Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Dialogic Inc. | d8k.htm |

Dialogic

Investor Presentation

November 2010

Exhibit 99.1 |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 2

Safe Harbor Statement

These slides and the accompanying oral presentation contain forward-looking statements and

information. Words such as may, will, expects, intends, plans, believes, targets, estimates and

variations of these words are intended to identify forward-looking statements. By

discussing the current perception of the market and making these forward-looking

statements, Dialogic is not undertaking an obligation to provide updates in the future.

Actual results may differ materially from those projected in these forward-looking statements and no one

should assume at a later date that these comments from today are still valid. All of these forward-looking statements are based on estimates and assumptions by Dialogic

management that, although are believed to be reasonable, are inherently uncertain.

Forward-looking statements involve risks and uncertainties, including, but not limited to,

economic, competitive, governmental and technological factors outside of the control of

Dialogic, risks related to the adoption and roll-out of Dialogic products and services,

risks related to ability to capitalize on growth opportunities and markets, risks related to the

synergies from Veraz-Dialogic merger and other risks that may cause the business, industry,

strategy or actual results to differ materially from the forward-looking statements. In addition to the above, please refer to the risk factors section of Dialogic’s most recent

filings with the SEC for a detailed discussion on risks that could cause these

differences. Any future product feature or related specification that may be referenced

are for information purposes only and are not commitments to deliver any technology or

enhancement. Dialogic reserves the right to modify future product plans at any time.

|

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 3

Dialogic at a Glance

Privately held Dialogic Corporation merged with publicly

traded Veraz

Networks on Oct. 1, 2010

Listed on NASDAQ (DLGC)

2011

Expected

Financial

Highlights

(adjusted

to

exclude

purchase

accounting

and

merger

related

expenses)

–

Revenue

$220M

-

$230M

–

Adjusted

EBITDA

Margin

greater

than

10%

–

Adjusted

Gross

Margins

60%

-

65%

–

No

customer

will

generate

more

than

5%

of

revenue

Global Customers “Build on Dialogic”

–

Industry leading portfolio of IP and TDM based multimedia

processing and call control enabling technologies and

products

Dialogic’s

Technology is Widely Deployed

–

In

High-Value

Solutions

that

are

in

use

by

over

2

Billion

Mobile Subscribers

–

In

Network

Infrastructure

that

carries

over

5

Billion

minutes of traffic per month |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 4

Global market segment share leader by revenue and profit metrics

Strength in key growth areas such as video, backhaul, and value added services

Uniquely positioned to capitalize on transition to IP and converged communications

70+ issued US Patents

Market Leadership in

Multimedia processing and Call

Control Infrastructure Platforms

Strong Financial Profile

Experienced

Management

Team

with Deep Industry Knowledge

Large and Growing Market

Opportunity

Proven Business Model and

Diversified Customer Base

Over 3,000 customers globally, with strength in both mature and emerging markets

Largest customer represents 4% of revenue; top 5 less than 15% of revenue

Well-established and long-standing distribution channel relationships

Industry transition to mobile broadband driving significant infrastructure upgrades with

key opportunities for multimedia processing and call control infrastructure

Faster growth in video network traffic represents significant upside

Mobile video advertising and wireless backhaul represent significant upside

Highly knowledgeable and motivated management team with extraordinary depth of

experience in both Enterprise and Service Provider markets

Significant tenure with Dialogic

Proven track record of integrating acquired businesses

Significant revenue scale

60% -

65% adjusted gross margin

Adjusted EBITDA margin greater than 10%

Proven track record of M&A to help build long-term shareholder value

Key Investment Highlights |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 5

Dialogic Growth Strategy

Leverage Dialogic’s

Current Leadership Position

–

Worldwide Leadership in Enabling Mobile Value-Added Services

–

Direct Position with Service Providers

•

Dialogic sells to 8 of the top 10 mobile service providers in the

world today

To Drive the Mobile Broadband Network

–

Video-Enabled Services, including video analytics

–

Bandwidth Optimized Solutions

–

Session Security

Dialogic:

