Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K RE EARNINGS RELEASE 11-11-2010 - AutoWeb, Inc. | form8k_111110.htm |

| EX-99.1 - PRESS RELEASE DATED 11-11-2010 - AutoWeb, Inc. | ex99_1.htm |

Exhibit 99.2

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 1

AUTOBYTEL INC

Moderator: Lawrence Brogan

November 11, 2010

4:00 p.m. CT

|

Operator:

|

Good day ladies and gentlemen. Welcome to Autobytel announces their third quarter financial results conference call. At this time, all participants are in a listen only mode. Later we will conduct a question-and-answer session and, instructions will be given at that time.

|

|

|

If anyone requires operator assistance during today's call please press star then zero on your touchtone phone. As a reminder, today's call is being recorded.

|

|

|

At this time, I would like to turn the conference over to the Senior Vice President of Strategic and Financial Planning, Mr. Larry Brogan. Sir, you may begin.

|

|

Lawrence Brogan:

|

Thank you, Joe. Hello everyone, and welcome to Autobytel's 2010 third quarter conference call. With me on the call today are Jeffrey Coats, President and Chief Executive Officer, and Curtis DeWalt, Senior Vice President and Chief Financial Officer.

|

|

|

Before we begin I'd like to remind you that during today’s call, including the Q&A session, any projections and forward-looking statements made regarding future events and the future financial performance of the company are covered by the Safe Harbor Statements contained in today’s press release and in the company’s public filings with the Securities and Exchange Commission. Actual events and results may differ materially from those forward-looking statements. Specifically, please refer to our Form 10-K for the year ended December 31, 2009, our Form 10-Q for the quarters ended June 30, 2010 and March 31, 2010 and our Form 10-Q for the quarter ended September 30, 2010, which we expect to file shortly.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 2

|

|

These filings identify the principal factors that could cause results to differ materially from those forward-looking statements. We are including slides with today's presentation to help illustrate some of the points being made and discussed during this call. You can access them by clicking on the link in today's press release or by going to our Web site at www.autobytel.com. When there, go to “Investor Relations” and then “News and Events.”

|

|

|

Also please note that during this call we will be discussing non-GAAP financial measures as defined by SEC Regulation G. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the slides posted on our Web site.

|

|

|

Now it is my pleasure to turn the call over to Jeff.

|

|

Jeffrey Coats:

|

Thank you, Larry. Good afternoon everyone. During the third quarter, we continued to build a strong foundation to meet our goals for sustained revenue growth, margin enhancement and profitability in 2011.

|

|

|

Our recent purchase of Cyber Ventures and Autotropolis was intended to solidify our position as the industry's premier provider of automotive related consumer purchase requests. After Curt reviews our third quarter financial performance, I'll return to discuss the acquisition in greater detail as well as some of our key initiatives. Curt?

|

|

Curtis DeWalt:

|

Thank you, Jeff. Before I begin I'd like to remind everyone the slides we're referring to on today's call can be found on our Web site under “Investor Relations” and then “News and Events.”

