Attached files

| file | filename |

|---|---|

| 8-K - OVERSEAS SHIPHOLDING GROUP INC | osg3q20108k.htm |

| EX-99 - OVERSEAS SHIPHOLDING GROUP INC | osg3q20108kex991.htm |

Third Quarter Fiscal 2010

Conference Call

Conference Call

November 2, 2010

page 2

This presentation contains forward-looking statements regarding the Company's prospects, including the outlook

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels and timing of

newbuilding and scrapping, prospects for certain strategic alliances and investments, forecasted newbuilding

delivery schedule for 2010 through 2013, projected scheduled drydock and off hire days for the fourth quarter of

2010, projected locked-in charter revenue and locked-in time charter days for 2010 through 2014 and thereafter,

forecasted 2010 vessel expenses, charter hire expenses, depreciation and amortization, general and

administrative expenses, interest expense, and levels of equity income and capital expenditures, projected 2011

vessel operating expenses and general and administrative expenses, ability to meet refinancing obligations in

2011 and 2012, the sustainability of OSG’s annual dividend, prospects of OSG’s strategy of being a market

leader in the segments in which it competes and the forecast of world economic activity and oil demand. These

statements are based on certain assumptions made by OSG management based on its experience and

perception of historical trends, current conditions, expected future developments and other factors it believes are

appropriate in the circumstances. Forward-looking statements are subject to a number of risks, uncertainties and

assumptions, many of which are beyond the control of OSG, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements. Factors, risks and uncertainties that could

cause actual results to differ from the expectations reflected in these forward-looking statements are described in

the Company’s Annual Report for 2009 on Form 10-K and those risks discussed in the other reports OSG files

with the Securities and Exchange Commission.

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels and timing of

newbuilding and scrapping, prospects for certain strategic alliances and investments, forecasted newbuilding

delivery schedule for 2010 through 2013, projected scheduled drydock and off hire days for the fourth quarter of

2010, projected locked-in charter revenue and locked-in time charter days for 2010 through 2014 and thereafter,

forecasted 2010 vessel expenses, charter hire expenses, depreciation and amortization, general and

administrative expenses, interest expense, and levels of equity income and capital expenditures, projected 2011

vessel operating expenses and general and administrative expenses, ability to meet refinancing obligations in

2011 and 2012, the sustainability of OSG’s annual dividend, prospects of OSG’s strategy of being a market

leader in the segments in which it competes and the forecast of world economic activity and oil demand. These

statements are based on certain assumptions made by OSG management based on its experience and

perception of historical trends, current conditions, expected future developments and other factors it believes are

appropriate in the circumstances. Forward-looking statements are subject to a number of risks, uncertainties and

assumptions, many of which are beyond the control of OSG, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements. Factors, risks and uncertainties that could

cause actual results to differ from the expectations reflected in these forward-looking statements are described in

the Company’s Annual Report for 2009 on Form 10-K and those risks discussed in the other reports OSG files

with the Securities and Exchange Commission.

