Attached files

0

0

Tower Bancorp, Inc.

Investor Presentation

Third Quarter 2010

Exhibit 99.1 |

1

ABOUT THIS PRESENTATION

This

presentation

contains

forward-looking

statements

that

are

intended

to

be

covered

by

the

safe

harbor

for

forward-

looking

statements

provided

by

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

are

not

statements

of

historical

fact,

and

can

be

identified

by

the

use

of

forward-looking

terminology

such

as

“believe,”

“expect,”

“may,”

“will,”

“should,”

“project,”

“plan,”

“seek,”

“target,”

“intend”

or

“anticipate”

or

the

negative

thereof

or

comparable

terminology.

Forward-looking

statements

include

discussions

of

strategy,

financial

projections

and

estimates

and

their

underlying

assumptions,

statements

regarding

plans,

objectives,

expectations

or

consequences

of

various

transactions,

and

statements

about

the

future

performance,

operations,

products

and

services

of

Tower

and

our

subsidiaries.

These

forward-looking

statements

are

subject

to

various

assumptions,

risks,

uncertainties

and

other

factors

including,

but

not

limited

to:

a

continuation

or

worsening

of

the

current

disruption

in

credit

and

other

markets;

the

ineffectiveness

of

Tower’s

business

strategy

due

to

changes

in

current

or

future

market

conditions;

the

effects

of

competition,

and

of

changes

in

laws

and

regulations

on

competition,

including

industry

consolidation

and

development

of

competing

financial

products

and

services;

interest

rate

movements;

the

performance

of

Tower’s

investment

portfolio;

changes

in

rates

of

deposit

and

loan

growth;

asset

quality

and

the

impact

on

assets

from

adverse

changes

in

the

economy

and

in

credit

or

other

markets

and

resulting

effects

on

credit

risk

and

asset

values;

inability

to

achieve

merger-related

synergies;

difficulties

in

integrating

distinct

business

operations,

including

information

technology;

capital

and

liquidity

strategies;

and

deteriorating

economic

conditions.

The

foregoing

review

of

important

factors

should

be

read

in

conjunction

with

the

risk

factors

and

other

cautionary

statements

included

in

documents

filed

by

Tower

Bancorp,

Inc.

with

the

Securities

and

Exchange

Commission,

including

Tower’s

Quarterly

Report

on

Form

10-

Q,

Annual

Report

on

Form

10-K

and

other

required

filings.

Because

of

these

uncertainties,

risks

and

the

possibility

of

changes

in

these

assumptions,

actual

results

could

differ

materially

from

those

expressed

in

any

forward-looking

statements.

Investors

are

cautioned

not

to

place

undue

reliance

on

these

statements.

Tower

Bancorp,

Inc.

assumes

no

duty

or

obligation

to

update

any

forward-looking

statements

made

in

this

presentation. |

2

INFORMATION ABOUT THE FIRST CHESTER COUNTY CORPORATION TRANSACTION

The

proposed

merger

of

First

Chester

County

Corporation

(“First

Chester”)

and

Tower

Bancorp,

Inc.

(“Tower”)

will

be

submitted

to

the

shareholders

of

First

Chester

and

Tower

for

their

consideration

and

approval.

In

connection

with

the

proposed

transaction,

Tower

has

filed

with

the

Securities

and

Exchange

Commission

(the

“SEC”)

a

registration

statement

on

Form

S-4,

which

has

been

declared

effective

by

the

SEC

and

includes

a

joint

proxy

statement/prospectus

and

other

relevant

documents

to

be

distributed

to

the

shareholders

of

Tower

and

First

Chester

on

or

about

November

5,

2010.

Investors

are

urged

to

read

the

registration

statement

and

the

joint

proxy

statement/prospectus

regarding

the

proposed

transaction

and

any

other

relevant

documents

filed

with

the

SEC,

as

well

as

any

amendments

or

supplements

to

those

documents,

because

they

will

contain

important

information.

Investors

can

obtain

a

free

copy

of

the

joint

proxy

statement/prospectus,

as

well

as

other

filings

containing

information

about

Tower

and

First

Chester,

free

of

charge

from

the

SEC’s

Internet

site

(www.sec.gov),

by

contacting

Tower

Bancorp,

Inc.,

112

Market

Street,

Harrisburg,

Pennsylvania

17101,

Attention:

Brent

Smith,

Investor

Relations,

telephone

717-724-4666

or

by

contacting

First

Chester

Financial

Corporation,

9

North

High

Street,

West

Chester,

Pennsylvania

19381

Attention:

John

Stoddart,

Investor

Relations,

telephone

484-881-4141.

INVESTORS

SHOULD

READ

THE

JOINT

PROXY

STATEMENT/PROSPECTUS

AND

OTHER

DOCUMENTS

TO

BE

FILED

WITH

THE

SEC

CAREFULLY

BEFORE

MAKING

A

DECISION

CONCERNING

THE

TRANSACTION.

Participants in the Transaction

Tower,

First

Chester

and

their

respective

directors,

executive

officers,

and

certain

other

members

of

management

and

employees

may

be

soliciting

proxies

from

Tower

and

First

Chester

shareholders

in

favor

of

the

transaction.

