Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WEYERHAEUSER CO | d8k.htm |

WEYERHAEUSER COMPANY

UBS Global Paper and Forest Products Conference

September 14, 2010

Exhibit 99.1 |

2

Forward-looking Statement

This

presentation

contains

statements

concerning

the

company’s

future

results

and

performance

that

are

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

statements

are

based

on

various

assumptions

and

may

not

be

accurate

because

of

risks

and

uncertainties

surrounding

these

assumptions.

Factors

listed

below,

as

well

as

other

factors,

may

cause

actual

results

to

differ

significantly

from

these

forward-looking

statements.

There

is

no

guarantee

that

any

of

the

events

anticipated

by

these

forward-looking

statements

will

occur.

If

any

of

the

events

occur,

there

is

no

guarantee

what

effect

they

will

have

on

company

operations

or

financial

condition.

The

company

will

not

update

these

forward-looking

statements

after

the

date

of

this

presentation.

Some

forward-looking

statements

discuss

the

company’s

plans,

strategies

and

intentions.

They

use

words

such

as

“expects,”

“may,”

“will,”

“believes,”

“should,”

“approximately,”

“anticipates,”

“estimates,”

and

“plans.”

In

addition,

these

words

may

use

the

positive

or

negative

or

other

variations

of

those

terms.

This

presentation

contains

forward-looking

statements

regarding

the

company’s

expectations,

including

operating

values

from

timberlands,

returns

from

silviculture

practices,

effects

of

scale

on

timberlands

operating

costs,

expected

timber

harvests

and

demand

for

logs,

demand

for

biomass,

environmental

benefits,

growth

of

land

ownership

and

management,

and

sources

of

additional

values

in

our

Timberlands

segment;

demand

for

saw

timber,

Canadian

timber

supplies,

cash

flows

from

increased

volumes

and

improved

mix,

and

capacity

and

costs

in

the

Wood

Products

segment;

demand

for

fluff

pulp,

manufacturing

capabilities

and

cost

reductions

in

the

Cellulose

Fiber

segment;

increases

in

housing

starts

in

our

single-

family

homebuilding

operations;

and

the

benefits

of

REIT

conversion.

Major

risks,

uncertainties

and

assumptions

that

affect

the

company’s

businesses

and

may

cause

actual

results

to

differ

from

these

forward-looking

statements,

include,

but

are

not

limited

to:

the effect of general economic conditions, including the level of interest

rates, availability of financing for home mortgages, strength of the U.S.

dollar, employment rates and housing starts;

market

demand

for

the

company’s

products,

which

is

related

to

the

strength

of

the

various

U.S.

business

segments

and

economic

conditions;

the successful execution of internal performance plans, including

restructurings and cost reduction initiatives; performance of the

company’s manufacturing operations, including maintenance requirements and operating efficiencies;

raw material, transportation and energy prices;

changes in the Company’s business support functions and support

costs; changes in legislation or tax rules;

the level of competition from domestic and foreign producers;

the effect of forestry, land use, environmental and other governmental

regulations; legal proceedings;

the risk of loss from fires, floods, windstorms, hurricanes, pest infestation

and other natural disasters; changes in accounting principles; and

other

factors

described

under

“Risk

Factors”

in

the

Company’s

annual

report

on

Form

10-K.

The company also is a large exporter and is affected by changes in economic

activity in Europe and Asia, particularly Japan, China and Korea. It

also is affected by changes in currency exchange rates, particularly the

relative value of the U.S. dollar to the euro and the Canadian dollar.

Restrictions on international trade or tariffs imposed on imports also may

affect the company. |

Dan Fulton

President and Chief Executive Officer |

4

Reasons to Own Weyerhaeuser

Valuable timberland holdings

Leader in adding and extracting value from timberlands

Uniquely positioned to benefit from the recovery

Focused on returning value to shareholders

Timberland-focused strategy

optimized by REIT structure |

5

Timberland Asset

Over 6.5 million acres of timberlands

Over 7 million acres of mineral rights

Does not include 15.2 million acres of forestland under license in

Canada Timberlands

Acres (000)

%

US West

US South

Uruguay

China JV

Total

Core

1,850

3,720

341

45

5,956

90.7%

Non-Core

213

394

-

-

607

9.3%

TOTAL

2,063

4,114

341

45

6,563

100% |

6

Timberland Strategy

Generate high returns on sustainably managed forests

Timberland focused on saw timber –

generates the

highest operating values

Proprietary silviculture practices generate highest return

from timberland

Scale operations create cost advantage

Capture additional value from timberlands

(minerals, oil & gas, environmental benefits)

Grow timberland holdings |

7

Positive Outlook for US Timber Values

Saw timber demand expected to grow

Driven by housing starts returning to trend

Shortfall in future Canadian harvest due to

pine beetle infestation

Canada has historically provided approximately

one third of US lumber supply

Export market remains strong and likely to expand

|

8

Weyerhaeuser Positioned to Capture Benefits

Harvest expected to increase 71% (2009 –

2019)

