Attached files

| file | filename |

|---|---|

| 8-K - SIRIUS XM HOLDINGS INC. | c62903_8-k.htm |

Liberty Media Investor Meeting

Mel Karmazin, CEO

October 1, 2010

Disclaimer on

forward-looking statements

The guidance contained herein are based upon a number of assumptions and estimates that, while considered reasonable by us when

taken as a whole, are inherently subject to significant

business, economic and competitive uncertainties and contingencies, many of

which are beyond our control. In addition, the guidance is based upon specific assumptions with respect to future business

conditions, some or all of which will change.

The guidance, like any forecast, is necessarily speculative in nature and it can be

expected that the assumptions upon which the guidance is based will not prove to be valid or will vary from actual results. Actual

results will vary from the guidance

and the variations may be material. Consequently, the guidance should not be regarded as a

representation by us or any other person that the subscribers, synergies, revenue, and adjusted EBITDA will actually be achieved. You

are cautioned

not to place undue reliance on this information.

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. Such statements include,

but are not limited to, statements about future financial and operating results, the combined company’s

plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified

by

words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “intend,” “plan,” “projection,”

“outlook” or words of

similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of

SIRIUS XM’s management and are inherently subject to significant business, economic and competitive uncertainties and

contingencies, many

of which are difficult to predict and generally beyond the control of SIRIUS and XM. Actual results may differ

materially from the results anticipated in these forward-looking statements.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations

expressed in the forward-looking statement:

our dependence upon automakers and other third parties, the substantial indebtedness of

SIRIUS and XM; the useful life of our satellites; and our competitive position versus other forms of audio and video

entertainment. Additional factors that

could cause SIRIUS’ and XM’s results to differ materially from those described in the forward-

looking statements can be found in SIRIUS’ Annual Report on Form 10-K for the year ended December 31, 2009 and its Quarterly Report

on Form

10-Q for the period ending June 30, 2010 and XM’s Annual Report on Form 10-K for the year ended December 31, 2009 and its

Quarterly Report on Form 10-Q for the period ending June 30, 2010, which are filed with the Securities and Exchange Commission

(the

“SEC”) and available at the SEC’s Internet site (http://www.sec.gov). The information set forth herein speaks only as of the date hereof,

and SIRIUS and XM disclaim any intention or obligation to update any forward looking statements

as a result of developments

occurring after the date of this communication.

Tremendous Growth Since Our 2001 Launch

Despite New Competition

1994 – Internet radio streaming

2001 – Satellite radio begins service

2001 – Apple iPods introduced

2003 – HD radio broadcasts begin

2005 – MP3 connectivity in vehicles

SIRIUS XM Highlights

Expected YE subscribers of ~20.1 million

Adj. Revenue to approach $2.8 billion in

2010

Adj. EBITDA approx. $575 million in 2010

Adj. EBITDA increase of over $1.1 billion

from 2007 to 2010E

Competitive Advantages

Satellite delivery system with 99.9%

continental U.S. coverage

Over 130 channels of curated content

Long term OEM agreements

Approximately $8 billion of NOL’s

Subscription model

Focused, pure-play satellite radio

company

Growth Statistics and Improvements

1H09

1H10

CHANGE

Penetration rate

55%

60%

+500 bp

Conversion rate

44.5%

45.9%

+140 bp

Churn rate

2.1%

1.9%

-20 bp

Subscribers

18.4 mm

19.5 mm

+6%

Adj. ARPU

$10.57

$11.65

+10%

Source: Company reports

Service Changes and Fees Continue to Drive Revenue

Best of SIRIUS/XM, October 2008

$4 premium upgrade

$8.99 multi-receiver pricing, March 2009

$2.99 streaming, March 2009

U.S. Music Royalty Fee, August 2009

Infotainment services

Launched iPhone, BlackBerry and

Android-Powered Smartphone Apps

Growth Opportunity in Services

Multiple infotainment services offered and

planned:

Traffic, weather, sports tracking, fuel listings,

movie listings, airport and flight conditions, red

light cameras

Other new services and audio features in

development

Coming in 2011: Satellite Radio 2.0

Anticipated availability in retail

stores in the fourth quarter 2011

Satellite Radio 2.0 expected to

provide more channels and

increased functionality

Positive OEM reaction

SIRIUS XM’s Superior Content is a

Significant Competitive Advantage

Over 69 Channels of Commercial-Free Music

Live Coverage of Every Major Sport

The Best in News, Talk and Entertainment

RENEWALS:

NBA, Oprah Radio, Martha Stewart,

expanded Book Radio and expanded

season of Metropolitan Opera

Programming: Cost Savings

and Continued Innovation

Pop-Up Channels including

Michael Jackson Tribute,

Woodstock and

The Who

NEW PROGRAMMING:

Rosie Radio, Glenn Beck,

Fantasy Sports,

John Madden,

Cooking with Emeril and MSNBC

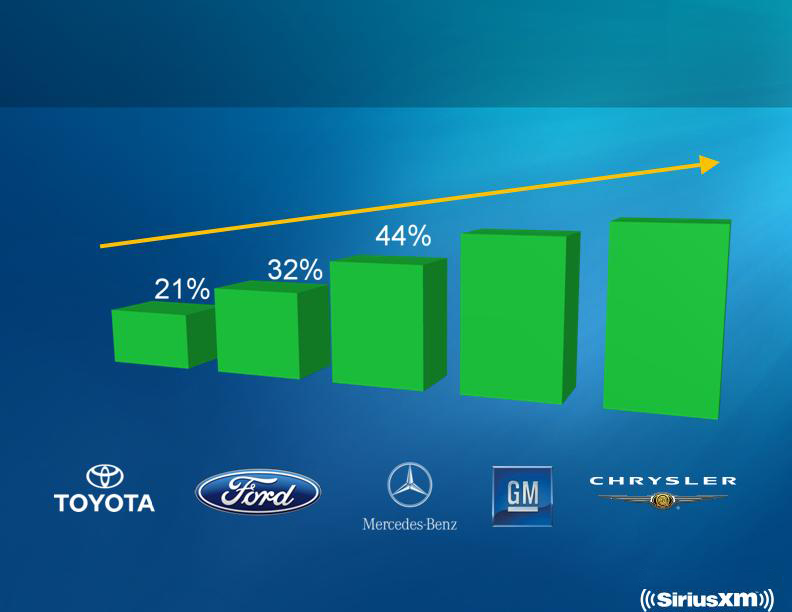

Penetration Gains at Automakers

OEM penetration as a percentage of U.S. auto sales

2006

2007

2008

2009

Source: Total US light vehicle sales per Global Insight and company estimates of SIRIUS XM

enabled sales; Represents factory and port installs only

55%

~60%

2010E

First Half 2010: Auto Sales Improve and

SIRIUS XM OEM Gross Adds Outperform

Source: Company data and industry sources

+14%

+49%

OEM Sales and

SIRIUS XM OEM Gross Adds

OEM Sales (mm)