Information

regarding

the

persons

who

may,

under

the

rules

of

the

SEC,

be

considered

participants

in

the

solicitation

of

the

Tower

and

First

Chester

shareholders

in

connection

with

the

proposed

transaction

is

set

forth

in

the

joint

proxy

statement/prospectus

filed

with

the

SEC.

You

can

also

find

information

about

Tower’s

executive

officers

and

directors

in

its

definitive

proxy

statement

filed

with

the

SEC

on

April

23,

2010,

which

is

available

at

the

SEC’s

Internet

site

(www.sec.gov).

Additional

information

about

First

Chester’s

executive

officers

and

directors

is

set

forth

in

its

Form

10-K

filed

with

the

SEC

on

July

27,

2010,

which

is

available

at

the

SEC’s

Internet

site.

You

can

also

obtain

free

copies

of

these

documents

from

Tower

or

First

Chester,

as

appropriate,

using

the

contact

information

above.

This

document

is

not

an

offer

to

sell

shares

of

Tower’s

securities

which

may

be

issued

in

the

proposed

transaction.

Such

securities

are

offered

only

by

means

of

the

joint

proxy

statement/prospectus

referred

to

above. |

3

COMPANY PROFILE

A Pennsylvania-chartered bank holding company

organized in 1983, with roots dating back to 1864

High-growth community bank headquartered in Harrisburg, Pennsylvania

Completed

a

merger

of

equals

transaction

on

March

31,

2009,

with

Graystone

Financial Corp. to create a $1.2 billion asset company

Pending

merger

with

First

Chester

County

Corporation

will

create

a

$2.7

billion

asset

company

Post-merger, will operate approximately 49 retail offices in eleven counties of

central and south-eastern Pennsylvania and Maryland

Strong corporate culture with clear strategic vision

Shares traded on NASDAQ Global Market under the symbol “TOBC”

|

4

COMPANY PROFILE

•

As of September 30, 2010:

–

Total Assets:

$ 1.6 billion

–

Gross Loans:

$ 1.3 billion

–

Deposits:

$ 1.4 billion

–

Shareholders’

Equity:

$ 165.7 million

–

Book Value Per Share:

$ 23.08

–

Tangible Book Value Per Share:

$ 21.02

–

Total Regulatory Capital Ratio:

13.18%

–

Market Capitalization:

$ 159.6 million

(as of October 25, 2010 as reported by SNL Financial)

|

5

PRO FORMA COMPANY PROFILE

•

Pro Forma For Pending Acquisition of First Chester County Corporation (as of June

30, 2010) (1) –

Total Assets:

$ 2.7 billion

–

Gross Loans:

$ 2.0 billion

–

Deposits:

$ 2.3 billion

–

Shareholders’

Equity:

$ 207.2 million

–

Book Value Per Share:

$ 22.90

(1) Pro Forma combined data is derived from Tower Bancorp, Inc. Registration

Statement on Form S-4, as filed with the SEC on September 3, 2010 as

amended on October 5, 2010 and November 1, 2010, and is subject to the assumptions, estimates and other qualifications set forth

therein

under

the

sections

titled

“Selected

Unaudited

Pro

Forma

Combined

Financial

Data

for

Tower”

and

“Unaudited

Pro

Forma

Combined

Financial Information.” |

6

MISSION, VISION AND VALUES

Mission Statement

Tower Bancorp, Inc. will positively impact lives by helping people achieve their

dreams. Vision Statement

Tower Bancorp, Inc. will be a high performing financial services

company that creates financial

success for consumer, business, and not for profit customers in the markets we

choose to serve.

Value Statement

Tower Bancorp, Inc. is committed to attracting and retaining employees who are

passionate about providing uncompromising service to our customers with a

sense of warmth, integrity, friendliness, and company spirit. We value

and respect each other because we truly believe that our success only comes

from working together for our team’s success. Making a Positive

Impact |

7

INTERNAL ENVIRONMENT

•

Strong organic growth complemented with strategic acquisitions

•

“Well Capitalized”

•

Strong balance sheet

•

Deep leadership team with over 150 years of combined in-market experience

•

Improved liquidity and visibility of stock

•

Continued strong asset quality ratios

•

Improved net interest margin

A Culture Where Our Leaders Are Our

Sustainable Competitive Advantage |

8

CORPORATE LEADERSHIP TEAM

ANDREW SAMUEL

JEFF RENNINGER

JANAK AMIN

MARK MERRILL

Chairman and Chief

Executive Officer

25 years banking

experience (25 years in-

market)

Prior experience: Fulton

Bank and Waypoint Bank

Chief Operating Officer

32 years banking

experience (23 years in-

market)

Prior experience: PNC

Bank, Meridian Bank and

Waypoint Bank

President,

Graystone Bank

21 years banking

experience (19 years in-

market)

Prior experience: Fulton

Bank and Waypoint Bank

Chief Financial Officer

12 years financial

experience

Prior experience:

Pricewaterhouse-Coopers

and Waypoint Bank

CARL LUNDBLAD

JANE TOMPKINS

JOE BERTOTTO

MIKE BAYLOR

General Counsel

13 years M&A, bank

regulatory, securities and

corporate experience (13

years in-market)

