Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - GOLDEN RIVER RESOURCES CORP. | a6447668_ex21.htm |

| EX-31.1 - EXHIBIT 31.1 - GOLDEN RIVER RESOURCES CORP. | a6447668_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - GOLDEN RIVER RESOURCES CORP. | a6447668_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - GOLDEN RIVER RESOURCES CORP. | a6447668_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - GOLDEN RIVER RESOURCES CORP. | a6447668_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

|

|

For the fiscal year ended: June 30, 2010

|

|

|

or

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

|

|

For the transition period from: _____________ to _____________

|

|

Commission File Number 0-16097

GOLDEN RIVER RESOURCES CORPORATION

(Exact name of Registrant as specified in its charter)

———————

|

Delaware

|

98-0079697

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

|

of Incorporation or Organization)

|

Identification No.)

|

Level 8, 580 St Kilda Road Melbourne, Victoria, 3004, Australia

(Address of principal executive offices) (Zip Code)

011 (613) 8532 2860

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

———————

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| o |

Yes

|

x

|

No

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| o |

Yes

|

x

|

No

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| x |

Yes

|

o

|

No

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for any such shorter period that the registrant was required to submit and post such file).*The registrant has not yet been phased into the interactive data requirements.

| o |

Yes

|

o

|

No

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

|

o

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer

|

o |

Accelerated filer

|

o | |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

| o |

Yes

|

x

|

No

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value based on the average bid and asked price on the over-the-counter market of the Registrant’s common stock, (“Common Stock”) held by non-affiliates of the Company was US$781,795 as at December 31, 2009.

There were 243,593,440 outstanding shares of Common Stock as of September 28, 2010.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

| o |

Yes

|

o

|

No

|

DOCUMENTS INCORPORATED BY REFERENCE

Not Applicable

INDEX

|

4

|

||

|

53

|

||

|

58

|

||

|

58

|

||

|

58

|

||

|

58

|

||

|

59

|

||

|

60

|

||

|

61

|

||

|

67

|

||

|

67

|

||

|

67

|

||

|

68

|

||

|

68

|

||

|

69

|

||

|

71

|

||

|

74

|

||

|

75

|

||

|

77

|

||

|

81

|

||

Item 1 Business

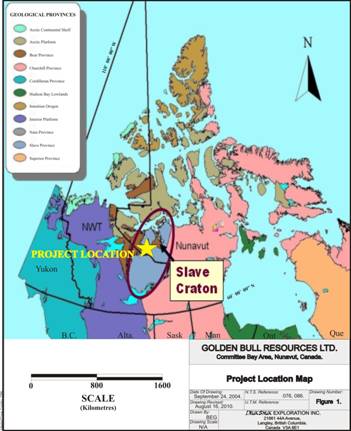

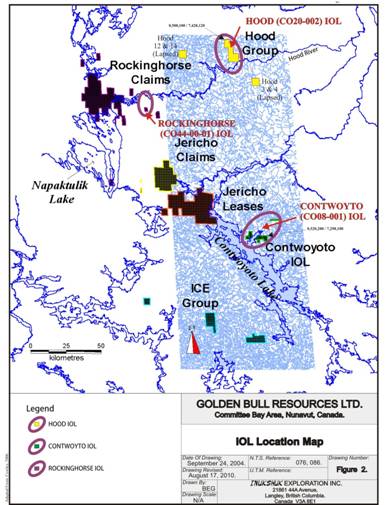

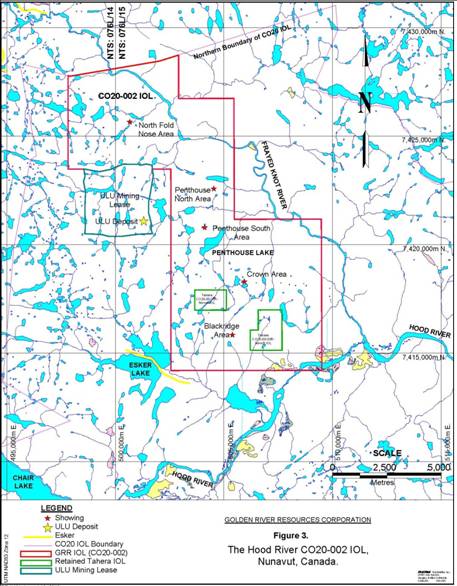

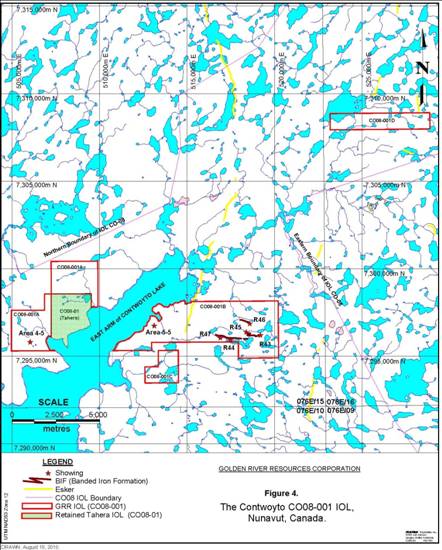

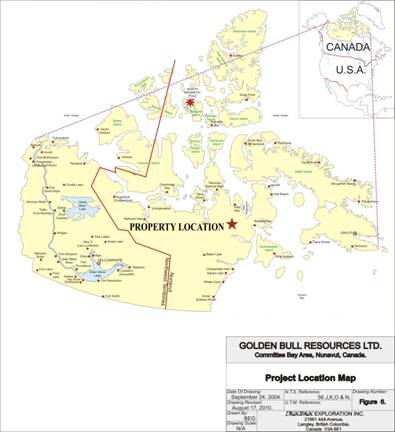

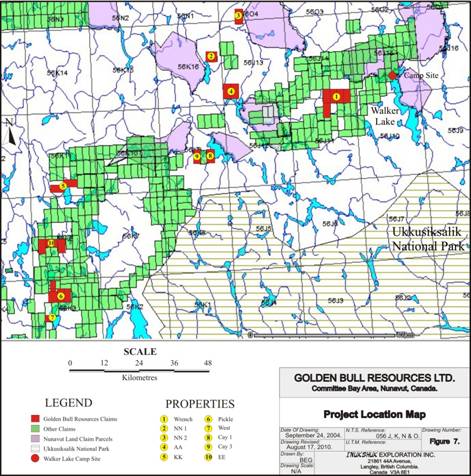

General

Our name is Golden River Resources Corporation and we sometimes refer to ourselves in this Annual Report as “Golden River Resources”, the “Company” or as “we,” “our,” or “us.” We changed our name from Bay Resources Ltd to Golden River Resources in March 2006. We are an exploration stage mining company. Our objective is to exploit our interest in the mineral claims in Nova Scotia and Nunavut, Canada which are in the Slave Craton and in the Committee Bay Greenstone Belt. Our principal exploration target is for gold and we are seeking to determine whether adequate gold reserves are present on the property covered by our claims to develop an operating mine. We are in the initial stages of our exploration program on the Slave and Committee Bay properties and have not yet identified any ore reserves. There are some base metal ore reserves on the Nova Scotia properties

We hold the interests in Nova Scotia through our subsidiary, Acadian Mining Corporation, a Canadian corporation (“Acadian”), in which we held a 68.7% interest at June 30, 2010 (71.5% as of the date of this Report); in the Slave Craton directly; and our wholly owned subsidiary named “Golden Bull Resources Corporation” (formerly 4075251 Canada Inc.) holds the interests in the Committee Bay Greenstone Belt. Our wholly-owned subsidiary is referred to in this Annual Report as “Golden Bull”.

We sometimes refer to our claims collectively in this Annual Report as either the “Fifteen Mile Stream”, “Beaver Dam”, “Tangier”, “Goldenville”, “Forest Hill” and “Scotia Mine” which are all properties owned by Acadian; “Slave Properties” held by us or the “Committee Bay Properties” held by Golden Bull. Our claims are registered in the Mining Recorders Office in the relevant Districts of Canada and give us the right to explore and mine minerals from the property covered by the claims.