|

|

|

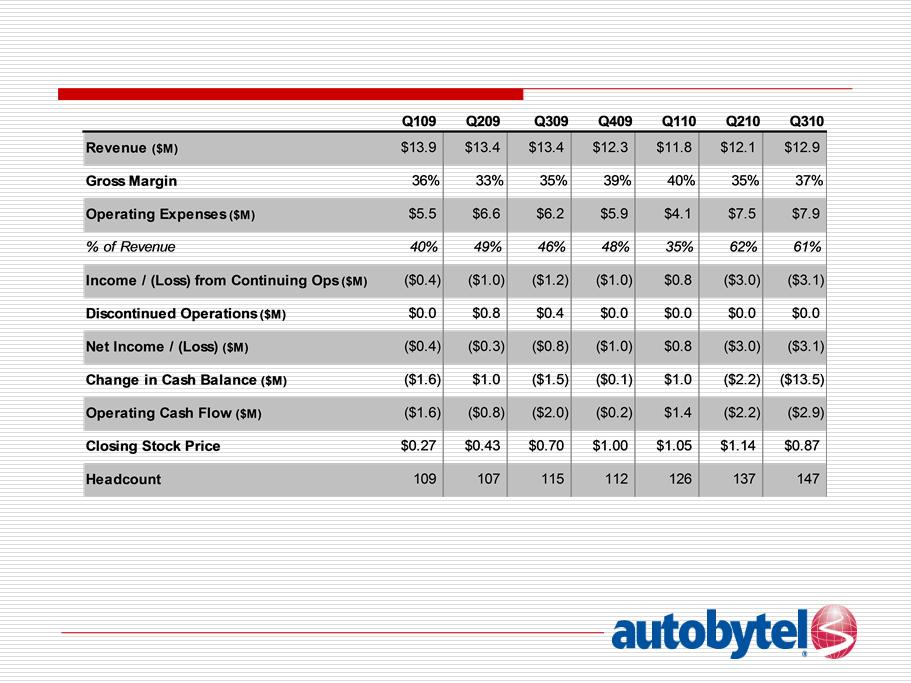

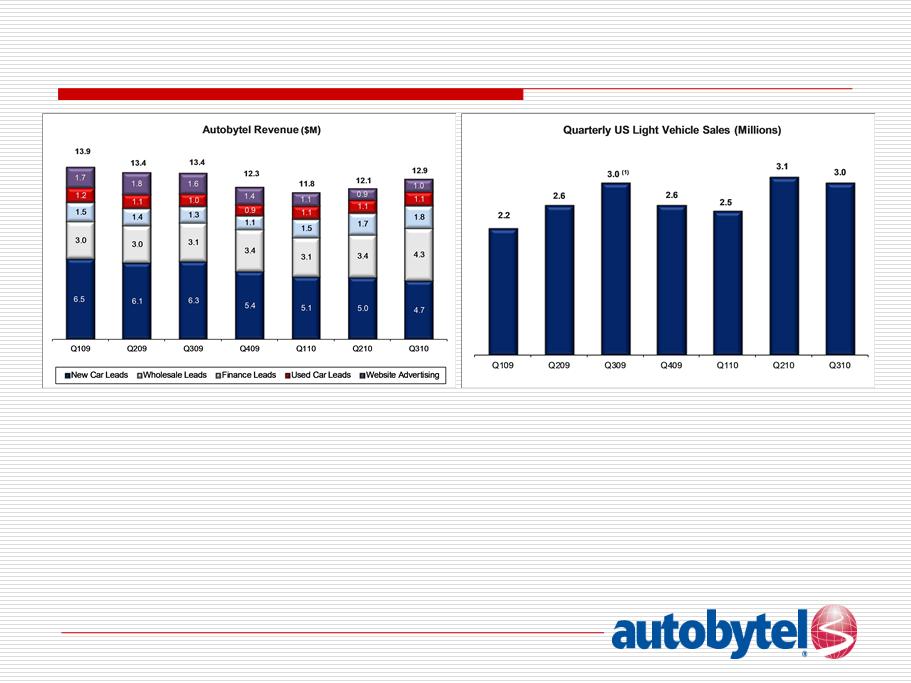

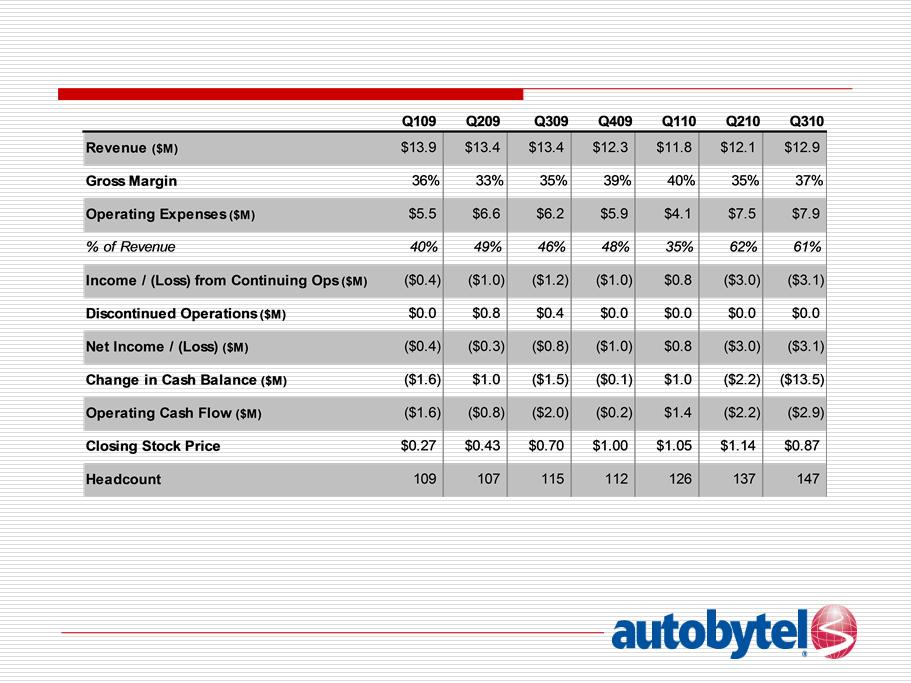

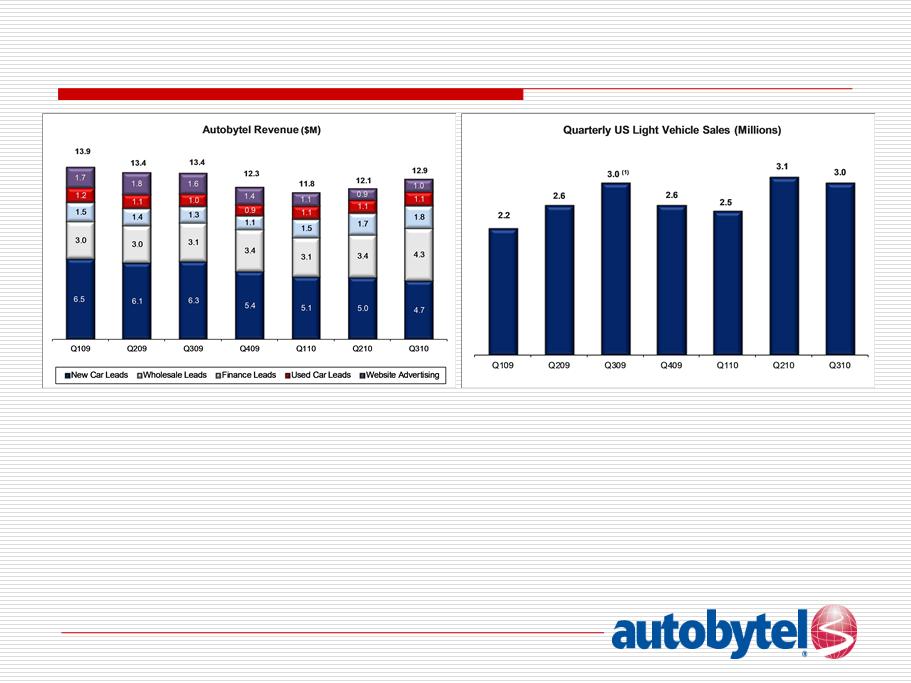

As shown on slide three, total revenues for Q3, although down approximately three percent year-over-year to 12.9 million were up seven percent on a sequential basis driven by improvements in our auto purchase request referral revenue as well as advertising revenue. This marks the second consecutive quarter of revenue gains.

|

|

|

Total auto purchase request revenue, which we refer to as lead revenue, increased two percent from the third quarter of last year and grew approximately six percent on a sequential basis, driven primarily by

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 3

|

|

substantially improved wholesale OEM purchase request revenue, which grew approximately 36 percent in Q3 over the same period last year and 24 percent on a sequential basis. The improvement was driven by a combination of new accounts added and existing accounts increasing their purchase request spending with Autobytel, a clear indication that our quality initiatives are working. The year-over-year and sequential improvements also benefited from two weeks of revenue from the addition of Cyber Ventures and Autotropolis.

|

|

|

Improvements in the wholesale early end channel were somewhat offset by a reduction in retail dealer purchase request revenue. While dealer count has increased in each of the last four quarters, our total purchase requests delivered per dealer is down on a year-over-year basis for two primary reasons. First, the 2009 period included the Cash for Clunkers program. Because of the popularity of this program in July and August of 2009 we had abnormally high purchase requests available in the marketplace which allowed higher delivery to dealers.

|

|

|

Secondly, in 2010, we have eliminated certain underperforming affiliates from our purchase request supply chain. The purchase requests are now being replaced with higher quality internally generated purchase requests. Sequentially dealer purchase request revenue declined by two percent from the second quarter of this year, the number of purchase requests delivered per dealer was down. We are confident that delivering the quality proposition and continued innovative program offerings will address revenue generating opportunities.

|

|

|

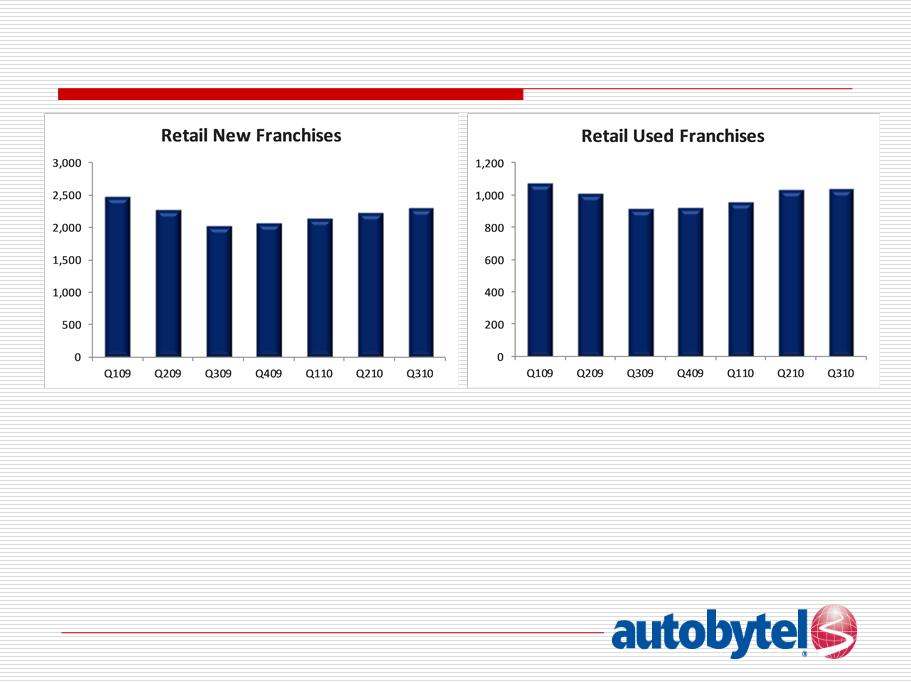

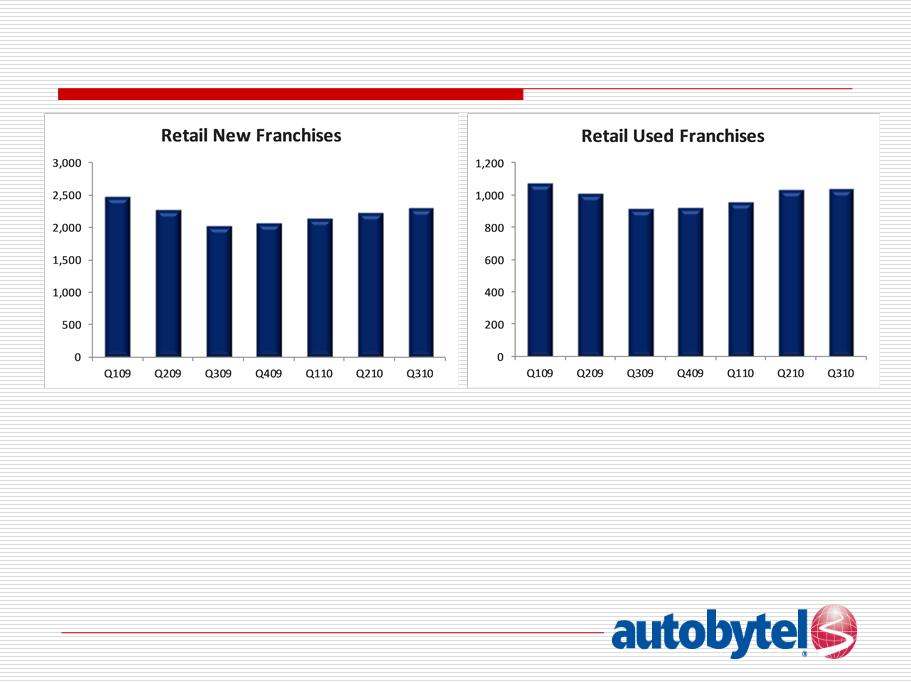

As seen on slide four, at the end of the third quarter our dealer network included nearly 2,300 new car franchises, up about 12 percent from the prior year period and three percent sequentially. Used car dealer franchises grew 13 percent to 1,042 at the end of the third quarter and were flat sequentially.

