Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2010

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ______ TO ______

COMMISSION FILE NUMBER 000-23195

TIER TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

DELAWARE

(State or other jurisdiction of Incorporation or organization)

|

94-3145844

(I.R.S. Employer Identification No.)

|

11130 Sunrise Valley Drive, Suite 300, Reston, Virginia 20191

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (571) 382-1000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

COMMON STOCK, $0.01 PAR VALUE

|

Name of each exchange on which registered

The NASDAQ STOCK MARKET, LLC

|

Securities registered pursuant to Section 12(g) of the Act

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer," "accelerated filer," and "smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer x

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of March 31, 2010, the aggregate market value of common stock held by non-affiliates of the registrant was $109,921,041, based on the closing sale price of the common stock on March 31, 2010, as reported on The NASDAQ Stock Market. As of November 16, 2010, there were 18,230,965 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Items 10, 11, 12, 13 and 14 of Part III (except for information required with respect to our executive officers, which is set forth under "Part I—Executive Officers") of this report, which will appear in our definitive proxy statement relating to our 2011 annual meeting of stockholders, is incorporated by reference into this report.

TIER TECHNOLOGIES, INC.

FORM 10-K

TABLE OF CONTENTS

|

Part I

|

1

|

|

Item 1—Business

|

1

|

|

Item 1A—Risk Factors

|

6

|

|

Item 1B—Unresolved Staff Comments

|

7

|

|

Item 2—Properties

|

13

|

|

Item 3—Legal Proceedings

|

14

|

|

Item 4—Removed And Reserved

|

14

|

|

Executive Officers Of The Registrant

|

15

|

|

Part II

|

15

|

|

Item 5—Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

15

|

|

Item 6—Selected Financial Data

|

18

|

|

Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

19

|

|

Item 7A—Quantitative and Qualitative Disclosures About Market Risk

|

35

|

|

Item 8—Financial Statements and Supplementary Data

|

36

|

|

Report of Independent Registered Public Accounting Firm

|

37

|

|

Item 9—Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

72

|

|

Item 9A—Controls and Procedures

|

72

|

|

Item 9B—Other Information

|

74

|

|

Part III

|

74

|

|

Item 10—Directors, Executive Officers and Corporate Governance

|

74

|

|

Item 11—Executive Compensation

|

74

|

|

Item 12—Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

74

|

|

Item 13—Certain Relationships and Related Transactions and Director Independence

|

74

|

|

Item 14—Principal Accountant Fees and Services

|

74

|

|

Part IV

|

75

|

|

Item 15—Exhibits, Financial Statement Schedules

|

75

|

|

Signatures

|

78

|

i

Private Securities Litigation Reform Act Safe Harbor Statement

Certain statements contained in this report, including statements regarding the future development of and demand for our services and our markets, anticipated trends in various expenses, expected costs of legal proceedings, expectations about our technology projects, and other statements that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These forward-looking statements relate to future events or our future financial and/or operating performance and can generally be identified as such because the context of the statement includes words such as "may," "will," "intends," "plans," "believes," "anticipates," "expects," "estimates," "shows," "predicts," "potential," "continue," or "opportunity," the negative of these words or words of similar import. These forward-looking statements are subject to risks and uncertainties, including the risks and uncertainties described and referred to under Item 1A—Risk Factors beginning on page 6, which could cause actual results to differ materially from those anticipated as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

GENERAL

Tier Technologies, Inc., or Tier, is a leading provider of biller direct electronic payment solutions, through our primary brand Official Payments. These solutions provide payment services via multiple channels including the Internet, automated Interactive Voice Response, or IVR, call center and point-of-sale, or POS, environments. We offer our clients a front-end platform designed expressly for the biller direct market with a single source solution that simplifies the management of electronic payments. Our solutions include multiple enhanced payment services, including convenience fee payments, absorbed payments, payment reminder and automated payment scheduling. We also offer our clients a range of payment choices, including credit and debit cards, electronic checks, cash and money orders, and emerging payment methods to meet the needs of their customers. By utilizing our solutions, clients can reduce, if not eliminate, their management and expense of payment technology, PCI data security requirements, and compliance with other payment industry standards while offering their customers secure and convenient means to pay their bills. The demand for our services has been driven by an increasing preference of consumers and merchants/billers to make payments electronically, increased acceptance of online, interactive voice response systems and contact management solutions, as well as by legislative mandates.

We perform these services in a variety of markets, which we refer to as verticals. Our current verticals include:

|

·

|

Federal—which includes federal income and business tax payments;

|

|

·

|

State and Local—which includes state and local income tax payments and business tax payments;

|

|

·

|

Property Tax—which covers state and local real property tax;

|

|

·

|

Utility;

|

|

·

|

Education—which consists of services to post-secondary educational institutions; and

|

|

·

|

Other—includes local government fines and fees, motor vehicle registration and payments, rent, insurance, K-12 meal pay and fee payments and personal property tax payments.

|

During fiscal 2010, we also provided services in one business area which we are currently in the process of winding-down. While we continue to support our existing contracts in this area, we are not pursuing new contracts. The business that we are winding down is our Voice and Systems Automation business, or VSA, which provides services for interactive voice response systems, including customization, installation and maintenance. We expect to complete our VSA business within the next two years.

1

Originally incorporated in 1991 in California, we reincorporated in Delaware effective July 15, 2005. We are headquartered in Reston, Virginia. As of September 30, 2010, our 220 employees and 23 contractors provided services to over 4,600 clients nationwide.

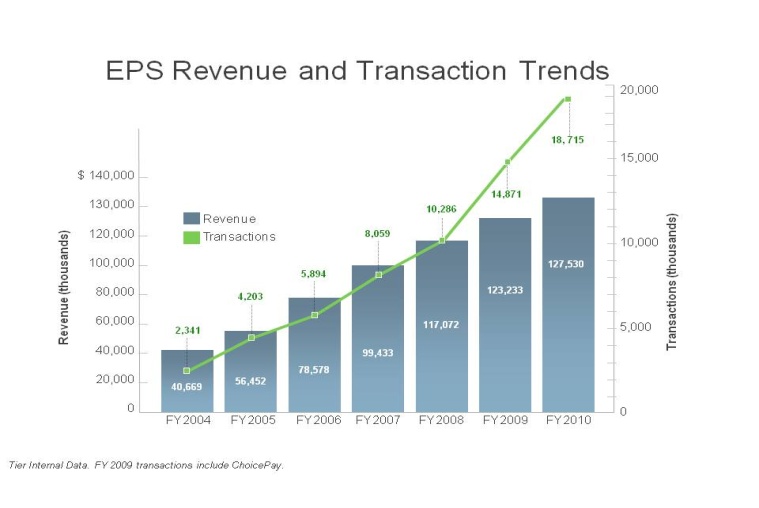

Our Continuing Operations consist of two reportable segments, Electronic Payment Solutions, or EPS, operations and Wind-down operations. Our Wind-down operations consist of one business area that we intend to wind down over the next two years. Revenues from our EPS operations were $127.2 million for the fiscal year ended September 30, 2010. For the fiscal year ended September 30, 2010, transaction volume increased 25.9% and total dollars processed increased 13.0% over the same period last year. Our EPS operations reported a net loss of $6.2 million for fiscal 2010. Revenues from our EPS operations make up 97.7% of our revenues from Continuing Operations. The seasonality of our business causes fluctuations from one quarter to the next within our revenues and direct costs. However, our general and administrative and selling and marketing expenses are more fixed in nature. We have successfully streamlined our costs to support our Wind-down operations, while still effectively managing our ongoing contracts.

