Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - PENGRAM CORP | form8k.htm |

ASSIGNMENT AGREEMENT

THIS AGREEMENT is dated for reference as of the 24th day of August, 2010.

| BETWEEM: |

| PENGRAM , a corporation duly formed under the laws of |

| Nevada with its principal office at 1200 Dupont Street, Suite 2J, Bellingham, WA |

| 98225 |

| (hereinafter called the "Assignor") |

| OF THE FIRST PART |

| AND: |

| MANADO GOLD CORP., a corporation duly formed under the laws of the |

| Province of British Columbia with its registered office at #950 – 650 West |

| Georgia Street, Vancouver, BC V6B 4N8 |

| (hereinafter called the "Assignee") |

| OF THE SECOND PART |

WHEREAS, pursuant to a letter agreement (the “Option Agreement”) dated November 2, 2009 as amended (a copy of which is attached as Schedule “A”) between the Assignor and Agus Abidin on behalf of the owners of the K.P. corporations holding the mineral properties (the “Concession Owners”) located in Northern Sulawesi, Indonesia (the “Manado Gold Property”), the Assignor acquired the right to earn up to 85% in the Manado Gold Property, details of which are set out in Schedule “A,”

AND WHEREAS, the Assignee wishes to acquire up to 75% of the Assignor’s interest in the Option Agreement and the Manado Gold Property,

NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration of the foregoing and of the mutual covenants and agreements hereinafter provided, the parties have agreed and do hereby agree as follows:

| 1. |

For the consideration set out in Paragraph 2 below, the Assignor agrees to assign to the Assignee a 75% undivided interest in the Option Agreement. The Assignee acknowledges that although the Assignor has completed the requirements to exercise its option, under the Option Agreement, to enter into a formal agreement (the “Formal Agreement”) for the acquisition of the Manado Gold Property, the Formal Agreement has not yet been executed pending the Concession Owners completing legal requirements in Indonesia to transfer the property tenements from K.P.’s under the old Indonesian mining law to U.I.P.’s under the new Mining Law No. 4 and obtaining P.M.A. approvals to permit foreign investment in the property holding companies. Upon the Assignee making the payments required by paragraph 2(a), the Assignor will permit the Assignee to participate in the drafting of the Formal Agreement and will not execute the Formal Agreement without the approval of the Assignee. | ||

| 2. |

The consideration for the assignment shall be as follows: | ||

| (a) |

The reimbursement by the Assignee of $80,000 in expenditures incurred by the Assignor in connection with the Option Agreement payable as follows: | ||

| (i) |

$40,000 US on execution of this Agreement; | ||

| (ii) |

$40,000 US on or before September 15, 2010. | ||

| (b) |

Incurring expenditures to complete exploration on or place into production the Manado Gold Property as follows: | ||

| (i) |

$250,000 US within one year of execution of the Formal Agreement; | ||

| (ii) |

$500,000 US prior to the 2nd anniversary of the execution of the Formal Agreement; and | ||

| (iii) |

$1,000,000 US prior to the 3rd anniversary of the execution of the Formal Agreement. | ||

1

| (c) |

Following completion of the expenditures set out in paragraph 2(b) above, making the expenditures necessary to complete a scoping study on the Manado Gold Property. | ||

| (d) |

Issuing 950,000 shares of the Assignee’s common stock to the Assignor’s wholly-owned subsidiary, Clisbako Minerals Inc., as follows: | ||

| (i) |

150,000 shares on execution of the Formal Agreement; | ||

| (ii) |

300,000 shares prior to the 1st anniversary of the execution of the Formal Agreement; and | ||

| (iii) |

500,000 shares prior to the 2nd anniversary of the execution of the Formal Agreement. | ||

| (e) |

Making payments to the Concession Owners as follows: | ||

| (i) |

$75,000 US on execution of the Formal Agreement; | ||

| (ii) |

$100,000 US on the 1st anniversary of the execution of the Formal Agreement; and | ||

| (iii) |

$200,000 on the 2nd anniversary of the execution of the Formal Agreement. | ||

| 3. |

Upon completing the payments expenditures and share issuances as set out above, the Assignee shall earn 75% of the Assignor’s interest in the Option Agreement and the Manado Gold Property as follows: | ||

| (a) |

7.5% upon completion of the items set out in paragraphs 2(a), 2(b)(i), 2(d)(i) and (2e)(i); | ||