Prior experience: Rhoads

& Sinon

Chief Credit Officer

34 years experience in the

financial services industry

with over 18 years in credit

policy formation

Prior experience: PNC

Bank and Waypoint Bank

Chief Culture Officer

29 years banking

experience

Prior experience: PNC

Bank and Waypoint Bank

Regional President,

Maryland Division

26 years in-market

banking experience

Prior experience:

Keystone Financial,

Waypoint Bank and PNC

Bank

Deep and proven management team with average experience of 24 years

|

9

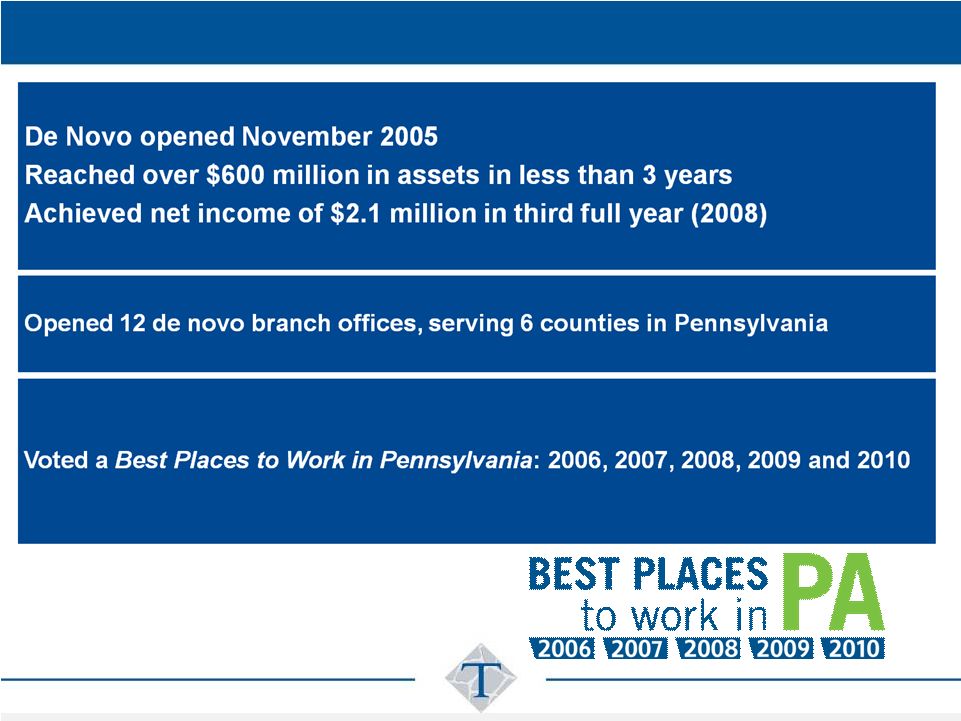

GRAYSTONE TOWER BANK ACCOMPLISHMENTS |

10

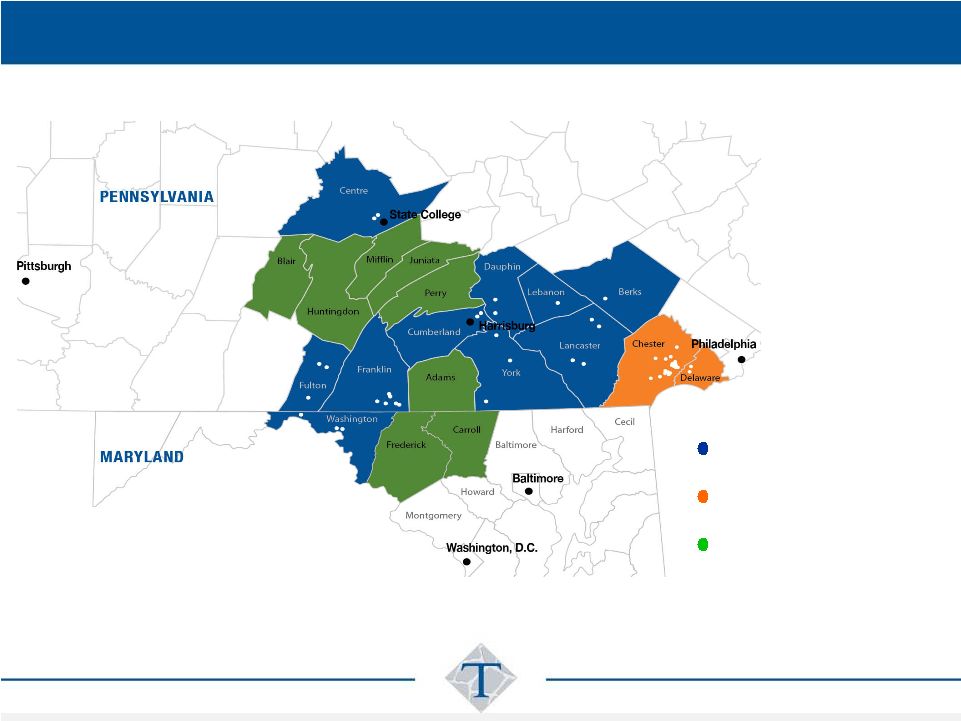

Potentially attractive growth and expansion opportunities

FOOTPRINT AND CURRENT GROWTH POTENTIAL

Note: Tower believes that a growth opportunity exists for the counties

appropriately marked above based on Tower’s close proximity to those counties,

management’s familiarity with the demographics and businesses and business

leaders in those counties and Tower’s reputation in those counties.