|

|

|

We delivered approximately 681,000 auto purchase requests in the third quarter of 2010, up one percent from last year's third quarter and up five percent sequentially. Year-over-year increases reflect increased delivery of purchase requests into our OEM channel.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 4

|

|

Finance request revenue was strong again this quarter, up 36 percent from last year's third quarter and up two percent on a sequential basis. While the subprime auto finance market has yet to return to its previously seen robust levels, credit has loosened somewhat and we believe further growth will follow. We had 253finance dealer franchises at the end of Q3 2010, up 36 percent from last year but down three percent sequentially.

|

|

|

We delivered approximately 117,000 finance requests in the third quarter of 2010, which was 34 percent higher than last year's third quarter and flat sequentially.

|

|

|

Advertising revenue declined by 36 percent in Q3 on a year-over-year basis but increased 19 percent sequentially. The year-over-year decrease related to an elevated level of Web site advertising and page use in the third quarter of 2009 resulting from the Government's Cash for Clunkers program. The sequential increase was driven by additional monetization of direct marketing campaigns.

|

|

|

Slide five provides a summary of our quarterly revenue by product line over the last several quarters. Gross margin increased to 36.8 percent for 2010 third quarter, up from 35.5 percent for the 2009 third quarter and up from 35 percent from the preceding second quarter. The increases are primarily related to a greater mix of internally generated auto purchase requests. There continues to be however an element of higher priced third party sourced purchase requests, which we consciously increased in the first half of 2010 to counter certain quality issues.

|

|

|

These purchases will continue for the foreseeable future but the margin drag will be more than offset by the margin enhancements arising from the acquisition. Our current analysis indicates that as a result of the acquisition of Cyber Ventures and Autotropolis, gross margin improvement of several hundred basis points could be achieved in the fourth quarter as well as throughout 2011, assuming revenue mix in other factors remain reasonably static.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 5

|

|

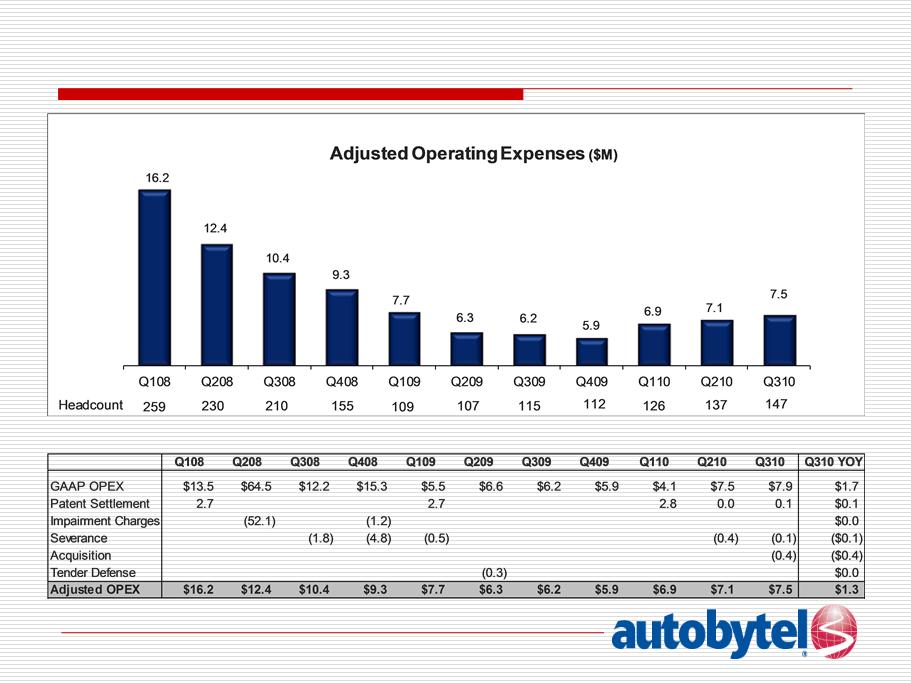

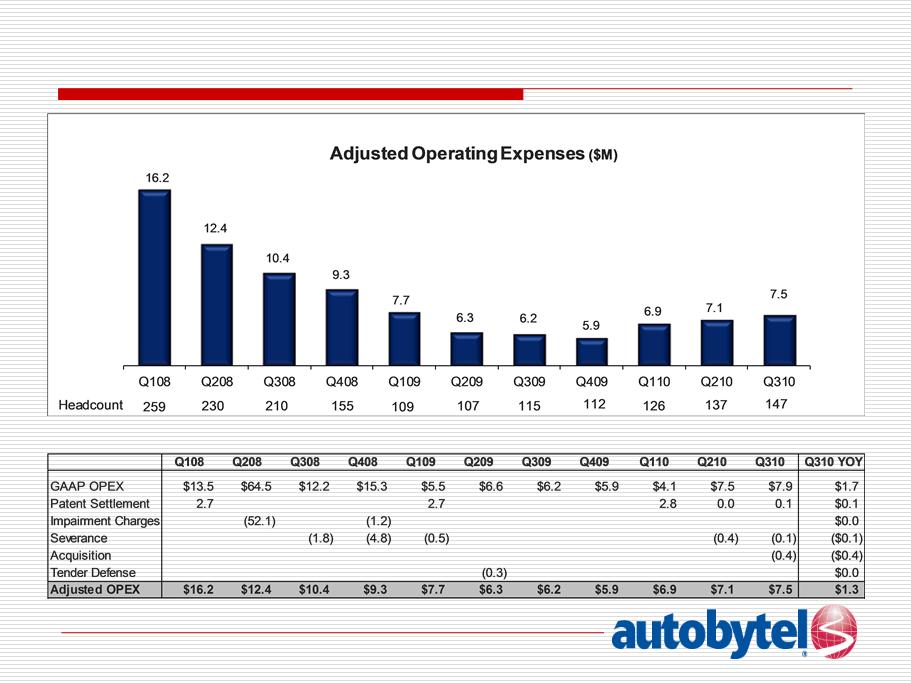

On slide six, you’ll see the changes to our cost structure and head count over the past two years. Operating expenses increased in the quarter as a result of the strategic investments made to enhance our long-term position in the marketplace, including activities related to the acquisition of Cyber Ventures and Autotropolis. Total operating expenses were $7.9 million for the 2010 third quarter up from $6.2 million for last year’s third quarter. In addition to acquisition expenses, the current quarter included increased personnel costs that were unrelated to the acquisition, as well as additional resources put behind branding and website initiatives as a result of our new association with the marketing firm Wunderman. We consider the majority of these branding and Web site initiative expenses to be one time or temporary in nature. Additionally, Jeff will be discussing approximately $6.3 million in annualized cost reductions that we had targeted.

|

|

|

Non-cash share based compensation for Q3 2010 was $231,000 compared with $267,000 in Q3 2009. Depreciation and amortization was $223,000 versus $358,000, respectively.

|

|

|

The net loss for the third quarter totaled $3.1 million or seven cents per share compared to a net loss of $799,000 or two cents per share last year. Last year’s third quarter net loss included a gain of $642,000 in discontinued operations related to the sale of our AVV business during January 2008.

|

|

|

Our cash and equivalent balance was $10.3 million at September 30th, down from $23.9 million at June 30th and $25.1 million at December 31, 2009. The decrease in cash relates mainly to the purchase of Cyber Ventures and Autotropolis, as well as a $1 million investment in Driver Side, which Jeff will discuss shortly. As a result of the acquisition, we are now carrying a $5 million note on our balance sheet. This convertible note will pay simple interest at a rate of six percent per annum.

|

|

|

With that, I’ll not turn the call back to Jeff.

