Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMEDISYS INC | d8k.htm |

| EX-99.2 - RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES - AMEDISYS INC | dex992.htm |

Investor Presentation

Leading Modern Home Health Care & Hospice

(September 2010)

Exhibit 99.1 |

Leading Modern Home Health & Hospice

Forward-looking

statements

This presentation may include forward-looking statements as defined by the

Private Securities Litigation Reform Act of 1995. These forward-looking

statements are based upon current expectations and assumptions about our

business that are subject to a variety of risks and uncertainties that could

cause actual

results

to

differ

materially

from

those

described

in

this

presentation.

You

should not rely on forward-looking statements as a prediction of future events.

Additional

information

regarding

factors

that

could

cause

actual

results

to

differ

materially from those discussed in any forward-looking statements are described

in reports and registration statements we file with the SEC, including our

Annual Report on Form 10-K and subsequent Quarterly Reports on Form

10-Q and Current Reports on Form 8-K, copies of which are available

on the Amedisys internet

website

http://www.amedisys.com

or

by

contacting

the

Amedisys

Investor

Relations department at (800) 467-2662.

We disclaim any obligation to update any forward-looking statements or any

changes in events, conditions or circumstances upon which any

forward-looking statement may be based except as required by law.

2

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we

have posted additional important

information such as press releases,

profiles concerning our business

and clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-

critical information regarding the

Company in advance of or in lieu of

distributing a press release or a

filing with the SEC disclosing the

same information. |

Leading Modern Home Health & Hospice

Management team

William F. Borne, Chairman and CEO

Founder and CEO since 1982

28 years leading the industry

Michael D. Snow, Chief Operating Officer

30 years leading health care operations

Wellmont, HealthSouth, HCA

Tim Barfield, Chief Development Officer

15 years of corporate development experience

Gov. Bobby Jindal

, Vinson & Elkins, The Shaw Group

Dale E. Redman, CPA, Chief Financial Officer

34 years of senior level financial experience

Winward

Capital, United Companies Financial

3

Jeffrey D. Jeter, Chief Compliance Officer

14 years of health care law and compliance expertise

Former Medicaid prosecutor, LA AG for DOJ

Michael O. Fleming, Chief Medical

Officer 29 years as a family physician

