Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cheniere Energy Partners, L.P. | form_8-k.htm |

Cheniere Energy Partners, L.P.

UBS 2010 MLP One-on-One

Conference

UBS 2010 MLP One-on-One

Conference

Forward Looking Statements

1

This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act of 1933, as amended. All statements, other than statements of historical facts,

included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

the Securities Act and Section 21E of the Securities Exchange Act of 1933, as amended. All statements, other than statements of historical facts,

included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

§ statements that we expect to commence or complete construction of a liquefaction facility by certain dates or at all;

§ statements that we expect to receive authorization from the Federal Energy Regulatory Commission, or FERC, or the Department of Energy, or

DOE, to construct and operate a proposed liquefaction facility by a certain date, or at all;

DOE, to construct and operate a proposed liquefaction facility by a certain date, or at all;

§ statements regarding future levels of domestic or foreign natural gas production and consumption, or the future level of LNG imports into North

America or exports from the U.S., or regarding projected future capacity of liquefaction or regasification facilities worldwide;

America or exports from the U.S., or regarding projected future capacity of liquefaction or regasification facilities worldwide;

§ statements regarding any financing transactions or arrangements, whether on the part of Cheniere or at the project level;

§ statements regarding any commercial arrangements marketed or potential arrangements to be performed in the future, including any cash

distributions and revenues anticipated to be received;

distributions and revenues anticipated to be received;

§ statements regarding the commercial terms and potential revenues from activities described in this presentation;

§ statements that our proposed liquefaction facility, when completed, will have certain characteristics, including a number of trains;

§ statements regarding our business strategy, our business plan or any other plans, forecasts, examples, models, forecasts or objectives, any or all of

which are subject to change;

which are subject to change;

§ statements regarding estimated corporate overhead expenses; and

§ any other statements that relate to non-historical information.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,”

“expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the

expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of

this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of

factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Current Reports on Form 8-K

filed with the Securities and Exchange Commission on August 6, 2010, which are incorporated by reference into this presentation. All forward-looking

statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking

statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,”

“expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the

expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of

this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of

factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Current Reports on Form 8-K

filed with the Securities and Exchange Commission on August 6, 2010, which are incorporated by reference into this presentation. All forward-looking

statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking

statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

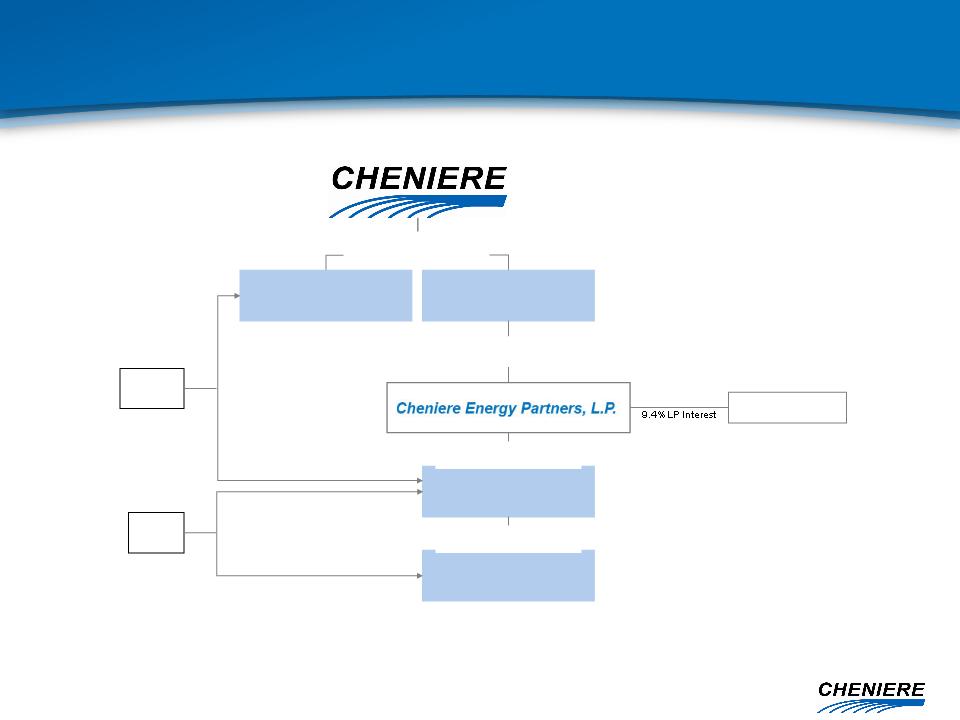

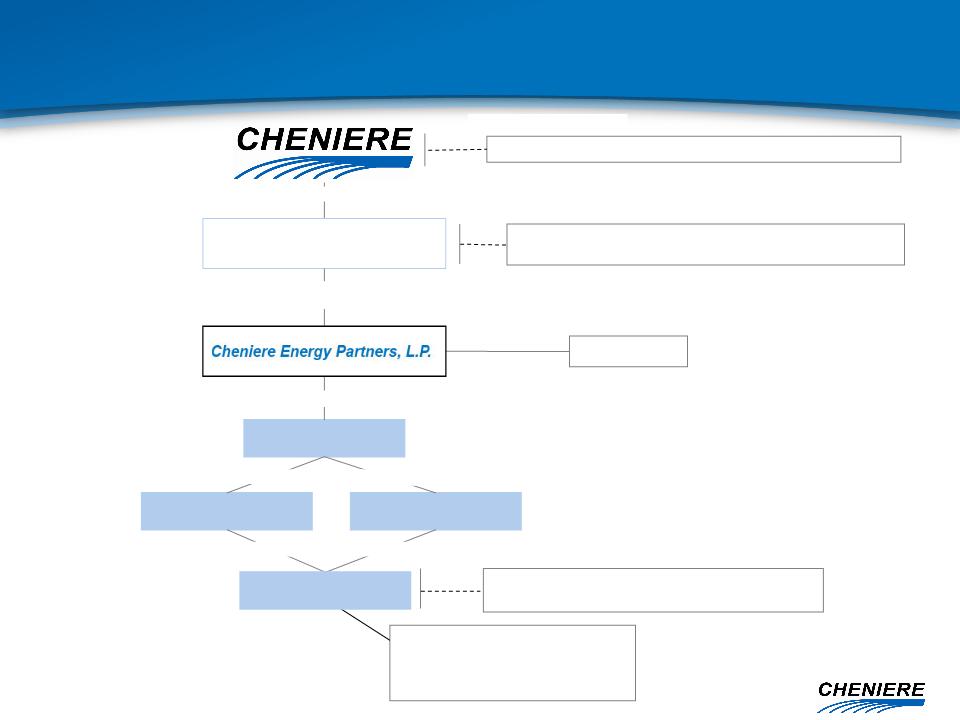

Cheniere Energy, Inc.

NYSE Amex US: LNG

Cheniere

Marketing

Marketing

§ 2 Bcf/d Regasification

Capacity at SPLNG

Capacity at SPLNG

Cheniere LNG

Holdings, LLC

Holdings, LLC

§ 90.6% Ownership of CQP

Cheniere Energy

Partners, L.P.

NYSE Amex US: CQP

Creole Trail

Pipeline

Pipeline

§ 2 Bcf/d Takeaway Capacity

for SPLNG

for SPLNG

Sabine Pass LNG,

L.P. (SPLNG)

L.P. (SPLNG)

§ 4 Bcf/d Regasification

Terminal, Fully Contracted

Terminal, Fully Contracted

Proposed Project

- Liquefaction

- Liquefaction

§ Add Liquefaction

Capabilities at SPLNG

Capabilities at SPLNG

88.6% (LP interest)

2.0% (GP interest)

Permitted

Projects

Projects

§ Corpus Christi LNG

§ Creole Trail LNG…

Cheniere Overview

|

TUA

|

Capacity

|

2010 Full-Year

Payments ($ in MM) |

|

Total LNG USA

Chevron USA

Cheniere Energy Investments*

|

1.0 Bcf/d

1.0 Bcf/d

2.0 Bcf/d

|

$123

$128

$252

|

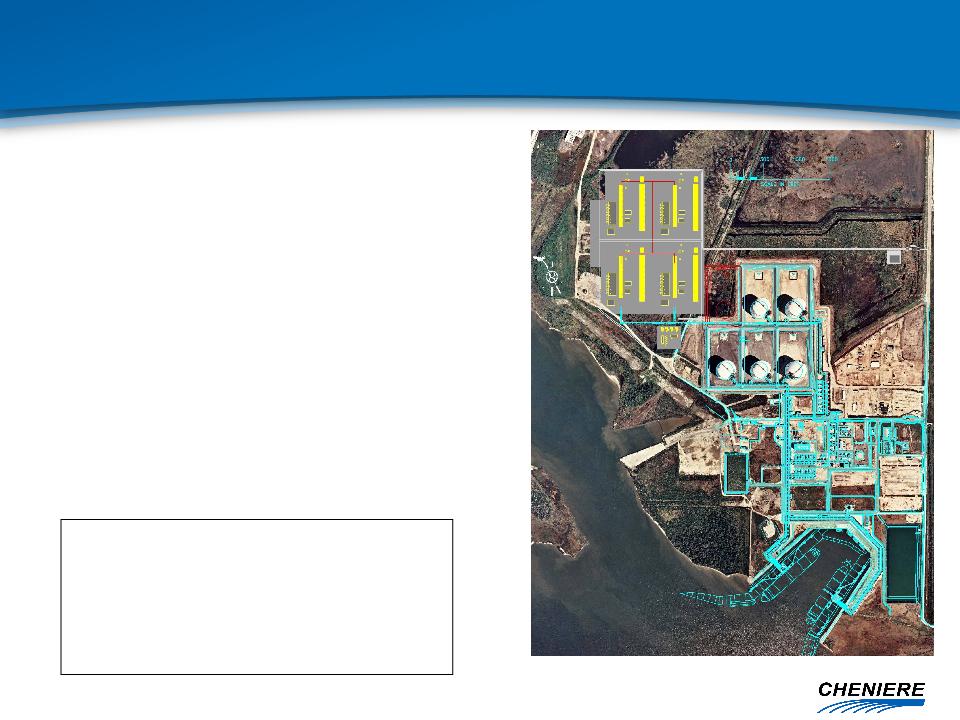

Aerial view of Sabine Pass LNG Terminal

3

* Cheniere Marketing assigned its TUA to Cheniere Energy Investments effective 7/1/2010.

Sabine Pass LNG

Cheniere Energy Partners, L.P. 100%

Cheniere Energy Partners, L.P. 100%

§ Vaporization

– ~4.3 Bcf/d peak send-out

§ Storage

– 5 tanks x 160,000 cm (16.9 Bcfe)