|

|

Jeffrey Coats:

|

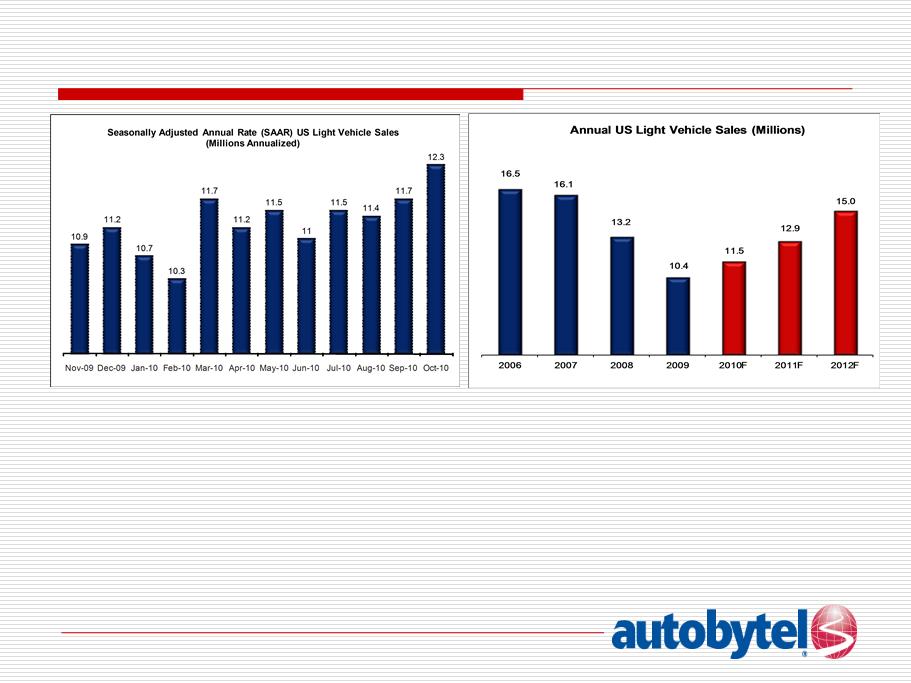

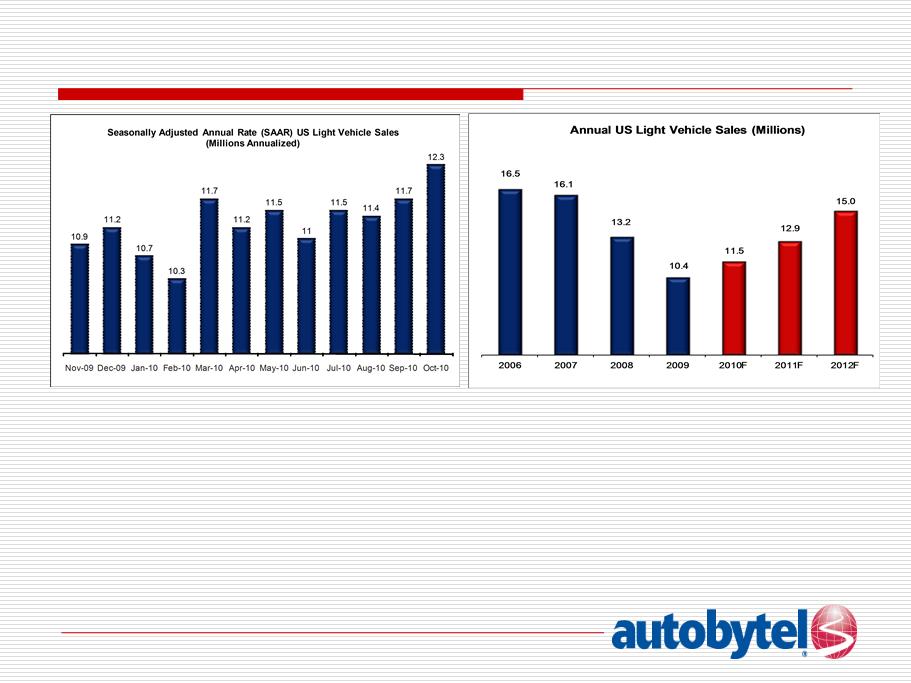

Thank you, Curt. As is widely known, the auto industry has been quite unsettling over the last few years; however, it is expected to more meaningfully recover by 2012 as you can see on slide seven.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 6

|

|

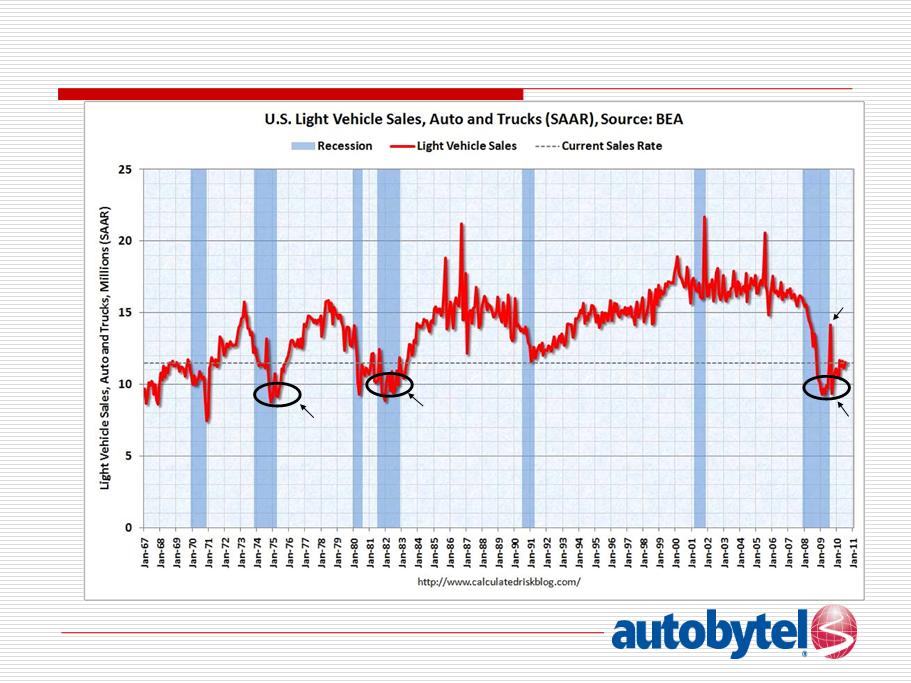

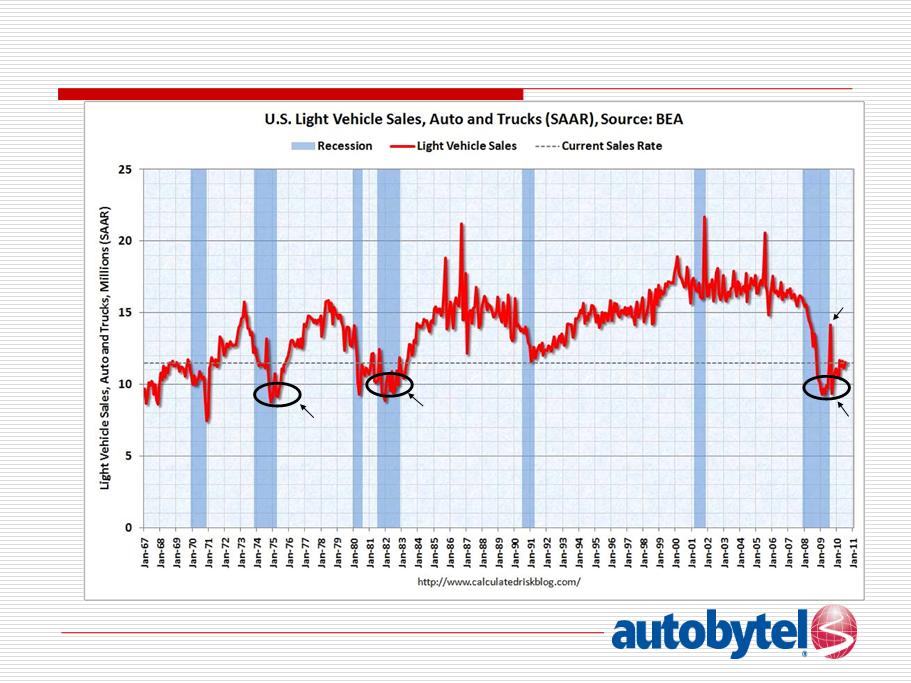

Although August was a very weak month for new car sales, September was solid, and October was surprisingly strong as well. Along with housing, the automotive sector probably got hit the hardest of any of the major industrial sectors. In fact, as you can see on slide eight before the summer of 2009 the last time annual U.S. vehicle sales dropped below the $10 million mark was 28 years ago during the severe recession of the early ‘80s followed by a nice recovery. In addition, the U.S. population is about 1/3 larger today than it was back in 1982. This chart would indicate that the past is prologue for the future, so the good news is that history indicates a relatively strong automotive rebound in the coming years.

|

|

|

This environment has taken a toll on just about everyone in the industry, including Autobytel. However, we have been using this time wisely to better position the company for an expected industry upturn and to create significant shareholder value.

