Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CENTER FINANCIAL CORP | q00471_8-k.htm |

| EX-99.1 - NEWS RELEASE - CENTER FINANCIAL CORP | ex99_2.htm |

|

|

|

|

CENTER FINANCIAL CORPORATION 6TH ANNUAL BANK CEO FORUM ATLANTA SEPTEMBER 21, 2010 |

|

|

|

|

SAFE HARBOR DURING THE COURSE OF THIS PRESENTATION, THE COMPANY MAY MAKE OR PRESENT FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS MAY BE SUBJECT TO THE SAFE-HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. SUCH STATEMENTS, INCLUDING STATEMENTS RELATED TO THE COMPANY'S GROWTH, MARKET POSITION AND FUTURE PERFORMANCE ARE PREDICTIONS BASED ON FACTORS AS CURRENTLY KNOWN TO THE COMPANY. ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. YOU ARE REFERRED TO THE DOCUMENTS THE COMPANY FILES FROM TIME TO TIME WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION, WHICH REVIEW THE RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE COMPANY'S PROJECTIONS OR FORWARD-LOOKING STATEMENTS. THE HISTORICAL RESULTS ACHIEVED BY THE COMPANY ARE NOT NECESSARILY INDICATIVE OF ITS FUTURE PROSPECTS. THE COMPANY UNDERTAKES NO OBLIGATION TO PUBLICLY UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. 2 |

|

|

|

|

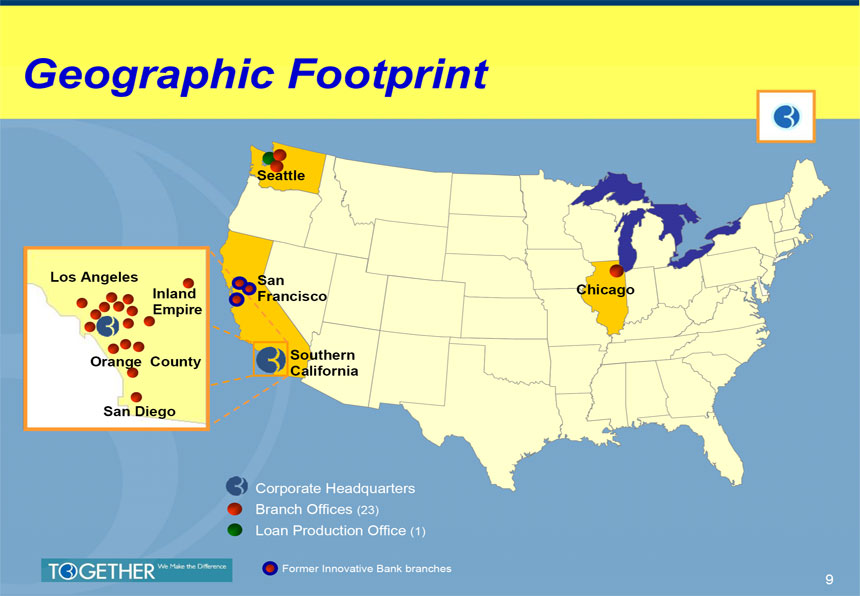

CENTER BANK - CORPORATE PROFILE 24 years of service as strong community business bank o INTERNATIONAL TRADE FINANCE EXPERTISE o NATIONALLY RECOGNIZED SBA LENDER - 2006 EXCELLENCE IN LENDING AWARD BASED ON HIGHEST ASSET QUALITY o LEADING PROVIDER OF SMALL BUSINESS-ORIENTED PRODUCTS & SERVICES - MOST COMPREHENSIVE OFFERING OF CASH MANAGEMENT SERVICES IN NICHE MARKET 23 offices spanning the West Coast and the Midwest WEST COAST OFFICES: o 16 branches in Southern California o 3 branches in Northern California o 2 branches and 1 loan production office in Seattle MIDWEST OFFICE: o 1 branch in Chicago Total assets of $2.3 billion Headquartered in Los Angeles - LARGEST KOREAN CONCENTRATION OUTSIDE REPUBLIC OF KOREA 3 |

|

|

|

|

RESILIENT KOREATOWN Continuing influx of Korean immigrants and funds o RATIFICATION OF VISA-WAIVER STATUS o RATIFICATION OF US-KOREA FTA o LIBERATION OF CURRENCY CONTROLS Mid-Wilshire financial district o SYMBOLIC FOR GROWTH IN LA'S KOREAN-AMERICAN COMMUNITY 4 |

|

|

|

|

SEASONED, CONSERVATIVE LEADERSHIP Jae Whan (J.W.) Yoo, President & CEO o 30+ YEARS BANKING INDUSTRY EXPERIENCE o SUCCESSFULLY RESOLVED LONG-STANDING KEIC LITIGATION o FORMER HAFC CEO WHO EXECUTED THE ACQUISITION OF PUBB Douglas J. Goddard, interim CFO o 25+ YEARS EXPERIENCE FINANCIAL REPORTING FOR THE COMMERCIAL BANKING SECTOR o FORMER EVP & CFO OF FIRST FEDERAL BANK OF CALIFORNIA o SIGNIFICANT M&A EXPERIENCE Jason Kim, SVP & CCO o 18-YEAR VETERAN OF CENTER BANK o RECOGNIZED FOR SIGNIFICANT GROWTH OF SBA PORTFOLIO WITH EXCEPTIONAL CREDIT QUALITY; LED CENTER TO BEING NAMED SBA'S 2006 "LENDER OF THE YEAR" Lisa Kim Pai, EVP, CRO, GC & Corp Secretary o EXTENSIVE EXPERIENCE AS GC FOR KOREAN-AMERICAN COMMUNITY BANKS o FORMER GC FOR HANMI BANK AND NARA BANK 5 |