§ Berthing / Unloading

– Two docks

– LNG carriers up to 266,000 cm

– Four dedicated tugs

§ Land

– 853 acres in Cameron Parish, LA

§ Accessibility - Deep Water Ship Channel

– Sabine River Channel dredged to 40 feet

§ Proximity

– 3.7 nautical miles from coast

– 22.8 nautical miles from outer buoy

§ LNG Re-Exporting Capability

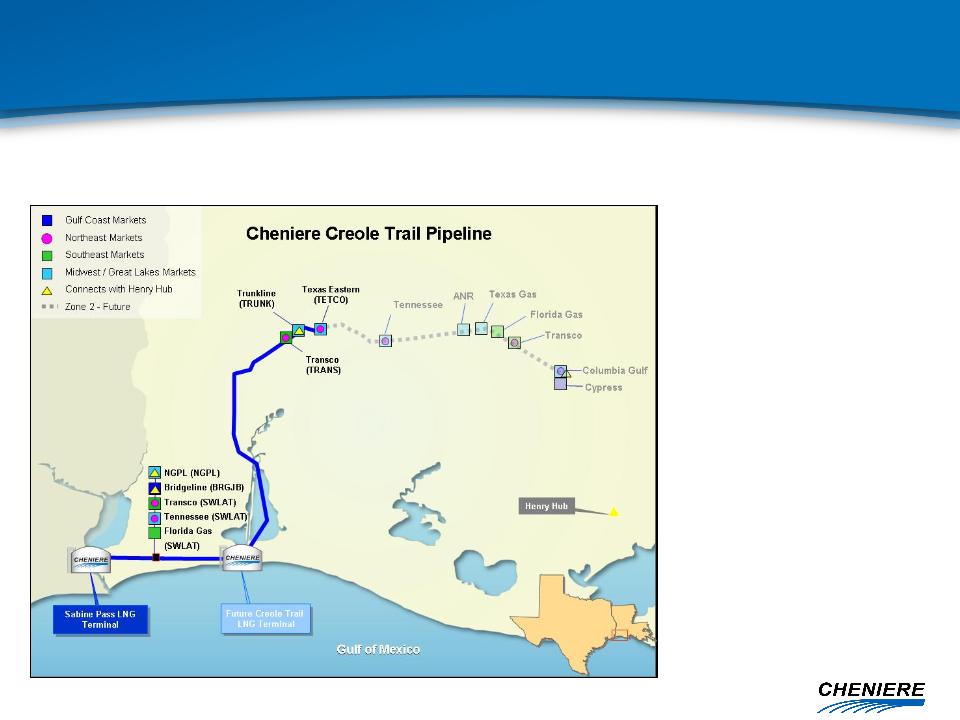

§ Size:

– 2.0 Bcf/d

§ Diameter:

– 42-inch diameter

§ Cost:

– ~$560 million first 94

miles

miles

§ Initial interconnects:

– 4.1 Bcf/d of

interconnect capacity

interconnect capacity

§ Provides optimal market access for LNG from the Sabine Pass terminal

§ First 94 miles complete and in-service, additional 58 miles permitted

* Commencement of construction is subject to regulatory approvals and a final investment decision contingent

upon Cheniere obtaining satisfactory construction contracts and long-term customer contracts sufficient to

underpin financing of the project.

upon Cheniere obtaining satisfactory construction contracts and long-term customer contracts sufficient to

underpin financing of the project.

Creole Trail Pipeline

Cheniere Energy, Inc. 100%

Cheniere Energy, Inc. 100%

Contracted Capacity - TUAs

(1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees.

(2) No inflation adjustments.

(3) Subject to annual inflation adjustment.

(4) Cheniere Marketing assigned its TUA to Cheniere Energy Investments effective 7/1/2010.

Summary of 20-year Terminal Use Agreements

Total Gas & Power N.A.

Chevron USA

Cheniere Energy Investments

Capacity

1.0 Bcf/d

1.0 Bcf/d

2.0 Bcf/d

Fees

(1)

Reservation Fee

(2)

$0.28/MMBTU

$0.28/MMBTU

$0.28/MMBTU

Opex Fee

(3)

$0.04/MMBTU

$0.04/MMBTU

$0.04/MMBTU

2010 Full-Year Payments

$123 million

$128 million

$252 million

Term

20 years

20 years

20 years

Guarantor

Total S.A.

Chevron Corp.

Cheniere Energy Partners, L.P.

Guarantor Credit Rating

Aa1/AA

Aa1/AA

B2/B+

Payment Start Date

April 1, 2009

July 1, 2009

January 1, 2009

6

(4)

3

Public Unit holders

Cheniere Energy

Investments, LLC

Sabine Pass LNG, L.P.

Cheniere LNG

Holdings, LLC

88.6% LP Interest

100% of 2% GP Interest

100% of 2% GP Interest

NYSE Amex US: LNG

NYSE Amex US: CQP

Cheniere

Marketing, LLC

VCRA

TUA

100% Ownership

Interest

Interest

100% Ownership

Interest

Interest

100% Ownership

Interest

Interest

Organizational Structure

TUA Assignment and new VCRA

TUA Assignment and new VCRA

§ CQP: Subordination period extended - distributions to sub units dependent on new business

generated, including future CMI fees under the VCRA

generated, including future CMI fees under the VCRA

§ LNG: Eliminates need for $64mm TUA reserve, funds from reserve used to pay down

$64mm on senior secured convertible loans

$64mm on senior secured convertible loans

§ CMI assigned its 2.0 Bcf/d TUA with Sabine Pass LNG to direct subsidiary of CQP, Cheniere

Energy Investments, LLC (“Investments”)

Energy Investments, LLC (“Investments”)

§ Investments makes TUA payments to Sabine Pass LNG effective 7/1/2010

§ CMI / Investments entered into a Variable Capacity Rights Agreement (“VCRA”) that gives CMI

rights provided in the TUA

rights provided in the TUA

§ CMI continues marketing TUA capacity on CQP’s behalf

§ CMI pays Investments 80% of positive gross margin for each cargo delivered at Sabine

Transaction Summary

Results

* No impact to arrangement between CMI and JPMorgan or any existing agreements with

other counterparties.

other counterparties.