|

|

|

Over the last several months, we’ve been identifying ways to further improve our effectiveness for auto dealers, auto manufacturers and consumers. The acquisition of Cyber Ventures and Autotropolis helps us in all of these areas and is truly a watershed event for Autobytel.

|

|

|

While some of our strategic activities, including the acquisition, have resulted in higher expenses this quarter and in Q4, I believe that these decisions have positioned us well. As noted in our press release today, as a result of reevaluation of our operations in connection with the integration of the acquisition, we have removed approximately $3.2 million of annualized head count related costs and identified an additional $1.8 million of annualized non-head count related costs. This equates to a reduction of 14 percent in our workforce. Fourth quarter severance expense related to these actions will be approximately $1 million. Additionally, we have identified approximately $1.3 million in annualized cost to revenue efficiencies in 2011.

|

|

|

Cyber Ventures and Autotropolis combined were the largest and last remaining independent high volume generators of high quality ready-to-buy consumer purchaserequests. As a result of the acquisition, Autobytel is now once again the country’s largest generator of new car purchase requests.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 7

|

|

In its early years, Autobytel generated essentially all of its leads internally through our website autobytel.com. With the advent of internet search, we began buying leads from a new class of lead generator. While this was the right decision for our business at the time, it is now clear that we need to continue our focus on building our web capabilities that allow us to self generate our purchase requests to drive quality, margin enhancement and profitability.

|

|

|

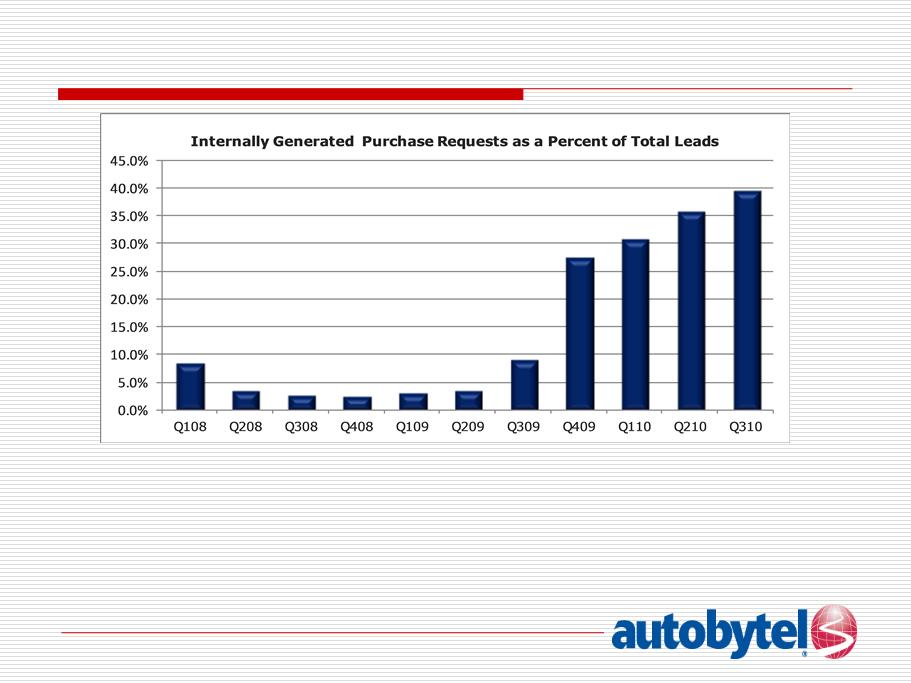

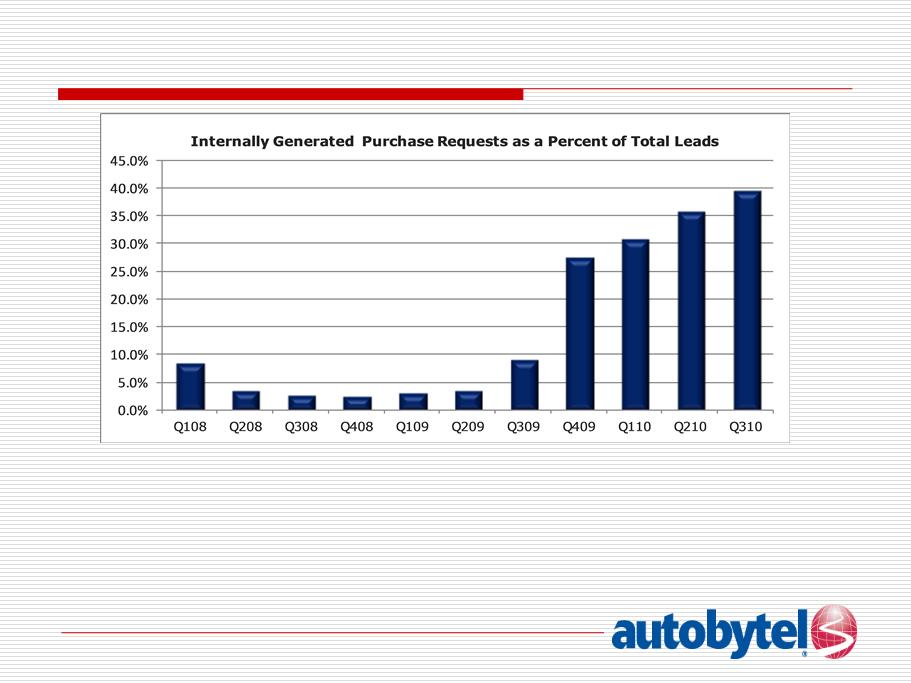

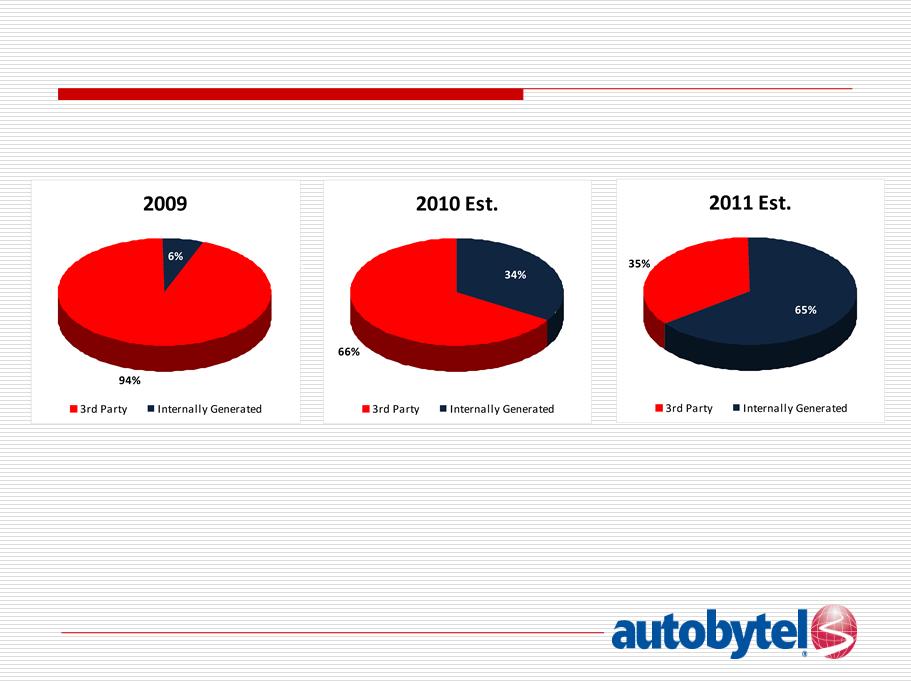

As you can see on slide 9, over the last five quarters we have made extensive progress in increasing the number of internally generated purchase requests through our network of consumer facing websites, which also substantially improved the quality of the purchase requests we are sending to our dealer and OEM customers. In the third quarter of this year, more than 39 percent of the total purchase requests we delivered were internally generated. This has been a key part of the improvement in our gross margins.