|

|

|

|

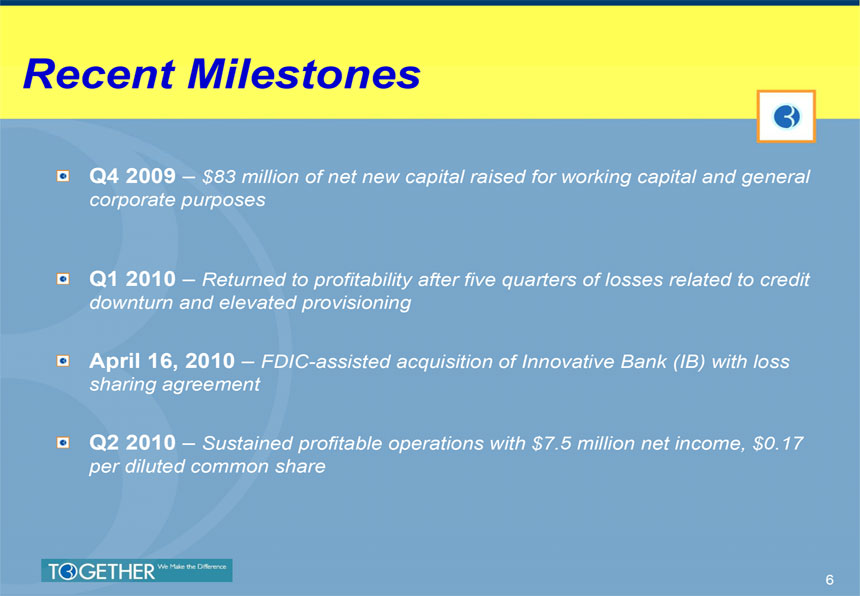

RECENT MILESTONES Q4 2009 - $83 MILLION OF NET NEW CAPITAL RAISED FOR WORKING CAPITAL AND GENERAL CORPORATE PURPOSES Q1 2010 - RETURNED TO PROFITABILITY AFTER FIVE QUARTERS OF LOSSES RELATED TO CREDIT DOWNTURN AND ELEVATED PROVISIONING APRIL 16, 2010 - FDIC-ASSISTED ACQUISITION OF INNOVATIVE BANK (IB) WITH LOSS SHARING AGREEMENT Q2 2010 - SUSTAINED PROFITABLE OPERATIONS WITH $7.5 MILLION NET INCOME, $0.17 PER DILUTED COMMON SHARE 6 |

|

|

|

|

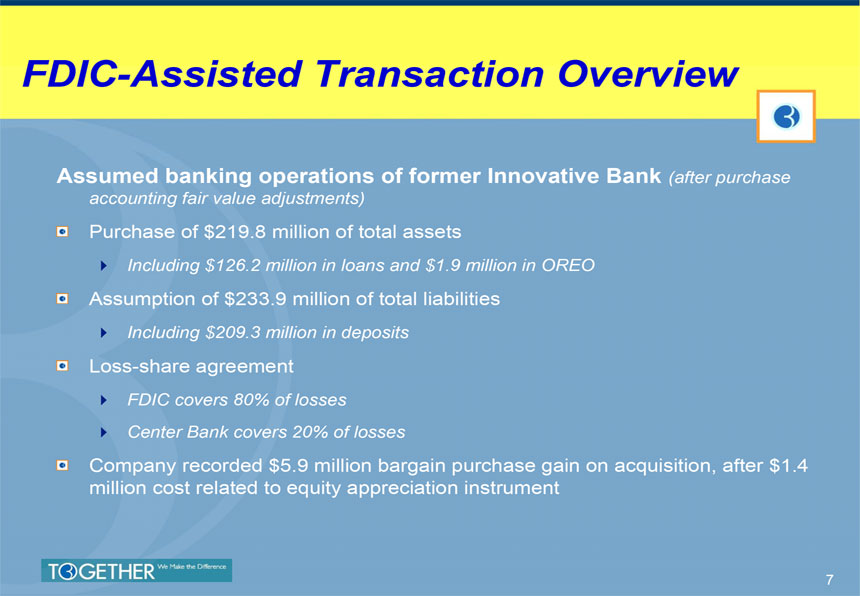

FDIC-ASSISTED TRANSACTION OVERVIEW ASSUMED BANKING OPERATIONS OF FORMER INNOVATIVE BANK (AFTER PURCHASE ACCOUNTING FAIR VALUE ADJUSTMENTS) Purchase of $219.8 million of total assets o INCLUDING $126.2 MILLION IN LOANS AND $1.9 MILLION IN OREO Assumption of $233.9 million of total liabilities o INCLUDING $209.3 MILLION IN DEPOSITS Loss-share agreement o FDIC COVERS 80% OF LOSSES o CENTER BANK COVERS 20% OF LOSSES Company recorded $5.9 million bargain purchase gain on acquisition, after $1.4 million cost related to equity appreciation instrument 7 |

|

|

|

|

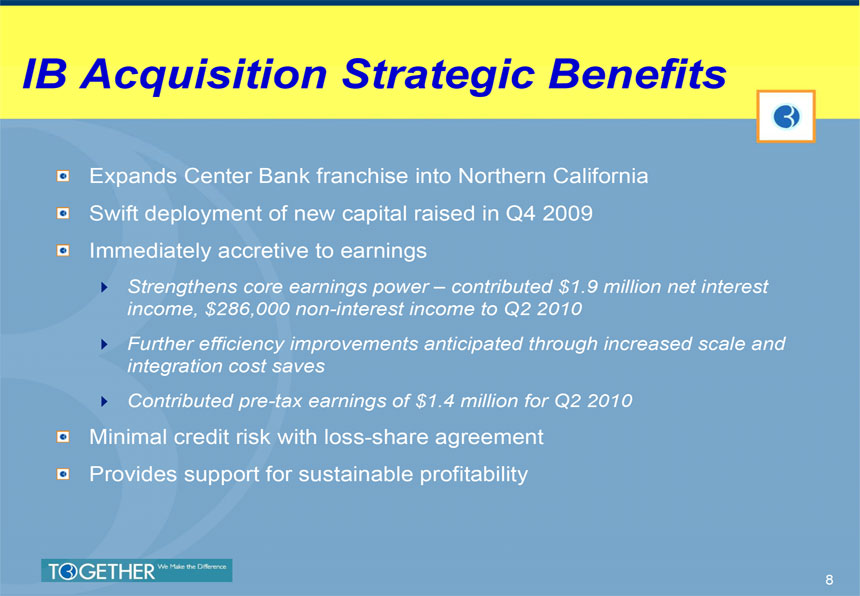

IB ACQUISITION STRATEGIC BENEFITS Expands Center Bank franchise into Northern California Swift deployment of new capital raised in Q4 2009 Immediately accretive to earnings o STRENGTHENS CORE EARNINGS POWER - CONTRIBUTED $1.9 MILLION NET INTEREST INCOME, $286,000 NON-INTEREST INCOME TO Q2 2010 o FURTHER EFFICIENCY IMPROVEMENTS ANTICIPATED THROUGH INCREASED SCALE AND INTEGRATION COST SAVES o CONTRIBUTED PRE-TAX EARNINGS OF $1.4 MILLION FOR Q2 2010 Minimal credit risk with loss-share agreement Provides support for sustainable profitability 8 |

|

|

|

|

GEOGRAPHIC FOOTPRINT Corporate Headquarters Branch Offices (23) Loan Production Office (1) Former Innovative Bank branches 9 |