Former President of AAFP, first industry CMO

G. Patrick Thompson, Chief Information Officer

23 years of corporate administration experience

Arthur Andersen, Turner Industries, The Shaw Group

David R. Bucey, General Counsel

24 years of experience in corporate law

Coca-Cola Company, McKenna Long & Aldridge |

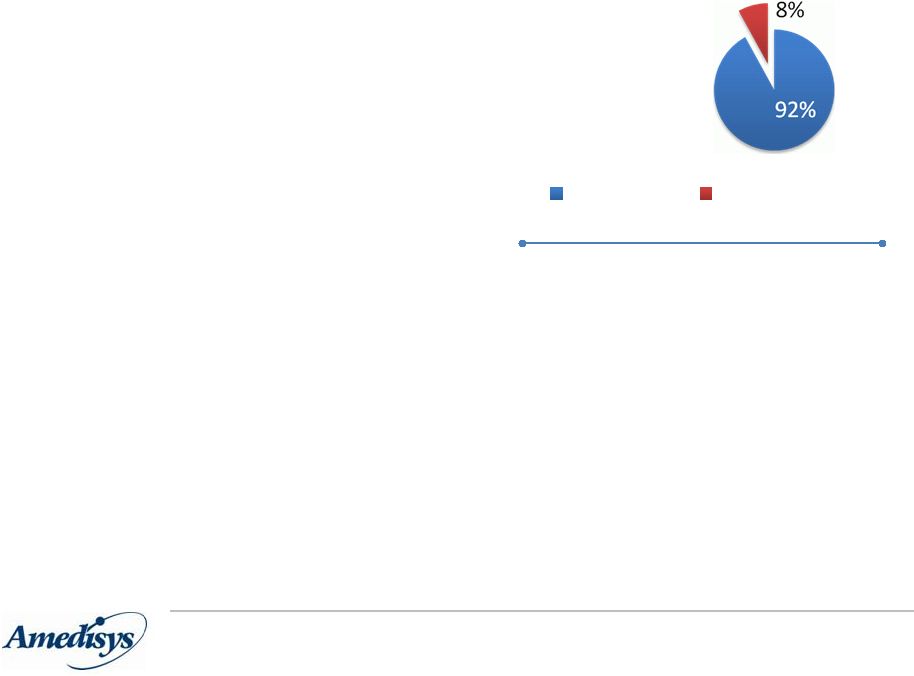

Leading Modern Home Health & Hospice

Company

overview

1

4

•

Founded in 1982, publicly listed

1994

•

601 locations in 45 states

•

Leading provider of home health

services

-

Services include skilled nursing

and therapy services

•

95% of Home Health revenue is

episodic based (both Medicare &

non-Medicare)

17,600 employees

Home Health:

-

Daily visits = 35,000

-

9.2 million visits run rate in 2010

Hospice:

-

Average daily census = 2,837

-

Average length of stay = 87 days

2010 revenue guidance = $1.650 billion²

Stats

Revenue Mix

92%

Home Health

Hospice

For the quarter ended June 30, 2010

Provided as of the date of our Form 8-K filed with the Securities and Exchange Commission on

August 9, 2010. 1

2 |

Leading Modern Home Health & Hospice

Home Health Division

5

•

Industry leader

–

Strong national footprint –

529 locations across

45 states as of June 30

–

$388 million revenue in 2Q 2010

•

Strong clinical quality

•

Experienced divisional leadership

•

World-class technology platform + enhancing

operating platform

•

Well positioned to capitalize on organic and

market opportunities

Point-of-care,

Mercury Doc

Care

Transitions

Advanced

Chronic Care

Management |

Leading Modern Home Health & Hospice

Hospice Division

6

Point-of-care,

Mercury Doc

(2011)

Essential to the

Care

Continuum

Advanced

Symptom

Management

•

Solid trajectory of internal growth

–

15% YTD growth in 2010; 33% growth over 2009

–

$34 million revenue in 2Q 2010

•

Record number of patient census

–

Average daily census = 2,800+

•

Operational efficiencies and quality care

processes drive strong margins

–

Operating income margin = 21%

•

Partnered with the country’s largest and leading

Home Health company

–

Offering comprehensive continuum of at-home care

–

Collective resources to drive operational and clinical

excellence

–

Cross referral opportunities to drive growth |

Leading Modern Home Health & Hospice

Rapid growth

In

the

past

two

and

a

half

years

(2007–

2010),

Amedisys

has grown from:

9,000 employees to 17,000

354 sites to more than 600 today

$700M in revenues to $1.65B

today

7

1

Annualized revenue guidance provided as of the date of our Form

8-K filed with the Securities and Exchange

Commission on August 9, 2010.