Discontinued Operations is a reportable segment, which consists of businesses we have divested through fiscal year 2009. We incur minimal residual expense relating to our divested operations. For the fiscal year ended September 30, 2010 we reported a net loss of $0.2 million for Discontinued Operations primarily associated with legal fees and restructuring expense as well as the write-off of a receivable determined to be uncollectible. These expenses were offset by a $0.6 million earn-out we received from the company that purchased our former Government Business Process Outsourcing, or GBPO, business, pursuant to a Purchase and Sale Agreement dated June 9, 2008.

ELECTRONIC PAYMENT SOLUTIONS

Our core business consists of our biller direct solutions, which we refer to as Electronic Payment Solutions, or EPS. We offer our services using several pricing options such as transaction fee, convenience fee, flat fee, or client absorbed fee (fees paid directly by the client, in lieu of those charges being paid by the constituent using the service), which can be billed as a percentage fee, a fixed fee, or some combination of both. We provide services and solutions in several different verticals. Our client base includes the U.S. Internal Revenue Service, or IRS, 27 states, the District of Columbia and nearly 4,600 additional clients, consisting primarily of local governments and other public sector clients and approximately 100 private sector clients. We processed 18.7 million customer transactions, representing $7.8 billion in payments processed across all of our verticals during fiscal 2010. As of September 30, 2010, we offered nearly 9,200 payment types. In certain instances, each customer transaction is composed of two sub-transactions, one for the payment amount and one for the fee.

Verticals

Federal—We provide businesses and individuals the opportunity to pay certain federal income and business tax obligations electronically via credit or debit cards. Payment options include all major credit cards: American Express®, Discover®, MasterCard®, Visa® and all major debit cards including some regional ATM card networks. Payment channels include Internet, IVR, and agent (a third-party provider who accepts payments on behalf of our client). The revenues we receive for these services are typically based on a percentage of dollars processed. During tax year 2010, we provided payment services for 23 types of tax forms for the IRS. The leading form paid through our services is the individual IRS Form 1040, and when taxpayers submit this form, they typically pay the “balance due” on their taxes at the conclusion of the tax year. Based on the timing of tax obligation due dates, we typically see higher revenues during our second and third quarters within this payment vertical, primarily due to the April 15th federal income tax deadline for personal and business income tax payments. Revenues from our Federal vertical represented 20.5% of EPS revenues for fiscal year 2010. Our contract with the IRS to provide payment services for federal tax payments contributed 17.1% of our EPS revenue for fiscal year 2010.

2

State and Local—We offer a variety of electronic payment solutions to state and local governments for electronic payments for personal income taxes and business taxes These governments can provide electronic payment options to their constituents via Internet, IVR, agent, POS, and wedge readers using all major credit cards (see above), debit cards and e-check. Based on the client contract, revenues can be earned in any of the pricing models mentioned above. Revenues earned within this vertical can be seasonal by nature, as due dates for various state and local taxes determine the timing of revenue earned. For fiscal year 2010, this vertical represented 8.5% of EPS revenue. None of our clients within this vertical contributed more than 10% to our total revenues for EPS for fiscal year 2010.

Property Tax—We offer a variety of electronic payment solutions to state and local governments for the collection of real property taxes. Electronic payment options include Internet, IVR, agent, POS, and wedge readers using all major credit cards (see above), debit cards and e-check. Depending on the client contract, revenues can be earned in any of the pricing models mentioned above. As with any of our tax-based business, revenues earned are seasonal by nature, as due dates for various state and local taxes determine the timing of revenue. For fiscal year 2010, this vertical represented 27.3% of EPS revenue. None of our clients within this vertical contributed more than 10% to our total revenues for EPS for fiscal year 2010.

Utility—Within this vertical we allow customers and constituents of various companies and municipalities to pay their utility obligations electronically using all major credit cards (see above), debit card, e-check, cash or money order. The utility company customers can utilize the Internet, IVR, POS, agent, walk-up locations or kiosks to make these payments. For fiscal year 2010, this vertical represented 15.3% of EPS revenue. None of our clients within this vertical generated more than 10% of our EPS revenues for fiscal year 2010.

Education—Our solutions within the education vertical service post-secondary education institutions. Solutions we provide to these clients include electronic payment options for tuition and fee payments, housing and alumni donations. Individuals with obligations to post-secondary institutions may pay their obligations using all major credit cards (as above) and e-check via Internet, IVR and POS. During fiscal year 2010, this vertical represented 13.6% of EPS revenue. None of our clients within this vertical generated more than 10% of our EPS revenues for fiscal year 2010.

Other—Our “other” vertical encompasses state and local courts and citations, rent payments and insurance payments for various entities, electronic payment options for meal and fee payments for K-12 educational institutions, plus personal property tax payments. Generally speaking, all major credit cards and e-check are accepted payment forms using the following payment channels: Internet, IVR, POS, agent, and wedge readers. During fiscal year 2010, this vertical represented 14.8% of our EPS revenues.

Revenue Trends

As seen in the chart below, EPS revenue and transaction volumes have increased over the past six years. These increases are attributable to several factors: (1) the shift among federal, state and local governments, education institutions and private entities to electronic payment options, (2) organic growth, including adding new vertical and payment options, and (3) general market shift in consumer preference from cash and check to electronic forms of payment.

3

Commencing in the fall of 2006, our Board oversaw a strategic review of our business. That review resulted in a decision to focus on electronic payment solutions and divest our other businesses. During fiscal 2009, we completed the divestiture of our former GBPO business and our former Packaged Software Systems Integrations, or PSSI, business. As part of our strategic decision to focus on electronic payment solutions, we have also invested in growing new verticals, especially education and utilities. We made these investments to provide a richer value proposition to our end-users by offering more billers and payment types that could be accessed through our primary site OfficialPayments.com and to diversify the risk to our investors by balancing concentration in vertical markets. The federal income tax vertical, which used to represent more than half of total company revenue, is now just over 20% of EPS revenue. Our education and utilities verticals, which were small to non-existent in 2007, currently represent more than 10% of EPS revenue.

|

Vertical

|

Revenue Contribution

Fiscal year 2010

|

CAGR(1)

|

|

Federal

|

20.5%

|

(9.3)%

|

|

State and Local

|

8.5%

|

5.4%

|

|

Property Tax

|

27.3%

|

3.1%

|

|

Utility

|

15.3%

|

55.6%

|

|

Education

|

13.6%

|

53.4%

|

|

Other

|

14.8%

|

11.5%

|

|

Total

|

100.0%

|

8.6%

|

|

(1)Compound Annual Growth Rate of EPS Revenue for Fiscal Year 2007 to Fiscal Year 2010

|

||

WIND-DOWN OPERATIONS

As of September 30, 2010, our Wind-down operations consist of our VSA business from our former GBPO segment whose operations are neither compatible with our long-term strategic direction nor complementary

4

with the other business units that we divested. We intend to complete these projects over the next two years. Our VSA business provides interactive voice response systems and support services, including customization, installation and maintenance. We service over 100 customers within this business. None of the VSA customers contributed more than 10% of our consolidated revenues.