A leading enabler for

unleashing profit from

video, voice and data for

advanced networks |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 6

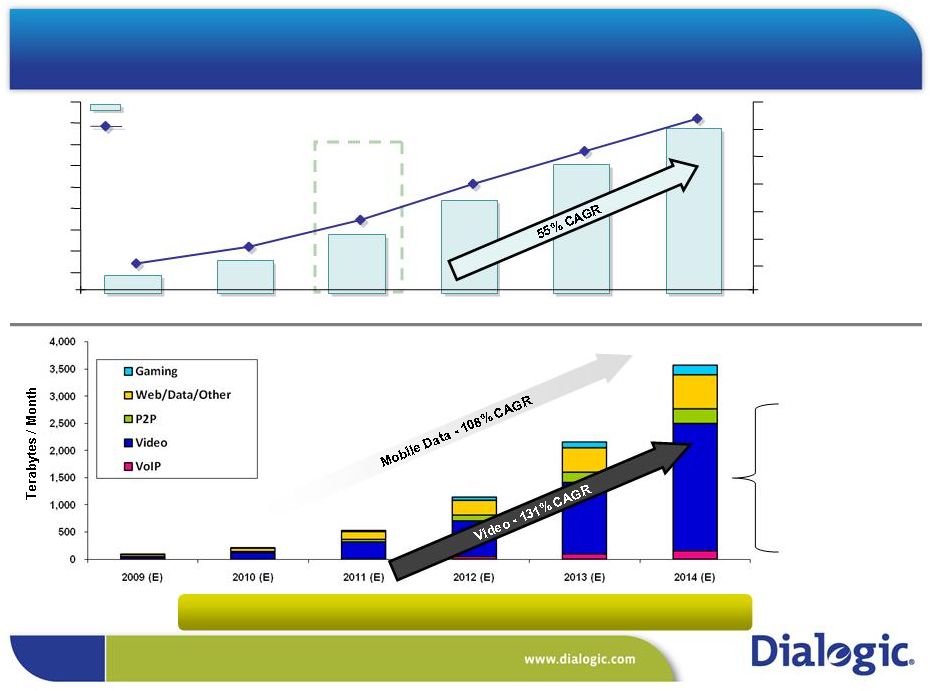

Source: Cisco Visual Networking Index

(VNI); Forecasting and Methodology, 2009-

2014, February 2010

Global Growth of Mobile Broadband Data Networks

Source: WorldWide

Mobile Industry Handbook, Portio

Research, October 2009

Video is growing

at nearly 3x the

pace of global

3G+ subscribers

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

2008

2009 (E)

2010 (E)

2011 (E)

2012 (E)

2013 (E)

0%

10%

20%

30%

40%

50%

60%

70%

3G+ Subscribers (Millions)

3G+ Penetration (%)

3G Tipping Point in 2010

429

774

1,366

2,189

3,024

3,876

11%

17%

27%

37%

52%

64%

Global Mobile Data Traffic

Global 3G+ Subscriber Forecast

Video Traffic is Outpacing 3G+ Network Growth |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 7