US will rise 60%; international to increase 4-fold

Cash flow driven by increased harvest volume,

mix and price recovery

Weyerhaeuser Global Fee Harvest Volume

0

5

10

15

20

25

30

35

0

1

2

3

4

5

6

7

8

9

International

North America

Fee Acres Owned |

9

Weyerhaeuser Positioned to Capitalize on

Attractive Timberland Outlook

Attractive outlook

US trend log demand exceeds domestic supply

International demand for logs increasing

Demand is increasing for biomass and environmental solutions

from the forest

Weyerhaeuser well positioned

Saw timber focused

Proprietary silviculture practices result in greater productivity

and margin

Scale and logistics provide cost advantage

Export log market capability

Additional value from minerals, oil & gas, environmental benefits

Recognized for sustainable management |

10

Recognized Leader in Sustainability |

11

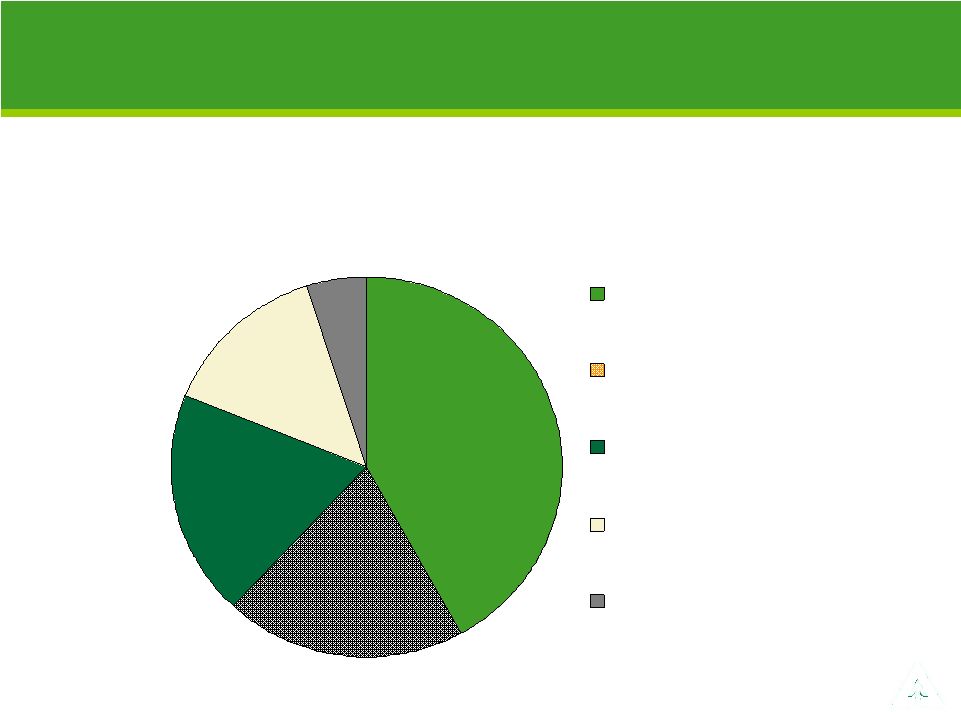

2009 Net Sales of $2.2 Billion

Wood Products |

12

Cellulose Fibers

42%

20%

19%

14%

5%

Fluff Pulp for Disposable

Hygiene Products

Pulp for Premium Towel &

Tissue

Liquid Packaging

Board

Specialty Chemical Cellulose

Pulp

Other Products

2009 Net Sales of $1.5 Billion |

13

WRECO (Weyerhaeuser Real Estate Co.)

2009 Net Sales of $900 million |

Patty Bedient

Executive Vice President and

Chief Financial Officer |

15

REIT structure best supports strategic direction

Benefit to the Company

Qualified earnings distributed to shareholders not taxed

at corporate level

Benefit to shareholders

Most dividends to shareholders taxed at capital gains rate

Benefits of REIT Conversion |

16

Changed legal structure

Moved non-qualifying business activities to

taxable REIT subsidiary (TRS)

Met REIT tests

Distributed special dividend

Final step: Elect REIT status on 2010 tax return

Completion of Steps for REIT Conversion |

17

Special Dividend Summary

$5.6 billion special dividend paid on September 1

$560 million in cash distributed

324.3 million common shares issued

535.9 million total common shares now outstanding

Shareholders who elected cash received

over 15% of the dividend in cash |

18

Third Quarter Accounting Impact of

Special Dividend Distribution

Changes to balance sheet

Cash reduced by $560 million

Deferred tax liability reduced by approximately $1.0 billion

Shareholders’

equity increased by $440 million

Changes to income statement

Tax benefit of $1.0 billion, as a result of the elimination

of deferred taxes

2010 income tax expense recalculated to reflect REIT treatment

Stock portion of E&P dividend treated as share issuance,

and EPS will be adjusted on a prospective basis |

19

Substantial Near-Term Liquidity

Cash Balance After

$1.3 billion

Special Dividend

Bank Revolving Credit Facility

$1.0 billion

(Expires 12/2011)

Total Debt (9/1/2010)

$5.1 billion

2010

2011

2012

2013

2014

2017-2033

$40

$30

$ 732

$433

$15

$3,891

Debt Maturity Schedule ($ millions) |

20

Post REIT Conversion Dividend Considerations

Macroeconomic climate

Earning potential of the company

Target capital structure

Appropriate debt levels

Long term liquidity

Maintaining access to capital

Affordability

Future growth opportunities

Guidance to be provided in December 2010 |

Dan Fulton

President and Chief Executive Officer |

22

Reasons to Own Weyerhaeuser

Valuable timberland holdings

Leader in adding and extracting value from timberlands

Uniquely positioned to benefit from the recovery

Focused on returning value to shareholders

Timberland-focused strategy

optimized by REIT structure |

|