| (b) |

11.25% upon completion of the items set out in paragraphs 2(b)(ii), 2(d)(ii) and (2e)(iii); | ||

| (c) |

19.5% upon completion of the items set out in paragraphs 2(b)(iii), 2(d)(iii) and (2e)(iii); and | ||

| (d) |

25.5% on completing the scoping study described in paragraph 2(c) above. | ||

| 4. |

In the event that the Assignee elects to exercise its option to purchase the Concession Owners’ 15% carried interest and subject to the Assignee being in good standing under this Agreement, the Assignee will have the right to participate as to 75% in the exercise of that option. | ||

| 5. |

Upon the Assignee earning the interests set out in paragraph 3, the Assignor will transfer such interests to the Assignee. In the event that such interests cannot be readily transferred to the Assignee, the Assignor will hold the same in trust for the Assignee. | ||

| 6. |

At any time after the Assignee has earned an interest in the Manado Gold the parties may, and upon the Assignee earning the entire 63.75% interest as set out in paragraph 3 the parties will, enter into an industry standard joint venture agreement for the continued development of the Manado Gold Property. | ||

| 7. |

In the event that the Assignee shall fail to make any payment, incur any exploration expenditures or issue any shares required to be made or issued by the Assignee under this Agreement, the right of the Assignee to earn any further interest in the Option Agreement, the Formal Agreement or the Manado Gold Property shall terminate and the Assignee will only be entitled to the interest earned to that date. | ||

| 8. |

Upon execution of the Formal Agreement, the Assignor shall make all share issuances to the Concession Holders required by the terms of the Formal Agreement. | ||

| 9. |

The entering into of this Agreement and the consummation of the transactions contemplated hereby will not result in the violation of any of the terms and provisions of the constating documents or bylaws of Assignor or the Assignee or of any indenture, instrument or agreement, written or oral, to which Assignor or the Assignee may be a party. | ||

| 10. |

The entering into of this Agreement and the consummation of the transactions contemplated hereby will not, to the best of the knowledge of the Assignee, result in the violation of any law or regulation of any local government bylaw or ordinance to which Assignor or the Assignee or their business may be subject. | ||

| 11. |

This Agreement has been duly authorized, validly executed and delivered by the Assignee. | ||

2

| 12. |

Time shall be of the essence of this Agreement. |

| 13. |

This Agreement contains the whole agreement between the parties hereto in respect of the Assignee’s acquisition of up to 75% of the Assignor’s interest in the Option Agreement and the Manado Gold Property and there are no warranties, representations, terms, conditions or collateral agreements expressed, implied or statutory, other than as expressly set forth in this Agreement. |

| 14. |

This Agreement shall enure to the benefit of and be binding upon the parties hereto and their respective successors and permitted assigns. The Assignee may not assign this Agreement without the consent of the Assignor which consent may be withheld for any reason whatsoever. |

| 15. |

Any notice to be given under this Agreement shall be duly and properly given if made in writing and delivered or telecopied to the addressee at the address as set out on page one of this Agreement. Any notice given as aforesaid shall be deemed to have been given or made on, if delivered, the date on which it was delivered or, if telecopied, on the next business day after it was telecopied. Any party hereto may change its address for notice from time to time by providing notice of such change to the other parties hereto in accordance with the foregoing. |

| 16. |

This Agreement may be executed in one or more counterparts, each of which so executed shall constitute an original and all of which together shall constitute one and the same agreement. |

| 17. |

This Agreement shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the laws of the Province of British Columbia, and each of the parties hereto irrevocably attorns to the jurisdiction of the courts of the Province of British Columbia. |

| 18. |

This Agreement has been prepared by O’Neill Law Corporation acting solely on behalf of the Assignee and the Assignor acknowledges that it has consented to O’Neill Law Corporation acting for the Assignee and that it has been advised to obtain independent legal advice. |

IN WITNESS WHEREOF the parties hereto have executed this Agreement as of the day and year first above written.