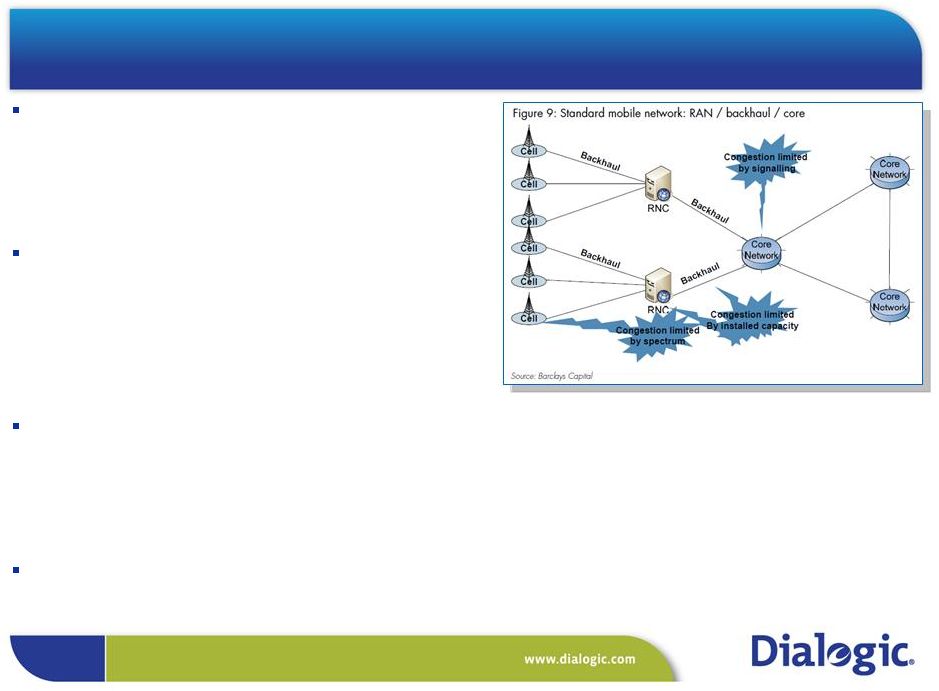

Explosion in Mobile Data Traffic Overwhelms Networks

Mobile Operators need to improve

their

customer experience in a cost effective manner

–

Fewer Dropped calls

–

Faster downloads

This is done via a variety of mechanisms

–

Increased Bandwidth

–

Expanding coverage

–

Implementing

more

efficient

and

network

and network topologies

Wireless Backhaul is one of the key mechanisms:

–

“Increasing

backhaul

capacity

is

a

top

priority

for

operators”

(Deutsche

Bank

2/10)

–

“Pockets

of

growth

in

mobile

backhaul”

(Barclay’s

Capital

9/13/10)

–

“Wireless

Backhaul

to

grow

41%

to

$117B

by

2014”

(Instat

9/15/10)

Session Security within the data session and at network junctures is also critical

–

SBC growth attributable to increased IP networks |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 8

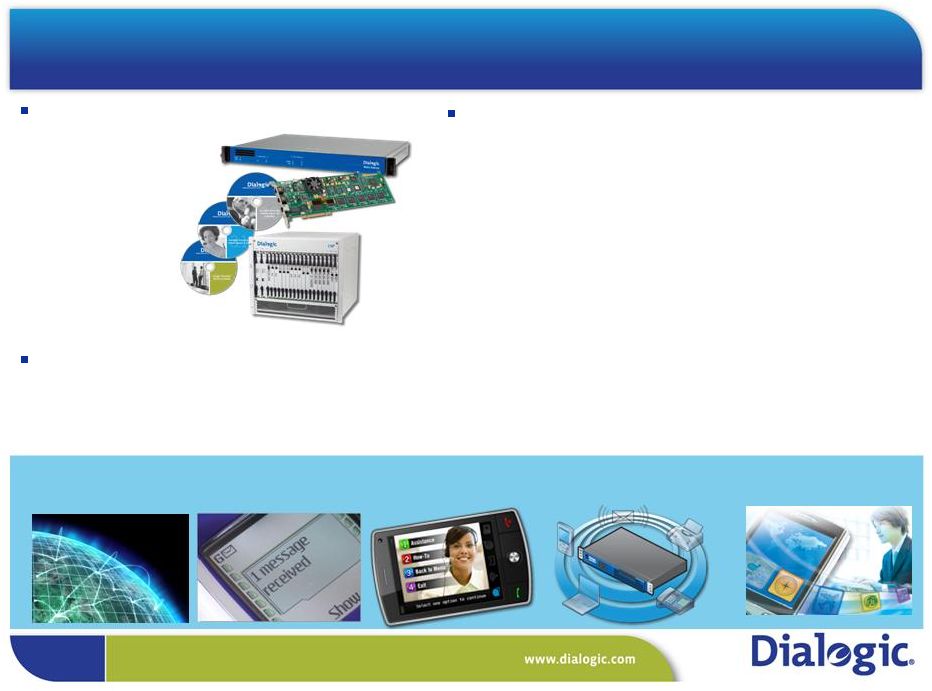

Why Dialogic Will Succeed:

We Already Play a Key Role in Everyday Communications

Dialogic’s

Technology

–

Software

–

Platforms

–

Boards

–

Turnkey

Solutions

Spans Global Communications Markets

–

Enterprise and Service Provider

–

Wireless and Wireline

Enabling our Customers To:

–

Focus

on their core competencies

•

Outsource complexities of network call control

and media processing to us

–

Create new services

•

Video-Enable

traditional voice and/or text

applications

•

Video advertising

insertion, including video

location based / contextual ads

–

Reduce

their CAPEX and OPEX

•

Connect disparate

networks •

Optimize voice and data

solutions Carrier VoIP

Unified Communications

Messaging

Mobile

Entertainment

IVR/IVVR |

©

Copyright 2010 Dialogic Inc. All rights reserved.

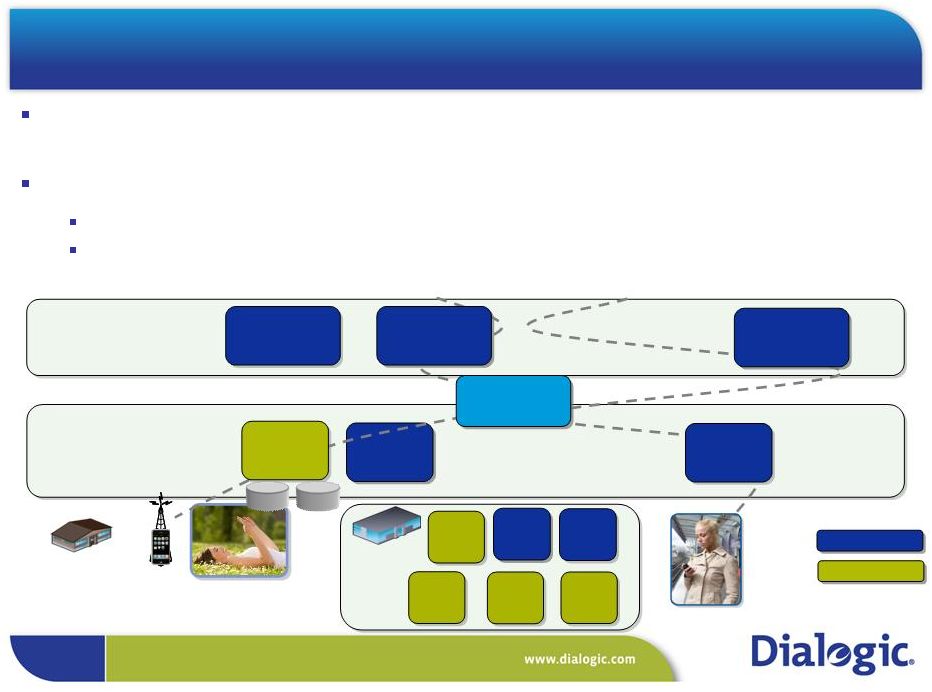

SLIDE 9

Bandwidth Optimized

VoIP Gateways

Broad Multimedia Processing and Call Control Infrastructure

Product Portfolio

Call Control

Infrastructure

Multimedia

Processing

Infrastructure

Session Border Controller

Wireless Backhaul

Bandwidth Optimization

Softswitch

Video

Gateways

Multimedia Processing

Server Platforms

Signaling

Services

Maintenance and Updates

Installation Professional Services

Services

Service Provider

CPE

Service Provider

CPE

Video Processing

Server Software |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 10

Dialogic’s

Investments Aligned with Growth Strategy

Increasing Demands for

Multimedia Applications

Increasing Demands to

do more with less

Video

Session Border

Controller

Mobile Backhaul

Beneficiaries

Growth Regions

Enterprise

Developers

Mobile Network

Operators

Customer

Focus

Core

Development

Focus |

Dialogic Video

Portfolio Dialogic’s Video Products are used:

To create mobile video content for a mobile video service

To transport mobile video content from one type of service to another

Mobile to mobile

Internet to mobile

To transform one type of content to another type

Video to a format that displays on user end-points or terminals of different sizes.

One codec to another codec.