We were incorporated in the State of Delaware on February 1, 1973. We commenced our mineral exploration activities in 2002. Prior thereto, we were engaged in a number of other business activities that have been discontinued. Our executive offices are at Level 8, 580 St. Kilda Road, Melbourne, Victoria 3004 Australia and we have an office at 1 Yonge Street, Suite 1801, Toronto, Ontario M5E 1W7, Canada. Our website location is www.goldenriverresources.com. Information included on our website shall not be deemed to be incorporated in this Annual Report. Our wholly owned subsidiary, Golden Bull, was incorporated on May 27, 2002 in the Province of Ontario, Canada and is licensed to do business in the Northwest Territories and Nunavut Canada.

Currency

Prior to July 1, 2009, the Company’s functional and reporting currency was the Australian dollar and its subsidiary, Golden Bull Resources Corporation’s functional currency was the Canadian dollar. However, as a result of the purchase of the controlling interest in Acadian Mining Corporation in Canada in July 2009, the Company determined that its fiscal 2010 revenue and expenses were going to be primarily denominated in Canadian dollars (CDN$). ASC Topic 830 “Foreign Currency Matters” states that the functional currency of an entity is the currency of the primary economic environment in which the entity operates. Accordingly the Company determined that from July 1, 2009 the functional and reporting currency of the Company was the Canadian dollar. Assets, liabilities and portions of equity were translated at the rate of exchange at July 1, 2009 and portions of equity were translated at historical exchange rates. Revenue and expenses were translated at actual rates. Translation gains and losses were included as part of accumulated other comprehensive loss.

4

Restatement of comparative numbers was made for the change in functional and reporting currency. The change was adopted prospectively beginning July 1, 2009 in accordance with ASC Topic 830.

References to dollars are to Canadian dollars (CDN$) unless otherwise indicated as being Australian dollars (A$) or United States dollars (US$). For the convenience of the reader, the Canadian Dollar figures for the year ended June 30, 2010 have been translated into United States Dollars (US$) using the rate of exchange at June 30, 2010 of CDN$1.00=US$0.9542.

History of the Company

Our predecessor corporation, Bayou Oil, was incorporated under the laws of Minnesota in 1973 and since that time it had a number of activities that have been ceased.

On February 13, 1998, we incorporated a 100% owned subsidiary, Baynex.com Pty Ltd (formerly Bayou Australia Pty Ltd), a corporation incorporated under the laws of Australia.

On June 29, 1999 we undertook a reverse stock split on a 1:20 basis and amended our Articles of Incorporation to amend the par value of our shares from US$0.15 cents to US$0.0001 cents per share. On September 27, 1999 we changed our name from Bayou International, Ltd to Baynet, Ltd.

In May 2000, we commenced work on the development of a B2B mining portal however, this was abandoned as it was considered uneconomic.

On August 21, 2000 we incorporated a new wholly owned subsidiary, Bay International Pty Ltd (now known as Bay Resources (Asia) Pty Ltd), a corporation incorporated under the laws of Australia. In October 2000, we changed our name to Bay Resources Ltd, and in March 2006, we changed it to Golden River Resources Corporation.

During fiscal 2001, we conducted a due diligence review of St. Andrew Goldfields Ltd (“St. Andrew”) with a view to taking a substantial investment in St. Andrew. Following the conclusion of the review, we decided not to proceed with the investment.

In May 2002, we incorporated a new wholly owned subsidiary, Golden Bull Resources Corporation (“Golden Bull”) (formerly 4075251 Canada Inc.), a corporation incorporated under the laws of Canada. Golden Bull is the vehicle that will be used by the Company to undertake exploration activities for gold on the Committee Bay Properties in Canada.

During the 2002 fiscal year we continued to expand our gold exploration business by:

|

|

(i)

|

entering into an agreement to explore for gold on Tahera’s extensive property interests on the Slave Craton in northern Canada; and

|

|

|

(ii)

|

making application via Golden Bull, for properties in the highly prospective Committee Bay Greenstone Belt in Nunavut, Canada.

|

In October 2002 we entered into an agreement (via our wholly owned subsidiary Bay Resources (Asia) Pty Ltd) with the Tibet Bureau of Geology and Minerals Exploration Development, China to earn a minimum 51% interest in the Xigaze copper belt running in a 200 kilometre east-west trend either side of Lhasa. However, in February 2003 we decided to withdraw from these arrangements as a result of further hurdles being placed before us by the Chinese authorities that were not known at the time of entering into the agreement.

In April 2008 the Company deregistered 100% owned inactive subsidiaries Baynex.com Pty Ltd and Bay Resources (Asia) Pty Ltd, both companies incorporated under the laws of Australia.

5

On March 17, 2009, the Company announced that it had reached agreement with Acadian (TSX: ADA) to subscribe in a private placement transaction for up to 338,111,334 common shares ("Offering") in Acadian for aggregate gross investment of up to CDN$10 million. The Offering was contemplated to close in two or more tranches. Following closing of all tranches, Golden River will hold 68.45% of Acadian.

The closing of the first tranche, for an aggregate of CDN$1.0 million (38,111,334 shares) was subject to receipt of the required regulatory approvals, including the approval of the Toronto Stock Exchange which occurred in early June 2009. The Company held a 19.9% interest in Acadian at June 30, 2009.

The remaining CDN$9 million of the Offering (300,000,000 shares at CDN$0.03 per share) closed in several tranches upon the receipt of all necessary regulatory approvals, approval of the shareholders of Acadian and the satisfaction of certain other conditions precedent, including completion of due diligence by the Company. Acadian obtained approval from its shareholders at its annual meeting in June 2009. Throughout July to October 2009, further closings for an aggregate of CDN$9 million occurred. In July 2010, the Company subscribed for a further 49,233,866 shares in Acadian at a cost of CDN$1,477,016 taking its interest in Acadian to 71.5%.

In early July 2009, the Company announced that it had closed a transaction to purchase from RAB Special Situations (Master) Fund Limited (“RAB”) the special warrant to purchase 10,000,000 shares of Common Stock in the Company for no additional consideration expiring on June 9, 2016; and the warrant to purchase 20,000,000 shares of Common Stock in the Company at an exercise price of $0.1542 per share ($0.0364541, per share as adjusted) expiring on April 30, 2011, held by RAB, for an aggregate purchase price of US$500,000. Closing occurred in early July 2009. Following settlement of the purchase, the Company cancelled the Special Warrant to purchase 10,000,000 shares of Common Stock in the Company for no additional consideration expiring on June 9, 2016, and the Warrant to purchase 20,000,000 shares of Common Stock in the Company at an exercise price of $0.1542 per share ($0.0364541, per share as adjusted) expiring on April 30, 2011.

During the fiscal year ended June 30, 2010, the Company entered into a subscription agreement with Northern Capital Resources Corp (“NCRC”) whereby NCRC would subscribe for 85 million shares at an issue price of US$0.10 per share to raise US$8.5 million. Subsequent to June 30, 2010, NCRC purchased an additional US$1.4 million in the Company’s shares at the same purchase price The proceeds have been utilized to help fund the acquisition of shares in Acadian and for working capital purposes. The Company’s Chairman, Chief Executive Officer and President, Mr. Joseph Gutnick, is the Chairman and Chief Executive Officer of NCRC and certain companies with which Mr. Gutnick is associated own approximately 45.67% of the outstanding common stock of NCRC. In addition, Legend International Holdings, Inc. (“Legend”), of which Mr. Gutnick is the Chairman and Chief Executive Officer, owns 26.08% of NCRC. NCRC currently holds approximately 92.02% of the outstanding common stock of the Company.

Effective May 10, 2010, the Company closed a transaction to purchase mineral properties in the Slave Craton of Northern Canada in accordance with terms originally agreed to in June 2008. Since 2002, the Company has held the rights to undertake gold and base metal exploration on the Slave Properties held by Tahera Diamond Corporation (“Tahera”) in Northern Canada, subject to entering into a separate access agreement each time Golden River Resources wished to undertake exploration. Under the transaction closed with Tahera, the Company has purchased these properties for a consideration of CDN$86,000 and the issue to Tahera of 3,000,000 shares of common stock in the Company. Tahera has retained rights to all diamond mineralization within the properties. As a result of the transaction, Golden River Resources now has unfettered access to these properties.