|

|

|

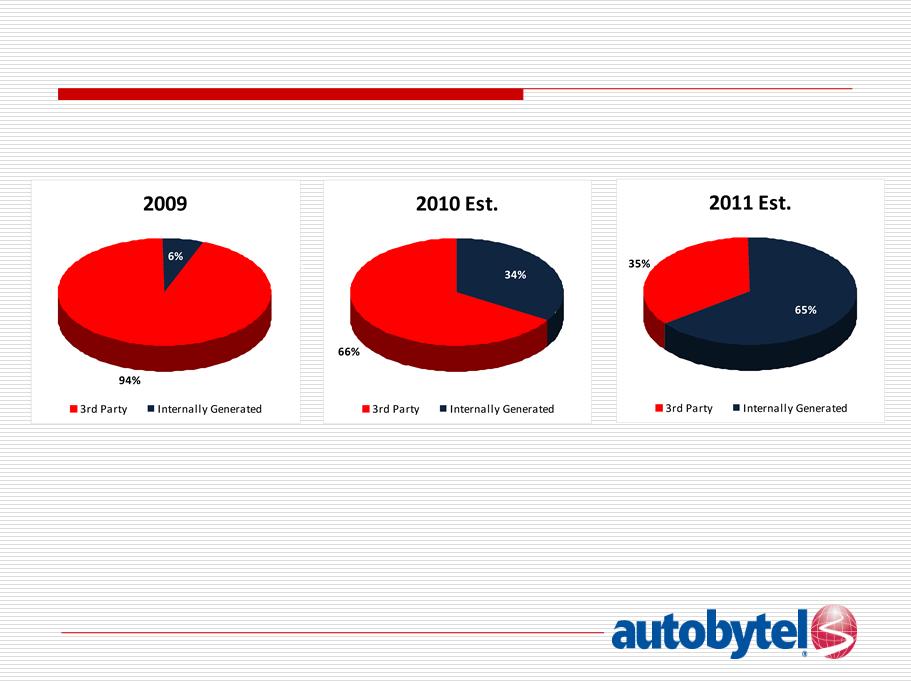

The addition of Cyber Ventures and Autotropolis is expected to increase internally generated purchase requests by more than 150 percent from about 80,000 to over 200,000 per month and total purchase requests by more than 40 percent, to over 320,000 per month. As you can see on slide 10, internally generated purchase requests are expected to grow to approximately 65 percent of our purchase requests in 2011, creating a fundamental shift within our industry, which is characterized by relationships where we are simultaneously competitors, suppliers and customers to, and of, one another.

|

|

|

As Curt mentioned, we believe we will see a gross margin improvement of several hundred basis points in Q4, and again throughout 2011 if our revenue mix and other factors remain reasonably steady.

|

|

|

So, why all of this focus on internally generated purchase requests? As I said before, internally generated purchase requests are generally of higher quality, and it is this higher quality that is the single most important factor to the dealers and manufacturers that participate in our programs and is vital to our ability to retain them and drive improved margins. The growth in our OEM business thus far is indicative of this progress.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 8

|

|

For some time, we have been discussing the importance of growing our dealer and manufacturer base by delivering the highest quality purchase requests available. A large and stable customer base provides the foundation from which to deliver innovative products and services and generate new revenue streams.

|

|

|

Our new and used dealer count has increased organically for four consecutive quarters. New car dealers have grown by more than 12 percent and used car dealers are up more than 13 percent over that same period.

|

|

|

With more than 200,000 internally generated purchase requests expected each month as a result of the acquisition and a host of products that help dealers sell more cars, we believe we have the right combination of compelling offerings to drive additional growth in our dealer base. Existing dealer products such as Web Leads+, iControl, E-Mail Manager and Quality Advantage will be joined by additional high value products that we can begin quickly monetizing.

|

|

|

As we have been integrating the Cyber Ventures and Autotropolis teams into our business, we have been extremely impressed with their creativity and knowledge of both the online and automotive markets. Of course, we knew this before the acquisition, but we are now beginning to benefit first hand from this.

|

|

|

One of the great things about Cyber Ventures and Autotropolis is that in addition to having built significant high quality purchase request generation capabilities, they will also enhance our internet footprint with more than 2 million additional pages expected each month. Given the work we have been doing to significantly enhance our web properties, we are excited to be immediately reaching a greater number of consumers. Now that we have successfully addressed past quality traffic issues, and with our click through rates at all time highs, we are now turning our attention to traffic volume.

|

|

|

As we’ve discussed, these enhancements are focused primarily on attracting a broader scale of consumers across all stages of the car shopping and ownership experience. In addition to the JD Power study we referenced last

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 9

|

|

quarter which shows that 80 percent of new vehicle buyers who use the internet visit third party sites like Autobytel, a new study by the same group found that 68 percent of used vehicle buyers use the internet in their shopping process, and that third party sites are more popular than dealer sites for this purpose.

|

|

|

We are also developing new robust content for car owners in order to engage consumers continually throughout the entire vehicle ownership life cycle, which will extend our relationship with them beyond their every once three to five year purchase cycle.

|

|

|

In addition to strengthening the Autobytel brand and generating repeat visits, attractive modernization opportunities exist at various key points throughout the car ownership life cycle. Although site advertising has not been a primary focus for us over the last 21 months, there are many ways we can benefit with a greater number of unique visitors and page views across our sites.

|

|

|

With current click through rates on our sites at all time highs, additional visitors should result in stronger ad performance and higher advertiser demand. Last quarter we announced the long-term alliance of Driverside.com, which provides the industry’s leading online vehicle ownership experience and the most comprehensive customer acquisition and retention program in the auto industry. We also invested $1 million in this exciting company to solidify our long-term relationship with them.

|

|

|

Driverside is powering our new My Garage ownership offering, which will allow users to receive personalized advice on service and maintenance, auto insurance, financing options, parts and accessories, warranty updates and vehicle equity. My Garage offers insight into OEM maintenance schedules, recalls, repair estimates, as well as ask an expert features, cost of vehicle owner information, service reminders and value alerts that tell consumers when their car is worth a pre-selected price target.

|

|

|

By customizing this type of critical information, we are creating a unique consumer proposition and multiple new revenue strings for Autobytel, including a new service request revenue opportunity.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 10

|

|

We plan to have My Garage integrated into our flagship Autobytel site by the time we launch our fully redesigned and updated site, which we have decided to launch in Q2 2011, to take full advantage of the assets and resources that we have gained as a result of the Cyber Ventures and Autotropolis acquisition as well as through our relationship with Wunderman.

|

|

|

Another exciting venture in the works revolves around the gold mine of in market intender data we have amassed over the years. A new partnership with Aperture, a Datran Media company, will help us turn this data into an actionable suite of tools that will allow brands to translate actual consumer shopping and media behavior insights into real-time campaign optimization. These insights, based on real consumer behavior, not self reported intent, has never before been available to auto manufacturers, large dealer groups, advertising agencies and publishers. The initial reception from the OEM community has been very positive. By leveraging the data we already have, we are not only providing increasing value to our manufacturer customers, but adding a new high margin opportunity for Autobytel.

|

|

|

I came on board as CEO in the midst of a very difficult automotive environment, and while Autobytel was certainly not immune to the problems faced by everyone in the industry, we have accomplished many things of which to be proud. We initially reduced expenses, refocused our business on eternally generated automotive purchase requests, and began improving the consumer experience on our network of web sites. In addition, we committed to rebuilding revenue and margins to drive toward profitability, the cost efficiency actions announced today amounting to more than $6 million of annualized cost of revenue and operating expense reductions are a meaningful milestone in our turn around plan.

|

|

|

We are taking the strategic action that will allow us to strengthen our customer and consumer relationships and return the Autobytel brand to a position of prominence throughout the automotive industry. These initiatives are already underway and will continue through the rest of this year and will make us stronger in 2011.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 11