To analyze/inspect video content for quality of experience purposes

Gaming

Color

Ring

Back

Tone

Video

Ring

Tone

Video Call

Completion

SMS and

Video

SMS

Mobile

Avatars

Video Ad

Insertion

Enhanced

Experience

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 11 |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 12

Dialogic Session Border Controller

Service

Transport

Value Added Service

Application Enablement

VoIP and Video

Media Gateways

Residential

Mobile

Multimedia

Servers

•

Mobile Commerce

•

Personalization

•

Entertainment

•

Information

•

Conferencing

Edge

Services

SBC

Signaling GW

Value Added

Services

Customer Apps

Enterprise

IP-

PBX

Unified

Messaging

Fax

Call Center/

IVR

Multimedia

Servers

Edge

Services

Dialogic

BW Optimization

(IP-IP VoIP, Data,

TDM-IP Voice)

SBC is natural course for Dialogic given our strength in application enablement and

service creation and transport

Dialogic’s SBC is:

Industry’s only 1U, fully redundant, carrier grade SBC

With RTP multiplexing for added Bandwidth Optimization |

©

Copyright 2010 Dialogic Inc. All rights reserved.

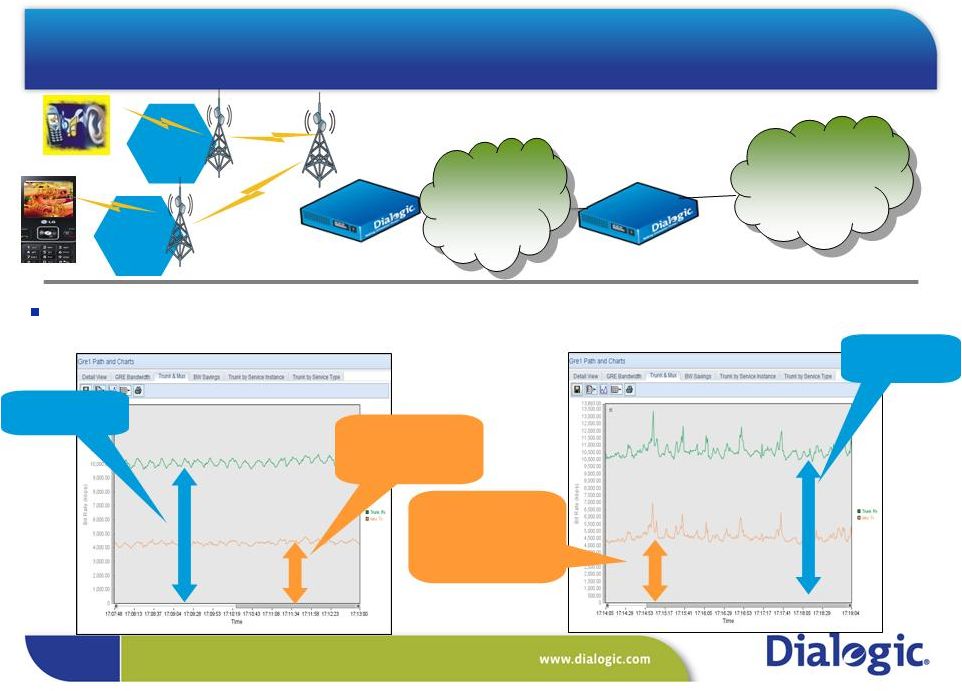

SLIDE 13

Dialogic

Corporation

-

Veraz

Networks

Confidential

Dialogic Mobile Backhaul

2G

3G

2G &3G

Core

Networks

Unoptimized

uplink

Optimized

uplink is <50% of

unoptimized link

Unoptimized

downlink

Optimized

downlink is <50% of

unoptimized

downlink

Measured Bandwidth Savings of 50% in a Tier 1 Provider backhaul network

Backhaul

Network |

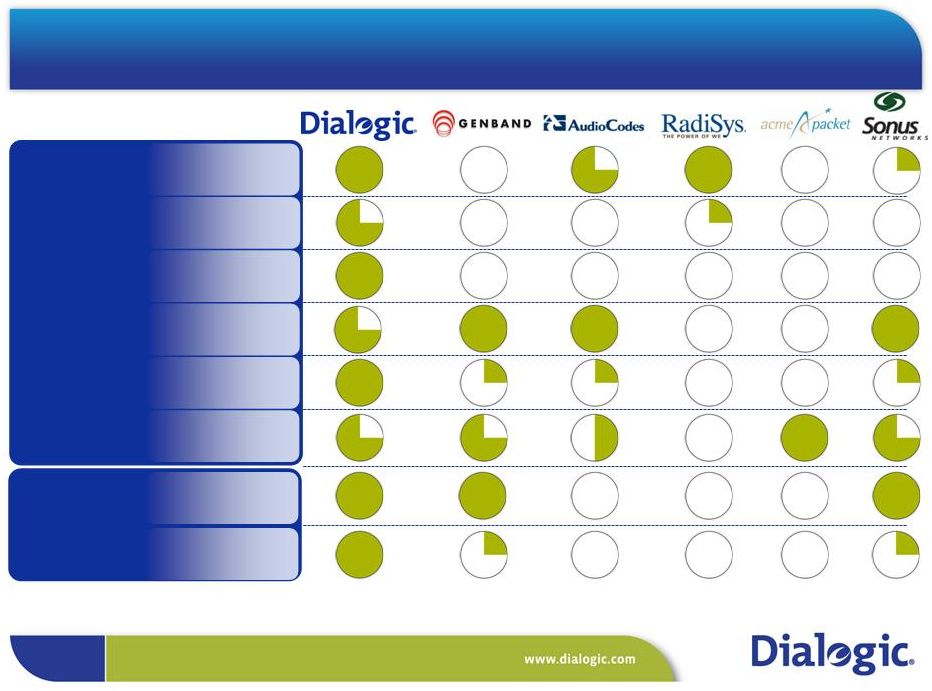

Unparalleled

Technology Leadership Call Control

Infrastructure

Multimedia

Processing

Infrastructure

Media Server

Platforms

Video Processing

Server Platforms

Video Gateways

VoIP Gateways

VoIP Bandwidth

Optimization

SBC

Softswitch

Signaling

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 14 |

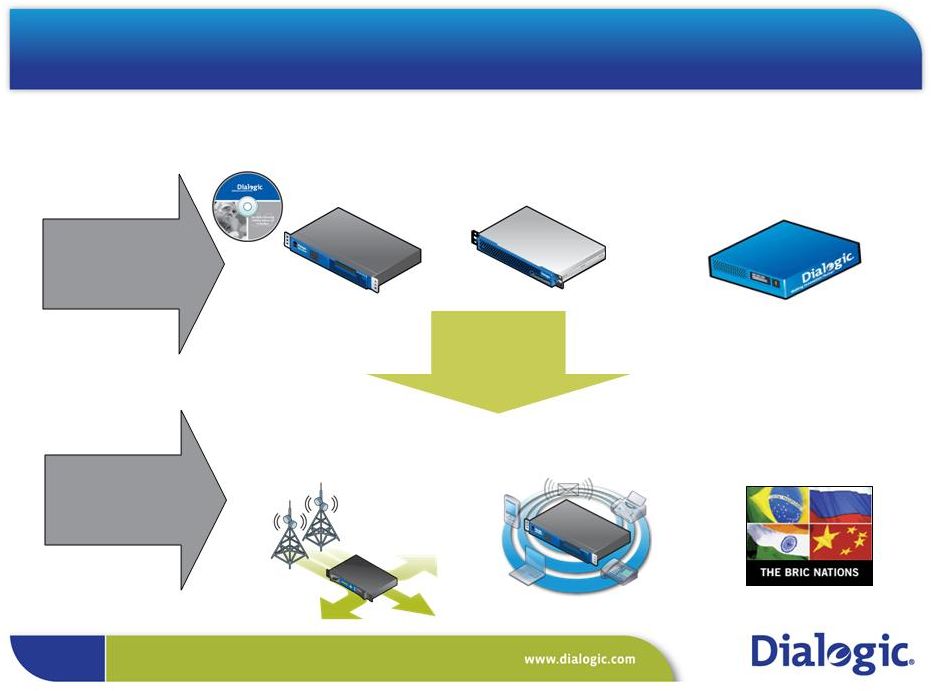

Direct

Sales

Distribution

Channel

Thousands

of

Resellers

Worldwide

Proven Business Model and Global Customer Base

Telecomm

Equipment

Manufacturers (TEMs)