Forward-Looking Statements

page 3

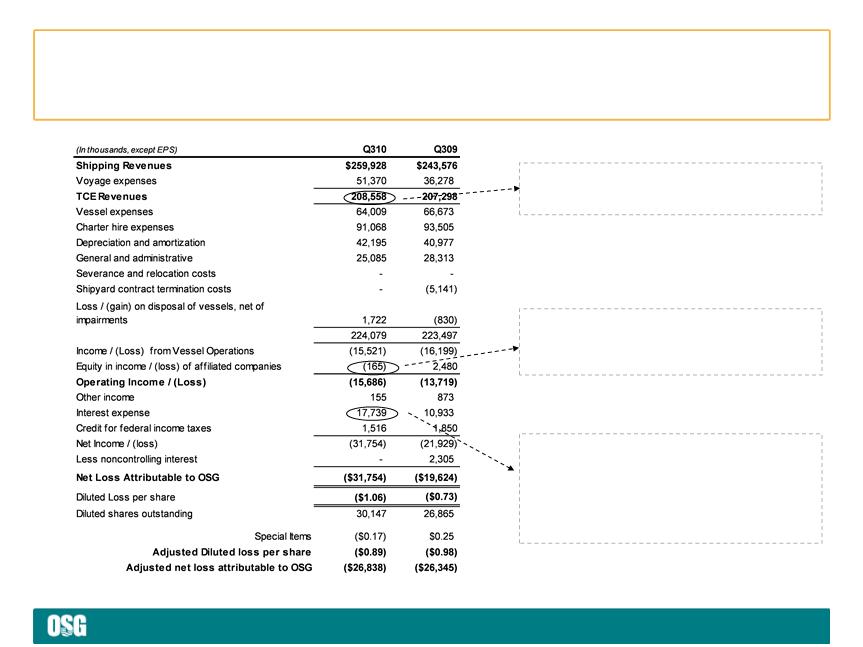

< Third quarter fiscal 2010 results

• TCE revenues were $209M up from $207M

• Reported net loss of $31.8M or $1.06 per diluted share

• Adjusted net loss was $26.8M; adjusted loss per share $0.89

< Converging events in third quarter led to tough market conditions

• Vessel supply increased due to release of floating storage and deliveries

• Ton-mile demand declined relative to 2Q 2010 due to China sourcing more

crude from the Middle East vs. West Africa

crude from the Middle East vs. West Africa

< TCE revenues impacted by mix of spot vs. synthetic and time charters

and expiring fixed rate business compared to 2009

and expiring fixed rate business compared to 2009

• While VLCC spot rates were up 40%, the mix drove a decline in TCE

quarter-over-quarter

quarter-over-quarter

• In the Products MR class, fixed days decreased and spot days increased

quarter-over-quarter

quarter-over-quarter

Financial Highlights

page 4

Quarterly Highlights

< Continued execution on our newbuild and fleet expansion

program

program

• Crude

- FSO Africa commenced 3-year service contract in August

- FSO joint venture expected to be profitable 4Q 2010 and beyond

- Restructuring of joint venture debt expected to return ~$60M in cash to

OSG Q4 2010

OSG Q4 2010

• Products

- Addition brings International Flag MR fleet to 31 vessels

• U.S. Flag

- Overseas Anacortes delivered; chartered-out to Tesoro for 3 years

- Two older vessels sold; one additional single hull vessel sale pending

- U.S. Flag fleet totals 23

< We continue to actively manage our orderbook

- Transaction increased construction commitments by < $5M

page 5

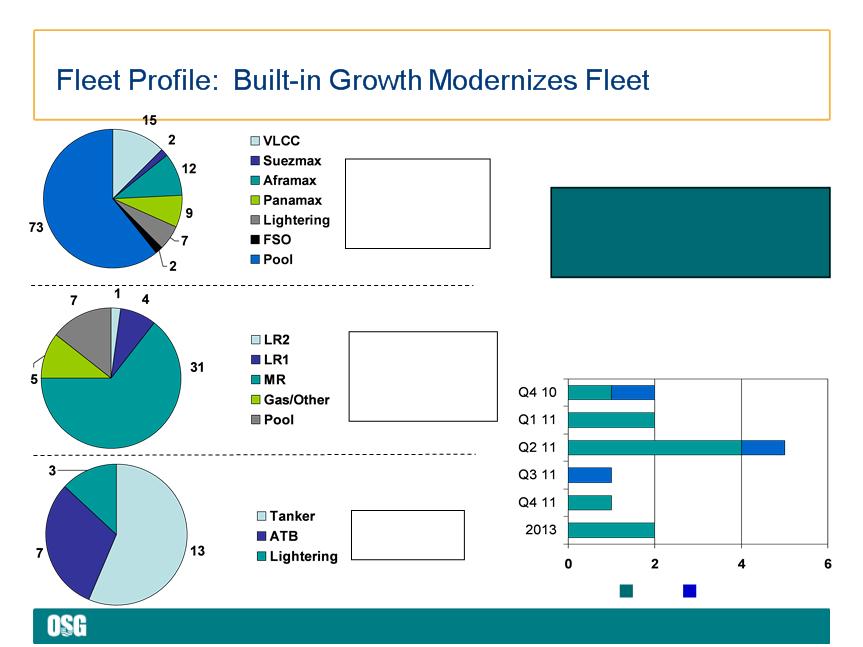

Vessel Delivery Schedule

Crude

47 OSG

73 Pool Ships

120

47 OSG

73 Pool Ships

120

Chartered-in

Owned

Total operating fleet 111

Total newbuild fleet 13

Total pool vessels 80

Total Fleet 204

Total newbuild fleet 13

Total pool vessels 80

Total Fleet 204

Products & Gas

41 OSG*

7 Pool Ships

48

41 OSG*

7 Pool Ships

48

U.S. Flag

23 OSG

23 OSG

* Includes car carrier and 4 LNG carriers

As of October 30, 2010

Operating Fleet

Operating Fleet

Operating Fleet

page 6

Commercial pools, COAs and triangulation trades

optimize OSG’s fleet, particularly in down markets

optimize OSG’s fleet, particularly in down markets

|

|

OSG Spot

Rates |

Clarksons

Average Spot *

|

Outperformance

|

|

VLCC

(Tankers International)

|

$32,017

|

$17,276

|

$14,741

|

|

Suezmax