1 |

Leading Modern Home Health & Hospice

2010 @ Amedisys

Strengthened management team

Enhancing infrastructure

Portfolio management

Realigning labor mix

Share repurchase

Managing external factors –

SFC, SEC

New CMS Proposed Rules

8

Top to middle

IT, Training, corporate support

Prune out unprofitable sites

Best athlete, continue shift to PPV

Confidence in our earnings potential

Opportunity to highlight value of HH

Opportunity for efficiency, new

growth |

Leading Modern Home Health & Hospice

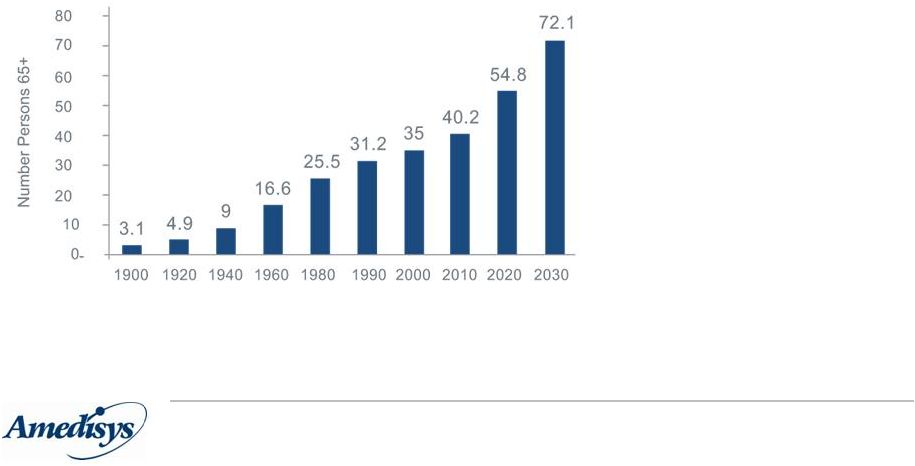

The age tsunami is inevitable

9

Between 2000 and

2030, the number of

people age 65+ will

more than double to

72.1 million

Source: Center for Medicare & Medicaid Services, September 2010

Figure 1: Number of Persons 65+

1900 –

2030, numbers in millions

Year (as of July 1) |

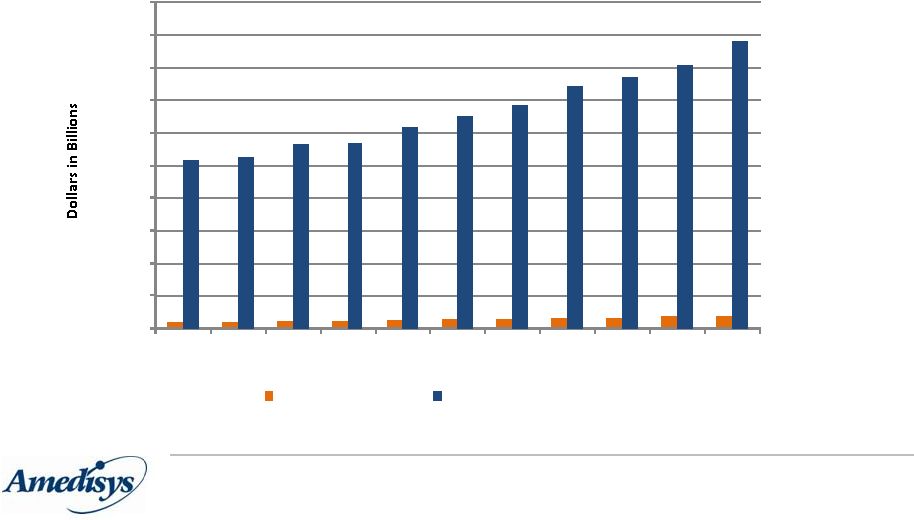

Leading Modern Home Health & Hospice

Medicare market size

10

Source:

CBO's

March

2009

Baseline:

Medicare

home

health

revenue,

offset

by

cuts

in

Health

Care

Reform

Bills.