Service

Providers

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 15 |

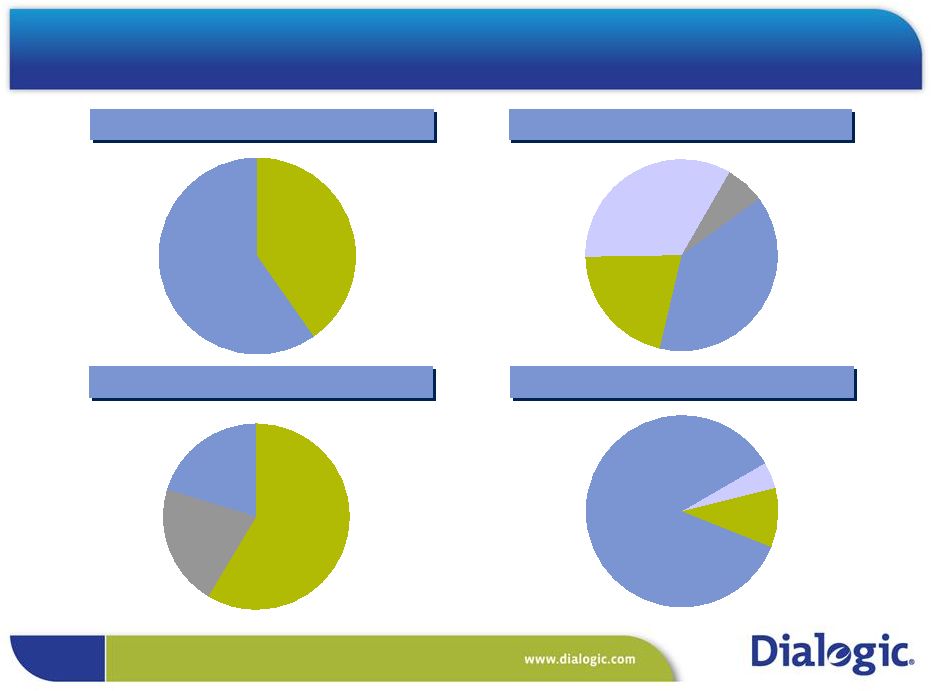

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 16

Direct Sales

59%

TEMs/ISVs

20%

Distributors/

Resellers

21%

NA

38%

APAC

21%

EMEA

34%

CALA

7%

Top

Customer

4%

Next 4

Customers

10%

Rest of

Customers

86%

Enterprise

40%

Service

Provider

60%

Diverse Customer Base with No Customer Generating More

than 5% of Revenue

1

Expected merged company mix based on 2009 historical data

Revenue Mix

Revenue Geo Distribution

Channel Mix

Customer Concentration

1 |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 17

Successful M&A and Integration History |

The Leading

Enabler for Unleashing Profit from

Video, Voice and Data for Advanced Networks

Delivering Platforms

–

Software

–

Platforms

–

Turnkey

Solutions

That Support Sustainable Growth

Trends

–

3G+

–

Mobile Internet

Enabling our Customers To:

–

Create new services

•

Video-Enable

traditional

voice

and/or

text

applications

•

Video

advertising

insertion,

including

video

location based / contextual ads

–

Reduce

their CAPEX and OPEX

•

Connect

disparate

networks

•

Optimize

voice

and

data

solutions

Optimized and Secure

Communications

Video Analytics

Ad Insertion

Mobile

Entertainment

IVR/IVVR

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 18 |

©

Copyright 2010 Dialogic Inc. All rights reserved.

SLIDE 19

www.dialogic.com

Dialogic, Veraz, Brooktrout among others as well as related logos, are either

registered trademarks or trademarks of Dialogic Inc. and all companies controlling, controlled by, or

under common control with Dialogic Inc. (“Dialogic”). The names of actual

companies and products mentioned herein are the trademarks of their respective owners.

10/10 |