Chester County Franchise

(Pro forma)

Current Graystone

Tower Franchise

Growth Markets |

11

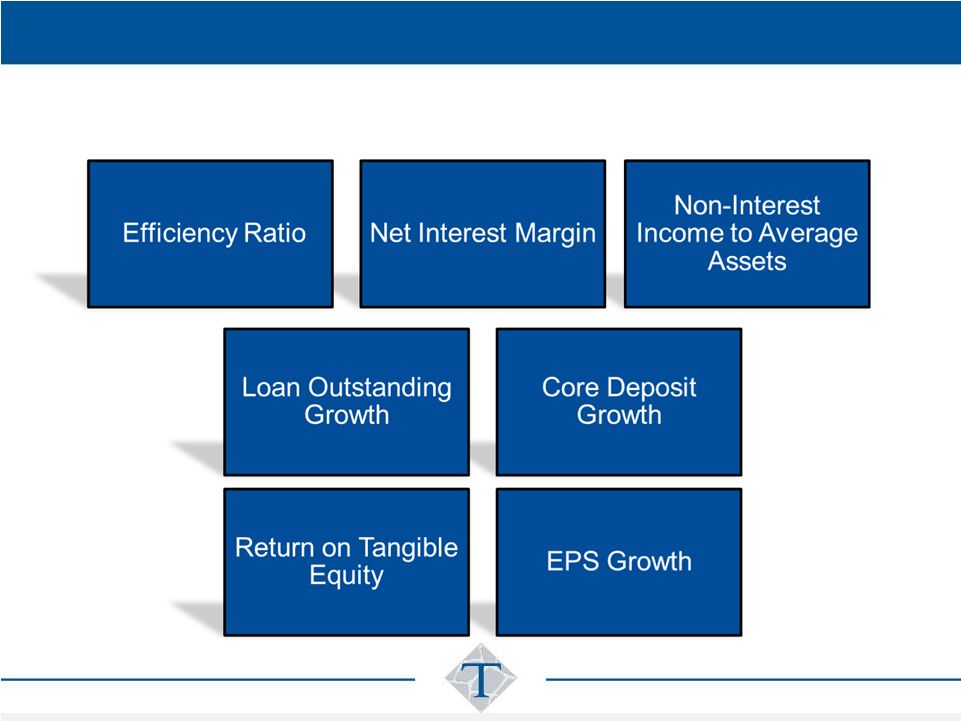

PERFORMANCE OBJECTIVES

Tower Bancorp Inc. will strive to be in the top 20% of our Peer

Group as defined by the Board of Directors in the following:

|

12

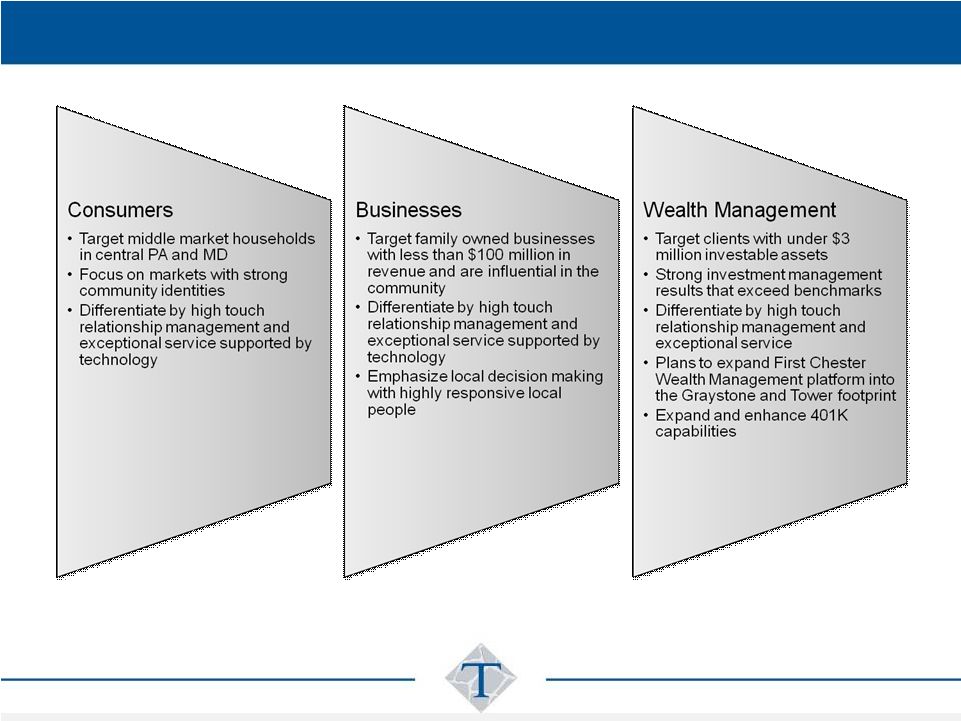

BUSINESS STRATEGIES |

13

CONFIRMED GROWTH MODEL

Tower Bancorp Inc. Pro

Forma $2.7 Billion Assets

49 Branches

“Creating Central/Southeastern

Pennsylvania’s Premier Community Bank” |

14

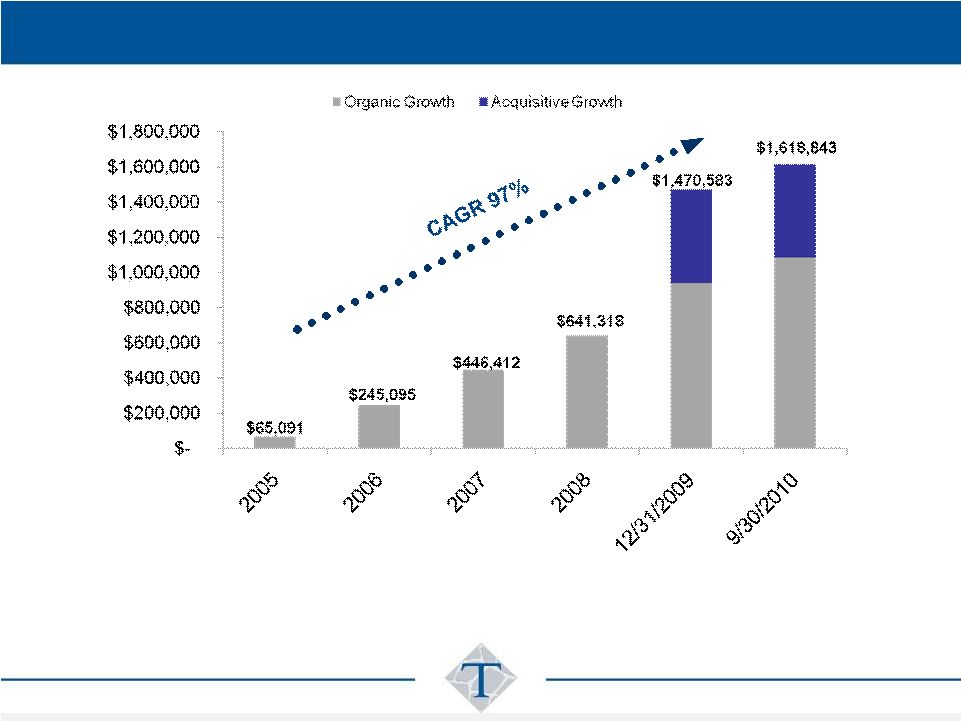

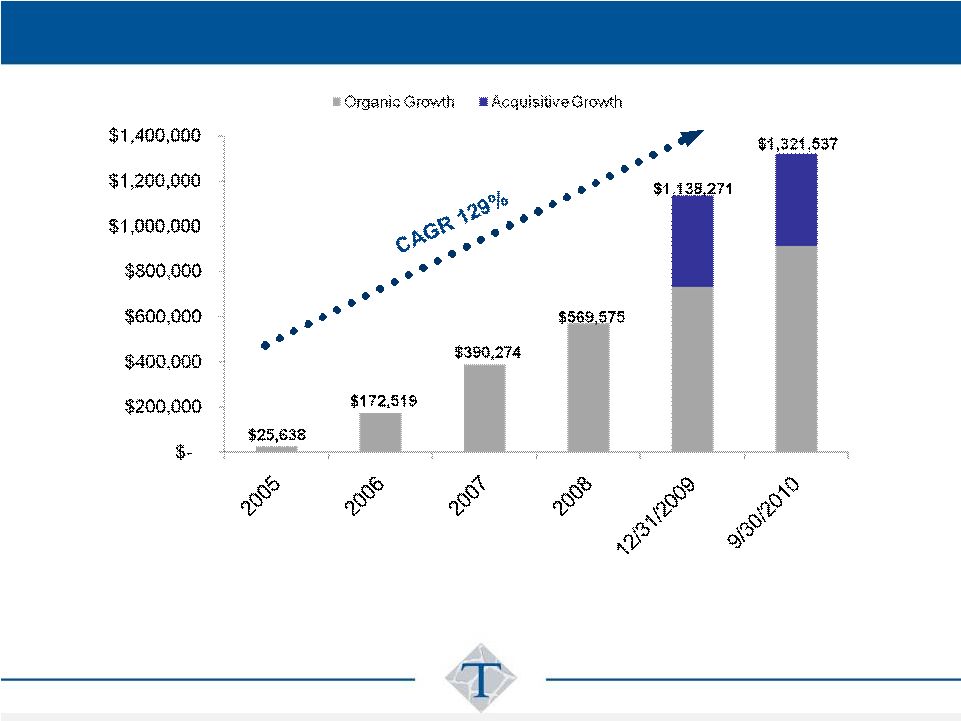

ASSET GROWTH ($000) (1) (2)

(1) All financial information for periods prior to March 31, 2009 represents

historical financials for Graystone Financial Corp., as the accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 |