On September 2, 2010, the Board of Directors of the Company and the holder of a majority of the outstanding shares of Common Stock approved a reverse stock split of the Common Stock of 10:1 and approved the mailing of an Information Statement to stockholders in relation to the reverse stock split. The Information Memorandum will be mailed to stockholders on or about September 30, 2010 and is effective 21 days after mailing.

6

It is the policy of our Board of Directors that we will not engage in any activities which would subject us to registration and reporting requirements of the Investment Company Act of 1940.

SEC Reports

We file annual, quarterly, current and other reports and information with the SEC. These filings can be viewed and downloaded from the Internet at the SEC’s website at www.sec.gov. In addition, these SEC filings are available at no cost as soon as reasonably practicable after the filing thereof on our website at www.goldenriverresources.com. These reports are also available to be read and copied at the SEC’s public reference room located at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330.

DESCRIPTION OF BUSINESS

Introduction

We are an exploration stage company engaged in the identification, acquisition, exploration and development of mining prospects believed to have gold mineralization. The main objective is to explore, identify, and develop commercially viable prospects over which we have rights that could produce revenues. These types of prospects may also contain mineralization of metals often found with gold, such as platinum and silver and other ‘base metals’ (copper, nickel, lead, zinc) which also may be worth processing. Exploration and development for commercially viable mineralization of any metal includes a high degree of risk which careful evaluation, experience and factual knowledge may not eliminate, and therefore, we may never produce any revenues.

We hold interests in Nova Scotia via our investment in Acadian; in the Slave Craton directly; and Golden Bull holds the interests in the Committee Bay Greenstone Belt. We are in the initial stages of exploration programs and have not yet identified any ore reserves.

Please note that the Glossary in Appendix A to the Annual Report contains definitions for the geological and other specialized terms used in this section.

Acadian Mining Corporation

On March 17, 2009, we entered into an Agreement with Acadian to complete a private placement. On completion, Golden River Resources held a 68.7% interest in Acadian. Since June 30, 2010, we have increased our interest in Acadian to 71.5%.

Cautionary Note to U.S. Investors Regarding Canadian Mining Terminology

As a Canadian public company listed on the Toronto Stock Exchange, Acadian is required to publicly disclose in Canada information about its mining properties in compliance with Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects (“NI43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended.

The terms “mineral reserve”, “proven mineral reserve” and “probably mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”) under the Securities Act. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

7

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7, are normally not permitted to be used in reports and registration statements filed with the SEC and have not been included in this Report. In addition, disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures and such unit measures have not been included in this Report.

Acadian – Gold Assets

Acadian is focused on exploring and developing a large portfolio of gold properties in Nova Scotia, Canada totalling approximately 66,000 hectares. Five of these are advanced properties with Canadian National Instrument 43-101 compliant gold mineralized material, two of which are being explored/developed as potential bulk tonnage-open pit deposits.

Acadian’s principal gold activities are focused on exploring and developing its five advanced properties, Beaver Dam, Forest Hill, Goldenville, Tangier and 15 Mile stream, and to a lesser extent on its other gold properties. The advanced properties collectively host measured and indicated mineralized material of 626,000 ounces of mineralized material as follows:

Gold Mineralized Material – Tonnage And Grade (Cut)

|

Property

|

Threshold

|

Tonnes

|

Grade g/t

|

||

|

Beaver Dam

|

0.3 g/t/3m

above 200m

|

9,080,000

|

1.53

|

||

|

1.0 g/t3m

below 200m

|

10,400,000

|

1.51

|

|||

|

Forest Hill

|

3.5 g/t/1.2m

|

225,000

|

14.91

|

||

|

383,000

|

11.93

|

||||

|

Goldenville

|

3.5 g/t/1.2m

|

63,000

|

14.72

|

||

|

385,000

|

12.38

|

||||

|

Tangier

|

3.5 g/t/1.2m

|

134,000

|

9.67

|

||

|

271,000

|

12.08

|

||||

|

15 Mile Stream

|

0.7 g/t

|

3,800,000

|

1.66

|

Introduction

Acadian is a Halifax-based corporation continued under the Canada Business Corporations Act. Acadian is engaged in the exploration, acquisition and development of gold, lead, zinc and barite properties primarily in the Province of Nova Scotia. Its current focus is to explore and develop its large portfolio of gold properties in Nova Scotia totaling approximately 66,000 hectares. Five of these are advanced properties with National Instrument 43-101 compliant gold mineralized materials, two of which (Beaver Dam and Fifteen Mile Stream) are being explored/developed as potential bulk tonnage-open pit deposits.

Acadian's wholly-owned subsidiary, ScoZinc Limited ("ScoZinc"), owns the lead-zinc property and mill known as the Scotia Mine situate in Gays River, Nova Scotia. The Scotia Mine was put into operation in 2007 and operated as an open pit mine. As a result of falling zinc and lead prices in 2008, mining operations were ceased on March 24, 2009 and the mine was placed on care and maintenance status. ScoZinc applied for, and was granted, protection under Canada's Creditors Arrangement Act ("CCAA") on December 22, 2008. The protection was subsequently extended to May 22, 2009 and, on May 28, 2009, following the creditor's endorsement of ScoZinc's proposed plan of arrangement ("Plan"), the Supreme Court of Nova Scotia ratified the Plan. ScoZinc completed the Plan in accordance with its terms on July 9, 2009.

8

Acadian is now focused on developing five advanced gold properties, Beaver Dam, Fifteen Mile Stream, Tangier, Forest Hill and Goldenville, which form the core holdings of the Scotia Goldfields project. Each of the five advanced properties host gold mineralized materials described in the Technical Reports prepared in compliance with National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"). Acadian is bringing a new approach to the development of Nova Scotia gold deposits by pursuing a multiple mine, central processing, managing and servicing strategy.

To date, Acadian has 7 material properties:

(i) Beaver Dam gold property, located in Halifax County, Nova Scotia;

(ii) Fifteen Mile Stream gold property, located in Halifax County, Nova Scotia;

(iii) Tangier gold property, located in Halifax County, Nova Scotia;

(iv) Forest Hill gold property, located in Guysborough County, Nova Scotia;

(v) Goldenville gold property, located in Guysborough County, Nova Scotia;

(vi) ScoZinc lead-zinc property, located in Gays River, Nova Scotia; and

(vii) Getty lead-zinc property, located in Hants County, Nova Scotia

Each of the material properties is described below.

Beaver Dam

Introduction

Beaver Dam is the primary focus of Acadian's gold program as it is potentially a key property in Acadian's central processing and servicing strategy. The Beaver Dam property consists of 36 contiguous mineral exploration claims held 100% by Acadian under exploration license 05920 and covers approximately 582.5 hectares of surface area in Halifax County, Nova Scotia, approximately 135 km east of the provincial capital city of Halifax.

The Beaver Dam property has been the focus of extensive past exploration, including surface diamond drill holes completed on the property since 1977, and underground development and bulk sampling completed in the late 1980s.

The current Beaver Dam Technical Report effective date of July 16, 2007, discloses an updated mineralized material estimate for the Beaver Dam deposit based all complied historical data and exploration and metallurgical results completed by Acadian during the 2005 and 2006 drill programs. This includes 238 historic and underground drill holes and 133 diamond drill holes drilled by Acadian. In addition, the results for 6 NQ diamond drill holes from the 2007 drill program and metallurgical results for 3 PQ diamond drill holes from the 2006 drill program were not included in this mineralized material estimate. A three dimensional block model was developed for the deposit using Gemcom Surpac 6.0 modeling software. Mineralized materials were estimated by inverse distance cubed methodology with a minimum block grade threshold of 0.30g/t and high grade capping of composites at 14g/t or 25g/t depending on the spatial domain. Results of the mineralized material estimation program are presented below and are considered compliant with Canadian NI 43-101.

Property Description and Location

The Beaver Dam gold property is 100% owned by Acadian and comprises 36 contiguous mineral exploration claims held by Acadian under exploration License 05920. The property covers approximately 582.5 hectares of surface area in Halifax County, Nova Scotia, approximately 135 km east of the provincial capital city of Halifax.