|

|

|

|

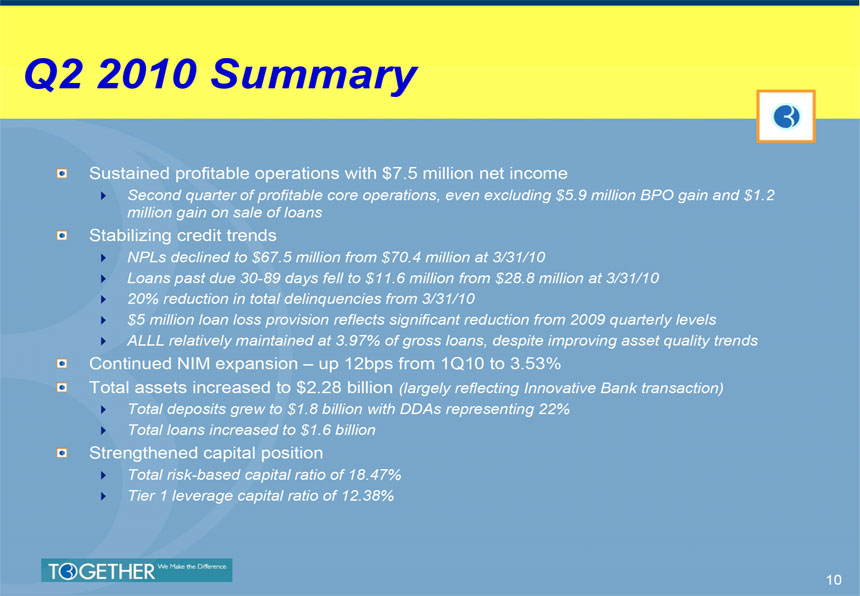

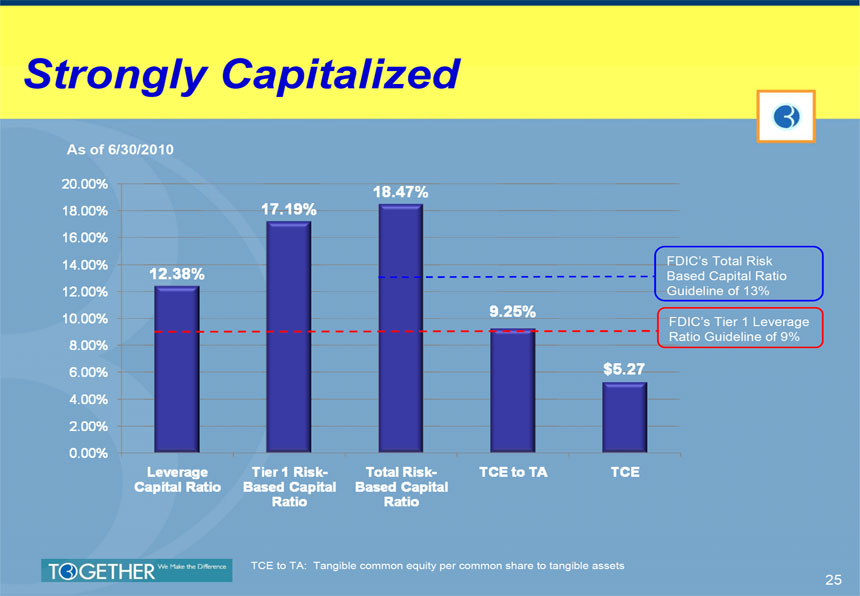

Q2 2010 SUMMARY Sustained profitable operations with $7.5 million net income o SECOND QUARTER OF PROFITABLE CORE OPERATIONS, EVEN EXCLUDING $5.9 MILLION BPO GAIN AND $1.2 MILLION GAIN ON SALE OF LOANS Stabilizing credit trends o NPLS DECLINED TO $67.5 MILLION FROM $70.4 MILLION AT 3/31/10 o LOANS PAST DUE 30-89 DAYS FELL TO $11.6 MILLION FROM $28.8 MILLION AT 3/31/10 o 20% REDUCTION IN TOTAL DELINQUENCIES FROM 3/31/10 o $5 MILLION LOAN LOSS PROVISION REFLECTS SIGNIFICANT REDUCTION FROM 2009 QUARTERLY LEVELS o ALLL RELATIVELY MAINTAINED AT 3.97% OF GROSS LOANS, DESPITE IMPROVING ASSET QUALITY TRENDS Continued NIM expansion - up 12bps from 1Q10 to 3.53% Total assets increased to $2.28 billion (LARGELY REFLECTING INNOVATIVE BANK TRANSACTION) o TOTAL DEPOSITS GREW TO $1.8 BILLION WITH DDAS REPRESENTING 22% o TOTAL LOANS INCREASED TO $1.6 BILLION Strengthened capital position o TOTAL RISK-BASED CAPITAL RATIO OF 18.47% o TIER 1 LEVERAGE CAPITAL RATIO OF 12.38% 10 |