15

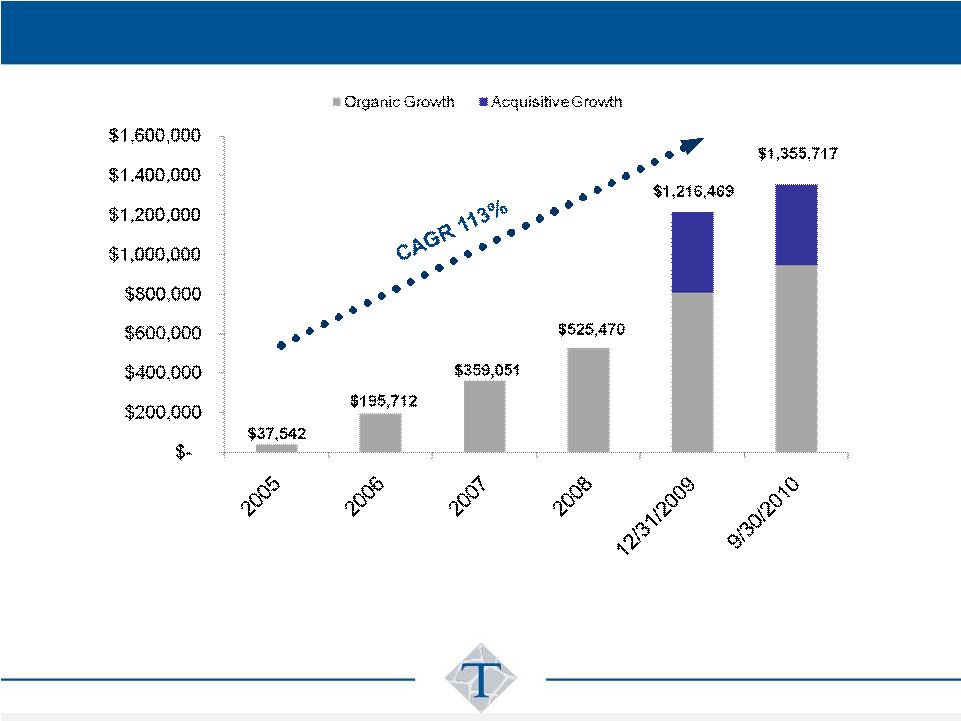

DEPOSIT GROWTH ($000) (1) (2)

(1) All financial information for periods prior to March 31, 2009 represents

historical financials for Graystone Financial Corp., as the accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 |

16

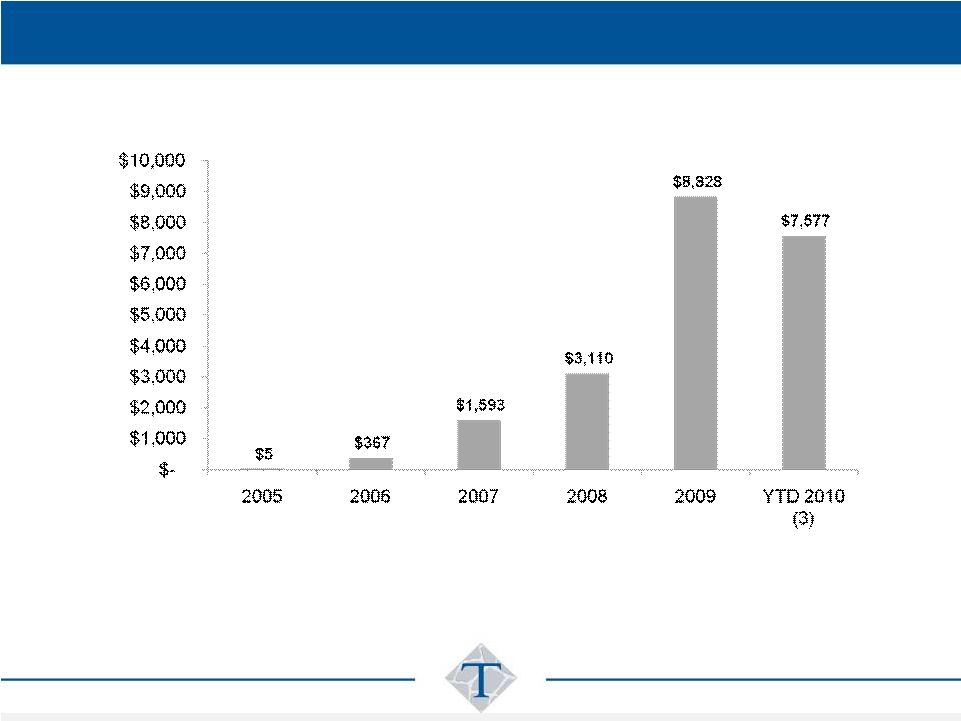

LOAN GROWTH ($000) (1) (2) (3)

(1) All financial information for periods prior to March 31, 2009 represents

historical financials for Graystone Financial Corp., as the accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 (3) Loans are presented as net of unearned income