SIRIUS XM OEM Gross Adds

Source: Company data and industry sources

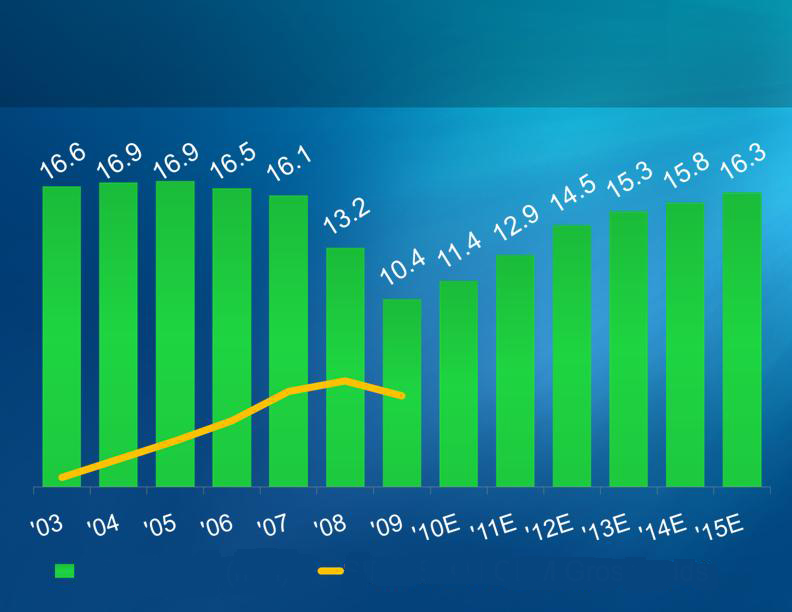

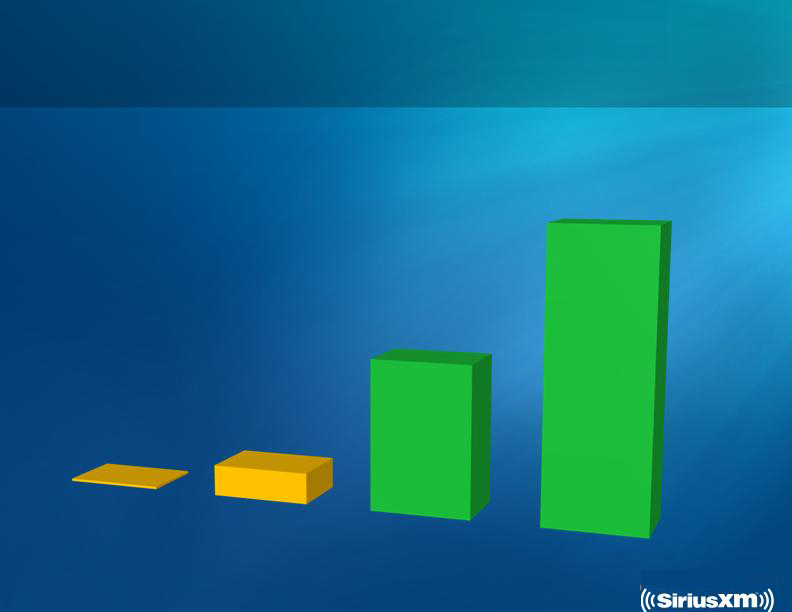

Factory-Enabled Vehicles in Operation to

Increase Dramatically (mm)

Source: Company estimates based on external industry estimates of 2010-15 automotive sales

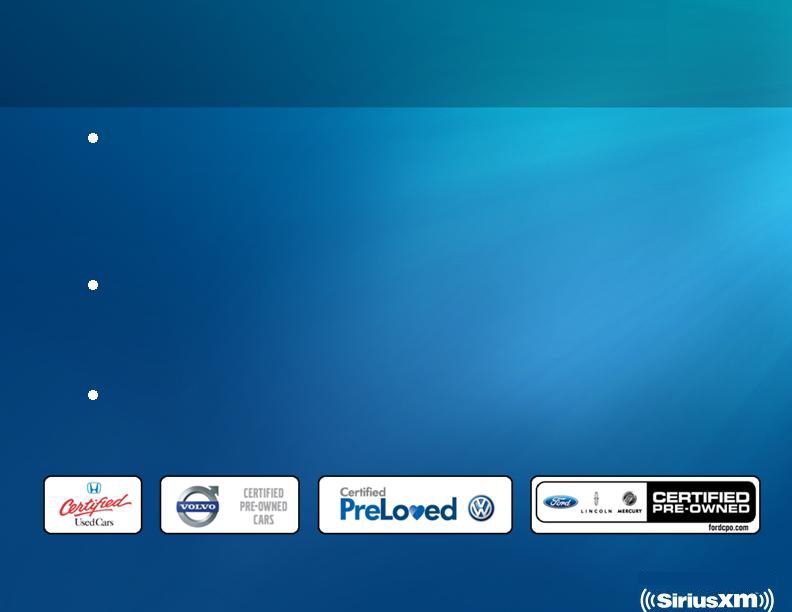

Certified Preowned Program (CPO)

Launched with

Acura, Audi, BMW,

Honda, General Motors, Mercedes-Benz,

Porsche, Volkswagen, Volvo and Ford

Additional programs expected to be

launched

OEM revenue sharing creates strong

arrangements

Continuing Growth Delivers

Record Number of Subscribers

Source: Company filings

Ending Subscribers 2003-2010E (mm)

