Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Crocs, Inc. | a10-17847_18k.htm |

Exhibit 99.1

|

|

www.crocs.com CREDIT SUISSE SMALL & MID CAP CONFERENCE BOSTON | SEPTEMBER 14, 2010 |

|

|

www.crocs.com REGARDING FORWARD LOOKING STATEMENTS This presentation may contain forward-looking statements, estimates or projections that are based on our current expectations. Any such statements, estimates or projections are subject to risks and uncertainties that could cause the actual results and outcomes to vary materially from these statements, estimates and projections. These risks and uncertainties are discussed in our filing with the Securities and Exchange Commission (SEC) including, without limitation, the Crocs, Inc. Annual Report on From 10-K for the year ended December 31, 2009 and subsequent filings with the SEC prior to the date hereof. Crocs, Inc. undertakes no obligation to update its forward-looking statements upon the receipt of new information, future events or otherwise. |

|

|

www.crocs.com CROCS | AGENDA History 2010 Profitable Growth The Company Today Regions Channels Strategy 2010 Marketing Campaign |

|

|

CROCS | HISTORY www.crocs.com History 2010 Profitable Growth The Company Today Regions Channels Strategy 2010 Marketing Campaign |

|

|

“Bring profound comfort, fun and innovation to the world's feet.” CROCS | WHO WE ARE www.crocs.com |

|

|

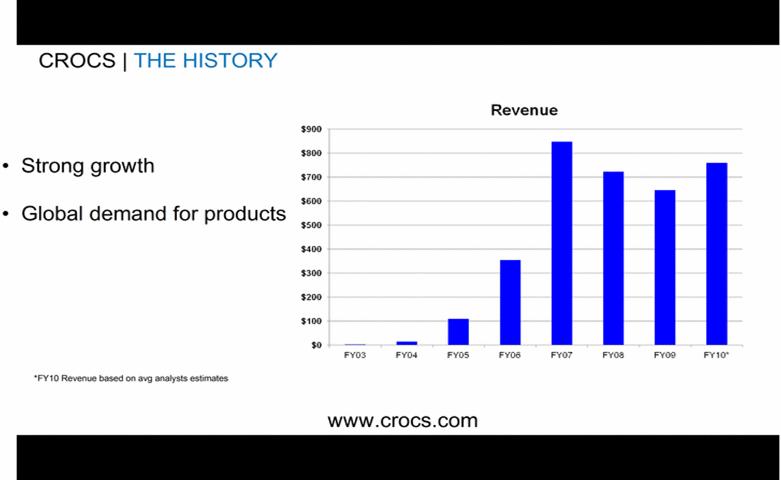

CROCS | THE HISTORY *FY10 Revenue based on avg analysts estimates Strong growth Global demand for products www.crocs.com |

|

|

CROCS | 2009: A YEAR OF RECOVERY Strong balance sheet : From $29.2 net cash* (2008) to $77.3 (2009) Bank debt free Inventory reduced ~60% Focused Global Wholesale Successful Direct to Consumer Global Expansion Exited marginal distribution channels Strengthened & expanded product line Streamlined operational structure www.crocs.com |

|

|

CROCS | 2010 PROFITABLE GROWTH History 2010 Profitable Growth The Company Today Regions Channels Strategy 2010 Marketing Campaign www.crocs.com |

|

|

CROCS | 2010: PROFITABLE GROWTH Strong Top line Growth (+19% growth June YTD) ASP improvement Significant Gross Margin improvement ( 55% June YTD) Leveraged SG & A (51% to 43% June YTD) Execute against profitability plans / $0.42 EPS June YTD Exciting new product line Invest in systems, processes and people Strong Q2 2010 Results Sales $228.0M EPS $0.37M Cash $97.0M www.crocs.com |

|

|

CROCS | THE COMPANY TODAY History 2010 Profitable Growth The Company Today Regions Channels Strategy 2010 Marketing Campaign www.crocs.com |

|

|

CROCS | THE BRAND TODAY Widely recognized global brand with ~60% of revenue generated internationally Global, strong, devoted and large consumer base in 129 countries in Asia, Europe, South America, Canada and US More than 140 million pairs sold since inception Recognized for comfort, casual, colorful and fun footwear Core consumer | women, men, children, teens / all ages from 2-102 ! Global consumer acceptance of broad portfolio of styles and new products ~31% June YTD 2010 revenue from new 2010 styles New product portfolio sell thru exceeding expectations S/S10 & F/W10 advertising raising brand awareness www.crocs.com |

|

|

CROCS | THE GLOBAL COMPANY TODAY Wholesale remains a primary channel ( +18% growth) Roughly 60% - 70% of revenues Beginning to segment by channel and style Strong growth in company-operated retail (+23% growth) Roughly 25% of revenues Guaranteed access to consumer Full presentation of Crocs product line Healthy growth in global internet channel (+17% growth) Roughly 10% of revenues 25.0% 66.0% Wholesale Retail Internet SALES June YTD 2010 9.0% www.crocs.com |