(Suezmax International)

|

$19,185

|

$14,308

|

$4,877

|

|

Aframax

(Aframax International) |

$15,518

|

$13,932

|

$1,586

|

|

Panamax

(Panamax International)

|

$16,557

|

$11,216

|

$5,341

|

|

MR

|

$13,057

|

$9,709

|

$3,348

|

*Clarksons rates for the period have been weighted according to the routes on which OSG’s vessels operate. See page 17 for more information.

Outperforming in Tough Market Conditions: 3Q 2010

page 7

(1) 2009 G&A excludes severance and relocation costs

G&A Expenses (1)

(~37%)

($ in millions)

Disciplined Expense Management

< Disciplined expense management continues

across shoreside operations

across shoreside operations

• Consolidation of Products and Gas business

units in the third quarter better leverages existing

staff

units in the third quarter better leverages existing

staff

• Renegotiated rents in Tampa, Singapore and

Athens; moved Philadelphia office to smaller

facility in Delaware

Athens; moved Philadelphia office to smaller

facility in Delaware

• New policies related to travel and

communications

communications

• New hires and replacement positions require

senior management approval

senior management approval

• Process improvement efforts and IT

infrastructure changes

infrastructure changes

< Tight vessel opex management by fleet

managers; expect to hold flat through 2011

managers; expect to hold flat through 2011

< Focused efforts on reducing G&A will continue

in 2011 and beyond

in 2011 and beyond

page 8

< Strong liquidity and balance sheet profile

• $1.5B in liquidity

• Attractive debt maturity profile

• Manageable debt and refinancing obligations

over next two years

over next two years

• Future construction commitments of $375M

fully funded

fully funded

< $1.75 annual dividend sustainable

< Ample room within covenants

As of September 30, 2010; future construction commitments after LR1/Aframax swap transaction.

|

Limit on Secured Debt

Maximum 30% |

18%

|

|

Maximum Leverage

Funded indebtedness to total capitalization <60% |

41%

|

|

Minimum Net Worth

Tangible net worth ³ $1.2B |

$2.6B

|

|

Minimum Unencumbered Assets

Tangible assets to unsecured debt ³ 150% |

256%

|

Covenants on $1.8B facility

Strong Balance Sheet and Liquidity

page 9

1Source IMF; 2Source IEA

While fourth quarter is starting out weaker than normal,

we expect the winter market will improve.

We believe a 2011 market turnaround is possible.

we expect the winter market will improve.

We believe a 2011 market turnaround is possible.