|

17

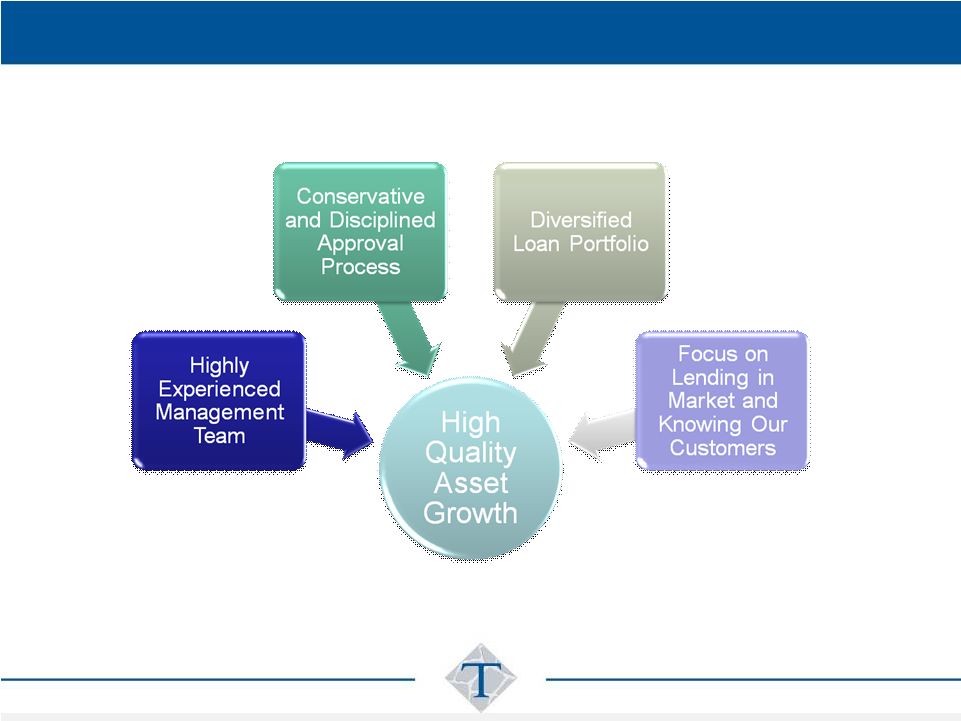

QUALITY ASSET GROWTH STRATEGY |

18

NON-INTEREST INCOME ($000) (1)

(2) (1) All financial information for periods prior to March 31, 2009

represents historical financials for Graystone Financial Corp., as the accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 (3) For nine months ended September 30, 2010

|

19

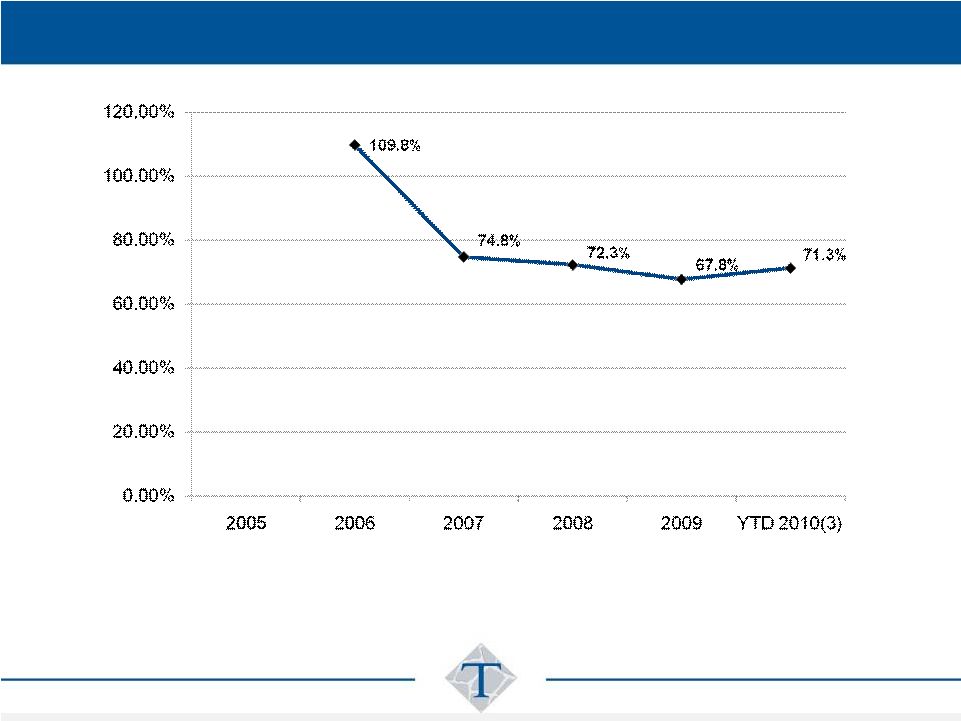

EFFICIENCY RATIO (1) (2)

(1)

All

financial

information

for

periods

prior

to

March

31,

2009

represents

historical

financials

for

Graystone

Financial

Corp.,

as

the

accounting

acquirer in the reverse merger

(2)

Efficiency

ratio

is

calculated

as

total

non-interest

expense

divided

by

the

total

of

net

interest

income

and

non-interest

income.