DATA SECURITY

Tier takes the integrity and security of the financial information it processes on behalf of individuals, businesses and other entities seriously. We are PCI Data Security Standard and National Automated Clearing House Association compliant, meaning we have professional security standards in place to protect the information we obtain to process electronic payments. We also undergo an annual comprehensive audit by the IRS. Tier has secured or is in the process of securing Money Transmitter Licenses in every state where this legislation is applicable.

During fiscal 2010, the responsibilities of our Data Security Committee of the Board of Directors were expanded to include operational risks. This committee’s primary function is to act on behalf of the board in fulfilling data security management responsibilities as defined by applicable law and regulations, as well as policies and procedures developed internally by Tier management. The Data Security Committee oversees our work on identifying and evaluating security and operational risks and implementing safeguards and programs on data security integrity and mitigation of security risks. This committee works with Tier management to enhance current, and develop new, technical policies and procedures which will strengthen security measures.

TECHNOLOGY

As a result of a number of acquisitions, including Official Payments Corporation, or OPC, EPOS Corporation and most recently, ChoicePay, Inc., we operate our business on multiple technology platforms. In 2009, we made the decision to consolidate our operations onto a single technology platform over time. While we have made some progress in the consolidation efforts, we determined in fiscal 2010 that completion of the development of a consolidated platform and the migration of our approximately 4,600 biller direct clients to that platform would take longer than originally anticipated. We are continuing to evaluate the platform consolidation project. We expect to review our plans related to a consolidated platform in mid-fiscal 2011. At this time, we have postponed all migration plans for current customers. During fiscal year 2011, we expect that our technology efforts will focus principally on (1) increasing platform stability by improving the platforms’ availability and reliability, (2) improving security and compliance, (3) retention of existing clients, by increasing the products and features available to clients, and (4) completion of infrastructure initiatives.

SEGMENT REPORTING

Tier manages and reports its business in three segments: EPS, Wind-down and Discontinued operations. Our Discontinued Operations consists of portions of our former GBPO and PSSI segments, which we have sold. Detailed information about the profitability of EPS and Wind-down can be found in Note 11—Segment Information to our Consolidated Financial Statements. Information about our Discontinued Operations can be found in Note 14—Discontinued Operations to our Consolidated Financial Statements.

SALES AND MARKETING

Our sales and marketing objective is to develop relationships with customers and clients that result in repeat long-term and cross-sale engagements. Throughout fiscal year 2010 our selling and marketing efforts have been dedicated to the growth of our EPS business. We have focused on upgrading our strategic information systems to allow us to establish direct relationships with end-users of our services, to grow transactions across verticals, and deepen the strength of our primary brand Official Payments. We continue these initiatives in utilizing our dedicated sales force, network of partnerships, experienced marketing team, and our senior executive group. Members of our executive team have a wide range of industry contacts and

5

established reputations in the electronic payments industry. They play a key role in developing, selling and managing major engagements. As a result of our market-focused sales approach, we believe that we are able to identify and qualify for opportunities quickly and cost-effectively.

We employ an integrated marketing strategy that creates broad-scale awareness to support targeted marketing initiatives to our existing and prospective customers and clients. These coordinated efforts are delivered by leveraging the resources and communication channels of our strategic partners, vertical clients and our own Official Payments communication channels. Our reliance on marketing partnerships has begun to diminish as the Official Payments customer base and client footprint have grown and we have successfully developed our own online targeted communication channels including email, web promotion and cross sell initiatives.

We are launching programs to increase customer adoption and utilization through expanded cross-selling capabilities and enhanced My Account functionality. My Account is a personal registration function offered through our subsidiary, Official Payments Corporation. We plan to launch new e-commerce products and payment services for partners and biller direct clients including additional payment channels such as mobile and walk-up payment.

INTELLECTUAL PROPERTY RIGHTS

Our success depends, in part, on protection of our methodologies, solutions and intellectual property rights. We rely upon a combination of nondisclosure, licensing and other contractual arrangements, as well as trade secret, copyright and trademark laws to protect our proprietary rights and the proprietary rights of third parties from whom we license intellectual property. We enter into nondisclosure agreements with all our employees, subcontractors and parties with whom we team. In addition, we control and limit distribution of proprietary information.

COMPETITION

The biller direct payments category is highly competitive and served by a wide array of organizations involved in transaction payment markets including Link2Gov, a subsidiary of FIS; RBS WorldPay; SallieMae Business Office Solutions; TouchNet Information Systems, Inc; CheckFree and Bill Matrix, subsidiaries of Fiserv; Oracle, and Online Resources. We believe that the principal competitive factors in our markets include reputation, industry expertise, client breadth, speed of development and implementation, technical expertise, effective marketing programs, competitive pricing and the ability to deliver results in a timely manner.

AVAILABLE INFORMATION

Our Internet address is www.tier.com. There we make available, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports, as soon as reasonably practicable after we electronically file such material with or furnish it to the Securities and Exchange Commission, or SEC. Our SEC reports can be accessed through the Investor Relations section of our Web site. The information found on our Web site is not part of this or any other report we file with or furnish to the SEC.

Investing in our common stock involves a degree of risk. You should carefully consider the risks and uncertainties described below in addition to the other information included or incorporated by reference in this annual report. If any of the following risks actually occur, our business, financial condition or results of operations would likely suffer. In that case, the trading price of our common stock could fall.

The following factors and other risk factors could cause our actual results to differ materially from those contained in forward-looking statements in this Form 10-K.

6

We have incurred losses in the past and may not be profitable in the future. While we reported net income of $1.1 million in fiscal year 2005, we have reported net losses of $6.2 million in fiscal 2010, $11.5 million in fiscal 2009, $27.4 million in fiscal 2008, $3.0 million in fiscal 2007, and $9.5 million in fiscal 2006.

Our revenues and operating margins may decline and may be difficult to forecast, which could result in a decline in our stock price. Our revenues, operating margins and cash flows are subject to significant variation from quarter to quarter due to a number of factors, many of which are outside our control. These factors include:

|

·

|

economic conditions in the marketplace, including recession;

|

|

·

|

loss of significant clients;

|

|

·

|

demand for our services;

|

|

·

|

seasonality of business, resulting from timing of property tax payments and federal and state income tax payments;

|

|

·

|

timing of service and product implementations;

|

|

·

|

unplanned increases in costs;

|

|

·

|

delays in completion of projects;

|

|

·

|

intense competition;

|

|

·

|

costs of compliance with laws and government regulations; and

|

|

·

|

costs of acquisitions, consolidation and integration of new business and technology.

|

The occurrence of any of these factors may cause the market price of our stock to decline or fluctuate significantly, which may result in substantial losses to investors. We believe that period-to-period comparisons of our operating results are not necessarily meaningful and/or indicative of future performance. From time to time, our operating results may fail to meet analysts’ and investors’ expectations, which could cause a significant decline in the market price of our stock. Fluctuations in the price and trading volume of our stock may be rapid and severe and may leave investors little time to react. Other factors that may affect the market price of our stock include announcements of technological innovations or new products or services by competitors and general economic or political conditions, such as recession, acts of war or terrorism. Fluctuations in the price of our stock could cause investors to lose all or part of their investment.

