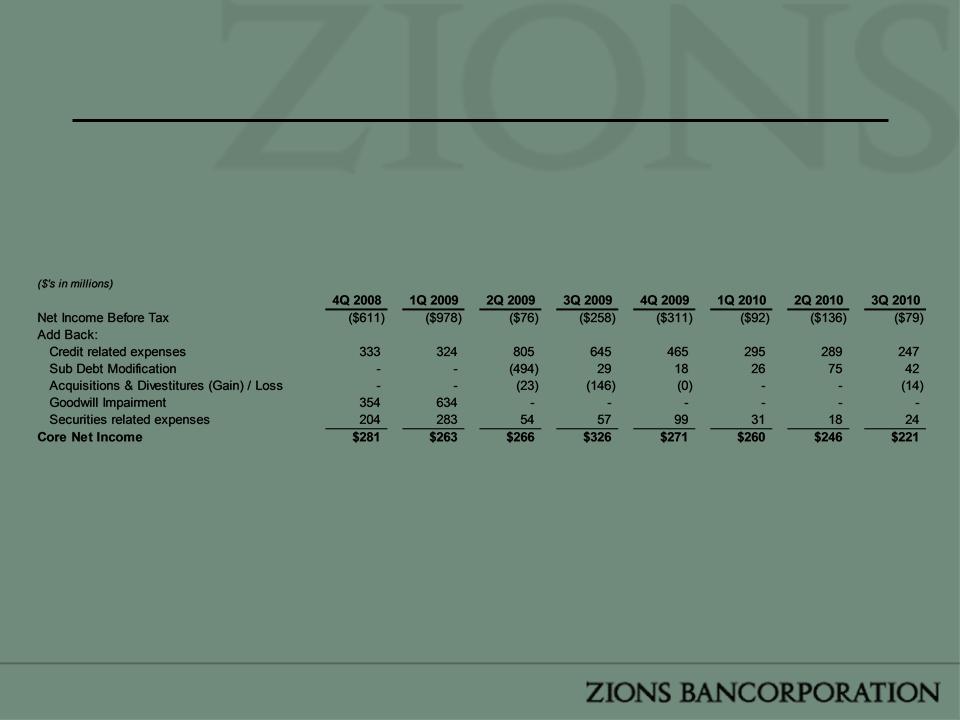

Core net income excludes items that are one time or non-recurring in nature. Incorporated in the Appendix of this presentation is the detail which

supports our core net income before tax calculations. 2Q09 - 4Q09 included material gains from loan portfolio swaps. Swaps are used to manage

interest rate risk and were generally added near the peak in the rate cycle. As hedges became ineffective, gains were realized.

supports our core net income before tax calculations. 2Q09 - 4Q09 included material gains from loan portfolio swaps. Swaps are used to manage

interest rate risk and were generally added near the peak in the rate cycle. As hedges became ineffective, gains were realized.