Kaiser

Family

Foundation

fact sheet August 2010. National Health Expenditure Projections, September

2010. $18

$19

$21

$23

$25

$27

$29

$30

$32

$35

$38

$507

$524

$566

$569

$617

$652

$684

$741

$771

$805

$878

$-

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Home Health Spend

Medicare Spend

•

Overall Medicare spend is expected to increase 173% during the next 10 years

•

Medicare home health spend is estimated to increase 211% during this same time

period, but continue to be only a fraction of total Medicare spend

|

Leading Modern Home Health & Hospice

Our strategy

11

Clinical

Excellence

Growth

Efficiency |

Leading Modern Home Health & Hospice

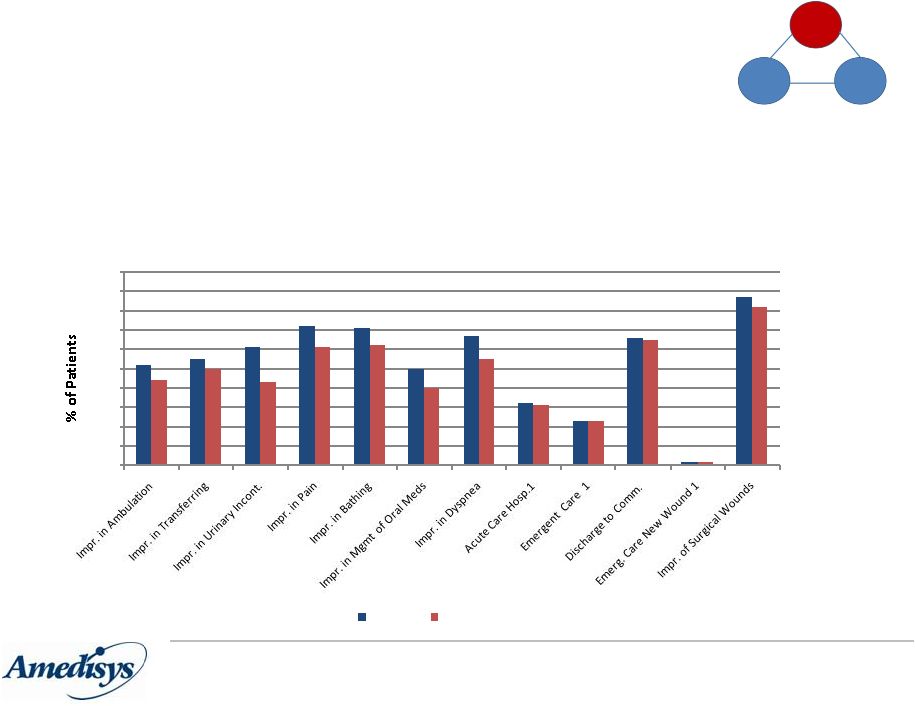

Clinical excellence

12

Amedisys

vs. Footprint –

Outcomes December 2009

•

Exceeded or met 11 out of 12 outcomes vs. footprint

•

Awarded $3.5 million in pay for performance demonstration project from CMS

•

Enhancing clinical excellence through better care transitions, investments in

medical director function, and focus on decreasing hospitalizations

52

55

61

72

71

50

67

32

23

66

1

87

44

50

43

61

62

40

55

31

23

65

1

82

0

10

20

30

40

50

60

70

80

90

100

Amedisys

Footprint |

Leading Modern Home Health & Hospice

Growth

13

Hospice: Aggressive build (current

share is ~1.2%) •

$15 billion industry in the United States (NHPCO)

•

US

hospice

patient

volumes

projected

to

grow

by

40%

over

next

5

years

(NHPCO)

•

Building best hospice in the country based on clinical superiority

•

Duke School of Medicine’s Institute on Care at the End of Life

Home Care: Continued expansion (current share is ~8%)

•Continue

to

differentiate

on

quality,

innovation,

technology

and

scale

•Building

the

only

nationwide

continuum

of

care

platform

–

Advanced

Chronic

Care

Management,

Standardization of Care

•Expand

care

management

programs

–

Behavioral

Health,

Advanced

Wound

Care

•Focus

on

internal

growth

–

Care

Transition

Platform,

Hospital

Partnerships,

strengthening

referral

relationships, better aligning business development and operations

|

Leading Modern Home Health & Hospice

Growth –

Corporate Development

14

Acquisitions: Home Care

•Continue to review opportunities

•Focused

on

strategic

expansion

–

CON

markets,

footprint

expansion,

market

depth,

hospital

system joint ventures

•Positioned well for increase in opportunities expected in 2011

Acquisitions: Hospice

•Continue

to

review

opportunities

–

robust

pipeline

•Focused

on

geographic

expansion

into

Amedisys

home

health

markets,

and

market

depth

Other:

•Exploring

revenue

diversification

strategies

and

care

management

expansion

opportunities

•Both internally developed or acquired |

Leading Modern Home Health & Hospice

Efficiency

15

Portfolio Management

•Detailed review of local agency performance

•Exit markets with chronic poor results, limited growth potential, and/or

intense competition •Consolidate overlapping agencies

•Review startup program

Ownership of Results

•Push down authority and responsibility to local, regional, and divisional

leaders •Provide tools to support their success

•More responsive to local market dynamics

Infrastructure Investment

•Continued investment in state-of-the-art operating system

•Upgrading accounting and HR system to Peoplesoft

•Rolling out Hospice Point-of-Care in 2011

|

Leading Modern Home Health & Hospice

Key differentiators

Clinical quality why we are in business

16

Compliance covers everything we do

Care Centers national distribution

Innovation industry leadership

Technology competitive advantage

|

Leading Modern Home Health & Hospice

Traditional

•

Assessment/Evaluation at Home

•

Skilled Nursing

•

Rehab

•

Medical Social Services

•

Home Health Aide Services

•

In Home Hospice Services

17 |

Leading Modern Home Health & Hospice

Modern

Innovative Treatment Modalities

o

Disease Management

o

Medication Management

o

Predictive

Modeling

-

Risk

Stratified

Patient Management

o

Continuous Evaluation/Assessment

o

Care Coordination

o

Multidisciplinary Rehabilitation Services

o

Health Coaching

o

Coumadin Management

o

Balanced

for

Life

-

Fall

Assessment/Prevention

o

Intensive Chronic Care Management

Caregiver Engagement

o

Clinical guidelines/oversight

Technology

o

Telemonitoring

/ Call Center Intervention

o

Point-of-Care Clinical Documentation

o

Physician Data Portal

18 |

Leading Modern Home Health & Hospice

Why Amedisys?

We are the only

modern Home Health & Hospice provider that….

•

has 600 Care Centers across the country and more than 16,000

skilled clinicians

•

has

the

resources

to

invest

in

advanced

technology,

clinical

track

development and talented people

•

cares for more than 35,000 Americans across the country everyday

and

more

than

500,000

Americans

each

year

19

Amedisys

does the right thing, at the right time, for every patient.

|

Leading Modern Home Health & Hospice

Financial Review

20 |

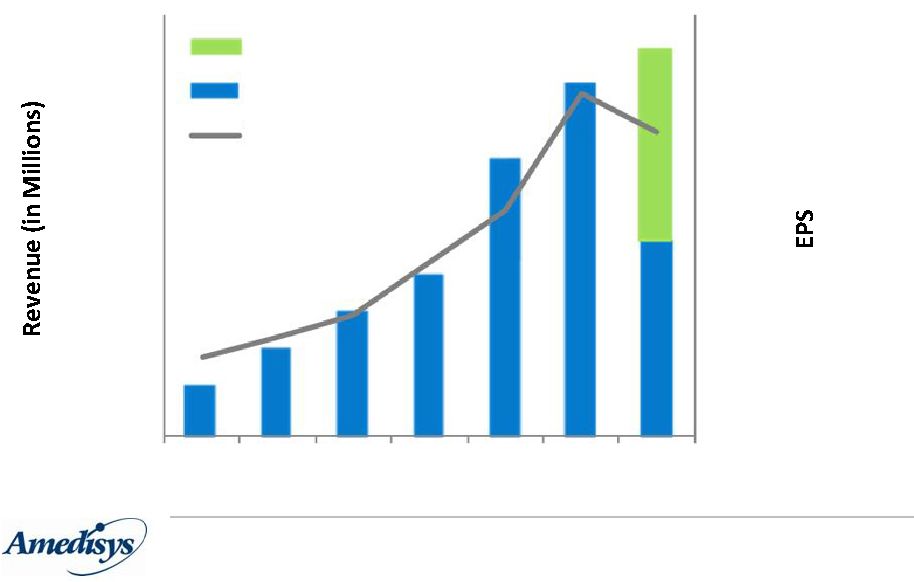

Leading Modern Home Health & Hospice

21

$-

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2004

2005

2006

2007

2008

2009

2010

Projected Revenue

Actual Revenue

EPS

Financial highlights |

Leading Modern Home Health & Hospice

Adjusted EBITDA is defined as net income attributable to Amedisys, Inc. before provision for