9

Tabulation of Acadian Exploration Licenses at Beaver Dam

|

Current

License

No.

|

NTS

Sheet

|

Tract

|

Claims

|

No. of Claims

|

Renewal Date

|

|

05920

|

11 E 2 A

11 E 2 A

11 E 2 A

11 E 2 A

|

59

60

61

62

|

JKLM NOPQ

EFGHJKLMNOPQ

ABCDEFGH

ABCDEFGH

|

8

12

8

8

|

March 22, 2010

|

|

TOTAL

|

36

|

The 36 claims of License 05920 form the specific focus of this report as the bulk of most previous exploration and mining activities and all current diamond drilling were carried out within this claim block.

Previous License 00047 was acquired from Westminer and subject to a pre-existing sliding scale royalty, payable to Acadia Mineral Ventures Limited ("AMV"), an unrelated company. The variable return net smelter royalty (NSR) payable to AMV is dependent on average mined ore grade ranging from 0.6% (at 4.7g/t or less) to a maximum of 3.0% (at 10.9g/t or more). $300,000 is available as credit against future royalties at a maximum of 50% per royalty payment, payable twice a year.

Previous License 04516 was purchased from Henry Schenkels and is subject to a sliding scale net smelter royalty. A 0.5% royalty is payable if gold is more than $265.01 US per ounce, to a maximum of 2% when the price goes above $320 US per ounce. Additional royalties exist for silver, copper, lead and zinc credits.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Beaver Dam Project is located in east central Nova Scotia on NTS 11E/02. Access from Halifax is by Highway 7 along the eastern shore for 120 kilometers to Sheet Harbour and then traveling northwest on Highway 224 between Sheet Harbour and Middle Musquodoboit for a distance of 18 kilometers. A gravel logging road runs northeast to Cameron Flowage, leading to the Beaver Dam Project, a distance of 7 kilometers from Highway 224. The town of Sheet Harbour is the nearest supply centre.

There is little evidence of the former mining activity at the site. The site was completely rehabilitated by Westminer upon closure of the mine in 1989. The portal and open cut mines were filled with waste rock, backfilled with soil and contoured. Ore and waste storage pads were covered with soil, contoured and seeded. A water control structure still remains on the property and water outflow has been dammed by beavers. All non-bedrock waste material was removed from the site. A power line and an onsite generator utilized during the previous operations have been removed from the site so no utilities are currently available.

The Beaver Dam Project is in an area of low topographic relief, with most of the area being at 140 meters elevation with scattered drumlins reaching 160 meters in elevation. Drainage is to the southeast along a number of poorly drained streams and shallow lakes. There are a number of boggy areas within the property. Vegetation consists of spruce, fir and some hardwood. Logging has been widely carried-out, more recently including clear-cutting in the immediate area of the deposit.

Eastern Nova Scotia is characterized by northern temperate zone climatic conditions moderated by proximity to the Atlantic Ocean. Distinct seasonal variations occur, with winter conditions of freezing and substantial snowfall expected from late November through late March. Spring and fall seasons are cool, with frequent periods of rain. Summer conditions can be expected to prevail from late June through early September, with modest rainfall and daily mean temperatures in the 15 to 20 degree Celsius range. Maximum daily summer temperatures to 30 degrees Celsius occur, with winter minimums in the minus 25 to minus 30 degrees Celsius range. Mineral exploration field programs can be efficiently undertaken during the period May through late November, while winter programs can be readily accommodated with appropriate allowance for weather delays.

10

Mineralized Material Estimates

Compiled and interpreted results from 238 historic surface and underground diamond drill holes, results of specific historic underground sampling programs, and 133 diamond drill holes completed by Acadian during the 2005 and 2006 drill programs were assessed for use in developing a mineralized material estimate for the Beaver Dam property.

The Tables below present cut and uncut gold grade estimates and corresponding tonnage estimates prepared for the Beaver Dam property as at July 16, 2007. These reflect combined results from the Main Zone Central and Main Zone Envelop, the Mill Shaft Zone and the area 600 meters to the north of the main mine area known as the North Zone.

Beaver Dam Mineralized Material Estimate 0.30 g/t Cutoff (Cut)

|

Class

|

Tonnes*

|

Gold g/t

|

|

|

Main Zone Central

|

9,080,000

|

1.53

|

|

|

Total M+ID

|

9,080,000

|

1.53

|

Beaver Dam Mineralized Material Estimate 0.30 g/t Cutoff (Uncut)

|

Class

|

Tonnes*

|

Gold g/t

|

|

|

Main Zone Central

|

M + ID

|

9,090,000

|

2.01

|

|

Total M+ID

|

M + ID

|

9,090,000

|

2.01

|

* Rounded

Fifteen Mile Stream

The Fifteen Mile Stream Property consists of three mineral licenses (06134, 06135 SL11/90) held by 6179053 Canada Incorporated (“6179053”) (a 100% owned subsidiary of Acadian) subject to a 1% net smelter royalty, which cover the main gold district. A NI 43-101 compliant technical report was completed on effective date of May 27, 2008. Several additional licenses held by Acadian surround the licenses of 6179053 Canada Limited and cover lands considered prospective for additional gold mineralization.

Introduction

Hudgtec Consulting Limited (“Hudgtec”) was retained in 2006 by 6179053 to complete an independent technical report and mineralized material estimate of its Fifteen Mile Stream Property in accordance with National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards on mineralized material and mineral reserves.

Work by Hudgtec included a comprehensive review and compilation of hardcopy and digital historic data on the property provided by 6179053 as well as additional historic and technical information located in the public record at NSNDR.

Property Description and Location

The Fifteen Mile Stream Property is located in eastern Halifax County in central Nova Scotia, approximately 95km northeast of the provincial capital, Halifax (Figure 1.0a 6179053 is the registered holder of 2 exploration and one special license (SL 11/90) that form its Fifteen Mile Stream Property.

11

Tabulation of Acadian's Exploration Licenses at Fifteen Mile Stream

|

License No.

|

NTS Sheet

|

Tract

|

Claims

|

No. of Claims

|

Renewal Date

|

|

06134

|

11 E 02 D

11 E 02 C

11 E 02 C

11 E 02 C

11 E 02 C

|

1

23

24

12

13

|

JKLMNOPQ

J

ABCDEFGHJKLM

LMNO

CDEF

|

29

|

May 20, 2010

|

|

06135

|

11 E 02 D

|

2

|

PQ

|

2

|

July 25 2010

|

|

SL11/90

|

11 E 02 D

|

23

|

ABCDEFGH

|

8

|

December 11 2010

|

|

05929

|

11 E 01 C

|

13

|

OP

|

2

|

April 8 2010

|

|

06812

|

11 E 02 D

|

1

|

FGH

|

3

|

April 8 2010

|

|

08226

|

11 E 02 D

11 E 02 D

11 E 02 D

11 E 02 D

|

1

11

12

14

|

ABC

JKLMNOPQ

ABCDEFGHJKPQ

AB

|

25

|

May 5 2010

|

|

08365

|

11 E 02 D

|

24

|

O

|

1

|

August 18 2010

|

|

08371

|

11 E 02 D

|

2

|

GH

|

2

|

August 21 2010

|

|

08443

|

11 E 02 D

11 E 02 D

|

23

24

|

KLOPQ

N

|

6

|

June 20 2010

|

|

08445

|

11 E 01 C

11 E 02 D

11 E 02 D

11 E 02 D

11 E 02 D

11 E 02 D

11 E 02 D

|

13

14

15

35

36

24

25

|

ABGHJKLMNQ

EFGHJKLMNOPQ

N

ABCDEFGH

ABCDEFGH

PQ

ABGH

|

45

|

April 18 2010

|

|

05930

|

11 E 01 C

|

14

|

CD

|

2

|

April 8 2010

|

|

Total

|

125

|

The three licenses held by 6179053 comprise a total of 39 contiguous claims covering a surface area of approximately 631 hectares. Mineral exploration licenses are issued by NSDNR under the Resources Act of 1990. Staking of claims in Nova Scotia is based on an NTS based map staking system and these claims have not been legally surveyed. Yearly assessment expenditures and renewal fees are required in order to keep the claims in good standing.