(3) For nine months ended September 30, 2010 |

20

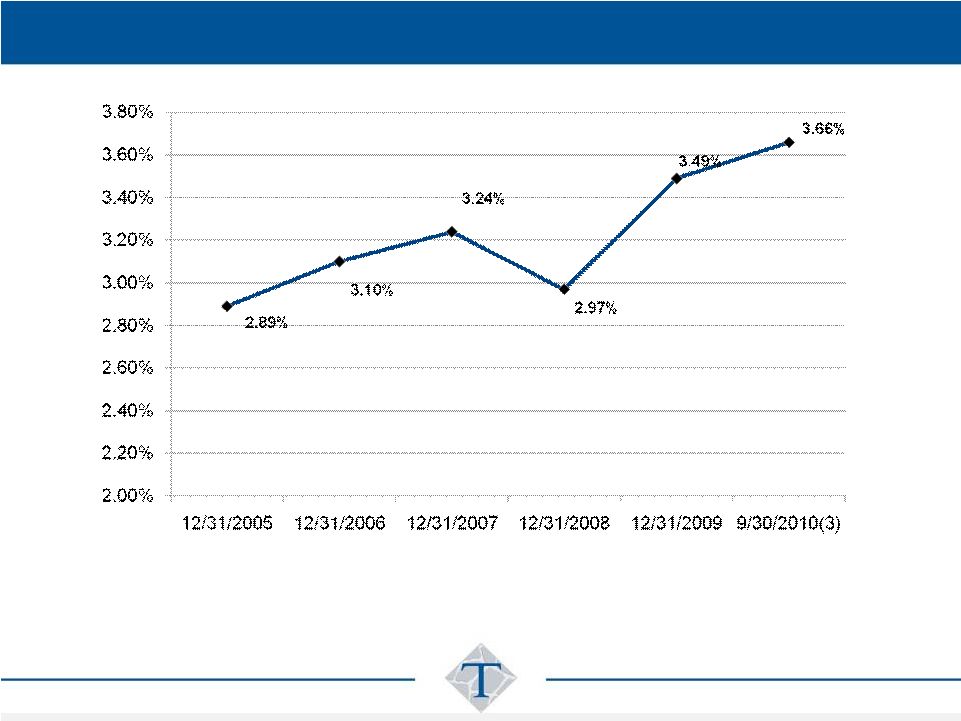

NET INTEREST MARGIN (1) (2)

(1) All financial information for periods prior to March 31, 2009 represents

historical financials for Graystone Financial Corp., as the accounting

acquirer in the reverse merger

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 (3) Net Interest margin for the nine months-ended

September 30, 2010 |

21

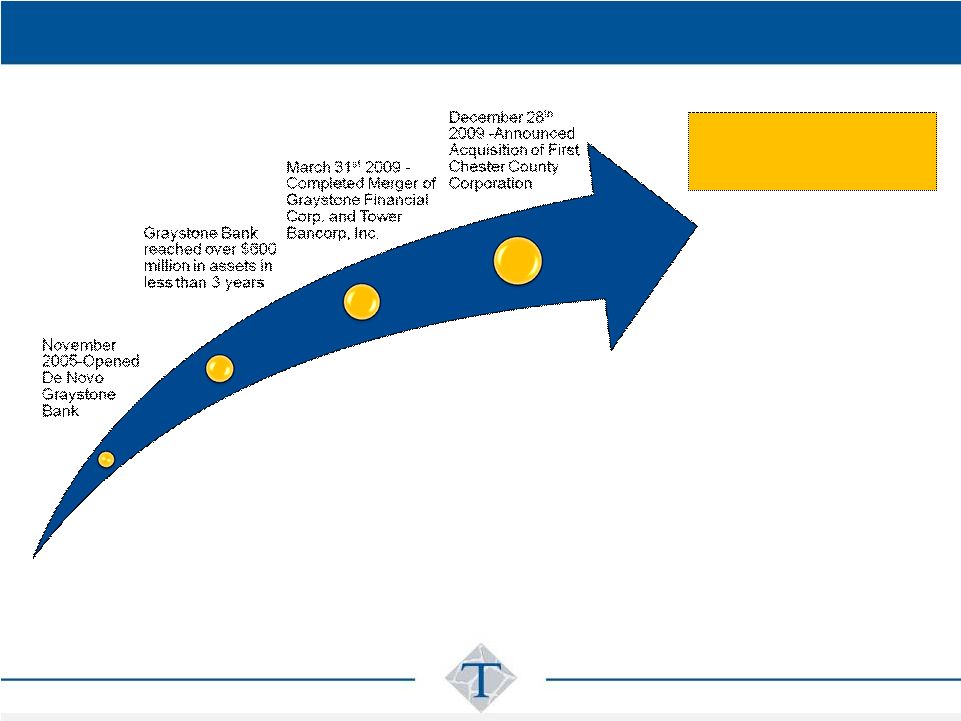

•

2005-2007 –

Graystone raised approximately $65 million of total capital in private

placements •

2008 –

Graystone grew to over $600 million in assets with Net Income $2.1 million in

third full year •

March 2009 -

Merger of equals of Graystone Financial Corp. and Tower Bancorp, Inc.

•

2009 -

NASDAQ Listing

•

2009-2010 –

Raised $21 million of subordinated debt with local investors

•

2009 -

Oversubscribed public offering with net proceeds of approximately $51.5

million •

December 2009 -

Announced acquisition of First Chester County Corporation

•

2009 –

2010 -

Increased visibility on Wall Street and growth in institutional

ownership

GRAYSTONE/TOWER STRATEGIC ACCOMPLISHMENTS |

22

INVESTMENT MERITS

•

Deep and broad management team with extensive in-market experience

•

Compelling culture that drives excellence

•

Disciplined approach to strategy development and execution

•

Successful and proven growth strategy

•

Diversified

credit

portfolio

with

a

conservative

focus

on

credit

quality

•

Significant franchise value

•

Anticipated earnings per share accretion with First Chester County Corporation

acquisition |

23

23

THANK YOU! |