|

|

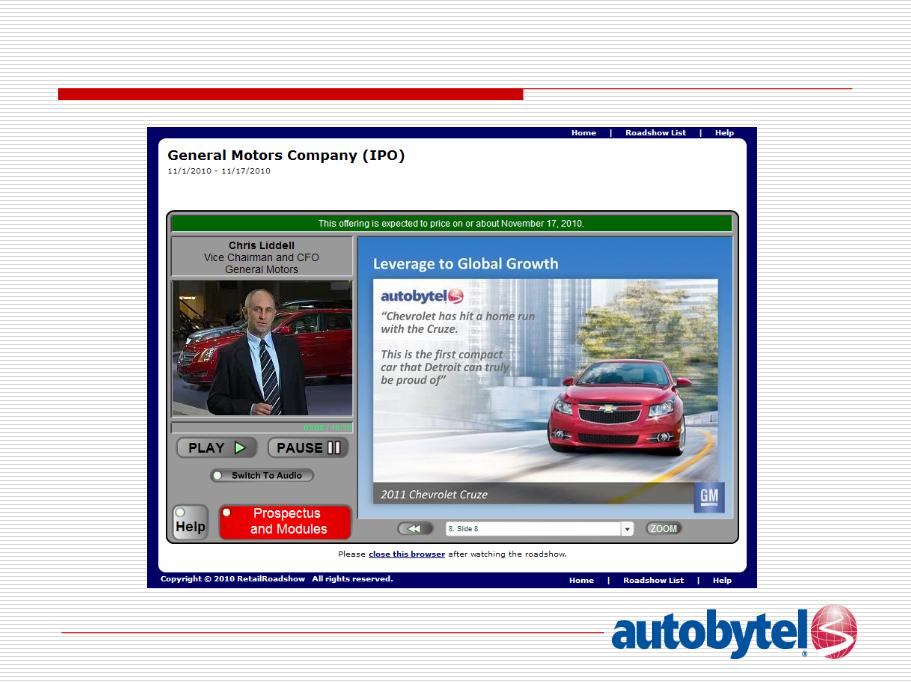

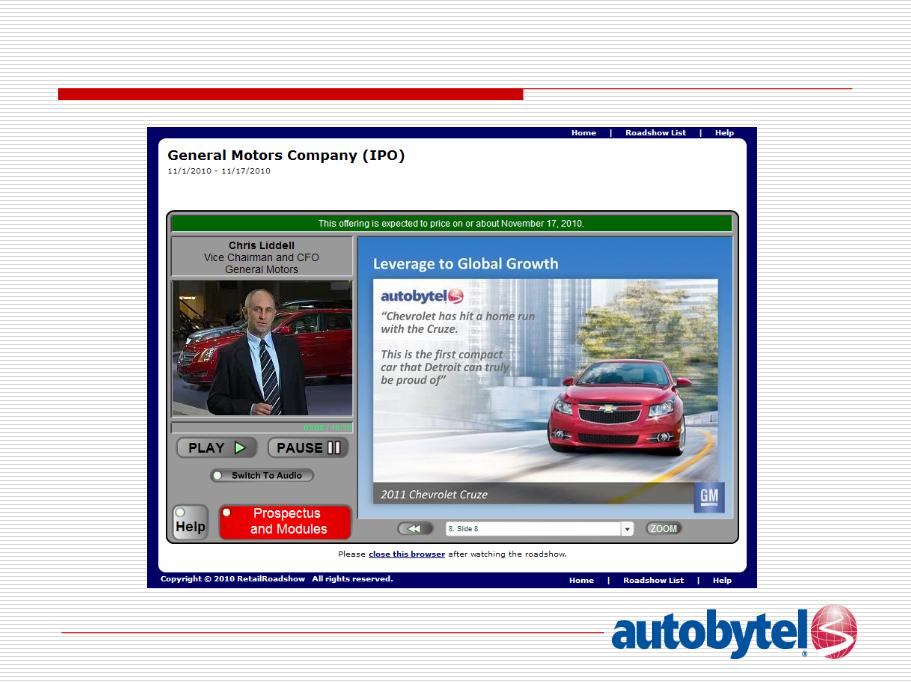

As evidence of progress and regaining our editorial voice with the consumer, General Motors recently included an excerpt from our website in the IPO Roadshow presentation, one of only three automotive websites quoted.

|

|

|

We've included a screen shot of this presentation page as slide 11. As a side, you can find the entire presentation on retailroadshow.com. It is quite an interesting overview of GM and its products which I encourage you all to view.

|

|

|

In closing, as I have mentioned we continue to see increasing activity in what we believe is a market ripe for consolidation. Our recent acquisition and the recent transactions announced with Kelley Blue Book, vAuto and Internet Brands just reinforced this. As we move forward, we continue to pursue strategic opportunities that we believe will provide significant benefits for our shareholders. I look forward to keeping you updated on our progress.

|

|

|

Joe, we're ready now to take questions.

|

|

Operator:

|

Thank you, sir. Ladies and gentlemen on the phones, if you have a question at this time, please press star then 1 on your touchtone phone. If your question has been answered or you wish to leave the queue for any reason, please press the pound key.

|

|

|

Once again ladies and gentlemen if you have a question at this time, please press star then 1 now. Our first question is from Steve Dyer with Craig Hallum.

|

|

Steve Dyer:

|

Thank you. Good afternoon guys.

|

|

Jeffrey Coats:

|

Hi Steve.

|

|

Steve Dyer:

|

You know, back when you did the acquisition you had indicated that kind of run rate for Autotropolis and Cyber Ventures was $10 million extra not the run rate 2009 revenue, but some of that, obviously, was to you guys. How should we think of the amount of revenue that’s additive to you going forward?

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 12

|

Jeffrey Coats:

|

It’s not going to be the full $10 million. It'll be something less than that. We were not a major customer of Cyber Ventures and Autotropolis of the three majors in our spacew We were actually the smallest of the three customers of them, so we will not see a major revenue degradation as a result of that; however, as we position ourselves number 1 in their purchase request waterfall, we will transfer price that revenue into our own dealer OEM bucket, so there will be some fall-off, but we don’t expect it to be meaningful. And then it, of course, will improve significantly our gross margin as a result.

|

|

Steve Dyer:

|

Yes. OK. Then Aperture – how meaningful do you expect that revenue to be either Q4 as you look out into next year?

|

|

Jeffrey Coats:

|

We currently don’t expect any Q4 revenue from that, but we would expect it to be seven figure revenue for us in 2011.

|

|

Steve Dyer:

|

OK, and then with respect to the cost cuts, how would you expect that to be reflected in the various lines of the income statement? Is there one particular area – I mean, excluding the severance charge, obviously. Is there one particular area that will see the bulk of that benefit?

|

|

Jeffrey Coats:

|

It will primarily show up in operating expenses.

|

|

Steve Dyer:

|

Any one line or spread out?

|

|

Jeffrey Coats:

|

Actually, it will be spread out across several lines.

|

|

Steve Dyer:

|

OK.

|

|

Jeffrey Coats:

|

The reductions were in various areas of the business as we look at changing our approach to doing certain things. …

|

|

Steve Dyer:

|

OK.

|

|

Steve Dyer:

|

OK, and then with respect to consolidation, obviously it's taken some time, but AutoTrader recently bought Kelley. What's sort of your color commentary on where the industry is with that and your role in that, if you wouldn’t mind?

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 13

|

Jeffrey Coats:

|

Well, I guess I can only give you a supposition. I think once coming out of the downturn, the M&A market starts opening up. Generally,.things start happening pretty quickly. It would be my expectation that we will see more consolidation in this marketplace, and we expect to be in the middle of it leading as much of it as we possibly can.

|

|

Steve Dyer:

|

OK. That’s it for me. Thanks guys.

|

|

Jeffrey Coats:

|

Thank you, Steve.

|

|

Operator:

|

Once again, ladies and gentlemen, if you have a question at this time please press star then 1 now. Our next question comes from Brian Horey with Aurelian Management.

|

|

Brian Horey:

|

Thanks for taking my question. I guess one of the questions was whether you expect to see any revenue impact from the head count cuts that you're making.

|

|

Jeffrey Coats:

|

Any negative revenue impact…

|

|

Brian Horey:

|

Yes.

|

|

Jeffrey Coats:

|

We do not expect to see any negative revenue impact from that.

|

|

Brian Horey:

|

OK, and then can you give us a sense as to what you think the kind of pro forma burn rate or P&L looks like after you get through the severance expenses and so forth?

|

|

Jeffrey Coats:

|

We believe, based on the actions we've taken, that we would expect to be profitable in 2011.

|

|

Brian Horey:

|

OK. Do you have kind of a minimum projection of when you're going to hit minimum cash level and when that might be, and what level that ought to be at?

|

|

Jeffrey Coats:

|

Well, there will obviously be some severance in the fourth quarter. There will be some incremental loss in the fourth quarter. We are not really quantifying that currently.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 14

|

Brian Horey:

|

OK. And then the last question I had was I realize that there are a lot of things moving around in real time, but there has been some consolidation in any industry as we've all talked about. Have you seen any manifestation of that in terms of pricing behavior or general competitive dynamic in the business at this point?

|

|

Jeffrey Coats:

|

I'm not sure I follow your question completely.

|

|

Brian Horey:

|

Well, I guess, has the competitive intensity of the business lessened any? Has the pricing dynamic gotten any better in the wake of some of these acquisitions that have happened?

|

|

Jeffrey Coats:

|

Do you mean from a day-to-day operation standpoint?

|

|

Brian Horey:

|

Yes.

|

|

Jeffrey Coats:

|

On the price or a company standpoint?

|

|

Brian Horey:

|

No, from a day-to-day operations.

|

|

Jeffrey Coats:

|

I think we see some upside from a pricing standpoint in our product lines as a result of what's going on.

|

|

Brian Horey:

|

OK. All right. Thanks very much.

|

|

Jeffrey Coats:

|

Thank you.

|

|

Operator:

|

Our next question comes from Kyle Krueger with Apollo Capital.

|

|

Kyle Krueger:

|

My questions were answered. Thanks, Jeff.

|

|

Jeffrey Coats:

|

Thank you.

|

|

Operator:

|

Showing no further questions, I would now like to turn the conference back to Jeff.

|

AUTOBYTEL INC

Moderator: Lawrence Brogan

11-11-10/4:00 p.m. CT

Confirmation # 21212737

Page 15

|

Jeffrey Coats:

|

We would like to thank you all for participating today. We're happy to answer any questions on a going forward basis,and we look forward very much to talking to you again in 2011.

|

|

|

Thank you, Joe.

|

|

Operator:

|

Ladies and gentlemen, thank you for your participation in today's conference call. This concludes the program, and you may now disconnect. Everyone have a great day.

|

|

|

END

|

November 11, 2010

Third Quarter 2010 Results

* Copyright (c) 2010 Autobytel Inc.