Exploration License 06135 was purchased by 6179053 from Meguma Resource Enterprises Inc. Meguma retains a 1% net smelter royalty agreement of which, 6179053 may elect at its sole discretion to purchase for $250,000, payable within 30 days of such election.

Records at the Registry and Information Management Services Division in Halifax confirmed the two main landowners recorded on Pan East documents from the 1980s as MacGregor Properties Ltd. of Halifax and the Crown. Two of the three main zones of mineralization, the Hudson and Egerton-MacLean occur on the MacGregor lands. The third zone of mineralization, the 149 East Zone is situated on land owned by the Crown.

No special governmental permits or approvals (apart from landowner or surface rights permission) are required to conduct exploration and drilling activities on the property. Drilling notification is required to be registered with NSDNR prior to commencement of any drilling activity. Additional permits are required prior to conducting trenching, mechanized bulk sampling or mining on the property.

12

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access to the site is via Highway 374 which connects several large towns in Pictou County (eg., Stellarton, New Glasgow) with the coastal community of Sheet Harbour, a small town of a few hundred inhabitants located about an hour drive east of Halifax. A well maintained logging road located approximately 30 km north of Sheet Harbour and 50km south of Stellarton runs east off Highway 374 and effectively splits the property into northern and southern halves. Exploration supplies and most other items, including drilling and excavation contractors related to advanced exploration programs are available in the Sheet Harbour, Stellarton or Truro Areas. A major hydroelectric transmission line is located approximately 1km west of Highway 374, approximately 3km west of the Egerton - MacLean Area.

The area can be characterized as unpopulated, gently rolling and forested with elevations between 110 and 175m above sea level. The main drainage pattern on the property is from the northeast to west-southwest via Seloam Brook, a major tributary to Fifteen Mile Stream that flows south into the Atlantic Ocean near Sheet Harbour. Seloam Brook originates from a small power dam located near the southwest corner of Seloam Lake and flows west-southwest across the property and adjacent to the Egerton - MacLean and Hudson Areas. Consequently, the topography in the Egerton - MacLean and Hudson Areas is low-lying and swampy. Previous reports on the property documented flooding of the Egerton - MacLean Area during flood events linked to opening of the dam on Seloam Lake by the Nova Scotia Power Commission.

The climate of the area is similar to those set forth above with respect to the Beaver Dam Project.

Mineralized Material Estimation

Mineralized material within the solids were classified at this early stage in the project as inferred mineralized materials due to a number of factors, including the wide drill hole spacing

|

|

•

|

incomplete sampling through the interpreted zones

|

|

|

•

|

limited historical quality control procedures

|

|

|

•

|

a significant nugget effect, and

|

|

|

•

|

complex geology (multiple fold hinges and shears)

|

Tangier

Introduction

The Tangier Project consists of 153 mineral claims within 11 mineral exploration licenses. Seventy-seven of the mineral claims were acquired by Acadian on March 24, 2003, under terms of a purchase agreement with Erdene Gold Inc. ("Erdene"). Acadian currently holds a 100% interest in these claims and acquired the mineral rights as part of its exploration, and evaluation programs to identify new gold targets on the Tangier Project. The Tangier Project totals 2,475 hectares of land located in Halifax County, Nova Scotia.

Mercator Geological Services Limited (“Mercator”) was retained in 2004 to complete an evaluation and technical assessment and identify new gold targets of the Tangier Project. This work included a review of government assessment reports, government and industry technical reports, digital government data (eg. GIS database), published maps, and digital airborne geophysical data. A large collection of original hard-copy technical files from the 1986 to 1999 underground and surface exploration programs completed by Coxheath and Tangier Mining Inc. ("TMI") and Tangier Limited Partnership ("TLP") were accessed through the Province of Nova Scotia. This data compilation and database management was the basis of the Tangier Technical Report and, in 2005 and 2006, several exploration programs were undertaken in areas of interest on the property.

13

Property Description and Location

The 150 contiguous exploration claims held by Acadian under 10 exploration licenses are detailed in the table below. These cover approximately 2,428 hectares of surface area and are located in Halifax County, Nova Scotia, approximately 85 kilometers east of the provincial capital city of Halifax. The 77 claims of exploration license 6140 form the specific focus of the existing NI 43-101 compliant technical report and mineralized material estimation due to concentration of most past exploration activity in the area covered by this license. Acadian holds an undivided 100% interest in all of their currently held mineral licenses at Tangier and the property is not subject to any royalties, back-in rights, payments or agreements with any other parties.

Tabulation of Acadian's Exploration Licenses at Tangier

|

License

No.

|

NTS

Sheet

|

Tract

|

Claims

|

No. of Claims

|

Renewal Date

|

|

06018

|

11 D 15 A

|

64

|

ABCD EFGH

|

8

|

January 21, 2011

|

|

06019

|

11 D 15 A

|

65

|

JKPQ

|

4

|

January 21, 2011

|

|

06020

|

11 D 15 A

|

66

55

|

BC

LMNO

|

6

|

January 21, 2011

|

|

06021

|

11 D 15 A

|

56

|

ABCD EFGH

|

8

|

January 21, 2011

|

|

06140

|

11 D 15 A

|

39

40

56

57

58

59

65

66

79

|

OPQ

OPQ

JKLM NOPQ

ABCD EFGH JKLM NOPQ

ABCD EFGH JKLM NOPQ

ABGH JK

ABCD EFGH

D EFGH JKLM NOPQ

ABCD

|

77

|

June 19, 2010

|

|

06261

|

11 D 15 A

|

65

|

LMNO

|

4

|

September14, 2010

|

|

08216

|

11 D 15 A

|

40

41

|

J

MN

|

3

|

April 21, 2010

|

|

08217

|

11 D 15 A

|

55

|

E

|

1

|

April 21, 2010

|

|

08218

|

11 D 15 A

|

64

|

JKL

|

3

|

April 21, 2010

|

|

08331

|

11 D 15 A

|

35

37

38

39

40

59

|

PQ

ABCGHJ

ABCDEFGHJKLMOPQ

JKLMN

EFGKLMN

C

|

36

|

September 8, 2010

|

|

TOTAL

|

150

|

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Tangier Project is located in the rural community of Tangier, approximately 85 kilometers by road east of Halifax, Nova Scotia. Highway 7 crosses the southern portion of the property and access to the northern section is by the Mooseland Road, as well as various associated forestry access roads and trails. Additionally, several site access trails from the mine area were established during the previous exploration periods and these continue to provide access potential.

The climatic conditions are the same as set forth above with respect to the Beaver Dam Project.

14

The region surrounding the Tangier Project shows topographic relief of 25 meters or less and is typically characterized by coniferous forest cover. The portal entrance on the Tangier mine site sits 15 meters above sea level. The northwest trending Tangier River valley is the most prominent drainage feature in the property area and numerous small brooks, ponds and bogs occurring within the property drain into this system. Local topographic relief takes the form of east to northeast trending bedrock ridges that parallel the strike of underlying Goldenville Formation greywacke units. One such ridge marks the location of the northeast-trending Tangier Anticline. A prominent northwest trending fracture set is present in bedrock exposures in this area and bedrock faults of similar orientation have been documented through drilling and mining activities. In several instances these northwest trending structures appear to have exerted control on surface drainage patterns. Overburden on the property consists of glacial till that varies in thickness from nil to 10 meters or more.

The Tangier area is rural and sparsely populated, with a substantial percentage of its economy based on forestry and fishing activity. The Blueberry Hill mine site is located immediately north of Highway 7 at Tangier in an area characterized by a few isolated homes and other buildings situated along Highway 7.

With respect to site infrastructure and services, direct access to the provincial electrical power grid is possible and cabling is present to the site itself. Several buildings associated with the TLP period remain on site, including those that housed milling equipment, the assay laboratory and mine dry facilities. Additionally, a tailings pond used during both Coxheath and TLP periods is present and intact.

Surface rights in the area of existing mine and mill infrastructure are currently held by Mr L. Mason of Tangier and surface rights over the larger exploration property includes numerous additional landowners. No difficulties have been encountered in the past with respect to gaining access to private lands in the area for the purpose of mineral exploration. Furthermore, Acadian has secured a property access agreement with the owner of the mine site area for purposes of additional property exploration.