Cheniere and CQP Restructure Marketing

Arrangement*

Arrangement*

Liquefaction Project

i

Sabine Pass to become bi-directional import/export facility

* Commencement of construction is subject to regulatory approvals and a final investment decision contingent

upon Cheniere obtaining satisfactory construction contracts and long-term customer contracts sufficient to

underpin financing of the project.

upon Cheniere obtaining satisfactory construction contracts and long-term customer contracts sufficient to

underpin financing of the project.

Expanding Operations - Liquefaction

Project*

Compelling Proposition

Project*

Compelling Proposition

§ Market fundamentals create opportunity to expand into exports

§ Export services provide customers with an attractively priced option to

access U.S. natural gas supply

access U.S. natural gas supply

§ Sabine Pass facility location is strategically situated

– Many existing assets in place needed for an export terminal reduces

capital required, cost estimates comparable to liquefaction

expansion economics

capital required, cost estimates comparable to liquefaction

expansion economics

– Abundance of supply and existing infrastructure in surrounding

regions, proximity to Henry Hub

regions, proximity to Henry Hub

§ Powerful tool for industry players to manage their portfolios

– Early indications of interest from both buyers and sellers of natural

gas and LNG

gas and LNG

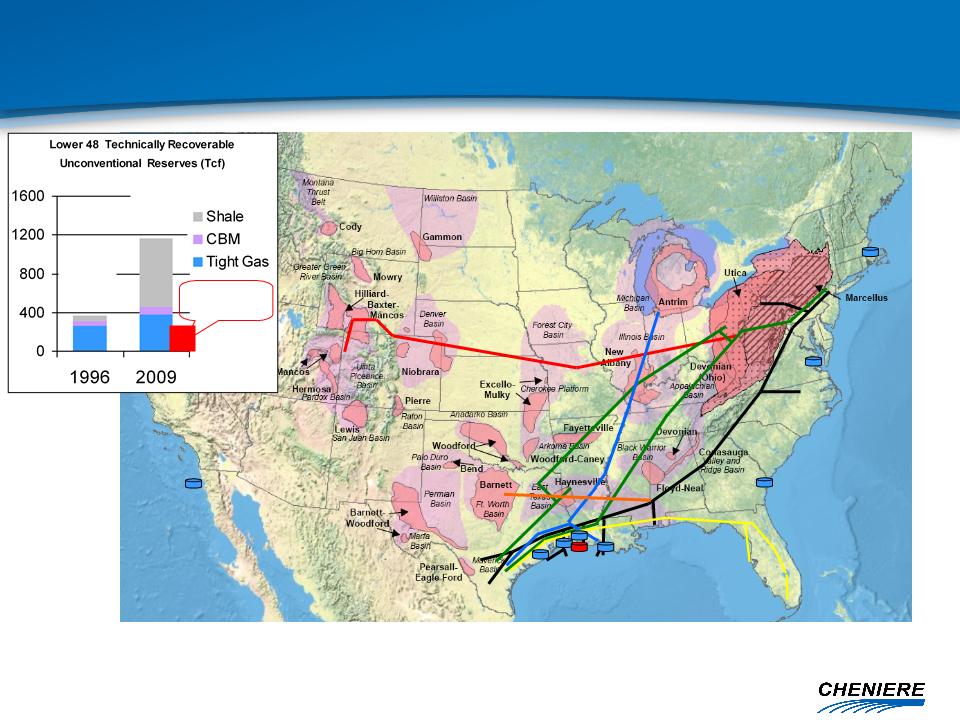

Market Fundamentals Drive Liquefaction

Project

Project

§ The U.S. has become the largest producer of natural gas in the world and

production costs rank among the lowest

production costs rank among the lowest

– Productive capacity at $6.50/MMBtu could reach 95 Bcf/d by 2020

§ U.S. natural gas demand not likely to keep pace with incremental supply as

demand continues to lag market forecasts, threatening to lead to price

volatility

demand continues to lag market forecasts, threatening to lead to price

volatility

§ Globally, a natural gas supply gap is projected to develop in 2014-15

– Key driver is decline of UK Continental Shelf production

– Exacerbates dependency of European consumers on imported gas

– Asian consumers highly dependent on imported LNG for gas supply