| PENGRAM CORPORATION | |

| /s/ Richard W. Donaldson | |

| By Its Authorized Signatory | |

| MANADO GOLD CORP. | |

| /s/ Logan B. Anderson | |

| By Its Authorized Signatory |

3

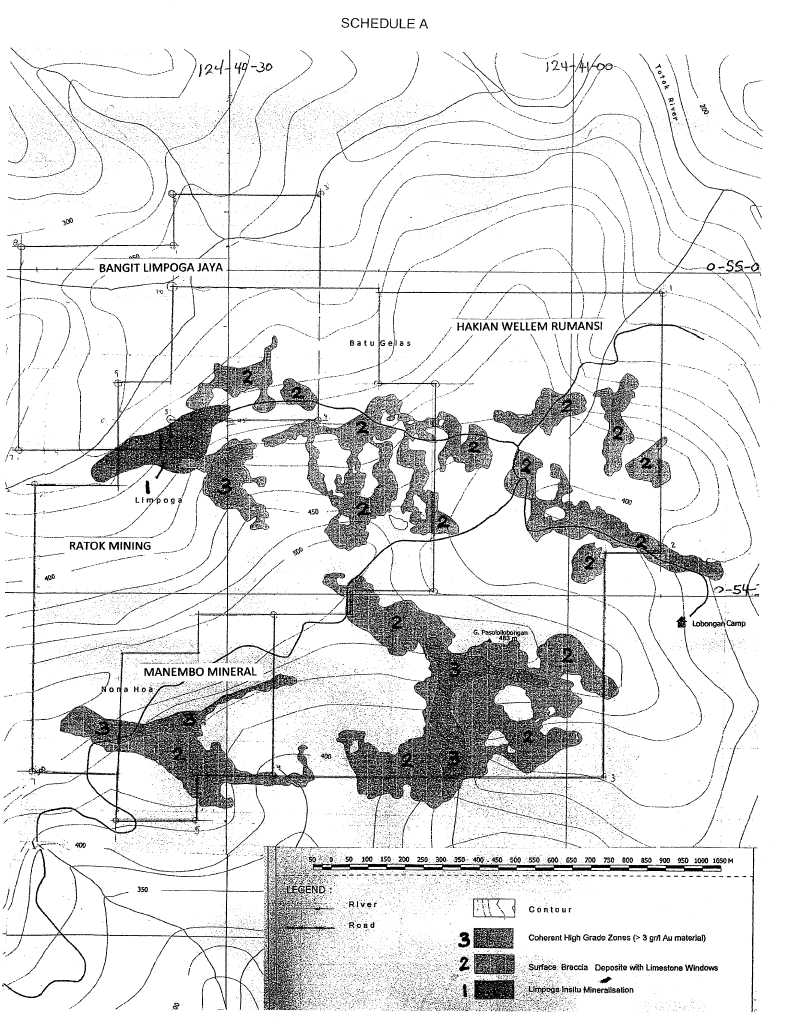

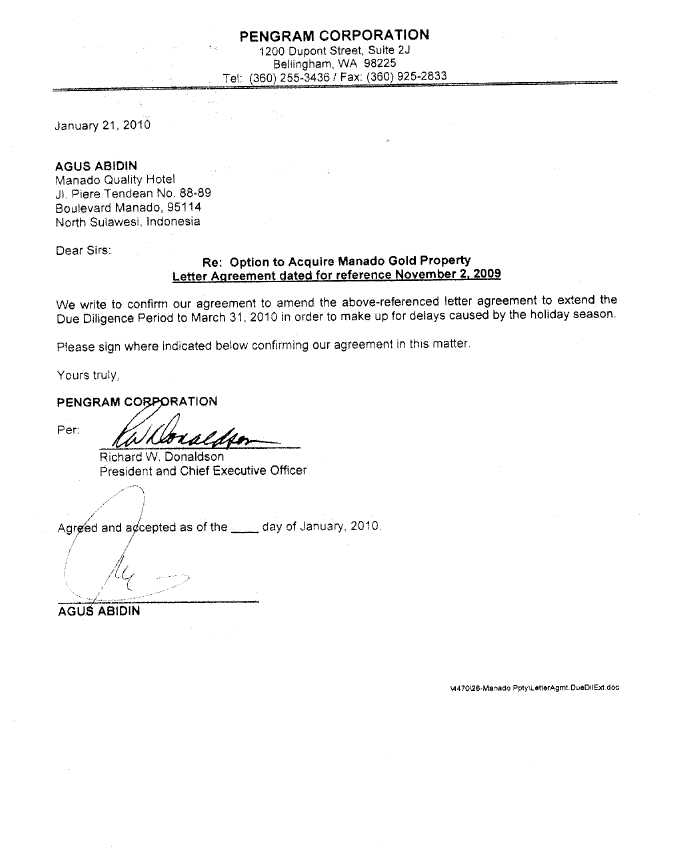

SCHEDULE A

4

| PENGRAM CORPORATION |

| 1200 Dupont Street, Suite 2J |

| Bellingham, WA 98225 |

| Tel: (360) 255-3436 / Fax: (360) 925-2833 |

November 2, 2009

AGUS ABIDIN

Manado Quality Hotel

Jl. Piere

Tendean No. 88-89

Boulevard Manado, 95114

North Sulawesi, Indonesia

Dear Sirs:

Re: Option to Acquire Manado Gold Property

This will confirm our understanding with respect to an option to be granted to Pengram Corporation (“Pengram”) to acquire interests in the four mineral concessions in the Lobongan District of Northern Sulawesi, Indonesia, as set out below and as more particularly outlined in Schedule A:

| A. | Bangkit Limpoga Jaya; |

| B. | Hakian Wellem Rumansi; |

| C. | Ratok Mining; and |

| D. | Manembo Mineral. |

The concessions are hereinafter referred to collectively as the “Concessions.” The owners of the concessions are hereinafter referred to as the "Concession Owners."

1. Concession Owners Representations

You have represented to us as follows:

| 1.1 | You own the Concessions or have been authorized to act on behalf of the Concession Owners and have the authority to deal with the Concessions in the manner contemplated by this letter agreement. |

| 1.2 | The Concessions are in good standing. |

| 1.3 | The Concessions cover the area where Newmont Minahasa Raya drilled 273 holes as more particularly described in the Report of Glenn White and Iip Hardjana dated January 1993. |

| 1.4 | There are no liens, charges or encumbrances on the Concessions. |

| 1.5 | There is no impediment or restriction that would prevent conducting exploration or development work on the Concessions other than requirements to obtain government permits or approvals under applicable Indonesian mining laws. |

2. Pengram Representations

Pengram has represented to you as follows:

| Pengram Corporation | |

| Mr. Agus Abidin | |

| November 2, 2009 |

| 2.1 | Pengram is a company incorporated under the laws of the State of Nevada and is in good standing under the laws of its jurisdiction of incorporation. |

||

| 2.2 | Pengram is a reporting company under the United States Securities Exchange Act of 1934 (the “Act”) and is in good standing with respect to its filings under the Act. |

||

| 2.3 | There have been no material adverse changes to Pengram since its most recent filing of its Quarterly Report on Form 10-Q for the nine months ended August 31, 2009 filed with the United States Securities and Exchange Commission on October 20, 2009. |

||

| 2.4 | Pengram's common shares are quoted on the OTC Bulletin Board under the symbol "PNGM.” |

||

| 3. | Option |

||

| 3.1 | In consideration of $35,000 USD to be paid on execution of this Agreement, you have agreed to grant Pengram the exclusive right, for a period of 90 days from the date of execution of this Agreement (the "Due Diligence Period") to enter into an acquisition agreement (the "Acquisition Agreement") to acquire up to an 85% undivided interest in the Concessions on the terms and conditions described under the heading "Acquisition Agreement" below. |

||

| 3.2 | At any time prior the expiration of the Due Diligence Period, Pengram may elect, by notice in writing, to exercise its option to enter into the Acquisition Agreement. The parties will use their best efforts during the 30 day period following such notice to prepare the formal Acquisition Agreement. |

||

| 3.3 | During the Due Diligence Period, the Concession Owners will permit Pengram's duly authorized representatives to enter onto the Concessions, take samples and conduct such other activities as may be necessary to conduct proper due diligence. The Concession Owners will provide Pengram's representatives with all data, title documents, reports or other information that the Concession Owners have in their possession relating to the Concessions and will assist Pengram as necessary to permit it to complete its due diligence. The Concession Owners will provide Pengram's representatives with such information about themselves as may be necessary for Pengram to determine their title to the Concessions and that the Concessions are free of liens, charges or encumbrances. |

||

| 4. | Acquisition Agreement |

||

| 4.1 | The Acquisition Agreement shall provide for the earning of interests by Pengram in the Concessions by making the cash payments, share issuances and completing work programs as follows: |

||

| I) | a 10% undivided interest by: |

||

| a) | paying $90,000 USD to the Concession Owners on execution of the Acquisition Agreement; |

||

| b) | issuing 150,000 common shares of Pengram to the Concession Owners on execution of the Acquisition Agreement; and |

||

| c) | completing a mineral exploration program at a cost of not less than $250,000 within one year of execution of the Acquisition Agreement. |