Mineralized Material Estimates

Compiled and interpreted results from 138 past surface and underground diamond drill holes and results of specific past underground sampling programs were assessed for use in developing a mineralized material estimate for the Tangier Project.

The table below presents cut and uncut gold grade estimates and corresponding tonnage estimates prepared for the Tangier Project as at September 29, 2004, a day following the effective date of the Tangier Technical Report. These reflect combined results from the Blueberry Hill Mine area as well as the Strawberry Hill and Mooseland East areas.

Mineralized Material Estimate for Tangier Project

Mineralized Material

|

Gold Grade Threshold

|

*Tonnes

|

Gold Grade (g/t)

Uncut

|

Gold Grade (g/t)

50 g/t Cut

|

|

3.5 g/t

|

134,000

|

9.67

|

9.67

|

|

2.0 g/t

|

206,000

|

7.23

|

7.23

|

|

1.0 g/t

|

294,000

|

5.48

|

5.48

|

*Rounded

15

Forest Hill

Introduction

The Forest Hill property consists of 92 contiguous mineral claims within 4 mineral exploration licenses. The Forest Hill property currently includes a 100% interest in these claims subject to a net smelter royalty agreement detailed below, and Acadian acquired the mineral rights as part of its exploration and evaluation programs to identify new gold targets on the Forest Hill property. The Forest Hill property totals 1,489 hectares of land located in Guysborough County, Nova Scotia.

Mercator was retained in July, 2003 by Acadian to complete an evaluation and technical assessment and identify new gold targets on the Forest Hill property. This work included a review of government assessment reports, government and industry technical reports, digital government data (eg. GIS database), published maps, and digital airborne geophysical data. A large collection of original hard-copy technical files from the 1982 to 1989 underground and surface exploration programs completed by Seabright, Westminer, DNR and Acadian were assessed. This data compilation and database management formed the basis of an NI 43-101 compliant mineralized material estimation effective August 10, 2004. Two subsequent drilling programs, managed by Mercator for Acadian generated mineralized material updates effective November 3, 2004 and September 28, 2005.

Property Description and Location

The 173 mineral exploration claims held by Acadian, under 6 exploration licenses, are detailed in the Table below. These claims cover approximately 2,800 hectares of surface area and are located in Guysborough County, Nova Scotia, approximately 40 kilometers southeast of Antigonish, Guysborough County. The NI 43-101 compliant Forest Hill Technical Report mineralized material estimations focus on license 05985 and special license 1/99 due to concentration of most past exploration activity in the area covered by these licenses. Acadian holds an undivided 100% interest in all claims with 64 of the claims being subject to a maximum 2.65% net smelter royalty under an agreement with Henry Schenkels.

Tabulation of Acadian's Exploration Licenses at Forest Hill

|

License No.

|

NTS Sheet

|

Tract

|

Claims

|

No. Of

Claims

|

Renewal Date

|

|

06029

|

11 F 5 B

|

47

|

LMNO

|

4

|

March 7, 2011

|

|

SL 1/99

|

11 F 5 B

|

49

|

BG

|

2

|

March 30, 2011

|

|

05981

|

11 F 5 B

11 F 5 B

|

46

47

|

HJ

EFGH

|

6

|

April 12, 2010

|

|

05985

|

11 F 5 A

11 F 5 A

11 F 5 B

11 F 5 B

11 F 5 B

11 F 5 B

11 F 5 A

11 F 5 A

|

37

60

47

48

49

50

38

59

|

JKLM NOPQ

All Claims

JKPQ

JKLM NOPQ

ACDE FHJK LMNO PQ

All Claims

MN

DEFG JKLM NOPQ

|

80

|

September 20, 2010

|

|

TOTAL

|

92

|

Many shafts and trenches have been backfilled at Forest Hill, however a number of small water-filled shafts and trenches still remain. Several localized areas have also been identified in which tailings deposits from historic milling operations are present. These are for the most part well documented and Westminer carried out a limited program of shaft back-filling on lands owned by Acadian prior to the sale of the surface title of a portion of the area to Votix Corporation Ltd. ("Votix"). Existing site conditions pose no obvious impediment to future exploration or potential development of the property. The Votix land at Forest Hill was acquired by Acadian in July 2009.

16

There are no known environmental liabilities on the Forest Hill Project as it exists. Based upon information reviewed, it would appear that existing site environmental conditions should not pose significant risk with respect to re-activation of exploration, mining and milling activities on the property; however, it is Acadian's responsibility pursuant to the Environment Act (Nova Scotia) ("Environment Act") and the Mineralized materials Act to obtain all permits to conduct such operations and comply with all laws and regulations for its activities.

The location of the known mineralized zones and mineralized material to date are: (a) the Teasdale shaft mine workings area specifically on the Schoolhouse 1, 2, 3A, 3B, 4A, 4B, 5A, 6A, Fraser Alimak veining package, Hudson veining package and Kennedy veining package, (b) adjacent to the limits of historic stoping on the Salmon River vein, centered at L950E, (d) on the Fraser Alimak veining package in L1200E to 1550E area as well as in the 1900 east development area and (e) on the Hudson veining package in the 1900 east development area and adjacent (south of) the Teasdale workings.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Forest Hill Project is located approximately 40 kilometers southeast of Antigonish, Guysborough County, at latitude 61° 45' 19" W - longitude 45° 18' 33" N, and is accessible via Highway 7 to Goshen and then by paved highway south to Country Harbour Cross Roads. From that point, the property is reached by traveling east 12 kilometres to the Forest Hill mine road which extends 5 kilometres south to the Teasdale shaft area. Numerous forest access roads, trails and a power line right of way provide further access across the property from this point.

The climatic conditions are the same as set forth above with respect to the Beaver Dam Project.

Mineral exploration field programs can be efficiently undertaken during the period May through late November, while winter programs can be readily accommodated with appropriate allowance for weather delays.

The area surrounding the Forest Hill Project is characterized as forested and unpopulated. Topography is gently rolling and ranges from a low of 100 meters above sea level to a high of 150 meters above sea level. Drainage is sluggish due to numerous swamps and bogs and several small lakes. Locally, northwest-southeast and northeast-trending bedrock fault zones appear to have exerted control on surface drainage patterns developed in this area of relatively thin glacial till.

The area surrounding the Forest Hill Project is rural and sparsely populated with a substantial percentage of its economy based on forestry sector activity. In recent years, development of a natural gas fractionation plant and pipeline system at nearby Goldboro, in support of offshore gas production facilities, has resulted in added economic diversity. Additional heavy industry development in the Goldboro area may take place in the future, in part due to availability of discounted natural gas rates available in a large municipal industrial park located in the community.

With specific reference to the Forest Hill Project, its undeveloped location, good road access, presence of a regional grid power line crossing the property, and presence of the modern Teasdale shaft and settling pond system used during the Seabright-Westminer period combine to make it an attractive location for future infrastructure development.

Key Surface rights in the area are currently held by the Crown and Acadian. No difficulties have been encountered in the past with respect to gaining access to the Crown (lease agreements) and private land in the area for the purpose of mineral exploration.

17

Mineralized Material Estimates

Compiled and interpreted results from the past surface and underground diamond drill holes, results of the 82 drill holes of Acadian's 2003-2005 exploration programs and summarized results of specific underground sampling programs were assessed by Mercator for use in developing a revised mineralized material estimate for the Forest Hill Project, inclusive of the 1900 East area of past bulk sampling and underground development. The definition of mineralized material and associated mineralized material categories used are those set out in the CIM Standards.

The Table below presents cut and uncut gold grade estimates and corresponding tonnage estimates prepared for the Forest Hill Project as at September 28, 2005. These reflect combined results from the mine area, the Goose Neck Lake area, the Line 2300E to 2650E area and the 1900 East area. Assumptions, estimation parameters, and methodologies associated with this estimate are discussed below under appropriate headings.