1.6

4.4

9.2

13.7

19.0

17.3

18.8

~20.1

Focus on Subscriber Retention

Yields Results

4.0%

1.8%

1.8%

1.5%

Netflix

SIRIUS

XM

DISH

DTV 1

Source: Public filings and industry estimates

1 DTV churn shown for DTV US only

2Q10 Comparative Monthly Churn Rates

4-5%

HBO/

Showtime/

Starz

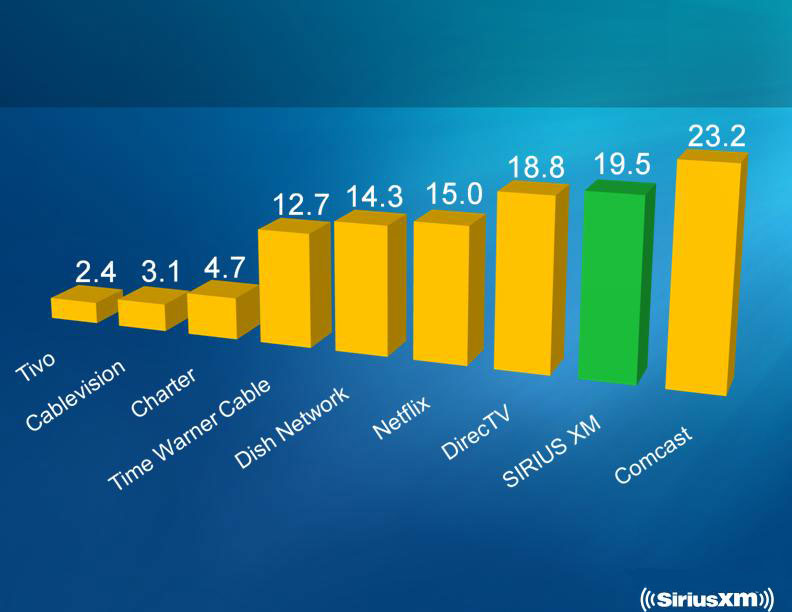

Among Largest U.S. Subscription

Media Businesses

2Q10 Total Basic Subscribers (in mm)

Source: Public filings

Significant Revenue and

EBITDA Growth

Source: Company reports

Approaching

$2,800

Arbitron Study Reveals More than

40 Million Listeners

1

Study conducted in October and November 2009. Based on a typical 2.75 hr. listening average

among subscribers in their cars; excludes music channels

SIRIUS XM is the preferred choice in the car1

SIRIUS XM

Radio Revenue

2001

2010E

Terrestrial Radio:

CCU, CBS, Citadel,

ETM, CMLS, etc.

$18 b (100%)

$15 b (80%)

IP Radio:

Last .fm, Slacker,

Pandora, Rhapsody,

etc., etc.

nil

< $1 b (5%)

Satellite Radio:

SIRIUS XM

nil

$2.8 b (15%)

TOTAL

$18.0 b

$18.8 b

Source: analyst estimates and industry reports

2010E Subscription Radio Revenue

TOTAL: $3.1 billion

Satellite Radio: $2.8 billion

Internet Radio: ~$0.3 billion

SIRIUS XM’s share of pay radio: 90%

Source: analyst estimates and industry reports

SIRIUS XM’s Superior Revenue Model

Internet

Radio

~$1.25

/ User

SIRIUS XM

$72

/ Listener

Source: Public filings and industry estimates

Terrestrial

Radio

$10-$20

/ Listener

2009E Annual Revenue

SIRIUS XM

$136

/ Subscriber

Investment Thesis: Improved Operating

Performance Lowers Borrowing Costs

February 2009: 15% secured

June 2009: 12.875% secured

August 2009: 10.375% secured

March 2010: 8.75% unsecured

Note: February 2009 transaction also included restructuring fees and equity issuance

Investment Thesis:

Operational Leverage Drives EBITDA

Contribution margin exceeds 70%

Adjusted EBITDA Margins

2008

2009

2010E

At

Maturity

(6%)

18%

21%

35%+

Source: Company reports

EBITDA margin improves dramatically as

we scale subscribers and revenue

Solid Balance Sheet and

Strong Liquidity Position

Year end 2010 cash balance should

approach $430 million based on FCF

guidance

Leverage ratio currently at

approximately 4.6x, a historic low for

our company, and will improve

No significant maturities until 2013

Investment Thesis: Completion of Satellite

Build Translates to More FCF

2005 • 2006 • 2007 • 2008 • 2009 • 2010 • 2011 • 2012 • 2013 • 2014 • 2015 • 2016 • 2017