Generally Stable Core Pre-Tax, Pre-Credit

Income

Income

21

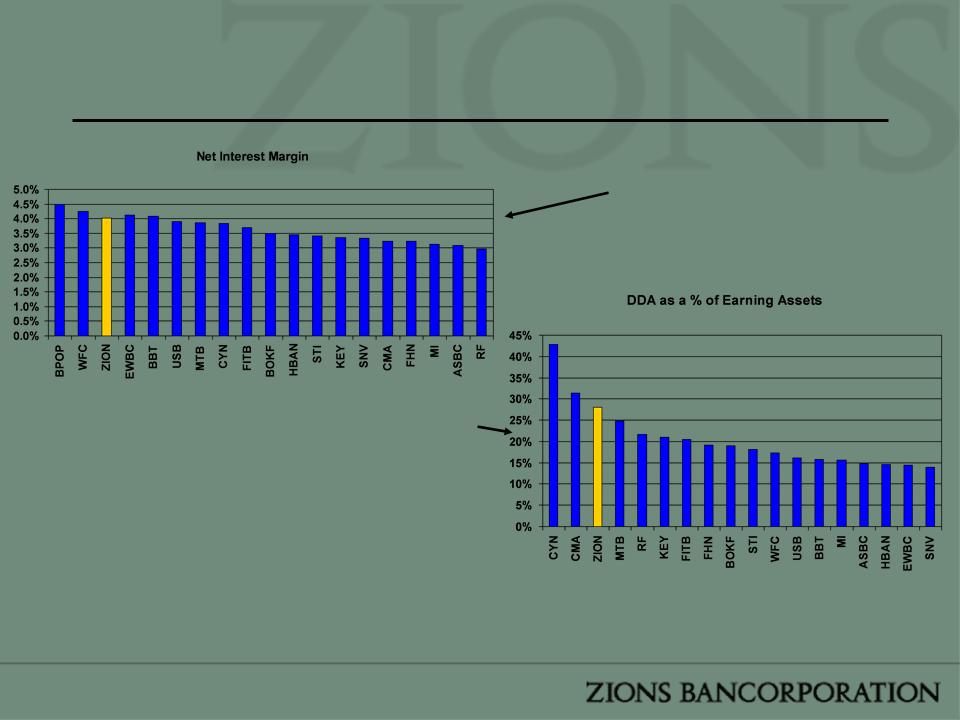

Net Interest Margin - 3Q10

Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and less than $200 billion plus footprint competitors WFC

and USB. Peer group not adjusted for accretion of interest income on FDIC acquired loans

and USB. Peer group not adjusted for accretion of interest income on FDIC acquired loans

Source: SNL as of 3Q 2010

Strong NIM

Driven in part by Strong

Demand Deposits

Demand Deposits

22

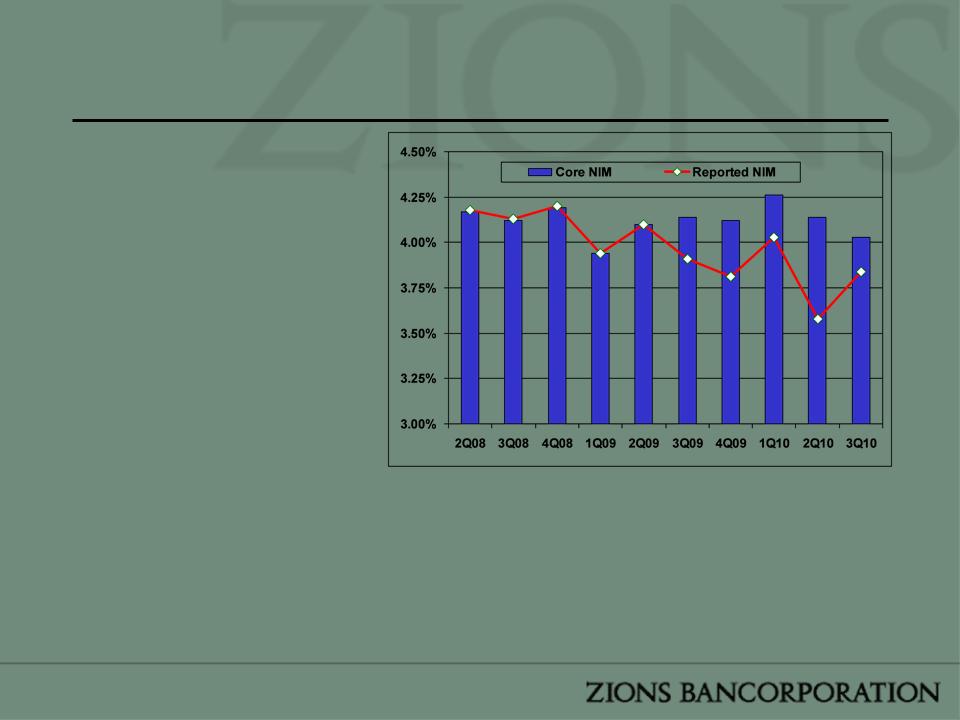

Core NIM Trends

• Zions expects net interest

sensitive income to increase

between an estimated 5.4% and

8.6% if interest rates were to

rise 200 bps*

sensitive income to increase

between an estimated 5.4% and

8.6% if interest rates were to

rise 200 bps*

• Core NIM (excludes discount

accretion) has been generally

stable

accretion) has been generally

stable

– Recent core NIM compression

attributable to a greater drag from

cash balances

attributable to a greater drag from

cash balances

– 1Q09 experienced a temporary dip

partially due to an intentional build

-up of excess liquidity during the

significant turmoil during late

2008/early 2009

partially due to an intentional build

-up of excess liquidity during the

significant turmoil during late

2008/early 2009

– Large senior note issuance in

September 2009 had about 8 bps

adverse impact on the core NIM in

4Q09

September 2009 had about 8 bps

adverse impact on the core NIM in

4Q09

(1) Cash drag refers to the adverse impact on the net interest margin due to the total balance of cash held in interest-bearing accounts. Assumptions

used to compute the cash drag include investing the cash at a rate of 4.5%, similar to the rate achieved on recent loan production. Liquidity targets and

loan demand are factors that may prevent fully deploying such cash; the cash drag is shown for illustrative purposes only.