Mineralized Material Estimate for Forest Hill Project

Mineralized Material

|

Gold Grade Threshold

|

*Tonnes

|

Gold Grade (g/t)

Uncut

|

Gold Grade (g/t)

50 g/t Cut

|

|

1 g/t

|

355,000

|

15.96

|

10.19

|

|

3.5 g/t

|

225,000

|

24.02

|

14.91

|

|

5.0 g/t

|

199,000

|

26.48

|

16.19

|

Goldenville

Introduction

Acadian acquired the mineral rights to the Goldenville Project as part of its exploration, evaluation and development program for gold mineralized materials in Nova Scotia and holds an undivided 100% right title and interest in all exploration licenses comprising the Goldenville Project.

Acadian retained Mercator to complete a mineralized material estimate of the Goldenville. The Goldenville Technical Report, with an effective date of March 1, 2005, was developed in accordance with NI 43-101 and in accordance with the CIM Standards.

The Goldenville gold district is regarded as one of the most significant in Nova Scotia based on its recorded gold production of approximately 212,300 ounces from 551,797 tonnes of ore between 1862 and 1942. This indicates an historic recovered grade of 11.97 g/t.

Project Description and Location

The Goldenville Project is located in Guysborough County, Nova Scotia, approximately 135 kilometers east of Halifax and 60 kilometers south of Antigonish. The village of Sherbrooke is located approximately 5 kilometers to the north. As shown in the table below, the Goldenville property consists of 116 contiguous mineral exploration claims under five mineral exploration licenses covering approximately 1878 hectares (4640 acres). Exploration license 05817 formed the specific focus of the Goldenville Technical Report and mineralized material estimation due to concentration of most past mining and exploration activity in the area covered by this license.

18

Tabulation of Acadian's Exploration Licenses at Goldenville

|

License No.

|

NTS Sheet

|

Tract

|

Claims

|

No. of Claims

|

Renewal Date

|

|

05817

|

11 F 04 B

11 F 04 C

11 E 01 A

11 E 01 A

11 E 01 D

11 E 01 D

|

108

12

97

98

1

2

|

LMNO

CDEF

JKLM NOPQ

JKLM NOPQ

ABCD EFGH

ABCD EFGH

|

40

|

December 9, 2010

|

|

08324

|

11 E 01 A

11 E 01 A

11 E 01 A

11 E 01 A

11 E 01 A

11 E 01 D

11 E 01 D

11 E 01 D

11 E 01 D

11 E 01 D

11 F 04 B

11 F 04 C

|

97

98

99

100

101

1

2

3

4

5

108

12

|

EFGH

EFGH

JKLMNOPQ

JKLMNOPQ

JKPQ

JKLM

JKLM

ABCDEFGHJKLM

ABCDEFGHJKLM

ABGHJK

EFGKP

BGKLM

|

76

|

April 9, 2010

|

|

Total

|

116

|

The mineral rights to this property are 100 per cent owned by Acadian. The property is not subject to any royalties, back-in rights, payments or agreements with any other parties.

Surface titles to lands covered by the Goldenville Project are held by various private interests and by the Crown. Notably, the main mineralized material area with the associated mine infrastructure occurs on a large block of provincial Crown land for which required access agreements had previously been arranged. Access agreements were also established at that time with various private landowners to accommodate surface exploration activities.

Acadian has not legally surveyed the mineral exploration claims at Goldenville. If a mining lease were granted at some time in the future, a legal survey of the claims would be required. Acadian had not applied for a mining lease at the time of report preparation.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Goldenville Project is easily accessible via Highway 7, which crosses the east end of the property, and 2 good quality gravel roads off of it run through the property. The village of Sherbrooke is located approximately 5 kilometers to the north of the Goldenville Project and provides access to basic services such as banking, grocery and other small stores, small restaurants and motel accommodations. Antigonish is located 60 kilometers to the north and is a much larger center with a substantial local supply base for most needs. Domestic power and telephone services are available at the Goldenville site.

The climatic conditions are the same as set forth above with respect to the Beaver Dam Project.

Numerous construction and heavy equipment contractors are based in Guysborough and Antigonish counties and many of these provided services during recent construction of the Sable Offshore Energy Inc. natural gas plant at nearby Goldboro and the associated pipeline infrastructure of Maritimes and Northeast Gas Pipeline Ltd. In general terms, the area can provide access to a well trained work force but lacks a recent history of mining operations. Unemployment levels in this predominantly rural area are typically higher than the provincial average.

19

The Goldenville property area is generally flat lying and occurs at an average elevation of approximately 55 meters above sea level. A large swampy area underlies the south central part of the claim group and the St. Mary's River crosses the eastern edge of the property. Glacial till cover is extensive in this area and limits bedrock exposure to an estimated 5% or less of surface area. A review of drilling records showed that overburden thickness ranges between 1m and 8m, and is primarily comprised of glacial till. Upper till zones in this part of Nova Scotia may be of far-traveled origin where drumlin structures are present but these typically overlie an otherwise locally derived basal till unit.

Original vegetative cover across the property was dominated by stands of balsam fir, spruce and hemlock, with isolated occurrences of hardwood. Historic mining activities have resulted in local disruption of the landscape by waste rock piles and clear cut forest harvesting has been carried on in some areas. A substantial acreage now shows various stages of forest re-growth

Mineralized Material Estimates

Compiled and interpreted results from 142 past surface and underground diamond drill holes and results of specific past underground sampling programs were assessed for use in developing a mineralized material estimate for the Goldenville Project. For report purposes, definitions of mineralized materials and associated mineralized material categories are those set out in the CIM Standards and further reflected in NI 43-101.

The table below presents cut and uncut gold grade estimates and corresponding tonnage estimates prepared for the Goldenville Project as of March 1, 2005. These reflect combined results from diamond drilling over a 1,700 meters area along strike between the Bluenose Mine and west of the Stuart Shaft as well as underground sampling from the Guysborough mine (Stuart shaft). Assumptions, estimation parameters and methodologies associated with these estimates are discussed below.

Mineralized Material Estimate for Goldenville

Mineralized Material

|

Gold grade

Threshold

|

Tonnes

Uncut

|

Gold Grade

Uncut (g/t)

|

Gold Grade

(g/t) 50 g cut

|

|

3.5g/t

|

62,554

|

16.62

|

14.72

|

|

2g/t

|

106,976

|

10.76

|

9.65

|

|

1g/t

|

181,047

|

6.96

|

6.31

|

ScoZinc Project

Project Description and Location

The ScoZinc Project includes the Scotia Mine located approximately 50 kilometers northeast of the Halifax Regional Municipality, Nova Scotia and one kilometer east of the community of Gays River in Halifax County. The Scotia Mine's general location is 45°02¢ North, 63°20¢ West. Acadian acquired 100% of the outstanding shares of ScoZinc on July 6, 2006 from HudBay thereby acquiring the Scotia Mine property and the other assets of ScoZinc.

The Scotia Mine property is subject to Mineral Lease 90-1, which consists of 615 hectares of mineral rights, including land with exploration potential for zinc/lead mineralization and 590 hectares of land ownership.

The Scotia Mine property also includes five exploration licenses in the general vicinity of the Scotia Mine. In total, the 79 claims cover 3,160 acres (1,279 hectares). These licenses are located along strike from the Scotia Mine deposit and include favorable host rocks similar to that at the mine site.

20

Tabulation of Acadian's Exploration Licenses on the ScoZinc Project

|

License

No. |

NTS Sheet

|

Tract

|

Claims

|

No. Of

Claims

|

Renewal Date

|

|

06268

|

11E3B

11E3B

11E3B

|

19

18

7

|

ABCD EFGH LMN

ABC EFGH

DE JKLM NOPQ

|

28

|

May 2, 2010

|

|

06304

|

11E3B

|

29

|

E

|

1

|

October 13, 2010

|

|

06303

|

11E3B

|

29

|

LMNOP

|

5

|

October 25, 2010

|

|

05851

|

11E3B

11E3B

|

45

46

|

FGH L

EFG

|

7

|

November 5, 2010

|

|

TOTAL

|

41

|

Mineral Lease 90-1, which covers the entire Scotia Mine site, was originally granted by the Crown to Westminer Canada Limited ("Westminer") on April 2, 1990, for a term of 20 years and may be renewed upon its expiration. Mineral Lease 90-1 grants sufficient rights for mining. A renewal application for a further 20 years was filed with the Nova Scotia Department of Resources on October 1, 2009. The Table below sets out claims comprising Mineral Lease 90-1.