§ Simultaneously, global LNG and pipeline gas suppliers continue to enforce oil-

price indexation in new contracts

price indexation in new contracts

– Key markets in Asia and Europe import over 70 Bcf/d of natural gas

– Imports forecast to increase by 26 Bcf/d over the next ten years

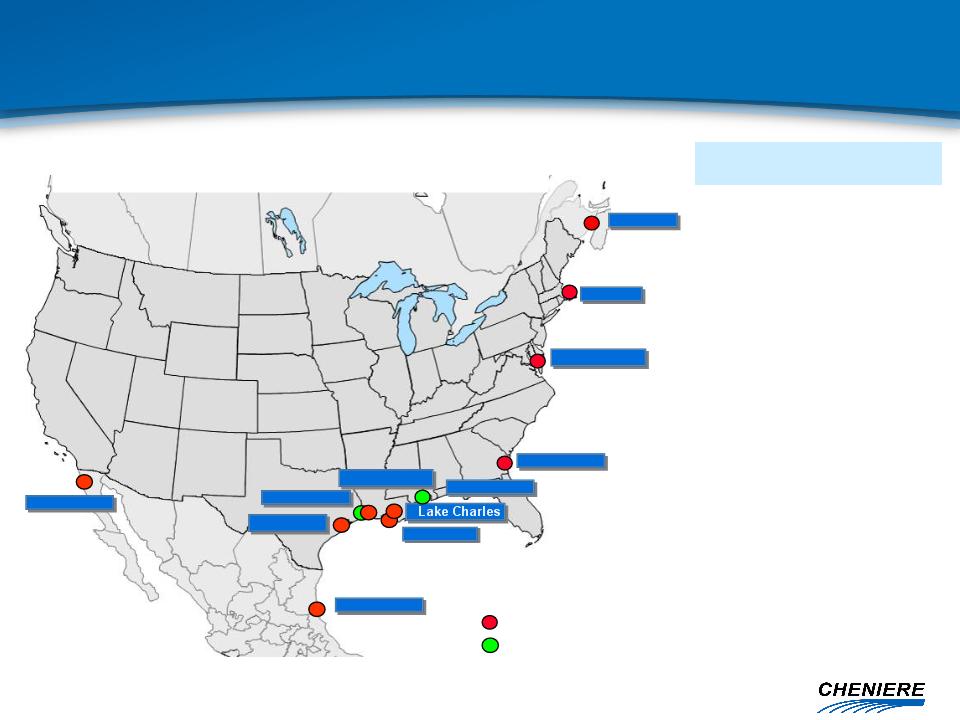

Sources: EIA (US map graphic, pipelines and LNG terminals placed by Cheniere)

Advanced Resources Intl (Lower 48 Unconventional Recoverable Reserves), ARI shale estimates updated April 2010

Depicted Pipelines: Rockies Express, Texas Eastern, Trunkline, Transco, FGT, C/P/SESH/Gulf Crossing (as a single route)

Depicted LNG terminals: Freeport, Golden Pass, Sabine Pass, Cameron, Trunkline, Elba Island, Cove Point, Everett

366

Tcf

Tcf

1,167

Tcf

Tcf

US Proved

Reserves

Reserves

U.S. Unconventional Reserves

Basins Proximate to Premium Markets and Major Pipelines

Basins Proximate to Premium Markets and Major Pipelines

3

Project Estimates:

§ Initial Phase: 1 Bcf/d (two modular

trains)

trains)

§ Second Phase: Additional 1 Bcf/d

§ Estimated capex similar to liquefaction

expansion economics

expansion economics

§ Commercial start date: 2015e

Sabine Pass LNG

Proposed Liquefaction Project - Overview

Proposed Liquefaction Project - Overview

§ Leveraging existing assets

– Large acreage position (853 acres)

• Can readily accommodate 4 liquefaction

trains (up to 2 Bcf/d capacity)

trains (up to 2 Bcf/d capacity)

– Existing infrastructure

• 2 docks, 4 dedicated tugs

• LNG storage tanks (5 x 160,000 cm)

• Power generation

• Pipeline connections (Creole Trail)

§ Gas sourced from pipeline grid - Henry Hub

indexed pricing

indexed pricing

§ “Demand Pull” model

– Global supply gap

– Diversity of supply

– Flexible processing

– Henry Hub indexation

450

400

350

300

250

200

150

100

50

0

Cost

ConocoPhillips-Bechtel - Global Liquefaction Collaboration

Source: ConocoPhillips-Bechtel

ConocoPhillips-Bechtel trains

$/Ton per Annum

Qatargas

Nigeria

RasGas

ELNGT1

Oman

ALNGT1

ALNGT1-3

ELNGT1-2

Low Cost Liquefaction Facilities

Proven Technology

Proven Technology

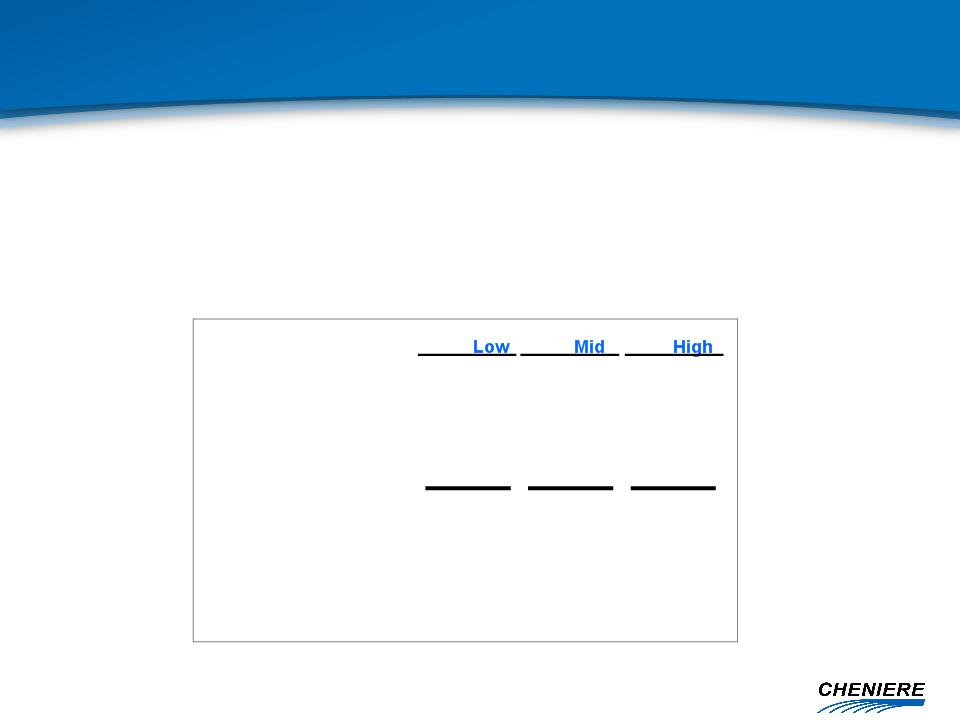

Capacity fee includes regasification and liquefaction services -

provides customer option to import or export

Estimated cost to purchase U.S. supply:

Commercial Structure

Estimated Terms for LNG Sales Agreements

Estimated Terms for LNG Sales Agreements

Ê Capacity Fee: $1.40/MMBtu to $1.75/MMBtu

§ “Take or Pay”, permits lifting or unloading cargoes

Ê LNG Export Commodity Charge: $HH./MMBtu

§ Delivery Terms: FOB

§ Prevailing price for eastbound flow in local pipelines

§ Paid on a per-MMBtu basis, per cargo loaded

Ê Fuel Surcharge: 8%-12%

§ Projected based on forecast export activity

§ Trued up from period to period

Source: Cheniere

Henry Hub Price

4.50

$

6.50

$

8.50

$

Terminal Fuel

0.45

0.65

0.85

Liquefaction Charge

1.50

1.50

1.50

Shipping Cost

1.00

1.00

1.00

Delivery Charges

2.95

$

3.15

$

3.35

$

DES Price (Europe)

7.45

$

9.65

$

11.85

$

Brent Crude @ 12.5%

59.60

$

77.20

$

94.80

$

$/MMBtu

Brent Crude @ 15%

49.67

64.33

79.00

$

$

$

Delivered Costs Compare Favorably

to European Price Estimates

to European Price Estimates

§ Assuming continued increase in U.S. natural gas production,

unconventional gas economics effectively cap Henry Hub at mid-range of

$6.50/MMBtu

unconventional gas economics effectively cap Henry Hub at mid-range of

$6.50/MMBtu

§ If oil remains above $65/Bbl, Sabine Pass LNG is cheaper than oil-

indexed pipeline gas in Europe on the margin, while forecast prices

above $77/Bbl justify it on an all-in basis

indexed pipeline gas in Europe on the margin, while forecast prices

above $77/Bbl justify it on an all-in basis

Strong support from local and state agencies

Regulatory Process

§ Dual regulatory tracks with the DOE and FERC

– DOE regulates imports and exports of natural gas

– FERC coordinates federal and state review of proposals

to build LNG terminals

to build LNG terminals

§ Key regulatory and legislative issues

– NEPA empowers FERC as the lead Federal agency for

preparation of an Environmental Impact Statement

preparation of an Environmental Impact Statement

– Other Federal and State agency involvement on issues

§ Typical Approvals Timeline - ~18-21 months

– NEPA pre-filing initiated in July 2010

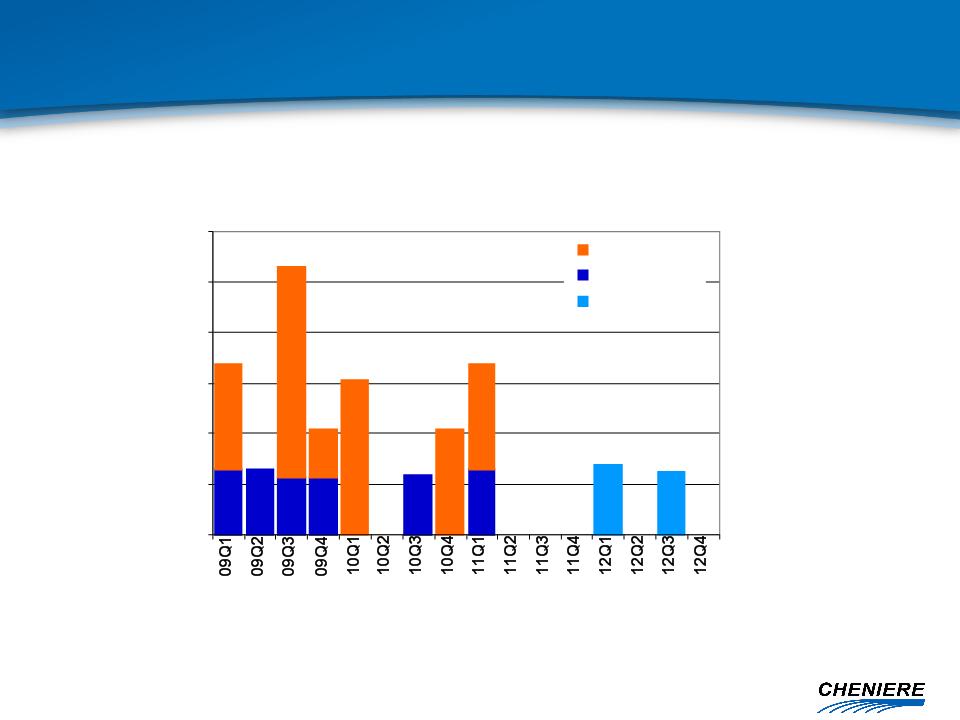

Financial

i

Disbursements

§ Operating Expenses

§ Management Fees

§ Debt Service

Annualized*

($ in MM)

*Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may

differ materially from, and there is no plan to update the forecast. See “Forward Looking Statements” cautions.

differ materially from, and there is no plan to update the forecast. See “Forward Looking Statements” cautions.

Distributable Cash Available

Distributions to GP and LP Unitholders

Note: Not included in disbursements above is an estimate of up to approximately $11 million of fees payable to Cheniere for

services provided under a management services agreement. Such fees are payable on a quarterly basis equal to the lesser

of 1) $2.5 million (subject to inflation) or 2) such amount of CQP’s unrestricted cash and cash equivalents as remains after

CQP has distributed in respect of each quarter for each common unit then outstanding an amount equal to the IQD and the

related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other

than Sabine Pass operating cash flows reserved for distributions in respect of the next four quarters.

services provided under a management services agreement. Such fees are payable on a quarterly basis equal to the lesser

of 1) $2.5 million (subject to inflation) or 2) such amount of CQP’s unrestricted cash and cash equivalents as remains after

CQP has distributed in respect of each quarter for each common unit then outstanding an amount equal to the IQD and the

related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other

than Sabine Pass operating cash flows reserved for distributions in respect of the next four quarters.

