Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOYOTA MOTOR CREDIT CORP | dp19303.htm |

Presentation to Fixed Income Investors

September 2010

|

|

Disclaimer Disclaimer

This presentation includes certain "forward-looking statements" within the

meaning of The U.S. Private Securities Litigation Reform Act of 1995.

These statements are based on current expectations and currently available

information.

Actual results may differ materially from these expectations due to certain

risks, uncertainties and other important factors, including the risk factors set

forth in the most recent annual and periodic reports of Toyota Motor Corporation

and Toyota Motor Credit Corporation

We do not undertake to update the forward-looking statements to reflect actual

results or changes in the factors affecting the forward-looking statements.

This presentation does not constitute an offer to sell or a solicitation of an

offer to purchase any securities. Any offer or sale of securities will be made

only by means of a prospectus and related documentation.

2

|

|

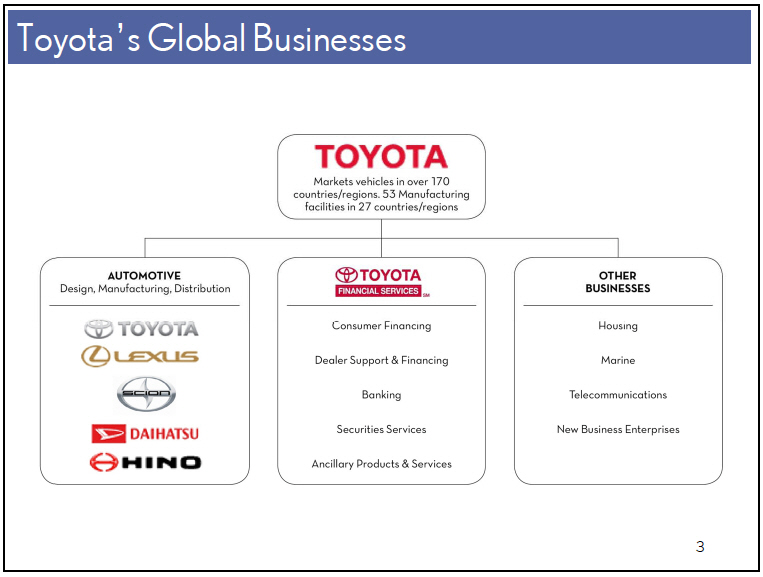

Toyota's Global Businesses

3

|

|

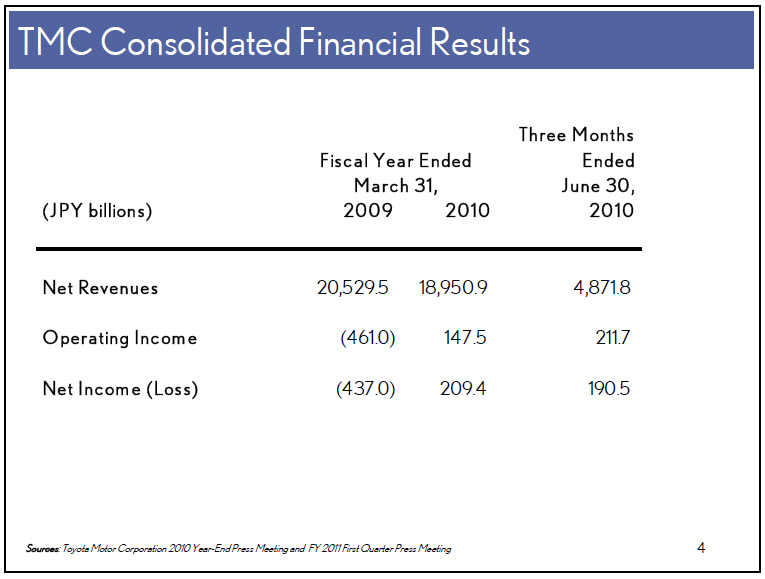

TMC Consolidated Financial Results

Three Months

Fiscal Year Ended Ended

March 31, June 30,

(JPY billions) 2009 2010 2010

-----------------------------------------------------------------

Net Revenues 20,529.5 18,950.9 4,871.8

Operating Income (461.0) 147.5 211.7

Net Incom e ( Loss) (437.0) 209.4 190.5

Sources: Toyota Motor Corporation 2010 Year-End Press Meeting and FY 2011 First

Quarter Press Meeting 4

4

|

|

TFS Group Global Presence

33 Countries andRegions Worldwide

5

|

|

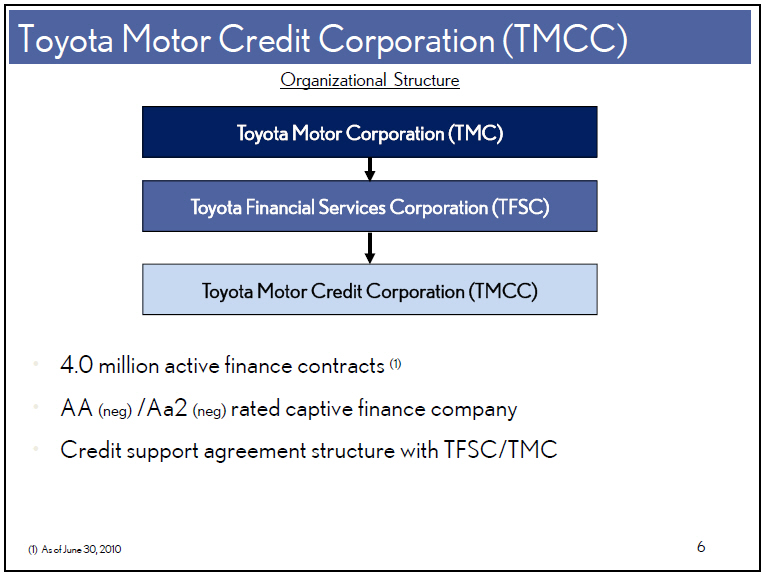

Toyota Motor Credit Corporation (TMCC)

Organizational Structure

Toyota Motor Corporation (TMC)

Toyota Financial Services Corporation (TFSC)

Toyota Motor Credit Corporation (TMCC)

4.0 million active finance contracts (1)

AA (neg) /Aa2 (neg) rated captive finance company

Credit support agreement structure with TFSC/TMC

(1) As of June 30, 2010

6

|

|

Credit Support Agreements

Securities* issued by TMCC (and various other TFSC subsidiaries) have the