Our income tax and property tax processing revenue has been negatively impacted by recent economic conditions and may continue to decline. As a result of the current global and U.S. economic conditions, including unemployment and real estate foreclosures, we have suffered a downturn in revenue in our property tax and federal verticals, due to decreased payments of federal income tax and property tax by taxpayers who pay taxes on our website and IVR payment processing systems. If current conditions do not improve, additional declines in revenue may occur, especially in the property tax and federal verticals, negatively impacting use of our services and our overall revenues.

We could suffer material losses and liability if our operations, systems or platforms are disrupted or fail to perform properly or effectively. The continued efficiency and proper functioning of our technical systems, platforms, and operational infrastructure is integral to our performance. We operate on multiple platforms. If any or all of the platforms or portions of the platforms, systems, or resources are disrupted or fail to perform properly or effectively, we could incur significant remediation costs and we might not be able to process transactions or provide services during the disruption or failure, which would result in a decrease in revenue. Our operations, systems and platforms might be disrupted or fail to perform properly for many reasons including operational or technical failures of our systems and platforms, human error, failure of third-party support and services, system failure due to age and lack of integrity of hardware and software infrastructure, existence of single points of failure which has resulted in system interruption and outages, diminished availability and reliability of our services causing us to fail to meet contractual service level requirements, and loss of key individuals or failure of key individuals to perform who have unique knowledge of system architecture and platform customizations. We process a high volume of time-sensitive payment

7

transactions. The majority of our tax-related transactions are processed in short periods of time, including between April 1 and April 15 of each tax year for federal tax payments. If there is a defect or malfunction in our platforms or system software or hardware, an interruption or failure due to damage or destruction, a loss of system or platform functionality, a delay in our system processing speed, a lack of system capacity, or a loss of personnel on short notice, even for a short period of time, our ability to process transactions and provide services may be significantly limited, delayed or eliminated, resulting in lost business and revenue and harm to our reputation. We might be required to incur significant costs to remediate or address any such defect, malfunction, interruption, failure, loss of functionality, delay, lack of capacity, or loss of personnel. Our insurance may not provide coverage or be adequate to compensate us for losses that may occur as a result of any such event, or any system, platform, security or operational failure or disruption.

In the event we proceed with consolidation of our technology platforms, the consolidation involves significant risk and may not be successful or may be delayed. We are in the process of evaluating the consolidation of our technology platforms. We currently maintain three processing platforms: one in San Ramon, California; one in Auburn, Alabama; and a third in Tulsa, Oklahoma, which we recently acquired in the ChoicePay acquisition. Consolidation of our technology platforms could result in significant risks, including restricted and limited transaction volume, operational inefficiencies, inability to add new products or services, inability to achieve our goals for fiscal year 2011 and 2012, inability to expand existing products and services, significant development costs, higher labor costs, increased hardware and software costs, inability to provide certain functionality, or system and service disruption or failure. Our business is highly dependent upon having safe and secure information technology platforms with sufficient capacity to meet both the high volume of transactions and the future growth of our business. If our ability to develop and/or acquire upgrades or replacements for our existing platforms does not keep pace with the growth of our business, we may not be able to meet our requirements for the sustainable and economic growth of the business. Furthermore, if we are not able to acquire or develop these platforms and systems on a timely and economical basis, our profitability may be adversely affected. If we are unable to successfully integrate and consolidate these technology platforms it could result in a significant loss of clients, loss of revenues, and risk of liability.

We could suffer material losses or significant disruption of our operations and business if we are not successful in integration and consolidation of our operations. We are consolidating and moving certain operations, facilities, departments, and positions as part of our strategic plan to save costs and eliminate duplicative operations and functions. We completed consolidation of the customer service/call center, client services, implementation services, and some information technology services from San Ramon, California, and Tulsa, Oklahoma, to our existing facility in Auburn, Alabama, and we consolidated financial operations to Reston, Virginia. If this restructuring and consolidation is not successful, we could suffer disruption of our operations, systems or services; incur a significant increase in costs; or suffer a loss of valuable staff and historical knowledge, which could have a material adverse impact on our business, significantly increase operating costs and result in operational weaknesses and compliance deficiencies. On January 27, 2009, we purchased substantially all of the assets of ChoicePay, Inc., an ePayments solution provider based in Tulsa, Oklahoma. The acquisition included intellectual property, the ChoicePay processing platform, systems, operations, services, products, clients, employees, and other resources. We may not be successful in integrating the acquired assets into our existing business, which could result in disruption of operations, inefficiencies, excess costs, legal and financial liability, additional outsourcing of services and consulting charges, failure to provide services and products as contracted with clients and vendors, and impairment of earning and operating results.

Security breaches or unauthorized access to confidential data and personally identifiable information in our facilities, computer networks, or databases, or those of our suppliers, may cause harm to our business and result in liability and systems interruptions. Our business requires us to obtain, process, use, and destroy confidential and personally identifiable data and information of clients and consumers. We have programs, procedures and policies in place to protect against security breaches, unauthorized access and fraud. Despite security measures we have taken, our systems may be vulnerable to physical break-ins, fraud, computer viruses, attacks by hackers and similar acts and events, causing interruption in service and

8

loss or theft of confidential data and personally identifiable information that we process and/or store. It is possible that our security controls over confidential information and personal data, our training on data security, and other practices we follow may not prevent the improper disclosure or unauthorized access to confidential data and personally identifiable information. In addition, our service could be subject to employee fraud or other internal security breaches, and we may be required to reimburse customers for any funds stolen as a result of such actions or breaches. Our third-party vendors or suppliers also may experience security breaches, fraud, computer viruses, attacks by hackers or other similar incidents involving the unauthorized access and theft of confidential data and personally identifiable information. In January 2009, Heartland Payment Systems reported a breach of security of its systems resulting in the loss or theft of personally identifiable information. We contract with Heartland for certain payment processing services for credit and debit transactions in the education market. Although no security breach occurred within our systems, and there is no specific information to date that our clients’ or their related consumers’ information or data was compromised as a result of this incident, if such client or consumer data and information was lost or stolen, such an incident could potentially result in compliance costs, loss of clients and revenues, liability and fines. Any security breach within our systems, software or hardware or our vendors’ or suppliers’ systems, software or hardware could result in unauthorized access, theft, loss, disclosure, deletion or modification of such data and information, and could cause harm to our business and reputation, liability for fines and damages, costs of notification, and a loss of clients and revenue.

Financial loss could result from fraudulent payments, lack of integrity of systems, or fraudulent use of our systems or the systems of third parties. We receive funds and facilitate payment and settlement of funds on behalf of clients, consumers and businesses for a variety of transaction types including debit/credit cards, ACH payments and other electronic bill payments. Our facilitation of these payments depends on the integrity of our systems and our technology infrastructure as well as the integrity of the systems and technology infrastructure of third parties in the payment transaction process such as financial institutions, processors, networks, and other businesses, and vendors and suppliers. In addition, our service could be subject to employee fraud or other internal security breaches, and we may be required to reimburse customers for any funds stolen as a result of such actions or breaches. If the integrity of this payment process is impaired or the ability to detect fraud or fraudulent payments compromised, including in connection with verification, authentication, settlement, and other payment processes, it could result in financial loss.