$251

7

$34

8

165

$51

$46

Estimated Future Cash Flows

Cheniere Energy Partners

Cheniere Energy Partners

Receipts

§ TUA Customers

§ Fuel Retainage, Tugs,

Other

Other

Cheniere Energy, Inc.

i

2010 Financial Developments

Cheniere Energy, Inc.

Cheniere Energy, Inc.

§ Entered into marketing arrangement with JPMorgan

– Reduced working capital requirements for cargo purchases/sales

§ Sold 30% equity in Freeport to pay down debt

– Paid down $102 million of 9.75% term loan

§ Assigned CMI TUA to CQP subsidiary and entered into new

variable capacity rights agreement

variable capacity rights agreement

– Released TUA reserve account, funds used to pay down $64 million of

convertible senior secured notes

convertible senior secured notes

§ Continuing to address upcoming debt maturities at Cheniere

– Considering best options to maintain shareholder value

$247

$247

$502

Put option Aug-2011*

2010

2011

2012

2018

Note: Balances as of June 30, 2010, reflect paydown of $64MM on convertible senior secured notes. Amounts do not include notes at SPLNG

*Maturity August 2018

JPMorgan Arrangement

§ Cheniere and JPMorgan joined LNG marketing efforts

§ CMI provides all services related to:

– Sourcing deals and negotiating contracts, purchasing, transporting,

receiving, storing, regasifying and selling cargoes of LNG and regasified

LNG on an exclusive basis

receiving, storing, regasifying and selling cargoes of LNG and regasified

LNG on an exclusive basis

§ JPM provides credit support

§ JPM pays a fixed fee and additional fees dependent upon

gross margins achieved

gross margins achieved

§ JPM acquired CMI’s commercial inventory as of April 1, 2010

§ JPM has option to sign 0.5 Bcf/d TUA at $0.32/MMBtu

Disbursements

§ G&A, net marketing

§ Pipeline & tug services

§ Other, incl adv tax payments

§ Debt service

Annualized*

($ in MM)

*Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no

plan to update the forecast. See “Forward Looking Statements” cautions. Estimates exclude earnings forecasts from operating activities.

plan to update the forecast. See “Forward Looking Statements” cautions. Estimates exclude earnings forecasts from operating activities.

**Approximately $11 million is fees for management services provided by Cheniere to CQP payable on a quarterly basis, equal to the lesser of 1) $2.5 million (subject to inflation) or 2)

such amount of CQP’s unrestricted cash and cash equivalents as remains after CQP has distributed in respect of each quarter for each common unit then outstanding an amount

equal to the IQD and the related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other than Sabine Pass operating

cash flows reserved for distributions in respect of the next four quarters.

such amount of CQP’s unrestricted cash and cash equivalents as remains after CQP has distributed in respect of each quarter for each common unit then outstanding an amount

equal to the IQD and the related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other than Sabine Pass operating

cash flows reserved for distributions in respect of the next four quarters.

Net cash outflow

§ Baseline case, excludes estimates for cargo activity, Marketing margins and project development

costs

costs

$20

8-19**

25-35

10

3-5

34

$45 - 55

Estimated Future Cash Flows

Cheniere Energy, Inc.

Cheniere Energy, Inc.

Receipts

§ Distributions from CQP (Common/GP)

§ Management fees from CQP

LNG Market Update

i

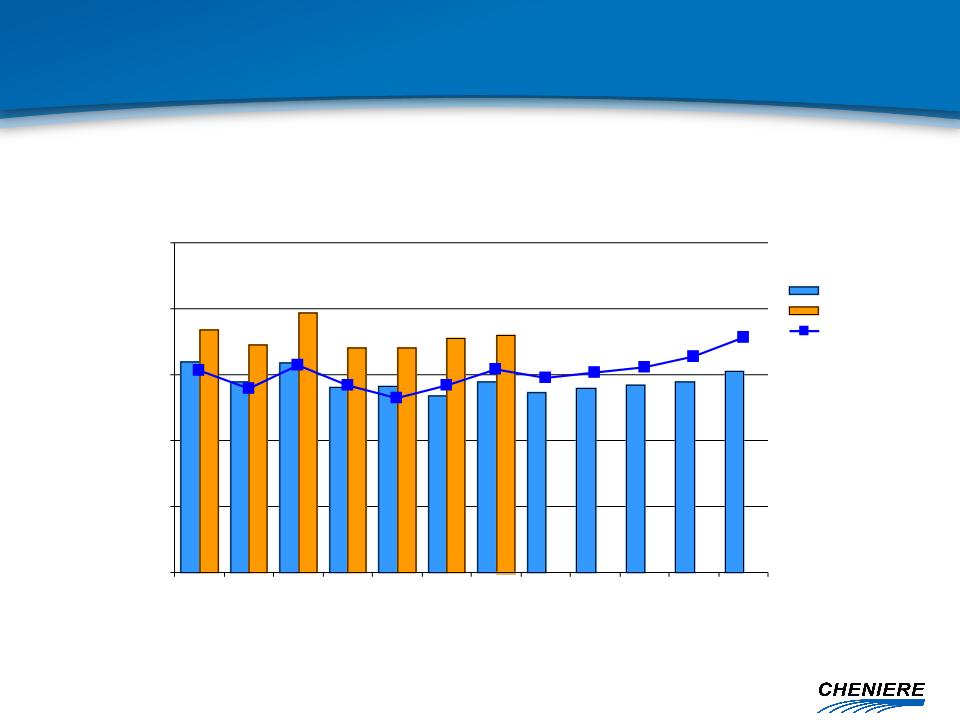

An additional 5.5 Bcf/d was produced over 2009, a 24% increase YoY in first half of 2010