income taxes, net interest (income) expense, and depreciation and amortization plus

certain TLC integration costs. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, income before income taxes, cash flow from

operating activities, or other traditional indicators of operating performance. This

calculation of adjusted EBITDA may not be comparable to a similarly titled measure

reported by other companies, since not all companies calculate this non-GAAP financial

measure in the same manner. Adjusted diluted earnings per share is defined as diluted

earnings per share plus the earnings per share effect of certain TLC acquisition costs. Adjusted diluted earnings per

share should not be considered as an alternative to, or more meaningful than, income before

income taxes, cash flow from operating activities, or other traditional indicators of

operating performance. This calculation of adjusted diluted earnings per share may not be comparable to a similarly titled measure reported by other

companies, since not all companies calculate this non-GAAP financial measure in the same

manner. 22

Summary financial results

($ in millions, except per share data)

2008

2009

2Q09

2Q10

Net revenue

$1,187.4

$1,513.5

$377.9

$422.3

Period-over-period growth

70.1%

27.5%

20.9%

11.7%

Gross margin

624.8

789.0

199.5

213.0

Percent of revenue

52.6%

52.1%

52.8%

50.4%

CFFO

150.7

247.7

75.8

54.4

Adjusted

EBITDA

181.4

261.8

67.4

63.4

Percent of revenue

15.3%

17.3%

17.8%

15.0%

Adjusted

Fully-diluted

EPS

$3.31

$4.89

$1.27

$1.13

1

2

1

2 |

Leading Modern Home Health & Hospice

23

Summary performance results

2008

2009

2Q09

2Q10

Agencies at period end

528

586

549

601

Period-over-period growth

49.2%

11.0%

10.2%

9.5%

Total visits

7,004,200

8,702,146

2,185,515

2,320,736

Period-over-period growth

62.8%

24.2%

18.0%

6.2%

Episodic-based admissions

199,371

231,782

58,209

63,076

Period-over-period growth

53.8%

16.3%

8.7%

8.4%

Episodic-based completed

episodes

353,076

411,975

102,209

109,420

Period-over-period growth

60.6%

16.7%

8.5%

7.1%

Episodic-based revenue per

episode

$2,854

$3,166

$3,166

$3,372

Period-over-period growth

7.3%

10.9%

11.4%

6.5% |

Leading Modern Home Health & Hospice

24

Summary balance sheet

Dec. 31, 2009

Jun. 30, 2010

Assets

Cash

$ 34.5

$ 116.0

Accounts Receivable, Net

150.3

151.9

Property and Equipment

91.9

112.1

Goodwill

786.9

790.2

Other

108.8

99.0

Total Assets

$ 1,172.4

$ 1,269.2

Liabilities and Equity

Debt

$ 215.2

$ 204.1

All Other Liabilities

220.9

237.6

Equity

736.3

827.5

Total Liabilities and Equity

$ 1,172.4

$ 1,269.2

Leverage Ratio

0.8x

0.7x |

Leading Modern Home Health & Hospice

Our calculation of days revenue outstanding, net at March 31, 2008 is derived by dividing our

ending net patient accounts receivable (i.e. net of estimated revenue adjustments, allowance for

doubtful accounts and excluding the patient accounts receivable assumed in the TLC Health Care

Services, Inc. (“TLC”) and Family Home Health Care, Inc. & Comprehensive Home Healthcare

Services, Inc. (“HMA”) acquisitions) by our average daily net patient revenue,

excluding the results of TLC and HMA for the three-month period ended March 31, 2008.