We could suffer material losses and liabilities if the services of any of our third party suppliers, vendors or other providers are disrupted, eliminated or fail to perform properly or effectively. Our payment solution services, systems, security, infrastructure and technology platforms are highly dependent on third party services, software, hardware, including data transmission and telecom service providers, subcontractors, co-location facilities, network access providers, card companies, processors, banks, merchants and other suppliers and providers. We also provide services on complex multi-party projects where we depend on integration and implementation of third-party products and services. The failure or loss of any of these third party systems, services, software or products, our inability to obtain third party replacement services, or damage to or destruction of such services could cause degraded functionality, loss of product and service offerings, restricted transaction capacity, limited processing speed and/or capacity, or system failure, which could result in significant cost, liability, diminished profitability and damage to our reputation and competitive position. Our insurance may not provide coverage or be adequate to compensate us for losses that may occur as a result of any such event, or any system, security or operational failure or disruption.

Our revenues and cash flows could decline significantly if we were unable to retain our largest client, or a number of significant clients. The majority of our client contracts, including our contract with the U.S. Internal Revenue Service, allow clients to terminate all or part of their contracts on short notice, or provide notice of non-renewal with little prior notification. Our contract with the IRS has generated 17.1%, 19.8%, and 27.8% of our annual revenues from Electronic Payment Solutions for fiscal years 2010, 2009, and 2008, respectively. In April 2009 we were one of three companies awarded a multi-year contract by the IRS to provide electronic payment solutions for personal and business taxes. The contract contains a base period

9

commencing April 2, 2009 and ending December 31, 2009 and four one-year option periods running until December 31, 2013. To obtain this contract, we reduced our historical pricing. We compete with the other contract award recipients to provide services to the IRS. If the other recipients reduce their prices, or if additional companies are awarded contracts, we may have to reduce our prices further to remain competitive. If we were unable to retain this client, or replace it in the event it is terminated, or if we were unable to renew this contract, or are unsuccessful in future re-bids of this contract, or if we are forced to reduce our prices in response to competitive pressures, our operating results and cash flows could decline significantly. Termination or non-renewal of a number of client contracts, or certain significant client contracts, including the IRS contract, or a number of large state, local, utility or education-related contracts, could result in significant loss of revenues and reduction in profitability.

Violation of any existing or future laws or regulations, including laws governing money transmitters and anti-money laundering laws, could expose us to substantial liability and fines, force us to cease providing our services, or force us to change our business practices. Our business is subject to numerous federal and state laws and regulations, including some states’ money transmitter regulations and related licensing requirements, and anti-money laundering laws. Compliance with federal and state laws and government regulations regarding money transmitters, money laundering, privacy, data security, fraud, and other laws and regulations associated with payment transaction services is critical to our business. New laws and regulations in these areas may be enacted, or existing ones changed, which could negatively impact our services, restrict or eliminate our ability to provide services, make our services unprofitable, or create significant liability for us. Our anti-money laundering program requires us to monitor transactions, report suspicious activity, and prohibit certain transactions. We are registered as a money services business, have a number of state money transmitter licenses and have additional applications for licensure as a money transmitter pending. We entered into consent orders with two states which included payment of a fine for unlicensed activity prior to our submission of the money transmitter application, and two other states have imposed an assessment or fine. In the future we may be subject to additional states’ money transmitter regulations, money laundering regulations, regulation of internet transactions, and related payment of fees and fines. We are also subject to the applicable rules of the credit/debit card association, the National Automated Clearing House Association (NACHA), and other industry standards. If we are found to be in violation of any laws, rules, regulations or standards, we could be exposed to significant financial liability, substantial fines and penalties, cease and desist orders, and other sanctions that could restrict or eliminate our ability to provide our services in one or more states or accept certain types of transactions in one or more states, or could force us to make costly changes to our business practices. Even if we are not forced to change our business practices, the costs of compliance and obtaining necessary licenses and regulatory approvals, could be substantial.

We could suffer material revenue losses and liability in the event the divested business projects and contracts are not successfully concluded. We have completed divestment of certain operations and portions of the business including our former Financial Institutions Data Match services, State Systems Integration, Financial Management Systems and Unemployment Insurance operations. Certain divestitures include contractual earn-outs and revenue sharing arrangements based on the buyers’ successful operation of the businesses divested. If the businesses are not profitable or there are revenue shortfalls, we may not receive the expected benefits from the divestitures, which could have an adverse impact on our revenues. Additionally, we remain liable for certain obligations under some of the divested projects and their related contracts. In February 2009, we completed the sale of our Unemployment Insurance, or UI, business to RKV Technologies, Inc, or RKV. The sale was completed pursuant to an Asset Purchase Agreement dated February 6, 2009. As a part of the agreement, Tier is required to leave in place a $2.4 million performance bond on the continuing contract for the State of Indiana, or the State. Subsequent to the sale of the UI business to RKV, the prime contractor, Haverstick Corporation, or Haverstick, the State, and RKV determined that the contract completion would be delayed and additional funding would be needed to complete the contract. In November 2009 Haverstick cancelled its contract with RKV and directly rehired various RKV resources and contractors. Tier retains certain liabilities for completion of the project, and continues as the indemnitor under the performance bond. Mediation is expected to take place by September 2011 to discuss the costs of project completion. If this contract or other divested contracts are not performed

10

successfully, or if there is a claim of delay or breach in connection with services or products provided by either us or the acquiring company, liability to Tier could result, causing damages, unanticipated costs, bond forfeitures and loss of revenue.

As a result of our divestitures and the transition to a primary focus on electronic payment solutions, our business is less diverse and therefore more vulnerable to changes affecting the electronic payments business generally. Our focus on electronic payment solutions since fiscal year 2007 and the divestiture of the majority of our legacy business units unrelated to electronic payment solutions, including software licensing and government system integration businesses, has resulted in loss of historical revenue sources and a decrease in diversification of services and markets. In the event of a business downturn in the electronic payment solutions business due to increased competition, loss of clients, economic conditions, technology changes, or in the event of increased costs, disruption in services, a change in laws, or other events related to the electronic payment solutions business, there could be a greater negative impact on our revenues than if we had retained our diverse businesses.

If we undertake acquisitions, they could be expensive, increase our costs or liabilities or disrupt our business. One of our strategies may be to pursue growth through acquisitions. Negotiations of potential acquisitions and the integration of acquired business operations could disrupt our business by diverting management attention away from day-to-day operations. Acquisitions of businesses or other material operations may require additional debt or equity financing, resulting in leverage or dilution of ownership. We also may not realize cost efficiencies or synergies that we anticipated when selecting our acquisition candidates. In addition, we may need to record write-downs from future impairments of identified intangible assets and goodwill, which could reduce our future reported earnings. Acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition. Any costs, liabilities or disruptions associated with any future acquisitions we may pursue could harm our operating results.

Changes in laws and government and regulatory compliance requirements may result in additional compliance costs and may adversely impact our reported earnings. Our business is subject to numerous federal, state and local laws, government regulations, corporate governance standards, compliance controls, accounting standards, licensing and bonding requirements, industry/association rules, and public disclosure requirements including under the Sarbanes Oxley Act of 2002, SEC regulations, and Nasdaq Stock Market rules. Compliance with and changes in these laws, regulations, standards and requirements may result in increased general and administrative expenses for outside services, increased risks associated with compliance, and a diversion of management time and attention from revenue-generating activities, which could curtail the growth of our business.