XM

3

XM

4

SIRIUS

5

XM

5

SIRIUS

6

LAUNCH DATE

Investment Thesis: Free Cash Flow

Higher Adjusted EBITDA

+ Lower Interest Expense

+ Lower Capital Expenditures

+ Cash Savings from NOL Use

= Free Cash Flow Growth

Management Priorities

Grow subscribers

Grow revenue

Continue to innovate

Manage churn

Continue cost reductions

Manage balance sheet

Cash flow growth

Reconciliation for SIRIUS XM

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

FY2005

FY2006

FY2007

FY2008

FY2009

As Reported Total Revenue

270,350

283,017

488,443

622,183

586,979

590,829

618,656

676,173

663,784

699,761

242,245

637,235

922,066

1,663,992

2,472,638

Predecessor Financial Information

308,454

318,035

104,704

-

-

-

-

-

558,266

933,417

1,136,542

731,194

-

Purchase Price Accounting Adjustments

-

-

19,629

21,925

18,501

17,007

10,951

7,606

6,779

5,799

-

-

-

41,554

54,065

Adjusted Total Revenue

578,804

601,052

612,776

644,108

605,480

607,836

629,607

683,779

670,563

705,560

800,511

1,570,652

2,058,608

2,436,740

2,526,703

As Reported Total Operating Expenses

358,975

351,066

5,315,420

675,281

545,918

553,594

552,301

592,500

538,644

574,127

1,071,385

1,704,959

1,435,156

6,700,741

2,244,312

Predecessor Financial Information

402,138

400,753

158,770

-

-

-

-

-

1,113,801

1,336,515

1,647,979

961,663

-

Purchase Price Accounting Adjustments

-

-

(4,709,722)

47,910

55,202

57,184

64,619

63,886

62,610

64,857

-

-

-

(4,661,812)

240,891

Adjusted Total Operating Expenses

761,113

751,819

764,468

723,191

601,120

610,778

616,920

656,386

601,254

638,984

2,185,186

3,041,474

3,083,135

3,000,592

2,485,203

As Reported Income (Loss) from

Operations

(88,625)

(68,049)

(4,826,977)

(53,098)

41,061

37,235

66,355

83,673

125,140

125,634

(829,140)

(1,067,724)

(513,090)

(5,036,749)

228,326

Predecessor Financial Information

(93,684)

(82,718)

(54,066)

-

-

-

-

-

(555,535)

(403,098)

(511,437)

(230,469)

-

Purchase Price Accounting Adjustments

-

-

4,729,351

(25,985)

(36,701)

(40,177)

(53,668)

(56,280)

(55,831)

(59,058)

-

-

-

4,703,366

(186,826)

Adjusted Income (Loss) from Operations

(182,309)

(150,767)

(151,692)

(79,083)

4,360

(2,942)

12,687

27,393

69,309

66,576

(1,384,675)

(1,470,822)

(1,024,527)

(563,852)

41,500

As Reported Depreciation and

Amortization

26,906

27,113

66,774

82,958

82,367

77,158

72,100

77,826

70,265

69,230

98,555

105,749

106,780

203,752

309,450

Predecessor Financial Information

45,483

32,438

10,828

-

-

-

-

-

-

-

145,870

168,880

187,196

88,749

-

Adjusted Depreciation and Amortization

72,389

59,551

77,602

82,958

82,367

77,158

72,100

77,826

70,265

69,230

244,425

274,629

293,976

292,501

309,450

As Reported Share-based Payment

Expense

22,262

17,151

24,005

23,987

20,179

29,701

17,674

6,427

17,182

15,901

163,078

437,918

78,900

87,405

73,981

Predecessor Financial Information

17,504

12,947

4,033

-

-

-

-

-

-

-

5,966

68,046

86,199

34,485

-

Purchase Price Accounting Adjustments

-

-

1,771

958

1,321

1,302

1,125

1,053

1,001

803

-

-

-

2,729

4,801

Adjusted Share-based Payment Expense

39,766

30,098

29,809

24,945

21,500

31,003

18,799

7,480

18,183

16,704

169,044

505,964

165,099

124,619

78,782

Reconciliation for SIRIUS XM

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

FY2005

FY2006

FY2007

FY2008

FY2009

As Reported Restructuring, Impairments

and Related Costs

-

-

7,430

2,977

614

27,000

2,554

2,640

-

1,803

-

10,917

-

10,434

32,807

Predecessor Financial Information

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Purchase Price Accounting Adjustments