-

5.0

10.0

15.0

20.0

25.0

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2008

2010

2009

Source: Poten, Waterborne for 2010 data

MT

LNG Production

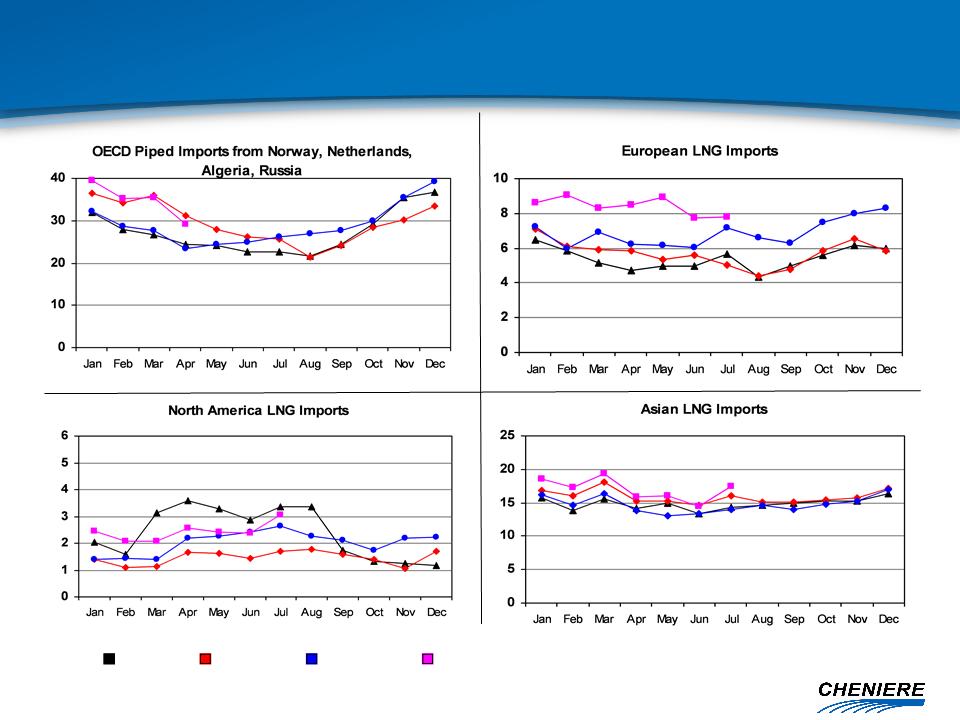

Source: Waterborne LNG, EIA

2007

2008

2009

2010

Historical Gas and LNG Demand by Region

(Bcf/d)

(Bcf/d)

Source: Cheniere Research

Liquefaction Capacity Additions by Region

-

0.5

1.0

1.5

2.0

2.5

3.0

Bcf/d

Middle East Gulf

Asia Pacific

Atlantic Basin

Firm Liquefaction Capacity Additions

Appendix

i

Everett

Cove Point

Elba Island

Sabine Pass

Freeport

Golden Pass

Cameron

Costa Azúl

Canaport

Existing

Under Construction

Altamira

Source: Websites of Terminal Owners

|

Terminal

Capacity Holder

|

Baseload

Sendout

(MMcf/d) |

|

Canaport

Repsol

|

|

|

Everett

Suez

|

|

|

Cove Point

BP, Statoil, Shell

|

|

|

Elba Island

BG, Marathon, Shell

|

|

|

Gulf LNG

Angola LNG, ENI

|

|

|

Lake Charles

BG

|

|

|

Freeport

ConocoPhillips, Dow, Mitsui

|

|

|

Sabine Pass

Total, Chevron, Cheniere

|

|

|

Cameron

Sempra, ENI

|

|

|

Golden Pass

ExxonMobil, ConocoPhillips, QP

|

|

|

Altamira

Shell, Total

|

|

|

Costa Azul

Shell, Sempra, Gazprom

|

|

|

Total

|

|

17.1 Bcf/d North American Atlantic Basin

capacity @ 65% utilization = 11.1 Bcf/d

capacity @ 65% utilization = 11.1 Bcf/d

Gulf LNG

1,000

700

1,800

800

1,300

1,800

1,500

4,000

1,500

2,000

700

1,000

18,100

North America Onshore Regasification Capacity

Public Unit holders

9.4% LP Interest

Cheniere Energy

Investments, LLC

Sabine Pass LNG-GP, LLC.

Sabine Pass LNG-LP, LLC

100% Ownership Interest

100% Ownership Interest

100% Ownership Interest

100% LP Interest

Non-Economic GP Interest

100% Ownership Interest

Cheniere LNG Holdings, LLC

$205 mm 2.25% Convertible Senior Unsecured Notes due 2012

$550 mm 7.25% Senior Secured Notes due 2013

$1,666 mm 7.50% Senior Secured Notes due 2016

88.6% LP Interest

100% of 2% GP Interest

100% of 2% GP Interest

NYSE Amex US: LNG

NYSE Amex US: CQP

3

$298 mm 9.75% Term Loan due 2012

$247 mm 12.0% Convertible Senior Secured Loans due 2018

Note: Balances as of June 30, 2010; convertible

senior secured loans balance reflects the $64MM pay

down from TUA reserve release.

senior secured loans balance reflects the $64MM pay

down from TUA reserve release.

Customer Annual TUA Pmt

Total $123MM

Chevron $128MM

Investments $252MM

Sabine Pass LNG, L.P.

Organizational Structure

CHENIERE ENERGY

Cheniere Energy

Contacts

Katie Pipkin, Vice President Finance & Investor

Relations

(713) 375-5110 - katie.pipkin@cheniere.com

Christina Burke, Manager Investor Relations

(713) 375-5104 - christina.burke@cheniere.com