used to compute the cash drag include investing the cash at a rate of 4.5%, similar to the rate achieved on recent loan production. Liquidity targets and

loan demand are factors that may prevent fully deploying such cash; the cash drag is shown for illustrative purposes only.

*Assumes a parallel shift in the yield curve; key assumptions include a slow and a fast deposit repricing response (i.e. if deposit rates are slow to

increase Zions expects a 7.2% increase in interest sensitive income, and if deposits were to reprice quickly Zions expects a 4.2% increase in interest

sensitive income); sensitivity analysis based on 2Q10 data

increase Zions expects a 7.2% increase in interest sensitive income, and if deposits were to reprice quickly Zions expects a 4.2% increase in interest

sensitive income); sensitivity analysis based on 2Q10 data

Due to the extinguishment/ reissuance of subordinated debt in June 2009, Zions experiences non-cash discount accretion, which increases interest

expense, reducing GAAP NIM

expense, reducing GAAP NIM

|

|

1Q0

9 |

2Q0

9 |

3Q0

9 |

4Q0

9 |

1Q1

0 |

2Q1

0 |

3Q1

0 |

|

|

Cash Drag (1)

|

|

24

bps |

17

bps |

16

bps |

24

bps |

20

bps |

35

bps |

46

bps |

23

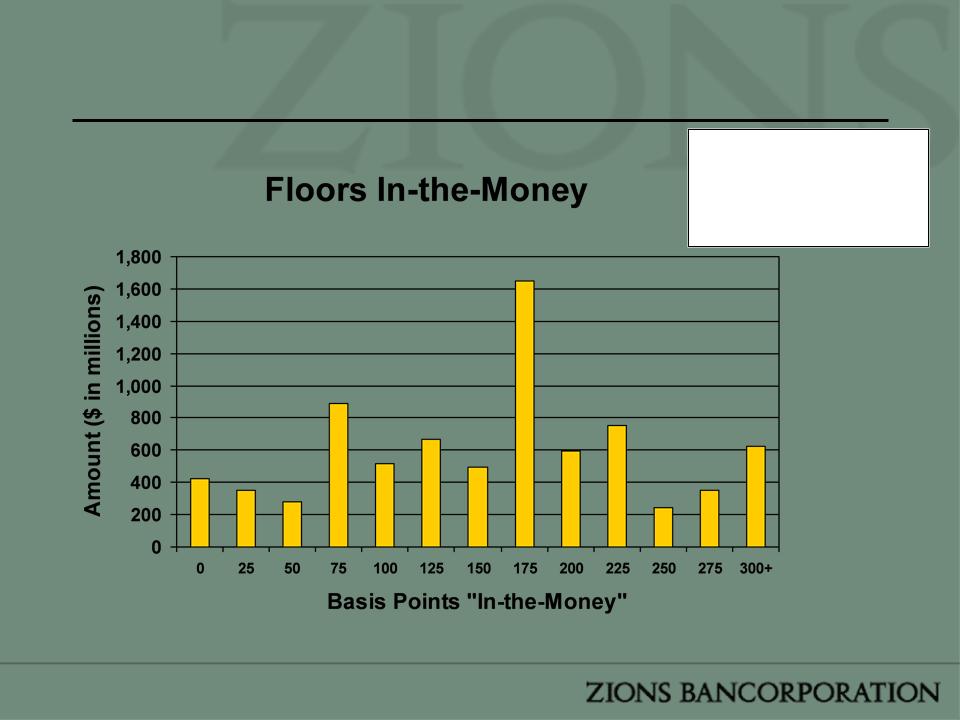

Loans with Floors (as of 6/30/10)

§ The total amount of loans

with floors that are in-the

-money equal

approximately $7.8B

with floors that are in-the

-money equal

approximately $7.8B

§ Weighted average in-the-

money floor: 156 bps

money floor: 156 bps

24

Interest Rate Risk Simulation - “Slow

Response”