Outlook

< Demand expectations

• GDP estimated to grow 4.2% in 20111

• World oil demand forecasted to grow by 1.4%2

• China

- Refinery expansion and demand growth continue

- Ton-mile expands as China sources more oil from Brazil, Caribbean and other Atlantic ports

< Products

• Ton-mile growth expected to continue from longer-haul trading patterns

• Ton-mile growth in the MR sector expected to exceed supply growth in 2011

• India’s export capacity is increasing

• Diesel arbitrage opportunities likely

< U.S. Flag

• Fundamentals expected to improve since Jones Act fleet expected to decline

< Orderbook. 2011 slippage could exceed 2010.

• With 2011 orderbook contract values well in excess of asset values and financing levels at

60% of market value, orderbook remains wildcard

60% of market value, orderbook remains wildcard

page 10

In Summary

< Focused on executing our strategy in any market

• We have reduced costs at sea and ashore

• We have negotiated improvements in our newbuilding commitments

• We have been patient about pursuing opportunities

• Challenging U.S. Flag and Crude newbuild/conversion projects are operational

• Scale, cargo systems and commercial infrastructure positions OSG to

outperform in weak markets

outperform in weak markets

• High levels of liquidity and financial flexibility maintained

< Following a consistent strategy throughout this difficult period positions

OSG to emerge ahead of the pack when markets recover

OSG to emerge ahead of the pack when markets recover

page *

Financial Review

Myles Itkin, CFO

page 12

63% of TCE revenues derived from spot market

compared with 43% in Q309. Expiring fixed rate

business was replaced at lower rates

compared with 43% in Q309. Expiring fixed rate

business was replaced at lower rates

FSO Africa commenced employment August 30.