benefit of a credit support agreement with TFSC

TFSC will own 100% of TMCC

TFSC will cause TMCC to maintain a tangible net worth of at least $100,000

If TMCC determines it will be unable to meet its payment obligations on any

securities, TFSC will make sufficient funds available to TMCC to ensure

that all such payment obligations are paid as due

TFSC in turn has the benefit of a credit support agreement with Toyota Motor

Corporation ("TMC")

Same key features as TFSC/TMCC credit support agreement

TMC will cause TFSC to maintain a tangible net worth of at least JPY10mm

* Securities defined as outstanding bonds, debentures, notes and other

investment securities and commercial paper.

7

|

|

TMCC Products and Services

Consumer Dealer Commercial

Finance Finance Finance Insurance

Retail Wholesale Forklift Service Agmts

Lease Real Estate Hino Medium Duty Ext. Warranty

Working Capital Class 8 Heavy Duty Guaranteed Auto

Revolving Credit Retail Protection

Lines Lease Roadside Assistance

8

|

|

TMCC Financial Performance -Select Data

(USD Millions)

Sources: TMCC March 31, 2010 10-K and June 30, 2010 10-Q 9

9

|

|

TMCC Earning Asset Composition TMCC Earning Asset Composition

Managed Assets

(USD billions)

Mar-2007 Mar-2008 Mar-2009 Mar-2010 Jun-2010

Lease Retail Sold (ABS) Wholesale and Other

Note: Segments may not sum to total due to rounding

Sources TMCC March 31, 2009 10-K, March 31, 2010 10-K and June 30, 2010 10-Q

64.5

10

|

|

Extensive Field Organization

Decentralized dealer and field support

Centralized servicing and collections

11

|

|

TMCC Financial Performance - Select Data

Three Months

Fiscal Year Ended March 31 Ended

June 30

(USD Millions) 2007 2008 2009 2010 2010

Over 60 Days Delinquent (1) 0.46% 0.59% 0.68% 0.44% 0.45%

Allowance for Credit Losses (1) (2) 0.85% 0.97% 2.51% 2.31% 1.74%

Net Credit Losses (3) 0.64% 0.91% 1 .37% 1.03% 0.54%

(1) Percentage of gross earning assets

(2) The quotient of allowance for credit losses divided by the sum of gross

finance receivables (net finance receivables less allowance for credit losses)

plus gross investments in operating leases (net investments in operating leases

less allowance for credit losses)