|

|

|

|

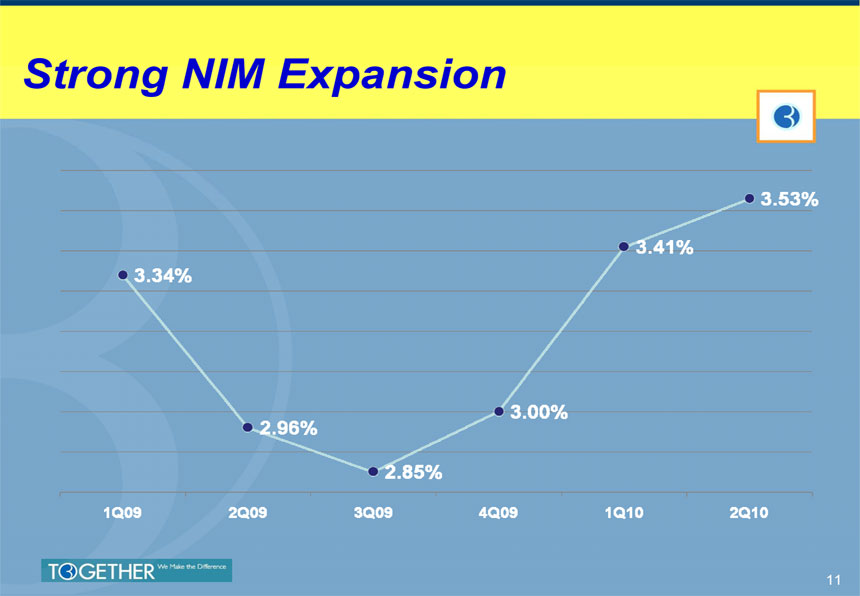

STRONG NIM EXPANSION 1Q09 3.34% 2Q09 2.96% 3Q09 2.85% 4Q09 3.00% 1Q10 3.41% 2Q10 3.53% 11 |

|

|

|

|

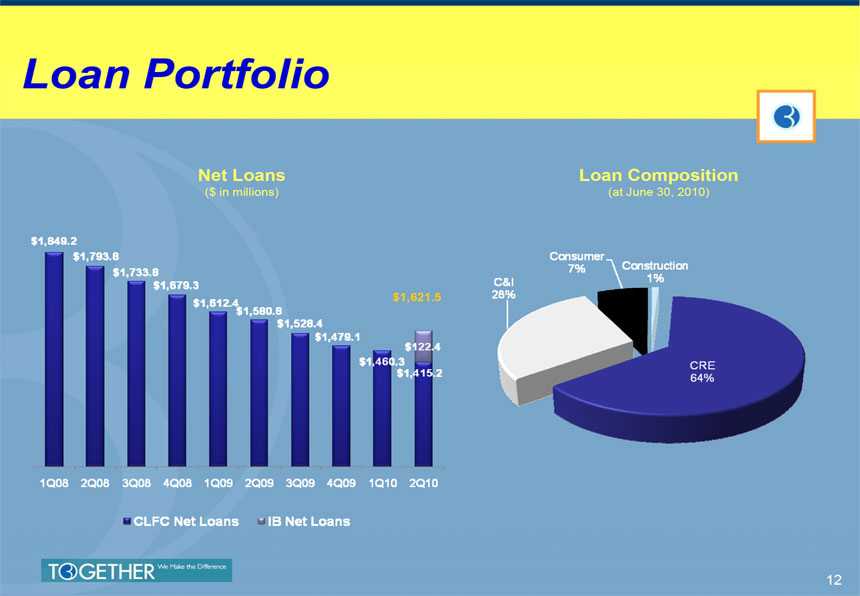

LOAN PORTFOLIO NET LOANS ($ in millions) CLFC Net Loans IB Net Loans 1Q08 $1,849.2 2Q08 $1,793.8 3Q08 $1,733.8 4Q08 $1,679.3 1Q09 $1,612.4 2Q09 $1,580.8 3Q09 $1,528.4 4Q09 $1,479.1 1Q10 $1,460.3 2Q10 $1,415.2 $122.4 LOAN COMPOSITION (at June 30, 2010) Construction 1% CRE 64% C&I 28% Consumer 7% 12 |

|

|

|

|

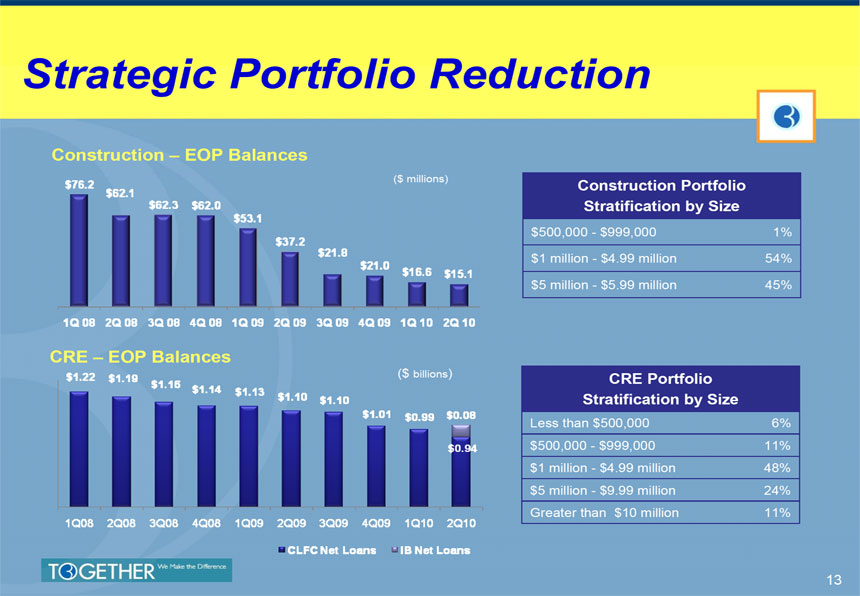

STRATEGIC PORTFOLIO REDUCTION CONSTRUCTION - EOP BALANCES ($ millions) 1Q 08 $76.2 2Q 08 $62.1 3Q 08 $62.3 4Q 08 $62.0 1Q 09 $53.1 2Q 09 $37.2 3Q 09 $21.8 4Q 09 $21.0 1Q 10 $16.6 2Q 10 $15.1 CONSTRUCTION PORTFOLIO STRATIFICATION BY SIZE $500,000 - $999,000 1% $1 million - $4.99 million 54% $5 million - $5.99 million 45% CRE - EOP BALANCES ($ billions) CLFC Net Loans IB Net Loans 1Q08 $ 1.22 2Q08 $ 1.19 3Q08 $ 1.16 4Q08 $ 1.14 1Q09 $ 1.13 2Q09 $ 1.10 3Q09 $ 1.10 4Q09 $ 1.01 1Q10 $ 0.99 2Q10 $ 0.94 $ 0.08 CRE PORTFOLIO STRATIFICATION BY SIZE Less than $500,000 6% $500,000 - $999,000 11% $1 million - $4.99 million 48% $5 million - $9.99 million 24% Greater than $10 million 11% 13 |