OSG’s share of loss for the quarter was $5.7M, which

included $3.0M related to interest rate swaps that are

marked-to-market through earnings

OSG’s share of loss for the quarter was $5.7M, which

included $3.0M related to interest rate swaps that are

marked-to-market through earnings

Debt maturity pushed out by issuing $300M of Notes

due 2018 which resulted in $5.0M increase in interest

expense, net of reduction in expense achieved by

repaying $42.0M in secured loans with an average

interest rate of 6%; average amount of floating rate

debt increased $193M quarter-over-quarter; 40bp

increase in average rate paid on floating rate debt

due 2018 which resulted in $5.0M increase in interest

expense, net of reduction in expense achieved by

repaying $42.0M in secured loans with an average

interest rate of 6%; average amount of floating rate

debt increased $193M quarter-over-quarter; 40bp

increase in average rate paid on floating rate debt

Financial Review - Income Statement

page 13

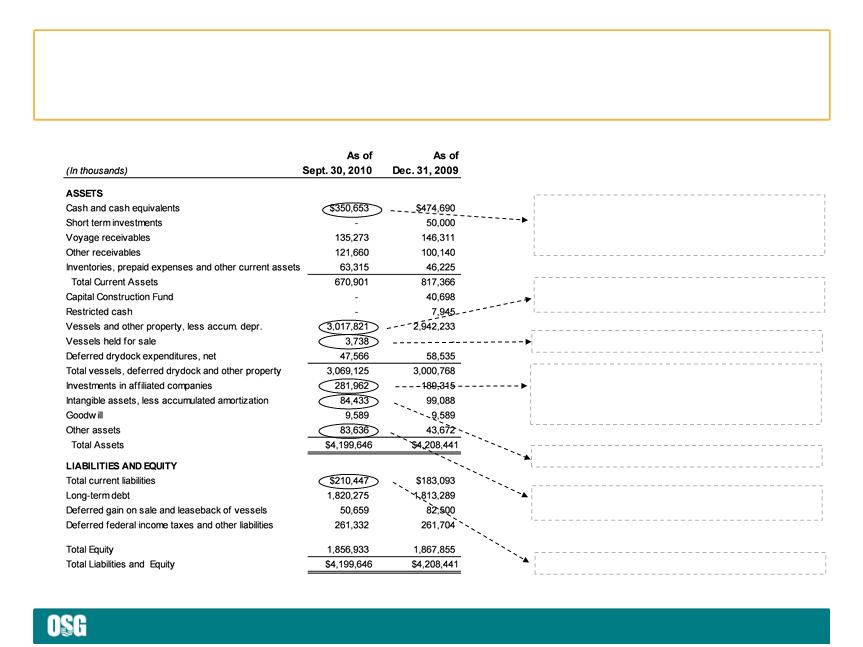

Raised $450M in capital market transactions Q1; net

reduction in outstanding balances under credit facilities of

$308M; vessel expenditures totaled $240M and $152M

advanced to FSO joint venture

reduction in outstanding balances under credit facilities of

$308M; vessel expenditures totaled $240M and $152M

advanced to FSO joint venture

Includes deposit related to the purchase of the Overseas

Kythnos, completed in Q4

Kythnos, completed in Q4

Includes CIP of $632M; reflects Q2 impairment of $12.5M

Represents Overseas Galena Bay

Funding conversion of FSOs and FSO Africa operating

costs ($80M); cash collateral required by FSO JV banking

facility ($72M); offset by net operating losses ($5.5M) and

distributions ($9M)

costs ($80M); cash collateral required by FSO JV banking

facility ($72M); offset by net operating losses ($5.5M) and

distributions ($9M)

Reflects Q2 impairment in crude lightering operations

Includes $13.3M dividend payable November 23

Financial Review - Balance Sheet

page 14

2010 Guidance

< Estimated vessel expenses (updated from $275M to $290M due to reductions in lubricating oils, stores, spares and repairs)

• $265M to $270M

< Time and bareboat charter hire expenses

• $365M to $380M

< Depreciation and Amortization

• $170M to $190M

< G&A (updated from $100M to $115M)

• Approximately $105M

< Equity income of affiliated companies (updated from $3M to $8M due to 3Q mark-to-market loss on FSO Africa interest

rate swaps due to further decline in long-term interest rates)

rate swaps due to further decline in long-term interest rates)

• $0M to $5M

< Interest expense

• Interest expense approx. $65M to $75M

< Capital expenditures

• $22M in full year drydock costs (Q4 detail: $8M on 8 vessels)

• $433M in full year newbuild progress payments, vessel improvements and capitalized interest (Q4

detail: $193M)

detail: $193M)

page 15

An invitation to OSG’s investors and lenders meeting

December 15, 2010

New York

Registration Required

Contact: Jennifer Schlueter

December 15, 2010

New York

Registration Required

Contact: Jennifer Schlueter

page *

Appendix

page 17

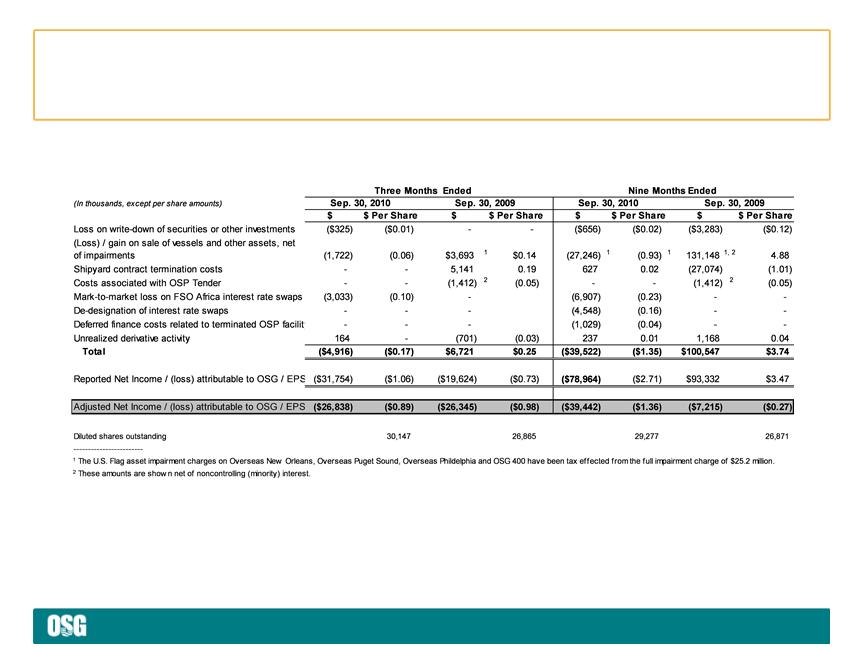

Set forth below are significant items of income and expense that affected the Company’s results for the three and nine months ended September