Response”

§ 12-month simulated impact - a static balance sheet, and is based on regression analysis comparing

deposit repricing changes against similar duration benchmark indices (e.g. Libor, U.S. Treasuries); it also

includes management input across all major geographies in which Zions does business, intended to adjust

for local market conditions(1). Assumes reduction of DDA of approximately $3 billion and a

commensurate reduction in cash balances. Change does not reflect cost savings associated with FDIC

premium expense on a lower asset base.

deposit repricing changes against similar duration benchmark indices (e.g. Libor, U.S. Treasuries); it also

includes management input across all major geographies in which Zions does business, intended to adjust

for local market conditions(1). Assumes reduction of DDA of approximately $3 billion and a

commensurate reduction in cash balances. Change does not reflect cost savings associated with FDIC

premium expense on a lower asset base.

(1) “Slow Response” refers to an assumption that market rates on deposits will adjust at a moderate rate (i.e. supply of deposits exceeds demand for

loans)

loans)

25

Securities Portfolio Comparison

Source: SNL as of 3Q 2010

MBS securities include residential mortgage pass-through investments that are not guaranteed by the U.S. Government

Takeaway - no material NIM compression risk from

MBS repricing

MBS repricing

26

• Zions’ asset sensitivity

implies a potentially stronger

net interest margin in a

rising rate environment

implies a potentially stronger

net interest margin in a

rising rate environment

• Near term pressure on loan

pricing may adversely affect

the net interest margin

pricing may adversely affect

the net interest margin

27

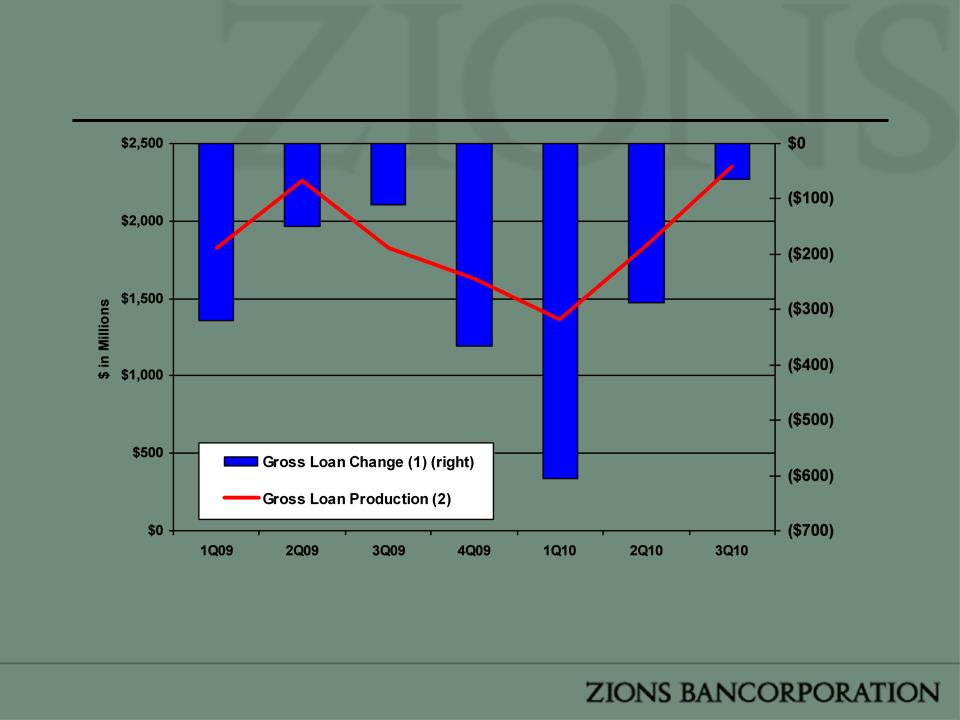

Loan Growth and Production Trends

(1) Linked quarter change in gross loan balance, excluding construction, land, development and FDIC-supported loans

(2) Loan production includes originations and renewals

28

Agenda

|

Overview of Zions

Key Performance Drivers

–Capital

–Credit Quality

–Revenue

Outlook Summary

|

|

|

29

Near Term Objectives

§ Reduce problem credits

– Continued intense focus on workouts

– On the margin, increase the use of A/B note structure

§ Increase lending activity

– Additional emphasis on government guaranteed lending

programs

programs

– C&I pipelines strengthening in some markets,

particularly small and middle-market enterprises

(SMEs)

particularly small and middle-market enterprises

(SMEs)