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Adjusted Restructuring, Impairments and

Related Costs

-

-

7,430

2,977

614

27,000

2,554

2,640

-

1,803

-

10,917

-

10,434

32,807

As Reported Impairment Goodwill

-

-

4,750,859

15,331

-

-

-

-

-

-

-

-

-

4,766,190

-

Predecessor Financial Information

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Purchase Price Accounting Adjustments

-

-

(4,750,859)

(15,331)

-

-

-

-

-

-

-

-

-

(4,766,190)

-

Adjusted Impairment of Goodwill

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Adjusted Total Operating Expenses

761,113

751,819

764,468

723,191

601,120

610,778

616,920

656,386

601,254

638,984

2,185,186

3,041,474

3,083,135

3,000,592

2,485,203

Less Adjusted:

Depreciation and Amortization

72,389

59,551

77,602

82,958

82,367

77,158

72,100

77,826

70,265

69,230

244,425

274,629

293,976

292,501

309,450

Share-based Payment Expense

39,766

30,098

29,809

24,945

21,500

31,003

18,799

7,480

18,183

16,704

169,044

505,964

165,099

124,619

78,782

Restructuring, Impairments and Related

Costs

-

-

7,430

2,977

614

27,000

2,554

2,640

-

1,803

-

10,917

-

10,434

32,807

Impairment of Goodwill

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Adjusted Cash Operating Expenses

648,958

662,170

649,627

612,311

496,639

475,617

523,467

568,440

512,806

551,247

1,771,717

2,249,964

2,624,060

2,573,038

2,064,164

Adjusted Income (Loss) from Operations

(182,309)

(150,767)

(151,692)

(79,083)

4,360

(2,942)

12,687

27,393

69,309

66,576

(1,384,675)

(1,470,822)

(1,024,527)

(563,852)

41,500

Add back Adjusted:

Depreciation and Amortization

72,389

59,551

77,602

82,958

82,367

77,158

72,100

77,826

70,265

69,230

244,425

274,629

293,976

292,501

309,450

Share-based Payment Expense

39,766

30,098

29,809

24,945

21,500

31,003

18,799

7,480

18,183

16,704

169,044

505,964

165,099

124,619

78,782

Restructuring, Impairments and Related

Costs

-

-

7,430

2,977

614

27,000

2,554

2,640

-

1,803

-

10,917

-

10,434

32,807

Impairment of Goodwill

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Adjusted EBITDA

(70,154)

(61,118)

(36,851)

31,797

108,841

132,219

106,140

115,339

157,757

154,313

(971,206)

(679,312)

(565,452)

(136,298)

462,539

Reconciliation for SIRIUS XM

ARPU is derived from total earned subscriber revenue, net advertising revenue and other subscription-related

revenue, net of purchase price accounting adjustments, divided by the

number of months in the period, divided by

the daily weighted average number of subscribers for the period. Other subscription-related revenue includes

amounts recognized on account of the U.S. Music Royalty Fee since the third quarter of 2009. Purchase

price

accounting adjustments include the recognition of deferred subscriber revenues not recognized in purchase price

accounting. ARPU is calculated as follows (in thousands, except for subscriber and per subscriber amounts):

Unaudited

For the Six Months Ended

June 30,

2010

2009

Subscriber revenue (GAAP)

$ 1,181,139

$ 1,121,151

Net advertising revenue (GAAP)

30,323

24,869

Other subscription-related revenue (GAAP)

104,641

-

Purchase price accounting adjustments

8,952

31,883

$ 1,325,055

$ 1,177,903

Daily weighted average number of subscribers

18,962,580

18,575,219

ARPU

$ 11.65

$ 10.57

Everything worth listening to is on