|

|

|

|

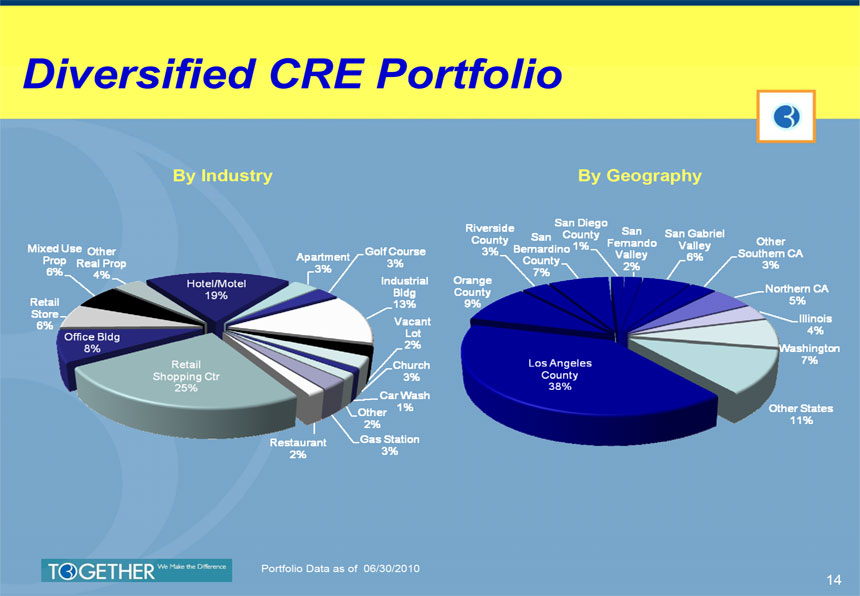

DIVERSIFIED CRE PORTFOLIO BY INDUSTRY Retail Shopping Ctr 25% Office Bldg 8% Retail Store 6% Mixed Use Prop 6% Other Real Prop 4% Hotel/Motel 19% Apartment 3% Golf Course 3% Industrial Bldg 13% Vacant Lot 2% Church 3% Car Wash 1% Other 2% Gas Station 3% Restaurant 2% BY GEOGRAPHY Los Angeles County 38% Orange County 9% Riverside County 3% San Bernardino County 7% San Diego County 1% San Fernando Valley 2% San Gabriel Valley 6% Other Southern CA 3% Northern CA 5% Illinois 4% Washington 7% Other States 11% Portfolio Data as of 06/30/2010 14 |

|

|

|

|

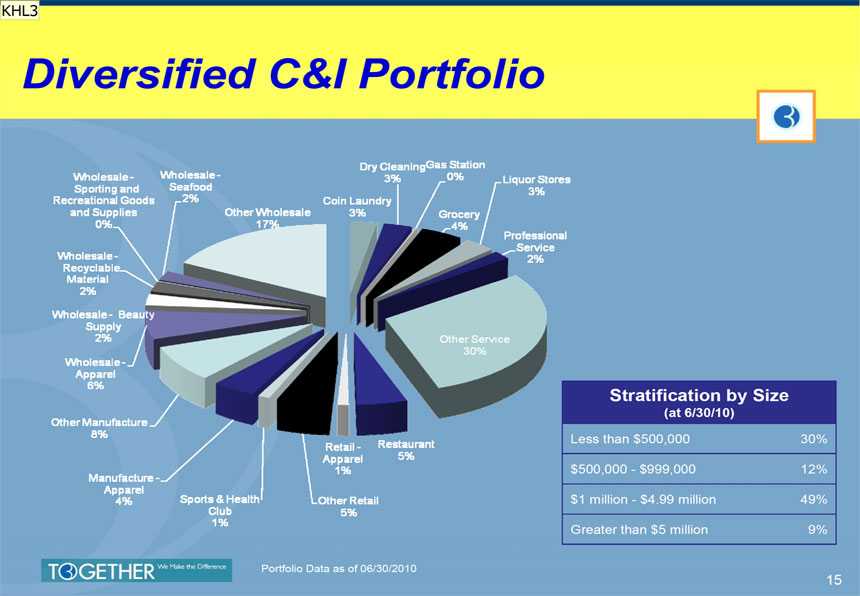

KHL3 DIVERSIFIED C&I PORTFOLIO Coin Laundry 3% Dry Cleaning 3% Gas Station 0% Grocery 4% Liquor Stores 3% Professional Service 2% Other Service 30% Restaurant 5% Retail - Apparel 1% Other Retail 5% Sports & Health Club 1% Manufacture - Apparel 4% Other Manufacture 8% Wholesale - Apparel 6% Wholesale - Beauty Supply 2% Wholesale - Recyclable Material 2% Wholesale - Sporting and Recreational Goods and Supplies 0% Wholesale - Seafood 2% Other Wholesale 17% STRATIFICATION BY SIZE (AT 6/30/10) Less than $500,000 30% $500,000 - $999,000 12% $1 million - $4.99 million 49% Greater than $5 million 9% Portfolio Data as of 06/30/2010 15 |

|

|

|

|

VIGILANCE TO CREDIT QUALITY Fully understanding the market EXTENSIVE MANAGEMENT EXPERIENCE DIRECTLY IN MARKETPLACE Strengthened SAD team Regular reviews of loan portfolio SEMI-ANNUAL EXTERNAL LOAN REVIEW COVERS 70% OF LOAN PORTFOLIO ANNUAL SELF STRESS TESTING OF PORTFOLIO SAMPLING EXPANDED TO QUARTERLY STRESS TEST OF 100% OF LOAN PORTFOLIO DEEP DIVE EXTERNAL LOAN REVIEW IN 4Q09 Ongoing credit training Stringent underwriting standards and guidelines 16 |

|

|

|

|

HEIGHTENED CREDIT RISK MANAGEMENT Asset quality task force PROACTIVE EXECUTIVE MANAGEMENT INVOLVEMENT BI-WEEKLY REVIEW OF DELINQUENT LOANS GREATER THAN $500,000 ACTION PLAN INITIATED FROM DAY ONE OF DELINQUENCY Internal stress testing mechanisms DEPLOYMENT OF NEW PROGRAM ENABLING MORE REGULAR TESTING QUARTERLY STRESS TEST BEING APPLIED TO 100% OF LOAN PORTFOLIO CAPITAL BURN DOWN ANALYSIS ASSUMING SIGNIFICANT CRE DEVALUATION Minimizing portfolio risk STRATEGIC SALES AND RUN-OFF OF CONSTRUCTION AND CRE PORTFOLIOS REVITALIZING SBA LENDING PIPELINE o Allows for growth with minimal risk given government guarantee o Low levels of loan loss provision required 17 |

|

|

|

|

DEEP DIVE EXTERNAL REVIEW IN 4Q09 Crowe Horwath reviewed 200 largest relationships 75%+ OF TOTAL CRE LOAN PORTFOLIO, INCLUDING 8 OF 20 LARGEST C&I LOANS Reviewed based on current LTV, DSC and Cap Rate conditions Review consistent with evolving regulatory standards MINIMAL TO NO CREDIT FOR BORROWER GUARANTEES, OTHER CHANGING CRITERIA Including prior review by Cabrera & Associates, 90%+ of total portfolio reviewed in 2009 REVIEW AND RESULTING PROVISION CREATED FOUNDATION FOR PROFITABLE 2010 18 |