||

| Pengram Corporation | |

| Mr. Agus Abidin | |

| November 2, 2009 |

| II) | an additional 15% undivided interest by: |

||

| a) | paying $100,000 to the Concession Owners on the 1st anniversary of execution of the Acquisition Agreement; |

||

| b) | issuing 300,000 common shares of Pengram to the Concession Owners on the 1st anniversary of the execution of the Acquisition Agreement; and |

||

| c) | completing additional mineral exploration programs at a cost of not less than $500,000 prior to the 2nd anniversary of the Acquisition Agreement. |

||

| III) | an additional 26% undivided interest by: |

||

| a) | paying $200,000 to the Concession Owners on the 2nd anniversary of execution of the Acquisition Agreement; |

||

| b) | issuing 500,000 common shares of Pengram to the Concession Owners on the 2nd anniversary of the execution of the Acquisition Agreement; and |

||

| c) | completing additional mineral exploration programs at a cost of not less than $1,000,000 prior to the 3rd anniversary of the Acquisition Agreement. |

||

| IV) | an additional 34% undivided interest on completion of a scoping study. |

||

| 4.2 | Upon Pengram earning an 85% interest as outlined above, the Concession Owners shall be carried and shall not be obligated to pay their proportionate share of the costs to complete a feasibility study and to place the property into commercial production; however, Pengram will have the right to pledge the Concession Owners' share of the property to obtain production financing. |

| 4.3 | On completion of a feasibility study, Pengram shall have the option to acquire the Concession Owners' 15% carried interest for a cash payment of $5,000,000. |

| 4.4 | The Acquisition Agreement shall include an area of mutual interest of 5 kilometers within which any properties acquired by the Concession Owners will be subject to a right of first refusal in favor of Pengram. |

| 4.5 | During the term of the Acquisition Agreement, Pengram will be obligated to pay all government filing or assessment fees necessary to keep the Concessions in good standing. |

| 4.6 | The Acquisition Agreement will be an option only and may be terminated by Pengram on 60 days notice. If the Acquisition Agreement is terminated, Pengram shall only be entitled to the interest it has earned to the termination date. |

| 4.7 | The Acquisition Agreement shall contain other customary terms and provisions consistent with industry practices. |

| 5. | Exclusivity |

| 5.1 | In consideration of the $35,000 payment described in paragraph 3.1 above and Pengram agreeing to undertake the costs and expenses of conducting due diligence, the Concession Owners agree that, during the Due Diligence Period, they will not seek or solicit, or engage anyone to seek or solicit, other suitors for a sale or joint venture of the Concessions, will not |

| Pengram Corporation | |

| Mr. Agus Abidin | |

| November 2, 2009 |

negotiate with other persons for a sale or joint venture of the Concessions, and will not make available to other potential suitors information concerning the Concessions. |

|

| 6. | Counterparts |

| 6.1 | This letter of intent may be executed in one or more counterparts, each of which so executed shall constitute an original and all of which together shall constitute one and the same letter of intent. |

If the foregoing is in accordance with your understanding of our agreements, please sign where indicated below.

Yours truly,

PENGRAM CORPORATION

| Per: | /s/ Richard W. Donaldson | |

| signed January 19, 2010 | ||

| Richard W. Donaldson | ||

| President and Chief Executive Officer |

Agreed and accepted as of the ____ day of ______________________, 2009.

/s/ Agus Abidin

_____________________________

AGUS ABIDIN

| PENGRAM CORPORATION |

| 1200 Dupont Street, Suite 2J |

| Bellingham, WA 98225 |

| Tel: (360) 255-3436 / Fax: (360) 925-2833 |

March 29, 2010

AGUS ABIDIN

Manado Quality Hotel

Jl. Piere

Tendean No. 88-89

Boulevard Manado, 95114

North Sulawesi, Indonesia

Dear Sirs:

Re: Option to Acquire Manado Gold Property

Letter Agreement dated for reference November 2, 2009

We write to confirm our agreement to amend the above-referenced letter agreement to further extend the Due Diligence Period to April 30, 2010 in order to make up for delays caused by the unavailability of persons to conduct due diligence during the 2010 Winter Olympics in Vancouver.

Please sign where indicated below confirming our agreement in this matter.

Yours truly,

PENGRAM CORPORATION

| Per: | /s/ Richard W. Donaldson |

| _____________________________ | |

| Richard W. Donaldson | |

| President and Chief Executive Officer |

Agreed and accepted as of the 30 day of March, 2010.

/s/ Agus Abidin

_____________________________

AGUS ABIDIN