30, 2010 and 2009, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results

30, 2010 and 2009, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results

Special Items Affecting Net Income/(Loss)

In calculating Clarksons average spot rates, each vessel class was weighted following OSG’s typical trading routes. This follows a similar

methodology used in how OSG calculates average spot rates during the period in the Operations section of Management’s Discussion and

Analysis reported in the Company’s 10-Q and 10-K filings. VLCC voyages were weighted 60% Arabian Gulf-East and 40% Arabian Gulf-

West; Suezmaxes weighted 100% using W. Africa to U.S.Gulf; Aframaxes weighted 100% using Caribbean-U.S. Gulf and U.S. Atlantic Coast;

Panamaxes are weighted 100% Caribbean-U.S. Gulf/U.S. Atlantic Coast since Clarksons does not publish rates for Ecuador-U.S. West Coast;

MRs weighted using 60% trans-Atlantic and 40% Caribbean-U.S. Atlantic Coast.

methodology used in how OSG calculates average spot rates during the period in the Operations section of Management’s Discussion and

Analysis reported in the Company’s 10-Q and 10-K filings. VLCC voyages were weighted 60% Arabian Gulf-East and 40% Arabian Gulf-

West; Suezmaxes weighted 100% using W. Africa to U.S.Gulf; Aframaxes weighted 100% using Caribbean-U.S. Gulf and U.S. Atlantic Coast;

Panamaxes are weighted 100% Caribbean-U.S. Gulf/U.S. Atlantic Coast since Clarksons does not publish rates for Ecuador-U.S. West Coast;

MRs weighted using 60% trans-Atlantic and 40% Caribbean-U.S. Atlantic Coast.

Methodology Used for Calculating Clarksons Average Spot Rates

Reconciling Items

page 18

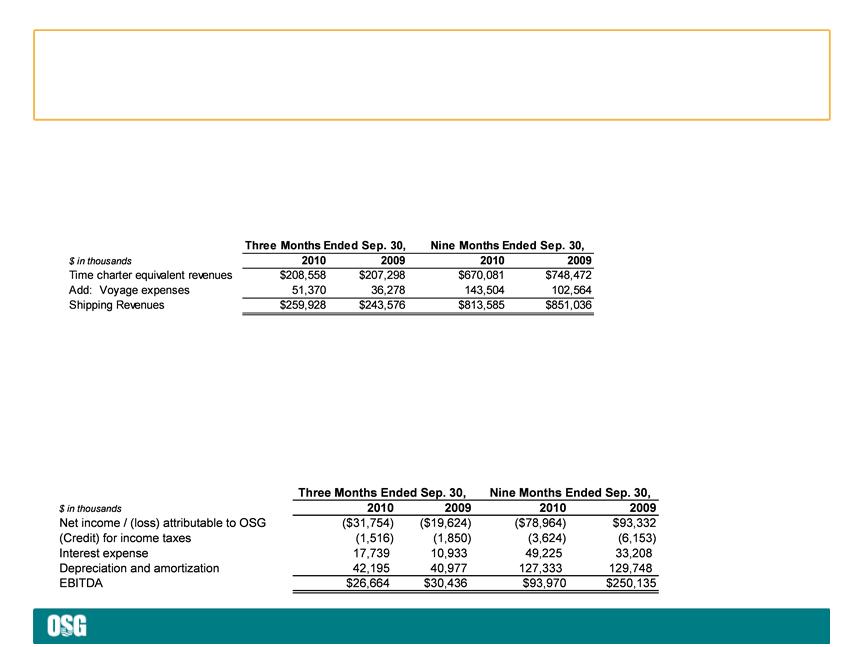

EBITDA represents operating earnings excluding net income / (loss) attributable to the noncontrolling interest, which is before interest expense and

income taxes, plus other income and depreciation and amortization expense. EBITDA is presented to provide investors with meaningful additional

information that management uses to monitor ongoing operating results and evaluate trends over comparative periods. EBITDA should not be

considered a substitute for net income / (loss) attributable to the Company or cash flow from operating activities prepared in accordance with

accounting principles generally accepted in the United States or as a measure of profitability or liquidity. While EBITDA is frequently used as a

measure of operating results and performance, it is not necessarily comparable to other similarly titled captions of other companies due to

differences in methods of calculation.