Claims comprising Mineral Lease 90-1.

|

NTS Sheet

|

Tract

|

Claims

|

No. of Claims

|

|

11E3B

|

5

19

20

28

29

|

NOP

JKPQ

BCDE FGK LMNO PQ

DEKL MNOP

ABCD FGH JKQ

|

3

4

13

8

10

|

|

TOTAL

|

38

|

Mineral Lease 90-1 was transferred from Westminer to Savage Resources Canada Company ("SRCC") in 1996. SRCC changed its name to Pasminco Resources Canada Company ("PRCC") in 1999. PRCC further changed its name to Pasminco Resources Canada Ltd. ("PRCL") in March 2002 upon amalgamating with 3063554 Nova Scotia Company. PRCL changed its name to ScoZinc Limited (ScoZinc) in November 2002.

Mineral Lease 90-1 is registered in the name of ScoZinc.

On May 15, 2003, Gallant Aggregates Limited ("Gallant") signed a 30-year lease and royalty agreement with ScoZinc to mine and remove aggregate from the Scotia Mine property for $1.00 per tonne of material removed ("Gallant Agreement"). The Gallant Agreement entitled Gallant, with certain limitations, to mine aggregate anywhere on ScoZinc's land. In January 2008, Gallant exercised its option under the Gallant Agreement to purchase approximately 25 acres of the Scotia Mine property.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Scotia Mine property is located approximately 65 kilometers northeast of Halifax, Nova Scotia. Access to the property is by paved roads and is approximately 15 kilometers off the Trans Canada Highway along Highway 224. The Halifax Stanfield International Airport is located 20 kilometers southwest of the Scotia Mine property.

The Scotia Mine property lies along the south side of the Gays River main branch, immediately east of the confluence with the Gays River south branch. The deposit is in a rural-residential area of central Nova Scotia that is typified by rolling topography and abundant surface water.

The climate is variable because of mixed continental and maritime weather patterns. Mean annual temperature is 5.9 degrees Celsius, mean annual precipitation is 1,250 mm and yearly evapo-transpiration is estimated to be 560 mm. The relatively mild climate for Canada permits year-round operations.

21

The Scotia Mine mill, designed and built in 1978 and 1979, uses a flotation process and has a design rated capacity of 1,350 tonnes per day. However, it has operated for extended periods at a rate of 2,000 tonnes per day. Other existing site infrastructure includes: (1) an administration building containing offices, a large boardroom, a dry, warehouses, workshops, and several heavy equipment bays; (2) a compressor building (1,600 square feet); (3) a tire shop (2,000 square feet); (4) a welding shop; (5) a geology building; (6) a water pump and treatment facility and (7) a core shed.

Acadian operates storage and ship loading facilities for lead and zinc concentrates at the seaport of Sheet Harbour, a distance of 80 kilometers from the Scotia Mine property over paved roads. ScoZinc constructed a 12,800 square foot warehouse facility at a cost of approximately $625,000 on lands it leases from Nova Scotia Business Incorporated. To date, lead concentrates have been shipped by containers through the Port of Halifax to overseas markets and by bulk truck transport to local markets.

The existing surface rights are sufficient for mining operations. Power is supplied through the regional grid at reasonable rates. Most of the mill's water requirements are satisfied by in-process recycling. Make-up water is drawn from the perennial Gays River. The existing tailings pond has sufficient capacity for the life of the project. There is also sufficient area for waste rock storage on the property.

Mineralized Materials and Mineral Reserve Estimates

The deposit is characterized by complex geometry and is difficult to model in terms of standard techniques. Lying along a "paleo-shoreline", it features repetitive changes in strike around a general trend of 060º azimuth, and with varying dip. For mineralized material calculation, the deposit was divided into 2 zones. The surface mineralized material zone ("Main Deposit"), south of Highway 224, includes lower grade, disseminated rock that is amenable to surface mining. The northeast underground zone ("Northeast Deposit") lies north of the highway. It consists of higher-grade, dipping mineralization. It lacks the lower grade, disseminated rock, making underground mining more attractive.

For both the surface and northeast underground zones, manual interpretation was required to properly model the geology. The Main Deposit was differentiated into a high-grade massive sulphide zone and a low-grade disseminated zone. Drill-hole data and underground openings were then plotted on hard-copy plans at ten meter intervals, and interpretations of the high-grade zone, the low-grade and the hanging-wall "Trench" were produced. Cut-off grades for the high-grade and low-grades zones were 7% zinc-equivalent and 2% zinc-equivalent, respectively.

The surface zone's geometry made it difficult to incorporate the true spatial relationship of the samples for estimation purposes without the use of "unfolding" techniques that transform the sample data into another co-ordinate space that honors the spatial relationships. Variography and estimation were conducted in the transformed space, and the results are then back-transformed into the original space.

Equal length composites were prepared from uncut assay values in a two step process. Initial composite intervals were defined from the intercepts of the drill holes with the high-grade and low-grade 3D solids of the mineralized zone. Equal length composites of 1.5 meters were then generated within these intervals – 1.5 meters is approximately the average length of the assay intervals.

3D experimental correlograms were generated using the transformed (un-folded) zinc and lead composite data, for both low-grade and high-grade mineralized zones below an elevation of 490 meters. Separate 3D experimental correlograms were generated using un-transformed composite data for the low-grade mineralized zone above 490 meters elevation, where the deposit is essentially horizontal in attitude. Nested correlogram models comprising nugget effect and two spherical components were fitted to all experimental variograms.

22

No evidence of specific gravity test work was available. Therefore, a formula for specific gravity based on zinc and lead grades was used for the mineralized zones.

Two block models were constructed for interpolation purposes, a primary model in normal (un-transformed) space, and a secondary, smaller model in transformed space for interpolation of the un-folded data.

The standard ordinary kriging ("OK") procedure was used to interpolate zinc and lead block values in the flat lying portions of the deposit above 490 meters elevation. Separate interpolations of zinc and lead block values for the LG and HG zones were kriged in three passes using OK, the transformed composites and the correlograms generated from those composites.

Because it was determined that the northeast underground zone would be most profitably mined using underground mining methods, a cut-off grade of 5% zinc equivalent was used to outline the mineralization on sections spaced 50 meters apart. To permit mechanized mining, the minimum mining width and height were both 2.4 meters.

One contiguous body made up the northeast underground mineralized materials. To determine the quantity of material, the outline area on each section was multiplied by its strike length (50 meters) to determine the volume. That figure was multiplied by an average specific gravity ("SG") of 2.9 to determine mass. To determine grade, the length-weighted-average grade and the true width of each intercept was calculated. The average section grade was determined by calculating the true-length-weighted-average grade of all of the section's intercepts. The average true width of the intercepts was also calculated.

Undiluted surface and underground mineralized materials were estimated to be (July 13, 2006):

|

Category

|

Volume

(m3)

|

SG

|

Tonnes

|

Zinc

Grade

|

Lead

Grade

|

|||||||||||||||

|

(Surface)

|

680,000 | 2.78 | 1,880,000 | 3.8 | % | 1.6 | % | |||||||||||||

|

Surface

|

810,000 | 2.77 | 2,250,000 | 3.2 | % | 1.4 | % | |||||||||||||

|

Underground1

|

381,000 | 2.90 | 1,110,000 | 6.6 | % | 3.7 | % | |||||||||||||

|

Subtotal

|

1,190,000 | 2.82 | 3,360,000 | 4.3 | % | 2.2 | % | |||||||||||||

|

(Surface and Underground)

|

1,870,000 | 2.80 | 5,240,000 | 4.1 | % | 2.0 | % | |||||||||||||

Notes:

1. Northeast Underground Zone

2. Undiluted mineralized materials

To estimate the surface reserves, an optimized pit shell was generated from the block model utilizing Whittle 3.4 pit optimization software. Only blocks in the measured and indicated category were considered as mineralized for this exercise. A surface mine plan, complete with haul roads, was designed using the optimum pit shells as a guide.