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), was signed into law which implements new laws and regulations. At this time, it is difficult to predict the extent to which the Dodd-Frank Act or the resulting rules and regulations will impact our business. Compliance with these new laws and regulations will likely result in additional costs which could be significant and could adversely impact the Company’s results of operations, financial condition and liquidity.

We operate in highly competitive markets. If we do not compete effectively, we could face price reductions, reduced profitability and loss of market share. Our business is focused on electronic payment transaction solutions and e-commerce services, which are highly competitive markets and are served by numerous international, national and local firms. Many of our competitors have significantly greater financial, technical and marketing resources and name recognition than we do. In addition, there are relatively low barriers to entry into these markets, and we expect to continue to face additional competition from new entrants into our markets. Parts of our business are subject to increasing pricing pressures from competitors, as well as from clients facing pressure to control costs. Some competitors are able to operate at significant losses for extended periods of time, which increases pricing pressure on our products and services. If we do not compete effectively, the demand for our products and services and our revenue growth and operating margins could decline, resulting in reduced profitability and loss of market share.

11

Our revenues may fluctuate, and our ability to maintain profitability is uncertain. Our business primarily provides credit and debit card and electronic check payment options for the payment of federal and state personal income taxes, real estate and personal property taxes, business taxes, fines for traffic violations and parking citations, educational, utility and rent obligations. Our revenues depend on consumers’ continued willingness to pay a convenience fee and our relationships with clients, such as government taxing authorities, educational institutions, public utilities and their respective constituents. Demand for our services could decline if consumers are not receptive to paying a convenience fee, card associations change their rules, laws are passed that do not allow us to charge the convenience fees, or if credit or debit card issuers, marketing partners, or alliance partners change terms, terminate services or products, or eliminate or reduce the value of rewards to consumers under their respective rewards programs. The fees charged by credit/debit card associations, financial institutions, and our suppliers can be increased with little or no notice, which could reduce our margins and harm our profitability.

Demand for our services could also be adversely affected by a decline in the use of the Internet, economic factors such as a decline in availability of credit, increased unemployment, foreclosures, or consumer migration to a new or different technology or payment method. The use of credit and debit cards and electronic checks (ACH) to make payments is subject to increasing competition and rapid technological change. If we are not able to develop, market and deliver competitive technologies, our market share will decline and our operating results and financial condition could suffer.

Change in interchange rates could have a significant impact on our cost of revenue generation. Interchange rates charged by credit and debit card companies through card issuing banks are a major factor in our delivery costs for the services we perform. A change in such rates could have a significant impact on our financial performance. On July 21, 2010, President Obama signed HR 4173, the Dodd-Frank Wall Street Reform and Consumer Protection Act. Section 1075 of this legislation requires the Federal Reserve to set guidelines for reasonable interchange transaction fees for electronic debit transactions. The Federal Reserve has nine months from the date of enactment to publish guidelines and the guidelines will become effective one year from the date of enactment. Among areas of relevance to the Company, the law provides for assessing if any interchange transaction fee is reasonable and proportionate to the cost incurred by the card issuer with respect to the transaction and prohibits payment card networks from restricting the number of payment card networks on which an electronic debit transaction may be processed, prohibits payment card networks from inhibiting the ability of the Company from setting a minimum transaction amount for credit card transactions.

The success of our business is based largely on our ability to attract and retain talented and qualified employees and contractors. The market for skilled workers in our industry is extremely competitive. In particular, qualified managers and senior technical and professional staff are in great demand. If we are not successful in our recruiting efforts or are unable to retain key employees, our ability to staff projects and deliver products and services may be adversely affected. We believe our success also depends upon the continued services of senior management and a number of key employees whose employment may terminate at any time. If one or more key employees resigns to join a competitor, to form a competing company, or as a result of termination or a divestiture, the loss of such personnel and any resulting loss of existing or potential clients could harm our competitive position.

If we are not able to protect our intellectual property, our business could suffer serious harm. Our systems and operating platforms, scripts, software code and other intellectual property are generally proprietary, confidential, and may be trade secrets. We protect our intellectual property rights through a variety of methods, such as use of nondisclosure and license agreements and use of trade secret, copyright and trademark laws. Despite our efforts to safeguard and protect our intellectual property and proprietary rights, there is no assurance that these steps will be adequate to avoid the loss or misappropriation of our rights or that we will be able to detect unauthorized use of our intellectual property rights. If we are unable to protect our intellectual property, competitors could market services or products similar to ours, and demand for our offerings could decline, resulting in an adverse impact on revenues.

12

We may be subject to infringement claims by third parties, resulting in increased costs and loss of business. Our business is dependent on intellectual property rights including software license rights and restrictions, and trademark rights. From time to time we receive notices from others claiming we are infringing on their intellectual property rights. Defending a claim of infringement against us could prevent or delay our providing products and services, cause us to pay substantial costs and damages or force us to redesign products or enter into royalty or licensing agreements on less favorable terms. If we are required to enter into such agreements or take such actions, our operating margins could decline.

As a result of the recent conditions in the financial and credit markets we may not be able to obtain credit. The recent worldwide and U.S. economic crisis has made it difficult to borrow money or obtain credit. We currently have no credit line or credit facility and rely solely on cash on hand, investments and cash from operations to fund our business. If current levels of economic and market disruption and volatility continue or worsen, there can be no assurance that credit, bank loans, contractual lending agreements or other funding sources will be available on reasonable terms, or at all. If we were not able to fund operations our level of services, staffing, resources or equipment may need to be reduced or eliminated which could negatively impact our revenue and stock price.

If we are not able to obtain adequate or affordable insurance coverage or bonds, we could face significant liability claims and increased premium costs and our ability to compete for business could be compromised. We maintain insurance to cover various risks in connection with our business. Additionally, our business includes projects that require us to obtain performance, statutory and bid bonds from a licensed surety. There is no guarantee that such insurance coverage or bonds will continue to be available on reasonable terms, or at all. If we are unable to obtain or maintain adequate insurance and bonding coverage, potential liabilities associated with the risks discussed in this report could exceed our coverage, and we may not be able to obtain new contracts or continue to provide existing services, which could result in decreased business opportunities and declining revenues.

Our markets are changing rapidly. If we are not able to adapt to changing conditions, we may lose market share and may not be able to compete effectively. The markets for our products are characterized by rapid changes in technology, client expectations and evolving industry standards. Our future success depends on our ability to innovate, develop, acquire and introduce successful new products and services for our target markets and to respond quickly to changes in the market. If we are unable to address these requirements, or if our products or services do not achieve market acceptance, we may lose market share, and our revenues could decline.

Our business is subject to increasing performance requirements, which could result in reduced revenues and increased liability. On certain projects we make performance guarantees, based upon defined operating specifications, service levels and delivery dates, which are sometimes backed by contractual guarantees and performance, statutory or bid bonds. Unsatisfactory performance of services, disruption of services, or unanticipated difficulties or delays in processing payments or providing contracted services may result in termination of the contract, a reduction in revenues, liability for penalties and damages, or claims against a bond. Additionally, the failure to meet client expectations could damage our reputation and compromise our ability to attract new business.