income taxes, plus other income and depreciation and amortization expense. EBITDA is presented to provide investors with meaningful additional

information that management uses to monitor ongoing operating results and evaluate trends over comparative periods. EBITDA should not be

considered a substitute for net income / (loss) attributable to the Company or cash flow from operating activities prepared in accordance with

accounting principles generally accepted in the United States or as a measure of profitability or liquidity. While EBITDA is frequently used as a

measure of operating results and performance, it is not necessarily comparable to other similarly titled captions of other companies due to

differences in methods of calculation.

EBITDA

Consistent with general practice in the shipping industry, the Company uses time charter equivalent revenues, which represents shipping revenues

less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. Time charter

equivalent revenues, a non-GAAP measure, provides additional meaningful information in conjunction with shipping revenues, the most directly

comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in

evaluating their financial performance.

less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. Time charter

equivalent revenues, a non-GAAP measure, provides additional meaningful information in conjunction with shipping revenues, the most directly

comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in

evaluating their financial performance.

TCE Revenues

Reconciling Items

page 19

|

|

Owned

|

Chartered-in

|

Total

|

Newbuild

|

Total

|

|

VLCC

|

9

|

6

|

15

|

2

|

17

|

|

FSO

|

2

|

-

|

2

|

-

|

2

|

|

Suezmax

|

-

|

2

|

2

|

-

|

2

|

|

Aframax

|

6

|

6

|

12

|

2

|

14

|

|

Panamax

|

9

|

-

|

9

|

-

|

9

|

|

Lightering

|

2

|

5

|

7

|

-

|

7

|

|

Total Crude

|

28

|

19

|

47

|

4

|

51

|

|

LR2

|

-

|

1

|

1

|

-

|

1

|

|

LR1

|

2

|

2

|

4

|

2

|

6

|

|

MR*

|

15

|

17

|

32

|

4

|

36

|

|

Total Products

|

17

|

20

|

37

|

6

|

43

|

|

Handysize

|

4

|

9

|

13

|

2

|

15

|

|

ATB

|

7

|

-

|

7

|

-

|

7

|

|

Lightering

|

3

|

-

|

3

|

1

|

4

|

|

Total U.S. Flag

|

14

|

9

|

23

|

3

|

26

|

|

Total Gas

|

4

|

-

|

4

|

-

|

4

|

|

TOTAL

|

63

|

48

|

111

|

13

|

124

|

*Products operating fleet Includes 2 owned U.S. Flag MRs that trade internationally and a car carrier; Products newbuild fleet includes a chemical tanker

Fleet Composition - As of 10/30/10

page 20

Off Hire and Scheduled Drydock

In addition to regular inspections by OSG personnel, all vessels are subject to periodic drydock, special survey and other

scheduled or known maintenance and repairs. The table below sets forth actual days off hire for the third quarter of 2010

and anticipated days off hire for the above-mentioned events by vessel class for the fourth quarter of 2010.

scheduled or known maintenance and repairs. The table below sets forth actual days off hire for the third quarter of 2010

and anticipated days off hire for the above-mentioned events by vessel class for the fourth quarter of 2010.