|

|

CROCS | THE REGION SUMMARY Approximately 61% of revenue generated internationally *Includes Canada and S. America Americas* (+17% Growth June YTD) Asia (+20% Growth June YTD) Europe (+20% Growth June YTD) www.crocs.com |

|

|

CROCS | GLOBAL WHOLESALE SUMMARY Global wholesale growth (+18% June YTD) Strong wholesale growth June YTD by region: Asia +28% Americas +15% Europe +13% Global acceptance of new product portfolio / strong sell thru SS11 pre-books : encouraged by early indications www.crocs.com |

|

|

CROCS | RETAIL ADVANTAGE www.crocs.com |

|

|

CROCS / GLOBAL RETAIL CHANNEL ADVANTAGE Global retail sales growth (+ 23% June YTD) Total company operated retail locations as of June 30, 2010: Total 363 Stores: 110 Outlets: 68 Store in Store: 94 Kiosks: 91 3rd Party: 414 Total global retail locations: 777 Advantage = guaranteed access to our consumer Advantage = guaranteed consumer access to full portfolio www.crocs.com |

|

|

CROCS | GLOBAL INTERNET CHANNEL ADVANTAGE Global Internet growth healthy (+17% growth June YTD) Business is strong and growing Key channel for new product launch & servicing our loyal consumers Currently 23 transactional sites globally Focus on expansion in Asia in Q3 Successful mobile commerce site launch in Q2 Advantage = guaranteed access to our consumer Advantage = guaranteed consumer access to full portfolio |

|

|

CROCS | U.S. RETAIL SUMMARY Retail growth (+31% June YTD) Strong impact of new product sell thru New product / in-line sell thru (+35% Q3 QTD) New product/ in line comps(+30% Q3 QTD) Sell thru of back to school featured products (+40% Q3 QTD) US comps growing Q1=+ 5%, Q2= +8%, QTD August =+12%, August YTD= +8% US retail results are encouraging www.crocs.com |

|

|

CROCS | STRATEGY History 2010 Profitable Growth The Company Today Regions Channels Strategy 2010 Marketing Campaign www.crocs.com |

|

|

CROCS | STRATEGIC DEVELOPMENT Balance Sheet Set Strategy Refocus Mgmt Attack Costs Rebuild Relationships Restore Confidence in the Street 2012 GLOBAL BRAND Top Line Growth Execute Plan Build Mgmt Team Profitability Product Driven Retail Operations SCM Excellence Invest in Systems Solid Growth New Markets\Products Perf Based Culture SG&A Leverage 3 Season Company Retail Expansion Diversify Mfg. Base Leverage Technology Predictable Growth Expand Market Share Mgmt Excellence Best in Class Service Design Leadership Retail Excellence Competitive Weapon Integrated Enterprise 2011 PROFITABLE EXPANSION 2010 RESTORE PROFITABILTY 2009 STABILIZE www.crocs.com |

|

|

CROCS | GLOBAL GROWTH OPPORTUNITIES Further penetrate existing wholesale account base Expanding in BRIC countries Reacquired distribution rights to key countries and territories Growing company owned retail (400 locations by year-end) Further development of international e-commerce platforms www.crocs.com |

|

|

1 Streamlining supply chain systems - Transition to more pre-bookings - Balanced mfg (sub contract vs. internal) capacities - Continuous improvements in distribution 2 Ship direct systems - Pack by store for major retailers (globally) - Pack by store for Crocs Retail CROCS | OPERATIONAL EFFICIENCIES / GROSS MARGIN LEVERAGE www.crocs.com |

|

|

www.crocs.com CROCS | NEW SS11 PRODUCTS ! Sneakers Toning Translucents |

|

|

www.crocs.com CROCS | DESIGN LEADERSHIP Global design resources USA ITALY JAPAN |

|

|

CROCS | Marketing Campaign History 2010 Profitable Growth The Company Today Regions Channels Strategy 2010 Marketing Campaign |

|

|

Successful SS10 advertising campaign Successful back to school advertising campaign Driving business to both wholesale & consumer direct Significant new product sell through / wholesale and consumer direct CROCS | 2010 MARKETING CAMPAIGN www.crocs.com |

|

|

CROCS | KEY INVESTMENT HIGHLIGHTS Strong, balanced global business model Large, loyal, global consumer base Diversified sale contributions in terms of distribution channels, geographies, demographics, and product styles Enhanced new product design and integrated marketing strategies driving new growth opportunities, channel segmentation and expanded product portfolio. Strategic investments creating industry leading margin expansion and cost reductions. www.crocs.com |

|

|

CROCS | KEY INVESTMENT HIGHLIGHTS Crocs Spring 2010 Commercial Back to School - Crocs www.crocs.com |

|

|

THANK YOU Investor Contact | ICR, Inc. | Brendon Frey | 203-682-8200 | brendon.frey@icrinc.com www.crocs.com |