Safe Harbor Statement and Non-GAAP Disclosures

The statements contained in this presentation that are not historical facts are forward-looking statements under

the federal securities laws. These forward-looking statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may

differ materially from what is expressed in, or implied by, such forward-looking statements. Autobytel undertakes

no obligation to update publicly any forward-looking statements, whether as a result of new information, future

events or otherwise. Among the important factors that could cause actual results to differ materially from those

expressed in, or implied by, the forward-looking statements are continuing adverse general economic conditions,

the economic impact of terrorist attacks or military actions, increased dealer attrition, pressure on dealer fees,

increased or unexpected competition, the failure to successfully launch new products and services, failure to

retain key employees or attract and integrate new employees, actual costs and expenses exceeding the charges

taken by Autobytel, changes in laws and regulations, costs of defending lawsuits and undertaking investigations

and related matters and other matters disclosed in Autobytel's filings with the Securities and Exchange

Commission. Investors are strongly encouraged to review our annual report on Form 10-K for the year ended

December 31, 2009, and other filings with the Securities and Exchange Commission for a discussion of risks and

uncertainties that could affect operating results and the market price of the company’s stock. In addition, the

current year financial information could be subject to a change as a result of subsequent events or the finalization

of our financial statement close which culminates with the filing of our Form 10-K.

the federal securities laws. These forward-looking statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may

differ materially from what is expressed in, or implied by, such forward-looking statements. Autobytel undertakes

no obligation to update publicly any forward-looking statements, whether as a result of new information, future

events or otherwise. Among the important factors that could cause actual results to differ materially from those

expressed in, or implied by, the forward-looking statements are continuing adverse general economic conditions,

the economic impact of terrorist attacks or military actions, increased dealer attrition, pressure on dealer fees,

increased or unexpected competition, the failure to successfully launch new products and services, failure to

retain key employees or attract and integrate new employees, actual costs and expenses exceeding the charges

taken by Autobytel, changes in laws and regulations, costs of defending lawsuits and undertaking investigations

and related matters and other matters disclosed in Autobytel's filings with the Securities and Exchange

Commission. Investors are strongly encouraged to review our annual report on Form 10-K for the year ended

December 31, 2009, and other filings with the Securities and Exchange Commission for a discussion of risks and

uncertainties that could affect operating results and the market price of the company’s stock. In addition, the

current year financial information could be subject to a change as a result of subsequent events or the finalization

of our financial statement close which culminates with the filing of our Form 10-K.

This presentation includes a discussion of “Adjusted OPEX”, which is a non-GAAP financial measure. The Company defines OPEX as GAAP operating expenses adjusted

for unusual, infrequent or non-recurring items. The Company believes this non-GAAP financial measure provides important supplemental information to management

and investors. This non-GAAP financial measure reflects an additional way of viewing aspects of the Company's operations that, when viewed with the GAAP results and

the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting the Company's

business and results of operations. This non-GAAP financial measure is used in addition to and in conjunction with results presented in accordance with GAAP and should

not be relied upon to the exclusion of GAAP financial measures. Management strongly encourages investors to review the Company's consolidated financial statements in

their entirety and to not rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these

financial measures with other companies' non-GAAP financial measures having the same or similar names. In addition, the Company expects to continue to incur

expenses similar to the non-GAAP adjustments described above, and exclusion of these items from the Company's non-GAAP measures should not be construed as an

inference that these costs are unusual, infrequent or non-recurring.

for unusual, infrequent or non-recurring items. The Company believes this non-GAAP financial measure provides important supplemental information to management

and investors. This non-GAAP financial measure reflects an additional way of viewing aspects of the Company's operations that, when viewed with the GAAP results and

the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting the Company's

business and results of operations. This non-GAAP financial measure is used in addition to and in conjunction with results presented in accordance with GAAP and should

not be relied upon to the exclusion of GAAP financial measures. Management strongly encourages investors to review the Company's consolidated financial statements in

their entirety and to not rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these

financial measures with other companies' non-GAAP financial measures having the same or similar names. In addition, the Company expects to continue to incur

expenses similar to the non-GAAP adjustments described above, and exclusion of these items from the Company's non-GAAP measures should not be construed as an

inference that these costs are unusual, infrequent or non-recurring.

* Copyright (c) 2010 Autobytel Inc.

Financial Overview

Comments

§ Sequential revenue increases for two consecutive quarters

§ Headcount reduced to 127 as of November 11, 2010

* Copyright (c) 2010 Autobytel Inc.

Dealer Franchises

Comments

§ Retail New Franchises are up 3% sequentially and up a total of 14%

over the previous four quarters

over the previous four quarters

§ Retail Used Franchises are flat sequentially and up 13% over the

previous four quarters

previous four quarters

* Copyright (c) 2010 Autobytel Inc.

Revenue Results

Source: Automotive News

(1) Cash for Clunkers Program occurred in Q3 2009

Comments

§ Wholesale/OEM Purchase Request Revenue up 36% over the prior year and

24% sequentially as a result of both organic growth and the acquisition

24% sequentially as a result of both organic growth and the acquisition

§ Finance Purchase Request Revenue up 37% over the prior year and 2%

sequentially

sequentially

§ New Car Revenue down slightly as a result of reducing low quality Purchase

Request suppliers ahead of the acquisition

Request suppliers ahead of the acquisition

* Copyright (c) 2010 Autobytel Inc.

Operating Expenses

GAAP Reconciliation

* Copyright (c) 2010 Autobytel Inc.

Auto Industry Sales

Comments

§ The 2010 Automotive market continues to be choppy in recovery

§ Q3 2010 was a mixed quarter, with vehicle sales flat to Q3 2009 JD Power

estimates, as strong growth in fleet sales offset retail softness

estimates, as strong growth in fleet sales offset retail softness

§ 2010 US light vehicle sales holding in the mid 11M range

§ Monthly rate of just under 1M Light Vehicles sold in October 2010 equates to a

12.3M Seasonally Adjusted Annual Rate

12.3M Seasonally Adjusted Annual Rate

Source: Automotive News, JD Power & Associates

The Current Macro Environment

Volker Recession

US Pop. = 232M

Energy Crisis

US Pop. = 216M

US Pop. = 308M

Cash for

Clunkers

Clunkers

* Copyright (c) 2010 Autobytel Inc.

* Copyright (c) 2010 Autobytel Inc.

Website Purchase Requests Increasing

Comments

§ Internally generated Purchase Request volume continued with

upward momentum, exceeding 39% of total Purchase Requests

upward momentum, exceeding 39% of total Purchase Requests

§ On a pro-forma basis, internally generated Purchase Requests would

have exceeded 55%, if Cyber Ventures and Autotropolis had been

consolidated during all of Q310

have exceeded 55%, if Cyber Ventures and Autotropolis had been

consolidated during all of Q310

Internally Generated Purchase Requests

2.7 Million Total

Purchase Requests

Purchase Requests

3.8 Million Total

Purchase Requests

Purchase Requests

2.8 Million Total

Purchase Requests

Purchase Requests

§ Major competitors in Consumer Purchase Request distribution acquire

substantially all of their Purchase Requests from third parties

substantially all of their Purchase Requests from third parties

§ Combination of Purchase Request Generation and distribution creates

significant competitive advantage

significant competitive advantage

Comments

* Copyright (c) 2010 Autobytel Inc.

* Copyright (c) 2010 Autobytel Inc.

Regaining Industry Voice