Off Hire Schedule

page 21

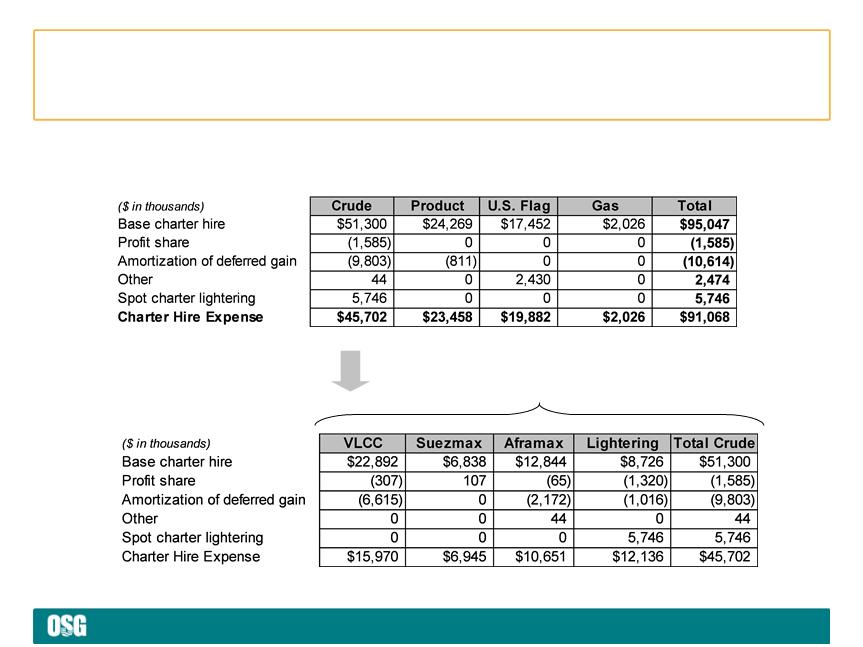

For the Quarter Ended September 30, 2010

Note: Vessels chartered-in for less than one year are not on the Company’s fleet list. During the second quarter, the Gas segment chartered in an LPG

carrier for an initial term that was less than one year.

carrier for an initial term that was less than one year.

Charter Hire Expense by Segment

page 22

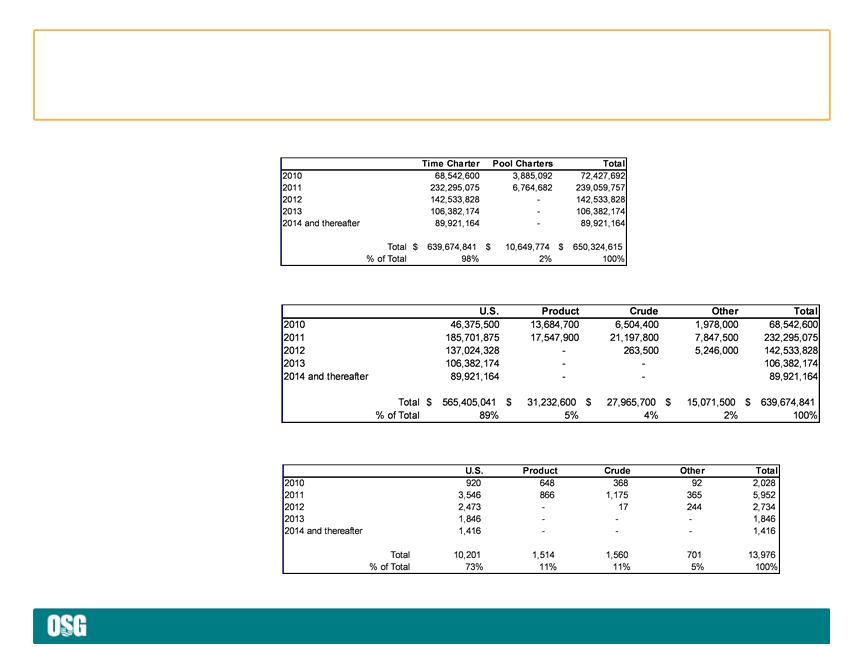

Locked-in Time Charter

Days by Segment

Days by Segment

Locked-in Time Charter

Revenue by Segment

Revenue by Segment

Locked-in

Charter Revenue

Charter Revenue

Locked-in time charter days for 2010 are as of 9/30/10 and will differ from a more current date used in Appendices 3 and 4 in the quarterly earnings

press release

press release

Future Revenue $/Days by Segment - As of 9/30/10

page *

www.osg.com