ITEM 1B—UNRESOLVED STAFF COMMENTS

There are no unresolved written comments that were received from the Securities and Exchange Commission’s staff 180 days or more before the end of our fiscal year 2010 regarding our periodic or current reports under the Securities Exchange Act of 1934.

As of September 30, 2010, we leased 38,324 square feet of space throughout the country, which includes our 25,583 square foot corporate headquarters in Reston, Virginia. We also leased 12,741 square feet of space in

13

California and Oklahoma, to support portions of our EPS operations. In addition, we own a 28,060 square-foot building in Alabama which houses certain administrative, call center, and other operations.

We are not currently involved in any material pending legal proceedings.

14

The names, ages and positions of our executive officers at November 1, 2010, are listed in the following table, together with their business experience during the past five years. Unless otherwise specified, all officers served continuously since the date indicated.

|

Name, age and position with Registrant

|

Date elected

or appointed

|

|

Alex P. Hart, Age 48 (a)

|

|

|

President, Chief Executive Officer and Director

|

August 2010

|

|

Ronald W. Johnston, Age 64 (b)

|

|

|

Senior Vice President, Chief Financial Officer

|

July 2008

|

|

Keith S. Kendrick, Age 53 (c)

|

|

|

Senior Vice President, Strategic Marketing

|

June 2008

|

|

Atul Garg, Age 44 (d)

|

|

|

Senior Vice President, Product Management

|

November 2010

|

|

Keith S. Omsberg, Age 49 (e)

|

|

|

Vice President, General Counsel and Corporate Secretary

|

April 2008

|

|

(a) Mr. Hart served as President of the Fuelman Fleet Cards business unit of Fleetcor Technologies, Inc., a provider of specialized payment products and services to commercial fleets, major oil companies and petroleum marketers, from September 2009 through August 2010. From May 2007 to April 2008 Mr. Hart served as Executive Vice President and General Manager of Electronic Banking Services for Check Free Corporation, a provider of financial electronic commerce products and services. From October 2002 to May 2007, he served as President and Chief Executive Officer of Corillian Corporation, a provider of online banking and bill payment software and services.

|

|

|

(b) Mr. Johnston served as a CFO partner with Tatum LLC, a professional services firm, from August 2007 through June 2008; CFO and Treasurer for Grantham Education Corporation, a for-profit post-secondary university, from October 2004 through March 2007; and CFO for WorldSpace Corporation, a satellite broadcast and content development company from September 2002 through September 2004.

|

|

|

(c) Mr. Kendrick served as Senior Vice President, Corporate Marketing and Strategy with EFunds Corporation, a publicly traded enterprise payments and data solutions company, from December 2005 through September 2007 and co-founder and Chief Executive Officer of Vericate Corporation, an analytical software company focused on fraud detection in the retail drug transaction industry, from January 2003 through March 2005.

|

|

|

(d) Mr. Garg served as Executive consultant, Senior Vice President with Fleetcor Technologies, Inc., a provider of specialized payment products and services to commercial fleets, major oil companies and petroleum marketers, from June 2009 to October 2010. Mr. Garg served as Senior Vice President, eBusiness from November 2007 to May 2009, Senior Vice President, Small Business Cards from October 2006 to November 2007, Senior Manager, Commercial Cards and Small Business from October 2004 to October 2006 and Director, Project Development, Private Label Credit Card from June 2002 to October 2004, for HSBC Bank USA, N.A., one of the world’s largest banks, providing personal financial services and commercial, global and private banking services.

|

|

|

(e) Mr. Omsberg served as Assistant General Counsel of Tier from June 2002 to April 2008.

|

|

ITEM 5—MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the Nasdaq Global Market under the symbol TIER. On November 8, 2010, there were 203 record holders of our common stock. The quarterly high and low prices per share during fiscal 2010 and 2009 were as follows:

15

|

Fiscal year ended September 30,

|

||||||||||||||||

|

2010

|

2009

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

First quarter

|

$ | 9.00 | $ | 7.43 | $ | 7.57 | $ | 3.41 | ||||||||

|

Second quarter

|

$ | 8.32 | $ | 7.10 | $ | 6.39 | $ | 4.48 | ||||||||

|

Third quarter

|

$ | 8.58 | $ | 5.99 | $ | 7.90 | $ | 4.35 | ||||||||

|

Fourth quarter

|

$ | 6.90 | $ | 4.53 | $ | 8.90 | $ | 7.10 | ||||||||

We have never declared or paid cash dividends on our common stock and do not anticipate doing so for the foreseeable future. Our current letter of credit facility prohibits us from declaring dividends.

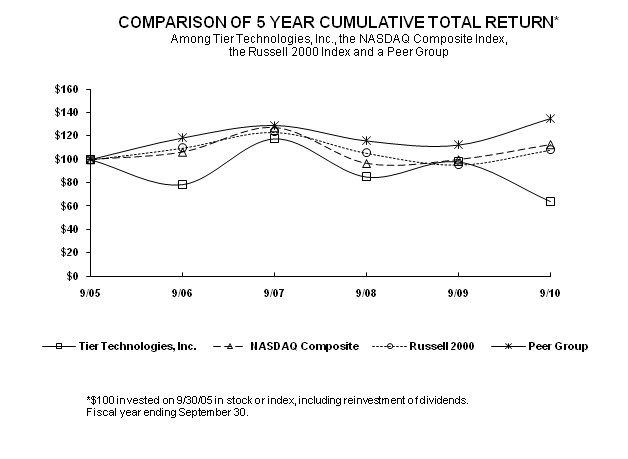

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

The following graph compares the percentage change in cumulative stockholder return on our common stock for the period September 30, 2005 through September 30, 2010, with the cumulative total return on the NASDAQ Composite Index, the Russell 2000 Index and a composite of selected peers. The peer group consists of: ACI Worldwide Inc., Alliance Data Systems Corporation, Bottomline Technologies (de), Inc, Fiserv, Inc., Global Payments Inc., Heartland Payment Systems, Inc., Jack Henry & Associates, Inc, Online Resource Corporation, Total Systems Services Inc and Wright Express Corporation. We selected these companies because these are all the public companies that operate primarily in the electronic payments industry. We have included a peer group index this year in order to facilitate a comparison between an investment in Tier and an investment in other companies in our industry. The comparison assumes $100.00 was invested on September 30, 2005 in our common stock and in each of the foregoing indices and assumes reinvestment of all dividends, if any.

16

|

Measurement

Date

|

Tier

Technologies, Inc.

|

NASDAQ

Composite

|

Russell

2000

|

Peer

Group

|

||||||||||||

|

9/30/05

|

$ | 100.00 | $ | 100.00 | $ | 100.00 | $ | 100.00 | ||||||||

|

9/30/06

|

78.61 | 106.39 | 109.92 | 118.44 | ||||||||||||

|

9/30/07

|

117.92 | 127.37 | 123.49 | 129.16 | ||||||||||||

|

9/30/08

|

85.09 | 96.70 | 105.60 | 115.92 | ||||||||||||

|

9/30/09

|

98.03 | 100.00 | 95.52 | 112.39 | ||||||||||||

|

9/30/10

|

64.05 | 112.86 | 108.27 | 134.99 | ||||||||||||

The information included under the heading "Comparison of 5 Year Cumulative Total Return" in Item 5 of this Annual Report on Form 10-K is "furnished" and not "filed" and shall not be deemed to be "soliciting material" or subject to Regulation 14A, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

During the three months ended September 30, 2010, we did not repurchase any of our common stock. On January 21, 2009, our Board of Directors authorized the repurchase of up to $15.0 million of our common stock in the open market from time to time. On August 13, 2009, the Board increased the maximum repurchase amount to $20.0 million. As of September 30, 2010, we had purchased 1,651,898 shares of common stock for

17

$12.3 million under this repurchase program. Up to $7.7 million worth of our common stock may be purchased by us under this repurchase program in the future.