|

|

|

|

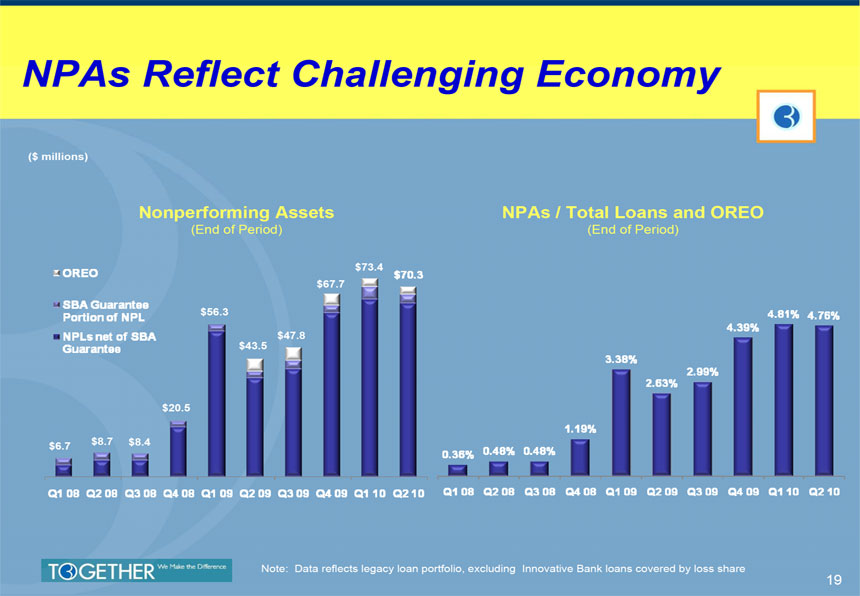

NPAS REFLECT CHALLENGING ECONOMY ($ millions) NONPERFORMING ASSETS (End of Period) OREO SBA Guarantee Portion of NPL NPLs net of SBA Guarantee Q1 08 $ 6.7 Q2 08 $ 8.7 Q3 08 $ 8.4 Q4 08 $20.5 Q1 09 $56.3 Q2 09 $43.5 Q3 09 $47.8 Q4 09 $67.7 Q1 10 $73.4 Q2 10 $70.3 NPAS / TOTAL LOANS AND OREO (End of Period) Q1 08 0.36% Q2 08 0.48% Q3 08 0.48% Q4 08 1.19% Q1 09 3.38% Q2 09 2.63% Q3 09 2.99% Q4 09 4.39% Q1 10 4.81% Q2 10 4.76% Note: Data reflects legacy loan portfolio, excluding Innovative Bank loans covered by loss share 19 |

|

|

|

|

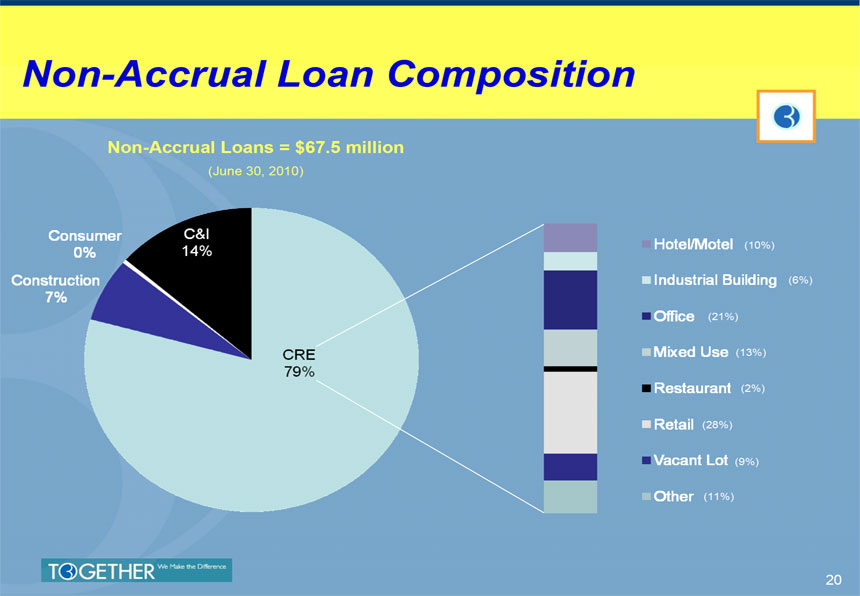

NON-ACCRUAL LOAN COMPOSITION CRE 79% Construction 7% Consumer 0% C&I 14% NON-ACCRUAL LOANS = $67.5 MILLION (June 30, 2010) Hotel/Motel (10%) Industrial Building (6%) Office (21%) Mixed Use (13%) Restaurant (2%) Retail (28%) Vacant Lot (9%) Other (11%) 20 |

|

|

|

|

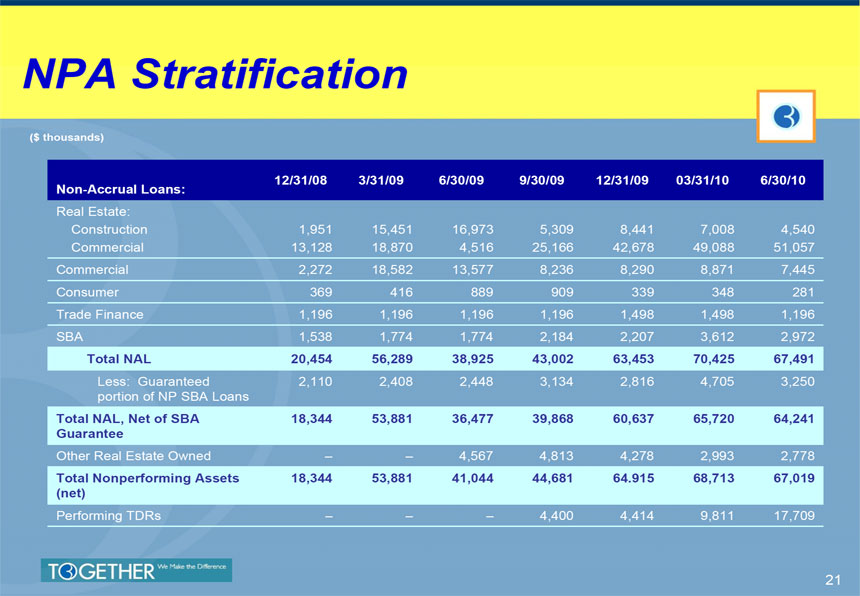

NPA STRATIFICATION ($ thousands) 12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 03/31/10 6/30/10 NON-ACCRUAL LOANS: Real Estate: Construction 1,951 15,451 16,973 5,309 8,441 7,008 4,540 Commercial 13,128 18,870 4,516 25,166 42,678 49,088 51,057 Commercial 2,272 18,582 13,577 8,236 8,290 8,871 7,445 Consumer 369 416 889 909 339 348 281 Trade Finance 1,196 1,196 1,196 1,196 1,498 1,498 1,196 SBA 1,538 1,774 1,774 2,184 2,207 3,612 2,972 TOTAL NAL 20,454 56,289 38,925 43,002 63,453 70,425 67,491 Less: Guaranteed 2,110 2,408 2,448 3,134 2,816 4,705 3,250 portion of NP SBA Loans TOTAL NAL, NET OF SBA 18,344 53,881 36,477 39,868 60,637 65,720 64,241 GUARANTEE Other Real Estate Owned - - 4,567 4,813 4,278 2,993 2,778 TOTAL NONPERFORMING ASSETS 18,344 53,881 41,044 44,681 64.915 68,713 67,019 (NET) Performing TDRs - - - 4,400 4,414 9,811 17,709 21 |