§ Reduce excess cash balances

– Use of off-balance sheet sweep accounts for business

checking

checking

– Lower interest rates on non-relationship interest bearing

accounts

accounts

– Marginally increase investments in agency securities

30

Outlook Summary

|

|

▼

|

|

Loans

|

|

|

▼

|

|

Nonperforming Assets

|

|

|

▼

|

|

Credit Costs

|

|

|

Est. 3.40% -

3.50% |

|

4Q10 GAAP Net Interest Margin (Reference:

Oct 21 8-K) (1) |

|

|

◄►

|

|

4Q10 Core Net Interest Margin (1)

|

|

|

◄►

|

|

Core Non-interest Expense

|

|

|

◄►

|

|

OTTI

|

|

|

◄▲

|

|

Capital Ratios

|

1) Accelerated amortization of sub debt discount in 4Q10 (~$73.3 million, or approximately 62 bps

NIM pressure) compared to 3Q10 ($27.5 million, or 23 bps NIM pressure)

NIM pressure) compared to 3Q10 ($27.5 million, or 23 bps NIM pressure)

Our outlook remains consistent with our earnings conference call and the

subsequent Form 8-k regarding subordinated debt conversion. Directionally, we

expect:

subsequent Form 8-k regarding subordinated debt conversion. Directionally, we

expect:

31

Appendix

32

Asset Sensitivity

§ Fixed-rate loans:

– Approximately one quarter of portfolio

– Duration of about 1.5 years

§ Variable-rate loans:

– Approximately three quarters of portfolio

– Floors on approximately 48% of variable-rate loans

– Swaps: $520 million (Pay Floating, Receive Fixed), down

from $545 million in the prior quarter

from $545 million in the prior quarter

33

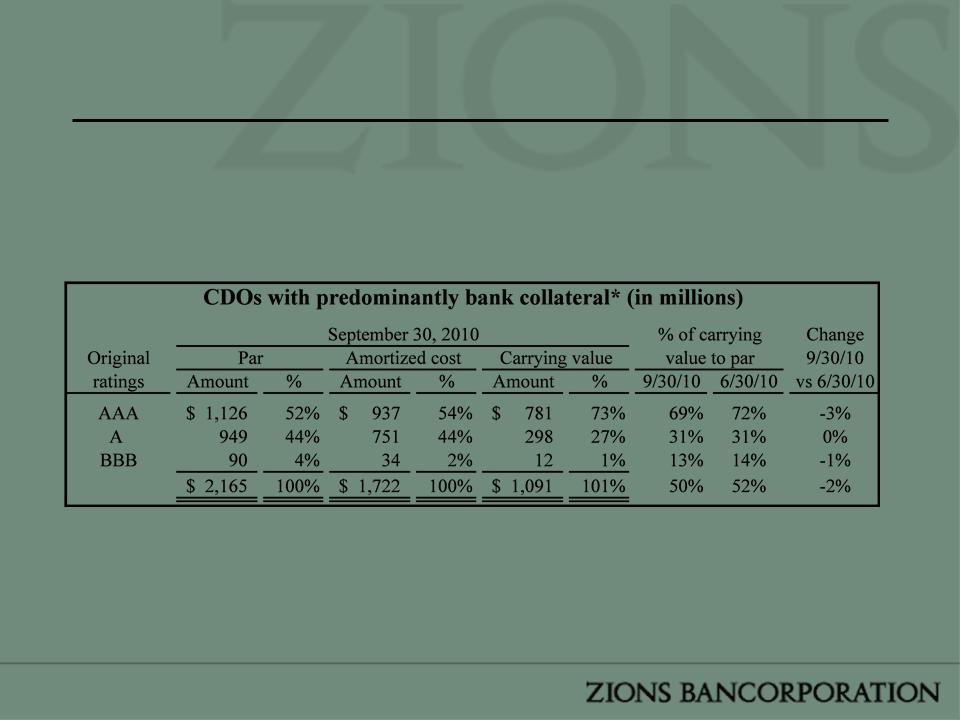

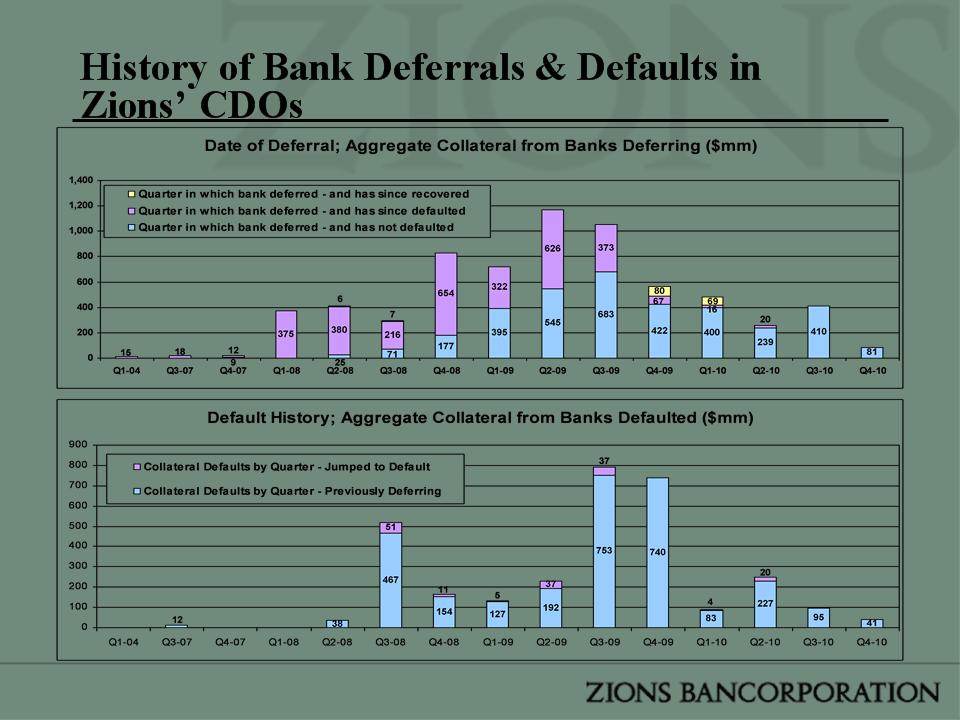

CDO Portfolio Summary

§ Credit-related OTTI losses in 3Q10: $23.7 million

– The increase in impairment (compared to 2Q10 OTTI of $18.1 million)

is primarily due to assumption changes in prepayment speeds on trust

preferred securities, given the adoption of the Dodd-Frank Act.

is primarily due to assumption changes in prepayment speeds on trust

preferred securities, given the adoption of the Dodd-Frank Act.

– Excluding that change, OTTI would have been approximately $12.1

million.

million.

*Table includes $2.2 billion par value of CDOs that are backed predominantly by bank trust preferred securities. The par value of all Bank &