Our calculation of days revenue outstanding, net is derived by dividing our ending net patient

accounts receivable (i.e. net of estimated revenue adjustments and allowance for doubtful accounts)

by our average daily net patient revenue for the three-month period.

25

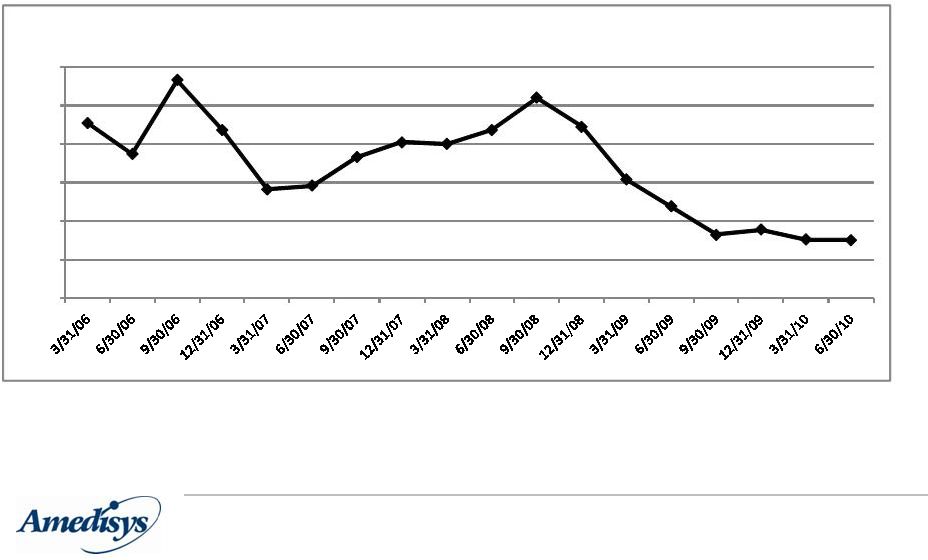

Days revenue outstanding (DSO)

(1)

47.7

43.7

53.3

46.8

39.1

39.6

43.3

45.2

45.0

46.8

51.0

47.2

40.4

36.9

33.2

33.9

32.6

32.5

25.0

30.0

35.0

40.0

45.0

50.0

55.0

DSO -

Net

(2)

(1)

(2) |

Leading Modern Home Health & Hospice

26

Liquidity

•

Cash balance at 6/30/10 = $116M

•

Available

line

of

credit

(LOC):

6/30/10

=

$235M

•

2010

Estimated

CFFO

-

Cap

Ex

=

$170M |

Leading Modern Home Health & Hospice

Guidance excludes the effects of future acquisitions, if they are made.

Provided as of the date of our Form 8-K filed with the Securities and Exchange Commission on

August 9, 2010. Without adjustment for any shares that may be repurchased under our Share

Repurchase Program. 27

Guidance¹

Calendar Year 2010²

Net revenue:

$1.625 -

$1.650 billion

EPS:

$4.20 -

$4.50

Diluted shares³:

28.8 million

1

2

3 |

Leading Modern Home Health & Hospice

Key references

28

Open Letter to Shareholders:

http://www.amedisys.com/pdf/Letter_to_Shareholders.pdf

Wyatt Matas

Report: (upon request)

kevin.leblanc@amedisys.com

Avalere

Study:

http://www.amedisys.com/pdf/avalere_results_051109.pdf

|

Leading Modern Home Health & Hospice

Contact information

Kevin B. LeBlanc

Director of Investor Relations

Amedisys, Inc.

5959 S. Sherwood Forest Boulevard

Baton Rouge, LA 70816

Office: 225.292.2031

Fax: 225.295.9653

kevin.leblanc@amedisys.com

29 |