|

|

|

|

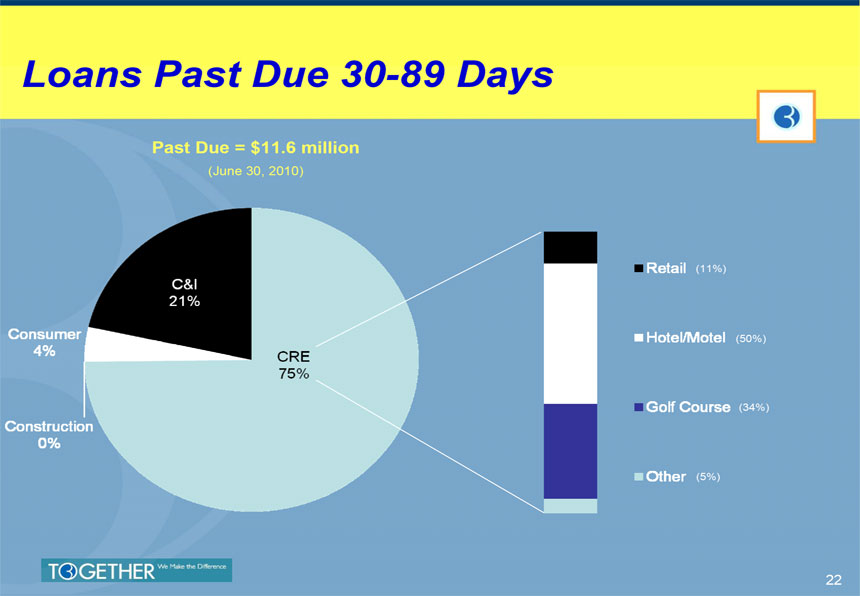

LOANS PAST DUE 30-89 DAYS PAST DUE = $11.6 MILLION (June 30, 2010) CRE 75% Construction 0% Consumer 4% C&I 21% Retail (11%) Hotel/Motel (50%) Golf Course (34%) Other (5%) 22 |

|

|

|

|

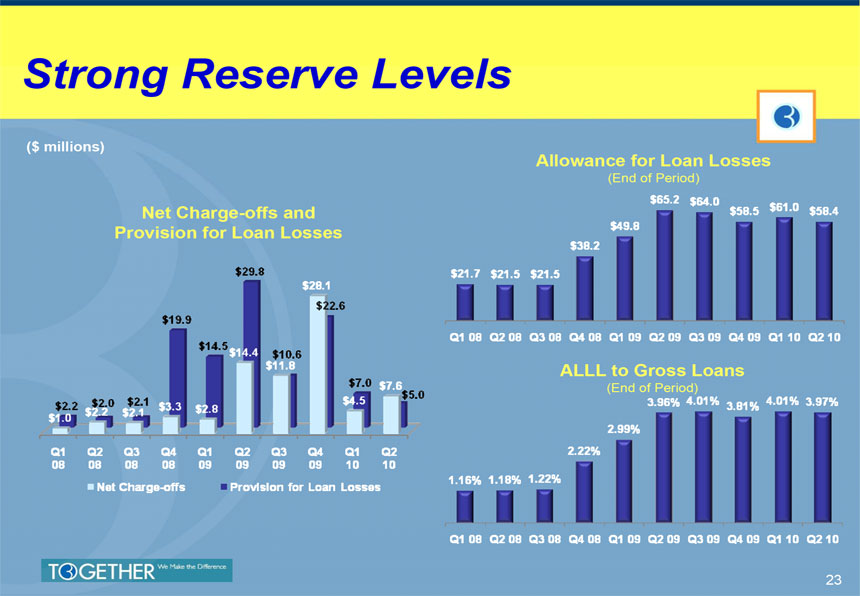

STRONG RESERVE LEVELS ($ millions) ALLOWANCE FOR LOAN LOSSES (End of Period) Q1 08 $21.7 Q2 08 $21.5 Q3 08 $21.5 Q4 08 $38.2 Q1 09 $49.8 Q2 09 $65.2 Q3 09 $64.0 Q4 09 $58.5 Q1 10 $61.0 Q2 10 $58.4 NET CHARGE-OFFS AND PROVISION FOR LOAN LOSSES Net Charge-offs Provision for Loan Losses Q1 08 $1.0 $2.2 Q2 08 $2.2 $2.0 Q3 08 $2.1 $2.1 Q4 08 $3.3 $19.9 Q1 09 $2.8 $14.5 Q2 09 $14.4 $29.8 Q3 09 $11.8 $10.6 Q4 09 $28.1 $22.6 Q1 10 $4.5 $7.0 Q2 10 $7.6 $5.0 ALLL TO GROSS LOANS (End of Period) Q1 08 1.16% Q2 08 1.18% Q3 08 1.22% Q4 08 2.22% Q1 09 2.99% Q2 09 3.96% Q3 09 4.01% Q4 09 3.81% Q1 10 4.01% Q2 10 3.97% 23 |