The following table summarizes selected consolidated financial data for the fiscal years ended September 30, 2006 through 2010. You should read the following selected consolidated financial data in conjunction with the financial statements, including the related notes, and Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations. Historical results are not necessarily indicative of results to be expected for any future period. Certain historical information in the following table has been reclassified to conform to the current year presentation.

|

Fiscal years ended September 30,

|

||||||||||||||||||||

|

(in thousands, except per share data)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Revenues

|

$ | 130,224 | $ | 128,246 | $ | 122,571 | $ | 108,306 | $ | 90,916 | ||||||||||

|

Costs and expenses

|

136,593 | 134,400 | 137,259 | 130,724 | 113,956 | |||||||||||||||

|

Loss from continuing operations before other income and income taxes

|

(6,369 | ) | (6,154 | ) | (14,688 | ) | (22,418 | ) | (23,040 | ) | ||||||||||

|

Other income

|

451 | 723 | 2,731 | 4,094 | 3,470 | |||||||||||||||

|

Loss from continuing operations before income taxes

|

(5,918 | ) | (5,431 | ) | (11,957 | ) | (18,324 | ) | (19,570 | ) | ||||||||||

|

Income tax provision

|

30 | 40 | 87 | 76 | 45 | |||||||||||||||

|

Loss from continuing operations

|

(5,948 | ) | (5,471 | ) | (12,044 | ) | (18,400 | ) | (19,615 | ) | ||||||||||

|

(Loss) income from discontinued operations, net

|

(245 | ) | (6,035 | ) | (15,401 | ) | 15,366 | 10,164 | ||||||||||||

|

Net loss

|

$ | (6,193 | ) | $ | (11,506 | ) | $ | (27,445 | ) | $ | (3,034 | ) | $ | (9,451 | ) | |||||

|

Total assets

|

$ | 113,025 | $ | 120,547 | $ | 137,351 | $ | 166,424 | $ | 169,860 | ||||||||||

|

Long-term obligations, less current portion

|

$ | 1,853 | $ | 1,121 | $ | 136 | $ | 200 | $ | 1,359 | ||||||||||

|

(Loss) earnings per share—Basic and diluted:

|

||||||||||||||||||||

|

Continuing operations

|

$ | (0.33 | ) | $ | (0.28 | ) | $ | (0.61 | ) | $ | (0.94 | ) | $ | (1.00 | ) | |||||

|

Discontinued operations

|

$ | (0.01 | ) | $ | (0.31 | ) | $ | (0.79 | ) | $ | 0.78 | $ | 0.52 | |||||||

|

Loss per share—Basic and diluted

|

$ | (0.34 | ) | $ | (0.59 | ) | $ | (1.40 | ) | $ | (0.16 | ) | $ | (0.48 | ) | |||||

|

Weighted average common shares used in computing:

|

||||||||||||||||||||

|

Basic and diluted (loss) earnings per share

|

18,153 | 19,438 | 19,616 | 19,512 | 19,495 | |||||||||||||||

18

This Management’s Discussion and Analysis of Financial Condition and Results of Operations includes forward-looking statements. We have based these forward-looking statements on our current plans, expectations and beliefs about future events. Our actual performance could differ materially from the expectations and beliefs reflected in the forward-looking statements in this section and throughout this report, as a result of the risks, uncertainties and assumptions discussed under Item 1A—Risk Factors of this Annual Report on Form 10-K and other factors discussed in this section. For information regarding what constitutes a forward-looking statement please refer to Private Securities Litigation Reform Act Safe Harbor Statement on page 1.

OVERVIEW

Tier Technologies, Inc., or Tier, is a leading provider of biller direct electronic payment solutions. These solutions provide processing for Web, call center and point-of-sale environments. We partner and connect with a host of payment processors and other payment service providers to offer our clients a single source solution that simplifies electronic payment management. Our solutions include multiple payment options, including bill presentment, convenience payments, installment payments and flexible payment scheduling. Our solutions offer our clients a range of online payment options, including credit and debit cards, electronic checks, cash and money orders, and alternative payment types.

SUMMARY OF FISCAL YEAR 2010 OPERATING RESULTS

The following table provides a summary of our operating results by segment for the fiscal year ended September 30, 2010, for our Electronic Payment Solutions, or EPS, operations, our Wind-down operations and Discontinued operations:

|

Year ended September 30, 2010

|

||||||||

|

(in thousands, except per share)

|

Net (loss) income

|

(Loss) earnings per share

|

||||||

|

Continuing Operations:

|

||||||||

|

EPS

|

$ | (6,207 | ) | $ | (0.34 | ) | ||

|

Wind-down

|

259 | 0.01 | ||||||

|

Total Continuing Operations

|

$ | (5,948 | ) | $ | (0.33 | ) | ||

|

Total Discontinued Operations

|

$ | (245 | ) | $ | (0.01 | ) | ||

|

Net loss

|

$ | (6,193 | ) | $ | (0.34 | ) | ||

Our Continuing Operations consists of EPS and Wind-down operations. Our Wind-down operations consist of one business area we intend to wind down over the next two years. Our revenues from our EPS operations were $127.2 million for the fiscal year ended September 30, 2010. Transaction volume grew 25.9% and total dollars processed grew 13.0% when compared to the fiscal year ended September 30, 2009. Given the nature of our transaction based business, increases in our revenue also result in increases in our direct costs, although not always at the same rate. Our direct costs increased 3.9% in fiscal year 2010 over fiscal year 2009, primarily due to additional co-location and telephonic costs associated with our data center consolidation efforts.

EPS operations reported a net loss of $6.2 million for the fiscal year ended September 30, 2010. The reported net loss for the fiscal year ended September 30, 2009 was $5.6 million. The $0.6 million variance is primarily attributable to the increase in direct costs as discussed above and an increase in depreciation expense as we continue to enhance our IT infrastructure and data security efforts. We incurred some one-time legal and severance costs, which further contributed to the increase in net loss year over year.

19

Our Wind-down operations reported net income of $0.3 million for the fiscal year ended September 30, 2010. We continue to make efforts to streamline our costs associated with supporting our Wind-down operations.

Our Discontinued Operations consist of businesses we have divested through February 2010. Our Discontinued Operations reported a net loss of $0.2 million for the fiscal year ended September 30, 2010.

STRATEGY AND GOALS FOR 2011

During fiscal 2011 we expect to focus on the following key objectives:

|

·

|

Expand market share in the biller direct market;

|

|

·

|

Strengthen our technology environment;

|

|

·

|

Establish a market driven approach to our business;

|

|

·

|

Strengthen our management team; and

|

|

·

|

Improve profitability.

|