(3) Percentage of average gross earning assets annualized

Note: All percentage figures calculated for years 2007, 2008 and 2009 were based

on a 150-day charge-off policy, which was changed to 120 days in fiscal 2010

Sources: TMCC March 31, 2009 10-K, March 31, 2010 10-K and June 30, 2010 10-Q

12

|

|

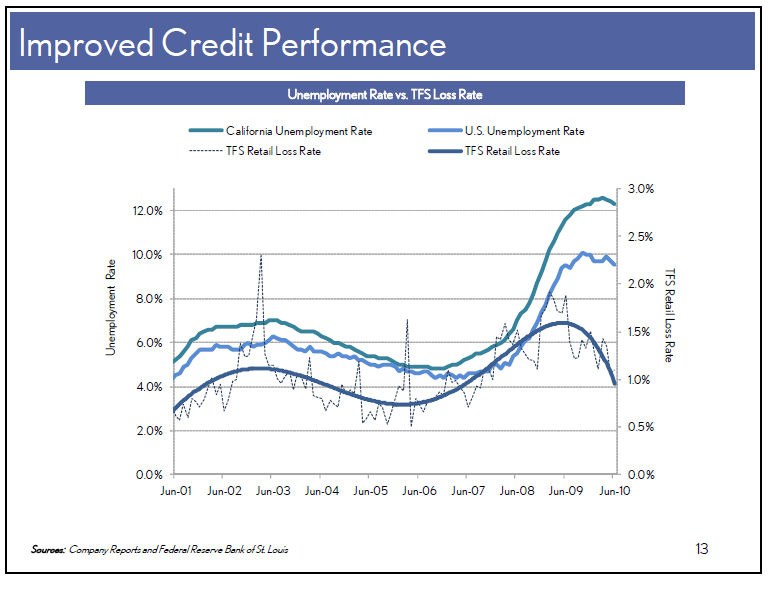

Improved Credit Performance

Unemployment Rate vs. TFS Loss Rate

Sources: Company Reports and Federal Reserve Bank of St. Louis

|

|

TMCC Funding Programs

14

|

|

Exceptional Liquidity Exceptional Liquidity

A-1+ / P-1 Direct Commercial Paper Program

Access to various domestic and international term markets

Billions of additional capacity in Global Benchmark Markets

Over USD 35 billion in salable retail loan receivables

USD 3.6 billion Short-term Investment Portfolio*

Backed by USD 13 billion multi-party back-stop credit facilities (USD 5

billion 364-day; USD 8 billion 5-year)

Inter-company lending infrastructure

Credit Support Agreements: TMCC - TFSC - TMC

* Average balance for three months ended June 30, 2010

Source: TMCC June 30, 2010 10-Q

15

|

|

TMCC Funding Program Objectives TMCC Funding Program Objectives

TMCC is committed to:

Maintaining funding diversity and exceptional liquidity

Issuing into strong demand with attractive deals

Identifying and developing new markets and investor relationships

Responding quickly to opportunities with best-in-class execution

16

|

|

Diversity in Debt Offerings

Term Debt Outstanding

By Deal Type By Currency

units in USD millions units in USD millions

As of June 30, 2010

Source: Company Reports

17

|

|

Funding Flexibility

Focus on More Diverse Maturities in USD Issuance(1)

FY '08 FY '09 FY '10 FYTD 11(2)

(1) Unsecured U.S. MTN issuance, excluding Structured Notes and Retail Notes.

(2) As of August 31, 2010

Source: Company Reports

18

|

|

Key Investment Highlights Key Investment Highlights

Financial strength supported by strong credit ratings

Transparent business model with exceptional liquidity

Rational funding programs with long term perspective

Diversification in bond offerings

Focus on proactively meeting needs of market

Strong emphasis placed on flexibility and responsiveness

19

|

|

|

|

|