|

|

|

|

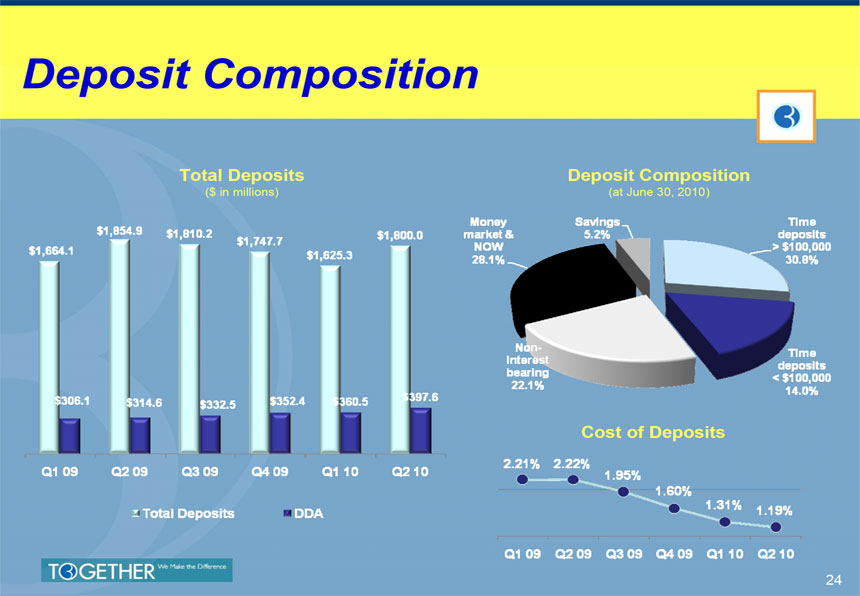

DEPOSIT COMPOSITION TOTAL DEPOSITS ($ in millions) Total Deposits DDA Q1 09 $1,664.1 $306.1 Q2 09 $1,854.9 $314.6 Q3 09 $1,810.2 $332.5 Q4 09 $1,747.7 $352.4 Q1 10 $1,625.3 $360.5 Q2 10 $1,800.0 $397.6 DEPOSIT COMPOSITION (at June 30, 2010) Time deposits > $100,000 30.8% Time deposits < $100,000 14.0% Non-interest bearing 22.1% Money market & NOW 28.1% Savings 5.2% COST OF DEPOSITS Q1 09 2.21% Q2 09 2.22% Q3 09 1.95% Q4 09 1.60% Q1 10 1.31% Q2 10 1.19% 24 |

|

|

|

|

STRONGLY CAPITALIZED As of 6/30/2010 Leverage Capital Ratio 12.38% Tier 1 Risk-Based Capital Ratio 17.19% Total Risk-Based Capital Ratio 18.47% TCE to TA 9.25% TCE $5.27 FDIC's Total Risk Based Capital Ratio Guideline of 13% FDIC's Tier 1 Leverage Ratio Guideline of 9% TCE to TA: Tangible common equity per common share to tangible assets 25 |

|

|

|

|

STRATEGIC MANAGEMENT INITIATIVES ENHANCED OPERATIONAL EFFICIENCIES APPROX. 18% REDUCTION IN CORE OPERATING EXPENSE STRUCTURE SINCE 1Q08 FTE COUNT LOWERED FROM PEAK OF 366 AS OF 3/31/08 TO 316 AS OF 6/30/10 SUCCESSFUL DELEVERAGING STRATEGY REAL ESTATE CONSTRUCTION PORTFOLIO REDUCED 80% FROM PEAK AT 1Q08 TO $15.1 MILLION AT 6/30/10 CRE PORTFOLIO DOWN-SIZED BY $207.9 MILLION FROM 1Q08 TO $1.0 BILLION AT 6/30/10 PROACTIVE BALANCE SHEET MANAGEMENT INCREASED LIQUIDITY LEVELS GIVEN CHALLENGING CREDIT ENVIRONMENT STRENGTHENING EARNINGS POWER MITIGATE POTENTIAL CREDIT RISK SPEEDY RESOLUTION OF PROBLEM CREDITS AGGRESSIVELY BUILT LOAN LOSS RESERVES STRENGTHENED CAPITAL POSITION TO CAPITALIZE ON OPPORTUNITIES AHEAD RAISED $12.8 MILLION IN A PRIVATE OFFERING THAT CLOSED ON NOVEMBER 30 RAISED $73.5 MILLION OF MANDATORILY CONVERTIBLE PRIVATE PLACEMENT CLEANSE THE BALANCE SHEET AND ADDRESS ALL OPEN CREDIT ISSUES 26 |

|

|

|

|

INVESTMENT HIGHLIGHTS Position of leadership in Korean-American niche by taking early actions FIRST TO DELEVERAGE CRE PORTFOLIO FIRST TO DOWN SIZE ORGANIZATION FIRST TO TAKE AGGRESSIVE STANCE ON CREDIT FIRST TO BUILD UP RESERVES FIRST TO RETURN TO SUSTAINED PROFITABILITY Enhanced operational efficiencies Significantly strengthened capital position Extensive stress testing and external loan reviews ensure adequate provisioning Cleansed balance sheet to maximize 2010 profitability Poised to capitalize on strategic opportunities ahead Strong executive management team with extensive M&A experience 27 |

|

|

|

|

THE RIGHT CHOICE With the right team doing the right things to ensure long term success... TOGETHER WE MAKE THE DIFFERENCE 28 |

|

|

|

|

|

|

|

|

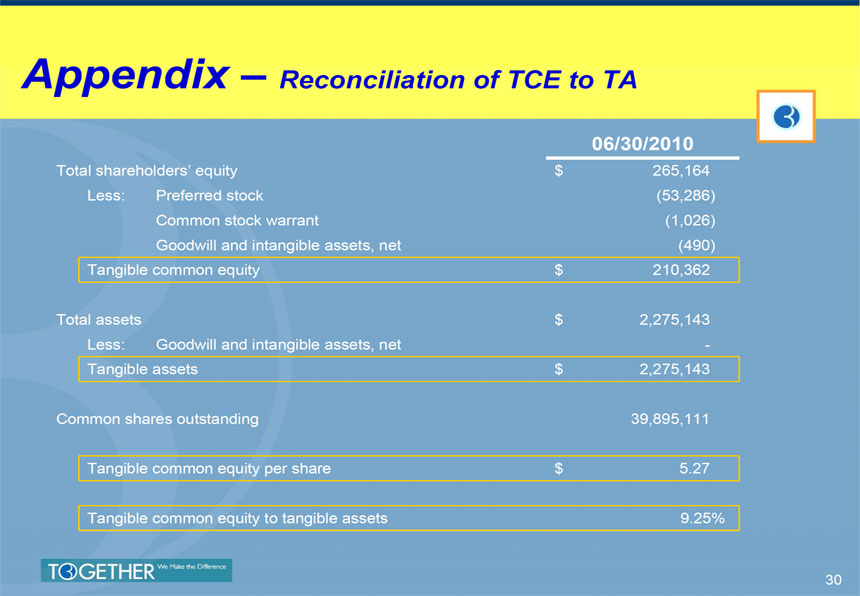

APPENDIX - RECONCILIATION OF TCE TO TA 06/30/2010 --------------- Total shareholders' equity $ 265,164 Less: Preferred stock (53,286) Common stock warrant (1,026) Goodwill and intangible assets, net (490) Tangible common equity $ 210,362 Total assets $ 2,275,143 Less: Goodwill and intangible assets, net - Tangible assets $ 2,275,143 Common shares outstanding 39,895,111 Tangible common equity per share $ 5.27 Tangible common equity to tangible assets 9.25% 30 |