Insurance backed CDOs is approximately $2.6 billion

Insurance backed CDOs is approximately $2.6 billion

34

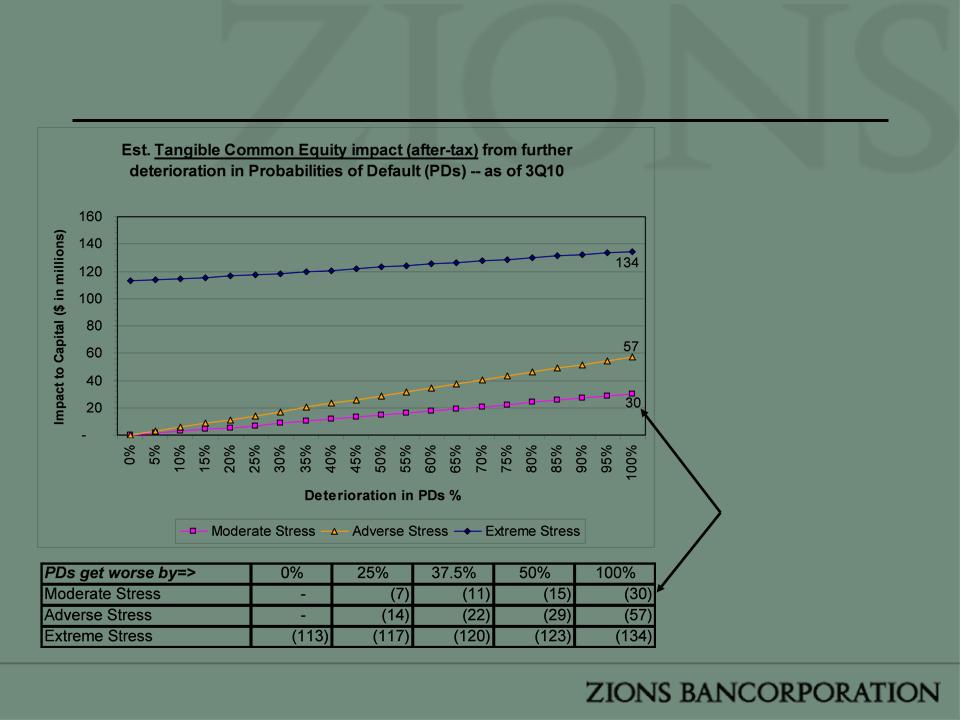

CDO Stress Testing - OTTI

§Deterioration in PDs % means that the

default curve applied to the performing

collateral of each deal is made worse

by the percentage indicated. Thus a

deal with a default curve of 5%

stressed to a 25% “Deterioration in

PDs %” would have a 6.25% default

probability curve applied to it, a deal

with 20% would go to 25% and so

forth. A “Deterioration in PDs %”

stress of 100% would double the PD

curve being applied to a deal's

collateral.

default curve applied to the performing

collateral of each deal is made worse

by the percentage indicated. Thus a

deal with a default curve of 5%

stressed to a 25% “Deterioration in

PDs %” would have a 6.25% default

probability curve applied to it, a deal

with 20% would go to 25% and so

forth. A “Deterioration in PDs %”

stress of 100% would double the PD

curve being applied to a deal's

collateral.

§Moderate Stress - The PD curve that

was applied to the performing

collateral of each CDO deal in the

pricing run is increased by the %

indicated and the resultant values

were used to estimate OTTI losses.

The Moderate Stress Scenario at

100% would result in approximately

$73 million of pre-tax OTTI losses.

was applied to the performing

collateral of each CDO deal in the

pricing run is increased by the %

indicated and the resultant values

were used to estimate OTTI losses.

The Moderate Stress Scenario at

100% would result in approximately

$73 million of pre-tax OTTI losses.

§Adverse Stress - Incorporates all of

the deterioration of PDs applied to the

performing collateral, but also stresses

the PDs applied to collateral in deferral

by the same deterioration

percentages. PDs on deferring

collateral are used to estimate the

value of the potential for this collateral

to cure in the future through recovery

or re-performance.

the deterioration of PDs applied to the

performing collateral, but also stresses

the PDs applied to collateral in deferral

by the same deterioration

percentages. PDs on deferring

collateral are used to estimate the

value of the potential for this collateral

to cure in the future through recovery

or re-performance.

§Extreme Stress - This is a very

severe stress scenario that uses the

“Moderate Stress” assumptions for

performing collateral, but also

immediately defaults all deferring

collateral instantly with no recovery

and no probability to re-perform in the

future.

severe stress scenario that uses the

“Moderate Stress” assumptions for

performing collateral, but also

immediately defaults all deferring

collateral instantly with no recovery

and no probability to re-perform in the

future.

35

CDO Stress Testing - Capital

§ Under various stress

scenarios, Zions’

modeling indicates

that OCI

(accumulated other

comprehensive

income) would

erode, although at a

significantly lower

amount than OTTI

(other than

temporary

impairment).

scenarios, Zions’

modeling indicates

that OCI

(accumulated other

comprehensive

income) would

erode, although at a

significantly lower

amount than OTTI

(other than

temporary

impairment).

§ Under the moderate

stress scenario at

100% greater PDs,

OTTI incurred would

be approximately $73

million pre-tax (see

previous slide).

Under that same

moderate stress

scenario at 100%

greater PDs, OCI

would only

deteriorate by

approximately $30

million after-tax.

stress scenario at

100% greater PDs,

OTTI incurred would

be approximately $73

million pre-tax (see

previous slide).

Under that same

moderate stress

scenario at 100%

greater PDs, OCI

would only

deteriorate by

approximately $30

million after-tax.

36

As of 10-28-10

37

Core Net Income Before Tax Detail

38

November 30, 2010